NDA Annual Report and Accounts 2021 to 2022

Published 14 July 2022

Overview of performance 2021/22

This overview section provides an insight into our work during 2021/22 and highlights areas of progress for this year. We have described these using our five strategic themes.

Chair's Statement

Dr Ros Rivaz, NDA Chair

After taking up my role as NDA Chair at the height of the pandemic, the last 12 months have provided many more opportunities to visit sites, meet teams delivering work and gain a deeper understanding of the complexities associated with our mission.

I continue to be impressed by the challenging and nationally important work being delivered by people all across the NDA group.

Health, safety and wellbeing is our highest priority and performance has remained strong and favourable in comparison to other industries, although incident rates have risen slightly from last year's all time low. This is in part connected to the challenge of recommencing some work activities as COVID-19 restrictions have eased.

We reach the end of the year confident that our mission and strategy remain clear and are pleased to highlight several successes. However, we are increasingly mindful of a particularly difficult operating environment. Rising costs of materials and energy, Government's fiscal pressures and the conflict in Ukraine are all factors which have an impact on our work, alongside operating in a competitive market for the skills we need to deliver our programmes.

Looking forward, it is clear there will be ongoing and increased pressure on public funding. Within that context, I'm pleased that the NDA has been trusted by Government with a funding settlement for the next three years that recognises the important work that we do and allows further progress to be made against our clean-up mission. The Board and I fully recognise that with that trust comes huge responsibility.

The Board

I continue to meet with representatives of the UK Government and devolved administrations at ministerial and official level, to ensure an ongoing dialogue on the context in which we carry out our mission.

I recently completed a Chair's review of the NDA. This was at the request of the Secretary of State's office when I took up the post and augments the outcomes of previous reports and reviews enabling us to move forward with a clear set of actions, particularly regarding projects and programmes.

An external Board effectiveness review which commenced in February 2021 has been finalised during the year. Externally facilitated reviews are undertaken every three years, with an internal review annually, in line with best practice. The 2021 review provided insights that are being used to enhance the way that we work, such as better reflecting the NDA's unique governance arrangements and making sure that the distinction between our role as a fiduciary board and obligations as a non-departmental public body, as set out in our Framework document with the Department for Business, Energy and Industrial Strategy and Scottish Government, is clearly articulated, understood and fulfilled.

We have also approved a schedule of reserved matters for the first time as a Board. This clarifies decision making authority by clearly setting out those areas specifically reserved for the Board's decision.

Chris Train OBE joined the Board as anon-executive Board member in January. Chris has significant experience in energy, utilities, regulation and infrastructure sectors with organisations such as Cadent, National Grid, Transco and Lattice. He is already proving to be an asset to us and is chairing the Programmes and Projects Committee of the Board, leading the scrutiny of the spend of a significant part of our £3 billionbudget.

I would like to take this opportunity to thank Rob Holden for his service and support as he concluded his term as a non-executive member of the NDA Board, having been in post since 2015.

Challenges of COVID-19

In 2020/21 the impact of COVID-19 was unprecedented on the NDA and organisations the world over. That impact has continued to be felt, and has required adaption to different restrictions in regions and nations of the UK at various pointsof the year. I am pleased that 2022 is so far bringing with it an opportunity for a sense of normality to resume.

As we begin moving on from the pandemic, the legacy that it has created continues to emerge with changes in the working environment, including flexible and virtual working. I also remain incredibly impressed and proud of the support that was offered to local organisations and small businesses, during that period. We have statutory obligations under the Energy Act to support socio-economic activities around our sites, and it is clear that this proactive and tailored help meant a great deal to both the recipients and employees of the NDA and our operating companies.

These contributions helped to build local resilience and I would like to think those communities are in a stronger position as a result. Very many of our employees also gave personal support and, on behalf of the Board, I would like to place on record a thank you to all those involved.

Reducing hazards and managing waste

High hazard reduction remains our primary objective and this report contains many examples of the diverse range of complex nuclear material, waste management, construction and demolition projects that are being progressed.

Stakeholders regularly raise with me theimportance of delivering our commitments, particularly in relation to waste management. The creation of Nuclear Waste Services will place an increased focus on waste management across the group, including the important work to find asuitable site and willing community to host a Geological Disposal Facility.

We continue to benefit from the input of our local and national stakeholders in this work and in delivering our wider mission. I want to thank them for engaging with us, challenging us, holding us to account and recognising the work being delivered by our teams.

Placing sustainability and people at the heart of our work

Sustainability has been high on the agenda in the UK this year, with Glasgow hosting the COP 26 United Nations Climate Change Conference andthe UK Government publishing its Net ZeroStrategy.

We recognise the important role that the NDA group performs in this area, with a legal and ethical responsibility to deliver our mission sustainably.

The NDA Board has established a Sustainability and Governance Committee, under the leadership of non-executive Board member Janet Ashdown, to ensure appropriate focus on this topic and others such as values and culture.

I welcome publication of a group-wide Diversity and Inclusion Strategy this year, setting out areas of focus between now and 2025. The Board is playing its part, with the gender balance of its membership and commitment to respect the wider diversity expectations of the Corporate Governance Code being key topics for the Nominations Committee.

Achieving the benefits of the NDA group

David Peattie and the wider Group Leadership Team have continued to take important steps towards realising the benefits of working more closely together as one NDA group. The vision for achieving this was set out in last year's report and I am grateful to David and the team for their clear leadership in driving forward this agenda.

The launch of Nuclear Transport Solutions and Nuclear Waste Services are good examples and significant steps towards simplifying the way that the group is structured.

The year ahead will see more progress, as Magnox and Dounreay join together, subject to regulatory agreement. I am confident that these changes, and the approach of working more closely as one NDA group, will bring many benefits in the future and help us to deliver increased value for taxpayers.

Being trusted to do more

I welcome Government's announcement that it has reached an agreement with EDF Energy which will see AGR sites transfer to the NDA, specifically into our Magnox organisation, for decommissioning in the future.

As we reached the end of the year, a joint project team has also been formed and a Memorandum of Understanding signed to consider the potential of transferring the Ministry of Defence's Vulcan site to the NDA group for decommissioning. Vulcan sits

adjacent to the Dounreay site and we expect to know more about the potential options in the next year.

While exploring and progressing these opportunities, our core mission remains unchanged and our primary focus remains on successfully delivering these commitments.

Looking ahead

It remains our priority to further build and retain the confidence of Government, our stakeholders and our workforce as we are trusted to deliver our mission and do more.

Steps have been taken towards a new trajectory, working more collaboratively across the group and developing an inclusive culture. A great deal has been achieved under David's leadership so far and I am confident he and his team will continue to make further progress towards simplifying governance and reporting arrangements in order to deliver our mission safely, effectively and efficiently.

Our work and, importantly, the way we carry it out has never been more important. The environment in which we are operating means that it is crucial we retain a firm focus on delivering value for money.

Meanwhile the increasing national and international priority placed on sustainability and achieving carbon net zero means it is equally important that the mission is delivered in the right way.

I would like to offer my thanks to members of the Board for their attention in response to various reviews this year and for their effective support and scrutiny of the activities of the NDA. My ongoing thanks also go to David and his leadership team for achieving significant steps towards delivery of the mission, while also establishing different ways of working and setting strong foundations to help us make further progress in the coming years.

Dr Ros Rivaz NDA Chair 7 July 2022

Group Chief Executive's statement

David Peattie, NDA group CEO

I'm delighted that decommissioning activity across the NDA group has significantly increased again this year, following the unprecedented impact of the pandemic in the previous 12 months.

The safety of our people and sites continues to be our highest priority. Despite another challenging year responding to changing restrictions, we put the right measures and protections in place that have enabled our operational teams to remain focused on hazard reduction.

Progressing our mission

The nationally important work that we do continues to be reflected in the level of funding committed by Government to progress our mission. I welcome our latest funding settlement and am acutely aware of the economic challenges facing the country, so our commitment has never been stronger to spend money wisely.

As Government publishes its Energy Security Strategy, with an ambition to support a new generation of nuclear power stations, our role to safely and securely reduce hazards at the UK's oldest nuclear facilities is in sharper focus, as is the need to provide waste management routes that support both our programme and any future requirements.

Skyline changes help to demonstrate the progress we're making and they don't come much higher than the removal of a giant diffuser, which had sat on top of the 125-metre Windscale Pile Chimney on the Sellafield site for 70 years. The chimney is the most prominent structure on the site and removing the diffuser was a painstaking job that took three years to complete.

There are similar examples of complex decommissioning challenges being met throughout the group. Magnox's Chapelcross site placed its first package of intermediate level waste (ILW), with material from its decommissioned cooling pond, in a new interim storage facility during 2021. Meanwhile large roof beams travelled to Caithness by sea, before being transferred to Dounreay, where they are being used for construction of the site's latest shielded radioactive waste store.

Our mission goes beyond existing sites. We're also responsible for identifying a suitable site and a willing host community for a Geological Disposal Facility (GDF). Four communities are now engaged in the process and a significant amount of technical work and stakeholder engagement is underway.

It will take years of detailed assessments before a final siting decision is taken, with the latest planning assumption that the GDF will be available for ILW from around 2050-2060 and high level waste and spent fuel from 2075.

Meanwhile we're progressing commitments in our strategy to investigate alternative treatment and disposal options that could further enhance the way we deliver our mission.

The NDA's work also crosses international borders and in November Nuclear Transport Solutions successfully delivered 16 MOX fuel assemblies to the Takahama Nuclear Power Station in Japan. It builds on a 45-year history of transporting nuclear materials between Europe and Japan with a flawless nuclear safety and security record.

Protecting our environment

We have an increasingly important role to support the UK Government's goals for green energy and achieving carbon net zero by 2050.

This year we published our Sustainability Strategy which sets out our ambitions and we are already seeing successes. This year the Nuclear Transport Solutions vessel Oceanic Pintail was decommissioned and, in a UK first, 100% was recycled. It's a fitting end to a vessel that served the UK with distinction for more than 30 years.

Meanwhile, an innovative approach is being taken to resurfacing work at the LLW Repository site. An additive, made of non-recyclable plastic, is being used in the tarmac, putting the material to use and avoiding it being sent to landfill.

Developing our people

People are central to the NDA's ability to deliver its mission. Our aim is to provide great places to work and I was pleased to launch our new group Diversity and Inclusion Strategy this year. It sets some challenging, but important targets between now and 2025 to take us further on this journey.

Inclusive culture and leadership is one of five focus areas within the strategy and our leadership standard, developed with input from all levels of the group, was recognised at the Learning Awards 2022. The standard is helping us build a collaborative culture and is creating consistency of what people can expect from our leaders.

In addition, our Leadership Academy, which is designed to help our people grow, is doing incredibly well and is now progressing its third cohort of participants.

Shaping our group

Our Group Leadership Team (GLT) has now been operating for a year and we are seeing real benefits from this collaborative approach. It brings together the NDA's Executive Leadership Team (ELT) with the Chief Executive Officers of our operating companies in one forum to shape the future of the group.

With all of our Site Licence Companies now subsidiaries, we're moving to a group structure that consists of the NDA and four operating companies. I've already reported the launch of Nuclear Transport Solutions and, in January this year, we created Nuclear Waste Services. This brings together LLW Repository Ltd and Radioactive Waste Management Ltd as one waste-focused organisation.

We've also announced that, subject to regulatory approval, Dounreay will join with Magnox in 2023. With Sellafield remaining a subsidiary company as it is today, the combined Magnox and Dounreay organisation will become the fourth of our operating 'pillars'.

Magnox will also be the home of the AGR reactors when they transfer from EDF Energy to the NDA for decommissioning. I am proud that the Government has trusted us to do more and discussions have started to prepare for the transition of the first AGR site when its defueling is complete.

Scrutiny and learning

In July we published the NDA's responses to the Magnox Inquiry, published in March 2021, as well as the Department for Business, Energy and Industrial Strategy's Departmental Review, which was published in July 2021.

Importantly, we've already taken significant steps to strengthen the NDA and improve the structure of the group and this is reflected in our response. While good progress has been made, our work continues and the reviews provide additional value as we develop and embed our new operating model.

Supporting our communities

We mustn't lose sight of our wider responsibilities in the communities where we operate and we continue to make investments that help those areas prepare for life beyond our decommissioning mission.

This year saw the completion of redevelopment work at Scrabster Harbour, close to Dounreay. A £5 million contribution from the NDA has helped increase capacity at St Ola Pier, allowing access to larger vessels and opening up opportunities such as offshore energy construction and maintenance, as well as cruise ships docking.

Meanwhile our support for the creation of business hubs is helping to create new jobs at different ends of the country. Whitehaven Bus Station in Cumbria opened in 2021, with the previously derelict facility providing modern business accommodation and winning awards for 'excellence in planning for heritage and culture' and 'excellence in planning for a successful economy' from the Royal Town Planning Institute.

The Romney Marsh Employment Hub, near our Dungeness A site in Kent, offers similar support to local businesses and was created with a £500,000 contribution from the NDA and Magnox. The scheme is expected to create up to 500 new jobs, which will play a significant role in mitigating the impact of future reductions at Dungeness A and B sites as decommissioning progresses.

Thank you

We are now seeing many of our in-person events return and staffing levels in our offices are on the increase. I see this interaction as vital to the delivery of our mission and I hope it signifies a move to improved working beyond the pandemic.

I would again like to thank all those working around the group for their dedicated service in what has been an unprecedented set of challenging circumstances. I'd also like to extend my ongoing thanks to our Board, the Governments of the UK and the devolved administrations and all our stakeholders.

It's clear we have some big challenges ahead but, as we continue our journey of reshaping the NDA group, I remain very confident that we are well placed to continue to make real progress in our nationally important mission.

David Peattie Accounting Officer and Group Chief Executive Officer 7 July 2022

Financial Review

Mel Zuydam, Group Chief Financial Officer

This year has seen revenues grow and investment made across our portfolio, with new transport and waste divisions formed, and preparations underway for the transfer of AGRs to the NDA group in the future.

While COVID-19 continued to impact operations and mission delivery during the year, our sites and businesses were able to manage the disruption it created and return to pre-COVID levels of productivity and mission progress by the end of the year. The latter part of the year did however see new financial risks emerging, particularly increases in energy prices. Combined with general inflation impacts, this will lead to a more challenging financial position for the group in the coming years. At the same time, we will maintain our focus on generating commercial income.

We have continued to portfolio manage our financial risks and opportunities, ensuring that we remained within the overall funding settlement agreed with Government through the Supplementary Estimate process. With a whole year of operation of our new Group Leadership Team and working closely with Government, we were able to take risk-based prioritised investment decisions and maximise our commercial revenues.

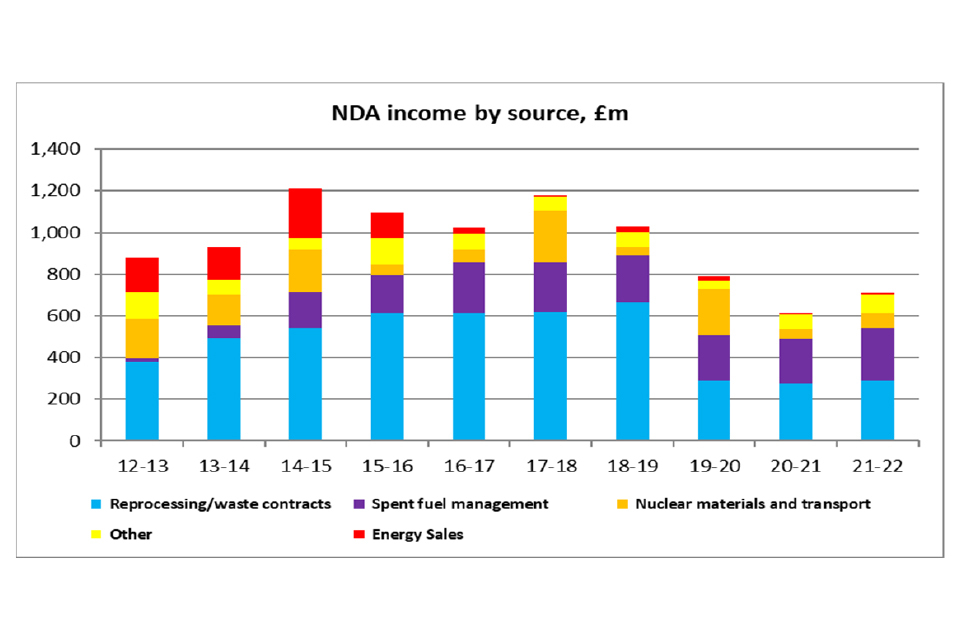

Our commercial revenues increased by 17% to £714 million, with increased fuel deliveries from the UK's operational nuclear power stations. Our net expenditure for the year was £2,758 million, compared to the original voted net expenditure limit of £2,791 million. Our capital investment was £2,024 million and our resource expenditure was £1,448 million.

Our funding for the medium-term was secured in Government's recent spending review, providing a platform for continued mission progress in the next few years. After a number of short-term settlements in recent years, this is a welcome development in our ability to create financial plans over a longer period.

This year saw the finalisation of the last two parent body organisation contracts, with Dounreay Site Restoration Limited (DSRL) and LLW Repository Limited becoming

NDA subsidiaries. It also saw the creation of Nuclear Waste Services, bringing together LLW Repository Limited and Radioactive Waste Management Limited (RWM). It was also a successful year of operations for our transport division, Nuclear Transport Solutions, which undertook substantial ship and rail transport deliveries, with revenues of £160 million.

Following an announcement by the UK Government and subsequent directions to the NDA issued by UK and Scottish Ministers, we can also look forward to the transition of AGR sites into the group in the future as they enter their decommissioning phase. This will increase the scope of our mission and create opportunities for synergies.

Our group-wide Integrated Financial Framework (IFF) delivered some important milestones, through a series of continuous improvement workstreams focused on people, reporting, controls and risk. A new enterprise resource planning system has been implemented, which is the first step in the modernisation of our suite of management information systems.

Improved performance reporting has also been delivered for use by the Group Leadership Team, NDA Board and Government, alongside improved investment review processes and delegations. We are now into our second year of intake to our Finance, Audit and Risk graduate scheme, and we have launched our first Finance apprentice scheme. This will help to ensure we have the right skills and resources in place to support the group as we look forward.

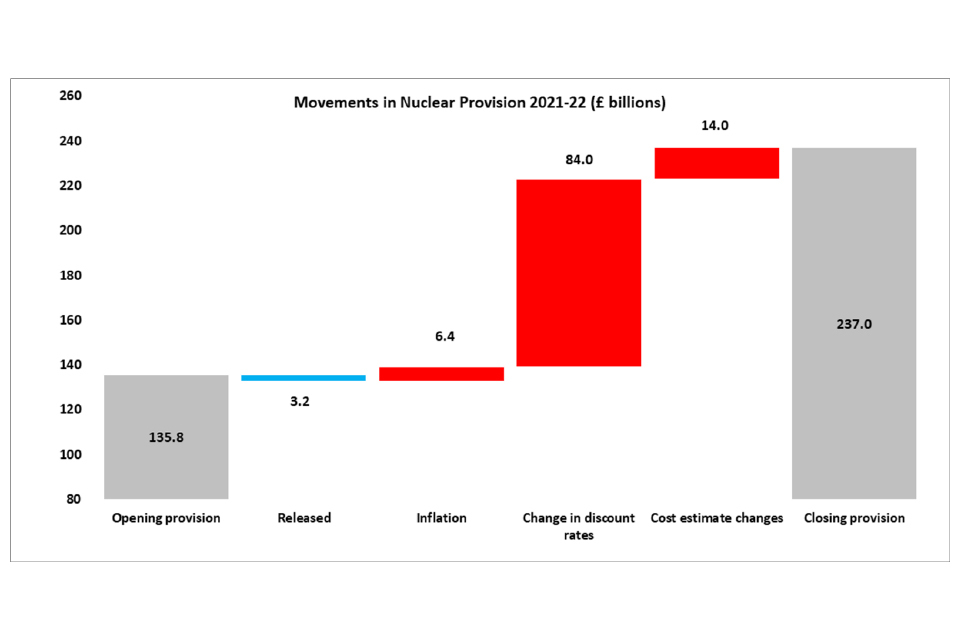

Since the year end, we have continued to see an increase in rates of inflation. We are reviewing the evolving impact on our spend forecasts and how this may impact on future assessments of our nuclear provision.

Performance against financial targets

| Limit/expected | Actual | |

|---|---|---|

| Expenditure | £3.391bn | £3.472bn |

| Income | £0.600bn | £0.714bn |

| Funding | £2.791bn | £2.758bn |

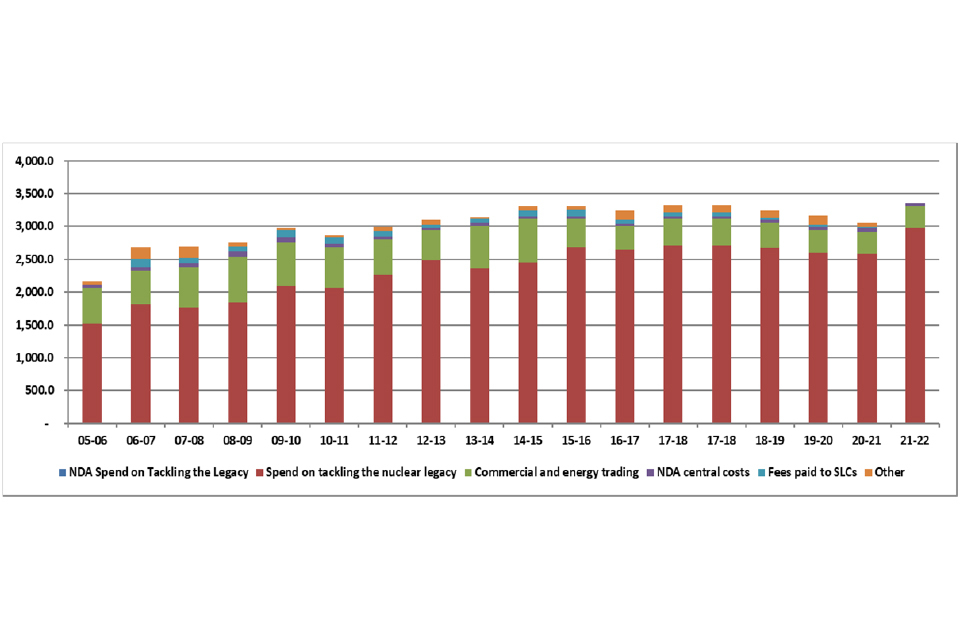

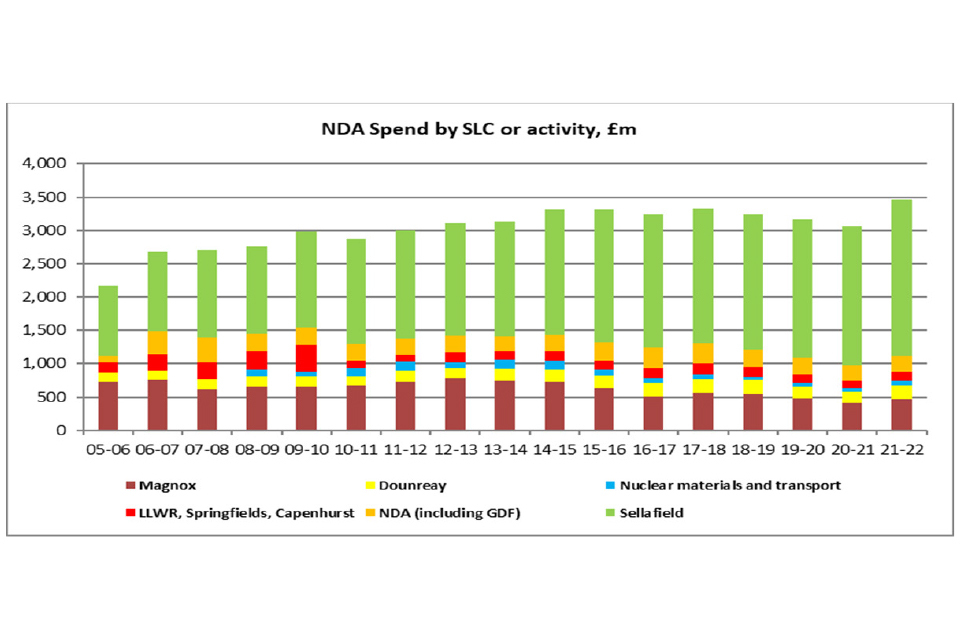

How £3.472bn funding was used to deliver the NDA mission:

| Subsidiary: | Amount: |

|---|---|

| Sellafield | £2.353bn |

| Magnox | £466m |

| Dounreay | £204m |

| LLWR | £89m |

| RWM | £80m |

| INS | £71m |

| Springfields and Capenhurst | £49m |

| Other | £160m |

Other costs:

| Costs: | Amount: |

|---|---|

| Industry costs | £119m |

| Energy costs | £5m |

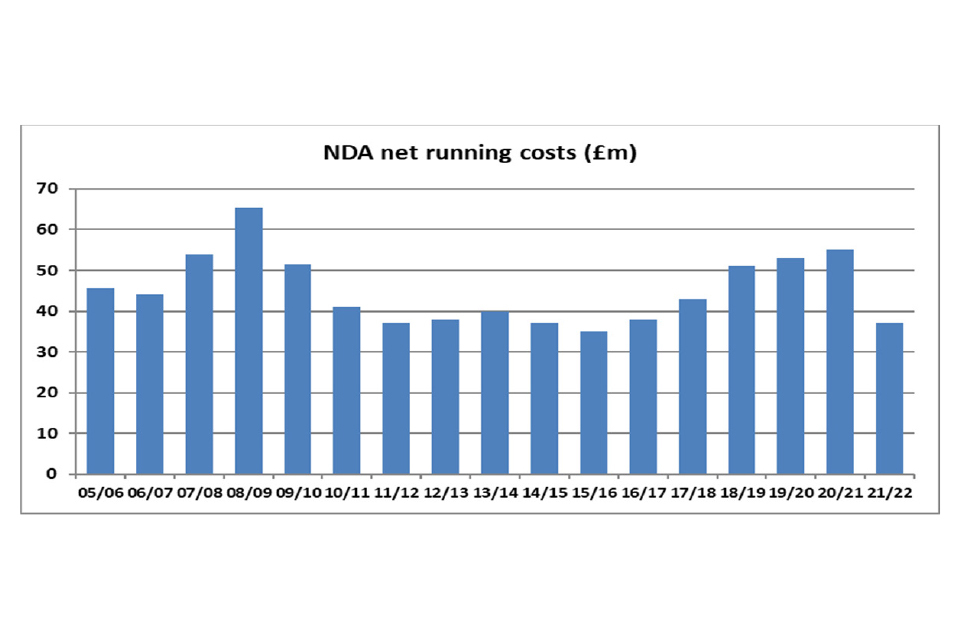

| NDA running costs | £36m |

| Total | £160m |

Breakdown of £714m NDA actual income:

| Income source: | Amount: |

|---|---|

| Reprocessing/waste contracts | £289m |

| Spent fuel management | £254m |

| Energy sales | £11m |

| Nuclear materials and transport | £70m |

| Other | £90m |

A total of £3.5 billion spent in the year

A net total of £2.8 billion funded by Government**

£0.7 billion of income

NDA's own running costs are 1.1% of overall group budget at £36 million

The NDA and our mission

The NDA is charged, on behalf of Government, with the mission to clean up the UK's earliest nuclear sites safely, securely and cost effectively. We're committed to overcoming the challenges of nuclear clean-up and decommissioning, leaving the 17 nuclear sites ready for their next use. We do this work with care for our people, communities and the environment, with safety, as always, our number one priority.

What we do

As owners of one of the largest nuclear decommissioning and remediation programmes in Europe, our main priority is to lead the work across the NDA group and develop the strategy for how it should be carried out. We also play an important role in supporting Government's aspiration for the UK to be a leader in the civil nuclear sector within our remit and areas of expertise. Our strategy is continually evolving and is updated every five years. Our fourth iteration was published in March 2021. We strive to deliver best value for the UK taxpayer by focusing on reducing the highest hazards and risks, while ensuring safe, secure, and environmentally responsible operations at our sites. We seek ways to reduce the level of public funding by generating revenue through our commercial activities.

How we're set up

We're a non-departmental public body created by the Energy Act 2004 to lead the clean-up and decommissioning work at our 17 sites. We're sponsored and funded by the Department for Business, Energy and Industrial Strategy (BEIS). Our plans for cleaning up the sites are approved by BEIS and Scottish ministers, who provide a framework for us. We have offices across the UK, in Cumbria, Warrington, Dounreay, Harwell and London and employ just over 350 permanent staff. As a non-departmental public body, the NDA supports a wide range of Government policy developments such as the Ten Point Plan for a Green Industrial Revolution with intellectual thought, physical assets and research and development.

Our sites

The UK's nuclear landscape began to take shape in the post-war period and has evolved over many decades. The focus during the Cold War arms race was on producing material for Britain's nuclear deterrent. When the nation's priorities shifted, facilities were turned into nuclear power stations, and, from1956 onwards, the UK's first nuclear power stations began generating electricity for homes and businesses. Fuel fabrication and reprocessing plants were built from the 1970s to 1990s.

Our 17 sites reflect this legacy and include the first fleet of nuclear power stations, research centres, fuel-related facilities, and Sellafield, which has the largest radioactive inventory and the most complex facilities to decommission.

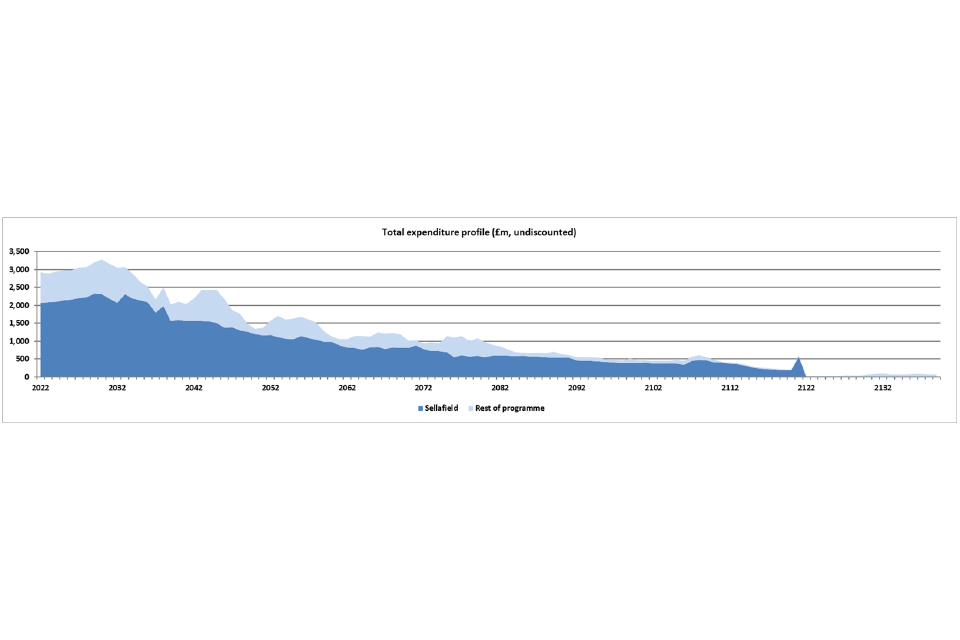

Current plans indicate it will take more than 100 years to complete our core mission of nuclear clean-up and waste management. The goal is to achieve the end state at all sites by 2125, with all land on Scottish sites expected to be de-designated by 2333.

map of the UK in green colour showing all 17 locations of our sites

The NDA group

Accomplishing this important work requires the best efforts of the entire NDA group.

Cleaning up and decommissioning the UK's nuclear legacy is a complex undertaking and relies on the full range of expertise and skills within the NDA group. Over the last few years, important decisions have been taken about how the organisations delivering our mission are managed, with the intention of simplifying structures and creating a stronger NDA group.

Last year we took the final steps to move to a group (subsidiary) operating model, away from the previous contractual, parent body organisation approach. Dounreay Site Restoration Limited (DSRL) became an NDA subsidiary in April 2021, followed by Low Level Waste Repository Limited (LLWR) in July. These follow similar changes for Sellafield in 2016 and Magnox in 2019.

Moving to a group model is enabling us to make further improvements and simplify structures. In January 2022 Radioactive Waste Management (RWM) and LLWR came together into one waste organisation, Nuclear Waste Services. We have also announced our intention to join Dounreay with Magnox, subject to regulatory agreement.

The NDA group will then be made up of the NDA and its four key component parts: Sellafield, Magnox with Dounreay, Nuclear Waste Services and Nuclear Transport Solutions. Our other subsidiaries include Rutherford Indemnity, NDA Archives, NDA Properties and Energus.

With the finalisation of this structure comes the ability to introduce group-wide policy statements in a number of areas. There are nine policy statements and the NDA and its operating companies will meet the requirements of these through their individual arrangements:

- Ethics

- Sustainability

- Socio-economics

- Health and safety

- Environment

- Security

- Accounting

- Value for money*

- Diversity and inclusion*

The scope of the NDA group is set to grow, following arrangements agreed by the Government and EDF Energy for decommissioning Britain's seven advanced gas-cooled reactor (AGR) stations.

The AGRs will reach the end of their operational lives over the next 10 years and, as they come offline, their ownership will transfer to the NDA for decommissioning, utilising the expertise of our group and significantly Magnox and its experience in decommissioning the older Magnox stations.

*Still under development

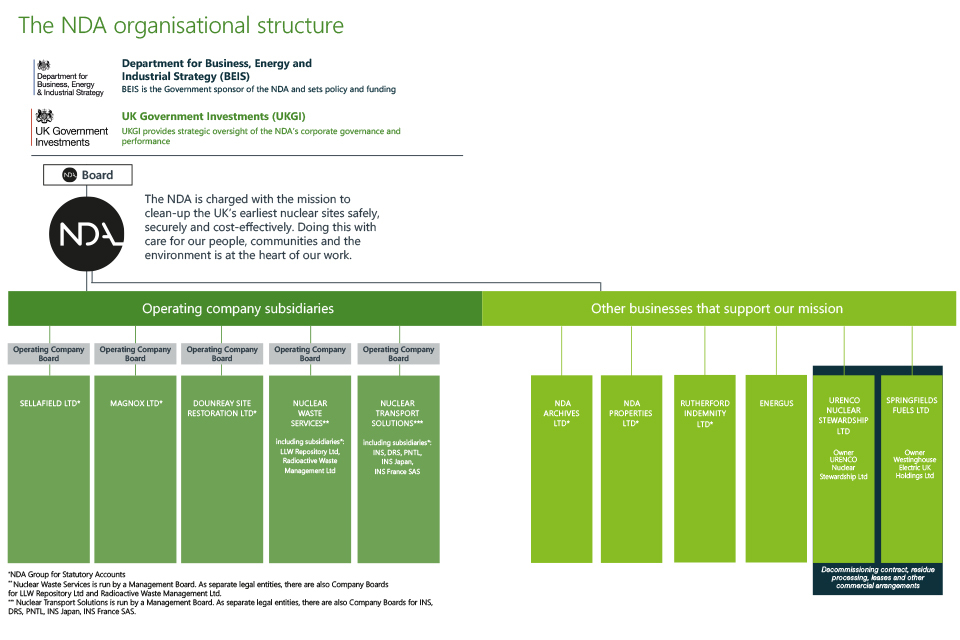

The NDA organisational structure

A full organisational structure showing NDA Board reporting to BEIS and UKGI. Then underneath are our operating company subsidiaries (each have their own Board) and other businesses that support our mission.

Our strategic approach and themes

Our Strategic themes

We use five strategic themes to describe all the activities needed to deliver the NDA's mission.

The first four strategic themes, Spent Fuels, Nuclear Materials, Integrated Waste Management and Site Decommissioning and Remediation relate directly to our clean-up and decommissioning work and are known as driving themes.

The fifth theme describes the important activities needed to support the delivery of our mission and is known as critical enablers. The diagram below demonstrates how they interplay.

Currently, the most urgent task is dealing with our sites' highest-hazard materials, spent fuel, nuclear materials and highly radioactive wastes.

Once the inventory has been made safe, the redundant nuclear facilities can be dismantled and demolished.

Integration of our strategies

Illustrative flowchart of how the strategic themes integrate and ultimately deliver the end mission

Our driving themes and strategic outcomes

Across our four driving themes, we break our mission down into 47 strategic outcomes. These outcomes represent the significant pieces of work that have to be achieved to deliver our mission.

In March 2021 we published our new strategy. As a consequence, we have revised some detail for a number of outcomes to ensure they continue to align with our strategic approach.

Increasingly, we're building a more accurate picture of the work that's been completed across our 47 outcomes and that which is still left to do.

The percentage figures in the charts opposite show how much of the work has been achieved in each outcome so far.

Overall, good progress continues to be made across our mission as we safely manage our nuclear inventory and reduce the risks associated with it. Last year saw more spent fuel of all types placed in interim storage.

More strategic outcomes will be achieved with the closure of the reprocessing facilities and the building of new modern treatment and storage facilities to manage nuclear material and waste, ultimately working towards the final disposal of nuclear inventory and the release of land for other economic uses.

Spent Fuels

Strategic outcomes 1-15

Our strategy defines our approach to managing the diverse range of spent fuels for which we are responsible, which are divided into Magnox, Oxide and Exotic. Once spent fuel is removed from a reactor, it is stored in a pond or dry store until it can be dispatched to Sellafield.

Reprocessing extracts materials (plutonium and uranium) that could potentially be re-used and also generates highly radioactive wastes, or fission products.

The NDA's strategy is to bring the reprocessing programme to an end. The Thermal Oxide Reprocessing Plant (THORP) has already closed and the Magnox reprocessing plant will follow. All remaining spent fuel will be safely stored until a permanent solution for disposal is available.

Our spent fuel work is separated into 15 strategic outcomes that we must deliver, outlined below.

Spent Magnox Fuel:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 1. All Magnox sites defueled | 100% | Sellafield, Magnox and NTS |

| 2. All legacy Magnox fuel retrieved | 25% | Sellafield |

| 3. All Magnox fuel reprocessing completed | 96% | Sellafield |

| 4. All remaining Magnox fuel in interim storage | 25% | Sellafield |

| 5. All remaining Magnox fuel disposed | 0% | Sellafield and NWS |

Spent Oxide fuel:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 6. All EDF Energy oxide fuel received | 60% | Sellafield and NTS |

| 7. All legacy oxide fuel retrieved | 100% | Sellafield |

| 8. All oxide fuel reprocessing completed | 100% | Sellafield |

| 9. All remaining oxide fuel in interim storage | 56% | Sellafield |

| 10. All remaining oxide fuel disposed | 0% | Sellafield and NWS |

Spent Exotic fuel:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 11. All exotic fuel defueled | 73% | Sellafield and Dounreay |

| 12. All exotic fuel consolidated | 62% | Sellafield, Dounreay and NTS |

| 13. All exotic fuel reprocessing completed | 93% | Sellafield |

| 14. All remaining exotic fuel in interim storage | 84% | Sellafield |

| 15. All remaining exotic fuel disposed | 0% | Sellafield and NWS |

Nuclear Materials

Strategic outcomes 16-25

Our strategy defines our approach to dealing with the inventory of uranics and plutonium currently stored on some of our sites. These nuclear materials are by-products from different phases of the fuel cycle, either manufacturing or reprocessing. All nuclear materials must be managed safely and securely, by either converting them into new fuel or immobilising and storing them until a permanent UK disposal facility is available.

All of our plutonium is stored at Sellafield. Our uranium is located at a number of our sites and we are continuing to consolidate it at sites which we consider are best suited to its management.

Our nuclear materials work is separated into 10 strategic outcomes that we must deliver, outlined below.

Plutonium:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 16. All plutonium produced | 97% | Sellafield |

| 17. All plutonium consolidated | 100% | Sellafield, Dounreay and NTS |

| 18. A: All plutonium repacked in long-term storage | 0% | Sellafield |

| 18. B: All cans not suitable for extended storage repackaged | 35% | |

| 19. All plutonium in interim storage | 0% | Sellafield |

| 20. All plutonium reused or disposed | 0% | Sellafield and NWS |

Uranics:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 21. All uranium produced | 94% | Sellafield |

| 22. All uranium consolidated | 80% | Sellafield, Magnox Dounreay, NTS, Capenhurst and Springfields |

| 23. All uranium treated | 4% | Capenhurst and Springfields |

| 24. All uranium in interim storage | 61% | Sellafield and Capenhurst |

| 25. All uranium reused or disposed | 3% | Sellafield, NWS and Capenhurst |

Case study - Nuclear Materials

Major Sellafield construction making progress

| MISSION DELIVERY Helping us to deliver strategic outcome: 19 |

Sellafield has seen progress with a large construction project this year, the Sellafield Product and Residue Store Retreatment Plant (SRP).

A huge slab has been constructed, forming the ground floor of the SRP, which will provide safe storage of special nuclear material.

The SRP pour marked a hefty 8,374m3 of concrete laid, reinforced with 1,230 tonnes of steel.

When finished the facility will be an integral part of our mission to create a clean and safe environment for future generations.

Find out more about this case study and meet some of those involved in the project in our ARAC case study blog.

Integrated Waste Management

Strategic outcomes 26-39

Our strategy considers how we manage all forms of waste arising from operating and decommissioning our sites, including waste retrieved from legacy facilities. Managing the large quantities of radioactive waste from electricity generation, research, the early defence programme and decommissioning is one of the NDA's biggest challenges. Some of this radioactive waste is in a raw (untreated) form, some has been treated and is being interim stored and, in the case of low level waste, some has already been permanently disposed of.

Retrieving, treating and interim storing the radioactive waste from Sellafield's four legacy ponds and silo facilities is the NDA's highest priority. Our Integrated Waste Management (IWM) work is separated into 14 strategic outcomes that we must deliver, outlined below.

Low Level Waste:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 26. All LLW produced | 7% | Sellafield, Magnox Dounreay, NWS, Capenhurst and Springfields |

| 27. All LLW treated - to enable diversion or reuse | 9% | Sellafield, Magnox Dounreay, NWS, NTS, Capenhurst and Springfields |

| 28. All waste suitable for disposal in NDA facilities | 15% | Sellafield, Magnox Dounreay, NWS, NTS, Capenhurst and Springfields |

| 29. All waste suitable for permitted landfill disposed | 4% | Sellafield, Magnox Dounreay, NWS, NTS, Capenhurst and Springfields |

Intermediate Level Waste:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 30. All ILW produced | 33% | Sellafield, Magnox Dounreay, NWS, Capenhurst and Springfields |

| 31. All legacy waste retrieved | 9% | Sellafield and NWS |

| 32. All ILW treated | 10% | Sellafield, Magnox Dounreay, Capenhurst and Springfields |

| 33. All ILW in interim storage | 15% | Sellafield, Magnox Dounreay, Capenhurst and Springfields |

| 34. All ILW disposed | 0% | Sellafield, NWS and NTS |

High Level Waste:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 35. All HLW produced | 71% | Sellafield |

| 36. All HLW treated | 74% | Sellafield and NTS |

| 37. All HLW waste in interim storage | 83% | Sellafield and NTS |

| 38. All overseas HLW exported | 11% | Sellafield and NTS |

| 39. All HLW disposed | 0% |

Case study - Integrated Waste Management

Chapelcross first active waste package in storage

| MISSION DELIVERY Helping us to deliver strategic outcome: 33 |

May 2021 saw the first active waste package placed in a storage facility at Magnox's Chapelcross site, achieving a major step forward for the site's waste management and clean-up programme.

The package, made of ductile cast iron, holds Intermediate Level Waste (ILW) from the site's former cooling ponds.

It was sent to an on-site interim storage facility which can hold more than 700 waste packages safely and securely for over 120 years.

The achievement is the first step to safely securing all the ILW generated during Chapelcross' operations, until the Scottish Government Higher Activity Waste Policy identifies final storage and disposal options for Scotland's ILW.

High hazard waste retrievals progress at Sellafield

| MISSION DELIVERY Helping us to deliver strategic outcome: 31 |

The first of three machines that will grab waste out of the Magnox Swarf Storage Silo (MSSS) at Sellafield moved into position in May 2021.

The 350-tonne Silo Emptying Plant (SEP2) machine was moved over three days across specially installed rails at the top of the silo from compartment six to compartment ten, where the first waste will be removed.

Shifting the equivalent weight of three blue whales along the metal rails was done by hand using twin tirfors, which are effectively a horizontal block and tackle arrangement.

It allowed preparations to begin for active commissioning and the upcoming start of retrievals, a major step towards cleaning up the most important hazard and risk reduction job on the site.

Major construction project milestone

| MISSION DELIVERY Helping us to deliver strategic outcome: 32 |

Sellafield site's Site Ion Exchange Effluent Plant (SIXEP) Continuity Project (SCP) has marked the first concrete pour on its construction site.

The SCP will help to ensure the continued operation of SIXEP.

SIXEP treats and makes safe the effluent created by risk reduction activities in the First Generation Magnox Storage Pond and Magnox Swarf Storage Silo. Completion of this work will enable Sellafield to continue treating this waste for decades to come.

Find out more about these case studies and meet some of those involved in our ARAC case study blog.

Site Decommissioning and Remediation

Strategic outcomes 40-47

Our strategy defines our approach to decommissioning redundant facilities and managing land quality in order that each site can be released for its next planned use.

After the buildings on our sites have been decommissioned, decontaminated and dismantled, the land will be cleaned up to allow it to be released for other uses. At that point, its ownership would transfer to the new user of the land.

The NDA is currently assessing alternatives for the final stages of decommissioning that could lead to earlier release of land, continued employment and opportunities to reuse the land.

Our site decommissioning and remediation work is separated into eight strategic outcomes that we must deliver, outlined below.

Operational and planned:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 40. All planned new buildings operational | TBD | Sellafield, Magnox Dounreay, NWS, and Capenhurst |

| 41. All buildings primary function completed | 38% | Sellafield, Magnox Dounreay, NWS, and Capenhurst |

Decommissioning and demolition:

| Strategic outcome: | Percentage complete by 2022: | Associated sites: |

|---|---|---|

| 42. All buildings decommissioned | 21% | Sellafield, Magnox Dounreay, NWS, and Capenhurst |

| 43. All buildings demolished or reused | 19% | Sellafield, Magnox Dounreay, NWS, and Capenhurst |

| 44. All land delicensed or relicensed | 9% | Magnox Dounreay and NWS |

| 45. All land in End State: all planned physical work complete | 43% | Sellafield, Magnox Dounreay, NWS, Capenhurst and Springfields |

| 46. All land demonstrated as suitable for reuse | 9% | Sellafield, Magnox Dounreay, NWS, Capenhurst and Springfields |

| 47. All land dedesignated or reused | 9% | Sellafield, Magnox Dounreay, NWS, and Capenhurst |

Case study - Integrated Waste Management

Sellafield skyline change

| MISSION DELIVERY Helping us to deliver strategic outcome: 42 43 |

The removal of a huge diffuser at the top of the Windscale Pile Chimney marked a key milestone for decommissioning work at Sellafield at the end of 2021.

The diffuser gave the 125-metre chimney its distinctive top-heavy appearance and has been part of the Cumbrian landscape for nearly 70 years.

Demolition work started in December 2018, with the first block removed in January 2019. It had to be cut up in-situ, more than 100 metres above ground.

Sections were then transported separately down to the ground, requiring 200 moves to clear the entire block. The achievement has also removed the seismic risk associated with the chimney. Work will now start on demolishing the chimney barrel.

The removal of this iconic part of such a large structure, and the progress made on the demolition work, marks an important achievement in our mission to clean up the UK's earliest nuclear sites.

Dounreay decommissioning success

| MISSION DELIVERY Helping us to deliver strategic outcome: 42 43 |

World-first innovation helped solve a significant decommissioning challenge at Dounreay, with 1,810 litres of radioactive sodium coolant removed from a shallow heel pool at the base of a reactor vessel within the site's Prototype Fast Reactor (PFR).

Two solutions were developed to remove the hazard. The first was the design and installation of 11 external heating elements to melt the sodium to allow it to be pumped out of the hard-to-reach pool. The second, was the creation of an in-reactor pump that was remotely manoeuvrable to reach the sodium pool.

Taking away the sodium heel pool removed a major obstacle to allow for the next stage of reactor decommissioning.

The technical and practical challenges to overcome were considerable. The project required input from all the disciplines and specialists available on site, as well as support from the supply chain and it could not have been delivered without this collaborative approach.

The next phase will be to decommission and remove the pump from the reactor and install the treatment system, which will use a water vapour/ nitrogen mixture, using purpose-built skids, to reach all the remaining sodium residues within the vessel and pipework. The project is on course to complete the clean-out work by the end of 2023.

Find out more about these case studies and meet some of those involved in our ARAC case study blog.

Our critical enablers

Our fifth strategic theme, critical enablers, covers the important activities needed to support the overall delivery of our mission.

Health, safety, environment and wellbeing

Safety is, and always will be, our number one priority. Our focus is to reduce the highest hazards and risks, while ensuring safe, secure and environmentally responsible operations at our sites. It's our duty to carry out this highly complex mission safely and efficiently while ensuring people and the environment are safeguarded at all times.

We aim to be recognised as a leading environmental remediation organisation. Our environment strategy is maturing and we are working towards a low carbon future and improved environmental outcomes to ensure that our mission outcomes are delivered in an environmentally sustainable manner.

Our strategy for health and wellbeing is to provide a supportive working environment across the NDA group by actively promoting and working with our employees and trade unions (see People) to develop and implement policies and standards with employee health and wellbeing at the forefront.

Sustainability

Our sustainability strategy is also maturing and its emphasis will change over time as our mission progresses. In the short-term, we are making specific efforts to measure our carbon footprint consistently across the NDA group and determine the impact of mission delivery to identify additional opportunities for decarbonisation. In the medium to long-term, ongoing collaboration on our technical grand challenges programme will generate further opportunities to improve the sustainability of our mission delivery.

Our recently published strategy sets out our ambition and focuses on delivering sustainable outcomes through decommissioning practices, with care for the environment, through positive and sustainable socio-economic outcomes for nuclear communities. For more information on sustainability at the NDA see page 66.

Security and resilience

Security is a fundamental element of all civil nuclear operations. We are committed to providing proportionate security and resilience solutions throughout the decommissioning lifecycle.

We recognise the many threats that face the NDA and its supply chain, from cyber attacks, data breaches and Information Technology (IT) system failures to extreme weather conditions, global pandemics and terrorism.

Our strategy brings the NDA operating companies together, taking a group-wide approach to security and resilience in order to improve collaborative working and, where appropriate, implement a shared approach to security arrangements.

Cyber security

Our cyber security strategy is well established, but requires further integration with organisational and operational planning across the whole NDA group. The nature of the threat continues to change and is so prevalent that we have established a group-wide programme (Cyber Security Resilience Programme) to ensure that we become an increasingly harder target for those who seek to do harm to our businesses or our sites. We will ensure that we can collectively protect ourselves, detect cyber incidents early and have mature response and recovery plans to minimise disruption to our core mission of nuclear clean-up and environmental restoration.

Research, development and innovation

Delivering our mission needs many 'never- done-before' solutions, which require significant innovative and novel engineering approaches.

Our strategy is to solve the challenging technical problems safely, while aiming to be more effective, efficient, and wherever possible, for less cost to the taxpayer. Research, development and innovation is essential to decommissioning our sites and is delivered in partnership with our supply chain.

Our strategy is established and effective, but our objective has evolved, and will continue to do so, in response to the priorities and challenges across the NDA group and the need for social acceptability of the NDA mission.

People

Our people are a significant strategic enabler to the delivery of our mission. We strive to create great and diverse places to work so that we can retain our people, maintain our skills base and recruit into our businesses.

Our people topic strategy has three main focus areas: ensuring we have the right people at the right time to deliver the mission; creating the culture in which our people can thrive; and working in partnership with our recognised trade unions and the broader stakeholder community.

Asset management

The NDA group has assets in all stages of the asset management lifecycle and we have a responsibility to secure safe, environmentally considerate and cost-effective asset management across the group.

To ensure our assets achieve this objective, we need a continually improving asset management approach informed by good practice that focuses on value for money mission delivery.

Our strategy continues to address the enduring risk that poor asset performance adversely impacts our mission. We will further develop our strategy for new and existing assets and look to obtain through-life asset management plans that fully integrate new assets into current operations.

Supply chain

A diverse, ethical, innovative, and resilient supply chain is essential to delivering the NDA mission and provides value for money for the UK taxpayer.

With our one NDA way of working, we are now uniquely placed to identify synergies across the group and continue to perform collaborative procurement activities.

We continue to broaden the routes to market and our supply base for the NDA group. A more diverse and sustainable range of suppliers with nuclear experience will provide greater resilience and access to innovative solutions for safe, secure and cost-effective decommissioning.

Information governance

The NDA owns most of the information produced and managed by the NDA group. We aim to support all businesses Information Governance topic aims to support all businesses within the group to comply with statutory and regulatory requirements and realise the value of these assets to enable delivery of the NDA mission. The first step has been achieved by embedding group- wide policies, procedures and guidance together with key centralised infrastructure consisting of an archive facility (Nucleus), a secure collaboration platform and a secure private cloud.

Socio-economics

We have a responsibility to support the maintenance of sustainable local economies for communities living near NDA sites and, where possible, contribute to regional economic growth.

The NDA group's socio-economic strategy is built upon supporting sustainable incomes, resilient economies and thriving communities. Our approach is to work locally. This means working in partnership with local authorities and organisations to better understand local needs.

In supporting our local communities, our primary strategy is to ensure that decisions that direct the delivery of our decommissioning mission support local sustainable and inclusive economic growth and greater social value wherever possible. To ensure our local communities can attract future economic activity, we prioritise support and fund projects which are consistent with our responsibilities to the UK taxpayer. We work in partnership with others to increase the impact of our funding.

Public and stakeholder engagement

Open and transparent engagement is key to building support, confidence and trust among all our stakeholders and we continue to encourage two-way dialogue about strategic direction and when consulting on statutory documents. The open dialogue we have with our stakeholders has encouraged the discussion of difficult and complex issues. We are committed to listening to and integrating a diverse range of views and

giving confidence to stakeholders that their views and input will be considered fully as part of this engagement, helping to drive and influence progress in delivering the NDA's mission. This would not be possible without the support of our stakeholders and the trust we have built with communities and local authorities close to our nuclear sites.

Transport and logistics

The effective delivery of the NDA mission relies on our ability to transport radioactive materials (for example, spent fuel, radioactive waste, contaminated items) and bulk materials (e.g. spoil, concrete, raw materials) to, from and between our sites.

In 2021, we brought together the extensive transport and logistics expertise of our subsidiaries, INS and DRS into a single transport division, Nuclear Transport Solutions (NTS) to support the NDA group and provide value beyond the NDA mission, both in the UK and overseas.

NTS specialises in the operational, commercial, engineering, legal and regulatory expertise that underpin nuclear transport and logistics operations.

International relations

The NDA's operating environment is inherently international and the risks we manage transcend national boundaries. The materials in our inventory have safety and security considerations on a global scale, and the policy framework in which our strategy is developed is underpinned by international standards and guidance.

The nuclear decommissioning market is growing globally and we will continue to use our experience and relationships to enhance the reputation of the UK nuclear industry, sharing our experience and skills, accessing peer reviews, and conducting joint technology development projects.

To find out more about our critical enablers please refer to our revised Strategy.

Sustainability at the NDA

Sustainability is a new critical enabler.

In 2021 the NDA group's Sustainability Policy and Strategy was approved with demonstrable influence and integration of the agreed approach across the operating companies.

Sustainability at the NDA is structured across four legacies; decommissioning, environmental, socio- economic and cultural.

Vision

Our group sustainability vision is to be recognised as a leader in transforming nuclear legacies into opportunities for local, regional and national sustainable development.

Definition

The NDA group's sustainability definition is to create value through nuclear decommissioning - at pace, affordably, with participation and creatively.

While an important part of sustainability is about protecting and enhancing the environment, as laid out in our environmental legacy, it also means protecting and enhancing the lives of people, creating sustainable local and regional economies, and creating an impact conscious and future focused mindset. In our decisions and actions, we have a responsibility to transform the legacies we have inherited to those we wish to leave behind.

A governance structure that reaches all levels within the NDA group is fundamental to achieving the vision. The creation of an NDA Board Sustainability and Governance Committee and engagement with the Group Leadership Team will enable the highest levels of leadership to expedite and achieve progress.

Key Performance Indicators (KPIs)

Sustainability KPIs have been defined in consultation with our functions and operating companies. They are intended to ensure meaningful progress across our four legacies, covering areas such as procurement, emission reductions, socio-economic spend and cultural changes.

The NDA has also recently launched mandatory sustainability training for its staff. This will help develop a culture of sustainability leadership, with key objectives to raise awareness and understand how the NDA's approach can be used in varying roles.

See pages 263 to 279 for more information on sustainability at the NDA and our performance this year.

Case study - Critical enablers – Sustainability

Recycling success for nuclear vessel

The decommissioning of Oceanic Pintail has set the standard for others to follow after 100% of the 3,865-tonne specialist nuclear vessel was recycled.

Nuclear Transport Solutions, which operated Oceanic Pintail, set Dales Marine Services the challenge of ensuring the world-class cargo vessel was reused.

Applying a number of innovative techniques, every part of the NDA-owned vessel was recycled in a UK first.

The achievement supports the NDA groups sustainability ambitions.

On track to cut plastic pollution

Nuclear Waste Services is playing its part in reducing waste plastic by substituting an additive in the tarmac used to resurface the perimeter track at the Low Level Waste Repository site.

In every tonne of asphalt used for resurfacing, 3kg of bitumen are replaced with the equivalent of the plastic additive.

This additive is composed of non-recyclable waste plastics which would have previously been destined for landfill.

Some 12,840kg of the additive will be used in the project. A single use plastic bag weighs around 4.5g, so the amount of recycled plastic equates to 2,853,333 single use bags that will now no longer reach landfill.

The Well Project

Western Excellence in Learning and Leadership (WELL) was a project co-designed by Sellafield Ltd, the NDA, Cumbria County Council and school heads from the Cumbria Alliance of System Leaders. It aims to close the disadvantage attainment gap, raise pupil achievement, improve the quality of teaching, and enhance students' health and wellbeing in Cumbria. Highlights include:

- 118 schools have implemented proven interventions to support resilience and learning for disadvantaged students

- 43 schools have completed youth mental health first aid training

- 40 schools now have staff qualified as Emotional Literacy Support Assistants

- 71 schools were provided with surplus IT equipment to support disadvantaged learners to access material through the lockdown

Find out more about these case studies and meet some of those involved in our ARAC case study blog.

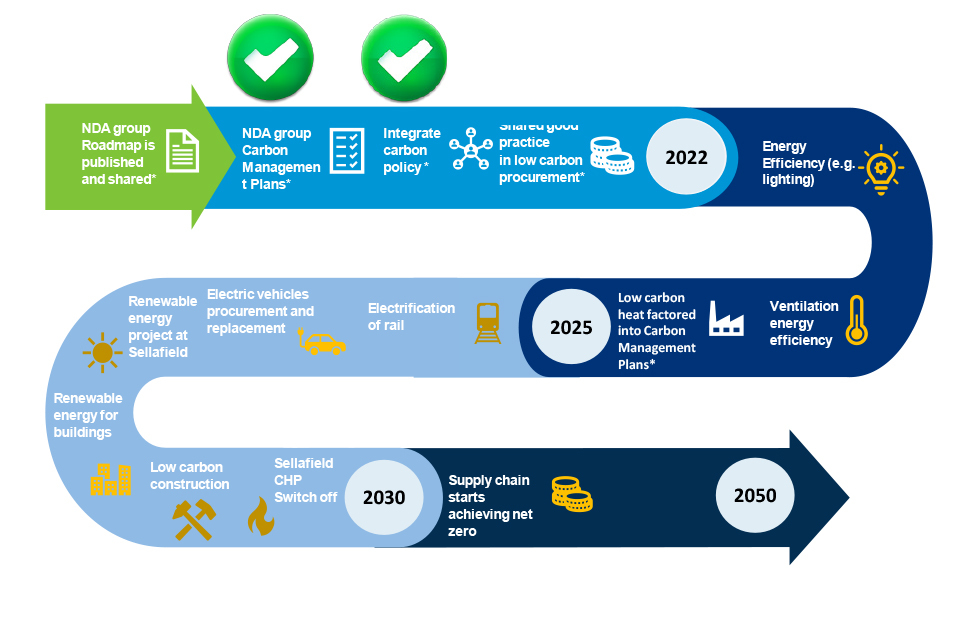

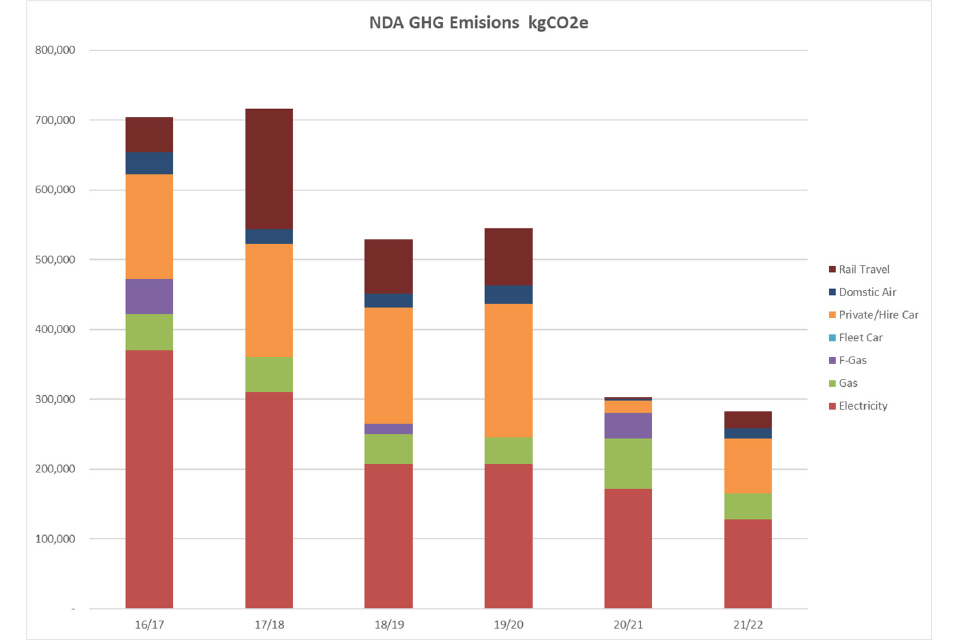

Carbon net zero journey

We have published an NDA group Carbon Policy setting out our commitment to achieve carbon net zero by 2050 and how this will be delivered.

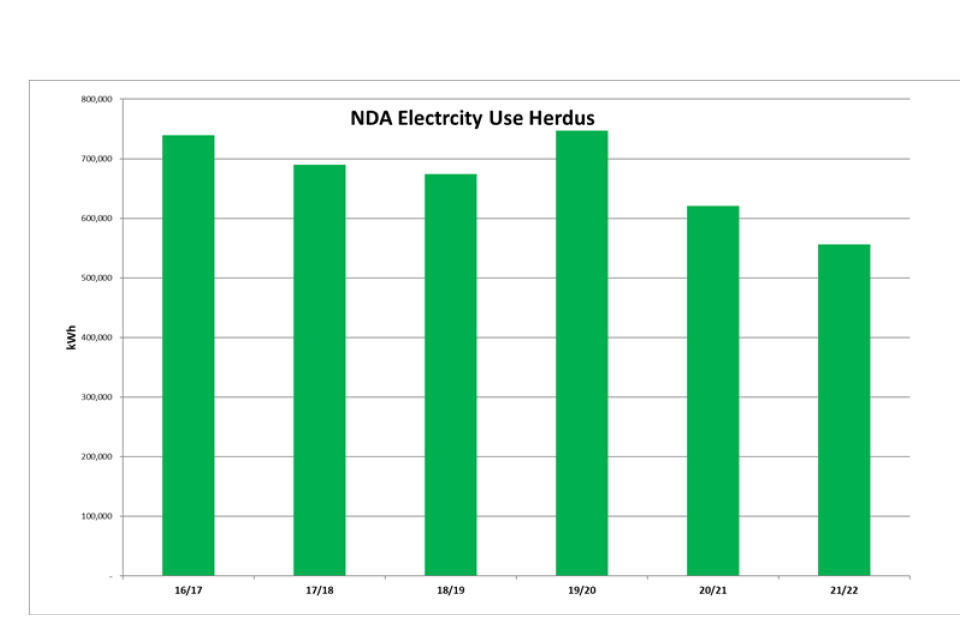

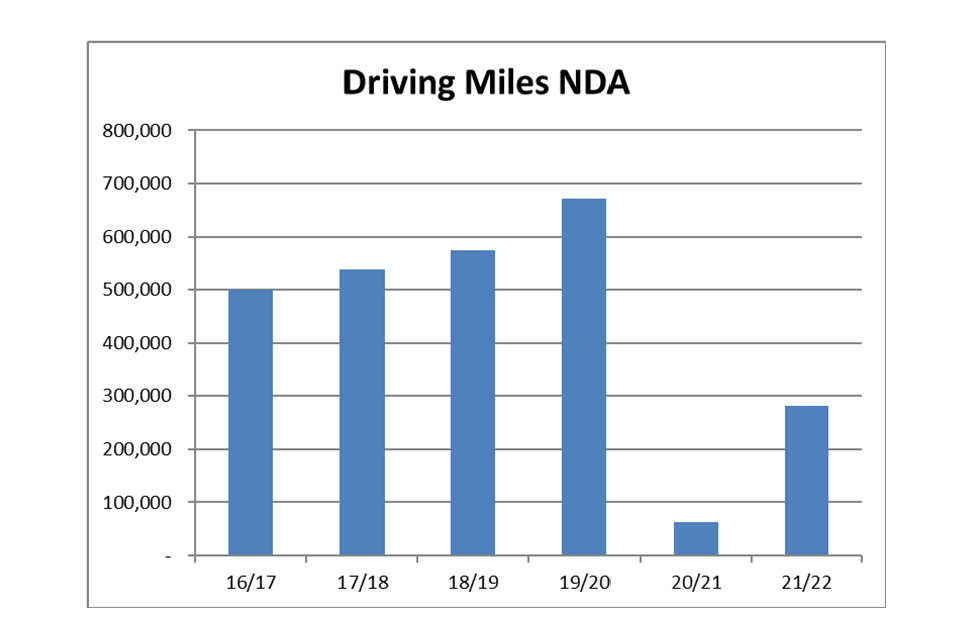

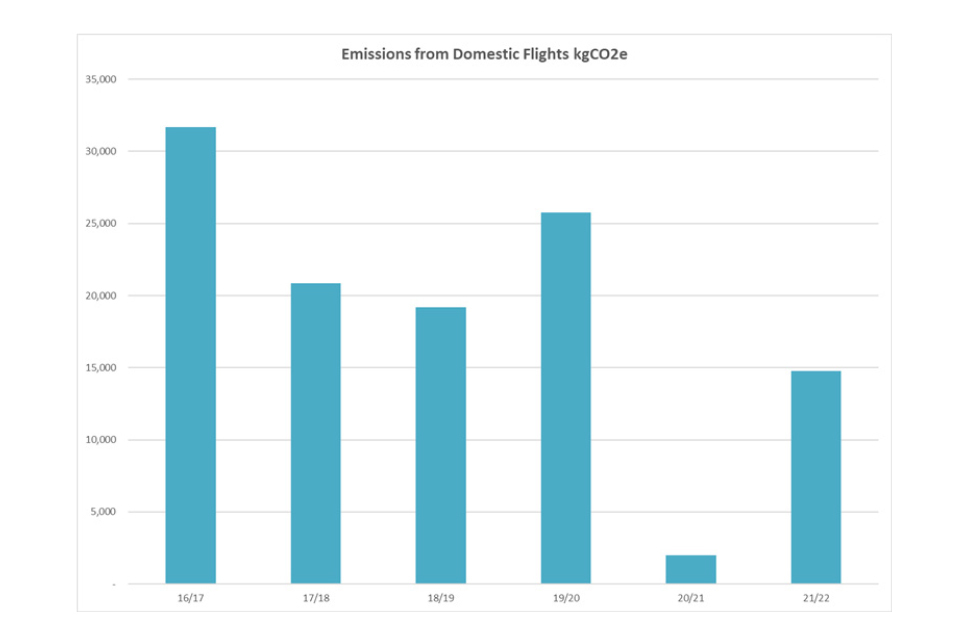

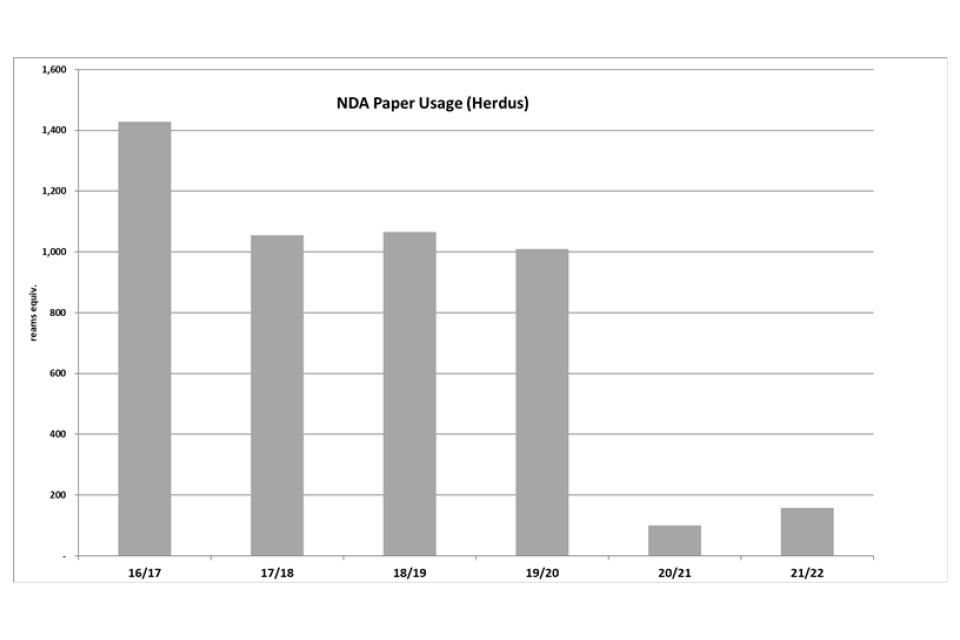

Base and stretch carbon emission reduction targets were set for 2021/22 and, while data is still being verified, most operating companies have met both targets – reducing the NDA group's scope one and two carbon footprint by around 15% (see page 267 for a description of these). This has been achieved because of positive changes in operational practices, as well as some continued impact from COVID-19 and energy generation plant outages. It compares to a reduction of around 16% in the previous year, where the impact of COVID-19 was much larger.

In addition, all operating companies have developed carbon management plans. There has been a

focus on energy audits to identify opportunities for reductions and efficiencies. Magnox in particular has exceeded its target and audited all its sites.

Challenging targets have been agreed with all operating companies for the year ahead and we are also ensuring that carbon emissions are now a consideration in our decision making and procurement process, with business case guidance updated to ensure this.

a visual representation of the NDA group carbon net zero roadmap showing the key dates from now until 2050 on a winding arrow.

Case study - Critical enablers - Socio-economics

Multi-million pound upgrades transform Scrabster Harbour

The latest port development at Scrabster Harbour, close to the Dounreay site in Caithness, was officially opened in December 2021.

St Ola Pier has been at the heart of a major development project to increase capacity and accommodate larger vessels at the port on the north coast of Scotland.

The investment will allow Scrabster to access new opportunities, including offshore energy and cruise ships.

The project has cost a total of £18.9 million, with NDA providing funding support of £5 million along with its partner Highlands and Islands Enterprise (HIE).

The opening of the pier is an example of our socio-economic strategy in action, helping Scrabster Harbour to develop a range of new opportunities and make a significant contribution to the long-term sustainability of the local economy.

Case study - Critical enablers - Equality, Diversity and Inclusion

NDA group inclusion strategy launched

A new NDA group inclusion strategy 2021-2025 has been launched.

Building on the foundations laid since our initial Equality, Diversity, and Inclusion strategy was published in 2018, the strategy focuses on five key areas and supporting commitments that we'll prioritise across the group as we move from foundation building to embedding inclusion into the DNA and culture of our organisations.

The strategy also includes goals against which we'll measure ourselves and use to report progress. The themes are:

- Inclusive culture and leadership

- Diverse workforce

- Embedding inclusion into our employee lifecycle

- Respect, dignity and employee voice

- Flexibility, agility and smarter working

Building great places to work remains a key part of our group vision. Creating workplaces where everyone feels respected, included and able to perform at their best, is not only the right thing to do but will help us to deliver our mission.

Case study - Critical enablers - Group Structure

Nuclear Waste Services launched

January 2022 saw the launch of Nuclear Waste Services (NWS) which brought together into one organisation the expertise of site operator Low Level Waste Repository Limited (LLWR), Geological Disposal Facility (GDF) developer Radioactive Waste Management Limited and the NDA group's Integrated Waste Management Programme.

NWS brings together a huge amount of expertise and capability in dealing with radioactive waste across the UK. It also maintains the commitments made to the GDF programme, to the Low Level Waste Repository, and to the communities we operate in.

The organisation builds on work delivered over many decades, while adding more essential services for customers in the nuclear energy, defence, industrial, medical, and research sectors.

By working more closely together we can enable better decision-making and help identify opportunities that can deliver wider benefits like earlier risk reduction at decommissioning sites or greater efficiency and lower costs to the taxpayer.

We announced our decision to create the new business at the start of 2021, as part of wider moves to simplify structures across the group and enhance capabilities. Its creation underlines our one NDA approach to working more collaboratively and efficiently to clean up the UK's earliest civil nuclear sites.

Case study - Critical enablers - Stakeholder Relations

Engaging on the Geological Disposal Facility

The Geological Disposal Facility (GDF) Programme team within Nuclear Waste Services is working with local communities to find a willing community and a suitable site to host a GDF.

In January 2021, Allerdale Working Group was launched and a Community Partnership was established a year later.

The Theddlethorpe GDF Working Group followed in October 2021 (Theddlethorpe, Lincolnshire), and a Community Partnership was formed in June 2022.

Community Partnerships unlock investment funding of up to £1 million a year for community projects that drive economic development, improve the environment and community well-being. This figure would rise to £2.5 million a year if site investigations progress to the point of deep borehole drilling.

The continued community engagement over the last 12 months follows the launch of the Copeland Working Group in November 2020, with0 two Community Partnerships for Mid Copeland and South Copeland subsequently established.

Case study - Critical enablers - Cyber Security

National Cyber collaboration

Working with partners from across the sector, the NDA's cyber security resilience programme held its fifth national cyber exercise Golden Osprey.

Working closely with Department for Business, Energy and Industrial Strategy, Office for Nuclear Regulation and the National Cyber Security Centre, the virtual event included an exercise scenario and simulation developed by a group of cross-sector experts.

To ensure an authentic scenario, the simulation exercise was supported by a host of industry organisations including, EDF Energy, Westinghouse Springfields Fuels, Urenco, Sellafield, Nuclear Transport Solutions, Dounreay, Atos, and the Civil Nuclear Constabulary.

The exercise provided the opportunity for experts to test and renew skills, improve technical knowledge and proficiency, and develop analytical and communications skills.

It was based on the concept of a sophisticated attack on critical infrastructure and the supply chains that support it.

Attended by over 20 different sector organisations from across the UK over the years, the one-of-a-kind exercise brings significant training and upskilling opportunities to the region.

Through on-site and remote visits, the exercise series has helped hundreds of people to better prepare and train for cyber incidents.

Case study - Critical enablers - Asset Management

Drones support decommissioning

Through group-wide collaboration, drones are now being used across a number of the NDA's sites to support decommissioning and clean-up work.

The unmanned aerial vehicles, that are remotely operated, are being used to get to places that are more difficult or hazardous for people to access.

The equipment is being used to perform maintenance activities every six months, supporting building condition monitoring and analysis to inform better asset management planning and plans.

The technology is helping Magnox's Wylfa site to inspect areas of internal integrity of its reactors that previously required scaffolding involving working at height and potential exposure to asbestos or radiation risk.

The use of drones is enabling better information to be provided that can be digitised to maintain building configuration and improve personnel safety. The Asset Management Digital Roadmap once implemented, will enable information from remote sensing capability like drones to be seamlessly managed. This will enable more effective decision making whilst removing workers from hazardous environments and allowing resources to be used elsewhere.

The new, more efficient approach to improved asset management is saving around £150,000 per year for this site alone with similar benefits being achieved across the Group.

Changing asset management practices to meet modern standards is a key commitment within Strategy 4.

Case study - Critical enablers - Research Development and Innovation

Robots helping to solve decommissioning challenges

A robot, called Lyra, has successfully surveyed an underground radioactive ventilation duct in Dounreay's redundant laboratories.

Following an initial trial at the Caithness site in 2020 in an inactive building and a limited survey in the laboratories that took place last year, a second-generation robot – Lyra - was developed, with an improved package of surveying measures including LIDAR (a laser detection system), multiple angle cameras, radiation probes and the ability to take swabs using a manipulator arm.

In February and April 2022, the Lyra robot, carried out a survey of the 140m-long underfloor duct which runs under the central corridor between the laboratories, providing useful information that will help to solve the challenge of decommissioning it.

The technology was developed by teams at Dounreay, the Robotics and Artificial Intelligence in Nuclear (RAIN) Hub and FIS360, and was made available for the survey through the National Nuclear User Facility's Hot Robotics programme.

Now the characterisation survey is complete, a comprehensive picture of the duct will help make informed decisions on how the duct should be decommissioned.

David Peattie Accounting Officer and Group Chief Executive Officer 7 July 2022

Accountability report

The accountability report sets out how the NDA meets the key accountability requirements to Government. The report is divided into three sections:

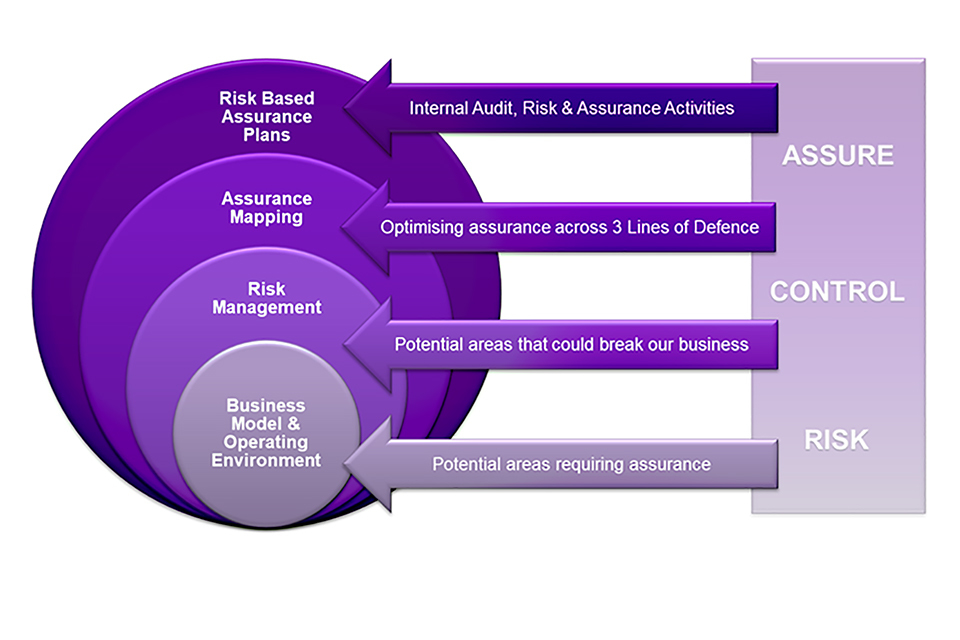

The corporate governance report which:

- Includes details of the Board members and leadership team

- Explains the governance structures and reviews our risk management and the internal control systems

Remuneration and people report which:

- Discloses the remuneration of our Board members

- Highlights employee matters and details staff numbers, costs and pension arrangements

Parliamentary accountability and audit report which includes:

- The Parliamentary accountability disclosures, reporting on losses and special payments and remote contingent liabilities of interest to Parliament

- The Audit report prepared by the National Audit Office setting out the Audit opinion on the annual accounts

Director's report

The NDA is an Executive Non-Departmental Public Body, established by the Energy Act 2004 to secure the decommissioning and clean-up of the UK's civil nuclear legacy. Since then, the NDA's remit has been extended to include the long-term management of all the UK's radioactive waste by finding appropriate storage and disposal solutions.

Accounts direction

These accounts have been prepared in a form directed by the Secretary of State with the approval of HM Treasury and in accordance with section 26 of the Energy Act 2004.

The Board comprises of a Non-Executive Chair, Non-Executive Members, the NDA Group Chief Executive Officer and the NDA Group Chief Financial Officer whose details are set out in the Governance Statement on page 106.

Directors' interests

Members of the NDA Board must declare any personal, private or commercial interests. A register of such interests is maintained by the NDA.

Rob Holden declared a commercial interest. He is a Non-Executive Director of NNB Generation Company (SZC) Ltd, a Non-Executive Director of Electricity North West Ltd and Director of North West Electricity Networks Ltd and therefore was excluded from any involvement with Moorside deliberations before he stood down from the NDA Board in January 2022.

The other members have no personal, private or commercial interests which present material conflicts with their role as a member of the NDA Board. See the full register of members' interests and the associated procedure.

Auditor of the NDA

The NDA is audited by the Comptroller and Auditor General (C&AG) in accordance with the Energy Act 2004. The services provided by the C&AG relate to statutory audit work for the NDA. No fees were paid to the C&AG for services other than statutory audit work.

Pensions

NDA employees are eligible to participate in the Civil Service Pension Arrangements. A small number of employees who transferred to the NDA from INS in 2019 continue to accrue benefits in the UKAEA Combined Pension Scheme.

Employees within the group participate in various defined benefit pension schemes detailed in note 26 to the accounts.

Group employees also participate in various schemes which are accounted for on a defined contribution basis, with details given in note 26 to the accounts.

Prompt payments

It is Government policy to pay 90% of undisputed invoices within five days, with the remainder paid within 30 days.

| 2021/22 | 2020/21 | 2019/20 | |

|---|---|---|---|

| Invoices paid within 5 days | 66.1% | 62.2% | 46.1% |

| Invoices paid within 30 days | 93.4% | 90.5% | 91.2% |

The average number of payment days from invoice date for a valid invoice was nine days, an improvement from 14 days in 2020/21. Performance compared with Government policy has been impacted by the lack of an integrated purchase to payment system which significantly reduces our ability to achieve five day payment terms and resolve invoice queries on a timely basis. As part of the Integrated Financial Framework we have implemented a new enterprise resource planning system in April 2022 which has introduced electronic approval workflows and improves our linkage between purchase orders and supplier invoices.

This provides a platform for improving our prompt payment performance.

Personal data

There were three data breaches during 2021/22.

Due to the nature, type or scale of personal data involved, all three incidents were self-reported to the Information Commissioner's Office, with no further action taken by them.

They did, however, suggest mitigating actions to reduce the chance of re-occurrence, all of which have been implemented.

Other disclosures

Disclosures on equal opportunities, learning and development and how the NDA engages with all staff are in the Remuneration and People Report on pages 181 to 239.

Details of investment in socio-economic developments, research and development and funding, counterparty and foreign exchange risk are all included in the financial statements.

The NDA's environmental performance is detailed in the Health, Safety, Security, Environment and Wellbeing report on pages 240 to 262.

Events after the reporting period

IAS 10 requires the NDA to disclose the date on which the accounts are authorised for issue. The Accounting Officer authorised these Financial Statements on 7 July 2022. The Report of the Comptroller and Auditor General was issued on 11 July 2022 (pages 298-311).

Low Level Waste Repository Limited acquired 100% of the issued share capital of Nuclear Waste Services Limited, which is a dormant company, on 15 June 2022. The event has no material financial effect on the company.

Going concern

A full explanation of the adoption of a going concern basis appears in note 2.1 of the financial statements.

Section 172 statement

The NDA sets out the issues and factors it takes account of in its decision-making in its Value Framework, which has been revised as part of Strategy 4.

As well as the general consideration of value for money and affordability, the NDA's Value Framework provides a structured mechanism to consider:

- Health and safety

- Security

- Environment

- Risk/hazard reduction

- Socio-economic impacts

- Finance

- Enabling the nuclear decommissioning mission

Strategic decisions coming to the NDA Board build in these considerations systematically and they are also reflected and assured in subsequent business case approvals.

To determine the relevance of stakeholders to our decision-making, the NDA segments its stakeholders into four broad categories:

- External governance and scrutiny: decision-makers with a direct or indirect impact on the NDA's ability to make decisions and allocate resources

- Employees, workforce and their representatives

- Supply chain and commercial partners

- Other influencers and opinion formers: MPs, MSPs, Welsh assembly members, County Councils, Borough Councils, civil society, Non- Governmental Organisations, local communities (including Site Stakeholder Groups), international organisations etc.

Stakeholder engagement is an enabler to mission delivery. It allows the NDA group to understand issues better by obtaining stakeholders' points of view, enabling better informed decisions and creating confidence in the operation of the organisation. Given the nature of its work, the NDA group has a large number and range of stakeholders and therefore stakeholder engagement is an important element of the NDA Board and executives' responsibilities. The executives and the senior leadership groups represent the organisation and build an ever- increasing understanding of stakeholders' interests.

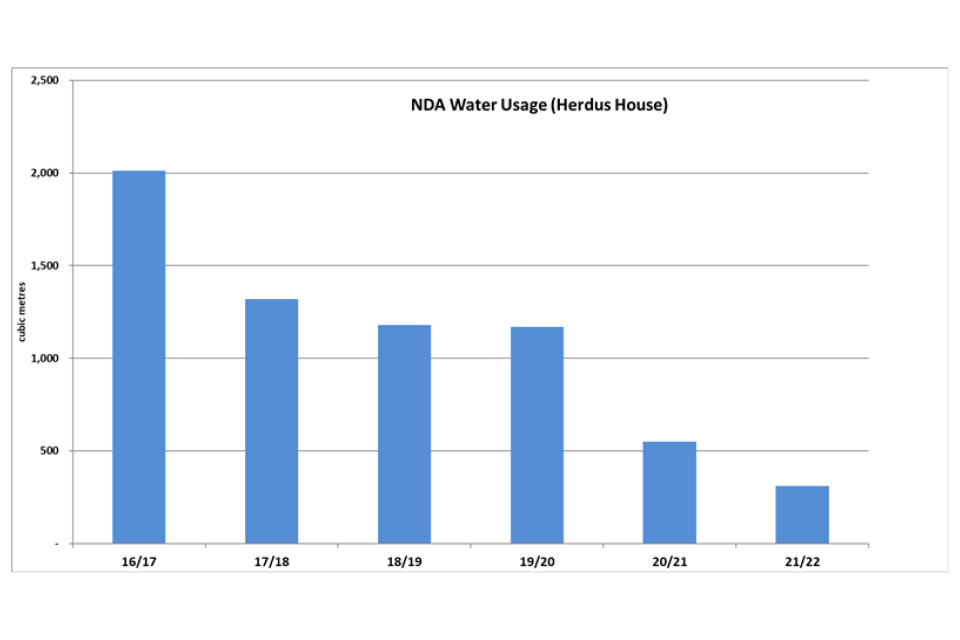

These leaders are supported by members of the communications team which contains specialists in stakeholder engagement with a deep understanding of stakeholder organisations and individuals. These structured engagements are supplemented by roadshows and by an annual stakeholder summit.