NDA Annual Report and Accounts 2016 to 2017

Published 19 July 2017

The Nuclear Decommissioning Authority (NDA) is a Non-Departmental Public Body created through the Energy Act 2004.

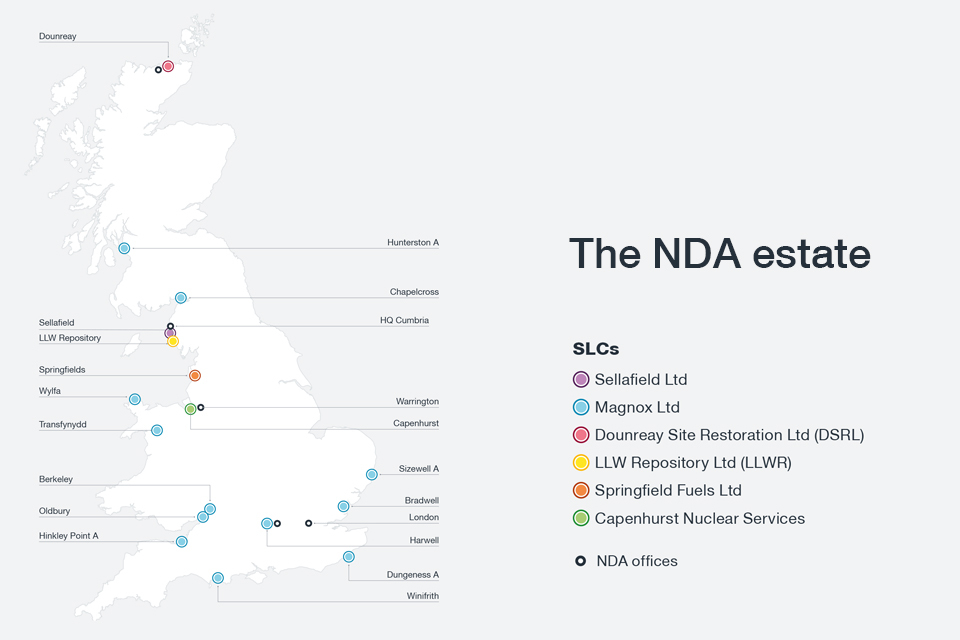

We employ just over 200 staff. Our headquarters are based in west Cumbria and we own 17 sites across England, Wales and Scotland, some dating back to the 1940s, plus the associated liabilities and assets.

We report to the Department for Business, Energy and Industrial Strategy (BEIS); for some aspects of our work in Scotland, we are responsible to Scottish ministers.

Our role is strategic: we establish the overall approach, allocate budgets, set targets and monitor progress. We do not have a hands-on role in cleaning up our facilities. Instead, we deliver our mission through others, primarily Site Licence Companies (SLCs).

| We are responsible for |

|---|

| – Decommissioning and cleaning up these nuclear facilities |

| – Ensuring that all waste products, both radioactive and nonradioactive, are safely managed |

| – Implementing policy on the long-term management of nuclear waste |

| – Developing UK-wide strategy and plans for nuclear Low Level Waste |

| – Scrutinising the decommissioning plans of EDF Energy, who own the operating fleet of Advanced Gas Cooled Reactor (AGR) nuclear power stations |

PERFORMANCE

Chairman’s Statement

Tom Smith, Chairman

We will vigorously seek to go on improving our performance year on year

We are overcoming challenges that once may have seemed impossible

Our performance in clean-up and decommissioning

Cleaning up and decommissioning the UK’s civil nuclear legacy is of the utmost national safety and security importance.

I am pleased that the government continues to commit sustained levels of public funding to our mission. But this rightly puts a great responsibility on us to spend that money wisely and deliver maximum benefit.

Last year, all the work we intended to deliver was done so within our budget. It included successful initiation of waste retrievals at some of Sellafield’s oldest, and most hazardous facilities, an objective the NDA has been working towards since its creation. This year’s good performance is described in more detail later in this report. We will vigorously seek to go on improving our performance year on year.

The 18,500-strong workforce across the NDA estate is an asset and has shown great commitment and enthusiasm to find innovative, smarter and increasingly more efficient ways of working to increase the pace of progress.

Despite our good progress, however, the Board remains concerned by the number of safety incidents reported across the estate last year. It is a disappointing increase and a priority area of focus for the Board and our new Chief Executive Officer (CEO).

We were greatly disappointed that a high court judgment in July 2016 found that we had acted unlawfully in the course of the competition to appoint a new parent body organisation for the Magnox sites.

EnergySolutions EU Ltd (now called ATK Energy EU Ltd), who brought the court action and its partner in bidding for the work, Bechtel, both had claims against the NDA. The Board judged that they were best settled out of court, to avoid the risk of prolonged and potentially more damaging litigation. We had the full support of Government in this and reached a full and final settlement of both claims in March 2017. This has drawn a line under the issue, but at a cost of around £100 million to the public purse, which we greatly regret.

Separately from the litigation, it became apparent over the course of the year that the Magnox contract awarded, at the conclusion of the competition, to the Cavendish Fluor Partnership (CFP) was at risk of legal challenge. This is because its scope and value had become materially different from that anticipated at the time of award. To avert the risk of further financial exposure to the taxpayer, the Board decided to terminate the contract, with the support of Government and CFP.

The termination will take effect in September 2019 and in the meantime we will continue to work with CFP to maintain progress on Magnox decommissioning.

The events around the Magnox competition and contract are now the subject of an independent inquiry, led by Stephen Holliday. We will cooperate with it and I believe that by taking on board its fi ndings and lessons the NDA will emerge as a stronger and better organisation.

We have already begun a vital piece of work to consider and decide on the arrangements that will offer value for money and best enable Magnox Ltd to make rapid progress in decommissioning following CFP’s departure in 2019.

Board changes Stephen Henwood stepped down from the Board after 9 years as Chairman of the NDA. For the last 4 of those, I had the privilege of serving on the Board under his leadership. I would like to place on record my warm thanks to Stephen for his many years of service and for all he has done for the NDA.

Ken McCallum stepped down as a non-executive director at the end of the year. I would like to thank him for his valuable contribution during 3 years with us. A replacement non-executive is currently being sought.

Among executive directors, Pete Lutwyche left the NDA and the Board in October 2016, having been with us for almost 3 years. We wish him well for the future. John Clarke left the Board on 28 February 2017, on completion of his term as CEO.

John led the NDA as its CEO from 2012 having joined the organisation in 2008 and his commitment to the organisation, and the sector, has been outstanding.

On behalf of my Board colleagues and the whole NDA, I would like to thank John and offer him every good wish for the future.

Chief Executive Succession

I am delighted to welcome David Peattie as the NDA’s new CEO. David joined the organisation on 1 March 2017 and was crucial in helping the organization conclude the Magnox litigation and contractual issues. He is a highly experienced leader and a strong asset for this organisation.

Thanks

I would like to close by thanking everyone involved in the NDA mission. We are overcoming challenges that once may have seemed impossible. We are not, however, complacent. Last year was a stark reminder that we are all custodians of the public purse and our stakeholders are rightly looking for excellent performance in all that we do. The NDA Board and its new leadership team are committed to nothing less.

Tom Smith

Chairman

Chief Executive’s Review

David Peattie, Chief Executive Officer

We reached a major milestone in our strategy to focus on cleaning up the oldest plants at Sellafield in securing regulatory approval to cut access holes in the Pile Fuel Cladding Silo.

£3.2 billion spent over the course of the year in addressing the complex decommissioning tasks across the estate

| Achievements |

|---|

| – Removal of the entire bulk stocks of nuclear fuel from the Pile Fuel Storage Pond |

| – Major breakthrough in clean-up of the Magnox Swarf Storage Silo |

| – At Dounreay, some of the highest hazards in the estate now destroyed |

Our results

I am pleased to report that we stayed within our allocated budget last year. This is despite the additional financial burden of around £100 million in legal and settlement costs arising from the litigation over the placing of the Magnox contract. Disciplined financial management and an ongoing commitment to more efficient working have played a large part in this success.

The total NDA spend was £3.2 billion in 2016/17. £2.2 billion came from government and £1.0 billion through commercial revenue. The cost of running the NDA itself was stable at just under £40 million, which is 1.3 per cent of the overall budget. 60 per cent of spend was at our largest, most complex site, Sellafield in Cumbria. The NDA’s decision to make Sellafi eld Ltd an NDA subsidiary is helping the site to focus on providing better value for money. Over £200 million in savings were generated in 2016/17.

The change is also enabling work to be prioritised on clean-up rather than commercial incentives. Whilst financial performance is important, our priority remains safety and I was disappointed to see a number of incidents in our estate last year. I am working with the sites to understand and resolve any issues to ensure the dip in our strong safety record is short-lived. We will continue to build an excellent safety culture and will not tolerate anything less.

Clean-up progress

We recently reached a major milestone in our strategy to focus on cleaning up the oldest plants at Sellafield. In March this year, the Office for Nuclear Regulation approved the cutting of six access holes in the Pile Fuel Cladding Silo. This is a huge step forward in preparing to retrieve waste from one of the site’s most hazardous facilities. The hugely talented Sellafield Ltd workforce, with support from the supply chain, has worked for years in preparation for this moment. This is one of the most visible signs yet of progress and is supported by the improvement in infrastructure, which has been invested in in recent years and will continue to be.

Over the next couple of years, the primary focus at Sellafield will increasingly be clean-up and decommissioning, as the site moves nearer to the planned cessation of fuel reprocessing. Excellent operational performance levels at the THORP and Magnox Reprocessing plants last year mean that they are on track to close in 2018 and 2020 respectively, as set out in the NDA Strategy.

In Scotland, I am pleased to report that a 10-year programme at another priority facility in our estate, the Dounreay Fast Reactor, has concluded. Toxic sodium potassium alloy used to cool the reactor has been successfully destroyed. Alongside this, the last of the higher activity liquid, generated by reprocessing the reactor fuel, has been grouted into drums for safe long-term storage.

All these achievements contribute to the safety and security of our estate and take Dounreay further along its journey to closure. As does the successful transfer of unirradiated fuel to Sellafield and the US, a key priority for the NDA and wider government.

In terms of our 12 Magnox sites, excellent progress in delivering the NDA Strategy is being made. We are on track to complete all near-term decommissioning at Bradwell, enabling it to become the first of our sites to enter a phase of ‘Care and Maintenance’ in 2019.

Only two Magnox plants are now left to defuel. Calder Hall at Sellafield passed the point of having 50 per cent of its fuel removed late last year, while Wylfa in Wales successfully overcame some mechanical issues before progressing.

By 2019, defueling will be completed at both sites. Outside of the core mission, the opening of Nucleus near Dounreay reaped the result of many years of planning to develop a single secure location for our historical records. Tens of thousands of plans, photographs and other materials from across our sites will eventually be housed in this facility.

Not only has our strategy for developing Nucleus created a secure home for our archives, it is also bringing economic benefit for the Caithness community in northern Scotland.

Changes in leadership

The NDA Executive team welcomed Duncan Thompson to the team as Sellafield Programme Director. Duncan has been with the organisation since 2006 and played a pivotal role in leading the NDA subsidiary arrangements for Sellafield. Meanwhile, the NDA said goodbye to Pete Lutwyche, NDA Chief Operating Officer. I would like to thank him for his significant contribution to the organisation and mission.

Privilege

On a personal note, it is a real privilege to have been asked to lead the NDA mission. Cleaning up and ensuring the safety and security of the UK’s legacy nuclear sites is recognised as one of the most important environmental clean-up jobs in the world. This may be my first nuclear role, but I bring 30 years of leadership and operational expertise from the oil and gas sector including North Sea decommissioning. I am working closely with government, our business units and communities to ensure I take this mission forward with the full support of our stakeholders.

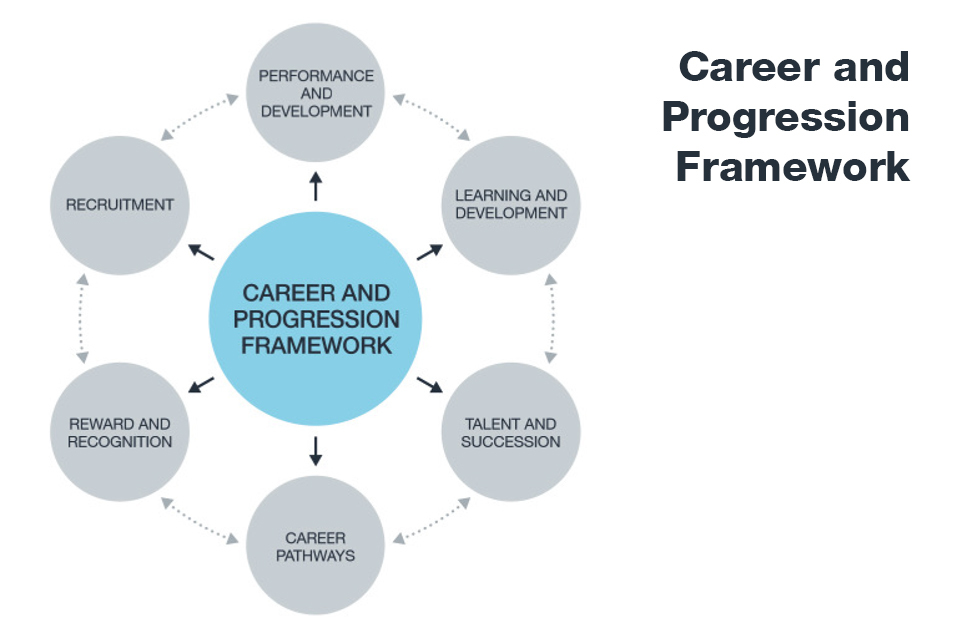

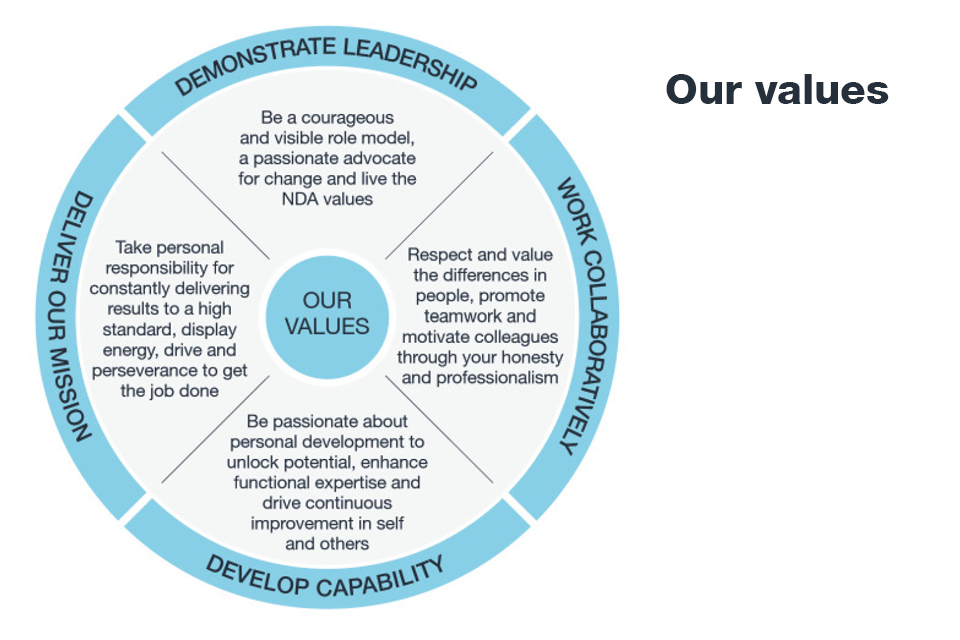

Within the NDA, I have been impressed by the deep level of commitment to the mission and by the professionalism of staff. Looking at our organisation in detail, I have identified some key areas for action: simplifying processes, encouraging innovation, developing our talent and harnessing motivation. Simply put, I am working towards a simpler, more focused, more disciplined and standardised NDA. I also plan to improve the way we measure, report and deliver performance across the estate.

Thanks

I would like to conclude by offering my sincerest thanks to my colleagues in the NDA, our subsidiaries and Site Licence Companies. I am also grateful to government and our supply chain and the many stakeholders and communities on whose support we depend.

This year has brought both success and challenge in equal measure. We will build on the successes and emerge from the challenges a stronger and more capable organisation - one placed to deliver its mission of efficiently and effectively, cleaning up the UK’s nuclear legacy.

David Peattie

Accounting Officer and Chief Executive Officer

11 July 2017

The NDA Estate and What We Do

The NDA mission

We are dealing with one of the most complex, long-term, environmental challenges in Europe.

We are responsible for decommissioning 17 nuclear sites spread across the UK. This includes the first generation of Magnox power stations, various research and fuel facilities and our largest, most complex site, Sellafield.

Our core objective is to decommission these sites safely, securely, cost-effectively and in a manner that protects the environment.

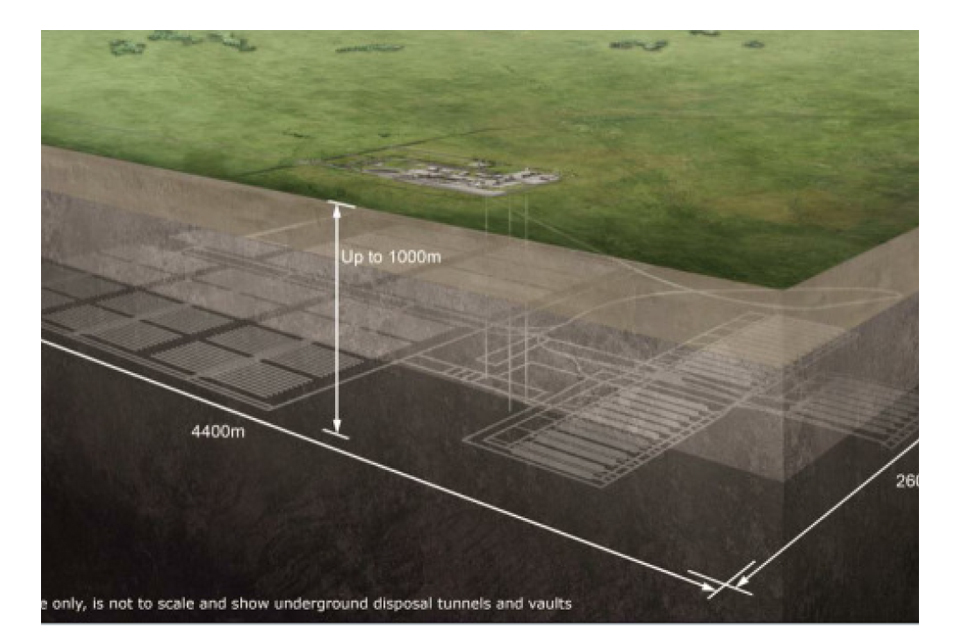

Our remit includes the development of an underground Geological Disposal Facility (GDF) as a permanent repository for the UK’s higher activity waste.

We also have a range of supplementary responsibilities including supply chain development, research and development, skills, socio-economic support for local communities and stakeholder engagement.

Under the latest government Spending Review in 2015, we were allocated more than £11 billion of grant funding over five years which, together with our income projections, will enable us to continue to make broad progress across the estate.

Along with all public sector organisations, we are committed to maximising efficiencies and are taking measures to secure £1 billion of savings over this 5-year period. This will be achieved by introducing technical and programme innovations and efficiency improvements.

How the estate operates

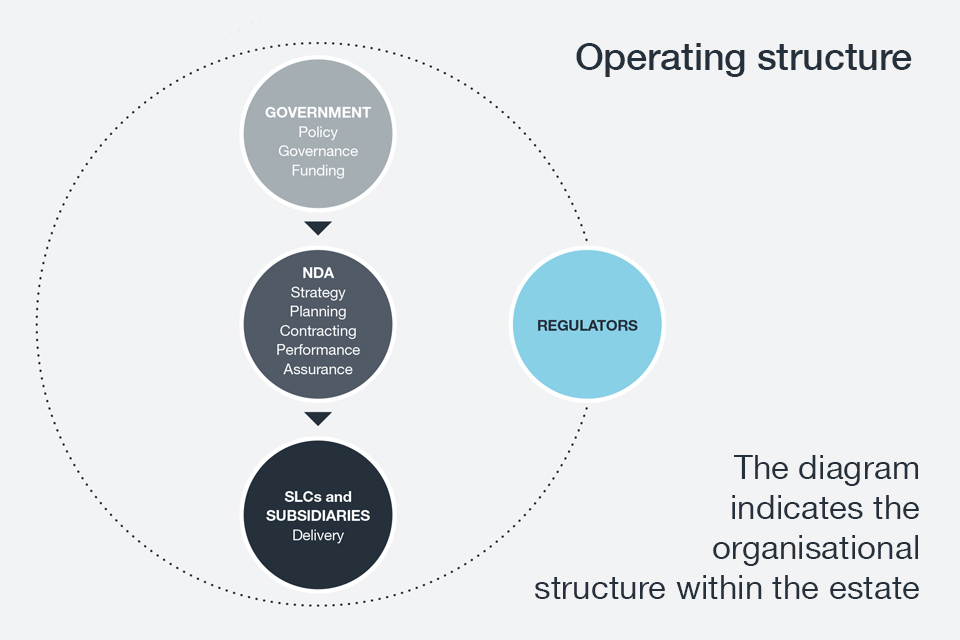

Operating structure

The NDA is a Non-Departmental Public Body sponsored by the Department for Business, Energy and Industrial Strategy (BEIS).

BEIS and Scottish Ministers are responsible for approving our plans and providing a policy framework for the NDA.

The NDA sets the estate-wide strategy, contract manages the operation of the Site Licence Companies (SLCs) and provides performance assurance across the estate to ensure value is delivered for the taxpayer.

The SLCs are responsible for delivering NDA site progress through running of day-to-day activities. The NDA also has a portfolio of subsidiaries, which operate a range of specialised services that are needed to do our work. Activities on sites are closely regulated by the Office for Nuclear Regulation (ONR), the Environment Agency (EA) Scottish Environmental Protection Agency (SEPA), Natural Resources Wales (NRW) and the Department for Transport (DfT). We seek to involve them in open dialogue and recognise their views as an important part of our strategic considerations.

The NDA estate

18,500 employees across the estate

800 hectares of nuclear licensed land

17 sites across the UK

7 subsidiaries (including Sellafield Ltd)

4 SLCs funded directly by the NDA

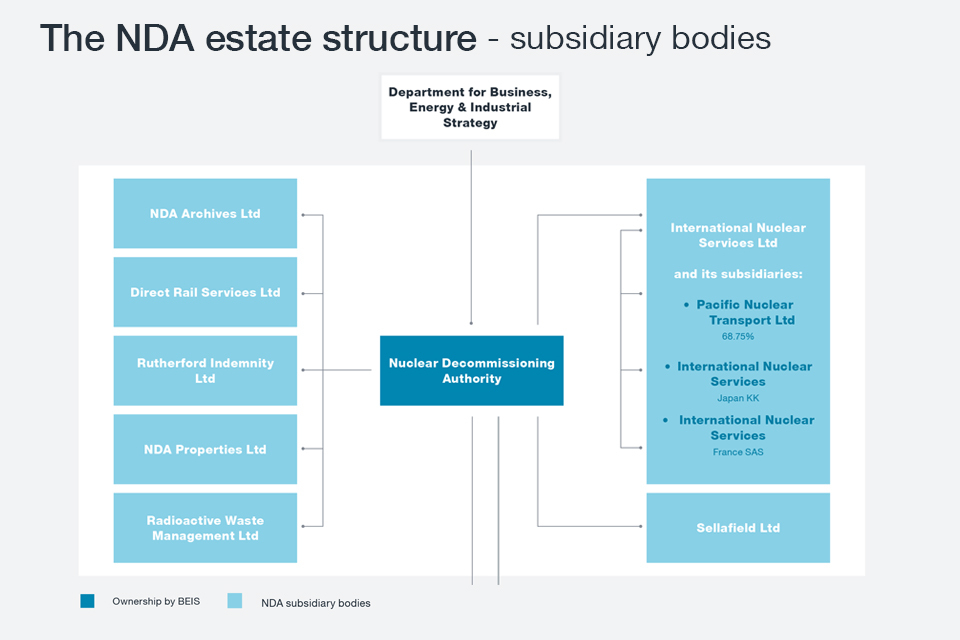

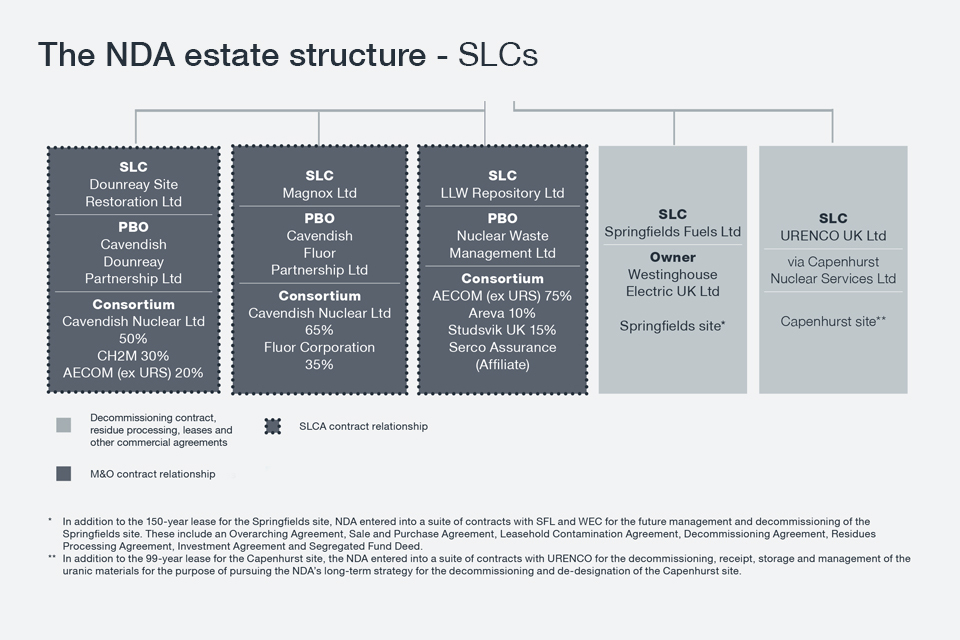

The NDA estate structure

The NDA estate structure: relationship with government and NDA wholly owned companies

The NDA estate structure: relationship with the rest of NDA estate

Key priorities over the last financial year include:

| Work category | Priorities |

|---|---|

| Operations and reprocessing | – Achievement of THORP and Magnox reprocessing targets – Continued defuelling of the last two reactors (Calder Hall and Wylfa) |

| Projects and capital expenditure for new facilities required for decommissioning | - Driving progress at Sellafield’s Legacy Ponds and Silos - Pile Fuel Cladding Silo doors installed |

| Retrieval, movement and storage of nuclear waste and materials | – Continued transfer of a range of nuclear materials from Dounreay and Harwell to Sellafield – Exporting 45 tonnes of fuel from First Generation Magnox Storage Pond to the Fuel Handling Plant |

| Demolition, care and maintenance and remediation | – Progress of Bradwell to Care and Maintenance |

| Improvements to mission delivery | - Implementation of the new management model at Sellafield, ensuring improved performance and value for money - Working on an appropriate model for Magnox following litigation - Achievement of SME spend target 25% - The opening of Nucleus (the Caithness and Nuclear Archives) at Wick and start of records acquisition into the archive - Workforce reform of pensions working with the government and trade unions |

The Year at a Glance

Top left: Dalton Cumbrian Facility (DCF); top right: Bradwell site in Essex; bottom left: Sellafield legacy pond; bottom right: Nucleus, archive in Wick

Bradwell

Bradwell has made major strides in its journey to be the UK’s first nuclear site completing all near-term decommissioning.

Calder Hall 50% +

The world’s oldest commercial-scale nuclear power station: more than half the spent fuel has now been successfully removed. It is one of only 2 Magnox sites left to complete the defueling programme.

Oldest storage silo

The first of 3 huge purpose-built specialist machines is now installed and being prepared to start removing waste from one of Sellafield’s oldest, most hazardous storage silos.

See Sellafield Silos case study

Dalton Cumbrian Facility

Cumbria’s world-class £20 million research facility has put the UK at the forefront of global expertise on radiation science.

See Dalton Cumbrian Facility case study

Archive open

Our newly constructed £21 million nuclear archive is now open, providing a secure home for valuable records from across the estate

Research and Development

We invest more than £85 million in R&D annually, and last year jointly invested £3 million for new technologies.

Sludge pumped out

For the first time, radioactive sludge is being pumped out of the world’s oldest and largest open-air spent fuel pond.

See Sellafield Pile Fuel Storage Pond study

88% of LLWR waste being diverted away from repository, including 3,858 tonnes of metals

2018 THORP reprocessing on track for closure date

Case studies

Sellafield legacy ponds

Work category: retrieval, movement and storage of nuclear waste and materials

Sellafield legacy ponds

50 tonnes of solid waste lifted out since 2016

10 years ahead of 2010 PFSP project plan

Part of the ageing ‘Legacy Ponds and Silos’ complex, the 2 pond facilities are among the most hazardous waste storage facilities on the site and a No 1 priority for decommissioning and clean-up.

First Generation Magnox Storage Pond (FGMSP)

At the First Generation Magnox Storage Pond (FGMSP), which dates back to the 1950s, real progress is being made on removing bulk quantities of waste after new equipment began operation 10 months ahead of schedule. The 6 metre deep pond holds spent fuel from the Magnox power stations and other miscellaneous materials. Over time, sludge has accumulated. Consisting of corroded waste material and organic matter such as algae and wind- blown vegetation, this sludge is highly radioactive. Up to 1 metre thick in places, it must be removed with great care, leaving the water in place as a radioactive shield for the remaining contents.

About the programme:

- First sludge removals began on a small scale in 2015

- The new Bulk Sludge Retrieval Tool was commissioned during 2016, helping to increase the rate of retrievals

- The first skip of solid fuel was lifted out in April 2016

- More than 50 tonnes of solid fuel have now been removed, around 10% of the total

- Bulk fuel, sludge and miscellaneous Beta Gamma waste exports are expected to be complete by 2033, massively reducing the pond’s risks and hazards

- The retrieved contents will be treated and packaged for long-term storage

Pile Fuel Storage Pond (PFSP)

Meanwhile, at 100 metres long, the open-air Pile Fuel Storage Pond (PFSP) is the world’s largest and oldest spent fuel storage pond. Opened in 1952, it was built to take spent fuel from the UK nuclear weapons programme, 4 years before the FGMSP. Bulk stocks of fuel have already been removed, leaving the sludge in the pond as the biggest remaining radioactive hazard.

This year for the first time, sludge has been pumped out of the pond to a purpose-built treatment plant next door, then transferred in a 500-litre drum to the Waste Encapsulation Plant. There, the drums are grouted and processed into a storage state ready for final disposal in a UK Geological Disposal Facility. It will take several years to remove all pond sludge.

About the programme:

- It is 10 years ahead of schedule outlined in the 2010 baseline.

- De-watering of the pond is the next stage.

- This is due to start in 2019 and expected to take 10 years.

Dorothy Gradden OBE, Head of Legacy Ponds for Sellafield Ltd, said:

This is one of the first examples of a legacy facility producing waste ready for a geological disposal facility – it’s a cradle-to-grave solution.

Sellafield legacy silos

Work category: projects and capital expenditure for new facilities required for decommissioning

Sellafield legacy silos

22 modules comprising 13,500 different parts, installed using 100 lifts

150 adults each door is as heavy as 150 adults

The 2 silo complexes are also among Sellafield’s oldest, most hazardous facilities that have been prioritised for decommissioning and clean-up.

Magnox Swarf Storage Silo (MSSS)

The Magnox Swarf Storage Silo (MSSS) was opened in 1964 to hold the metallic debris produced when the outer cladding was shaved off spent Magnox fuel before reprocessing. The highly radioactive debris, known as swarf, is stored under water in 22 compartments.

The first of 3 machines designed to retrieve the swarf is now in place on top of the silo, and is undergoing inactive commissioning. This was the culmination of over a year’s effort, involving 100-plus separate crane lifts to install the 22 modules that make up the 360-tonne machine. The other 2 machines are now being tested off-site prior to installation. When complete the 3 machines are expected to operate for many years to remove the waste.

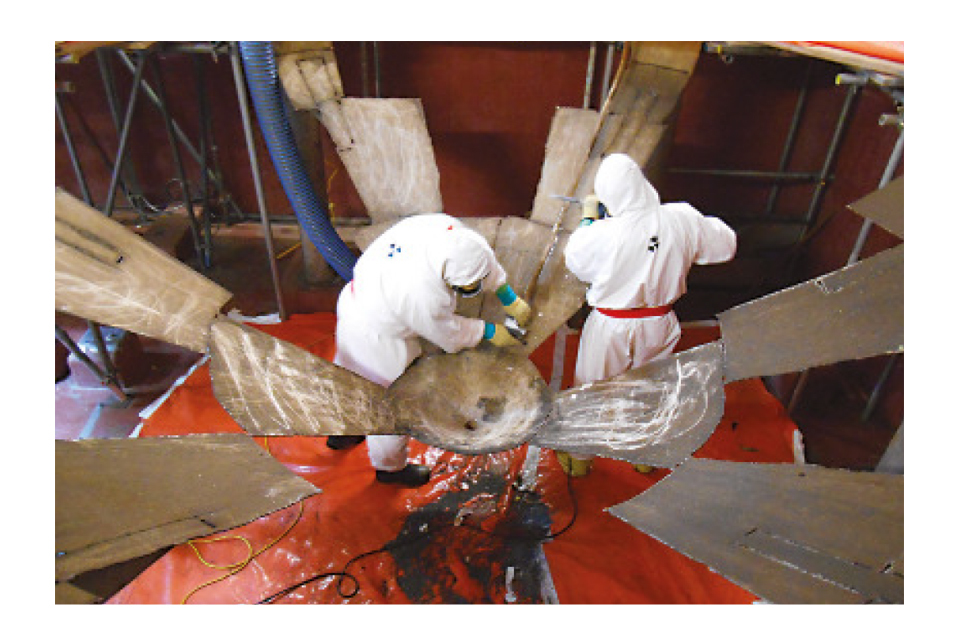

Pile Fuel Cladding Silo (PFCS)

The Pile Fuel Cladding Silo (PFCS) holds fuel cladding removed from the Windscale Pile that helped to create the UK’s nuclear deterrent, along with cladding from Magnox fuel. The air inside the silos was replaced by inert argon gas in 2001 to reduce the fire risk. Although non-toxic, argon cannot be breathed so all work must be carried out remotely and the atmosphere maintained during retrievals.

Two significant steps forward have been taken.

The last of 6 huge stainless steel doors, each 7 metres tall by 4 metres wide and each as heavy as 150 adults, has now been fixed in place. Holes will now be cut behind the doors, enabling remote controlled grabs to reach in, drop down and pull out the waste. These should be in place to allow the start of retrievals in 2020.

Meanwhile, engineers are using an innovative water jet to remove 6 large plates of steel while maintaining the inert atmosphere. The deflector plates, each about the size of a small car, were used to guide waste into the chambers when it was put into the silo.

Each plate has now been cut into approximately 150 pieces, using water and finely ground stone blasted at the speed of sound to prevent sparks. The pieces fall into the chambers and will be removed along with the cladding when waste retrievals begin.

Gary Snow, Head of the PFCS Programme, said:

Removing the plates inside the silo is like keyhole surgery, but on an industrial scale.

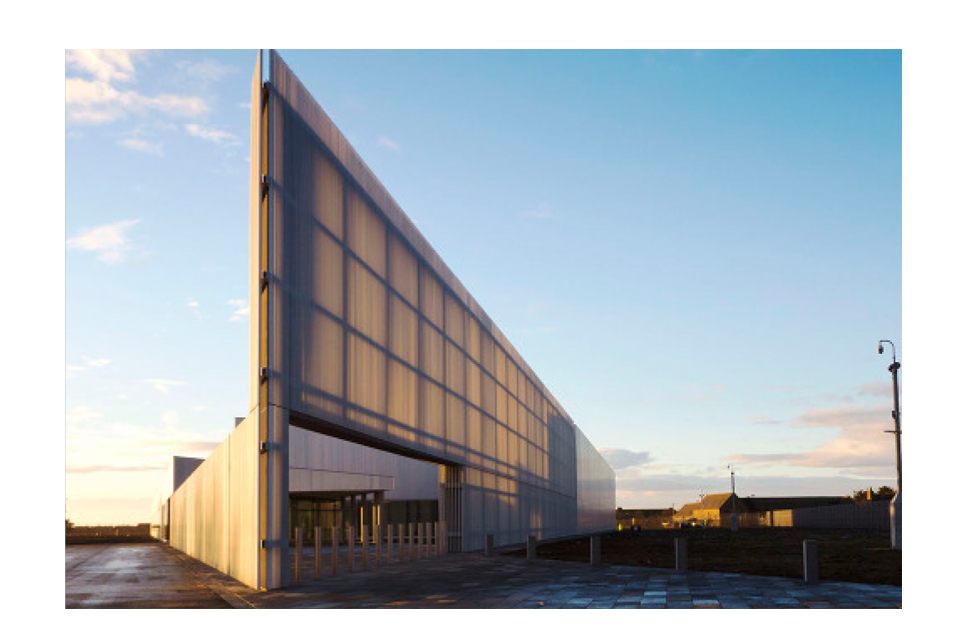

Bradwell

Work category: demolition, care and maintenance and remediation

Bradwell site

By 2019 only the 2 reactor buildings, the weather-proofed pond structures and ILW store will remain

In 10 years the remaining Magnox sites will all reach the Care and Maintenance stage in the next 10 years

During the Care and Maintenance (C&M) phase a site is left in a safe and secure state to allow time for radiation levels in reactor cores to decay naturally. Following this period, final decommissioning and site clearance can take place.

Over the last 12 months, a number of significant milestones were reached at Bradwell. These mark the culmination of complex programmes spanning at least four years and put it well on track to be the first NDA site to enter the C&M phase.

Key milestones:

Weather-proof aluminium cladding

The most visible sign of progress is the new cladding encasing the 2 reactor buildings, a project that began in 2012 and concluded in June 2016.

All underground waste vaults on the site have now been emptied – a first for a Magnox site

This means an area equivalent to 5 tennis courts is decontaminated and can now be covered ready for the C&M phase.

Pond decontamination

At the pond complex, the walls, floor and ceiling have been decontaminated over a 4 year period - equivalent in size to the area of a rugby pitch.

Metallic Fuel Element Debris (FED)

The introduction of innovative techniques has meant that this Intermediate Level Waste (ILW) is either being dissolved in a specially designed plant that dramatically reduces its volume prior to packaging for disposal or being treated and size reduced before disposal at Low Level Waste Repository (LLWR) - good cross-estate co-operation making this possible.

Removing redundant equipment and decontamination work

More than 2.5km of pipework and 120-plus tonnes of metal waste were removed.

Planning permission

Planning permission has also been granted that will enable ILW from Dungeness A and Sizewell A to be brought for storage at Bradwell’s purpose-built Interim Storage Facility (ISF). This supports the NDA’s strategy of consolidating waste at fewer regional stores rather than individual sites, reducing costs and simplifying ongoing monitoring processes required during C&M.

Research and development

Work category: improvements to mission delivery

Research and development

The NDA invests more than £85 million a year in R&D across the estate. The bulk of this is focused on addressing challenges encountered during decommissioning work on sites. Around £7 million is spent directly by the NDA, in particular on innovation that can be applied across numerous sites.

Direct spending allows for more innovative ideas, and to support early development through to market-readiness. Following a number of joint funding initiatives with Innovate UK, the government’s innovation agency, which targeted the wider nuclear sector, the NDA has taken the lead in running a £3 million competition to demonstrate new technologies for decommissioning hazardous nuclear processing cells found across our estate, particularly at Sellafield. The cells are part of the THORP and Magnox reprocessing plants which are due to close in 2018 and 2020 respectively and contain thousands of assorted items that may be radiologically contaminated.

The goal is to combine technologies – such as robotics, other autonomous systems, sensors and detectors, imaging and virtual reality - into an integrated system. Together, these will establish what is in the cells, how its contents should be accessed, cleaned, cut up, sorted and packaged.

An illustration of the integrated approach is the development of the LaserSnake robotic equipment. In 2008, the NDA allocated £1 million to demonstrate the effectiveness of lasers, widely used by non-nuclear industries, for cutting up metal and removing contaminated concrete surfaces.

The process proved very successful leaving little waste, ideal for situations too hazardous or inaccessible for people.

Collaboration with a small robotics business then led to the first LaserSnake project, where a laser cutting head was attached to a snake-like robot arm and demonstrated in a non-active environment. Subsequent funding from a joint Innovate UK, NDA and BEIS initiative funded an extended SME-led consortium to develop LaserSnake2, a larger, more accurate snake robot, with lightweight cutting heads and the capability to cut thicker sections.

This design reduces the impact of radiation by ensuring sensitive electronic components stay outside radioactive areas.

Tested in a cell at Sellafield and controlled remotely, LaserSnake2 successfully cut up a double-walled stainless steel vessel with a 32mm thick inner shell. The trial confirmed its reliability in a radioactive environment. Benefits of laser cutting:

- Fast and efficient

- Safer and cheaper than conventional approaches

- Produces less secondary waste

Conventional processes depended on workers in air-fed suits manually cutting up vessels with heavy-duty sawing equipment, restricted to working for a few hours at a time.

Sellafield has thousands of items that must be cut up for removal before buildings can be decommissioned. Other sites, both in the UK and overseas, could also benefit, while aerospace and defence industries have already realised LaserSnake2’s potential.

LaserSnake2 can be customised for a range of conditions and is ready for commercial deployment. Its journey took 4 years and many steps, including collaboration between developers on investment, collaboration with Sellafield Ltd and ongoing support from sponsors NDA, Innovate UK and BEIS.

Dalton Cumbrian Facility

Work category: improvements to mission delivery

Dalton Cumbrian Facility

The need for world-leading expertise was identified during the NDA’s early days. Faced with an overwhelming need to get to grips with a legacy of redundant test reactors, historic research centres and a fleet of elderly power stations – as well as Sellafield’s innumerable complexities – the huge gaps in decommissioning knowledge were clear.

A £20 million collaboration agreement between the NDA and The University of Manchester, home to the pioneering Dalton Nuclear Institute, led to the development of the Dalton Cumbrian Facility (DCF), close to the heart of the UK’s most hazardous, complex decommissioning problems at Sellafield.

Opened in 2011, the goal was to build a research centre covering 2 crucial scientific disciplines that would support the NDA’s mission and add to the body of knowledge for future decommissioning programmes both in the UK and elsewhere. The agreement concluded in October 2016.

Radiation science

Radiation science focuses on understanding exactly how materials and chemical systems are affected by radiation. This is vital to decommissioning and radioactive waste management, allowing the behaviour of packaged waste to be predicted over future decades.

The DCF boasts unique features that are unrivalled in the UK and among the best worldwide. These include 2 particle accelerators, allowing a single sample to be subjected to 2 forms of radiation at once. This is being developed into the world’s highest-energy dual-beam particle accelerator system. A self-shielded gamma irradiator which can supply a dose rate equivalent to spent fuel, plus a suite of extensive analytical laboratories complete this bespoke setup.

These enable replication, in laboratory- controlled conditions, of the damage caused to materials by ionising radiation. This way, understanding of how the damage occurs can be developed at an early stage and future behaviour modelled in great detail.

DCF’s work has reinvigorated the UK’s research base in this field, pushing the UK right to the forefront of global expertise.

Nuclear engineering decommissioning

This area focuses on developing new technologies, particularly robotics, to characterise and decommission facilities. This includes characterising radiation fields and assessing fault tolerance of robotic components to ionising radiation.

Technology developed at DCF will imminently be deployed on Sellafield site.

Covering both areas is a team of 7 core research staff based at the DCF, plus 6 post-doctoral research associates, while 21 PhD projects have been completed and more than 100 papers published.

Links with the commercial nuclear sector are now substantial. Industry has funded a number of PhD studies covering a range of projects associated with specific problems experienced at site level.

In partnership with the National Nuclear Laboratory, DCF hosted Cumbria’s innovation-driving business support organisation Innovus. This partnership, with funding support from the NDA and the government’s Regional Growth Fund, helped to grow the innovative ideas of many small Cumbrian businesses into commercial products. Funding from the Research Councils enabled DCF to become a founding member of the National Nuclear User Facility and it has recently become part of the UK National Ion Beam Centre, enabling academics from across the UK to access its facilities.

Overall, the future is bright, with DCF continuing to attract new research funding from the NDA estate, the UK nuclear industry and the research councils. It has become a key component in delivering the UK’s Nuclear Industrial Strategy published in 2013.

Nucleus

Work category: improvements to mission delivery

Nucleus, archive in Wick

80,000 boxes of archived records are held in off-site storage by Sellafield Ltd alone

26 km of shelving in secure pods, will ensure the records are catalogued, indexed and preserved

The NDA’s nuclear archive, Nucleus, in Wick is now open for business, providing a home for important nuclear records from across the estate. Located near Dounreay, the £21 million investment has a dual role. As well as nuclear records, Nucleus will house a collection of local Caithness records that has outgrown its existing home.

An exercise lasting at least five years is now under way to move thousands of plans, photographs, drawings and other records from diverse locations.

Sellafield Ltd alone has more than 80,000 boxes of archived records in off-site storage, plus material on site and in various offices. The 12 Magnox Ltd sites have a similar-sized collection in storage, while the number of electronic records across the estate is believed to number hundreds of millions.

Dounreay’s records – including over 300,000 photographs and an estimated 200 tonnes of documents – were among the first nuclear archives to start arriving, with the full estate-wide collection due for transfer over the coming years. Secure pods will hold the records, which will be catalogued, indexed and preserved. Old decaying documents will be transferred to archive-quality paper and digitised.

Humidity and temperature will be carefully controlled to minimise the potential for deterioration. Nucleus employs approximately 20 people including archivists, preservation experts and support staff.

The archive will play an important role for public and academic research. It will also feature in the development of a future geological disposal facility (GDF), acting as a central repository for detailed waste records that must be safeguarded for many generations.

Discussions are under way with the Ministry of Defence, new build developers and operators of the UK’s current nuclear power stations, as well as other key stakeholders with Land Quality records-related requirements, to potentially consolidate their records at Nucleus.

Nucleus is part of a wider Information Governance Programme (IGP) across the estate, our subsidiaries and other nuclear organisations. Under IGP, we are developing projects to safeguard sensitive material, retain records and share knowledge to support decommissioning activities. We are also ensuring access and agreeing systems for managing the information in both digital and hard-copy formats and, where possible and once developed, proactively accessible via cloud technologies and/or websites – while keeping it useable – well into the future.

Financial Overview

David Batters, Chief Financial Officer and Estate Programme Director

| Headlines |

|---|

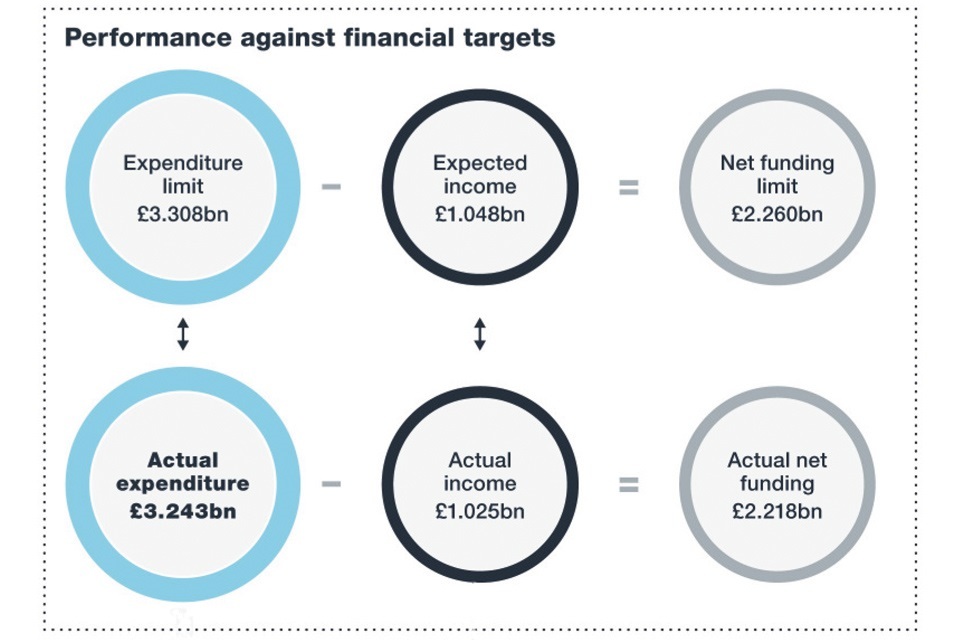

| – A total of £3.243 billion spent in the year |

| – £1.025 billion income |

| – Meaning a net total of £2.218 billion funded by the government |

| – Movements in provisions and other balance sheet items totalled £2.870 billion |

| – Equals net comprehensive expenditure of £5.088 billion |

£38 million NDA’s own running costs are 1.2% of overall estate budget

The NDA has again managed expenditure within the strict funding boundaries agreed by Parliament, and in line with the Spending Review totals agreed in 2015. Over the year, we have spent £3.2 billion, making strong progress across the estate.

Importantly, through careful prioritisation of expenditure and by deferral of a limited amount of scope, we have been able to manage the unforeseen additional costs of the Magnox litigation settlement. We have secured over £1 billion of commercial income through the year, reducing the net impact on the public purse to £2 billion.

It is important to review this performance in context – it is essentially a snapshot of 1 year in a 100+ year programme of activity. The complexity of the critical projects at Sellafield, which are often at a relatively early stage in both design and delivery, mean that there is inherent uncertainty in both the cost and schedule for the necessary work.

There is more stability in the cost estimates across the Magnox sites and at Dounreay. Nevertheless there has been an overall increase of £1.6 billion in the undiscounted cost of completing the NDA mission. For the details behind the key numbers see Nuclear Provision section.

The way in which we contract for delivery of work has changed significantly this year, with Sellafield becoming a subsidiary of the NDA from April 2016. Consequently there has been a substantial reduction this year in fees paid to Parent Body Organisations (PBOs).

All expenditure has been focused on improvements in the operation of the site resulting from the change. Work is under way to procure specialist support to help the management of the site in delivery of key programme and projects.

We continue to drive value for money in our own expenditure, with the cost of running the NDA itself remaining below £40 million (or 1.2% of the overall NDA budget) and continued investment in research and socio-economic initiatives.

The spending review settlement required a commitment from the NDA to deliver efficiency savings of £1 billion, and it is pleasing to say that good progress is being made towards achievement of that target.

David Batters

Chief Financial Officer and Estate Programme Director

11 July 2017

Performance against financial targetes

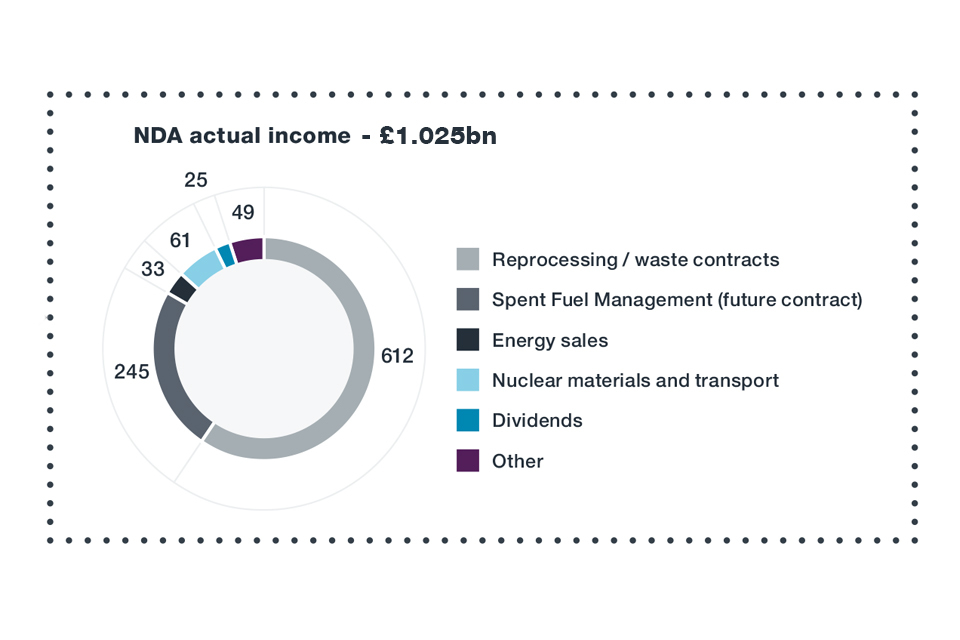

NDA actual income

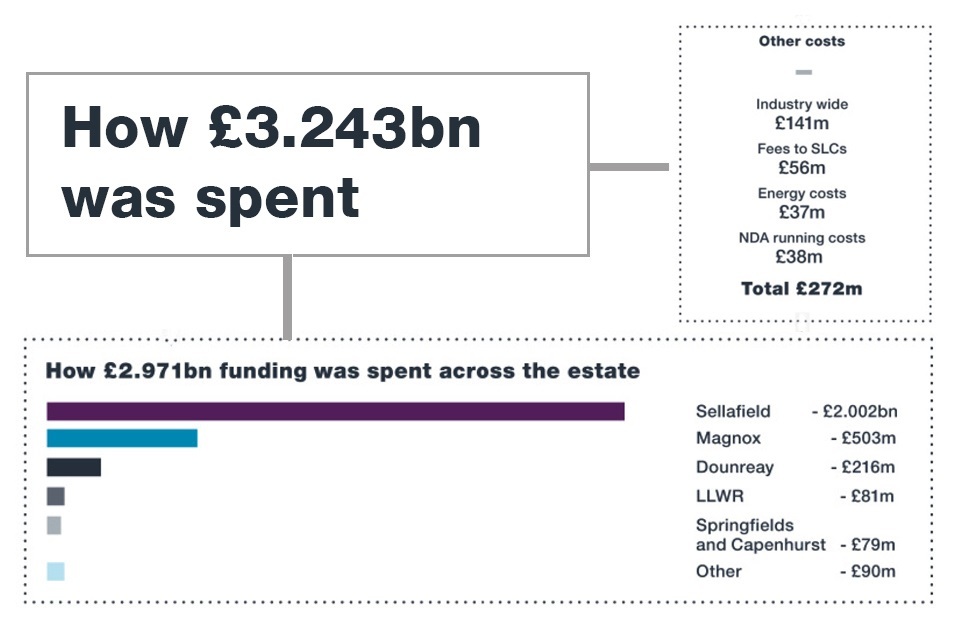

NDA estate expenditure

Financial Summary 2016/17

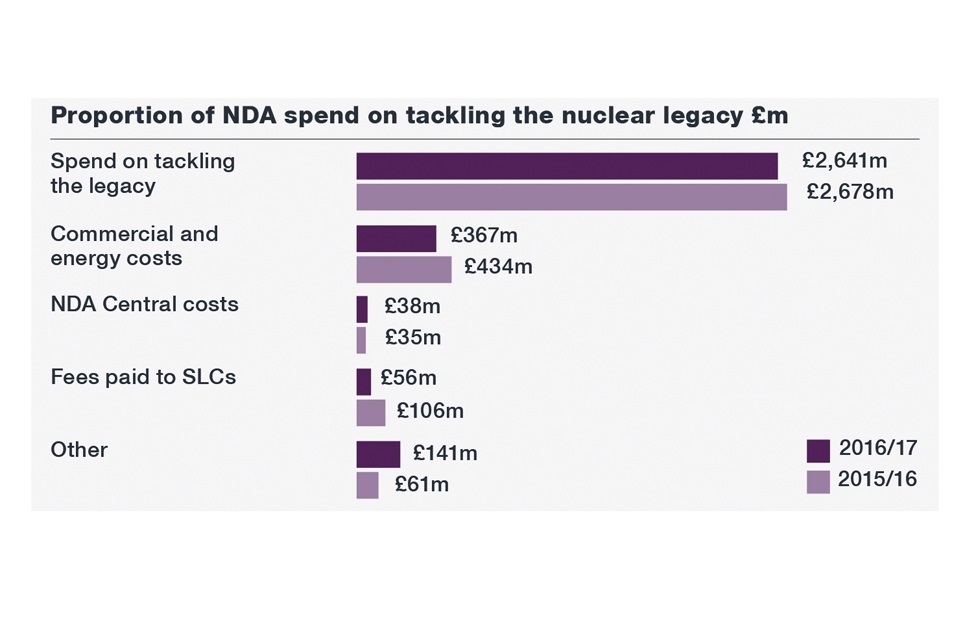

NDA spend on tackling the legacy

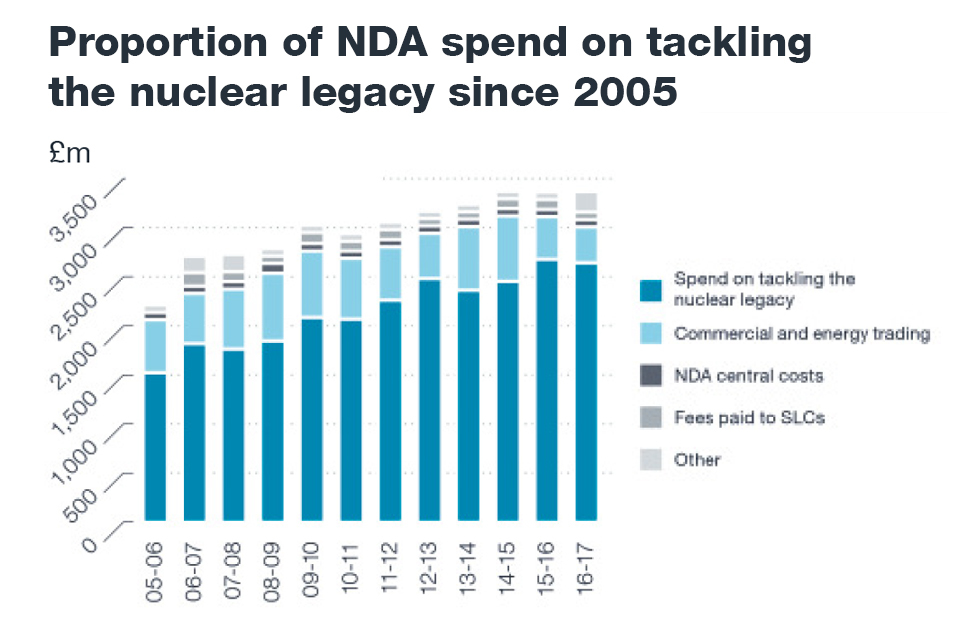

The bulk of NDA’s budget is directed towards tackling the nuclear legacy, by funding the decommissioning carried out by SLCs. The remainder funds commercial operations, industry-wide costs, fees to SLCs and the NDA’s own running costs.

Proportion spend on tackling the nuclear legacy

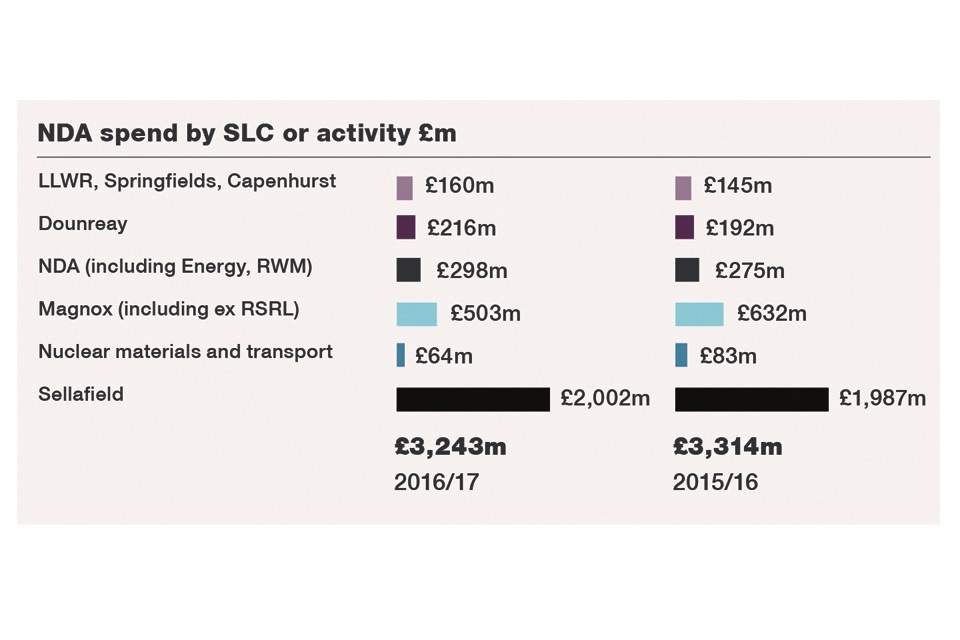

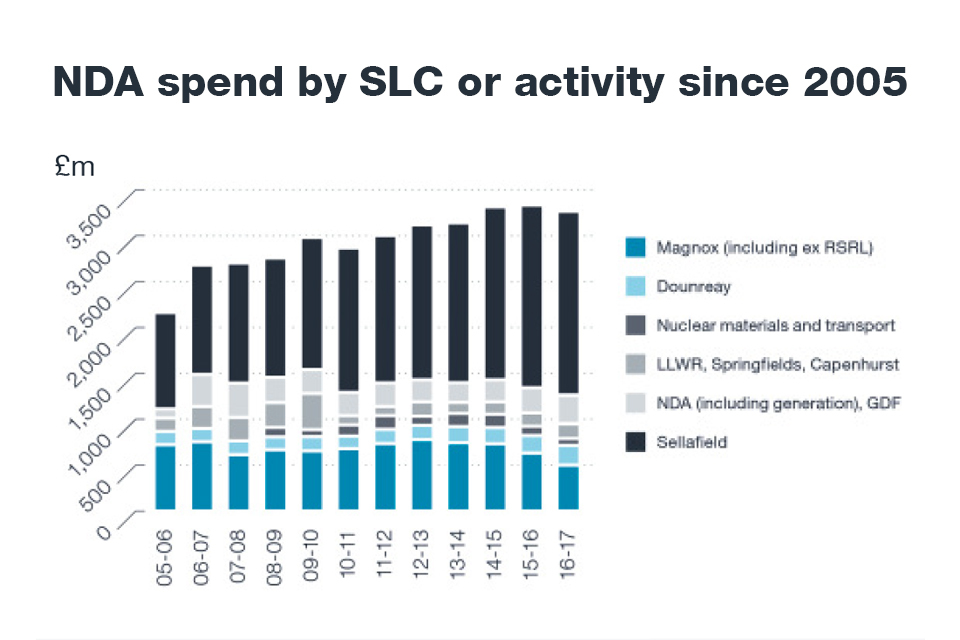

NDA spend by SLC

Spend in 2016/17 was £3.3 billion. More than 60% of this was spent at Sellafield, reflecting the priority given to the site. Expenditure at Sellafield has increased during NDA’s existence and now stands at £2 billion per year.

NDA spend by SLC

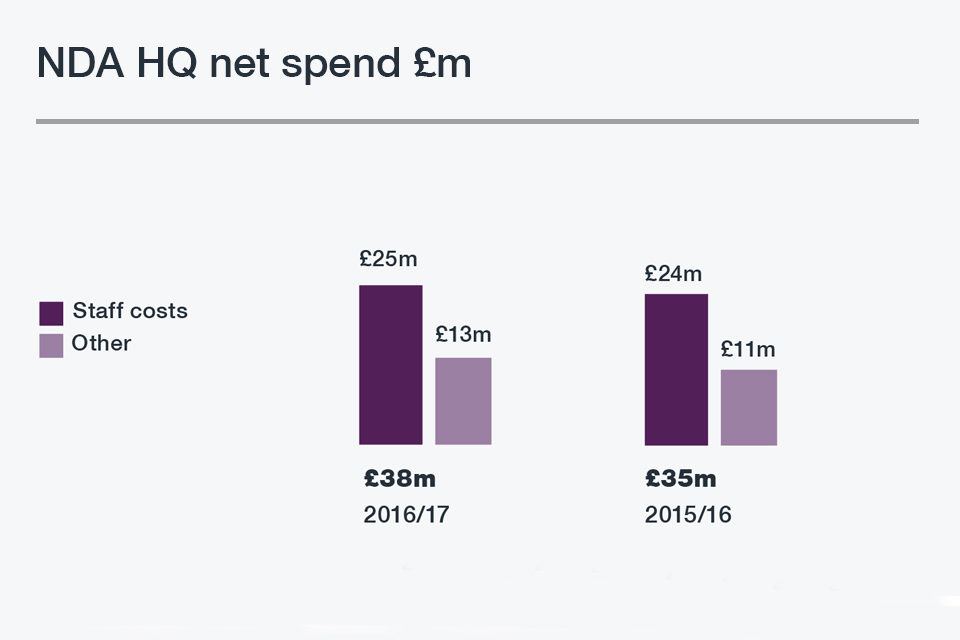

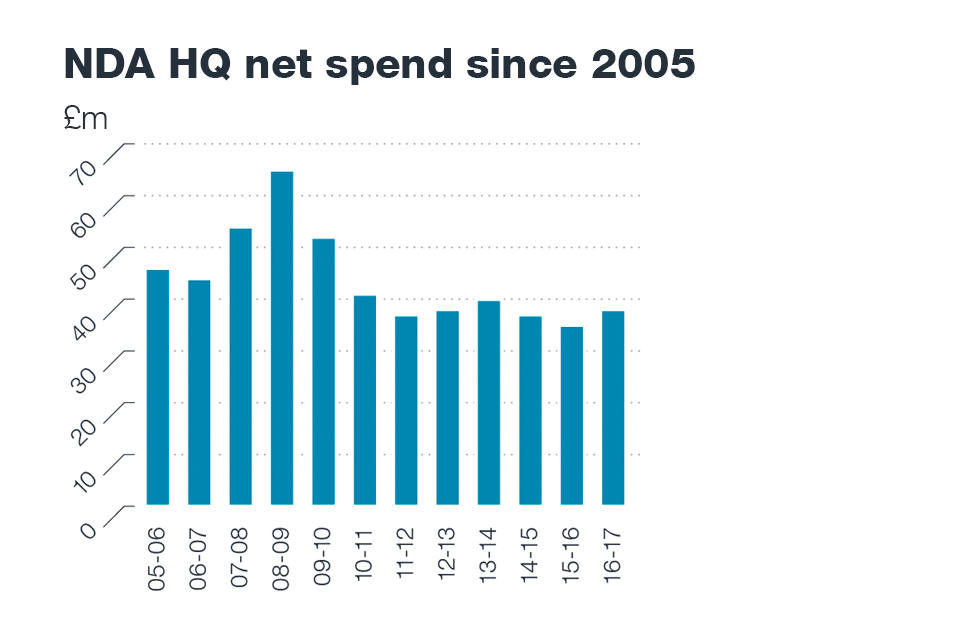

NDA HQ spend

NDA’s own running costs remain below £40 million per year, or approximately 1.2% of overall expenditure.

NDA HQ net spend

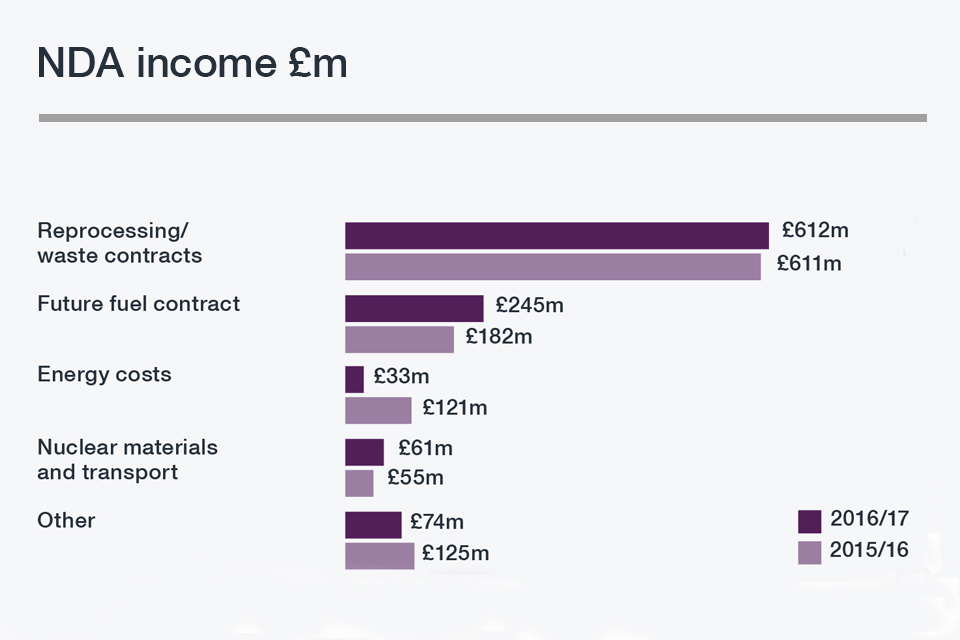

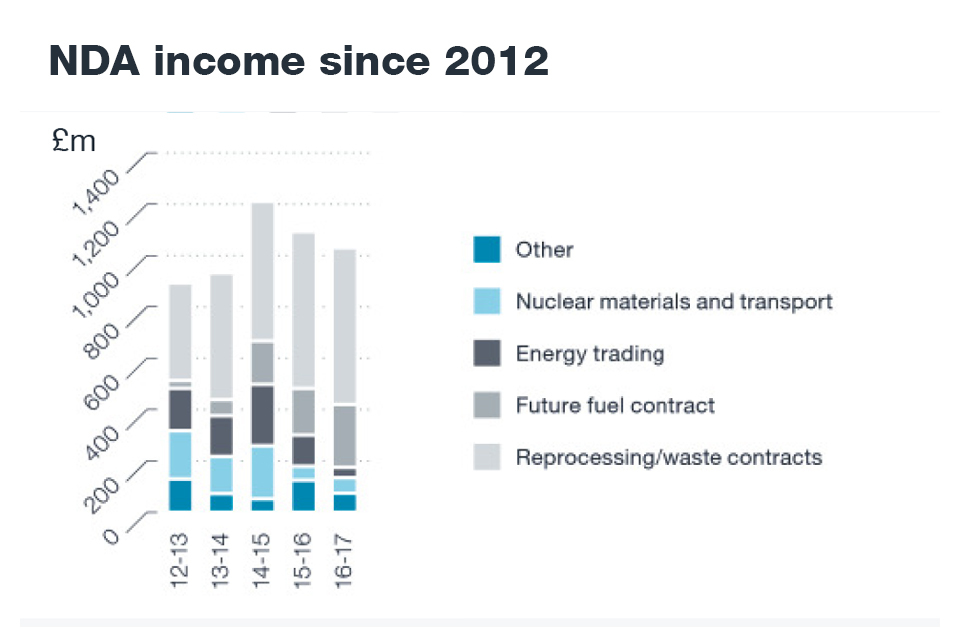

NDA’s income

NDA recognised income of over £1 billion in the year, with 85% arising from reprocessing and management of spent fuels and waste.

NDA income

Financial Summary - since 2005

NDA spend on tackling the legacy

The proportion of NDA expenditure tackling the nuclear legacy has increased since 2005, with a corresponding reduction in commercial costs as commercial operations wind down.

Proportion of NDA spend on tackling legacy since 2005

NDA spend by SLC

Sellafield has always been the NDA’s largest area of spend, and has been increasingly prioritised in recent years as funding has been directed towards the estate’s highest hazards.

NDA spend by SLC or activity since 2005

NDA HQ spend

After the early years in establishing the NDA’s structure and programme, annual running costs have stabilised at below £40 million per year.

NDA HQ net spend since 2005

NDA’s income

In recent years electricity generation income has reduced, leaving reprocessing and management of spent fuels and waste as the dominant source of income.

NDA income since 2012

Nuclear Provision

The Nuclear Provision is a single point number in the Statement of Financial Position which represents the discounted estimated cost of the decommissioning mission.

The NDA management’s best estimate of the future costs of the estate is based on an assumed inventory of materials, using strategies for retrieval and disposal over several decades. Each of these elements (quantity, method and time to treat) is uncertain in their own right, as is the cost of developing the necessary technology and plans to deal with these activities. The quality of the forecast becomes less certain as time goes out, and acceptable standards of clean-up and end states may change.

It is important to understand the basis of this estimate and the inherent uncertainty around it, and therefore that it is simply a single point in a credible range of potential outcomes. For more detail see Appendix A.

Changes in 2016/17 estimate - Authority

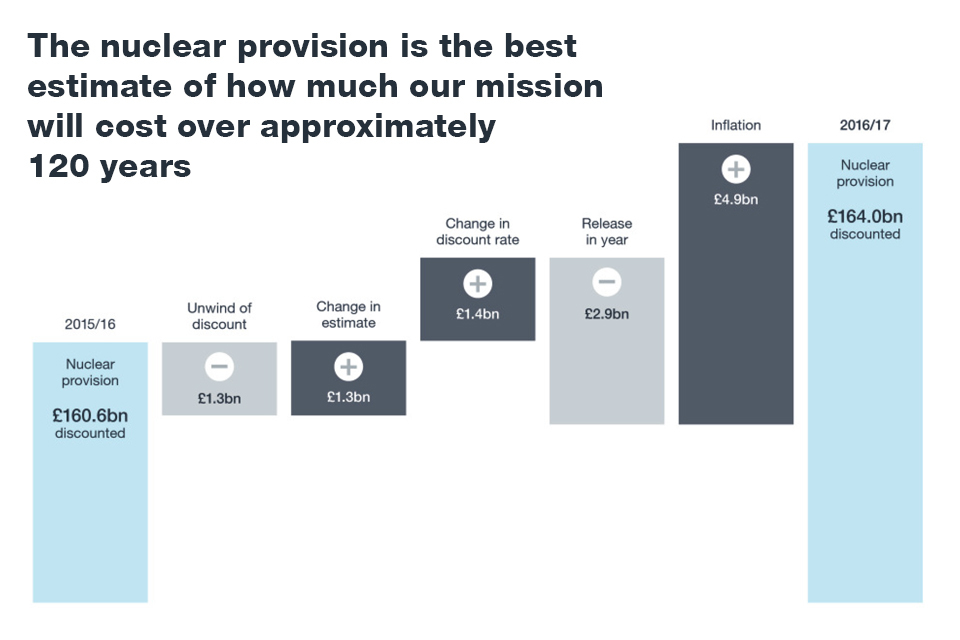

The discounted nuclear provision at the end of 2015/16 was £160.6 billion. Since then the movements have been:

- The value provided for 2016/17 released from the provision -£2.9 billion

- Increases from inflation + £4.9 billion

- Unwinding of the existing discount applied to the provision every year - £1.3 billion

- The impact of the changes in discount rates + £1.4 billion

- Cost estimate changes which increase the liability estimate by a net + £1.3 billion.

These movements bring the 2016/17 Authority estimate to £164.0 billion discounted.

Movements in the nuclear provision, the best estimate of how much our mission will cost over approximately 120 years

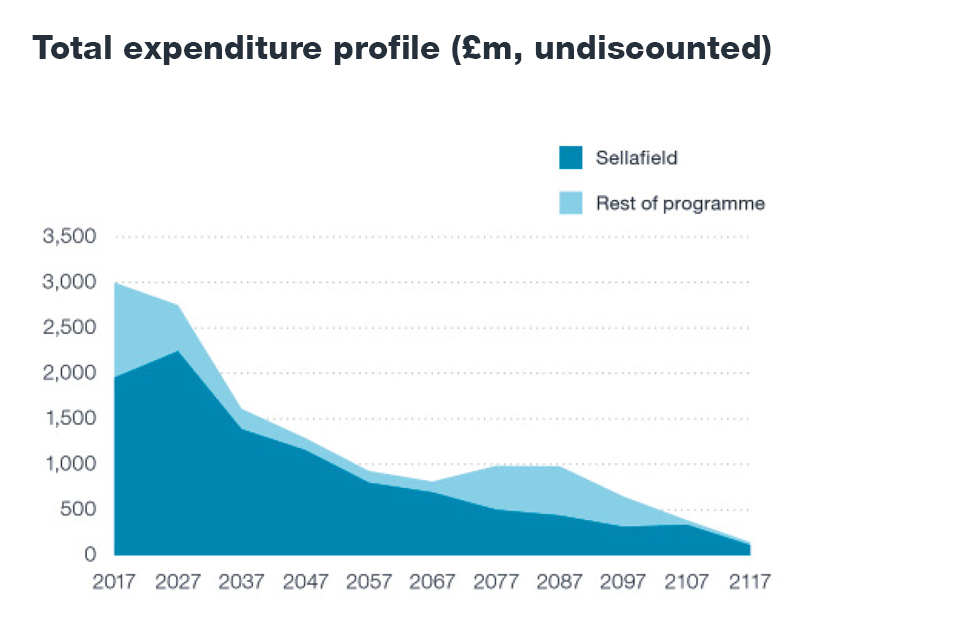

Total expenditure profile (£m, undiscounted)

The graph above shows the undiscounted expenditure profile for future years (excluding NDA administrative and other non-programme costs, and some commercial costs) from lifetime cost projections from each of the SLCs.

The expenditure profile illustrates a downward trend in expenditure over the next 50 years, following a short-term peak over the next 10 years, as sites enter into Care and Maintenance with subsequent increases in expenditure in the period from 2070 when final site clearance work on Magnox sites is undertaken.

Movements in provision - discounted

| Total discounted nuclear liabilities | 2015/16 discounted £m | Unwind of discount £m | Discount rate change £m | Released in year £m | Inflation | Other cost change £m | Movement discounted £m | 2016/17 discounted £m | 2016/17 undiscounted £m |

|---|---|---|---|---|---|---|---|---|---|

| Magnox Limited | (23,329) | 193 | (170) | 659 | (707) | (374) | (399) | (23,728) | (15,150) |

| Sellafield Limited | (117,421) | 924 | (1,075) | 1,940 | (3,582) | (716) | (2,509) | (119,930) | (89,627) |

| Dounreay Site Restoration Limited | (2,713) | 21 | (101) | 177 | (81) | 0 | 16 | (2,697) | (2,378) |

| LLW Repository Limited | (755) | 6 | (6) | 19 | (23) | 0 | (4) | (759) | (576) |

| INS Contracts | (20) | 0 | (1) | 0 | (1) | (30) | (32) | (52) | (43) |

| Springfields | (901) | 8 | (6) | 45 | (27) | 0 | 20 | (881) | (595) |

| Capenhurst | (1,190) | 10 | (18) | 34 | (37) | 0 | (11) | (1,201) | (968) |

| Geological Disposal Facility | (14,264) | 111 | (64) | 28 | (438) | (123) | (486) | (14,750) | (9,655) |

| Authority | (160,593) | 1,273 | (1,441) | 2,902 | (4,896) | (1,243) | (3,405) | (163,998) | (118,992) |

| NDA group companies | (79) | 0 | (4) | 0 | (3) | (61) | (68) | (147) | (131) |

| Group provision adjustment | 0 | 640 | 640 | 640 | 640 | ||||

| NDA Group | (160,672) | (1,273 | (1,445) | 2,902 | (4,899) | (664) | (2,833) | (163,505) | (118,483) |

Health, Safety, Security, Safeguards and Environment (HSSSE) Report

Introduction

The safety of people, protection of the environment and security of nuclear materials and information are NDA’s overriding priorities and dictate our approach to all activities across the estate.

We expect good performance in environment, health, safety and security that reflects both international standards and policies, and relevant good practice from UK industry.

Serious accidents are rare. The number of injuries under RIDDOR is well below the UK national average for organisations of a similar size, but there was an increase in the number of near misses and first aid cases that fall below the reporting threshold.

We were disappointed to see a number of INES events at our sites which indicates a reduction in the multiple safety layers that provide defence in depth.

While legal responsibilities rest with the SLCs, subsidiaries and contractors who work on the estate, it is NDA’s duty to develop a strategy and programmes that have particular regard for safety, the environment and security and we take our responsibilities seriously. We hold to account those who fail to meet our expectations and are working with the sites to ensure the dip in our strong safety record is short-lived.

Environmental performance on the NDA estate

The NDA measures environmental performance as the number of non-compliances with environmental permits. In 2016/17, the estate reported 60 non-compliances, slightly fewer than last year. Most were technical breaches, and none resulted in a significant environmental impact.

- In a year of good performance, Sellafield reacted well to an event which saw a steady increase in radioactive discharges via one of the surface water sewers. The increase was very small and within permitted limits. Control of chemicals remains a challenge for the site and, at the request of the Environment Agency, Sellafield has reviewed its management arrangements, and implemented an improvement programme. We are encouraged by Sellafield’s response and we will monitor their progress.

- Dounreay’s environmental performance has improved. However, the Scottish Environment Protection Agency (SEPA) provided a 2016 end-of-year ‘at risk’ rating for the management of radioactive waste, and a ‘poor’ rating for management of the low level waste vaults. While we, and DSRL, were disappointed with this outcome, there are signs of recovery. It is for DSRL to embed the better practices expected by NDA and SEPA. We have an open dialogue with DSRL and we will monitor their progress.

- Performance at Magnox improved. The focus on characterisation, sentencing, reporting and consignment of wastes has raised standards, but towards the end of the year, there were a small number of events concerning the despatch of wastes from sites. These resulted in a warning letter from the Environment Agency. None of these events were harmful to the environment, and Magnox learned from this experience. More positively, Magnox completed its environmental improvement programme for 2016/17, which included the removal of 50% of the legacy waste at 10 sites.

- Elsewhere in the estate, we were pleased to note good environmental performance at LLW Repository, and in our subsidiaries NDA Properties Ltd, International Nuclear Services/Pacific Nuclear Transport Ltd, Radioactive Waste Management and Direct Rail Services Ltd.

The NDA recognises that measuring site performance is wider than the number of environmental non-compliances against permits. So we are collaborating with the Environment Agency and our SLCs to develop a broader set of indicators for environmental performance, which we will use for our report next year.

Nuclear and conventional safety performance on the NDA estate

We use a suite of metrics, targets and performance indicators to understand safety performance. We also visit sites to carry out safety audits and discuss safety with managers, workers and trade union representatives. The results are reported to the NDA Executive and NDA Safety and Security Committee, which is a sub-committee of the NDA Board, and the findings are raised with SLC management and Parent Body Organisations.

One issue of concern in 2016/17 was the reporting by Sellafield of 3 radiological events rated at INES2, the estate’s first at that level since 2009.

INES is the International Nuclear and Radiological Event Scale set by the International Atomic Energy Agency, with scales ranging from 1-7. INES is primarily intended to aid understanding between the technical community, the media and the public on radiological events. A rating is not in itself a reliable indicator of the severity of an event, because INES is a communication tool, not an objective scientific scale.

In total, our sites reported 9 INES events, 6 at Level 1 (Anomaly), which is the lowest level and 3 at Level 2 (Incident).

The NDA takes the safety of people working with radiation seriously and we have, working with the SLCs concerned, reviewed all 9 INES events. It is the SLCs’ duty to report and investigate events on the site, to take action to control risks, and prevent recurrence. We were content that SLCs had carried out a proper investigation, and learned from what had happened.

We also monitor nuclear and radiological events that do not attract INES ratings. The rate of occurrence of these events was similar to those of previous years. On conventional safety, all parts of the estate saw an increase in the number and severity of events that could have resulted in serious injury.

Number of INES events by SLC

| Magnox | DSRL | LLWR | Sellafield | Total | |

|---|---|---|---|---|---|

| 2015/16 | 3 | 1 | 0 | 2 | 6 |

| 2016/17 | 1 | 2 | 0 | 6 | 9 |

Note - more detail of these events can be found in Appendix B.

Sellafield

On conventional safety, the good performance of recent years continued and the site ended 2016/17 with a Recordable Incident Rate of 0.29, a creditable achievement comparable to high-performing public and private sector organisations of similar size.

However, towards the end of the year, 3 radiological safety events were assigned INES2 (‘Incident’) ratings.

None of the events had any impact on public safety, or on the safety of operations at the site, and it is unlikely that the health of people involved will be affected. Sellafield and NDA are equally committed to learning from what has happened. We have reviewed Sellafield’s response to the INES2 events, and do not consider that they indicate a serious decline in safety performance.

Dounreay

There was a deterioration in safety performance at Dounreay, and DSRL and NDA concluded that improvements introduced following the 2014 sodium tank farm fire have not been sustained. The site is receiving attention and assistance from its parent body. More positively, from December 2016, the site reported fewer injuries and events.

Magnox

This year, we were pleased to note sustained improvement to overcome a dip in performance in the previous year at all Magnox sites. Our own assurance work has confirmed the presence of good safety management, and an appropriate safety culture.

In common with many large industrial structures of a similar age, all Magnox sites have historical issues with the management of asbestos, which will become clearer as decommissioning progresses. In January 2017, the ONR served an Improvement Notice on the Wylfa site, requiring improvements in the management of asbestos.

NDA has continued to engage with Magnox to improve the management of asbestos, and progress has been made. The scale and nature of this issue means that further work is required to reduce the risk and control the hazard.

Low Level Waste Repository

LLWR has maintained its safety performance through initiatives such as the ‘Perfect Day’ principle, which combines safety with work delivery and management effectiveness. As LLWR makes proportionately greater use of contract labour than other NDA sites, the management of contractors is an important part of their approach to safety.

We will repeat the estate-wide Safety Climate Survey during 2017/18 and use the results to inform our approach to the assurance of safety, and the development of our strategy on the environment, health and safety.

Conventional Safety – Reporting of Injuries, Diseases and Dangerous Occurrence Regulations (RIDDOR)

In 2016/17, a total of 20 Specified Injuries and Lost Time Accidents (LTA) were reported to the regulators, under RIDDOR.

Slips, trips, falls and strains still cause the majority of lost-time accidents. Injuries that are more serious remain rare.

A reliable measure for conventional safety performance across sectors is the rate of injuries or cases of ill health per 100,000 employees. The average rate for the SLCs in 2016/17 was 81 per 100,000 employees compared to 118 per 100,000 employees the previous year. For comparison, HSE’s most recently published data (from 2015/16) indicates a UK rate of 274.

| Safety injuries by SLC | 2016/17 RIDDOR specified injuries | > 7 day LTA | Total |

|---|---|---|---|

| Magnox | 2 | 3 | 5 |

| DSRL | 0 | 0 | 0 |

| LLWR | 0 | 0 | 0 |

| Sellafield | 3 | 12 | 15 |

| Total | 5 | 15 | 20 |

| Safety injuries by SLC | 2015/16 RIDDOR specified injuries | > 7 day LTA | Total |

|---|---|---|---|

| Magnox | 5 | 4 | 9 |

| DSRL | 1 | 3 | 4 |

| LLWR | 0 | 0 | 0 |

| Sellafield | 7 | 8 | 15 |

| Total | 13 | 15 | 28 |

Security Performance- Site Licence Companies (SLCs)

Security Focus

Ensuring appropriate security performance and meeting UK strategic goals is as important as achieving good safety performance. This year, working with other stakeholders including BEIS and regulators, our focus has been to reduce risk in cyber security and the supply chain, improve resilience and open the NDA archive building at Wick, Nucleus, which will store sensitive nuclear information. Specifically, we have:

- Provided cyber security specialist support to the new NDA Cyber Resilience Programme

- Maintained achievement of the required government targets for assessing information risk management

- Engaged with BEIS, ONR, NDA subsidiaries and SLCs to identify supply chain risks across the estate

- Initiated a pan-nuclear sector working group to develop options for a single supply chain assurance solution

- Engaged with power generators to broaden consultation on supply chain risks and develop options for a single supplier assurance solution

- Worked closely with Cumbria Local Resilience Executive Board to identify new options following a decision to stop current plans to build a dedicated Strategic Control Centre

- Worked closely with Cumbria Local Resilience Programme Board to plan resilience exercises

- Worked with Sellafield Ltd to define requirements for their Off-Site Command Facility

- Worked closely with NDA Archives Ltd to commission security equipment and implement security plans (physical, cyber, personnel and procedural) for the archive and achieve regulator accreditation for the storage and handling of Sensitive Nuclear Information

- Engaged with BEIS, ONR and participants from across the civil nuclear sector to review how sensitive nuclear information is defined and marked

There has been a mixed performance across the SLCs during 2016/17. The NDA Security Team has maintained direct involvement with each SLC, including site visits and regular monthly interactions with the Security Directors.

Environmental performance at NDA

Safety and environmental performance in the NDA

As the employer of some 238 people across multiple locations, we have responsibilities for the safety and well-being of our staff, the security of information we use, and our own impact on the environment.

NDA’s in-house safety performance has been good, with only minor accidents recorded during the year, and a small number of first aid cases.

See Something, Say Something, the NDA’s event reporting process, was introduced in 2015 and has bedded in well. Trends and types of event are presented quarterly to safety representatives and the NDA Executive Committee. This information has been used to develop safety, health and environmental improvements, and during this year we ran successful campaigns in personal wellbeing, fitness, road safety, workplace stress and office safety.

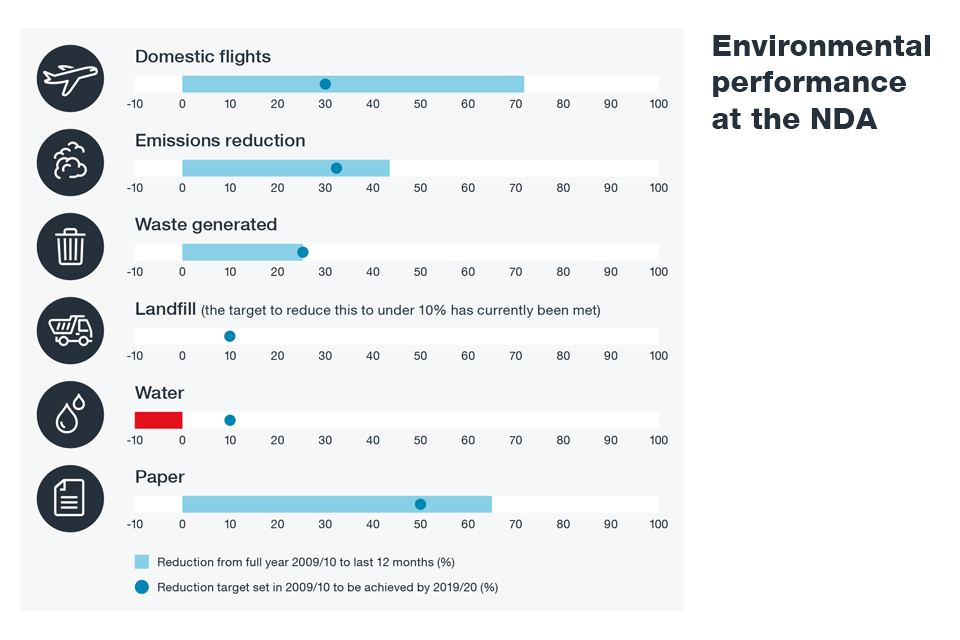

The Government has set environmental and sustainability targets that must be met by 2019/20. NDA reports as an NDPB, and our progress is shown above.

We expect to meet the 2019/20 targets for domestic flights, emissions and waste.

While we are already ahead of the target for paper use, we noted an increase during this year and we have introduced a number of measures in response, including better use of technology as a replacement for paper documents.

We are pleased to report that none of our waste now goes to landfill. Reducing our water use however, is more challenging as we have moved a number of people into our HQ at Cumbria.

ACCOUNTABILITY

Directors’ Report

The Nuclear Decommissioning Authority is an Executive Non-Departmental Public Body (NDPB), established on 22 July 2004 under the Energy Act (2004) with the primary objective of overseeing and monitoring the decommissioning and clean-up of the UK’s civil nuclear legacy.

Since then, the NDA’s remit has been extended to include the long-term management of all the UK’s radioactive waste by finding appropriate storage and disposal solutions.

Accounts direction

These accounts have been prepared in a form directed by the Secretary of State with the approval of HM Treasury and in accordance with section 26 of the Energy Act (2004).

Directors’ interests

Directors of the NDA must declare any personal, private or commercial interests. A register of such interests is maintained by the NDA.

No director has any personal, private or commercial interests which would conflict with his or her role as a director of the NDA.

Directors comprise of senior management and non-executives whose details are set out in the Governance Statement.

Auditor of the NDA

The NDA is audited by the Comptroller and Auditor General (C&AG) in accordance with the Energy Act 2004. The services provided by the C&AG relate to statutory audit work for the NDA. No fees were paid to the C&AG for services other than statutory audit work.

Pensions

All NDA employees are eligible to participate in the Civil Service Pension Arrangements. Employees within the Group participate in various defined benefit pension schemes detailed in note 26 to the accounts.

Group employees also participate in various schemes which are accounted for on a defined contribution basis, with details given in note 26 to the accounts.

Charitable and political donations

The NDA did not make any charitable or political donations during the year (2015/16 - £Nil).

Better payment practice

The NDA supports the Better Payment Practice Code in its treatment of suppliers. The key principles are to settle the terms of payment with suppliers when agreeing the transaction, to settle disputes on invoices without delay and to ensure that suppliers are made aware of the terms of payment and to abide by the terms of payment. During the year, the NDA has achieved a 92.84% success rate for payment of suppliers in accordance with terms (2015/16 – 94.94%). The average number of payment days from invoice date was 29 days and for a valid invoice, (i.e. one with all details correct and entered on the accounting system), 12 days (2015/16 - 28 days and 10 days). The proportion that is the aggregate amount owed to trade creditors at the year-end compared to the aggregate amount invoiced by suppliers expressed as a number of days is 18.40 days (2015/16 – 12.71 days).

Personal data

There has been a loss of personal data reported to NDA during the year. A supplier, on contract to NDA between 2007 and 2009 to provide dosimetry services, discovered that a server being managed by a sub-contractor and containing Personally Identifiable Information (PII) had been infected with malware and that a copy of certain data had been exported. A small number of NDA staff (current and former) were affected and an exercise to contact them all to inform them of the data breach has now been completed. A subsequent investigation has concluded that the sub-contractor should not have retained NDA staff PII following termination of the contract and confirmed that the compromised data has now been expunged from their IT systems.

Other Disclosures

Some disclosures that are required in the Director’s Report have been included elsewhere in the Annual Report. Disclosures on Equal Opportunities, Learning and Development and how the NDA engages with all staff are in the Staff Report. Details of investment in socio-economic developments, research and development and funding, counterparty and foreign exchange risk are all included in the financial statements. The NDA’s environmental performance is detailed in the HSSSE report.

No events affecting these accounts have occurred since the reporting date. A full explanation of the adoption of a going concern basis appears in note 2.1 of the financial statements.

Statement of Accounting Officer’s Responsibilities

Under Section 26 of the Energy Act 2004, the Secretary of State (with approval of HM Treasury) has directed the NDA to prepare a statement of accounts in the form and on the basis set out in the Accounts Direction.

The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the NDA and of its income and expenditure, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

- Observe the Accounts Direction issued by the Secretary of State (with approval of HM Treasury), including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis

- Make judgements and estimates on a reasonable basis

- State whether applicable accounting standards have been followed, as set out in the Government Financial Reporting Manual, and disclose and explain any material departures in the accounts, and

- Prepare the accounts on a going concern basis.

The Accounting Officer for the Department for Business, Energy and Industrial Strategy (BEIS) has designated the Chief Executive as Accounting Officer for the NDA.

The responsibilities of an Accounting Officer including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records for safeguarding the NDA’s assets, are set out in Managing Public Money published by HM Treasury.

In addition, the Accounting Officer confirms that, as far as he is aware, there is no relevant audit information of which the NDA’s auditors are unaware, and that he has taken all steps necessary to ensure that he is aware of any relevant audit information, and that the NDA’s auditors are aware of that information.

He takes responsibility for ensuring that the NDA Annual Report and Accounts as a whole is fair, balanced and understandable in both the preparation of the document and in making the judgements necessary in preparation of the document.

Governance Statement

Introduction

The NDA is sponsored by the Department for Business, Energy and Industrial Strategy (BEIS). Oversight and governance of the NDA is provided by UK Government Investments (UKGI). The formal agreement between the NDA and BEIS is set out in a framework document, supported by a Memorandum of Understanding between BEIS and UKGI.

This governance statement summarises the structure of the NDA Board and the Executive and the effective governance over the key activities undertaken during 2016/17. It explains the frameworks used to measure the effectiveness of delivery, the findings of key audit and assurance reviews and associated improvement actions.

The Authority’s Governance Framework

We are governed by the Energy Act 2004, the government’s Framework Document and Cabinet Office guidelines for Non-Departmental Public Bodies (NDPBs). Our structure is summarised below and further explained in this statement.

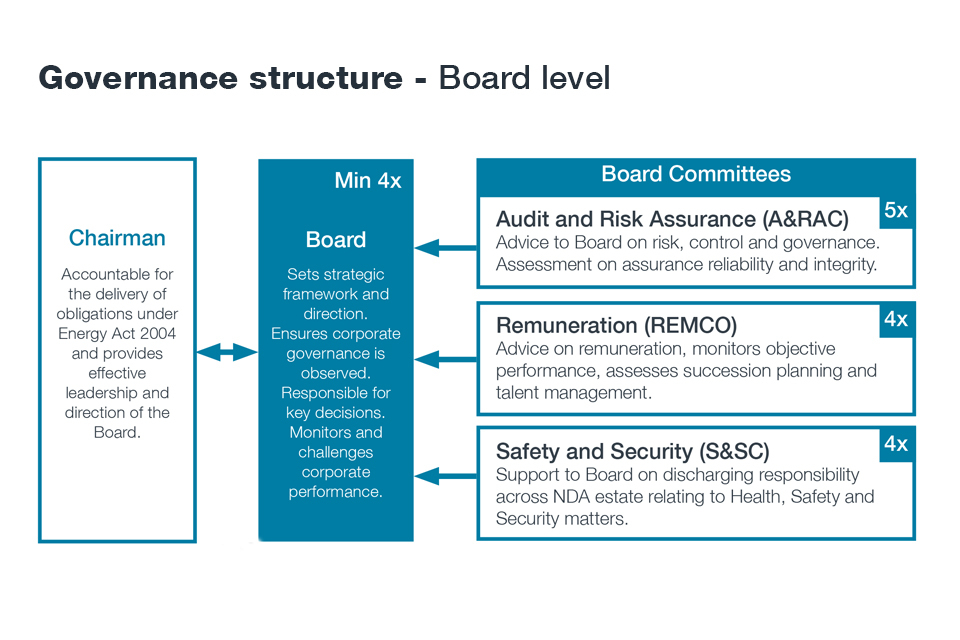

Governance structure - Board level

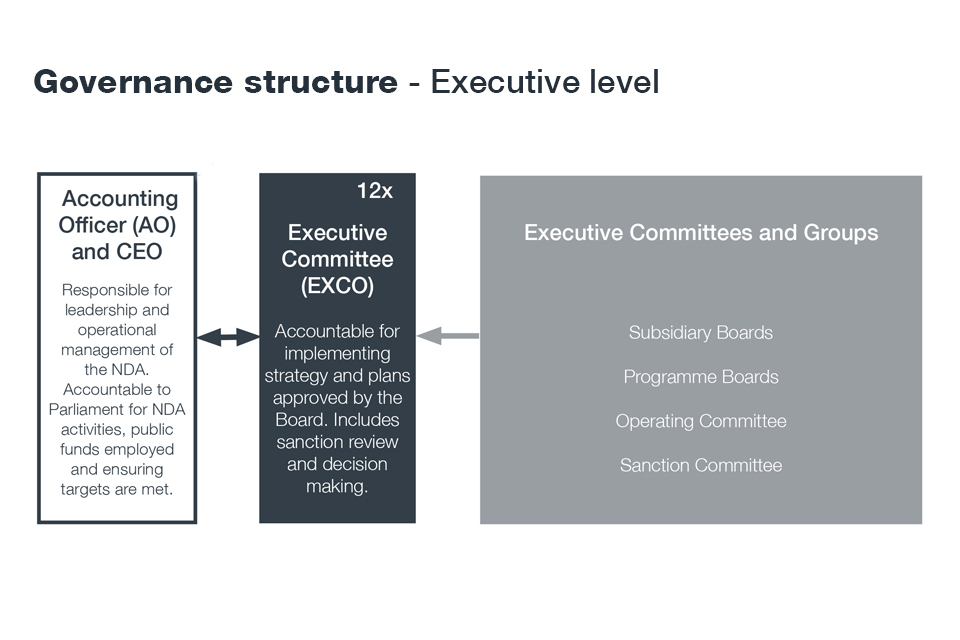

Governance structure - Executive level

Note: The Board have established a Programme and Projects Committee (P&P Committee). The first meeting took place in May 2017. This committee will provide oversight on major projects and programmes requiring enhanced assurance and/or Board sanction.

The current NDA Board: back row from left to right, Volker Beckers, David Peattie, Adrian Simper, Tom Smith and Rob Holden. Front row, from the left, Evelyn Dickey, Janet Ashdown and David Batters.

At the 31 March 2017, we had 9 Directors - three executive plus 6 Non-Executive Directors (NEDs) including the Non-Executive Chair. Board membership and current terms, committees and attendance for those who have served during 2016/17 are summarised below:

Number of meetings (held) and attended

| Name | Position and Current Term | Board (13) | A&RAC (5) | REMCO (4) | S&SC (4) |

|---|---|---|---|---|---|

| Stephen Henwood | Chairman (1 Mar 2008 - 28 Feb 2017) | 9 of 9 | 3 of 4 | 3 of 3 | 1 of 3 |

| Tom Smith | Senior NED (5 Mar 2013 - 28 Feb 2017) and Chairman (from 1 Mar 2017 - 28 Feb 2020) | 13 of 13 | 4 of 5 | - | 1 of 1 |

| Volker Beckers | NED (1 Mar 2015 - 28 Feb 2018) and Chair of A&RAC (from 17 Mar 2016) | 12 of 13 | 5 of 5 | - | - |

| Evelyn Dickey | NED (1 Mar 2015 - 28 Feb 2018) and Chair of REMCO (from 1 Jun 2015) | 13 of 13 | - | 4 of 4 | - |

| Janet Ashdown | NED (1 Jun 2015 - 31 May 2018), Chair of S&SC (from 17 Mar 2016) and Senior NED (from 1 Mar 2017) | 12 of 13 | 4 of 5 | - | 4 of 4 |

| Ken McCallum | NED (1 Mar 2014 - 31 Mar 2017) | 11 of 13 | - | 3 of 4 | - |

| Rob Holden | NED (1 Jun 2015 - 31 May 2018) | 12 of 13 | - | 4 of 4 | 4 of 4 |

| John Clarke | CEO and Accounting Officer (2 Apr 2012 - 28 Feb 2017) | 9 of 9 | 3 of 3 | 3 of 3 | 2 of 3 |

| David Batters | Chief Financial Officer (from 18 Oct 2010) | 13 of 13 | 4 of 5 | - | 3 of 4 |

| Adrian Simper | Director of Strategy (from 1 Mar 2014) | 13 of 13 | - | - | - |

| Pete Lutwyche | Chief Operating Officer (3 Mar 2014 - 31 Oct 2016) | 5 of 5 | - | - | 2 of 2 |

| David Peattie | CEO and Accounting Officer (from 1 Mar 2017) | 4 of 4 | 1 of 1 | 1 of 1 | 1 of 1 |

Current Non-Executive Directors (NEDs) including Non-Executive Chair

Tom Smith - Chairman

Tom began his career in the Diplomatic Service, working in London, Hong Kong and Beijing between 1979 and 1990, when he was part of the team that negotiated the 1984 treaty with China on Hong Kong.

In 1990 he joined Trafalgar House plc and held several senior positions before becoming Managing Director of Midland Expressway Ltd (MEL) in 1997, in which role he led the development and construction of the M6Toll, the UK’s first privately financed toll motorway. He subsequently joined the Go-Ahead Group plc as Managing Director Rail Development and over 10 years was instrumental in turning Go-Ahead into one of the country’s largest passenger rail operators. He was Chairman of the Association of Train Operating Companies from 2009 to 2013. He was a non-executive director of Highways England from 2014 to 2016.

Current external appointments include:

- Chair - Angel Trains Group

- Member - Institute of Directors

Rob Holden CBE – Non-Executive Director

Between 1999 and 2009, Rob led the London and Continental Railways (LCR) team in a series of transactions that secured the future of the Channel Tunnel Rail Link (later renamed High Speed 1). In 2009 he was awarded a CBE for services to the rail industry.

Current external appointments include: Non-Executive Director - Electricity North West Chair - High Speed 1 Other positions - Participation on Price Waterhouse Cooper’s infrastructure advisory board.

Work for the Cabinet Office’s Major Projects Review Group.

Volker Beckers – Non-Executive Director

Volker was Group CEO of RWE Npower plc until the end of 2012 and prior to this, its Group CFO from 2003 to 2009. He has worked in a variety of trade and industry bodies, including the CBI President’s Committee, on the Board of the German-British Chamber of Industry and Commerce, and, since 1999, as Deputy Chair of the Executive Commercial Management Committee at the German Association of Energy and Water Industries (BDEW). He was also member of the Executive Committee of UKBCSE (now Energy UK). He chairs the Business Energy Forum and is Honorary VP of the Energy and Utilities Forum.

Current external appointments include:

- Non-Executive Director - Elexon Ltd

- Chair - SpencerAM Ltd (until August 2016), Albion Community Power plc, Reactive Technologies Ltd.

- Director and Honorary VP - British Institute of Energy Economics

- Other positions - Member of the Board of Directors, Danske Commodities A/S; Vice- Chairman (since October 2016), Member of UK PwC Advisory Board

Janet Ashdown – Non-Executive Director

Janet worked for BP plc for over 30 years, holding a number of local and global positions in fuel supply, manufacturing, oil trading and retail marketing. She was a senior leader in BP, running BP’s UK retail and commercial fuel business in her last role. Janet was, until the end of 2012, Chief Executive Officer of Harvest Energy Ltd.

Current external appointments include:

- Non-Executive Director - SIG plc; Marshall’s plc.

- Chair - ‘Hope in Tottenham’ charity.

Evelyn Dickey – Non-Executive Director

Evelyn has extensive HR experience leading design and delivery of major change programmes, business restructuring, employee relations, resourcing, executive remuneration, organisational capability and performance management initiatives.

Evelyn has worked in HR consultancy and as HR Director (HR Operations) for Boots the Chemist, before joining Severn Trent’s HR function in November 2006.

Current external appointments include:

- Director - HR Function, Severn Trent

Board Performance

Compliance with the Government Code of Corporate Governance

We comply with the Government Code of Corporate Governance and government guidance for an arm’s length body of our size and complexity:

- The Board monitors the NDA’s performance and directs its business effectively, including playing an active role in stakeholder relations

- The Chair is responsible for leading the Board and non-executive directors to challenge and help develop strategy

- The Board receives frequent updates on the NDA’s financial position, forecasts and sensitivities

- The Board has an appropriate balance of skills and experience to discharge its responsibilities

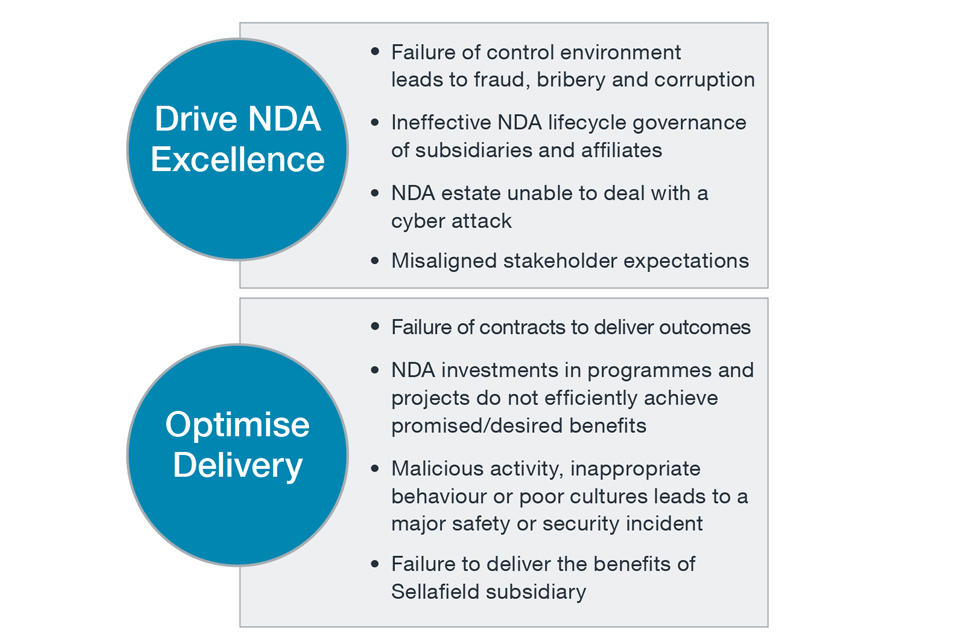

- The Board ensures that a balanced assessment of performance is reported to BEIS and regularly debates the main (corporate strategic) risks facing the NDA

- The Audit and Risk Assurance committee has oversight of, and provides challenge to, the management and internal control systems

- The Board places particular emphasis on the quality and integrity of the data submitted for its use. Critical processes and outputs fall within the control of the NDA Assurance Framework and are subject to peer review and/ or independent review by Internal Audit.

- The Board reviews the terms of reference for its sub-committees annually

- Executive director remuneration is determined by the remuneration committee within the guidelines set by HM Treasury and BEIS. Non-Executive remuneration is set by BEIS and reviewed annually

Board performance and effectiveness review

The Board undertakes an annual evaluation of its effectiveness, led by the senior non-executive director. In 2016, this took the form of a measured assessment against the National Audit Office’s (NAO) criteria for good practice in public sector boards. The conclusion was that the Board operates well and performs satisfactorily or better as measured against the NAO criteria and that this had been achieved at a period of transition, particularly in the non-executive membership of the Board.

Several areas for improvement were identified, notably:

- A need for greater Board engagement in setting and reviewing strategy on a regular basis. In response to this, a full day of strategy review was held in October 2016. This will be repeated annually and, in addition, the agenda of regular Board meetings now includes a greater focus on strategic issues, which management are encouraged to bring to the Board.

- The quality of the performance reports to the Board needs to be improved, in particular to include forward as well as backward-looking performance assessments, early warnings of issues and detail on management actions to address performance shortcomings. These changes have been progressively implemented by management, and performance reporting is a priority area of our new CEO.

- The Board, and particularly the non-executive members, would benefit from improved engagement with the NDA’s key government stakeholders. Ways of doing this have been discussed with BEIS and UKGI, and are being implemented in the current year.

For the 2017 review, it is planned to arrange external facilitation to provide a more independent and in-depth evaluation.

Board Committees

The Board is supported by its committees as outlined below:

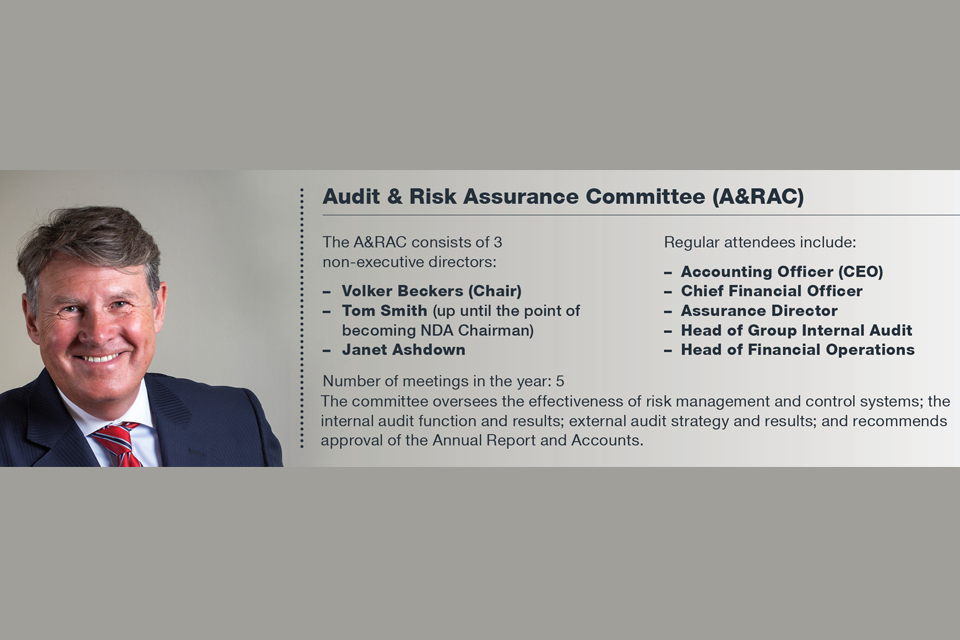

Audit & Risk Assurance Committee (A&RAC) members

During the year, the Audit & Risk Assurance Committee has:

- Ensured the NDA met all financial reporting obligations

- Ensured that NDA accounting practices are in line with BEIS and HM Treasury guidance

- Supported the NDA’s changed approach to risk management, which places increased emphasis on the strategic risks facing the organisation

- Provided oversight of the control framework for information risk management and associated improvement plans

- Provided oversight on the further development of the NDA’s Risk and Assurance Framework.

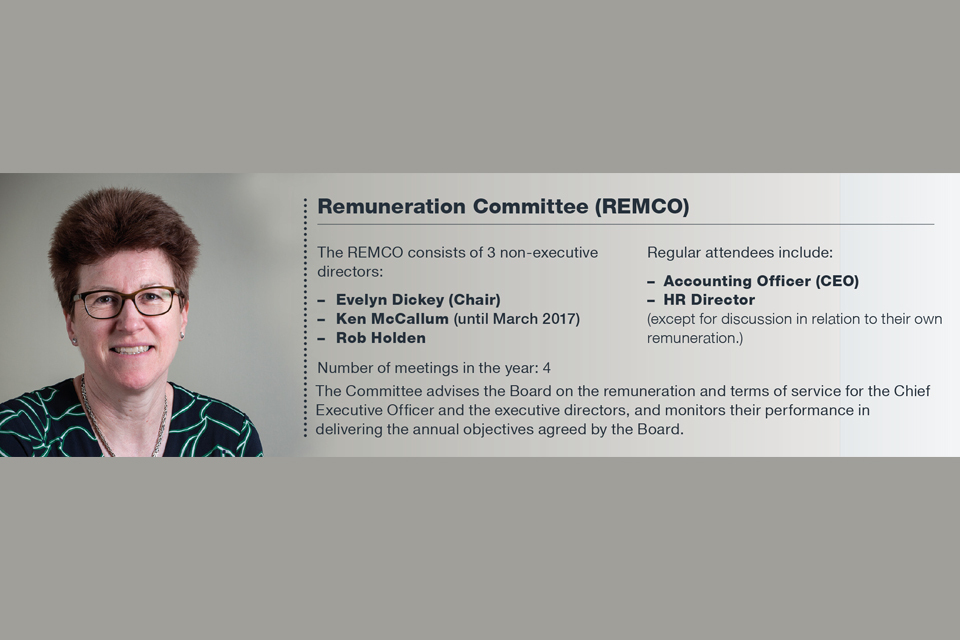

Remuneration Committee (REMCO) members

More details on Remuneration Committee are contained in the Remuneration and Staff report.

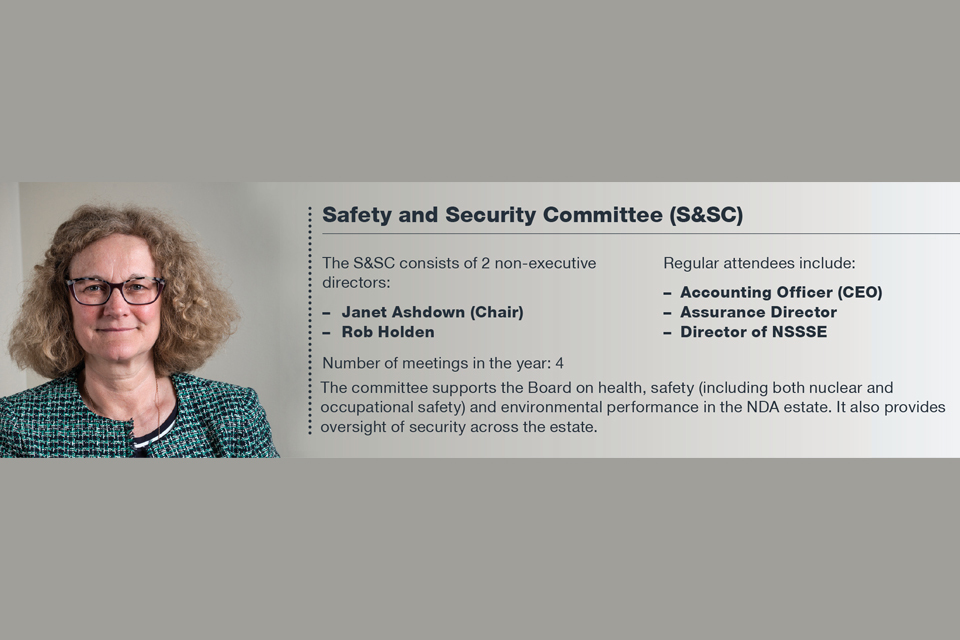

Safety and Security Committee (S&SC) members

Issues reviewed by the Safety and Security Committee (S&SC) during the year included the estate-wide safety risk management, safety performance with particular focus on specific incidents and the SLC response to these, and overall trend analysis.

On behalf of the Board, the Committee also pays particular attention to the corporate strategic risk ‘NDA Estate unable to deal with a cyber attack’.

Executive leadership team

David Peattie: Chief Executive - Executive Board Director

David began his career at BP in 1979 as a petroleum engineer and, during 33 years at the company, held a number of technical, commercial and senior management positions.

His roles included Head of BP Group Investor Relations, Commercial Director of BP Chemicals, Deputy Head of Global Exploration and Production, Head of BP Group Planning, and finally as Head of BP Russia where he was responsible for BP’s interests in the TNK-BP joint venture as well as its businesses in the Russian Arctic and Sakhalin. In addition, he was BP’s lead Director on the board of TNK-BP and Chairman of its Health, Safety and Environment Committee.

Current additional appointments include:

Director - Peattie Energy Advisory Ltd

Adrian Simper OBE: Strategy and Technology Director - Executive Board Director

Adrian joined the nuclear industry in R&D at Sellafield. His subsequent career has included strategic roles in R&D and technology, project delivery, commercial and finance both in the UK and the US.

He played a key role in setting up the NDA through the transfer of assets and liabilities from BNFL and the associated re-structuring of BNFL.

He was appointed to the Order of the British Empire (OBE) in the 2017 New Year Honours’ list, recognising his services to the UK nuclear industry in Japan.

Current additional appointments include:

- Chair - International Nuclear Services Ltd, Radioactive Waste Management Ltd (until August 2016)

- Other positions - Trustee of St Bees School

David Batters: Chief Financial Officer and Programme Director - Executive Board Director

Prior to joining the NDA, David spent more than 20 years with BAE Systems and predecessor companies in which he held a variety of roles, primarily in finance including; Mergers & Acquisitions, Planning & Analysis, Reporting, Project Accounting and as Finance Director of a number of businesses.