Income-related benefits: estimates of take-up: financial year 2018 to 2019

Published 29 October 2020

Applies to England, Scotland and Wales

The Income-Related Benefits: Estimates of Take-up report looks at estimates of take-up for income-related benefits.

The benefits covered are:

- Pension Credit (PC)

- Housing Benefit (HB)

- Income Support (IS) and Income-related (IR) Employment and Support Allowance (ESA)

Take-up refers to the receipt of benefits someone is entitled to and we estimate take-up in 2 ways:

- by numbers of people who claim these benefits (‘caseload’)

- by the amount these people claim (‘expenditure’)

1. Estimates of Take-up by Caseload and Expenditure

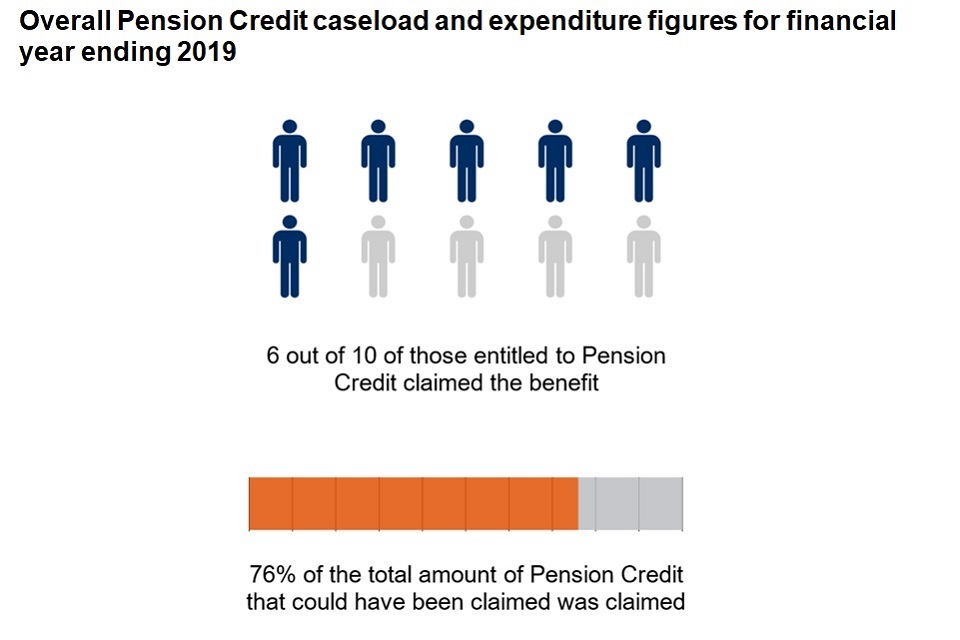

Pension Credit

The estimates show that:

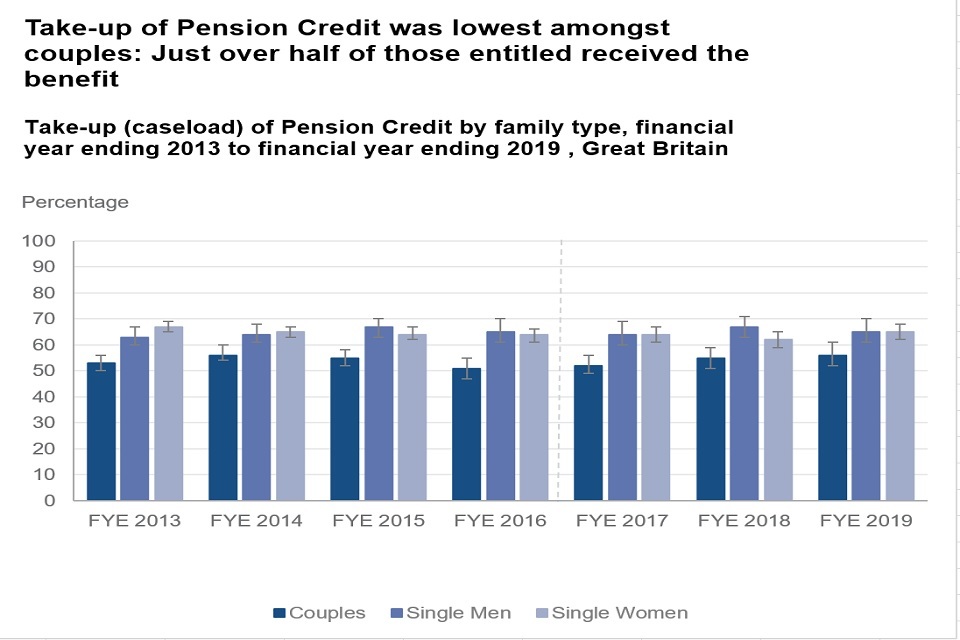

- caseload – 6 out of 10 of those entitled to Pension Credit claimed the benefit

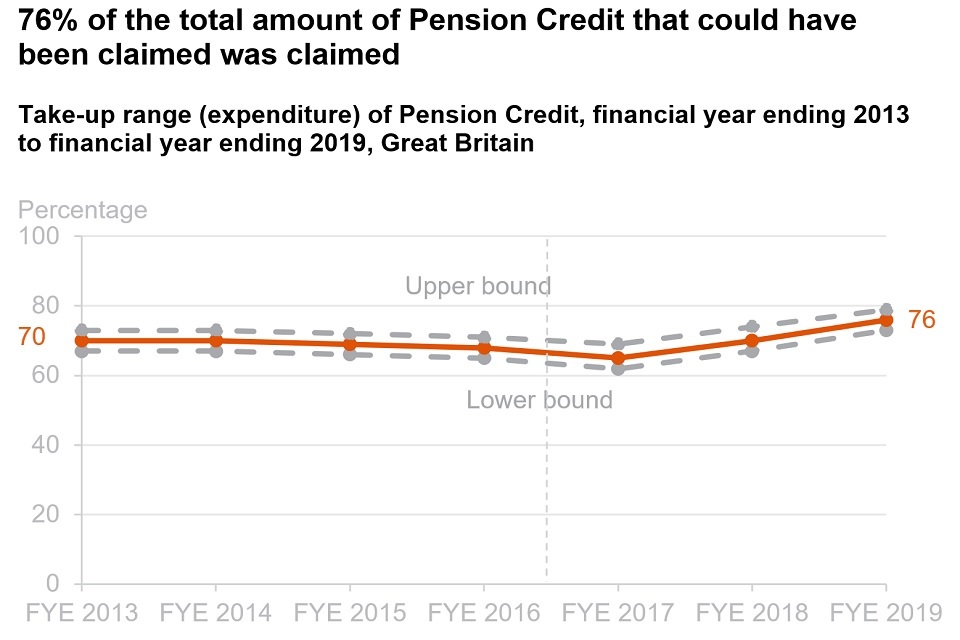

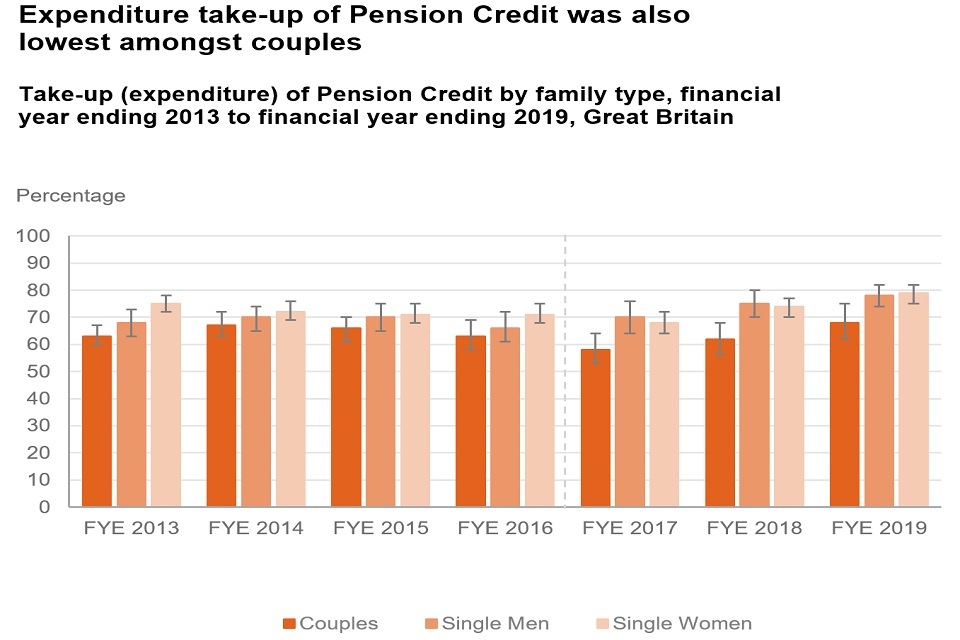

- expenditure – 76% of the total amount of Pension Credit that could have been claimed was claimed

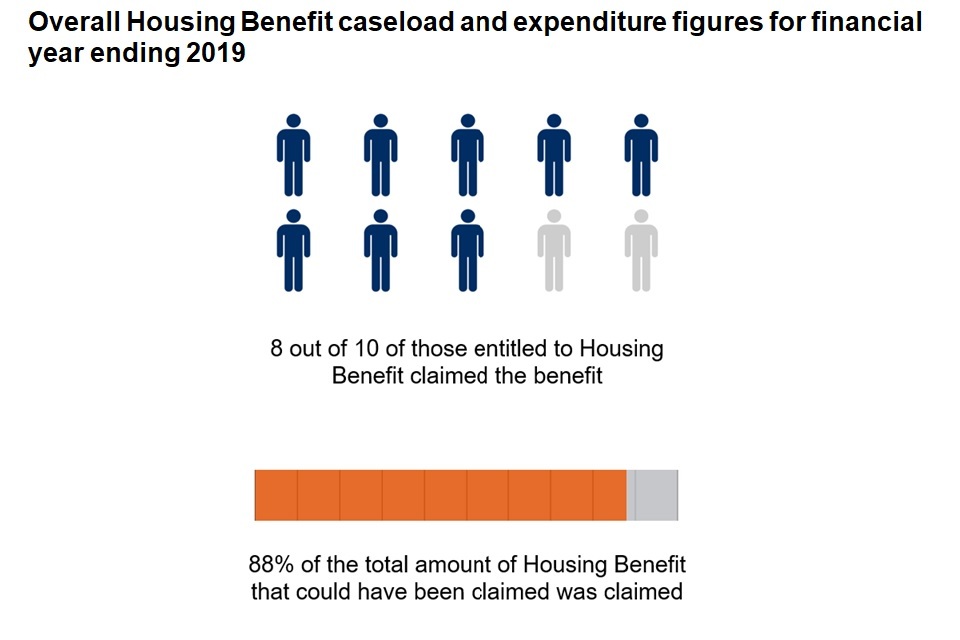

Housing Benefit

The estimates show that:

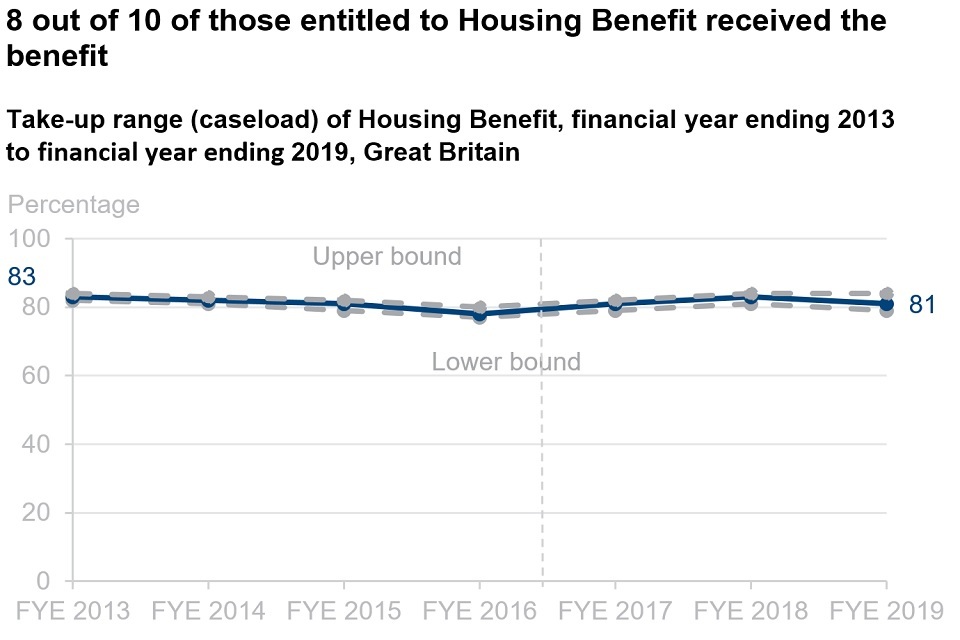

- caseload – 8 out of 10 of those entitled to Housing Benefit claimed the benefit

- expenditure – 88% of the total amount of Housing Benefit that could have been claimed was claimed

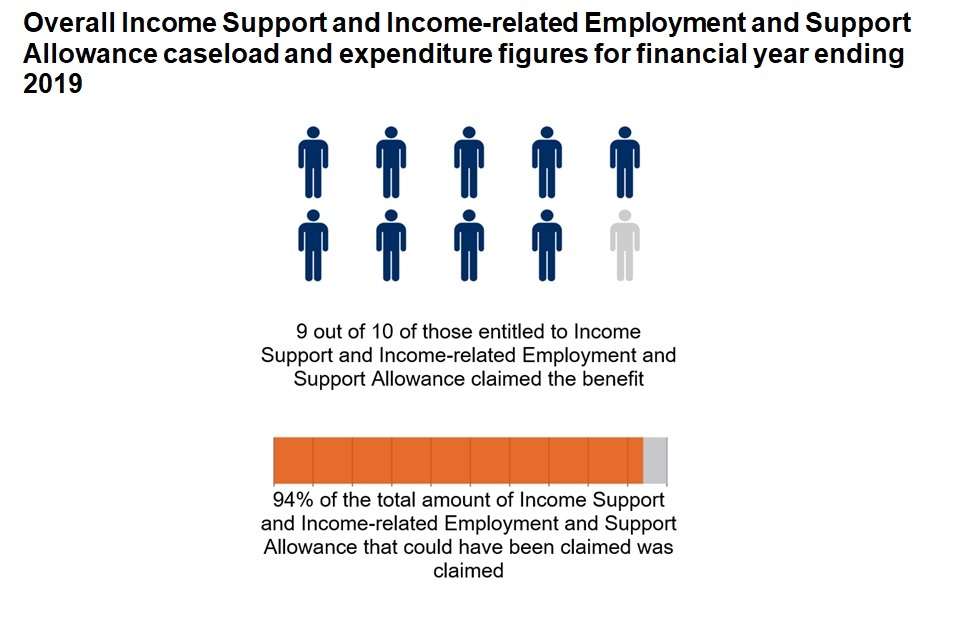

Income Support and Income-related Employment and Support Allowance

The estimates show that:

- caseload – 9 out of 10 of those entitled to Income Support or Income-related Employment and Support Allowance claimed the benefit

- expenditure – 94% of the total amount of Income Support or Income-related Employment and Support Allowance that could have been claimed was claimed

2. Estimates of non-take-up for families and expenditure

Pension Credit

The estimates show that:

- caseload – up to 1 million families who were entitled to receive Pension Credit did not claim the benefit

- expenditure – up to £1.8 billion of available Pension Credit went unclaimed:

- on average, this amounted to around £1,700 per year for each family entitled to receive Pension Credit who did not claim the benefit

Housing Benefit

The estimates show that:

- caseload – up to 1.1 million families who were entitled to receive Housing Benefit did not claim the benefit

- expenditure – up to £3.4 billion of available Housing Benefit went unclaimed:

- on average, this amounted to around £3,100 per year for each family entitled to receive Housing Benefit who did not claim the benefit

Income Support and Income-related Employment and Support Allowance

The evidence shows that:

- caseload – up to 0.3 million families who were entitled to receive Income Support or Income-related Employment and Support Allowance did not claim the benefit

- expenditure – up to £1.2 billion of available Income Support or Income-related Employment and Support Allowance went unclaimed:

- on average, this amounted to around £4,200 per year for each family entitled to receive Income Support or Income-related Employment and Support Allowance who did not claim the benefit

3. What you need to know

Introduction

This report provides estimates of the take-up for the following income-related benefits in Great Britain for the financial year ending 2019 (FYE 2019):

- Pension Credit

- Housing Benefit

- Income Support and Income-related Employment and Support Allowance (combined, as it is not possible to distinguish between these eligible cases in our modelling)

Take-up refers to the receipt of benefits someone is entitled to. There are some people who are entitled to benefits but have not claimed them. An income related benefit is a benefit where a potential claimant’s income is taken into account when deciding whether they are entitled to the benefit. This income can include income from savings or earnings.

Take-up of benefits can be affected by multiple factors. Trying to explain the reasons for non-take-up is difficult and we do not have data in our modelling to do this. Take-up may be affected by broad factors such as the attractiveness of the benefit, lack of awareness of the benefit or application procedure, lack of awareness of entitlement, the perceived stigma of receiving a benefit (Eurofound 2015.

Take-up statistics are not available at a lower geographic level than Great Britain. This is due to the survey sample sizes for entitled non-recipients being too small to be able to calculate take-up rates in smaller geographical regions.

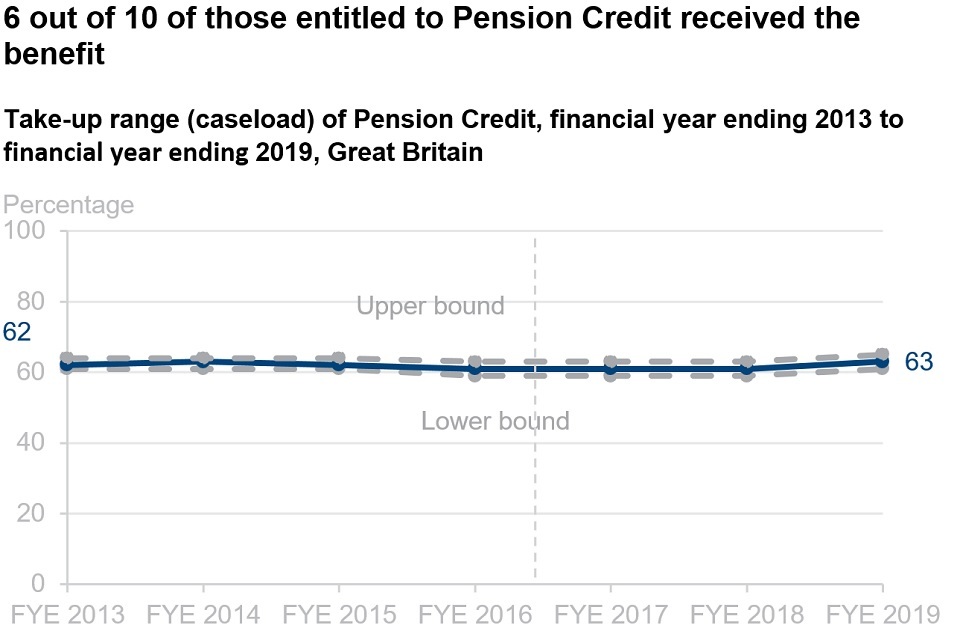

Methodological refinements were applied to the data from FYE 2017. Therefore, comparisons to previous years should be treated with caution. See the revisions to the statistics section in the Background Information and methodology note for more details.

The bar charts which show the breakdowns of the take-up caseload and expenditure statistics include 95% confidence intervals. These 95% confidence intervals indicate the level of uncertainty in the take-up estimates due to them being produced from sample data.

Content of the report

Take-up is estimated in two ways. It is estimated by:

-

caseload – over a one-year period, the average number of benefit recipients who received each benefit compared to the number if everyone entitled to the benefit had claimed it.

-

expenditure – over a one-year period, the average amount of a benefit claimed multiplied by the total number of people claiming it, compared to the total amount if everyone entitled to the benefit had claimed it.

Note that the caseload figures are rounded to the nearest 10,000 and percentages are rounded to the nearest percentage point. Also note that for expenditure figures, the amounts claimed and unclaimed are rounded to the nearest £10 million and percentages are rounded to the nearest percentage point.

Caseload and expenditure take-up rates are estimated using a formula that gives a single, or ‘point’, estimate together with lower and upper bound estimates. Throughout this report a ‘family’ refers to either a single adult or a married or cohabiting couple, and any dependent children.

In reporting average annual amounts unclaimed we have used mean weekly amounts to be consistent with the estimated total amount unclaimed. Information on median weekly amounts unclaimed is available in the reference tables.

Percentage point differences stated in this publication have been calculated on rounded percentages. Statistically significant differences in this publication are clearly stated. For more information on statistical significance see Section 8. This report contains data from between FYE 2013 and FYE 2019. Data for FYE 2010 can be found in the reference tables.

Further information

A comprehensive set of reference tables breaking down headline results presented in this publication, along with a quick guide on how to use them, is available online here: Reference Tables and Guide. Data from these reference tables are referenced throughout this report.

4. Pension Credit

In the FYE 2019 an estimated 63% of families who were entitled to Pension Credit received it. This is similar to the take-up rate in FYE 2013. The rate has been stable over the period. The take-up rate in FYE 2019 is 2 percentage points higher than in FYE 2018.

For the FYE 2019, take-up of Guarantee Credit (70%) continued to be higher than take-up of Savings Credit only (42%). This difference was statistically significant. This could be influenced by the difference in the average weekly amounts people were entitled to. The estimated average (mean) weekly amount unclaimed for Guarantee Credit (£49) was substantially higher than Savings Credit only (£7).

Take-up of Pension Credit by those aged under 75 continued to be higher than those aged 75 or over. This has generally been the story across the time period. In FYE 2019 caseload take-up was an estimated 64% for those aged under 75 and 62% for those aged 75 or over.

See Tables PC1, PC2 and PC9 for full data

Expenditure take-up had been relatively stable since FYE 2013 until FYE 2016. In FYE 2019 an estimated 76% of the total amount of Pension Credit that could have been claimed was claimed. This was 6 percentage points higher than for the FYE 2018. This difference is statistically significant. As this is higher than the caseload take-up rate this implies those not taking up Pension Credit may only be eligible for smaller amounts.

Expenditure take-up of Guarantee Credit (77%) continued to be higher than expenditure take-up of Savings Credit only (44%). This difference was statistically significant.

Expenditure take-up of Pension Credit by those aged under 75 (77%) was higher than that of those aged 75 or over (75%).

See Tables PC2 and PC10 for full data.

There have been consistent trends in the take-up of Pension Credit between couples, single men and single women since FYE 2013. For the FYE 2019, the caseload take-up of Pension Credit by couples (56%) continued to be lower than that of single males (65%) and single females (65%).

See Table PC3 for full data.

There have been broadly consistent trends in the take-up of Pension Credit between couples, single men and single women since FYE 2013. For the FYE 2019, expenditure take-up of Pension Credit by couples (68%) continued to be lower than that of single males (78%) and single females (79%). The difference between couples and single females is statistically significant.

See Table PC4 for full data.

5. Housing Benefit

In the FYE 2019 an estimated 81% of families who were entitled to Housing Benefit received it. This is similar to the take-up rate in FYE 2013. The take-up rate in FYE 2019 is 2 percentage points lower than in FYE 2018. The rate has been broadly stable over the period.

See table HB1 for full data.

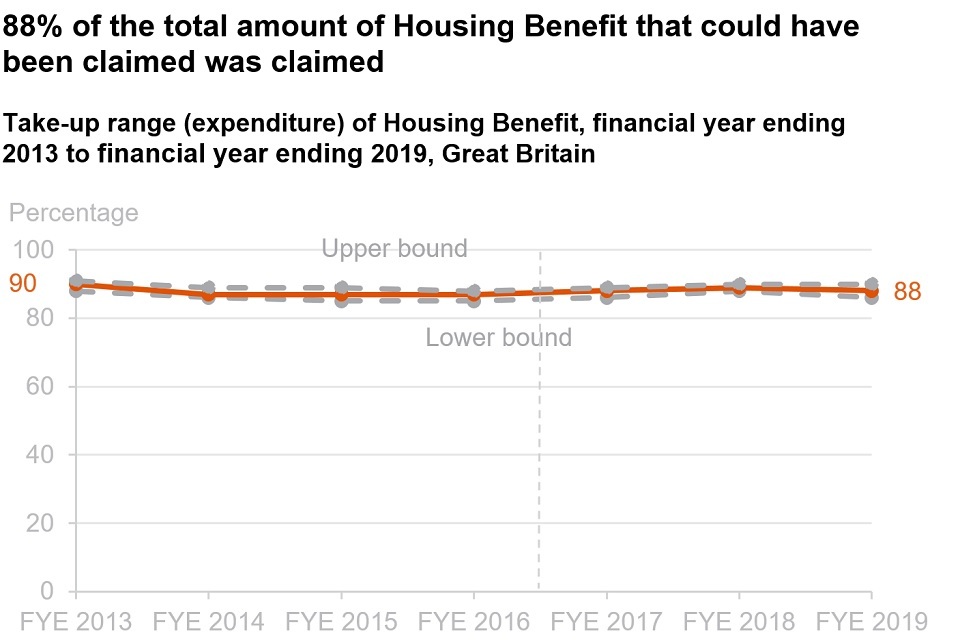

In the FYE 2019 an estimated 88% of the total amount of Housing Benefit that could have been claimed was claimed. The take-up rate in FYE 2019 is 1 percentage point lower than in FYE 2018. The rate has been broadly stable over the period.

See table HB2 for full data.

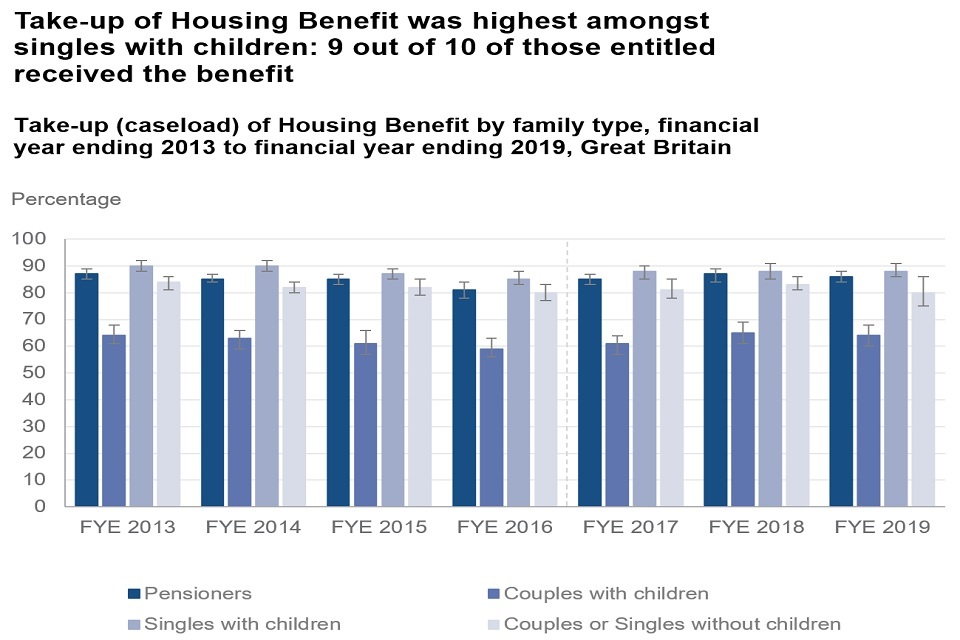

Take-up of Housing Benefit also varies by family type with consistent patterns between groups seen since FYE 2013. In FYE 2019 singles with children (88 %) and couples or singles without children (80%) had higher take-up rates than couples with children (64%). Both these differences are statistically significant. Pensioners had a higher take-up rate (86%) than non-pensioners overall (79%).

See Tables HB1 and HB3 for full data.

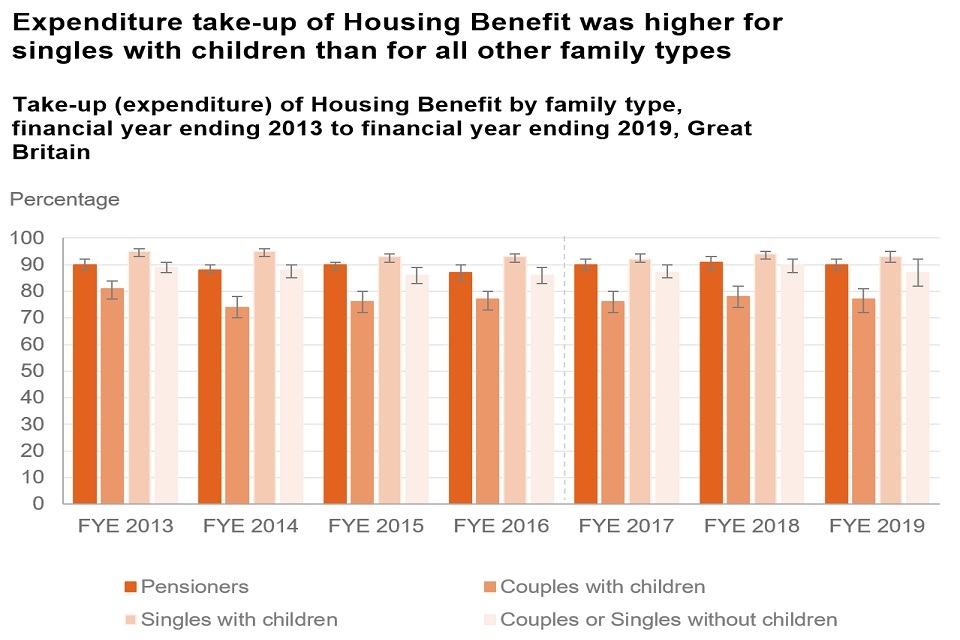

Expenditure take-up of Housing Benefit also varies by family type with consistent patterns between groups seen since FYE 2013. For the FYE 2019, both singles with children (93%) and couples or singles without children (87%) had a higher expenditure take-up rate than couples with children (77%). These differences are statistically significant. Pensioners had a higher expenditure take-up rate (90%) than non-pensioners overall (87%).

See Tables HB2 and HB4 for full data.

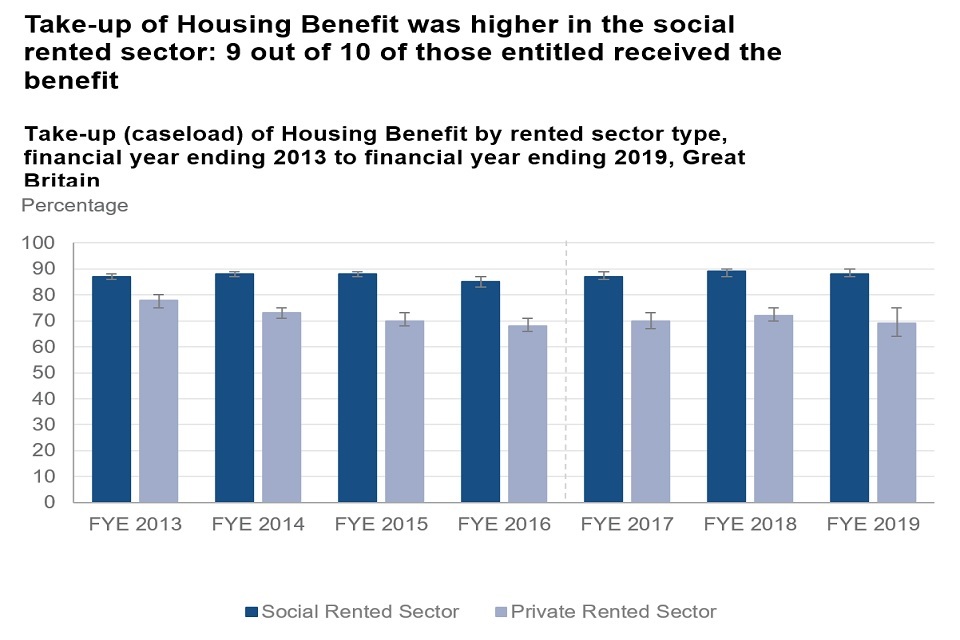

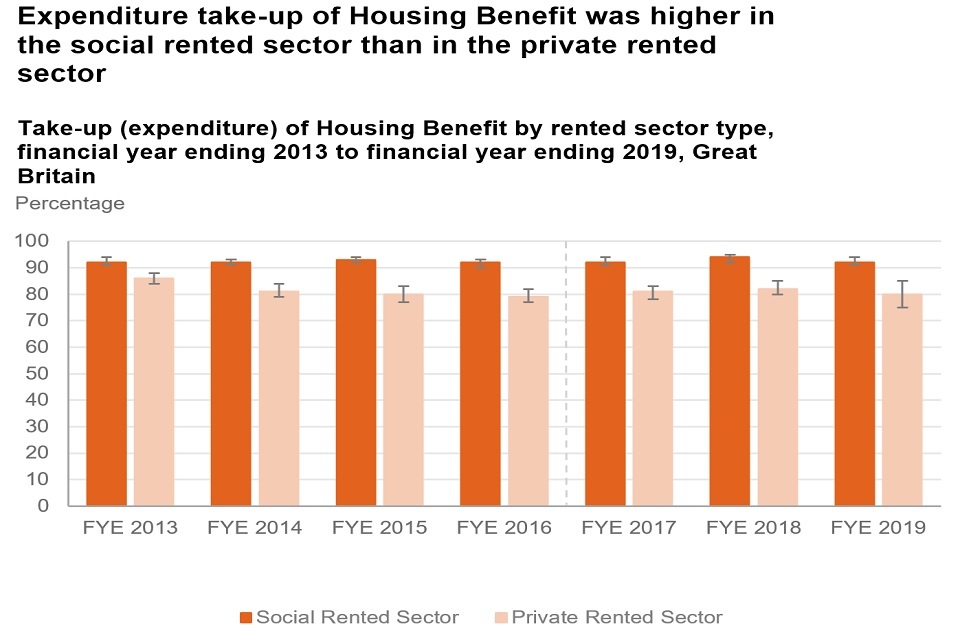

Take-up of Housing Benefit varied by rental sector and has done so consistently since 2013. For the FYE 2019, the caseload take-up rate for families in the social rented sector (88%) continued to be higher than the take-up rates for families in the private rented sector (69%). This difference was statistically significant.

See Table HB5 for full data.

Expenditure take-up of Housing Benefit varied by rental sector and has done consistently since FYE 2013. For the FYE 2019, the expenditure take-up rate for families in the social rented sector (92%) continued to be higher than the expenditure take-up rate for families in the private rented sector (80%). This difference was statistically significant.

See Table HB6 for full data.

6. Income Support and Income-related Employment and Support Allowance

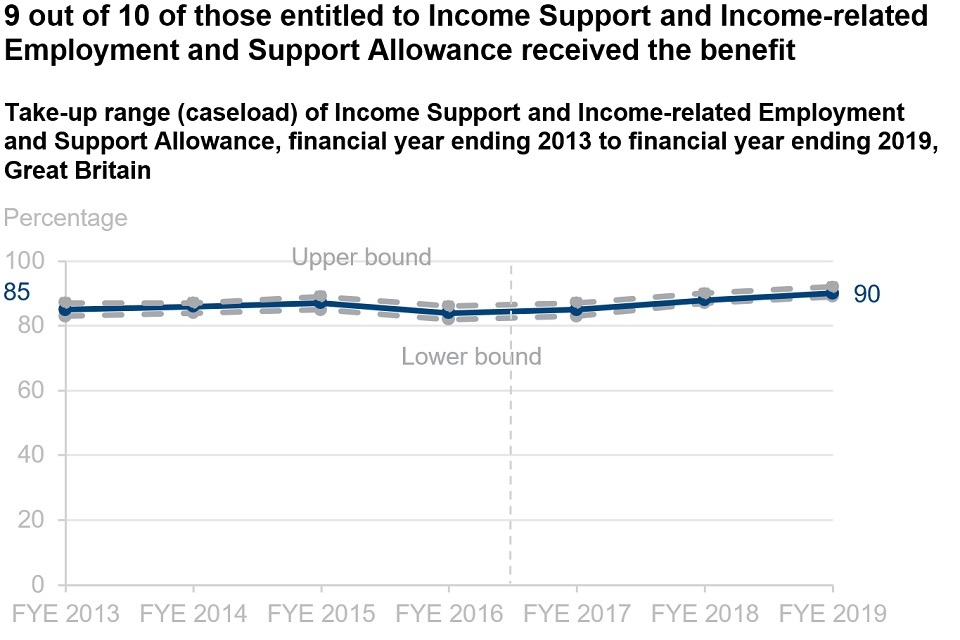

An estimated 90% of families who were entitled to Income Support or Income-related Employment and Support Allowance in FYE 2019 received the benefit. This was 2 percentage points higher than in FYE 2018 and 5 percentage points higher than FYE 2013. The trend has been broadly stable since FYE 2013.

See Table ISESA1 for full data.

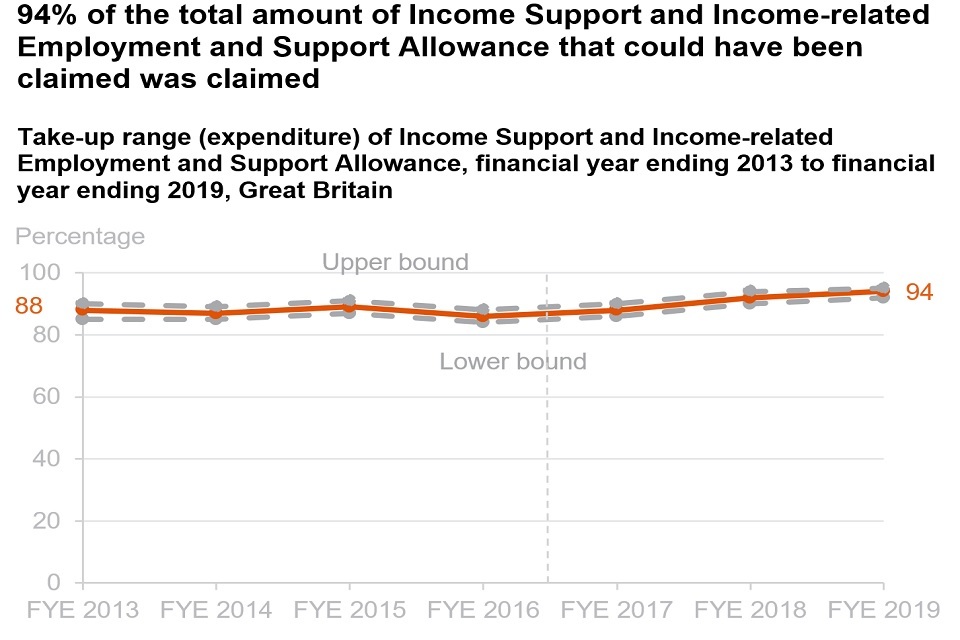

In FYE 2019, an estimated 94% of the total amount of Income Support or Income-related Employment and Support Allowance that could have been claimed was claimed. This was 2 percentage points higher than in FYE 2018.

See Table ISESA2 for full data.

7. Overview of methodology

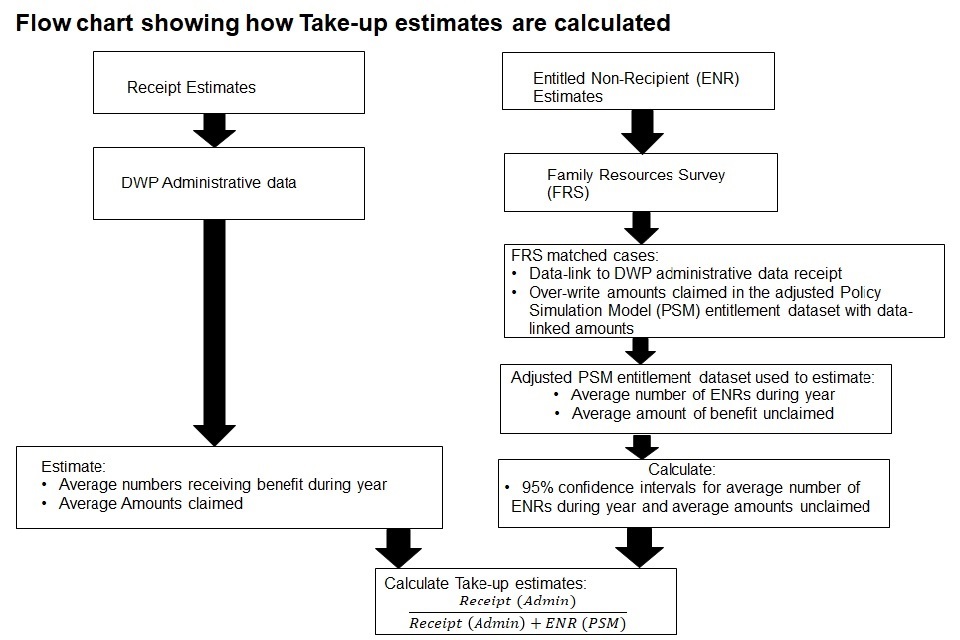

The methodology for deriving the estimates of take up is complex. Figures in this report are based on Department for Work and Pensions (DWP) administrative data, local authority administrative data and data from the Family Resources Survey (FRS). The survey data from the FRS are then modelled using a static microsimulation model known as the Policy Simulation Model (PSM). The PSM is a model of the tax and benefit system of the UK. The source data for the model comes primarily from the FRS with benefit and tax credits entitlement and tax or National Insurance liability calculated for each FRS family.

To produce the take-up estimates, information can be taken from DWP administrative data sources to look at the average number of those in receipt of the benefit along with the average amount claimed. However, because administrative benefit entitlement data sets do not exist, survey-based estimates of the population and unclaimed amounts for those who are entitled but not receiving (ENRs) are needed. A combination of an adjusted data set from the PSM, which includes survey data linked to administrative data, and reported receipt from the FRS are used to produce these estimates. The data linking approach has continued to develop resulting in increasing match rates and more use of admin data over time.

The estimates for the ENRs are calculated with confidence intervals which provide a lower and upper range for the average number of ENRs and the average amount claimed. These estimates, along with the central estimates are incorporated into the take-up formulae. Caseload and expenditure take-up rates are estimated. A point estimate is calculated. The lower and upper bound estimates of those not in receipt are used to estimate lower and upper take-up bounds. Statistical tests are performed on the point estimates to identify significant differences between the take-up rates between years and between groups.

There are limitations to this methodology but it aims to produce the best take-up estimates based on the evidence available. Specifically, with regards to calculating ESA entitlement, it is not possible to perfectly model ESA eligibility because there are no data available for the PSM to use on the outcomes of individual Work Capability Assessments or doctors’ certificates that people would have if they applied to claim ESA. Some proxies for ESA eligibility are however used such as Disability Living Allowance (DLA) or Personal Independence Payment (PIP) uptake and blind or not blind status.

Take-up of benefits can be affected by a number of factors. Trying to explain the reasons for non-take-up is difficult and we do not have the data in our modelling to do this. For more information on the factors which can affect take-up see the links in section 8.

See the Background Information and methodology note for more information, available here: Background Information and methodology note.

8. About these statistics

Official statistics

As an Official Statistic, Income-Related Benefits: Estimates of Take-up is fully compliant with the code of practice for statistics.

Where to find out more

Income-related benefits has further outputs and reference tables from take-up analysis, alongside our background information and methodology note which provides further detail on methodology and recent policy changes which may affect benefit take-up.

The background Information and methodology note also includes information on issues relating to the take-up of benefits which were reviewed in a paper by Eurofound.

Read more information about Eurofound:

Read DWP statistics on benefit receipt and expenditure:

Information on entitlement and how to claim a benefit.

A guide to the different definitions of earnings and income, with information on alternative sources of data.

More useful information on income and earning statistics.

Other National and Official statistics

Read a schedule of DWP’s statistical releases over the next 12 months and a list of the most recent releases.

In accordance with the Code of Practice for Statistics, DWP statistics are also announced in the GOV.UK statistics release calendar.

Using the take-up estimates for analysis

Survey data

This publication is based on modelled survey data – it is therefore subject to sampling variation and other forms of error associated with a sample survey. Relative to administrative records the FRS under-reports benefit receipt. See the FRS background note and methodology for more details. The FRS survey data used in the production of take-up statistics is not designed specifically to measure entitlement criteria to the same extent as an application for a specific benefit. It is a multi-purpose household survey.

Sample

Due to the restrictions in modelling and available data, certain populations are excluded from our analysis. The figures presented in this publication and accompanying reference tables only include those living in private households in Great Britain. As a result of the exclusions noted, recipient totals and expenditure estimates in this report may differ from those in other published sources.

Sampling Error

Results from surveys are estimates and not precise figures - in general terms the smaller the sample size, the larger the uncertainty.

Policy Simulation Model

As a model, the PSM is subject to a range of assumptions, beyond that of a typical survey. Of particular importance to take-up statistics are the methodologies for estimating entitlement and specific assumptions for making population estimates from the sample (known as grossing). These are described in more depth in the Background and methodology note.

Statistical significance

This is a technical concept that says whether a reported change is likely to have arisen only by chance due to variations in the sampling. We calculate 95% confidence intervals around estimates in take-up which sets a standard that, where any change is reported as statistically significant, there is less than a 1 in 20 chance that the reported difference is due to sampling variation and there is no real underlying change.

Statistically significant differences in this publication are clearly stated.

Interpretation

Care should be taken when interpreting take-up statistics. For instance, if the upper limit of a caseload take-up range is 90%, this does not mean that at least 10% of the entitled population never take up their entitlement. This is because some of the shortfall in take-up may represent a delay in claiming or processing benefit that is eventually received. The confidence intervals are therefore used to represent the range in which we estimate the overall true rate of take-up, averaged over the whole year, lies.

Enquires and feedback

DWP would like to hear your views on our statistical publications. If you use any of our statistics publications, we would be interested in hearing what you use them for and how well they meet your requirements: Send your comments by email to: irb.takeup@dwp.gov.uk.

Press enquiries should be directed to the DWP Press Office, telephone: 0203 267 5144.

Enquiries about these statistics should be directed by email to:irb.takeup@dwp.gov.uk

Producers of this release: Narayan Jayaram and Jonathan Howard

Responsible statistician: Neil Sorensen

ISBN: 978-1-78659-228-6

Next edition October or November 2021