HM Procurator General & Treasury Solicitor Annual Report and Accounts 2024–25

Updated 21 August 2025

HM Procurator General and Treasury Solicitor: Annual Report and Accounts - 2024-25

For the year ended 31 March 2025

Accounts presented to the House of Commons pursuant to section 6(4) of the Government Resources and Accounts Act 2000

Annual Report presented to the House of Commons by Command of His Majesty

This is part of a series of departmental publications which, along with the Main and Supplementary Estimates 2025-26 and the document Public Expenditure: Statistical Analyses 2024, present the government’s outturn for 2024-25 and planned expenditure for 2025-26

© Crown copyright 2025

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit: www.nationalarchives.gov.uk/doc/open-government-licence/version/3

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned

This publication is available at: www.gov.uk/official-documents

Any enquiries regarding this publication should be sent to us at:

Government Legal Department,

102 Petty France,

London SW1H

9GL

ISBN 978-1-5286-5706-8

E03357417

07/25

Performance Report

The Performance Report includes a summary of the department's purpose and activities (the Overview) followed by a review of progress against performance measures and an overview of significant events that have taken place during the financial year (the Performance Analysis). A summary of risks and mitigating actions is set out in the Governance Statement on page 30.

Overview

Introduction

The Office of the Solicitor for the affairs of His Majesty’s Treasury (the Treasury Solicitor) was incorporated as a corporation sole by the Treasury Solicitor Act 1876. Since then the nature of the work of the Government Legal Department has expanded greatly and today it provides a comprehensive legal service to other government departments in England and Wales and is one of the largest legal organisations in the country. The Treasury Solicitor is also Head of the Government Legal Profession.

The Government Legal Department (GLD) is a non-ministerial government department and executive agency. In addition to being responsible for all financial activity within GLD, the Treasury Solicitor is also responsible for financial matters at the Attorney General’s Office (AGO) and His Majesty’s Crown Prosecution Service Inspectorate (HMCPSI).

The financial statements on pages 69 to 85 cover all these bodies and have been prepared under an accounts direction issued in December 2024 by HM Treasury (HMT), in accordance with section 5(2) of the Government Resources and Accounts Act 2000. The Accounts demonstrate the resources that have been consumed in delivering the department’s objectives. They have been prepared in accordance with the guidance set out in the Government Financial Reporting Manual (FReM).

Entities within the Accounts

These Accounts present the consolidated results for 2024-25 of the:

-

Government Legal Department (GLD)

-

Attorney General’s Office (AGO)

-

HM Crown Prosecution Service Inspectorate (HMCPSI)

The governance structure of the entities presented in the Accounts is set out in the Governance Statement on page 21.

Government Legal Department

GLD’s purpose is to help the government to govern well, within the rule of law.

GLD’s vision is to be:

-

An outstanding legal organisation, committed to the highest standards of service and professionalism.

-

A brilliant place to work, where we can all thrive and fulfil our potential.

The principal activities of GLD are as follows:

-

Advisory - GLD has expert advisory teams specialising in the work of their client department, providing risk-based and solution-focused legal advice. GLD lawyers are crucial throughout the lifecycle of government policy. They advise on and draft legislation and work to take it through Parliament; advising departments and ministers on the legal implications of government policy, and ensuring it stands up to Parliamentary scrutiny.

-

Litigation - GLD’s litigation group is comprised of four divisions: Defence and Security, Home Office and Immigration, Justice and Development and the Covid Inquiry Team. Litigation lawyers handle high profile public and private law litigation for central government departments, security agencies, and other public bodies; including UK military and security bodies. The divisions also undertake inquest, inquiry and injunctive work for GLD’s clients. GLD litigation teams are currently handling approximately 27,000 pieces of litigation.

-

Employment - As one of the largest employment law practices in the country, GLD’s Employment Group advise on complex and fast-moving legal areas including: claims for unfair dismissal and relating to discrimination; pay issues; contractual issues and terms and conditions; and whistleblowing claims. The TUPE (Transfer of Undertakings Protection of Employment) and Transactional Hub provides specialist advice on employment and pensions issues to help manage employment-related risks, while the Industrial Hub advises on trade union matters and industrial action. The National Security Hub manages advice work and litigation claims requiring a knowledge of security vetting or the management of protected material.

-

Commercial - The Commercial Law Group (CLGp) provides expert advice on transactional, litigation, property and advisory commercial legal matters. Transactional and advisory teams advise government departments on their commercial work, ensuring value for money in the purchase of goods and services for the public sector. The litigation and dispute resolution team supports the government in high profile legal claims, and saves taxpayer money by pursuing alternative forums (mediation, adjudication). The GLD Property Hub provides strategic commercial property advice, and supports government departments and agencies via training on property issues.

-

The Statutory Instrument (SI) Hub is the GLD’s specialist statutory instrument drafting service and Centre of Excellence for secondary legislation, with 30 lawyers drafting secondary legislation for all of GLD’s client departments. The SI Hub Centre of Excellence makes a major contribution to helping lawyers across GLD improve the quality of their drafting, through its structured SI training programme, the annual SI conference and drafting guidance.

-

The Chief Operating Officer (COO) Group is responsible for developing the department’s strategy and plans and leading and coordinating programmes of activity across the department to deliver cost effective legal and support services that address the needs of our clients and staff. The Finance, Operations and Digital Directorate covers finance, planning and performance, procurement, facilities management, security, digital and data, business assurance and resilience and records management services. The Strategy, People and Culture Directorate covers human resources (HR), governance and strategy, business management, communications and engagement, and project delivery. The Legal Operations Directorate includes: Bona Vacantia Division, on behalf of the Crown’s Nominee, administers the estates of people who die intestate and without relatives entitled to inherit and collects the assets of dissolved companies and failed trusts in England, Wales and Northern Ireland, except in the Duchies of Cornwall and Lancaster. The costs of the division are recovered from the estates and assets it administers. The proceeds of bona vacantia are accounted for in the Crown’s Nominee Accounts and separately notified to Parliament as prescribed in the Treasury Solicitor (Crown’s Nominee) Rules 1997 (SI.1997/2870). The Knowledge and Innovation Division lead on developing the department’s integrated Legal Knowledge, Capability and Innovation Strategy, working with legal divisions to professionalise legal knowledge and learning activity and to develop innovative and flexible approaches to meeting client needs. The Legal Delivery Division leads on building a future-fit legal environment through standardisation, automation, and innovative technologies, including AI. The division offer lawyers integrated support, flexible resourcing, and data-driven insights. Its focus is on efficiency, smart resource allocation, and continuous improvement to deliver high-quality legal services.

Attorney General’s Office

The Attorney General’s Office (the AGO) is a specialist ministerial department serving the Attorney General and the Solicitor General (the Law Officers for England and Wales) across the full range of their functions.

The Law Officers are the government’s chief legal advisers, helping the government to deliver policy in the context of upholding and promoting the rule of law and performing a visible and effective role as leaders in the domestic and international legal community.

They also have sponsorship responsibilities in relation to the Government Legal Department (GLD), Crown Prosecution Service (CPS), the Serious Fraud Office (SFO) and His Majesty's Crown Prosecution Service Inspectorate (HMCPSI). They take a close interest in any matters of criminal justice policy and practice bearing on the role of the prosecutors. In addition, they perform a range of civil and criminal law litigation functions exercisable in the public interest, including referring sentences which may be unduly lenient to the Court of Appeal, bringing proceedings for contempt of court and authorising applications for fresh inquests. The Attorney General is Chief Legal Advisor to the government and is answerable in Parliament for the operations of the GLD, CPS, and SFO. The Attorney General is also head of the Bar of England and Wales and exercises a leadership role in relation to the wider legal professions. The Attorney holds, ex officio, the separate office of Advocate General for Northern Ireland.

The AGO’s Business Plan set out its priorities for 2024-25 and is published on gov.uk. The plan is reviewed each year based on ministerial priorities, and business requirements. The AGO’s objectives focused on:

-

Helping deliver government policy in the context of the Law Officers’ constitutional role in relation to the Rule of Law

-

Defining and delivering the Law Officers’ public interest functions in the interests of the administration of justice

-

Sponsoring the Law Officers’ Departments and connecting the work of the prosecutors with wider criminal justice policy.

-

Ensuring a high performing and efficient Attorney General’s Office which meets its legal and performance obligations.

HM Crown Prosecution Service Inspectorate

The Crown Prosecution Service Inspectorate Act 2000 created the role of HM Chief Inspector of the Crown Prosecution Service. The Chief Inspector is appointed by, and reports, to the Attorney General. The Chief Inspector also fulfils the function of Chief Executive of HM Crown Prosecution Service Inspectorate. Since it was established, the Inspectorate’s statutory remit has been broadened to include the Serious Fraud Office (ASBCP Act 2014 – section 149 commencement).

The purpose of the Inspectorate’s work is to inspect the operation of the Crown Prosecution Service (CPS) and Serious Fraud Office (SFO) and to provide independently assessed evidence to allow others to hold those agencies to account thereby encouraging improvement. HMCPSI can undertake inspection by invitation.

HMCPSI’s strategic objectives are:

-

To deliver independent high-quality, evidence-based assessments of the CPS and SFO to inform them and those who hold them to account.

-

To work collaboratively with other inspectorates and develop effective working relationships to address issues that involve more than one criminal justice agency and deliver independent high-quality, evidence-based joint assessments.

-

To publish reports which are understandable and convey the message effectively.

-

To use our independent assessments to inform and contribute to debates on criminal justice issues.

-

To recruit and develop the most qualified people so HMCPSI has a high-performing workforce with the right skills and values for the job.

-

To run an efficient and effective organisation that meets the best standards of a government department in order to provide value for money.

Performance Analysis

Performance Measures

The following performance measures were agreed with HMT. These all relate to GLD.

| Performance Measure | Outturn 2024-25 | Outturn 2023-24 |

|---|---|---|

| To improve client satisfaction rating: | ||

| Percentage Good or Excellent | 95% | 95% |

| Average score (Excellent: 10, Good: 5, Acceptable: 0, Poor: -5, Unacceptable: -10) | 7.99 | 7.85 |

| To recover from clients the full operating costs of chargeable services | Achieved | Achieved |

| To retain Lexcel accreditation | Achieved | Achieved |

Client Satisfaction

GLD's aim is to achieve a 95% or above rating in its annual survey of client satisfaction, and while 95% of GLD clients rated its services as Good or Excellent the percentage score was static. Using the average score, GLD scored 7.99, a 2% increase from last year. The survey has highlighted some issues that need to be addressed, and actions are being taken in response.

Lexcel

GLD Litigation, Employment and Commercial Law Directorates were once again found to meet the requirements of the Lexcel Standard, after a full re-assessment by an independent external auditor, leading to reaccreditation by The Law Society. The Lexcel assessor concluded that “it remains very clear that in Lexcel terms, the organisation remains an extremely well run, and extremely well managed organisation.”

Full cost recovery

GLD is primarily funded from the fees charged to clients for its legal services. GLD fee rates are set in accordance with the HMT publication - Managing Public Money - and are designed to recover the costs incurred by the department. Financial performance is monitored throughout the year, and on a quarterly basis, GLD undertake a formal exercise to forecast the financial outturn for the year. GLD's commitment to its clients is to ensure that they benefit from better than budgeted financial performance and if the forecasting exercise at the end of quarter 2 predicts a significant surplus, GLD evaluates the underlying reasons, consider the financial risks for the remainder of the year and assess whether a fee reduction should be made in-year.

Full cost recovery was achieved in 2024-25 and, a surplus of £15m (2023-24: £8.3m) was generated after rebates of £12m. From this surplus £4m was set aside to fund additional capital requirements. In setting fees and budgets for the year, key factors include the level of litigation demand, the level of staff turnover, the level of investment required to deliver our objectives and the use of third parties to support our legal work. In determining these and other financial factors, GLD take account of the factors underlying the previous years financial performance and the likelihood of them recurring. GLD also continually review and refine its fee setting and forecasting processes to minimise the level of surplus that may arise.

Significant events during the financial year

Government Legal Department

In the GLD Business Plan 2024-25, the GLD Board set out the key legal and strategic priorities GLD would focus on to help the government deliver for citizens, including examples of how the department's work contributes towards the government's 5 Missions.

By way of case studies and commentary, the GLD Annual Report and Accounts 2024-25 provides substantial details of significant events and achievements. It is available at: www.gov.uk/gld.

Attorney General’s Office

The General Election in July meant a new mission led government, and for the AGO, 3 new ministers, cutting across the House of Commons and the House of Lords, which has increased the parliamentary work.

The Prime Ministers focus on the Rule of Law is a priority for the Attorney, the AGO therefore has developed a Rule of Law Team to support the Attorney in delivery of this objective.

The AGO have worked collaboratively across the Law Officer Departments and HM Treasury to coordinate the interim 2025 Spending Review response, and subsequent Zero-Based Reviews.

The AGO provided high quality support across all the Law Officers’ core functions. The Law Officers accomplished a wide variety of Parliamentary business in both Houses, including departmental oral questions every six weeks. Working closely with the Office of the Advocate General for Scotland, the AGO supported the Law Officers’ role on the Parliamentary Business and Legislation (PBL) Committee and worked with departments to find solutions to legal difficulties in proposed legislation. In 2024 the AGO responded to 139 MP letters (2023 - 177), answering 73% within the deadline (2023 - 85%).

Our public interest work continues to grow, and we have seen referrals to AGO of unduly lenient sentence cases for consideration by the Law Officers stabilise at a relatively high level, as illustrated by the following table:

| 2024 | 2023 | |

|---|---|---|

| Referrals | 1,223 | 1,201 |

| In scope | 831 | 841 |

| Referred to the Court of Appeal | 146 | 138 |

Throughout the course of 2024 we have run 31 recruitment campaigns and successfully onboarded 23 new people into the AGO including legal trainees and short term secondees. Each new starter has received an induction pack, participated in an induction event which are held monthly, and had introductory conversations with the Director General and Director.

HM Crown Prosecution Service Inspectorate

We started the year with an interim Chief Inspector in post. Following a recruitment exercise that had to be paused for the general election, Anthony Rogers was appointed as our fifth Chief Inspector in February 2025.

HMCPSI delivered a full programme of inspection and published six reports.

-

Serious Fraud Office – handling and management of disclosure. Published April 2024

-

The Service Prosecuting Authority (SPA) – inspection by invitation looking at the quality of casework in the SPA. Published November 2024

-

An examination of cases referred to the Crown Prosecution Service included in the London Stalking Review 2024. Published December 2024

-

Area Inspection Programme - a follow-up inspection looking at the quality of casework in the 14 CPS areas in England and Wales

-

A follow-up inspection of the effectiveness of the Crown Prosecution Service policy and guidance for the handling of cases involving the National Referral Mechanism. Published February 2025

-

An inspection of how the Crown Prosecution Service uses individual quality assessments to monitor and improve casework quality.

In partnership with the Criminal Justice System inspectorates, HMCPSI jointly published one report.

- Criminal Justice Joint Inspection response to the Victims’ Commissioner’s recommendations. Published November 2024

Risk

GLD risks are aligned with the risk categories in HM Treasury’s risk management guidance – “The Orange Book". The risks were agreed by the GLD Board in December 2024.

The AGO has adopted the Orange Book approach to risk management, which has been developed alongside partners in Government Legal Department. Strategic risks and mitigating actions are discussed at each Executive Board, together with quarterly deep dives to ensure risk is managed effectively.

The HMCPSI principal risks are managed by its Management Board.

Details of principal risks, and plans and mitigations in respect of these risks are set out in the Governance Statement on page 30.

Future Development

Government Legal Department

Delivery of the GLD Business Plan in 2025-26 will see GLD progress its strategic ambitions in the second year of its strategy (2024-27). GLD will build on its previous success expanding national offices, strengthening deployment of collaborative tools and technologies, and enhancing both leadership capabilities and offer to GLD people as it implements the new GLD People Strategy. In developing the Business Plan for 2025-26, GLD has tested the scale of its ambition, and ensured that projects and initiatives will improve productivity and efficiency, supporting commitments made during the Spending Review.

Further details about these plans will be set out in GLD's 2025-26 Business Plan on gov.uk.

Attorney General’s Office

Following the success of PowerBi being used to produce meaningful management information, we are working with CPS who provide our IT infrastructure to build on this success by automating production of data to increase efficiency and improve data and analysis of our performance across a wide range of professions.

During the forthcoming year we will be exploring the options for building on the ULS application, in the development of a document management system to improve our Knowledge and Information Management, and what automation can be built in to increase efficiency through innovation.

The AGO will be working with corporate stakeholders from across the Law Officer Departments to decrease duplication and increase efficiency consistent with the principles set out in the Spending Review commission.

The 2025-26 Annual Report and Business plan will be produced for the start of the new fiscal year and will be published on gov.uk.

HM Crown Prosecution Service Inspectorate

HMCPSI will continue to provide evidence for others to hold the CPS and SFO to account in order to encourage improvement in the performance of the prosecution services. It will work with the inspected agencies to identify and promote good practice and continue to undertake a robust follow-up process.

HMCPSI will also continue to help other jurisdictions with advice, assistance and the sharing of best practice when invited to do so. We are currently responding to two overseas requests.

We are also this year, as an inspection by invitation by a public prosecutor, inspecting the Health and Safety Executive using our “by invitation” powers. We are also considering with Whitehall Prosecutors Group how HMCPSI may use its experience to help other public prosecutors understand best practice of assurance.

Further details are shown in HMCPSI’s 2025-26 Business Plan, to be available at: www.justiceinspectorates.gov.uk/hmcpsi.

Sustainability Performance

All departments are required to participate actively in developing action plans to achieve and report their performance against the ‘Greening Government Commitments’ (GGC) and to report on Task Force on Climate-related Financial Disclosures (TCFD).

A summary of the department’s performance and action taken in 2024-25 to improve sustainability is provided in the Sustainability Report at Annex A (page 86).

Complaints to the Parliamentary Ombudsman

There were no complaints in respect of GLD, the AGO or HMCPSI.

Performance in responding to correspondence from the public

GLD does not normally receive correspondence from members of the public since it conducts the majority of its business with other government departments. When it does receive such correspondence, it normally relates to the way cases have been handled or people feeling they were treated unfairly. GLD received 188 Freedom of Information (FOI) requests, responding to 91% within the statutory deadline (2023-24: 179 FOI received, responding to 97% within the statutory deadline).

The AGO received 235 FOI requests in 2024-25; 87% were responded to within the statutory deadline (2023-24: 210 FOI received, responding to 91% within the statutory deadline).

HMCPSI does not normally receive correspondence from members of the public as its business relates entirely to the inspection of the CPS and SFO. Any letters received tend to be complaints about interaction with the Criminal Justice System and are rarely matters where HMCPSI can intervene or assist. In these circumstances HMCPSI signposts to those who complain where they can go for assistance. HMCPSI received 12 FOI requests, and they were all dealt with within the statutory deadline (2023-24: 16, all responded to within the statutory deadline).

Financial Results

In delivering its wide range of legal services to its clients, legal and strategic policy advice and support to the Law Officers, and inspection and assessment of prosecution services, the department spent £386.8m (2023-24: £350.2m). After taking into account income of £393.0m (2023-24: £349.3m), the net resource requirement for 2024-25 was net income of £6.2m (2023-24: £1.0m net expenditure), £14.5m less than the sum approved by Parliament in the 2024-25 Supplementary Estimate for HM Procurator General and Treasury Solicitor (2023-24: £10.3m less than the sum approved by Parliament).

Total operating income was £393.0m (2023-24: £349.3m). GLD's income from legal fees and charges to clients increased this year to reflect demand for legal services - £330.7m (2023-24: £290.5m). Other income streams were: £54.2m from the recovery of disbursements incurred in providing legal services to clients (2023-24: £51.2m); £4.9m was recovered from the Crown’s Nominee (2023-24: £4.7m) and other income of £3.2m including subscription services was received (2023-24: £2.9m).

GLD is primarily funded from the fees charged to clients for its legal services whereas AGO and HMCPSI are funded by the Parliamentary vote. Full cost recovery was achieved by GLD. A surplus of £15m was generated (2023-24: £8.3m). £4m of the surplus was required to support additional capital requirements. The surplus has primarily been driven by higher demand for litigation services which has resulted in increased resources and higher chargeable hours per member of staff in the GLD Litigation Group.

Taxpayers' Equity is £21.6m at 31 March 2025 (£24.5m at 31 March 2024) comprising total assets of £110.3m (non-current assets of £31.4m, trade and other receivables of £53.6m, and cash of £25.3m); and current and non-current liabilities of £88.7m (trade and other payables, lease liabilities and provisions). Further details are in the Notes to the Accounts.

PES (2021) 03 requires departments to include an annex disaggregating the financial results and staff numbers by entities within the consolidation boundary. These requirements have been met through the Staff report (page 47) and Note 2 to the financial statements.

Comparison of Estimate and Outturn

GLD underspent by £14m against its voted funding, generating an overall surplus against full cost recovery. The surplus has primarily been driven by higher demand for litigation services which has resulted in increased resources and higher chargeable hours per member of staff in the GLD Litigation Group.

The AGO underspent against budget by £0.2m, mainly on account of lower administrative costs.

HMCPSI underspent against budget by £0.2m, mainly on account of lower staff costs.

The department underspent its net cash requirement by £25m, due to movements in working capital.

The capital budget was underspent by £0.5m mainly due to lower expenditure on network and information technology..

Reconciliation of Resource Expenditure between Estimates, Accounts and Budgets

| £m | 2024-25 | 2023-24 |

|---|---|---|

| Net Resource Outturn (Estimates) | (6.2) | 1.0 |

| Net Operating (Income) / Expenditure (Accounts) | (6.2) | 1.0 |

| Resource Budget Outturn (Budget) | (6.2) | 1.0 |

| Of which | ||

| Departmental Expenditure Limits | (6.3) | 1.3 |

| Annually Managed Expenditure | 0.1 | (0.3) |

Susanna McGibbon KC (Hon)

Accounting Officer

4 July 2025

Accountability Report

The Accountability Report includes a corporate governance report, a remuneration and staff report and a parliamentary accountability and audit report. These sections reflect financial reporting and parliamentary accountability reporting requirements.

Corporate Governance Report

Directors’ Report

Directors

The Governance Statement on page 19 includes the ministerial titles and names of ministers who had responsibility for the department for the year, the name of the permanent head of the department and the composition of the GLD Board. Management matters in the AGO are the responsibility of the Director General and HMCPSI is led by the Chief Inspector, who also fulfils the function of Chief Executive.

Register of interests

No directorships or other significant interests, which may have caused a conflict with their management responsibilities, were held by any Board Members. Note 16 to the Accounts includes related party interests identified.

Personal data related incidents

All government departments are required to publish information about any serious personal data related incidents, which have to be reported to the Information Commissioner (ICO). There was one personal data breach incident which was duly referred to the Information Commissioners Office for review in 2024-25.

Audit

The National Audit Office (NAO) on behalf of the Comptroller and Auditor General audits HM Procurator General and Treasury Solicitor Accounts.

The C&AG also audit the Crown’s Nominee Accounts administered by the Bona Vacantia Division of the department.

The auditors provide no further assurance or other advisory services.

Remuneration to external auditors for non-audit work

GLD, the AGO and HMCPSI did not pay any remuneration to the NAO for non-audit work. The notional audit fee for the departmental audit was £106k of which £87k relates to the audit of the GLD Annual Report and Accounts (2023-24: £102k of which £84k relates to GLD).

Statement of Accounting Officer’s Responsibilities

Under the Government Resources and Accounts Act 2000, HMT has directed HM Procurator General and Treasury Solicitor to prepare, for each financial year, Resource Accounts detailing the resources acquired, held or disposed of during the year and the use of resources by the department during the year. The Accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the department and of its income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing the Accounts, the Principal Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by HMT, including the relevant accounting and disclosure requirements and apply suitable accounting policies on a consistent basis;

-

make judgments and estimates on a reasonable basis;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed and disclose and explain any material departures in the Accounts;

-

prepare the Accounts on a going concern basis; and

-

confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgments required for determining that it is fair, balanced and understandable.

HMT has appointed the permanent head of the department as Principal Accounting Officer of the department.

In addition, the Principal Accounting Officer has appointed HM Chief Inspector, Anthony Rogers, as Accounting Officer for HMCPSI, to be accountable for that part of the department’s Accounts relating to HMCPSI and Douglas Wilson KC (Hon) OBE, Director General of the AGO, as Accounting Officer for AGO, to be accountable for that part of the department's Accounts relating to AGO. These appointments do not detract from the head of department’s overall responsibility as Accounting Officer for the department’s accounts.

The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding the department’s assets, are set out in Managing Public Money, published by HMT.

As Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that the department’s auditors are aware of that information. As far as I am aware, there is no relevant audit information of which the auditors are unaware.

Governance Statement

The Office of the Solicitor for the affairs of His Majesty’s Treasury (the Treasury Solicitor) was incorporated as a corporation sole by the Treasury Solicitor Act 1876.

The Government Legal Department (GLD) is a non-ministerial department and was established as an Executive Agency on 1 April 1996. Ministerial oversight and accountability to Parliament lies with the Attorney General. HM Procurator General and Treasury Solicitor leads the department, in the roles of Permanent Secretary and Chief Executive.

The Treasury Solicitor is accountable to the Attorney General for the running of GLD; and as Chief Legal Adviser to government, the Attorney has a close interest in the legal advice and legal services being provided to government by GLD and the wider Government Legal Profession. An interim Framework Agreement governs the relationship between GLD and Law Officers and the Attorney General’s Office.

Ministers

The ministers who had responsibility for the department during the year were:

-

The Rt Hon Victoria Prentis KC, MP, Attorney General to 5 July 2024

-

Robert Courts KC, MP, Solicitor General to 5 July 2024

-

The Rt Hon Lord Richard Hermer KC, Attorney General from 5 July 2024

-

Sarah Sackman KC MP, Solicitor General from 9 July 2024 to 2 December 2024

-

Lucy Rigby KC MP, Solicitor General from 2 December 2024

Accounting Officer System Statement

As Accounting Officer of HM Procurator General and Treasury Solicitor, I am personally responsible for safeguarding the public funds for which I have been given charge under the name of the HM Procurator General and Treasury Solicitor Estimate. This includes responsibility for GLD, AGO and HMCPSI. To help me ensure I am fulfilling my responsibilities as an Accounting Officer, this Governance Statement also describes the accountability system in place, and the relationship between GLD, the AGO and HMCPSI.

To support me in discharging my responsibilities, there is a framework of delegated authority in place. The GLD Board also supports me. Management matters in the AGO are the responsibility of the Director General and HMCPSI is led by the Chief Inspector, who also fulfils the function of Chief Executive. Both the Chief Inspector HMCPSI and the Director General AGO have been appointed as Accounting Officers for HMCPSI and AGO respectively. In accordance with Managing Public Money, this relationship is set out in writing. The Director General, AGO and the Chief Inspector HMPCSI meet me regularly and each provides an annual assurance report. The AGO Director General and AGO officials meet the Law Officers regularly to provide high quality legal and strategic policy advice and support. The HMCPSI Chief Inspector meets regularly with the Law Officers to provide assurance on the practices of the CPS and SFO.

The department enters into contracts with third party suppliers in the normal course of business. There are no significant contracts. GLD administers the Attorney General’s Panel Counsel. The Attorney General maintains four panels of junior counsel to undertake civil and EU work for all government departments. There is also a Public International Law Panel to undertake such work on behalf of government. These are in addition to any standing counsel and the First Treasury Counsel, Sir James Eadie KC. There are three London Panels (an A Panel for senior juniors, a B Panel for middle juniors, a C Panel for junior juniors) and a regional panel. The size of each panel is determined by need. All government departments and agencies of government departments must use the Panels.

Working with the Crown Commercial Service, GLD has also reviewed how external legal services are purchased from private sector law firms and has put in a place a Legal Services Panel, a Financial and Complex Legal Services Panel, a Trade Panel and a Rail Panel.

HMCPSI has a Management Board made up of the Chief Inspector, the Deputy Chief Inspectors and senior leaders that report to the Deputy Chiefs. The Board’s functions are advisory and supervisory. The Board meets every six weeks. Anthony Rogers was appointed Chief Inspector 1st February 2025 having filled the post on an interim basis from February 2024.

The AGO Executive Board is responsible for setting the strategic direction of the department, fostering a positive working culture, delivering key objectives, and ensuring prudent fiscal management. The board meet monthly on a formal basis, which is underpinned by a Board Operating Framework consistent to Corporate Governance code. In 2024-25 the AGO developed a non-executive staff member role on the board to provide external challenge.

GLD Board and sub-committees

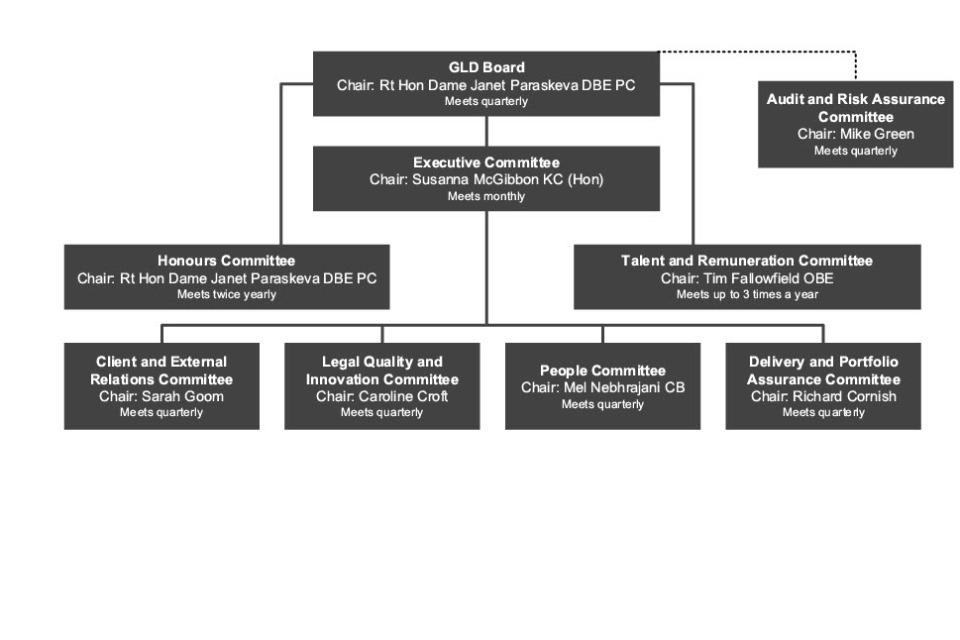

The GLD Governance structure at the reporting period date is set out below:

GLD Board

Chair: The Rt Hon Dame Janet Paraskeva DBE PC, Lead Non-Executive Board Member

The Board is GLD’s collective strategic leadership group, comprised of Executives and Non-Executive members, and a representative from the Attorney General’s Office. It focuses on strategic matters for the department, setting the overall vision and strategic direction for the organisation, to ensure the delivery of GLD’s strategic aims and objectives through long-term business and financial planning, and the GLD 2024-27 Strategy (which sets the department’s priorities, current and future needs). It supports the Chair in providing leadership of strategic business matters, and oversight of the delivery of legal services as well as the performance and governance of the organisation. It also supports the Permanent Secretary and Treasury Solicitor in their role as Chief Executive and Accounting Officer of GLD, and in their accountability to the Attorney General. The Board operates collectively, holding the Executive to account for the leadership and outcomes of the department.

The Board is supported by the Board’s sub-committees which comprise of the Executive Committee, the Audit and Risk Assurance Committee, the Honours Committee, and the Talent and Renumeration Committee.

Changes made during the reporting period

Having established a new composition in March 2024 (via the recruitment of two Non-Executive Board Members in February 2024), one of which is the new independent Chair, the new Board construct is now advisory rather than decision-making, supported by its refreshed Terms of Reference and Board Operating Framework (the terms of reference for other committees in the governance structure are being updated to align and strengthen the structure). See Professionalisation of GLD’s Governance section below.

Committee Membership

Current committee membership is drawn from GLD’s Executive (relevant to expertise), and Non-Executive members. The Lead Non-Executive Board Member is independent Chair of the Board.

Board Members

Membership of the GLD Board from 1 April 2024 to 31 March 2025 was as follows:

Executive members:

Susanna McGibbon KC (Hon), Permanent Secretary, Treasury Solicitor and Chief Executive

Richard Cornish, Director General Chief Operating Officer

Carmel Thornton, Finance, Operations and Digital Director

Ex-officio member:

Douglas Wilson KC (Hon) OBE Director General, Attorney General's Office

Non-Executive Board Members:

The Rt Hon Dame Janet Paraskeva DBE PC

Mike Green

Tim Fallowfield OBE

Non-Executive Board Members

The Rt Hon Dame Janet Paraskeva DBE PC, Lead Non-Executive Board Member

Dame Janet was Chief Executive of the Law Society from 2000 to 2006, preparing it for the advent of the Legal Services Act 2007 by establishing separate regulatory functions for the SRA and the OLC.

She has since served as First Civil Service Commissioner, been an independent member of the Consumer Council for Water, a Non-Executive Director of the Serious and Organised Crime Agency, Chair of the Child Maintenance and Enforcement Commission, and Chair of the Appointments Commission for the States of Jersey. She also serves as a trustee of the charity Contemporary Applied Arts, as Vice Chair of the Games Rating Authority, Chair of Primary Eye Care Services, and is Chair of Council for Licenced Conveyancers, the Construction Skills Certification Scheme, and the Southern Co-op.

Dame Janet was made a Privy Councillor to assist in her role as a member of the Detainee Inquiry established by the Prime Minister in 2010.

Mike Green, Non-Executive Board Member

A Fellow of the Institute of Chartered Accountants in England and Wales and a graduate of the London School of Economics, Mike qualified as a chartered accountant with what is now KPMG and spent 11 years with the audit practice before a 20-year career in Commercial Television. He has held senior finance roles at TVS Television Limited and Carlton Communications plc and was involved in the Carlton/Granada merger which formed ITV plc. Following the merger, Mike moved to ITV and ultimately held the role of Deputy Group Finance Director. He also represented ITV on a number of joint venture boards in the UK and internationally.

Currently Mike is a Director, Audit Committee Chair and a member of the Service Quality Committee at Anchor Hanover, a housing association specialising in older people’s housing and operating over 100 care homes. Mike is also a Trustee of the Royal Television Society, a charity advancing public education in the practice, technology, art, and science of television. He was also a Non-Executive on the Board and committees of an NHS Foundation Trust for 10 years.

Tim Fallowfield OBE, Non-Executive Board Member

Tim retired from Sainsbury’s in 2024 having joined as Company Secretary and General Counsel in 2001 and being appointed to the Operating Board in September 2004. Tim was responsible for governance and risk management, leading the Corporate Services Division comprising Legal and Regulatory, Information Security and Cyber, Safety, Shareholder Services, Insurance and Central Security. He chaired the Group Safety Committee and the Data Governance Committee. Tim joined Sainsbury’s from Exel plc, the global logistics company, where he was Company Secretary and Head of Legal Services. He began his career at the international law firm Clifford Chance and is a qualified solicitor.

Tim is a Trustee of Save the Children UK and Chair of the Sainsbury Archive. He chaired the Disability Confident Business Leaders Group between 2016-23 which works with government in shaping the disability employment agenda and in raising awareness of the benefits of employing disabled people. He was awarded an OBE for services to Disability Awareness in the 2020 New Year’s Honours list.

Board attendance

The Board met 5 times 2024-25, (which included 4 formal meetings and 1 additional meeting in 2024, to endorse the 2023-24 GLD Annual Reports and Accounts), with attendance as follows:

| Executive members | Eligible to attend | Attended (to end March) |

|---|---|---|

| Susanna McGibbon KC (Hon) | 5 | 5 |

| Carmel Thornton | 5 | 4 |

| Richard Cornish | 5 | 4 |

| Ex-officio member - Douglas Wilson KC (Hon) OBE | 5 | 5 |

| Non-executive members | Eligible to attend | Attended (to end March) |

|---|---|---|

| The Rt Hon Dame Janet Paraskeva DBE PC | 5 | 5 |

| Mike Green | 5 | 5 |

| Tim Fallowfield OBE | 5 | 5 |

The Board's work covers the 5 main areas expected by the 2017 Corporate Governance in Central Government Departments: Code of Good Practice:

-

Strategy – steering the department so that decision-making and strategic objectives are in line with the 2024-27 Strategy and that these are scrutinised, most especially by the external expertise and perspectives of the Non-Executive Board Members.

-

Commercial focus – scrutinising the allocation of resources to achieve plans; ensuring controls are in place to manage Risk (receiving adequate assurance from the Audit and Risk Assurance Committee that effective controls are in place).

-

Talented people – GLD has a People Strategy to help ensure that GLD has the capability to deliver and to meet current and future needs.

-

Results focus/performance – the Board endorses the annual Business Plan and monitors and manages departmental performance against it.

-

Management information – the Board receives quarterly performance and risk reporting, containing clear, consistent and comparable performance information.

Honours Committee

Chair: The Rt Hon Dame Janet Paraskeva DBE PC, GLD Lead Non-Executive Board Member

The Honours Committee is a new GLD Board sub-committee, responsible for reviewing nominations for National Honours for merit, exceptional achievement, or service. It oversees the nominations process for GLD employees for the King’s Birthday and New Year Honours; it also informs the formal submission and pipeline of GLD nominations to the Cabinet Office through moderation of nominations.

The Honours Committee reviews nominations of GLD employees for the State Honours Committee; and also has the ability to nominate for other Independent Honours Committees as appropriate.

The Honours Committee is also responsible for determining potential candidates for Royal Garden Party invites once a year and may also be also called upon to moderate Honorary King’s Counsel nominations as these arise. Lastly, the Committee is notified of any additional Honours awarded throughout the year which do not require moderation (for example, Imperial Service Medals). This is to promote these in line with the GLD 2024-27 Strategy and celebrate the great achievements of those at GLD.

The Honours Committee meets twice yearly and met one time in 2024-25 after its formation in November 2024.

Changes made during the reporting period

The Honours Committee was formed during the reporting period 2024-25 and had its first meeting in November 2024.

Honours Committee members

Membership of the Honours Committee from 27 November 2024 to 31 March 2025 and is as follows:

Susanna McGibbon KC (Hon), Permanent Secretary and Chief Executive

Caroline Croft, Director General of Employment with Economic Recovery and UK Governance

Mel Nebhrajani CB, Director General of Litigation with Justice and Security

Sarah Goom, Director General of Commercial with Trade and International

Richard Cornish, Director General, Chief Operating Officer

Damian Paterson, Strategy, People and Culture Director

Non-Executive members

The Rt Hon Dame Janet Paraskeva DBE PC

Honours Committee Attendance

The Honours Committee met 1 time between November 2024 and March 2025, with attendance as follows:

| Executive members | Eligible to attend | Attended (to end March) |

|---|---|---|

| Susanna McGibbon KC (Hon) | 1 | 1 |

| Caroline Croft | 1 | 1 |

| Mel Nebhrajani CB | 1 | 1 |

| Sarah Goom | 1 | 1 |

| Richard Cornish | 1 | 1 |

| Damian Paterson | 1 | 1 |

| Non-executive members | ||

| The Rt Hon Dame Janet Paraskeva DBE PC | 1 | 1 |

Talent and Remuneration Committee

Chair: Tim Fallowfield OBE, Non-Executive Board Member

The Talent and Remuneration Committee (TRC) is a new GLD Board sub-committee and is responsible for providing assurance relating to the support, investment, and recognition of GLD’s Senior Civil Servants (SCS). It oversees talent management and succession planning for our most senior cohort and business critical roles and nominations for high potential development interventions and programmes.

TRC is also responsible for overseeing and directing SCS pay and setting reward strategies that meet GLD’s business needs (in accordance with the SCS Practitioner Guidance) and monitoring the results to ensure compliance with diversity legislation, taking any appropriate action as necessary. This includes seeking assurance that due process has been undertaken relating to SCS performance to enable pay recommendations to be made to the Committee.

TRC meets three times per annum and met one time in the period 2024-25 since its formation (February 2025).

Changes made during the reporting period

The Talent and Remuneration Committee was formed during the reporting period 2024-25 and had its first meeting in February 2025.

Audit and Risk Assurance Committee

Chair: Mike Green, Non-Executive Board Member

The Audit and Risk Assurance Committee (ARAC) is a sub-committee of the GLD Board. It supports the Principal Accounting Officer by monitoring and reviewing the department's risk, control, and governance processes, as well as the associated assurance processes, including external and internal audit.

The Committee meets quarterly and convened four times in 2024-25. A private meeting with the external and internal auditors, without GLD colleagues present, was held before each meeting. The Committee consists of Non-Executive members and an independent member (Asif Bhatti) and is attended by executives and external and internal auditors.

The Committee oversaw the audit process and advised the Principal Accounting Officer on the financial integrity of three sets of accounts: Agency accounts, departmental accounts, and the Crown’s Nominee accounts for 2023-24, including the external auditors’ opinion. The Committee was satisfied with the quality of the external auditors’ work and their approach to their responsibilities. At its final meeting of 2024-25 the Committee reviewed the external auditors’ audit plans for the 31 March 2025 year end. For the financial year ending 31 March 2025, there was a change in audit arrangements, with the department’s external auditors, the NAO, bringing the GLD audits, which had previously been outsourced, in-house. The NAO have always had overall responsibility for the audits but resourcing the audits in house was a change in delivery method. The risks associated with this change and proposed mitigations were discussed with the Committee.

ARAC continued its deep dive programme, which covered the Pay and Reward Modernisation Project Closure and the Legal Practice Management (LPM) Project to ensure proper visibility of the related risks and issues. The Committee also considered the findings contained in the Reports prepared by the Head of Internal Audit, based on an Internal Audit Plan agreed in advance by the Committee, and monitored the implementation of internal audit recommendations. Internal Audit also issued 3 management letters assessing the governance, risk and project management for LPM, which were discussed by the Committee.

The Committee received quarterly updates on the ongoing work on GLD’s Principal Risks, Risk Framework, and assurance map, and advised the Board on risk appetite in light of GLD’s new strategic plan. No new Raising a Concern: Whistleblowing incidents were reported throughout the year. Finally, as part of its remit, the Committee reviewed security matters twice a year, with specific attention to Cyber Security, incident reporting, and the application of policies and procedures relating to Health and Safety, along with an annual report on the application of the Business Appointment Rules. Additionally, it reviewed GLD’s position on fraud and noted the latest developments.

In line with the HM Treasury ARAC Handbook, the Committee reviewed its own effectiveness, as well as the effectiveness of the internal and external audit functions.

Changes made during the reporting period

From September 2024, the Director General Chief Operating Officer joined the Committee as a permanent attendee.

The Committee was quorate at each meeting. A breakdown of members’ attendance is shown below:

Audit and Risk Assurance Committee attendance

ARAC met 4 times between April 2024 and March 2025, with attendance as follows:

| Non-executive members | Eligible to attend | Attended (to end March) |

|---|---|---|

| Mike Green | 4 | 4 |

| Tim Fallowfield OBE | 4 | 3 |

| Asif Bhatti (independent member) | 4 | 4 |

Executive Committee

Chair: Susanna McGibbon KC (Hon), Permanent Secretary and Treasury Solicitor

The Executive Committee (ExCo) is a sub-committee of the GLD Board. It consists of GLD’s Executive colleagues. ExCo meets once a month, with additional exceptional meetings if required. ExCo oversees the operational delivery of all aspects of the business, monitors performance against GLD objectives and reviews and oversees departmental risk and other critical business issues. It leads, motivates and challenges the department. It supports the Board in delivering GLD’s Strategic Objectives and monitors and sets direction for the assurance committees reporting into it.

The Committee met 11 times in 2024-25. An annual business planning process, overseen by ExCo, sets the department’s priorities and resourcing for the year ahead. Over the past year some of the topics that ExCo have considered include the 2024-27 GLD Strategy; resourcing; performance reporting including Quarterly Performance Reports; 2025-28 People Strategy; Spending Review; Legal Operations Directorate; Principal Risk Register and Innovation and AI strategies.

ExCo is supported by 4 sub-committees: the Legal Quality and Innovation Committee (LQIC), Delivery and Project Assurance Committee (DPAC); Client and External Relations Committee (CERC) and People Committee (PC).

Changes made during the reporting period

None

Client and External Relations Committee

Chair: Sarah Goom, Legal Director General, Commercial with Trade and International

The Client and External Relations Committee (CERC) is an Executive Committee sub-committee that makes decisions, provides strategic direction, oversight and assurance for: (i) the conduct and effectiveness of GLD’s client relationships; (ii) the procurement of external legal services for GLD’s clients, as well as the quality, value for money and efficiency of those services; (iii) fostering cohesive relationships within the Government Legal Profession; and (iv) effective engagement with wider legal sector stakeholders including regulators, to support the delivery of our services and the Business Plan.

The Committee meets quarterly and met four times in 2024-25.

Over the past year, the Committee has overseen a number of key initiatives. In relation to client care, CERC has overseen the development of a comprehensive Client Feedback System, including the refreshing of Client Deep Dives and Legal Project Reviews, as well as analysing the outcomes of the annual Client Satisfaction Survey.

In relation to GLD’s external legal suppliers, the Committee oversaw the recommendation to increase panel counsel fees and closely monitored GLD’s joint project with Crown Commercial Service to procure the new legal services framework agreement, the Legal Panel for Government.

Additionally, the Committee provided oversight and assurance in the delivery of the Government Legal Profession Strategy (up to the implementation stage) and agreed on the initial draft for the External Relations Strategy. Work on this strategy will continue into the next financial year.

As part of best practice, Governance undertook a light touch review of CERC in 2024-25. Any recommendations arising from the review will be considered and implemented as appropriate in 2025-26.

Changes made during the reporting period

The existing Diversity and Inclusion (D&I) members for this Committee were put in place for an additional one-year tenure.

Legal Quality and Innovation Committee

Chair: Caroline Croft, Legal Director General, Employment with Economic Recovery and UK Governance

The Legal Quality and Innovation Committee (LQIC) is an Executive Committee sub-committee and focuses on matters relating to the quality and effectiveness of our legal work and innovation in the delivery of GLD’s legal services.

LQIC makes decisions and provides strategic direction, oversight, and assurance for the quality and effectiveness of GLD’s legal services; the design, delivery, and effectiveness of legal knowledge resources, legal capability and training, and legal induction; and innovation in the delivery of legal services. The committee also oversees GLD’s quality accreditation and recognition processes, such as Lexcel, and the legal quality and innovation priorities in our Business Plans.

LQIC’s meets quarterly and met 4 times in 2024-25. Meetings are themed, so that each concentrate on a particular aspect of its remit. Key areas of assurance have included GLD’s legislative work, our Centres of Excellence, the department’s legal knowledge and learning systems, and GLD’s evolving use of AI.

Significant decisions taken during the year include approving a new process for Quality Assurance in advisory directorates, improvements to our legal induction and training and the initiation of a project to examine and improve GLD’s expertise in drafting draft legislation.

As the Chief Operating Officer (COO) Group, and the Legal Operations Directorate have become established, the Committee has worked closely with these new parts of GLD to ensure that GLD has the expertise, tools and innovation to deliver first-class legal services ever more efficiently and effectively. The Committee has worked to ensure that the quality of the data that it receives to help it fulfil its remit continues to improve and has embedded data deep-dives into specific aspects of its remit during its meetings. This builds on a review of data led by the Chair during the last reporting period. In line with best practice, there was also a light-touch review of the Committee’s governance arrangements. Any recommendations which emerge from the review will be considered and put into effect as appropriate in 2025-26.

Looking ahead, LQIC will continue to monitor, assure and support the implementation of strategic initiatives, ensuring that GLD remains at the forefront of legal excellence and innovation.

Changes made during the reporting period

Daniel Denman (Legal Director and GLD Knowledge Champion) left the Committee in December 2024 when he left the organisation. He will be replaced by the new GLD Knowledge Champion.

The existing D&I members for this Committee were put in place for an additional one-year tenure.

People Committee

Chair: Mel Nebhrajani CB, Legal Director General, Litigation with Justice and Security.

The People Committee (PC) is an Executive Committee sub-committee and oversees the organisation’s People Strategy and related policies. The PC reviews key workforce metrics, risks, and actions, particularly in legal resourcing, capacity, capability, and pay and reward. It also monitors the effectiveness and wellbeing of employees and diversity and inclusion, supporting leadership initiatives across legal and corporate services. Committee decisions are based on a range of data that includes responses to the People Survey.

The PC meets quarterly, with additional meetings if required, and met 4 times in 2024-25. Over the past year, the PC has driven critical work, including refreshing the GLD’s 2025-28 People Strategy, reviewing changes to capability-based pay, and transforming recruitment strategies. Members also discussed developments for internal legal career pathways. PC also welcomed and considered the twice-yearly Health and Wellbeing Report, which helps members monitor and identify risks related to activities within its remit. This Report is also shared with the GLD Board for assurance. The committee regularly discusses key data trends and assess the relevance of the metrics considered.

In line with the GLD Board’s ongoing commitment to increasing diversity in GLD’s decision making bodies, SCS and delegated grade Diversity and Inclusion members have remained a staple of the committee’s membership. The current D&I members were put in place from April 2024 and have a one-year tenure.

In line with best practice, there was also a light-touch review of the Committee’s governance arrangements. Any recommendations which emerge from the review will be considered and put into effect as appropriate in 2025-26.

Changes made during the reporting period

None

Delivery and Portfolio Assurance Committee

Chair: Richard Cornish, Director General Chief Operating Officer

The Delivery and Portfolio Assurance Committee (DPAC) is an Executive Committee sub-committee and plays a critical role in ensuring the implementation of GLD’s key priorities as defined in the annual Business Plan and the Strategic Objectives outlined in the GLD 2024-2027 Strategy. Established in mid2024, DPAC enhances assurance and reporting on the department's strategic effectiveness.

DPAC’s focus is on a transformational agenda for GLD’s corporate services and legal operations functions and a mission to drive forward key departmental projects and initiatives.

DPAC meets quarterly and had 4 meetings in 2024-25. Its inaugural meeting involved the review and of its Terms of Reference, including definition of roles, and responsibilities. Key discussions included processes for commissioning and monitoring the Business Plan

Delivery Report and approaches to in-year changes to the Business Plan with a focus on a Change Assessment Gateway which sets out a framework and process for deciding whether to add a new project or initiative as an in-year priority for the Business Plan. DPAC oversees multiple departmental performance metrics, aiming to consolidate these into a unified product and monitoring business plan projects, initiatives and metrics for success measures.

Subsequent meetings have focused on reviewing the GLD Business Plan Delivery Report, establishing baseline milestones, and considering change control procedures. Significant areas of deliberation have included IT resilience with an examination of the work undertaken by GLD’s Information, Governance, and Digital and Data teams to enhance the department’s IT infrastructure, the management of security information risk as well as risk management related to business planning.

Future agenda items will include addressing identified risks and challenges with dedicated deep dive sessions. The Committee will continue focusing on key projects such as the Legal Practice Management project, with regular reviews.

Changes made during the reporting period

The committee will be recruiting two new Diversity and Inclusion members to align with best practice across GLD’s governance committees, and in parallel with a review of the membership of all the committees. Following a review of the Investment and Portfolio Assurance Committee (IPAC) circa a year after its creation, a decision was reached by the Executive Committee to establish DPAC to replace IPAC, as part of the changes in how the department plans and monitors of the delivery of the Business Plan, and a renewed focus on the importance of the project profession. The review found that there was a continued need to monitor the capacity of the business to both implement and receive change, and the original design and purpose of IPAC did not align with the volume and nature of projects within GLD required to deliver our Strategy year on year. See also Professionalisation of GLD’s Governance section below.

Professionalisation of GLD’s governance

The department continues to align and enhance its governance, delivery and accountability arrangements, in line with the 2024-27 Strategy and current Business Plan, following the new Board composition in March 2024 and the appointment of a DG Chief Operating Officer.

Recognising that to achieve the department’s ambition of being an environment fit for the future, the department’s structures and processes need to be responsive and adaptive; as such the Board’s supporting documents have been updated, which the rest of the governance structure will align to, including the two new Board sub-committees, that were agreed by the Executive Committee and the GLD Board in June 2024 (Talent and Remuneration Committee, and Honours Committee).

The Talent and Renumeration Committee merged two former HR-led committees (Talent and Succession and SCS Pay Committees) as part of increasing GLD support, investment and recognition of GLD’s Senior Civil Servants (SCS). It oversees the SCS remuneration and pay strategy decisions within the SCS pay envelope set centrally by the Cabinet Office. It also oversees talent management and succession planning for GLD’s most senior cohort and business critical roles and nominations for high potential development interventions and programmes. The Honours Committee increases the transparency and utility of nominations for State or Legal Honours as part of GLD’s reward and recognition strategy.

The Governance Team is also undertaking light touch reviews of three of the Executive Committee sub-committees (Client and External Relations Committee, Legal Quality and Assurance Committee and People Committee). These reviews aim to ensure that the sub-committees are functioning effectively, in line with best practice and are aligned by formal and professional processes. The recommendations will be discussed and implemented during this coming financial year.

During the financial year, the Shadow Board was dissolved, recognising that the GLD Board is advisory. The Shadow Board was part of GLD’s informal governance; an advisory staff forum which acted as a feedback mechanism to the Board. To ensure staff feedback remains part of decision making within GLD, committee papers for the Executive Committee and its sub-committees are shared with senior colleagues across the organisation, to feed in their comments. The team also continues to enhance the committee observer scheme and promote staff engagement sessions with Board members (at all GLD National locations, on a rotating basis).

The contribution of Non-Executives’ external public and private sector expertise is an integral part of amplifying the impact of the strategic changes made to-date, and their ongoing contributions should provide better engagement, quality, outcomes, ultimately benefitting the delivery of our legal services.

The GLD Board’s performance

GLD adheres to centrally set standards of good governance practice for government departmental boards and follows the Board Effectiveness Evaluation process, where possible, recommended in guidance produced by the Cabinet Office. The evaluation of the Board this year considered the effectiveness of the group under the following headings:

-

Board Members’ personal evaluation

-

Governance arrangements

-

The work of the Board

-

Composition and culture

-

Support and organisation

-

Progress and impact

The recommendations will be discussed and implemented during this coming financial year. Progress on the recommendations from the previous evaluation was reviewed during the reporting year and implementation made by 31 March 2025.

As aforementioned, in line with recent changes to the governance structure, the Board Terms of Reference and the Board Operating Framework has been redrafted, (the terms of reference for other committees in the governance structure are being updated as part of the Committee Review work to align).

Compliance with the Corporate Governance in Central Government Departments: Code of Good Practice

The Corporate Governance in Central Government Departments: Code of Good Practice applies primarily to ministerial departments. This means that the key provisions relating to the composition of Boards do not apply to GLD; specifically, the involvement of ministers and the requirement to have roughly equal numbers of ministers, senior civil servants, and non-executive directors.

Management of interests and Business Appointments

GLD has a policy, published in its Staff Handbook, on outside activities and employment. The general principles are that official time must not be spent on any outside activity without the approval of the Head of Division. Individuals must not engage in any outside activity, which would in any way tend to impair their effectiveness in their official duties or be inconsistent with their position as civil servants, or as members of GLD.

No member of staff may carry out private legal work except, and subject to permission of the Treasury Solicitor, in relation to non-contentious family matters, or pro-bono work.

Individuals must seek permission from the Head of HR, via a senior manager in their business area to ensure there is no risk in respect of conflict of interest with, or potential damage to the credibility of GLD before:

-

taking any job or position, which might affect their official work directly or indirectly; or

-

undertaking any outside work involving official information; or

-

undertaking any work involving payment by another government department or agency on their own account.

Where permission is granted the relevant documentation is filed in the individual’s personnel folder.

There are strict rules in place for those responsible for procurement or management of contracts and on an annual basis all Directors are asked to complete a Declaration of Related Party Interests.

GLD also has a policy on Business interests and shareholdings, also published in the Staff Handbook. This states that there is no objection to civil servants investing in shareholdings unless the nature of their work is such as to require constraints on this. Individuals must not be involved in any work, which could affect the value of their private investments, or the value of those on which they give advice to others; nor must staff use information acquired in the course of their work to advance their private financial interests or those of others.

Individuals must declare to the Finance, Operations and Digital Director any business interests or shareholdings (including directorships) which they or members of their immediate family (spouse/partner and children) hold - to the extent to which they are aware of them - which they would be able to further as a result of their official position. They must comply with any subsequent instructions from the Finance, Operations and Digital Director regarding the retention, disposal or management of such holdings.

In line with Cabinet Office guidance, GLD will ensure that:

-

All senior civil servants are required to routinely declare any relevant interests to the Permanent Secretary. This will include providing a ‘nil return’ should they have no relevant outside interests.

-

Senior civil servants continue to declare any outside interests on appointment, or if their circumstances change, in real time.

-

These returns are scrutinised within GLD by the Audit and Risk Assurance Committee, with assurance of this process set out in the Annual Report and Accounts, and a return is provided to the Cabinet Office, providing assurance that all outside interests are being managed appropriately.

-

As part of or alongside the Annual Report and Accounts GLD will publish a register of relevant interests for all members of the departmental Board, including senior civil servants.

-

When a civil servant is appointed, as part of the recruitment process the hiring manager is satisfied they can comply with the requirements of the Civil Service Code. The individual must ensure that any interests they do have are compliant with their obligations as a civil servant. If their employer considers there is any real or perceived conflict from their outside interests, the individual must resolve that conflict - for example, by giving up any outside employment

-

After a civil servant is appointed, they declare relevant private interests in real time to their line manager and, if necessary, senior management. They will be required to comply with any instructions from GLD relating to those interests. They will also be required to seek permission before taking up any outside engagement which might affect their work.

Special Advisers

In line with the current Declaration of Interests policy for Special Advisers, the Special Advisers to the Attorney General are asked to declare any relevant interests or confirm they do not consider they have any relevant interests. The Director General of the Attorney General’s Office considers the returns provided and will publish any relevant interests.

Business Appointments

The Audit and Risk Assurance Committee monitor compliance with the Business Appointment rules, receiving an Annual Report from Human Resources. In compliance with Business Appointment rules, the department is transparent in the advice given to individual applications for senior staff, including special advisers. A summary of advice given is published at: https://www.gov.uk/government/publications/ago-gld-and-hmcpsi-business-appointment-rules.

In 2024-25 there were 14 exits from the Senior Civil Service (SCS). No BAR applications were submitted to the department from SCS or from staff members at delegated grades. There were no breaches of rules in the preceding year.

Risk Management in GLD

Risk management practices comply with the requirements of the Orange Book’s (HM Treasury risk management guidance) Main Principles. Our principal risks are also aligned to the risk categories in the Orange Book.

The ARAC provides a challenge function to the department’s risk management arrangements, including deep dive reviews, internal audit reviews and the assurance of processes.

Risk management is embedded at every level in the department by encouraging empowerment and delegation so that risks can be managed proactively by those with the local knowledge and experience, and who are held accountable for the effective management of those risks.

The process is to identify and evaluate a risk, determine an appropriate response, and actively manage the response to ensure that GLD’s exposure is limited to an acceptable level.

Principal risks are agreed by the GLD Board and monitored by the ARAC, and each key strategic risk is owned by an Executive Committee member. The risks and actions to mitigate them are reported quarterly to the Executive Committee and the Board. The principal risks and the actions to mitigate them are detailed in the GLD business plan.

Risk Profile

GLD’s key principal risks and mitigating actions which are:

| Orange Book Risk Category | Risk Description | Rating | Plans and Mitigations |

|---|---|---|---|

| Property | GLD does not deliver on its Health and Safety obligations caused by poor management leading to unsafe and unsuitable buildings or unsuitable equipment for staff. | 4 - Green | A robust management plan is in place, which includes regular health and safety liaison with our public sector landlords, to ensure that GLD’s legal responsibilities are met through risk assessment and safety awareness management. Competent persons are in place to deliver these and GLD has set up a Health and Wellbeing Group to oversee health, safety, and wellbeing within GLD. GLD engages with landlords through building house and safety committees. |

| Business Continuity | We do not prepare for significant external events which impact the delivery of legal services or cost recovery. | 4 - Green | GLD has a robust command and control structure to manage disruption to the delivery of GLD services; which is overseen by the GLD Incident Management Team; this takes into consideration the disparate locations of staff and the specific requirements of business areas; these plans are reviewed annually and tested to ensure that they are effective and would minimise the impact of disruption on GLD business operations. |

| Security | We do not keep pace with emerging threats or a failure of compliance as a result of inappropriate awareness, culture and practice across personnel, physical and cyber security domains. Resulting in harm, or sanctions, or has an adverse impact on our ability to deliver legal services to our clients. | 6 - Amber | We comply with the requirements of our Information Security Management System, as well as GovS007 Functional Standard and Minimum-Security Standards across all security functions (Physical, Personnel, Cyber and Technical). We ensure all staff are appropriately security cleared and communicate securely with counsel and other third parties. All staff complete the mandatory annual ‘Security and Data Protection’ training. There is also Security Education and Awareness training products available on GLD’s Learning Management System (LMS). Assurance is obtained through maintaining various cyber related certifications and accreditations, such as the ISO27001, Cyber Assessment Framework (CAF) and Government Cryptographic Standards (IS4). This allows us to provide and support secure IT equipment and services to the National Security team, amongst others. We have IT solutions to identify, protect and respond to cyber-attacks. |