ECLAIMS Process for Self-Declared Adjustments (SDAs) - Applicant Guidance

Updated 21 February 2023

1. Self-Declared Adjustments (SDAs)

Where a Grant Recipient (GR) identifies voluntarily that an error has been made in a claim which has already been paid by the European Social Fund (ESF) Managing Authority (MA), the GR can submit an SDA (CPR Article 122(2) (b)).

When a GR submits an SDA, the ESF MA will review the type of error, the circumstances under which it occurred and the pattern of other SDAs and Irregularities relating to the same project. The ESF MA will then decide if the issue reported via the new SDA should be treated as a Technical or Clerical Adjustment (TCA) or instead be treated as an Irregularity.

If an error reported by the GR is treated as a TCA by the ESF MA the GR will need to repay the funds and those funds can then be re-cycled into the same ESF Project for use as part of a later, valid claim.

If an error reported by the GR is treated as an Irregularity by the ESF MA, again the GR will need to repay the funds, however those funds cannot be re-cycled into the same ESF Project. The contracted value for the ESF Project will therefore be reduced by the total value of the Irregularity and those funds will not be available for re-use by that ESF Project.

Where you need to repay funds affected by an SDA, your Contract Manager (CM) (or CFO Lead) will confirm how these funds will be recovered from you for example via offsetting against a future claim or, if the final claim has already been paid for your ESF Project, via Demand Note or Debt Recovery processes.

An SDA can be submitted at any time, see paragraph below.

The SDA must link to a claim period which has already been paid and usually be within the same calendar year the claim was made. If an SDA is submitted outside this period, the MA will consider these declarations on a case-by-case basis.

If a GR submits an SDA Adjustment after they have been notified that the same ESF Project has been selected for an Article 125 On-The-Spot Visit, or Article 127 Audit Authority (AA) visit, but the visit has not yet taken place, or the visit has taken place and the associated outcomes are still being finalised by the MA or AA, the SDA will usually be treated as an Irregularity.

Where a GR is notified that their ESF Project has been selected for an article 125 or 127 inspections, but there is an existing error they have already identified but not yet submitted via SDA, the GR should collate evidence of detection and other details of the error as usual, including the date the error was identified and evidence of the identification date and ensure this information is uploaded into ECLAIMS as part of the SDA.

The ESF MA will then consider this information – including the date of error detection in comparison to the date the GR was notified of the upcoming A125 or A127 visit - when deciding if the SDA should be treated as a TCA or an Irregularity.

Where a GR has been notified that their ESF Project has been selected for audit by another audit body for example. National Audit Office (NAO), European Commission Auditors (ECA), then SDAs should not be submitted for that ESF Project until the relevant NAO or EC audit has been completed

In all cases, where an ESF Project submits an SDA, but the same ESF Project has made the same or similar errors in the past, but they have failed to sufficiently rectify their systems to avoid the same errors again, the ESF MA may choose to treat the new SDA as an Irregularity, rather than a TCA.

GR should contact the CM prior to entering any SDAs on ECLAIMS to discuss the issue they are trying to resolve and agree whether an SDA is appropriate. If an SDA is agreed, the GR should also notify their CM by email once they have completed submission of the relevant SDA.

SDAs should only be used to correct or deduct monies from previous claim and only where the GR has paid more funds than they are entitled to as a result of the error.

If a GR identifies an error which means they may have under-claimed funds in their previous claims, this should not be corrected via the SDA process.

Instead, the GR should include the missing expenditure in their next quarterly claim, ensuring the relevant expenditure description explains the reason for this element of the claim.

The GR should also be able to provide the relevant documentary evidence relating to that expenditure if the MA selects that expenditure for a claims check.

For example, a GR incurs an invoice cost of £110 ESF costs from a supplier. However, in their next claim they mis-claim and only request £100 ESF for that expenditure and the claim is then paid by the MA.

As a result of a later internal check, the GR realises they have under- claimed £10 ESF. The GR can include an expenditure line for the £10 ESF funding in their next claim, explaining this is a £10 under-claim against a previous total invoice amount of £110 ESF.

If selected for an evidence check, the original evidence of the invoice will be needed, together with:

- an explanation of which previous, paid ESF claim the under-claimed expenditure relates to

- the Transaction Line ID number for the original, under-claimed expenditure

- and the descriptor wording used in the previous claim for that under-claimed item of expenditure

Prior to the submission of any under-claimed funds in a new ESF claim, the GR should discuss this with their CM.

If, once the ESF MA has considered all the SDA information, they decide to treat the SDA as a TCA this will be recorded in ECLAIMS and the SDA will show in the system as Converted to TCA.

If the ESF MA decided to treat an SDA as an Irregularity, this again will be recorded in ECLAIMS, and the SDA will show in the system as Converted to Irregularity.

In both cases the ESF CM will notify the GR of the outcome of their SDA.

2. Irregularities

Definition: CPR Article 2 (36): irregularity means any breach of Union law, or of national law relating to its application, resulting from an act or omission by an economic operator involved in the implementation of the European Structural Investment Funds (ESIF), which has, or would have, the effect of prejudicing the budget of the Union by charging an unjustified item of expenditure to the budget of the Union.

To reduce the risk of GR incurring and claiming ineligible expenditure, below are examples of common irregularities, please note this list is not exhaustive:

- missing items of paperwork such as invoices or bank statements

- costs not defrayed or paid by the lead applicant or partner (of a consortium type project)

- deficiencies in the ESF Project’s management and control systems

- failure to retain, share and protect project documentation in line with ESF guidance

- failure to adhere to ESIF Branding and Publicity Guidance for example, not displaying posters or logos on project documentation

- using an unapproved apportionment methodology for shared overhead costs

- not undertaking a fair, open, transparent, and competitive procurement exercise in line with EU Regulations

- staff costs, including any applicable hourly rate and or fixed rate methodologies, not calculated in line with the agreed methodology, ESF Eligibility Rules or ESF Programme Guidance

- any over-claiming for the costs of items, services or staff included in a claim to the ESF MA.

- no evidence, insufficient evidence or ineligible evidence to substantiate participant claimed outputs such as on programme, completions, progression, achievement and job outcomes

- no evidence, insufficient evidence or ineligible evidence to support outputs or results

- costs claimed for activities that are not project specific or within the correct priority axis or investment priority

- failure to adhere to State Aid regulations

- no evidence or insufficient evidence to demonstrate a participant is eligible for ESF support

- claiming for staff not detailed in the ESF Funding Agreement (FA) or Application or a subsequent updated staff list agreed in advance with the ESF CM.

It is the ESF MA decision on whether an error reported via the SDA route should be treated as a TCA or an Irregularity.

3. How to report and submit a Self-Declared Adjustment

All SDAs should be submitted by the GR using the ECLAIMS IT system.

The GR should contact the CM prior to entering any SDAs on ECLAIMS to discuss the issue they are trying to resolve and agree whether an SDA is appropriate.

If an SDA is agreed, the GR should also notify their CM via email once they have completed submission of the relevant SDA.

When calculating and inputting the SDA value, the GR should ensure that Flat Rate Indirect Costs (FRIC) are not included in the recorded SDA value by their ECLAIMS SDA Editor.

If the affected error has any related FRIC costs, these will automatically be calculated and added by the ECLAIMS system.

GRs should identify staff to perform the SDA Editor role, this will be formalised within ECLAIMS once the ECLAIMS external user access form has been completed.

SDA Editors are tasked with creating and submitting the SDA on behalf of the GR, including collating all the relevant information in the form and associated documents and ensuring supporting documents are uploaded to ECLAIMS as part of the SDA.

The GR should ensure that each SDA recorded in ECLAIMS is accurate and that the information recorded includes the following details:

- how was the error discovered – by whom and as part of what checks

- the date of discovery

- which transaction lines are affected in each previously paid claim

- the amount of funding affected

- the remedial action taken to reduce the risk of the same error occurring again in future

- all supporting calculation information for example exact calculation breakdown and or comparison of costs claimed vs costs which should have been claimed, which has been used to determine the amount of the SDA

- for delegated ESF non-CLLD grant projects using Delegated Grant Defrayal Model 2 (set out in Action Note 026/18 on GOV.UK) Only, if a local GR organisation has returned unspent grant funding to the Accountable Body but the Accountable Body has already claimed and been paid this grant funding by the MA the supporting evidence for the resulting SDA should also include details of the defrayed, original grant funding payment to the local GR as well as the reason for the return of funds by the local GR.

Failure to provide this information may result in the SDA being rejected.

An SDA will only be processed once the MA has sufficient information to make a decision on how the SDA should be treated. If the MA does not have sufficient information, they will return the SDA to the GR via ECLAIMS, requesting the missing information.

The GR will then need to address the issues raised by the MA and then re-submit the SDA, again using ECLAIMS.

4. How to record and submit a Self-Declared Adjustment on ECLAIMS

When the SDA Editor logs into ECLAIMS, from the options menu. Select Self-Declared Adjustments.

The SDA home screen is then displayed and shows any existing SDAs for the same ESF Project. To create a new SDA, select Add new SDA.

The SDA Editor must complete the Details and Financial Breakdown by Category sections in turn by selecting next.

The Action section is optional, History is automatically populated by the system.

When Save Draft is selected, this will show in the SDA home screen with a status of created and it can be edited. Only select Submit when the SDA Editor has fully completed all relevant sections and the SDA Reviewer has approved the content.

Populate the fields in the Details screen:

Source: ensure Self-Declared Adjustment is populated here.

Other Reference: is an optional free text box, the editor can enter any references their project has used for this SDA.

Date Detected: Date the SDA was identified.

Name: is a free text box, insert the name of the officer who detected the SDA.

Function: this is a free text box, insert the function of the officer’s role.

Workplace or team options: ensure GR is populated here.

Comment: is an optional free text box, enter any additional, supporting information or comments here not already recorded in the previous fields

Select Next to continue to the following section Financial Breakdown by Category.

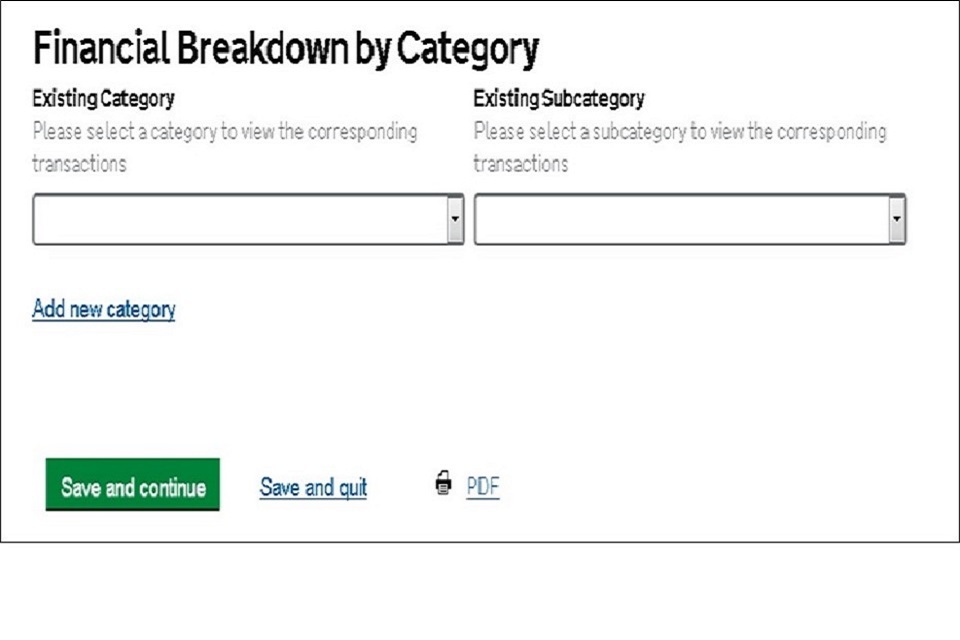

In the Financial Breakdown by Category section, the drop-down menu will not work, the SDA Editor must select Add new category first.

Image above shows the Financial Breakdown by Category screen add new category must be selected first.

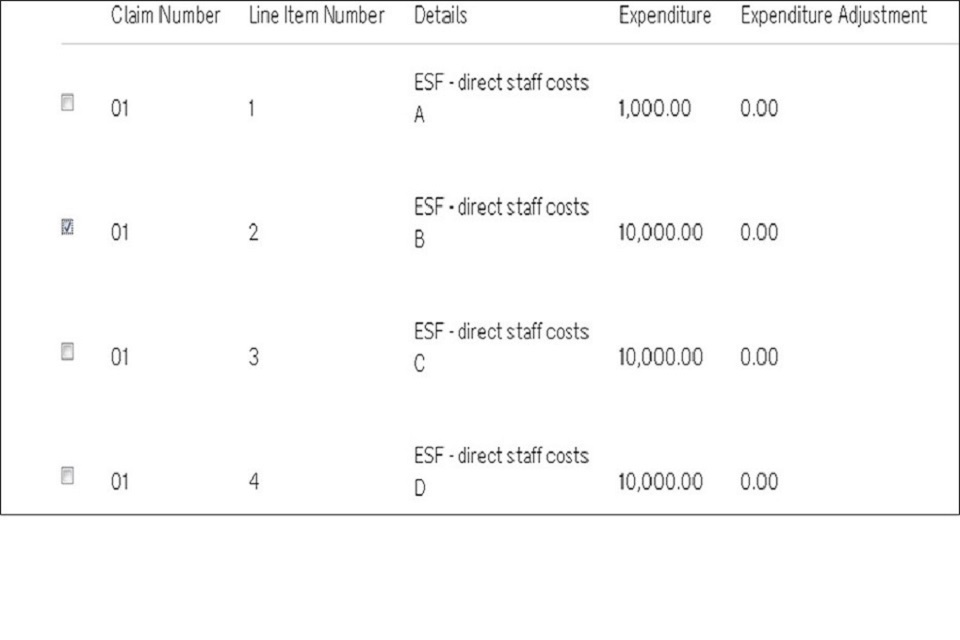

All submitted claims will appear at the top of the screen, from here, the SDA Editor must select the claim the SDA refers to using the tick box then select View Transactions. This will enable the editor to select the applicable transaction.

Image above shows the transaction, the applicable one must be selected.

Once the transactions relative to the SDA have been selected, click the Categorise transactions link which is located at the bottom of the screen.

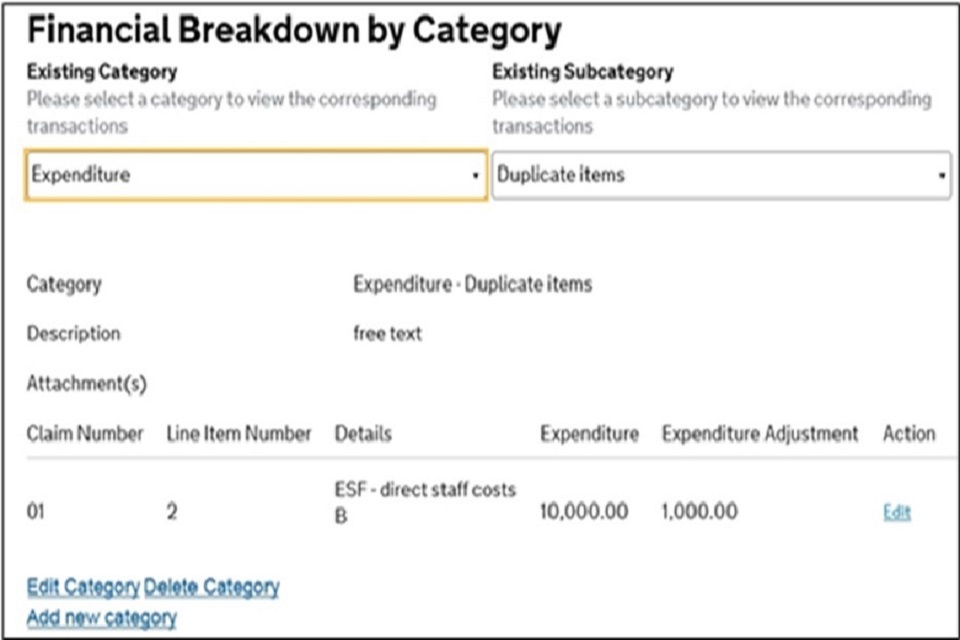

There will be two drop down menus at the top of the screen (you may need to scroll up the page), use the first Category drop down menu to select the area the SDA falls under, for example expenditure, publicity or contractual etc.

Using the Subcategory drop down menu, select an option that most appropriately describes the nature of the error. In this case we have selected expenditure in the main category field and duplicate items in the subcategory field.

The Description field should be used to enter precise details of the SDA such as the type of funding – ESF or Match, its value. Please refer to section 3.4 of this guidance for required details.

Under File, there is the function to upload supporting documentation. If you have not done so in the Description box, you must upload an explanation regarding the expenditure here together with a copy of any supporting calculations. Only the following file types should be uploaded to ECLAIMS:.xlsx / .doc / .docx / .pdf / .txt

NOTE: When you select ‘browse’ you will be able to select the relevant document from your electronic folder(s). You will then be presented with some additional fields to record the File Description and File Category for that document.

Please ensure supporting documents are uploaded with a clear, appropriate file name and with a unique version number recorded in the File Description field.

The document file name must also include the ESF claim periods covered by the SDA for example 2018Q1, 2018Q2.

For example:

SDA Breakdown Calculation – 2018Q1 2018Q2 – V1.0

When uploading each document, you should also include you select the File Category; ‘Irregularities Letter or Report’ for all SDA supporting documents.

If you have more than one supporting document to upload, select Add Another. Once you have uploaded all supporting documents, click OK to continue.

Next, on the same Financial Breakdown by Category screen, select Edit against each transaction line in each claim where you need to record an SDA error value for that transaction line.

Image shows financial breakdown by Category

Enter the total SDA adjustment value (ESF + Match minus costs) for example how much overspend there is, ensuring you never use negative values select save.

NOTE: When calculating the ESF plus Match figure to record in this field, you do not need to include any Flat Rate Indirect Costs applicable to that expenditure.

ECLAIMS will automatically check that line to see if there were any Flat Rate Indirect Costs (FRIC) included in that line of expenditure and, if so, ECLAIMS will add on any extra FRIC costs before doing a final calculation using the correct intervention rate and presenting you with an accurate, grand total figure.

If your ESF Project covers more than one Category of Region (CoR), you will be presented with a box to complete for each CoR.

Please record the relevant SDA amount per individual CoR per selected transaction line.

Once you have completed the correct figures, select Save and repeat for each claim and line item affected by the SDA.

The SDA Editor will return to the screen below. From this screen there are options for editing the SDA if required.

Using the drop-down menus at the top of the screen, the SDA Editor must select the category and sub-category to be amended.

A summary for that category will be displayed below showing the details entered, then:

- to change either the claim, transaction, financial category (drop down), description or attachments for a category, select Edit Category. Follow steps from 4.8 to 4.17 in this guidance document, make amendments where necessary by selecting the appropriate content

- save Changes must be selected to continue

- to amend the breakdown, reselect edit

- to delete a category, use both drop down menus to select the relevant category and select Delete Category

- to add more categories, select Add new Category which will take the SDA Editor back to earlier step, proceed as normal

- once all categories have been added, select Next to continue

Action is optional, it allows further specific SDA details to be entered, if required, click on insert. Select Next to proceed.

If you have submitted your SDA to the ESF MA, but the MA has returned the SDA to you for further information and or action, you can record the action you have taken in this screen before re-submitting your SDA to the MA.

In each case, once you have recorded your comments select Insert to ensure your comments are saved.

The final screen History will display any history relating to the SDA, including any amendments made by the SDA Editor or Reviewer.

From here, the editor can either save as a draft or submit. The SDA Editor should select Save draft and once the SDA Reviewer is content the information is accurate, they should select Submit, then contact their CM to notify them that the SDA has been submitted to the MA.

The SDA Editor or Reviewer will return to the SDA home screen which will display the SDAs and its status:

- when the SDA Editor has selected Save draft the status will show as created and can be edited

- when the SDA Reviewer has selected Submit this will show as draft and cannot be edited

Once the SDA has been saved as a draft, the option to Delete will also appear. If this option is selected, a confirmation message will appear. Once yes has been selected, the draft SDA will be removed from the system.

Once the MA has reviewed your SDA and decided on the relevant action, they will record the outcome in ECLAIMS.

Your CM (or CFO Lead) will also notify you of the outcome, including any relevant arrangements that will be used to recover the affected funds from you.

5. Double Corrections

Double or multiple corrections are acceptable as long as the corrections are for different reasons and take other corrections into account where appropriate.

The GR should carefully consider whether previous corrections have already been raised on the claim period.

The GR should discuss this with their CM prior to raising an SDA on ECLAIMS.

6. Extrapolated Error

If your audit trail is not in place to evidence the data submissions, you have made then the MA will recover the funds paid to you.

Errors found in a sample of your data could be extrapolated to give an error over your whole ESF contract. Extrapolated errors will be input by the AA and apply to the entire claim period.

The AA will calculate the extrapolated (or projected) irregular amount and input the figure on to ECLAIMS.

Projects should be aware that if the appropriate evidence and audit trail is not available for audit purposes, an auditor may be unable to quantify the expenditure as a direct cost.

The cost would therefore be deemed ineligible and corrective action by the project would be required – this may include repayment of any direct costs claimed which are not eligible or a higher figure extrapolated from the sample where the ineligible costs are discovered.

In cases where an ESF Project is asked to pay costs to an organisation via internal cost transfer or a similar method, but that organisation has not incurred an actual, direct cost, the affected costs cannot be claimed from the ESF MA as a direct cost as there will be no supporting evidence of defrayal from the parent organisation.

7. Negative Transactions

ECLAIMS will allow the submission of negative transactions. GR must agree the use of these within their claims with either their CM or CFO Lead within the MA.

Where a negative transaction forms part of the financial correction, any confirmation must take in to account the impact of that negative transaction on the financial correction and the corresponding positive transaction to which it relates.

8. Project Financial Profile

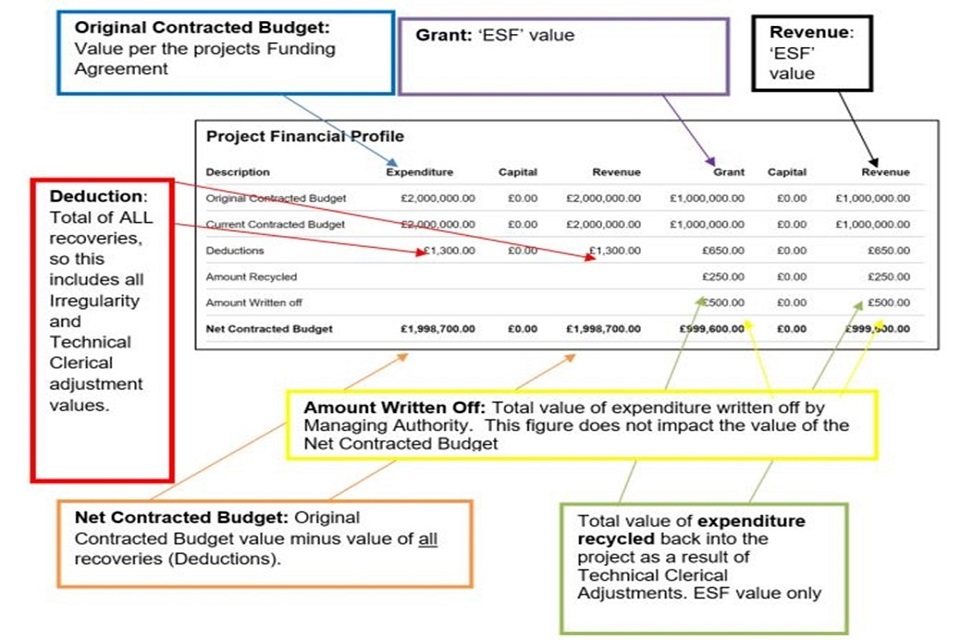

The Project Financial Profile (PFP) Table shows the financial position of the project, in particular funds available to spend and the cumulative value of expenditure recovered due to Irregularities and TCA combined, and expenditure recycled solely related to TCAs. You can access the Project Financial Profile table from the Options menu on the Project main screen.

An explanation of the different fields in the Project Financial Profile table can be found below:

Image above shows a populated example of the Project Financial Profile Screen.

Examples:

If the MA have decided that the expenditure should be treated as an Irregularity, the funds will be recovered but will not be recycled back to the project.

- the Original Contracted Budget value will not change

- deductions will increase to reflect the value of the new Irregularity (Note: The Deductions figure is the total value of all Irregularities and TCAs)

- amount Recycled will not change because funds relating to Irregularities are not recycled back to the project

- the Net Contracted Budget applicable to your ESF Project will reduce. You will then only be able to commit and spend funding up to the value of your revised Net Contracted Budget figure

In the example below, a £1,351.15 Irregularity, has been processed on a project that is 50% ESF funded and 50% match funded.

You will see on the left side of the screen.

- a £1,351.15 Deduction

- the Net Contracted Budget has reduced by £1,351.15 of £1,999,648.45

- he original contracted budget remains unchanged

On the right side of the screen, you will see:

- the £1,351.15 Deduction has been split to reflect the 50% ESF value. (£675.58)

- the Net Contracted budget has reduced to reflect the deduction

- the Original Contracted Budget remains unchanged

If the MA have decided that expenditure is to be treated as a TCA, funds will be recovered from the projects finances before being recycled back to the project.

- the Original Contracted Budget value will not change

- deductions will increase to reflect the value of the new technical clerical adjustment (note: this figure is the total value of all Irregularities and TCAs)

- amount Recycled will increase to reflect the addition of expenditure solely relating to TCAs (split by Match and ESF values)

- the Net Contracted Budget will not reduce as a result of the Technical or Clerical Error

NOTE: When checking to see the current total amount of ESF funding applicable to your project, the figures in the ‘Expenditure’ and ‘Revenue’ columns in the right side of the Financial Profiles table will show you the current, applicable amounts.

To calculate the total amount of ESF + match funding applicable to your project, you can then do an offline calculation and multiply the current ‘Revenue Net Contracted Budget’ figure in the right-hand bottom corner of the Financial Profile Table by the current intervention rate for your ESF Project.

Continuing the example above, a £100 SDA has now been submitted by the GR. The MA have agreed that funds should be recycled and therefore convert the SDA to a TCA.

On the right side of the screen, you will see:

- the £100 Deduction has been split to reflect 50% ESF value (£50)

- the Net Contracted budge in both the Grant and Revenue columns remains unchanged

- the Original Contracted Budget remains unchanged

Note: You may notice that the PFP table shows a Net Contracted Budget value that is higher than the Original Contracted Budget (Funding Agreement value); this higher figure will show until the process for recycling funds back to the project has completed by the Managing Authority.

9. History

The History screen for each Irregularity or TCA reflects the action that has been taken.

If you want to view the History of an Irregularity or SDA, select the Irregularities or TCA or SDA hyperlink from the left menu.

Then select view against the relevant Irregularity, TCA or SDA

In this example you can see that the SDA status was converted to a TCA to enable funds to be recycled back to the project.

You will now be able to view the Version History by selecting the History hyperlink at the top of the screen.

You are then presented with the different versions. In this example there are two versions. You can view each version by selecting the view hyperlink.

Version 1 shows the action taken by the GR submitting the SDA. Version 2 shows the action taken by the MA Irregularity Manager to convert the SDA to a TCA.