Claims Process – Guidance for Co-Financing Organisations

Updated 21 February 2023

Version 8

Published 21 February 2023

Introduction

This guidance should be read in conjunction with the terms and conditions set out in your European Social Fund (ESF) Memorandum of Understanding (MOU) [footnote 1] including your approved Co-financing Organisation (CFO) final Full Application for European Structural Investment Fund (ESIF) funding. These documents set out the eligible parameters, scope of activities and the key deliverables that are to be reported to the Managing Authority (MA).[footnote 2]

For a CFO to report on delivery and draw down ESF Grant Funding in line with the terms and conditions set out in their ESF MOU, an application for reimbursement ‘Grant Claim’ must be made.

All Claims should be submitted via Electronic Claims and Information Management System (ECLAIMS). Secure access to ECLAIMS will be arranged for staff within the CFO Claims Team who have the relevant authority to act as Authorised Signatories and, or a named authoriser for each claim.

Before any payments can be processed the CFO must have completed and returned a fully accurate ‘Bank Details Form’ to the ESF MA. A blank form will be sent to the CFO with their new MOU and once accurately completed and returned, this will allow the MA to enable actual payment.

A Project Inception Visit (PIV) must also have taken place prior to submission of the first claim(s) for any new MOU(s) and, following this visit, the ESF MA will have confirmed in writing, usually via email, that the CFO is invited to submit their first financial claims. For CFOs, a single PIV may cover one or more projects or MOUs.

All pre-grant payment conditions stated in the MOU must be met prior to the first instalment and subsequent grant payments.

The CFO must ensure from the outset that robust and suitable systems and processes are in place locally in order to maintain adequate audit trails and manage information effectively and efficiently. All project information must be retained and made available for verification or any audit throughout delivery and post completion under the retention of documentation requirements in accordance with the European Social Fund document retention guidance and ESF National Eligibility Rules and Programme Guidance.

Unless agreed otherwise with the ESF MA, the first submitted claim should include all spend or activity undertaken on the project up to and including the current Claim Instalment Period. The CFO must ensure that any expenditure included in the first claim meets the relevant defrayal rules set out in this guidance.

All applicable Claim periods prior to the initial Claim Period must be completed as ‘Nil Claims’ on ECLAIMS by the CFO. Progress Reports will not be required for the initial ‘Nil Claims’ periods but will be required for all subsequent claim periods.

Your ESF Contract Manager (CM) will contact you regarding the Final Claim process up to 6 months prior to any final Claim.

Definitions

For the purposes of this guidance:

-

MOU is the agreement between the MA or IB and the CFO

-

contract is the agreement between the CFO and their lead provider or grantee (Grant Recipient)

Please also see the glossary at Annex 4 in this guide.

Timing

Claims must be submitted to the ESF MA in arrears, via ECLAIMS, reporting on a pre-defined period of actual activity. This is referred to as the ‘Claim Instalment Period’.

Claim Instalment Periods are based on calendar quarters as detailed below:

-

quarter 1, 1 January – 31 March

-

quarter 2, 1 April – 30 June

-

quarter 3, 1 July – 30 September

-

quarter 4, 1 October – 31 December

Claims are determined by the Claims Schedule set out in the MOU. Claims (including ‘Nil Claims’) should be started in chronological order; CFOs cannot start a new Claim on ECLAIMS until a Claim for the previous Claim Period has been started.

Claims are to be submitted for each MOU, via ECLAIMS, within 60 calendar days of the end of the preceding Claim Instalment Period.

The MA will aim to finalise payment into the CFO’s nominated Bank Account within 30 working days from the point at which all claim information is agreed by the ESF MA as correct and complete for example, there are no outstanding issues, actions or concerns that could potentially lead to an Irregularity.

Late or missing claims

The CFO must notify the MA promptly if at any time they become aware that they are unable to make a Grant Claim in accordance with the outlined timescales or in accordance with the expenditure profile.

In cases where there has still been no claim submission, the CM may take the opportunity to remind you that under section 10.1 of your MOU that:

- the MA may withhold any or all of the payments and, or

- require part or all of the ESF to be repaid if it is reasonably considered that that the CFO is failing to retain information and

- provide information requested by the MA, the Certifying Authority (CA), the European Commission (EC), the European Court of Auditors, or the Audit Authority

For this reason, the CFO should ensure prompt submission of Claims in line with the ESF MA Claim Schedule.

Where a CFO Project is covered by a Funding Agreement (FA), rather than an MOU, under the terms and conditions set out in their FA, failure to submit claims within their contractual timescales may be an event of default and could therefore lead to the Department enacting its rights to suspend, reduce or cease to make payments in respect of the relevant ESF Project.

If a Claim is not submitted in line with the CFO FA Claim Schedule, the CM will provide at least one email prompt to the Grant Recipient (GR). If a claim is still not forthcoming, the CM will consider whether ‘Event of Default’ action is appropriate.

Final Claim

CFOs must submit their final claim no later than 60 calendar days after the end of the Claim Instalment Period in which the Financial Completion Date falls. The 60 calendar day deadline is currently set to be 29th February 2024.

The final claim can be submitted as soon as possible following your project financial completion date, as detailed in your Funding Agreement. On submission, the final claim must be full and complete in line with Funding Agreement conditions.

No late claims will be accepted by the MA, no late claim action will be undertaken and there will be no exceptions.

CFOs also need to consider and will be asked by the MA, to demonstrate how they will resource not only the claim submission but also subsequent related activities during 2024 and beyond. This will include ensuring appropriate staff are available and have the correct access on ECLAIMS to undertake the activity required.

Claim process

The Claim process is an integral part of the contract management and control environment employed by the MA in managing the Programme. Although Claims are a mechanism for CFOs to draw down their ESIF Grant it also provides key information on MOU progress and performance.

The information provided enables the MA to obtain assurances and carry out Article 125 Desk-Based Evidence Checks (DBEC) and ‘On-the-Spot’ Visits (OTSV) to determine the validity of the activities currently undertaken, for the on-going project delivery and these will take place outside of the Claims process.

All claims should be submitted to the MA via ECLAIMS. The following documentation should be uploaded as supporting documentation, unless the MA has agreed any specific, alternative arrangements with the CFO for a given claim or claim period.

Such arrangements must be documented in writing and will be retained by the ESF MA as part of the audit trail for any affected claims:

- ESF Transaction List

- ESF Participant Data Schema (not application to Investment Priority (IP) 2.2 and Priority Axis 3 outputs or results)

- IP2.2 project need to submit a completed the IP2.2 Claim Form on GOV.UK

Each project must also submit a detailed narrative Progress Report with their quarterly claim. The Progress Report information should be recorded directly into the relevant screen(s) and fields in ECLAIMS.

Subject to agreement with their CM a project may be allowed to provide their report via a separate document which must then be uploaded into ECLAIMS.

However, you should note that you will still need to work through the Progress Report screens in ECLAIMS in these circumstances before attaching your narrative report otherwise ECLAIMS will not allow submission of your claim.

CFOs must ensure all required Progress Report sections or topics as set out in the ECLAIMS Progress Report screens are fully covered.

This is regardless of whether the progress report is

- fully input direct to ECLAIMS

- input to ECLAIMS with a separate uploading supporting document

Follow this link to the section covering the ESF Progress Report.

CFOs who are delivering activities under IP2.2 must report progress against their Output and Result profiles in both the IP2.2 Claim Form and the Progress Report. The Progress Report should include numerical performance against profiles, as well as any specific narrative progress update.

As part of the PIV process, CFOs should have already identified staff to perform the ‘Claim Editor’ role in ECLAIMS – bearing in mind that financial claims can only be generated and submitted in ECLAIMS by individuals who have been assigned the ‘Claim Editor’ user role, including uploading of any supporting documents.

CFOs must ensure that the final compiled claim is checked by a ‘Claim Reviewer’ in their organisation prior to submission of the claim via ECLAIMS. The ‘Claim Reviewer’ must be a named individual who has been agreed as a ‘Named Authoriser’ (for example, an authorised CFO ECLAIMS External user) between the CFO and ESF MA. The ‘Claim Reviewer’ must be a different person to the CFO ECLAIMS User who is recorded as “Submitting” the claim to the ESF MA – the name of the person submitting the claim can be found in the ‘Activity Log’ of the ‘Manage Claims’ menu in ECLAIMS.

If a CFO submits a claim without ‘Claim Reviewer’ action recorded in ECLAIMS, or if the ‘Claim Reviewer’ is not a recognised ‘Named Authoriser’ for the project, the claim will be rejected by the ESF MA and returned to the CFO for remedial action.

Claims are to be submitted in arrears for each Instalment Period and only eligible expenditure defrayed (incurred and ‘paid’, for example, cleared bank account) by the end of that period can be included in the Claim for reimbursement. By exception, any expenditure for previous periods can also be included, as long as this has not already been included in another Claim and a statement has been included in the expenditure description field confirming this.

At the point each Claim is submitted to the MA on ECLAIMS, the CFO must notify their ESF CM via email, to ensure timely action can be completed to check the information provided and authorise and approve the resulting payment.

The CFO must notify the MA promptly if at any time it becomes aware that it is unable to make a Grant Claim in accordance with the outlined timescales or in accordance with the expenditure profile.

In the event that no expenditure has been defrayed during the Instalment Period, a ‘Nil Claim’ must still be submitted. Once a Project has been invited by the MA to make their first financial Claim, all Claims thereafter – including ‘Nil Claims’ must include a Progress Report.

If at any stage the CFO identifies any mistakes or omissions in any of its Claims, whether paid or in the process of being paid, they must contact their ESF CM as soon as possible.

Where clerical and or technical errors are identified on Claims that have already been paid, GRs will need to contact their CM.

Financial information

This section aims to guide you through the key areas to check when collating the detail for your Claim.

ESF CFO Admin costs can be submitted as a single entry line but must adhere to all other relevant stipulations listed below. If requested by the MA or IB, an itemised list will need to be provided for the purposes of Annual Monitoring and Audit Verification.

All expenditure which is to be claimed must:

-

fall within the agreed scope of activities outlined in the MOU and the agreed expenditure categories. Since the application stage, the Cost Category headings have been aligned with the ECLAIMS system to allow a smooth transition to the IT service. Please refer to the Cost Category Reconciliation below to ensure the correct Cost Category headings are used

-

be at Contract or MOU level – whichever is more granular or detailed

-

conform to all respects of the eligibility criteria as set out in the ESF National Eligibility Rules and Programme Guidance.

-

be defrayed (incurred and ‘paid’, for example, and have cleared bank account) by the end date of the Claim Instalment Period. The date paid is the date the payment appears on your bank statement. For large organisations, the Bankers Automated Clearing Services (BACS) defrayal date may be acceptable, this should be discussed with the MA

-

only include Irrecoverable Value Added Tax (VAT) if this has been agreed as an eligible cost with the MA during the Full Appraisal process

-

be able to be backed up by a full audit trail containing all original source documentation from receipted invoices to bank statements and accounting documents of equivalent verifiable value. These need to be maintained and made available for Article 125 ‘On-the-Spot’ checks and audits and must be retained in accordance with European Social Fund document retention guidance and the ESF National Eligibility Rules and ProgrammeGuidance.

Transactions List

A Transaction List, itemising each type of expenditure (ESF or Match), must be uploaded directly into ECLAIMS to support each Claim. This Transaction List must provide the MA, or any other audit body, with clear detail relating to all the costs being claimed. It is important that this information is entered accurately and provides a clear description of the costs to enable the reader to determine their eligibility. The use of acronyms and jargon should be avoided to aid clarity to the reader.

Note: CFOs may show salaries as a single line, but full and complete records must be kept by the CFO for each individual within this Claim for Audit purposes - this will be tested annually as part of the Verification Cycle.

The Transaction List spreadsheet contains three tabs entitled ‘Guidance’, ‘Transactions’ and ‘Summary’. The Transaction List is designed to enable upload to ECLAIMS.

It is strongly recommended that you read the ‘Guidance’ tab thoroughly before attempting to work through the Setup and populate the ‘Transactions’ tab. If at any time you are unsure of the level of detail required after checking with guidance, please check with your CM before uploading.

Unless agreed otherwise with the ESF MA, the CFO should separate their lines of expenditure between

- ESF Admin Costs

- ESF – Contract Costs and

- Match – Contract Costs

A separate document detailing the expenditure relating to each contract should be provided on request to the ESF Verification Team.

In the case of the The National Lottery Community Fund (TNLCF), as their delivery model uses cash match, they must only use the ESF Admin Costs and ESF – Contract Costs headings.

The details required when completing the Transaction List screen in ECLAIMS are explained below along with descriptions on whether these are mandatory ECLAIMS fields, and what they are validated against.

The details required when completing the Transaction List screen in ECLAIMS are explained below along with descriptions on whether these are mandatory ECLAIMS fields, and what they are validated against.

Note:

a) the fields labelled as mandatory below are those which will automatically be validated by ECLAIMS and if they are not completed accurately, the Claim will be rejected

b) for data collection purposes all fields must be completed where possible regardless of whether they are labelled as mandatory or not

c) all monetary figures must be to 2 decimal places; .005 and above, rounded to .01; .004 and below, rounded to .00

d) dates should be added in with slashes DD/MM/YYYY as ECLAIMS will not accept full-stops - and will automatically change to YYYY-MM-DD when the ‘Export’ button is pressed

Once the Transaction List has been completed the ‘Export’ button will need to be activated prior to submission to ECLAIMS. This button creates a spreadsheet without macros or any other formatting, so it is in a format that ECLAIMS can accept.

For instructions on uploading the Transaction List please follow this link to the ESF ECLAIMS External Users Guidance

Cost category

(Mandatory) Select the eligible cost as agreed and set out in your MOU. The headings you must select from are:

- ESF – CFO Admin

- ESF – Contract Costs

- Match – Contract Costs

Other cost categories in the Transaction List are not applicable to CFOs and should not be used.

If the Cost Categories in your MOU pre-date the implementation of the new ECLAIMS cost categories above, you will need to select the relevant cost category on the Transaction List using the mapping below.

Cost Category Reconciliation

| On Financial Annex | On Transaction List |

| Salaries | ESF - CFO Admin (up to 10% of contract costs) |

| Admin Costs | ESF - CFO Admin (up to 10% of contract costs) |

| Consultancy | ESF - CFO Admin (up to 10% of contract costs) |

| Depreciation | ESF - CFO Admin (up to 10% of contract costs) |

| Marketing | ESF - CFO Admin (up to 10% of contract costs) |

| Office Costs | ESF - CFO Admin (up to 10% of contract costs) |

| Office Direct Costs ESF - CFO Admin (up to 10% of contract costs) | |

| Other Staff Costs | ESF - CFO Admin (up to 10% of contract costs) |

| Professional Fees | ESF - CFO Admin (up to 10% of contract costs) |

| Rent | ESF - CFO Admin (up to 10% of contract costs) |

| Contract Costs | ESF- Contract Costs and Match - Contract Costs |

Delivery Partner

(Mandatory) If your project has Delivery Partners, you must insert the Identification (ID) number applicable to that Delivery Partner in column C of the Transaction List. You must record this value in Column C against all transaction lines relating to that partner. If your project has no delivery partners, please enter a ‘0’ into column C on each transaction line.

You can find the correct ID number for each of your Delivery Partners in ECLAIMS by visiting the Full Application option from the left-hand menu on your project screen in ECLAIMS and scrolling down to the Delivery Partner table.

If you have an existing Delivery Partner and their information is not recorded in the Delivery Partner table in ECLAIMS, you will need to add their information to the table before you can include them in your financial claim.

If you have a new Delivery Partner and their information is not recorded in the Delivery Partner table in ECLAIMS, you will need to add their information to the table before you can include them in your financial claim. If you have a new Delivery Partner, you must submit a Project Change Request (PCR) to the MA first for approval before including them in the Delivery Partner table and any Financial Claims.

Priority Axis

(Mandatory – this must align with MOU) Select the applicable Priority Axis as agreed and specified in your grant MOU.

Investment priority

(Mandatory – this must align with MOU) Select the applicable Investment Priority as agreed and specified in your grant MOU.

Procurement Contract ID

(Mandatory) If a transaction line is as a result of Procurement undertaken by your project, you should record the relevant Procurement Record ID number in Column F in each case. The Procurement Record ID number can be found in the Procurement Register for your ESF project on ECLAIMS.

If the transaction line is not a result of procurement by your project, then please leave column F blank.

Lower-level procurement such as that found within TNLCF Projects will be addressed on a case-by-case basis and will not routinely appear on the procurement register. MA CFO Leads will discuss these arrangements with the CFO where necessary.

Supplier name

(Mandatory) Enter the name of supplier, creditor, payee or employee.

Supplier Value Added Tax (VAT) number

Enter the supplier VAT number.

Invoice reference

(Mandatory) this may be an Invoice, or receipt or reference number (created by the CFO and must be auditable). All documents should be given a separate unique reference number to clearly identify the item of expenditure for audit purposes. See table below for further details.

Invoice date

(Mandatory) Date on the invoice or if salaries the date posted on your accounting system. Dates can be added in using slashes – as ECLAIMS will not accept full-stops - and will automatically change to YYYY-MM-DD when the ‘Export’ button is pressed.

Defrayal date

(Mandatory) Date the money was defrayed or paid (for example, the date the money left your bank account – as shown on your bank statement). (For large organisations, the BACS defrayal date maybe acceptable and should be discussed with the MA). Dates can be added in using slashes – as ECLAIMS will not accept full-stops - and will automatically change to YYYY-MM-DD when the ‘Export’ button is pressed.

If organisations pay their NI and pension contributions monthly, it can be automatically accepted that these will be paid, and that the relevant defrayal date is the date the payroll is paid. This approach is used for Article 125 testing.

Defrayal method

(Mandatory) Select from the drop-down list the method of payment, for example, BACS, Cheque, Credit Card. See table below for further details.

Defrayal reference

(Mandatory) Enter payment reference relevant to transaction. If this is part of a BACS run this number will need to be created, unique and auditable. See below for further details.

| Entry | Potential Issues | Recommended Methodology |

| Invoice Dates | Multiple Dates | Use the date of the final document being claimed for in the Claim quarter, for example, if there are invoices ranging from 01/02/17 – 31/03/17, use ‘31/03/17’ |

| Defrayal Dates | Multiple Dates | Use the date of the final document being claimed for in the Claim quarter, for example, if there are invoices ranging from 01/02/17 – 31/03/17, use ‘31/03/17’ |

| Invoice Reference | Multiple References | Use the Reference that corresponds with the ‘date’ above |

| Defrayal References | Multiple References | Use the Reference that corresponds with the ‘date’ above |

| Defrayal Method | Multiple Methods | Use the Method that corresponds with the ‘date’ above |

Note: Additional narrative regarding other document dates, references and methods should be included in Comments.

Expenditure description

(Mandatory) Full description of the item of expenditure being claimed to ensure clarity for any reader on what is being included. Connections between defrayal, invoice dates and salary paid dates should be explained, for example, if they are the same date. Additionally, if an employee works full-time on ESF, include this in the description.

Note: If the expense relates to a participant, the unique participant identifier must be included within the expenditure description. This ensures that, if there are any issues with this participant on the PDS, it will be possible to identify and rectify any related expenditure where needed. The participant’s name must not be used.

Apportionment details

Indicate how the eligible value is derived from the original invoice or receipt value, for example, the method of apportionment, ineligible costs removed.

If a cost is apportioned between ESF, Match and, or Youth Employment Initiative (YEI), more than one Category of Region (CoR) and, or more than one Investment Priority, you must include details here of how the cost has been apportioned in each case.

Total Invoice Value (excluding VAT)

(Mandatory) Indicate the total, Net of VAT, expenditure value of the invoice or receipt, (total documented value excluding VAT).

If a cost is apportioned between ESF, Match and or YEI, more than one CoR and or more than one Investment Priority (IP), the Total Invoice Value must still be completed with the actual, total overall amount of the invoice. The ‘Total Eligible Value’ field will then be the place where you will need to record the actual expenditure amount to be claimed after any apportionment has been taken into account.

Total Irrecoverable VAT

State the Irrecoverable VAT value which cannot be recovered from another source HM Revenue Custom (HMRC) of the invoice or receipt following any adjustments for apportionments or ineligible costs.

Note: if you are VAT registered and are able to recover VAT but are choosing not to do so, these costs still cannot be included in your claim.

Only record irrecoverable VAT in this field if you are claiming it back through ESF.

Total Eligible Value

(Mandatory) Enter the project eligible expenditure amount after any apportionment or adjustments have been applied and Irrecoverable VAT added in. This is the expenditure value minus adjustments for which ESF is being claimed against.

Eligible for Flat Rate Indirect Costs

(Mandatory) Select ‘No’ from drop-down menu - These are NOT applicable to CFOs, so ‘No’ should be used here.

Total Category of Region Expenditure

(Mandatory – only relevant if Claim covers more than one CoR.) If you have only one CoR you do not need to enter data into cells T, U and V.

Note: If you have more than one CoR and your MOU or Funding Agreement was agreed prior to 09/03/17, you will need to contact your CM to obtain this information

Descriptions of Defrayed Expenditure

The item for which funding is being claimed must have a clear description. The description must be detailed enough to allow the reader to consider its validity without the need to see the actual evidence at this stage.

The table below provides guidance on acceptable/unacceptable expenditure descriptions and level of detail required.

Please note that this is for illustrative purposes only and it is not an exhaustive list:

| Unacceptable Description | Acceptable Description |

| Room hire | Room hired for [state purpose and with whom] on [date] at [place] |

| Catering | Catering charge for [state purpose] on [date] at [place] |

| Salary | Salary for [state at least one of name, post, payroll number] for period dd/mm/yy to dd/mm/yy. The description should also include whether the staff member is working all or part of their time on the project. If working part of their time, the description must include the number of hours worked and the hourly rate or ‘Fixed Percentage’ figure used so the MA can see how the total amount being claimed for that individual has been determined. |

| Salaries | Salaries for project management or delivery team for period dd/mm/yy to dd/mm/yy. (A complete breakdown of the evidence supporting each salary cost – identifying the post holders or employees claimed should be retained for Audit purposes) |

| Expenses | Expenses for [name] covering period dd/mm/yy to dd/mm/yy [type of expense for example, mileage, parking, subsistence, claim reference number if applicable] |

| Equipment or Materials | Purchase of [name or short description of item of equipment and or materials] received on dd/mm/yy, as shown in the [Funding Agreement]. |

| Mobile charges | Mobile phone rental or call charges for [name of person] covering period dd/mm/yy to dd/mm/yy. |

| Rent (only applicable if direct cost) | Rent charged for [identify premises charged] to cover period dd/mm/yy to dd/mm/yy. |

Follow this link to Annex 2 which provides a help sheet for invoice transactions and this link to Annex 3which provides a help sheet for salary transactions. These are broad guides only for information required at ‘On-the-Spot’ Visits (OTSV) and not for submission with the Claim.

Credit notes

Where your project receives a credit note from a partner or supplier, but that expenditure has already been included and paid in a previous ESF claim, you should raise a Self-Declared Adjustment (SDA) for the full value of the credit note.

If you then incur further costs with the same supplier or partner against your Project and want to use the credit note as payment or part-payment of those costs you should complete the following steps:

- record the full value of the new expenditure or invoice in your Transaction List

- ensure the description of the transaction explains how much of the invoice or expenditure is being paid via credit note

- ensure you retain a copy of the credit note, and evidence of the supplier or partner acceptance of the credit note as payment or part-payment as evidence of defrayal

- if requested as part of the Desk-Based Evidence Checks (DBECs), OTSV visit or Audit Authority checks, you will need to provide the credit note as evidence of defrayal

If your Project received a credit note from a partner or supplier for expenditure which has not yet been included in an ESF claim, the amount of any expenditure being claimed from the ESF MA against that supplier or partner for the activities covered by the credit note should be reduced by the value of the credit note. This is because expenditure covered by a credit note is not ‘defrayed’ until the credit note has been spent with the relevant partner or supplier.

Internal Cost Transfers

If your organisation uses Internal Cost Transfers as part of your payment processes for ESF costs, you should be aware that evidence of the Internal Cost Transfer itself is not sufficient evidence of defrayal of those ESF project costs.

Where an ESF project is operating as a separate entity within a wider organisation (for example an ESF project within a Local Authority) and the ESF Project pays an additional direct cost to the wider organisation via internal cost transfer, there must be a process in place and a clear audit trail showing:

- the transfer of funds between the ESF Project and the wider organisation receiving those funds, and

- evidence of the same, actual costs being incurred for example defrayed by the wider organisation who is receiving payment from the ESF Project to a third party

If the payment is made by an internal cost transfer and there is no supporting evidence as outlined above, the evidence of the internal cost transfer alone is not sufficient evidence of defrayal, and any expenditure should be removed from the claim unless the required defrayal evidence can be provided.

An example of a compliant audit trail for internal cost transfers could be as follows:

- evidence of an invoice or request for payment from a parent organisation to the ESF project, setting out the specific, direct costs to be paid by the ESF Project and what services or goods have been provided by the parent organisation to the ESF Project

- evidence of the ESF Project transferring the relevant direct costs amount to the parent organisation. For example a financial journal entry, or a cost centre transfer record

- evidence of the direct, actual costs incurred by the parent organisation and evidence they have defrayed those costs, as a result of the goods or services provided to the ESF Project for example, relevant bank statements, or evidence of a BACS run

Your ESF Project should only claim costs from the MA which have been incurred by the parent or other organisation. This guidance above is not exhaustive and, depending on the complexity of the internal cost transfer arrangements, the MA may request other documentation in support of any transactions where internal cost transfers are part of the payment process. This is to ensure there is sufficient documentary evidence for each step from initial payment by the ESF Project to defrayal.

Participant Data Schema (PDS)

Where ESF delivery is being conducted remotely, in the majority of cases projects should use the postcode recorded on the Funding Agreement (for their physical base in the LEP area) as the delivery postcode on the Grant Recipients data storage system (or for the ESFA CFO - Individual Learning Record (ILR). This will ensure that remote activity, such as virtual staff working from home, that is delivered under the Funding Agreement and directly benefits the LEP area under which the Funding Agreement sits, can be considered eligible. If a new temporary postcode is used under this easement, it must be one which falls in the same Category of Region as your project is delivering in, otherwise ECLAIMS will not validate your Participant Data Schema.

Output and Result targets are key performance indicators for ESIF programmes. Every project justifies the level of investment requested from ESIF by agreeing to achieve a number of programme defined outputs and result targets. These targets are scoped and referenced in the application for ESIF funding which is appraised by the MA and form an important part of the MOU or FA.

Before submitting any output or results data to the ESF MA, the CFO must ensure they have a full audit trail containing all original source documentation for each output and result being reported. This must be in line with the ESF Data Evidence Requirements - Eligibility and Results published on GOV.UK. This audit trail must be maintained and made available for verification checks and audits and must be retained in accordance with the European Social Fund document retention guidance and ESF National Eligibility Rules and Programme Guidance.

With the exception of IP 2.2 and Priority Axis 3 (Technical Assistance) deliverables, all outputs and results to be claimed for during the respective Claim Period should be recorded and submitted to the ESF MA using the Participant Data Schema (PDS) form. It is good practice to submit a single PDS with each claim – however, if you have a significant number of lines to report for example, 5,000 or over, you may discuss with your CM whether by exception you can submit more than one PDS for a given claim period by exception. Progress against IP2.2 and Priority Axis 3 outputs and results must be reported as part of the project Progress Report.

IP2.2 deliverables must be reported on the IP2.2 Claim Form on GOV.UK.

As stated in the Participant Data Schema Guidance participant identifiers are how the MA track participants and their progress. Each participant must have a unique and persistent identifier number.

European Union (EU) data protection regulations require that no unnecessary identifying or personal data is collected about the participant. Additionally the guidance on the Data Protection Act sets out that consideration should be given to not only the identifying potential of individual items of data but the impact of the total data collected. Participant IDs should not be based on any of the following:

- participant’s first names

- participant’s surnames

- participant’s full address

Importantly as a beneficiary organisation you must be able to reconcile a Participant ID to a single unique participant, for both audit purposes and participant survey selection. If a participant is selected for a follow up survey, the evaluation team will contact you to request the participant contact details which will be held and processed in a separate system with greater security.

The Participant ID should contain a unique prefix signifier relating to the organisation, submitting the data, and contain a maximum 22 characters, including the prefix signifier.

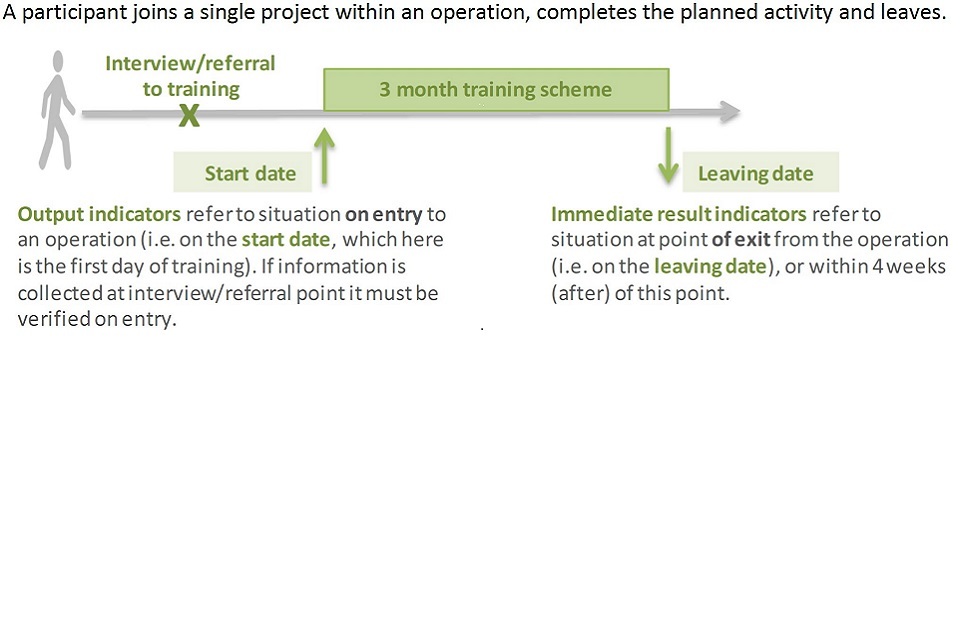

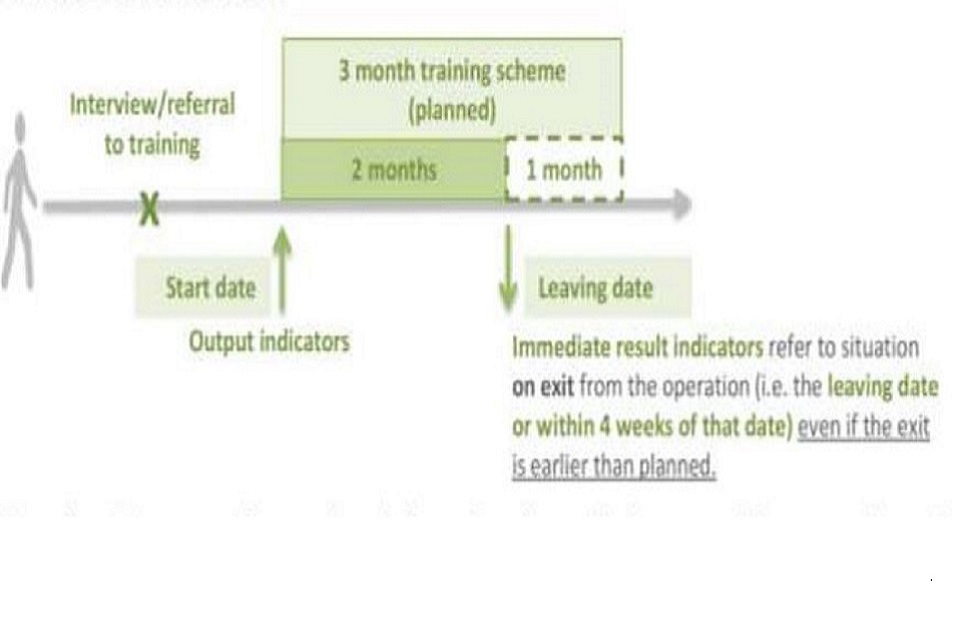

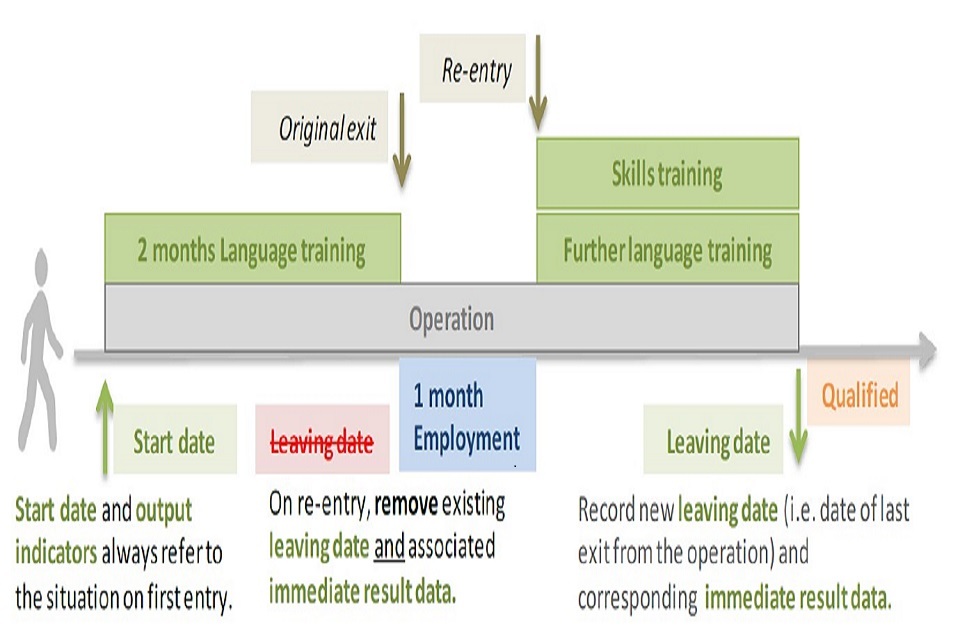

Annex 6 of this guidance includes examples of a range of scenarios which may occur in delivery of an ESF product and how these impact on the reporting of associated outputs and results. GRs should ensure they take account of these scenarios when completing their PDS each quarter.

Once the PDS has been completed and the CFO is content that all data in the schema is correct, the ‘Create Export Sheet’ button must be pressed prior to uploading the document into ECLAIMS. This creates a spreadsheet which is in a format that ECLAIMS can accept i.e. without macros. For instructions on uploading of the PDS please see the ESF ECLAIMS External User Guidance

Follow this link to the latest version of the PDS form, as well as full guidance on how to complete the form on GOV.UK

National level, Dual Forecast Form

A National level, Dual Forecast and Submission Form should be completed by the CFO and submitted as a supporting document with each claim. Your CFO CM will discuss this with you if applicable.

The CFO should email or upload the National level, Dual Forecast and Submission Form to the MA CM

For Greater London Authority (GLA), CFOs should submit a GLA level Dual Forecast Form to their GLA contact via email.

Procurement

All new procurement exercises, already undertaken or yet to be undertaken must be recorded in the Procurement Register in ECLAIMS.

The first recorded exercise will be automatically allocated a Procurement Record ID 1, any additional or subsequent procurement exercises added to the register will be allocated a sequential Procurement Record ID of 2,3 or 4.

Reference to any completed procurement exercises as well as any planned future procurements should be included in the Procurement’ section of your Progress Report, this includes any CFO procured contracts which are used as match funding.

Where a procurement exercise has already been completed, and has not been reviewed, or fully reviewed at appraisal or PIV stage.

For example

- the procurement exercise has been undertaken after the PIV was finalised

- completed after the PIV was finalised

These will need to be reviewed at the Desk-Based Administrative Checks (DBAC) stage and an ESF Public Procurement Checklist may need to be completed.

The Checklist is not required where a Contracting Authority has carried out a procurement exercise where the value is below £24,999.99.

In such cases, the CM undertaking the DBAC will still carry out existing, relevant procurement checks to ensure the CFO is aware of and adhering to the ESIF National Procurement Requirements

Where the ESF Public Procurement Checklist is required, you will be asked to complete and return the checklist to the CM, together with any specified Core Documents relating to that procurement exercise.

In all cases the supporting Core Documents and completed checklist should be uploaded into ECLAIMS via the Procurement Register.

- Note: For TNLCF it is essential that all procurement exercises are identified by adding the name in the procurement Title, for example ‘Procurement of IT’ (Delivery Partner – Joe Bloggs Training).

The ‘ESF Public Procurement Checklist’ can be issued at any point in the DBAC process, however the review of any relevant procurement exercises must be finished before any costs from that procurement exercises are included in an ESF Claim.

Where you have completed more than one procurement exercise a separate checklist should be completed for each individual procurement exercise.

Where a single procurement exercise has resulted in the award of a number of individual contracts, a single ESF Public Procurement Checklist can be completed.

If the CM undertaking the procurement checks is unable to obtain sufficient assurance that a Procurement exercise has been undertaken compliantly, they will consider whether expenditure relating to that procurement exercise should be excluded from the current and any future claims for the given ESF Project, or whether a Financial Correction would be appropriate.

Depending on the seriousness of the issue

- the CM may also consider whether the MOU or FA for that ESF Project should be terminated by the MA

- it may also be necessary to consider whether other CFO MOUs or FAs linked to that procurement exercise should be terminated by the MA

Once the CM has completed the relevant procurement checks, they will notify you of the outcome, including any impacts on current and, or future claims. The CM will also update the Procurement Register in ECLAIMS wto show that the procurement checks have been completed.

You must notify the CM of any instances where you:

- have decided not to progress with a planned procurement

- have withdrawn a contracted procurement

- will not be making purchases for the ESF project under a contracted procurement

ESF Progress Report

A full and comprehensive narrative Progress Report must be completed and submitted to the MA with each quarterly claim.

The Progress Report must be recorded directly into the relevant screens and fields in ECLAIMS, unless the CFO has a prior agreement from the CM that they can submit their report as a separate document, uploaded into ECLAIMS as part of the package of claims documentation.

You should note that you will still need to work through the Progress Report screens in ECLAIMS in these circumstances before attaching your narrative report otherwise ECLAIMS will not allow submission of your claim.

Regardless of the completion method, the report must contain suitable commentary on the performance and progress of the project to date and the planned activity going forward.

This must

- provide sufficient detail to demonstrate successful delivery of the activities and deliverables and

- include the measures being put in place to bring the project back on rack if there is any ‘slippage’ of performance

The claim may be rejected on ECLAIMS if any of the information is incomplete or is considered insufficient or incorrect

Where it is deemed necessary, the ESF MA may still request specified individual MOU or contract level Progress Reports to accompany the national report.

For the ‘Equal Opportunities’ section of the progress report, the CFO should provide an update of progress in terms of promoting equality and equality performance. This should constitute a short, written narrative in the equal opportunities field of the report – the narrative should also cover progress against the ESF Project specific Equality and Diversity Implementation Plan, including any achievements against targets within the Implementation Plan.

As a minimum, for the Equal Opportunities element of their Progress Report, the CFO should provide an update on the following within their narrative:

- any improvements

- updates

- amendments

- details of progress against profile in terms of any equality targets; and any

- under-performance identified, and the mitigating or correct action that will be taken

That you have made during the claim instalment period in terms of the governance of the Equality and Diversity theme in your project.

As well as:

- any progress in achieving aims during the claim instalment period

- any progress in achieving objectives during the claim instalment period

These should be set out in your Equality and Diversity policy or implementation plan and supporting evidence provided.

As a minimum, for the Sustainable Development section of your Progress Report, the CFO should provide an update on the following within the narrative:

- any improvements

- updates

- amendments

That you have made during the claim instalment period in terms of the governance of the Sustainable Development theme in your project.

As well as

- any progress in achieving aims during the claim instalment period

- any progress in achieving objectives during the claim instalment period

These should be set out in your sustainable development policy or implementation plan and supporting evidence provided.

MA Claims checks

The Checklist (below) lists examples of the types of questions the MA will consider when looking at a submitted claim and the relevant supporting documents

CFOs must ensure that information and supporting documents submitted as part of the claim itself, as well as any subsequent evidence or source documentation submitted to the MA in response to DBECs, satisfy the checks listed below.

Expenditure

| Question | Managing Authority Check |

| Q1 Do all of the defrayal dates fall after the invoice dates? | Defrayal should usually follow receipt of invoice. However, there may be circumstances where the invoice is received after defrayal. In these circumstances you should request an explanation from the CFO and provide comments in the comment box. |

| Q2 Does the expenditure detail or description provide sufficient information? | If no, sufficient evidence then claim should be returned to the CFO to amend. |

| Q3 Does the treatment of VAT within the Transaction List follow the agreed approach? | The treatment of VAT will be outlined in the Full Application. If VAT has been included in the Claim that is different from the agreed approach, then the Claim must be returned to the CFO to amend. |

| Q4 Do you consider all of the expenditure, within the sample, to be both relevant and eligible, as detailed within the Funding Agreement? | If no, claim should be returned or the Claim Approver should select the items of ineligible expenditure to be removed. |

| Q5 Is all the expenditure claimed under the appropriate cost heading? | If no, claim should be returned or the Claim Approver should select the items of ineligible expenditure to be removed. |

| Q6 Do the apportionment methods used follow the agreed methodologies and are they still relevant? | If no, the Claim should be returned to the CFO in order for apportionment methodologies to be revised. |

| Q7 If applicable, have hourly rate methods been agreed and are they still relevant? | If no, the Claim should be returned to the CFO in order for hourly rates to be revised. |

| Q8 Has sample evidence verification check been undertaken on the Claim? | Desk based checks should be undertaken on every Claim unless subject to an exception. |

| Q9 Will the project reach the retention limit with this Claim? | Not applicable to ESF at present |

| Q10 Has a detailed progress and monitoring report been completed and is this satisfactory? | Please refer to Annex 1 for information on what should be provided in the progress section. |

| Q11 Have all relevant procurements to the Claim Period been recorded and do they comply with European Union (EU) thresholds? | Review Procurement Register and if it has not been updated where applicable, or CFO has not advised there have been no updates, then raise an issue with the CFO to provide the information to enable the Procurement Register to be completed. If procurement does not comply with EU requirements the claim should be suspended until the issue is investigated and resolved. Please refer to ESIF national procurement requirements. |

| Q12 Have there been any changes to the project’s State Aid status or measures? | The Grant Receipt must provide an update on State Aid in their Progress Report. Do the State Aid measures in the Progress Report align with those in the project Funding Agreement or MOU? If the response is ‘no’, ensure the ESF State Aid Checklist is issued to the Grant Recipient and resulting Managing Authority action taken. A response of Not Applicable is not acceptable. If the Grant Recipient has recorded a response of N/A, this should be rejected by the Contract Manager and referred back to the Grant Recipient so they can provide an acceptable response before the claim is approved. |

| Q13 Are the outputs and results confirmed as eligible? | Review outputs and results evidence and provide explanation as to how they are eligible. If not eligible, then return to the CFO to amend. |

| Q14 During the checking of the Claim, have any potential Irregularities been identified that relate to this or any previous Claims? | This includes systemic errors that you may wish to raise and also flat-rate corrections. |

| Q15 Are there any outstanding actions which may impact on the payment of this claim? | This could relate to a Project Inception Visit, Article 125 and, or Article 127 actions that are outstanding, consideration needs to be given if this would be something that would prevent payment. |

Annex 2 provides a help sheet for invoice transactions, and Annex 3 provides a help sheet for salary transactions. These are broad guidelines only.

Article 125 checks

Before the Claim is paid, the MA will undertake DBAC of all submitted documents to ensure all relevant information has been submitted.

There are two different types of Article 125 Defrayal Documentary Check:

DBECs

For CFOs these will be undertaken by the Verification Team, within a specified time window, post Claim payment.

This will involve a selection of both ESF and Match contract payments across all MOUs thereby giving each Claim payment an equal chance for selection.

- evidence for the majority of CFOs will be required at individual learner level with its associated cost, supported by defrayal evidence

- there will be no Desk Based Checks for the Big Lottery Fund in favour of an increased number of ’On-the-Spot’ transaction line checks instead for selected providers

OTSVs

For CFOs these will be undertaken by the Verification Team Post-Claim payment. Further guidance on the visits will be provided by the MA

Annex 1: Progress report

Progress

If a single contract covers more than one Local Enterprise Partnership area, the Management Information must be separated respectively on submission of the Claim.

Expenditure

You should report on the performance of actual expenditure against the profiled values contained in the FA or MOU and recorded on ECLAIMS.

Information should include actual expenditure for the current claim period and cumulative achievement for previous claim periods.

Upload any internal Management Information (MI) currently used to report progress to date against the deliverables within your project or use a separate document.

Expenditure must be broken down by:

- Investment Priority, and (where applicable)

- Category of Region

Comments or separate documentation as referenced above must include future forecast figures, for example contracted expenditure profiles for remaining claim periods for every claim, this will support the CMs in reviewing the performance of each project.

Variances from the contracted profiled forecast, slippage, must be fully explained and justified within the Progress Report and submitted along with the claim.

You should explain whether the project is still on track and to budget, and expenditure ‘slippage’ must be explained and justified with plans outlined on how the ‘slippage’ will be addressed.

Any potential overspend in cost categories or a request to re-profile expenditure should be flagged up here.

Any actual underspend variance greater than 15% from the contracted expenditure profiles may result in de-commitment or withdrawal of ESIF funding in line with the underperformance policy.

Any anticipated variances should be discussed with your CM as soon as possible, who will consider whether a PCR is required.

Your CM will discuss this with you if applicable.

Where a PCR has recently been approved, if this changes the future, contracted expenditure profiles, but the amended figures have not yet been updated in ECLAIMS, add a note to the Progress Report explaining why the reported figures do not match your current ECLAIMS expenditure profiles.

Targets - Outputs, Results and Additional Targets

You should report on the actual achievement of targets and future forecast compared to the profile outlined in the FA or MOU.

Information should include actual achievement for the current claim period and cumulative achievement for previous claim periods.

Upload any internal MI currently used to report progress to date against the deliverables within your project or use a separate document.

Outputs and Results must be broken down by

- Investment Priority

and (where applicable)

- Category of Region.

This should include full and comprehensive information on actual performance against each individual Output and Result category for your project previous and current claim periods.

Variances from the contracted profiles, ‘slippage,’ must be fully explained and justified within the Progress Report and submitted along with the claim.

The contracted target levels for the remaining claim periods, is required with every claim to support ESF CM in reviewing the performance of each project.

Any actual under performance with a variance greater than 15% from the contracted targets may result in de-commitment or withdrawal of ESIF funding in line with underperformance policy.

Identify any specific issues encountered relating to measuring or evidencing the targets or take up of assistance from businesses.

If there is any slippage, provide detail on remedial measures being put in place to bring things back on track. Any anticipated variances should be discussed with your CM as soon as possible, who will consider whether a PCR is required.

Your CM will discuss this with you if applicable.

Where a PCR has recently been approved, if this changes the future, contracted output and, or result profiles, but the amended figures have not yet been updated in ECLAIMS, you should complete the Progress Report with the approved, revised PCR contracted figures to explain why the ‘figures do not match the ECLAIMS profiles.

Objectives and project specific conditions

Report progress on specific conditions in the MOU.

Income – excess & unexpected and Article 61/65.8

Not applicable to ESF – Input ‘not applicable ’

Equal opportunities

For Equal Opportunities you should provide an update of progress in terms of promoting equality and equality performance.

- you should provide a short, written narrative in the equal opportunities field of the report. The narrative should cover on what improvements, updates and, or amendments have been made to show how the Equality policies and implementation plans have progressed in the Claim Instalment Period

- as a minimum, you should provide an update on the following within the narrative

- details of progress against the ESF Project specific Equality and Diversity Implementation Plan for the project

- details of any reviews undertaken, who led that review, what documentation was produced and if any further revisions were made to the plan as a result

- some basic detail on performance against profile in terms of any equality targets, including any achievements against targets within the Implementation Plan

- whether or not any under-performance has been identified, and, if so, the mitigating or corrective action that will be taken

- where appropriate, what specific actions are being taken to promote female recruitment

- where appropriate, what specific actions are being taken to tackle obstacles created by caring responsibilities

- what specific actions are being taken around Disability access for example to buildings

- what commitment is in place to provide specialised support for disabled

- when the next review is scheduled

- any evidence in support of the above must be uploaded with the Progress Report

Match funding

Report on the funding received during the Claim Instalment Period as well as the cumulative values received to-date. Any potential changes to the funding package should also be referred to.

Milestones and future activity

Summary of planned activities for the next Claim Instalment Period

An outline of the key activities planned for the next Claim Instalment Period including any key dates or events. If there is any future major activity planned beyond the next Instalment Period, you should provide an update in this section. You will also need to report against any slippage in the current claim period that may impact the delivery of your project.

State Aid

State Aid measures applicable to the project will have been identified at appraisal and will automatically feed through to the Claims Profile. Provide an update on State Aid received as a CFO and what State Aid has been dispersed to employer beneficiaries, including those relating to paid work placements and internships including those relating to paid work placements and internships.

Your progress report must include a narrative explaining what checks have been undertaken to ensure that the project is operating State Aid processes in line with your ESF FA and the following published European Social Fund 2014 to 2020 State Aid Guidance Your narrative should also explain how you have ensured a complete set of State Aid evidence is being retained in line with the published ESF Document Retention guidance.

You should also refer to the guidance issued in Action Note 058/21 when considering the narrative for this section.

For Projects which have a state aid exemption your Progress Report should reflect the exemption applicable as per the CFO or as a result of a CFO Variation. The only exemptions applicable to the ESF Programme are:

- De Minimis

- 45030 Aid for Disadvantaged Workers General Block Exemption (GBER)

- 45031 Training Aid (GBER)

All other exemptions are not applicable to the ESF Programme. A blank exemption is a permissible response if either state aid does not apply or there has been no use of the agreed exemption within the claim instalment period.

In addition, the GR must also ensure they have valued the aid appropriately and provided detail on the methodology used by the project. In the ESF programme there are two methods permissible for valuing aid. Method 1 is the preferred approach and should be used by projects, and only where in exceptional cases should the Grant Recipient use Method 2.

Details on the methods are provided below:

- method 1 relates to an average of the costs if that support was bought privately. Using this method, the GR will need to explain how they have calculated that average, for example through comparison of three other suppliers and calculating the average of the costs based on this information

or

- method 2 relates to their real costs (such as the hourly rate of the member of staff who is providing the support, plus the 15 or 40% FRIC attributed to that salary. The GR should use the hourly rate applied to the member of staff undertaking the cost with an uplift of the appropriate FRIC for the project by the number of hours to complete the task to identify the level of aid

These are the only methods available for use. No other methodology proposed by GRs can be used

Valuing Aid – worked examples

Method 1

A GR is providing a Small and Medium Enterprise (SME) with a Training Needs Analysis (TNA), and then developing a training plan for a group of the staff who work for the SME.

In this case, the Grant Recipient takes an average of the costs 3 other providers would charge the SME for this activity, so, for example.

- Joe Bloggs Training Ltd would charge £1,500 for a TNA for an SME with less than 50 employees, and a further £500 for a training plan, giving a total of £2,000

- Jane Doe College Services Ltd would charge £1,350 for a TNA and a further £700 for a bespoke training plan, so total would be £2,050

- Training R Us Ltd would charge £1,700 for the TNA, and include the bespoke training plan free of charge

Therefore, the average of these providers would be (£2,000 + £2,050 + £1,700 = £5,750 divided by 3) £1,916.67 worth of aid.

If the project is using the De Minimis route, this would be the amount of De Minimis aid that they need to tell the SME that they have received. If the project is using the GBER, this is the total aid amount, and they will need to seek the SME contribution to this total (under Training Aid for example, the SME must contribute 50% of these costs, so the GR would need to invoice the SME for £958.34).

Method 2

The GR is providing an SME with a TNA, and then developing a training plan for a group of the staff who work for the SME, as above.

In this case, the GR should take the hourly rate for the member of staff doing the TNA, include the Flat Rate Indirect Cost (FRIC) uplift, then multiply that by the number of hours taken to carry out the TNA and development of the plan. For example, £27:15 per hour (including 15% FRIC) x 43 hours = £1,167.45 worth of aid.

If De Minimis applies, this is the amount of De Minimis aid the GR will need to inform the SME they have received, and if they are using the GBER they will need to invoice the SME for 50% of the costs (£583.73).

For those claims where either of the GBER exemptions outlined above are acceptable against the project the progress report should also include the value of aid for the claim instalment period. However, although the value of aid is not a requirement where De Minimis applies the GR is still required to have calculated the value of aid using one of the methodologies above to ensure the aid is calculated and reported on for the purposes of 3-year €200,000 ceiling.

A response of Not Applicable is not acceptable on any aspect of State Aid, including the valuing method, level of aid and the exemption applied. If you record a response of Not Applicable or equivalent, the CM will not be able to approve your claim. Instead they will refer your claim back to you, requesting that you provide an updated, acceptable response.

If you have assessed at application stage, that State Aid does not apply to your project you should confirm here that that there has been no change, and that you have assessed that State Aid is not relevant to this claim.

If your assessment of State Aid has changed you should discuss this separately with your CM.

Further Progress

Sustainability monitoring

You must report on the Sustainable Development of your project, including

- is there an adequate Sustainability policy and implementation plan in place?

- are the policy and plan subject to regular review?

- who is responsible for leading that review?

- what documentation is produced?

- any progress updates?

- when is the next review due?

- any improvements, updates, or amendments that you have made in terms of the governance of the Sustainable Development theme in your project?

- any progress in achieving aims and objectives set out in your sustainable development policy or implementation plan during the claim instalment period?

- any evidence in support of the above must be uploaded with the Progress Report supporting evidence

Branding and publicity

Report on any publicity activity that has taken place during the Claim Instalment Period. This may include publicity material, leaflets, banners or stationery and any press releases, newspaper articles or publicity events. Review any evidence uploaded referring to Branding and publicity requirements for the 2014 to 2020 European Regional Development Fund and European Social Fund.

Procurement

Reference to any completed procurement exercises as well as any planned future procurements should be included in the Procurement’ section of your Progress Report, this includes any CFO procured contracts which are used as match funding.

Where there are procurements that have already been completed, that have not been reviewed, or fully reviewed at appraisal or Project Inception Visit (PIV) stage – for example, the procurement exercise has been undertaken or completed after the PIV was finalised – these will need to be reviewed at the Desk-Based Administrative Checks stage and an ESF Public Procurement Checklist may need to be completed.

The Checklist is not required where a Contracting Authority has carried out a procurement exercise where the value is below £24,999.99. In such cases, the Contract Manager undertaking the DBAC will still carry out existing, relevant procurement checks to ensure the CFO is aware of and adhering to the ESIF National Procurement Requirements. published on GOV.UK.

Where the ESF Public Procurement Checklist is required, you will be asked to complete and return the checklist to the Contract Manager, together with any specified ‘Core Documents’.

All supporting ‘Core Documents’ and completed checklist should be uploaded into ECLAIMS.

Note: For TNLCF it is essential that all procurement exercises are identified by adding the name in the procurement Title, for example ‘Procurement of IT’ (Delivery Partner – Joe Bloggs Training).

The ‘ESF Public Procurement Checklist’ can be issued at any point in the DBAC process, however the review of any relevant procurement exercises must be finished before any costs from that procurement exercises are included in an ESF Claim.

Where you have completed more than one procurement exercise a separate checklist should be completed for each individual procurement exercise.

Where a single procurement exercise has resulted in the award of a number of individual contracts, a single ESF Public Procurement Checklist can be completed.

If the CM undertaking the procurement checks is unable to obtain sufficient assurance that a Procurement exercise has been undertaken compliantly, they will consider whether expenditure relating to that procurement exercise should be excluded from the current and any future claims for the given ESF Project, or whether a Financial Correction would be appropriate.

Depending on the seriousness of the issue, the CM may also consider whether the MOU or FA for that ESF Project should be terminated by the MA. Depending on the seriousness of the issue, it may also be necessary to consider whether other CFO MOUs or FAs linked to that procurement exercise should be terminated by the MA.

Once the CM has completed the relevant procurement checks, they will notify you of the outcome, including any impacts on current and, or future claims. The CM will also update the Procurement Register in ECLAIMS with details of that procurement exercise.

You must notify the CM of any instances where you:

- have decided not to progress with a planned procurement

- have withdrawn a contracted procurement

- will not be making purchases for the ESF project under a contracted procurement.

Assets

Not applicable to ESF – Input ‘Not Applicable’

Annex 2: Help Sheet for Invoice Transactions

Please note this is not submitted with a Claim but is an aid to information required as part of the Article 125 checks undertaken for CFO ESF Projects.

All submissions should be clearly understandable to a third party with no link to the project and we suggest you test this internally before submitting evidence

| Transaction List Reference | For example, A,B,C, Red, Green, Blue. | |

| Date: The invoice should be dated within, or close to, the period. | Period Covered. This may be different from the actual date of the invoice. | |

| Project Name | Items specifically purchased for the Project, to which the invoice is being charged, should be referenced on the invoice. | |

| Invoice No or Reference. | This reference should follow through all levels of related documentation to at least the point it is posted to the purchase ledger. | |

| Purchase order ref | This reference can be an alternative, or additional to, the Invoice number and, if used, on relevant documentation to defrayal. | |

| Name / Company providing Invoice | Additional information to identify invoice as appropriate. | |

| Amount Claimed | Ideally this will be 100% to the Project. However, if it is an apportionment, an invoice covering a number of projects or, if the amounts do not match in any way, this should be clearly highlighted and an explanatory note and/or calculation included. The explanatory note and/or calculation must be initialled and dated. | |

| Scheduled Payment | If the invoice is a part payment with a scheduled call-off agreed, the purchase order should also be provided as evidence the call-off payment is correct. | |

| Purchase Ledger | The invoice should be shown on the Purchase Ledger and shown as paid. A screen dump of the Purchase Ledger showing this should be provided and wherever possible this should link to the BACS payment. | |

| BACS Run | For example, the payment should be clearly shown within the BACS run with explanatory figures linking this to respective documents. Wherever possible the amount claimed should be highlighted in a BACS build up. | |

| Bank Statement | For example, defrayal of costs from the Bank Account. The figure being defrayed should match that of the BACS run. If the Bank Statement figures do not match BACS an explanation of the difference should be included with backup documentation and calculations to demonstrate the Bank Statement figure. |

Annex 3: Help sheet template for salary transactions

Please note this is not submitted with a Claim but is an aid to information required as part of the Article 125 checks undertaken for CFO ESF Projects.

All submissions should be clearly understandable to a third party with no link to the project and we suggest you test this internally before submitting evidence.

| Project Name | For example, ESF123 | |

| Claim Month | Month Year | |

| Transaction List Item Reference | For example, A, B, C or Red, Green, Blue | |

| Employee Name | For example, A.N. Other | |

| Payroll no. | ||

| Gross Pay per Month | ||

| Amount claimed in Period | ||

| Project cost code used | ||

| Job Description | For example, Job Description for the role of Officer in relation to transaction item attached for A.N. Other. Needs to name the project and make reference to being parted funded by European funding. For instance, you may use the Job Description for the role of Officer in relation to transaction item attached for A.N. Other. Needs to name the project and make reference to being parted funded by European funding. | |

| Time sheet (Only needed if the employee is being claimed on an hourly rate against the project or is a ‘Volunteer Time in Kind member of the ESF Project) | For example, 10 hours for A.N. Other employed on ESF123 or 10 hours’ x £15 per hour = £150 (Total hours worked in the period on all projects ESF and non ESF should be recorded on all timesheets. If a cost code is used this should be clarified with the checking officer). It should be signed by the Employee and counter signed by their Line Manager. | |

| Hourly Rates | Shows actual calculation used to determine the hourly rate for A.N. Other, as well as the type of hourly rate methodology used. For all ESF projects who responded to calls published on or after 17th March 2016, the 1720 Hourly Rate calculation set out in Section 10 of the ESF Programme Guidance must be used for staff who work part time or part of their time on the ESF Project, unless the ESF Project has opted instead to use the ‘Fixed Percentage’ methodology for that individual. Evidence to be retained for OTSV/audit purposes for hourly rate cases needs to include Show the final hourly rate amount resulting from the 1720 calculation and how the calculation has been based on the ‘latest documented annual gross employment costs’ for that individual as set out in the most up-to-date Granular Budget or Staff Costs Master List document, agreed with the ESF Managing Authority at the most recent staff costs hourly rate review point. Show how the Grant Recipient has ensured that only the hours worked by the individual during the claim period have been used for calculating the eligible staff costs. Annual leave should not be included as this is already taken into account in the 1720 methodology. Evidence of the latest documented annual gross employment costs used the calculation for example a Payslip, P60 or similar. |

Fixed percentage staff costs

A copy of the contractual document which confirms the fixed percentage of time per month the employee is working on the ESF Project and a copy of the payslip and any other documents, where necessary, which show the actual gross employment costs which have been used to calculate the correct ‘Fixed Percentage’ ESF Direct Staff Costs amount for the selected transaction line.

Payroll report

For example, payroll report detailing total gross pay and all pay costs for A.N. Other for [Month] as highlighted. A narrative should be provided if it is not clearly possible to demonstrate links between the documents for both full time and hourly charged employees. Where possible provide a link between the BACS payment and the monies defrayed. If this link cannot be clearly made an explanation should be provided as to why not.

Screen dumps are acceptable as long as the accounting package is identified and certified as a true copy as stated below.

Pay Advice Reports

For example, breakdown of pay costs, pay deductions and net pay due to the employee.

BACS run

For example, total Organisation payroll of [£X] with explanatory figures linking this to respective documents. As with payroll above, notes should be added to documents to demonstrate links between them. Supporting calculations where NI is paid on a different BACS run should be included and a note provided making the link. Wherever possible the amount claimed should be highlighted in a BACS build up and included within the evidence.

Bank statement

For example, defrayal of costs from the Bank Account. The figure being defrayed should match that of the BACS run. If the Bank Statement figures do not match BACS an explanation of the difference should be included with backup documentation and calculations to demonstrate the Bank Statement figure.

National Insurance

If organisations pay their NI and pension contributions monthly, it can be automatically accepted that these will be paid, and that the relevant defrayal date is the date the payroll is paid. This approach is used for Article 125 testing.

All submissions should be clearly understandable to a third party with no link to the project and we suggest you test this internally before submitting evidence.

Annex 4: Glossary

| Defrayal | Claims are to be submitted in arrears for each Instalment Period and only eligible expenditure defrayed (incurred and ‘paid’ (cleared bank account)) by the end of that period can be included in the Claim for reimbursement. | |

| Claim | The CFO must notify the MA promptly if at any time it becomes aware that it is unable to make a Grant Claim in accordance with the outlined timescales or in accordance with the expenditure profile. | |

| Intervention Rate | Grant payments are calculated as a percentage “Intervention Rate” against expenditure reported within the Claim. | |

| Nil Claim | In the event where no expenditure has been defrayed during the Instalment Period a Claim must still be submitted through ECLAIMS, providing details of progress towards delivery and achievement of the project objectives or activities. | |

| Payment | The Claim will only be processed for payment once the MA is satisfied that all information is present, complete and complies with the terms and conditions of the MOU and National Eligibility Rules. It will take an average 8–10 days for payments to be issued from SSCL after receipt of the SOP1. | |

| Errors | If at any stage the CFO identifies any mistakes or omissions on any of its Claims, whether paid or in the process of being paid, they must contact the MA as soon as possible. Where errors relating to data are identified on Claims that have already been paid CFOs will need to follow the Self-Declared Adjustment process detailed in the Self-Declared Adjustment Guidance. | |

| Issue | A transaction on ECLAIMS where your CM asks you to take additional action on the claim you have submitted for instance amending or removing details on a transaction line. | |

| Query | A transaction on ECLAIMS where your CM has a question regarding the claims information you have supplied and needs further details and or clarification. You must formally respond to all queries via ECLAIMS even if you have provided the information verbally, by email. You should not tick the ‘Query Complete’ box despite the instruction to do so on ECLAIMS. |

Annex 5: Common claim errors

Based on the ESF Programme claims received to-date, the following are good practices recommended for all GRs, including CFOs, to avoid queries and support the submission of admissible, ‘right first time’ claims.

Transaction list

1.Descriptions of expenditure in Transaction Lists should be sufficiently detailed to enable the MA to immediately understand what exactly the expenditure is so that it can be readily checked and confirmed as eligible. Descriptions should not include abbreviations or jargon which the MA may not understand.

2.Where ‘Other Direct Costs’ are directly related to a specific participant (for example, childcare costs, travel costs), the CFO must include the participant unique identifier from the PDS in the expenditure description in the Transaction List, to allow the MA to attribute the costs to a valid participant. Actual participant names must not be included in the Transaction List or PDS.

3.Where applicable, a clear description of the apportionment between CoRs, IPs, ESF & Match and (if applicable) YEI, should be noted in the Apportionment Details column, so the MA can understand how, from the total invoice value, the CFO has arrived at the total eligible amount.

4.The total invoice value must EXCLUDE VAT

Participant Data Schema

-

Ensure you are using the correct, latest version as published on GOV.UK

-

Once the participant data has been added via the relevant drop-down boxes, and the export sheet has been created, DO NOT overtype any of the information in the PDS, before uploading it to ECLAIMS – this will risk validation errors and or may result in the wrong MI being reported for your project.

-