Background information: ESA outcomes of Work Capability Assessments

Updated 17 December 2025

1. Information

1.1. Benefit introduction

Timeline of Employment and Support Allowance (ESA) key dates

| Date | Description |

|---|---|

| October 2008 | Employment and Support Allowance is introduced |

| October 2010 | Incapacity Benefit reassessments commence to assess eligibility for ESA |

| October 2013 | Introduction of Mandatory Reconsiderations |

| May 2016 | Universal Credit begins rolling out nationally to replace income-related ESA new claims |

| December 2018 | Universal Credit rolled out to every Jobcentre in Great Britain |

| March 2020 | COVID-19 pandemic strikes |

| July 2020 | Connor Review ruling modifies the pathway to appeals for some Fit for Work decisions |

On 27 October 2008, pre-existing benefits paid on grounds of incapacity and disability, that is Incapacity Benefit (IB), Severe Disablement Allowance (SDA) and Income Support (IS), were replaced with Employment and Support Allowance (ESA) for all new claimants.

ESA places greater emphasis on the individual’s functional capabilities. The new benefit is more aligned with Jobseeker’s Allowance (JSA) in:

- providing support and encouragement to move claimants with health conditions towards employment

- paying at a pre-assessment rate equal to JSA’s

Starting from October 2010, most claimants receiving IB, SDA and IS on the grounds of illness or disability have been assessed for ESA entitlement.

Universal Credit (UC) was rolled out to every Jobcentre across Great Britain by December 2018 and from this date started to replace income-related ESA for most new claimants. Since 27th January 2021 all new claims for ESA are now to New Style ESA (NSESA), which is based on a claimant’s National Insurance Contributions.

NSESA entitlement lasts for 365 days unless the claimant has been placed in the support group (SG) by that date. On NSESA there is no time limit for individuals allocated to the SG.

COVID-19 operational changes

In March 2020, in response to the COVID-19 pandemic, changes were put in place to process claims and ensure those eligible received their benefit, while keeping customers and staff safe. These changes included the suspension of face-to-face assessments. Paper-based assessments were carried out as usual and, wherever possible, telephone assessments were used.

Telephone assessments were introduced in May 2020 allowing for Support Group (SG) decisions, while Work Related Activity Group (WRAG) decisions became possible from September 2020 and Fit for Work (FfW) decisions from February 2021. Video assessments were trialled in November 2020 for SG, to then include WRAG as possible outcomes in December 2020 and FfW from April 2021. Those applying because of coronavirus needed to obtain an isolation note.

As part of the Government’s strategy to support people affected by the coronavirus, DWP made changes to ensure access to the benefit system for those needing financial help. Eligibility for ESA was temporarily adjusted; if new claimants who satisfied the normal conditions of entitlement were either infected with COVID-19 or advised to self-isolate, or were caring for a child who fell in to either of these categories, they were treated as having Limited Capability for Work (LCW) from day one of their award. They were not required to provide fit notes or have a WCA.

The first seven days of a claim to ESA are usually unpaid and are known as ‘waiting days’. During these temporary adjustments, everyone who made a new claim for ESA, satisfied the normal conditions of entitlement and was infected with COVID-19 or had been advised to stay at home and self-isolate in line with Government guidance, or was caring for a child who fell into either of those categories, was entitled from day one of their claim. This included those extremely vulnerable people who had been advised to ‘shield’ because they were at high risk of severe illness.

Note: The ESA temporary Coronavirus regulations came into force on 13 March 2020 and applied to 24 March 2022.

1.2. The Work Capability Assessment

Whether as part of a new claim or an IB reassessment, the typical customer journey includes the Work Capability Assessment (WCA) process as a key part of the ESA regime. The WCA is used to assess functional and non-functional capability for work and eligibility for benefit. The health care provider carries out all assessments, be those on the basis of paper evidence alone, by seeing the claimant face-to-face or by telephone. WCAs had been delivered by Atos Healthcare until 2015, when the Centre for Health and Disability Assessments (CHDA) took over. After carrying out their assessment, the healthcare professional (HCP) provides a recommendation to the Department for Work and Pensions (DWP) Decision Maker (DM), who makes the final decision.

An assessment can have 3 possible outcomes:

1. Individuals can be found not to have Limited Capability for Work (LCW) – thereby they are ‘Fit for Work’ (FfW)

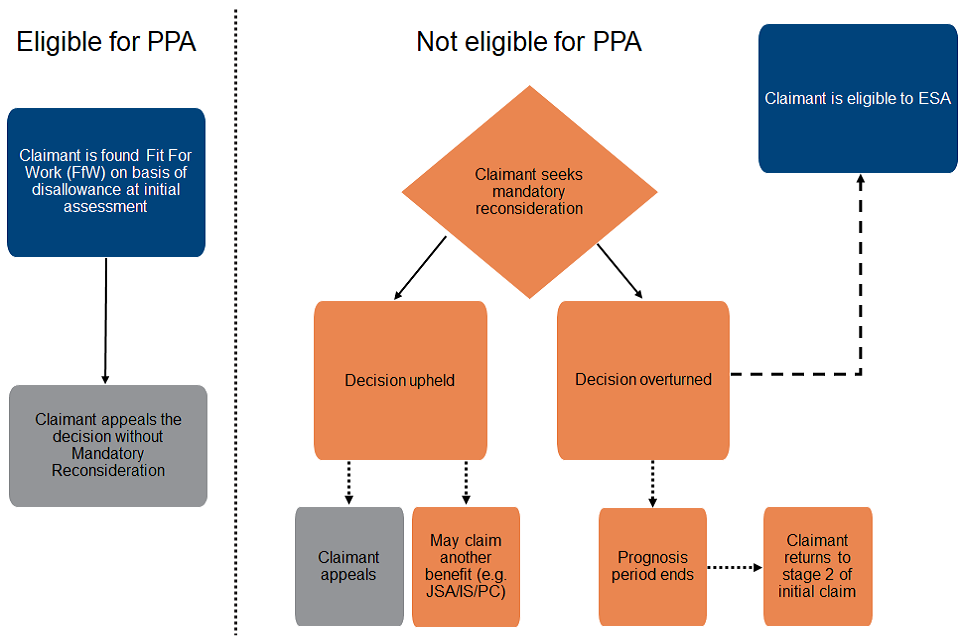

Their ESA claim closes and, depending on their circumstances, they can make a claim for New Style Jobseeker’s Allowance (NSJSA) and/or UC. At the same time they can dispute their ESA decision. Where the WCA is the individual’s first such assessment they can appeal to HM Courts & Tribunals Service (HMCTS) and continue to be paid ESA pending the appeal being heard.

All other claimants have to go through the Mandatory Reconsideration (MR) process before they can appeal. ESA is not paid during the MR process. If these individuals do appeal they will not be paid ESA pending their appeal being heard. These individuals can claim NSJSA whilst their MR and appeal are being considered. In both instances if the appeal is successful any arrears due will be paid back to the date of the hearing.

2. Individuals can be found to have LCW

The benefit continues and the claimant is placed in the Work Related Activity Group (WRAG). Claimants cannot be required to work or to seek work, but are required to engage in work-related activity, and are provided with support to prepare for work, where possible. Due to the work-related activity component, the payment for being found to have LCW used to be higher than the equivalent for JSA. However, the work-related activity component was removed in April 2017, with the payment now equalling the amount on JSA, which is also equivalent to the assessment (pre-WCA) rate of ESA.

As above, this decision can be disputed first through MR and then appeal – this will be where the claimant is arguing they should be in the SG, with the ESA awarded continuing to be paid at the same rate throughout the dispute process.

3. Individuals can be found to have limited capability for work and work related activity (LCWRA)

Those with the most severe health conditions or disabilities, for whom work is not viable, are placed in the SG and receive a support component. They are not required to attend work-focused interviews or undertake work-related activity, although they can do so if they wish.

After WCA, if a claimant has been found to be either LCW or LCWRA, the HCP/DM respectively sets a review period after which the claimant should be reassessed. Review periods are usually set between 6 and 36 months, based on when the HCP/DM believes there might be a change in the claimant’s condition. At this point a repeat assessment would be appropriate.

Additionally, for claimants with the most severe and lifelong health conditions or disabilities, whose level of function would always mean that they would have LCWRA, and be unlikely ever to be able to move into work, will from 29 September 2017 no longer be routinely reassessed.

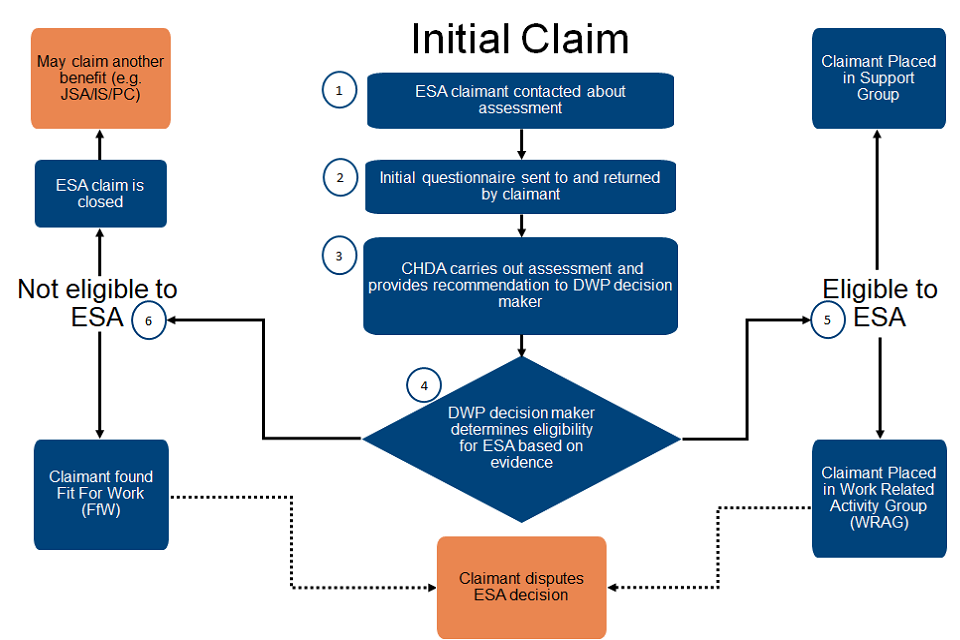

1.3. Claimant journey

After the claimant has made their initial claim to ESA, they will be issued a WCA50 to complete and return to CHDA, to enable a WCA to be arranged.

The assessment is normally applied to all claimants within the first 13 weeks of claiming Employment and Support Allowance. To assist the decision maker to determine whether the claimant has limited capability for work, the assessment looks at the effects of any health condition or disability on a claimant’s ability to carry out a range of everyday activities.

The assessment helps the decision maker to determine if a claimant has limited capability for work, and if so, whether they also have limited capability for work related-activity (LCWRA). It also helps determine the rate at which Employment and Support Allowance is awarded from Week 14, when the main phase is applied if the claimant is found to have limited capability for work (LCW).

-

Claimants that have only LCW will be placed in the Work-Related Activity Group (WRAG)

-

Claimants that meet one of the LCWRA descriptors, outlined later in this guide see section 2.2.1, will be placed in the Support Group (SG)

-

If a claimant does not have LCW, they will be provided with advice about registering for employment and claiming other benefits

Employment and Support Allowance new claims customer journey

If the claimant thinks the decision is wrong, they need to get in touch with Jobcentre Plus within 1 month of the date of the decision letter. If contact is made later, then Jobcentre Plus may not be able to help. The claimant, or someone else who has the authority to act on their behalf, can:

- ask DWP to explain the decision

- ask DWP to write to the claimant with the reasons for the decision

- ask DWP to look at the decision again (the claimant may think something has been overlooked or some facts not taken into account, or they may have more information to provide which could affect the decision) – this is called a mandatory reconsideration

- appeal against the decision to an independent tribunal (but this must be in writing)

The claimant can do any of the actions listed above, or they can do all of them.

Note: As a result of High Court decision in July 2020, MR has been discontinued for any claimant who, having been found Fit for Work (FfW) following an initial WCA would, if they appealed, be paid ESA pending the outcome of that appeal. This is known as Payment Pending Appeal (PPA). Not all claimants qualify, and it applies only to Fit for Work disallowance decisions, not decisions such as disallowance due to Failure to Return a Questionnaire or Failure to Attend a WCA.

Claimant disputes outcome of WCA

1.4. Decision-making basis

1.4.1. Reasons for Work Related Activity Group assignment

The possible recorded reasons for placement in the WRAG are:

- scored 15 points or more against the Schedule 2 (LCW) functional descriptors (due to physical impairment or mental, cognitive and intellectual impairment, or a combination of both)

- non-functional or ‘Treat as’ limited capability for work criteria apply

1.4.2. Reasons for Support Group assignment

The possible recorded reasons for placement in the SG are:

- scoring against one or more of the Schedule 3 (LCWRA) functional descriptors (due to physical impairment or mental, cognitive and intellectual impairment, or a combination of both)

- non-functional or ‘Treat as’ limited capability for work-related activity criteria apply

- meeting the Special Rules for Terminal Illness (SRTI) criteria

1.4.3. Non-specified reasons for allocation to either the Work Related Activity Group or Support Group

When claims are processed clerically, only a record of initial decision, and decision after reconsiderations or successful appeal is available. For these cases there is no information on functional impairment.

1.5. International comparability

This report breaks down ESA claims into the World Health Organisation’s (WHO) International Classification of Diseases, 2010 (ICD-10). This enables some comparisons between countries.

Northern Ireland has its own benefit system. However, statistics for Northern Ireland WCA are not yet available and are unlikely to be produced in the near future.

1.6. Closed and live claims

A sizeable percentage of ESA new claims were closed before an assessment took place and a small proportion were still in progress at the time the data were extracted. Current data does not allow anything conclusive to be said about the destinations of closed and in-progress cases, nor to infer what would have been or would be the outcome of the assessment.

However, DWP has published research investigating why some cases were closed before assessment. It found that an important reason why ESA claims in the sample were withdrawn or closed before they were fully assessed was due to individuals recovering and either returning to work, or claiming a benefit more appropriate to their situation. ESA claims were also closed or withdrawn due to non-return of the WCA50 questionnaire.

Some customers reported being deterred from continuing their claim by the WCA50, particularly for marginal claims when the questionnaire was deemed too time-consuming or for cases where they had an alternative source of income such as part-time, self-employment or family support. A fairly widespread reason for claims closed by Jobcentre Plus was that the claim for ESA was income-based, and that the customer’s partner had started work. ESA claims had also ended for a variety of other reasons including extended periods abroad, and claiming Maternity Allowance.

Cases shown as ‘in-progress’ in this publication are not necessarily waiting for an assessment following referral to the assessment provider, but may include clerical cases where it has not been possible to match the DWP data with data from the assessment provider, cases not yet referred for an assessment by DWP and cases where an assessment has been completed but the outcome is not yet associated with the DWP record.

1.7 Benefit eligibility

ESA provides financial help to people of working age who are unable to work because of illness or disability. Eligibility to the assessment phase of the benefit is dependent on personal circumstances. The most up to date information on eligibility is available on the GOV.UK website.

On 27 October 2008, pre-existing benefits paid on grounds of incapacity and disability, that is Incapacity Benefit (IB), Severe Disablement Allowance (SDA) and Income Support (IS), were replaced with ESA for all new claimants. Claimants already in receipt of these benefits at the said date could remain on those benefits (if still satisfying entitlement conditions) until their claims are reassessed for ESA entitlement.

From December 2018 Universal Credit has now replaced most new claims for income-based ESA.

IB and IS

IB was a contributory benefit payable if the claimant had paid sufficient National Insurance (NI) contributions. People without sufficient NI contributions could claim IS on grounds of incapacity instead. IS could be paid on its own or it could top up IB.

Eligibility for IB and IS was assessed under the Personal Capability Assessment (PCA). The PCA was a points-related assessment of the extent to which a claimant’s condition affected their ability to perform a range of activities. It consisted of two parts: a physical/sensory assessment and a mental health assessment. The WCA was a logical development of the PCA.

SDA

Some claimants still get SDA due to being severely disabled and incapable of work before April 2001.

1.7.1 Claimant conditions

ESA has 2 strands:

- income-related strand

- contributory strand

1. Contributory Employment and Support Allowance (ESA (C)

This is also known as New Style ESA) is a contributory benefit accessible via a National Insurance contribution test. A claimant may be entitled to ESA (C) if they have paid enough NI contributions. From May 2012, the Welfare Reform Act 2012 introduced a time limit to ESA-C of 12 months for people not in the SG. From 27 January 2021, all new claims made to ESA can only be ESA (C).

2. Income-related Employment and Support Allowance (ESA-IR) (claims made prior to 27/01/21)

A claimant may be entitled to ESA-IR (regardless of how much they have paid by way of NI contributions), if they met the financial requirements. This means they must have savings of less than £16,000, and, if they have a partner or civil partner, this person must be working for less than 24 hours per week on average. People who require further financial support may be able to claim Universal Credit, depending on their personal circumstances).

Note: claimants entitled to SG ESA-C and WRAG/SG ESA-IR are not subject to this time limit.

Starting in October 2010, most claimants who receive IB, SDA and IS paid on the grounds of illness or disability will be re-assessed to see if they qualify for ESA. If they qualify for ESA, their IB, SDA, IS claim is converted into an ESA claim. As with IB, ESA (C) can be paid with an income-related top up and a transitional addition can be awarded on top of ESA if appropriate.

1.7.2 Youth provision

Prior to May 2012, special ESA (C) provisions applied for certain young people. To get this, a claimant needed to be aged between 16 and 20 (or under 25, if in education or training at least 3 months immediately before turning 20).

Entitlement was based on inability to work for health reasons for at least 28 weeks, and having been resident and present in Great Britain for 26-out-of-52-weeks prior to the claim. From May 2012, the Welfare Reform Act 2012 abolished this provision and all new claims of this kind are now subject to the same ESA (C) conditions.

1.7.3 Overseas claimants

A person living or working abroad may be entitled to claim ESA. To do this, a claimant might have paid enough UK NI contributions in the past or the equivalent in certain other countries. These can be either a country within the European Economic Area, one that has a reciprocal social security agreement with the UK, or else they might have worked abroad for an employer based in the UK and paid NI contributions for the first 52 weeks of that employment.

1.8 Benefit structure – ESA new claims

Time on ESA is divided into 2 phases by the WCA process.

1.8.1 Assessment phase – 13 weeks

When a claimant first applies for the benefit, they proceed to the assessment phase. During this time, they undergo the WCA process. Individual claimants do not have to engage in work-related activity. They receive the benefit paid at the assessment phase rate (equivalent to JSA personal allowances).

The typical customer journey entails that, while in the assessment phase, the claimant has to provide regular fit notes and report any change of circumstances.

The claimant is assessed against the criteria set out in legislation. Most of them are sent a limited capability for work questionnaire (also known as the WCA50) and following completion are invited to a face-to-face assessment with a trained healthcare professional (HCP) working for CHDA.

However, depending on the severity of an individual’s condition, some claimant journeys will differ. For example, those who meet the SRTI criteria are fast-tracked into the Support Group on the basis of paper evidence at the start of the assessment phase, rather than having a full assessment.

Information gathered through the questionnaire and the face-to-face assessment, together with any other evidence provided by the claimant or requested by the assessment provider, is used by the DWP’s decision maker to determine their eligibility for ESA main phase.

1.8.2 Main phase (outcomes of the Work Capability Assessment process)

There are 3 possible outcomes to the WCA:

1. Individuals can be found Fit for Work

The claim closes and the claimant can move onto NSJSA and/or Universal Credit, if eligible, or payment can continue where the claimant appeals and qualifies for a payment pending appeal as above at para 1.2.

2. Individuals can be found to have limited capability for work

They are allowed the benefit and placed in the Work Related Activity Group. WRAG members are not expected to work, but are provided with help and support to prepare for work where possible.

3. Individuals can be found to have limited capability for work and work related activity

They are allowed the benefit and placed in the Support Group. These claimants have the most severe functional impairments, therefore they are provided with unconditional support and receive a higher premium.

1.8.3 Repeat assessments

All claimants in WRAG and SG have had a review period set by the HCP/DM indicating when they should be assessed again. Individuals are then reassessed through repeat assessments after the initial or last prognosis period expires.

Review periods are usually set between 6 and 36 months, based on when the HCP/DM believes there may be a change in the claimant’s condition. At this point a repeat assessment would be appropriate. Reassessments ensure the eligibility conditions for ESA still apply and the group allocation is still appropriate.

1.9 Benefit structure – reassessment of incapacity benefits

IB, SDA and IS claimants are assessed through the WCA process to determine their capability for work and eligibility for ESA whilst still on their current benefit. Claimants who qualify for conversion to ESA will move directly into the ‘Main phase’ of ESA.

They will immediately be placed in either the WRAG or SG, receiving the relevant personal allowance and component and transitional addition if appropriate.

1.9.1 Reassessment of IB, SDA and IS claims

DWP is reassessing everyone (with some small exceptions) on Incapacity Benefit (IB), Severe Disablement Allowance (SDA) and Income Support (IS) (where this is paid because of an illness or disability), to see if they are ready and capable of work. The reassessment is based on the WCA and focuses on what an individual can do despite their health condition or disability, rather than simply what they cannot do.

Those claimants who, following assessment, are found not to be immediately ready for and capable of work will have their existing awards of incapacity benefits terminated, and will be converted to ESA. The process of reassessing cases to check if they are eligible for ESA is almost complete.

2. Work Capability Assessment changes

Reviews of Work Capability Assessments

The Work Capability Assessment was developed by medical and technical experts alongside Health and Disability organisations. It is subject to continuous review.

2.1 Department-led review

A department-led review of the Work Capability Assessment began in March 2009 and engaged with medical and other experts and Health and Disability representative groups. It was published on 29 March 2010 and made some recommendations to guide the development of Work Capability Assessment. The review’s recommendations included:

- making greater provision for individuals awaiting or between courses of chemotherapy

- making greater provision for individuals receiving residential treatment for drug or alcohol misuse

- expanding the Support Group to cover more people with certain communication problems and severe disability due to mental health conditions

- taking greater account of how an individual has adapted to a condition or disability

- simplifying the language of the descriptors to ensure fair, consistent and transparent application

These changes were implemented on 28 March 2011.

2.1.1 Revision of the functional assessment

Following the department-led review of the Work Capability Assessment, revised criteria were introduced on 28 March 2011. Claimants who received the limited capability for work questionnaire on or after 14 March 2011 were assessed under the new criteria. What this means is that between March and June 2011 the majority were assessed under the revised criteria.

2.1.2 Independent reviews of the Work Capability Assessment

The government has a statutory commitment to independently review the Work Capability Assessment annually for the first five years of its operation. All five reviews have been undertaken and published.

In the first review, published in November 2010, Professor Harrington made a series of practical recommendations for improving the Work Capability Assessment, all of which the government has accepted and now implemented. These include:

- improving the way Jobcentre Plus communicates with claimants

- introducing mental, cognitive and intellectual ‘Champions’ into assessment centres to improve the assessment of these functions

- empowering and improving training for decision makers

- improving the transparency of the process

In the second review, published in November 2011, Professor Harrington (while satisfied that the department had taken the advice in his first review) made further recommendations to improve the WCA’s fairness and effectiveness. The government endorsed Professor Harrington’s second review and accepted the majority of its recommendations. For the remainder, they conducted work to assess the feasibility and implications of the remaining recommendations and have now accepted these.

In the third review, Professor Harrington set out a series of recommendations to the government which complement the recommendations from his first and second reviews. The government welcomed Professor Harrington’s findings and recommendations and responded with how it will work towards achieving all of these.

On 26 February 2013 the Secretary of State for Work and Pensions appointed Dr Paul Litchfield to undertake the fourth independent review of the Work Capability Assessment.

In the fourth independent review, published in December 2013, Dr Litchfield made 32 recommendations to the department to improve the WCA and 5 further recommendations to the Department for Social Development in Northern Ireland. The key findings and recommendations from his report are around simplifying the WCA process, improving the way people going through an assessment feel they are treated, improving decision making and improving knowledge of mental health for Decision Makers and Healthcare Professionals.

The fifth and final independent review was published on 27 November 2014. Dr Litchfield built on the work of the 4 previous independent reviews, reflecting on some of the key changes, examining the impact on outcomes from the WCA and considering what lessons may have been learned for the design of any future assessment. The review focused on:

- the development of the Work Capability Assessment since 2008

- the Support Group

- perceptions

- decision making and processes

- groups meriting special attention

- the future direction of the Work Capability Assessment

Dr Litchfield made 33 recommendations, 28 of which relate to the Department for Work and Pensions while the other five relate to the Department for Social Development in Northern Ireland. The government Response was published on 27th February 2015, with DWP accepting all the recommendations except the request to review the geographical allocation of MR casework.

The decision was supported by figures provided in the response to the review, showing that the great majority of claimants were “Very satisfied” or “Satisfied” with the MR service response. DWP also explained that staff are adequately trained regardless of location, and that the casework allocation is optimised to ensure flexibility to meet demand. Background and full text of reports are on the departmental website.

2.2 Decision Making process

2.2.1 Determining limited capability for work

For more information on how the assessment process helps the decision maker (DM) to determine if a claimant has limited capability for work, and if so, whether they also have limited capability for work related-activity see the following guide: A guide to Employment and Support Allowance – the Work Capability Assessment.

The GOV.UK website provides a broad explanation, including a document explaining the functional impairments in further detail.

Note that the department does not always capture the reason for placement in the Support Group (as with the Work Related Activity Group). This is often due to assessments recorded clerically where the reason is not stated, such as where assignment follows an appeal or mandatory reconsideration.

The Employment and Support Allowance Regulations 2008 legislation, specifically Part 6, gives more detail on allocation.