Practice guide 36A: receivers appointed under the provisions of the Law of Property Act 1925

Updated 10 October 2022

Applies to England and Wales

Please note that HM Land Registry’s practice guides are aimed primarily at solicitors and other conveyancers. They often deal with complex matters and use legal terms.

To view the update history for this practice guide, please see practice guide 36A: update history.

1. Introduction

This guide gives guidance on the land registration aspects of transfers and leases of a registered estate where the disposition is executed on behalf of the borrower by receivers appointed under the provisions of the Law of Property Act 1925. It is intended for use by insolvency practitioners and conveyancers.

It covers Law of Property Act receivers appointed in relation to both individuals and corporate bodies. For other aspects of personal insolvency, see practice guide 34: personal insolvency. For other aspects of corporate insolvency, see practice guide 35: corporate insolvency.

Since 8 December 2017, the insolvency processes for a limited liability partnership mostly mirror those available to insolvent companies, so in this guide, the expressions “company” or “corporate body” may be read (on or after 8 December 2017) as including limited liability partnerships. (However, the Insolvency Rules 1986 still apply to limited liability partnerships where a petition for administration was presented before 15 September 2003.)

Law of Property Act receivership is a difficult area of law, particularly as regards the nature of receivership and delegation of powers to the receiver. This guide therefore is not a definitive statement of the law but sets out HM Land Registry practice and requirements based on HM Land Registry’s interpretation of the law.

This guide does not specifically cover successors in title to the original borrower. In addition, because transactions involving Law of Property Act receivers are normally transfers on sale, this guide assumes that a transfer is involved. Section: Where the disposition is a lease briefly covers leases by a receiver. A summary table is set out in Appendix: summary table.

2. Law of Property Act receivers

2.1 Definition

A Law of Property Act receiver is a receiver appointed either under statutory powers (sections 101(1), 103 and 109 of the Law of Property Act 1925) or under an express power contained in a mortgage, who does not meet the requirements for an administrative receiver.

An administrative receiver must be an insolvency practitioner and is either:

-

(i) a receiver or manager of the whole (or substantially the whole) of a company’s property appointed by, or on behalf of, the holders of any debenture of the company secured by a charge which, as created, was a floating charge, or such a charge and one or more other securities

-

(ii) a person who would be such a receiver or manager but for the appointment of some other person as the receiver of part of the company’s property (section 29(2) of the Insolvency Act 1986)

The holder of a qualifying floating charge in respect of a company’s property created on or after 15 September 2003 may not appoint an administrative receiver of the company, subject to exceptions (section 72A of the Insolvency Act 1986).

The statutory power to appoint a receiver arises when the mortgage money has become payable and the power of sale is exercisable.

2.2 Appointment

The lender may appoint a Law of Property Act receiver under the statutory power by writing under hand. The statutory power may be varied, extended or excluded by the mortgage, which may contain an express power to appoint (sections 109(3) and 101(4) of the Law of Property Act 1925). Most mortgages now contain express provisions determining when an appointment may be made.

The registrar needs to be satisfied that the power of sale, and hence power to appoint the Law of Property Act receiver, has arisen (even if the power has not become exercisable) (see Bailey v Barnes [1894] 1 Ch.25 @ 35), otherwise the Law of Property Act receiver cannot make good title to a purchaser (see section 109(1) of the Law of Property Act 1925). Where the appointment is by court order, the registrar will assume that the court has satisfied itself as to the terms of the mortgage or debenture and that the power to appoint has arisen; the court order (or a certified copy) will suffice. Where the appointment is not made by the court and a full copy of the mortgage or debenture, containing all details of the mortgage terms, is not filed at HM Land Registry, then the applicant must supply evidence (such as a certificate by the lender or its conveyancer) that the power of appointment has arisen.

A body corporate or an undischarged bankrupt cannot act as receiver of the property of a company (except in the latter case under an appointment made by the court) (see sections 30 and 31 of the Insolvency Act 1986).

Where more than one Law of Property Act receiver is appointed, the instrument of appointment (or court order) must make it clear whether they can act jointly and severally, or jointly only.

Any challenge to the validity of the mortgage or debenture (which will affect the power to appoint) that is within the actual knowledge of the Law of Property Act receiver or the applicant must be disclosed to the registrar. If the registrar becomes aware for some other reason of the possibility of such a challenge, then notices may be served, giving an opportunity to object, before the application can proceed further and the receiver and applicant may be required to certify that they were not aware of any such challenge at the time of completion of the disposition sought to be registered. The existence of a Law of Property Act receiver does not prevent an administrator being appointed, nor is an Law of Property Act receiver automatically dismissed if this happens. However, a Law of Property Act receiver must vacate office if required to do so by the administrator (see Paragraph 41(2) of Schedule B1).

Where an administrator has been appointed prior to the appointment of the Law of Property Act receiver, the consent of the administrator or the permission of the court to the appointment of the Law of Property Act receiver must be lodged with the application to register the disposition, failing which the registrar will serve notice on the administrator, giving the opportunity to object, before the application can proceed further.

2.3 Powers

Section 109 of the Law of Property Act 1925 enables a lender to appoint a receiver once the mortgage money has become due, but the section confers very limited statutory powers, which must be varied or extended if the Law of Property Act receiver is to have power to dispose of the mortgaged property.

The lender’s power to appoint a receiver is therefore normally extended to empower the receiver to sell the mortgaged property and execute a conveyance or transfer of it in the name of the borrower. Such a provision in a mortgage is itself a power of attorney in favour of the receiver, whether or not it is expressed as such, and whether or not the mortgage also contains a specific power of attorney in favour of the receiver. The receiver does not need to execute a transfer as attorney; it is sufficient if they are expressed to execute it on behalf of the borrower (see further in Execution by Law of Property Act receiver).

3. Key issues common to dispositions by Law of Property Act receivers

3.1 Is the disposition effective so as to enable the registrar to register it?

If there is more than one borrower (or for some other reason there is a trust of land), a transfer by a single Law of Property Act receiver can still be effective. Trustees have power to mortgage the property and can delegate to the receiver the power to sell and convey the mortgaged land. Delegation by more than one borrower (whether individuals or companies) to a single receiver (for example “collective delegation” under section 11 of the Trustee Act 2000) will be effective for registration purposes (the joint proprietor/borrowers are acting through a single agent) and a transfer executed by a single receiver can be registered. If, however, there is a Form A restriction in the title register of the mortgaged property, then overreaching will need to be considered (see If the disposition can be registered, can any existing Form A (or Form J or K) restriction be removed or cancelled?), so as to determine whether or not the restriction can be removed or cancelled on registration of the transfer.

However, where a sole individual or company borrower is registered as proprietor with a Form A restriction, then a transfer or lease under which capital money arises cannot be registered, even if more than one Law of Property Act receiver executes the deed, since the transfer or lease will be a disposition by a sole proprietor and so caught by the restriction.

3.2 If the disposition can be registered, can any existing Form A (or Form J or K) restriction be removed or cancelled?

3.2.1 Removal or cancellation of Form A restriction

The question of overreaching (and the possible need for execution of a disposition by at least two receivers) needs to be considered by HM Land Registry only where there is a Form A restriction in the title register of the mortgaged property.

The registrar may remove a Form A restriction either automatically, under rule 99 of the Land Registration Rules 2003, if they are satisfied that any third-party beneficial interests have been overreached, or pursuant to an application for cancellation under rule 97 of the Land Registration Rules 2003, if they are satisfied that the restriction is no longer required.

3.2.1.1 Automatic removal under rule 99 of the Land Registration Rules 2003

The registrar can remove the Form A restriction automatically if satisfied that any third-party beneficial interests (ie not those of the trustee proprietors/borrowers) have been overreached by the disposition lodged for registration. If, as is normally the case, the Law of Property Act receiver is acting on behalf of the borrower(s), and therefore as their agent, then the Form A restriction cannot safely be removed unless there were at least two proprietors/borrowers, and at least two receivers who execute the transfer. This is because section 2(1)(iii) of the Law of Property Act 1925 does not operate (because the disposition is not by the lender) and so reliance must be placed on section 2(1)(ii). This latter provision allows (by reference to section 27 of the Law of Property Act.) for overreaching where:

- the transfer is by at least two trustees, and

- the capital money is paid to, or applied by the direction of, at least two trustees

These two requirements are not satisfied where the transfer is executed by, and the capital money paid to, or applied by the direction of, a single attorney (see Section 7, Trustee Delegation Act 1999) (for example, where a single receiver executes on behalf of joint borrowers (“collective delegation”), or the same receiver executes on behalf of each borrower). Hence the need for at least two trustees and two receivers.

Example: Section 7 of the Trustee Delegation Act 1999 is considered to apply even where there has been collective delegation under section 11 of the Trustee Act 2000 because of the provisions of sections 13(1) and 26(b) of the Trustee Act 2000, and section 27 of the Law of Property Act is an example of a “restriction” for the purposes of both these provisions. There is also an argument that sections 12(2) and 15 of the Trustee Act 2000 apply to the appointment of joint receivers, although if these provisions are not met then the saving provisions of section 24 of that Act will probably apply.

3.2.1.2 Application for cancellation under rule 97 of the Land Registration Rules 2003

If the transfer is not executed by at least two receivers and so has not apparently had overreaching effect, it is unlikely that the registrar, when registering it, will be satisfied that the registered estate is no longer subject to a trust of land (as required by rule 99 of the Land Registration Rules 2003). In that case, the Form A restriction should be removed only if the transferee makes an application for its cancellation (under rule 97 of the Land Registration Rules 2003) and can satisfy the registrar that the restriction is no longer required because either:

- the registered estate was not subject to any third party beneficial interest prior to the transfer (so that the registered proprietors/borrowers, or one or more of them, were the only person(s) with a beneficial interest)

- any beneficial interest has been postponed to the legal estate being transferred, as a result of section 29(1) of the Land Registration Act 2002 (which will be the case if the beneficiary was not in actual occupation at the time of the transfer (see section 29(2)(a)(ii) and Schedule 3, para. 2 of the Land Registration Act 2002) and so the beneficial interest was not an overriding interest)

Acceptable evidence will be either:

- an unqualified certificate from a conveyancer acting for either the receiver or for the applicant (that is, the transferee) confirming, on the basis of their own knowledge of the facts, that at the time of the transfer there was no third party with a beneficial interest in actual occupation of the property

- a statutory declaration or statement of truth from the applicant that either there was no third-party beneficial interest affecting the registered estate at the time of the transfer or that, if there was, it was not an overriding interest

3.2.2 Retention of form A restriction

If the applicant cannot meet the requirements of either rule 99 or rule 97 of the Land Registration Rules 2003 (see Removal or cancellation Form A restriction), then the Form A restriction will remain in the register even if the transfer is registered. Since it is HM Land Registry practice not to have more than one Form A restriction in the register, the “retained” Form A restriction will continue to protect:

- any third party beneficial interests existing at the date of the transfer which have not been overreached, and

- the beneficial interests arising under any new trust

where there are joint transferees and the survivor will be unable to give a valid receipt for capital monies arising on a disposition of the registered estate.

The purpose of the Form A restriction is to indicate the existence of a trust of land and to ensure that overreaching takes place, where appropriate, not to protect specific beneficial interests.

3.2.3 Cancellation of Form J and Form K restrictions

Similarly, the registrar cannot register the transfer and consider automatic cancellation of a Form J or Form K restriction unless:

- the Form J or Form K restriction has been complied with, and

- the registrar is satisfied that the beneficial interests have been overreached or the registered estate is no longer subject to a trust of land

3.3 Is the disposition affected by the bankruptcy, death, incapacity or winding up of the borrower?

The mortgage will usually give the Law of Property Act receiver the right to sell or otherwise dispose of the mortgaged property and will often include a power of attorney in the receiver’s favour. The power of attorney is not a security power and will not survive liquidation of a company. However, the power to hold and dispose of the mortgaged property and the power to execute in the name and on behalf of the borrower will survive liquidation of a company (Sowman v David Samuel Trust Ltd. ([1978] 1 All ER 616.); Barrows v Chief Land Registrar (The Times, 20 October 1977). The Barrows case does not exclude the possibility of this principle applying in the case of individual insolvency. HM Land Registry’s view is that the right of the Law of Property Act receiver to sell on behalf of the borrower will survive winding up and bankruptcy as well as death and incapacity.

In a winding-up of a company by the court, any disposition of the company’s property after commencement of the winding-up is void unless sanctioned by an order of the court (section 127, Insolvency Act 1986). However, where a mortgage has been created prior to the winding-up, any subsequent disposition by the mortgage holder or receiver under powers contained in the mortgage does not require an order of the court.

The provisions of sections 238 to 241, 244 and 245 of the Insolvency Act 1986 that relate to transactions at an undervalue, preferences, extortionate credit transactions and the avoidance of certain floating charges may have the effect of invalidating the mortgage wholly or in part. If, when an application based on a disposal by a receiver is being considered, there is any suggestion that the liquidator may be seeking to have the mortgage avoided under these provisions, we may serve an appropriate notice giving an opportunity for objection under section 73 of the Land Registration Act 2002.

Similar considerations are likely to apply where it appears that a trustee in bankruptcy may seek to avoid the mortgage under sections 339, 340, 343 or 423 of the Insolvency Act 1986, while having regard to the provisions of section 342(2) and (2A).

If the applicant is aware of any such challenge you must disclose it to us when the application is lodged.

The summary table in Appendix: summary table covers the points in Is the disposition effective so as to enable the registrar to register it? and If the disposition can be registered, can any existing Form A (or Form J or K) restriction be removed or cancelled?.

4. Where the disposition is a lease

4.1 Has there been a grant of a valid lease?

Assuming that the lease, if granted and executed by the borrower(s)/landlord(s) themselves, would be a registrable lease, validity depends on:

- whether the mortgage extends the receiver’s limited powers in section 101(3), Law of Property Act 1925 and gives the receiver the power to grant the registrable lease, and

- whether there has been a valid appointment of the receiver (and if more than one receiver is appointed but the lease is executed by only one of them, the appointment must provide that they can act severally – assuming that the mortgage does not prevent this)

If these conditions are met, then the lease would appear to be validly granted.

4.2 Can the lease be registered?

On the assumption that a valid lease has been granted and there is no other relevant restriction in the register:

- if there is no Form A restriction in the title register of the mortgaged property, then the lease can be registered

- if there are joint borrowers/landlords registered as proprietors of the mortgaged property with a Form A restriction, a lease executed by a single receiver on their behalf can be registered (it is not a disposition by a sole proprietor)

- if there is a sole borrower/landlord registered as proprietor of the mortgaged property with a Form A restriction, a lease executed by either a single receiver or joint receivers on their behalf cannot be registered (it is a disposition by a sole proprietor and so caught by the restriction)

4.3 What about any Form A restriction?

HM Land Registry’s view is that execution by a single receiver (whether or not joint receivers were appointed) will not overreach since, irrespective of how the receiver’s delegated powers arose, reliance must be placed on s.2(1)(ii) of the Law of Property Act 1925 (see Automatic removal under rule 99 of the Land Registration Rules 2003). This is so, even if it is argued that the appointment of the single receiver was a collective delegation under section 11 of the Trustee Act 2000.

Any Form A restriction on the borrower/landlord’s title protects a trust interest affecting that title and so will remain on that title. It will not be carried forward to the new leasehold title even if the grant of the lease has not had overreaching effect.

The summary table in Appendix: summary table covers the points in Where the disposition is a lease.

5. Execution by Law of Property Act receiver

A Law of Property Act receiver has no statutory power to execute on behalf of the borrower.

If the receiver’s power to execute is contained only in a clause conferring a specific power of attorney, so that the receiver executes as attorney, then, even if the power is under 12 months old, the applicant for registration will need to lodge with the application a statutory declaration or statement of truth declaring (if such is the case) that they did not, at the time of the completion of the transaction, know of any revocation of the power or know of the occurrence of any event (such as the bankruptcy, death or mental incapacity of the individual or winding-up of the company) which may have had the effect of revoking the power.

Alternatively, we will accept a certificate signed by a conveyancer certifying (if such is the case) that the applicant did not, at the time of completion of the transaction, know of any revocation of the power or know of the occurrence of any event (such as the bankruptcy, death or mental incapacity of the individual or the winding-up of the company) which may have had the effect of revoking the power.

However, as stated in Powers, a mortgage that confers a right to sell or otherwise dispose of the mortgaged property (and so the right to execute a transfer (or lease) in the name and on behalf of the borrower) creates a general power of agency in favour of the receiver, even if no separate power of attorney is conferred by the mortgage. It is then not necessary for the receiver to execute a transfer as attorney for the borrower; it is sufficient if the disposition is expressed to be executed by the receiver on behalf of the borrower. The statutory declaration, statement of truth or certificate referred to above will not be required. Where the mortgage contains both a general power as above and a power of attorney then we will treat the disposition as having been executed by the receiver on behalf of the borrower, and not under the power of attorney (unless, of course, the form of execution prevents us from doing this).

In the case of a company borrower, the transfer can also, at the direction of the receiver which should be made clear in the words of execution), be either:

- sealed by the company using its common seal in the presence of the duly authorised officers of the company

- signed as a deed by two authorised signatories (either two directors, or a director and the secretary/a joint secretary of the company), or by a single director in the presence of an attesting witness

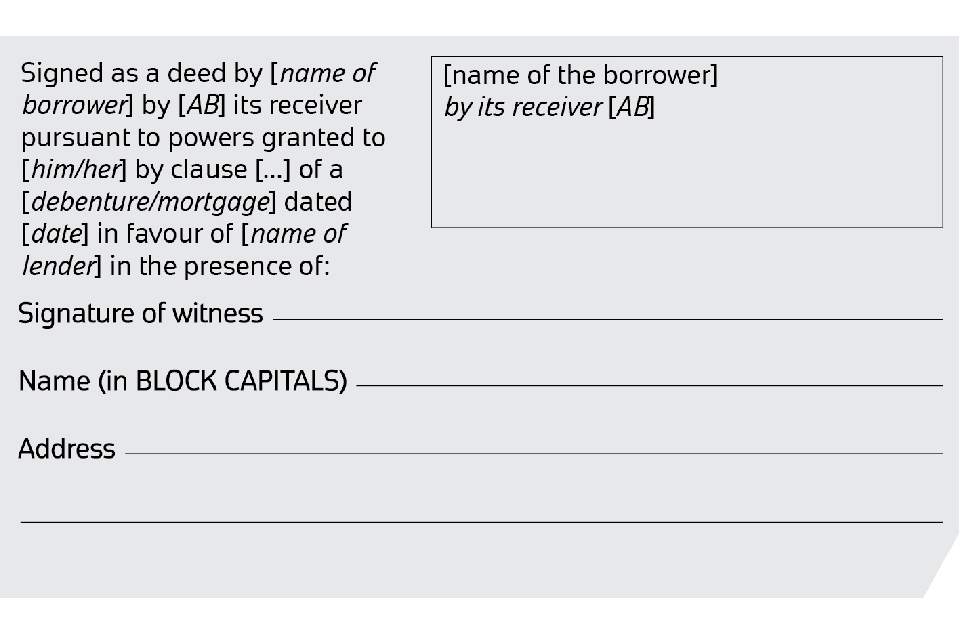

Below is a suggested form of execution by an Law of Property Act receiver in the name and on behalf of a borrower under the authority of provisions contained in the mortgage or debenture (that is, not pursuant to a specific power of attorney).

suggested form of execution by an LPA receiver

6. Release of an estate from mortgages and charges on a disposition by Law of Property Act receiver

The Law of Property Act receiver is the agent of the borrower, not of the lender (section 109(2) of the Law of Property Act 1925). It may be helpful to remember that the receiver is a receiver of land (whereas an administrator is administrator of a company).

The receiver has no power to discharge the property from any mortgage or charge, including the mortgage or mortgage under which the receiver was appointed, regardless of their dates of creation.

On a sale or other disposition by the Law of Property Act receiver the purchaser must ensure that a release is obtained for all mortgages and charges from which that purchaser is to take the property free. This includes the need to obtain a release from the mortgage under which the Law of Property Act receiver is appointed and from any mortgages and charges dated after it.

7. Application for registration based on a disposition by Law of Property Act receiver: evidence required

If your application for registration is based on a disposition by a receiver, we will require, in addition to the normal evidence:

- the mortgage or a certified copy of it (but not if the title is registered and the mortgage is already registered or noted and a copy is filed with us, containing all the applicable terms and conditions of the mortgage – see further below). We will check that the mortgage:

- is properly executed

- contains the appropriate provisions to allow the receiver to be appointed and to carry out the disposition (if these provisions are not apparent from the mortgage deed itself, or from the copy filed with us, then other evidence, such as the mortgage terms and conditions, should be lodged)

- has been registered under section 395 of the Companies Act 1985 or section 860, section 878 or section 859A of the Companies Act 2006, where the borrower is a company registered under the Companies Acts

-

evidence that the power of appointment of a receiver under the mortgage has arisen. Where the receiver’s appointment is made by court order, the order (or a certified copy) will suffice. Where the appointment is not made by the court we will require evidence (such as a certificate by the chargee or by their conveyancer on their behalf) that the power of appointment under the mortgage or debenture has arisen, unless this is evident from a full copy of the mortgage or debenture filed at HM Land Registry

-

the instrument of appointment of the receiver or a certified copy of it (if joint receivers are appointed but only one has executed the transfer or lease, the appointment must state whether they can act jointly and severally)

-

a release or discharge from all mortgages or charges, including the mortgage, from which the applicant is to take the property free. If the title is already registered, the release or discharge will need to cover only those mortgages or charges that have been protected in the register

-

if the receiver executes as attorney, evidence of non-revocation where appropriate: see Execution by Law of Property Act receiver

-

details of any challenge to the validity of the mortgage (for example by a third-party or a creditor (including another lender)) that is within the actual knowledge of the Law of Property Act receiver or the applicant. Where the borrower is a company and the challenge is by a liquidator or administrator of the company, or the borrower is an individual or partnership and the challenge is by a trustee in bankruptcy, details of the name and address of the liquidator, administrator or trustee in bankruptcy should be provided

-

the consent of any previously appointed administrator, or the permission of the court, to the appointment of the receiver where required (see Appointment)

- if the registered proprietor of the registered estate is an overseas entity and the disposition is made in the exercise of a power of sale or leasing by a receiver appointed by the proprietor of a registered charge, or by a specified insolvency practitioner in specified circumstances, evidence to comply with the following restriction if this appears in the register:

RESTRICTION: No disposition within section 27(2)(a), (b)(i) or (f) of the Land Registration Act 2002 is to be completed by registration unless one of the provisions in paragraph 3(2)(a)-(f) of Schedule 4A to that Act applies.

For more information, please see practice guide 78: overseas entities. Please note that the Regulations which will define ‘a specified insolvency practitioner’ and ‘specified circumstances’ have not yet been made.

8. Register entries consequent on appointment of a Law of Property Act receiver

8.1 Noting the receiver’s appointment

The mortgage under which the Law of Property Act receiver is appointed should already be registered or noted against the title. However, the property remains vested in the borrower, and therefore the receiver cannot be registered as proprietor of the title nor can the receiver’s appointment be noted in the register.

8.2 Change of address

However, if the mortgage gives the receiver power to apply on behalf of the borrower, the receiver may apply to add an additional address or change the borrower’s address (a maximum of three addresses are allowed - rule 198 of the Land Registration Rules 2003), to ensure that the borrower’s address for service in the register is one at which any HM Land Registry notices will be received. Bear in mind that, once the receivership has ended, it will not be possible to remove the receiver’s address if that would leave the registered proprietor with no address for service.

If you want to make such an application, we require:

- a form AP1

- a certified copy of the receiver’s appointment

- evidence that the receiver has power to apply on behalf of the borrower

- a certified copy of the mortgage (if it is not already registered or noted)

No fee is payable for this application.

8.3 Restrictions or notices relying on section 37 of the Insolvency Act 1986

We may also see applications for restrictions or notices by receivers relying on section 37 of the Insolvency Act 1986. We consider that section 37 does not give rise to an interest that affects the registered estate and the application will be cancelled.

9. Appendix: summary table

The following assumptions are made for the purposes of the summary table below.

- the mortgage or charge under which the receiver(s) is/were appointed is a registered charge and includes a provision to the effect that any receiver may sell the property and execute a conveyance of the property charged in the name of the borrower(s)

- the registered proprietor of the mortgage or charge appointed the receiver(s)

- the registered proprietor(s) of the registered estate is/are the original borrower(s)

- any registered proprietor that is a company has not been dissolved

- the transfer or lease is for valuable consideration

- the application to register the disposition (that is, to complete by registration) is otherwise in order

- where only some of the receivers who were appointed have executed the transfer or lease (for example, two receivers are appointed but only one executes, or three receivers are appointed but only two execute), the receivers were appointed jointly and severally

For the purposes of the table, it does not matter if the proprietor(s)/original borrower(s) is/are, in the case of an individual, bankrupt, dead or suffering from mental incapacity, or, in the case of a company, being wound up.

| Disposition | Can the disposition be registered? Note: In each case below there is a valid transfer or lease | Can the Form A restriction be cancelled? |

|---|---|---|

| 1. Transfer where: sole individual or company is proprietor and no Form A. | Yes | N/a |

| 2. Transfer where: sole individual or company is proprietor and Form A. | No (even if there is more than one receiver) as the transfer will be a disposition by a sole proprietor and so caught by the restriction | No |

| 3. Transfer where: two or more individuals and/or companies are proprietors and no Form A and single receiver executes the transfer | Yes | N/a |

| 4. Transfer where: two or more individuals and/or companies are proprietors and Form A and single receiver executes the transfer | Yes (the Form A restriction does not catch the transfer because it is not a “disposition by a sole proprietor” but by joint proprietors – acting through a single receiver) | Not normally – the transferee needs to make an application for cancellation of the restriction |

| 5. Transfer where:two or more individuals and/or companies are proprietors and Form A and at least two receivers execute the transfer | Yes | Yes |

| 6. Registrable lease and the circumstances are as at 1, 3, 4 or 5 above (reading “transfer” as “lease”) | Yes | No – but the restriction is not carried forward to the new leasehold title |

| 7. Registrable lease and the circumstances are as at 2 above (reading “transfer” as “lease”) | No (even if there is more than one receiver) as the transfer will be a disposition by a sole proprietor and so caught by the restriction | No |

10. Things to remember

We only provide factual information and impartial advice about our procedures. Read more about the advice we give.