Group accounting manual: IFRS 16 supplement

Updated 25 November 2021

Introduction

1.1 IFRS 16, leases, is set to supersede IAS 17, leases, SIC 15, operating leases – incentives, SIC 27, evaluation the substance of transactions involving the legal form of a lease, and IFRIC 4, determining whether an arrangement contains a lease.

1.2 The objective of IFRS 16 is to report information that faithfully represents lease transactions and provides a better basis for users of financial statements to assess the amount, timing and uncertainty of cash flows arising from leases.

1.3 IFRS 16 as adapted and interpreted by the Financial Reporting Manual (FReM), will be effective from 1 April 2022.

1.4 This does not extend to a limited number of entities across government who report following UK adopted IFRS in accordance with the Companies Act 2006 (CA 2006), for their individual statutory accounts and consequently adopted the standard in 2019 to 2020.

1.5 As the Group Accounting Manual (GAM) forms part of the accounts direction that is issued to reporting entities within the Department of Health and Social Care (DHSC) accounting boundary, the accounting requirements detailed within the GAM reflect the appropriate requirements for that financial year.

1.6 Therefore, guidance around lease accounting in the 2021 to 2022 GAM reflects the appropriate treatments and reporting requirements per IAS 17, rather than requirements under IFRS 16.

Purpose of this document

1.7 This guidance is designed to both advise group bodies required to implement IFRS 16 in their statutory accounts as to how best to align with DHSC group policies when the standard is adopted by the FReM and to assist other group bodies adopting the standard in 2022 to 2023 in developing their preparedness.

1.8 The GAM IFRS 16 Supplement incorporates the requirements of the 2021 to 2022 FReM for DHSC bodies as well as IFRS 16 Application Guidance published by HM Treasury.

1.9 Refinement of the HM Treasury application guidance is ongoing. This supplement reflects the latest position as published in the FReM and application guidance by HM Treasury and determinations made by the Financial Reporting Advisory Board.

1.10 Where further refinements are made to HM Treasury guidance, these will be reflected in any draft of 2022 to 2023 GAM consulted upon in 2022.

1.11 DHSC remain keen to obtain user feedback on the guidance being offered for IFRS 16. We will continue to seek user feedback through the GAM consultation processes prior to IFRS 16 adoption.

1.12 Users should note that as the IFRS 16 Supplement has been consulted on over numerous financial years, they should ensure the most up to date guidance is being followed.

1.13 This document represents the latest IFRS 16 guidance published by DHSC in October 2021.

Format

1.14 This document contains the guidance that is to be included in chapters 2, 4 and 5 of the 2022 to 2023 GAM.

1.15 Text describing the intended location of the IFRS 16 guidance in the GAM will precede each guidance extract. Guidance extracts are contained within quotation marks.

1.16 For the purposes of this document the definitions employed in chapter 1 of the GAM should be interpreted as equally applicable to this guidance.

2. IFRS 16 guidance for chapter 2 of the GAM

2.1 The budgeting approach has been confirmed by HM Treasury in a publication on gov.uk titled IFRS 16 Lease Supplementary budgeting guidance.

2.2 HM Treasury confirm that the guiding principle is for the budgeting approach to align with the accounting treatment under IFRS 16. While this is predominantly the case, there are nuances that preparers should be aware of.

2.3 As such the following detail will be provided in chapter 2, budgeting framework.

2.4 IFRS 16 leases - while the guiding principle within HM Treasury’s IFRS 16 supplementary budgeting guidance is for the budgeting approach to follow the accounting treatment for IFRS 16 and, where relevant, to follow the current approaches laid out in the consolidated budgeting guidance (CBG), preparers should note:

- an entity will incur a CDEL charge equal to the right of use asset value recognised in the entity’s accounts at the commencement of a lease in 2022 to 2023 and beyond, for arrangements that are not subject to the low value and short-term expedients offered in the standard

- existing lease arrangements that establish a right of use asset value on transition to IFRS 16 do not generate a corresponding CDEL charge. There is however an RDEL impact for existing lease arrangements transitioned to IFRS 16 due to the interest and depreciation charges incurred for both transitioning and newly commencing leases

- lease modification or remeasurement and re-assessment of a lease liability will have a CDEL impact. Post transition, existing arrangements can have a CDEL impact. HM Treasury’s budgeting guidance identifies the scenarios in which arrangements create a CDEL impact throughout the term of an arrangement

- peppercorn leases are treated akin to donated assets

- revaluation, impairment and entries for a barter transaction will continue to be applied per standing guidance in HM Treasury’s CBG

3. IFRS 16 guidance for chapter 4 of the GAM

3.1 Significant changes will be made to chapter 4 of the GAM with the introduction of IFRS 16.

3.2 On top of text covering the various FReM adaptations and interpretations of IFRS 16, text will be provided regarding accounting for sale and leaseback transactions and an additional annex will provide more detailed application guidance for group bodies.

3.3 These additions and revisions to the GAM are detailed below.

Sale and leaseback transactions

3.4 IFRS 16 requires an entity to consider whether a transaction meets the requirements of IFRS 15 to determine the appropriate accounting treatment.

3.5 The following text has been developed to be inserted into chapter 4, accounting for income and expenditure.

3.6 IFRS 16 governs arrangements where a seller transfers an asset to another entity and leases the asset back from the buyer. Both parties are required to apply paragraphs 99 to 103 of the standard.

3.7 IFRS 16 requires entities to assess whether a performance obligation is satisfied to determine whether the transfer is accounted for as a sale. Where the sale satisfies the requirements of IFRS 15:

- the seller-lessee measures the right of use asset at the proportion of the previous carrying amount that relates to the right of use retained by the seller-lessee

- the buyer-lessor shall account for both the purchase applying the appropriate standards and the lease as a lessor arrangement per IFRS 16

3.8 Where either the sale is below fair value or the leasing arrangement below market rates, adjustments are required to measure the proceeds at fair value.

3.9 Below market terms are to be accounted for as a prepayment of lease payments and above market terms shall be accounted for as additional financing provided by the buyer to the seller.

3.10 The adjustment must be measured with reference to the more determinable of the consideration of the sale as compared to the fair value of the asset or the difference between the lease payments and the market rate equivalent.

3.11 If the transaction does not meet the sale recognition requirements of IFRS 15, the seller shall continue to recognise the asset and will recognise a financial liability equal to the proceeds and the buyer will recognise a financial asset equal to the proceeds, but will not recognise the transferred asset.

3.12 It is the substance of the arrangement that determines whether IFRS 15 and 16 or IFRS 9 are applied to a sale and leaseback transaction.

3.13 Additional information relating to sale and leaseback transactions may be required to satisfy disclosure objective in IFRS 16.

IFRS 16 adaptations and interpretations

3.14 The leased asset section of chapter 4 will be replaced. The below text also contains the currently agreed set of FReM adaptations and interpretations for transition to and adoption of IFRS 16.

3.15 The relevant standard is IFRS 16 leases. This standard supersedes IAS 17, leases, SIC 15, operating leases – incentives, SIC 27, evaluation the substance of transactions involving the legal form of a lease, and IFRIC 4, determining whether an arrangement contains a lease.

3.16 The objective of IFRS 16 is to report information that faithfully represents lease transactions and provides a better basis for users of financial statements to assess the amount, timing and uncertainty of cash flows arising from leases.

3.17 Under IFRS 16 a contract, or arrangement per the adaptation referenced in paragraph 3.23, is assessed to be or contain a lease, if a right to control use of an asset for a period time is conveyed, in exchange for consideration.

3.18 Identification of a lease is governed by an assessment of the substance of the arrangement against the criteria set out in paragraphs B9 to B31 of the standard and where appropriate, the transition expedient referenced in paragraph 3.22 below. IFRS 16 carries forward the concept of a right of use asset as established by IFRIC 4.

3.19 Regarding lessor accounting, the accounting treatments are predominantly carried forward from IAS 17.

3.20 Asymmetrical accounting treatments are therefore established through this standard due to the persistence of most lessor accounting treatments. This will have an impact on DHSC group reporting requirements.

3.21 Practitioners should make themselves familiar with the definitions, classifications and measurements employed, application appendices in the standard together with public sector application as per the below FReM interpretations and adaptations.

3.22 IFRS 16 is interpreted by the FReM as follows:

- the option to apply the election in IFRS 16 (5 (a)) has been withdrawn. All entities must apply the recognition and measurement exemption for short-term leases in accordance with IFRS 16 paragraphs 6 to 8.

- where lessees cannot readily determine the interest rate implicit in the lease, they are required to use the HM Treasury discount rates promulgated in PES papers as their incremental borrowing rate. However, if an entity can demonstrate that another discount rate would more accurately represent their incremental borrowing rate (for example, if it undertakes external borrowing independently of the Exchequer), it should use that discount rate as their incremental borrowing rate.

- the option to reassess whether a contract is, or contains, a lease at the date of initial application has been withdrawn. All entities should use the practical expedient detailed in IFRS 16 (C3). There is a presumption that entities have been applying guidance in IAS 17 and IFRIC 4 appropriately in the past. Therefore, any known misapplication of the definition of a lease guidance should be corrected in accordance with IAS 8.

- the subsequent measurement basis for right-of-use assets shall be consistent with the principles for subsequent measurement of property, plant and equipment set out in the adaptations to IAS 16.

- upon transition, the accounting policy choice to retrospectively restate in accordance with IAS 8 has been withdrawn. All entities applying this Manual shall recognise the cumulative effects of initially applying IFRS 16 recognised at the date of initial application as an adjustment to the opening balances of taxpayers’ equity (or other component of equity, as appropriate) per IFRS 16(C5(b)).

- upon transition, entities should measure the right-of-use asset for leases previously classified as operating leases per IFRS 16((C8 (b)(ii))); at an amount equal to the lease liability, adjusted by the amount of any prepaid or accrued lease payments relating to that lease recognised in the statement of financial position immediately before the date of initial application.

- upon transition all entities applying the FReM must apply the following options for leases previously classified as operating leases:

- no adjustments for leases for which the underlying asset is of low value that will be accounted for applying IFRS 16 (6) per (IFRS 16 C9 (a))

- no adjustment for leases for which the lease term ends within 12 months of the date of initial application. (IFRS 16 C10 (c)) There remains a requirement to include costs associated with these leases in the short-term leases expense disclosure.

- use hindsight in determining the lease term if the contract contains options to extend or terminate the lease. (IFRS 16 C10 (e))

3.23 Additionally, IFRS 16 is adapted by the FReM as follows:

- the definition of a contract is expanded to include intra-UK government agreements where non-performance may not be enforceable by law.

- peppercorn leases are defined as leases for which the consideration paid is nil or nominal (that is, significantly below market value). Peppercorn leases are in the scope of IFRS 16 if they meet the definition of a lease in all aspects apart from containing consideration. All lessees shall account for peppercorn leases using the following criteria:

- recognise a right-of-use asset and initially measure it at current value in existing use or fair value, depending on whether the right-of-use asset will be held for its service potential and as set out in paragraphs 10.1.4 and 10.1.6 of the FReM. If the right of use asset meets the definition of a heritage asset it should be initially measured in accordance with paragraphs 10.1.34 to 10.1.39 of the FReM

- recognise a lease liability measured in accordance with IFRS 16

- recognise any difference between the carrying amount of the right-of-use asset and the lease liability as income as required by IAS 20 as interpreted by the FReM

- subsequently measure the right-of-use asset following the principles of IFRS 16 as adapted and interpreted by the FReM

- upon transition, any peppercorn leases that were not previously classified as finance leases under IAS 17, including those considered to be outside the scope of IAS 17 courtesy of not involving an exchange of consideration, shall be recognised as follows:

- the right-of-use asset shall be measured at current value in existing use or fair value, depending on whether the right-of-use asset will be held for its service potential and as set out in paragraphs 10.1.4-10.1.6 of the FReM, as at the date of initial application; If the right of use asset meets the definition of a heritage asset, it should be initially measured in accordance with guidance on heritage assets in the FReM

- the lease liability shall be measured at the present value of lease payments, discounted using the lessee’s incremental borrowing rate at the date of initial application

- the difference between the carrying amount of the right-of-use asset and lease liability shall be included as part of the adjustment to the opening balances of taxpayers’ equity (or other component of equity, as appropriate) per IFRS 16 (C5(b))

3.24 More detailed guidance on lease accounting is given in chapter 4 annex 11 and in HM Treasury’s IFRS 16 application guidance.

PDC dividend calculation update

3.25 Peppercorn leases will be treated akin to donated assets. Therefore the PDC dividend impact of peppercorn arrangements will align to the treatment of donated assets. As such the PDC dividend calculation will include reference to peppercorn leases where adjustments are made for a donated asset.

PFI/LIFT and IFRS 16 interactions

3.26 The current approach to accounting for PFI arrangements adopts an IAS 17 based approach in measuring PFI liabilities.

3.27 Per IAS 17 where payments vary based on factors other than time (such as through changes to the retail or consumer price indexes), these contingent rents are expensed in the period in which they occur.

3.28 Whilst accounting for service concession arrangements is identified as out of the scope of IFRS 16, as IAS 17 is employed in the accounting for PFI arrangements, the implementation of IFRS 16 in 2022 to 2023 will in turn have an impact on the accounting for PFI arrangements.

3.29 HM Treasury and the Financial Reporting Advisory Board have confirmed that continuing to employ an approach based on a standard that is no longer applicable, is not appropriate for when IFRS 16 is adopted across the public sector in 2022 to 2023.

3.30 IFRS 16 contains a different measurement approach to variable lease payments that depend on an index rate or other rate than under IAS 17.

3.31 Rather than such payments being expensed in the period in which they are occur as contingent rent, under IFRS 16, such variable payments are incorporated to the measurement of the lease liability.

3.32 This will impact the value of the PFI liability as presented on the balance sheet of an entity and require adjustment to be made to the PFI modelling which was predicated on an IAS 17 approach.

3.33 HM Treasury is expected to provide guidance regarding the implementation of changes to accounting for PFI arrangements, during 2021 which will be referenced in chapter 4 annex 5 of the 2022 to 2023 GAM and consulted upon in 2022.

Update to chapter 4 annex 7: HM Treasury discount rates

3.34 Per the HM Treasury adaptations and interpretations for IFRS 16, where lessees cannot readily determine the interest rate implicit in the lease, they are required to use the HM Treasury discount rates promulgated in PES papers as their incremental borrowing rate. In addition, all existing operating leases transitioning to IFRS 16 on 1 April 2022 are required to be discounted using the incremental borrowing rate at the date of initial application, even where there is a rate implicit in the lease.

3.35 HM Treasury has been publishing lease discount rates for early adopting entities within the annual discount rate publications. Whilst these have not been replicated in the GAM due to the application of IAS 17 for the DHSC Group account, they have been referenced in the FAQ documents published alongside the GAM for 2019 to 2020 and 2020 to 2021.

3.36 The latest HM Treasury publication confirms that a nominal rate of 0.91% is to be applied for leases that transition, commence, or are remeasured in a manner that requires use of a revised discount rate, during the 2021 calendar year. For the 2020 calendar year this rate was 1.27%.

3.37 It is important to note that unlike other rates provided by HM Treasury, the lease discount rate is provided on a calendar year basis rather than a financial year basis, so a lease commencing on 13 March 2022 should not employ the 2021 calendar year rate, but a different rate that will be communicated by HM Treasury in December 2021.

3.38 Rates for future calendar years will be published on an annual basis by HM Treasury in the regular December rates update, which will be replicated in the GAM on adoption of IFRS 16. The incremental borrowing rate for existing operating leases transitioning on 1 April 2022 has not yet been published by HM Treasury. Approaches to discount rates for data collection exercises that take in future calendar years, will be communicated by the relevant national body.

Additional lease accounting annex for chapter 4

3.39 An additional annex has been constructed to offer application guidance in the manner provided for IFRS 9 as part of the 2018 to 2019 update to the GAM and it will be inserted into the 2022 to 2023 GAM per the following text.

Chapter 4 annex 11: Accounting for Leases under IFRS 16

Introduction

3.40 This annex provides an overview of the revised accounting requirements for leases and guidance on how to apply them. It describes how IFRS 16 is adapted and interpreted in the FReM and in this manual. It also addresses the transition from IAS 17 to IFRS 16 in the 2022 to 2023 financial year.

3.41 IFRS 16, leases was published in its completed version in January 2016. It introduces a singular lessee accounting approach to the measurement and classification of leases, as well as a modified classification approach for lessors.

3.42 The standard provides for enhanced disclosure requirements for both lessee and lessors.

IFRS standards

3.43 The relevant standard is:

- IFRS 16, leases

3.44 The accounting for some leases is already covered by specific IFRS standards and thus fall outside of scope of IFRS 16. This includes:

- leases relating to the exploration for or use of minerals, oil, natural gas and similar non-regenerative resources;

- leases of biological assets within the scope of IAS 41 Agriculture held by a lessee

- service concession arrangements within the scope of IFRIC 12 Service Concession Arrangements, from an operator perspective. Entities should note the application of IFRS 16 to the accounting for PFI arrangements detailed in chapter 4 annex 5 of the GAM

- licenses of intellectual property by a lessor in scope of IFRS 15 Revenue from Contracts with Customers

- rights held by a lessee under licensing arrangements within the scope of IAS 38 Intangible Assets for items as described in 3 (e) of the standard (patents, copyrights and picture films for example). The option to apply IFRS 16 to intangible assets per paragraph 4 of the standard is separately considered in paragraph 3.109.

3.45 Additionally, practitioners should have an awareness of where application of other standards is required by IFRS 16. Instances include IFRS 9 impairment reviews and IFRS 15 to govern sale and leasebacks as well as consideration allocation of non-lease components for lessors.

HM Treasury interpretations and adaptations

3.46 HM Treasury has interpreted and adapted IFRS 16 as set out in the FReM and detailed in this guidance at paragraphs 3.22 and 3.23.

Key concepts

Identifying a lease

3.47 At the inception of a contract an entity shall assess whether a contract is or contains a lease. Inception is defined as the earlier of the date by which an agreement is reached and the date by which a commitment is made by the parties to the contract regarding the principal terms and conditions of a lease.

3.48 Paragraphs B9 to B31 of the standard offer significant guidance on the systematic approach to be taken to determine whether a contract or arrangement contains or is a lease. This approach requires the consideration of three high level questions:

- is there an identified asset (inferred or specified by the arrangement) that the supplier doesn’t have a substantive right to substitute throughout the period of use? Substitution that cannot be prevented by the customer, or substitution that enables the supplier to economically benefit from the situation would be viewed as delivering substantive substitutional rights for the supplier

- does the customer have the right to obtain substantially all of the economic benefits from use of the asset throughout the period of use by the customer? (for example, by having exclusive use of the asset throughout that period). Economic benefits can be direct and indirect, primary outputs and by-products.

-

does the customer have the right to direct how and for what purpose the asset is used? The customer is viewed most basically as having this right if it can make changes to how and for what purposes the asset is used during the period of use. Examples given in the standard include:

- the rights to change what type and amount of output the asset produces

- the right to change when the asset is used, or the output produced

- the right to change where the asset is used, and the output is produced

- and right to change whether the asset is used, or the output is produced

3.49 The illustrative examples below provide sectoral examples of the assessment required in B9 to B31 being employed

3.50 The below judgements will not provide accounting determinations for all instances in which entities enter into such arrangements

The examples do not remove the requirement for each entity to assess at the inception of a contract, whether the contract is or contains a lease, per paragraph 9 of the standard.

Illustrative examples

Example 1: staff benefits - car leases scheme

A company (employer) provides its employees with a car lease scheme. Under the scheme employees can lease cars using the employer’s lease car suppliers, normally for a period of 3 years. The employee benefits from insurance cover and maintenance charges which will be included in the rental payments. In exchange the employee commits to the monthly lease rental payments which are collected from the salary through salary sacrifice. The employee is also responsible for selecting the car and regular maintenance throughout the period of the lease. At the end of the lease term car is returned to the dealer and the employee accept any liability arising from excess mileage and inadequate maintenance during lease term.

The arrangement does not contain a lease for the employer.

Although the employer accepts some financial liability in this arrangement (such as early termination fee paid to the car dealer if the employee was to retire on ill health grounds or be made redundant, which should be accounted for as appropriate), IFRS 16, paragraph B9, states that, to assess whether a contract conveys the right to control the use of an identified asset, an entity shall assess whether it has both:

- the right to obtain substantially all the economic benefits from use of the asset

- the right to direct the use of the identified asset

In this scenario, it is the employee, not the employer, who has the rights in 1 and 2 above, with the substance of the arrangement being that the employer entity is simply facilitating a tax effective way for the employee to obtain the vehicle. This is demonstrable by the fact that the arrangement must be terminated if the employee reaches the national minimum wage limit.

The vehicle is effectively the employee’s vehicle to use as he or she wishes, with the lease payments being a salary sacrifice to optimise the employee’s tax position.

Example 2: continuing healthcare

A Clinical Commissioning Group (CCG) (customer) enters into a contract with a local independent care home (supplier) to rent 10 care beds in single occupancy rooms and for provision of supplementary services including full board and medical care provided by staff of the care home. Premises provided by the supplier also include a dedicated therapy space, dining space and access to resident lounges and communal area. The agreement specifies the number of rooms, but the customer does not stipulate which rooms should be made available. Substitution rights by the supplier are not considered to be substantive.

This agreement contains an explicitly identified asset: single occupancy bedroom as well as implicitly identified asset: access to common areas. The customer has the right to obtain substantially all of the economic benefits of the rooms that are specified within the contract and some economic benefits from the shared areas.

The contract does not contain a lease.

The contract may contain an identified asset from which the customer will enjoy substantially all the economic benefits. The arrangement does not give the customer the right to change how and for what purpose the “rooms” are used, but the purpose of the rooms is pre-determined in the contract. The customer does not have further decision-making rights about the use of the rooms during the period of use. The customer has no right to operate the asset during its use, or to direct operations in a manner that conveys this right, with the supplier fully able to determine its operating approach. The customer has not designed the asset either. The customer therefore does not possess the right to direct the use of the asset per B24 (b) (i) or (ii).

3.51 It is important to note that in identifying a lease there are FReM adaptations to consider, alongside the transitional expedient mandated to be employed which does not require the application of paragraphs 9 to 11 in IFRS 16 adoption for existing leases.

3.52 The FReM adaptation to widen the definition of a contract to cover intra governmental arrangements that aren’t legally enforceable, ensures that all lease like arrangements of an intra governmental nature, formal or informal, should be interpreted as in scope of IFRS 16, as the substance of the arrangement is akin to an enforceable contract.

3.53 Despite the adaptation, it remains necessary to assess such arrangements to ensure the intra governmental arrangement to be determined a lease does meet the requirements of IFRS 16 described above.

3.54 Arrangements that involve a peppercorn consideration are to be identified as a leasing arrangement and are to be accounted for in accordance with the adaptation detailed in paragraph 3.23.

3.55 The application of the public sector approach for peppercorn leases under IFRS 16 is only applicable to arrangements that meet the definition of lease in every other respect.

3.56 A lessee has an option to employ the expedient offered in paragraph 15 of IFRS 16 that states a lessee can account for lease and non-lease components of a contract as a single lease, by class of underlying asset.

3.57 Such componentisation is only available where the entity is a lessee. For lessors, consideration for non-lease components of a contract must be allocated in line with IFRS 15 paragraphs 73 to 90.

Lease term

3.58 The lease term begins at the commencement date and includes any rent-free periods provided to the lessee by the lessor.

3.59 The commencement date is the date on which a lessor makes an underlying asset available for use by a lessee.

3.60 The right of use asset and corresponding lease liability as measured per the below guidance, are only recognised at the commencement date.

3.61 This is different to the inception date which relates to when an agreement is reached between the parties as defined in paragraph 3.38

3.62 A lease term is defined by the standard as the non-cancellable period for which a lessee has a right to use an underlying asset, together with both:

- periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option

- periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option

3.63 After the commencement date, a lessee is only required to reassess the lease term upon the occurrence of a significant event or a significant change in circumstances that is within control of the lessee and affects whether the lessee is reasonably certain to exercise, or not exercise, an option which previously informed the assessment made regarding the lease term.

3.64 Instances of significant events or changes include:

- significant leasehold improvements not anticipated at the commencement date

- a significant modification to, or customisation of, the underlying asset that was not anticipated at the commencement date

- the inception of a sublease of the underlying asset for a period beyond the end of the previously determined lease term

3.65 Guidance on short-term exemptions available to entities have been provided in paragraphs 3.95 to 3.99 of this manual.

3.66 Additional guidance on assessment of the lease term can be found in the appendix B of IFRS 16 in paragraphs B34 to B41.

Lessee accounting

Measurement of a lease

3.67 Guidance concerning the initial and subsequent measurement of a lease is clearly articulated through the standard and is therefore briefly summarised below.

3.68 Greater detail is offered regarding the application of the mandated recognition exemption concerning lease length and for leases in which the underlying asset is of low value.

Initial measurement

3.69 Paragraphs 23 to 28 of IFRS 16 govern the initial measurement of the right of use asset and lease liability.

3.70 Per paragraphs 24 and 27 of the standard the initial measurement of the asset and lease liability should factor in the following:

- for the right of use asset; the lease liability, lease prepayments or incentives, initial direct costs or an estimate of any dismantling, removal or restoring costs relating to either restoring the location of the asset or restoring the underlying asset itself, unless costs are incurred to produce inventories

- for the lease liability: fixed and variable payments, amounts payable under residual value guarantees, exercising purchase options if reasonably certain to exercise, or termination payment if the lease term reflects the exercise of this

3.71 Note the interpretation offered in paragraph 3.22 where lessees cannot readily determine the implicit interest rate in the lease, lessees should employ the discount rate promulgated in the PES and repeated in chapter 4 annex 7 of the GAM. This is to ensure that the lease liability is measured at the present value of lease payments not paid at that date.

3.72 Irrecoverable VAT should not be included in the lease liability and therefore is not part of the value of the right of use asset that is derived in part from the lease liability.

3.73 Therefore irrecoverable VAT arising from a leasing arrangement should be expensed in the period that it is due per IFRIC 21 rather than form part of the lease liability recognised.

3.74 It is important to note that this treatment is not aligned to the approach taken for purchased non-current assets. A specific statement as to the treatment of irrecoverable VAT for leasing arrangements is given in chapter 5 annex 1 in the example accounting policy note.

Fair value cap in IAS 17

3.75 Per paragraph 20 of IAS 17 a finance lease was recognised on commencement of a lease, at an amount equal to the fair value of the leased property or if lower the present value of the minimum lease payments. This is expressed as the ‘fair value cap’.

3.76 Per the initial measurement of a right of use asset, such a cap no longer exists.

3.77 This may mean new arrangements that would have been seen as finance leases under IAS 17 returning a different measurement on commencement under IFRS 16, which may have budgeting implications per chapter 2 of the GAM.

Non-lease components

3.78 Entities are required to separate consideration for non-lease components included in the lease contract.

3.79 Examples of common non-lease components may include; maintenance provided by the lessor throughout the contract, operating personnel to operate the vehicle for the lessee, common-area maintenance in the building which is subject to a lease agreement etc.

3.80 IFRS 16 provides the lessee with an option to combine lease and associated service components and account for them as a single lease.

3.81 A lessee can elect to employ this expedient per class of underlying asset.

3.82 If a lessee separates lease and non-lease components, it should capitalise only amounts related to the lease components.

3.83 Lessors shall allocate the consideration in the contract applying paragraphs 73 to 90 of IFRS 15.

Subsequent measurement

Revaluation approach

3.84 The subsequent measurement of the right of use asset shall be consistent with the principles for subsequent measurement of property, plant and equipment set out in IAS 16 as adapted by the FReM.

3.85 Accordingly, the right of use assets should be measured at either fair value or current value in existing use.

3.86 Preparers should note that employment of a revaluation approach for IFRS 16, consistent with the FReM application of revaluation under IAS 16, does not preclude use of the cost model for IFRS 16.

3.87 The HM Treasury application guidance identifies that the cost model can function as an appropriate proxy to the current value in use or fair value as:

- lease arrangements will often contain provisions to update rental payments in light of market conditions

- cost is a suitable proxy under the FReM application of IAS 16 for owned assets with shorter economic lives and or lower values and this will equally apply to leased assets

3.88 The guidance also identifies that a cost model will not be an appropriate proxy when:

- a longer-term lease has no terms that require lease payments to be updated for market conditions or there is a significant period between those updates

- fair value or current value in use could fluctuate significantly due to changes in market prices and conditions

3.89 Therefore, before requiring a valuer to calculate the full replacement cost of the right of use asset for the remaining term of the arrangement, per the HM Treasury application guidance paragraphs 3.17 to 3.19, entities should complete the following assessment:

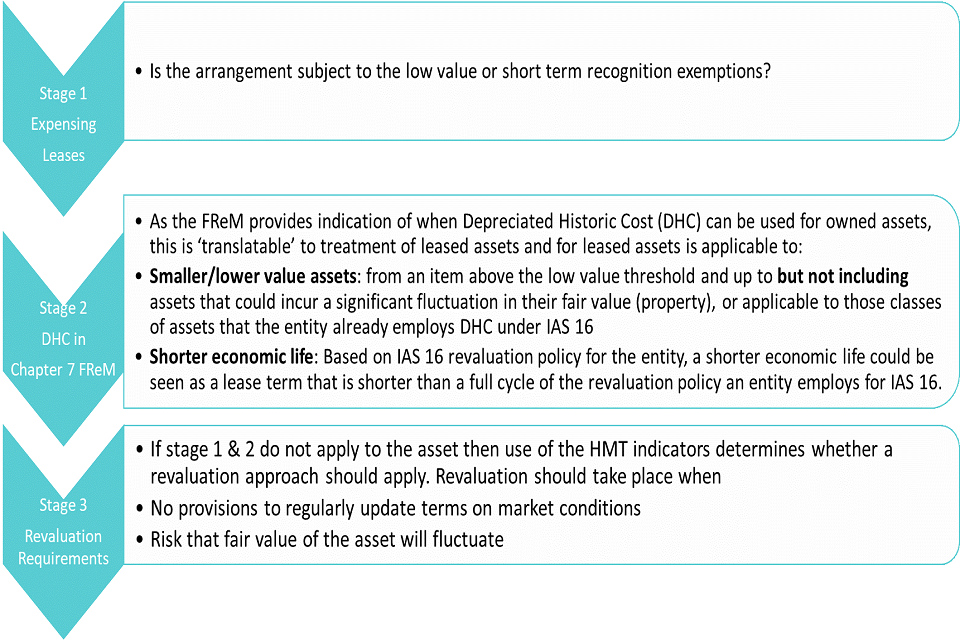

Figure 1: steps to revaluation approach

3.90 The HM Treasury guidance does not provide absolute criteria as to what constitutes a significant period of time between rent reviews.

3.91 An example of a scenario requiring formal revaluation is provided in which a 30 year property lease with a rent review after year 15 and the market for the property is both active and volatile.

3.92 As such, preparers should use judgement to determine when rent reviews are appropriately sequenced throughout the life of a leasing arrangement.

3.93 Figure 1 identifies that entities may wish to look to their revaluation policy for plant, property and equipment when judging what is appropriate.

3.94 To ensure consistency of subsequent measurement for both leased and owned assets, preparers may consider that rent reviews sequenced throughout the life of a leasing arrangement, in alignment to the cycle of formal revaluations undertaken for owned assets, constitutes sufficiently regular updates for market conditions.

3.95 As identified in the HM Treasury Application guidance, paragraph 3.19, a cost model approach is considered an appropriate proxy where there is not a material difference between valuations produced via cost or revaluation approaches.

3.96 As such there may be instances in which cost cannot be considered a suitable proxy for current value in existing use or fair value.

3.97 Entities must use judgement to determine whether cost would be an appropriate proxy once the term, value, regularity of rent reviews and market volatility has been considered.

3.98 An example of a right of use asset not appropriate to hold at cost would be a lease offered at below market value. This assessment should be performed on an asset by asset basis.

Transfer of ownership of underlying asset

3.99 If ownership of the underlying asset is transferred to the lessee at the end of the term or if the costs of the asset reflect that the lessee will exercise a purchase option, depreciation should be incurred from the commencement date to the end of the useful life of the underlying asset.

3.100 Except in such instances as described above, depreciation should be incurred at the shorter of the useful life or the end of the lease term.

Lease liability

3.101 Subsequent measurement of the lease liability should factor in increases and decreases in the carrying amount relating to interest incurred and lease payments made respectively, as well as any remeasurement made to reflect a re-assessment of or modification made to the lease.

3.102 Paragraphs 39 to 46 of the standard govern reassessment of the lease liability.

Recognition exemptions

Short-term leases

3.103 HM Treasury has mandated the employment of the recognition exemption offered in paragraph 5 (a) of the standard in relation to short-term leases.

3.104 In such instances the lessee shall recognise lease payments as an expense on a straight line or other systematic basis.

3.105 A short-term lease is any lease that at the commencement date of the lease (when the lessor makes an underlying asset available for use), has a lease term of 12 months or less.

3.106 The exemption does not remove the requirement for the lessee to consider the lease term in line with paragraphs 18 to 21 and B34 to B41 of the standard.

3.107 It is critical for the lessee to consider the substance of the arrangement to determine the lease term and therefore the appropriate application of the recognition exemption.

3.108 BC94 of IFRS 16 asserts that the rigour of the assessment expected to be applied to determine the lease term, reduces the risk of non-substantive break clauses being inserted into contracts, solely for accounting purposes.

3.109 Guidance on the lease term assessment has been provided in paragraphs 3.50 to 3.58 of this supplement.

Leases of low value underlying assets

3.110 DHSC group bodies must adopt a low value lease exemption threshold of £5,000 and exercise the recognition exemption for leases in which the underlying asset is determined to be of a low value.

3.111 The mandated value is consistent with the capitalisation threshold of non-current assets as provided in the Group Accounting Manual paragraph 4.126. However the threshold as applied to leased assets should exclude any irrecoverable VAT charges.

3.112 The assessment of whether the arrangement constitutes a lease for which the underlying asset is of low value, should be made on a lease by lease basis.

3.113 An underlying asset can only be of low value if:

- the lessee can benefit from the use of the underlying asset on its own or with other resources readily available to the lessee

- the underlying asset is not highly dependent on or highly interrelated with, other assets

3.114 In instances in which a wider arrangement / right of use asset is the aggregate of individual leases for low value component assets (BC 102 offers the example of IT equipment), entities should not apply the recognition exemption.

3.115 This ensures a consistency of approach between leased and owned assets in capitalising low value functionally interdependent assets per IAS 16 terminology and highly dependent or interrelated assets per IFRS 16 terminology.

3.116 It is important to note that there are disclosure requirements based on the application of the recognition exemptions.

Intangible assets

3.117 As identified in paragraph 3.35 an option to apply IFRS 16 to the leasing of intangible assets not covered in paragraph 3 (e) is provided within the standard.

3.118 The Department is mandating that the option of applying IFRS 16 to relevant intangible assets such as software, is not to be exercised by entities within the DHSC Group. The example accounting policy note in chapter 5 Annex 1 of the GAM will reflect this accordingly.

3.119 Entities that have accounted for such intangibles under IAS 17 and IFRIC 4 should apply the transitioning provisions of IFRS 16, mandated per the FReM and GAM, in full for any ongoing arrangements. When a new arrangement is entered into, this would then be accounted for under IAS 38 rather than IFRS 16.

Lessor accounting

3.120 Lessor accounting is predominantly carried forward from IAS 17.

3.121 The main changes relate to additional guidance around modification, specific treatment regarding sub leasing arrangements and enhanced disclosure requirements, which are covered below.

Lessor classification of leases

3.122 At inception a lessor must consider whether the arrangement substantially transfers all the risks and rewards incidental to ownership of an underlying asset.

3.123 Accordingly, IFRS 16 predominantly maintains the accounting treatments in which:

- lease from its Statement of Financial Position, recognising a receivable at an amount equal to the net investment in the lease

- for operating leases, lessors recognise lease payments received as income on a straight line or other systematic basis

Lease modifications

3.124 IFRS 16 provides additional guidance in respect of lessors regarding the treatment for modification of leases.

3.125 Modification occurs when there is a change in the scope of a lease, or consideration for a lease that was not part of the original terms and conditions, such as adding or terminating the right to use one or more underlying assets or extending or shortening the contractual lease term.

3.126 Paragraph 87 of the standard details the approach an entity must take regarding modification of an operating lease.

3.127 For a finance lease, the entity must judge whether a separate lease is established by the modification, or whether the modification would have established an operating lease at inception.

3.128 If neither of these scenarios account for the modification that has taken place, the entity must apply the modification of contractual cashflow requirements as expressed in paragraphs 5.4.3 and 5.5.12 of IFRS 9.

3.129 Paragraphs 79 and 80 of IFRS 16 details the approach to take for finance lease modifications.

Accounting for subleases

3.130 Under IFRS 16 an intermediate lessor must classify the sublease with reference to the head lease rather than with reference to the underlying asset. As such the sublease would be classified:

- as an operating lease if the head lease is expensed on a systematic basis per the short-term lease recognition exemption mandated to be applied by the FReM

- otherwise by reference to the right of use asset arising from the head lease rather than with reference to the underlying asset

3.131 It is anticipated that more subleasing arrangements will therefore be classified as finance leases. The IASB set out their reasoning behind this in BC232 to BC234 of IFRS 16. In short, they identify that:

- it is appropriate for the head lease and sublease to be accounted for separately as generally each contract is negotiated separately with different counterparties and thus obligations from the head lease aren’t extinguished by the sublease

- it is the right of use asset that the intermediate lessor controls rather than the underlying asset, which justifies the classification of the lease with reference to the right of use asset rather than the underlying asset;

- the intermediate lessors risk associated with the right of use asset can be converted into credit risk via a subleasing arrangement. Accounting per a finance lease and recognising a receivable for the net investment in the sub lease does reflect that risk

- if the sublease covers the remaining term of the head lease the intermediate lessor no longer has the right to use the underlying asset and in such instances, it is appropriate to derecognise the right of use asset and recognise the net investment in a sublease

- the approach reflects a real economic difference as the intermediate lessor only has the right of use asset for a period of time and if sub-letting for all of the remaining term then it does effectively transfer the asset. This is a distinct economic reality compared to an operating lease in which a lessor will derive economic benefit once the lease term has ended

Illustrative example

Example 3: sublease classifications

DHSC enters in to a 5-year lease for the 2nd floor of a building with a supplier.

At the end of year one DHSC subleases the entire 2nd floor of the building to one of its group bodies, for the remaining 4 years of the head lease.

DHSC as the intermediate lessor classifies the sublease by reference to the right of use asset.

As the sublease substantially transfers the risks and rewards of ownership of the right of use asset to the group body it classifies the sublease as a finance lease.

DHSC derecognise the right of use asset relating to the head lease and recognises a receivable equal to the net investment in the sublease, recognising any difference as profit or loss . The lease liability pertaining to the head lease continues to be recognised in DHSC’s Statement of Financial Position, with finance income on the sublease and interest expense being recognised on the head lease.

If the sublease was for one year instead of the remaining 4 years DHSC would have entered into an operating lease in which it would recognise lease income from the group body on a straight line basis and continue to recognise the right of use asset and lease liability, coupled with the ongoing charges for depreciation and interest expense.

3.132 On transition to IFRS 16 there are additional requirements for intermediate lessors which are detailed in paragraph 3.149.

3.133 Practitioners should therefore ensure they are familiar with the implications of this aspect of IFRS 16.

3.134 The extent to which public sector entities sublease, both internally and externally to the DHSC group, it is expected that this may have a significant impact on entities.

Transition

3.135 The FReM mandates a number of transition arrangements. It is therefore important for lessees and lessors to be aware of the treatments required.

Identifying a lease

3.136 The FReM mandates the application of the practical expedient outlined in paragraph C3 of the standard in which IFRS 16 is applied to contracts that fell within the scope of IAS 17 and IFRIC 4 and not applied to those identified as not containing a lease under the previous standards.

3.137 This applies to all arrangements except for peppercorn leases which on transition must be accounted for per the HM Treasury adaptation described in paragraph 3.23.

3.138 As such only leases entered into, or modified after the date of initial application, require the revised assessment to be undertaken per paragraphs 9 to 11 and B9 to B31 of IFRS 16.

3.139 Entities should be aware that the interpretation put forward by HM Treasury presumes that IAS 17 and IFRIC 4 had been appropriately applied to all arrangements and is therefore caveated to identify that any known misapplication should be corrected as a prior period error in accordance with IAS 8 before the application of IFRS 16.

3.140 In applying the expedient offered in C3, entities need to apply the transition requirements outlined in C5 to C18 to those arrangements assessed as containing a lease.

Lessee accounting

3.141 The FReM mandates the application of C5 (b) in which the prior year comparatives are not restated, but entities shall recognise the cumulative effect of initially applying the standard at the date of initial application, as an adjustment to taxpayers’ equity (or other component of equity as appropriate).

3.142 This is in line with the transition arrangements for IFRS 9 and 15.

3.143 The ‘cumulative catch up approach’ coupled with FReM interpretations surrounding transition, require specific approaches to be taken for leases previously classified as operating leases. These are:

- recognition of a lease liability measured at the present value of the remaining lease payments, discounted by the incremental borrowing rate:

- practitioners should note that use of an incremental borrowing rate is therefore mandated on transition, with no option to consider the interest rate implicit in existing operating leases

- the election to measure the right of use asset at an amount equal to the lease liability adjusted by prepaid or accrued amounts recognised in the statement of financial position immediately before application of IFRS 16, has been mandated via the FReM for transition

- the need to apply IAS 36 to right of use assets at the date of initial application unless the entity uses the expedient offered to rely on its assessment under IAS 37 as to whether leases are onerous immediately before the date of initial application, as an alternative to performing an impairment review

- a need to measure a right of use asset at fair value if it meets the definition of investment property under IAS 40

- the election to not make any adjustment for leases for which the underlying asset is of low value is mandated by the FReM

- the expedient to not apply the requirements in paragraph C8 and described in bullets one and two above is mandated by the FReM where the lease term is to end within 12 months of the initial date of application. Such arrangements are to be accounted for similarly to all short-term leases

- the option to employ hindsight in determining the lease term if the contract contains options to extend or terminate the lease is mandated by the FReM

3.144 Paragraphs C9 and C10 offer additional expedients and options that lessees should be familiar with.

3.145 Regarding leases previously classed as finance leases, the carrying amounts of the right of use asset and lease liability should remain as the same as they were immediately before the date of initial application.

3.146 Paragraph C12 of the standard prescribes specific disclosure requirements based on employment of the cumulative catch up approach.

3.147 Note that where expedients are employed, mandated by the FReM or selected to be applied by the entity, their employment is disclosed as per the example accounting policy note in chapter 5 annex 1.

Lessor accounting

3.148 In line with the carry forward of the lessor approach from IAS 17, there is no requirement for a lessor to make adjustments on transition to IFRS 16. However, a notable transition impact is felt for intermediate lessors.

3.149 Under paragraph C15 all intermediate lessors are required to reassess subleases classified as operating leases under IAS 17 to determine whether they should continue to be classified as operating leases or whether they should be accounted for as finance leases.

3.150 Entities should note that this reassessment is required despite the expedient in C3 being applied.

3.151 The assessment is required to be performed at the date of initial application on the basis of the remaining contractual term and terms and conditions of the head lease and sublease at that date.

3.152 Further detail is provided above as to the assessment of subleases under IFRS 16.

Sale and leaseback transactions

3.153 On transition, whilst an entity is not to reassess sale and leaseback transactions entered into before the date of initial application, entities should note that if the transaction generated a sale and a finance lease, the lease should be accounted in the same way as any finance lease in existence at the initial date of application, by the seller.

3.154 If generating an operating lease, the operating lease should be measured in the same way as any other operating leases at the initial date of application. The right of use asset in this instance must also be adjusted to recognise any deferred gains or losses in relation to below market terms recognised in the statement of financial position immediately before the initial date of application.

Disclosures

3.155 IFRS 16 provides enhanced disclosure requirements based on the objective identified in paragraphs 51 and 89 of the standard, to give a basis for users of financial statements to assess the effect that leases have on the financial position, financial performance and cash flows of lessees and lessors.

3.156 Entities are reminded that the materiality considerations offered in the Conceptual Framework and in IAS 1 are pervasive across all standards.

3.157 Care must be taken to not reduce the understandability of financial statements.

3.158 Summarisation schedules may take a particular approach to reporting requirements due to the aggregated materiality of certain disclosures for national bodies or DHSC Group.

Lessee disclosures

3.159 IFRS 16 requires disclosure through a single note or a separate section in the financial statement for where an entity is a lessee.

3.160 When information is already presented elsewhere, a cross reference to this detail in the lessee’s note is sufficient to avoid duplication.

3.161 For each reporting period the lessee is required to provide quantitative disclosures listed below in a tabular format unless another format is more appropriate:

- depreciation charge by class of underlying asset

- interest expense on lease liability

- expense relating to short term leases that have a remaining term of less than 12 months:

- this may involve disclosing the amount of lease commitment if the portfolio of short-term future commitments is dissimilar to those reported in during the period

- expense of low value assets that aren’t accounted for as short-term leases. The application of the recognition exemption must also be disclosed

- expense relating to variable lease payments not included in the measurement of a lease liability

- income from subleasing right of use assets

- total cash outflow for leases

- additions to right of use assets

- gains or losses from sale and leaseback transactions

- the carrying amount of right of use assets by underlying class at the end of the reporting period

3.162 Regarding the maturity of lease liabilities, a lessee shall disclose separately a maturity analysis through applying the applicable requirements of IFRS 7 (paragraphs 39 and B11).

3.163 This must be separate to the maturity analyses of other financial liabilities.

3.164 Further quantitative and qualitative information regarding the leasing activities of an entity may be required to meet the disclosure objective of enabling users to assess impacts of leases on financial performance and the financial statements per paragraph 59 of the standard.

3.165 Paragraphs B48 to B52 of IFRS 16 provide further detail as to the nature of the considerations that should be made to determine whether additional information is required.

3.166 Considerations regarding the relevant and apparent nature of the context in which entities enter into lessee arrangements will determine as to whether additional information relating to variable lease payments, the exercising or otherwise of options, residual value guarantees and sale and leaseback transactions, is appropriate to be disclosed.

3.167 BC 224 to 227 of IFRS 16 identifies deviations from industry practices and exposure to other risks arising from lessee arrangements, as examples where further disclosure may be required.

Lessor disclosures

3.168 A lessor is required to provide the following disclosure in a tabular format per IFRS 16:

- selling profit or loss on finance leases

- finance income on the net investment in finance leases

- income relating to variable lease payments not included in the measurement of the net investment for finance leases

- lease income on operating leases, but separately disclosing variable lease payments that don’t depend on an index or rate

3.169 Regarding finance leases a lessor shall also provide a quantitative and qualitative explanation of significant changes in the carrying amount of the net investment in finance leases.

3.170 A lessor is also required to disclose a maturity analysis of the lease payments receivable conveying the undiscounted payments to be received on an annual basis for each of the next 5 years with a total of the amounts for receivables due over 5 years.

3.171 The lessor is required to reconcile this to the net investment in a lease, which is expected to identify unearned finance income and unguaranteed residual value.

3.172 Regarding operating leases, for items of PPE the lessor shall apply the disclosure requirements of IAS 16.

3.173 Accordingly, IAS 16 disclosure for PPE shall be provided separately for assets subject to operating leases and owned assets held and used by the lessor.

3.174 Where appropriate lessors must make disclosures per the requirements of IAS 36, IAS 38, IAS 40 and IAS 41 for assets subject to operating leases.

3.175 For finance leases, lessors must disclose a maturity analyses showing the undiscounted lease payments to be received on an annual basis for each of the next 5 years and then a total amount for all other payments beyond 5 years should be disclosed.

3.176 Further to the quantitative disclosures and similar to the rationale behind lessee disclosures, a lessor shall disclose additional information as prescribed by paragraph 92 of IFRS 16, where it is judged that such additional information enables the entity to achieve the disclosure objective of the standard.

Transition

3.177 In employing the cumulative catch up approach per C5 (b) of IFRS 16, as well as disclosing the necessary detail per IAS 8 paragraph 28 on initial application of the standard, in place of detail requested in 28 (f) of IAS 28, entities must disclose:

- the lessee’s weighted average incremental borrowing rate applied to lease liabilities recognised in the statement of financial position on initial application

- an explanation of any difference between operating lease commitments disclosed at the end of the reporting period preceding initial application discounted using the incremental borrowing rate determined and lease liabilities recognised on initial application

- the practical expedients employed

3.178 There is no requirement in the standard for entities to derive a notional accumulated depreciation figure, to disclose for ongoing operating leases transitioning to IFRS 16.

Lessee presentation

Statement of financial position

3.179 The standard prescribes that right of use assets and lease liabilities are presented separately from other assets and liabilities.

3.180 If there isn’t separate presentation in the statement of financial position the lessee must include the right of use assets within the same line item as if they were owned and then disclose which line items in the statement of financial position contain right of use assets and lease liabilities.

3.181 Summarisation schedules and accounts templates may take a specific approach to presentation.

3.182 Where right of use assets meet the definition of investment property, these are exempt from the above requirement and are required to be disclosed as part of investment property.

Statement of comprehensive income or statement of comprehensive net expenditure

3.183 It is noted that interest expense on the lease liability is a component of finance costs. Depreciation charge on a right of use asset must be separately presented from the interest expense.

Statement of cash flows

3.184 The cash payments for the principal of the lease liability shall be classified within financing activities, with the interest element being classified per the requirements of IAS 7 for interest paid.

3.185 Payments related to short-term leases, low value assets and variable lease payments not included in the measurement of the lease liability being included within operating activities.

Lessor’s presentation

3.186 A lessor must present in its statement of financial position underlying assets subject to an operating lease according to the nature of the underlying asset.

Further guidance

3.187 HM Treasury has published its current version of the IFRS 16 public sector application guidance.

3.188 HM Treasury has published IFRS 16 Leases Supplementary budgeting guidance which outlines budgeting treatment for the new standard.

3.189 NHS England and NHS Improvement has published IFRS 16 Implementation Guidance to inform the approach for NHS providers and NHS England Group entities.

3.190 NHS England and NHS Improvement has published an IFRS 16 frequently asked questions document that is being updated on a rolling basis to cover key issues with IFRS 16 implementation as they arise. These are relevant to all DHSC Group bodies as well as specifically addressing issues in the NHS.

3.191 The department has liaised with and therefore endorses the consistency of the guidance to the GAM.

4. IFRS 16 guidance in chapter 5 of the GAM

4.1 The substantial changes developed for chapter 5 of the 2022 to 2023 GAM relate to the commitments under leases detailed in the main body of the chapter and revised accounting policy note developed for transition to IFRS 16 in chapter 5 annex 1 of the GAM.

IFRS 16 guidance in chapter 5: main body

4.2 The changes made to the disclosure requirements in chapter 5 reference the detail that will be set out in chapter 4 Annex 11.

4.3 It is important to note that while disclosures for PFI, LIFT and other service concession arrangements currently refers to IAS 17, the HM Treasury guidance describing the transition to applying IFRS 16 in relation to accounting for PFI arrangements from the application of IAS 17, will set out any revised disclosure requirements.

4.4 As such the main changes developed for the main body of chapter 5 is per the following text:

Commitments under leases

4.5 The relevant standard is IFRS 16. The disclosures prescribed by this standard and the specific disclosure objective for both lessee and lessor are outlined in chapter 4 annex 11.

4.6 It is expected in the standard that these disclosures take the form of one note, but where the information is disclosed elsewhere in the financial statements, the detail should be cross referenced in the leases note rather than duplicated.

IFRS 16 disclosure in chapter 5 annex 1 of the GAM

4.7 Per the overhaul of the disclosure requirements for IFRS 9 and 15 in the accounting policy note on transition to those standards, a similar revision has been developed for IFRS 16 per the following text:

1.18 Leases

A lease is a contract or part of a contract that conveys the right to use an asset for a period of time in exchange for consideration.

IFRS 16 leases is effective across public sector from 1 April 2022. The transition to IFRS 16 has been completed in accordance with paragraph C5 (b) of the Standard, applying IFRS 16 requirements retrospectively recognising the cumulative effects at the date of initial application.

In the transition to IFRS 16 a number of elections and practical expedients offered in the standard have been employed. These are as follows:

The entity has applied the practical expedient offered in the standard per paragraph C3 to apply IFRS 16 to contracts or arrangements previously identified as containing a lease under the previous leasing standards IAS 17 leases and IFRIC 4 determining whether an arrangement contains a lease and not to those that were identified as not containing a lease under previous leasing standards.

On initial application [The entity] has measured the right of use assets for leases previously classified as operating leases per IFRS 16 C8 (b)(ii), at an amount equal to the lease liability adjusted for accrued or prepaid lease payments.

No adjustments have been made for operating leases in which the underlying asset is of low value per paragraph C9 (a) of the standard.

The transitional provisions have not been applied to operating leases whose terms end within 12 months of the date of initial application has been employed per paragraph C10 (c) of IFRS 16.

Hindsight is used to determine the lease term when contracts or arrangements contain options to extend or terminate the lease in accordance with C10 (e) of IFRS 16.

List any other transition expedients employed by the entity at its discretion.

Due to transitional provisions employed the requirements for identifying a lease within paragraphs 9 to 11 of IFRS 16 are not employed for leases in existence at the initial date of application. Leases entered into on or after the 1st April 20xx will be assessed under the requirements of IFRS 16.

There are further expedients or election that have been employed by [the entity] in applying IFRS 16. These include:

- the measurement requirements under IFRS 16 are not applied to leases with a term of 12 months or less under paragraph 5 (a) of IFRS 16

- the measurement requirements under IFRS 16 are not applied to leases where the underlying asset is of a low value which are identified as those assets of a value of less than £5,000, excluding any irrecoverable VAT, under paragraph 5 (b) of IFRS 16

The entity will not apply IFRS 16 to any new leases of intangible assets applying the treatment described in section 1.14 instead.

List any other expedients employed by the entity (such as low value 5(b) or 15 on componentisation HM Treasury have adapted the public sector approach to IFRS 16 which impacts on the identification and measurement of leasing arrangements that will be accounted for under IFRS 16

The entity is required to apply IFRS 16 to lease like arrangements entered into with other public sector entities that are in substance akin to an enforceable contract, that in their formal legal form may not be enforceable. Prior to accounting for such arrangements under IFRS 16 [the entity] has assessed that in all other respects these arrangements meet the definition of a lease under the standard.

The entity is required to apply IFRS 16 to lease like arrangements entered into in which consideration exchanged is nil or nominal, therefore significantly below market value. These arrangements are described as peppercorn leases. Such arrangements are again required to meet the definition of a lease in every other respect prior to inclusion in the scope of IFRS 16. The accounting for peppercorn arrangements aligns to that identified for donated assets. Peppercorn leases are different in substance to arrangements in which consideration is below market value but not significantly below market value.

The nature of the accounting policy change for the lessee is more significant than for the lessor under IFRS 16. IFRS 16 introduces a singular lessee approach to measurement and classification in which lessees recognise a right of use asset.

For the lessor leases remain classified as finance leases when substantially all the risks and rewards incidental to ownership of an underlying asset are transferred to the lessee. When this transfer does not occur, leases are classified as operating leases.

1.18.1 The entity as lessee

At the commencement date for the leasing arrangement a lessee shall recognise a right of use asset and corresponding lease liability. The entity employs a revaluation model for the subsequent measurement of its right of use assets unless cost is considered to be an appropriate proxy for current value in existing use or fair value in line with the accounting policy for owned assets. Where consideration exchanged is identified as below market value, cost is not considered to be an appropriate proxy to value the right of use asset.

Irrecoverable VAT is expensed in the period to which it relates and therefore not included in the measurement of the lease liability and consequently the value of the right of use asset.

The incremental borrowing rate of [ ] has been applied to the lease liabilities recognised at the date of initial application of IFRS 16.

Where changes in future lease payments result from a change in an index or rate or rent review, the lease liabilities are remeasured using an unchanged discount rate.

Where there is a change in a lease term or an option to purchase the underlying asset [the entity] applies a revised rate to the remaining lease liability.

Where existing leases are modified [the entity] must determine whether the arrangement constitutes a separate lease and apply the standard accordingly.

Lease payments are recognised as an expense on a straight-line or another systematic basis over the lease term, where the lease term is in substance 12 months or less, or is elected as a lease containing low value underlying asset by [the entity].

1.18.2 [The entity] as lessor (where relevant)

A lessor shall classify each of its leases as an operating or finance lease. A lease is classified as finance lease when the lease substantially transfers all the risks and rewards incidental to ownership of an underlying asset. Where substantially all the risks and rewards are not transferred, a lease is classified as an operating lease.

Amounts due from lessees under finance leases are recorded as receivables at the amount of [the entity]’s net investment in the leases. Finance lease income is allocated to accounting periods to reflect a constant periodic rate of return on [the entity]’s net investment outstanding in respect of the leases.

Income from operating leases is recognised on a straight-line or another systematic basis over the term of the lease. Initial direct costs incurred in negotiating and arranging an operating lease are added to the carrying amount of the leased asset and recognised as an expense on a straight-line basis over the lease term.

Where [the entity] is an intermediate lessor, being a lessor and a lessee regarding the same underlying asset, classification of the sublease is required to be made by the intermediate lessor considering the term of the arrangement and the nature of the right of use asset arising from the head lease.

On transition [the entity] has reassessed the classification of all of its continuing subleasing arrangements.