CCS annual report and accounts 2022 to 2023: accessible version

Updated 17 July 2023

Presented to Parliament pursuant to Section 4 (6A) (b) of the Government Trading Funds Act 1973 (as amended by the Government Trading Act 1990).

Ordered by the House of Commons to be printed on 17 July 2023.

HC1627

Welcome to the Crown Commercial Service Annual Report and Accounts 2022/23

In 2022/23 the Crown Commercial Service, as a Trading Fund and an Executive Agency of the Cabinet Office, helped organisations across the entire public sector to save time and money on buying their everyday goods and services.

Performance highlights and commercial benefits including savings

-

£25.3 billion of public sector spend was channelled through our commercial agreements

-

our employee engagement index, as measured by the Civil Service People Survey is 69% maintaining top quartile performance

-

we helped customers with procurements worth a total annual contract value of over £2.3 billion

-

customers who have used our agreements have achieved commercial benefits equivalent to £3.8 billion

-

in line with government policy on prompt payment we paid 98.9% of undisputed supplier invoices within five days and 100% of undisputed payments due within 30 days

-

our G-Cloud framework marks its 10-year anniversary, with £1.5 billion in commercial benefits achieved for public sector customers

-

we launched our new Carbon Net Zero funding page on our website, bringing all open CNZ grants and funding opportunities from across the government into one place

-

our Net Promoter Scores for customer satisfaction over the year were: +65 for Customer Service +69 for Assisted Procurement

-

we announce that 17 projects have been formally awarded, totalling over £700 million, in the first year of our partnership with NHS England to help build and reconfigure NHS England estates, through the Construction Works and Associated Services 2 / ProCure 23 agreement

Year at a glance:

April 2022

We announced funding of the new Contract Management Pioneer Programme, in partnership with the Department for Levelling Up, Housing and Communities, to boost commercial capability in local government.

May 2022

The CCS Energy Team, together with EDF, wins the Best Contract Delivery category for 2021/22 at the UK National GO Awards. The project saw over 25,000 electricity meters transferred to EDF to ensure the best experience and value was delivered for the public sector. This was the largest transfer ever attempted within the UK with 100% success.

June 2022

We receive a Gold award in Mind’s Workplace Wellbeing Awards in recognition of our long-term and in-depth commitment to supporting the mental health of our colleagues.

July 2022

We announce the roll out and £12.8 million of funding for the Atamis e-commerce system, enabling one common procurement platform for all NHS Trusts in England.

August 2022

We launched our new digital transformation guide for the NHS, built around the Central Digital and Data Office’s technology code of practice.

September 2022

We put in place a new, first of its kind, Big Data and Analytics agreement to help support the requirements of the government and the wider public sector as they continue to use data to innovate.

October 2022

We produced a new glossary of the most common procurement terms and abbreviations to help provide customers with a useful reference when buying goods and services for their organisation.

November 2022

Our Customer Service Centre wins Contact Centre of the Year at the Northern Contact Centre Awards 2022, for evidencing delivery of world-class customer service, exceptional levels of staff engagement and a unique smarter working approach.

December 2022

Our Chief Executive, Simon Tse, is recognised in the King’s New Year honours list and receives a CBE for his services to the public sector and race equality.

January 2023

We negotiate a new Memorandum of Understanding with software provider, ServiceNow, to support consistent innovation across government and the wider public sector digital public services.

February 2023

We launch our new Commercial Insider series, in which CCS experts discuss the key themes and debates in public procurement right now and share their own experiences as leaders of the government commercial profession.

March 2023

We announce the award of our new Supply of Energy 2 agreement - the biggest energy contract ever awarded in the public sector, expected to supply up to £51 billion of electricity and gas, and saving central government and wider public sector organisations over £2 billion.

Who we are

Our values shape and drive everything we do. We listen, respect, collaborate and trust in order to deliver with confidence

Crown Commercial Service is an Executive Agency and Trading Fund of the Cabinet Office and a key constituent of the Government Commercial Function.

Purpose: Our purpose is to help the UK public sector get better value for money from its procurement of common goods and services.

Ambition: Our ambition is to increase the value that we help the public sector achieve from commercial and procurement activity, by sustainably increasing the depth of our impact and the breadth of our coverage.

Vision: Our vision is to be the provider of choice for public sector organisations seeking commercial and procurement solutions. CCS will be a customer focused organisation trusted and admired by buyers and suppliers for our expertise and the quality of the service we offer and the solutions we provide.

Glossary

ALB: Arm’s Length Body, an organisation that delivers a public service, is not a ministerial government department, and which operates to a greater or lesser extent at a distance from ministers

BSI: British Standards Institute

Carbon Net Zero: The target for the UK to bring all greenhouse gas emissions to net zero by 2050. Any emissions would be balanced by schemes to offset an equivalent amount of greenhouse gases from the atmosphere, such as planting trees or using technology like carbon capture and storage

CCS: Crown Commercial Service

CETV: Cash Equivalent Transfer Value

CG&S: Common goods and services, products and services that multiple organisations need to purchase, from locum doctors and laptops, to police cars and electricity

CIPS: Chartered Institute of Procurement and Supply

CG: central government, the ministerial departments

CO: Cabinet Office

Commercial benefits: The value that CCS drives for customers when purchasing through our commercial agreements. Our methodology allows for 2 routes for benefit calculations:

-

‘Spend Benefits’ are based on sampling all spend through a commercial agreement and calculating average benefit for all the customer population using the agreement compared to current comparator market prices

-

‘Change Benefits’ are a specific measure applicable to an individual customer usually as a result of a business change influenced by CCS and signed off accordingly by the customer

CRM: Customer Relationship Management. Either the processes of managing customer relationships or the tools/software we use to manage customer information

CRP: Carbon reduction plans

CSC: Customer Service Centre

DDS: Digital and Data Services

DfE: Department for Education

DHSC: Department of Health and Social Care

DLUHC: Department of Levelling Up, Housing and Communities

DPS: Dynamic Purchasing Systems

Executive Board: The Executive Board manages the delivery of CCS’s strategic aims and provides leadership to the organisation. The Executive Board is chaired by the Chief Executive and includes Director-level representation from the key directorates and functions in CCS

FM: Facilities Management

FReM: The Government Financial Reporting Manual, which is the technical accounting guide for the preparation of financial statements

FTEs: Full time equivalent, the hours worked by one employee on a full-time basis

GBS: Government Buying Standards

GCF: Government Commercial Function

G-Cloud: CCS’s commercial agreement for use by the UK public sector to buy cloud computing services covering hosting, software and cloud support on a commodity based, pay-as-you go service

GCO: Government Commercial Organisation

GDS: Government Digital Service

GDPR: General Data Protection Regulation

GGC: Greening Government Commitments

GIAA: Government Internal Audit Agency

GPA: Government Property Agency

KPI: Key Performance Indicator

ICT: Information and Communication Technology

ISO 14001: An internationally agreed standard that sets out the requirements for an environmental management system

LGBT+/LGBTQ+: Lesbian, Gay, Bisexual, Transgender, Queer/Questioning plus other communities

MoU: Memorandum of Understanding, a type of agreement between two or more parties

MPM: Managing Public Money, HM Treasury guidance for managing the spending of public funds

MSAT: Modern Slavery Assessment Tool

NAO: National Audit Office

NHS BSA: NHS Business Services Authority

NHS FOM: NHS Future Operating Model, the programme to enhance procurement efficiency and effectiveness across the NHS

NHS SBS: NHS Shared Business Services

NPS: Net Promoter Score, a measure of customer satisfaction

OGSA: Operational Governance Self Assessment, part of CCS’s management assurance process

PBOs: Professional buying organisations that put in place and manage contracts and frameworks for commonly purchased goods and services, which can be accessed by most UK public sector organisations

PCSPS: Principal Civil Service Pension Scheme

PES: Public Expenditure System

PFI: Private Finance Initiative

PPG: Public Procurement Gateway

PPN: Procurement Policy Note

PPR: Planning, Performance and Risk

PSC: Public Sector Contract, a shorter and simpler government contract developed and used by CCS

RMI: Report Management Information system, the new system for suppliers to submit their returns to CCS

ROCE: Return on Capital Employed

SAM: Strategic Account Management

SCS: Senior Civil Service

Smarter Working: Smarter working empowers Civil Servants to make the right decisions about where, when and how they work; optimising the use of workplaces and technology, and realising savings for the taxpayer. It improves productivity through a focus on outputs and enables a better work life balance for all

SMEs: Small and medium-sized enterprises (business of less than 250 employees)

SOCI: Statement of comprehensive income

Social value: Social value legislation requires buyers of public sector services to consider whether there are related social, economic or environmental benefits that can be delivered through the contract, for example, creating more apprenticeships or reducing carbon emissions

SOFP: Statement of financial position

Spend types:

-

Direct spend represents spend where the commercial agreement/framework used for call off is owned and managed by CCS. This includes agreements originally let by other organisations and then transferred to CCS

-

Transacted spend represents spend through an agreement that is placed and owned by another organisation but for which CCS has offered significant buying advice or support or Spend where the CCS influence is focused on enabling a route to market for customers, who are then buying a secondary product

-

Public Sector Commercial Agreement spend are memoranda of understanding (MoU) with suppliers that set a maximum charge for goods or services that the supplier agrees to adhere to within/across the public sector

SRO: Senior Responsible Owner, the individual responsible for ensuring that a programme or project meets its objectives

SSRB: Senior Salaries Review Body

WPS: Wider public sector, including local government, health and education, and third sector (charities)

Performance report

Chair’s Statement

When writing my Chair’s Statement for last year’s Annual Report, I had anticipated this being my last, with plans to step down in 2022/23. A change in circumstances afforded me an opportunity to remain with CCS for an additional year, and I’m delighted to be able to reflect back on yet another successful year for the organisation.

CCS has emerged from the Covid-19 pandemic with a stronger reputation across the public sector, demonstrating its commercial expertise and supporting public sector buyers with the challenges that they faced.

In recent months, we have seen the impact of inflation and price rises across the UK. CCS’s agreements have helped our customers to navigate these challenges and continue to deliver significant commercial benefits.

In 2022/23, CCS achieved well over £3 billion of commercial benefits for its customers for the first time. Alongside this, CCS has increased the total spend through its commercial agreements reaching over £30 billion. This is a considerable achievement considering that when I started my appointment as Chair seven years ago, CCS had £12.4 billion of spend through its agreements, and £725 million of commercial benefits.

I’m delighted that as a result of CCS’s growth over the last few years we are now in a position to invest in programmes and projects to help further develop commercial capability across the public sector.

As CCS continues to mature as an organisation, we have had to rethink our organisational design and review our current and future capabilities, particularly within the technology and digital space, to ensure that we are set up for the future. Part of this focus has been the development of comprehensive market segmentation tools, enabling faster, more appropriate solutions for customers.

The organisation has proudly and consistently improved levels of productivity and continues to focus on efficiency, cognisant of the headcount challenges set by our parent department, the Cabinet Office. What remains the priority for the organisation are our customers’ needs.

CCS has extremely dedicated and passionate staff, and I continue to be impressed by their commitment to excellent customer service. The Civil Service People Survey results from 2022 demonstrate that CCS remains a positive place to work. I would like to take this opportunity to express my gratitude towards each and every staff member, for their continued excellence in delivery. I would also like to thank my fellow Non-Executive colleagues for their continued support.

Congratulations must go to Simon and his Executive Board for their fantastic work in leading the organisation. Simon being awarded a CBE in the King’s New Year’s Honours is richly deserved. Finally, I must give thanks to all of CCS’s customers and suppliers who continue to work closely with us to realise savings across the public sector.

Tony van Kralingen

Chair

Chief Executive’s introduction

2022/23 finally brought us into the post-pandemic era, although challenges brought on by the pandemic have remained as we readjust how we live and work. We have, indeed, faced other tests during this period, witnessing the invasion of Ukraine by Russian forces and the conflict that continues there, and the sad passing of Her Late Majesty Queen Elizabeth II.

Reflecting on the past year, I’m extremely proud of the resilience, professionalism, integrity and flexibility demonstrated by our CCS family. Colleagues have demonstrated their unwavering commitment and support to our public sector customers in meeting their commercial requirements as they, in turn, have responded to the challenges that the past year has brought.

The benefits we bring to our customers

It is through this support for our customers that this year we have delivered commercial benefits of well over £3 billion - an incredible achievement. This comes very soon after reaching over £2.5 billion in commercial benefits for the very first time last year, so achieving another significant milestone is a testament to the hard work and dedication of our people.

Commercial benefits are how we deliver real value for our customers. It’s important to remember that we also deliver additional benefits, including the support we offer in helping our customers with their procurement policy priorities. Whether that’s enabling apprenticeship schemes, working to achieve Carbon Net Zero, modern slavery requirements and more, customers can use our commercial agreements to support those ambitions.

Our Assisted Procurement Service continues to mature, delivering contracts with an Annual Contract Value of £2.3 billion in 2022/23 through 395 procurements, representing a return to pre-pandemic levels of Annual Contract Value. Our priority is to continue to deliver complex, high value procurements for our customers, saving them time and resources on conducting these themselves.

We awarded 26 new commercial agreements this year and as we keep evolving and maturing our product portfolio we continue to see growth in the total spend through our commercial agreements, achieving £30 billion of spend this year. This outstanding performance puts CCS in the enviable position of being able to invest our surplus in improving our operational effectiveness and commercial capability across the entire public sector.

In 2022/23 we committed to invest £12 million in the NHS to enable the implementation of a common procurement platform across the health service. Within the first year of the programme, we and they have already realised significant benefits and efficiencies, with further still expected as the platform is more widely rolled out across NHS organisations.

We have also continued to invest, in partnership with the DLUHC, in providing a commercial capability training programme to the Local Government sector.

These investments are a source of great pride for myself and colleagues across CCS. They perfectly demonstrate the important work that we have carried out over recent years to develop and enhance our relationships and reputation with customers across the wider public sector.

Through these strengthened relationships we have seen increased growth in spend from the wider public sector again in 2022/23, and indeed, we aim to further embed this new approach to market segmentation in 2023/24 to grow this spend further.

Our customer satisfaction remains high, with Net Promoter Scores of +69 and +65 for Assisted Procurements and Customer Service respectively. We are investigating how best to measure customer satisfaction across all of our products and services, to use this insight in order to develop our service offering even further, to better meet or exceed customer needs and ensure exceptional delivery for our customers.

Our digital journey

Our digital journey continues and 2022/23 saw the launch of our new Contracts Award Service for selected products, with a view to expanding the products offered through this service in the near future.

We have also launched the Public Procurement Gateway, which provides a single sign-on for customers and suppliers to register and use our systems, simplifying their digital journey and removing the need to log in to multiple different platforms.

Along with success in this area, we must acknowledge that there have also been challenges, as we continue to evolve our digital offering and build our capability and maturity in the digital space. We know there is more that we can do to improve the experience for our customers and suppliers, and our communications with them regarding our new digital products. Addressing these challenges will be a priority for us going forwards.

Our people

Central to everything that we do and everything that we have achieved, this and every year, are our people. An important tool to enable us to understand how our colleagues feel about working at CCS, and address the priority issues that colleagues are facing, is the Civil Service People Survey. Whilst we saw a modest dip in engagement scores in 2022 from the previous year, I’m pleased to report that we remained in the top 25% for our overall staff engagement results.

The insights we gain from the survey help us to develop and implement our local engagement action plans, and directly address key issues affecting colleagues and make improvements. I’m also pleased to observe that we saw a reduction in scores relating to bullying and discrimination within CCS.

As an organisation, we know we must continue to evolve and develop to build resilience and opportunity for future success, improving our operations, products and service offerings. 2022/23 saw the introduction of the new Chief Commercial Officer role.

Along with the majority of Civil Service organisations, we continue to respond to the headcount reduction targets set by the Cabinet Office. It is important to ensure that we remain a well run and efficient organisation, and I am pleased that we have maintained a Moderate internal audit opinion again this year.

The wellbeing of colleagues is a priority and I’m pleased to confirm the launch of our new wellbeing strategy last summer. In recognition of our work in this area, we achieved a Gold award in the Mind Workplace Wellbeing Index, in our second year of entering the awards.

In 2022/23, we hosted in-person all staff events at each of our office locations, and this provided an opportunity to meet all of the new colleagues who had joined us throughout the pandemic.

We now have eight staff networks across a range of protected characteristics and themes. These networks are led and convened by volunteers from across our organisation, actively contributing to ensure that CCS is an inclusive, supportive and all round positive place to work.

The staff networks have led a broad range of initiatives during the year. These have included a Social Mobility Outreach Programme in partnership with the Government Commercial Function, two reverse mentoring cohorts, the collection of social mobility and caring data for colleagues, and an Inclusion and Diversity calendar for the organisation

Industry recognition

CCS has been recognised through several industry awards over the past year. Our Energy team took home the award for Best Contract Delivery at the national GO Awards, with two other teams also shortlisted. CCS teams were nominated in four categories at this year’s Government Commercial Function Leadership Awards.

Our Customer Service Centre was named Contact Centre of the Year at the Northern Contact Centre Awards 2022, which includes both private and public sector organisations. A huge congratulations to the teams in receipt of this external recognition for outstanding service to our customers.

Looking to the future with thanks to all CCS colleagues

As we look ahead to the new financial year, we are keenly aware of the challenges ahead of us. The new Procurement Bill is currently making its way through Parliament. Our Transforming Public Procurement project is working tirelessly to ensure that we are prepared for this. We are working closely in partnership with the Cabinet Office Procurement Policy team to ensure that we can provide as much guidance and support to our suppliers and customers ahead of the new Regulations being introduced. The Procurement Bill will introduce significant changes to the way that public procurement is carried out in the UK, and we do not underestimate the impact that this will have on our operations.

We have a clear vision for our future as we look to double the commercial benefits we deliver to £6 billion per year for public sector customers. Underpinning this vision is a comprehensive strategy that is focused on developing our products and services and ensuring that the customer is at the centre of everything we do.

We want to deepen our impact and bring our commercial expertise to bear across the entire public sector. I remain confident that this is within our reach, and I know how committed CCS colleagues are to ensuring that we are a strong, effective and resilient organisation, both in terms of exceptional delivery and also as a place to work.

The CCS Board have once again provided me, and the organisation, with great support and advice, whilst also applying significant scrutiny to ensure that we are the best organisation we can be. I am grateful to our Chair, Tony van Kralingen, for extending his tenure on the Board and continuing to provide me with great counsel throughout the year.

It saddens me greatly to reflect on the loss of our much valued colleague Michael Evans in December 2022. Working most recently as a Commercial Agreement Manager within the Food Category as part of the Workplace Services team, Michael is greatly missed by everyone in CCS.

My sincerest and heartfelt thanks go to all of my CCS colleagues for another exceptional year of delivery. Once again, colleagues have risen to the challenges that they have faced, and I am so proud of each and every one of you. Thank you.

Simon Tse CBE

Chief Executive and Accounting Officer

In memoriam

Michael Evans

20 July 1989 to 9 December 2022

Statement of purpose, scope and strategy

CCS has three strategic priorities:

- extending our coverage and influence

- deepening the value CCS adds

- enabling better outcomes

Our business strategy implements our strategic priorities by focusing on enhancing CCS’s key interventions - Customer, Service and Products - and sustaining and developing the critical enabling activity which will allow the organisation to operate effectively and sustainably at a greater scale. It is aligned to the Government Commercial Function strategy and supports the delivery of the Commercial Functional Plan.

-

Living our Values

-

Building Capability

-

Organisational Effectiveness

Service: Making the most of our expertise and data to influence the public sector, bring our expert procurement and category resources to bear sustainably, where they can add most value, while enabling wider access to CCS’s offering digitally.

Product: Maintain a strong portfolio of products and solutions - including digital tools – drawing on our customer/sector insight and category knowledge to ensure they are easy to use, support access for capable suppliers, and drive price as well as social, economic and policy outcomes.

Customer: Increase our understanding of our target customers through market segmentation and strategic account management, improve their experience, and use partnerships to influence more spend, customers and transactions.

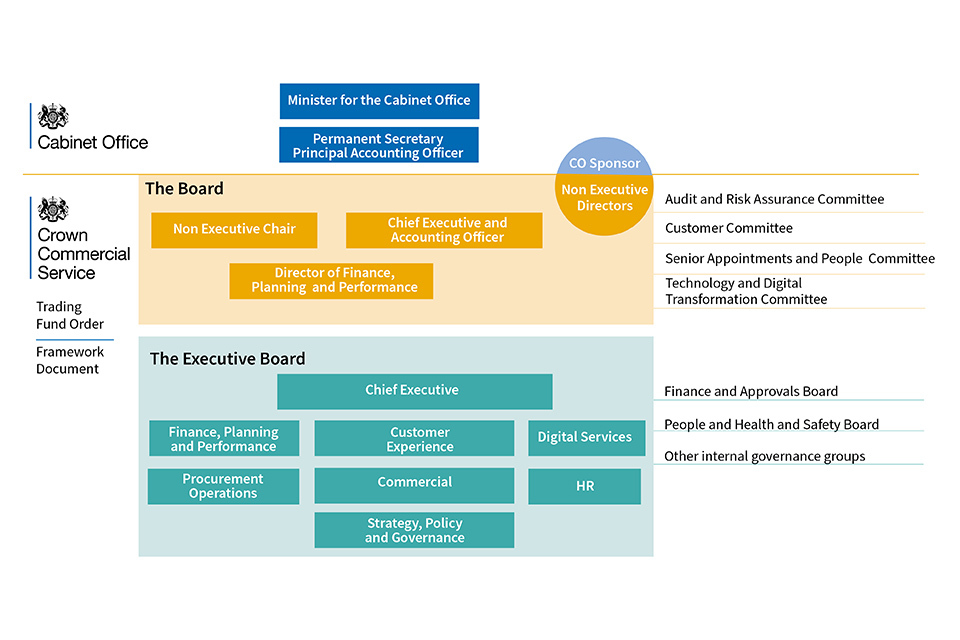

Organisational structure

Our organisational structure and governance arrangements are:

- Minister for the Cabinet Office

- Permanent Secretary and Principal Accounting Officer

- Cabinet Office Sponsor

- Trading Fund Order

- Framework Document

The Board:

- Non-Executive Chairman

- Chief Executive and Accounting Officer

- Director of Finance, Planning and Performance

- Non-Executive Directors

The Executive Board:

- Chief Executive

- Finance, Planning and Performance

- Customer Experience

- Digital Services

- Procurement Operations

- Commercial

- Strategy, Policy and Governance

- HR

Board sub-committees:

- the Audit and Risk Assurance Committee

- the Customer Committee

- the Senior Appointments and People Committee

- the Technology and Digital Transformation Committee

Executive Board sub-committees:

- the Finance and Approvals Board

- the People and Health and Safety Board

- other internal governance groups

Performance overview

The purpose of this section is to provide a summary of progress made against the three strategic priorities within our organisational strategy along with an overview of our financial performance. It also sets out the key strategic risks that have been and continue to be actively managed as we move forward.

1. Extending our coverage and influence

We’ve continued to extend our coverage increasing the spend transacted through our agreements, both by increasing the number of organisations that use CCS agreements and by increasing the amount of spending that individual organisations transact through them. Over the course of the year we recorded £25.3 billion of direct spend (£23.2bn in 2021/22), £2.9 billion of public sector commercial agreement spend (£2.5bn in 2021/22) and £2.9 billion of transacted spend (£1.9bn in 2021/22) through our commercial agreements.

In parallel, we’ve developed our engagement with key sectors outside central government supporting the NHS with the roll out of e-commerce platforms and helping local authorities with access to contract management training. We’ve developed new relationships and partnerships with other representative public sector organisations to develop commercial solutions that meet their and their stakeholders’ needs. We’ve developed and deployed our category and procurement expertise more widely, entering new markets, and providing new commercial routes and digital channels, as we’ve refreshed our portfolio of commercial agreements, with 26 new agreements procured this year.

We have also strengthened our engagement and communications providing our customers with access to category strategies, commercial insight and procurement guidance to help them buy effectively in our categories and tackle key strategic challenges, such as Carbon Net Zero. We’ve made progress in extending the assisted procurement service we provide for public sector buyers, running the call off procurement process through our agreements on their behalf while maintaining its quality. In line with our strategy we have increased the total Annual Contract Value of transactions supported by our assisted procurement service to £2.3 billion in 2022/23, and deployed our specialist procurement teams to undertake more complex and higher value transactions. We have maintained our Net Promoter Scores for both our Customer Service (+65) and Assisted Procurement Service (+69) as we have done so.

2. Deepening the value CCS adds

CCS commercial agreements help public sector organisations to buy more efficiently and effectively, enabling access to capable suppliers on favourable terms and with maximum prices that have been set through competitive procurement processes that leverage the combined scale of public sector business to be transacted through each agreement.

Once live, CCS agreements then provide for further competitions at call off so that buyers can compete their specific requirements and push prices down further if they wish. Beyond this, CCS employs a number of mechanisms to help public sector organisations secure the best possible price when they buy. CCS is designing new pricing mechanisms into our framework agreements so that pricing can be reviewed as volume thresholds are reached and operates Memorandums of Understanding with key suppliers in certain categories (such as software licences) so that all public sector buyers have access to reduced prices as the combined volume of public sector demand for a particular item rises. In key categories CCS runs aggregation events to coordinate purchases from our frameworks by multiple buyers along with e-auction processes to secure the maximum competitive tension.

In 2022/23, CCS recorded commercial benefits of £3.6 billion from a comparison of the prices paid by organisations using CCS commercial agreements and market comparators. We also recorded a further £206 million in change benefits where our work helped the public sector take a different approach and avoid costs. We will be looking to capture more.

3. Enabling better outcomes

It is central to CCS’s strategy that buyers can achieve not only good prices from using CCS products and services but also can achieve a range of other outcomes: confidence that they are procuring compliantly with procurement regulations, confidence in the capability of their suppliers and the resilience of supply chains, and confidence that they can support the policy and social and economic outcomes that matter.

During the course of the year, we have been working to understand the details of the reforms to the public procurement regulations that the government is proposing and in particular how CCS will need to adjust its processes and ways of working so that we will be ready - once the reforms are live - not only to remain compliant but also to maximise the opportunity which the reforms offer to improve public procurement for CCS, for the buyers that use our agreements and for suppliers.

We have also taken steps to strengthen our supplier assurance, in particular by building our capacity to assess and monitor suppliers’ economic and financial standing in line with commercial best practice.

We have taken action to ensure our commercial agreements help drive policy through procurement - tackling modern slavery, enabling social value and sustainability as well as supporting small and medium-sized enterprises (SMEs) access to public procurement opportunities and encouraging prompt payment practice.

Financial performance

We exceeded our financial targets in 2022/23. Total income was £177.6 million and expenditure was £94.9 million, delivering a surplus before other operating costs of £82.7 million (2021/22: £85.8m). Other operating costs of £4.2 million were also incurred relating to the NHS Future Operating Model, Digital and Data Services, and Procurement Capability. After interest and dividends, the retained surplus was £45.3 million (2021/22: £68.5m). The in-year surplus achieved was the result of planned and continuing growth in use of our commercial agreements, especially through increased usage of partnership arrangements to drive better value and improve the commercial benefits arising to customers. We also continued to manage our cost base effectively with headcount in the organisation particularly closely managed following Cabinet Office direction.

The opening General Reserve of £132.1 million increased to £177.5 million. Indexation of intangible assets resulted in a revaluation gain of £0.05 million. There was no change to Public Dividend Capital (£0.35m) meaning that the total of taxpayers’ equity in CCS increased from £132.6 million to £178.0 million. More information is contained within the notes to the accounts on pages 85 to 101.

The Dividend which the Cabinet Office receives from CCS was £36.0 million in 2022/23 (2021/22: £15.0m). This covers the costs of the Complex Transactions, Continuous Improvement, Markets, Sourcing and Suppliers and Policy teams which were previously transferred from CCS to the Cabinet Office. The Dividend is also used to fund the expansion of commercial capability across government, including upskilling the commercial workforce, providing expertise on complex projects and managing relationships with strategic suppliers.

In 2022/23 CCS achieved a Return on Capital Employed of 50.6% (2021/22: 84.9%) which was significantly above the 5% target as set out in the Treasury Minute.

The last five years of CCS’s income and costs are shown on page 103.

Our strategy of inward investment for the future, stimulating growth in customer spend and increased commercial benefits continued in 2022/23. CCS continues to invest to enhance internal systems, digitise online access to our commercial agreements and improve ways of working for both our customer users and suppliers.

We have continued our commitment to paying creditors in line with government policy on prompt payment. In 2022/23, CCS paid 98.9% (2021/22: 99.9%) of undisputed supplier invoices within 5 days and 100% (2021/22: 100%) of undisputed payments due within 30 days.

As a Trading Fund, CCS is expected to generate sufficient funds to meet its operating costs and prevent the need for recourse to the Cabinet Office or HM Treasury for financial support. Prudent financial management means that CCS should ensure sufficient cash reserves are in place to mitigate against financial risk arising from any sudden reduction in customer demand, unexpected increases in expenditure or inability to collect income through systems failure. CCS will continue to adopt prudent cash and working capital management to ensure it is able to continue to operate as a going concern.

Key issues and risks that could affect CCS in achieving its objectives

We manage risk across all activities carried out by the business at a strategic and operational level, focusing on achievement of our Business Plan objectives. Risk management is coordinated across a network of risk management champions and business managers representing each team within the business.

The Executive Board reviews the Strategic Risk Register and the effectiveness of mitigations on a monthly basis. The main Board and its sub-committees also review the Strategic Risk Register with a focus on the effectiveness and impact of mitigating actions.

Operational risks are reviewed by the Risk Assurance Group and a summary report is provided to the Executive Board on a monthly basis.

The Audit and Risk Assurance Committee provides scrutiny of the overall system of governance, risk management and control and the Committee Chair provides an annual update to the Cabinet Office Audit and Risk Committee.

The areas of strategic risk that had the potential for preventing the business from achieving its objectives in 2022/23 are set out in the following table. All of these risks are subject to continuous review.

The areas of strategic risk that had the potential for preventing the business from achieving its objectives in 2022/23 are set out in the following table. All of these risks are subject to continuous review.

| Risk area | Risk ‘Failure to’ | Key mitigations applied | Impact of mitigations |

|---|---|---|---|

| Customer | Deepen our relationships with customers and extend our presence and engagement within our market sectors, as defined by market segmentation | Implementation of market segmentation strategies and strategic account management. Further development of the partnership arrangements with other professional buying organisations. Initial development of a more robust approach to capture customer feedback. Development of richer data and customer insight to better support our customers achieve better value from their procurements. | The level of risk has been reduced. The impact has remained the same (significant) but the likelihood has reduced from severe to moderate. |

| Product | Provide a clear and compelling set of products and solutions with easy access to a diverse range of suppliers that meet the needs of customers, deliver value, achieve policy outcomes and which sustain required levels of business growth |

Product portfolio review with ongoing consolidation of products to better meet customer needs aligned to market segmentation strategies and customer sectors. Improved enterprise-wide governance of commercial agreement design. Procurement reform programme established to ensure readiness of commercial agreements to meet the requirements of the new regime and customer expectations. Review, refinement and greater standardisation of commercial agreement customer guidance. Implementation of a more robust approach to supplier management through development of more effective policies and procedures and training. |

The level of risk has been reduced. The impact has reduced from severe to moderate and likelihood has reduced from very likely to unlikely. |

| Service | Maintain and extend the use of the services and support we provide to customers through making best use of our capability in running procurement operations and our category expertise and knowledge of markets and suppliers | Creation of capacity for carrying out more assisted procurements through reducing the volume of low value procurements for customers. Commercial futures workstreams established to review and improve advisory services relating to category strategies, commercial solutions, supply market strategy and product sourcing strategy. Review of organisational approach to facilitating aggregated procurement for customers through mechanisms such as e-auctions and implementation of volume pricing mechanisms within commercial agreements as part of their design. |

The level of risk has been reduced. The impact has reduced from significant to moderate and likelihood has reduced from very likely to likely. |

| People Capability | Attract, develop and retain the required capability and to deploy resources flexibly across the organisation to meet priority business needs and to sustain continued business growth | Further refinement and implementation of the Strategic Workforce Plan along with annual pay review to determine competitiveness of reward package, including salary. Implementation of improved talent management and succession planning. Budget provision for contracting with service delivery partners established to address shortfalls in specialist capability and capacity more broadly. Establishment of a project delivery function to better manage the implementation of projects and programmes. |

The level of risk has reduced. The impact has reduced from significant to moderate and the likelihood has remained the same (possible). |

| Technology & Digital Capability | Deliver technology and digital solutions aligned to the business strategy which meets the needs of our business and our customers (buyers and suppliers) | Digital strategy review resulting in the design of a more effective target operating model which aims to create the right balance of in-house expertise/leadership with operational excellence. Improved governance of digital project development along with the establishment of a digital analytics capability. Continuous improvement of information and cyber security. |

The level of risk has reduced. The impact has remained the same (significant). The likelihood has reduced from very likely to unlikely. |

| Organisational Effectiveness | Continuously improve organisational efficiency, effectiveness and sustain business growth | Implementation of a new governance structure to better support the Executive Board (three sub committees; P&S, DD&T and People, Health & Safety & Finance). Annual operational management assurance assessment carried out with review and challenge by the Accounting Officer. Assessment against functional standards. Continued focus on organisational efficiency (more with less) through planning and organisational performance reviews. Establishment of budget for Service Delivery Partners to create capacity. |

The level of risk has reduced. The impact has reduced from significant to moderate and the likelihood has reduced from possible to unlikely. However, there is a significant amount of business change being implemented which must not distract the organisation from delivering ‘business as usual’ activities. |

Performance analysis

How CCS measures its performance

Organisational performance has been measured on a monthly basis through a corporate dashboard, which tracks progress against business plan objectives and the business strategy and forms the basis of a formal monthly review at the Executive Board. The Executive Board also performs a quarterly performance review with a focus on key risks and issues.

Organisational performance has been a standing agenda item at Board meetings. A summary performance report has been produced for this, drawing upon the corporate dashboard. Additionally, the monthly summary performance report has been issued for use by staff.

Performance against Business Plan objectives

Below we have set out our key performance measures and the resulting assessment and achievements mapped against the components of the organisation’s business strategy and strategic objectives. CCS operates a set of strategic KPIs and these are set out beneath the performance tables.

Commercial benefits

| Performance measure | Assessment and achievements |

|---|---|

| Target £2,613 million of spend related commercial benefits representing a target gross margin 7.9% on £30.43 billion. This comprises: • £1,611 million for CG with a target gross margin of 8.12% on £18.24 billion of spend • £1,002 million for WPS with a target gross margin of 7.59% on £12.20 billion of spend Target £100 million of business change related benefits |

Fully Achieved Total £3,591 million of spend related benefits representing a gross margin of 10.37% on £31.02 billion comprising: • £2,371 million for CG with a gross margin of 10.83% on £19.51 billion of spend • £1,220 million for WPS with a gross margin of 9.59% on £11.51 billion of spend £206 million of business change related benefits were also signed off by customers |

Spend growth

| Performance measure | Assessment and achievement |

|---|---|

| Direct spend of £25.40 billion (2021/22: £23.20bn) Of which: CG £15.99 billion (2021/22: £16.09bn) WPS £9.41 billion (2021/22: £7.11bn) |

Partially Achieved Direct Spend of £25.30 billion Of which: CG £16.94 billion WPS £8.36 billion |

| Performance measure | Assessment and achievement |

|---|---|

| Public sector commercial agreement spend of £2.44 billion (+£210m on 2021/22) |

Fully Achieved Public Sector Commercial Agreement Spend of £2.85 billion |

| Transacted spend of £2.59 billion (-£1.31bn on 2021/22) |

Fully Achieved Transacted Spend of £2.87 billion |

Key objectives

| Customer | ||

|---|---|---|

| Performance measure | Assessment & achievements | |

| Sector strategies | All 7 sector strategies developed and being implemented by March 2023 | Partially achieved All strategies developed. Priority Delivery Authorities established to lead on implementation with more being established in financial year 2023/24 |

| Partnerships | Achieve at least a 20% increase in spend through new and / or existing partnerships compared to £2.2bn baseline for FY 2021/22 | Fully achieved Spend growth of £530 million (21%) achieved |

| Opportunity management | >40% of potential opportunities by volume converted into new business | Fully achieved Conversion rate of 70% achieved |

| Marketing - generating leads | Generate >5,000 leads and prospects with evidence of new opportunities in the pipeline | Fully achieved c8,000 leads & prospects generated |

| Self serve user feedback | Establish a feedback mechanism for commercial agreements by March 2023 | Not achieved Business case approved with implementation delayed to financial year 2023/24 |

| Product | ||

|---|---|---|

| Performance measure | Assessment & achievements | |

| Cross category solutions | Establish business cases for new cross cutting commercial agreements or solutions for use by customers by March 2023 | Partially achieved An increasing number of mandates for new and replacement commercial agreements were approved with cross category design as part of portfolio consolidation |

| Volume pricing mechanisms | Establish approach to test and implement volume pricing in the design of commercial agreements by September 2022 | Partially achieved Policies and principles established which require new and replacement commercial agreements to include, where appropriate, volume pricing and aggregation mechanisms in their design. Implementation is scheduled for FY 2023/24 as part of the commercial agreement development process |

| Compliant & effective Product portfolio | Award up to 27 commercial agreements | Partially achieved 26 commercial agreements awarded. The business requirement to prioritise and consolidate new and replacement agreements resulted in commercial agreement redesigns and fewer awards |

| Influencing and shaping Procurement Reform | Establish and implement programme to prepare organisation for rules reform | Fully achieved Programme established with workstreams ensuring organisational readiness. The programme will continue into FY 2023/24 |

| Gap analysis completed by December 2022 | Fully achieved Issues to address have been identified and the workstreams are systematically putting in place requirements |

|

| Policy through procurement & commercial standards | All awarded CAs have social value & other relevant policy considerations as well as alignment to commercial standards factored into the design | Fully achieved All awarded commercial agreements have been assured for alignment to policy requirements (where applicable) as part of the governance process |

| Service | ||

|---|---|---|

| Performance Measure | Assessment and achievements | |

| Expand capacity of assisted procurement service | Full business case for expansion of procurement service developed, signed off and with resources identified by June 2022 | Partially achieved Change of strategic direction arising from CO 2025 and constraints. Focus has been on reducing volume of low value procurement to create capacity for high value procurements |

| Achieve Annual Contract Value of at least £2bn through assisted procurements |

Fully achieved £2.29 billion Annual Contract Value with 93% delivered within agreed timescales |

|

| Post procurement NPS score is at least maintained at 55 | Fully achieved Post Procurement Score of +69 |

|

| Category advice | Capture and record all significant change and advisory impacts | Fully achieved Business change benefits of £206 million were achieved for our customers |

| Category & thematic advice | Implement recommendations from the CNZ and PFI projects | Partially achieved Both projects are on track to deliver target benefits. PFI has been embedded into ‘business as usual’ operations. CNZ enters Phase 2 of the project during FY 2023/24 |

| CCS strategic supplier relationship management (SSRM) | CCS SSRM programme defined and agreed with the Markets & Suppliers unit within the Cabinet Office’s Central Commercial Team by September 2022 | Partially achieved Further enhancements are being carried out through the refinement of the operating model for the Commercial Directorate |

Strategic Key Performance Indicators

Our organisational performance is measured through a set of KPIs. They are used to both measure in year performance as well as inform target setting and planning for future years to maintain target trend.

| Headline measure | 2022/23 target | 2022/23 result | ||

|---|---|---|---|---|

| Business growth - the extent to which we are growing our business | 1 | Direct spend as a percentage of total spend on CG&S | Increase market share to 20.94% | Partially achieved A market share of 20.86% |

| Business efficiency - our cost in relation to our outputs | 2 | Core cost as a percentage of aggregate spend | To achieve a cost ratio of less than 0.31% | Fully achieved A cost ratio of 0.28% |

| 3 | Core cost as percentage of spend related commercial benefits | To achieve a cost ratio of less than 3.66% | Fully achieved A cost ratio of 2.43% |

|

| Business effectiveness - how effective we are in achieving benefits for our customers | 4 | Spend related benefits as a percentage of aggregate spend | To achieve an effectiveness ratio of more than 7.91% | Fully achieved An effectiveness ratio of 10.37% |

| 5 | Income as a percentage of aggregate spend | To achieve an effectiveness ratio of 0.57% | Fully achieved An effectiveness ratio of 0.57% |

|

| Customer - what our customers think of our services | 6 | Customer Service Net Promoter Score | +55 | Fully achieved +65 |

| 7 | Assisted Procurement Net Promoter Score | +55 | Fully achieved +69 |

|

| People - how engaged are our people | 8 | Engagement score | Maintain top quartile | Fully achieved 69 |

| Financial - our effectiveness in financial management | 9 | Income less expenditure (P&L) / Net surplus (deficit) - pre Dividend | Target of £58.13 million | Fully achieved Surplus of £81.32 million - which includes interest received |

| 10 | Percentage rate of increase in income versus rate of increase in core cost | Target of 149.0% | Fully achieved 166.3% |

Key measures of success

Commercial benefits - the value that CCS drives for customers when purchasing through our commercial agreements. Our methodology allows for two routes for benefit calculations:

- ‘Spend Benefits’ are based on sampling all spend through a commercial agreement and calculating average benefit for all the customer population using the agreement, compared to current comparator market prices

- ‘Change Benefits’ are a specific measure applicable to an individual customer usually as a result of a business change influenced by CCS and signed off accordingly by the customer

Our aim is to continue to attract more business from both new and existing customers so that the public sector is able to realise increased commercial benefits in terms of benchmarked prices, as well as quality goods and services.

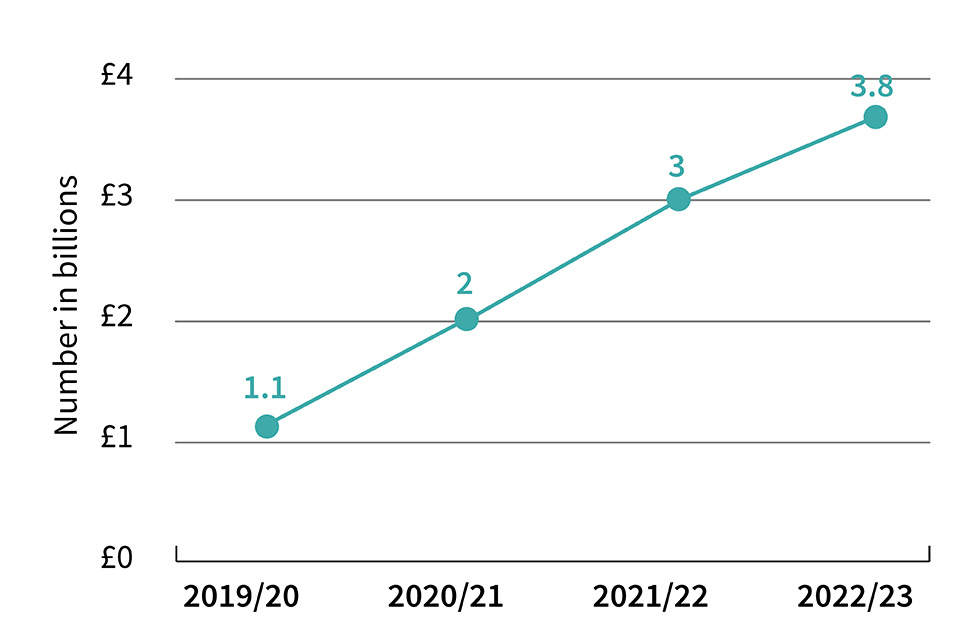

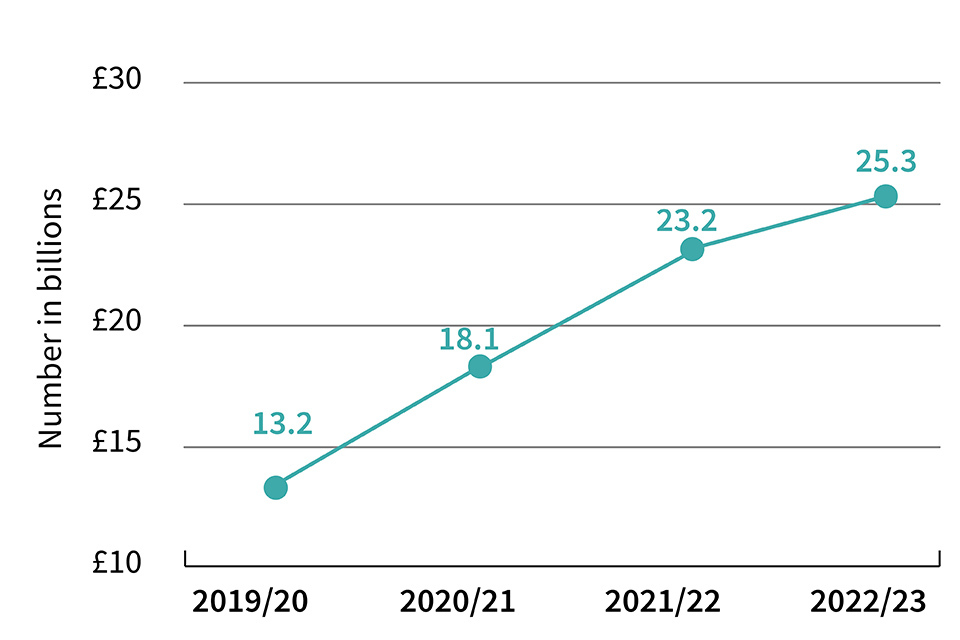

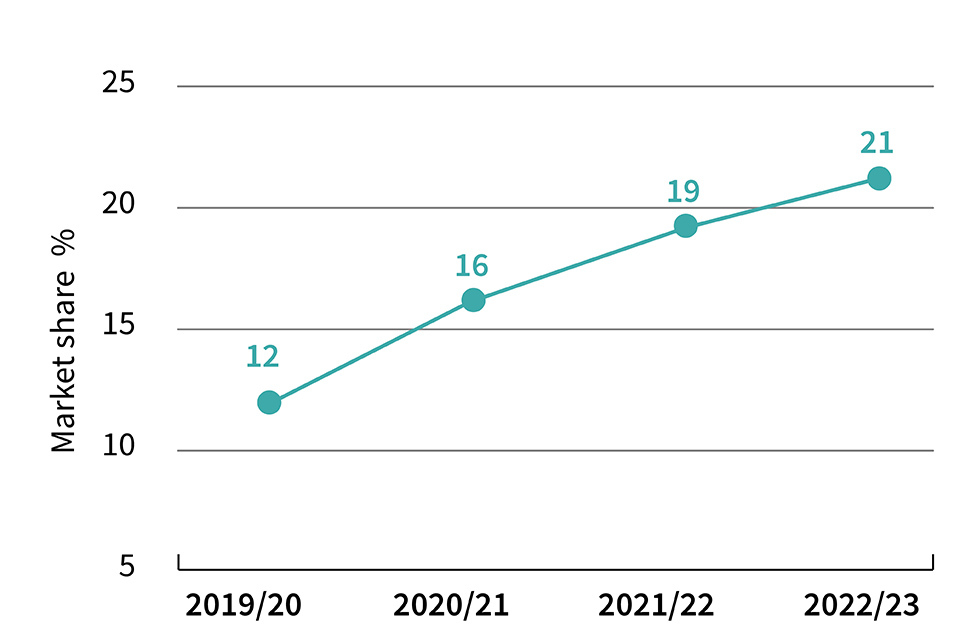

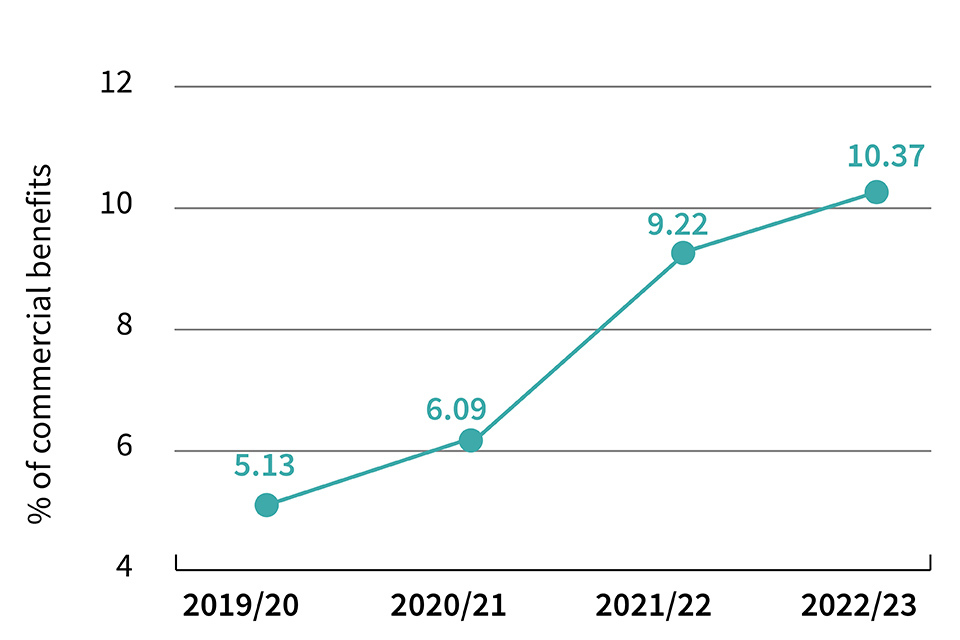

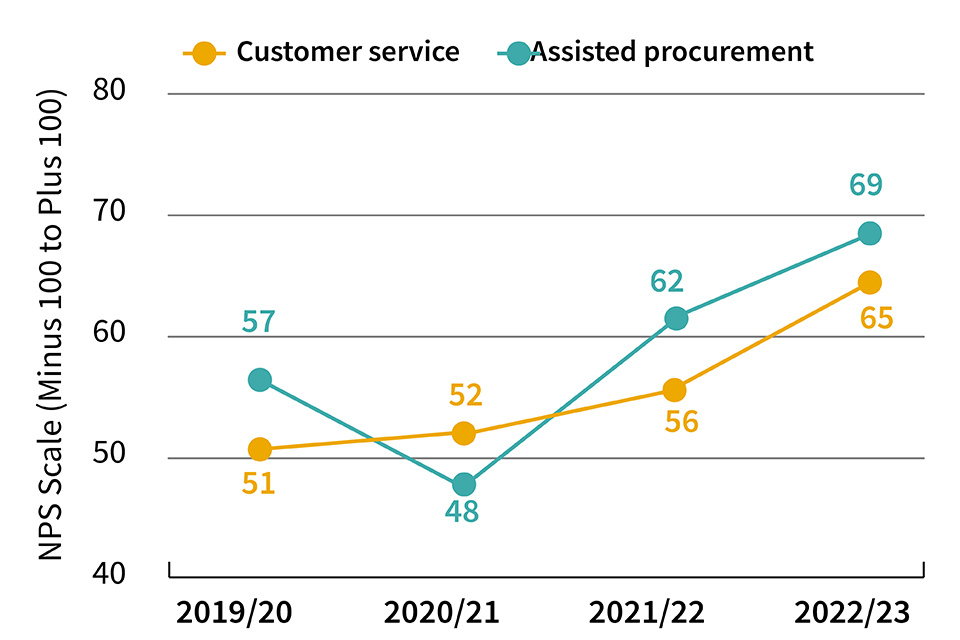

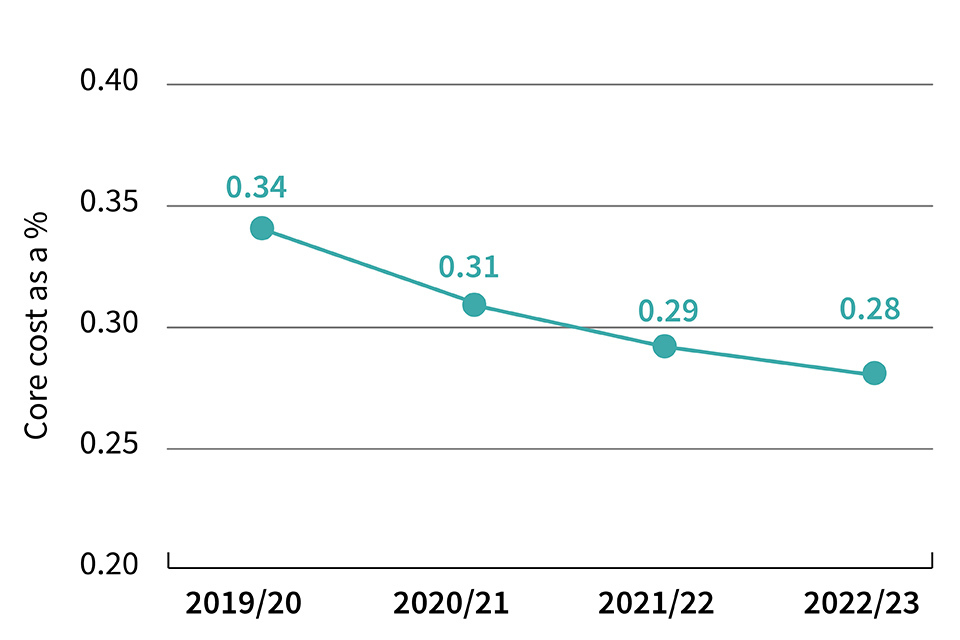

The graphs illustrate over the period 2019/20 to 2022/23 the following:

- growth in commercial benefits achieved through commercial agreements

- growth in spend directly through our agreements

- growth in our market share

- the gross rate of return - benefits as a percentage of spend

- the upward trend in our Net Promoter Scores for Assisted Procurement and Customer Service

- the downward trend in our core costs in relation to the output we manage (spend through the portfolio of commercial agreements)

Growth in commercial benefits achieved through commercial agreements

Commercial benefits (all spend types and change initiatives) for the financial year 2022/23 are £3.8 billion, up from £3.0 billion for the financial year 2021/22.

Direct spend and market share on common goods and services

Direct spend growth for the financial year 2022/23 is £25.3 billion, up from £23.2 billion for the financial year 2021/22.

Market share

Market share for the financial year 2022/23 is 21 percent, up from 19 percent for the financial year 2021/22.

Gross rate of return

The spend related commercial benefits as a percentage of aggregate spend for financial year 2022/23 is 10.37 percent, up from 9.22 percent for financial year 2021/22.

Net promoter scores

The NPS customer service score for 2022/23 was +65 for customer service and +69 for assisted procurement compared to +56 for customer service and +62 for assisted procurement in 2021/22.

Efficiency: cost in relation to output (spend channelled through commercial agreements)

Core cost as a percentage of aggregate spend managed for financial year 2022/23 is 0.28 percent, down from 0.29 percent for financial year 2021/22.

Sustainability report

The government has made a commitment to be CNZ by 2050. The Greening Government Commitments demonstrate how the government is working to improve the environmental performance of its estate and operations. As an organisation we are committed to supporting the GGCs in reducing our impact in these areas, to contribute towards meeting this target.

Our CCS estate is managed by the Government Property Agency and its partners. In previous years our landlords have reported on our GHG emissions, waste and water usage. However, we are now working closely with the GPA to provide data that reflects our proportion of office space in our shared buildings, in order to accurately report on our performance going forward.

We continue to work closely with the GPA and our landlords in reducing the environmental impact of our estate.

The Greening Government Commitments

The GGCs set out the actions government departments and their partner organisations will take to reduce their impacts on the environment in the period 2021 to 2025.

The following GGC reporting areas are not applicable to CCS and are therefore excluded from this report:

-

Nature recovery and biodiversity action planning – CCS does not have any significant natural capital. Our staff have participated in a number of ‘green’ voluntary initiatives across the UK throughout the year including beach cleans, brush cutting, habitat creation and general parkland maintenance to compensate for the lack of opportunity in this area within our estates and operation. CCS will look to incorporate a biodiversity action plan where possible in our climate change adaptation plan

-

Travel car fleet – CCS do not own, lease or hire any fleet cars and therefore cannot report on this area. However we are able to report on official business travel through other methods as detailed below

-

ICT – Environmental impacts of ICT and paper usage will be reported by the Cabinet Office who provide CCS’s ICT equipment. CCS have moved all of our internally managed services on to the AWS and Azure public clouds and benefit from the activities undertaken by those service providers with regards to the sustainability, carbon tracking and waste reduction associated with the services we host with them, as well as the reporting they provide in support of those efforts

Below is an overview of CCS’s performance against each GGC for the year 2022/23, with a breakdown of the metrics for each area included underneath.

Mitigating Climate Change: working towards Net Zero by 2050

CCS’s overall GHG emissions for the period 2022/23 are 316 tCO₂e and our direct GHG emissions are 217 tCO₂e. We have recently completed smarter working refurbishments to our offices, as well as upgrades to lighting, heating, ventilation and air conditioning systems which were part funded by the GPA’s Life Cycle Replacement and Net Zero programmes. In addition, the CCS travel policy has been updated to state that lower carbon options must be considered first when booking any business travel, with rail travel remaining the preferred option. To encourage greener commuting, CCS continues to offer a ‘Cycle to Work’ scheme to all employees and we currently have 10 active members of the scheme, an increase in headcount of 7 on last year’s report. It should also be noted that three of our five office buildings are currently on green energy tariffs to support the net zero target, and as part of our climate change adaptation plan we will be working with the GPA to move the remaining two sites across to a green tariff when contracts are up for renewal in the near future.

Minimising waste and promoting resource efficiency

In 2022/23 CCS produced 21.14 tonnes of waste, equating to 0.96 tCO₂e. Our waste bins are categorised and clearly labelled allowing us to manage waste efficiently, and monitor output. There is a strong focus on recycling across our offices with 63% of our total waste for the year having been recycled, helped by regular comms reminding staff how to correctly use the waste bins.

CCS has minimal single use plastic across the organisation. All of our offices are equipped with ceramic mugs and glasses, stainless steel cutlery and ceramic plates for staff to use. In 2022 reusable cups were also introduced across all offices for staff to use when visiting food outlets for hot beverages to reduce single use plastic in the supply chain.

Finite resource consumption - reducing water use

The amount of water consumed across the CCS estate in 2022/23 was 1,440.53 cubic metres. The introduction of smarter working across the organisation has been a large driver in reducing consumption as staff are now able to work flexibly from a location to suit their needs rather than being office based. In addition, the recent office refurbishments have introduced combined hot and cold taps which have replaced the need for separate hot water boilers or kettles. These taps are an efficient system which only cool or heat what is required to avoid water waste and as an ISO14001 accredited manufacturer, they are helping to reduce emissions in the supply chain.

Procuring sustainable products and services

We remain committed to supporting the government’s 25 Year Environment Plan and the transition to a Net Zero GreenHouse Gas emission economy by 2050. We use relevant standards in contract specifications, and build in contractual levers such as social value provisions, enabling users of our agreements to meet their own sustainability goals.

In particular CCS is committed to the following sustainable procurement priorities:

-

applying relevant and appropriate buying standards and best practice industry innovation to all our procurement activity

-

reducing carbon emissions through the procurement of energy across government and the public sector

-

ensuring our procurements make a contribution towards reducing single use plastics in the supply of goods

-

ensuring our procurements and wider activities make a contribution towards the government’s Net Zero target for 2050

-

enabling the delivery of social value in public sector contracts through effective contract levers

-

helping address the risks of modern day slavery in government’s supply chains

-

supporting small and medium-sized enterprises through our procurements

Government Buying Standards

The Government Buying Standards (GBS) are a principal source of procurement guidance and set minimum mandatory buying standards for certain goods and services such as paper, office technology equipment, cleaning products, furniture and textiles, construction and fleet. Where relevant and aligned with the timing of their procurement, these standards are explicitly referenced in CCS’s current commercial agreements. CCS also consults with policy experts in other departments, as well as relying on the considerable expertise of our category teams who will incorporate industry level best practice where relevant.

Modern Slavery Prevention

We are committed to tackling modern slavery in global supply chains. Our agreements are designed to prevent modern slavery as part of our wider supplier due diligence. We continue to implement the key activities outlined in our Modern Slavery Statement, which sets out our approach to managing labour risks in our supply chains. The statement is available to view on our website.

We are working to ensure that there are appropriate measures in place to mitigate the risk of modern slavery throughout the whole commercial agreement lifecycle. All new commercial agreements are reviewed to ensure that they include a modern slavery risk assessment and outline the steps that will be taken to prevent the occurrence of forced labour abuses in the supply chain if the risk level is high.

Key to our work since April 2021 has been a determined focus on conducting effective follow-up conversations with suppliers whose Modern Slavery Assessment Tool (MSAT) assessments have returned high risk scores. We have held follow-up reviews with numerous suppliers, which has encouraged them to make improvements to their operations and risk management processes.

We understand how important access to information is in empowering our customers to buy responsibly. Our making responsible decisions web pages provide guidance and information on how we enable sustainable procurement.

Social Value

We continue to work with the Cabinet Office to fully embed PPN 06/20 and follow best practice in social value.

Our category strategies specifically address the opportunities to deliver social value in each market where we operate. Our new agreements are designed to allow customers to create tangible benefits in towns and cities across the UK, including an evaluation of suppliers’ approaches during the procurement stage.

Our internal network of social value champions continues to peer review each procurement for social value inclusion and share best practice across the organisation. Every new agreement we have launched in the past year has included social value provisions, enabling customers to work towards their economic, social and environmental objectives through procurement.

Where relevant, we include the ‘Fighting Climate Change’ social value theme in our agreements, meaning customers can ask suppliers to help them support environmental initiatives, including reduction of single use plastics in the delivery of contracts.

Small and medium-sized enterprises

We have seen continued good progress with our efforts to enable small and medium-sized enterprises to participate in our commercial agreements, with £2.59 billion (14.4%) of central government spend directly with 1,541 SMEs. This represents an increase of £340 million in spend compared to 2021/22. We continue to design our commercial agreements so that SMEs are able to benefit and that is why 70% of the suppliers on CCS’s commercial agreements are either micro (33%), small (24%) or medium (13%) sized enterprises.

Carbon Reduction Plans

Commercial agreements are being created with sustainability built in from the start. Where applicable, we apply PPN 06/21, requiring bidders to provide a Carbon Reduction plan, ensuring that agreement suppliers are committed to achieving CNZ by 2050. In support of this, the Sustainability team has delivered fortnightly training sessions on the PPN to raise awareness of the policy and its requirements, helping suppliers understand how to create a compliant Carbon Reduction Plan. This financial year, over 2,000 free tickets have been ordered by suppliers and customers for these sessions.

Additionally, our CRP Compliance Team has been offering a free assessment to ensure the Carbon Reduction Plans of suppliers on existing agreements are compliant. Since November, we have also started linking supplier Carbon Reduction Plans to the CCS website, both when suppliers have provided their plan voluntarily or as part of a tender requirement.

Carbon Net Zero projects

To support the government’s commitment to the United Nations Net Zero 2050 target, CCS has created a CNZ project team to identify the ways the organisation can help to deliver the Net Zero target of reducing GHG emissions by at least 100% against 1990 levels. The team has been involved with providing customer advice and assistance, supplier training and employee learning.

Employee engagement and knowledge-building are central to our project’s success. We have continued to team up with Get Informed Know your Impact (Giki) to bring colleagues a personalised employee sustainability engagement programme. Giki Zero Pro is an interactive way to learn more about climate change and what actions can help cut carbon emissions. As part of this programme, we have recruited sustainability champions to drive engagement and action, create tailored learning programmes, and encourage participation through new ideas.

Funding CNZ projects is a big consideration when developing plans. To support our customers, we have started collating a list of open CNZ grants and funding opportunities from across government into a single place. The grants are mapped to appropriate routes to market offered by CCS, making it easy for customers to fund and operationalise Net Zero initiatives. The Carbon Net Zero funding and grants page was launched in September 2022 and is updated on a regular basis.

In November 2022, CCS was awarded a place on the Net Zero 50 list for the work achieved by the CNZ delivery team, which has been supporting our customers to operationalise their Net Zero strategies to reduce carbon emissions through greener procurement.

Adapting to climate change

In 2023/24 CCS will develop a Sustainability Strategy which will set out the approach we intend to take towards the cross government target of CNZ by 2050.

As part of this strategy we will include a climate change adaptation risk assessment of our estate and an action plan as to how we will work towards the Net Zero target. CCS’s Workplace Services team will work closely with GPA who are leading on the reduction of carbon emissions from their buildings through the Life Cycle Replacement and Net Zero programmes. Over the next 5 years GPA plans to upgrade the heating, ventilation, lighting and utility meters across their estates, including those buildings occupied by CCS. We will work together to review CCS’s current systems and needs ensuring, where applicable, that any upgrade projects are successfully delivered - contributing to the reduction in our carbon emissions.

The Sustainability Strategy will also aim to increase carbon literacy amongst our staff enabling them to make informed green choices, both in the workplace and at home through initiatives such as Giki Zero. We will continue to put in place learning and development opportunities to educate in this area, as well as introduce training specific to our commercial team, looking at sustainable procurement in the supply chain.

We will continue to build awareness of green volunteering opportunities as well as provide an active Green Network as a forum for engagement on sustainability. We will work closely with our communications team on delivering an effective sustainability engagement plan at key points throughout the year using events, newsletters and blogs, as well as continue to provide information to colleagues through the CNZ hub on the intranet.

CCS Greening Government Commitments data

The tables below show the data gathered for 2022/23 on scope 1-3 emissions, including waste, water and official business travel. The data only includes those CCS offices in scope for reporting and has been extrapolated from full building data, showing figures based on space occupied.

The offices reported on below are:

-

Birmingham - 23 Stephenson Street - 70m2 - 48 FTE

-

Liverpool - The Capital Building - 1876.7m2 - 455 FTE

-

London - 10 South Colonnade, Canary Wharf - 482m2 - 127 FTE

-

Norwich - Rosebery Court, St Andrews Business Park - 1652m2 - 170 FTE

To avoid double counting, any data relating to our office at Concept House in Newport has been excluded as it will be reported by the Intellectual Property Office (IPO).

| Scope | Emission source/ activity | Detail | Amount (kWh) | tCO₂e | Expenditure (£) |

|---|---|---|---|---|---|

| Scope 1 | Natural Gas (CCS contribution) |

London | 2,945 | 0.5 | 73.00 |

| Birmingham | 0 | 0 | 0.00 | ||

| Liverpool | 23,291 | 4.3 | - | ||

| Norwich | 152,065 | 28 | 8,957.00 | ||

| TOTAL SCOPE 1 | 178,301 | 33 | 9,030.00 |

| Scope | Emission source/ activity | Detail | Amount (kWh) | tCO₂e | Expenditure (£) |

|---|---|---|---|---|---|

| Scope 2 | Electricity generated (CCS contribution) | London | 104,819 | 20.3 | 8,257.00 |

| Birmingham | 16,179 | 3.1 | 1,209.00 | ||

| Liverpool | 630,927 | 122.0 | - | ||

| Norwich | 201,764 | 39.0 | 47,698.00 | ||

| TOTAL SCOPE 2 | 953,689 | 184 | 57,164.00 |

As CCS’s emission data has previously been reported by our landlords as part of a whole building, we do not have access to the apportioned data required for the last 3-5 years for this report. However, steps are being put in place to ensure data is gathered at this granular level moving forward, and as such 2022/23 will become the baseline for CCS’s sustainability reporting.

NB: Figures in italics below indicate that the total usage reported for that line includes estimates for part of the year due to issues with gathering data. Estimates have been based on averages taken from the actual figures received. Some expenditure data is also unavailable. Processes are being put in place to avoid missing data in future reports.

| Scope | Emission source/ activity | Detail | Amount | tCO₂e | Expenditure (£) |

|---|---|---|---|---|---|

| Scope 3 | Upstream transportation and distribution | Transport of event equipment (miles) | 3,985 | 1.3 | - |

| Business travel* | Car (hire + grey fleet, miles) | 113,435 | 31.2 | 40,503.21 | |

| Rail travel (passenger, km) | 1,276,126 | 45.3 | 334,745.40 | ||

| Air (passenger, km) | 2,504 | 0.4 | 854.94 | ||

| Hotel stay | UK (room per night) | 1,300 | 13.5 | 110,434.49 | |

| UK (London) (room per night) | 510 | 5.9 | 64,753.35 | ||

| Waste disposal (CCS contribution) |

Energy from waste (tonnes) | 6.70 | 0.1 | - | |

| Landfill (tonnes) | 1.20 | 0.5 | - | ||

| Recycling (tonnes) | 13.24 | 0.3 | - | ||

| Water (CCS contribution) |

Water supply (m3) | 1,440.53 | 0.2 | 3102.00** | |

| Water treatment (m3) | 1,440.53 | 0.4 | |||

| Downstream transportation and distribution | (miles) | 0.00 | 0 | 0.00 | |

| TOTAL SCOPE 3 | 99 | 551,291.39 |

*Business travel does not include GCO deployed staff as their travel is booked via Cabinet Office

**Water expenditure excludes Birmingham and Liverpool as the data is currently unavailable

Scope 1 - direct emissions from owned or controlled sources

Scope 2 - indirect emissions from the purchase and use of electricity, steam, heating and cooling

Scope 3 - all other indirect emissions that occur in the upstream and downstream activities of an organisation

Further reporting areas

Sustainable Construction

During 2022/23 CCS completed the refurbishment programme at our Newport, Norwich and Liverpool offices in collaboration with the GPA. Although environmental assessment methods such as Building Research Establishment Environmental Assessment Method (BREEAM) were not used for the project, architectural specification did include the following clauses/items in relation to sustainability:

-

for office acoustics, a particular manufacturer was specified as they have a sustainability strategy that aligns with the UN’s Sustainable Development Goals

-

a specific manufacturer was requested for the kitchen installations, as this company has adopted sustainable practices in relation to material sourcing, manufacturing and their distribution fleet that has allowed them to achieve carbon neutrality in their factories in the UK and reach zero waste to landfill in their production operations

-

a specific brand of durable paints were requested as they can withstand repeated cleaning thus reducing maintenance cycles and the amount of re-decoration undertaken during the lifetime of the building. This brand also offers a recycling scheme for empty cans

-

the supply chain was encouraged to deliver materials to site without packaging

-

older furniture surplus to requirements was donated to local charities, businesses, schools and other government departments

-

where new furniture was procured, recyclable materials were requested where appropriate

Simon Tse CBE

Chief Executive and Accounting Officer

07 July 2022

Accountability Report

This Accountability report includes the:

-

Corporate governance report

-

Remuneration and staff report

-

Parliamentary accountability and audit report

The purpose of the corporate governance report is to provide an overview of CCS’s governance arrangements and the Accounting Officer’s responsibilities in managing and controlling the resources of the CCS Trading Fund during the financial year.

The remuneration and staff report sets out the policy and disclosures on directors’ remuneration as required by the Companies Act 2006 sections 420 - 422 and as interpreted in the Government Financial Reporting Manual. It also provides details on CCS’s staff numbers, composition, costs and other staff-related matters.

The Parliamentary Accountability and Audit Report brings together the key parliamentary accountability documents within the Annual Report and Accounts.

Corporate Governance report

Directors’ report

As an Executive Agency of the Cabinet Office, CCS is accountable to the Chancellor of the Duchy of Lancaster and Minister for the Cabinet Office. The holders of both roles during the financial year were:

-

The Rt Hon Steve Barclay MP (Chancellor of the Duchy of Lancaster and Minister for the Cabinet Office) from 1 April to 7 July 2022

-

The Rt Hon Kit Malthouse MP (Chancellor of the Duchy of Lancaster) from 7 July to 6 September 2022

-

The Rt Hon Nadhim Zahawi MP (Chancellor of the Duchy of Lancaster) from 6 September to 25 October 2022

-

The Rt Hon Oliver Dowden CBE MP (Chancellor of the Duchy of Lancaster and Secretary of State) from 25 October 2022 to date

-

Rt Hon Michael Ellis KC MP (Minister for the Cabinet Office) from 1 April to 6 September 2022

-

Rt Hon Edward Argar MP (Paymaster General and Minister for the Cabinet Office) from 6 September to 14 October 2022

-

Rt Hon Chris Philp MP (Paymaster General and Minister for the Cabinet Office) from 14 to 25 October 2022

-

Rt Hon Jeremy Quin MP (Paymaster General and Minister for the Cabinet Office) from 25 October 2022 to date

-

The sponsor of CCS is the Government Chief Commercial Officer, Gareth Rhys Williams

The governance of CCS was directed by the Board, comprising the Chair, Non-Executive Directors, Chief Executive and Director of Finance, Planning and Performance. Tony van Kralingen was Non-Executive Chair during the reporting period and Simon Tse CBE was Chief Executive and Accounting Officer for the Trading Fund for the period 1 April 2022 to 31 March 2023.

After eight years of service as a Non-Executive Director, David Wakefield stepped down from the CCS Board in November 2022. Steve Weiner was appointed as a new Non-Executive Director from September 2022 and became Chair of the Audit and Risk Assurance Committee from November 2022. Sara Halton was also appointed as a new Non-Executive Director from September 2022.

The attendance list is provided on page 44 and the remuneration of all Board members during the year is shown on page 53 of the remuneration and staff report.

Managing outside interests