Consolidated budgeting guidance 2014 to 2015

Updated 3 July 2014

Foreword

Context

The fiscal mandate, against which the independent Office for Budget Responsibility judges the Government’s plans, is to eliminate the structural current budget deficit over a five year rolling horizon. The Spending Review 2010 set out how the Government will deliver its deficit reduction plan reducing spending by around £80 billion by 2014-15.

Since then the UK economy has been hit by a series of shocks that significantly weakened the economic and fiscal outlook. In the Spending Round 2013, the Government announced its plans to ensure it continues to meet its fiscal targets and protect the economy and will reduce pending by around £11 billion in 2015-16.

Since the Online System for Central Accounting and Reporting (OSCAR) was introduced in 2012, a system of Common Chart of Account Codes has been introduced. The introduction of these Common Chart of Account Codes will ensure the reporting of public spending data will be consistent, accurate and timely across all Departments.

Years of applicability

This budgeting guidance applies to in year control from 2014-15.

Substantive changes to budgets

This section sets out the main areas where the guidance has been changed for 2014-15

The guidance on Prior Period Adjustments (PPAs) has been updated to clarify the use of such adjustment and to align the Estimates treatment with that in accounts. See Appendix 5 to Chapter 1 for details.

The guidance on Budget Exchange has been updated to include details of the flexibilities to retain income from asset sales as announced in the Spending Round 2013. See Chapter 2 for details.

The guidance on the recording of Single Use Military Equipment has been updated to comply with the changes to the treatment in National Accounts as laid out in the updated European System of Accounts 2010 (ESA10). See Chapter 6 for details.

The guidance on the impact of the revaluation of impairments has been updated in relation to Higher Education loans book not for sale (e.g. post Browne loans). See Chapter 8 for details.

1. Overview: Introduction to budgeting

Purpose of public expenditure control

The budgeting system has two main objectives:

- to support the achievement of macro-economic stability by ensuring that public expenditure is controlled in support of the government’s fiscal framework

- to provide good incentives for departments to manage spending well so as to provide high quality public services that offer value for money to the tax-payer

In addition, the Treasury tries to keep down the compliance costs of the budgeting system and of the overall public spending control framework.

Fiscal framework

The Government’s objectives for fiscal policy are set out in the Charter for Budget Responsibility. These are to:

- ensure sustainable public finances that support confidence in the economy, promote intergenerational fairness, and ensure the effectiveness of wider government policy

- support and improve the effectiveness of monetary policy in stabilising economic fluctuations

The means to achieving these objectives are through the Government’s fiscal mandate, which the Chancellor announced in the June 2010 Budget. The fiscal policy mandate is also set out in the Charter for Budget Responsibility:

- it is a forward-looking target to achieve cyclically-adjusted current balance by the end of the rolling, five-year forecast period

- supplemented by a target for public sector net debt as a percentage of GDP to be falling at a fixed date of 2015-16, ensuring the public finances are restored to a sustainable path

The mandate and the supplementary target for debt are measured with reference to two fiscal aggregates:

| Cyclically-adjusted current balance | Measures total managed expenditure (minus spending on net investment) less public sector current receipts, after adjusting for any spare capacity in the economy. |

| Public Sector Net Debt (PSND ex) | A measure of the stock of debt that includes the government’s financial liabilities (such as gilts and National Savings) less liquid assets. Finance leases and on balance sheet PFI, lending under financial transactions made for policy reasons, such as lending to students, increase PSND. Placing surplus money on deposit creates a liquid asset, which offsets gross debt. |

The Government will use the ONS measures that exclude the temporary effects of financial interventions but account for any permanent cost to the taxpayer.

These aggregates are measured using the National Accounts. These are prepared in accordance with the internationally agreed framework ‘European System of Accounts’ (ESA95). ESA95 in turn is consistent with the System of National Accounts (SNA93), which was prepared under the auspices of the United Nations and is in use across the globe. The Office for National Statistics (ONS), acting as an independent agency, is responsible for the National Accounts.

Comparison with Departmental Accounts

Departmental Accounts (DAs) are based on International Financial Reporting Standards (IFRS) as interpreted by the Financial Reporting Manual (FReM). Many transactions are treated in the same way in DAs and National Accounts: pay is a current expense in any system of accounts. But there are a number of differences between the two systems of accounts.

These differences in accounting treatment explain some of the cases where DAs and budgets treat transactions differently, since budgets are trying to achieve objectives expressed in terms of the National Accounts rather than IFRS accounts. The number of these differences has been reduced as a result of Treasury’s Alignment Project, which was implemented for budgets in 2010-11.

Annex A lists the main differences between budgets and DAs.

Role of the department

The budgeting system tries to ensure that departments have good incentives to manage their business well, to prioritise across programmes, and to obtain value for money.

So for example, departments are given SR settlements that allow for sensible planning. There are rules allowing departments to offset certain income against budgets when that helps management.

The Government published a framework for improving spending control. This sets out the Government’s priorities for spending control in terms of monitoring, managing and the scrutiny of public spending.

Compliance costs

Compliance costs are kept down by basing the budgeting rules on the DAs that departments draw up for parliamentary and public reporting purposes. Treasury intends that the treatment of transactions should always be aligned between budgets, Estimates, and accounts where possible.

However, where it is desirable either because of the need to support the fiscal framework or because controlling spending against information in DAs would not provide the right incentives for departments, the budgeting rules have a different treatment from DAs. In such cases departmental Estimates will normally follow the budgeting treatment.

Role of HM Treasury

The Treasury is responsible for the design of the budgeting system. We will always be happy to explain the budgeting rules. It is only the Treasury which may finally determine the budgeting treatment of a transaction.

The guidance does not cover every case. Sometimes we have deliberately kept the guidance simple for departments because certain transactions are rare or typically small. But there might be cases where if a large instance of such a transaction were to take place it would impact on the fiscal framework. So we will sometimes impose restrictions, even if the guidance does not provide for them, to protect the fiscal framework or to provide better incentives for departments. If departments face new circumstances, which might lead to difficulties for the fiscal framework, they should contact their Treasury spending team before they undertake the transaction.

Sometimes departments’ or public bodies’ consultants offer them suggestions for ways round the spending control framework. We have no interest in such schemes. Departments are asked to go with the spirit of the spending control framework. If a transaction is clearly just a way round the letter of the rules, then departments should follow the spirit of the rules. If you are in doubt, talk to your spending team.

Treasury Ministers have the right to modify the budgeting guidance at any time, although in practice we try to keep changes to a minimum and we generally consult departments before making significant changes.

Budgeting policies

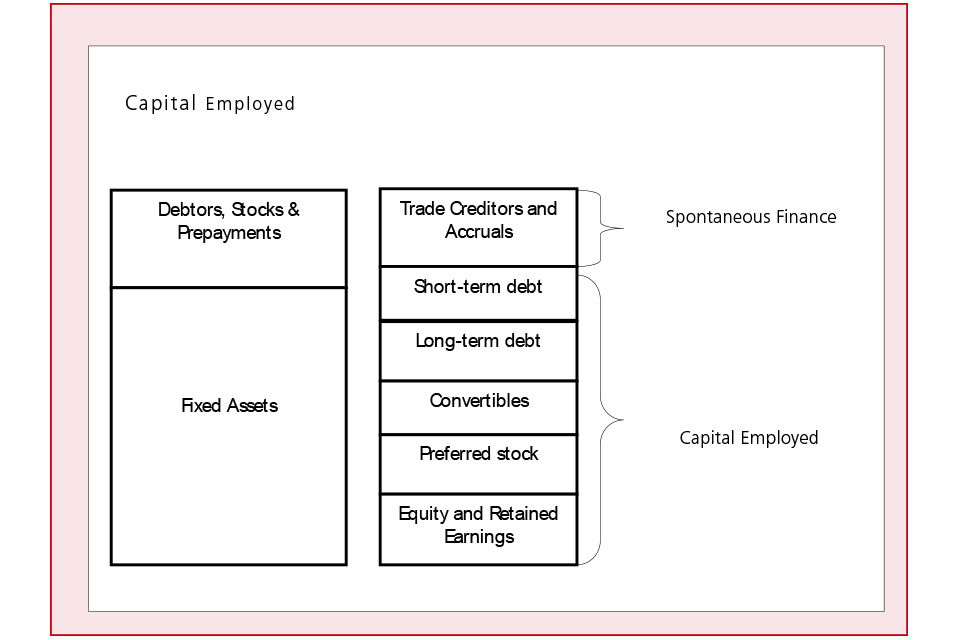

Resource and Capital budgets; Administration budgets

Departments have separate budgets for:

| Resource | Current expenditure such as pay or procurement and including depreciation, which is the current cost associated with the ownership of assets. |

| Capital | For new investment and net policy lending. |

Within the Resource budget DEL there are separate administration controls set in Spending Reviews. Administration budgets cover expenditure on running Central Government entities but excluding their frontline activities.

Appendix 1 to this chapter summarises the contents of budgets. Appendix 2 sets out the control totals diagrammatically. Appendix 3 sets out a list of the control totals – departments and their Treasury spending teams should at all times have a shared understanding of what the control totals are and how the department’s spending matches up against them. Appendix 4 details the criteria for AME treatment of levy funded bodies. Appendix 5 provides details of the treatment of Prior Period Adjustments (PPAs) in accounts, Estimates and budgets. Appendix 6 provides information on dealing with Machinery of Government changes.

Cash is not controlled directly through the budgeting system. However, the Net Cash Requirement for Supply Expenditure is controlled through the Supply Estimates processes. Changes in the expected level of use of cash provide useful monitoring information. Departments should discuss the reasons for planned increases in the level of cash spending with their Treasury Spending Teams.

Purpose of Budgetary Control Totals

These controls support the achievement of the fiscal framework and provide management incentives for departments.

Resource budgets are Treasury’s control over the level of current spending that impact on Surplus on the Current Budget (SOCB). Within the Resource budget some transactions will have an immediate or near-immediate impact on the fiscal position, for example pay, procurement and depreciation. Other transactions will only have an effect in future periods, for example the take-up of provisions, or revaluation of assets. Both types of transaction fall within the resource budget.

Administration budgets are controlled to ensure that as much money as practicable is available for front line services and programmes. Provision in the Resource budget that is not in Administration budgets is termed programme spending.

Capital budgets are controlled because net investment increases Net Borrowing and hence the level of debt.

Departmental Expenditure Limits (DEL) and Annually Managed Expenditure (AME)

Departmental Resource and Capital budgets are divided into:

| DEL | Limits are set in the Spending Review. Departments may not exceed the limits that they have been set. |

| AME | Budgets are set by the Treasury and may be reviewed with departments in the run-up to the Budget. Departments need to monitor AME closely and inform Treasury if they expect AME spending to rise above forecast. Whilst Treasury accepts that in some areas of AME inherent volatility may mean departments do not have the ability to manage the spending within budgets in that financial year, any expected increases in AME require Treasury approval. |

Within each of these budgets departments are expected to pursue efficiencies and prioritise expenditure in order to optimise the value for money of spending.

DEL or AME

As mentioned in paragraph 1.25 some transactions in the Resource budget do not have an immediate impact upon the Surplus on Current Budget (SOCB). In most cases these transactions will be recorded in Resource AME in order to allow HMT to control transactions which will have an immediate impact on SOCB in DEL. These transactions include the take-up and revaluation of provisions, and revaluations.

Where a transaction does have an immediate impact on SOCB it will follow the standard criteria set out below to determine whether the programme should be recorded in DEL or in AME.

Criteria for treatment in DEL or AME

All programmes are in DEL unless the Chief Secretary has determined that they should be in AME. The Chief Secretary may agree to put programmes into AME if:

- They are not only demand-led but also exceptionally volatile in a way that could not be controlled by the department and where the programmes are so large that departments could not be expected to absorb the effects of volatility in their DELs; or

- For other reasons they are not suitable for inclusion in firm four year plans set in the spending review. For example: Lottery spending is the product of the hypothecated tax on the National Lottery and may not be reprioritised elsewhere. Certain levy-funded bodies, which serve particular industries, are also in AME – see Appendix 4 to this chapter.

The Treasury regularly reviews whether programmes in AME are still suitable for AME treatment. Where appropriate programmes are moved into DEL.

Normally, a programme will have both its Resource and Capital budget impact in either DEL or AME, but there are some exceptions. Where a department agrees an exception with Treasury it should be included in their settlement letter during the spending review process.

The Treasury continues to look at what the options are to improve incentives to control AME.

Management of DEL programmes

Both DEL and AME programmes need to be managed to maximise effectiveness, efficiency and economy in the use of public funds. For programmes in DEL that is well understood. Because DEL programmes compete for resources within a fixed envelope departments are under a clear pressure to review programmes, re prioritise and pursue efficiency measures.

It is therefore important that departments produce and share with the Treasury accurate in-year forecasts of DEL spending and risks. The key elements of the monthly financial data submitted on OSCAR must be consistent with internal financial management information, such as Board reports and management accounts. Any inconsistency arising from timing differences must be reconcilable.

Where appropriate in the management of DEL programmes:

- the impact of DEL spending on AME spending needs to be considered; for example, DEL usually includes the cost of administering AME programmes and the quality of administration can have a significant impact on AME expenditure (and some DEL and AME programmes are complementary)

- if a proposed DEL spending change has extra costs for AME spending, then the proposal needs to be cleared with the Treasury before being implemented; the assumption is that any increases in AME will lead to matching reductions in DEL budgets

Management of AME programmes

AME programmes are spending like any other. They impact on the fiscal framework in the same way as DEL spending. They need taxes to be raised to finance them. So careful monitoring and management is just as important as it is with DEL. The nature of certain AME programmes means that some aspects of management, e.g. forecasting, are more important than with most DEL programmes.

The management of AME programmes serves the same ends as the management of DEL programmes, but the volatility of many AME programmes means that careful management is important.

Departments are reminded that with AME programmes also, just as with DEL, they need to put in place processes to monitor spending in year, to identify longer-term trends in spending, and to provide robust projections of future spending. Early identification of changes in AME spending is needed to allow risks to be managed effectively. In particular, departments should monitor spending in Resource AME and ensure that they take steps where appropriate to prevent undue increases in spending that affects the Surplus on the Current Budget (SOCB).

Departments should also review AME programmes regularly to ensure that they are helping to achieve government objectives effectively and efficiently. Departments should discuss with the Treasury proposals for optimising AME spending programmes.

They must obtain Treasury approval in advance for any changes which would increase AME spending (this includes both policy reforms and any administrative changes which impact on expenditure, for example measures to promote take-up) or if AME is likely to rise above expectation. Where the actions/inaction of a department increase AME, they are assumed to fund the increases in AME by reductions in their DEL budgets, or by identifying firm savings in AME. If AME spending is expected to come out higher than forecast, departments should also be prepared to discuss what steps should be taken to offset these increases. Whilst Treasury accepts that in some areas of AME inherent volatility may mean departments do not have the ability to manage the spending within budgets in that financial year, if the higher spending is likely to be permanent the department may be required to offset this elsewhere in their DEL or AME budgets.

Finally, departments should consider carefully the impact of AME spending on DEL spending and vice versa, both within and across departments. For example, DEL usually includes the cost of administering AME programmes and the quality of administration can have a significant impact on AME expenditure. And some DEL and AME programmes are complementary.

Switches

Switches and classification changes

Switches are real changes in provision reflecting real world changes in spending or plans. They need to be distinguished from classification changes, which restate budgets to reflect new ways of scoring an unchanged activity.

Suppose a department has activity X which costs £50 million and which is within administration budgets.

If the department cuts the costs of activity X by £10 million, it has made a real reduction in spending. It then has £10 million that it may reallocate to other spending in administration budgets or that it may switch to programme spending.

If the Treasury agrees that activity X should no longer be in administration budgets, then budgets are restated: the administration budget is reduced by £50 million, and the programme budget increased by £50 million within an unchanged Resource Budget DEL. The reclassification does not create spending headroom within the administration budget.

There is a passage below on types of adjustment to budgets.

Restrictions on switches

So that the control totals can work, departments are restricted in the switches they may make between them:

| Departments may not switch provision from AME to DEL. Such switches would prejudice the functioning of firm four-year budgets for DEL. Where the actions/inaction of a Department increase AME, they are assumed to fund the increases in AME by reductions in their DEL budgets. |

| Departments may not switch provision from Capital budgets to Resource budgets; such switches would mean that money that had been earmarked for investment was used for current spending. Such switches would impact upon Surplus on the Current budget. Departments may switch provision from Resource budget DEL to the Capital budget DEL but not from ring-fenced elements. |

| Departments are expected to manage their Resource budget DEL as an integrated whole, optimising spending across programmes (including programmes managed by ALBs and those involving Public Corporations). In order to encourage value for money and to support achievement of the fiscal framework, there are two general restrictions on the freedom to move provision across Resource DEL. |

| Departments may not switch from programme budgets to administration budgets. Such switches would mean increasing provision for back-office or policy staff at the expense of front line staff and programmes. Departments are free to switch provision from administration budgets to programme budgets. |

| Depreciation and impairments are ring-fenced within RDEL. If Treasury have agreed that depreciation will score to RAME then this will also be ring-fenced within RAME. Budget cover may not be reprioritised from within the ring-fence. If an impairment meets the criteria for scoring to RAME (as set out in Chapter 3 paragraph 3.30) this will also form part of the RAME ring-fence. Departments may freely switch provision from outside of the ring-fence to depreciation and impairments costs. |

| There are restrictions on switching into and out of support for local authorities. |

To relax any of the above restrictions would impact on the government’s fiscal mandate or its administration costs target and would therefore need to be absorbed by the Reserve (see paragraphs 1.50 to 1.54 below). For this reason, any request to waive the above restrictions is viewed in the same way as a request for support from the Reserve and the same process (which is outlined below) will be followed.

Policy ring-fences

In addition, as part of the SR settlement, some spending might be subject to specific ring-fences. If so, departments may not move money across the ring-fence, except as specified in the SR settlement. Ring-fences are normally set at the level of RDEL or CDEL. However, closer controls (e.g. on administration spending) may be set.

Departmental Unallocated Provision

Departments are encouraged not to allocate their DELs fully against their programmes at the start of a financial year but to hold some provision back to deal with unforeseen pressures that emerge subsequently, including utilisation of provisions. This unallocated budget is referred to as the Departmental Unallocated Provision (DUP).

DUP is reported in the Main Estimate as the difference between budgetary limits and the amounts allocated to specific functions; it is included within its own separate Estimate Line (within voted DEL) but cannot be spent by the department unless it is subsequently reallocated to appropriate functions in the Supplementary Estimate.

The Reserve

Departments are expected to manage their DEL budgets so as to stay within them. If pressures arise in one part of a DEL, departments should respond by:

- managing the pressures down

- using their DUP

- re-prioritising and making offsetting savings elsewhere in the budget

- deferring spending elsewhere in the budget

- transferring provision from Resource DEL to Capital DEL (if the pressure is in Capital DEL)

Exceptionally, a department may seek support from the Reserve. As part of the spending plans announced in Spending Reviews, the government allocates a Reserve for genuinely unforeseen contingencies that departments cannot absorb within their DELs. Separate Reserves are held for Resource and Capital DEL; both are small. Support from the Reserve to departments’ Resource or Capital DELs is non-recurrent i.e. it will not affect departments’ SR baselines. Increases are generally stripped out when baselines are agreed for Spending Reviews. The failure to hold sufficient contingency will count against the department when decisions about granting support from the Reserve are taken.

If the Chief Secretary agrees to provide support to a department from the Reserve then the amount will be repayable the following year by means of a reduction in the department’s DEL.

Departments that think they might require support from the Reserve should contact their Treasury spending team early so that alternative courses of action can be fully discussed while there is still time to put them into effect. Departments’ proposals should set out:

- the size of the pressure

- The cause of the pressure and why it was unforeseen

- the offsetting actions that have been taken and could be taken to manage the pressure and to absorb it, including cutting costs, cutting inefficiencies, cutting unnecessary programmes and cutting lower priority budgets

- the residual pressure, split into capital and resource, and the administration costs and programme elements

- the corrective actions they mean to take if support from the Reserve is agreed, as regards the substance of the policy, improved financial management, and paying back the amount provided

The drawdown of funding from the Reserve is subject to an assessment of need, realism and affordability at the time at which the funds are released. Reserve claims approved by the Chief Secretary should therefore normally be voted at Supplementary Estimates when such an assessment can most easily be made.

The Reserve and contingent liabilities

Departments are required to report contingent liabilities to Parliament. This process is separate from budgeting. The recording of contingent liabilities does not guarantee departments’ access to the Reserve. If a contingent liability matures, the normal budgeting procedures apply. That is, departments are expected to cover the costs by making offsetting savings as normal.

Keeping track of the numbers

Departments are expected to keep track of their authorised control totals on OSCAR as these change with Machinery of Government changes, other classification and transfer changes, issues from central funds, authorised transfers to RDEL, and – exceptionally – issues from the Reserve. Departments and spending teams should at all times use OSCAR to have a common understanding of the authorised levels of:

- resource budget DEL and within it:

- administration budgets

- non-ring-fenced Resource budget DEL

- capital budget DEL

- departments and spending teams should also have a common understanding of the planned levels – and risks of variances to plans – of:

- resource budget AME

- capital budget AME

Departments are expected to monitor spending against plan and to share information with their Treasury spending team (via bilaterally agreed information supply) and the Treasury collectively (via OSCAR).

Breaches of budgetary limits

Any breach of a budgetary limit is treated seriously, and departments need to take remedial action. Note that breaches can arise as a result of past errors treated as Prior Period Adjustments in accounts. See Appendix 5 for more details of how Prior Period Adjustments (PPAs) should be treated in budgets.

This passage sets out the process to follow where a department’s final outturn breaches the final level set for any of the following limits:

- resource budget – DEL

- administration budget

- capital Budget – DEL

- resource Budget – AME

- capital Budget – AME

For breaches in DEL the responsible Minister should write to the Chief Secretary as soon as practicable after the end of the year setting out:

- the size of the breach;

- why it occurred; and

- the remedial action that the department is proposing, including

- improvements in financial management to deal with the specific cause of the breach

- improvements in financial management to improve overall forecasting and control of the department’s control totals

- information that will be provided to the Departmental Board and to the Treasury to evidence these improvements

When departments overspend against their control totals, there will be an offsetting reduction in the corresponding control total in the following year.

Breaches in departmental AME do not automatically incur a penalty. However, unforeseen changes in spending may indicate poor financial management by departments. The department should therefore write to the Spending Team providing the same information as set out for breaches in DEL above. This should include the options for offsetting the higher spending through savings elsewhere in either the department’s DEL or AME.

Departments should discuss with their Treasury spending teams their proposals before their Minister writes to the Chief Secretary.

Policies that affect other departments’ spending

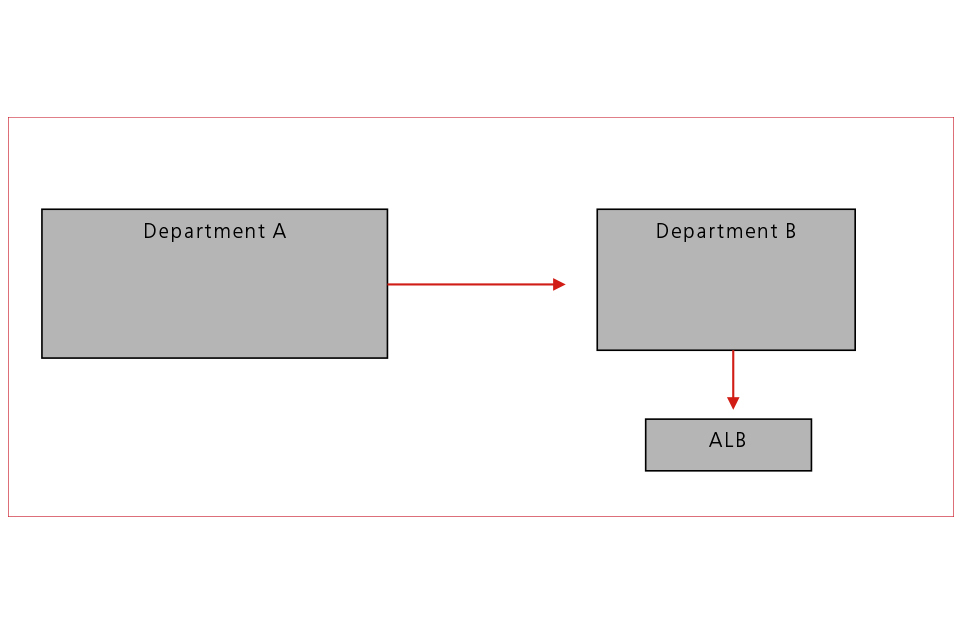

One department’s policies may affect the spending of another department. Sometimes the link is obvious, for example where several departments have joint responsibility for a change to outcomes. In other cases the link may be less clear: for example, the creation of a new offence may impose burdens on the police, prosecutors, legal aid, and offender management budgets. European Community directives may also impose costs on a range of departments.

There has been a long standing set of general principles governing the question of policy changes with resource implications affecting more than one department. These include:

| Any department proposing new policies, in whatever context, must always quantify the effects on public expenditure prior to a policy decision being made. In doing so, it must assess the effects not only on its own spending but also on the spending of other government departments, the devolved administrations for Scotland, Wales and Northern Ireland, and local authorities. |

| Decisions on how to finance a new proposal must be taken simultaneously with the policy decision. It is for the department proposing a change to consult those concerned (including HM Treasury) and agree new policy, including the finance of that policy, before a proposal goes forward for collective consideration. |

| The agreement on financing the downstream costs of new policy on another department may provide either that the costs be met by the originating department or that they be met by the department on which those costs fall. |

| In the absence of explicit agreement to the contrary, the normal presumption is that the originating department will absorb the cost. |

| Where consultation has not taken place, the strong presumption is that all costs, including those affecting other departments, will be absorbed by the department responsible for the new policy. |

| Where the originating department absorbs the cost it should make budget transfers to affected departments covering the whole of the SR period. |

| Where the costs fall, or come fully on stream, in the next SR period, it is for the department(s) that will meet the costs to conduct the SR discussions with the Treasury on funding in the next SR period. Where that department is the originating department, it should make budget transfers after the conclusion of the SR. |

| These arrangements include cases where a department’s policies impact on the AME spending of another department. The originating department may be expected to make DEL offsets to cover increases in AME spending (see passage on Management of AME Programmes above). |

| Treasury agreement is needed for all new policies with expenditure implications (see Managing Public Money). However, the Treasury does not arbitrate between departments on the question of who should bear downstream costs and will not provide funding where no agreement has been reached. |

Where department A has or introduces a policy that benefits another department B it may seek a contribution to the costs from that other department B. There is however no obligation on B to pay.

Any new proposals, regardless of where they originate, fall to the department responsible for implementing the proposals.

Charging for services

Where a department introduces charges for a service previously provided for free, or moves from a subsidised service to full cost recovery, it should normally transfer DEL cover to any customers in the Central Government sector to leave them no better and no worse off.

Retaining income / receipts

Only some of the income that come to a department benefits budgets. Separate chapters in respect of Resource and Capital budgets set out when departments may set income against DEL spending. That covers both which sorts of income count as negative RDEL / CDEL and also when departments may obtain the benefit of income higher than the levels taken into account in the SR.

New burdens on Local Authorities

Where a department wishes to impose burdens on Local Authorities, it is responsible for securing the necessary resources and fully funding them by budget transfer to ensure that there is no upward pressure on council tax levels. A new burden is defined as any policy or initiative which increases the cost of providing Local Authority services.

The policy applies to any new burden imposed on Local Authorities (including police and fire authorities) except for policies, which apply the same rules to Local Authorities and to private sector bodies (for example a change in the rate of employers’ National Insurance contributions).

Departments contemplating a potential new burden should contact CLG (Local Government Finance Directorate) at the earliest possible stage to discuss the procedures to be followed – see Annex B for contacts.

Transactions between departments

Transactions between public sector bodies should be constructed simply. For example, where department A buys an asset from department B the purchase price should normally be paid in full in cash on the day of completion. Departments should not enter into or spend money on complex deals which do not have a clear justification in fairness or incentives as these are unlikely to be good value for the public sector overall. Departments should not seek to exploit differences in budgeting rules between different public sector entities. Where departments are unsure how best to construct a transaction with a public sector body they should consult HMT.

Budget tax increases

Where the Chancellor announces tax increases that impact on departments the normal rule is that tax lies where it falls.

Types of adjustments to budgets

Adjustments within or between departments’ overall budgetary limits fall into three categories. In summary:

| Policy / Plan adjustments | Reflect deliberate decisions by departments to increase or decrease spending in a particular policy area, or in the way a policy is delivered (i.e. moving to a charging regime). |

| Classification adjustments | Reflect changes in budgetary totals driven by changes in the way the Treasury account or budget for spending rather than by actual changes in the level of activity or an increase / decrease in spending. For example the changes in budgeting policy announced in this guidance will be implemented as classification adjustments. Classification adjustments also include Machinery of Government changes where responsibility for spending moves from one Central Government body to another. Accounting policy changes – whether driven by the department or by the National Audit Office – also count as classification changes; note that these changes need the agreement of the Treasury. Changes in estimation or valuation techniques count as policy / plan adjustments or effect levels of spending against unchanged limits. |

| Inter departmental adjustments / Budget cover transfers | Reflect changes in detailed spending plans as a result of an agreed transfer of budgetary cover from one Department to another. Examples of where a transfer is appropriate is where there is an allocation from a ‘shared pot’, for example, the Criminal Justice Reserve, or when a Department agrees to transfer cover to another Department to cover one-off costs incurred as a result of a change in policy. |

The changes are implemented in different ways in budgets:

- departments are expected to accommodate the effects of policy / plan adjustments in their budgets, making offsetting reductions in spending

- classification adjustments lead to budgets being restated, normally across all the 8 or 9 open years on the OSCAR system

- interdepartmental adjustments / Budget cover transfers lead to restated limits of the departments concerned

In addition departments may record changes to their expenditure numbers as Budgetary Outturn adjustments, which are not a change to the budget – they are used to describe changes against final budget allocations and are used for recording outturn.

It is the Treasury that determines finally what type of adjustment a change is. Departments that are in doubt should contact their Treasury spending team.

Annex C sets out where to find further guidance on types of adjustment.

Public sector and public bodies

The public sector in the National Accounts comprises Central Government and Local Government, which together make General Government, and Public Corporations (bodies which are publicly owned or controlled and which operate in a market or which trade). Budgeting rules apply to all bodies in Central Government.

It is the Office for National Statistics (ONS) that determines whether a body is in the public sector. You can look up the sector classification of bodies where that has been determined by the ONS in their Sector Classification Guide publication (see Annex C for the link).

The Treasury publishes a guidance note on sector classification (see Annex C for the link). In broad terms, bodies are in the public sector if they are owned or controlled by public sector bodies. A body will be controlled for example if the sponsoring department appoints a majority of Board members. Sometimes a lesser degree of influence can still be held to give control. The legal form of a body does not tell you what sector it is in. So, for example, if an ALB sets up a wholly owned subsidiary in the form of a limited company under the Companies Act that body would be public sector because it would be wholly controlled by the ALB.

Subsidiaries, interests in associates and joint ventures classified to the public sector are consolidated with parent bodies for budgeting. So if an ALB sets up a public sector non-trading body it will be part of the ALB’s DEL allocation from the parent department.

Departments and public bodies who are in doubt about an actual or proposed body’s sector classification should approach the Treasury for advice. The ONS should only be approached via the Treasury. That restriction on direct access to the ONS is so that the Treasury can:

- advise departments on the interaction of classification and policy (the ONS do not involve themselves in policy formulation)

- consider the implications for budgeting of any proposal

- provide the right information to ONS in the right way, without lobbying, and respecting the ONS’ independence

Departments that are setting up a new body that will be or might be in the public sector should contact the Treasury’s budgeting and classification branch with their proposals for budgeting, accounting and recording the body. The Treasury will pass the information on to:

- the ONS

- the Cabinet Office (see the section on Arms Length Bodies (ALBs) below) who are responsible for ensuring proper governance, which includes accountability and financial management, of central government public bodies and Public Corporations (PCs)

Departments should not spend money on consultancy advice on National Accounts sector classification and should discourage their sponsored bodies from doing so. Sector classification is unlikely to be an area where consultants have expertise. The Treasury will provide advice on request.

Departmental accounts and the National Accounts

IFRS standards include criteria for judging when bodies should be regarded as subsidiaries; the Financial Reporting Manual (the FReM) has adapted the standards so that consolidation applies only to bodies classified to the Central Government sector. Where a reporting body has a subsidiary that falls within the FReM definition it should be consolidated within group accounts. The criteria applied by IFRS (as adapted) are very similar to those used in National Accounts so normally the decision whether a body is a subsidiary under IFRS (as adapted) and whether it is a public sector body in the National Accounts under ESA95 will be consistent.

Whole of Government Accounts (WGA)

The Treasury produces WGA IFRS based accounts that are a consolidation of the accounts of most public sector bodies. Inclusion in WGA is based on the same National Accounts standards as budgets and Departmental Accounts. Since WGA includes the whole public sector all bodies classified as Central Government, Local Government, or Public Corporations, within National Accounts will be consolidated by WGA.

Arms Length Bodies (ALBs)

The term Arms Length Bodies (ALBs) is taken to include a department’s executive NDPB’s and Trading Funds where these bodies have been classified as being within Central Government by the Office for National Statistics (ONS).

For accountability and governance purposes the Cabinet Office has lead responsibility for the classification of ALB’s and will designate bodies into the various categories using its own criteria. Where departments are setting up a new body they should contact the Cabinet Office to discuss the governance arrangements. The Cabinet Office classification of entities will not necessarily line up with the National Accounts. The budget and financial control framework is based on National Accounts classifications, when the term ALB is used this should be taken to mean all Central Government bodies other than departments, their agencies or PCs.

Budgets, Estimates and accounts

Budgets, Estimate and accounts have three distinct frameworks and are used by Government for different purposes. In previous years there have been significant differences between the figures recorded in each of the frameworks, with certain transactions and programmes being recorded differently according to different sets of rules.

Budgets, Estimates and accounts are now substantially aligned, and the vast majority of spending by departments and their ALBs scores in the budget and Estimate at the same value and with the same timing as in accounts.

In broad terms however, in order to keep down compliance costs for departments, the budgeting treatment of items is generally based on the treatment in departmental accounts. Annex A sets out the main differences between DAs , Estimates and budgets.

In practice therefore when considering how to score a transaction you should:

- start by considering the treatment of the transaction in DAs

- consider whether the budgeting treatment is the same as the DA treatment or different, and so establish the budgeting treatment

- once you know the accounting and budgeting treatment you can determine the Estimates treatment

Accounts

Departments and other public bodies have to produce audited accounts that report to the public and for parliament on how they have used the resources at their disposal (defined in terms of accounting aggregates rather than budgeting aggregates). These accounts are normally for the body in question, and for subsidiaries or other bodies within the accounting boundary.

The underlying rules for departmental accounts are specified in the Financial Reporting Manual (FReM), produced by the Treasury and based on International Financial Reporting Standards (IFRS). IFRS in DAs provides in some cases a different cut of information from that used for budgeting or the fiscal framework.

Department’s accounts are audited annually by the Comptroller and Auditor General of the National Audit Office (NAO), who reports his findings to Parliament.

Accounting rules change from time to time. When they do, the Treasury consider the impact on budgets. Sometimes changes to accounting rules are not carried through into budgets. Departments are consulted on changes to accounting through FReM exposure drafts.

Departments should determine the accounting treatment, checking in cases of doubt with their NAO auditors on the application of the FReM in specific cases and with the Treasury’s Government Financial Reporting (GFR) team on the interpretation of the FReM more generally. A link to where you can find full guidance on accounts is given in Annex C.

In some places this budgeting guidance summarises or describes accounting rules. That is done to provide context for the definitive statement of the budgeting rules. However, the only authoritative description of the accounting rules is in the FReM, and the summary in this budgeting guidance should be seen as indicative only.

Supply Estimates

Estimates are the mechanism by which Parliament authorises departmental spending.

Estimates require Parliament to vote limits for Resource DEL, Resource AME, Capital DEL and Capital AME, as well as any voted spending outside of budgets and the department’s net cash requirement. These voted limits may differ from the figures in departmental budgets and Estimates, as elements of the department’s budgets may fall within non-voted spending. The sum of voted and non-voted spending in DEL and AME will equal the figures in departmental budgets.

In the same way as budgets, Estimates are voted net of retained income. Any income treated as negative DEL or AME in budgets will net off against voted limits in the Estimate.

In rare cases some income may be treated as a Consolidated Fund Extra Receipt (CFER), and will not be retained by the department but returned to the Consolidated Fund. This will most commonly occur when the department has failed to anticipate this category of income or has generated more income than is allowed to be treated as within budgets.

A link to where you can find full guidance on Estimates is given in Annex C.

Presentation of total spending

Total managed expenditure

The Government’s main measure for reporting overall public spending is Total Managed Expenditure (TME), a measure drawn from the National Accounts. TME may be defined as the sum of the public sector’s current and capital expenditure. Current expenditure is presented net of sales of goods and services while capital expenditure is presented as net of asset sales.

Capital expenditure may be divided into:

- the element that replaces the extent to which the capital stock has depreciated

- net investment

Therefore, TME may be defined as the sum of public sector current expenditure, net investment, and depreciation.

TME is also the sum of DEL, Departmental AME and non-Departmental AME (including accounting adjustments).

Resource budget, Capital budget

A department’s Resource budget is the sum of the Resource budget: DEL and the Resource budget: AME. The Capital budget is the sum of the Capital budget: DEL and the Capital budget: AME.

Neither the Resource budget nor the Capital budget is a control total, since departments may not make switches from AME to DEL. But they are useful numbers to present since they show the total current and capital spending in the budgets of the department. And they remind readers of spending data that both DEL and AME spending are spending: both need to be financed by taxes and borrowing.

Total DEL

In addition to the control totals, there is a presentational aggregate; Total DEL. Total DEL is not a control total. It is a standard way of showing total current and capital spending in DEL. It is defined as:

- Resource budget: DEL

- Plus Capital budget: DEL

- Less Depreciation in DEL

Depreciation here includes DEL impairments.

Depreciation is excluded from Total DEL because adding together depreciation and investment may be seen by some as in a sense double counting.

Recording income and expenditure

Transactions should be recorded accurately on OSCAR. OSCAR supplies information for a wide range of users and uses:

- the Treasury’s planning and control of public spending

- the Treasury’s monitoring and forecasting of spending against the fiscal framework

- Treasury publications, such as Public Expenditure Statistical Analyses

- operational publications, such as Main and Supplementary Estimates

- departmental publications, such as the common core tables in Departmental Reports

- the National Accounts, including measures of the fiscal framework

- the input side of ONS’ measures of public sector productivity

You can see that often departments themselves are directly affected by the accuracy of information on OSCAR.

Where to find the guidance on recording is shown in Annex C.

Appendices to Chapter 1

1. Summary content of budgets

This table summarises the main standard contents of Resource and Capital budgets. Budgets are divided into DEL and AME. The Resource budget DEL is divided into Administration and Programme.

Content of budgets

| Resource Budget | Capital Budget | |

|---|---|---|

| Department’s own transactions with the private sector | Expenditure on an accruals basis, including administration costs, pay, superannuation liability charges and other pensions contributions or current service pensions costs, grants to individuals, subsidies to private sector companies. Take up of provisions, movements in value of provisions, and release of provisions (as well as the expenditure offset by the release of the provision – except provisions related to capital expenditure). Profit/loss on disposal of assets. Depreciation and impairments on the department’s assets. Less income treated as negative DEL/AME, for example sale of services. Note: Excludes revaluations charged to revaluation reserve. | Expenditure on new fixed assets on an accruals basis includes assets bought under finance leases and transactions that are in substance borrowing (i.e. on-balance sheet PFI deals). Less Net book value of sales of fixed assets. Net policy lending to the private sector. Capital grants to the private sector. |

| ALB transactions with the private sector | As the department. Note: the department’s grant in aid to ALBs is excluded from budgets. | As the department. |

| NHS Trusts (England) | As the department. | As the department. |

| Support for Local Authorities | Current grants to Local Authorities. | Capital grants to Local Authorities Supported Capital Expenditure (revenue). |

| Public Corporations | Subsidies paid to Public Corporations. Less interest and dividends received from Public Corporations. | Investment grants paid to Public Corporations. Net lending to Public Corporations (Voted and NLF). Public Corporations’ market and overseas borrowing (including on balance sheet PFI). Less equity withdrawals from Public Corporations. |

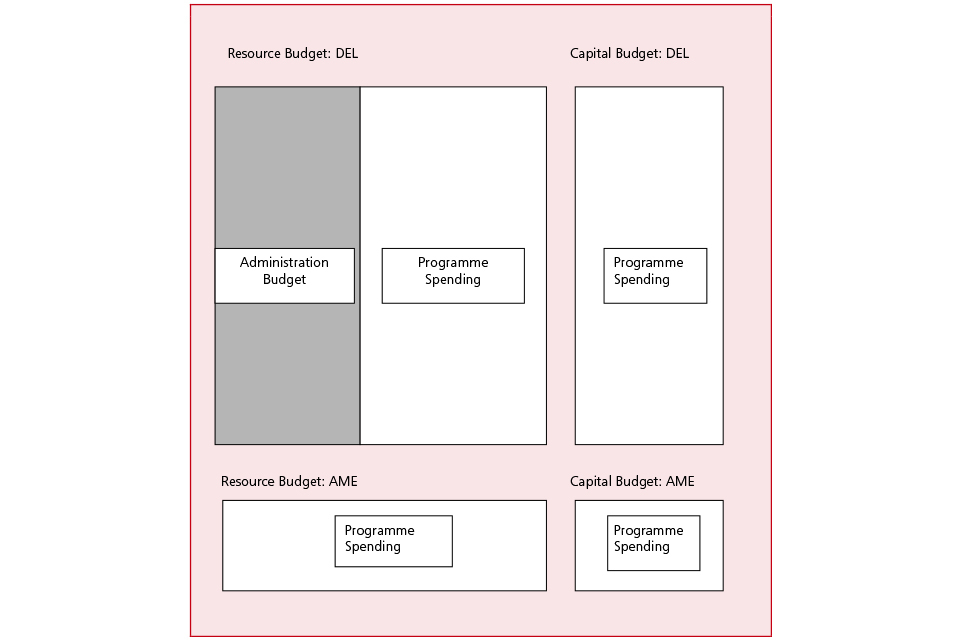

2. Diagram of existing budgetary categories

Diagram of existing budgetary categories

3. The department’s control and planning totals

Departments and their Treasury spending teams should at all times have a shared understanding of what their control and planning totals are, whether the department’s spending is on track to stay within limits, and what the risks are.

The control totals are:

- Resource DEL

- Administration budget

- Capital DEL

- Any department-specific ring-fenced budget

The planning totals are:

- Resource Departmental AME

- Capital AME

4. Criteria for AME treatment of levy-funded bodies

The Chief Secretary has determined that the spending of a number of levy-funded bodies should be in AME rather than DEL. The Chief Secretary takes such decisions case by case. The AME treatment of individual bodies is kept under review.

Where an AME treatment has been approved for spending, the income from the levy must also be recorded in AME by the body.

While the Treasury has no plan to recommend to the Chief Secretary that any further levy-funded bodies should have AME treatment, the criteria that the Chief Secretary uses are set out below.

Criteria for deciding whether a levy-funded body should score in AME

- The body should in broad terms provide services (“services” could include a compensation fund) to an industry or group of industries or the workforce in that industry.

- The body should be wholly or mainly funded by a levy on the industry. There should be substantial industry consensus involved in the setting of the levy or the direction of the expenditure or both.

- The expenditure must be suitably ring-fenced. Normally, that would mean that the whole body should fall into this category.

- The body should be self-financing in cash terms. With no recourse to departmental grants or subsidies. Where, exceptionally, grants or subsidies are paid (including grants financed by the EC), the expenditure funded by those grants would score in DEL.

- Draw-down of reserves should be permitted and normal short term modest size overdrafts. But the bodies should not normally borrow long term. Where, exceptionally, borrowing other than short-term overdrafts, finances expenditure, it would normally score in DEL.

- The body should meet relevant efficiency and other criteria: * the licence or levy is appropriate, i.e. applied in the economically most advantageous way in the circumstances * introducing the levy or licence should not materially restrict the Government’s fiscal policy * there should be adequate efficiency regimes in place to keep costs down, including stretching targets and regular efficiency reviews * suitable arrangements should exist to prevent the body from abusing its power to set the level of the levy; for example, the levy might need approval by the Minister * there will be periodic reviews involving the Treasury of the operation of the levies, including whether they should exist at all, what scale of activity is appropriate, and the level of charges set

5. Prior Period Adjustments

Prior period adjustments (PPAs are adjustments applicable and are required in Estimates where data for an earlier year needs to be restated. As such PPAs are primarily an accounting concept. They negate the need to re-open accounts where a material error or omission is found from previous years, or where a department makes a material change to its accounting policies. All PPAs should be discussed with the auditor at the earliest possible opportunity.

PPAs in Supply Estimates

From a Supply perspective PPAs fall into two categories:

- a restatement of data following a change in accounting standards or other changes to accounting policy outside the department’s control

- the correction of an error or omission in the previously recording of data

In terms of Supply (the provision of money from Parliament) and budget the Government is primarily interested in the second kind of PPA, where an error or omission has been discovered, or the department changes accounting policy on its own initiative (i.e. not an externally driven change in accounting standards). This is because changes initiated by the department, or an error in previous recording, have the potential to change net budgets and thus the reported outturn for previous years. In such cases HMT believes it is proper that Parliamentary authority is sought for the budgetary cover that should have been sought previously had the expenditure been identified correctly.

PPAs obviates any need to re-open accounts that have been signed off by the Comptroller and Auditor General (C&AG) of the National Audit Office (NAO), but also provides – retrospective – parliamentary authority for the expenditure. PPAs must therefore be included in voted Supply in an Estimate.

Externally driven changes

Where a PPA results from a change in accounting standards, this is treated as a classification adjustment for budgets. There is therefore no need to seek Parliamentary authority, but the change and its impact should be identified in “Note F Accounting Policy changes” in the next available Supply Estimate.

PPAs in Supply Estimates

PPAs can be included in Main or Supplementary Estimates if discovered in time, for example, as part of the mid-year reporting exercise. They are most likely to occur in this form where a department initiates a change in accounting policy as it is under the control of the department as to when it happens. As stated earlier, the department should seek non-budget cover for the PPA, where the PPA accounts for all previous years’ expenditure, ending at the resource accounting implementation year of 2001-02.This is required even when the Department was in a position to fund the expenditure from budget cover if it had been recognised in the correct year initially.

If the need for a PPA is discovered whilst resource accounts are being compiled it will be allocated to the non-budget section of the Statement of Parliamentary Supply (SoPS). The PPA should reflect the prior year data only, but capped by the start of resource accounting in government, i.e. departments should not seek cover for events prior to 2001-02, the first full year of resource accounting.

Materiality

PPAs can only be made for material errors or changes in accounting policy. Whilst there is no such concept of materiality in budgets (the database goes down to the nearest £1,000). If the NAO have accepted a PPA as not material, to be absorbed in that year’s budgets, then HMT will follow suit.

Excess Votes

Normally departments do not have any non-budget provision unless a PPA is recognised when compiling an Estimate. PPAs discovered during the compilation of accounts could not have been foreseen: the lack of any or sufficient non-budget provision in the Estimate will lead to an Excess Vote. The normal process for regulating Excesses will then be followed.

Negative PPAs: no need for approval

Whilst it is possible to have negative PPAs in accountancy terms, Supply does not require Parliament to approve a smaller number. Parliament approves a ceiling for expenditure against which departments are judged; it has no need to vote something which is already within an approved limit.

Re-recording budgets on the database

Once the year in which the PPA features has passed, departments should re-state budgets to reflect the true budgetary hit (DEL or AME, resource or capital) in the years affected on the database. This will ensure that the budget reflects the true outturn. Note that the database will only hold outturn for five previous years; any impact beyond that cannot be captured electronically but should be reported in the accounts and noted in the Estimate.

6. Machinery of Government Change (MOG)

A Machinery of Government change occurs when there is a transfer of function between one (or more) Government Departments and there is a resulting change in the Departmental Accounting Officer responsibility. Departments should begin the process of agreeing amounts and budgets to be transferred as soon as a MOG has been announced. Departments should be aware of the following key points when reflecting a MOG change:

| A MOG in isolation should not affect the spending power of either the transferring or receiving department (i.e. no department should be left better or worse off as a result of the transfer of the budget. |

| The transfer must completely net out between the two (or more) departments, (e.g. DEL budget being transferred by one department must be recorded as DEL by the receiving department). Each department involved in the MOG should ensure that the information being provided by them is checked and agrees with that being provided by the other department to ensure that information provided is complete, consistent and correct. |

| Should the function (following the transfer) require provision in excess of the amount being transferred, the additional provision will not be part of the MOG and the receiving department should seek additional budget as normal. |

| The Accounting Officer in the transferring department will have formal responsibility for the transferred function up until the relevant Estimate and related legislation has received Parliamentary approval. From that point onward the Accounting Officer will be fully accountable for the transferred function (i.e. not only in the current and future year but also for the historical period also).It is therefore essential that the Accounting Officer in the receiving department seeks assurance about the values of transferred items and that they receive all documentation relating to the function from the transferring department. |

Other transfers of function within the public sector, for example, transfers between arm’s length bodies within a single departmental group, or between local and central government will not require historic restatement. The net impact of assets and liabilities transferring should not affect the spending power of the transferring or receiving department. Further guidance on the accounting treatment for all business combinations under common control is available on the FReM website. A link to the FReM is given in Annex C.

2. Budget Exchange

Budget Exchange is a mechanism that allows departments to carry forward a forecast DEL underspend from one year to the next. It is intended that Budget Exchange will provide departments with flexibility to manage their budgets, while strengthening spending control and providing greater certainty in order to support effective planning.

Under Budget Exchange, departments may surrender a forecast DEL underspend in advance of the end of the financial year (by means of a DEL reduction in the Supplementary Estimate) in return for a corresponding DEL increase in the following year, subject to a prudent limit.

There will be no scope to carry forward underspends that are not forecast in advance of the Supplementary Estimate.

Budget Exchange will be available on all DEL control totals (including non-voted DEL), subject to the usual restrictions:

- a Capital DEL underspend may not be carried forward as Resource DEL

- a Resource DEL underspend generated on programme expenditure may not be used to increase administration budgets

- an underspend within the Resource DEL depreciation ring-fence may only be used to increase the Resource DEL depreciation ring-fence

- underspends generated within a policy ring-fence will only be eligible for carry-forward within the same policy ring-fence

Separate arrangements will apply to the Devolved Administrations.

Approval process

Formal Treasury approval is required for any increase to DELs. However, it is intended that approval to utilise Budget Exchange will be granted automatically up to a prescribed limit and subject to the other conditions detailed below, though Treasury reserves the right to withhold approval in exceptional circumstances.

The amounts that departments will be permitted to carry forward are set out in the table below, where the limit is expressed as a percentage of Resource DEL and Capital DEL in the year in which the underspend is forecast to occur. These limits vary by size of department in recognition of the difficulties faced by smaller departments in managing slippage between years and there are separate limits for Resource DEL and Capital DEL.

Budget Exchange Limits

| Size of Department | RDEL Limit | CDEL Limit |

|---|---|---|

| Total DEL* <£2bn | 2% | 4% |

| Total DEL >£2bn but <£14bn | 1% | 2% |

| Total DEL >£14bn | 0.75% | 1.5% |

| * Where total DEL = Resource DEL excluding depreciation + Capital DEL as set out in Table A9 of the Spending Review 2010. |

Departments will be free to elect how to split their Resource DEL carry-forward limit between Administration and programme budgets and between depreciation and non-depreciation.

Preventing the accumulation of spending power over time

To further ensure that the fiscal cost of Budget Exchange is manageable and that spending power is not allowed to accumulate over time, Budget Exchange will only be permitted from one year to the next. To operationalise this, any carry-forward from the previous year will be netted off the amount that can be carried forward into the next year. A worked example is shown below for a department with £1 billion DEL each year:

- In Year 1 the department forecast an underspend of £20 million. It reduces its Year 1 DEL to £980 million and increases its Year 2 DEL by a corresponding amount to £1,020 million.

- In Year 2 the department forecasts an underspend of £30 million (against its new DEL of £1,020 million). It reduces its DEL by this amount, to £990 million. However, the amount brought forward from Year 1 must be netted off the amount that the Department is allowed to carry into Year 3. Therefore the department is only allowed to increase its Year 3 DEL by £10 million to £1,010 million.

- In Year 3 the department forecasts an underspend of £10 million (against its new DEL of £1,010 million) and reduces its DEL by this amount, to £1,000 million. However, it cannot carry anything forward to Year 4 as the £10 million carried-over from Year 2 is netted off.

In the above example, we assume ALL other Budget Exchange rules are in effect.

Timing

The Budget Exchange process will be run to a Supplementary Estimates timetable. The exact timing will be confirmed in a PES paper ahead of the Supplementary Estimate, but it is likely that departments will need to inform the Treasury of the amounts that they wish to carry forward by late November/early December.

The in-year DEL reductions will be effected in the Supplementary Estimate, with the corresponding DEL increase awarded at the time of the Main Estimate the following year.

Budget Exchange and the Reserve

Departments may not generally carry-forward an underspend if they are simultaneously seeking to draw funds from the Reserve. As always, the drawdown of funds from the Reserve is subject to an assessment of need and so emerging underspends should be the first call for meeting pressures before additional funding is sought.

Overspends

There is no scope to change DELs after the Supplementary Estimate. Any department that uses Budget Exchange and then subsequently breaches a DEL control total will be treated like any other overspend and will be subject to the same process outlined in Chapter 1. Departments will need to take this into consideration when surrendering a forecast underspend. Departments are under no obligation to surrender their entire forecast underspend.

Flexibility for the retention of income from asset sales

It can be challenging for departments to match asset sale proceeds with capital expenditure perfectly on an annual basis. Therefore, as announced at Spending Round 2013, departments now have additional Budget Exchange flexibilities to carry forward the CDEL proceeds from the sale of tangible assets so that they do not have to be spent in the same year.

The flexibility will be considered on a case-by-case basis, subject to the following conditions:

- the department can demonstrate clearly that it has approved capital projects in subsequent years on which to spend these receipts

- that the additional CDEL carry forward does not exceed £200 million; the Treasury will consider requests to apply this flexibility to larger amounts – departments should discuss any examples of this with its Spending Team proactively as soon as such amounts are anticipated

- it will apply only to asset sale proceeds which departments normally have agreement to retain (i.e. from the sale of land and property and does not include proceeds from sales of financial transactions, which will generally continue to flow in full to the exchequer)

In some cases, departments may prefer to keep the resource benefit that results from the Exchequer using asset sale proceeds to pay down debt and hence reduce interest payments. Therefore, instead of keeping the proceeds from a tangible asset sale, departments may surrender the proceeds in full to the Exchequer in exchange for an ongoing RDEL uplift equivalent to 3.5 per cent of the proceeds surrendered p.a. This will be subject to the following conditions:

- the Treasury will consider each application on a case-by-case basis

- as per the flexibility above, it only applies to asset sale proceeds which departments have agreement to retain normally

In order that the Treasury can monitor the overall effect of these policies on the fiscal aggregates, departments should notify their Spending Team six weeks ahead of the Autumn Statement in each year if they envisage using either of these flexibilities on asset sales in that financial year.

These flexibilities do not affect any other rules around the retention and utilisation of asset sale income.

For areas of protected spend, the Treasury may not be able to offer the asset sale flexibilities above. We invite you to discuss asset sales on areas of protected spend with your Spending Team directly.

Cascading Budget Exchange

Departments are responsible for deciding whether to cascade Budget Exchange, or an alternative system for carrying forward underspends, to their Arms Length Bodies (ALBs). Departments will be responsible for managing any pressures this would create within their DEL.

3. Resource Budget

Overview

The Resource budget scores most of the department’s current expenditure. Expenditure is recorded on an accruals basis. So the Resource budget includes expenditure on pay, current procurement, current grants and subsidies, depreciation and the take-up, revaluation and release of provisions (as well as the cash payments associated with the release of the provision – which are recorded by economic type, i.e. pay, current procurement etc as above).

Since the Resource budget includes the resource consequences of acquiring and owning assets (depreciation and maintenance), departments should consider the inter-relationship of the resource and capital budgets when planning and monitoring expenditure. That inclusion should also help departments manage their entire asset stock as well as considering annual changes to the stock through new investments or disposals.

This chapter covers in detail the treatment of some specific items of departmental expenditure in the Resource budget. ALB expenditure scores in budgets in the same way as departments’ – see also chapter on ALBs. See next chapter for the treatment of income in Resource budgets. See separate chapters for the Resource budget implications of loans to the private sector, PFI deals, support for Local Authorities and support for Public Corporations. See also separate chapters for the rules governing the division of the Resource budget into Administration budgets / programme expenditure.

Items of Central Government’s own expenditure score in the resource budget at the same value and with the same timing as in the Statement of Comprehensive Net Expenditure (SoCNE) in the departmental accounts. Care should be taken however as there are a couple of exceptions to this rule.

Grants and subsidies

DAs do not distinguish between current grants and subsidies and capital grants. However, the National Accounts do, with current grants and subsidies affecting the current balance and capital grants not. Therefore departments have to distinguish between current and capital grants according to National Accounts principles. Current grants and subsidies score in the Resource budget; capital grants score in the Capital budget.

Current grants are paid to individuals and to not for profit bodies serving households. Subsidies are current payments paid to profit making bodies designed to influence levels of production, prices or wages.

Capital grants are unrequited transfer payments, which the recipient has to use to:

- buy capital assets (land, buildings, machinery etc.)

- buy stocks

- repay debt (but not to pay early repayment debt interest premia)

- acquire long-term financial assets, or financial assets used to generate a long-term return

Where grants are paid that may be used at the recipient’s discretion either on capital or on current expenditure they should be treated as current grants or subsidies. Both capital and current grants should be reflected in budgets for the year in which they accrue, which may be different to when the grant conditions are met by the receiving body.

Normally, debts are written off because the department is unable to enforce the debt against the debtor. Capital grants are imputed in the National Accounts in those cases where debts are written off “by mutual consent”, that is, where for policy reasons the creditor department chooses not to enforce the debt. See section on impairments of financial assets below.

Payments of compensation to owners of capital goods destroyed or damaged by acts of war or natural disasters count as capital grants.

Major payments in compensation for extensive damage or serious injuries not covered by insurance policies may also count as capital grants – departments should consult the Treasury.

Pensions bulk transfer payments are treated as capital transactions in the National Accounts and pass through the resource budget (albeit offset by the release of the provision) – see pensions chapter.

Resource budget consequences of asset ownership

Tangible and intangible fixed assets

The impact of tangible (e.g. land, buildings, IT systems) and intangible (e.g. patents, IT software, trademarks) fixed assets on the Resource budget is through depreciation, maintenance costs and impairments, which score in the Resource budget, and in DEL or AME as set out in this guidance. Gains or losses on the disposal of tangible and intangible fixed assets also score in Resource DEL (subject to the limits indicated in Chapter 4). Further guidance on the treatment of new capital spending on tangible and intangible fixed assets and investments and on the disposal of assets can be found in the chapter on Capital budgets.

Investments

Financial investments are treated in the same manner as other fixed assets. As they are not depreciated, they normally only impact on the resource budget through returns received on the investment or impairments.

They should be recorded on the department’s balance sheet according to the appropriate treatment in the FReM with any fluctuations in value being dealt with through the revaluation reserve. Where no revaluation reserve exists, price movements which go through the department’s SoCNE should score to the department’s Resource AME budget. Where an investment suffers an impairment (i.e. a permanent write-off of value) this amount should be included in the resource budget as set out below. For further detail on the treatment of different types of investments in public sector bodies outside the departmental boundary, or other financial instruments, please refer to the FReM.

Depreciation

Depreciation is a measure of the wearing out, consumption or other reduction in useful life of a fixed asset, whether arising from use, passage of time or obsolescence through technical or market changes. Depreciation is charged on fixed assets annually and scores in the resource budget.

Accounting policies for depreciating assets are chosen by the Department, as set out in the FReM. Departments should consult with the Treasury before changing significant accounting policies and estimation techniques where it appears that there could be a potential impact on budgets and on the National Accounts.

Depreciation should always be a positive number. If a department nonetheless believes that negative depreciation is appropriate, they are asked to write to their designated contact in the Government Financial Reporting (GFR) Team, HM Treasury, explaining the circumstances before tallying their data.

To calculate the depreciation charge for budgeting purposes, departments should include all depreciation on all assets, however they were originally funded.

Depreciation usually scores in departments’ Resource DEL budgets. Within the resource DEL budget, depreciation scores to administration or programme depending on whether the underlying assets are used to support administration or programme delivery.

Depreciation ring-fence

The budgets for depreciation and impairments scoring in DEL are within a ring-fenced part of the RDEL budget. Departments should have a shared understanding with Treasury what part of their RDEL budget is within this ring-fence. RDEL provision can be switched freely into the ring-fence, but provision cannot be moved out to fund other RDEL spending. Also departments cannot switch RDEL from within the depreciation ring-fence into CDEL. As well as scoring against the depreciation ring-fence, administration depreciation additionally scores to a department’s administration control total.

The principle of a ring-fence will apply in the exceptional cases where Treasury has agreed that the depreciation scores to AME budgets.

Donated assets

Where the purchases of assets were funded from the Lottery, from a capital grant from the private sector, the asset was a donation in kind, or the asset was purchased from a donation, the depreciation should be recorded in AME rather than DEL. Where an asset is part funded through capital grant, only that element of the depreciation that relates to the grant will be recorded in AME, the rest of the depreciation will be in DEL as normal.

The intention of this exceptional treatment is to ensure departments have appropriate incentives and budgetary flexibility to accept grants.

Chapter 7 contains further detail on the budgeting for receiving capital grants.

Impairments

Impairments are recorded where there is the permanent loss or write-off of recoverable value of an asset below the value recorded on the balance sheet in the accounts.

Impairments – intangible assets

Where an impairment is applied to tangible fixed assets or leased tangible fixed assets, the budgeting treatment is dependent on the reason for incurring the impairment. The same budgeting treatment applies to intangible fixed assets, but where a department believes an intangible is subject to one of the categories of impairment below it should first contact HMT.