Child Support Agency quarterly summary of statistics: June 2020 (experimental)

Published 28 October 2020

Applies to England, Scotland and Wales

The latest release of these statistics can be found in the collection of CSA statistics.

This release of statistics is on the Child Support Agency, to June 2020. The release includes revisions to previously published statistics.

The next release is planned for January 2021.

1. Introduction

The Child Support Agency (CSA) was set up in 1993 and in 2012 the Child Maintenance Service (CMS) was created to replace the CSA. The closure of the CSA is progressing, all on-going liabilities have ended and all cases held on the CSA IT systems have been closed. A small number of CSA cases remain which have historical debt built up under the CSA schemes. These remaining cases have been moved onto the CMS IT systems. This remaining debt is being addressed by offering a final chance at collection where this is possible at a reasonable cost to the taxpayer, as outlined in the child maintenance compliance and arrears strategy.

Effect of COVID-19

This publication covers data up to the end of June 2020. During this period, the CMS was affected by the COVID-19 outbreak and the resultant changes to the department’s operational priorities. In the UK, the lockdown began on 23 March 2020.

2. Main Stories

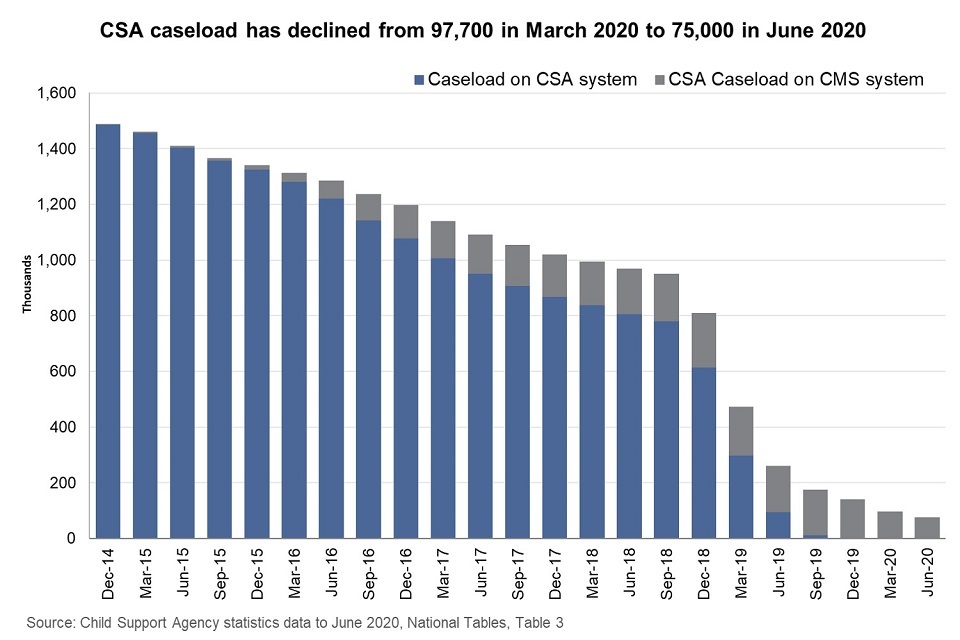

The number of CSA cases held on CSA or CMS IT systems decreased from 97,700 in March 2020 to 75,000 in June 2020. The caseload has been steadily declining since December 2014 and declining sharply since December 2018. The reduction in caseload is due to the closure of cases as outlined in the child maintenance compliance and arrears strategy. All cases on the CSA computer system have now been closed.

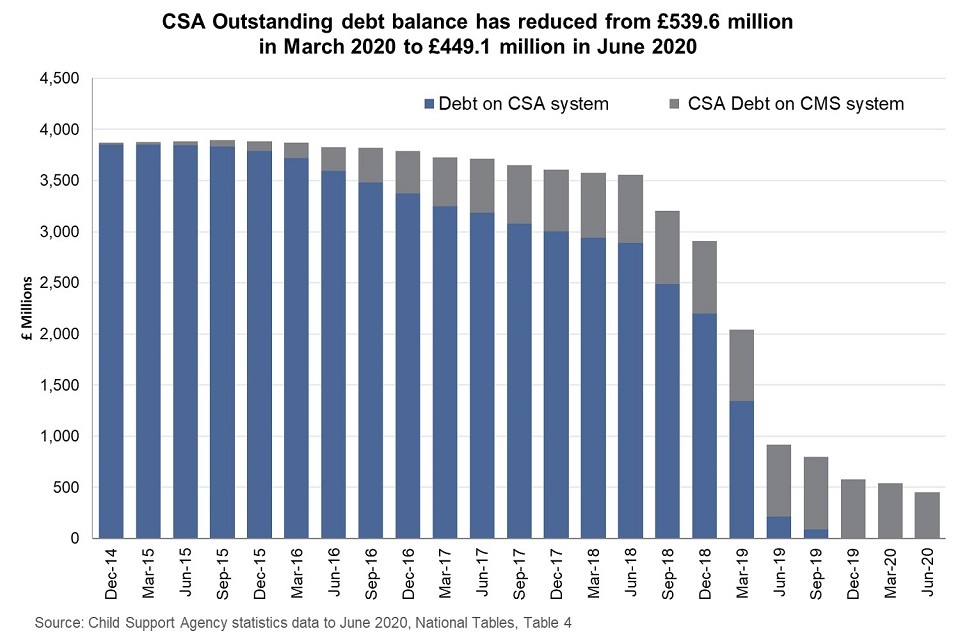

The CSA historical debt balance continues to reduce. The amount of CSA debt held on CSA or CMS IT systems has decreased from £539.6 million in March 2020 to £449.1 million in June 2020. The outstanding debt balance has been steadily declining since December 2016 and declining sharply since September 2018. Debt owed to Government and debt which has no reasonable chance of being collected is written off.

Between 13 December 2018, when the compliance and arrears strategy work started, and 30 June 2020:

-

the CSA has written to 211,100 parents with care to ask if they want a last attempt to be made to try to collect the debt owed to them – this includes all 134,700 parents with an eligible case on the CSA system and 76,400 parents with a case on the CMS system

-

577,900 cases with non-paying historical debt have had the debt adjusted or written off, of which 167,500 were on the CMS IT system – system records showed the cases had a total debt value of £1,926.6 million, of which £852.4 million was owed to government only

3. What you need to know

Child maintenance is financial support between separated parents to help with the everyday costs of looking after children.

The parent with care (PWC) is the parent with the main day to day care of the children. The non-resident parent (NRP) is the parent who does not have day to day care of the children.

Some CSA historical debt balances are adjusted either because the debt has already been paid, or it was created in error. Some CSA historical debt is written off, either because the parent with care has told us they do not want this debt or did not respond to the representation letter, it would cost more to collect the debt than it is worth or it has been deemed uncollectable.

Representation is the process of writing to parents to ask if they want us to make a last attempt at collecting the debt owed to them, where it is cost effective to do so.

This publication covers CSA child maintenance cases which have historical debt built up under the CSA schemes, some of which have been moved onto the CMS computer system to enable the closure of CSA systems. It does not cover cases which originated in the Child Maintenance Service.

Compliance and Arrears Strategy

The child maintenance compliance and arrears strategy sets out how government will address non-paying historical debt that built up on the CSA schemes. The CSA will write to the PWC to ask if they want a last attempt to be made to try to collect their debt in cases where:

- it has built up on CSA systems and there has been no recent payment made

- the case started before 1 November 2008 and the debt is over £1000 or

- the case started on or after 1 November 2008 and the debt is over £500

This process is called ‘representation’. If the PWC responds stating that they still want their debt, the CSA or CMS (depending on where the case is held) will determine whether there is a reasonable chance of collection and proceed appropriately, in most cases by writing to the non-resident parent.

Debt less than £500 (or debt less than £1000 for older cases) will be written off. We will not ask parents in these cases if they want their debt collected, as collection activity would cost more than the debt is worth, but a notification letter will be issued to both parents explaining what has happened with their case. In cases with debt below £65, the debt will be written off and notification letters will not be issued.

All debt owed to government accrued in the CSA will be written off as collecting this debt will not benefit families and it would cost more to collect than the debt is worth. Debt owed to government built up under a CSA policy that has now ended. This policy required the NRP to repay the government for some of the benefits paid to support their children.

4. Parent with care representation process

In cases where we offer the PWC the chance to ask for collection of the debt owed to them the CSA, or CMS if the case has been moved onto the CMS IT system, will write to the PWC. They are advised to respond (via a formal representation) if they still want the debt owed to them to be pursued. If the PWC asks for the debt to be collected the CSA performs a number of checks to establish whether there is a realistic chance of collection and what activity is reasonable. Where the PWC does not want us to collect the debt, does not respond within 60 days of the first letter, or the case is deemed as having little chance of successful collection the debt will be written off.

In total 224,200 cases have started the PWC representation process.

Parent with care representation process on CSA Systems

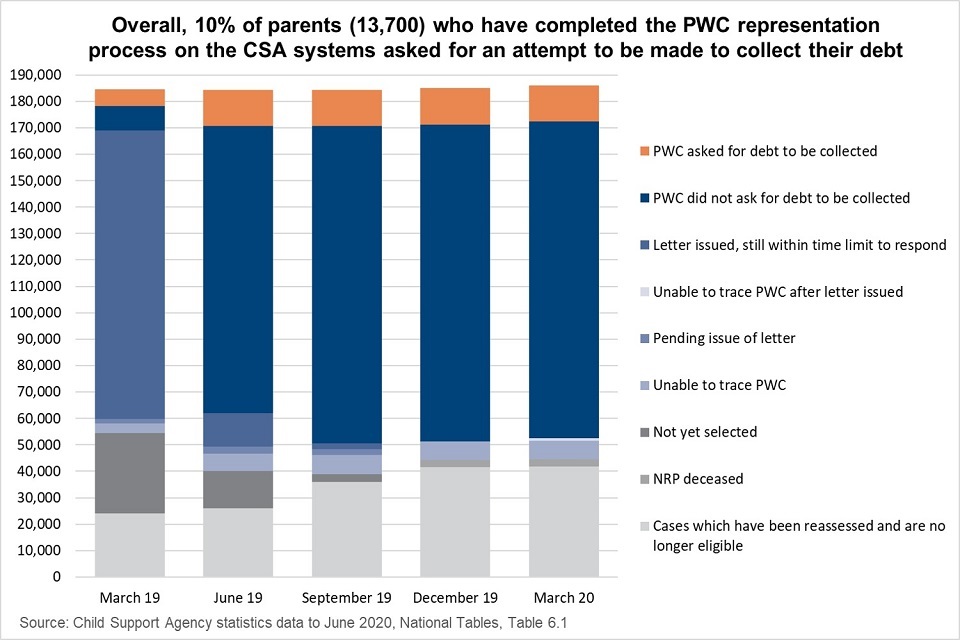

All cases held on CSA systems and eligible for representation had completed the parent with care representation process by the end of March 2020.

The first letters were sent to PWCs on 14 December 2018. At this date there were 184,400 cases on CSA systems with system records showing historical debt over £500, or over £1,000 depending on the age of the case. Each individual case has now been reviewed and a total of 143,700 cases went through the parent with care representation process on CSA systems. See Tables 5.1, 5.2, 6.1 and 6.2 of the national tables for full data.

As at March 2020:

In 41,900 (23%) cases either the debt was found to be incorrectly recorded and was adjusted to an amount below the eligibility threshold, the parent started to make payments or the case had to be processed clerically. These cases were therefore not eligible for representation. In addition, some non-eligible cases as of 13 December 2018 have also been reassessed and become eligible as they progress through the programme, and these additional cases have been selected into representation.

All 143,700 cases have now completed the parent with care representation process. There are no cases remaining that are still within the time limit to respond.

Of the 143,700 cases that have completed the process:

- in 7,000 (5%) cases we were unable to trace the PWC

- 2,700 (2%) cases were unable to progress because the NRP is deceased

- in 134,700 (94%) cases we have written to the PWC and of these cases:

- in 800 (1%) cases we were unable to trace the PWC after the letter was issued

- in 13,700 (10%) cases parents have asked us to attempt collection of the debt owed – these cases have progressed into the non-resident parent representation process (see Table 7.1 and 7.2 of the national tables)

- in 120,000 (89%) cases parents have either told us that they do not want us to collect the debt, or have not responded to the letter or reminder letter within 60 days of the first letter

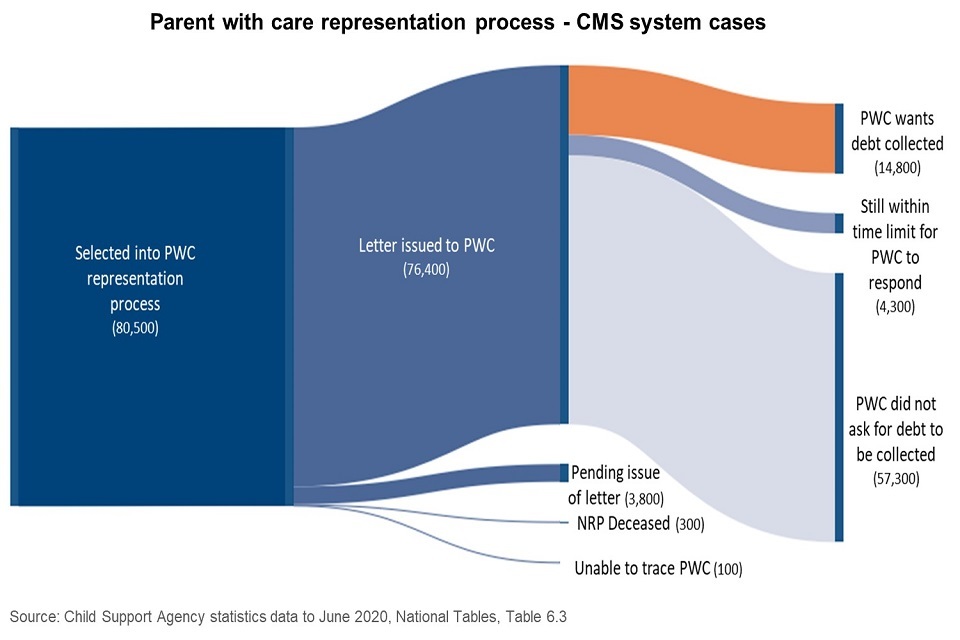

Parent with care representation process on CMS Systems

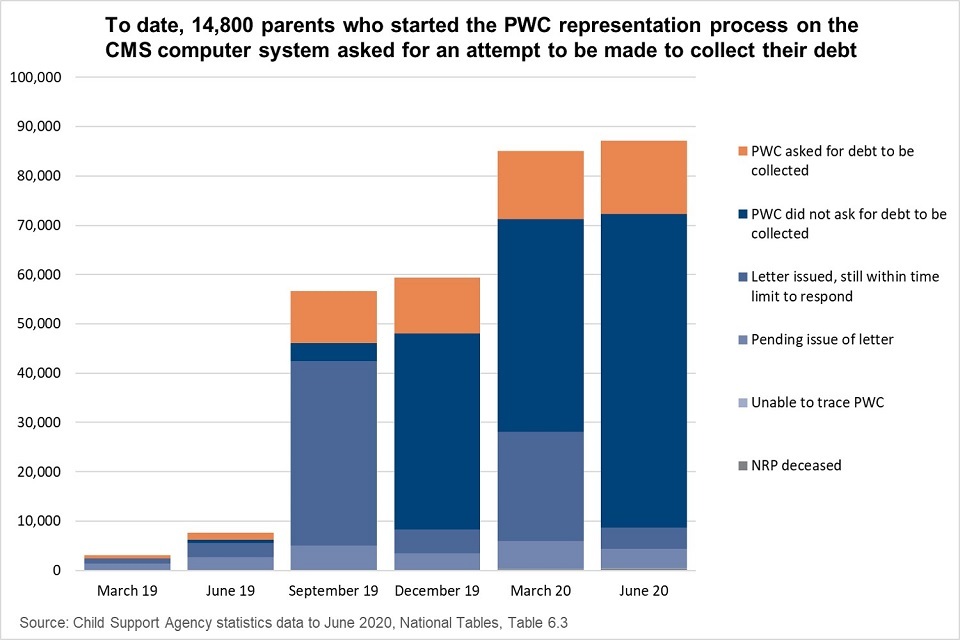

80,500 cases held on CMS systems and eligible for representation had started the parent with care representation process by the end of June 2020.

The first action taken in the representation process for cases on the CMS system is to attempt to re-establish payment. Cases can move between paying and not paying and a case must be non-paying to be eligible for representation. It is not, therefore, possible to calculate an initial stock of cases for representation on the CMS system. See Tables 5.3, 5.4, 6.3 and 6.4 of the national tables for full data.

As at June 2020, of the 80,500 cases that have started the process:

- in 100 (0%) cases we were unable to trace the PWC

- 300 (0%) cases were unable to progress because the NRP is deceased

- in 3,800 (5%) cases issue of the letter is on hold while we attempt to trace a reliable address for the PWC

- in 76,400 (95%) cases we have written to the PWC and of these cases:

- in 14,800 (19%) cases parents have asked us to attempt collection of the debt owed – these cases have progressed into the non-resident parent representation process

- in 57,300 (75%) cases parents have either told us that they do not want us to collect the debt, or have not responded to the letter or reminder letter within 60 days of the first letter being issued

- 4,300 (6%) cases are still within the time limit to respond

5. Non-resident parent representation process

In cases where the PWC responds asking for the debt to be collected, the CSA, or CMS if the case has been moved onto the CMS IT system, performs a number of checks to establish whether there is a realistic chance of collection. If there is, they write to the NRP to ask for payment of the debt. If the NRP is unable to repay the debt in full, the case is transferred for on-going attempts to collect the money owed. Where the case is deemed as having little chance of successful collection the debt is written off.

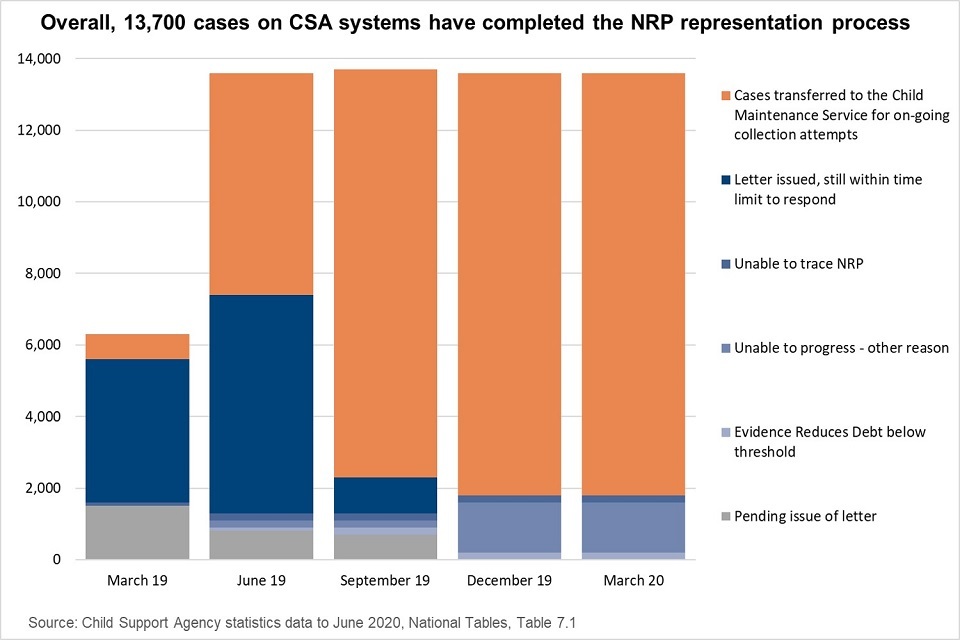

Non-resident parent representation process on CSA systems

All cases held on CSA systems and eligible for representation had completed the non-resident parent representation process by the end of March 2020.

See Tables 7.1, 7.2, 9.1 and 9.2 of the national tables for full data.

As at March 2020:

All 13,700 cases have completed the non-resident parent representation process. Of these cases:

- in 200 (1%) cases we were unable to trace the NRP

- in 1,400 (10%) cases we were unable to progress for another reason such as a payment has been received, the debt is deemed uncollectable, or the NRP is deceased

- in 12,100 (88%) cases we have written to the NRP and of these cases:

- in 200 (2%) cases the NRP has produced evidence which reduces the debt balance below the threshold for representation

- 11,800 (98%) cases have been transferred to the CMS system for on-going attempts to collect the debt

See Table 8 of the national tables for information about debt collection activity.

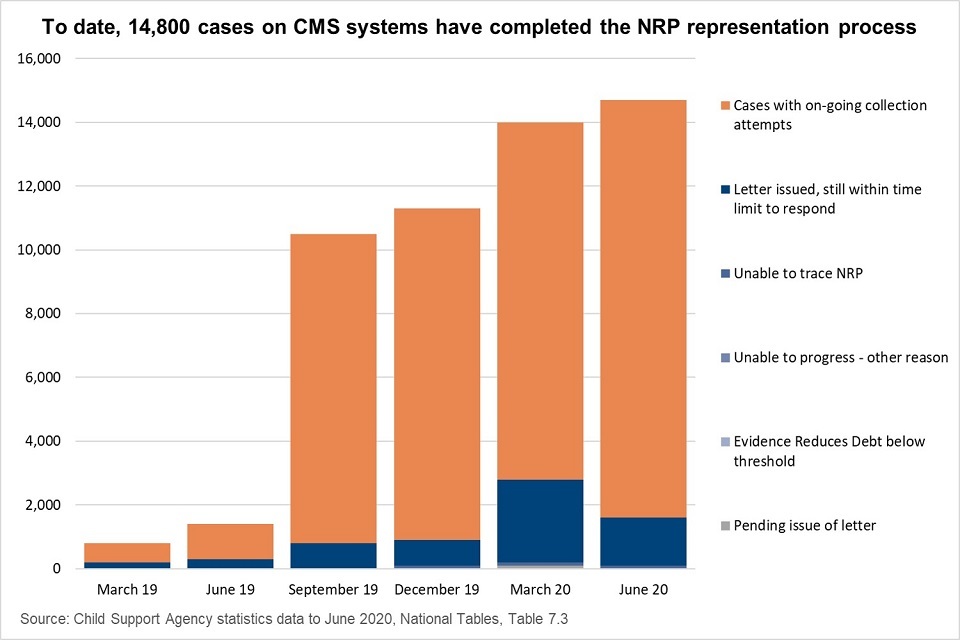

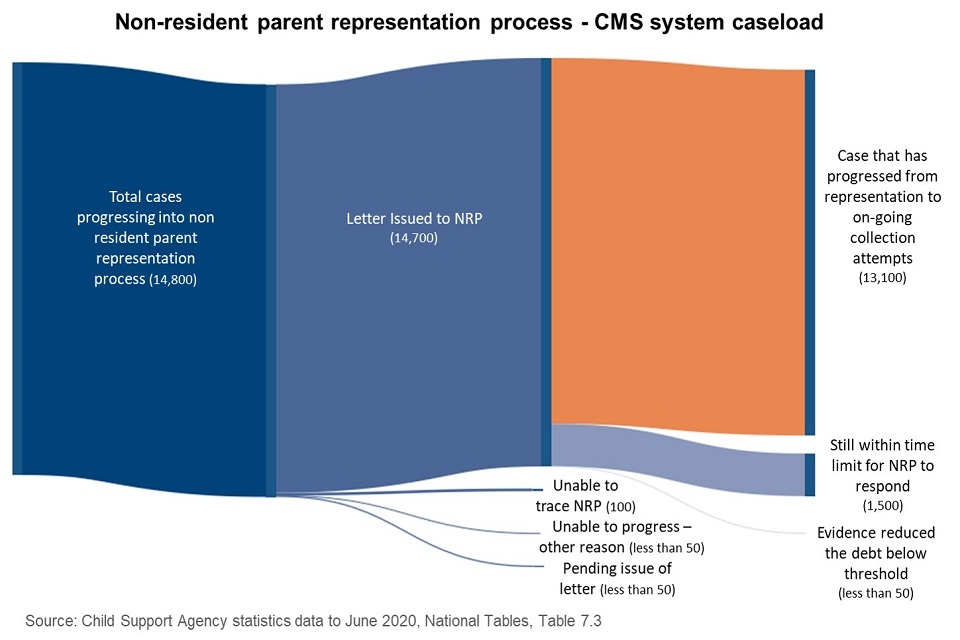

Non-resident parent representation process on CMS systems

14,800 cases held on CMS systems and eligible for representation had started the non-resident parent representation process by the end of June 2020.

See Tables 7.3, 7.4, 9.3 and 9.4 of the national tables for full data.

As at June 2020, of the 14,800 cases that have started the process:

- in 100 (1%) cases we were unable to trace the NRP

- in less than 50 (0%) cases we were unable to progress for another reason such as a payment has been received, the debt is deemed uncollectable, or the NRP is deceased

- in 14,700 (99%) cases we have written to the NRP and of these cases:

- in less than 50 (0%) cases the NRP has produced evidence which reduces the debt balance below the threshold for representation

- 13,100 (89%) cases have been transferred for on-going attempts to collect the debt

- 1,500 (10%) cases are still within the time limit to respond

See Table 8 of the national tables for information about debt collection activity.

6. CSA debt written off

The Child Support Agency has written off historical debt on 577,900 cases. 410,400 cases were held on CSA systems and 167,500 cases were held on CMS systems. These cases had system records showing a total debt value of £1,926.6 million. £1,483.2 million from cases held on CSA systems and £443.4 million from cases held on CMS systems.

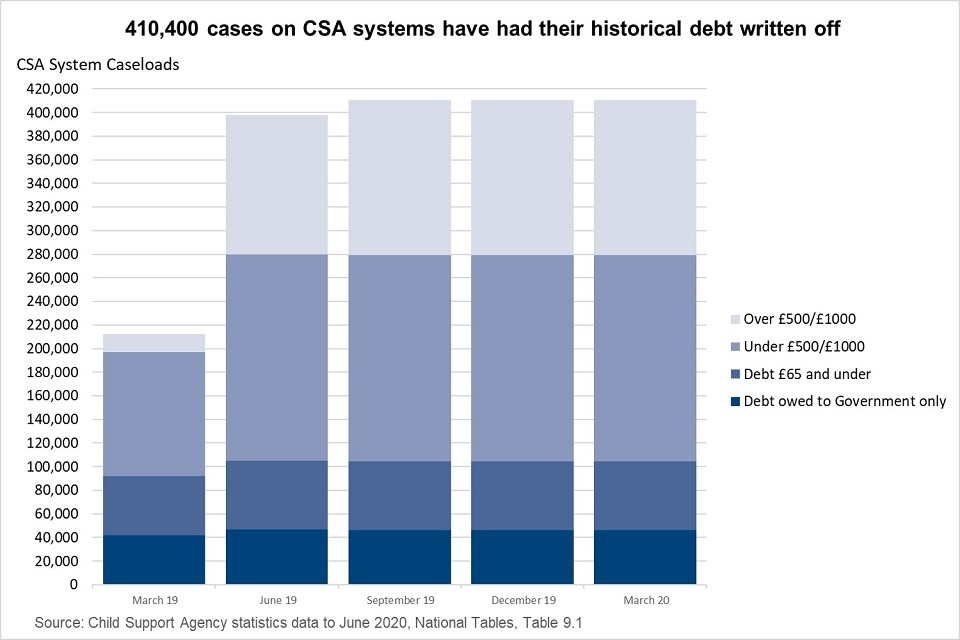

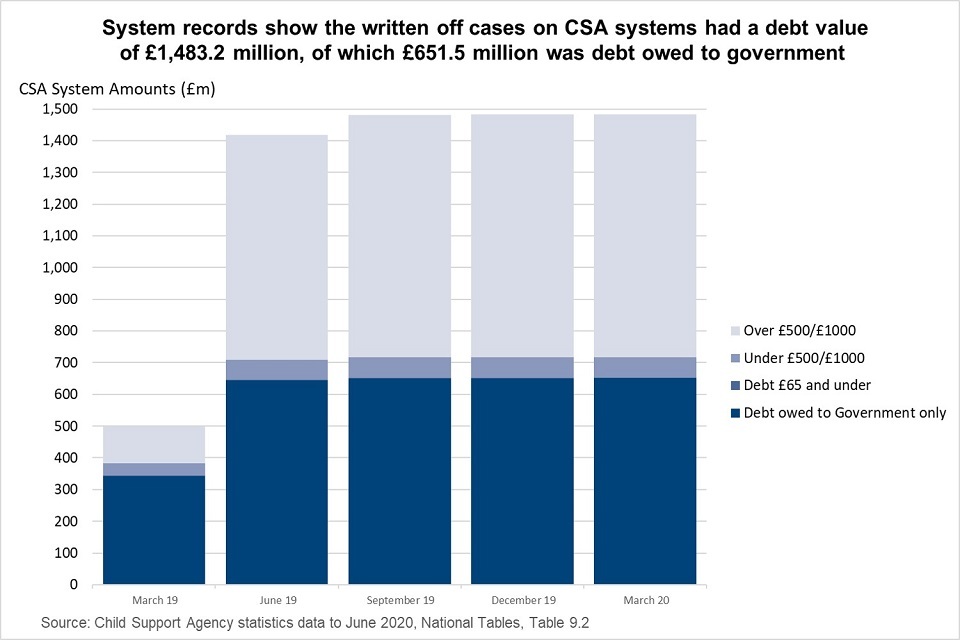

CSA debt written off on CSA systems

As of March 2020, there were 410,400 Child Support Agency cases held on CSA systems which have had their historical arrears adjusted or written off since the start of the compliance and arrears programme activity on 13 December 2018. These cases had system records showing a total debt value of £1,483.2 million. Of these:

- 46,200 (11%) cases had system records showing debt which was owed to government only with a total value of £651.5 million

- 58,300 (14%) cases had system records showing debt owed to parents of £65 or under with a total value of £1.6 million

- 174,600 (43%) cases had system records showing debt owed to parents of £500/£1,000 or less (depending on the start date of the case) with a total value of £64.7 million

- 131,300 (32%) cases had system records showing debt owed to parents which was more than £500/£1,000 (depending on the start date of the case) with a total value of £765.4 million – in these cases, either we were unable to trace the PWC, the PWC did not ask for the debt to be collected, the debt has been adjusted due to corrections or production of evidence that payment has been made, or the debt has been deemed uncollectable

All CSA system cases which were eligible for representation have completed the process (more detail about PWC representation). See Tables 9.1 and 9.2 of the national tables for full data.

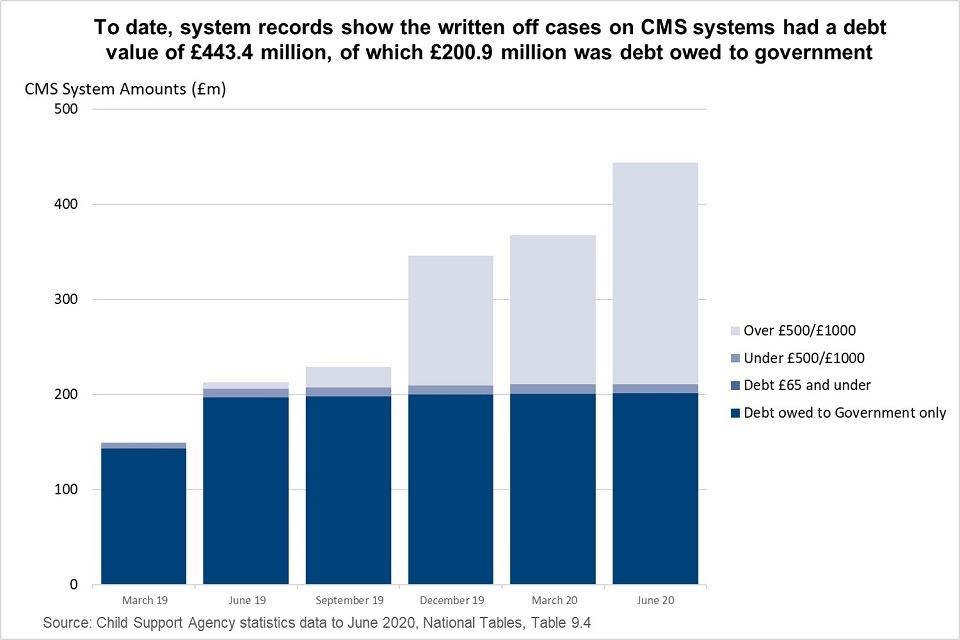

CSA debt written off on CMS systems

As of June 2020, there were 167,500 Child Support Agency cases held on CMS IT systems which have had their historical arrears adjusted or written off since the start of the compliance and arrears programme activity on 13 December 2018. These cases had system records showing a total debt value of £443.4 million. Of these:

- 58,800 (35%) cases had system records showing debt which was owed to government only with a total value of £200.9 million

- 5,200 (3%) cases had system records showing debt owed to parents of £65 or under with a total value of £0.1 million

- 38,400 (23%) cases had system records showing debt owed to parents of £500/£1,000 or less (depending on the start date of the case) with a total value of £9.6 million

- 65,200 (39%) cases had system records showing debt owed to parents which was more than £500/£1,000 (depending on the start date of the case) with a total value of £232.8 million – in these cases, either we were unable to trace the PWC, the PWC did not ask for the debt to be collected, the debt has been adjusted due to corrections or production of evidence that payment has been made, or the debt has been deemed uncollectable

Some cases which are eligible for representation have not yet completed the process (more detail about PWC representation). See Tables 9.3 and 9.4 of the national tables for full data.

7. About these statistics

Caseload figures contained within this publication are rounded to the nearest hundred or percent. Amounts are rounded to the nearest hundred thousand. These statistics have been developed using guidelines set out by the UK Statistics Authority.

The statistics have been produced using new data and a new methodology which is still subject to on-going development and testing and they may therefore be revised in future publications. For this reason, they are badged as experimental statistics. Always refer to the most recent release for the most up to date statistics.

A number of cases had their debt adjusted prior to 13th December 2018 as part of the case closure programme. These adjustments were reported in the Child Support Agency case closure statistics.

8. Where to find out more

Find more information relating to Child Support Agency cases, available via the National Data Tables

Read previous releases of these statistics.

Read information relating to the Child Support Agency case closure statistics.

Read guidance on the compliance and arrears strategy.

Read the consultation outcome of the compliance and arrears strategy.

Some statistics on debt that has been transferred from the CSA to the Child Maintenance Service are sourced from the 1993 and 2003 Child Maintenance Schemes Client Funds Accounts.

Read statistics on the performance of the Child Maintenance Service.

Read details on child maintenance arrangements made after speaking to the Child Maintenance Options service, including family based arrangements.

Authors: Gail Ludlam and Philippa Roddis

Lead statistician: Belinda Selby

Feedback is welcome, send comments to: cm.analysis.research@dwp.gov.uk