Hydrogen Champion Report: Recommendations to government and industry to accelerate the development of the UK hydrogen economy

Published 22 March 2023

Executive summary

Jane Toogood, the Chief Executive of Catalyst Technologies at Johnson Matthey and Co-Chair of the Hydrogen Advisory Council, was appointed in July 2022 as the UK’s Hydrogen Champion by the then Secretary of State for Business, Energy and Industrial Strategy (BEIS). The Hydrogen Champion is an independent expert advisor, whose purpose is to engage with industry stakeholders and investors to identify barriers and enablers to investment in electrolytic hydrogen projects and Track 1 Carbon Capture Usage and Storage (CCUS) enabled projects, and to make recommendations to the Secretary of State on what government and industry could do to accelerate investment in the hydrogen economy. The scope of work also covers hydrogen demand, transportation and storage and the development of a UK hydrogen supply chain.

Hydrogen presents a significant growth opportunity across all regions of the UK, supporting decarbonisation and improving energy security, while system balancing our renewable power generation. It is also the only route for a significant portion of our existing energy intensive industry to decarbonise. Our natural advantages of plentiful renewable energy from offshore wind and one-third of Europe’s potential CO2 storage position the UK for rapid progress.

The UK government showed early policy leadership with the publication of our world-leading Hydrogen Strategy in August 2021. BEIS and now the Department for Energy Security and Net Zero (DESNZ) have created a policy framework to develop a hydrogen market that will underpin the next stage of market growth.

Other countries have also mobilised to realise the opportunities presented by hydrogen. In the United States, recent legislation provides very significant government subsidies for low carbon hydrogen production, which risks drawing investment away from the UK. Canada, the EU and individual EU member states are following with ambitious incentives and investment in large-scale projects to develop hydrogen production and attract supply chain investment.

Now is the time for further action: significant private sector finance is needed to deliver the UK’s ambitions. While global investors and major industry players have substantial funding available, not least because some industries cannot decarbonise without hydrogen, they are weighing up alternative investment options. Some are prioritising opportunities elsewhere, but a sizable number are waiting to see how projects develop in the UK.

The UK Hydrogen Champion has been tasked with examining whether the UK is really doing everything it can to maintain momentum and realise hydrogen opportunities. Through extensive engagement with over 100 stakeholders, a strong common theme has emerged around the need for greater clarity on upcoming policy decisions for hydrogen users, the funding available and overall delivery of the hydrogen roadmap to 2030 and beyond. The recommendations in this report are intended to address these policy and regulatory concerns, highlight project challenges, and identify opportunities for industry to contribute more to solutions.

This is an independent report and does not reflect government policy. The case studies quoted or illustrated in this report do not make judgements on the quality or relative importance of the projects. Any reference to such projects has no bearing on their likelihood of selection under current or future subsidy schemes.

Summary recommendations

Recommendations for government

Government recommendation 1

Kickstart investment by overcoming barriers to deliver the first CCUS-enabled and electrolytic hydrogen production projects at scale. This will boost investor confidence, build project momentum and drive UK content.

Supporting actions:

- Set dates for pending final Net Zero Hydrogen Fund (NZHF) and Hydrogen Production Business Model (HPBM) project decisions, stick to them and provide an estimated timeline for passage of the Energy Bill.

- Resolve early cross-chain risk sharing affecting CCUS-enabled hydrogen producers and their industrial consumers through additional protection in the business model.

- Set targets for each electrolytic funding round to deliver world-scale electrolyser projects to drive scale-up and deliver UK content and capability.

- Ease the temporal correlation rules for early rounds of electrolytic hydrogen production to reduce costs and allow projects to be right-sized.

Government recommendation 2

Provide a clear vision for investors on how and when hydrogen will scale-up beyond the first round of projects in the initial CCUS industrial clusters. CCUS-enabled hydrogen production needs significant enabling infrastructure, so uncertainty affects these projects more than electrolytic enabled production.

Supporting actions:

- Provide a clear scale-up plan to follow for connecting the hydrogen economy across the UK regions.

- Provide more clarity for the next set of hydrogen clusters. The Scottish Cluster has excellent large-scale opportunities in CCUS and electrolytic enabled hydrogen, including from curtailed wind. It needs early clarity about cluster timing and process to attract and retain investment, together with a clear infrastructure plan to facilitate delivery of hydrogen to the rest of the UK.

Government recommendation 3

Drive rapid development of the hydrogen economy by stimulating demand in blending, heating and transport.

Supporting actions:

- Make the strategic decision to support blending of hydrogen into the gas network in 2023 and confirm a ‘minded to’ position on suitable commercial arrangements to support blending.

- Provide early clarity on the nature of the decision on hydrogen heating for homes, including how it will be funded, to give the networks the information they need to begin detailed planning. The decision should clarify when and where hydrogen can legally be used, subject to the safety case being proved as soon as reasonably practicable. Consider an early mandate for ‘hydrogen ready’ boilers.

- Incentivise the construction of hydrogen re-fueling stations and purchase of hydrogen HGVs, set numerical targets to stimulate demand and align the UK with the EU in our ambition for hydrogen road transport.

- Align the Renewable Fuels Transport Obligation rules around additionality and greenhouse gas emissions with the Low Carbon Hydrogen Standard, where possible.

The government’s ambition for hydrogen in road transport should seek to emulate the excellent progress made with aviation, where the UK set a world-leading target for zero carbon fuel. Road transport contributes around 25% of UK carbon emissions but we have no targets for fuel cell electric vehicles or zero carbon fuels and uncertainties remain around the timing and technology pathways for decarbonisation of all road vehicles.

Government recommendation 4

Create a plan for integrated energy infrastructure to deliver an optimal future energy system incorporating gas, electricity and hydrogen (and CO2), enabling balancing of intermittent renewable power generation. Capturing the significant wider system efficiency benefits has the potential to deliver up to £38bn cost savings[footnote 1]. Industry and government should work more closely together to develop this plan.

Supporting action:

- Expand the proposed role of the Future Systems Operator (FSO) to include responsibility for developing a strategic plan for the hydrogen network, integrated with its electricity and gas network planning responsibilities to maximise cost efficiencies. In advance of this, create an early plan.

Government recommendation 5

Provide an integrated plan for the implementation of the Hydrogen Strategy to 2030, building on the existing roadmap. Collaboration and shared accountability between industry and government will be fostered by a visible, joined-up plan for hydrogen across government departments, coordinated by DESNZ.

Recommendations for industry

Whilst government has most of the levers to stimulate a hydrogen economy, there are key areas where industry has a role to play.

Industry recommendation 1

Industry should work closely with government in dedicated work groups to help resolve problems and gaps in resource. For example, dedicating expert resource and working in partnership with the HSE and DESNZ could speed up the safety assessments needed on blending and heating. Industry could improve the effectiveness of formal consultations by working in closer partnership with government, for example, on blending, where industry has data and experience from other markets.

Industry recommendation 2

Industry and trade associations should work together to evaluate the scale of the economic opportunity of hydrogen, to ensure this is not underestimated. The government would benefit from additional data to provide the full picture of how many jobs the hydrogen economy could create.

Industry recommendation 3

Industry should work closely with government to identify UK strengths, make voluntary commitments to deliver UK content and to formulate a wider supply chain strategy that builds on UK strengths, as has been done for aviation.

Industry recommendation 4

An industry supported delivery workstream on skills is required both to join up industry, government and academia and to ensure that near and long-term skill needs are met within the supply chain strategy.

Introduction

With advantages of geography, geology, infrastructure and technological expertise, the UK is strongly positioned to enable rapid decarbonisation across UK industry, particularly in the hard-to-abate sectors like glass, cement, steel and parts of the chemical sector. The UK Hydrogen Strategy published by BEIS in August 2021 showed early leadership from the UK government by setting out how the UK could use low carbon hydrogen to help meet its legally binding commitment to achieve Net Zero by 2050 and reduce greenhouse gas (GHG) emissions under the Sixth Carbon Budget, as required by the Climate Change Act. The government’s ambitious target of up to 10GW of production capacity by 2030 (doubled in the Energy Security Strategy from the original 5GW) is supported by a combination of well thought-out policy support (such as the hydrogen business models and the low carbon hydrogen standard) and additional funding to give the UK a head-start in the development of the global hydrogen economy.

Hydrogen is not the only solution, but an essential part of the integrated energy jigsaw puzzle needed to achieve decarbonisation and ensure the UK’s energy security. Government analysis suggests that by 2050, the UK will need between 250 and 460 TWh of hydrogen, delivering 20-35% of the UK’s final energy consumption – equivalent to the UK’s total energy consumption today. Hydrogen also represents a significant growth opportunity: DESNZ estimates that by 2030, the sector could support over 12,000 jobs and unlock over £9 billion in private investment – and that, by 2050, this could increase to 100,000 jobs and £13bn in GVA.

In recent months, however, the invasion of Ukraine, the consequent energy crisis and the determination of most Western countries to eliminate their dependence on Russian gas, has led governments around the world to accelerate their plans to decarbonise and to increase their plans and incentives for hydrogen production.

The US Hydrogen Strategy calls for 10 million metric tonnes (mMT) of clean hydrogen by 2030, 20mMT by 2040 and 50Mmt by 2050. The US has also passed the Inflation Reduction Act and the Infrastructure, Investment and Jobs Act, which between them provide $430bn to modernise the US energy system, including $13bn in tax credits to low carbon hydrogen producers, which reduce the costs of electrolytic hydrogen to almost zero. The Canadian government has announced a 40% hydrogen investment tax credit and a Canadian Growth Fund, whose remit includes hydrogen, worth CAD$15bn.

The EU has doubled its hydrogen production target to 20mMT by 2030 and provided at least €16bn in funding for hydrogen, including €10.6bn for 2 Important Projects of Common European Interest (IPCEI) and €3bn for a new Hydrogen Bank. Individual EU member states, such as Germany, the Netherlands and France have also announced ambitious new government funded investments in hydrogen. The EU is reviewing state-aid rules to see how member states can compete with the subsidies on offer in North America.

These measures have transformed the global investment environment for hydrogen, as multi-national industrials (including the oil and gas majors), private equity and dedicated hydrogen funds search for the optimal return on their capital. Significant funding is available but global investment is being drawn to the US and Canada: some investors have already made the decision to prioritise projects outside the UK.

Following delays in the passage of the Energy Bill, and with decisions on the next phase of CCS industrial cluster sequencing and the Net Zero Hydrogen Fund application process pending, there is market uncertainty. It is time for the UK government to take key policy decisions to encourage investment in hydrogen production and to stimulate demand (including for exports). Industry must also work more pro-actively with government to build a hydrogen economy which drives growth in skills and UK based supply chains.

Kickstarting investment

Government recommendation 1

Kickstart investment by overcoming barriers to deliver the first CCUS-enabled and electrolytic hydrogen production projects at scale. This will boost investor confidence, build project momentum and drive UK content.

Supporting actions:

- Set dates for pending final Net Zero Hydrogen Fund (NZHF) and Hydrogen Production Business Model (HPBM) project decisions, stick to them and provide an estimated timeline for passage of the Energy Bill.

- Resolve early cross-chain risk sharing affecting CCUS-enabled hydrogen producers and their industrial consumers through additional protection in the business model.

- Set targets for each electrolytic funding round to deliver world-scale electrolyser projects to drive scale-up and deliver UK content and capability.

- Ease the temporal correlation rules for early rounds of electrolytic hydrogen production to reduce costs and allow projects to be right-sized.

Background

In July 2022, the government doubled the UK’s ambition for up to 10GW of low carbon hydrogen production capacity by 2030, with at least half of this coming from electrolytic hydrogen. The stated goal is to have up to 1GW of electrolytic hydrogen and up to 1GW of CCUS-enabled hydrogen operational or in construction by 2025.

Our natural advantages of plentiful potential renewable energy from offshore wind and one-third of Europe’s CO2 storage position the UK for rapid progress. During our engagement, the UK’s twin track approach was frequently cited by stakeholders and investors as a strong advantage. Including CCUS-enabled hydrogen allows the UK to swiftly scale-up hydrogen production, to meet the needs of hard to decarbonise sectors, initially within the main industrial clusters.

Importance of project decision dates and the passage of the Energy Bill

There is a perception by industry that processes are too slow. Then BEIS Ministers verbally shared an initial intention to launch the first Electrolytic Hydrogen Allocation Round (HAR1) in 2020, but this did not take place until July 2022. A shortlist of projects due to move to due diligence, is now planned for publication in Q1 2023.

Initially, industry anticipated that the selection decisions for CCUS-enabled hydrogen projects would take place in the summer of 2022. In August 2022, 4 CCUS-enabled hydrogen projects were shortlisted in the Phase-2 Cluster Process for Track-1 with the final decision now likely in March 2023. Heads of Terms for the hydrogen production business model contract have now been published, with engagement on the draft full Low Carbon Hydrogen Agreement (LCHA) expected in Q2 2023 and the final LCHA for initial projects expected to be published from Q3 2023.

In addition to clarifying the funding envelope, investor confidence will be significantly strengthened if DESNZ can provide clarity and certainty on timelines for the critical decisions affecting these projects, including on the passage of key enabling legislation in the Energy Bill (subject to uncertainty over Parliamentary scrutiny, which is well understood).

Impact of decision delays on CCUS-enabled hydrogen

Feedback from project developers across the clusters is that delayed decisions around funding risk a growing number of these global investors shifting their focus to prioritise projects with early proof points in North America instead. We were told by projects that they had anticipated announcements regarding NZHF Strand 1 in September and that these perceived delays to decisions were interpreted negatively by their Boards in relation to investment decisions within the Track 1 Clusters. DESNZ have clarified that the commitment made in September was to provide an assessment outcome and this has been completed.

DESNZ is seeking a whole cluster Final Business Case, akin to a private sector Final Investment Decision (FID), around Q1 2024. This approach runs the risk of significant delay to the industrial cluster projects. The first mover advantage is key to deliver supply chain capability and the growth opportunities associated with development in the clusters. The opportunities associated with driving early deployment are significant, and government and the private sector need to work together to manage cross chain risks associated with timing differentials in investment decisions, in order to secure these benefits. This includes, for example, finalising full support contracts for all elements of the chain early enough to unlock the possibility of the longest build time elements to make early investments in long lead time items.

For the earliest cluster projects, particularly HyNet, it is critical that the initial project contract CFD negotiations are completed on time in 2023, to enable project developers to move forward at pace and unlock early private sector investment against an agreed contract. Without this, hydrogen production from these early cluster assets will only become available from Q3 2027.

Figure 1: Timeline of government funding milestones and suggestions to support industry decision-making

Net Zero Hydrogen Fund Strands 1 & 2:

- Fund launched - Q2 2022

- Technical assessment - Q2-Q3 2022

- Financial review and due diligence - Q4 2022

- Grant offer letters due early 2023 - Q1 2023 TBC (a precise decision date could help board decision making)

HAR1:

- HAR launched - Q3 2022

- Applications closed - end of Q3 2022

- Shortlisting Q1 and more detail on offer stage - Q4 2022 into Q1 2023 TBC (timeline to specific offer decision date would help board decision making)

Phase 2 Track 1 CCUS cluster sequencing projects (4):

- Projects shortlisted - Q3 2022

- 1st CCUS project FID required - Q4 2023 (Timeline with steps to earliest FID date could help minimise project risks and prevent delays)

HPBM process:

- Heads of Terms finalised - Q4 2022

- Draft Low Carbon Hydrogen Agreement published - Q2 2023

Industrial Demand, UK Emission Trading Scheme (UK ETS), Cross Chain Risks & Hydrogen Production Business Models

To meet Net Zero targets, industrial emissions need to reduce by at least two-thirds by 2035 and by at least 90% by 2050. Fuel switching to hydrogen has the potential to reduce annual industrial emissions by between 7 and 18 MtCO2e by 2050[footnote 2]. As a source of early hydrogen demand, industrial consumption is likely to account for at least half of the hydrogen in use up to 2030. For feedstock users, hydrogen is a unique decarbonisation route, for some others with large-scale high heat combustion requirements, it is the only viable commercial alternative.

UK industry, particularly the energy intensive sectors, must make profound changes to reduce emissions over the next 5 years. The stringency of the UK ETS target is expected to increase sharply in 2024, to align with overall legally binding targets, likely increasing emission costs for industry. High energy prices are already significantly affecting a number of these sectors and there have been several supply chain casualties already, within existing supply chains using hydrogen[footnote 3]. If foreign owners of these industrial assets prioritise investments elsewhere, further industrial production capacity within the clusters could be permanently lost.

Impact of cross chain risk on CCUS-enabled hydrogen and industrial consumers

We were told by the earliest industrial off-takers that “government’s strategic position on hydrogen, as a fuel of the future and as part of a substantial national hydrogen economy is an extremely important principle to provide confidence to make key decisions and investments regarding future energy sources”. Whilst the price support mechanism and contract duration are welcomed by industry, there remains a barrier in the Transport and Storage (T&S) of CO2. For early and first of a kind projects, risk needs to be proportionally allocated to prevent parties being exposed to material risks outside their control. It is currently envisaged that, in the event that the T&S system is non-operational, hydrogen producers should either pass through resulting ETS emission costs to consumers or be exposed to those costs directly. If a hydrogen producer ceases production, due to the non-availability of the CO2 T&S, DESNZ do not propose to provide any support for the producer’s incurred costs. Ultimately this is a critical issue for government to resolve, given the risks fall beyond the control of both hydrogen producers and consumers, cannot be managed by them and that this is consequently providing a significant barrier to investment. If DESNZ are averse to the T&S network bearing this risk that would in ordinary commercial circumstances fall to them, further government intervention will be required to address this.

The role of risk allocation to government on early cross chain issues (CO2 T&S risk and hydrogen offtake risk) is recognised. As detail emerges, however, significant risk is being allocated to the private sector. Although many of the risks dissipate once the infrastructure and projects are fully operational, the early risk must be fairly addressed to unlock financing for these production projects. A deliverable solution needs to be found to ensure that these projects are also investible for the industrial hydrogen consumers.

Case study: Encirc 360

Situated in the HyNet North-West cluster, Encirc is UK’s largest container glass manufacturer, producing more than 1 in 3 of the UK’s glass bottles. Encirc has worked closely with Glass Futures, to establish the capabilities of various low carbon furnaces and the wider potential of hydrogen in its process.

Encirc has recently announced its intention to build a new hydrogen-powered furnace at its Cheshire site to be operational from 2027. Global drinks brand Diageo has agreed to be a key customer of the new ultra-low carbon furnace, in a partnership that aims to create 200 million Net Zero bottles a year by 2030. It will be the world’s first Net Zero bottles created at scale.

Using hydrogen from the Vertex hydrogen plant, the project will change the face of UK glass manufacturing. This project facilitates a wider sustainability masterplan and expansion at Encirc, creating more than 200 jobs and futureproofing the existing 1,000 strong workforce.

UK Content and the role of targets in electrolytic funding rounds

Speed and delivery focus are critical for all the early project funding rounds. Concern about the availability of components, if projects are delayed, was a strong common theme among project developers. Although electrolyser availability was one key aspect called out specifically for electrolytic projects in Strand 3 if there are delays, concerns also included contractor availability across both electrolytic and blue hydrogen projects, due to speed of delivery and scale up elsewhere in the world.

To deliver UK content and develop supply chains, demonstrating First of a Kind (FOAK) world scale electrolyser capability is vital as electrolytic hydrogen production scales up over the next 4-5 years. Transparency around the scale, timing and funding envelope for future rounds was also considered critical by project developers both to attract investment but also as a key mechanism to support the development of experienced local supply chains to reduce future costs.

While the EU is focused on selecting, funding, and delivering specific FOAK projects at scale to drive momentum, the UK has focused on developing detailed market mechanisms to foster scale up. ‘World scale’ is currently an electrolytic project of around approximately 100MW. Many of our current projects are relatively small in scale (several MW only) and, consequently, the UK risks falling behind from a supply chain perspective. Including a target for a world scale project within each of the future early electrolytic rounds could be one means to address this. These targets could be publicly published or simply internally tracked within DESNZ.

There may also be a need for DESNZ to ‘borrow forward’ from future funding to fund these types of ‘strategic’, world scale projects that are critical to supply chain scale up, where these would exceed or use a substantial proportion of annual funding allocation.

Delivering against a target designed to foster construction of large-scale plants may also necessitate greater flexibility around timing, as bigger projects will focus on larger consumers and will be tied to the source of demand, rather than finding locations with existing grid assets that have additional spare capacity. Issues in securing grid access have been highlighted consistently throughout our engagement, most recently by the Western Gateway[footnote 4]. We were given the example of a world-scale plant in West Wales that failed to meet the target criteria around the operation date due within the Strand 3 funding round as it was unable to secure grid access until 3 months after the 2025 deadline.

To work around this constraint, smaller project developers are locating their projects where they can utilise underused existing grid access.

Ensure technical rules do not increase CAPEX cost of electrolytic hydrogen production

While it should also be noted that the UK position is more flexible than the EU in allowing non-contracted grid electricity to be used to supplement renewable volumes, the benefits of the rules proposed by the EU to ease temporal correlation restrictions for early projects have been repeatedly highlighted by project developers. Temporal correlation forces project developers to turn the electrolyser up and down in line with availability of renewables, significantly increasing capex. One project explained that capex had been doubled by UK temporal correlation rules. Not only would they need to install more hydrogen storage to smooth the intermittency of the input renewable electricity, but to operate with an average 30% load factor and still produce enough hydrogen to meet off-taker demand, the plant would need to be built 3 times bigger. The UK should further ease the rules for early projects, over the next few years as the hydrogen economy develops momentum.

Case study: Gigastack

Led by Phillips 66 Limited and Ørsted (UK) Limited, the project aims to harness offshore wind to power electrolysis and produce electrolytic hydrogen, a lower-emission fuel, to power industry by 2025. Through a 100 MWe-scale electrolyser system using renewable power from the Hornsea Two offshore windfarms, hydrogen will be produced through electrolysis and supplied to Phillips 66 Limited’s Humber Refinery. The refinery is Europe’s only synthetic graphite producer and the UK’s only at-scale producer of Sustainable Aviation Fuel, along with a range of other fuels.

Gigastack could contribute significantly towards the UK government’s 2025 target of 2.5 GWth electrolytic hydrogen and could act as a stepping-stone towards the UK government’s 2030 target of 5 GW. The project has the potential to support the UK’s offshore wind sector, the UK’s electrolyser supply chain and catalyse the renewable hydrogen sector by providing a blueprint for deploying scalable electrolyser technology in the UK.

A clear vision for hydrogen scale-up

Government recommendation 2

Provide a clear vision for investors on how and when hydrogen will scale-up beyond the first round of projects in the initial CCUS industrial clusters. CCUS-enabled hydrogen production needs significant enabling infrastructure, so uncertainty affects these projects more than electrolytic enabled production.

Supporting actions:

- Provide a clear scale-up plan to follow for connecting the hydrogen economy across the UK regions.

- Provide more clarity for the next set of hydrogen clusters. The Scottish Cluster has excellent large-scale opportunities in CCUS and electrolytic enabled hydrogen, including from curtailed wind. It needs early clarity about cluster timing and process to attract and retain investment, together with a clear infrastructure plan to facilitate delivery of hydrogen to the rest of the UK.

The need for a clear scale-up plan across the UK regions

The UK’s early focus on the development of low carbon industrial clusters is world-leading. In November 2020, a commitment was made to deploy CCUS in 2 industrial clusters by the mid-2020s, and a further 2 clusters by 2030. In October 2021, BEIS announced the Track-1 clusters and an additional reserve cluster. The Track 1 clusters provide a hub for hydrogen development at this early stage, so delivering them is critical for investor confidence.

Investors now need a clear view of how the hydrogen economy will scale up across sectors and regions through both further CCUS clusters and electrolytic hydrogen availability. As one example, a number of the key industrial hydrogen consuming sectors, including ceramics and cement, are largely located outside clusters. They need clarity about when the infrastructure will be available to provide them with hydrogen to plan their decarbonisation roadmaps.

Clarity for the next set of hydrogen clusters

Scotland has excellent large-scale hydrogen opportunities, both CCUS-enabled and electrolytic, but the larger demand for hydrogen is in the rest of the UK. The UK government should provide Track 2 cluster timing and infrastructure development in order to prevent the risk of investment moving away from Scotland. The Scottish government estimates that over £6bn of investment would become available immediately following the Scottish project’s award of cluster funding status.

The South-West Cluster, though further behind in its planning than Scotland, has an outstanding hydrogen opportunity centred around aviation innovation which could deliver £20bn in regional GVA and 15,000 FTE jobs by 2050[footnote 5].

Stimulating demand

Government recommendation 3

Drive rapid development of the hydrogen economy by stimulating demand in blending, heating and transport.

Supporting actions:

- Make the strategic decision to support blending of hydrogen into the gas network in 2023 and confirm a ‘minded to’ position on suitable commercial arrangements to support blending.

- Provide early clarity on the nature of the decision on hydrogen heating for homes, including how it will be funded, to give the networks the information they need to begin detailed planning. The decision should clarify when and where hydrogen can legally be used, subject to the safety case being proved as soon as reasonably practicable. Consider an early mandate for ‘hydrogen ready’ boilers.

- Incentivise the construction of hydrogen re-fueling stations and purchase of hydrogen HGVs, set numerical targets to stimulate demand and align the UK with the EU in our ambition for hydrogen road transport.

- Align the Renewable Fuels Transport Obligation rules around additionality and greenhouse gas emissions with the Low Carbon Hydrogen Standard, where possible.

The government’s ambition for hydrogen in road transport should seek to emulate the excellent progress made with aviation, where the UK set a world-leading target for zero carbon fuel. Road transport contributes around 25% of UK carbon emissions but we have no targets for fuel cell electric vehicles or zero carbon fuels and uncertainties remain around the timing and technology pathways for decarbonisation of all road vehicles.

Hydrogen blending

Hydrogen is currently limited to 0.1% by volume in the GB gas network by the Gas Safety (Management) Regulations. DESNZ is aiming to reach a policy decision in 2023 on whether to allow blending of up to 20% hydrogen by volume in the gas distribution networks. It is envisaged that a policy decision on blending into the gas transmission network will follow. Resource should be provided for HSE to enable the safety case to be assessed. Safety trials were recently concluded for distribution level blending and are due to be finalised by late 2023 for transmission level blending.

In addition to completing the safety assessment, blending must also demonstrate strategic and economic value. Due to the necessary industry and legislative changes, DESNZ do not anticipate that blending could occur at scale before 2025 at the earliest.

Blending potentially aids investment, reduces emissions, enables supply and demand to be balanced and facilitates early experience with hydrogen, including in the gas National Transmission System (NTS), subject to satisfactory demonstration of the safety case. Blending is essential in the near term to enable the hydrogen economy to meet its targets and achieve critical mass. Speeding up a strategic decision to allow blending in 2023 via the preferred way forward is welcome but blending must be available by 2025 to unlock investment in hydrogen production. Further formal consultations are likely to take up additional time, so DESNZ should consider other swifter mechanisms to seek stakeholder views.

Blending does more than balance supply and demand to unlock the growth of the UK hydrogen economy. Hydrogen blending alone could support up to approximately 5 GW of hydrogen production near term and has the lowest risk profile of off-takers. This significantly helps to make CCUS-enabled hydrogen projects investible during scale-up. Blending can also reduce curtailed renewable electricity and provides one of the lowest levellised costs of hydrogen. 6 MtCO2 pa of carbon savings could provide a material contribution to Carbon Budgets 5 and 6 with minimal disruption. It also has the potential to help build social acceptance.

Industry was also keen to emphasise that the subsidy support should be equivalent to that available to other offtakers in order to overcome the ‘chicken and egg’ problem of production and supply. DESNZ has strongly emphasised the need to prioritise industrial consumers. Whether or not support is supplied through a business model, a mechanism will be required to address this, so adequate support is provided but hydrogen is not used preferentially for blending.

Requirements for a Positive Strategic Blending Decision in 2023

The preferred way forward should be based on the safety and economic benefits of blending and an in-principle decision should not require all the commercial, regulatory, and operational arrangements needed to implement blending to be fully developed.

A positive strategic blending decision in 2023 has several key elements:

- Blending should be included into the gas NTS, subject to a satisfactory NTS safety case and solutions to address issues around connection and the needs of transmission connected customers for whom blended hydrogen is problematic.

- The government provides sufficient and appropriate support, potentially via a business model.

- The timeframe and duration of government support to blending is clear.

Figure 2: Indicative end uses of hydrogen, comparing proportion used for blending against commercial and industrial contracted volumes in different scenarios to demonstrate the potential role of blending as a flexible offtaker.

Scenario | Blending offtake | C&I - | -: | -: Hydrogen production starts | 100% | - C&I demand starts | 60% | 40% C&I demand increases | 10% | 90% Disruption to C&I demand | 70% | 30% C&I demand recovers | 10% | 90%

Hydrogen for heat

In 2021, the residential sector emitted 68.1 MtCO2, accounting for 19.9% of all carbon dioxide emissions in the UK[footnote 6]. The main source of emissions in the residential sector is the use of fossil fuels (mainly natural gas) for heating and cooking. Currently 85% or 23 million homes are connected to the gas grid with most of the remaining 15% or 4 million using oil or LPG or as their main heating fuel or using electric heating. In the next 10 to 15 years, most of these systems will need to be replaced with low-carbon alternatives if the UK is to meet its net zero target. Hydrogen demand from heat could increase sharply, increasing from up to 1% of heat demand by 2030 to around 27% of heat demand by 2035 (in the most bullish scenario).

The UK government has committed to deliver a neighbourhood trial by 2024 and a village scale trial by 2025, deciding on the location for the village trial in 2023. All the safety and technical evidence is required before 2025, so that the village trial can go ahead. By 2025, plans will be finalised for a potential hydrogen heated town to be delivered by 2030, as the potential first stage of an enduring roll out of hydrogen heating. It is proposed that ministerial decisions on whether and how hydrogen should play a role in decarbonising heat in the UK, alongside electrification and heat networks, will be made in 2026 and will include a decision on whether to proceed with plans for the Town Pilot. Only after 2030 would hydrogen for heat have any meaningful role to play, but scale-up could be swift beyond 2030, with heating (for both domestic and commercial purposes) potentially accounting for up to around 40% of total hydrogen demand by 2050.

In the run up to and during the trial, communication and attitude monitoring is of paramount importance to all parties, alongside the need for a long-term communications strategy around hydrogen for heating, with roles for both industry and government.

International context

In 2023, a 3-year project in the Netherlands testing 100% hydrogen domestic heating in 12 houses in Lochem became first large-scale pilot of its kind. Baxi’s parent company, BDR Thermea Group, is testing its 100% hydrogen boilers in 12 inhabited homes, with hydrogen supplied via an existing natural gas grid.

Background to the recommendations

DESNZ are taking a fully integrated approach to the decarbonisation of domestic and non-domestic heating. Domestically, heat pumps offer higher efficiency in terms of heat output per unit of energy input, but there is a need to take into account wider costs and barriers such as hard-to-insulate properties and electricity network constraints. Once these factors are taken into account, some whole system studies indicate that hydrogen heat pathways could be cheaper in certain circumstances. Reliability, resilience, affordability, and acceptance must also be considered. Hydrogen heating could potentially be an important strategic option though DESNZ are clear this needs to be investigated further.

There is no one perfect solution for UK domestic heat, and hydrogen has a potential role to play, as has been recognised by the Climate Change Committee[footnote 7]. Two or 3 times the amount of energy currently flows through the gas grid than it does through our electricity infrastructure. Within the decarbonisation transition for UK domestic heat, where we have a high existing dependency on gas for heating already, where our housing stock is the oldest in Europe, and less easily insulated and adapted for heat pumps, hydrogen has the potential to form part of the solution,[footnote 8] subject to the safety case being met.

It is recognised that incentives and measures are needed to deliver heat pump uptake, but the approach proposed is not technology neutral. At present, it is suggested that companies will be set a quota of Heat Pump Systems that they must sell, and that figure will be based on overall market share for boilers. It is recommended that hydrogen ready boilers be excluded from these market share calculations until a hydrogen ready boiler mandate is put in place, since they will produce zero carbon emissions when running on hydrogen.

The nature of the heat decision

The hydrogen for heat decision should be taken in 2026 with a clear focus on the safety case. This decision is a milestone within a wider plan. Currently there is little clarity around how the decision will be made, the criteria that will be used and the nature of decision itself. Industry is looking for clarity around where, when and in what circumstances hydrogen for heat will be enabled, funded and implemented. This gap in the plan must be addressed, as business planning for the RIIO 3 process for gas transmission and distribution (2026-2030) will occur early in 2024 and decisions will be made by Ofgem in 2025. Yet the decision around heat is not due until 2026.

Industry recommendation 1

Industry should work closely with government in dedicated work groups to help resolve problems and gaps in resource. For example, dedicating expert resource and working in partnership with the HSE and DESNZ could speed up the safety assessments needed on blending and heating. Industry could improve the effectiveness of formal consultations by working in closer partnership with government, for example, on blending, where industry has data and experience from other markets.

Case study: Worcester Bosch

The UK market is for 1.6m to 1.7m boilers every year. It is an area where we have a strong UK capability with potential export opportunities. UK firms have been at the forefront of developing domestic hydrogen appliances that demonstrate the safe use of hydrogen as a fuel in producing domestic heating, hot water, and cooking. Worcester Bosch have developed hydrogen ready boilers which can be initially installed to operate on natural gas then converted to hydrogen with a simple intervention, at the same price as a new gas boiler.

Given UK government’s timelines for deciding on a role for hydrogen in heating, Worcester Bosch recently took the decision to pivot its hydrogen technology-focused resource away from hydrogen activity. Providing early certainty around the government’s intention to put in place a hydrogen-ready boiler mandate with effect from 2026 would support the development of these UK capabilities at no cost to government or consumers and ensure that that boilers are available when needed, given the 2 to 3 years it takes to ramp up production.

Figure 3: Timeline of hydrogen, targets, policy development, regulation and private sector expectations.

Regulation:

- Open letter - 2022

- RIIO GD3 & GT3 framework development[A],[B] - 2022-2026

- RIIO GD3 & GT3 draft and final determinations - 2026

- RIIO GD3 & GT3 start - 2026

- RIIO GD3 & GT3 period (expected) - 2026-2030

Policy:

- Legislation for production BMs & Billage (Energy Bill)[D] - 2022

- BEIS blending decision - 2023

- Progress of legislation - 2023-2024

- First expected commercial sale - 2025

- BEIS T&S BMs decision[A],[C] - 2025

- 2GW by 2025 - 2025

- Progress of legislation - 2025-2026

- Aim for hydrogen-ready boilers to be mandated from - 2026

- BEIS hydrogen heating decision[B] - 2026

- 10GW by 2030 - 2030

Infrastructure:

- Project Union start - 2022

- Pre-FEED - 2023-2024

- FID for first blue H2 projects[C],[D]

- FEED - 2024-2025

- Hydrogen Village[D] - 2025

- First blue H2 projects operational - 2025

- 2 CCUS clusters - 2026

- Construction - 2026-2030

- Hydrogen Town - 2030

- 4 CCUS Clusters - 2030 on

A. In the absence of a decision on hydrogen for heat, it is difficult for networks plan to plan for RIIO-3.

B. The RIIO-3 framework cannot take into account T&S business models which haven’t been finalised.

C. The first blue hydrogen projects will struggle to take FID in the absence of a clear business model for transport.

D. Energy Bill contains provisions which are integral to the business models for hydrogen production and village trial, but needs a clear timeline for swift passage through the Parliamentary process to meet the necessary timelines.

Hydrogen in transport

Moving away from a broader application for hydrogen, DfT are largely focused on exploring hydrogen within heavier applications such as aviation, maritime and heavy road freight. This report has focused on recommendations associated primarily with road transport and aviation where UK content capabilities are good and timely progress is key. There are, however, hydrogen related opportunities in both rail and maritime that also merit further exploration.

Setting numerical road transport targets

Policy is fully focused on demonstrating zero emission at the tailpipe, which currently excludes on road combustion applications. Embedded in programmes to explore multiple zero emission technologies, DfT are running several trials, demonstrations and R&D to inform their hydrogen transport policy:

- Tees Valley Hydrogen Transport Hub – to inform where hydrogen works well across transport and other sectors using or creating hydrogen in the region.

- Zero Emission Road Freight Demonstration – largest at-scale demonstration of multiple zero emission technologies to power heavy goods vehicles (HGVs) in the world, running until March 2025 to build an evidence base to enable strategic long term national infrastructure decisions which will have implications for hydrogen fueled HGVs and refueling infrastructure.

- Zero Emission Bus Funding, a portion of which could benefit hydrogen fuel cell buses

- Clean Maritime Demonstration Competition – to support design and development of clean maritime solutions that include hydrogen technologies.

- Jet Zero Council – with a Zero Emission Flight Delivery Group focused on hydrogen.

- Rail Safety and Standards – the RSSB are undertaking work to explore use and storage of hydrogen for trains.

DfT are developing a Low Carbon Fuels strategy which could impact hydrogen demand in future. It will examine how various low carbon fuels and feedstocks for sustainable fuels are likely to be marshalled across transport modes to help meet carbon budgets into the 2040s.

Of the various existing options, the use of hydrogen for rail is likely to be limited and shipping will not become a significant source of demand until after 2030, although it could swiftly overtake road transport at that juncture. Road transport/offroad vehicles are a significant source of near-term hydrogen demand and alongside aviation, a key potential source of UK content with regional economic benefits.

Aviation

UK aviation has an outstanding platform for innovation and growth with strong capabilities focused on hydrogen. Thought leadership, technology development and an effective forum to deliver industry investment and ambition characterise our approach in this area. Hydrogen has a role to play in Sustainable Aviation Fuel (SAF) and as a standalone fuel. The UK has a target of net zero domestic aviation by 2040, which will require the rapid development of new technology. Without any changes in the sector, aviation will be responsible for 39% of the UK’s emissions by 2050.

Heavy goods vehicles (HGVs)

Offering a mixed refueling solution has the potential to provide infrastructure savings. In the UK, hydrogen fuel cell electric vehicle (FCEV) technology will be required for HGVs, buses, and other high-use vehicles on and offroad, so the largest vehicle OEMs are developing technology for both FCEVs and Battery Electric Vehicles (BEVs). In addition, there are multiple off-road applications in (for example) mining and construction where the UK has strong capability and hydrogen combustion has a role to play. However, despite early ambition and strong UK content opportunities given our innovation, engineering and supply chain capabilities, our approach around on- and off-road vehicles risks falling behind. This will negatively impact our growth if our international logistics infrastructure does not decarbonise in tandem with our nearest trade partners.

The UK is taking an incremental approach, centered on a £2.2m hydrogen hub pilot in Teesside between 2021 and October 2022, with Phase 2 scaling up the hub, commencing in early 2023. Other policy tools could be leveraged to enable a swifter transition from market creation to market growth in hydrogen transport uses.

A clear strategy with targets for hydrogen fuel cell electric vehicles for transport as well as battery electric vehicles is essential for the UK to keep pace with EU developments, such as the vote by the European Parliament to develop the EU hydrogen refuelling infrastructure by constructing a hydrogen refuelling station every 100km on all EU trunk routes by 2027. In the UK, hydrogen refuelling stations have been closed down, leaving only 9, many of which operate infrequently.

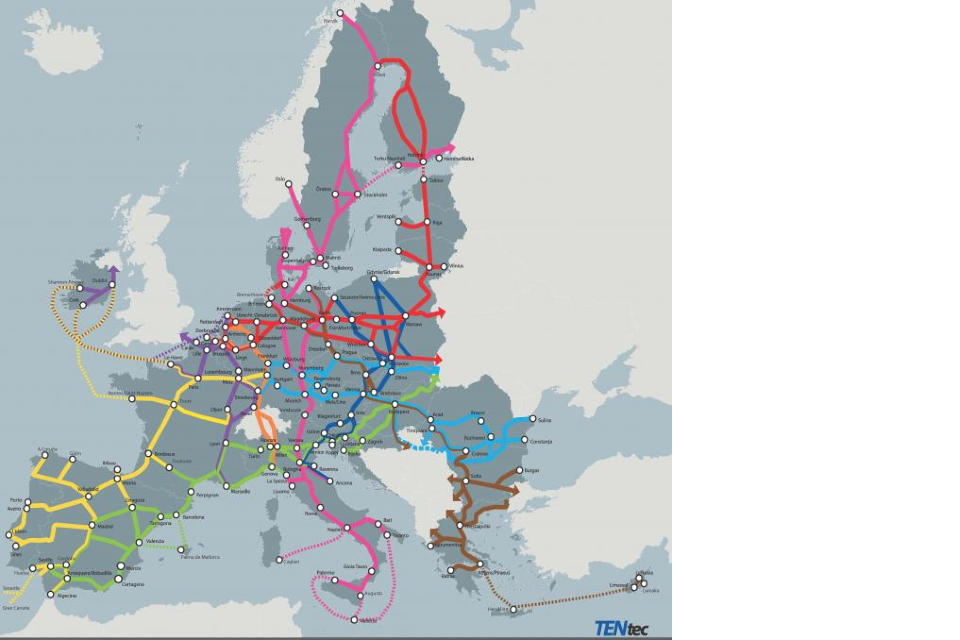

Figure 4: Trans European Transport Network, fostering development of a Europe-wide network of railway lines, roads, inland waterways, maritime shipping routes, ports, airports and railroad terminals.

Source: European Commission: Mobility and Transport.

Case study: aviation in the South-West

The Department for International Trade (DIT) has recognised the South-West of England as a High Potential Opportunity (HPO) for the development, demonstration, and adoption of new and emerging aviation technologies. The introduction of hydrogen-powered aircraft is a unique opportunity for the UK: according to the Aerospace Technology Institute, bringing forward the first generation of hydrogen aircraft in the UK would create 38,000 high-productivity, high-paid jobs in the regions, with the South-West having the most to gain.

International context On a global basis, currently, over 95% of the energy used for road transport is currently fossil fuel based. There is no silver bullet to solve this, so a transition will be required. While BEV technology is generally more mature, it is accepted around the world (particularly in Asia) that other technologies, such as FCEVs and e-fuels for combustion engines will also be needed. This is partly because battery technology is not developed to enable longer haul, heavy use vehicles and partly because the level and location of renewable electricity generation will not be able to support a wholesale transition to electricity.

According to McKinsey, sales of fuel cell vehicles grew by 65% between 2020 and 2021, with a sevenfold increase in the sale of fuel cell trucks in China. Vehicle OEMs have developed 87 fuel cell vehicle platforms to date, up from 61 in 2021 (about 70% are in China). Most of the current platforms are for fuel cell buses, followed by trucks and light vehicles.

Infrastructure is a critical enabler. About 700 hydrogen refuelling stations were installed globally by the end of 2021, reflecting 25% annual growth from the end of 2020. About half of these are in Japan, South Korea, and China, with about 100 stations added in the past year, reflecting annual growth of about 35%. Europe accounts for about 230 stations and the US 80.

Aligning standards

Within the UK Low Carbon Hydrogen Standard, we have set a sound bar to deliver emission reduction against our world leading emission reduction targets. The majority of the NZHF electrolytic hydrogen projects engaged with for this report have more than one off-taker, with most including transport. Consistency between standards would reduce regulatory complexity for these projects. Significant, consistent feedback was received that Renewable Fuel Transport Obligation (RTFO) should be aligned with additionality requirements and greenhouse gas thresholds in the Low Carbon Hydrogen Standard (LCHS). DfT has indicated that the RTFO is legally required to deliver real time carbon savings which take into account displacement of energy from the grid and that consequently, the RTFO must retain additionality. Wherever possible, however, the RTFO should align with the Low Carbon Hydrogen Standard (LCHS): this should be further considered within any future review of the RTFO.

Easing temporal correlation rules (as discussed under Government Recommendation 1) was also deemed helpful both to support the individual investment cases and to enable UK hydrogen projects to compete for capital internationally. It would, according to some stakeholders, have the added benefit of reducing regulatory complexity for smaller projects.

Table 1: Comparison of standards between the LCHS, RTFO and in the EU.

| LCHS | RTFO | EU | |

|---|---|---|---|

| GHG threshold | 20g CO2eq/MJ LHV | 32.9g CO2eq/MJ | 28.2g CO2eq/MJ |

| GHG scope | Upstream and production | Upstream, production and transport/distribution to the pump | Full lifecycle |

| Additionality of renewable electricity required | No, but encouraged through grant scoring | Yes. Refurbishment, life extension, curtailed ok | No until 1 January 2027, then yes |

| Sleeve power through grid (PPA) | Yes | Yes | Yes |

| Temporal correlation | 30 minutes; monthly reporting | 30 minutes; monthly reporting | Monthly until 1 January 2027, then hourly |

Integrated energy infrastructure

Government recommendation 4

Create a plan for integrated energy infrastructure to deliver an optimal future energy system incorporating gas, electricity and hydrogen (and CO2), enabling balancing of intermittent renewable power generation. Capturing the significant wider system efficiency benefits has the potential to deliver up to £38bn cost savings[footnote 10]. Industry and government must work more closely together to develop this plan.

Supporting action:

- Expand the proposed role of the Future Systems Operator (FSO) to include responsibility for developing a strategic plan for the hydrogen network, integrated with its electricity and gas network planning responsibilities to maximise cost efficiencies. In advance of this, create an early plan.

In the British Energy Security Strategy (BESS), HMG committed to designing, by 2025, new business models for hydrogen T&S infrastructure. The first step towards this was the recent consultation on hydrogen T & S infrastructure business models which closed on 22 November 2022.

In the meantime, DESNZ have been finding pragmatic short-term solutions to enable the initial pipeline infrastructure to be developed. They have expanded the scope of strand 1 (DEVEX) support of the NZHF to include associated on-site T&S FEED costs and sought to include costs for limited infrastructure in the hydrogen business model where it is necessary, affordable, and value for money. They have been working with Ofgem to consider what work needs to happen now and to find an appropriate funding mechanism to support this. This remains a critical area of focus for projects until the business models are in place.

International context A proactive approach is required to ensure that a lack of hydrogen transport infrastructure does not risk undermining UK hydrogen investment. On the continent, governments are moving swiftly to develop the enabling hydrogen pipeline infrastructure backbone facilitated by the EU-wide 10-year network development plan. The legislation also proposes to establish a European Network of Network Operators for Hydrogen (ENNOH) where hydrogen network operators can cooperate, with one of its roles to develop a non-binding EU-wide 10-year development plan for hydrogen infrastructure. The Dutch government has already tasked grid operator Gasunie with developing a national hydrogen grid in steps by 2030.

Recommendation context

Hydrogen transport and storage infrastructure will be a critical enabler to meet government’s 10GW ambition. Alongside connecting producers and consumers, well-developed hydrogen transport and storage can deliver system savings. Excess renewable electricity can be used to produce hydrogen, which can then be stored over time. Analysis by AFRY estimates that long duration energy storage, supplied predominantly by hydrogen, could provide between £13-24bn savings to the electricity system between 2030 and 2050 – by reducing network constraints and seasonal imbalances emerging from an increasingly weather-driven system[footnote 11].

As in so many other areas, hydrogen is an essential piece of a bigger puzzle. However, it requires an integrated, long-term approach to deliver benefits. A recent stakeholder workshop event concluded that the savings would be supported by many ‘no regret’ network investments, common across all of National Grid’s Future Energy System (FES) 2022 scenarios, over the next decade[footnote 12]. Maximising renewable generation on the system is key to meeting UK net-zero ambitions. According to the modelling work, this requires an increase in the importance of dispatchable peak supply with up to 32 GW of hydrogen turbines and a similar magnitude of demand-side flexibility resources.

Electrolyser capacity has a significant impact on the share of curtailed power (Figure 5). Material near term savings have been identified to address curtailment payments around existing onshore wind in SW Scotland by NGN. Modelled using the established FES, by 2050, curtailment reaches over 26% of annual supply across the UK in a limited energy system integration scenario compared to less than 1% in the integrated ones. Looking forward, it is evident that one of the biggest roles hydrogen has to play is to help balance the grid. An integrated long term energy plan is essential to drive cost efficient, timely infrastructure and helps us to meet net zero timelines.

Figure 5: Graph to show the impact of installed electrolyser capacity on proportion of power which is curtailed power in different FES scenarios[footnote 12].

Graph showing how electrolyser capacity has an impact on the share of curtailed power in different FES scenarios:

- Consumer Transformation (CT)

- System Transformation (ST)

- Leading The Way (LW)

Curtailment is minimised in all integrated scenarios, and is highest in the Limited Integration sensitivity:

- Curtailment reaches over 26% of annual supply in a limited integration world compared to less than 1% in the integrated ones.

- In 2050, LW and ST have at least 2 times higher installed electrolyser capacity than CT; this leads to 8 times less curtailment in ST and LW.

- In 2040 , despite having about the same electrolyser capacity in ST as CT, the share of electricity curtailed is higher in ST due to the role of other solutions.

Transport and storage infrastructure is critical to deliver the hydrogen from curtailed wind (especially in Scotland) to the centres of demand further south. The absence of this infrastructure acts as a deterrent to investment. Early certainty around the development of a hydrogen backbone is a key enabler. To ensure that the necessary decision timelines can be met, T&S business models are needed swiftly. Near term practical solutions, with industry, Ofgem and DESNZ working together, are essential until the hydrogen transport and storage business models are in place.

While progress is being made to deliver funding for essential, enabling pipeline infrastructure for the earliest projects, it would be helpful to consider practical solutions for the next stage of hydrogen pipeline infrastructure required across the clusters, where early decision making is critical to minimise overall system delivery costs. The Humber hydrogen pipeline is a good example: 25% project saving are available if CO2 and hydrogen pipeline infrastructure are developed together. Due to the competitive nature of the process, government intervention is needed to ensure that economically optimal pipeline infrastructure solutions are found in Teesside and Humber clusters.

Near term solutions are also required for hydrogen storage infrastructure. National Grid’s Future Energy Scenarios suggests that between 11 TWh and 56 TWh of storage may be required in 2050 across varying net zero scenarios[footnote 13]. To put this into context, in gas terms, this is enough gas to supply the UK for between 5 days and 28 days. Hydrogen storage is, moreover, critical to deliver a balanced grid. UK is well placed with both depleted oil and gas fields offshore for long range storage and suitable shorter-range onshore salt cavern storage to serve the initial track 1 clusters. However, salt cavern stores can take up to 10 years to develop from the inception which means that critical storage infrastructure need to progress before the T&S business models are available.

Case study: Aldbrough pathfinder project

Aldbrough hydrogen storage, a joint project between SSE and Equinor, has the potential to be one of the world’s largest hydrogen storage facilities providing 320GWh storage in time to support UK’s 2030 hydrogen target. In advance of this, the SSE’s Aldbrough Hydrogen Pathfinder project integrates hydrogen production via grid electrolysis (with renewable power via a PPA), cavern storage and 49MW hydrogen to power generation using Siemens SGT 800 turbine. By taking an ecosystem approach, the project has been devised as a “proof-of-concept” for the green hydrogen production to power value case, delivering valuable system integration learnings that will underpin the development of hydrogen to power at scale as well as cost benefits that can be applied more widely. The project is critically dependent on the development of the hydrogen transmission system and would benefit from ‘Fast Track Consenting’ introduced through British Energy Security Strategy.

A visible, integrated plan

Government recommendation 5

Provide an integrated plan for the implementation of the Hydrogen Strategy to 2030, building on the existing roadmap. Collaboration and shared accountability between industry and government will be fostered by a visible, joined-up plan for hydrogen across government departments, coordinated by DESNZ.

The UK government showed early policy leadership with the publication of a world-leading Hydrogen Strategy in August 2021. However, within government, there is a strong need for a joined-up plan for hydrogen across government departments, coordinated by DESNZ, laying out dependencies between departments, identifying gaps and pinch-points in the timeline to ensure that both project investment and government decarbonisation goals are delivered on time. Working back from the 2030 targets already agreed, the government should develop the Hydrogen Strategy to the next level of detailed milestones to make clear which decisions are needed to be taken by when.

While integrated planning is needed internally within government, a reasonable degree of detail around these plans needs to be visible to hydrogen stakeholders. This is important to restore confidence, identify issues and put in place resource to address them to keep the development of a complex, integrated economy on track.

This requires a range of deliverables, some of which have already been covered in the report:

- The Hydrogen Advisory Council needs sufficient visibility of the plan to identify gaps and pinch-points where government and industry should join resources and work together to remove barriers.

- Investors need concrete information about decision deadlines for projects and key demand decisions to underpin their own decision-making processes and to restore confidence.

- Industry need visibility around how and when hydrogen infrastructure will be scaled up across the UK to understand when hydrogen will be available to support planning and investment.

- Greater visibility around the long term funding envelope will provide clarity for investors and can also help to drive the supply chain strategy to deliver UK content.

The scale of economic opportunity

Industry recommendation 2

Industry and trade associations should work together to evaluate the scale of the economic opportunity of hydrogen, to ensure this is not underestimated. The government would benefit from additional data to provide the full picture of how many jobs the hydrogen economy could create.

DESNZ has estimated that by 2030 the sector could support over 12,000 jobs and unlock over £9 billion in private investment – and that by 2050 this could increase to 100,000 jobs and £13bn in GVA. Due to the way in which government numbers are calculated, however, this probably underestimates the scale of the opportunity in terms of both the number of high-quality, well-paid jobs together with the economic impact associated with the development of a UK hydrogen economy. From a levelling up perspective the location of the jobs that would be both protected and new jobs created is relevant.

There have been several studies completed across the various clusters but each of these is slightly different in terms of the approach used and the nature of the numbers produced (timings, jobs and bottom-line impact).

To garner targeted investment to deliver the investment required industry should work with trade associations to collate the review the work that has been done and to provide a coherent overview of the opportunity across the UK on a consistent basis. The work should identify:

- Private investment unlocked

- GVA impact

- Jobs supported including jobs protected and new jobs added

This work could be carried out alongside the work associated with UK content in the context of the Supply Chain Strategy, to make sure that it accurately reflects the scale and breadth of the UK economic opportunity. It should also encompass the savings associated with using hydrogen in an integrated energy system.

UK content

Industry recommendation 3

Industry should work closely with government to identify UK strengths, make voluntary commitments to deliver UK content and to formulate a wider supply chain strategy that builds on UK strengths, as has been done for aviation.

The Hydrogen Sector Development Action Plan (SDAP), published in July 2022, sets out the actions government, industry and the research and innovation community can take to seize the supply chain opportunities presented by the low carbon hydrogen economy and for UK businesses to position themselves at the forefront of the emerging hydrogen market.

Figure 6: Industrial clusters visited by the Hydrogen Champion between October and December 2022.

Scotland:

- Up to £25 billion GVA by 2045

- 300,000 jobs by 2045

- 5GW Hydrogen by 2030 and 25GW by 2045

Teesside:

- £3.25 billion investment in hydrogen projects

- 3,000 hydrogen jobs, within 20,000 total associated with clean growth

North West & North Wales:

- £17 billion GVA from hydrogen cluster development

- HyNet alone will deliver 6,000 new jobs

Humber:

- £15 billion private investment by 2030

- CCS and hydrogen projects support around 15,000 direct jobs & £1.1 billion in GVA annually, on average, during the construction phase to c.2031

- 30% of UK hydrogen production target by 2030

South West Cluster:

- £20 billion in regional GVA by 2050

- 15,000 FTE jobs by 2050

Western Gateway:

- Aiming to add £34 billion to the UK & attract £4bn investment by 2030

Within the SDAP the government stated that it would ask industry to lead a process to voluntarily set levels of ambition for supply chain participation in UK hydrogen projects. The proposed process is for industry-led working groups to assess UK capabilities and recommend voluntary levels of ambition in key parts of the value chain, which may include production, T&S, and potential end-uses such as transport and power. Industry and government are expected to start discussions in early 2023. The process will be supported by Hydrogen UK and industry recommendations will be presented to the Hydrogen Advisory Council.

Context to the recommendations

Whilst the SDAP provided an excellent starting point, there are also learnings from the offshore wind experience. It is vital that key supply chain strengths and opportunities are identified within a wider strategic plan and proposals put in place to enable their development. In addition to skills, innovation has an integral role to play in the development of content, particularly in the late TRL stages. Although innovation will be critical long-term, at this juncture, the evolution of the hydrogen economy is reliant on scale-up capability rather than invention. Innovation capability has not therefore been a key area of focus in the report. However, the need for support to procure gaseous and liquefied hydrogen production at scale to enable rapid demonstration of commercial scale technology and deployments in key consumption markets is a strong, consistent theme which merits exploration by DESNZ. It is evident from speaking to electrolyser projects applying for funding that this is a strong driver for many of the smaller projects. Some of the hydrogen supply issues to test and demonstrate hydrogen transport, for example, may be resolved through these forthcoming electrolytic projects. In the immediate term, however, difficulty in procuring hydrogen is choking project development and equipment testing.

Buses, coaches, HGVs and offroad vehicles may be developed in the UK if the incentives can be put in place to foster scale up. Regional government procurement needs to continue to be used strategically together with hydrogen vehicle targets. UK electrolytic hydrogen production must grow by 4 orders of magnitude by 2035[footnote 14]. This growth encompasses electrolyser production together with the wider technology and associated supply chain capabilities. Beyond our fuel cells and electrolyser expertise, there will be pinch-points around certain components that can be made in the UK, including valves and specific compressors. Materials supply chain strengths should also be considered. For example, precious metals are a constraint for electrolyser production, but UK has world leading experience and capability in precious metal recycling. Composites and materials for storage tanks and pipelines are another potential area of UK content. During a visit to the South-West, it was evident that UK cryogenic skills, rare outside space industry, are a precious and useful capability associated with hydrogen aircraft development.

Three broad areas were highlighted for further analysis within the Hydrogen Champion roundtable discussions that took place, including the one specifically covering innovation and UK content:

- Electrolysers and fuel cells

- Storage, tanks, pipelines, and distribution technology

- Control and safety systems

In addition to excellent engineering capability, it was acknowledged that our regulatory expertise is strong. This can be used to deliver a competitive advantage for UK industry via robust product and safety standards, although a well-documented overview of hydrogen regulation is a key enabler[footnote 15].

Skills

Industry recommendation 4

An industry supported delivery workstream on skills is required both to join up industry, government and academia and to ensure that near and long-term skill needs are met within the supply chain strategy.

If the UK is to meet its ambition to transform its nascent hydrogen sector into a thriving, low carbon hydrogen economy, it needs to invest now to ensure its workforce is equipped to deliver this change and take up the good quality jobs[footnote 16] that a future hydrogen economy would generate. A failure to do so risks acting as a brake on industrial transformation and green economic growth.

The Green Jobs Delivery Group was established by government to bring together leaders from business, industry, trade unions and academia to drive forwards the upskilling and training of the green workforce of the future and has focused on skills within the power and nature sectors. The group includes ministers from 4 government departments (DESNZ, DWP, DEFRA and DfE) as well as other departments when required, and is co-chaired by industry and has proved to be an effective model. This group could provide a good template for development across the hydrogen sector.

Investment in future skills and capabilities must be delivered at every level, from school to university and from apprentices to research leaders. Interventions need to ensure equality of opportunity, provide opportunities for reskilling and upskilling workers from other industries, inspire new entrants to the sector and attract the very best mobile talent from around the world.

While this work should continue to be strongly supported by industry, it requires a close partnership with government and academia to ensure that near term needs are met through the Local Skills Action Plans and long term through full use of the Skills Value Chain approach.

Government approach and current position

In the transition to green jobs, the proposals within Skills for Jobs: Lifelong Learning for Opportunity and Growth are already delivering impact. Modularised interventions through the Skills Boot Camp programmes have been making upskilling and reskilling accessible for employers. The launch of T-Levels is encouraging post-16 students to take an alternative education route to A Levels and the significant investment in the FE sector, including the Institutes of Technology, provides accessible skills solutions to a wide range of students and employers.

In addition to these, macro interventions reports commissioned by organisations such as Industrial Decarbonisation Research Innovation Centre (IDRIC) have identified immediate gaps in the number of people with the skills needed to deliver industrial decarbonisation[footnote 17] and begun to understand the gaps in the broader hydrogen skills landscape.[footnote 18]

Understanding the immediate skills needs

At the regional level, work is underway through Local Skills Improvement Plans (LSIPs) to identify near-term regional skills needs across multiple sectors. Funded by the Department for Education (DfE), LSIPs across 40+ areas bring together employers, colleges, independent training providers, and other local stakeholders to understand the skills needs of the local labour market. Tailored to their local areas, there is understandably variation in the methodologies they use and the extent to which they focus on hydrogen as a priority sector.

There is an urgent need now to aggregate the LSIP outputs and other relevant sector studies to build an integrated view of immediate hydrogen skills needs. Action should be taken swiftly to avoid generating a fragmented approach to skills investment and interventions.

Planning now for future skills needs

In parallel to provisioning skills needs over the short term, we need to understand and invest in those hydrogen specific skills that will increasingly be in demand over the next 5 years and beyond. Work is now underway to embed a systematic, robust, evidence-based approach to foresee future workforce skills needs, curate content and pathways to address skills gaps and deliver and diffuse this content through the existing skills ecosystem via the adoption of the Skills Value Chain approach (SVC)[footnote 19].

Following the High Value Manufacturing (HVM) Catapult’s publication of the ‘Manufacturing the Future Workforce Report’ in early 2020 and the delivery of the DfE funded Emerging Skills Project during 2021/22, the importance of a Skills Value Chain approach that aligns and connects the development of future workforce skills with emerging technologies was included in BEIS’s Innovation Strategy (mid 2021). This set out the continuing role of the Gatsby Foundation and that of UKRI, through Innovate UK, to develop a leadership role in identifying critical innovation emerging skills gaps. Innovate UK’s Plan for Action in early 2022 continued the commitment to Skills Value Chain principles and led to the creation of a Workforce Foresighting Hub (WFSH) to accelerate the scope, scale and pace of the development and application of foresighting future workforce skills. This reflects the changed assumption that ‘skills and workforce’ matters lie within a Catapult’s remit to maximise the impact of each Catapult’s innovation work.

Figure 7: The skills value chain described by the High Value Manufacturing Catapult.

Convene (to establish needs):

- Foresight future workforce capability

- Define role, occupations and standards

Curate (and create resources):

- Develop modular curriculum and content

- Set-up assurance, validation and recognition

Deliver (and diffuse):

- Deliver early stage training (inc. teachers)

- Scale-up with cooperating providers

Source: Manufacturing the Future Workforce

A major recommendation of the report was to implement the ‘Skills Value Chain’ (SVC) The SVC aligns the skills development of the future workforce with the needs and opportunities of emerging and more productive technologies. By involving technology, employer and educator groups in a coherent and connected way, the SVC delivers value for all stakeholders. The SVC approach links technology strategy to future workforce requirements, highlighting where new standards, qualifications and, crucially, upskilling courses are required for the current workforce using modular training and learning-through-work approaches. It also captures the essential step of investing in those that will teach new content and scale-up provision as demand grows and technology diffusion occurs.