16 to 19 further education allocation calculation toolkit: 2021 to 2022

Updated 18 March 2021

Applies to England

1. Introduction

We have published details of the funding arrangements for the academic year 2021 to 2022 for students aged 16 to 19 and students aged 19 to 25 with an Education, Health and Care (EHC) plan on GOV.UK. This includes details of changes in 2021 to 2022 as a result of

-

the additional funding as announced by the Chancellor to enable the continuation of

- the current funding rates

- advanced maths premium

- high value course premium

- level 3 programme maths and English payments

- industry placement capacity and delivery funding

- current programme cost weightings

- T Level funding

-

the change to the indices of multiple deprivation used for 16 to 19 funding calculations

We calculate 16 to 19 funding allocations using data that you returned previously. In this case, we are using primarily 2019 to 2020 data to calculate funding elements affecting your allocation for 2021 to 2022.

The allocation calculation toolkit (ACT) shows you the data we have used to calculate your funding elements. You can use it to check that the data is calculating the factors and other values used in your funding allocation as you expect it to. This may show you where there are errors in your data returns, and therefore highlight instances where you might want to submit a business case. You should submit a business case relating to the data within the ACT after you have received and reviewed your allocation statement. The deadline for submitting cases is 30 April 2021, as published in the allocations timeline on GOV.UK.

This guide explains the practical detail of how we have used your data within the 16 to 19 further education (FE) ACT to calculate the various elements of the funding formula for your institution. When we refer to an FE institution in this guide it includes general FE colleges, sixth-form colleges, local authority providers, independent learning providers and higher education institutions delivering FE provision.

If you have any queries about the information in this guide, please contact us using our online enquiry form.

2. Your 16 to 19 FE allocation calculation toolkit

To show you how we have used your data to calculate the funding elements used in your 2021 to 2022 allocation, we have prepared a 16 to 19 FE ACT for you. The ACT includes 5 separate sheets.

Funding elements – a summary of the key elements calculated from your 2019 to 2020 R14 data that we will use to calculate your 2021 to 2022 funding.

Programme – student-level data that shows information such as age, funding band, condition of funding status, and programme information such as programme type and core aim in 2019 to 2020.

Aims – the individual learning aims from your 2019 to 2020 R14 data return, identifying for each student which learning aim is the core/programme aim.

Glossary – a technical description of each column in both the Aims and Programme sheets of the workbook. You can use this sheet to identify the specific data fields we have used when looking at your data.

Comments – a tool to enable you to add notes to the data on the Aims and Programme sheets when reviewing the information shown.

If we do not have a full set of 2019 to 2020 data for your institution, then we have not produced an ACT file for you. In this case, you can still see how we make the calculations by reviewing our example ACT which is available on GOV.UK alongside this guidance.

3. What’s new in ACT

We have added new information to ACT this year:

-

Capacity Delivery Fund (CDF) – Industry Placements (policy change):

- the Funding Elements sheet now identifies the split between level 2 and level 3 students

-

the funding factors and instances per student displayed on the Funding Elements sheet will now be displayed to 5 decimal places. This will be consistent with the 2021 to 2022 16 to 19 allocation statement

-

the 2021 to 2022 retention factor (a change for the 2021 to 2022 academic year only):

-

as a result of the impact of coronavirus (COVID-19) the 2021 to 2022 retention factor will not be calculated from 2019 to 2020 data. Instead, we will calculate the retention factor using a weighted average of student and retention funding allocated in 2020 to 2021 and 2019 to 2020

-

the Funding Elements sheet will provide details of:

- the retention factor used to calculate your 2019 to 2020 funding

- the retention factor used to calculate your 2020 to 2021 funding

- your 2021 to 2022 weighted average retention factor

-

the Programme sheet will return a value of ‘Not Calculated’ for the Student Retained column

-

4. Features of the 16 to 19 revenue funding methodology

4.1 What data have we used in ACT?

Individualised Learner Record (ILR) return: 2019 to 2020 R14 data[footnote 1].

4.2 Why do we use 2019 to 2020 data?

Your 2019 to 2020 R14 data is the last full-year set of data that you returned. We use it to understand the characteristics of your institution and its delivery.

You can find a detailed description of data sources in the glossary sheet of your ACT.

4.3 Who counts?

We fund students aged 16 to 19, students aged 19 to 25 who have an EHC plan and 19+ continuing students. We include students’ 16 to 19 funded learning aims in the calculation of funding factors for your 2021 to 2022 funding allocation when the students count as valid starts in the 2019 to 2020 dataset. Students count as starts when they complete the appropriate qualifying period, which is based on the duration of the study programme.

4.4 Table 1: Student qualifying period

| Study programme planned hours and planned length in-year | Qualifying period |

|---|---|

| 450 hours or more | 6 weeks (42 days) |

| Fewer than 450 hours 24 weeks or longer | 6 weeks (42 days) |

| Fewer than 450 hours 2 to 24 weeks | 2 weeks (14 days) |

Programmes with a planned duration of less than 2 weeks and students who are in summer schools (aged 15 or under with a start date on or after 1 June 2020) are not counted.

5. Core/programme aim and study programme type

In the 2019 to 2020 ILR institutions record a core aim for every 16 to 19 funded student and, for traineeship students, a programme aim. We use this information to:

- determine whether the programme is academic or vocational

- determine whether a programme is a traineeship

- calculate programme cost weighting

- calculate the high value courses premium

- calculate the level 3 programme maths and English payment

Where a student has multiple core or programme aims recorded across the academic year, we use the latest core aim for calculation purposes.

If the core aim qualification is one of these types, the study programme is academic:

- A level (excluding General Studies or Critical Thinking)

- GCSE

- International Baccalaureate

- Pre-U Diploma

- Free Standing Maths Qualification (FSMQ)

- Access to HE

If the student’s core aim in the ILR is not one of the listed types, the student’s programme is categorised as vocational.

6. The 16 to 19 revenue funding formula

All institutions are funded in the same way to teach 16 to 19-year olds and high needs students up to the age of 25. Funding allocations for 2021 to 2022 are calculated using a funding formula.

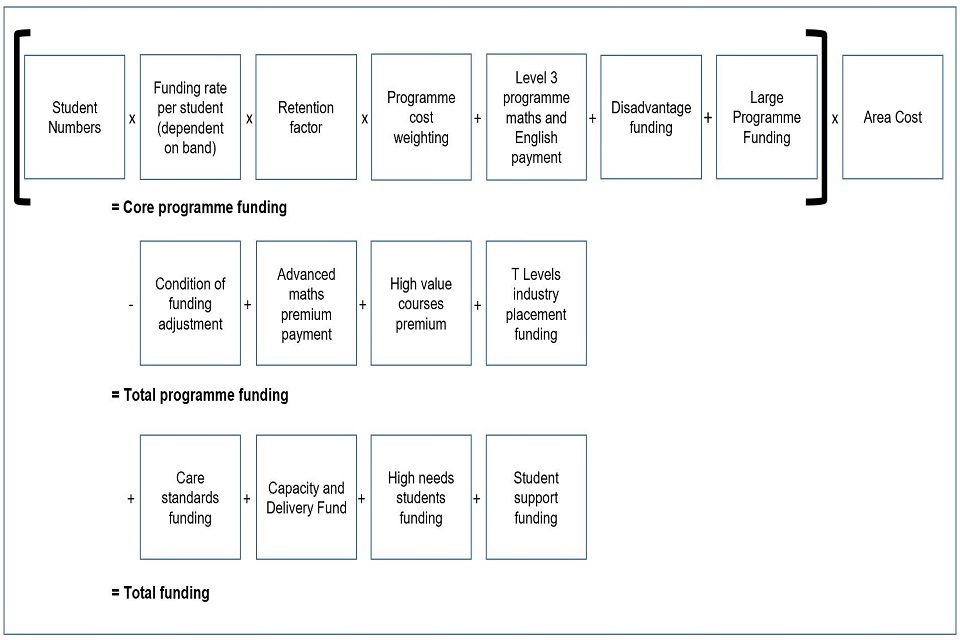

6.1 Figure 1: 16 to 19 funding formula

16 to 19 funding formula diagram

Please note that it is likely that not all of the funding elements are relevant to your institution. An overview of 16 to 19 funding is available on GOV.UK.

This guidance document has been simplified to only include detailed chapters for the elements of the funding formula above that have corresponding data in your ACT file. The areas not covered are listed below with links to further details on GOV.UK.

7. Student numbers

We measure the learning delivered by your institution by counting the number of students and looking at the size of their programmes.

We start by calculating your lagged student numbers to decide how many students should be included in your funding for 2021 to 2022. We have published the data sources and methods we will use to calculate your lagged student number on GOV.UK.

Your lagged student number is not included in your ACT; it will be confirmed on your allocation statement.

8. Student funding bands

We fund at different rates depending on the size of the programme your students are studying, and in some cases their age and high needs status.

8.1 Table 2: Student funding Student funding bands

| Band | Annual planned hours | Category |

|---|---|---|

| 5 | 540+ hours | 16 and 17 year olds and Students aged 18 and over with high needs* |

| 4a | 450+ hours | Students aged 18 and over who are not high needs |

| 4b | 450 to 539 hours | 16 and 17 year olds |

| 3 | 360 to 449 hours | All ages |

| 2 | 280 to 359 hours | All ages |

| 1 | Up to 279 hours | All ages |

*For these purposes, the definition for an 18+ high needs student is where the ILR indicates that a local authority has paid element 3 ‘top-up’ funding for the student (learner funding and monitoring (FAM) type = HNS and learner FAM code = 1). There is a column on the programme sheet ‘High Needs Student’ (column H) that shows which students are classified as high needs students.

Your ACT contains a table showing the distribution of students by funding bands based on your 2019 to 2020 data. We use data from the programme sheet (column Q shows the funding band) to calculate these volumes.

We will apply the proportions calculated from these volumes (also shown in table 1 on the funding elements sheet) to your lagged student numbers for the 2021 to 2022 academic year.

For institutions delivering T Levels in 2021 to 2022 your funding statement will show students funded in higher bands than displayed in the ACT file. ACT shows delivery in 2019 to 2020 only, whereas when we calculate your allocation, we will remove the number of T Level students attracting funding from band 5 and fund them at the appropriate higher band.

9. Retention factor

As set out in the Further education (FE) operational guidance, for 2021 to 2022 only, we will use a weighted average retention factor to calculate your 2021 to 2022 funding.

We will calculate your weighted average retention factor based on your 2019 to 2020 and 2020 to 2021 retention factors weighted by the allocated student funding in each year. The allocated student funding is the figure shown in the first stage of the allocation calculation on your allocation statement for each year by multiplying student numbers in each band by the funding rate for that band, before retention is applied.

We first multiply the retention factor in 2019 to 2020 and 2020 to 2021 by the allocated student funding in each year giving the total ‘retention funding’.

| Sum of 2019 to 2020 and 2020 to 2021 ‘retention funding’ | = | (2019 to 2020 retention factor x 2019 to 2020 allocated student funding) | + | (2020 to 2021 retention factor x 2020 to 2021 allocated student funding) |

We then use the sum of your 2019 to 2020 and 2020 to 2021 ‘retention funding’ and divide this by the total allocated student funding for the two years to calculate the 2021 to 2022 weighted average retention factor for your institution.

| 2021 to 2022 weighted average retention factor | = | Sum of 2019 to 2020 and 2020 to 2021 retention funding | ÷ | (2019 to 2020 allocated student funding + 2020 to 2021 allocated student funding) |

If your institution’s 2020 to 2021 retention factor was calculated using lagged funding data, but your 2019 to 2020 retention factor was calculated using a national average then your 2021 to 2022 retention factor will be based on your 2020 to 2021 retention factor only.

Your ACT file will return a ‘Not Calculated’ retention status for each student on the programme sheet (column W).

On the funding elements sheet, for reference cell D21 will show your 2019 to 2020 retention factor and E21 will show your 2020 to 2021 retention factor.

Cell F21 on the funding elements sheet will show the calculated 2021 to 2022 weighted average retention factor for your institution. It is important to note that this is a weighted average calculated as described above and not a direct mathematical average of your 2019 to 2020 and 2020 to 2021 retention factors.

10. Programme cost weighting (PCW)

This part of the funding formula reflects the fact that some courses are more expensive to teach than others. We use sector subject areas (SSA) to determine weightings.

We determine whether to apply a weighting, and if so, what the value should be, using the core aim for vocational programmes.

Academic programmes are base weighted except where the programme contains 2 or more science A levels. Where this is the case, we give a weighting of 10%.

There are 5 weightings which provide an extra 10%, 20%, 30%, 40% or 75% above the base rate.

Columns X to Z on the programme sheet show the programme cost weighting for each of your students.

11. Calculation

You can see your overall programme cost weighting on the funding elements sheet in table 2 (cell F23).

The calculation of the overall programme cost weighting uses data on the programme sheet to weight the factors for individual students based on their programme size:

- we determine the funding band (column Q) using the total planned hours in the funding year (column P), the age of the student (column B) and whether the student is a high needs student (column H)

- for students in funding bands 5 to 2, we derive a weighting value using set hours for each band, and we record this as the weighting multiplier in column S

11.1 Table 4: Base weighting values

| Funding band | Annual planned hours | Weighting value used for calculation |

|---|---|---|

| 5 | 540+ hours | 600 |

| 4a | 450+ hours | 495 |

| 4b | 450 to 539 hours | Mid-point 495 |

| 3 | 360 to 449 hours | Mid-point 405 |

| 2 | 280 to 359 hours | Mid-point 320 |

| 1 | Up to 279 hours | Total hours |

We calculate a weighted student-level programme cost weighting factor.

| weighted cost weighting factor (column Z) | = | weighting multiplier (column S) | × | cost weighting factor value (column Y) |

We then use the weighted student-level programme cost weighting factors to calculate the overall programme cost weighting factor for your institution.

| programme cost weighting factor | = | sum of weighted cost weighting factor (column Z) where funded student (column I) is marked as ‘Yes’ | ÷ | sum of weighting multiplier (column S) for all students who meet the funding eligibility criteria (funded student = ‘Yes’ in column I) |

12. Disadvantage funding

Disadvantage funding has 2 elements: one based on the home postcode of your students, the other based on prior attainment of your students in English and maths GCSE at age 16.

Your disadvantage factors are on the funding elements sheet in table 2:

- block 1: economic deprivation

- block 2: prior attainment in GCSE English and maths

13. Block 1: economic deprivation

We determine whether to allocate disadvantage funding based on where your students live. To do this we look up their home postcode in the Index of Multiple Deprivation (IMD) 2019. Using IMD 2019 is a change in 2021 to 2022, as previously disadvantage funding used the postcode uplifts calculated from IMD 2015.

The IMD is an official government index that uses education, crime, health, employment, and income statistics to tell us how deprived areas are. We assign an uplift to those students who live in the 27% most deprived areas of the country.

Column AA in the programme sheet shows the disadvantage uplift factor for each student. If a student is not eligible for block 1 disadvantage funding, this column shows 1.0000.

13.1 Calculation

You can see your overall economic deprivation factor on the funding elements sheet (cell F24).

The calculation of the overall economic deprivation factor uses the data on the programme sheet to weight the factors for individual students based on their programme size:

- we determine the funding band (column Q) using the total planned hours in the funding year (column P)

- for students in funding bands 5 to 2, we derive a weighting value (see table 4) using set hours for each band, and record this as the weighting multiplier in column S

We calculate a weighted student-level disadvantage uplift.

| weighted disadvantage uplift (column AB) | = | weighting multiplier (column S) | × | student’s disadvantage uplift factor (column AA) |

We then use the weighted student-level disadvantage uplift to calculate the overall block 1 disadvantage factor for your institution.

| block 1 disadvantage/economic deprivation factor | = | sum of weighted disadvantage uplift (column AB) minus sum of weighting multiplier (column S) where funded student (column I) is marked as ‘Yes’ | ÷ | sum of the weighting multiplier (column S) for all students who meet the funding eligibility criteria, (funded student = ‘Yes’ in column I) |

14. Block 2: prior attainment

Disadvantage block 2 provides funds to support students with additional needs including moderate learning difficulties and disabilities. We base disadvantage block 2 funding on low prior attainment in maths and English.

We use data from the 2019 to 2020 ILR to calculate the average block 2 instances per student to be used in the calculation of your funding.

14.1 Calculation

We look at the grades your students attained in GCSE English and maths by the end of year 11. We take this information from the ILR FAM field eligibility for EFA disadvantage funding (EDF).

We calculate for each student the number of instances where English and/or maths was not achieved by year 11. A student can therefore be worth a maximum of 2 instances.

14.2 Table 5: Block 2 instance example

| Example | GCSE English below A*-C/9-4 | GCSE maths below A*-C/9-4 | Student instance value |

|---|---|---|---|

| Student 1 | No | No | 0 |

| Student 2 | Yes | No | 1 |

| Student 3 | No | Yes | 1 |

| Student 4 | Yes | Yes | 2 |

We calculate the disadvantage block 2 instances per student in the following way:

| disadvantage block 2 instances per student | = | sum of total instances (column AE) where funded student (column I) is marked as ‘Yes’ | ÷ | total funded students (where column I is marked as ‘Yes’) |

Table 2 on the funding element sheet (cell F25) shows the calculated instances per student.

15. Discretionary bursary funding

Last year we revised the way that 16 to 19 discretionary bursary allocations are calculated to better match financial disadvantage and student needs across the county.

Further details including narrated presentations to explain the changes can be found alongside this guidance on GOV.UK.

16. Element 1: financial disadvantage

We determine whether to allocate discretionary bursary disadvantage funding by looking at where your students live. To do this we look up their home postcode in the Index of Multiple Deprivation (IMD) 2019 as we do for disadvantage block 1 funding. Using IMD 2019 is a change in 2021 to 2022. Previously financial disadvantage funding used the postcode uplifts calculated from IMD 2015. We assign an instance value to those students who live in the 27% most deprived areas of the country.

16.1 Table 6: Financial Disadvantage Instance Values

| IMD Deprivation of Home Postcode | Instance Value |

|---|---|

| Top 9% most deprived (<=9%) | 1.0 |

| Next 9% most deprived (>9% to <=18%) | 0.8 |

| Next 9% most deprived (>18% to <=27%) | 0.6 |

Column D in the programme sheet shows if the student is living in the top 27% most deprived areas and column AO shows the instance value for each student. If a student is not in the top 27% and does not qualify for discretionary bursary financial disadvantage funding or if the postcode is unknown this column will show ‘Not in top 27%’.

16.2 Calculation

This uses the data on the programme sheet to calculate an average number of instances per funded student.

We calculate this in the following way:

| discretionary bursary element 1: financial disadvantage instances per student | = | sum of financial disadvantage instances (column AO) where funded student (column I) is marked as ‘Yes’ | ÷ | total funded students (where column I is marked as ‘Yes’) |

You can see your instances per student on the funding elements sheet (cell F28).

17. Element 2a: student costs - travel

Element 2a student costs for travel provides funding to support students from the top 60% most deprived areas (based on IMD 2019) with their travel costs. Using IMD 2019 is a change in 2021 to 2022, previously deprived areas were based on IMD 2015. We do not include residential students (where column F in the programme sheet = ‘Yes’).

Column D in the programme sheet shows if the student is from the top 60% most deprived areas. We show how we have calculated the instance value for each student in columns AP to AS.

If a student is not eligible for discretionary bursary funding to support travel, we will state why in the columns.

The maximum total instance value for a student is 1 (column AS on the programme sheet). We base the instance value on two parts:

- rurality, where we class a student’s current postcode (column E) as a rural area we give an instance value of 0.5 (column AP)

- the distance travelled between the student’s postcode for travel (column E) and the delivery location of their learning (column V), the table below shows the instance value given (column AQ) based on the straight line distance between the two postcodes

17.1 Table 7: distance travelled instance values

| Distance travelled | Instance value |

|---|---|

| >= 20km | 0.500 |

| >= 10km and < 20km | 0.333 |

| >= 3km and < 10km | 0.167 |

| < 3km | 0.000 |

If the student is resident and learning in London, they are able to take up the Travel for London (TfL) offer; where this is the case, we will halve their instance value based on the above. Column AR on the programme sheet indicates where this is the case.

Column AS shows the student’s total instance value for travel.

17.2 Calculation

The calculation uses the data on the programme sheet to calculate an average number of instances per funded student.

We calculate this in the following way:

| discretionary bursary element 2a: student costs - travel instances per student | = | sum of travel costs total instances (column AS) where funded student (column I) is marked as ‘Yes’ | ÷ | total funded students (where column I is marked as ‘Yes’) |

You can see your instances per student on the funding elements sheet (cell F29).

18. Element 2b: student costs – Industry Placements

Element 2b - student costs for Industry Placements - provides funding to support students from the top 60% most deprived areas based on IMD 2019 who are undertaking an Industry Placement via the Capacity and Delivery Fund or as part of a T Level programme from the 2021 to 2022 academic year. Using IMD 2019 is a change in 2021 to 2022, previously deprived areas were based on IMD 2015.

Column D in the programme sheet shows if the student is living in the top 60% most deprived areas.

If the student’s study programme makes them eligible for Industry Placement funding via CDF (column AV) and they are from the top 60% most deprived areas, we will give them an instance value of 1 in column AW.

We will only allocate funding for Industry Placements to institutions who submitted an approved plan, opted in and have an Ofsted overall effectiveness grading of “Requires Improvement” or better.

18.1 Calculation

The calculation of this value uses the data on the programme sheet, we calculate this in the following way:

| Discretionary bursary element 2b: student costs – Industry Placement instances | = | sum of Industry Placements instances (column AW) where funded student (column I) is marked as ‘Yes’ |

You can see your total instances on the funding elements sheet (cell F57).

19. Level 3 programme maths and English payment

We give extra funding to providers to deliver maths and English to students doing substantial level 3 study programmes and T Levels.

Students are eligible for additional funding in the first year of a level 3 programme when they have not yet attained a GCSE grade 9 to 4 (or equivalent) in maths and/or English, and their study programme meets at least one of these criteria:

- it includes at least 2 A levels

- it includes level 3 qualification of at least 360 guided learning hours (GLH)

- it is a T Level programme

19.1 Table 8: Funding rates for maths and English in level 3 programmes

| Programme length | Payment per subject |

|---|---|

| 1 year programme | £375 |

| 2 year programme | £750 |

We pay an instance of funding for each subject in which a student does not hold a GCSE. This means that a student who has not achieved either English or maths will receive one instance, and those without both GCSEs will receive 2 instances.

We only pay the 2 year rate for students who are continuing at the end of the first year. Otherwise, we pay the rate for a 1-year programme.

We use historic information from the latest full year’s data to determine which students are eligible for the extra funding. For the 2021 to 2022 allocations, we used data from 2019 to 2020.

More information on maths and English study in level 3 programmes is available on GOV.UK.

19.2 Calculation

We look at:

- the level of study programme using the qualification aims taken matched to LARS

- the study programme planned length to determine if 1 or 2 year

- the prior attainment of your students attained in GCSE maths and English (we take this information from the ILR EngGrade, MathGrade and condition of funding fields (ECF and MCF)) to determine if we should award instances

Where a student is on a qualifying level 3 programme, we calculate for each student the number of instances where English and/or maths was not achieved before starting their study programme (and whether they are on a 1 year or 2 year programme). A student can therefore be worth a maximum of 2 instances.

19.3 Table 9: Level 3 programme maths and English instance example (applies to either 1 or 2 year)

| Example | GCSE English below A*-C/9-4 | GCSE maths below A*-C/9-4 | Student instance value |

|---|---|---|---|

| Student 1 | No | No | 0 |

| Student 2 | Yes | No | 1 |

| Student 3 | No | Yes | 1 |

| Student 4 | Yes | Yes | 2 |

If a student is not eligible for the payment, we will state why in columns AH and AK on the programme sheet with further explanation on the glossary sheet.

We calculate the level 3 programme maths and English payment instances per student for 1 year and 2 year programmes for your institution by adding the instance values (shown on the programme sheet in columns AH and AK) for those students who meet the funding eligibility criteria (column I = Yes) together and dividing by the total number of funded students (column I = Yes). This gives an average instance value per funded student; we have shown the calculated instances per student in table 2 on the funding elements sheet (cells F26 and F27).

20. 16 to 19 Free Meals

We use the 2019 to 2020 ILR to identify which students to include in the 16 to 19 free meals calculation, those that are eligible for and those that have taken free meals in the academic year. We use the proportion of students taking free meals in the 2021 to 2022 calculation. Students that are 14 or 15 that are eligible for free school meals elsewhere are not included.

Where there are no students eligible for and taking 16 to 19 free meals in 2019 to 2020 (shown as 0% on the funding elements sheet) we will use the proportion of students who received free meals in 2018 to 2019 to calculate your 2021 to 2022 allocation (if both years’ data show 0 students then we will use 0% for your allocation calculation). We will show the final percentage used on your funding statement.

20.1 Calculation

The calculation uses the data on the programme sheet to calculate the percentage of students taking free meals.

We calculate this in the following way:

| proportion of students on free meals | = | sum of 16 to 19 free meals taken (column AU) where funded student (column I) is marked as ‘Yes’ | ÷ | sum of students included in 16 to 19 free meals calculation (column AT) where funded student (column I) is marked as ‘Yes’ |

You can see your proportion of students on free meals based on 2019 to 2020 R14 on the funding elements sheet (cell F33).

21. Maths and English condition of funding (CoF)

Students who do not hold a GCSE grade 9 to 4, A* to C or equivalent qualification in these subjects must study maths and/or English as part of their study programme in each academic year. There will be an impact on your 2021 to 2022 allocation when these students are not enrolled on either maths and/or English GCSE or stepping stone qualifications (where applicable) in academic year 2019 to 2020, and are not recorded as exempt.

We have published full details of how we will apply the condition of funding (including mitigation arrangements) on GOV.UK.

The Condition of Funding (CoF) table on the funding elements sheet (students not meeting CoF, column F) shows how many students you had that did not meet the condition of funding in 2019 to 2020 compared to the total students. We have split the data by funding band.

The Condition of Funding (CoF) table does not include any students who are 19+ continuers who were previously funded through the adult budget (19+ continuers not in sixth form colleges), as they are not currently in scope for the condition of funding.

You can see which students did not meet the condition of funding on the programme sheet (student meets condition of funding, column AN = No). We have derived this from the ILR FAM field EDF (eligibility for EFA disadvantage funding). Column AL shows the student’s English status and column AM shows their maths status. Where either of these columns equals ‘Doesn’t have and not studying’ or ‘Has Grade D and not studying’, the student does not meet the condition of funding.

22. Care Standards: residential accommodation for young people aged under 18

Care Standards funding is available to specialist colleges and other individual institutions where students are in residence because similar provision is not available locally.

To be eligible for Care Standards funding an institution must:

- be registered with Ofsted or the Care Quality Commission (CQC) for inspection under the Care Standards regulations

- have a minimum of 12 students funded under the 16 to 19 young people’s model aged under 18 in residential accommodation on campus, as recorded in the ILR

The Funding rates and formula guidance has further details on care standards funding.

The programme sheet shows which students are living in institutions-run residential accommodation (Residential Student, column F) on the ILR. Column G indicates whether the student is eligible for care standards funding based on column F and the criteria outlined above. Cell F49 on the funding elements sheet shows the total number of students eligible for care standards funding in 2021 to 2022.

23. Capacity Delivery Fund (CDF) – Industry Placements

CDF is to facilitate the build-up of capacity and capability to deliver substantial industry placements and deliver such placements. We first paid CDF in the 2018 to 2019 academic year. The placements are for students on vocational and technical study programmes at level 2 and level 3. We recognise that the delivery of significant numbers of industry placements as part of T Levels is a significant step change for the sector. As industry placements are a compulsory part of T Levels, CDF funding is available for providers to build their capacity ahead of the roll out in 2020. We have published further information about CDF on GOV.UK.

Column AV on the programme sheet shows which students are eligible for CDF. Cell F57 on the funding elements sheet shows the total number of students eligible for CDF funding in 2021 to 2022.

We will only allocate CDF funding to institutions who have students studying eligible programmes in 2019 to 2020 that have submitted an approved plan, opted in and have an Ofsted overall effectiveness grading of “Requires Improvement” or better. The allocation statement will confirm the CDF funding.

24. High Value Courses Premium (HVCP)

The High Value Courses Premium (HVCP) supports providers to increase the number of students studying substantial programmes in particular subjects.

The premium is £400 per eligible student.

We pay the premium for full and part time programmes that meet one of the following criteria:

- substantial A level programmes – those including at least 2 qualifying A levels

- substantial vocational programmes – those including a qualifying qualification of at least 360 GLH

- T Levels [in the specified subject areas]

We have published a full list of the qualifications that qualify for the premium.

24.1 Table 10: Subjects and SSAs for the HVCP

| A level subjects | Sector subject areas (SSAs) for vocational courses and T Levels |

|---|---|

| Biology | SSA 4.1: Engineering |

| Chemistry | SSA 4.2: Manufacturing technologies |

| Computer science | SSA 4.3: Transport operations and maintenance |

| Design and technology | SSA 5.1: Building and construction |

| Electronics | SSA 6.1: ICT for practitioners |

| Further mathematics | |

| Mathematics | |

| Physics | |

| Statistics |

We use historic information from the latest full year’s data to determine which students are eligible for the extra funding. For the 2021 to 2022 allocations, we used data from 2019 to 2020.

More information on the high value course premium is available on GOV.UK.

24.2 Calculation

The aims sheet shows the study programme qualifications for each student, column F shows if the qualification is on the qualifying qualifications list.

The calculation uses the data on the programme sheet to calculate the number of students qualifying for HVCP.

We calculate this in the following way:

| HVCP qualifying students | = | sum of qualifies for HVCP funding (column AX) where funded student (column I) is marked as ‘Yes’ |

You can see your total qualifying students on the funding elements sheet (cell F62).

25. Area cost allowance

Some areas of the country are more expensive to teach in and the area cost allowance reflects this.

We normally base the area cost uplift on the delivery location of the institution’s provision. Where institutions deliver provision across local authorities with different factors, we will calculate the area cost factor, using a weighted average of the area costs uplift for each delivery postcode.

We review the area cost factors for institutions that return ILR data every year. This review identifies institutions that have dispersed delivery and/or an area cost factor, based on delivery postcodes, that is significantly different from the factor in the previous year.

When institutions merge, we will review their area cost uplift factors. In the first year we will calculate the area cost uplift factor for the merged institution as the weighted average of the factors for the predecessor institutions. After that, we will use the weighted average method for geographically dispersed delivery.

There is more detail on the area cost calculation for geographically-dispersed delivery in the Funding rates and formula guidance on GOV.UK.

The area cost factor for your institution is on the funding elements sheet in table 2 (cell F30).

-

2020 to 2021 and 2019 to 2020 funding data will be used to calculate the 2021 to 2022 retention factor. ↩