People - not products - are the secret to scaling up businesses

Independent study shows investors and businesses fail to see eye-to-eye on what drives innovative companies to attract private investment and scale up.

Start up colleagues in co-working space. Credit: goodluz at Shutterstock.com.

British businesses are missing opportunities to secure investment, grow and scale up because of misunderstandings in what investors are looking for, according to a new report published by Innovate UK.

‘Scaling up: the investor perspective’ compares the views of investors and scale-up small to medium-sized enterprises on the factors for success. It includes the views of investors both in the UK and internationally.

Mismatch between businesses and investors

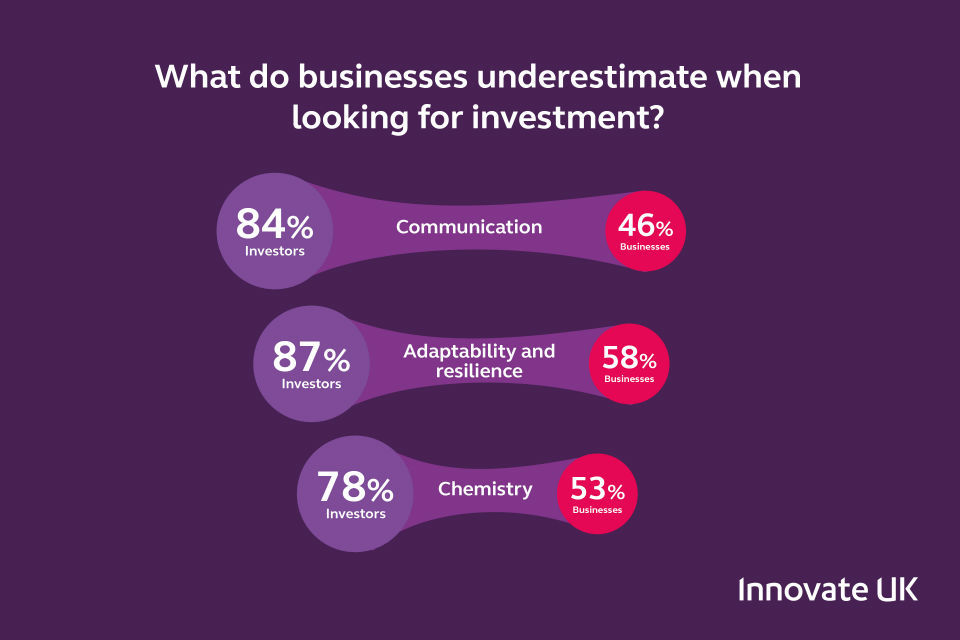

The report finds that business leaders consistently underestimate the value investors place on ‘softer’ aspects, for example:

- 78 per cent of investors thought chemistry was important, versus 53 per cent of businesses

- poor communication was a deal breaker for 84 per cent of investors, compared to just under half (46 per cent) of businesses

- a lack of adaptability and resilience was a deal breaker for 87 per cent of investors. Only 58 per cent of businesses thought this to be the case

What businesses underestimate when looking for investment.

Strong management vital to success

Both investors (96 per cent) and businesses (82 per cent) had a similar level of agreement that a strong management team is the most important ingredient for scale-up success. They also agreed that drive and passion were the top qualities.

The management qualities investors look for.

It follows that almost all (97 per cent) investors agreed that a weak management team was the number one deal breaker. Three-quarters (74 per cent) have actually turned down an investment opportunity based on gut feeling.

Key elements to scale up success.

Chris Wade, venture partner at Octopus Ventures, comments:

I have been developing a 20-year thesis that nothing works out from a company pitch; their products or services always end up taking a different direction. A strong team can build a company, but a weak team – even with a brilliantly compelling idea – wouldn’t be one for us to invest in.

Other factors considered to be deal breakers

The report highlighted further disconnect when it came to understanding what investors look for:

- two-thirds of businesses (65 per cent) thought timescale to exit was a deal breaker, while less than a third (28 per cent) of investors said that they had turned down an investment opportunity for this reason

- 70 per cent of investors felt cultural fit was a deal breaker, versus only 50 per cent of businesses

- interestingly, businesses overestimated the importance of fit with the investor’s portfolio, with 74 per cent believing it to be of consideration, compared to 55 per cent of investors

5 areas of weakness that cause investors to turn down scale up businesses.

International expansion and growth

In addition to looking at the factors for scale-up investment success, the report also looked at SMEs’ plans for international expansion.

It found that 92 per cent of UK businesses are either currently exporting or plan to do so in the next 12 months. Lack of local market knowledge and having the right contacts are seen as 2 of the biggest barriers in doing so and achieving international growth.

In terms of inward investment, the UK is seen as a target by investors, with 47 per cent saying that UK scale-ups are more attractive than those in other countries.

Connecting innovators with investment

Innovate UK will use the results of this research to inform and improve its work on follow-on investment and the formulation of innovation loans, which are due to launch during November 2017.

Dr Ruth McKernan CBE, CEO of Innovate UK says:

Attracting investment is often a challenge for innovative businesses and the brilliant people at their heart.

At Innovate UK we are increasing our focus on connecting innovators with both government grant funding and venture capital investment, to turbo-charge their journeys to success and the UK’s economic growth.

Further inform and engage the sectors

Commenting on the report, Dr Jeremy Silver, Chief Executive Officer, Digital Catapult, adds:

Digital Catapult helps UK companies of all sizes grow and scale their businesses through digital innovation. We want to help more companies grow faster for longer, rather than rushing to trade sales.

We recognise that this requires entrepreneurial and investor confidence, and run projects to help companies achieve those goals; recent successes include Nymbly, Cambridge Bio-Augmentation Systems and Smartify. We launched Dimension Studio last week, which sees Digital Catapult partnering with Microsoft and Hammerhead to bring world-leading volumetric capture technology to the UK.

This new report on scale-ups will further inform and engage the key players in this sector.

About the research

Innovate UK commissioned the report to identify how investors, government organisations and advisors can better support innovative UK businesses to scale and export, in line with the UK’s Industrial Strategy.

Independent research agency, Ebiquity questioned a total of 250 innovative SMEs and investors between June and September 2017.