January 2016 Market Trend Data

Land Registry's monthly Market Trend Data for residential property prices in England and Wales.

January 2016

The January data shows an annual price increase of 7.1% which takes the average property value in England and Wales to £191,812.

Monthly house prices have risen by 2.5% since December 2015.

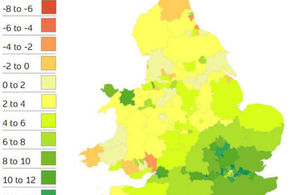

The regional data indicates that:

- London experienced the greatest increase in its average property value over the last 12 months with a movement of 13.9%

- Wales experienced the greatest monthly growth with an increase of 3.7%

- the North East saw the lowest annual price growth with an increase of 0.2%

- the North East also saw the most significant monthly price fall with a decrease of 1.6%

Sales and repossessions during November 2015, the most up-to-date figures available, show that:

- the number of completed house sales in England and Wales fell by 2% to 72,167 compared with 73,282 in in November 2014

- the number of properties sold in England and Wales for more than £1 million increased by 14% to 1,091 from 953 a year earlier

- repossessions in England and Wales fell by 54% to 346 compared with 753 in November 2014

- the region with the greatest fall in the number of repossession sales was the South West with a fall of 78% from November 2014

Access the full January HPI report.

Price change by region

| Region | Monthly change since December 2015 | Annual change since January 2015 | Average price January 2016 |

|---|---|---|---|

| Wales | 3.7% | 6.8% | £125,665 |

| London | 2.8% | 13.9% | £530,409 |

| England and Wales | 2.5% | 7.1% | £191,812 |

| South East | 2.2% | 10.7% | £266,603 |

| West Midlands | 1.7% | 6.6% | £144,185 |

| South West | 1.6% | 6.2% | £198,288 |

| East Midlands | 1.1% | 4.4% | £138,825 |

| East | 0.7% | 8.9% | £217,341 |

| Yorkshire and Humber | 0.6% | 3.7% | £124,949 |

| North West | -0.4% | 2.1% | £114,504 |

| North East | -1.6% | 0.2% | £97,117 |

Average price by property type 2016 to 2015

| Average price by property type (England and Wales) | January 2016 | January 2015 | Difference |

|---|---|---|---|

| Detached | £299,762 | £280,485 | 6.9% |

| Semi-detached | £181,422 | £170,345 | 6.5% |

| Terraced | £143,839 | £134,569 | 6.9% |

| Flat/maisonette | £187,160 | £172,963 | 8.2% |

| All | £191,812 | £179,076 | 7.1% |

Sales volumes 2014 to 2013

| Month | Sales 2014 England and Wales |

Sales 2013 England and Wales |

Difference |

|---|---|---|---|

| January | 65,274 | 43,435 | 50% |

| February | 65,088 | 45,306 | 44% |

| March | 67,421 | 54,784 | 23% |

| April | 70,377 | 51,101 | 38% |

| May | 77,620 | 66,417 | 17% |

| June | 80,959 | 66,256 | 22% |

| July | 84,769 | 73,801 | 15% |

| August | 87,950 | 79,576 | 11% |

| September | 78,926 | 69,780 | 13% |

| October | 86,467 | 76,756 | 13% |

| November | 73,282 | 82,948 | -12% |

| December | 78,150 | 79,729 | -2% |

| Total | 916,283 | 789,889 | 16% |

Sales volumes 2015 to 2014

| Month | Sales 2015 England and Wales |

Sales 2014 England and Wales |

Difference |

|---|---|---|---|

| January | 56,886 | 65,274 | -13% |

| February | 58,000 | 65,088 | -11% |

| March | 65,486 | 67,421 | -3% |

| April | 62,539 | 70,377 | -11% |

| May | 72,211 | 77,620 | -7% |

| June | 81,512 | 80,959 | 1% |

| July | 89,717 | 84,769 | 6% |

| August | 81,226 | 87,950 | -8% |

| September | 77,453 | 78,926 | -2% |

| October | 83,763 | 86,467 | -3% |

| November | 72,167 | 73,282 | -2% |

Repossessions by region 2015 to 2014

| Repossessions by region | November 2015 | November 2014 | Difference |

|---|---|---|---|

| East | 18 | 46 | -61% |

| East Midlands | 20 | 71 | -72% |

| London | 23 | 58 | -60% |

| North East | 13 | 22 | -41% |

| North West | 110 | 182 | -40% |

| South East | 42 | 65 | -35% |

| South West | 11 | 49 | -78% |

| Wales | 33 | 79 | -58% |

| West Midlands | 27 | 71 | -62% |

| Yorkshire and The Humber | 49 | 110 | -55% |

| All | 346 | 753 | -54% |

Access January Price Paid Data dataset.

Notes to editors

- Market Trend Data is published on the 20th working day of each month. The February 2016 House Price Index (HPI) will be published at 9.30am on Wednesday 30 March 2016. Price Paid Data is published at 11am on the same day.

- A calendar with release dates of the headline figure and the full HPI is available.

- The HPI uses a sample size that is larger than all other statistical measures available. It is calculated using Land Registry’s dataset of all single residential property sales completed in England and Wales since January 1995 subject to exclusions.

- Land Registry’s dataset contains details on more than 20 million residential transactions. Of these, more than 7 million are identifiable matched pairs, providing the basis for the repeat sales regression analysis used to complete the index. This technique of quality adjustment ensures an “apples to apples” comparison between properties.

- The adjusted headline statistics for England and Wales on p14 of the monthly HPI report include additional repossession data.

- The repossession data is based on the number of transactions lodged with Land Registry by lenders exercising their power of sale. Once we have identified these transactions, we extract the price paid information from the related register entry.

- Although the HPI goes back to January 1995, we have been recording repossessions comprehensively only since 2006. This means that historic repossession data is not available prior to January 2006. Read more information about repossessions data.

- HPI background tables are available as Open Data in Excel and CSV formats and in machine readable format as linked data They are available for free use and re-use under the Open Government Licence (OGL).

- Price Paid Data is residential property price data for all the residential property sales in England and Wales that are lodged with us for registration in that month.

The following information is available for each property: * the full address * the price paid * the date of transfer * the property type * whether it is new build or not * whether it is freehold or leasehold - Price Paid Data can be downloaded in txt and CSV formats and in a machine-readable format as linked data It is available for anyone to examine or re-use free of charge under the OGL.

- Price Paid Data includes Standard Price Paid Data (SPPD) for single residential property sales at full market value and Additional Price Paid Data (APPD) for transactions previously excluded from SPPD such as: * transfers to a non-private individual, for example a company, corporate body or business * transfers under a power of sale (repossessions) * buy-to-lets (where they can be identified by a mortgage)

- The information available for each property indicates whether it is APPD or SPPD and the record’s status - addition/change/deletion (A/C/D).

- As a government department established in 1862, executive agency and trading fund responsible to the Secretary of State for Business, Innovation and Skills, Land Registry keeps and maintains the Land Register for England and Wales. The Land Register has been open to public inspection since 1990.

- With the largest transactional database of its kind detailing more than 24 million titles, Land Registry underpins the economy by safeguarding ownership of many billions of pounds worth of property.

- For further information about Land Registry visit www.gov.uk/land-registry.

- Follow us on Twitter @LandRegGov our blog and LinkedIn and Facebook.

Contact

Press Office

Trafalgar House

1 Bedford Park

Croydon

CR0 2AQ

Email HMLRPressOffice@landregistry.gov.uk

Phone (Monday to Friday 8:30am to 5:30pm) 0300 006 3365

Mobile (5:30pm to 8:30am weekdays, all weekend and public holidays) 07864 689 344