The UK Single Trade Window: Consultation on Features to Inform Design and Legislation

Published 21 July 2022

Foreword

When the United Kingdom left the European Union, we regained the right to manage our own borders in a way that works for Britain. With British businesses and people being hit by rising costs caused by Russia’s war in Ukraine, the government is accelerating our transformative programme to digitise Britain’s borders, harnessing new technologies and data to reduce friction and costs for businesses and consumers. Our aim, as set out in the UK Border Strategy, is clear: to create the most effective border in the world.

Our new border will embrace innovation, simplify processes for traders and travellers, and improve the security and biosecurity of the UK. The UK Single Trade Window is at the heart of this ambition. The UK government has committed £180m to build a world-leading Single Trade Window which will reduce costs and bureaucracy for traders at the border.

Once fully delivered, traders will be able to deal with the government through a single gateway, improving trade flows and cutting costs. It will reshape trader interactions with the border, saving businesses time and money and lowering barriers to entry for international trade.

At a time where global pressures are driving up the cost of living, the Single Trade Window has the potential to be transformative, saving businesses money and reducing the cost of doing business with the UK. Our aim is that the Single Trade Window will ultimately be the UK’s new international trade platform, representing a crucial step in the UK’s future as an independent trading nation and fulfilling a fundamental aim of leaving the European Union.

Cooperation and co-design are critical to the success of our Border Strategy, and the Single Trade Window. In December 2021, we published a Discussion Paper to set out our thinking and seek initial views on the Single Trade Window. This consultation builds on the feedback you gave us, providing further detail on the government’s approach as we prepare to legislate. We will follow this up by publishing a Target Operating Model in the autumn that will set out our new regime for Safety and Security and Sanitary and Phytosanitary border controls.

Our mission is to build a world-leading system which makes the lives of traders easier, reducing friction and costs, underpinned by robust and seamless data sharing, whilst protecting our borders. With your help, we can make this a reality. I encourage everyone who wants to be part of this mission to put forward your views.

Rt Hon Jacob Rees Mogg, MP Minister for Brexit Opportunities and Government Efficiency

Rt Hon Lucy Frazer QC, MP Financial Secretary to the Treasury

Introduction

Context

In December 2020 the government published the UK Border Strategy[footnote 1]. This consultation sets out our vision for the UK border to be the most effective in the world. A border which embraces innovation, simplifies processes for traders and travellers and improves the security and biosecurity of the UK. One of the programmes proposed within the strategy was the development of a Single Trade Window (STW), to create a single gateway for all transactional data from traders into government. This paper sets out for consultation the principles underpinning the legislative changes necessary to deliver the STW. The consultation is intended to inform our legislative approach and is aimed at those stakeholders involved in the importing and exporting of goods, including those who provide services to businesses who import and/or export goods, such as intermediaries, haulage firms, carriers, and Community System Providers (CSPs). We also welcome views from other interested parties.

Context

This consultation follows a discussion paper entitled ‘UK Single Trade Window - Policy discussion paper’[footnote 2], published by the government in December 2021. The Discussion Paper detailed a number of key policy and design choices for the UK STW, and posed questions for stakeholders around these. Insight and views were gathered on these questions through detailed engagement and written responses from a range of businesses, industry and border intermediaries. Responses to this engagement have informed the proposals set out in this consultation and a summary of these written responses is included at Annex B. Government also commissioned research to interview smaller traders to seek their views on the topics included in the Discussion Paper. An executive summary of their feedback is provided in Annex C, and findings are also published on gov.uk[footnote 3].

Scope of this Consultation

Building on the themes outlined in the Discussion Paper and the feedback received, this consultation focuses on the following areas concerning the expected legislative changes necessary to deliver the STW:

- The collection, use and sharing of data within government, including where this could support functionalities such as pre-population and multifiling[footnote 4];

- Enabling government visibility, and use of, supply chain data, with the aim of reducing data entry and administrative burdens of submitting border data to government, whilst maintaining the government’s compliance capability; and

- Facilitating trade through targeted international data sharing with other countries and territories, subject to appropriate data protection arrangements.

Additionally, the consultation sets out the government’s proposals for the STW to ultimately become the sole point of entry for transactional border data, which was not a part of the previous Discussion Paper.

The Discussion Paper also set out questions on two further areas:

- Self-declaration: the extent to which the STW functionality could enable a wider range of traders and/or intermediaries to submit border data directly to government.

- How the STW should work with existing port and commercial systems, including CSPs.

The government has not, at this stage, identified any specific legislative barriers to enabling these elements within STW, and as such they are not within the scope of this consultation. We will continue to engage with stakeholders on these issues separately.

The government is working separately with industry regarding the development of the Target Operating Model (TOM) - specifically the future design of the Sanitary and Phytosanitary (SPS), and Safety and Security (S&S) regimes. These regimes will not be within the scope of this consultation as they are being reviewed separately. As the STW will sit at the heart of the future TOM, the views gathered through this consultation will help shape both the design of the TOM we publish in the autumn and the legislation to deliver it.

UK Single Trade Window (STW)

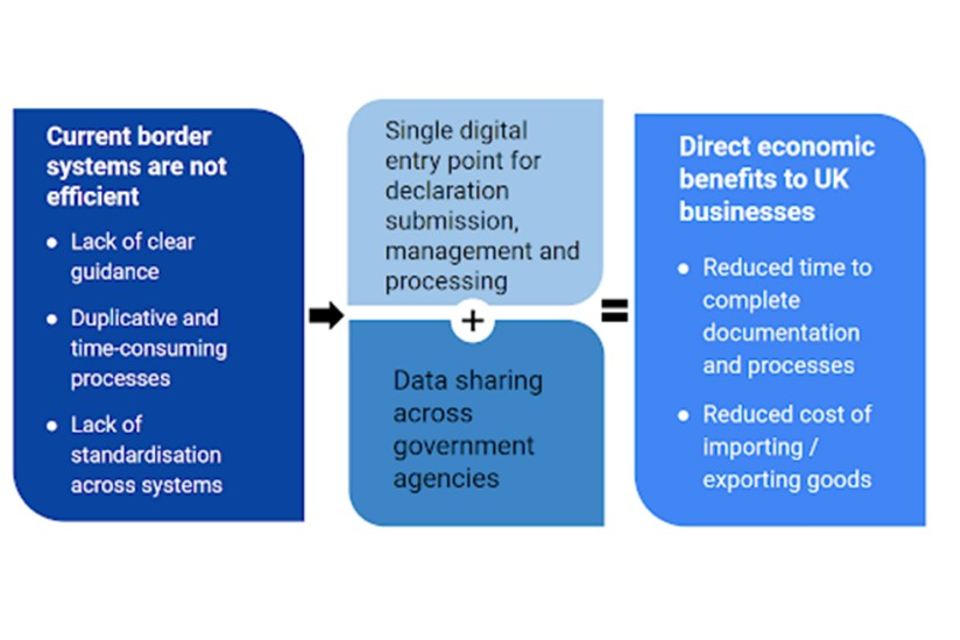

The UK Border Strategy (pdf, 6.7 MB)[footnote 5] committed to begin development of a world-leading UK Single Trade Window, creating a single gateway into government through which all information required to import and export can be submitted to border authorities and agencies. This will transform the way traders and industry engage with government on border processes, by providing a single electronic entry point, which enables the streamlined completion of all import, export, S&S and transit-related regulatory requirements.

The Objectives of the UK STW

The UK STW will reshape trader interactions with the border, using technology and data to create a “tell us once, in one place” digital system that brings benefits to business by saving them time and money, and lowering barriers to entry for international trade. When fully implemented, government’s ambition is that through the STW, organisations will be able to:

- Make use of a simplified user experience when interacting with government services to manage their trades;

- Be guided through every stage of the trade lifecycle;

- Provide data once, in a single place, to satisfy all government import, export, safety and security and transit obligations when trading;

- Apply for and manage all licences, permits and authorisations in a single place;

- Have full visibility of the status of current trades (for example where goods are held at the port for an inspection or testing to ensure they meet regulatory standards) and view historic trades; and

- Make use of their supply chain data to provide better data to government, in a less burdensome way.

The STW will mean that traders and intermediaries can provide the data required to meet their border obligations just once, with the aim of significantly reducing the administrative burden of border declarations.

Legislative Changes Needed

To deliver a world leading STW, the government must make changes to the legislation governing the collection, use and sharing of data. The government must also make any necessary changes to the legislation underpinning specific declaration types, to ensure it is compatible with the STW.

This is because the current legislative framework for border requirements has been designed to deliver the current model for border processes based on individual departmental needs rather than taking a holistic view of the border system from the user’s perspective. This requires data to be submitted to multiple government departments, through multiple portals, in the form of declarations and other border requirements such as licences and authorisations. This can sometimes involve duplicative and time consuming submission processes.

Areas for Consultation

As the sections below will demonstrate, the government sees that there are four key areas to consider with regard to legislative change to support the delivery of the STW:

- The collection, use and sharing of data within government including to support prepopulation and multi-filing;

- Enabling government visibility, and use of, supply chain data;

- Facilitating trade through targeted international data sharing with other countries and territories, subject to appropriate data protection arrangements; and

- Transitioning to the STW as the sole point of entry to government systems collecting data to government systems collecting data required for transactional processes at the border at an appropriately identified time in the longer term.

The government recognises that making better use of border data is crucial to delivering on the commitments of the UK Border Strategy, and that a STW is at the core of this. Nevertheless, we recognise that border data can often include commercially sensitive information and should therefore only be used and shared with the appropriate safeguards in place. We welcome stakeholders’ views on the government’s proposals, whether those proposals will achieve the stated user aims of the STW and the UK Border Strategy, and what safeguards should be put in place to ensure border data is used both effectively and appropriately.

1. Data Collection, Use and Sharing

Delivering the STW will change the way border data is collected by the government. As set out above, there are currently multiple government systems which are involved in moving goods across the UK border. Traders and intermediaries submit data to each system as required, with some of this data being duplicative. This creates additional complexity and cost for border users. A UK STW will provide a streamlined entry point to services through which traders and intermediaries can submit data once, where possible, to government.

Broadly, data collection, use and sharing changes would be implemented with a goal of facilitating efficiencies for the benefit of traders, industry and government. Examples of the types of functionalities which new legislation could seek to support to enable these efficiencies and benefits for traders and industry are:

- Data collection and sharing across government to reduce duplicative data entry;

- Data sharing to support the decisions government makes about which goods to check;

- Data sharing from departments and agencies with HMRC to support messaging to traders via the STW;

- Data sharing with third parties, where this would enable potential features such as:

- re-using data already held by government or from other sources to reduce the data requested from businesses;

- allowing multiple actors to input data into a single declaration, licence or certificate, otherwise known as ‘multi-filing’ (if desired);

- Sharing of supply chain data (which is discussed in section 2 below) with the government to reduce trader administrative burdens and to deliver the government’s border objectives to secure our borders whilst encouraging trade.

Whilst significant improvements have been made to the border data sharing landscape, including through the Trade Act 2021, the government recognises there is further to go to enable the data collection and sharing which is necessary to deliver the STW.

HMRC’s Role

Services forming part of the STW will be available through the STW platform hosted by HMRC , and when fully operational, data for all border processes will be submitted to the appropriate authorities responsible for the relevant border process through the STW. For example, information required for the movement of goods subject to Sanitary and Phytosanitary (SPS) controls would be shared with HMRC through the STW, before being automatically shared with Defra, or the appropriate body in the devolved administrations, as the relevant public body responsible for the border controls on these goods. Not only will this enable the STW to streamline data submission requirements by removing duplication, it will also ensure that businesses only have to navigate a single entry point to government services to manage the declarations, authorisations, and licences required to move goods, and will receive relevant messaging from public bodies in one place.

Similarly, the STW will share data with other departments and public bodies with responsibility for licences, authorisations, and declaration types including, but not limited to, DIT, DfT, DCMS, HO, BEIS, FCDO and MHRA. Moreover, as indicated above, data may be shared within and across departments and public bodies for the purpose of improving the efficiency of data submission and wider border processes. This could include enabling functionalities such as the reuse of data already held by the government, multi-filing, and other process improvements such as improved risking capabilities. Cabinet Office and HMRC will work closely with departments, devolved administrations, and public bodies to ensure that legislation facilitating HMRC’s role as the host of the STW improves data sharing across government, ensuring these bodies have access to the data they need to perform their role at the border.

To enable this information exchange, HMRC will need new legal powers to collect and share information across government. This is because current legislation generally only permits specific departments, authorities and agencies to collect particular information for their own purposes, which in some cases limits the sharing of duplicated data between departments. It is not designed to support a modern, world-leading STW, which seeks to make the best use of data already collected, or to create new, efficient mechanisms for data to be submitted to government as a whole. Furthermore, HMRC, as the department responsible for collecting and sharing data through the STW for government, is limited in its activities to those set out as its functions in the Commissioners for Revenue and Customs Act (CRCA) 2005[footnote 6], and other relevant legislation. These limitations apply to all HMRC activities, including the collection, processing and use of data. As the delivery of the STW will require HMRC to handle data which is outside of its current functions, legislative change will be required to provide HMRC with the appropriate legal basis to conduct these activities.

HMRC will therefore need to establish a series of new information sharing gateways, allowing the sharing of data back and forth between departments. These information sharing gateways will allow HMRC to send and receive all relevant information needed to operate the STW and support the wider trade ecosystem. However, the gateways will be limited by purpose and only allow information to be shared when it is needed to support agreed departmental functions, in particular, facilitating the movement of goods across the border and ensuring that all relevant controls can be conducted efficiently.

Furthermore, the government will need to assess whether existing powers available to other departments, such as those listed above, are sufficient to share information with HMRC to enable messaging to be passed to declarants via the STW. For instance, where a good subject to SPS controls requires lab testing, sufficient data sharing powers will be required to ensure that the outcome of this testing can be communicated from the appropriate authority to the declarant, via the STW. Where such powers are not already available, government will need to consider how these should be established in legislation.

In addition to the limits legislation will impose on how data submitted to HMRC can be collected and shared, we anticipate that all data submitted to HMRC will be subject to HMRC’s statutory duty of confidentiality under section 18 of the Commissioners of Revenue and Customs Act 2005 (CRCA)[footnote 7], or similar protections including the Trade Act 2021, appropriate to the data sharing activities envisaged under STW. The application of section 18 of the CRCA or similar protections in these circumstances would seek to ensure that data is only shared by HMRC where the purpose is clear and can be linked back to the operation of the STW. Similarly, we will ensure that appropriate protections are in place for the sharing of personal data, including those under the Data Protection Act 2018[footnote 8]. However, we continue to explore all possible avenues of ensuring such safeguards through necessary legislative changes, and to ensure they are consistent with the data sharing requirements of a world leading STW.

As the STW departs from the current model to deliver a single point of entry for border data, the government will need to ensure that sufficient flexibility is built into the design of the STW, across the technology and legislation required for its delivery. This will enable the STW to keep pace with industry changes and best practice, to take advantage of opportunities to streamline border processes as we strike agreements with international partners, and to continue to reduce the burdens placed on UK businesses seeking to import or export. We therefore welcome stakeholders’ views on:

1 - Whether the proposed changes will enable the functionality industry would expect to see from a STW?

2 - Whether you have concerns about the collection of the data required for other government departments and public bodies’ border processes by HMRC, via the STW? If so, please provide details as to what the concerns are and how they could be addressed or mitigated?

3 - What safeguards would you expect to see in relation to the sharing of data between HMRC and other government departments and public bodies?

4 - Any other views you have on the proposed changes.

Data Sharing and Reuse Between Traders, Intermediaries and Commercial Partners for Data Submissions to HMG

We are continuing to design the full functionality of the STW, including options to allow further data sharing and reuse. For example, pre-populating declaration data for traders where this is already held by the government and allowing more than one party to contribute to declarations. Particularly:

- In relation to the identification and authentication of users for access to the STW;

- In situations where data is submitted, or available, to government;

- for the same type of declaration from the same declarant;

- for a different type of declaration from the same declarant;

- from third parties not making the declaration, for example, where data from the supply chain or elsewhere is reused to complete a declaration.

Our intention is that specific, relevant data could be shared between two or more parties where they have agreed that they have a commercial relationship, and as a result of this agreement, are content for data to be reused between declaration types. Alternatively, where such a commercial agreement is in place, STW users could complete a declaration either collaboratively through contributions from multiple parties, or by reusing supply chain data where the original data is owned by a different party. We understand functionality to allow STW users to collaborate on a declaration may already be available in commercial software offerings.

HMRC will need additional legislative powers to allow for this functionality as some of the data to be shared or reused is owned by different parties. We anticipate that these powers would be subject to the same types of limitations as discussed above. The type of data to be reused and shared would also need to be clearly articulated. We continue to explore this area of functionality but the types of data would likely include identifying information, such as trader or intermediary names and business addresses. We would welcome views on this proposal.

Currently, border users and their commercial partners are liable for the information they provide in declarations. Data sharing and reuse, in the various forms outlined in the previous section, could result in potential dispute around who is liable for the data used to populate and submit declarations. Similarly, there may be questions around who is liable for the supply chain data contained within commercial systems which the government is seeking to access (see ‘Enabling the Use of Supply Chain Data’ section below), where the data is typically provided by various supply chain actors.

The government’s lead option, at present, is that liability for the accuracy of data submitted should not change as a consequence of data sharing, reuse and supply chain data features. So regardless of the source of the data, the party submitting the declaration should retain responsibility for verifying the accuracy of the content and submitting it to government.

We welcome stakeholders’ views on:

5 - How they envisage liability could be retained with the party responsible for submitting the border data required by the government, when there are multiple providers of the data or data is obtained through supply chain systems?

6 - Whether border users and their commercial partners would be willing for HMRC to share data:

- to complete different border data obligations,

- where there are data fields common across different declarations; and,

- the data has been provided by different parties and can be reused to support the completion of a different declaration related to the same movement of goods?

7 - Whether border users and their commercial partners have any concerns with this proposal? If so, could you please provide details as to what the concerns are and how you feel they could be addressed or mitigated?

8 - Whether border users and their commercial partners would be supportive of STW functionality that would enable them to collaborate on the completion of a declaration (i.e. multi-filing), on the understanding that legal responsibility for completing border obligations would remain in the same place?

9 - What safeguards would you expect to see in relation to:

- The sharing of data from the supply chain and between traders, intermediaries and their commercial partners in the completion of a declaration?

- Enabling two or more parties to collaborate on a declaration?

- The sharing of data between declaration types?

10 - Any other views you have on the proposed changes.

2. Enabling the Use of Supply Chain Data

The government wants to enable frictionless trade, which requires government to have much better, complete and timely data about goods moving across the UK border. To this end, government is exploring whether it can get greater visibility of quality goods data directly from businesses’ commercial supply chain management systems in an automated way. The aim is to receive data from as far upstream in the supply chain as possible, for example from the raw producer of the material which feeds into the production of the good. This data would be that which businesses already have on the stocks for their day-to-day operations, so there would be no additional burden on them in sourcing the data.

The government’s Policy Discussion Paper recognised the benefits of using supply chain data in border processes, including:

- More robust traceability and assurance of the provenance and movements of goods to government, businesses and consumers;

- Better targeted and automated risk assessments, and therefore more timely clearances;

- Reducing the administrative burden from manually inputting information at successive steps in the supply chain, and;

- Supporting automated customs and other border processes, through government accessing supply chain data, thus significantly reducing trader costs and administrative burdens, and driving border innovation.

It was also noted that more complete and timely data could also empower business and government to strengthen the resilience of critical supply chains, such as those relating to critical minerals, and enable a more agile response to threats of supply chain disruption.

The government has launched the Ecosystem of Trust Pilots to demonstrate how supply chain visibility and physical assurance technology can produce benefits for traders and government. Over the second half of 2022, pilots will test how supply chain data platforms can provide high-quality industry data to government in a timely and automated way. This could significantly reduce the trader’s administrative burdens (by automating the collection of data required in declarations) and reduce the need for physical checks at the border for our most trusted traders. Evaluation outputs from the pilots are expected from December 2022.

Whilst the pilots gather evidence about the benefits and scalability of Supply Chain Visibility (SCV) technology, we need to understand where legislation is required to underpin its use, for instance to enable the receipt, sharing and use of supply chain data for a broad range of functions.

Providing Businesses with the Option of Using a Supply Chain Visibility Feature

Government already receives voluntary data through declarations, and some businesses provide access to some supply chain data to government voluntarily. The STW service enabling supply chain visibility will take a similar voluntary approach with businesses having the choice to provide their data via this mechanism. Given the benefits to risking and other aspects of official and commercial border processes, businesses who participate in a supply chain data visibility feature would be expected to have an improved experience when moving goods across the UK border. However, providing supply chain data would remain optional for businesses who could choose to make use of it or use standard border processes to move goods.

We welcome stakeholders’ views on:

11 - What supply chain data they hold.

12 - Whether they have any concerns around introducing an optional supply chain visibility feature to the STW?

13 - If so, could you please provide details as to what the concerns are and how they could be addressed?

Permission for the Government to Receive Supply Chain Data Held in Commercial Systems

As mentioned above, the government may seek to use the data provided by supply chain actors to commercial systems, such as those offered by private sector data processing intermediaries. In order for government to receive this data, those supply chain actors providing data to the commercial system will each need to provide their agreement to the commercial system to allow for the sharing of data onwards with government. This could, for example, be as part of a general user agreement or contract entered into by government with the commercial system, or it could be provided by a series of more detailed choices made by the supply chain actors about precisely what particular types of data held within the commercial system government had permission to see.

These agreements would give effect to the government policy objective of ensuring businesses have a choice as to whether to provide supply chain data. They would also ensure information processed by government was compliant with data protection principles, and would address supply chain actors’ concerns on the potential use of their data by providing clarity on the circumstances, extent and means via which this data may be accessed by the government.

We welcome stakeholders’ views on:

14 - If the government uses data received from supply chain actors for a broad range of uses, what level of benefits would be needed to incentivise traders and other affected actors to invest in and support this approach?

15 - Whether there are any further concerns that would need to be addressed in order for affected supply chain actors to be content with the sharing of their supply chain data with the government?

The Legal Basis for Processing and Sharing Supply Chain Data

The processing of supply chain data for the management of official border requirements would be underpinned by the existing powers of government departments and public bodies. The sharing of this data by HMRC with other government departments and public bodies would be underpinned by the new information sharing gateway referenced in the section above on data collection, use and sharing.

However, much of the data that the government intends to access from supply chains (such as information relating to the early stages of a supply chain from the raw producer and manufacturer of the good), is additional to the mandatory data provided through existing means such as transactional declarations. As mentioned, this additional data would provide insight into the provenance of the goods to provide confidence around quality and therefore risk and pricing. The processing of these novel forms of data will need a legal underpinning.

To address this we propose to legislate to enable HMRC, as the department responsible for the STW, to collect businesses’ supply chain data (which will include commercial and potentially personal data). We would also legislate for the new information sharing gateways required for the STW to cover the sharing of this data with the other government departments and public bodies referenced in the ‘Data Collection, Use and Sharing’ section above. These legislative changes would mean the STW could access and share supply chain data with other government departments and public bodies in order to realise benefits for border processes, whilst remaining consistent with HMRC duties under the CRCA.

Businesses would have a choice of whether to allow the government, via the STW, to receive their supply chain data. In the event that they choose to participate in the supply chain data visibility feature, the collection of this data within government would be underpinned by STW legislation. This legislation would give powers to HMRC to collect data on the production, distribution, financing and administration of products which are moved into or out of UK territory and enable the sharing of this information with other government departments and bodies with access to the STW. Data will be treated the same way irrespective of the route by which it is provided to government. Where businesses have chosen to provide data via the supply chain visibility route, HMRC will be able to see data which was previously provided through existing channels, as well as the novel supply chain data the government is interested in. This novel data would be treated the same way as data which the government is required to collect. Businesses would not be able to withdraw data already provided to government.

We welcome stakeholders’ views on:

16 - Whether, and under what circumstances and conditions, they would be comfortable with sharing additional supply chain data with the government?

17 - Whether and what limits should be in place for HMRC around using supply chain data?

18 - Whether HMRC should share supply chain data with other government departments to perform their border activities, such as making decisions on risks or checks, and what limitations or safeguards should be in place if this was permitted?

Proportionality

Introducing a supply chain visibility feature into the STW will mean that more data than is received currently through declarations is likely to be available to government. The additional data collected should however be aligned and proportionate to the purpose for which it will be used by the government. For example, bulk downloading and sharing of data with other government departments may not be appropriate, depending on how clearly focused on, and necessary to the purpose this collection of data is. The right balance will need to be struck when considering whether the additional data is actually beneficial and useful for the government’s objectives or whether it is too intrusive.

We welcome stakeholders’ views on:

19 - What tests or limitations should be applied to ensure that the data the government is accessing through supply chain data systems is proportionate?

Future Uses for Supply Chain Data

Commercial supply chain data provides new, richer data points that may allow the government to develop new capabilities. For example, supply chain data can provide robust traceability of the provenance and the real-time movements of goods. For government, the ability to understand key supply chain events could be advantageous in allowing the identification of points of failure in the supply of particular goods. For businesses, increased visibility of their supply chains brings the opportunity to make efficiencies.

We welcome stakeholders’ views on:

20 - Whether they would be comfortable with government using their data for additional purposes, such as improving the UK’s supply chain resilience. Are there any additional purposes you would be particularly supportive of, or against?

A second ambitious use of supply chain data is its potential to inform how border data requirements are met in the long-term future. As noted in the UK Border Strategy, there could in principle be scope for the provision of discrete declarations to be superseded by a more automated flow of data, for traders providing government access to their supply chain data. This could further reduce trader administrative burdens, however there would be many issues and practicalities to address in proceeding with such a fundamental change, such as how to ensure that appropriate liabilities with respect to the information provided to government could be identified, and when necessary, enforced. In developing the Target Operating Model, the Government will explore some of these issues.

3. International Data Sharing

In addition to ensuring that changes to legislation support the introduction of the STW, it will also be important that government plans for the future and the opportunities regarding sharing data with other countries, via the STW. 41 countries have developed a form of operational STW as of 2018, with a further 76 STWs currently in development (including the UK)[footnote 9]. It is the government’s intention to develop the STW in such a way that it allows for it to be interoperable with other countries’ and territories’ systems and for data to be exchanged between these systems.

The government already shares data with other countries and trading partners, for multiple purposes relating to security, trade, and customs amongst others. Existing powers are, however, likely to be insufficient for the ambitions of international interoperability through the STW. The government expects that international data sharing, or ‘international interoperability’ as it is often referred to in relation to Single Windows, could provide significant benefits to both traders and government in the future. This kind of international data sharing will likely require specific legal gateways for data to be shared with the countries of territories identified. It may be necessary to provide HMRC with a power to enable these gateways to be implemented on a case-by-case basis, setting out the specific requirements that need to be met to enable government to share data with the country or territory in question. It is also likely that these powers may be limited by the need for data to be controlled in the country or territories identified.

There are different possibilities as to how international interoperability could be implemented:

- International interoperability could enable the sharing of export information submitted to the UK STW with another country or territory’s Single Window, which could facilitate the improved movement of goods by providing more information to the other country’s government or the importer in the other country or territory. In practice, this could mean that when a trader or intermediary submits the required data to fulfil their customs obligations through their STW account, this information could be used by their counterparts in the other country or territory. This could allow the data to be reused for the customs obligations required in the other country or territory, if the data standards and data sets used have been internationally agreed. This functionality could potentially be enabled either directly through the STW account, or externally in a format that would allow sharing outside of the UK STW as an interim step to full interoperability with other countries or territories at a later stage. The objective would be to reduce the administrative burdens associated with the full spectrum of international trade-related responsibilities and obligations.

- International interoperability could also mean improved government-to-government information being exchanged for risking purposes. The UK STW could enable the government to securely share data with other countries’ or territories’ governments in order to better risk the movement of goods between territories, increasing the effectiveness of any interventions at the border, or before goods reach the border. For example, this could include sharing lists of importers and exporters between governments to improve risk assessments, which in turn could translate into benefits for traders and intermediaries in the form of more targeted interventions based on the risks identified and fewer interventions or delays to goods during the import-export process as a result. This better targeting could also potentially translate into better customs revenue protection.

Best-in-class systems, such as Sweden, New Zealand and Canada, already have advanced capabilities including a real-time view of processing for traders and integration with border security risking capabilities, and others, such as Singapore, have an integrated risk management system. Interoperability with STWs containing these kinds of advanced capabilities could enable further benefits for traders, such as accessing a real-time view of processing.

The Digital Trade Principles, agreed by the G7 countries including the UK, were published at the end of 2021. These principles include developing Single Windows around common standards, with international interoperability as a key goal, and in line with the best practice recommendations of the World Customs Organisation (WCO). The potential benefits of this include closer cooperation between countries or territories that align with WCO common standards on customs requirements, and reduced administrative costs for traders from the same information needing to be submitted to two or more national authorities. To facilitate this exchange of data in the most effective way, we need to internationally and collectively establish which common set of data standards we should use to enable smooth data exchanges with other governments.

Agreements to share data made between the UK and other countries or territories on a case-by-case basis with appropriate safeguards in place, will enable international interoperability to be facilitated by consistent, or straightforwardly compatible data and technological standards. We welcome views on the data standards and principles the UK, and potentially the wider international community, ought to use moving forward to future-proof and maintain the high quality of systems. We also wish to understand the extent to which international standards, and requirements set by other countries or territories, are influencing businesses’ decisions regarding system choices and capabilities.

As we are at an early stage of development of the STW, we do not yet have a detailed view on what the exact model of interoperability between the UK and other countries or territories should be, and this will largely be determined by bilateral agreements with that country or territory. We do, however, know that we will need to have sufficient flexibility in the data collection and sharing powers we seek to introduce. We will also want to introduce powers to address any limitations in the current data protection legislation regime. They will need to enable international interoperability, and to allow agreements with other countries or territories to be pursued.

The government recognises that the sharing of information with other countries or territories typically requires a specific legal basis. Whilst the government expects to follow this approach in enabling international interoperability for the STW, flexibility will be required to ensure the legislation can accommodate the specific model of interoperability agreed between the UK and a given other country or territory as we develop our thinking in this area. As mentioned above we expect that sharing data with other countries or territories will require specific legal gateways for the country or territory identified and HMRC powers so that specific requirements can be implemented.

We welcome stakeholders’ views on:

21 - What standards the UK, and potentially the wider international community, ought to use moving forward to future-proof and maintain the high quality of systems?

22 - The extent to which international standards, and requirements set by other countries or territories, are influencing businesses’ decisions regarding system choices and capabilities.

23 - Whether you have concerns about the adoption of WCO and UN/CEFACT data standards[footnote 10]? If so, could you please give detail as to what the concerns are and how you feel they could be addressed or mitigated?

24 - What safeguards would you expect to see in relation to the sharing of data between HMRC and with other countries’ or territories’ Single Windows?

25 - What are your views on the benefits and/or concerns regarding the potential different forms of interoperability identified above, and any other ways that government may be able to support international data sharing where it may benefit trade?

26 - Any other views you have on the proposed changes.

4. Transitioning to the STW as the Sole Point of Entry for Transactional Border Data

As has been acknowledged above, there are currently multiple systems in numerous departments and public bodies with which traders and intermediaries need to engage to move goods across the border. In the longer term, the government’s working assumption is that the STW becomes the sole route for providing data and applying for licences and authorisations. This will ultimately ease the administrative burdens on traders and/or intermediaries.

As it is developed, the STW will initially sit alongside existing channels of input for transactional border data. During this period, prior to the government transitioning to the STW as the sole point of entry for transactional border data, the government envisages that software providers and their customers will be able to move to the STW in line with their business needs, in order to achieve the likely benefits this will bring.

For the majority of traders who use brokers or commercial software, this eventual move to the STW service will not affect how data is shared by them with their broker or software, notwithstanding the benefits which the STW will hold in streamlining the existing multiple routes of data submission, centralising processes such as applying for authorisations and licences, and the potential to access supply chain data.

However, this eventual move to the STW will mean a substantial change for those commercial software providers who interact with government systems. The government acknowledges the large investment of time and money that traders and the border industry are putting into the move from the current customs declaration system, the Customs Handling of Import and Export Freight (CHIEF) system, to the new Customs Declaration Service (CDS). We are keen to ensure this investment is not lost when users move to the STW, and indeed CDS will continue to be an enduring government border system. Furthermore, government will seek in the design of the STW to reuse and build upon existing APIs wherever possible.

The government recognises that it will be inefficient to maintain duplicative means of entry for required transactional border data of the same kind. This means that ultimately, we will move away from the current suite of multiple separate data submission requirements for transactional border processes. Where possible we will limit the need for businesses to incur costs in switching between current forms of data submission process, and those supported by the STW, through reusing or building upon existing APIs, and by reusing or building upon existing services as part of the suite of services making up the STW. However, traders and intermediaries will ultimately need to ensure that the software they use is compatible with the STW API, or that they are registered to use any self-declaration offering provided by the STW. The STW will foster industry innovation through adopting an API First approach, which will underpin an ecosystem of trade services and ultimately provide more choice to customers.

The government does not anticipate that this move to the STW being the sole point of entry will happen in the near future, and there will be a significant period of dual-running of existing and STW channels of data input whilst traders and intermediaries become comfortable with the service. The government does, however, anticipate that the time and cost saving benefits of interacting with the STW rather than existing methods of data input, will incentivise border users - whether traders, intermediaries or software developers - to voluntarily move to the STW before the government transitions to it as the sole point of data entry.

The government will, however, consider multiple factors, which may include the extent of user take-up of STW services by businesses of all sizes, the extent to which declaration and licence types have been integrated into the STW, and the wider context affecting traders and intermediaries when determining the appropriate point to make this transition.

The government will also consider the way in which this transition is delivered. There are likely to be two possible models for delivering this; transitioning all border processes to be delivered solely through STW at a single point in time, or taking a staged approach where border processes are transitioned incrementally. Given that this transition is unlikely to take place in the short or medium term, the government will keep these options under review, and would welcome stakeholder views on the risks and benefits of these options, and any mitigations to help address any identified risks.

Where legislative change is required to facilitate this transition, the government will seek to deliver the necessary powers to enable this change to take place in due course. This will enable the decision to transition to the STW as the sole avenue of data entry for transactional border processes, to be taken when it is deemed operationally appropriate to do so, having reflected on and considered views from those parties affected by the transition.

We welcome stakeholders’ views on:

27 - Whether the criteria proposed above – user take up, and integration of declaration and licence types – are appropriate to consider for the point at which the STW becomes the sole point of entry?

28 - Whether other criteria should also be considered to make this decision? If so, what other criteria should be considered and the reasons for doing so?

29 - What risks and benefits stakeholders can foresee with the options for implementing this transition; namely at a single point in time or incrementally, and how identified risks may be mitigated?

30 - Any other views you have on the proposed changes.

Questionnaire

Data Collection, Use and Sharing

We welcome stakeholders’ views on:

1 - Whether the proposed changes will enable the functionality industry would expect to see from a STW?

2 - Whether you have concerns about the collection of the data required for other government departments and public bodies’ border processes by HMRC, via the STW? If so, please provide details as to what the concerns are and how they could be addressed or mitigated?

3 - What safeguards would you expect to see in relation to the sharing of data between HMRC and other government departments and public bodies?

4 - Any other views you have on the proposed changes.

5 - How they envisage liability could be retained with the party responsible for submitting the border data required by the Government, when there are multiple providers of the data or data is obtained through supply chain systems?

6 - Whether border users and their commercial partners would be willing for HMRC to share data:

- to complete different border data obligations,

- where there are data fields common across different declarations; and,

- the data has been provided by different parties and can be reused to support the completion of a different declaration related to the same movement of goods?

7 - Whether border users and their commercial partners have any concerns with this proposal? If so, could you please provide details as to what the concerns are and how you feel they could be addressed or mitigated?

8 - Whether border users and their commercial partners would be supportive of STW functionality that would enable them to collaborate on the completion of a declaration (i.e. multi-filing), on the understanding that legal responsibility for completing border obligations would remain in the same place?

9 - What safeguards would you expect to see in relation to:

- The sharing of data from the supply chain and between traders, intermediaries and their commercial partners in the completion of a declaration?

- Enabling two or more parties to collaborate on a declaration?

- The sharing of data between declaration types?

10 - Any other views on the proposed changes.

Supply Chain Data

We welcome stakeholders’ views on:

11 - What supply chain data they hold.

12 - Whether they have any concerns around introducing an optional supply chain visibility feature to the STW?

13 - If so, could you please provide details as to what the concerns are and how they could be addressed?

14 - If the government uses data received from supply chain actors for a broad range of uses, what level of benefits would be needed to incentivise traders and other affected actors to invest in and support this approach?

15 - Whether there are any further concerns that would need to be addressed in order for affected supply chain actors to be content with the sharing of their supply chain data with the government?

16 - Whether, and under what circumstances and conditions, they would be comfortable with sharing additional supply chain data with the government?

17 - Whether and what limits should be in place for HMRC around using supply chain data?

18 - Whether HMRC should share supply chain data with other government departments to perform their border activities, such as making decisions on risks or checks, and what limitations or safeguards should be in place if this was permitted?

19 - What tests or limitations should be applied to ensure that the data the government is accessing through supply chain data systems is proportionate?

20 - Whether they would be comfortable with government using their data for additional purposes, such as improving the UK’s supply chain resilience. Are there any additional purposes you would be particularly supportive of, or against?

International Data Sharing

We welcome stakeholders’ views on:

21 - What standards the UK, and potentially the wider international community, ought to use moving forward to future-proof and maintain the high quality of systems?

22 - The extent to which international standards, and requirements set by other countries or territories, are influencing businesses’ decisions regarding system choices and capabilities.

23 - Whether you have concerns about the adoption of WCO and UN/CEFACT data standards[footnote 11]? If so, could you please give detail as to what the concerns are and how you feel they could be addressed or mitigated?

24 - What safeguards would you expect to see in relation to the sharing of data between HMRC and with other countries’ or territories’ Single Windows?

25 - What are your views on the benefits and/or concerns regarding the potential different forms of interoperability identified above, and any other ways that government may be able to support international data sharing where it may benefit trade?

26 - Any other views you have on the proposed changes.

Transitioning to the STW as the Sole Point of Entry for Transactional Border Data

We welcome stakeholders’ views on:

27 - Whether the criteria proposed above – user take up, and integration of declaration and licence types – are appropriate to consider for the point at which the STW becomes the sole point of entry?

28 - Whether other criteria should also be considered to make this decision? If so, what other criteria should be considered and the reasons for doing so?

29 - What risks and benefits stakeholders can foresee with the options for implementing this transition; namely at a single point in time or incrementally, and how identified risks may be mitigated?

30 - Any other views you have on the proposed changes.

Thank you for participating in this consultation exercise.

Contact Details and How to Respond

For information about how we treat your personal data when you respond to our consultation, please see the Privacy Notice at Annex A.

Please send your response by 15/09/22 to either:

STW Consultation, GC13, 100 Parliament Street, London, SW1A 2BQ

Email: btbo-event-enquiries@cabinetoffice.gov.uk

Complaints or comments

If you have any complaints or comments about the consultation process you should contact the Cabinet Office at the above address.

Extra copies

Alternative format versions of this publication can be requested from btbo-event-enquiries@cabinetoffice.gov.uk.

Confidentiality

If you want the information that you provide to be treated as confidential, please explain to us why you regard the information you have provided as confidential. We will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the Cabinet Office.

Glossary of Terms

APIs - Application Programming Interfaces

CDS - Customs Declaration System

CHIEF - Customs Handling of Import and Export Freight

CRCA - Commissioners for Revenue and Customs Act 2005

CSP - Community System Provider

DCSA - Digital Container Shipping Association

GDPR - General Data Protection Regulation

IATA - International Air Transport Association

IPAFFS - Imports of Products, Animals, Food and Feed Systems

Multi-filing - Multi-filing refers to where multiple actors in the supply chain input data into the same declaration based on their own knowledge / responsibilities, reducing the burden on one individual actor to manually collate data from other actors.

Pre-population - Pre-population of data refers to where declarations would be automatically completed using data previously received, with a view to reducing duplicative entry of data for traders.

SCV - Supply Chain Visibility

SPS - Sanitary and Phytosanitary

S&S - Safety and Security

STW - Single Trade Window

TOM - Target Operating Model

UN/CEFACT - United Nations Centre for Trade Facilitation and Electronic Business

WCO - World Customs Organisation

WTO - World Trade Organisation

Annex A – Privacy Notice for Cabinet Office consultations

This notice sets out how we will use your personal data, and your rights. It is made under Articles 13 and/or 14 of the UK General Data Protection Regulation (GDPR).

YOUR DATA

Purpose

The purpose for which we are processing your personal data is to obtain the opinions of members of the public, parliamentarians and representatives of organisations and companies about departmental policies, proposals, or generally to obtain public opinion data on an issue of public interest.

The data

We will process the following personal data: name, address, email address, job title (where given), and employer (where given), as well as opinions.

We will also process additional biographical information about respondents or third parties where it is volunteered.

Legal basis of processing

The legal basis for processing your personal data is that it is necessary for the performance of a task carried out in the public interest or in the exercise of official authority vested in the data controller. In this case that is consulting on departmental policies or proposals, or obtaining opinion data, in order to develop good effective policies.

Sensitive personal data is personal data revealing racial or ethnic origin, political opinions, religious or philosophical beliefs, or trade union membership, and the processing of genetic data, biometric data for the purpose of uniquely identifying a natural person, data concerning health or data concerning a natural person’s sex life or sexual orientation.

The legal basis for processing your sensitive personal data, or data about criminal convictions (where you volunteer it), is that it is necessary for reasons of substantial public interest for the exercise of a function of the Crown, a Minister of the Crown, or a government department. The function is consulting on departmental policies or proposals, or obtaining opinion data, in order to develop good effective policies.

Recipients

Where individuals submit responses, we may publish their responses, but we will not publicly identify them. We will endeavour to remove any information that may lead to individuals being identified.

Responses submitted by organisations or representatives of organisations may be published in full.

Where information about responses is not published, it may be shared with officials within other public bodies in order to help develop policy.

As your personal data will be stored on our IT infrastructure it will also be shared with our data processors who provide email, and document management and storage services.

We may share your personal data where required to be law, for example in relation to a request made under the Freedom of Information Act 2000.

Retention

Published information will generally be retained indefinitely on the basis that the information is of historic value. This would include, for example, personal data about representatives of organisations.

Responses from individuals will be retained in identifiable form for three calendar years after the consultation has concluded.

Where personal data have not been obtained from you

Your personal data were obtained by us from a respondent to a consultation.

YOUR RIGHTS

You have the right to request information about how your personal data are processed, and to request a copy of that personal data.

You have the right to request that any inaccuracies in your personal data are rectified without delay.

You have the right to request that any incomplete personal data are completed, including by means of a supplementary statement.

You have the right to request that your personal data are erased if there is no longer a justification for them to be processed.

You have the right in certain circumstances (for example, where accuracy is contested) to request that the processing of your personal data is restricted.

You have the right to object to the processing of your personal data where it is processed for direct marketing purposes.

You have the right to object to the processing of your personal data.

INTERNATIONAL TRANSFERS

As your personal data is stored on our IT infrastructure, and shared with our data processors, it may be transferred and stored securely outside the UK. Where that is the case it will be subject to equivalent legal protection through an adequacy decision or the use of Standard Contractual Clauses.

CONTACT DETAILS

The data controller for your personal data is the Cabinet Office. The contact details for the data controller are:

Cabinet Office

70 Whitehall, London

SW1A 2AS

Public Enquiries: Online Contact Form

The Data Protection Officer provides independent advice and monitoring of Cabinet Office’s use of personal information.

The contact details for the data controller’s Data Protection Officer are: dpo@cabinetoffice.gov.uk

COMPLAINTS

If you consider that your personal data has been misused or mishandled, you may make a complaint to the Information Commissioner, who is an independent regulator. The Information Commissioner can be contacted at: Information Commissioner’s Office, Wycliffe House, Water Lane, Wilmslow, Cheshire, SK9 5AF, or 0303 123 1113, or icocasework@ico.org.uk. Any complaint to the Information Commissioner is without prejudice to your right to seek redress through the courts.

Annex B – Responses to the UK Single Trade Window Policy Discussion Paper

As set out above, we sought views on the key themes outlined in the Policy Discussion Paper;

- The collection, use and sharing of data within government, including where this could support functionalities such as pre-population and multifiling;

- Enabling government visibility, and use of, supply chain data, with the aim of reducing data entry and administrative burdens of submitting border data to government, whilst maintaining the government’s compliance capability[footnote 12].

- Facilitating trade through targeted international data sharing with other countries and territories, subject to appropriate data protection arrangements;

- Self-declaration: the extent to which the STW functionality could enable a wider range of traders and/or intermediaries to submit border data directly to government.

- How the STW should work with existing port and commercial systems, including CSPs.

Responses to STW Policy Discussion Paper on Data Collection, Use and Sharing

During our previous engagement with stakeholders around the Policy Discussion Paper, we focused on two aspects of data use in particular - ‘pre-population’ of declarations and ‘multi-filing’. This includes data sharing using information government authorities and agencies already have in relation to a trader/intermediary and their commercial partners, or information already available from a trade.

In response to the questions posed in the Policy Discussion Paper, most businesses saw data sharing or pre-population as being a useful function in the STW in order to reduce duplication and potentially the time spent on submitting data across government systems. There were also thought to be benefits to the cross-pollination between customs declarations and other declarations such as the pre-notifications made into the Import of Products, Animals, Food and Feed System (IPAFFS), which could streamline the process of importing goods.

A number of views were expressed with regard to government considerations to the various potential sources of data for sharing/pre-population, but most notable was the need for the reliability of data and where it was sourced from. However, there wasn’t a consensus on the sources themselves, with some respondents believing that government should build on existing official sources first - for example, existing HMRC-held data or Companies House information - while others favoured information from companies/third parties.

Commercial software commonly provides pre-population features already, and some concern was raised by software providers with regard to the potential impact any government STW self-serve could have on the private sector should it include pre-population/data sharing. Potential errors in the data shared were raised by some stakeholders as a risk, and concern was expressed about where accountability would lie for such errors in those circumstances.

Regarding multi-filing, the main benefits communicated during the Policy Discussion Paper engagement were that multiple organisations involved in a trade could input information into the same declaration, rather than one organisation needing to collate the information. For example, traders and intermediaries could collaborate together adding relevant information directly into the same declaration.

Some traders viewed this model of multi-filing in a positive light, although there were concerns on data sharing and the security of the information they were inputting into a declaration. There is a need to reiterate that any STW developed will prioritise the security and proper handling of data to ensure privacy for traders.

There were additional concerns of traders inputting information in an incorrect format, especially since multi-filing can allow more than one party to contribute to the same declaration. Finally, there were concerns around the potential implications for liabilities with businesses expressing a desire to proactively confirm the data was correct.

The government anticipates that the types of data shared would likely include the information commonly required for border processes, such as trader, commodity and routing information. Information shared would be subject to the consent of the trader. This data could include commercially sensitive information or personal data, where that is required for the border process in question.

HMRC will continue to consider how data sharing can be successfully used within the design for the STW in a way that reduces administrative burdens without increasing risk. We will continue to engage with industry on these choices.

Responses to STW Policy Discussion Paper - Supply Chain Data

The Policy Discussion Paper stated that the government wanted to work alongside the private sector to harness how new technologies could use supply chain data to create a more frictionless trading experience.

Feedback from stakeholders during engagement on the Policy Discussion Paper acknowledged that the private sector is rapidly developing supply chain data visibility capabilities and that there is potential for benefits for traders and government. They were generally positive about the use of supply chain data to help reduce border frictions and wanted to see pilots and evidence of the benefits to industry. The principal concern was data security and the need for controls around how commercially sensitive data is shared.

Responses to STW Policy Discussion Paper - International Data Sharing

During engagement on the Policy Discussion Paper, we heard overall business interest and enthusiasm for international interoperability for the purpose of reducing administrative burdens.

The importance for the UK STW to adopt common international standards such as the World Customs Organisation (WCO) data model and those from the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT) was noted. Other frameworks mentioned were from the WTO, the Digital Container Shipping Association (DCSA), the International Air Transport Association (IATA) ONE Record and LWIN (the world’s biggest open-source database for wine and spirits). These data exchange principles between countries would benefit those countries without a STW.

The main challenges identified were the alignment of legal frameworks and technology standards with other countries and protecting commercially sensitive data. It was felt that the information required by those countries that have signed Free Trade Agreements with the UK should be prioritised so that government departments/agencies are able to meet the legal and regulatory requirements.

Responses to the STW Policy Discussion Paper - Self-Serve Functionality within the STW

The government welcomes the responses received, which highlighted support from some stakeholders for a comprehensive self-serve option in the STW. Discussion largely focused on whether the government should extend a STW self-serve functionality to custom import declarations, but many businesses expressed support for a self-serve option to be available for as many government border processes as possible, in one single place in the STW.

Some traders, particularly those from Small and Medium-sized Enterprises, and occasionally from large business, expressed some interest in self-declaring their custom import declarations and many expressed their interest in using it. The rationale for supporting this approach was the belief that it could reduce time, costs and effort for businesses, and, with suitable user-friendly templates, it could remove third party software costs for businesses, ultimately making movements more efficient and potentially improving compliance. Academics and international trade experts view a self-serve feature as crucial for a STW from a strategic perspective, with potential for long-term benefits to increasing the number of users engaged in international trade.

However, most intermediaries and all commercial software providers expressed concern over the ability of traders to self-serve their own custom import declarations, citing lack of expertise potentially contributing to an increased risk of non-compliant declarations unless they received proper guidance/and or support. Further concern was raised by software developers that a government self-serve function with highly advanced data functionality similar to what is currently available on the market, offered to users for free, could impact the commercial marketplace. Almost all stakeholders acknowledged that the vast majority of users will still use intermediaries and/or commercial software due to the complexity around border processes and the wider benefits associated with private sector options.

Many recognised that customs is inherently complex due to the amount and detail of information needed in order to keep borders secure. Respondents were keen for guidance and support to be provided through multiple communication channels. Government produced webinars, online reference materials and a single cross-government support desk/helpline were some of the suggestions. A single entry point for support was thought by a number of respondents to be particularly beneficial for small firms.

Responses to the STW Policy Discussion Paper - CSPs

The government welcomes the responses received, which found that there are varying levels of knowledge and understanding about the CSP landscape, with business largely unaware of the CSP model but a greater awareness amongst intermediaries and other border stakeholders.

Of those respondents who were aware of and had been exposed to CSPs, it was recognised that CSPs are generally providing a good service.

Suggestions to change the CSP model were put forward by respondents, for example, a single fee structure that would allow more flexible access to any inventory linked port. The need to keep current arrangements as they are was flagged by CSPs and ports, on the basis that this would avoid any potential disruption with changes to the port systems and processes, but CSPs and ports also recognised that interoperability between their different systems could be improved.

The government will take forward further engagement with key stakeholders, to determine how improvements can be made, on how the STW could best achieve its aims of reduced cost and complexity in the context of CSP operations at ports.

Annex C - Executive Summary of ‘Exploring Small Traders’ Attitudes Towards the Single Trade Window’ by Kantar Public

Full findings of this research are published on GOV.UK.

The government has committed to developing a Single Trade Window, to simplify and streamline trader interactions with border agencies. A UK STW has the potential to provide a single data portal into which traders and those acting on behalf of traders can submit data once to government in a standardised format, to fulfil all import, export, and transit related regulatory requirements. Research was needed to understand small traders’ views of the STW and how it might affect the way they trade. Views were sought on potential features of the STW, including options for self-declaration, pre-population, multi-filing and sharing supply chain data with government.

HMRC commissioned independent research agency Kantar Public to conduct qualitative research with small traders. Interviews were conducted with 57 small businesses who imported or exported goods to or from the UK. The sample included a mix of business sizes (though all traders had under 50 employees), a mix of intermediary use for declarations, as well as patterns and frequency of trade. Interviews lasted 45 to 60 minutes and were conducted by telephone or videocall, between 2 February and 15 March 2022. This research was conducted in addition to a Policy Discussion Paper[footnote 13] on policy proposals for the STW, which was published on GOV.UK to seek views from a wide range of stakeholders.

Key Findings

The concept of the STW was well received by small traders, who were keen to see streamlining of the current system. The views of traders towards the STW were influenced by the following considerations:

- Understanding of customs is varied. Those with the least knowledge were often unaware that declarations are a part of the customs process, that it is something they were paying someone else for and something they could potentially do themselves. For these traders, the decision to outsource declarations was not necessarily a conscious one.

-

Traders with some knowledge of import and export declarations tended to feel overwhelmed by what they regarded as a highly complex process. Due to their unfamiliarity with the process and requirements, or low confidence, these traders often felt their time could be better spent elsewhere in the business and therefore regarded the cost of outsourcing declarations to be good value. For them, outsourcing currently avoided hassle and reduced the risk of errors, which would lead to consignments being delayed. Despite low reported knowledge, however, traders were often collecting a fair amount of declaration data themselves (e.g. commodity codes), and sometimes underestimated how much they knew.

- A small number of those traders interviewed completed and submitted declarations themselves using commercial software. Traders in this group had usually accessed some kind of training through HMRC or their carrier, and once they had learnt the system, found it relatively straightforward to complete and submit declarations themselves.

- While not all traders would be (immediately) affected by the single point of entry and data sharing between government departments (because they were only engaging with HMRC), those who were affected felt that reduced duplication would be very beneficial.

Trader Views on Self-declaration, Pre-population, Multi-filing and the Linking of Supply Chain Data

Self-declaration, pre-population, multi-filing, and linking supply chain data with government systems are potential functionalities of the STW.

Self-declaration was seen as a good idea, though it did not appeal to all traders in the same way. Interest was based on a consideration of whether the benefits outweighed what they often assumed would be a fairly significant time investment to learn the system:

- Those completing declaration documentation in-house were the most likely to recognise the benefits to their business; they were motivated primarily by the opportunity to be more in control of their imports and exports and to reduce their costs. These traders sometimes thought that self-declaration could eventually increase their international trade.

- Businesses with smaller margins, who were confident dealing with customs processes, were interested to test whether self-declaration would save them time or money. They were also motivated by greater control, cost-savings, and the ability to see all their declarations and documentation in one place.

- Those trading small volumes or exclusively using Fast Parcel Operators perceived self-declaration could represent duplication rather than simplification, so traders in this group felt they were unlikely to use a self-declaration service as it may not suit their business or their skill set. To use self-declaration, these traders would need to be convinced that it simplified the process to such an extent that it made it worth their while to invest time understanding the process.

Once launched, traders felt they would need support from HMRC and other sources to use self-declaration, particularly in the early stages. They would value simple guides tailored to non-experts, searchable guidance, a telephone helpline and face-to-face seminars and webinars.