Proposals for changes to Gambling Commission fees from 1 October 2021

Updated 14 June 2021

Executive Summary

1.1. This consultation, which is based on recommendations from the Gambling Commission to Government, seeks views on proposals for changes to Gambling Commission fees. It proposes an uplift to enable the Commission to continue to recover its costs and respond to new challenges.

1.2. Changes will be brought into force by secondary legislation. Our intention is to introduce the proposed annual fee increases for remote licences and all application fee increases on 1 October 2021. We also plan to make other changes to simplify the fees system, including removing annual fee discounts for combined and multiple licences, at the same time. However, to reflect the particular difficulties caused to the land-based sector over the past year by the Covid-19 pandemic, we plan to leave the main fees payable by existing non-remote operators (annual licence fees) unchanged for 2021/22, implementing this uplift in April 2022.

1.3. The Commission is experiencing new challenges in regulation which are expected to grow in significance in coming years:

-

Increased technological developments including product and payment innovation.

-

Changes in the size and shape of the market partially caused by consolidation, meaning the operators it regulates are increasingly global operators.

-

Increasing risks associated with unlicensed operators and the need to protect consumers and the industry from ‘black market’ encroachment.

1.4. It has been adapting and up skilling its staff to keep pace with the changing landscape and plans to go further in future. The table below summarises the main elements of its proposed responses to the challenges outlined above.

Key elements of the proposed response to Challenge 1:

-

More specialist technical staff, including a Chief Product Officer (CPO), to understand and translate the impact of technological changes, and staff with technical and investigative expertise.

-

Investing in tools to improve its approach to compliance.

-

Developing its approach to making better use of the wealth of data available.

Key elements of the proposed response to Challenge 2:

-

More staff whose focus is on driving the international regulatory agenda, and working with international regulatory partners and agencies.

-

More specialist staff to interrogate and understand complex corporate structures.

-

Increased legal capacity to defend positions.

Key elements of the proposed response to Challenge 3:

-

More staff to proactively and systematically identify the scale of illegal gambling.

-

More resources to robustly tackle illegal gambling, including increased legal capacity for prosecutions.

1.5. The proposed responses to these key challenges are not fixed and will need to evolve over time. The estimated additional investment that is proposed is based on the Commission’s current knowledge and represents its best estimate of the additional costs it will incur in the short to medium term, to further address the key challenges it is facing. As the Commission recruits staff with more specialist technical knowledge, they will help to develop the Commission’s longer-term plans and strategic ambitions.

1.6. Alongside its fee income the Commission has been drawing on its reserves in recent years, as planned in the last review of fees. Both the level of reserves and the extent to which they have been drawn on have been higher than anticipated at that time. The reserves will not be sufficient to make this a continuing option for future years. The effects of Covid-19 are also expected to impact its income in 2021/22 as well as in 2020/21.

1.7. The Commission has taken action in 2020-21 which is expected to result in significant efficiency savings in 2021-22, primarily through a programme of restructuring. It has also identified opportunities to make further efficiencies through continuing with that programme and through smarter working and modernisation of processes. However, to regulate effectively going forward, its fees income will also have to be increased.

1.8. The Government has announced a review of the Gambling Act 2005, with a Call for Evidence published on 8 December 2020. This will include looking at the Commission’s powers and resources. While that may lead to further changes to the fees system in future, the proposals in this consultation are aimed at ensuring the Gambling Commission is able to meet ongoing challenges while the Review progresses.

Summary of proposed changes to annual fees for operating licences

1.9. The Commission aims to allocate its forecast costs to the different gambling sectors, individual licence types and fee categories in a way that ensures that fees are cost reflective and fair. The largest increases in annual fees are therefore proposed for remote and gambling software operators, because it is predominantly these types of licensee that are driving the challenges set out above. Each fee band for remote operating licences (other than lottery and gaming machine technical licences) and for gambling software licences will therefore see an annual fee increase of 55% (see Annex 2 for further detail). We propose to increase annual fees for remote operating licences in October 2021.

1.10. The Commission is also proposing increases to non-remote fees to reflect increasing costs of maintaining current activity levels and challenges that are relevant for the non-remote sector, such as product and payment innovation. Each fee band for non-remote licences, other than gambling software, will see an increase of 15%. [footnote 1] it is important that the costs of regulation are borne by the industry and that the Commission is funded to respond effectively to the challenges set out here.

1.11. However, the Department and the Commission recognise that the non-remote sector has been impacted very significantly by the nationwide restrictions introduced in response to the Covid-19 outbreak, and a significant number of premises have been closed for large parts of the year. To reflect this, we are proposing to leave annual licence renewal fees for existing non-remote operators unchanged in 2021/22, with uplifts only coming into force in April 2022.

1.12. In addition to this phased implementation, most fee bands are based on gross gambling yield (GGY), which is the difference between money staked and winnings paid out, or equivalent to gross profits. This means that if an operator’s projected income reduces before their next annual fee is due they may apply to the Commission to vary their licence to enter a lower fee band. Their fee would then be based on this updated fee band.

1.13. The Commission proposes to simplify the fee structure by removing the discounts on annual fees available for licensees who hold licences for multiple types of gambling activity (combined or multiple licences). This better reflects the regulatory costs incurred; it would also reduce the costs associated with managing the discount process and allow the Commission to build in more automation. We propose to remove these discounts from the fees structure in October 2021, for both the remote and non-remote sectors.

1.14. Licences which rely on Random Number Generator (RNG) software – i.e. remote casino, bingo and virtual betting licences – pay an additional annual fee for any combination of these three licences, which is currently £2,500 or £5,000 depending on the number of activities licensed. This fee has not been increased since 2009. These additional fees will be doubled, as will the additional annual fees for ‘host’ licences (casino games host, bingo games host and virtual betting host licences). This will better reflect the costs of regulating these types of licensee.

1.15. The Commission proposes to add additional fee categories for society lottery licences, with new higher fee bands for larger societies whose annual proceeds grow in excess of £10m, following the increase in the per calendar year proceeds limit from £10m to £50m. It also proposes additional fee categories and higher fees for the largest external lottery managers, to ensure the full and proportionate recovery of regulatory costs from this sector.

1.16. Overall, the Gambling Commission estimates these changes will lead to increases in operating licence annual fees between 15% and 21% for most non-remote licensees who remain in the same fee band (and for most licensees that hold both a non-remote and remote gaming machine technical, society lottery or external lottery manager licence). There will be increases in operating licence annual fees between 55% and 72% for all other remote licensees and all gambling software licensees. Annual fee increases for remote licences would come into effect from October 2021, but annual fee increases for non-remote licences would come into effect from April 2022.

1.17. Remote licensees, particularly small and medium-sized licensees for whom the flat RNG fee represents a higher proportion of their total fee, will see the largest increases in percentage terms. This is because the Commission’s regulatory costs for the remote sector are significantly higher than the level of fees currently paid by many types of remote business. Remote licensees will also benefit most from increased work to tackle black market encroachment. The Commission estimates that if the proposals are implemented, the total annual fees payable by the gambling industry will be 0.22% of the industry GGY (excluding the National Lottery).

Summary of application fee changes

1.18. The cost of assessing new licence applications has increased over the years, partly because of additional checks being required but also due to the increased complexity of applications. The Commission is therefore proposing to increase all licence application fees by 60%, from October 2021, to ensure that it covers its costs.

1.19. Increases in application fees would apply to all operator applications – new entrants, changes of corporate control, and those seeking to change or vary their licence. The increase in application fees would apply equally across the non-remote and remote sectors.

1.20. For a small non-remote business applying for a new operating licence (eg an adult gaming centre, bingo or general betting (standard) applicant with a projected annual GGY of £250,000), the 60% increase would mean that the new proposed application fee would represent 0.6% of that applicant’s projected GGY. For a small remote casino operator with a projected GGY of £250,000, the proposed application fee would represent 1.7% of its projected GGY.

1.21. New application fees are also being proposed for the new fee categories being proposed for society lottery and external lottery manager licences.

1.22. Personal licence application and maintenance fees remain unchanged under the proposals, as increasing regulatory cost has been balanced by efficiency savings due to improved technology.

Introduction

The Gambling Commission

2.1. The Gambling Commission regulates commercial gambling in Great Britain. All operators providing gambling facilities to GB customers must be licensed by the Commission, which has powers to set licence conditions and codes of practice, and to monitor and enforce compliance. The Commission also has a duty to provide advice to the Secretary of State on matters relating to the regulation of gambling. Its regulation is based on three licensing objectives:

-

Preventing gambling from being a source of crime or disorder, being associated with crime or disorder or being used to support crime

-

Ensuring that gambling is conducted in a fair and open way

-

Protecting children and other vulnerable persons from being harmed or exploited by gambling

2.2. The Gambling Act 2005 (‘the 2005 Act’) gives the Secretary of State for Digital, Culture, Media and Sport (‘the Secretary of State’) the power to make regulations setting fees to be paid to the Commission for operating and personal licences. These fees are set in accordance with the 2005 Act, with HM Treasury’s rules and guidance on fees, levies and charges, at a level that enables the Commission to recover the full costs of regulating the gambling market in accordance with its statutory functions.

2.3. The proposals set out here aim to ensure that the Commission’s costs continue to be recovered on a proportionate and equitable basis from the different types and sizes of licensee across each of the gambling sectors it regulates. They are designed to ensure that gambling remains tightly regulated and that the regulator can respond effectively to new and changing risks, while doing so in a way which is efficient and represents good value for money.

2.4. The National Audit Office (NAO) and Public Accounts Committee recently published reports on gambling regulation which recommended DCMS and the Commission consider the case for changes to the Commission’s fees model. This was to enable it to respond to challenges identified in the reports, such as building its capacity to analyse data and intelligence, to enhance its ability to respond to new areas of risk and potentially to look at the scope for financial incentives to operator compliance. Government and the Gambling Commission have set out how it is responding to the areas for improvement identified, including by improving its use of data and developing further measures to evaluate its impact. [footnote 2]

2.5. Government has announced a review of the Gambling Act 2005, and any changes to the way gambling is regulated or the Gambling Commission’s powers and responsibilities may require the fees scheme to be revisited. The changes which are now being proposed are an uplift under the existing fees system, to ensure that the Commission can continue to address the areas identified by the NAO and respond to the immediate challenges it is facing regulating a dynamic and innovative industry.

Industry changes

2.6. The current gross gambling yield (GGY) of the gambling industry is broadly the same as it was when fees were last revised in 2017, at £10.8bn. [footnote 3] But the way people gamble and the products they choose has changed, and the industry has adapted to this. For example, over the same time period, remote gambling [footnote 4] grew from 44% to 53% of the total, and by 2019, half of remote gamblers had used their mobile phones for gambling. The costs of regulating a remote market which has grown swiftly and become more complex have increased.

2.7. The following chapters set out the Gambling Commission’s view of its regulatory costs, its projections for fee income in the coming year and the changes needed to recover its costs, maintain its reserves and continue to tackle key emerging challenges.

Gambling Commission regulatory costs

Summary

-

The Commission’s regulatory activity with regard to commercial gambling is broadly categorised according to its key statutory functions under the Gambling Act 2005. It licenses, regulates and advises.

-

Given the significant harms gambling can cause, the need to maintain public confidence in regulation, and the ambitious outcomes the Commission wants to deliver, there is no scope for a reduction of the existing level of regulatory activity over the coming years. Although inflation has been low in recent years, it puts an upward pressure on the cost of maintaining this level of activity each year.

-

The Commission is also facing some key challenges around increased technological development, changes to the size and shape of the market and increasing risks associated with unlicensed operators.

-

These challenges will require it to undertake additional (or different) activity and spend more resources in order to ensure the licensing objectives are upheld, and consumers are protected. A detailed outline of the challenges and the action taken in response is at Annex One.

-

These cost increases will be offset to some degree by efficiency savings. However, these will not be sufficient on their own and therefore the Commission is proposing increases to fees.

The Commission’s current regulatory activity

3.1. The Commission’s activity can, broadly speaking, be categorised under one of the three core statutory functions in the Gambling Act 2005. The Commission:

| Licences… | The Commission provides licences to operators and individuals, varies those licences when appropriate, and undertakes the associated work with maintaining licences through their lifecycle. |

| Regulates… | The Commission develops and maintains the regulatory framework. It checks compliance against this framework and takes action where operators and individuals are failing to follow the rules and regulations. |

| Advises… | The Commission has a statutory duty to advise both central and local government on the impact of gambling and its regulation. |

The cost of delivering current levels of regulatory activity

3.2. For the financial year 2020-21, the Commission’s estimate of its total operating cost is £21.4m. The table below shows how it has allocated costs to particular activities, split according to the core functions described above. The figure which follows the table provides more detail on what types of work are included in each of the activity categories.

Table 1: Cost allocation across activity types

| License | Regulate | Regulate | Regulate | Advise | Total | |

|---|---|---|---|---|---|---|

| FY | Licensing | Policy | Operational | Partnership working | Gathering Information | (£000s) |

| 2020/2021 | 2.353 | 5133 | 9,197 | 2,567 | 2,139 | 21,389 |

| 11% | 24% | 43% | 12% | 10% | 100% |

Figure 1: explanatory notes for table 1

License

- Licensing: annual account reviews, general account management. Processing applications and variations, and changes of corporate control. Processing personal licence applications.

Regulate

-

Policy: horizon-scanning, responding to innovation, developing the regulatory framework, consumer policy, betting integrity, anti-money laundering, consumer research.

-

Operational: proactive and reactive compliance, enforcement against unlicensed and licensed operators, intelligence and risk assessment work.

-

Partnership working: shared regulation including with local authorities, international and other regulators, raising standards by working with industry, leading on its National Strategy to Reduce Gambling Harms.

Advise

- Gathering information and advising: gathering and publishing gambling statistics, and participation and prevalence data, managing advisory panels, producing advice for Government.

3.3. There are several reasons why the Commission thinks its costs will increase beyond inflationary rises. These reasons are set out in the sections that follow.

Key challenges

3.4. The Commission is facing some key challenges which will require it to undertake additional (or different) activity and spend more resources in order to ensure the licensing objectives are upheld, and consumers are protected. The key challenges are:

-

Increased technological developments including product and payment innovation.

-

Changes to the size and shape of the market, particularly consolidation by mergers and acquisitions, and globalisation.

-

Increasing risks associated with unlicensed operators to protect consumers and the industry from ‘black market’ encroachment.

3.5. Further detail of these key challenges is included in Annex One.

Summary of the Commission’s proposed response

3.6. This section summarises the main elements of the Commission’s proposed responses to the key challenges outlined above and in Annex One.

Key elements of the proposed response to Challenge 1:

-

More specialist technical staff, including a Chief Product Officer (CPO), to understand and translate the impact of technological changes, and staff with technical and investigative expertise.

-

Investing in tools to improve its approach to compliance.

-

Developing its approach to making better use of the wealth of data available.

Key elements of the proposed response to Challenge 2:

-

More staff whose focus is on driving the international regulatory agenda, and working with international regulatory partners and agencies.

-

More specialist staff to interrogate and understand complex corporate structures.

-

Increased legal capacity to defend positions.

Key elements of the proposed response to Challenge 3:

-

More staff to proactively and systematically identify the scale of illegal gambling.

-

More resources to robustly tackle illegal gambling, including increased legal capacity for prosecutions.

Key challenges – cost breakdown of the Commission’s proposed response

3.7. The proposed responses to these key challenges are not fixed and will need to evolve over time. The estimated additional investment that is required is based on current knowledge and represents the costs the Commission thinks it will incur in the short to medium term.

3.8. The need to evolve the Commission’s response is particularly the case for Key Challenge 1, Increased technological developments. The breakdown below sets out the current best estimates of the costs the Commission estimates it will incur in the short to medium term, to step up activity in response to the key challenges it faces. This includes employing more specialist staff. Once this additional specialist resource is in place, it will be part of their role to help develop and shape the Commission’s strategic ambitions and future plans for addressing the key challenges.

3.9. Costs may continue to increase in the future and over the longer term, in particular because the Commission considers the challenges identified here are likely to increase in size and complexity. Actual spending will be subject to ongoing business planning decisions in due course.

Table 2: Estimated breakdown of investment required to respond to the three challenges

| Key Challenge | Cost by financial year (£m) | ||

|---|---|---|---|

| 2021/22 | 2022/23 | 2023/24 | |

| 1. Increased technological developments including product and payment innovation | 0.2 | 1.1 | 1.2 |

| 2. Changes to the size and shape of the market. Particularly consolidation by mergers and acquisitions, and globalisation | 0.1 | 1.0 | 1.0 |

| 3. Increasing risks associated with unlicensed operators. Protecting consumers and the industry from ‘black market’ encroachment | 0.1 | 0.3 | 0.3 |

| TOTAL | 0.4 | 2.4 | 2.5 |

Efficiency savings

3.10. The increases in the Commission’s costs outlined above need to be offset against savings it can make in delivering its regulatory functions. The Commission has continued to set itself challenging efficiency targets in order to ensure it is delivering effective regulation and protecting consumers in the most cost-effective way possible. In the financial year 2020/21, the Commission has delivered activity which it estimates will make between £1.7m and £2m efficiency savings (with the full impact of those savings to be realised in 2021/22), representing nearly 10% of its total operating cost. This will be achieved primarily by implementing a programme of restructuring, reshaping the organisation to ensure it has the right balance of skills and can focus on the areas posing the greatest risk.

3.11. In addition to these significant savings, the Commission has identified a number of opportunities to make further efficiencies starting in 2021-22. Work to progress the proposed efficiency savings is below:

-

Reduce travel and subsistence costs by engaging with stakeholders in more creative ways, such as video conferencing, rather than relying on face-to-face meetings.

-

Explore the potential to save on accommodation costs by sharing office space with another organisation. However, the potential for this to generate significant savings may be limited due to an anticipated lower demand for office space in a post-covid world and they would not be realised until 2022-23 at the earliest.

-

Identify more opportunities to modernise processes and digital services to include greater automation and allow for even more self-service.

3.12. There is the potential for more ambitious savings in the longer-term, but these will require detailed exploration and discussion with key stakeholders.

3.13. Despite these delivered and prospective efficiency savings there is still a need for additional income to allow the Commission to regulate effectively, robustly meet the challenges it is facing, and deliver ambitious targets. The Commission forecasts that its costs will continue to increase, rising to a figure of approximately £23m by the year 2023-24.

3.14. The table below shows the Commission’s current best estimates for the costs of different activities in future years.

Table 3: Cost allocation across activity types – future years

| Core function | Activity | Financial year | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2020/21 | 2021/22 | 2022/23 | 2023/24 | |||||||

| £m | % | £m | % | £m | % | £m | % | |||

| License | Licensing: annual fees | 0.67 | 3% | 0.56 | 3% | 0.57 | 3% | 0.58 | 3% | |

| Licensing: applications, variation & Change of Corporate Control | 1.51 | 7% | 1.47 | 7% | 1.50 | 7% | 1.50 | 7% | ||

| Licensing: Personal Licence | 0.12 | 1% | 0.12 | 1% | 0.12 | 1% | 0.12 | 1% | ||

| Regulate | Policy | 5.18 | 24% | 4.66 | 23% | 4.76 | 21% | 4.90 | 21% | |

| Operational | 9.28 | 43% | 9.07 | 44% | 9.08 | 41% | 9.36 | 41% | ||

| Partnership working | 2.59 | 12% | 2.90 | 14% | 2.96 | 13% | 3.06 | 13% | ||

| Using operator data | - | 0% | - | 0% | 1.69 | 8% | 1.76 | 8% | ||

| Advise | Gathering information and advising | 2.04 | 10% | 1.70 | 8% | 1.74 | 8% | 1.79 | 8% | |

| Total (£m) | 21.39 | 20.48 | 22.42 | 23.07 |

Gambling Commission income

4.1. The Commission forecasts that without increases in fees it will see a decline in income in 2021-22. It has seen a decline in the number of premises-based (non-remote) gambling operators and the rate of growth of online is now slowing. It has also seen merger and acquisition activity in the industry which has reduced income. The cost of pension contributions has also increased.

4.2. The decline in income has been exacerbated by the impact of Covid-19 which has had a significant impact on the gambling industry – notably on the non-remote sector. Most operator fees are based on the gross gambling yield (GGY) which they are expected to generate during the year. The Commission’s budgeted income for 2020-21 (excluding National Lottery regulation) was £20.4m and latest figures suggest that actual income will be around £700k less than that, due to the impact of Covid-19 on industry GGY (primarily the non-remote sector).

4.3. Although a recovery in non-remote GGY is expected as restrictions are eased, the Commission does not know how quickly this will happen, or to what extent. During this period it does not expect the costs of regulation to reduce significantly, because some of its regulatory costs are not directly proportionate to GGY and during years when levels of activity may fluctuate it is difficult to make significant reductions in its fixed costs within short periods of time. The Commission calculates that every £1bn of reduced industry GGY would lead to a reduction of around £1.5m in its fee income, approximately 7% of its current yearly income.

4.4. Alongside its fee income, the Commission has been drawing on its reserves in recent years, as planned in the last review of fees, but the extent to which they have been drawn on has been higher than anticipated at that time. The reserves will not be sufficient to make this a continuing option for future years, meaning its fee income will have to be increased.

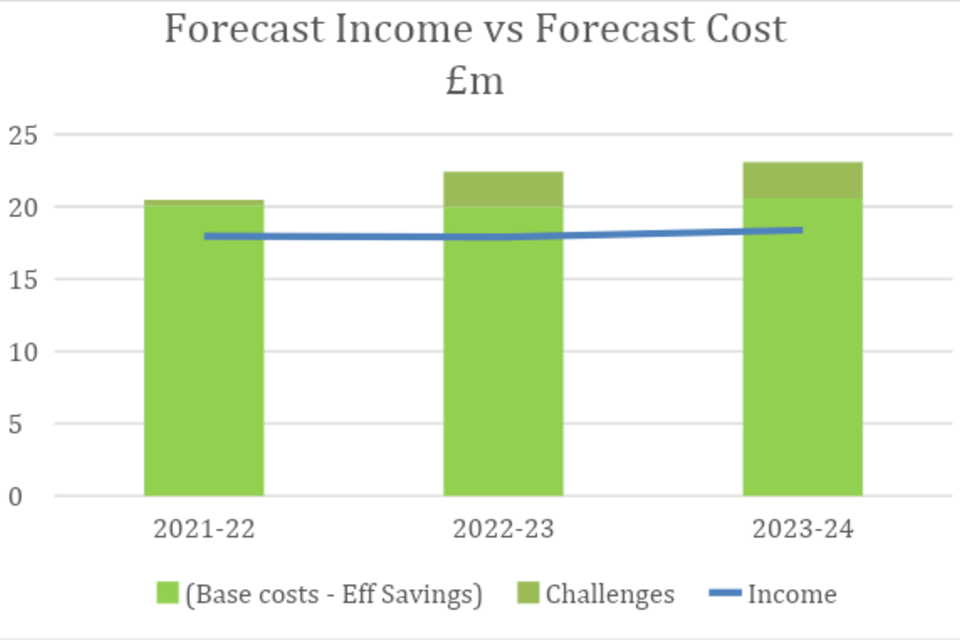

4.5. Without changes to fees the Commission expects to see a difference between its income and expenditure of around £3m per year by 2023-24. This is without any additional investment in new work to deal with the challenges set out above which it estimates will cost between £2m and £3m per annum. The Commission has also assumed additional efficiency savings of between £1m and £1.25m per annum from 2022/23. Taking this all into account the Commission’s forecast costs would be around £4.7m higher than its forecast income by 2023-24, if the current fees system were to remain unchanged. (see Figure 3 and Table 4).

Figure 3: Forecast income pre changes to fees vs forecast costs

Table 4: Difference between forecast income (under the current system) and forecast costs

| Forecast income and forecast costs (£m) | Financial year | ||

|---|---|---|---|

| 2021-22 | 2022-23 | 2023-24 | |

| Maintaining current levels of activity | 20.5 | 21.0 | 21.8 |

| Meeting key challenges | 0.4 | 2.4 | 2.5 |

| Efficiency savings | -0.4 | -1.1 | -1.2 |

| Total estimated costs | 20.5 | 22.4 | 23.1 |

| Post-Covid income forecast (pre changes to fees) | 17.1 | 17.9 | 18.4 |

| Funding Gap* | -3.4 | -4.6 | -4.7 |

*Figures in the table may not sum due to rounding

4.6. The proposals set out here are based on forecasts for the next couple of years. It is more difficult to predict income further ahead as the full extent of the impact of Covid-19 is not yet known. There may be changes to the wider gambling landscape affecting the Commission’s cost base and its income, including for example stemming from the Review of the Gambling Act. A comparison of the Commission’s current income forecast with its income following the fees uplift is included in Table 5 below.

Table 5: Difference between forecast income (under the current system) and with the proposed fees uplift

| 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|

| Income forecast without fees uplift | 17.1 | 17.9 | 18.4 |

| Income forecast with fees uplift | 20.0 | 24.5 | 26.1 |

Gambling Commission proposals for changes to annual fees

Headline proposals

-

Increases to annual fees for all remote operating licences would come into effect from October 2021.

-

The removal of the current 5% annual fee discounts for combined operating licences, and for those that hold both non-remote and remote operating licences, would take effect in October 2021.

-

Increases to annual fees for all non-remote operating licences would come into effect from April 2022.

The proposed changes to fees are summarised below. The Commission estimates that if these proposals are implemented, the total annual fees payable by the gambling industry will be 0.22% of industry GGY (excluding the National Lottery).

-

Each fee band for non-remote operating licences (other than ‘non-remote’’ gambling software) would increase by 15%. [footnote 5]

-

The fee increases experienced by some non-remote licensees would be slightly higher than 15% where the licensee holds a combined non-remote licence. This is due to the proposed removal of annual fee discounts for combined licences.

-

Each fee band for remote operating licences (other than remote lottery and remote gaming machine technical licences) and for non-remote gambling software licences would increase by 55% under the proposals.

-

Around a dozen remote licensees would receive annual fee increases between 62% and 72% where their licences combine remote casino, bingo and virtual betting. This is due to proposed increases in both the principal annual fee amount (based on the total GGY generated across the casino, bingo and virtual betting activities) and the flat additional annual fee payable for licences that combine these three types of licence.

-

The annual fees for most society lottery and ELM licences (non-remote and remote) would increase by 15%. Those lottery operators that hold both non-remote and remote licences would receive fee increases of around 21%, due to the proposed removal of discounts for holding two licences. The annual fee increases for the very largest ELMs would be between 37% and 58%.

The Commission estimates that if these proposals are implemented, the total annual fees payable by the gambling industry, as a percentage of industry GGY (excluding the National Lottery), will increase from 0.16% to 0.22% of GGY.

The headline proposals by licence type are:

-

The annual fees for remote casino, bingo and betting licences (virtual event betting, real event betting, pool betting, betting intermediary, trading room, and licences that allow betting by telephone or email only) and for all gambling software licences would increase by 55%.

- There is an increase to the ‘flat’ additional annual fee payable for combined remote operating licences which include (any two or three of) remote casino, bingo and/or virtual event betting. Where the combined licence includes any two of those licence types, the flat additional annual fee payable will increase from £2,500 to £5,000. Where the combined licence includes all three of those types, the additional flat annual fee would increase from £5,000 to £10,000.

- The annual fees for ‘host’ licences (for those businesses that provide gambling facilities through another’s business-to-customer operation) and non-remote and remote gambling software licences would increase by 55%. The ‘flat’ additional annual fees for licences that combine two or three ‘host’ licence types would also double, from £1,875 to £3,750 for licences that combine two host licence types and from £3,750 to £7,500 for those that combine all three.

- The annual fees for non-remote and remote society lottery and external lottery manager (ELM) licences would increase by at least 15%. The level of fee increase would however be much higher for any society lottery that has taken advantage of the new limits brought in this year and now generates greater than £10m proceeds per annum, as these would therefore be allocated to one of the new proposed higher fee categories. The level of fee increase would also be much higher than 15% for the small number of ELMs that manage greater than £10m proceeds per annum and which would therefore be allocated into the new proposed fee categories at the top end of the ELM fees structure.

- The annual fees for all gaming machine technical licences would increase by 15%.

- The annual fees for all other non-remote licences would increase by 15%.

- The removal of the 5% discounts in annual fees for those who hold combined operating licences (subject to the changes described above for specific combinations of remote casino, bingo and virtual event betting, and for combinations of host licences), and also the removal of the 5% discounts for those who hold both a non-remote and remote licence.

5.1. Set out below are proposals for how the Commission’s forecast costs would be allocated to different gambling sectors, licence types and fee categories.

Background

5.2. The current fees structure dates from April 2017. Non-remote operators, whose fees had previously been based on the number of premises they had, instead paid fees on an annual GGY basis from that date. A number of additional fee categories to many licence types were also brought in in 2017, aimed at providing greater fairness in the structure by ensuring that cost recovery was spread more proportionately among differently sized operators. For the purpose of this proposal, the Commission proposes to retain the broad structure of licence types and fee categories introduced in 2017.

The approach to allocating costs and setting fee levels

5.3. The Commission must allocate its costs to the different gambling sectors, individual licence types and fee categories, to ensure that fees are charged to operators in a way that is cost reflective and fair. It also should ensure that the Commission can recover its full costs through fees and maintain its reserves at an appropriate level.

Annual Fees

5.4. The Commission is proposing the largest increases in annual fees for:

-

Remote business-to-customer operators. This includes remote casino, bingo and all remote betting operators (including those licensed for real event betting, virtual event betting, pool betting, intermediaries and trading rooms, and those providing betting by telephone or email).

-

Gambling software. Those business-to-business operators who manufacture and supply software for use by remote business-to-customer operators.

-

Host licensees. Those who make their games available to consumers through other remote operators’ platforms.

5.5. It is predominantly these types of licensee that are driving the increased regulatory burden. They are also the licensees that would benefit most from increasing efforts to reduce consumer access to illegal online operators. In particular, the remote sector is driving the bulk of the Commission’s costs in respect of the need to:

-

respond to innovation in product and payment development that challenges the regulatory framework, and the corresponding need for the regulator to develop its horizon scanning capability, invest in technical expertise and make better use of data.

-

invest in compliance tools such as improved hardware to better interrogate app-based products and innovative software tools to assess compliance by remote operators.

-

develop partnerships with international regulators and other organisations to allow the Commission to deal more robustly with the challenges posed by international digital platforms and providers. interrogate, analyse and understand complex business structures and financial arrangements, which are often international in nature.

-

focus increasing efforts on unlicensed entities that provide remote gambling, the costs of which should be recovered primarily from the remote sector given that such unlicensed activity threatens the integrity of that sector first and foremost.

5.6. However, the proposals for annual fee increases are not limited to the remote operators described above. The Commission does not envisage any reduction in its current levels of regulatory activity, and it will, at least, need to maintain those levels in coming years. Inflationary rises in the Commission’s overheads mean that some fee increases are necessary for all operators so that its costs can be recovered in full.

5.7. There are also elements of the regulatory challenges which are being partly driven by the non-remote sector, for example product and payment innovation. Other elements, such as the need for the Commission to be resourced to respond to the industry’s increased willingness to challenge its decisions, should be borne in part by the non-remote sector from which such challenges also emanate.

Increasing fees for Random Number Generator (RNG) and host licences

5.8. A composite fee arrangement was introduced in 2009 for remote licences that combine any two or three of the virtual event betting, bingo and/or casino licences. A licensee pays a principal amount based on the total GGY generated from those activities, and also pays a flat additional annual fee for the second and/or third licence activities on that combined licence.

5.9. These additional flat fees recognise that there is a residual level of complexity in regulating different types of RNG-based products. However, given the increasingly innovative nature of gaming and virtual betting product development, and the challenges posed by these products to the regulatory framework (for example, the need to consider whether any given product would meet the legal definitions of either ‘gaming’ or ‘betting’, or indeed whether a product would be caught as ‘gambling’ at all), the levels of these flat fees are currently too low to reflect the Commission’s regulatory effort. It is therefore proposing to double these flat fees.

5.10. A similar arrangement applies to combined licences that combine any two or three of the remote casino (game host), bingo (game host) and/or virtual event betting (host) licences. It is therefore also proposing to double the flat fees associated with these licences.

Removing discounts for licensees who hold other combined licences or dual licences

5.11. In addition to increasing annual fees and the flat fees for combined RNG licences and combined host licences, the Commission is also proposing to remove some of the discounts that are currently offered.

Annual fees discounts

5.12. Currently, licensees who have any other type of combined licence (i.e. either a non-remote or a remote licence that includes two or more different types of licence activity) [footnote 6] receive a 5% annual fee discount on all of those licensed activities except for the activity that attracts the highest individual annual fee. For example, for a non-remote licence that combines casino, bingo and betting licence activities, the casino element of that licence (which attracts the highest annual fee of the three) would receive no discount on the annual fee payable for a non-remote casino licence of that fee category; but the bingo and betting licence activities (attracting lower annual fees than the casino element) would be subject to 5% discounts on the usual annual fees payable for those types of licence. These discounts were originally intended to reflect assumed efficiencies from regulating combined licensees.

5.13. In addition to (and separate from) any discounts applied to a non-remote or a remote combined licence, a further 5% discount is applied to both operating licences in circumstances where a licensee holds both a non-remote and remote licence (discount for dual licences) – again reflecting assumed efficiencies.

5.14. The Commission is proposing to remove these 5% discounts for both combined and dual licences. It has considered the effort involved in regulating licensees with combined and dual licences. The regulatory costs incurred by such licensed entities are no less than the costs of regulating separate entities or activities. These discounts mean that the Commission is not fully recovering its regulatory costs from those licensees that operate such significantly different types of business (that is, there are no real efficiencies between, for example, the betting, arcade and gaming machine technical elements of a licensee’s business, as each of the three elements are disparate in terms of the nature of those activities undertaken in reliance on such a combined licence).

5.15. Further, the Commission has estimated that the costs it incurs in administering and maintaining this system of discounts (for example, the effort involved by both Licensing and Finance staff in manually adjusting discounts and fees payable when a licensee surrenders one of its licences or removes a licence activity from a combined licence) can create inefficiencies, despite licensed entities paying lower overall fees as a result of the discount regime. Removing such discounts would allow the Commission to build in more automation and self-service elements for licensees to calculate otherwise complicated annual fees, allowing future efficiencies to be obtained.

5.16. The proposals mean that licensees would instead pay 100% of the annual fee payable for each of the activities for which they are licensed, thereby ensuring that the Commission recovers its regulatory costs appropriately from those who hold combined licences and/or are licensed for both non-remote and remote activities.

First annual fees discounts

5.17. First annual fees are subject to a 25% discount on the full annual fee amount that would otherwise be payable (‘first annual fees’ are the annual fee amount payable by new licensees, in contrast to the usual annual fees payable in the second and subsequent years after being licensed). On top of that 25% discount, there is currently an additional 5% discount on first annual fees where the licensee has been granted a combined operating licence.

5.18. The Commission proposes to remove the 5% discount described above in respect of first annual fees, where licensees have been granted a combined licence. However, the initial 25% discount for all first annual fees, including for combined licences, would remain in place. It is consistent with the Commission’s regulatory costs to retain that 25% discount as there is a reduced level of regulatory work that needs to be undertaken in respect of a licensee’s first year of operation.

5.19. When it receives an application for a licence, the Commission has a statutory duty to consider the applicant’s suitability to provide gambling activities. In some cases, the Commission identifies issues at the application stage that are not significant enough to warrant a refusal of the application, but which need to be addressed by the operator within its first year of trading to ensure compliance. This would therefore necessitate some focused compliance effort on the Commission’s part, but there is not normally a need to carry out full-scale compliance activity within the first year of an operator’s trading, as the Commission has already assessed the applicant and identified most concerns.

Society lotteries

5.20. The highest fee categories for society lottery licences currently allow a society to generate any amount of proceeds greater than £500,000 per annum, subject to the statutory maximum limits on aggregate proceeds a licence can generate in a calendar year, [footnote 7] without incurring any higher annual fees.

5.21. Until recently, a single society lottery licence could generate aggregate proceeds up to a £10m per calendar year statutory limit. That has increased to £50m, following changes made by the Government earlier in the year, which were informed by evidence-based advice from the Commission. The increased limit enables some larger society lotteries trading under a common brand to rationalise and hold fewer licences, leading to a potential reduction in income for the Commission. The amount of regulation required, however, is unchanged and could possibly increase.

5.22. The Commission therefore proposes that a number of additional fee categories are added, to both the non-remote and remote society lottery licences, with higher fees for society lottery licences that generate aggregate society lottery proceeds in excess of £10m per annum. The proposed additional fee categories will still enable larger society lotteries trading under a common brand to rationalise their operating licences and reduce their administrative costs, as the Government changes envisaged, but will also enable the Commission to continue to recover its regulatory costs.

External lottery managers (ELMs)

5.23. The Commission has also reviewed both the regulatory costs it incurs from ELMs and the existing fees structure for that type of operator. The highest fee categories for ELMs currently allow such operators to manage any amount of lottery proceeds greater than £10m per annum, although a number of ELMs currently manage lotteries that collectively generate far more than this amount.

5.24. The Commission needs to ensure that it recovers its regulatory costs fully and proportionately from ELMs, in particular from the small number of ELMs who, between them, manage around 80% of the proceeds generated by all licensed society lotteries. The increase to the statutory proceeds limit for society lotteries means the scale of the proceeds being managed by ELMs could increase, risking a reduction in the income received by the Commission. Therefore an increase in fees is proposed to ensure the Commission can continue to carry out its regulatory responsibilities effectively, alongside additional fee categories for the largest operators.

5.25. In addition to proposing additional fees and fee categories for larger society lottery licences, the proposals also include the addition of fee categories at the top end for both the non-remote and remote ELM licences, with higher fees for ELMs that manage greater than £10m proceeds per annum.

5.26. Detailed proposals for annual fees by licence type are set out in Annex Two.

Gambling Commission proposals for changes to application fees

Headline proposals Fees for all operating licence applications would increase by 60% from October 2021. This includes applications:

-

for a new operating licence of any type or fee category

-

to continue an operating licence after a change of corporate control

-

to vary an existing operating licence (i.e., adding or removing a licence activity; changing the fee category, head office address or a trading name; adding or removing a key person to/from the schedules to an operating licence; or otherwise adding, removing or amending a licence condition).

6.1. As set out previously, fees should be cost reflective of the regulatory burden the licensed activity poses. The Commission charges application fees to process applications for new entrants to the market, or when existing licensees want to make changes to the way they are structured, or the activities they offer (an application to vary a licence). Some of the challenges facing the Commission have an impact on the costs of processing applications, particularly the shift towards more complex and global organisations.

6.2. Forecasting the type and number of applications that are likely to be received is very challenging for the Commission as it learns more about the impact of Covid-19 on an already unpredictable gambling industry. The Commission is continually taking account of data from the industry which it receives regularly. The proposals presented here are the result of the Commission using its best estimates from data received to date to inform its forecasts.

6.3. The costs to assess applications have increased over the years as a result of a number of changes to the Commission’s regulatory approach. This includes factors such as additional checks being required because of changes to the regulatory rulebook, but also due to the increased complexity of applications. The Commission is having to deal with more complex applications and changes of corporate control, which are costing more to process, and it expects this will increase in the future.

6.4. Overall, application income has remained reasonably stable since the last changes to fees, resulting in a gradual increase in the difference between application income received and application processing costs. As a result, the Commission is not fully recovering its application processing costs. This has been further affected by the impact of Covid-19 driving further consolidation in the industry and reducing the number of new entrants into the gambling market. Without an increase to fees the Commission expects to receive £0.9m from application fee income in 2021/22, and expects its costs to be around £1.5m.

6.5. In order for the Commission to recover its application processing costs across all operator application types, it proposes to increase all application fees by 60% from October 2021. For a small non-remote business applying for a new operating licence (eg an adult gaming centre, bingo or general betting (standard) applicant with a projected annual GGY of £250,000), the 60% increase would mean that the new proposed application fee would represent 0.6% of that applicant’s projected GGY. For a small remote casino operator with a projected GGY of £250,000, the proposed application fee would represent 1.7% of its projected GGY.

6.6. Increases in application fees would apply to all new operator applications and those seeking to change or vary the licence. The increase would apply equally across the non-remote and remote sectors. New application fees would also be introduced for the additional fee categories proposed for society lottery and ELM licences.

6.7. Discounts for new licence applications and variation applications that involve multiple licence activities and products would remain unchanged. Detailed proposals for application fees by licence type are set out in Annex Three.

6.8. Personal licence application fees remain unchanged under the proposals, as increasing regulatory cost has been balanced by efficiency savings due to improved technology.

Consultation questions

7.1. You are invited to comment freely on any aspect of this consultation document. However, you may find it useful to refer to the checklist of questions below, which cover the main points on which the department would particularly welcome views. Where possible, please:

-

be specific in your responses

-

explain the reasons behind your agreement or disagreement with a proposal

-

suggest what alternative you would prefer in place of any proposals you may disagree with.

Consultation question 1: Do you agree that annual fees should be increased in line with the proposals set out here, in order to enable the Commission to meet the challenges it has identified?

Consultation question 2: Do you agree with the proposals to increase the additional flat fees for licences that combine remote casino, bingo and/or virtual event betting (RNG licences), and the flat fees for those that combine host licences?

Consultation question 3: Do you agree with the proposals to remove the 5% annual fee (and first annual fee) discounts for other types of combined licence, and the 5% annual fee discount where both non-remote and remote licences are held?

Consultation question 4: Do you agree with the proposals to introduce additional fee categories for society lotteries and ELMs that generate (or manage) greater than £10m proceeds per annum?

Consultation question 5: Do you agree with the proposal to increase application fees to better reflect the costs involved in processing applications?

7.2. Please send your responses to gcfeesreview2021@dcms.gov.uk, copied to feesreview@gamblingcommission.gov.uk by 26/03/2021

Privacy Notice

The Data Controllers are listed here:

- The Department for Digital, Culture, Media & Sport (“DCMS”). The Data protection Officer can be contacted at dcmsdataprotection@dcms.gov.uk

- The Gambling Commission. The data protection officer can be contacted at DPO@gamblingcommission.gov.uk

You can find out more here: Personal Information Charter

And here: Privacy and cookies: gamblingcommission.gov.uk

Why are we collecting your data?

Your personal data is being collected as an essential part of the consultation process, so that we can contact you regarding your response and for statistical purposes such as to ensure individuals and organisations cannot respond more than once.

Our legal basis for processing your personal data

The Data Protection Legislation states that, as government departments, the departments may process personal data as necessary for the effective performance of a task carried out in the public interest (i.e. a consultation).

We will not:

- sell or rent your data to third parties

- share your data with third parties for marketing purposes

- use your data analytics

We will share your data if we are required to do so by law - for example, by court order, or to prevent fraud or other crime.

With whom we will be sharing your personal data

Copies of response may be published after the consultation closes. If we do so, unless you indicate otherwise, we will ensure that neither you nor the organisation you represent are identifiable, and any responses used to illustrate findings will be anonymised.

Consultation privacy statement

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals, amongst other things, with obligations of confidence. In view of this, it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information, we will take full account of your explanation, but we cannot give assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimed generated by your IT system will not, of itself, be regarded as binding on the Departments.

For how long we will keep your personal data, or criteria used to determine the retention period

Your personal data will be held for two years after the consultation is closed. This is so that the department is able to contact you regarding the result of the consultation following analysis of the responses.

Your rights, e.g. access, rectification, erasure

The data we are collecting is your personal data, and you have considerable say over what happens to it. You have the right:

- to see what data we have about you

- to ask us to stop using your data, but keep it on record

- to have all or some of your data deleted or corrected

- to lodge a complaint with the independent Information Commissioner (ICO) if you think we are not handling your data faily or in accordance with the law

You can contact the ICO at https://ico.org.uk, or phone 0303 123 1113. ICO, Wycliffe House, Water Lane, Wilmslow, Cheshire SK9 5AF.

Your personal data will not be sent outside the EEA.

Your personal data will not be used for any automated decision making

Your personal data will be stored in a secure government IT system. We are committed to doing all that we can to keep your data secure. We have set up systems and processes to prevent unauthorised access or disclosure of your data.

We also make sure that any third parties that we deal with keep all personal data they process on our behalf secure.

Changes to this policy

We may change this privacy policy. Any changes to this privacy policy will apply to you and your data immediately. If these changes affect how your personal data is processed, the controllers will take reasonable steps to let you know.

Annex One: Gambling Commission’s assessment of key challenges

1. Insights from the Commission’s horizon-scanning activity and input from its Digital Advisory Panel and the Advisory Board for Safer Gambling show that it is facing some key challenges which mean the Commission needs to do even more to uphold the Licensing Objectives and protect consumers.

2. The Commission also recognises that it will need further investment to strengthen regulation in line with the recommendations of the National Audit Office, Public Accounts Committee and House of Lords reports on gambling regulation [footnote 8] , and to ensure the Commission continues to be an effective gambling regulator.

3. The challenges the Commission has identified are most pronounced in the online and digital gambling market but are by no means unique to them. The challenges are:

- Increased technological developments including product and payment innovation.

- Changes in the size and shape of the market partially caused by consolidation, meaning operators it regulates are increasingly global operators.

- Increasing risks associated with unlicensed operators and the need to protect consumers and the industry from ‘black market’ encroachment.

4. For each of the key challenges this section outlines:

| What the challenge is: | a description of the key external developments that are driving possible risks to the Licensing Objectives |

| The response: | the key things that the Commission needs to do to address the challenge and ensure the Licensing Objectives are upheld |

5. For clarity, these challenges and proposed solutions are presented as distinct and discrete issues. However, they are often complex and interrelated, and the proposed responses will address several overlapping challenges.

6. The proposals that are set out below for addressing these challenges are based on what is known today. In certain areas these responses will have to evolve over time, so the proposals outlined here are relatively near-term. As the Commission’s thinking and expertise develops in these areas it will develop its response further. However, it is clear the Commission needs additional investment now to ensure that it has the right skills and expertise to develop and implement the solutions.

7. Under the Gambling Act 2005, fees must be set by the Secretary of State by statutory instrument. As part of the Review of the Gambling Act, Government is considering whether there is a case for enabling a more flexible approach to setting fees. In addition, if there are any changes to the Gambling Commission’s powers and responsibilities in future, the implications for fees will also be considered.

Key challenge 1: Increased technological developments

The gambling industry is innovative and responsive to changes in consumer demand. The current GGY of the industry is broadly the same as it was when fees were last revised in 2017, at £10.8bn (including society lotteries) [footnote 9] [footnote 10] but the way people gamble and the products they choose has changed over that period. For example, over that period remote gambling grew from 44% to 53% of the total, and in 2019, half of remote gamblers used their mobile phones for gambling. [footnote 11]

An increasingly digital industry has accelerated innovation and development. This has resulted in gambling products that are increasingly: instantaneous, immersive, accessible, ubiquitous, integrated with other entertainment offerings, peer-to-peer in nature, and more personalised to individuals (both the products themselves and any calls to action to participate in them).

The Commission is also continuing to see products which blur the boundaries between gambling and other activities, challenge the interpretation of the statutory definition of gambling, utilise novel delivery mechanisms or ways of accessing the products, and/or incorporate non-traditional payment methods.

8. To respond to this challenge the Commission needs to be able to develop its capacity and capability in a number of areas. The additional expertise required is scarce and expensive, as it requires individuals with technological expertise, commercial knowledge, and an understanding of regulating digital markets. The areas are set out below:

Improve its understanding of the technological developments

9. The Commission plans to develop its horizon-scanning capability so it can better anticipate, monitor and prepare for emerging developments, and how they are (or could be) deployed by the industry. It also plans to invest in more experts who can understand the technical detail, engage with the industry, and translate learnings back into the Commission and into government advice. The Commission also plans to further develop its capacity to analyse these inputs and extract key implications for the Licensing Objectives, and how technological developments can be exploited to improve outcomes for consumers.

Better exploit data

10. In an increasingly technology-led and data-driven industry, the Commission wants to develop its approach to exploiting data. There is a wealth of data held by operators. This data can help to better understand player behaviour, and enhance the Commission’s ability to identify possible risks to the Licensing Objectives. In the longer-term, it will need more investment in the technology, skills and expertise required to obtain, store, manipulate and analyse data. There are various potential models for how this could work in practice. The proposals set out here include investment to allow the Commission to explore what is possible, define the outcomes it wants to achieve in this space, and scope potential solutions for getting there. It will also allow it to continue working with the industry to develop a ‘single-customer view’.

11. Understanding player behaviour and consumers’ response to technological developments is not necessarily restricted to interrogating data from operators. The Commission will require further investment to improve its collection of participation and prevalence data and other research activity. This will allow the Commission to get quicker access to more robust data on what gambling activities people are participating in, how they engage with these products, and the negative consequences which arise from their play. It will also mean that the Commission will be able to more quickly understand the impact of its interventions.

Improve its regulatory response

12. The Commission needs to use the full range of its powers to ensure any risks to the Licensing Objectives are mitigated, and any negative consequences are prevented or minimised. However, in a dynamic, evolving industry it is likely that alongside traditional regulatory responses, new and creative responses are needed which involve engaging with industry, often at the highest levels. In addition to rebalancing staff, for example as a result of its recent restructure, these proposals will help the Commission ensure it has the right skill set for this work.

13. The Commission will need to invest in compliance tools such as improved hardware to better interrogate app-based products and deploy innovative software tools (for example web-scraping, bots and avatars) to assess operator compliance more effectively and efficiently. Alongside this investment in technology solutions, it will require greater levels of resource with technical and investigative expertise to ensure it can investigate and act when breaches or unlicensed operators are found.

Key challenge 2: changes to the size and shape of the market.

The British gambling market structure is becoming increasingly global and complex, with more licensed operators having complicated organisational/ownership structures, and/or providing services in a number of international markets. An increasingly globalised sector means the key risks the Commission faces (including money-laundering, betting integrity etc) are global in nature, and require global measures in response.

Over the past few years the Commission has also seen significant consolidation in the gambling market, and some high-profile mergers, meaning it is regulating an increasing number of large entities. This is particularly pronounced in the online sector. This increased market consolidation results in large, well-resourced organisations that are more willing and better equipped to robustly challenge the Commission’s positions and regulatory decisions.

14. More than ever before, global problems require global solutions, and while the Commission already works closely with international regulatory partners, there will need to be a step change in activity in this area. The Commission plans to employ more staff whose focus is on driving the international regulatory agenda. This will help it to understand the trends and risks arising from the increasingly global nature of licensed and unlicensed gambling and work with a range of organisations to develop innovative solutions.

15. Greater investment is needed to ensure the Commission has increased skills, expertise and experience in interrogating, analysing and understanding complex business structures and financial arrangements, which are often international in nature. This includes greater internal resources with knowledge of mergers and acquisitions, including more people with forensic accountancy skills. While these skills are primarily relevant to licence applications and variations, they also form an important component of annual fee-funded activity, as they make a significant contribution to the work on compliance and enforcement actions.

16. Lastly, the Commission needs to increase its preparation for, and upskill itself in response to, the industry’s increased willingness to challenge decisions. It needs to be adequately resourced to enhance its ability to robustly defend its position, which potentially requires both internal support and external legal advice. The additional resource would also contribute to strengthening the Commission’s decision making processes.

Key challenge 3: Increasing risks associated with unlicensed operators

The Commission continues to see unlicensed operators provide facilities to British consumers, in contravention of the Gambling Act 2005. To date, the Commission has tackled such infringements as and when it became aware of them. The Commission plans to build its capacity and capability to identify and tackle those operators who are providing illegal gambling services to British consumers more actively and systematically.

The risks posed by unlicensed operators are becoming increasingly acute given technological developments, in particular the:

- ability of individuals or companies to provide gambling facilities via social media.

- continual blurring of lines between gambling and non-gambling products.

- increasing ubiquity of Virtual Private Networks (VPNs) and non-traditional payment methods meaning tech-savvy consumers can bypass location-based restrictions more easily.

17. To date, the Commission has not seen evidence that the provision of unlicensed gambling has caused significant detriment or harm to a large number of British consumers. However, its understanding of the exact scale of this issue needs to be improved.

18. So far, the Commission has focused on responding to individual reports of unlicensed operators as they have emerged, targeting its limited resources on the highest-risk areas and prioritising instances where there is a known British gambler ‘footprint’.

19. The Commission is seeing increasing numbers of illegal websites that originate in jurisdictions with either extremely permissive regulatory regimes or no regulatory oversight, and/or are being run by individuals with suspected links to serious and organised crime. The Commission has also seen a steady increase in the number of issues it has had to consider in this area, peaking at 69 in 2018, and with 50 such reports received as of the end of July 2020. The number of ‘Cease and Desist’ notices issued by the Commission continues to rise year-on-year from 43 in 2017/18, to 69 in 2019/20.

20. The prevalence of illegal lotteries facilitated through social media is also a growing concern, particularly as these groups start to demonstrate greater sophistication. Intelligence suggests that vulnerable individuals may be being targeted to host these groups, and that organised crime groups are seeking to exploit them. In 2019/20, 85 ‘Cease and Desist’ notices for social media lotteries were issued and 2,455 Suspicious Activity Reports (SARs) were submitted on this topic.

21. Given this increasing risk, the Commission believes that addressing this issue requires additional resources and capability. This requires a shift to a more proactive stance. The Commission will conduct a systematic investigation into the scale and scope of the issue, and then take the appropriate steps to respond (and the Commission has already begun work to review the powers available to it in this area).

22. Even if there are not large numbers of unlicensed operators providing gambling facilities to British consumers, responding to the ones identified is likely to prove expensive because:

- The investigative and evidential process is precise, time-consuming and highly-skilled.

- The question of whether some operators are acting illegally is increasingly complex, with companies increasingly operating in grey areas, pushing boundaries, or developing products which challenge the statutory definition of gambling.

- Prosecutions (if they are required) are expensive, and recovery of costs is reliant on a successful prosecution and a court award.

- The difficulty in identifying individuals behind illegal websites, combined with their ability to simply resurface under a slightly different guise (‘phoenixing’) means the Commission must expand and deploy its enforcement toolkit to disrupt illegal operators in other ways. This requires engagement with a range of other organisations, including other regulators, payment providers, social media companies, internet service providers and search engines. Such engagement can be time-consuming and will often be international in nature.

- Technological advances that allow consumers to bypass restrictions are becoming increasingly accessible, which means it needs to devote resources to keep pace and ensure its disruption toolkit remains effective.

23. All of the above requires additional resources, and the specialist and technical nature of such resources can prove expensive.

Annex Two: Detailed proposals for changes to annual fees by licence type

It is proposed that:

-

Increases to annual fees for all remote operating licences would come into effect from October 2021.

-

The removal of the current 5% annual fee discounts for combined operating licences, and for those that hold both non-remote and remote operating licences, would take effect in October 2021.

-

Increases to annual fees for all non-remote operating licences would come into effect from April 2022.

Remote casino, bingo and virtual event betting

1. Each of the fee categories for these licences would be subject to annual fee increases of 55% under the proposals. To enable comparison, the tables below show the proposed annual fees by fee category, underneath the current annual fees payable by fee category (including the GGY parameters of the fee category itself).

| Category | F1 | G1 | G2 | H1 | I1 | J1 | K1 | L1 | M1 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Casino | GGY | Less than £550,000 | £550,000 to £2m | £2m to £5.5m | £5.5m to £25m | £25m to £100m | £100m to £250m | £250m to £550m | £550 to £1bn | £1bn or greater |

| Current Annual Fee | £2,709 | £6,488 | £9,480 | £13,307 | £35,541 | £68,146 | £136,455 | £387,083 | £387,083 plus £125,000 for every £500m of GGY above £1bn GGY | |

| Proposed Annual Fee | £4,199 | £10,056 | £14,694 | £20,626 | £55,089 | £105,626 | £211,505 | £599,979 | £599,979 plus £125,000 for every £500m of GGY above £1bn GGY | |

| Bingo | GGY | Less than £550,000 | £550,000 to £2m | £2m to £5.5m | £5.5m to £25m | £25m to £100m | £100m to £250m | £250m to £550m | £550 to £1bn | £1bn or greater |

| Current Annual Fee | £2,709 | £6,488 | £9,480 | £13,307 | £35,541 | £68,146 | £136,455 | £387,083 | £387,083 plus £125,000 for every £500m of GGY above £1bn GGY | |

| Proposed Annual Fee | £4,199 | £10,056 | £14,694 | £20,626 | £55,089 | £105,626 | £211,505 | £599,979 | £599,979 plus £125,000 for every £500m of GGY above £1bn GGY | |

| General Betting Standard (Virtual Events) | GGY | Less than £550,000 | £550,000 to £2m | £2m to £5.5m | £5.5m to £25m | £25m to £100m | £100m to £250m | £250m to £550m | £550 to £1bn | £1bn or greater |

| Current Annual Fee | £2,709 | £6,488 | £9,480 | £13,307 | £35,541 | £68,146 | £136,455 | £387,083 | £387,083 plus £125,000 for every £500m of GGY above £1bn GGY | |

| Proposed Annual Fee | £4,199 | £10,056 | £14,694 | £20,626 | £55,089 | £105,626 | £211,505 | £599,979 | £599,979 plus £125,000 for every £500m of GGY above £1bn GGY |

2. The proposals would retain the arrangements that are in place for operators that hold a combined licence that specifically combines any two or three of the remote casino, bingo and/or virtual event betting licences.

3. It is proposed that the flat annual fee of £2,500 payable for a licence that combines two of remote casino, bingo and virtual event betting is increased to £5,000. The flat annual fee payable for a licence that combines all three activities would increase from £5,000 to £10,000.

Remote casino (game host), bingo (game host) and virtual event betting (host)

4. Each of the fee categories for these licences would be subject to annual fee increases of 55% under the proposals. To enable comparison, the tables below show the proposed annual fees by fee category, underneath the current annual fees payable by fee category (including the GGY parameters of the fee category itself).

| Category | F1 | G1 | G2 | H1 | I1 | J1 | K1 | L1 | M1 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Game host (casino) | GGY | Less than £550,000 | £550,000 to £2m | £2m to £5.5m | £5.5m to £25m | £25m to £100m | £100m to £250m | £250m to £550m | £550 to £1bn | £1bn or greater | |

| Current Annual Fee | £2,027 | £4,855 | £7,094 | £9,958 | £26,595 | £50,993 | £102,108 | £289,652 | £289,652 plus £100,000 for every £500m of GGY above £1bn GGY | ||

| Proposed Annual Fee | £3,142 | £7,525 | £10,996 | £15,435 | £41,222 | £79,039 | £158,267 | £448,961 | £448,961 plus £100,000 for every £500m of GGY above £1bn GGY | ||

| Game host (bingo) | GGY | Less than £550,000 | £550,000 to £2m | £2m to £5.5m | £5.5m to £25m | £25m to £100m | £100m to £250m | £250m to £550m | £550 to £1bn | £1bn or greater | |

| Current Annual Fee | £2,027 | £4,855 | £7,094 | £9,958 | £26,595 | £50,993 | £102,108 | £289,652 | £289,652 plus £100,000 for every £500m of GGY above £1bn GGY | ||

| Proposed Annual Fee | £3,142 | £7,525 | £10,996 | £15,435 | £41,222 | £79,039 | £158,267 | £448,961 | £448,961 plus £100,000 for every £500m of GGY above £1bn GGY | ||

| Betting Host (virtual events only) | GGY | Less than £550,000 | £550,000 to £2m | £2m to £5.5m | £5.5m to £25m | £25m to £100m | £100m to £250m | £250m to £550m | £550 to £1bn | £1bn or greater | |

| Current Annual Fee | £2,027 | £4,855 | £7,094 | £9,958 | £26,595 | £50,993 | £102,108 | £289,652 | £289,652 plus £100,000 for every £500m of GGY above £1bn GGY | ||

| Proposed Annual Fee | £3,142 | £7,525 | £10,996 | £15,435 | £41,222 | £79,039 | £158,267 | £448,961 | £448,961 plus £100,000 for every £500m of GGY above £1bn GGY |

5. The section above described the specific arrangements for remote operating licences that combine any two or three of the remote casino, bingo and/or virtual event betting licences. A similar arrangement applies to combined licences that combine any two or three of the remote casino (game host), bingo (game host) and/or virtual event betting (host) licences.