Call for Evidence: Improving connectivity for Very Hard to Reach premises

Updated 25 May 2022

Ministerial Foreword

The government is committed to making the UK a global leader in digital connectivity. Levelling up means not just building new roads and railways, but also ensuring that reliable, long-lasting gigabit-capable connections are made widely available across the UK.

Having robust telecoms networks in place is more important now than ever. Digital connectivity has been a lifeline, permitting millions to work at home, providing information and entertainment to those in isolation and allowing children to continue their education while their schools were closed.

I am proud of the work done so far by the telecoms industry, supported by the government and Ofcom, which has already delivered gigabit-capable broadband to over 11 million premises in the UK, including more than half a million homes and businesses in hard to reach areas. However, there is a lot more to be done.

Our rural communities need good digital connectivity to thrive in an increasingly connected world, and we are committed to ensuring that no part of the UK is left behind. We have always known that it would be more difficult to deliver gigabit connectivity to the hardest to reach parts of the UK, around 20% of UK premises, and that is why we have committed a record £5 billion of capital funding to support deployment in these areas.

This call for evidence is focussed on delivering improved broadband to Very Hard to Reach premises, i.e. the most rural and remote premises within the hardest to reach areas of the country, where the costs of delivering broadband rise exponentially. We are seeking contributions from rural consumers and businesses, as well as telecommunications companies and organisations representative of all of these groups.

Detailed information about the demand for broadband services, their invaluable benefits, current barriers to deployment and take-up, and additional evidence from suppliers and vendors on technology availability, maturity, capabilities and costs to provide connectivity in Very Hard to Reach areas, either in the UK or overseas, will all help inform the government’s approach. I am keen that decisions about better broadband are based on evidence from those who will be most affected by them, and I look forward to receiving your responses.

Matt Warman MP

Parliamentary Under-Secretary of State

Minister for Digital Infrastructure

Section 1 - Overview of this call for evidence

The UK government’s ambition is to deliver nationwide gigabit-capable broadband as soon as possible. We have set a clear strategy through the Future Telecoms Infrastructure Review, Statement of Strategic Priorities, and the record planned investment in the £5 billion UK Gigabit Programme. In the period to 2025, we are targeting a minimum of 85% gigabit-capable coverage but are working with the industry to accelerate delivery to get as close to 100% as possible.

To support private sector deployment in the most commercial 80% of the UK, the government will continue to implement an ambitious programme of work to incentivise investment in gigabit-capable broadband and remove barriers to rollout. Delivering gigabit-capable broadband in the hardest to reach 20% of the UK is more challenging, which is why the government has set out detailed plans to support the delivery of gigabit-capable connectivity to these areas through its UK Gigabit Programme.

This programme builds on the previous programmes that the government has established to improve broadband in less well-served areas. For example, the £1.9 billion Superfast Broadband programme has delivered superfast broadband speeds to over 5.5 million UK premises (approaching 20% of the UK). Through public and private sector investment, superfast broadband is now available to 97% of UK premises and the UK has one of the highest rates of superfast coverage in Europe, including in rural areas.[footnote 1]

The Superfast programme is continuing alongside the UK Gigabit Programme, and it is now mainly delivering full fibre broadband to the 3% of UK premises that do not yet have access to superfast speeds. Before the launch of the UK Gigabit Programme, the government also rolled out other programmes such as the Local Full Fibre Networks programme and Rural Gigabit Connectivity programme to stimulate gigabit broadband rollout, including in more rural and remote areas.

Through the broadband Universal Service Obligation (USO), the government has legislated to provide every household with a ‘backstop’ legal right to request a decent broadband connection, providing a minimum download speed of 10 Mbps and an upload speed of 1 Mbps. The broadband USO is funded by the telecoms industry and is subject to a cost threshold of £3,400 per premise. Consumers are required to pay the excess costs of connection above this threshold.

Since this legislation was enacted in the Digital Economy Act 2017, the number of premises that cannot get a broadband service that meets the minimum specification under the USO has fallen from 1.1 million premises to fewer than 200,000 premises.[footnote 2] This is due to the government’s Superfast Broadband programme but also significant improvements in 4G network coverage and a wider availability of Fixed Wireless Access (FWA) services. Our £5 billion UK Gigabit Programme will also prioritise premises without access to superfast broadband speeds, wherever possible.

We expect that the number of premises that cannot get a USO level service will reduce over time as a result of further government investment in broadband, including through the £5 billion UK Gigabit Programme, as well as the USO itself. In February 2021, eight months after the launch of the USO, BT stated that they were building USO connections to over 5,500 premises across the UK.[footnote 3] The vast majority of these premises are being upgraded to a gigabit-capable full fibre connection compared to the minimum download speed of 10 Mbps under the USO. BT’s next report is due by 30 April 2021 and we expect that thousands more premises will be benefiting from the USO by that point.

However, the costs of improving broadband coverage rise exponentially as deployment continues into the final percentage point of most remote premises. A very small proportion of premises - potentially less than 100,000 - are therefore likely to be significantly above the broadband USO’s reasonable cost threshold and considered “Very Hard to Reach” with gigabit-capable broadband technologies like fibre to the premises technology. This is due to factors like their isolated geographic locations or the often substantial distances between them and existing or planned telecoms infrastructure, which make it challenging to deliver improved broadband.

The government is determined to explore all possible options for improving broadband connectivity for these Very Hard to Reach premises. The purpose of this call for evidence, which will be open for 12 weeks, is to develop our understanding of these areas and seek more information on:

- Demand: Consumer and business demand for broadband services in Very Hard to Reach areas. In particular, we are seeking information on current provision and adoption patterns by consumers and businesses in these areas, including businesses in the agricultural sector.

- Benefits: Further evidence on the benefits that delivering enhanced broadband services to Very Hard to Reach areas yields, including social, environmental or economic benefits.

- Barriers: Evidence of barriers to user adoption (other than services being unavailable in an area), and evidence relating to barriers that may impede infrastructure operators and service providers from offering improved broadband services in these areas. This evidence could also relate to barriers to investment (for parties providing finance for such investments).

- Approaches: Evidence relating to the availability, maturity, capabilities and costs of advanced technologies and novel approaches to provide connectivity in Very Hard to Reach areas, either within the UK or from overseas.

We are seeking evidence from four types of stakeholders:

- Consumer users of broadband services, in particular those who are resident in remote rural parts of the UK and cannot access broadband speeds that meet the minimum specification under the broadband USO.

- Business users of broadband services in these areas, including those working in the agricultural sector.

- Market participants, including infrastructure suppliers/operators, retail or independent broadband service providers, mobile network operators and equipment vendors.

- Representative organisations, who may for example be representing rural stakeholders, consumer groups or any sub-groups of the stakeholders listed above. This group could also include local government bodies and rural enterprise partnerships.

The approach to responding to this call for evidence differs slightly depending on the type of respondent. Further details on how to respond, including links to the online survey, information relating to how evidence will be handled and used by the government, and how to access alternative format and language versions is set out in the final section of this document.

Section 2 - Background and current broadband programmes

In this section, we outline:

- what we mean by a Very Hard to Reach premises, for the purpose of this call for evidence

- current government broadband policy and how it relates to Very Hard to Reach premises

- current investment programmes and how they relate to Very Hard to Reach premises

2.1 What is a ‘Very Hard to Reach’ premises?

Whether the future needs of premises can be served commercially with specific telecommunications technologies depends on several often interrelated factors. This includes the geographic location of the premises (and its neighbours), the availability of existing infrastructure and appropriate technologies, and the potential investment return.

This call for evidence focusses on premises that are primarily Very Hard to Reach as a result of their geographic location. Some contributing factors to geographic isolation are set out in Table 2.1 below.

Table 2.1: Factors causing geographic isolation of premises

| Factor | Explanation |

| Physical isolation | The premises is located at a substantial distance from any neighbouring premises. |

| Sparse distribution | The premises has neighbours, but these neighbours are a considerable distance from each other. |

| Distance to interconnection or ‘backhaul’ | The distance from the premises to other accessible points of interconnection for telecommunications purposes is substantial. |

| Island locations | As above, but a particularly challenging example if there is no submarine cable capacity to the island. Even small towns can prove Very Hard to Reach in this instance. |

| Occluded by terrain or other barriers | The presence of mountain ranges, valleys/canyons, marshlands/bogs or excessive foliage prevents shorter routes or certain technologies. |

| Access related issues | Regulatory or climatic hurdles that are linked to the geographic location of the premises. These can be related to weather conditions (build in certain locations cannot occur year-round), or due to regulations in National Parks/Areas of Outstanding National Beauty (AONBs), or other access or wayleave restrictions. |

According to data provided by the Office for National Statistics (ONS), there are approximately 420,000 premises in the UK which are classified as ‘remote’. This represents 1.4% of the total number of premises in the UK, of which a subset is potentially Very Hard to Reach for broadband services. Premises from some other rurality codes may also be considered Very Hard to Reach.

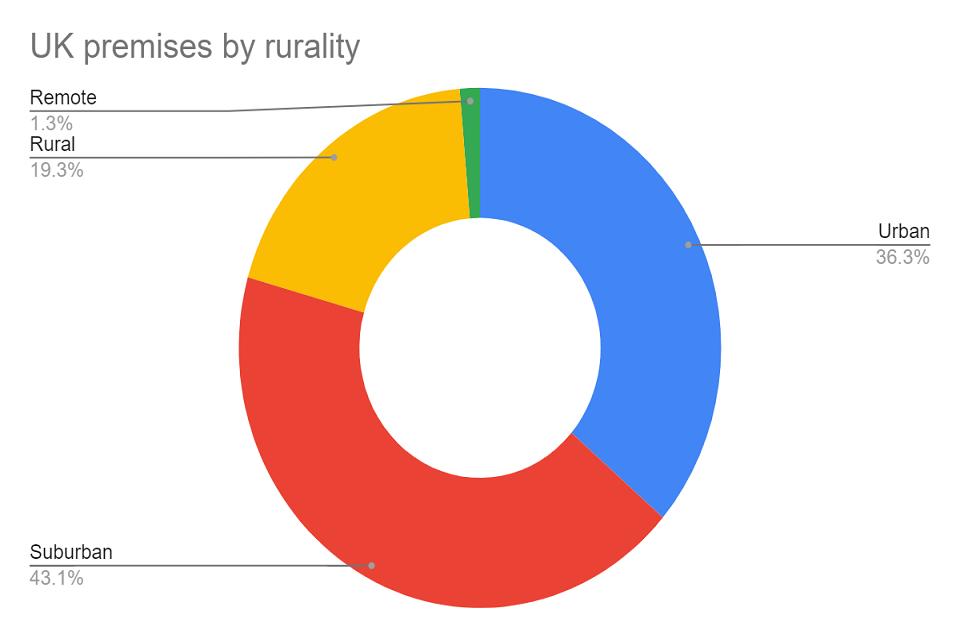

Figure 2.2: UK Premises by rurality

Remote: 1.3%, Rural: 19.3%, Urban: 36.3%, Suburban: 43.1%

Source: UK Premises defined by Ofcom Connected Nations 2020. Rurality definitions from the National Statistics Postcode Lookup and ONS Postcode Directory.[footnote 4]

Other premises may not be geographically Very Hard to Reach, but present a potentially high cost to upgrade or serve if economies of scale are lacking as a result of network deployment strategies and the availability of legacy services. For example, this can occur where:

-

a telecoms infrastructure provider makes a discrete choice not to include a premises in a network rollout (even though the premises is not geographically Very Hard to Reach), for example, due to access issues at the time of the construction works.

-

a technology has been withdrawn or become otherwise unavailable (but neighbouring premises remain served). This can occur where wireless networks are modified, or suppliers become insolvent.

-

the technology employed in a rollout has a limitation which has unexpectedly led to the premises not being covered, or an underlying network element is underperforming (for example, fixed wireless coverage issues relative to desk-based radio planning, insufficient cabinet space due to underestimated demand, or poorly maintained legacy copper or aluminium lines reducing actual service speeds).

-

the premises is connected to an aggregation point, local exchange or radio mast which is much further away than the one its neighbours are connected to (and the technology used is distance-limited). This can be the case where new settlements have changed the distribution of premises in an area, for example through new estates, or where a communications provider has rationalised telephone exchanges or is using newly available ducts.

-

the premises has been inadvertently missed due to inaccurate data on the location or status of the premises.

There are also examples where the premises themselves change over time, resulting in high upgrade costs even though they are not geographically Very Hard to Reach or located in remote rural areas. This can include where:

-

a new single premises is created (or an existing premises is subdivided) in an area which has already been otherwise upgraded. The single premises then faces all of the costs of the work required

-

a new development of premises is built with a new rollout or technology, but a small number of premises nearby are not connected and are therefore left behind, and are potentially less economic to return to at a later date.

To address issues with new build connectivity, the government is intending to amend Building Regulations to ensure that new build homes in England are built with next generation digital infrastructure. This legislation will build on the commitments that the government has already secured from network operators to work with housing developers to provide gigabit-capable connectivity to new build developments across the UK. New build connectivity in Scotland, Wales and Northern Ireland is a matter for the Devolved Administrations.

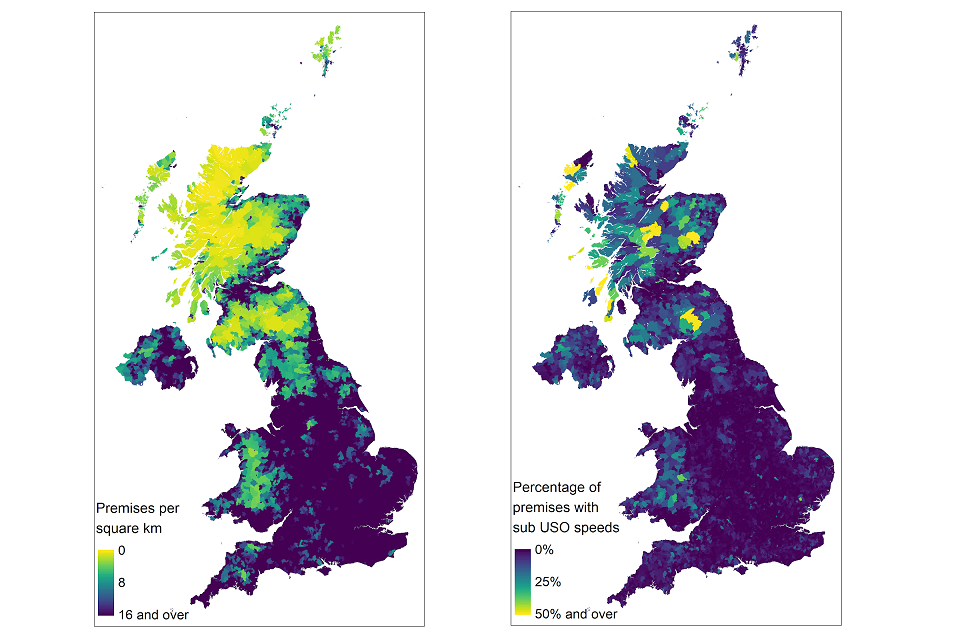

‘Remote’ premises are disproportionately located in the Devolved Administrations, as demonstrated by the map on the left below. However, some areas of England also have a relatively high proportion of remote premises, including parts of Cumbria, the North York Moors and the Quantock Hills in Somerset. We have compared the ONS data on premises per square km with Ofcom data on the percentage of premises with sub-USO speeds (on any infrastructure) and the maps below show clearly that those with sub-USO speeds are usually found in the most remote areas, which is to be expected.

Figure 2.3: Maps of UK premises density (left) and the proportion of premises receiving sub-USO speeds (right)

| Spatial distribution of premises, based on Epoch 78 of AddressBase Premium, with premises following theOfcom Connected Nations definition | Potential USO eligible premises, based on Ofcom data to 1st September 2020, mapped via LSOA (England and Wales), Intermediate Zone (Scotland) and SOA (Northern Ireland) as defined in the National Statistics Postcode Lookup. Does not reflect actual USO eligibility due to ongoing network procurements or voucher-based projects supported with government funding, and certain other data adjustments. |

Despite geographic and other challenges, telecommunications suppliers are already delivering connectivity to some of these premises, including through commercial deployments, recent UK government supported interventions (such as the Superfast Broadband programme) and community broadband schemes and collaborations being delivered by the likes of B4RN, Balquhidder, Broadway Partners and Wessex Internet. Further examples of what the government has done and is doing to improve digital infrastructure in rural and remote areas are outlined below.

2.2 Ongoing programmes and market interventions

Superfast Broadband programme

The government’s Superfast Broadband programme was established in 2010 to ensure that the UK had one of the best superfast broadband networks in Europe. This included subsidising deployment to areas of the country that are less commercially viable.

The programme has already delivered upgraded broadband connections to more than 5.5 million UK premises (approaching 20% of the UK). As a result of this programme and private sector investment, around 97% of UK premises have access to superfast speeds. According to the European Commission’s latest Digital Economy and Society report, the UK ranked eighth for superfast connectivity across a selection of countries in Europe and even higher for superfast connectivity in rural areas.

The government’s latest evaluation report[footnote 5] on its Superfast Broadband Programme found that it has delivered economic benefits of £2.7 billion since 2012, as well as:

-

A surge in the value of homes sold in programme areas between 2012 and 2019 by up to £3,500, a rise of 1.16% worth £1.52 billion

-

17,600 more jobs in programme areas, including 2,100 lifted from long-term unemployment creating an increase in gross value added (GVA) by £125 million

-

£1.1 billion gained in GVA through increased workplace productivity

-

The availability of faster coverage also helped power businesses and sparked a £1.9 billion increase in total annual turnover for firms based in areas upgraded through the programme.

The report also concluded that the programme’s value for money is continuing to rise. For every £1 invested by the government in the programme, an additional £2.70-£3.80 of economic and social benefits has already been created in the UK economy.

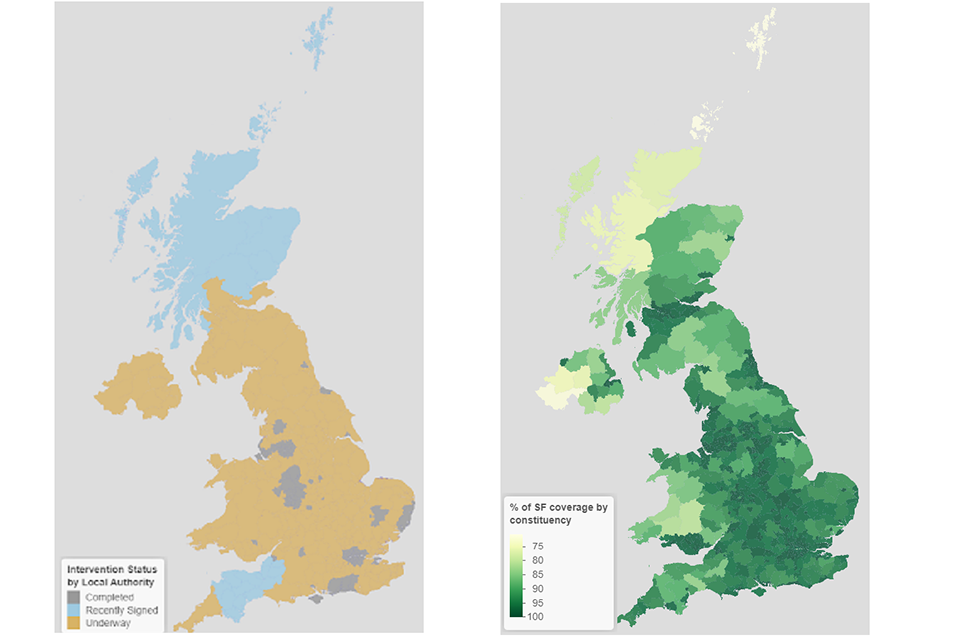

Figure 2.4: Ongoing Superfast interventions by local authority area and Superfast availability by constituency

Source: Internal BDUK Superfast Programme data; Ofcom Connected Nations 2020 Constituency level data

Note: Additional contracts in Devon, Somerset and the North of Scotland have been awarded to four suppliers, and detailed remapping and scheduling of the rollout by premises is now being undertaken.

Recent bids under the Superfast Broadband programme illustrate that the appetite of suppliers and the potential reach of their networks into these areas can vary substantially (see table 2.5).

Table 2.5 Public subsidy to recent Superfast procurements using FTTP

| Procurement | Supplier | Premises addressed (and degree of rurality) | Solution contracted (FTTP/FTTC[footnote 6] and delivery timeframe) | Public Subsidy (announced value) | Subsidy / premises (average) |

| Connecting Cheshire (East) | Airband | 4,000 | FTTP, by March 2023 | £4.5m | £1,125 |

| Connecting Devon & Somerset (Phase 3) | Airband | 37,500 | FTTP, by the end of 2024 | £25.5m | £680 |

| Truespeed | 15,000 | £6.7m | £447 | ||

| Wessex Internet | 3,600 | £4.7m | £1,306 | ||

| Connecting Suffolk (Phase 3) | Openreach | 5,000, rural | Undisclosed | £21.75m | £4,345 |

| Project Stratum | Fibrus | 76,000, rural & very remote | FTTP, by the end of 2025 | £165m | £2,171 |

| R100 Central | Openreach | 32,000, mainly rural | FTTC / FTTP, by the end of 2023* | £83m | £2,594 |

| R100 South | Openreach | 21,000, rural, some remote | FTTP, by summer 2024 | £133m | £6,333 |

| Superfast Yorkshire (P3) | Openreach | 14,329 | 87% FTTP, rest FTTC | £20.5m | £1,431 |

Note:

- All data public domain as announced/published

- The table does not include “supplier contribution” to capital or resource build.

- Public subsidy is total from the UK Government, Devolved Administrations, Local Bodies and other sources.

- R100 Central details exclude additional funding from the UK government to upgrade the remaining Fibre to the Premises Cabinet (FTTC) premises to full fibre connections.

- R100 South value is initially announced contract value.

Gigabit voucher scheme

Starting in March 2018, the government’s gigabit voucher scheme provided eligible homes and businesses across the UK with vouchers to support the deployment of gigabit-capable broadband. During the first wave of the scheme, the Government invested over £60 million in vouchers.

In May 2019, the government launched the second wave of the scheme, focussed on rural areas. This scheme is now closed to new project submissions as we migrate to a new voucher under the £5 billion UK Gigabit Programme. The gigabit voucher scheme has issued over 66,000 vouchers to homes and businesses across the UK, worth up to £127 million.

Many vouchers have been awarded to suppliers using novel technologies, low-cost build approaches and extensive community engagement to serve them. For example, voucher-supported efforts of Alncom, Balquhidder, Broadband for the Rural North (B4RN), Hence Broadband Partners, and Wessex Internet have delivered several projects addressing the needs of premises in the hardest to reach 1% of premises, and there is the potential for this to continue under the £5 billion UK Gigabit Programme.

Support from the UK government has been complemented by additional activity in Wales and Scotland, and by top-up funding in 18 English local authorities. By employing various approaches, this additional funding has, wherever possible, been targeted at those most in need.

Figure 2.6: Case studies of Rural Gigabit Voucher projects

Source: Case Studies – Gigabit Vouchers

Public sector hubs and other contracts

The government has had a programme to provide gigabit-capable upgrades to connectivity for public and community buildings, such as council offices, schools, libraries and GP surgeries, to meet public sector needs and act as full fibre ‘hubs’ off which industry can build their residential networks and connect surrounding homes and businesses. These are predominantly in rural areas, for example, the Brook Community Primary School in the Kent Downs AONB (Area of Outstanding Natural Beauty), and include some of the most remote locations in the UK, including for example the last school to be connected in Wales (Ysgol Llanychllwydog School, Fishguard)[footnote 7].

These projects are complemented by other public sector investments, including the Maritime and Coastguard Agency’s £170 million contract[footnote 8] to increase network resilience and upgrade connections to 155 remote radio sites, and the improved broadband connectivity to 110 vaccination sites[footnote 9] as part of the recent COVID-19 pandemic response.

Over 40 suppliers are already registered[footnote 10] for the government’s preferred procurement route, with as many again working through the registration process, and the government expects many more sites to be connected. However, in some of the most remote parts of the UK, there are no publicly-owned assets upon which such interventions can be built quickly and efficiently.

Gigabit procurements

The UK Gigabit Programme is a multi-intervention programme, led by Building Digital UK (BDUK), working in partnership with local authorities and the devolved administrations. The majority of connections in this programme will be delivered through supply-side interventions (procurements), complemented by demand-led measures (vouchers and hub projects delivering improved connections to public sector sites).

In December 2020, the government set out further details of the draft procurement strategy[footnote 11] for the UK Gigabit Programme, including its approach to awarding contracts for the £5 billion, which will mean that a range of telecoms providers - from the very small to very large - can take part. Further details are being published today (19th March 2021). A substantial majority of the £5 billion will be invested in such procurements.[footnote 12]

These procurements have been designed to encourage suppliers to provide gigabit-capable connections to as many premises as possible in the designated intervention areas. The procurements are also technology-neutral, subject to the deployed technology meeting the required service specification and wholesale access conditions.

Broadband Universal Service Obligation

The Broadband Universal Service Obligation came into effect on 20 March 2020, providing consumers with a right to request a decent broadband service, providing download speeds of at least 10 Mbps and upload speeds of 1 Mbps. The last data published by Ofcom in Connected Nations 2020, on 17 December 2020, estimated that around 190,000 premises may be eligible to apply (unless they are due to be covered by a government funded programme expected to roll out within 12 months).

Delivery of the broadband Universal Service Obligation (USO) is the responsibility of Ofcom as set out in legislation, and has been designated to two Universal Service Providers: BT and KCOM (in Kingston upon Hull only).

Since launching the USO in March 2020:

- BT has approved more than 500 projects, resulting in over 5,500 additional premises, including those in some of the most rural and challenging areas, set to receive improved broadband connectivity as a direct result

- KCOM has indicated that all of the premises within its service area have the potential to access a decent broadband USO level service at prices consistent with, or below, the requirements set out in the Universal Service Conditions. In the first six months of the scheme, KCOM consequently had no eligible applications for USO-level service

The number of eligible premises fell from approximately 2.6 million at the initial stages of policy design in 2016, to 610,000 before the USO was launched in March 2020, to less than 190,000 (or 0.6% of all UK premises) today. Additional government broadband rollout programmes will further reduce the number of premises eligible for the USO in the coming years. The positive impact of this will be particularly felt in the Devolved Administrations.

However, the government is aware that there have been issues arising from the implementation of the USO, primarily relating to high quotes for receiving a connection. As a result, Ofcom opened an investigation into BT’s compliance with the USO’s regulatory conditions in October 2020, and in January 2021 Ofcom announced that it would provide a further update by the end of March 2021 following additional evidence gathering.

We anticipate that premises will continue to be connected under the USO and that the cost of connecting some of these premises will fall as other infrastructure becomes available nearby.

Mobile Connectivity Strategy

Alongside its work on improving fixed broadband connectivity, the government is committed to extending 4G mobile coverage to 95% of the UK. On 9 March 2020, we agreed a £1 billion deal with the Mobile Network Operators (MNOs) to establish the Shared Rural Network.

This initiative will see the four MNOs collectively invest over £530 million in a shared network of new and existing phone masts to help address partial ‘not-spots’ - areas where there is currently coverage from at least one, but not all, operators. Furthermore, the government will invest over £500 million to significantly reduce ‘total not-spots’ - those hard-to-reach areas where there is currently no coverage from any operator. With funding now available, the government and the operators remain confident that combined coverage will be delivered to 95% of UK geography by the end of 2025, with areas around the UK starting to see improvements to 4G coverage long before completion.

Section 3 - Rationale for this call for evidence

The aforementioned programmes will substantially support the delivery of enhanced broadband services and mobile connectivity to Very Hard to Reach premises over time.

However, they are not guaranteed to deliver gigabit broadband to all of these premises since doing so involves substantial and uncertain cost.

Furthermore, based on initial government analysis, up to 1% of premises could be prohibitively expensive and may require alternative technologies.[footnote 13] However, reviewing predicted coverage against actual coverage indicates that some of the most geographically remote 1% of premises have already been connected. In many cases, this is due to the work completed under previous phases of the Superfast programme, as well as gigabit voucher projects and community schemes. A review of recent contracts placed and vouchers issued suggest that we can expect the number of premises with such connections to continue to rise.

We also expect that the commercialisation of new technologies and the greater availability of radio spectrum resources will make it possible to connect many more of these premises to improved broadband services. However, through this call for evidence, the government is seeking evidence about the demand for enhanced broadband connectivity in these areas, as well as the potential benefits, barriers and potential technology approaches.

This call for evidence seeks responses on the following matters:

Table 3.1 - Topics, evidence sought, and rationale

| Topic | Evidence sought and rationale |

| Demand | Information on the current and future anticipated needs of consumers and businesses specifically located in Very Hard to Reach, remote locations.We are also seeking information on current broadband provision and adoption patterns by consumers and businesses in these areas, including businesses in the agricultural sector. The details of the evidence we are seeking on demand are set out in Section 4. |

| Benefits | The government already reviews the benefits of intervention into broadband market delivery as part of existing programmes. This includes economic, social and environmental benefits. However, qualitative evidence suggests that the circumstances of people living and working in the hardest to reach locations of the UK can differ substantially from even the rural norm. This can be compounded by the lack of other infrastructure and the distance required to travel to physically access services as an alternative. The nature and make-up of the rural economy in the most remote parts of the UK is also exceptional, and evidence provided to DCMS by other departments suggests particularly low productivity versus international comparables. We are therefore seeking further evidence - in particular, quantitative data - of the benefits that delivering enhanced broadband services to such areas yields. Whilst some data is available to support this assessment, more data from agricultural businesses and consumer representative organisations would be helpful. The details of the evidence we are seeking on demand are set out in Section 5. |

| Barriers | Availability of services is a barrier in many remote rural locations of the UK. Through this call for evidence and parallel consultation with suppliers, we will establish further details of future availability of new and emerging technologies, to complement existing substantial data on network availability and performance. The demographics of residents in the most remote rural areas of the UK and the nature of the rural businesses suggest that levels of awareness of the availability and capability of digital technologies are a barrier to adoption. Consumers and consumer representative groups have provided evidence to DCMS and Ofcom on their experience with previous interventions, and we seek input from those located in the most remote locations to compare their experience with those in other parts of the UK. Suppliers delivering in, or considering expanding into remote rural areas have told the government that they face particular economic, administrative and practical barriers in addressing this market effectively, and we seek input from them through this call on barriers specific to, or acute in, this particular segment of the market. We are particularly keen to gain further input from smaller suppliers, including independent wireless service providers offering or planning to offer gigabit-capable or upgradeable wireless technologies, and those with a strategic focus on rural areas. The details of the evidence we are seeking on demand are set out in Section 6. |

| Approaches | The government is aware that innovation continues to make new solutions possible and to improve economic viability in Very Hard to Reach locations. Reviewing approaches taken in other countries to address this challenge - including some with topology and terrain even more challenging than the most remote parts of the UK - suggests that diverse approaches may provide new possibilities and improved value for money for interventions. We are therefore seeking additional evidence from suppliers and vendors on technology availability, maturity, capabilities and costs relating to advanced technologies and novel approaches to provide connectivity in Very Hard to Reach areas, either in the UK or overseas. We are also engaging with industry directly, in parallel to this call for evidence. The details of the evidence we are seeking on demand are set out in Section 7. |

Section 4 - Topic A: Demand for improved broadband in Very Hard to Reach locations

In this section we:

- summarise the sources of current evidence on usage and demand already available

- explain why we are calling for further evidence on demand and needs

- summarise the questions on demand for broadband that we are addressing to different types of respondent through this call for evidence

4.1 Current Evidence on Demand

A wide range of evidence on current levels of demand for, and take-up of, broadband services in rural areas is already available to the government. This includes, but is not limited to:

- information from the BDUK superfast evaluation[footnote 14]

- data from Ofcom, including their “Communications Market Report”[footnote 15] and consumer “Home broadband performance report”[footnote 16]

- line performance from suppliers, via Ofcom, at either the postcode or the premises level

- average usage data (traffic/month), at the postcode level for fixed wired networks (i.e. FTTC, FTTP, and cable networks that rely on a physical medium from the exchange to the premises)

- more general take-up and adoption data from Ofcom, from GigaTAG[footnote 17] and the performance monitoring of networks deployed under previous procurements

- the extent of home working by rurality, reported by DEFRA and the UK Government Statistical Service

Previous consultations have also provided evidence on how consumers in rural areas use broadband services and which applications stimulate this demand. This evidence includes, but is not limited to:

- information provided to the government, including during consultations on the Superfast programme, through the work of select committees such as the Environment, Food and Rural Affairs Committee and other Parliamentary groups, such as the All-Party Parliamentary Group for Rural Services.

- evidence provided by suppliers during discussions on the UK Gigabit Programme

- evidence provided as part of consultations on the USO

- work undertaken by Ofcom when advising the government in 2016 on the minimum decent broadband speed for the USO

- evidence provided by stakeholders and representative organisations as part of discussions before this call for evidence

This evidence suggests that consumers in remote rural areas are more likely to work from home (before the COVID-19 pandemic began) and that remote rural locations contain proportionately more registered businesses than other rurality types.

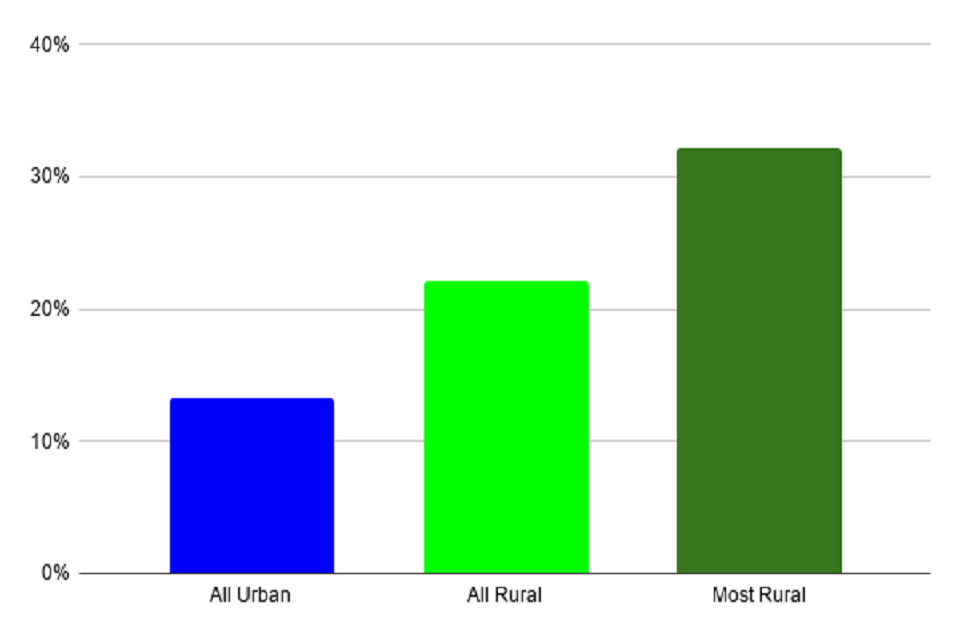

Figure 4.1: Percentages of homeworkers in England in 2019

Source: Statistical Digest of Rural England

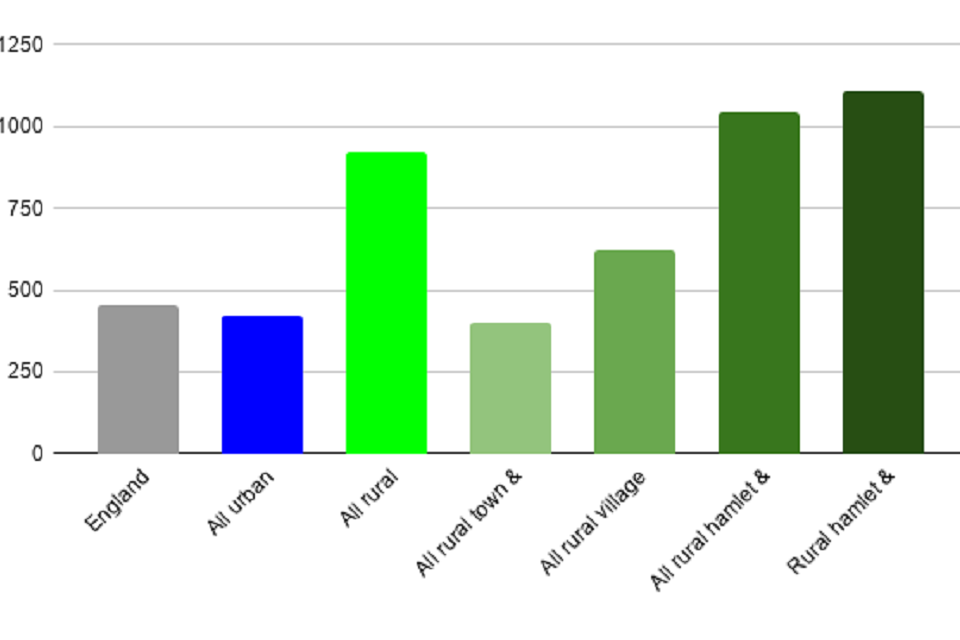

Figure 4.2: Number of registered businesses per 10,000 population in England in 2019/20

Source: Statistical Digest of Rural England

Table 4.3: Number of registered businesses in Rural Hamlets & Isolated dwellings split by industry in England in 2019/20

| Industry | Number of firms | Percentage of firms |

| Administrative and support services | 765 | 4.8% |

| Agriculture, forestry and fishing | 8,095 | 50.4% |

| Arts, entertainment and recreation | 390 | 2.4% |

| Construction | 1,120 | 7.0% |

| Education, health and social work | 410 | 2.6% |

| Finance | 95 | 0.6% |

| Accommodation & food service activities | 940 | 5.9% |

| Information and communication | 370 | 2.3% |

| Manufacturing | 615 | 3.8% |

| Mining/quarrying and utilities | 170 | 1.1% |

| Professional, scientific & technical services | 1000 | 6.2% |

| Public admin and defence; other services | 375 | 2.3% |

| Real estate activities | 300 | 1.9% |

| Transport and storage | 290 | 1.8% |

| Wholesale, retail & repair of motor vehicles | 1,120 | 7.0% |

| Total | 16,055 | 100.0% |

Source: Statistical Digest of Rural England

4.2 Why we are calling for further evidence

We need to understand in more detail the specific needs of communities and businesses located in Very Hard to Reach locations. We also wish to understand in more detail how consumers and businesses in these locations expect their needs and requirements for broadband services to change over time. This will help us to optimise future policy for these areas and to compare these requirements to the benefits they expect to derive, in a more geographically specific manner. We wish to further explore how consumers and businesses in these locations expect their needs and requirements for broadband services to change over time. This will help us to optimise future policy for these areas and to compare these requirements to the benefits they expect to derive, in a more geographically specific manner.

Available evidence on demand for broadband services at a granular level is often affected by measurement techniques or substantial aggregation of data. For example:

-

information derived about line speed performance suggests substantial limitations on service speeds on remote rural lines using older networks. Estimates for data demand based on measurements in locations where supply has been constrained are problematic, and likely to understate the underlying actual level of demand

-

evidence on the usage of customers in these locations using non-wired technologies (i.e. wireless solutions, such as fixed wireless access or non-terrestrial solutions, e.g. satellite-based communications) is generally limited, and not correlated to specific geography

-

evidence on demand and usage is often disconnected from relevant background information (for example on the nature or sector of the rural business, or the current occupancy level of the premises)

4.3 Summary of questions on demand, by type of respondent

The evidence we are seeking on demand for improved broadband in Very Hard to Reach areas is set out below, arranged by respondent type. The questions below are summaries of those in the online survey. Please note that the questions may be worded differently for analysis purposes.

Table 4.4: Questions on demand

| We are asking consumers: | |

| A1 | For basic data to analyse responses (such as household size, etc) |

| A2 | What types of devices and services do the residents in your premises use? |

| A3 | What broadband services do you use today, and how much do they cost? |

| A4 | What are the current speeds that you receive, and are they what was advertised? |

| A5 | How reliable is your current service and how satisfied are you? |

| A6 | What broadband download speed do you think you currently require? |

| A7 | How much would you value an improved connection speed? |

| A8 | To what extent do you have access to and use mobile data alternatives to fixed broadband services? |

| A9 | How has the COVID-19 pandemic affected your needs for broadband/digital connectivity? |

| We are asking businesses: | |

| A10 | Basic data to analyse responses (such as size and type/sector of the business) |

| A11 | Which online applications are essential to the operation of your business? |

| A12 | What broadband services does the business use today? (and for agricultural businesses, further details of their service provision across the farm, etc) |

| A13 | How satisfied are you with your current broadband service? |

| A14 | How reliable is your current service and how satisfied are you? |

| A15 | What broadband product parameters do you think you currently require? |

| A16 | How has the COVID-19 pandemic affected your business needs for broadband/digital connectivity? |

| We are asking market participants: | |

| A17 | Which services and solutions do you offer to customers in rural, remote areas? |

| A18 | How would you describe the awareness of customers (in rural, remote areas) of the connectivity services that you offer? |

| A19 | What product uptake, speed choices, and usage levels do you experience from customers in remote rural areas? |

| A20 | How has the most popular speed choice changed compared to 3 years ago? |

| A21 | Do you supply premises level coverage data to Ofcom for the Connected Nations coverage/performance reporting? |

| A22 | What do you project customer data consumption growth to be in these areas? |

| A23 | How has the COVID-19 pandemic affected consumption patterns and has this changed your plans for launching new services? |

| A24 | When planning your network expansions, how do you consider the varying needs of customers across different premises/premises types? |

| A25 | How current and detailed would you say the data on which you can plan your investment decisions is? |

| A26 | Do you offer a community-based partnership or allow mechanisms for consumers to group together to register interest when expanding your networks? If so, what has been your experience with this? |

| A27 | Do you already utilise UK government funding? (and related details) |

| A28 | Do you offer discounts to install/service costs based on customer or community labour or asset contributions to remote rural projects? (Examples: Self dig, site provision, site power). If so, how has the customer response been? |

In addition, we are seeking evidence from representative organisations on this topic. Responses may address any of the themes above in broad or specific terms. Responses from such parties may address any of the themes above in broad or specific terms.

Section 5 - Topic B: Benefits of improved broadband in Very Hard to Reach locations

In this section we:

- summarise the sources of current evidence on benefits that are already available

- explain why we are calling for further evidence on benefits for these locations

- summarise the questions on benefits arising from the availability of improved broadband that we are addressing to different types of respondent through this call for evidence

5.1 Current Evidence on Benefits

Similar to demand, a wide range of evidence on the benefits of broadband services to consumers and businesses in rural areas is already available to the government. This includes, but is not limited to:

- quantitative data from the evaluation reports of previous programmes, notably the latest superfast broadband evaluation report[18]

- the SQW UK Broadband Impact Study[footnote 19]

- qualitative interviews with the beneficiaries of such programmes, including interviews undertaken as part of the Rural Gigabit programme

- better internet connectivity can lead to efficiencies in service delivery within the public sector. These sectors include, but are not limited to, health services, educational institutions, leisure facilities, local authority functions, criminal justice services and energy and transport sectors. For example, one Government funded fibre project has reported that better connectivity in the health sector can enable an increase in monthly e-consultations by GP surgeries by 400% by 2025 and reduce face-face patient follow up by 35% through the introduction of virtual appointments.

- by improving the availability and reliability of high-speed internet, people feel more digitally included which can lead to an increase in wellbeing. The Superfast evaluation quantified the impact of broadband on wellbeing. It found that increasing household internet speed to superfast speeds was associated with a wellbeing improvement equivalent to £225 per premises per year[footnote 20]

- academic studies on the effect of broadband provision on house/asset prices, including Molnar et al (2013)[footnote 21], Ahlfeldt (2017)[footnote 22]

- information gathered or produced by 5G Rural First[footnote 23], a co-innovation project led by Cisco alongside principal partner University of Strathclyde, DCMS and others

- Rural England’s unlocking digital potential of rural areas across the UK[footnote 24]

- consultancy studies. For example, Analysys Mason estimated the benefits of 5G connectivity[footnote 25] in the agricultural sector to be ~£2.2 billion; international benchmarks, for example, the US Federal Communications Commission (FCC) published a report on the impact of broadband penetration on US farm productivity[footnote 26]

- DCMS conducted a 5G testbed study, the analysis/evaluations for this examined the impacts of 5G connectivity on farms across the UK.

Previous consultations have also provided evidence on the benefits of improved broadband services in rural areas. This evidence includes, but is not limited to:

- evidence provided by suppliers during discussions on the UK Gigabit Programme

- evidence provided to the government by stakeholders and representative organisations as part of discussions prior to this call for evidence

- Ofcom’s 2018 study across 35 OECD countries, assessing the economic impact of broadband and how it exhibits diminishing marginal returns.[footnote 27]

- Centre for Economics and Business Research Centre for Economics and Business Research report written on behalf of Openreach assessing the economic impacts of full fibre on the UK economy[footnote 28]

- The National Infrastructure Commission contacted Frontier Economics to examine the future benefits of broadband, which estimated the benefits of 5G and Full Fibre/G.fast whilst assessing some of the costs[footnote 29]

- the Imperial College London land value uplift study[footnote 30] which attributed 3% land value increases to broadband and used data from across the UK.

This evidence suggests that remote rural residents face substantially greater travel times and disruption to their working and social time to access basic services. This evidence also suggests that remote rural businesses are disproportionately agricultural. Agriculture is a sector where there is a substantial productivity gap in the UK compared to other sectors and countries. The benefits of ‘agri-tech’ to improve productivity are partly dependent on the availability of improved digital connectivity.

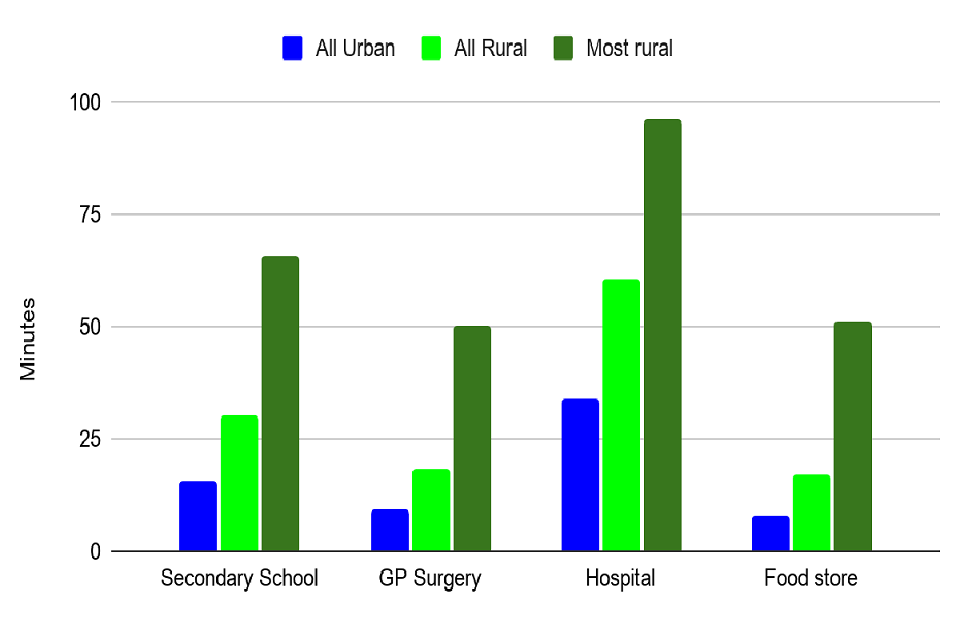

Figure 5.1: Average minimum travel time to reach the nearest key services by public transport or walking in England in 2016

Source: Statistical Digest of Rural England

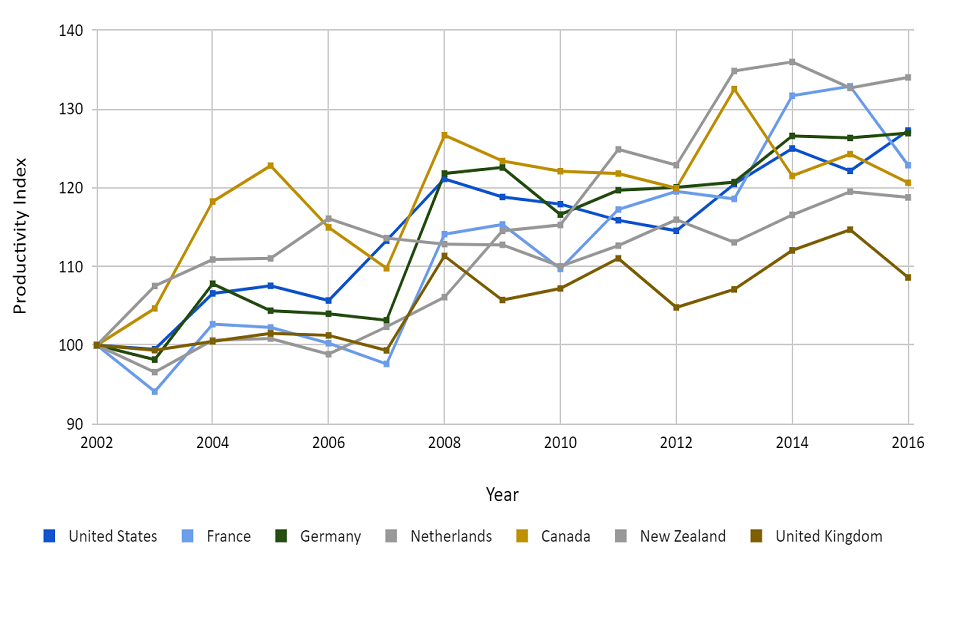

Figure 5.2: International Index of Agricultural Productivity

Source: International Agricultural Productivity

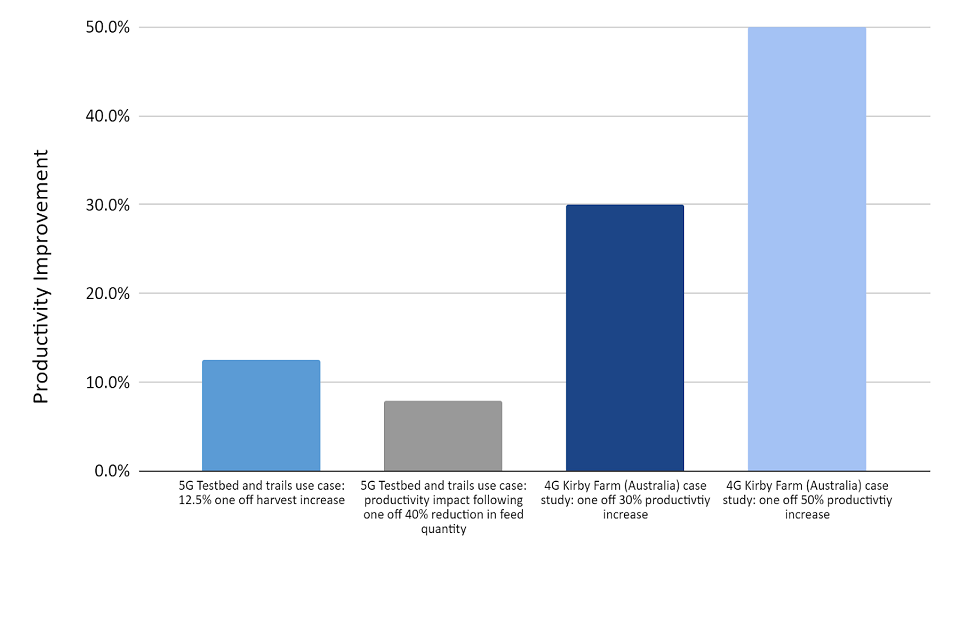

Figure 5.3: The impact improved connectivity on farms has on productivity

Source: Kirby Farm - NBP Benefits Report, 5G Testbeds & Trials

Note that the 5G impacts are measured individually, meaning the impacts do not account for the full number of additional productivity benefits to farms which may be observed following a 5G connection. The 5G impacts are also emerging data, so may be subject to change. Kirby Farm is classified as a highly productive farm based in Australia, so may experience differing productivity impacts to the average farm here in the UK.

Qualitative evidence provided to the Department through correspondence with MPs and their constituents also provides examples of mitigation strategies employed by rural businesses in particular, in the absence of appropriate digital connectivity. This ranges from geographic displacement to additional travel to the employment of agents located in market towns with better connectivity to complete transactions and services (with potential delays and inefficiencies).

5.2 Why we are calling for further evidence

We wish to further quantify where possible the social, environmental and economic benefits of the provision of improved broadband for consumers and businesses who are located in Very Hard to Reach locations.

Whilst there is already a substantial evidence base for the benefits of broadband for consumers and businesses generally within the UK, and a selection of academic literature on the potential benefits of rural ‘agri-tech’, it is difficult to assess how these benefits can be apportioned to specific geographic areas.

Many studies consider rural areas in their entirety and are not focussed only on remote rural or Very Hard to Reach areas. Generally, productivity data has not been linked to the underlying level of availability and adoption of digital connectivity. Furthermore, the availability of some digital communications and agri-tech applications in the UK is relatively recent and difficult to correlate to economic output data. Data on the (non-digital) alternative strategies available to consumers and businesses in remote rural areas is also difficult to compile.

This evidence will allow us to assess the benefits of improved and more reliable broadband in Very Hard to Reach locations, in relation to their geographic remoteness and current level of access to digital connectivity and alternative services.

5.3 Summary of questions on benefits, by type of respondent

The evidence we are seeking on the benefits of improved broadband in Very Hard to Reach areas is set out below, arranged by respondent type. The questions below are summaries of those in the online survey, where the questions may be worded differently for analysis purposes.

Table 5.4: Questions on benefits

| We are asking consumers: | |

| B1 | How would access to improved broadband benefit you in particular? |

| B2 | Have you ever used or been offered a virtual health service, such as an online GP session? ○ How would you rate this service based on your experience? |

| B3 | Has your household made use of tele/virtual education? ○ How has your virtual education experience compared before and after March 2020 (the beginning of the first COVID-19 lockdown)? |

| B4 | Do you have access to the following services (regardless of whether your premises has made use of them): ○ Online libraries? ○ Online medical appointments? ○ Online learning? ○ Online banking? |

| B5 | How do you think better broadband would affect: ○ Your ability to keep in touch with friends and family? ○ Your access to online entertainment (e.g. films and TV streaming)? ○ Your access to support services? ○ Your ability to work at home? |

| B6 | How do you think having access to these services would affect your wellbeing and welfare? |

| We are asking businesses: | |

| B7 | How would access to improved broadband benefit you in particular? |

| B8 | Which online applications are important to the operation of your business? |

| B9 | Which of the following does your business have access to and makes use of? ○ Online accounting ○ Online orders ○ Online conferencing ○ Online banking |

| B10 | Does your internet connection enable or inhibit: ○ Remote working? ○ Customer or supplier access? ○ Business efficiency or cost savings? ○ Cloud data storage and security? ○ Business flexibility? ○ Access to new markets? ○ Profitability? ○ Product or service range? ○ Access to training? ○ Staffing and recruitment? |

| B11 | Has digital connectivity enabled your business to enter different markets or sectors in addition to your original business activities? |

| We are asking market participants: | |

| B12 | Have you made any assessment of the economic or social benefits of the provision of your services to remote rural customers? |

| B13 | If barriers were removed, how would you rate the improvement in: ○ Capital cost requirements? ○ Operating expenditures? ○ Administrative burdens? ○ The overall business case for investment? |

In addition, we are seeking evidence from representative organisations on this topic. Responses from such organisations may address any of the themes above in broad or specific terms.

Section 6 - Topic C: Barriers to delivering or accessing improved broadband in Very Hard to Reach locations

In this section we:

- summarise the sources of current evidence on barriers that prevent the delivery or adoption of broadband in Very Hard to Reach areas that are already available

- explain why we are calling for further evidence on these barriers

- summarise the questions on barriers encountered by consumers, businesses and suppliers with regards to improved broadband services in Very Hard to Reach areas

6.1 Current Evidence on Barriers

The presence and availability of networks is a fundamental barrier to the adoption of improved broadband services. Information is already available to the government on the extent to which broadband services are available to end-users, gathered through:

- Ofcom’s Connected Nations reports (based on data provided by operators)

- public disclosure and investor releases by operators

- third party data sources, including proprietary reports

- information provided through consultations and public reviews

The extent and quality of data available to the government on network availability does vary in quality and extent. For example:

-

data on ‘fixed wired’ broadband networks is substantial and detailed, usually to the premises level

-

data on ‘fixed wireless’ networks is less detailed, and by its nature reliant on modelling assumptions. It is more typically predictive than ‘measurement’ based. Less speed/capacity data is also included than in ‘fixed wired’ network reporting

-

data on independent wireless networks is substantially less detailed and limited to a single speed. In many cases, smaller operators do not provide such data to Ofcom through the Connected Nations data gathering process

-

substantive data on broadband delivery through non-terrestrial (for example, satellite) provision is much more limited, and provided on a case-by-case basis by satellite providers

Information on other barriers is also relevant to this call, and some information on this is available to the government, including;

-

pricing of ongoing services: Generally, price information is in the public domain, though the degree to which prices in remote rural and Very Hard to Reach locations are influenced by lower use of wholesale offerings (and thus a smaller choice of retail ISP offerings) is complex to assess

-

pricing of infrastructure installation costs: More limited information is available on the cost of installation of services to consumers, where required, given that these are often bespoke installations and private contractual agreements between consumers/businesses and telecoms suppliers

-

degree of engagement with voucher schemes: Government is aware of the level of applications for, and delivery of connections supported by voucher schemes in uncommercial areas. However, these applications are only visible to the government once the applicants successfully find a supplier. The main exception to this is areas covered in particular by the Broadband Upgrade Fund[footnote 31] pilot run by BDUK in 2020/2021

-

the extent of engagement with Universal Service Providers: Some information is provided in mandatory reporting by BT and KCOM, under the conditions laid upon them by Ofcom as part of the broadband USO

-

financial investment incentives: Engagement with suppliers and private debt/equity providers, as well as activity linked to investments made by the government (such as the Digital Infrastructure Investment Fund) or through procurements provides some information on the availability of capital to the sector, and the investor positions on risk and return

-

capital and operational cost of networks: Substantial detailed data is available to the government on the cost of network infrastructure and the cost of running network infrastructure. However, less information is available on newer technologies, and some costs (and techniques) are substantially different in remote rural areas.

The Department receives qualitative evidence through correspondence from MPs and their constituents regarding the barriers they face in improving their broadband connection. The most common barriers to consumers are:

-

high quotes are given by broadband providers

-

information on future builds or current availability is not clearly available

-

general lack of infrastructure, e.g. premises too far away from the cabinet, no/intermittent 4G signal

-

the premises has missed out or been excluded from previous network build

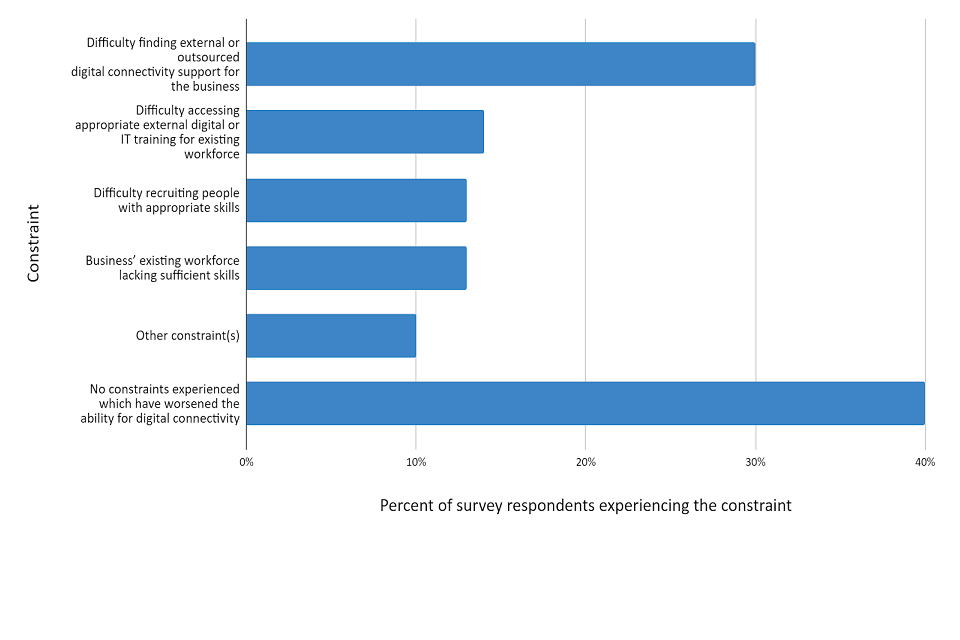

Figure 6.1: Rural businesses’ constraints to going digital

Source: Rural England

6.2 Why we are calling for further evidence

We wish to assess how best to remove barriers to delivering improved broadband to consumers in Very Hard to Reach locations, to realise its benefits without distorting any existing competitive commercial markets. To do this we require evidence that:

- helps to confirm our existing data on the availability of networks

- provides more information on the extent of upfront costs faced by consumers in Very Hard to Reach areas

- illuminates any price and non-price barriers that are substantially different for users located in remote rural areas compared to rural locations in general

- provides further information on the experience of consumers and businesses with existing schemes in Very Hard to Reach locations

6.3 Summary of questions on barriers, by type of respondent

The evidence we are seeking on barriers to delivering improved broadband in Very Hard to Reach areas is set out below, arranged by respondent type. The questions below are summaries of those in the online survey, where the questions may be worded differently for analysis purposes.

Table 6.2: Questions on barriers

| We are asking consumers: | |

| C1 | If you do not use a home broadband service, why not? |

| C2 | Have you had to change your use of applications or browsing behaviour as a result of limitations of your broadband service? |

| C3 | Have you changed package, supplier, or technology as a result of constraints with your broadband service in this remote location? |

| C4 | If you changed technology to improve broadband, which technology did you change from and to? |

| C5 | Have you explored the use of fixed wireless services in your area? |

| C6 | Have you explored the use of satellite services for broadband? |

| C7 | Where relevant: ○ Explored new broadband services that are expected to arrive in your area ○ Explored a community broadband scheme (such as a Community Fibre Partnership) ○ Applied for a broadband connectivity voucher (from either the UK government, your Local Authority or a Devolved Government scheme?) ○ Have you been advised (in writing or otherwise) that you are potentially eligible to request an improved connection through the Broadband Universal Service obligation (provided by BT or KCOM, in Kingston upon Hull only)? |

| We are asking businesses: | |

| C8 | Have you experienced any of the following constraints in adopting digital connectivity for your firm, beyond any connectivity challenges: ○ Finding external digital support ○ Accessing appropriate digital training ○ Recruiting people with digital skills ○ Existing workforce lacks digital skills ○ Other |

| C9 | Have you changed package, supplier, or technology as a result of constraints with your broadband service in this remote location? |

| C10 | If you changed technology to improve broadband, which technology did you change from and to? |

| C11 | Have you explored the use of fixed wireless services in your area? |

| C12 | Have you explored the use of satellite services for broadband? |

| C13 | Where relevant: ○ Explored new broadband services that are expected to arrive in your area○ Explored a community broadband scheme (such as a Community Fibre Partnership) ○ Applied for a broadband connectivity voucher (from either the UK government, your Local Authority or a Devolved Government scheme?) ○ Have you been advised (in writing or otherwise) that you are potentially eligible to request an improved connection through the Broadband Universal Service obligation (provided by BT or KCOM, in Kingston upon Hull only)? |

| We are asking market participants: | |

| C14 | What factors make it challenging to invest in remote rural areas? |

| C15 | How do you consider ‘Protected Landscapes’ (for example, National Parks, AONB) when making your investment decisions? |

| C16 | How would you describe the disposition of your investors towards investments in remote rural areas? |

| C17 | What do you think the willingness to pay for services in remote rural areas is in comparison to more urban areas? |

| C18 | How much higher or lower do you estimate the average capital costs to be in remote rural areas in comparison to more urban areas? |

| C19 | How much higher or lower do you estimate the average operational costs to be in remote rural areas in comparison to more urban areas? |

| C20 | How would you describe your level of access to information on where underserved premises in remote rural areas of the UK are located? |

| C21 | How would you describe staffing and recruitment challenges to support remote rural network deployment? |

| C22 | Are there other regulatory or administrative barriers to you expanding your offering/presence in remote rural areas? |

| C23 | To what extent is the availability (or otherwise) of competitive provision of backhaul services generally an impediment to your deployment of otherwise economic solutions to Very Hard to Reach premises in remote rural locations? |

| C24 | To what extent are any absent submarine cable (or microwave) links to islands an impediment to your deployment of otherwise affordable solutions to Very Hard to Reach premises located off the UK mainland? |

| C25 | To what extent is the availability (or otherwise) of appropriate access to power supplies services generally an impediment to your deployment of otherwise economic solutions to Very Hard to Reach premises in remote rural locations? |

| C26 | Previous and upcoming legislative changes notwithstanding, to what extent is the availability (or otherwise) is access to potential site locations an impediment to your deployment of otherwise economic solutions to Very Hard to Reach premises in remote rural locations? |

| C27 | Is your organisation registered as a supplier as part of the following schemes and procurements? ○ Superfast Broadband scheme ○ Gigabit Voucher Scheme ○ Public Sector Hub upgrades & Gigabit-Capable Connectivity DPS ○ Market engagement for upcoming UK Gigabit Programme Gigabit Procurements ○ other |

In addition, we are seeking evidence from representative organisations on this topic. Responses from such organisations may address any of the themes above in broad or specific terms.

Section 7 - Topic D: Approaches to supplying improved broadband in Very Hard to Reach locations

In this section we:

- summarise the sources of current evidence already available on approaches to supplying improved broadband, including examples of technologies employed in other countries to address this challenge. This includes:

- new fibre technologies

- new wireless technologies

- space-based technologies

- high altitude platforms

- explain why we are calling for further evidence on these approaches

- summarise our key questions in this call for evidence, which are primarily addressed to market participants, including telecommunications infrastructure and service providers, and telecommunications equipment vendors.

- do not set out any policy proposals for supplying improved broadband in Very Hard to Reach locations

- are not seeking responses from consumers and business users, due to the technical nature of the topic

7.1 Current Evidence on Approaches

Examples from other countries illustrate that new technology approaches can transform the delivery of improved broadband to Very Hard to Reach locations. However, some technology solutions require compromises in performance and capacity, carry substantial commercial, financial and technical risks, and may have uncertain long-term affordability.

New fibre technologies

Since its invention in 1952 in the UK by Narinder Singh Kapany at Imperial College London, innovation in materials and manufacturing - as well as installation techniques - have dramatically reduced the cost of using fibre in telecommunications networks. Its stability, resilience and upgradability (by replacing active electronics) make it ideal for future-proof networks, wherever deployment costs allow.

Innovation in fibre technologies continues, and as widespread FTTP rollouts continue worldwide, new approaches continue to reduce costs. For example:

-

Connectorisation: connectorisation is becoming increasingly popular as a method to simplify the construction of networks and minimise the skill level and time required to otherwise manually ‘splice’ different cables together. This is a key evolving technology, given skill and manpower shortages in the industry as a result of many rollouts occurring at the same time.

-

Large core fibres (LCF): some researchers are experimenting with larger fibre cores that whilst requiring more material, can require less installation skill and potentially lower transmission losses. Small diameter fibres are not always the best solution in some parts of the network even though they take up less space and weigh less, because very light cables can be more prone to damage by wind in aerial deployments on poles.

-

Hollow core fibres: industrial and academic research[footnote 32] has in recent years explored the use of fibres with a hollow core, which may exceed the performance of solid glass fibres, particularly in short pulses. Lumenisity Ltd[footnote 33] (a spin-out of the University of Southampton), and NKT Photonics[footnote 34] are both working with hollow core technology.

-

Fibre-in-water: the inert nature of glass/plastic fibre means that it can be deployed inside (as well as alongside) pipes carrying other mediums. The UK hosted several of the earliest commercial networks employing fibre deployed through waste-water mains (including early start-up H20 Networks’ academic campus deployments in North Wales, and Scottish Water deployments in Fife). More recently fibre in potable (drinking) water technologies have been developed, which allow FTTP deployment through existing pipes, minimising for example the cost of trenching in suburban environments (see for example CRALEY Group[footnote 35], assisted by a government Innovate UK grant). This technology is also deployed in the US and Spain.

Given the pace of innovation and the falling price of some deployment technologies, we are seeking further evidence in this field to inform policy development and our costing tools.

New wireless technologies

Wireless technologies continue to advance rapidly, and the performance of commercial systems based on 4G, 4G LTE and 5G standards continue to rise. The availability of new radio spectrum and advances in technology mean that wireless networks can deliver speeds that are similar to fixed broadband networks. 5G in particular brought Massive-MIMO and a much wider range of frequency bands into scope, subject to the availability and appropriate licensing of such bands in many countries. 5G also supports carrier aggregation (where a device remains connected to two different bands at the same time) and dual connectivity (where a device can draw on bandwidth from multiple types of networks). Further rapid development and innovation is expected.

Low and mid band frequency developments

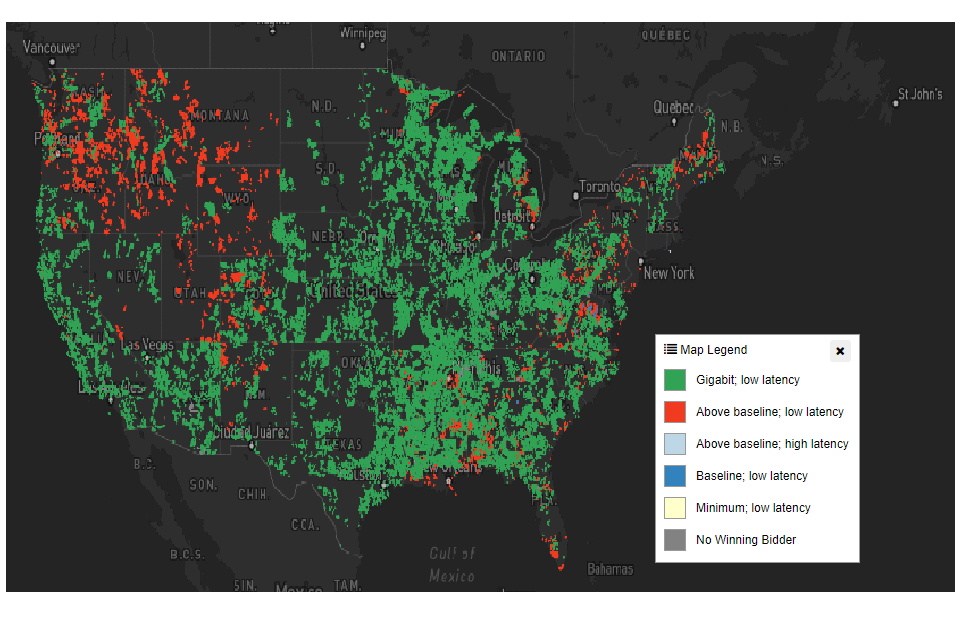

Ofcom is conducting a further auction[footnote 36] of 5G-compatible bands, including 80 megahertz in the 700MHz band and 120 megahertz of spectrum in the 3.6 GHz-3.8 GHz band. These frequencies offer a substantial range due to their propagation characteristics and the greater availability of spectrum in these bands could have a substantial impact on the reach of 4G or 5G networks deployed using them in the UK. The outcome of the principal stage of this auction was announced by Ofcom on 17 March[footnote 37], with assignment stage results to follow. This auction is separate to the previous award of 5G compatible spectrum at 3.4GHz in Ofcom’s auction in 2019.

Higher frequency developments

In the last two years, a selection of radio solutions have become commercially available based on the 802.11ad (WiGig) standard and supporting the V-band (60GHz) and E-band (70-80GHz). Many of these technologies are gigabit-capable and include point-to-point and point-to-multipoint solutions from vendors including Adtran, Adwin, Aviat, Cambium, MicroTik, Radwin, Siklu and Ubiquiti. Many of these products are already technically compliant with the conditions of some of the government’s gigabit-capable investment programmes. Facebook’s Terragraph is also a V-band multi-node solution.

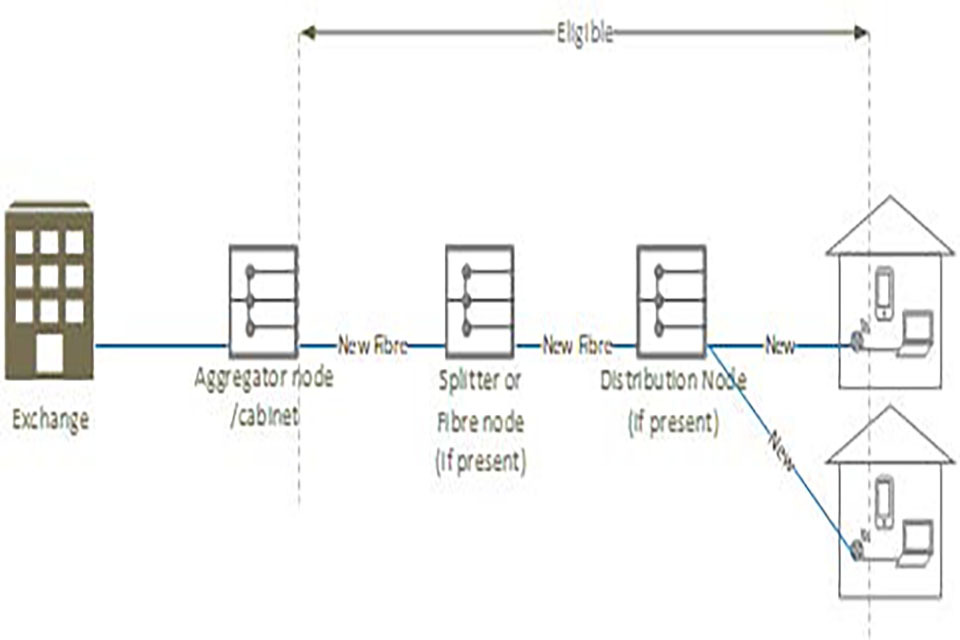

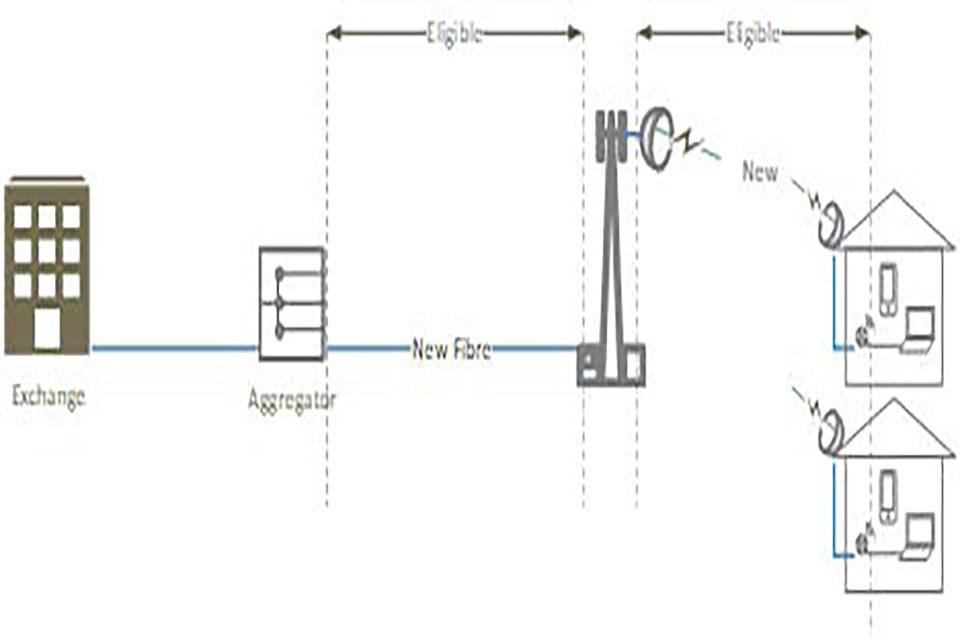

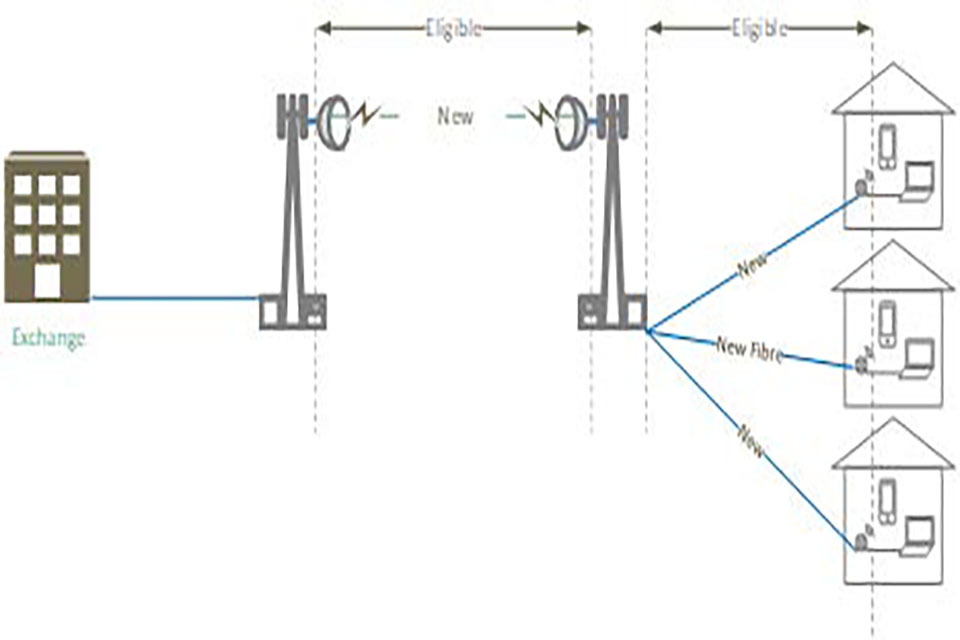

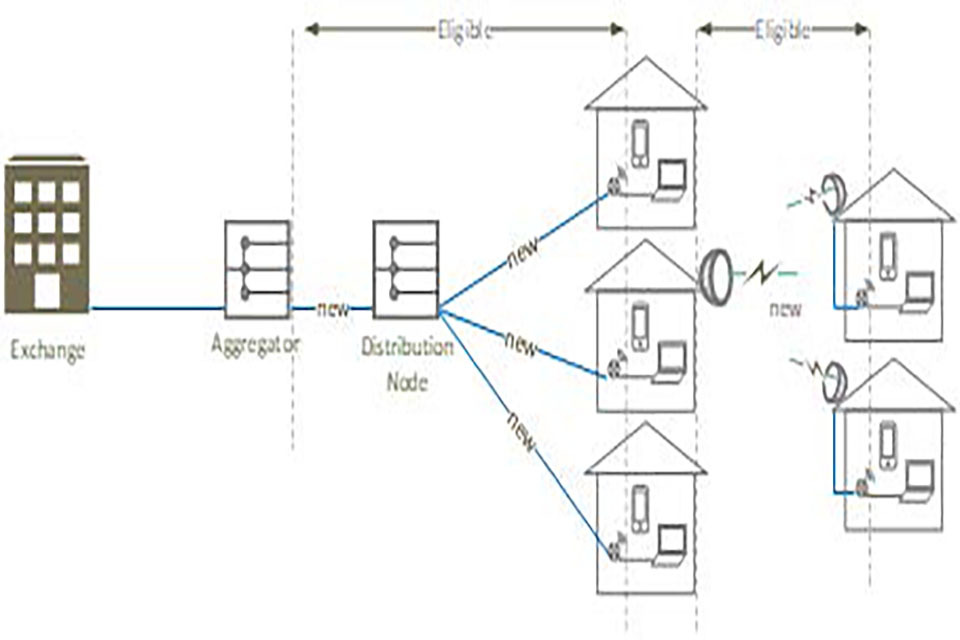

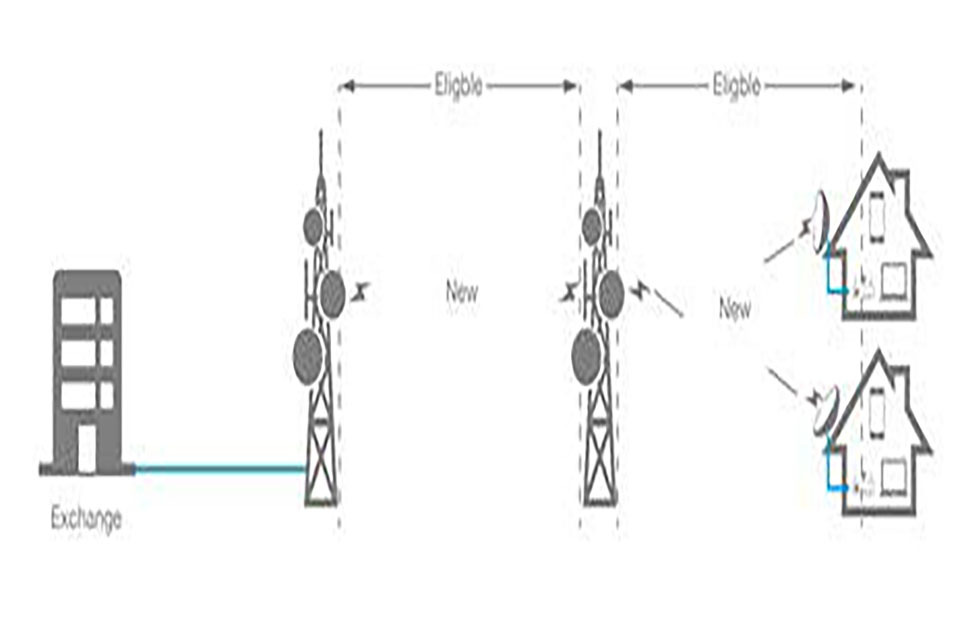

Figure 7.1: Topologies for wireless and hybrid wireless gigabit networks

1. Typical Deployment (Fibre)

2a. Example Deployment (Wireless)

2b. Example Deployment (Wireless)

2c. Example Deployment (Wireless)

2d. Example Deployment (Wireless)

Note: For further details, see BDUK supplier guidance for gigabit-capable deployments

Work on the later 802.11ay WiGig standard has proceeded further recently,[footnote 38] reaching conditional 802 EC approval in November 2020, pending IEEE Revision Committee (RevCom) and the Sustainability Accounting Standards Board (SASB) approvals expected in Q1 2021. This standard enables at least one mode of operation capable of supporting a maximum throughput of at least 20 Gbps while maintaining or improving the power efficiency per station. It also defines operations for license-exempt bands above 45 GHz while ensuring backward compatibility and coexistence with legacy directional multi-gigabit stations (defined by IEEE 802.11ad-2012 amendment) operating in the same band.

Pre-standard equipment based on 802.11ay is already available, based on chipsets from Qualcomm, who also suggest that as of 2021 commercial 5G mmWave services are now available in more than 55 cities in the US and 160 areas of Japan. However, the potential timing of availability of full standard equipment in substantial volumes in the UK is unclear.

These technologies are usually range limited but are of substantial interest for both urban area deployments and for connections in rural and remote environments where final premises are in small clusters, and the connectivity barrier for fixed gigabit services is related to backhaul availability or access issues that prevent fibre build. Whilst much of the initial attention on mmWave technology has been centred on urban and suburban deployments, Qualcomm and Ericsson have also demonstrated the use of 4G/5G standards for extended range;

-

With U.S. Cellular having a commercial network in Wisconsin, achieving a 5+ kilometre range while sustaining sub-Gigabit 5G mmWave FWA data rates (of around 100+ Mbps)[footnote 39]

-

With NBN in a rural location in Australia, achieving a 7.3km line of light link using 28GHz mmWave for 5GNR, another LTE radio for the anchor band and Qualcomm directional antenna.

-

With TIM in Italy, achieving speeds of 1 Gbps on 26 GHz millimetre-wave (mmWave) frequencies over distances of 6.5 kilometres on TIM’s live network. This again used a 5G mmWave high power antenna-integrated radio, Casa Systems’ AurusAI 5G mmWave CPE, and a Qualcomm antenna.

OpenRAN

OpenRAN initiatives are driven by aspirations by some industry participants for vendor diversity (greater choice and resilience in the supply chain), extreme automation for better economics for cloud-based technologies and open interfaces to allow programmable RANs and near-real-time control of radio resources.

The OpenRAN architecture creates a multi-vendor, multi-operator, open ecosystem of interoperable components for the various RAN elements and from different vendors. There is already widespread interest in OpenRAN from many operators, including Rakuten (Japan), Vodafone Group (a co-chair of the OpenRAN project group), Telefonica, Deutsche Telekom (Germany), Sprint (US), and Etisalat (UAE).

OpenRAN is particularly relevant in a rural context, where low total cost of ownership is key to ensuring that base station economics achieve ‘break even’ as early as possible. The vast majority of the tens of thousands of trial sites for OpenRAN are located in rural areas, in both developed and developing countries. Vodafone, for example, committed in November 2020 to the deployment of OpenRAN at 2,600 cell sites across Wales and the South West of England.[footnote 40]

Further information on OpenRAN is available in particular from the Telecoms Infrastructure Project (TIP)[footnote 41] and the OpenRAN Alliance,[footnote 42] as well as third party commentators.[footnote 43]

Dynamic Spectrum Allocation

This technology combines shared access to spectrum with management via new tools including AI and distributed ledgers. Dynamic spectrum management tools allow for more efficient use of spectrum through enhanced spectrum sharing, and could be particularly beneficial to enable the provision of wireless broadband services in remote and rural areas where pockets of spectrum are potentially underutilised.

Shared access licenses are already available in the UK, in particular in the 1800 MHz,

2300 MHz, 3800 - 4200 MHz band and at 24.25-26.5 GHz (in this band limited to indoor low power licences),[footnote 44] though uptake has been limited so far.

This technology is already available but rapid development is expected:

-

Dynamic spectrum access techniques are already used in the UK in so-called TV White Space, which is unused spectrum in the frequency bands used for Digital Terrestrial Television broadcasting. This was tested during the DCMS-supported 5GRIT (5G Rural Integrated Testbed) pilot trials, which involved King’s College, London and commercial operators Quickline and Broadway Partners, and earlier activity in Argyll and Bute.[footnote 45]

-

In 2019, dynamic spectrum-sharing[footnote 46] was demonstrated in Ericsson’s R&D lab in Ottawa, Canada using an Ericsson macro radio that supports both 4G and 5G, along with a mobile test device powered by the Qualcomm Snapdragon X55 5G Modem-RF System, and a commercial LTE smartphone.

-

In the United States, the Citizens Broadband Radio Service (CBRS) introduced a three-tiered spectrum sharing framework underpinned by dynamic spectrum access technology to enable a variety of users and innovative use cases to access 3.5 GHz spectrum, while protecting government and other incumbent users.

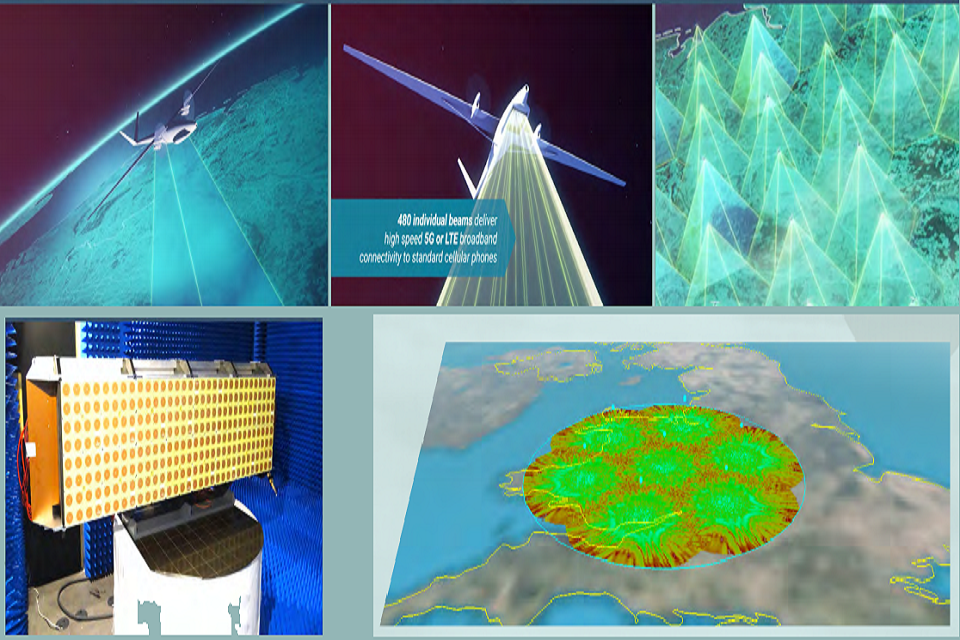

Space-based technologies

Initial generations of communications satellites relied on high geostationary orbits, and the 2000s saw a raft of new broadband satellite constellations trying to achieve commerciality. Recent generations of satellites are utilising new orbits that are closer to the Earth to offer new capabilities. Advances in antenna design, as well as the availability of new spectrum bands, has ushered in an era of ‘High Throughput’ satellites that employ steerable spot beams to concentrate and enhance the availability of capacity within specific coverage areas.

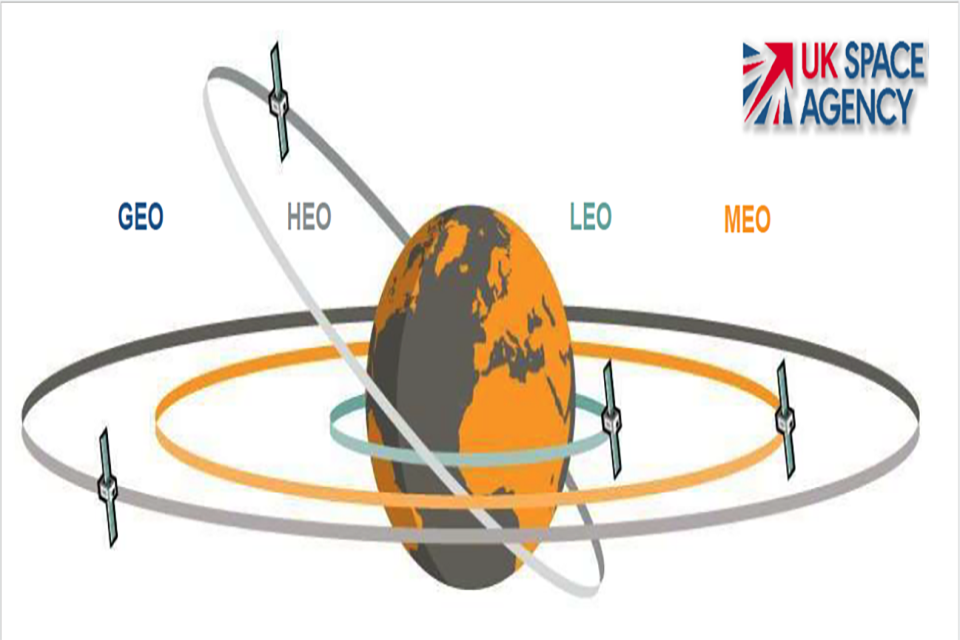

The following information details the different types of satellite orbit.

Figure 7.2: Orbits

Source: UK Space Agency

| Satellite Orbit | Orbit Description | Examples (non-exhaustive) |

|---|---|---|

| GEO (Geosynchronous Orbit) | At approx. 35,800km. Typically communication, TV and weather satellites, they stay over the same point of the equator by matching the direction and speed of the Earth’s rotation. This means that from the ground they appear motionless. | Viasat-2Inmarsat-4GalileoEutelsat KonnectIntelsat EPIC |

| HEO (High Elliptical Orbit) | Elliptical orbits speed around the bottom of their path, and slow towards the top, allowing them to spend more time in sight of a certain area. | Previous Sirius (satellite radio) satellites. |

| MEO (Medium Earth Orbit) | At approx. 20,000km. These are mainly GPS and other positioning satellites, often networked together to create a ‘constellation’, allowing broader coverage. | GPSO3bO3b mPower |

| LEO (Low Earth Orbit) | Between 180 and 800km. Typically Earth observation satellites, whose close orbits enable better visibility of the Earth’s surface. | Iridium / Iridium NEXTTelesat LightspeedStarlink (Space-X)OneWeb (Bharti, UKG)Project Kuiper (Amazon) |