Financial case study: commercial woodland over 100 hectares

Find out how creating a commercial woodland over 100 hectares stacks up with income through grants, timber, and carbon credits

Understanding woodland financials

Woodland creation is a long-term commitment that can diversify your income. Planting the right tree in the right place, can provide new and reliable income streams and far-reaching benefits for your land, your local community and the environment.

Potential income from a new woodland is dependent on several factors. This includes species, how quickly trees grow, spacing, how long before harvesting occurs (rotation length), woodland size, and the location of your woodland – all of which can vary considerably resulting in several possible combinations and outcomes.

This case study shows how a real landowner created productive woodland. All figures are rounded to the nearest £100 and accurate as of September 2024.

Creating a commercial woodland that benefits nature recovery

A landowner in the north east of England had large area of semi-improved grass land. To meet their management and financial objectives, they created a large-scale productive woodland across approximately 100 hectares of this land. This woodland will also provide wider benefits to society.

The landowner applied for the Woodland Creation Planning Grant (WCPG) and the England Woodland Creation Offer (EWCO) to help fund the project. Over time, the new woodland will:

- increase biodiversity

- sequester carbon

- develop productive stands of broadleaf and conifer species

Additionally, the landowner could benefit from private finance through the Woodland Carbon Code (WCC) and timber markets.

A treemap chart shows the income breakdown of EWCO and WCPG grants. Maintenance: £614,800. Standard costs: £426,800. Woodland infrastructure: £117,700. WCPG: £30,500. Additional contributions - nature recovery: £17,000.

Woodland Creation Planning Grant (WCPG)

Designing new woodland requires bringing together your objectives with the site’s context, suitability; and environmental, economic, and social factors into a UK Forestry Standard (UKFS) compliant plan. This plan helps secure regulatory approval for converting land to woodland.

WCPG provides funding to help cover the cost of producing a UKFS compliant woodland creation design. This project received £30,500 in WCPG grant payments.

England Woodland Creation Offer (EWCO)

EWCO supports the establishment of new woodland by offering financial support for capital costs to plant and protect young trees, costs for maintaining those trees for up to 15 years after planting and installing infrastructure to manage your woodland.

The grant recognises the public and environmental benefits that woodlands bring through stackable payments called Additional Contributions. These encourage planting the right tree in the right place for the right reason.

This 100+ hectare woodland project will receive £1,206,300 (£11,800 per hectare) in EWCO grant payments over 15 years following initial capital work. This includes standard costs, maintenance payments, Additional Contributions and infrastructure payments.

Standard costs for capital work

This project received a payment of £426,800 for capital items needed to make the woodland happen – this covers the cost of buying trees and tree tubes, fencing, gates and other essentials, which offsets most of the establishment costs for this woodland. The highest expenses were deer fencing, purchasing and planting a total of 550,000 trees.

Maintenance payments

The landowner will receive maintenance payments of £400 per hectare for 15 years after planting, totalling £614,800. These payments help with the cost of tree replacement, weeding around the trees and the management of open space within the woodland.

Land managers should expect some tree losses in the early years of planting and plan for replacements. Appropriate maintenance and protection will help minimise these losses. For a project of this scale, up to 165,000 replacement trees might be needed in the first few years.

Additional contributions

EWCO provides extra stackable payments for woodland projects that provide wider benefits to people and the environment. Eligibility depends on the woodland’s design and location.

Woodland projects focused on timber production can deliver a range of public benefits. This new woodland qualified for an Additional Contribution for nature recovery benefits.

The landowner planted approximately 15 hectares of native woodland within the scheme. Converting semi-improved grassland to native woodland in these areas will improve biodiversity, which qualified for a one-off low nature recovery payment of £17,000.

Income from timber

The demand for wood products in the UK hugely outweighs domestic production. We import over 73% of our timber, which was valued at £9.0 billion in 2022, making the UK the second largest net importer of forest products in the world1. This strong market demand for timber creates income opportunities for woodland owners.

This new woodland could generate income from timber in 2 ways:

- the sale of standing trees, usually via an agent, that is harvested by the buyer

- the sale of timber harvested by the woodland owner and sold as accessible from the roadside

This case study focuses on sale of standing timber over a 50-year period. The woodland is expected to produce 115,400m3 of timber through:

- regular thinning every 5-years (starting year 14)

- a clear fell of 27 hectares of conifer woodland (in year 34)

Using an average standing price of £35/m3 for conifer timber, the present value from timber income is estimated to be £1,426,704 (£13,900 per hectare).

Price assumptions

We used £35/m³ based on the average timber price over the last 5 years. Timber prices have the possibility to be higher than assumed in this case study due to the following reasons:

- conifer timber prices have increased 200% over the past 20 years

- future UK timber demand is expected to remain strong

For simplicity, this case study doesn’t account for increasing maintenance costs over time.

Income from carbon

Carbon markets present an opportunity for landowners to generate more income from their land, by selling the additional carbon that new woodlands will sequester to help mitigate the impacts of climate change.

The Woodland Carbon Code (WCC) is the quality assurance standard for UK-based woodland creation projects hoping to generate carbon credits. Woodland creation projects can sell two types of carbon units under the Code:

Pending Issuance Units (PIUs)

These represent estimated future carbon capture. They’re not guaranteed, so can’t be used to report against emissions, but instead allow companies to plan for future offsetting. PIUs convert into WCUs in vintages and at certain points in time, when this occurs the ‘promise’ of future carbon has been verified as converted into actual carbon storage in the woodland.

Woodland Carbon Units (WCUs)

WCUs are verified units that represent one tonne of carbon dioxide that has been sequestered from the atmosphere. Companies purchasing WCUs make statements about their carbon neutrality as soon as they own them. This often results in a higher price per unit than PIUs. These units are independently verified in vintages after planting.

Projects under the code must meet a set of requirements, including a financial additionality test. This test must show carbon finance is necessary to make the project viable, and woodland income (without carbon credits) doesn’t exceed current land use income.

In this case study, the financial additionality test was passed, woodland creation would generate less income than the existing land use without carbon finance. So, the opportunity to join the voluntary carbon market could be taken up. To find out more about woodland and carbon, read our woodland creation fact sheet.

For this case study it has been assumed that all carbon units will be sold upfront as PIUs however, landowners can choose when to sell these units possibly speculating on future carbon price rises.

The project was registered and validated under the code and the landowner will verify its progress every 10 years from year 5 onwards, selling all its PIUs up front in Year 5. While landowners can hold credits to potentially benefit from future price increases, this case study assumes all units will be sold upfront as PIUs.

Over the first 35 years, the new woodland is likely to deliver over 30,000 WCUs. Using the average price of successful bids at the Woodland Carbon Guarantee auction in 2024 of £25 and assuming upfront sale in year 5 the estimated income from the carbon market is £768,100 (£7,500 per hectare).

A bar chart shows estimated woodland carbon units (WCUs) for various years. Year 5 estimates 70 WCUs. Year 15: 16,610 WCUs. Year 25: 10,230 WCUs. Year 34: 3,020 WCUs. The total estimates 30,730 WCUs.

How does this compare to agricultural income?

As with any change, there will be some costs associated with the establishment of woodland. For this landowner, who previously used the land for various crops, the main cost is foregone agricultural income.

While it’s impossible to predict agricultural income with certainty over a 50-year period, this case study uses the 5-year average Farm Business Income from the annual Farm Business Survey (FBS) for England and Wales to estimate the income foregone.

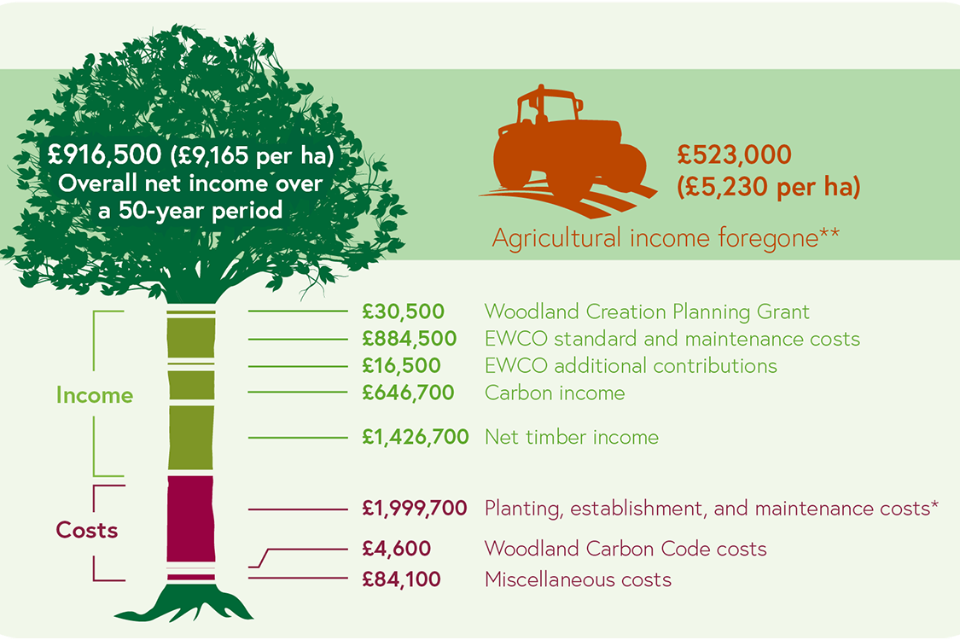

An infographic showing the comparison of net income (including agricultural income foregone) and net income (excluding agricultural income foregone).

| Description of Income | Income | Description of Costs | Costs |

|---|---|---|---|

| WPCG | £30,500 | ||

| EWCO standard costs and maintenance payments | £884,500 | Planting, establishment, and maintenance costs | £1,999,700 |

| EWCO additional contributions | £16,500 | ||

| Carbon income | £646,700 | Woodland Carbon Code costs | £4,600 |

| Net timber income | £1,426,700 | ||

| Miscellaneous costs such as insurance | £84,100 | ||

| Agricultural income forgone | 523,000 | ||

| Total income | £3,004,900 | Total costs | £2,088,400 |

When will this income be seen?

While EWCO payments are made up front once planting is completed, followed by 15 years of maintenance, income from timber is realised at different time periods.

The table below displays the timeline of net income over a 50-year period. When looking at net income over time it can be determined that this productive forestry site is likely to break even between year 31 and 35 when the highest amount of timber income is received.

| Period | Income | Costs | Net Income |

|---|---|---|---|

| 0-10 | £1,560,700 | £1,985,000 | -£424,300 |

| 10-20 | £366,300 | £35,600 | £330,700 |

| 20-30 | £378,300 | £25,100 | £353,200 |

| 30-40 | £800,200 | £372,100 | £428,000 |

| 40-50 | £13,000 | £12,300 | £700 |

Wider benefits of woodland creation

Well-managed woodlands can not only offer an additional income stream, but they can also help you cut costs, for example, you could choose to heat buildings with wood fuel harvested from your woodland. Trees offer much more than just commercial benefits and carbon capture: woodlands can support our health and well-being, improve air and water quality, boost biodiversity, protect crops and livestock, prevent nutrient loss and soil erosion, and alleviate flooding.

Discover the benefits of planting trees and learn about the positive impact trees can have on your business in our fact sheet: woods mean business.