Application process

This section includes the key things you need to know and the information you will need before applying for the FETF.

This section includes the key things you need to know before applying for the FETF.

How and when to apply?

Applications are made online via the ‘FETF Application Portal’ which can be accessed from the Farming Investment Fund page on GOV.UK. Applications can be made between 16 November 2021 to midday 7 January 2022. Applications will not be accepted once the portal has closed.

There is a YouTube video which demonstrates how to complete the online application on GOV.UK.

The earlier you submit your application, the more time you will have to address any errors and submit a new application.

Are your details up to date? And registering on Rural Payments.

Some of the details needed when making your application must exactly match those on Rural Payments, so check these are correct before starting your application. If not, update them. You can find guidance on updating your details in the Rural Payment service on GOV.UK.

You must make sure that your Rural Payments record is up to date for your:

- email address

- business name

- business postcode

- full name

- permissions

To check this on Rural Payments you will need to find your main SBI and a Customer Registration Number (CRN) if you get other payments from us, like the Basic Payment Scheme. You will find these on any letters you have had from us. To find out how to find your CRN in the Rural Payments service call the Rural Payments helpline on 03000 200 301.

If you are an agent applying on behalf of a customer, you must make sure that you have the correct permissions in place in Rural Payments. Carry on reading for information on permissions, or see our YouTube clip on how to add someone to your business and amend your permission on the Rural Payment service

If you are not registered on Rural Payments, then you will need to register. To register for the Rural Payments service, please call our helpline on 03000 200 301 and select the options to speak to the Rural Payments team.

For information on how we handle personal data, go to GOV.UK and search Rural Payments Agency personal information charter.

How to check your details on Rural Payments

To check this on Rural Payments you will need to find your main SBI and a CRN if you get other payments from us, like the Basic Payment Scheme. You will find these on any letters you have had from us.

Once logged in you can check and update the following if required:

- that your CRN is linked to your SBI. If you are unsure how to find your CRN, call the Rural Payments helpline on 03000 200 301

- that your email address is correct

- that your business name, address and postcode are up to date

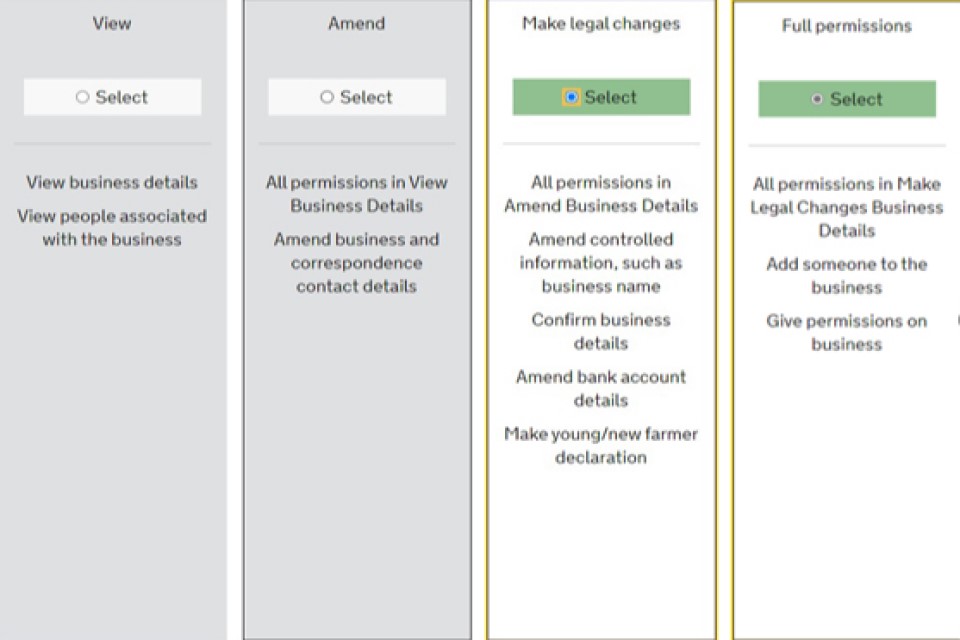

- that the CRN you intend to apply with on the application portal has a permission level of either ‘Make legal changes’ or ‘Full permissions’

You can find guidance on updating your details in the Rural Payment service on GOV.UK.

Registering your bank or building society account for payment

For the business to receive a payment you will need to register bank or building society account details. You can only do this over the phone – call us on 03000 200 301 and choose the ‘bank’ option. For security reasons, we will not call you and ask for bank or building society details. If we do need to contact you, you will be asked to call the helpline on 03000 200 301.

Permissions

You can give other people access to your business in Rural Payments. There are different levels of permission depending on what you want them to be able to do. You can only do this if you have ‘Full permissions’ yourself and the other person is also registered. This is linked to the CRN number.

See our YouTube clip on how to add someone to your business and amend your permission on the Rural Payment service.

If you are an agent applying on behalf of a customer or not the customer registered on Rural Payments, you must:

- use your own CRN number

- have permission to ‘Make legal changes’ for the business in Rural Payments

The CRN you intend to apply with on the application portal has a permission level of either ‘Legal changes’ or ‘Full permissions’.

You can find guidance on updating your details in the Rural Payment service on GOV.UK.

Refundable deposits

When applying, to help reduce possible supply issues, a supplier / manufacturer may agree to reserve your Item with a refundable deposit. You’ll need them to agree the deposit will be refunded if you are unable to proceed with the purchase.

The refundable deposit is a form of security to guarantee the manufacture and/or supply of an Item, and not to pay the whole amount. The invoice for the Item must state ‘refundable deposit’ for that section of the payment. Paying a refundable deposit is done entirely at your own risk, because we cannot guarantee your application will be successful due to the competitive nature of the grant (see below).

If you are successful and awarded a grant the following condition must be met at the time you submit your claim, or it will be rejected:

- The refundable deposit is paid by you in advance and is not for more than 40% of the total cost of the Item.

- The refundable deposit cannot have been paid before the opening of the application window on 16 November 2021

Information you will need

A list of the Items you want to apply for funding for in each of the Item categories. Annex 3 provides a full list of available Items you can apply for and Annex 4 provides a quick reference breakdown of Items by agricultural type, horticulture, and forestry sector.

To apply you will need the information listed below, which must match exactly the details on Rural Payments:

- Your Customer Reference Number (CRN)

- Single Business Identifier (SBI)

- Email address

- Business name

- Business address and postcode

- Your personal record on Rural Payments must have been set up with a permission level of ‘Make legal changes’ or ‘Full permissions’ for the business you are applying for.

You will also need the following information (if relevant):

- Correspondence email address

- Companies House Number if you are a Limited company

- VAT Number if registered for VAT

- The amount of land in hectares of any holdings you farm or manage, associated with your SBI

- An estimate of how many animals you keep, which species, sex and age

- County Parish Holding (CPH) number if you keep animals

- Available Items you want listed in Annex 3

- The number of people you employ

- If you are a woodland / forestry owner, the relevant land parcel IDs

If you are an agent applying on behalf of a customer, you must:

- Use your own Customer Reference Number (CRN)

- Have a permission level for the business on Rural Payments of ‘Make legal changes’ or ‘Full permissions’

Making your application

Once you have all the information you need to make your application you should do so using Farming Equipment & Technology Fund on GOV.UK.

Your online application should take no more than 20 minutes to complete. Please complete all relevant questions and do not move away from the webpage or close the internet browser until you have submitted your application. You will not be able to save your application and return to it later.

If you enter information which is incorrect or in the wrong format, a prompt will appear telling you how to correct this. You will not be able to continue until you have added the information needed.

For help completing the online application you can view our YouTube video How to apply for the Farming Equipment and Technology Fund.

If you make a mistake on the portal or need to make any changes

If you submit your application and realise you have made a mistake before the deadline, you can submit a new application. If we receive more than one application with the same SBI number, we will only consider the most recent application in each round.

Withdrawing an application

You can withdraw your application at any time. Please email FETFClaims@rpa.gov.uk to confirm this and tell us your FETF reference number.

Initial application checks

We will assess all applications using the information submitted to check for eligibility. We will complete some initial checks and where possible let you know if your application has not been accepted before the submission deadline.

If your application is not accepted

If the details you provide do not match those in Rural Payments, your application cannot be accepted. This will be because:

- the CRN is not linked to the SBI number

- the email address does not match

- the postcode does not match

- the business name does not match

- you or your agent do not have the correct permissions

If you submit your application before the closing date of midday 7 January 2022, we will tell you if the information provided doesn’t match that in Rural Payments. You can then submit a new application. If the portal is closed and we can’t verify the details from your application against Rural Payments, we will let you know and give you 5 working days to email the correct information to us. You can make no other changes to your application.

Scoring and checking your application

Once the portal has closed, the Items in your application will be scored, based on how they meet the following criteria:

- productivity

- animal health and welfare

- environmental benefits, including biodiversity

You will not automatically get a grant. The grant is expected to be highly competitive, and you are competing against all applications received and scored against the same criteria.

Applications will also be checked to make sure that:

- the applicant is a farmer, horticulturalist, forestry owner or contractor to the industry

- Items are not being funded using funding obtained from another grant

- funding has not been sought for the same Items under the Rural Development Programme for England (RDPE) 2014 - 2020 (for example, LEADER)

- the narrative supplied to ‘why there are no animal numbers’ is valid

- applicants have either land or animals if they have applied for a specific Item, for example, pig Items applied for therefore should have pigs

- Items where the specification limits the number allowed per application aren’t exceeded

When will I hear about my application?

We will decide as soon as possible after the closing date of the application window. We can’t give updates on individual applications until they have all been checked and scored.

Application result

This section details what happens if your application is either successful or unsuccessful.

If your request for a grant is approved

If your application is approved:

- we will email you a Grant Funding Agreement (GFA), which also includes the claim form. You will need to accept your GFA using the online acceptance portal.

- you will then be able to order or buy the Items you applied for funding for. Please order your Items as soon as you have accepted the GFA to allow delivery of your Items before you claim.

- all the Items in the GFA must be purchased if you wish to proceed with your claim. The list of Items in the GFA cannot be changed unless exceptional circumstances apply, and you have RPA’s prior written consent. You must buy, pay for in full (with the funds having left your bank or building society account), install and claim for all Items by midnight on 31 October 2022. If you do not buy and install all the Items you applied for, your whole claim may be rejected.

- you must keep accurate records of all spending (receipts and invoices) for the Items, as you will need to provide these as supporting evidence for your claim. For audit reasons, you must not make cash payments for any grant funded Items.

Grant terms and conditions

The offer of a grant is subject to the terms and conditions set out in:

- Annex 1 of this manual (Fund specific conditions of grant), and

- Annex 2 of this manual (FETF terms and conditions)

Failure to meet the requirements of any relevant legislation or the terms and conditions of the grant could result in the grant being terminated, and/or the recovery of grant already paid.

If your application is rejected

If your application is rejected, we will send you an email to tell you why, for example:

- your application did not meet the minimum score threshold for the round

- we could not verify the link between the CRN and SBI number you provided, using the information held in Rural Payments

- we could not verify the email address or postcode or business name you provided, and it/they did not match those registered in Rural Payments

- we could not verify your agent was authorised to apply on your behalf and the details did not match those registered in Rural Payments

- you have received funding for one or more of the Items in your application under a Fruit and Vegetables Producer Organisation Operational Programme or another RDPE scheme including LEADER or Countryside Productivity

- you are not a farmer, horticulturalist, forestry owner or contractor to the industry

- your contractor’s registered business address is not in England

In all cases your application will be refused if we find that:

- there are reasonable grounds to suspect that the applicant has provided false or misleading information

- the applicant has not met the eligibility criteria for receipt of financial assistance

- the applicant has failed to provide information or evidence requested

If your application of grant support is refused in full, we will tell you why within a reasonable period of time. You can query this decision by contacting us within 60 days from the date you were notified, and providing any additional supporting information you have. We will review our decision and provide a response. If you are still unhappy with the decision you can make a complaint. Full guidance about how to complain is available on our complaints procedure page on GOV.UK.