Things you need to know

Find out how to register and make sure your business details are correct on the Rural Payments system and the application process

Before applying, you must be registered in the Rural Payment service and make sure that your business details are up to date. The details in the Rural Payments service must exactly match your details in the application portal.

When you register for Rural Payments service, you must first verify your identity. Do this online with GOV.UK Verify – as this gives you simple, trusted and secure access to all public services.

If you have any difficulties in registering through GOV.UK Verify, please call our helpline on 03000 200 301 and select the options to speak to the Rural Payments team. Only use this option if your query is about accessing the Rural Payments service. If your query is about eligible items, you should select the option for the Countryside Productivity Small Grants team.

You must have a Single Business Identifier (SBI) number and Customer Reference Number (CRN). We won’t be able to process your application without these.

You will normally have a main SBI and a CRN if you get other payments from us, like the Basic Payment Scheme. You will find these on any letters you have had from us.

Please see our YouTube clip on how to find your CRN number, using Verify.

If you are not registered on Verify, please call the helpline on 03000 200 301 and select the options to speak to the Rural Payments team who can advise you of your CRN.

You must also make sure that your Rural Payments service record is up-to-date for your:

- email address

- business name

- business postcode

- full name

- permissions

All of the above details you input into the portal must exactly match what is on Rural Payments. If your details do not match, your application will not be accepted.

For information on how we handle personal data, go to GOV.UK and search ’Rural Payments Agency personal information charter’.

Permissions

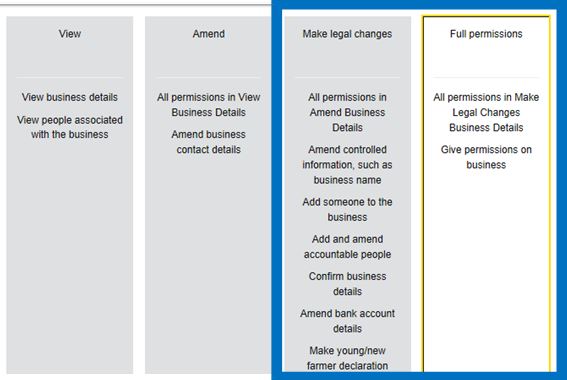

You can give other people access to your business in the Rural Payments service. There are different levels of permission depending on what you want them to be able to do. You can only do this if you have full permission yourself and the other person is also registered.

You must have permission to ‘Make legal changes’ or ‘Full permissions’. This is linked to the CRN number.

If you are an agent applying on behalf of a client, you must:

- use your own CRN number

- have permission to make legal changes for the business in the Rural Payments service

You can find guidance on updating your details in the Rural Payment service on GOV.UK.

Bank Account

For the business to receive rural grants and payments, you will need to register bank account details. You can only do this over the phone – call us on 03000 200 301 and choose the ‘bank’ option. For security reasons, we will not call you and ask for bank details. If we do need to contact you, you will be asked to call the helpline on 03000 200 301.

If your application is approved, you must have sufficient funds to pay for the items in advance of receiving your grant payment as this is paid in arrears.

For the purpose of the CPSG Round 3 grant, this funding is not restricted by Industrial de minimis.

The grant is awarded under Article 17(3) of Regulation (EU) No. 1305/2013 of the European Parliament and of the Council of 17 December 2013 by virtue of an exemption to the state aid rules provided in Article 81 of that Regulation.

You should apply using the online portal on the Countryside Productivity page on GOV.UK. This will be live between 7 October 2020 and midday 4 November 2020. Applications will not be accepted once the portal has closed.

You need to be registered in the Rural Payments service and check that the email address in your ‘Business details’ is used regularly by your business. All correspondence about your application will using this email address.

After you submit your application, you will receive an automatic email receipt from us with a unique 6 digit reference number. Please keep a note of this number and use it in all future correspondence about your application.

Please use your SBI number and Business name to contact us.

Add CPSGEnquiries@rpa.gov.uk to your trusted senders list, and remember to check your spam and junk mail folders.

Please contact us at CPSGEnquiries@rpa.gov.uk, or call 03000 200 301 and follow the options for the Countryside Productivity Small Grant scheme.

If you submit your application and realise you have made a mistake, you will not be able to make any changes.

However, if the application window is still open, you can submit a new application.

If we receive more than one application from a business in a particular round (based on the SBI number provided), we will only consider the most recent application.

You can withdraw your application at any time. Please email CPSGClaims@rpa.gov.uk to confirm this and tell us your unique 6 digit reference number.

The offer of a grant is subject to the terms and conditions set out in:

- Annex 1 of this handbook (scheme specific conditions of grant), and

- Annex 2 of this handbook (CPSG terms and conditions)

Failure to meet the requirements of any relevant legislation or the terms and conditions of the grant could result in the grant being terminated and / or the recovery of grant already paid.