Universal Credit and Child Tax Credit claimants: statistics related to the policy to provide support for a maximum of 2 children, April 2021

Updated 23 July 2021

Main Stories

The statistics show:

- on 2 April 2021, there were 308,520 households that had a third or subsequent child born on or after 6 April 2017 that were not receiving the child element of Universal Credit or Child Tax Credit because of the policy to provide support for a maximum of two children

- 14,000 households that had a third or subsequent child born on or after 6 April 2017 were in receipt of an exception

- the most common reason for an exception was for multiple births (10,160 or 73% of those with an exception)

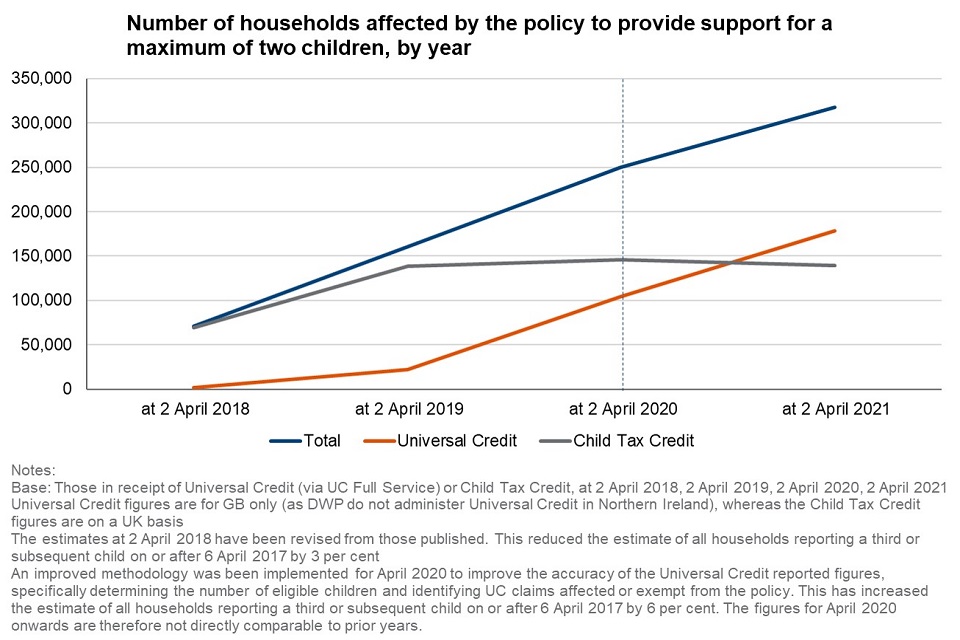

- the number of households affected by the policy has increased since 2018

Guidance

Note that figures may not sum due to rounding.

Guidance on these statistics is available in the background information and methodology document.

Overall numbers of households affected by the policy to provide support for a maximum of two children

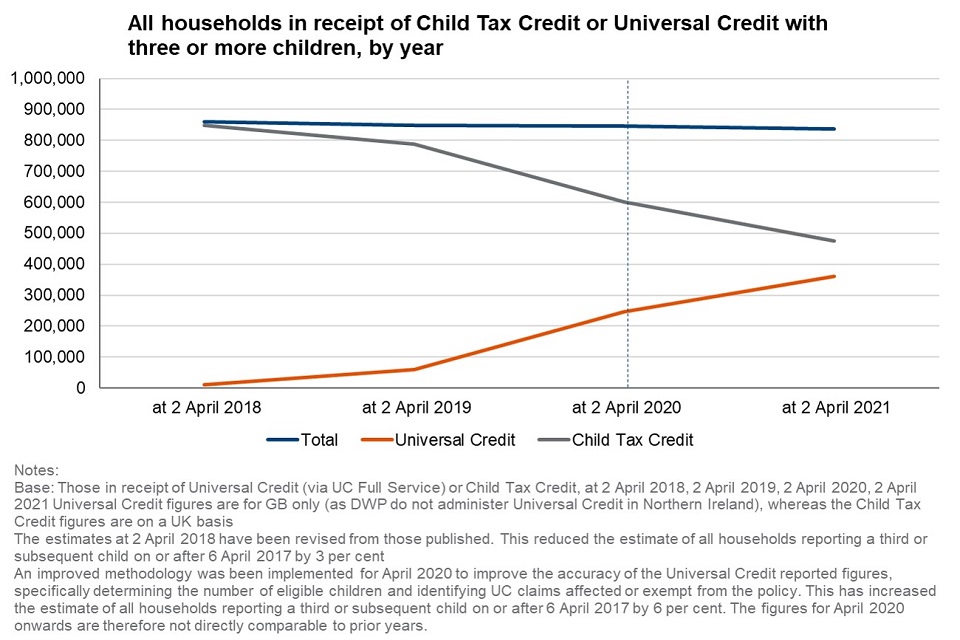

As of 2 April 2021, there were in total around 836,000 households with three or more children claiming either Universal Credit (361,000) or Child Tax Credit (475,000).

Of these, a total of 318,000 households across UC and CTC were affected by the policy to provide support for a maximum of two children, which was introduced in April 2017. Around 309,000 (97%) were not receiving a child element or amount for at least one child in their household. Around 14,000 households (4%) were receiving an exception to the policy.

The majority of households affected were in receipt of UC (56%). The proportion of UC households in the total is expected to rise over time as UC continues to roll out whereas the proportion of CTC households is expected to fall.

The 318,000 households affected by the policy represents 38% of all households with a third or subsequent child claiming UC or CTC. This proportion will grow over time as more households with three or more children will include a child born on or after 6 April 2017.

Total number of households in receipt of Universal Credit or Child Tax Credit affected by the policy to provide support for a maximum of two children, 2 April 2021

| Total | Universal Credit | Child Tax Credit | |

|---|---|---|---|

| All households in receipt of UC or CTC with three or more children | 836,020 | 360,980 | 475,040 |

| Affected households (reporting a third or subsequent child on or after 6 April 2017) | 317,500 | 178,190 | 139,310 |

| Households not receiving a child element/amount for at least one child | 308,520 | 172,630 | 135,890 |

| Households in receipt of an exception | 14,000 | 8,350 | 5,650 |

Note: Universal Credit figures are for GB only (as DWP do not administer Universal Credit in Northern Ireland), whereas the Child Tax Credit figures are on a UK basis.

Note: The affected households figures do not equal the sum of the two components below as there are households both not receiving a child element/amount for one child and in receipt of an exception for another child.

Overall numbers of households with an exception

On 2 April 2021, around 8,000 households claiming Universal Credit and around 6,000 households claiming Child Tax Credit were in receipt of at least one exception.

Across both UC and CTC, more than 10,000 households (73% of all those with an exception) were in receipt of a multiple birth exception. Nearly 2,000 households, or 14% of households with an exception, received a non-parental care exception, including households subject to the ordering provisions of the non-parental care exception where the child is a first or second child. About 4% of households with an exception were received due to adoption and over 1,000 households (10% of households with an exception) received a non-consensual conception exception.

Number of households in receipt of Universal Credit or Child Tax Credit with an exception to the policy to provide support for a maximum of two children, by category, 2 April 2021

| Total | Universal Credit | Child Tax Credit | |

|---|---|---|---|

| Total - Households in receipt of an exception | 14,000 | 8,350 | 5,650 |

| Multiple birth | 10,160 | 6,030 | 4,130 |

| Non-parental care | 1,990 | 1,120 | 870 |

| Adoption | 540 | 460 | 80 |

| Non-consensual conception | 1,330 | 760 | 570 |

Note: Universal Credit figures are for GB only (as DWP do not administer Universal Credit in Northern Ireland), whereas the Child Tax Credit figures are on a UK basis.

Note: The total does not equal the sum of the components as there are a number of households that have exceptions in more than one category. They are counted once in each appropriate category but only once in the total.

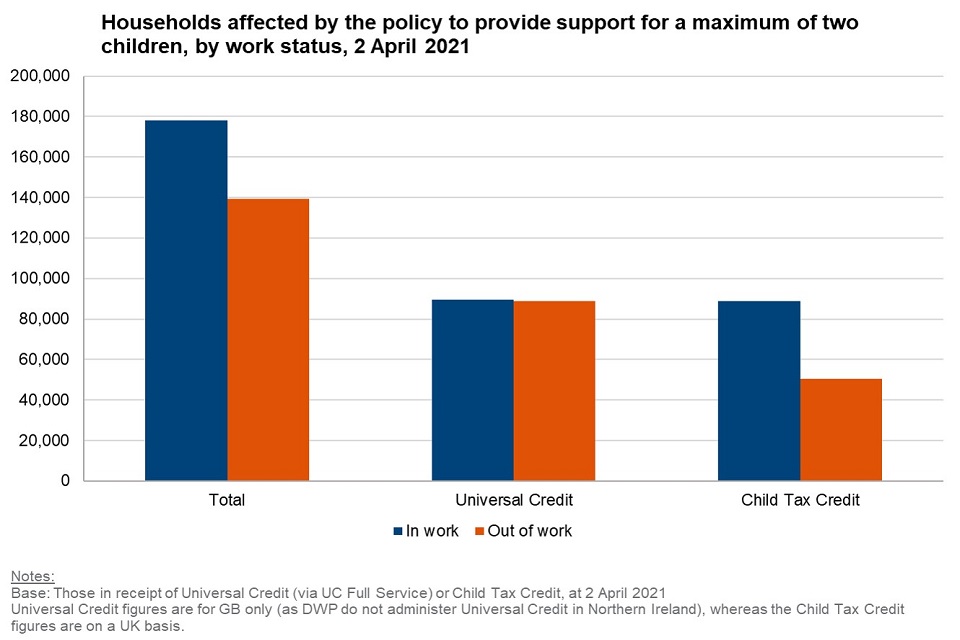

Households affected by the policy to provide support for a maximum of two children, by work status

“In work” is defined as eligible for Working Tax Credit within the tax credit system, or in receipt of employment income within Universal Credit. Overall, most claimants affected by the policy – 56% – are classified as in-work.

64% of Child Tax Credit Claimants affected by the policy are in work; a higher proportion than UC (50%).

A slightly lower proportion of households with an exception are in-work (50%) compared to those without an exception for at least one child (56%).

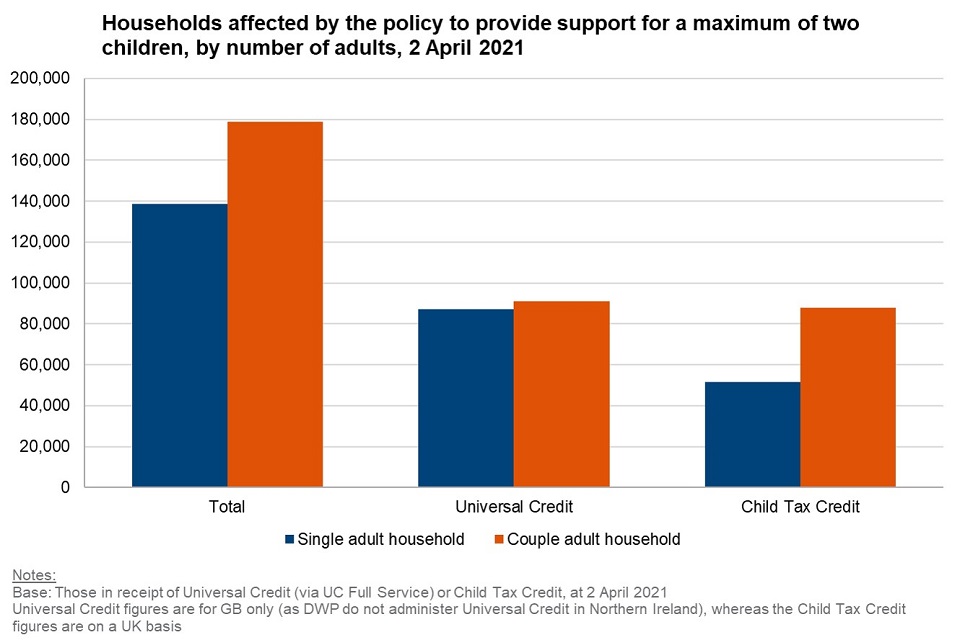

Households affected by the policy to provide support for a maximum of two children, by number of adults

56% of households affected by the policy have two adults in the household. The remainder are single adult households. The proportion of couples is higher in Child Tax Credit (63%) than in Universal Credit (51%). This may reflect the population of UC at this stage of its rollout.

The proportion of couples amongst households with an exception across the two systems is lower (48%) than those not receiving a child element or amount (57%).

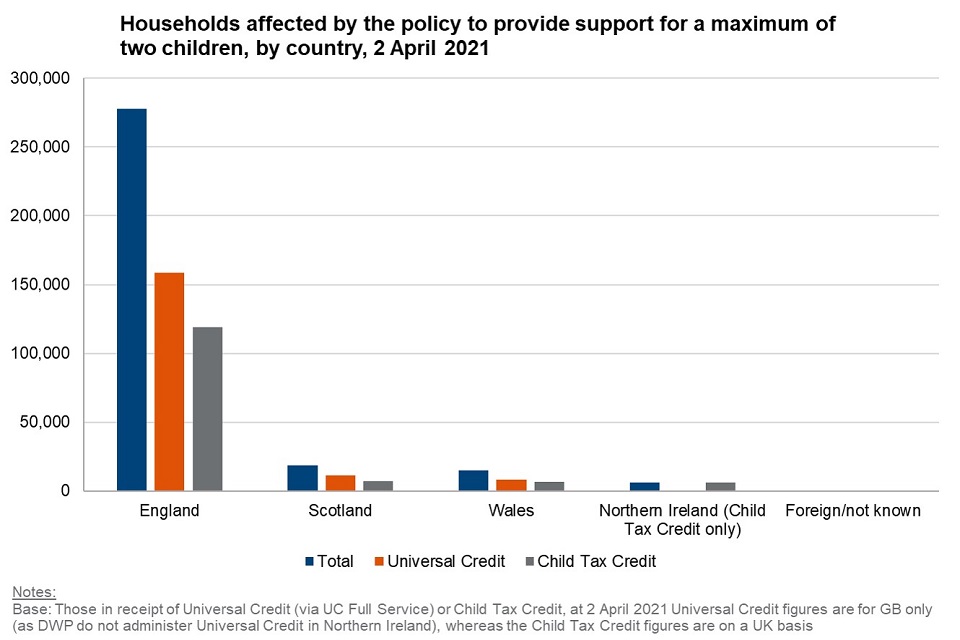

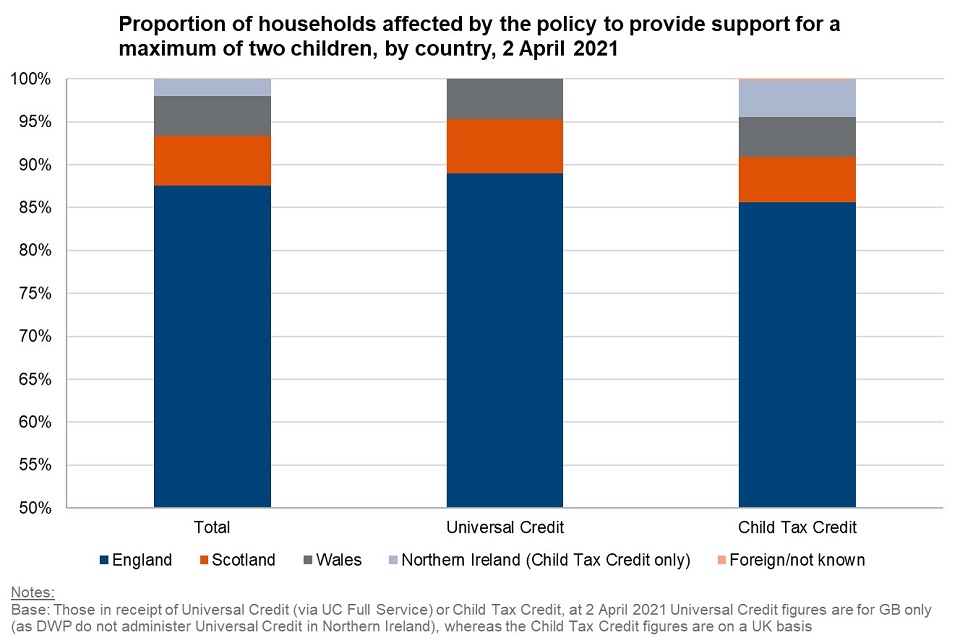

Households affected by the policy to provide support for a maximum of two children, by country

Around 278,000 (88%) of those in GB Universal Credit households and UK Child Tax Credit households affected by the policy were residents in England in April 2021. 19,000 (6%) were residents in Scotland and almost 15,000 (5%) in Wales. Nearly 6,000 (2%) were CTC recipients in Northern Ireland. A small number of CTC claimants (less than 1,000) were either resident abroad or their country could not be identified from the data.

Around 4% of households in England who were affected by the policy were in receipt of an exception in April 2021. About 5% of households affected in Scotland received an exception, as did 5% of households in Wales and 4% of CTC households in Northern Ireland.

These figures reflect areas of responsibility of the Department for Work and Pensions (DWP) and HM Revenue & Customs (HMRC). Consequently, UC statistics relate to Great Britain whereas statistics on CTC relate to the United Kingdom.

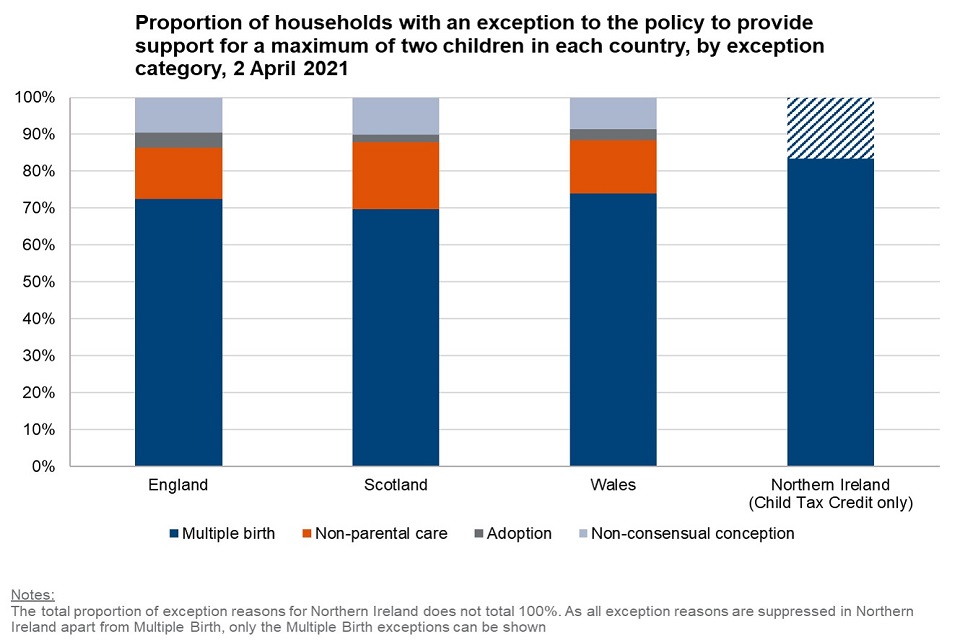

Households with an exception to the policy to provide support for a maximum of two children, by country and exception category

Across all countries of the UK, households with a multiple birth were the most common type of exception, accounting for 73% of Universal Credit or Child Tax Credit households with an exception in England, 70% of households in Scotland, 75% of households in Wales and 83% of CTC households only in Northern Ireland. Given small population sizes related to the fact that the policy had been in operation for only four years by April 2021, it is not recommended to draw robust conclusions from the differing proportions of households with other types of exceptions by country at this point in time, due to both rounding and the suppression of small numbers of cases. As noted earlier, in future years the numbers affected by the policy, and the numbers of exceptions, are expected to increase.

These figures reflect areas of responsibility of DWP and HMRC. Consequently, UC statistics relate to Great Britain whereas statistics on CTC relate to the United Kingdom.

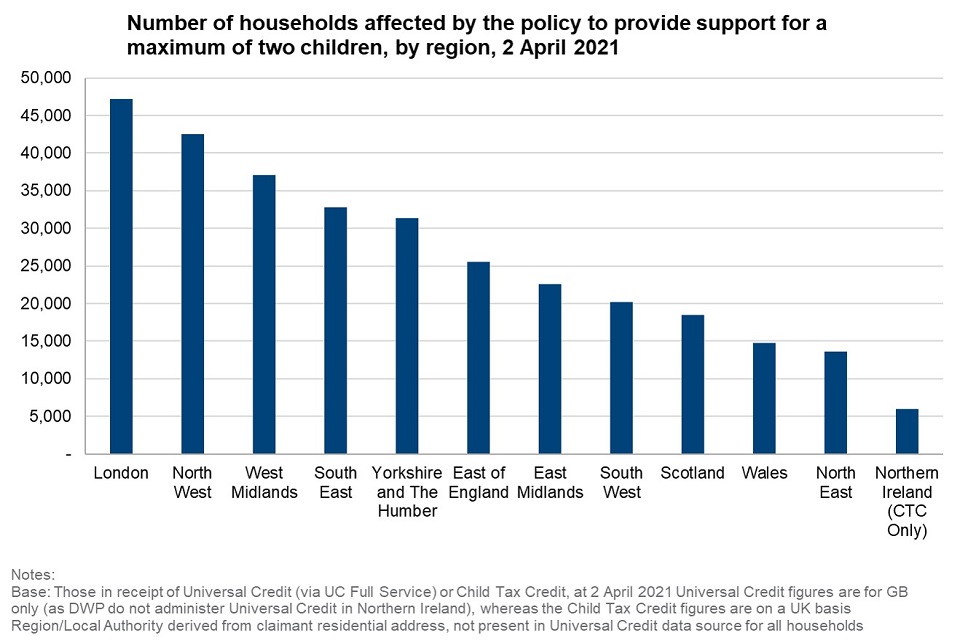

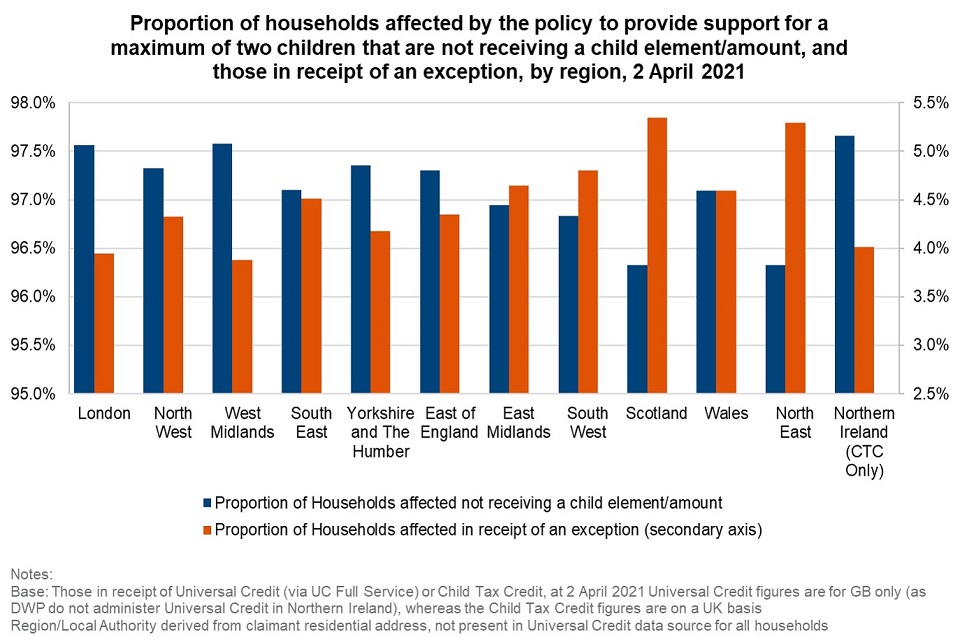

Households affected by the policy to provide support for a maximum of two children, by region

Breakdowns by region are new statistics included this year for the first time.

There are 12 first level regions in the UK, 9 such regions in England, together with Scotland, Wales, and Northern Ireland. The region of London contains the largest number of households that are affected by the policy with a total of 47,000 households being affected. Within GB, the North East contains the lowest number of households affected by the policy with a total of 14,000 households affected. Child Tax Credit claimants are the only households that can be affected by the policy in Northern Ireland, which consequently contains the lowest number of households affected by the policy in the UK with a total of 6,000.

The proportion of households not receiving a child element/amount for all regions lies between 96 and 98% of all households affected by the policy, with no clear disparities between regions. Similarly, the proportion of households with an exception lies between 4 and 5% of all households affected across all regions.

There are a small number of households (5,000) in the Universal Credit data where the region could not be identified. Since DWP cannot accurately assume the region of these claimants, they have been represented by the “Unknown” category.

These figures reflect areas of responsibility of DWP and HMRC. Consequently, UC statistics relate to Great Britain whereas statistics on CTC relate to the United Kingdom.

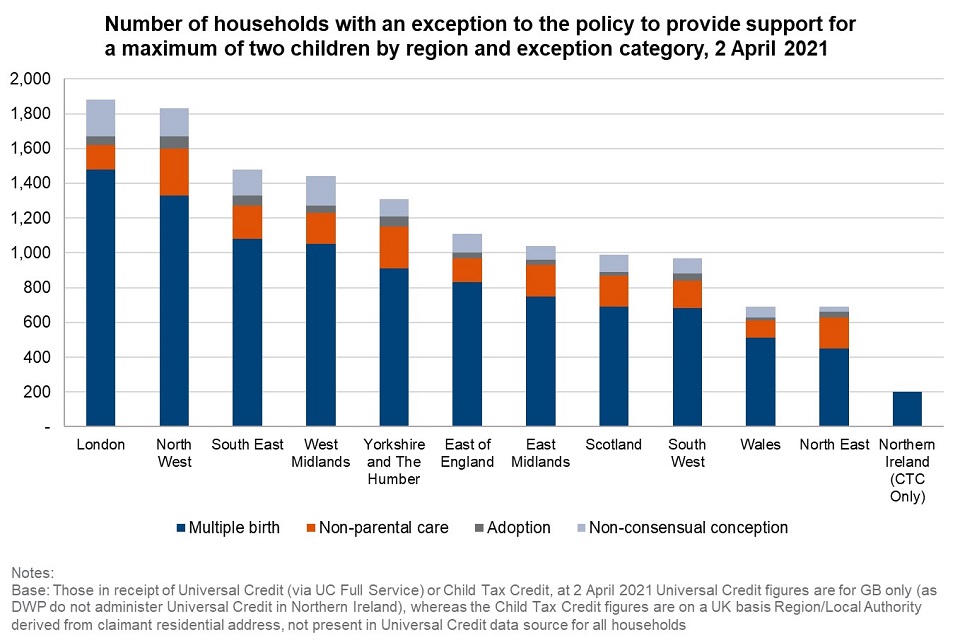

Households with an exception to the policy to provide support for a maximum of two children, by region and exception category

Breakdowns by region are new statistics included this year for the first time.

There are 12 first level regions in the UK, 9 such regions in England, together with Scotland, Wales, and Northern Ireland. In line with the national picture, the most common exception across all regions is the multiple birth exception whilst the least common exception is adoption.

There are a small number of households (310) in the UC data where the region could not be identified. Since DWP cannot accurately assume the region of these claimants, they have been represented by the “Unknown” category.

These figures reflect areas of responsibility of DWP and HMRC. Consequently, UC statistics relate to Great Britain whereas statistics on Child Tax Credit relate to the United Kingdom.

Overall numbers of households affected by the policy to provide support for a maximum of two children, not receiving a child element/amount for at least one child, by region and local authority

Breakdowns by region are new statistics included this year for the first time.

As of 2 April 2021, there are 367 local authorities in GB (in the UK there are 378 due to the inclusion of Northern Ireland).

The region and local authority information is derived from the claimant residential address, and this cannot be identified for all households within the Universal Credit data source. Therefore, there are a small number of households with an “Unknown” region and local authority.

DWP and HMRC have provided figures for the number of households not receiving a child element/amount for at least one child. As local authorities vary greatly in population, the number of households not receiving a child element/amount for at least one child for one local authority cannot be directly compared to another local authority. Consequently, it is not recommended to draw conclusions from the relative volume of households not receiving a child element/amount for at least one child.

There are a small number of households in the UC data where the region and local authority of the claimant’s residential address could not be identified. Since the DWP cannot accurately assume the region/local authority of these claimants, they have been represented by the “Unknown” category.

These figures reflect areas of responsibility of DWP and HMRC. Consequently, UC statistics relate to Great Britain whereas statistics on Child Tax Credit relate to the United Kingdom.

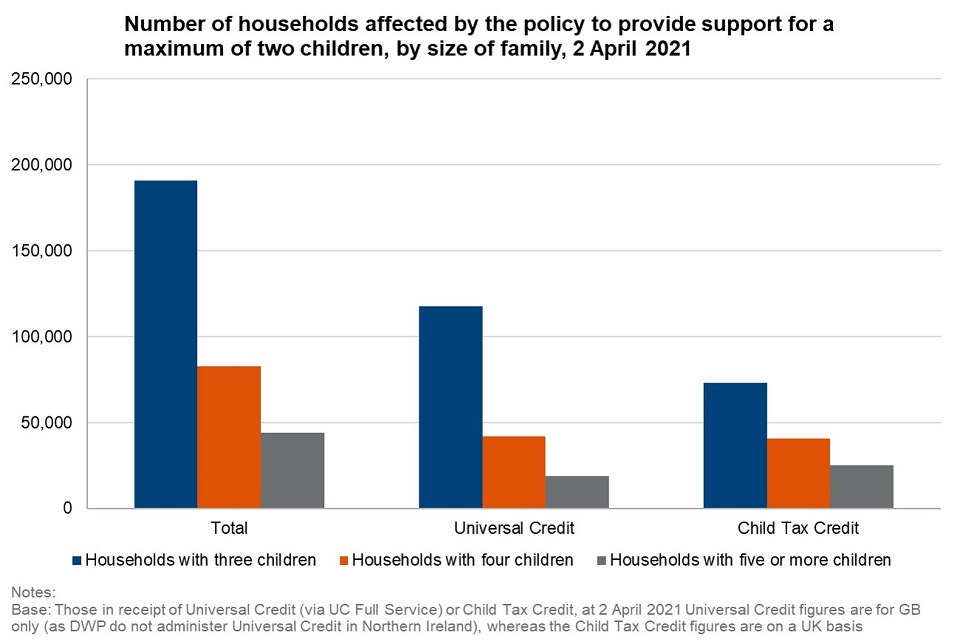

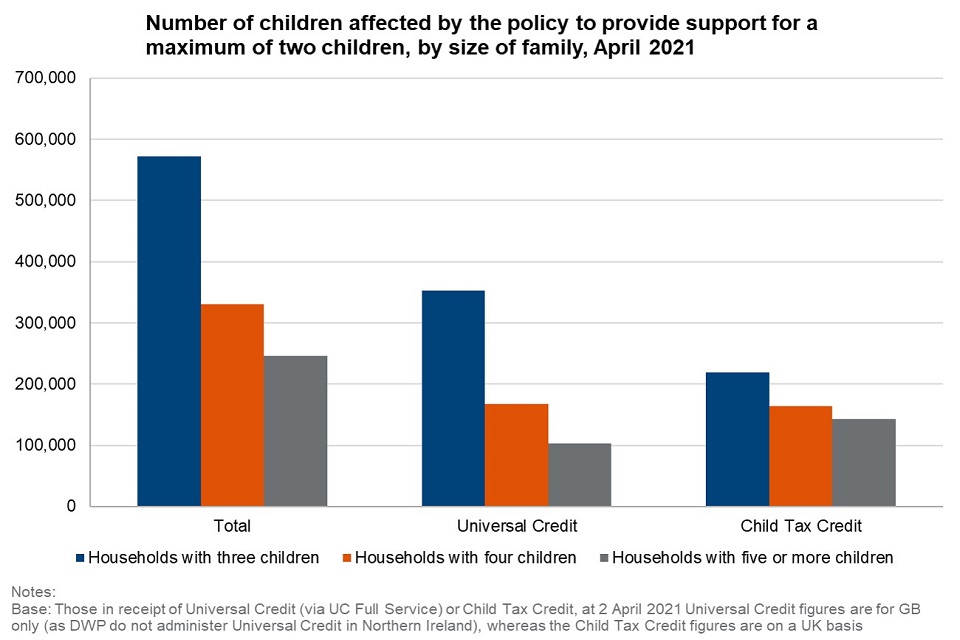

Households affected by the policy to provide support for a maximum of two children, by number of children

Out of 318,000 households affected by the policy, 200,000 have three children, 83,000 have 4 children and 44,000 have five or more children.

The majority of households affected by the policy, 60%, contain three children, with 26% containing four children. The remaining 14% are households with five or more children. The proportion of three child households is lower in Child Tax Credit (53%) than in Universal Credit (66%). This may reflect the population of UC at this stage of the rollout and the way this policy has been implemented.

Overall, there are around 1.1 million children in households affected by the policy, with 50% in households with three children. 29% are in households with four children, with the remaining 21% being in households with five or more children.

Overall numbers of households affected by the policy to provide support for a maximum of two children, by year

There has been a net increase of 67,000 as of 2 April 2021 of the number of households in receipt of Universal Credit or Child Tax Credit affected by the policy to provide support for a maximum two children since the last publication. UC increased by 74,000 while CTC fell by 7,000. This trend is expected as new claimants cannot apply for CTC and must instead apply for UC.

The total number of households with three or more children on 2 April 2021, including children born before 6 April 2017, reduced slightly from 846,000 to 836,000 households. Whilst the number of households with three or more children is going up in UC as expected, the overall fall in these figures is due to the reduction over the past year in CTC households with three or more children, which fell by 125,000.

Feedback

We welcome feedback.

We are committed to improving the official statistics we publish. We want to encourage and promote user engagement, so we can improve our statistical outputs. We would welcome any views you have using the contact information below:

DWP Press Office

Telephone: 0115 965 8781

Statistical contacts

A Mays, S Lewis and J Reast:

ucad.briefinganalysis@dwp.gov.uk

B Y Seworde and D Bailey:

benefitsandcredits.analysis@hmrc.gov.uk