Strategic export controls commentary: 1 April to 30 June 2023

Updated 13 June 2024

1. Statistical commentary

Coverage: UK

Frequency: Quarterly

Date of publication: 16 January 2024

Next publication: March to April 2024 (provisional)

Statistical Contact: ECJU.statistics@businessandtrade.gov.uk

Website: Strategic export controls licensing data

This statistics release provides the data about decisions made on licence applications to the Export Control Joint Unit (ECJU) of the Department for Business and Trade (DBT).

The ECJU is the regulatory body which controls exports of military goods and dual-use goods (civilian goods that can be used for military purposes) from the UK.

2. Headline results

-

between 1 April and 30 June 2023 (2023 Q2), there were a total of 3,056 licensing decisions for standard individual export licences (SIELs), up 116 (3.9%) from 2,940 in the previous quarter (2023 Q1)

-

of these standard licensing decisions in 2023 Q2, 2,868 (93.8%) were issued, 186 (6.1%) were refused, and 2 (0.1%) licences were revoked

-

licensing decisions for open individual export licences (OIELs) were up by 16 (19.8%) compared with the previous quarter, from 81 in 2023 Q1 to 97 in 2023 Q2

-

of these open licensing decisions in 2023 Q2, 84 (84.6%) were issued, 12 (12.4%) were rejected, and 1 (1.0%) licence was revoked

-

in 2023 Q2, 55% of SIELs were processed to first outcome within 20 working days, down from 66% in the previous quarter. 90% of SIELs were processed to first outcome within 60 working days, up from 88% in the previous quarter. 44% of OIELs were processed to first outcome within 60 working days, down from 48% in the previous quarter. Percentages of SIELs processed to first outcome within 20 and 60 working days do not include SIELs processed in LITE for the 2023 Q1 and 2023 Q2 reporting periods so comparing figures from these reporting periods with previous reporting periods should be done so with care – see Background notes for further details.

-

for the 2022 calendar year, 62% of SIELs were processed to first outcome within 20 working days, down from 69% in the previous year (2021). 89% of SIELs were processed to first outcome within 60 working days, a down from 91% in the previous year. 26% of OIELs were processed to first outcome within 60 working days, down from 47% in the previous year.

3. Introduction

This commentary accompanies the latest quarterly strategic export controls statistics data tables, published on the DBT strategic export controls statistics web page on 16 January 2024. The data tables present the latest detailed information on licensing decisions for each quarter from 2008 Q1 to 2023 Q2. The data presented here is based on a snapshot of live data from 16 October 2023.

Most licence applications are submitted to and processed by the Export Control Joint Unit (ECJU) through a purpose-built online licensing system called SPIRE. However, ECJU is in the process of introducing a new digital system for export licensing, known as LITE, which will replace its legacy system, SPIRE. With the introduction of LITE in 2021, this release has included data from both SPIRE and LITE from the 2021 Q3 publication onwards. Prior to the 2021 Q3 publication, this release provided data solely from SPIRE.

Whilst the 2023 Q2 publication still includes data from both SPIRE and LITE, there are some limitations in how we have published the LITE data for the 2023 Q1 and 2023 Q2 reporting periods, with these limitations caveated alongside the impacted figures in the commentary and Table 4 – see Background notes for further details.

There are several types of licence and the type of licence applied for will depend on numerous factors such as the type and volume of goods being exported, the destination and who will be using the goods.

The statistics present a picture of how licensing decisions have been made, which is useful for policy officials in the ECJU and also allows analysis of the operational efficacy of the licensing system. The data are also regularly used by the press, non-government organisations and academics to evaluate strategic export control policies. Further detail is available in this document under uses of the data.

4. Summary of results

4.1 Issued licences

-

Export and trade control licences give permission for certain strategic exports to be made from the UK to another destination, and for overseas trade in strategic goods. The actual number and value of transactions made under the licences is likely to be less than the total made available under the licences issued. This is because some licences will not be used to make all of the exports authorised and others will not be used at all

-

Standard individual export licences (SIELs) are by far the most common licence type issued. The number of SIELs issued each quarter since 2008 Q1 has averaged 3,135, much higher than open individual export licences (OIELs) (73), standard individual trade control licences (SITCLs) (41) and open individual trade control licences (OITCLs) (6). Registrations to use open general export licences (OGELs) have averaged 358 each quarter since 2008 Q1

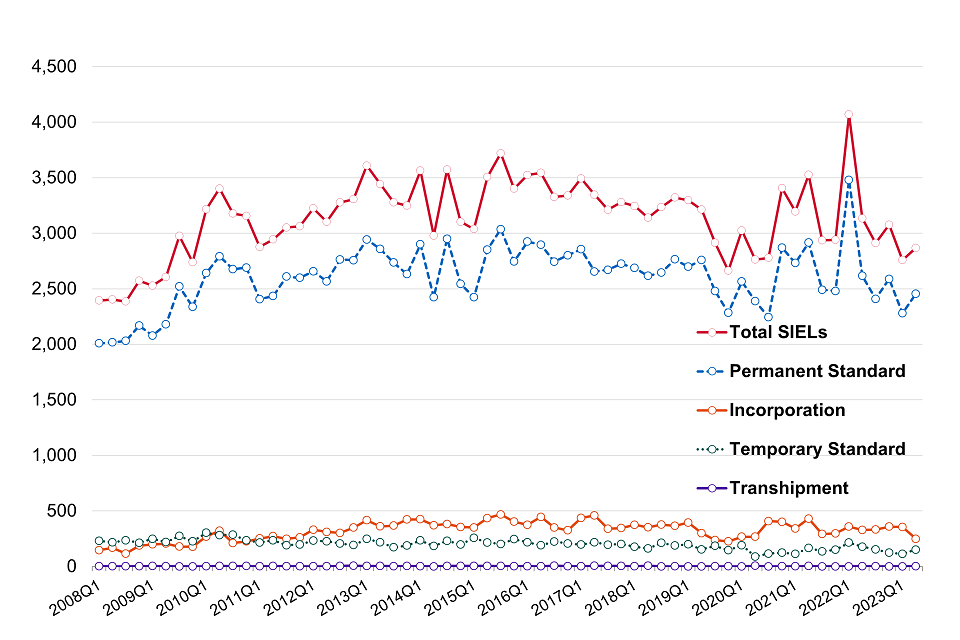

Chart 1: Number of SIELs issued, by licence sub-type

-

Issued SIELs are predominantly of the ‘permanent standard’ sub-type (see Chart 1) which is clearly driving the overall trend in total SIELs. However, ‘temporary standard’ and ‘incorporation’ SIELs are not insignificant, accounting for around 6% and 10% (respectively) of issued SIELs on average each quarter

-

Total issued SIELs each quarter increased slowly between 2008 Q1 and 2013 Q1, when they reached 3,609, although there was a notable dip in licences issued in 2014 Q2. This coincided with the rollout of a new IT system in the Department for Business, Innovation and Skills, which is likely to explain the fall. The peak in the following quarter is likely to be due to the ECJU clearing the backlog of applications that had accumulated

-

The increase between 2014 Q2 and 2014 Q3 is likely to be explained by operational reasons. Increased resourcing from around May 2014 helped with more licence decisions being made. The number of licences issued in 2015 Q3 was the highest to that date since records began in 2008 Q1 at 3,720. Again, this is likely to be explained by operational reasons

-

The number of licences issued in 2019 Q4 was the lowest since 2009 Q2 at 2,663. This is likely to be due to the effects of the judgment of the Court of Appeal of 20 June 2019 regarding licences for Saudi Arabia for equipment for possible use in Yemen, the Secretary of State’s subsequent statement to Parliament regarding licences for exports to Saudi Arabia and its coalition partners (United Arab Emirates, Kuwait, Egypt, Bahrain, Jordan, Sudan) which might be used in the conflict in Yemen, and the Foreign Secretary’s statement to Parliament of 15 October 2019 regarding export licences for items that might be used in Turkish military operations in Syria

-

The increase from 2,778 SIELs issued in 2020 Q3 to 3,406 in 2020 Q4 is likely to be due to increased licence processing to clear the backlog of applications arising from the judgment of the Court of Appeal of 20 June 2019

-

The decrease from 3,526 SIELs issued in 2021 Q2 to 2,937 in 2021 Q3 and 2,940 in 2021 Q4 is likely to be explained by a decrease in applications submitted, and operational reasons, specifically a temporary shortage in resourcing

-

A record high of 4,069 SIELs were issued in 2022 Q1. This peak is likely due to ECJU working to clear the backlog of applications which had arisen due to a previous shortage in resourcing, as well as the resumption of licensing for export to Turkey, the latter of which was set out on 13 December 2021 in notice to exporters 2021/15

-

In 2023 Q1, 2,758 SIELs were issued. This was the lowest number of SIELs issued since 2019 Q4. There was a combination of factors during 2023 Q1 that impacted upon ECJU’s ability to process licences. These factors included the ongoing impact of transitioning from our existing digital service (SPIRE) to a new digital licensing service (LITE) and the increased workload caused by the added complexity in considering cases following the Military End Use Control refresh in May 2022

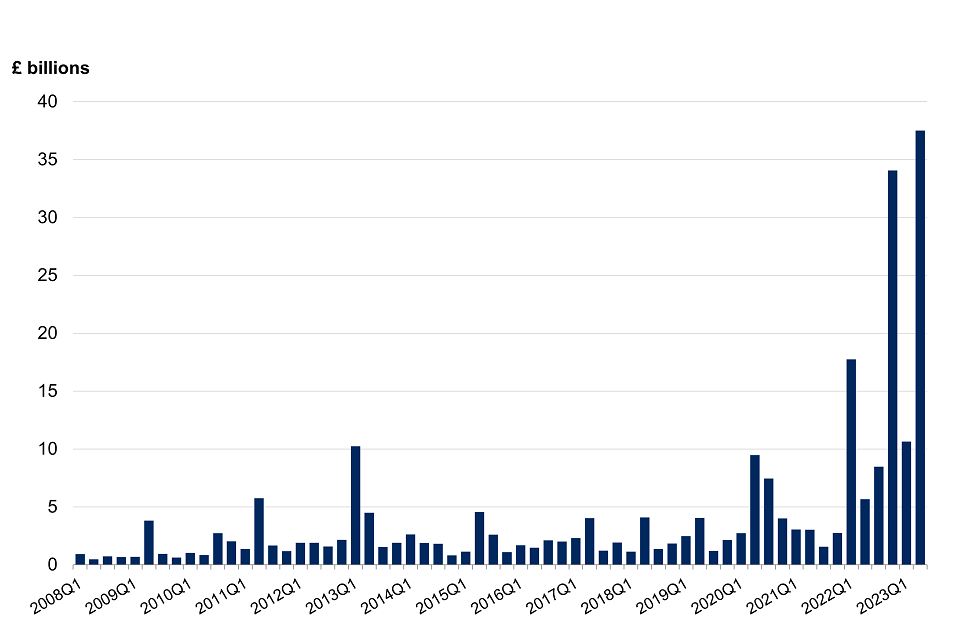

Chart 2: Value of goods issued for exportation under SIEL licences

-

Chart 2 shows how the value of goods issued for exportation under SIELs can vary a lot from quarter to quarter, with a handful of high value licences often explaining peaks in the data. The goods are valued by the licence applicant and not all goods licensed are actually exported

-

Noticeable peaks in 2009 Q2, 2011 Q2, 2013 Q1, 2013 Q2, 2015 Q2, 2017 Q2, 2018 Q2, 2020 Q2, 2020 Q3, throughout 2022, and in 2023 Q1 can be explained by a handful of licences. Around £1.5 billion of the £3.8 billion worth of goods licensed in 2009 Q2 was for combat aircraft to Saudi Arabia. A series of high value licences (between £10 million and £20 million) for equipment employing cryptography (secure communications techniques) to Malaysia, totalling around £615 million, along with a licence to the USA for materials containing enriched and natural uranium, valued at around £575 million also contributed to the 2009 Q2 peak

-

In 2011 Q2, goods valued at £2.3 billion, largely relating to components for military aero-engines, licensed to France, made up a large proportion of the £5.7 billion of goods. Around £1.5 billion was for combat aircraft to Saudi Arabia, which were issued due to the previous licence for goods in 2009 Q2 not being fully utilised. Where licences are not fully utilised a new application for the goods may be made. As a result, a particular good may be licensed several times within the historical trend

-

In 2013 Q1, equipment employing cryptography, for non-military use, was issued for export to Israel, which made up most of the value of licences issued in that quarter. Although issued, this licence was surrendered before any goods were shipped

-

In 2013 Q2, the approximately £1.5 billion of combat aircraft to Saudi Arabia had still not been fully shipped, so new licences were again issued for the same value of the same goods. The same happened again in 2015 Q2; new licences were again issued for a similar value of the same goods

-

In 2015 Q3, one licence for Saudi Arabia accounted for approximately 40% of the total value of all SIELs issued in that quarter; this was part of a long-term contract for the delivery, over a number of years, of a new munitions capability

-

In 2017 Q2, a peak in the value of goods licensed can be explained by a couple of licences. Around £1.2 billion is related to a licence for combat aircraft to Oman. Around £800 million is related to a further licence to Saudi Arabia for the delivery, over a number of years, of a new munitions capability as noted above. This was issued due to the previous licence for goods in 2015 Q3 not being fully utilised

-

In 2018 Q2, one licence for the United States of America accounted for over 60% of the total value of all SIELs issued in that quarter. This licence, valued at £2.8 billion, was for information security equipment to the USA for holding in stock. This licence was re-issued in 2019 Q2, which explains the peak in the value of goods licensed in this period

-

In 2020 Q2, the value of 9 licences for the United States of America combined accounted for around 89% of the total value of all SIELs issued in that quarter. These licences, valued at £8.2 billion in total, were for information security equipment to the USA for holding in stock

-

In 2020 Q3, the value of one licence for the United States of America accounted for around 60% of the total value of all SIELs issued in that quarter. This licence, valued at £4.1 billion in total, was for information security equipment to the USA for holding in stock

-

In 2022 Q1, 23 high value licences for China, India, South Korea and Taiwan accounted for around 89% of the total value of all SIELs issued in the quarter. These licences, valued at £15.7 billion in total, were for information security equipment and software for information security equipment

-

In 2022 Q2, the value of one licence for Qatar accounted for over 40% of the total value of all SIELs issued in that quarter. This licence, valued at £2.4 billion in total, was for the delivery, over a number of years, of combat aircraft. The value of 4 licences for Russia accounted for £220m of the £227m total value, and was for the return of cultural items to museums in Russia which had been on loan to UK museums

-

In 2022 Q3, 11 high value licences for China, India and Taiwan accounted for over 70% of the total value of all SIELs issued in that quarter. These licences, valued at £6.0 billion in total, were for information security equipment and software for information security equipment

-

In 2022 Q4, 40 high value licenses for China, South Korea, India, Taiwan, Vietnam and Hong Kong accounted for over 94% of the total value of all SIELs issued in that quarter. These licences, valued at £32.1 billion in total, were for information security equipment and software for information security equipment

-

In 2023 Q1, 12 high value licences, valued at £9.1 billion accounted for over 85% of the total value of all SIELs issued in that quarter. Ten of these licences were for information security equipment and software for information security equipment to China, India and Taiwan. The 2 remaining licences were for materials containing depleted, enriched and/or natural uranium to South Korea and Spain

-

In 2023 Q2, 32 high value licences for Abu Dhabi, China, India, South Korea, Singapore, Taiwan, United States and Vietnam accounted for over 96% of the total value of all SIELs issued in that quarter. These licences, valued at £36.2 billion, were for information security equipment and software for information security equipment

-

Unlike SIELs for permanent export, a temporary SIEL may permit the export of the goods to multiple destinations, provided they are returned to the UK within 12 months of export. For example, an item might be exported from the UK for an exhibition in one country, before being moved directly to another exhibition in a second country, and so on, before they are returned to the UK. Currently the total value of temporary goods is calculated as the sum of temporary goods licensed to each destination, meaning that the same goods can be counted multiple times. The values of goods licensed for temporary export, using the current methodology, make up 2% of all goods values across all SIELs between 2008 Q1 and 2023 Q2. However, there have been quarters within this time period in which the proportion of goods values licensed for temporary export under SIELs has been considerably higher (for example, in 2008 Q2 the value of goods on temporary licences was 23%, 2015 Q2 was 20% and 2014 Q2 was 13%)

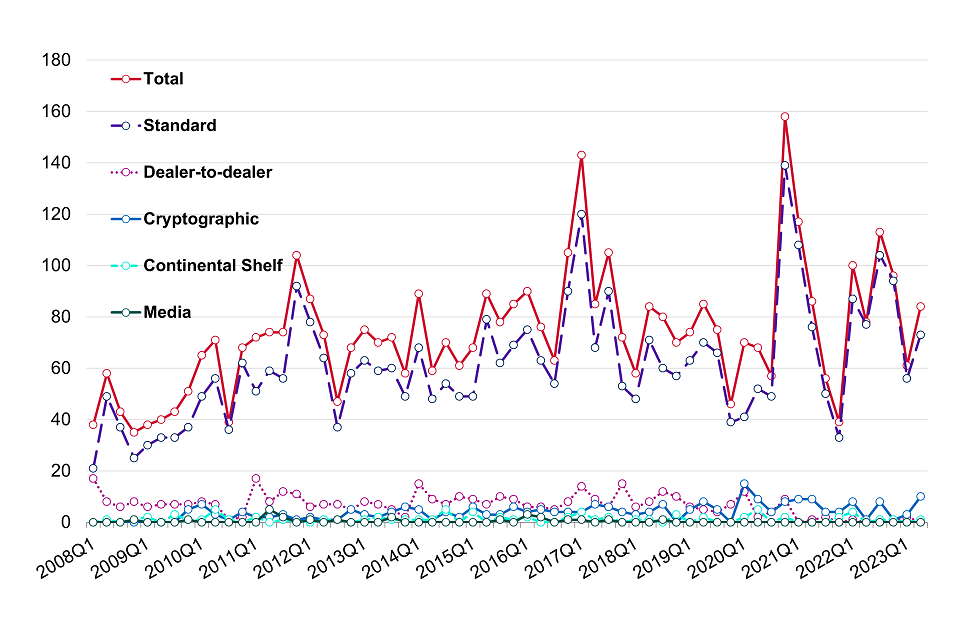

Chart 3: Number of OIELs issued by licence sub-type

-

Issued OIELs were largely comprised of ‘standard’ OIELs (see Chart 3). The number of OIELs issued is much smaller than the number of SIELs issued, however the quantity of goods for exportation is generally not limited on OIELs

-

The peaks of 105, 143 and 105 OIELs issued in 2016 Q4, 2017 Q1 and 2017 Q3 respectively were primarily a result of clearing a backlog of applications that had built up, which also explains why the number issued in 2016 Q3 was lower than the average for the previous quarters. OIELs can be renewed every 5 years and these peaks also coincide with an increased number of renewal applications over these periods

-

The increase from 57 OIELs issued in 2020 Q3 to a record high of 158 in 2020 Q4 was likely due to higher volumes of applications being received, which included unusually high volumes for OIELs to export information security equipment and technology to the United States. There was also a partial clearing of the backlog of applications arising from the judgment of the Court of Appeal of 20 June 2019 which could also be attributed to some of the increase

-

The increase from 39 OIELs issued in 2021 Q4 to 100 in 2022 Q1 was likely due to operational reasons, specifically ECJU working to clear a backlog of applications which had accumulated

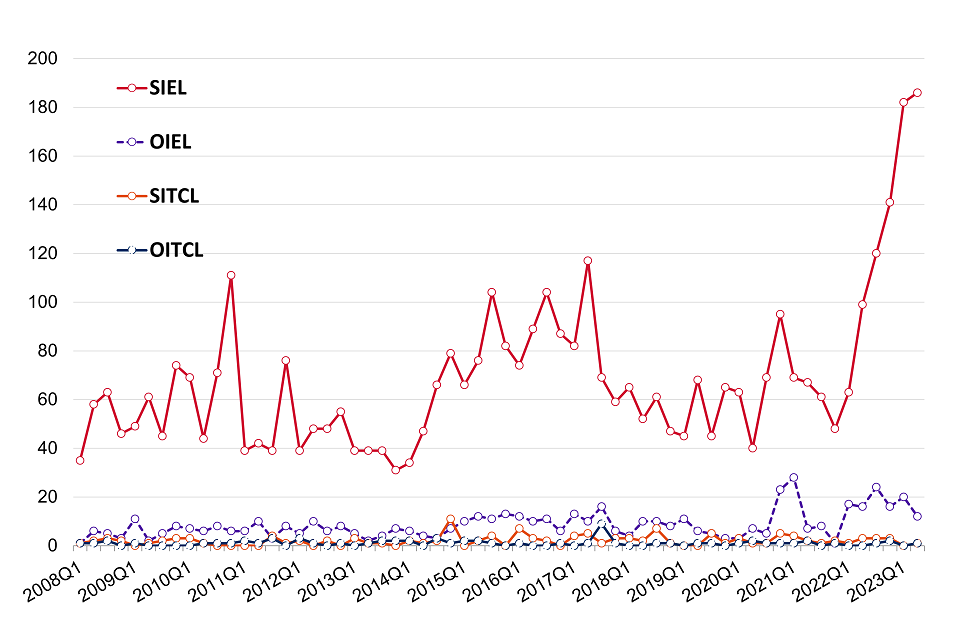

Chart 4: Number of licences refused/rejected by licence type

-

The numbers of SIELs and SITCLs refused and OIELs and OITCLs rejected tend to be much lower than the numbers issued (see Chart 4). The number of SIELs refused in each quarter between 2008 Q1 and 2023 Q2 has averaged 68 but some periods have seen over 100 refusals, including 2010 Q4 when 111 were refused, 2015 Q3 when 104 were refused, 2016 Q3 when 104 were refused, 2017 Q2 when 117 were refused, 2022 Q3 when 120 were refused, 2022 Q4 when 141 were refused, 2023 Q1 when 182 were refused and 2023 Q2 when 186 were refused.

-

In 2010 Q4, most (85) of these were refusals for licences to Iran, due to a broader range of sanctions coming into effect on 25 October 2010 (Council Regulation (EU) No 961/2010). Please see the ECJU website for more details about sanctions on Iran

-

In 2015 Q3, around a quarter of the refusals were for licences to Russia (26). Along with Russia, refusals for licences to China (22), Iran (17) and Pakistan (10) made up the bulk of the 104 refusals. Each of these refusals were due to sanctions in place for these destinations

-

In 2016 Q3, refusals for licences to United Arab Emirates (28), Pakistan (17), China (16) and Iran (11) made up the bulk of the 104 refusals

-

In 2017 Q2, the bulk of refusals were for licences to Pakistan (40), Russia (20) and Iran (10), predominantly under the end use controls

-

In 2022 Q2, the majority of refusals were for licences to China (39) and Russia (20). The high number of refusals for China were mainly due to the new military end-use control and the addition of China to the list of destinations subject to the military end-use control. These were announced on 8 December 2021 and came into effect on 19th May 2022. The high number of refusals for Russia were mainly due to sanctions introduced following Russia’s invasion of Ukraine

-

In 2022 Q3, the majority of refusals were for licences to China (81) and Turkey (13). A number of refusals for China continued to be related to the new military end-use controls and the addition of China to the list of destinations subject to the military end-use control. The high number of refusals to Turkey were due to the wide scope of Russia sanctions which require us to prevent sanctioned items being supplied to a person connected with Russia

-

In 2022 Q4, the majority of refusals were for licences to China (95) and Russia (22). A number of refusals for China continued to be related to the new military end-use controls and the addition of China to the list of destinations subject to the military end-use control. The high number of refusals for Russia were mainly due to sanctions introduced following Russia’s invasion of Ukraine

-

In 2023 Q1, the majority of refusals were for licences to China (159). The majority of refusals for China continued to be related to the new military end-use controls and the addition of China to the list of destinations subject to the military end-use control.

-

In 2023 Q2, the majority of refusals were for licences to China (158). The majority of refusals for China continued to be related to the new military end-use controls and the addition of China to the list of destinations subject to the military end-use control.

Table 1: Number of licences revoked by licence type

| Period | OIEL | OITCL | SIEL | SITCL |

|---|---|---|---|---|

| 2008 Q1 | 0 | 0 | 1 | 0 |

| 2008 Q2 | 0 | 0 | 1 | 0 |

| 2008 Q3 | 7 | 0 | 0 | 0 |

| 2008 Q4 | 6 | 0 | 19 | 0 |

| 2009 Q1 | 0 | 0 | 1 | 0 |

| 2009 Q2 | 0 | 0 | 1 | 0 |

| 2009 Q3 | 1 | 0 | 10 | 0 |

| 2009 Q4 | 0 | 0 | 2 | 0 |

| 2010 Q1 | 0 | 0 | 0 | 0 |

| 2010 Q2 | 0 | 0 | 0 | 0 |

| 2010 Q3 | 0 | 0 | 0 | 0 |

| 2010 Q4 | 0 | 0 | 0 | 0 |

| 2011 Q1 | 14 | 0 | 121 | 2 |

| 2011 Q2 | 1 | 0 | 2 | 0 |

| 2011 Q3 | 1 | 0 | 1 | 0 |

| 2011 Q4 | 0 | 0 | 1 | 0 |

| 2012 Q1 | 0 | 0 | 2 | 0 |

| 2012 Q2 | 7 | 0 | 38 | 0 |

| 2012 Q3 | 0 | 0 | 2 | 0 |

| 2012 Q4 | 1 | 0 | 0 | 0 |

| 2013 Q1 | 0 | 0 | 0 | 0 |

| 2013 Q2 | 1 | 0 | 5 | 0 |

| 2013 Q3 | 0 | 0 | 6 | 0 |

| 2013 Q4 | 3 | 0 | 5 | 0 |

| 2014 Q1 | 12 | 1 | 2 | 0 |

| 2014 Q2 | 0 | 0 | 11 | 0 |

| 2014 Q3 | 50 | 1 | 35 | 0 |

| 2014 Q4 | 0 | 0 | 1 | 0 |

| 2015 Q1 | 2 | 0 | 9 | 0 |

| 2015 Q2 | 2 | 0 | 3 | 0 |

| 2015 Q3 | 1 | 0 | 0 | 0 |

| 2015 Q4 | 0 | 0 | 0 | 0 |

| 2016 Q1 | 0 | 0 | 0 | 0 |

| 2016 Q2 | 0 | 0 | 0 | 0 |

| 2016 Q3 | 0 | 0 | 0 | 0 |

| 2016 Q4 | 0 | 0 | 1 | 0 |

| 2017 Q1 | 0 | 0 | 1 | 0 |

| 2017 Q2 | 0 | 0 | 0 | 0 |

| 2017 Q3 | 0 | 0 | 0 | 0 |

| 2017 Q4 | 13 | 0 | 5 | 0 |

| 2018 Q1 | 0 | 0 | 1 | 0 |

| 2018 Q2 | 2 | 0 | 2 | 0 |

| 2018 Q3 | 1 | 0 | 0 | 0 |

| 2018 Q4 | 1 | 0 | 1 | 0 |

| 2019 Q1 | 1 | 0 | 0 | 0 |

| 2019 Q2 | 0 | 0 | 3 | 0 |

| 2019 Q3 | 3 | 0 | 6 | 0 |

| 2019 Q4 | 0 | 0 | 2 | 0 |

| 2020 Q1 | 1 | 0 | 10 | 0 |

| 2020 Q2 | 0 | 0 | 0 | 0 |

| 2020 Q3 | 1 | 0 | 0 | 0 |

| 2020 Q4 | 0 | 0 | 0 | 0 |

| 2021 Q1 | 0 | 0 | 0 | 0 |

| 2021 Q2 | 0 | 0 | 0 | 0 |

| 2021 Q3 | 4 | 0 | 9 | 13 |

| 2021 Q4 | 0 | 0 | 0 | 0 |

| 2022 Q1 | 1 | 0 | 102 | 0 |

| 2022 Q2 | 0 | 1 | 1 | 3 |

| 2022 Q3 | 0 | 0 | 0 | 0 |

| 2022 Q4 | 0 | 0 | 0 | 0 |

| 2023 Q1 | 0 | 0 | 0 | 0 |

| 2023 Q2 | 1 | 0 | 2 | 0 |

Source: Table A, Strategic Export Controls Licensing Statistics

-

Table 1 shows that SIEL revocations peaked in 2011 Q1, with smaller peaks in 2008 Q4, 2012 Q2, 2014 Q3, 2021 Q3 and 2022 Q1. Each can be explained by the implementation of various sanctions, or as a result of licence reviews following a change of circumstances in the destination country or region

-

The relatively large number of SIEL revocations in 2011 Q1 was due to above average numbers for Libya (46), Egypt (36) and Bahrain (23) related to the introduction of sanctions associated to the Arab Spring

-

Sanctions on Iran (12) were the primary reason behind the small peak of SIEL revocations in 2008 Q4. The conflict between Georgia and Russia also played a part, with 6 revocations for licences to Georgia. A change in policy towards strategic exports to Argentina in 2012 Q2 saw 37 licences revoked

-

OIEL revocations peaked in 2014 Q3, due to 50 revocations to Russia due to restrictions introduced with respect to the Russia-Ukraine conflict. This was accompanied by 25 SIEL revocations to Russia. Again, most SIEL revocations were for permanent standard SIELs

-

Revocations for OIELs, SIELs and SITCLs rose in 2021 Q3, due to 25 revocations following from the Taliban taking control of Afghanistan

-

The large number of SIEL revocations (102) in 2022 Q1 was due to new sanctions being introduced following Russia’s unprovoked and illegal invasion of Ukraine in February 2022. 91 of the revocations were for licences to Russia. A number of the other revocations were for incorporation SIELs with Russia as an ultimate end user

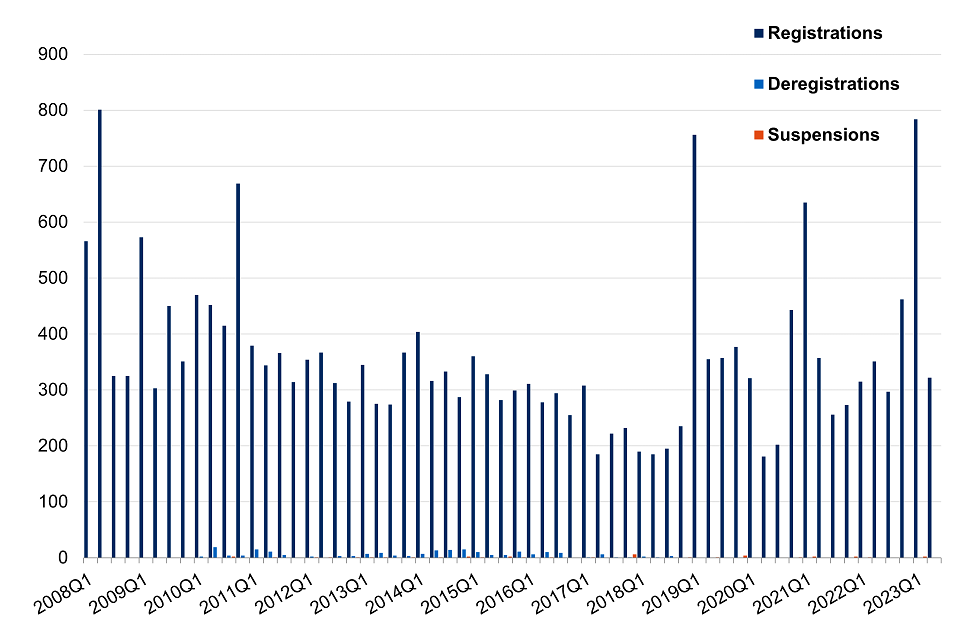

Chart 5: OGEL registrations, suspensions and deregistrations

-

OGEL registrations were fairly consistent from 2011 Q2 until a peak in 2019 Q1. This was primarily due to a new OGEL that became available for registration on 1 February 2019 for export of dual-use items to EU member states. Although this OGEL would not come into force until the end of the transition period, the ECJU encouraged advance registrations to ensure continuity for exporters. Peaks are also seen in 2010 Q4, largely due to registrations to the ‘Military Goods, Software and Technology’ OGEL and in 2008 Q2, partly due to relatively large numbers of registrations to the ‘Technology for Military Goods’ and ‘Military Goods, Software and Technology: Government or NATO End-Use’ OGELs, but partly due to above average registrations across a number of other OGELs

-

An increase in registrations in 2020 Q4 was largely due to an increase in registrations for the ‘Export of Dual-Use items to EU Member States’ OGEL, as exporters prepared for the end of the EU transition period. The increase in 2021 Q1 is again largely due to registrations for the ‘Export of Dual-Use items to EU Member States’ OGEL but also for the retained general export authorisations, all of which came into force at the end of the transition period

-

On the 30 September 2022, ECJU re-instated the ability to register for and use 26 OGELs. When these 26 open general licences were originally locked, preventing further registration, ECJU created a set of parallel open general licences with fewer permitted destinations. These parallel OGELS were no longer required and were revoked on 30 December 2022. The increase in registrations in 2023 Q1 was mainly due to Exporters being required to register for the 26 OGELS which were now available, and which replaced those that were revoked. Further information on these can be found in the Notices to Exporters, NTE 2022/25 and NTE 2022/34

5. Goods with military and non-military control entries

Control entries are the codes assigned to each good on the consolidated list of goods that require export authorisation (herein ‘consolidated list’). For example, all control entries beginning ‘ML’ (such as ML1, ML8 etc) are control entries for military goods. The process of assigning control entries to goods is called Rating.

In some cases, goods can be made subject to control if they do not appear on the consolidated list. Goods that the exporter has been told, knows or suspects are, or may be, intended for ‘Weapon of Mass Destruction (WMD) purposes’ are given the rating ‘END’. Goods that the exporter has been told, knows or suspects are, or may be, intended for use as components in, or production or test equipment for, military equipment in an embargoed destination; or may be intended for use as parts of military goods illegally obtained from the UK, irrespective of destination, are given the rating ‘MEND’. Both of these ‘end-use’ ratings are also sometimes referred to as ‘catch all’ ratings.

The list can be found on the UK strategic export control lists page.

Control entries provide in-depth descriptions for the classification of licensable goods. Table 2 and Table 3 provides summary descriptions of control entries based on the consolidated list of goods that require export authorisation. High ranking control entries have been combined where they cover similar goods (specified in square brackets in Tables 2 and 3). Note that licence counts are only an indication of export volumes and counts are not the same as goods quantity.

5.1 Military goods licensed

Table 2: Top-5 military goods licensed on permanent standard SIELs in 2022, by number of licences

| Top-5 military use | Number of licences |

|---|---|

| Aircraft, components and related equipment [ML10] | 1,240 |

| Firearms [ML1] | 783 |

| Vehicles and components [ML6] | 486 |

| Military Technology [ML22] | 470 |

| Bombs, missiles and related equipment and components [ML4] | 416 |

Source: Table H, Strategic export controls licensing statistics

5.2 Non-military goods licensed

Table 3: Top-5 non-military goods licensed on permanent standard SIELs in 2022, by number of licences

| Top-5 non-military use | Number of licences |

|---|---|

| Equipment and software with “information security” capability [5A002, 5D002] | 1,477 |

| Non-Military Firearms (Firearms Regulation Annex I) [FR AI] | 973 |

| Imaging cameras [6A003] | 420 |

| Chemical processing equipment (for example, pumps, valves) [2B350] | 399 |

| Human and animal pathogens and “toxins” [1C351] | 352 |

Source: Table H, Strategic export controls licensing statistics

6. End-user destinations

6.1 Number of licences issued

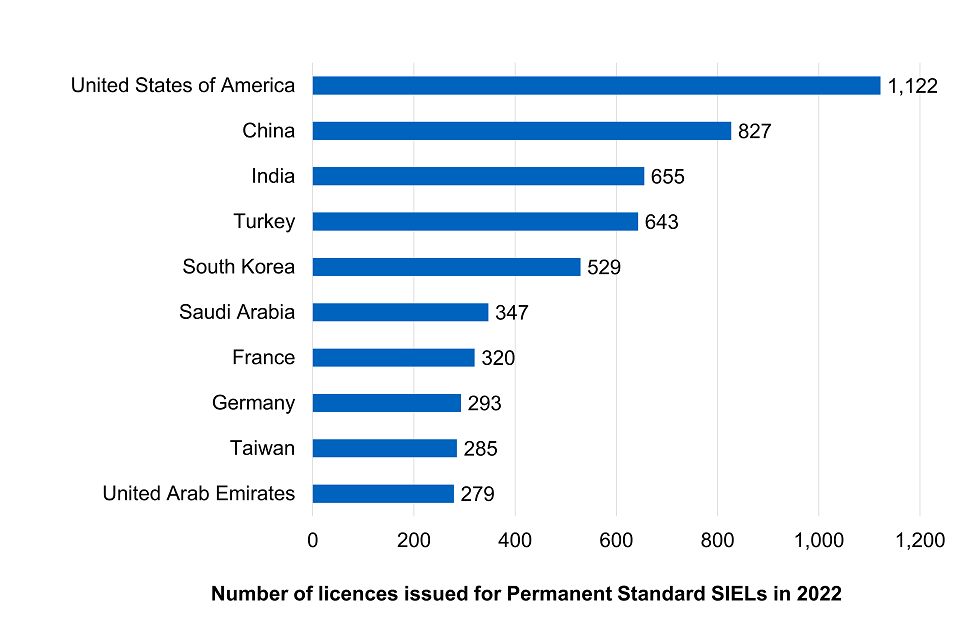

In 2022, the United States of America was the end user destination with the highest number of licences issued for exportation of strategic goods under permanent standard SIELs, with 1,122 licences. The next end users with the highest number of licences issued for exportation of strategic goods under permanent standard SIELs were China (827) and India (655).

Map 1: Number of licences issued per end user destination in 2022

Chart 6: Top 10 end-user destinations licensed, 2022

6.2 Value of licences issued

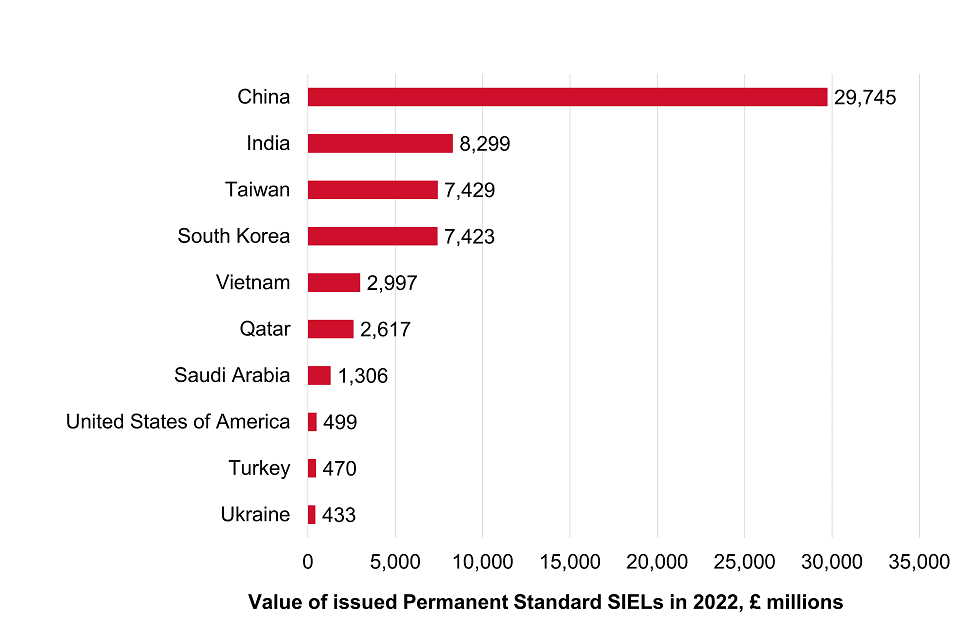

In 2022, China was the end user destination with the highest value of licences issued for exportation of strategic goods under ‘Permanent Standard’ SIELs, with licences issued for exportation of £29.7 billion worth of goods (as valued by applicants). The next end users with the highest value of licences issued for goods under Permanent Standard SIELs were India (£8.3 billion) and Taiwan (£7.4 billion). Goods are valued by the licence applicant, and not all goods licensed are actually exported.

Map 2: Value of licences issued per end user destination in 2022

Chart 7: Top 10 end-user destinations licensed in terms of licence values, 2022

7. Initial processing statistics

7.1 Latest quarter

-

On receipt of a SIEL application, ECJU’s target is to process 70% of cases within 20 working days and 99% within 60 working days. ECJU also aim to process 60% of OIEL applications within 60 working days

-

In 2023 Q2, 55% of SIEL applications (where applications were closed for the first time, that is, not counting re-opened and re-closed licences) were completed within 20 working days, down from 66% in 2023 Q1. By 60 working days, 90% of SIELs had been completed, up from 88% in 2023 Q1. By 60 working days, 44% of OIEL applications were completed, down from 48% in 2023 Q1. Percentages of SIELs processed to first outcome within 20 and 60 working days do not include SIELs processed in LITE for the 2023 Q1 and 2023 Q2 reporting periods so comparing figures from this reporting period with previous reporting periods should be done so with care – see Background notes for further details.

-

There was a combination of factors during 2023 Q1 and 2023 Q2 that impacted upon ECJU’s ability to meet processing targets. These factors included the ongoing impact of transitioning from our existing digital service (SPIRE) to a new digital licensing service (LITE) and the increased workload caused by the added complexity in considering cases following the Military End Use Control refresh in May 2022

Table 4: Processing statistics for SIEL applications closed during 2023 Q2

| Types of licences | Number of applications completed in 20 working days | % applications completed in 20 working days | Number of applications completed in 60 working days | % applications completed in 60 working days | Median processing time (days) |

|---|---|---|---|---|---|

| Total SIELs | 2,053 | 55 | 3,340 | 90 | 18 |

| Permanent | 1,795 | 55 | 2,918 | 89 | 18 |

| Temporary | 104 | 68 | 149 | 98 | 14 |

| Transhipment | 2 | 50 | 3 | 75 | 28 |

| Incorporation | 148 | 54 | 259 | 95 | 19 |

| For items covered by the Torture Regulation (Permanent or Temporary) | 4 | 33 | 11 | 92 | 23 |

Source: Table B, strategic export controls licensing statistics

Table 4 includes data for applications that were stopped or withdrawn before the application was closed as well as applications that were processed, but did not require a licence. Therefore, the number of applications completed will be different to the total number of licensing decisions. SIEL figures presented in this table do not include SIELs processed in LITE for the 2023 Q2 reporting period so comparing figures from this reporting period with previous reporting periods should be done so with care – see Background notes for further details.

7.2 Latest full calendar year

-

In the 2022 calendar year, 62% of SIEL applications were completed within 20 working days, down from 69% in 2021. By 60 working days, 89% of SIELs had been completed, down from 91% in 2021. By 60 working days, 26% of OIEL applications were completed, down from 47% in 2021

-

There was a combination of factors during 2022 that impacted upon ECJU’s ability to meet processing targets. These factors included the added complexity in considering cases following the Military End Use Control refresh in May 2022, the expediting of applications to Ukraine following Russia’s illegal invasion of Ukraine, transitioning from our existing digital service (SPIRE) to a new digital licensing service (LITE), resolving historic backlogs of certain applications to Turkey at the start of 2022, and the long-standing ECJU resourcing challenges

8. Glossary of licence types

8.1 Licence types

- Standard individual export licences (SIELs) are specific to an individual exporter and generally allow shipments of specified items to a specified recipient up to the quantity specified by the licence. There are 5 main subtypes; permanent standard, temporary standard, incorporation, transhipment and SIELs for Goods covered by the Torture Regulation

- Open individual export licences (OIELs) are specific to an individual exporter and cover multiple shipments of specified items to specified destinations and/or, in some cases, specified recipients. Licences permitting permanent export are generally valid for up to 5 years from the date of issue. However, OIELs covering the export to EU Member States of goods entered on the Military List and Dealer to Dealer OIELs (an OIEL subtype) are generally valid for 3 years

- An open individual trade control licence (OITCL) is specific to a named trader and covers involvement in trading of a generally unlimited supply of specific goods between specific source and destination countries and/or specified senders, recipients and end-users. OITCLs are generally valid for 5 years

- A standard individual trade control licence (SITCL) is specific to a named trader and covers involvement in trading of a set quantity of specific goods between a specific source and destination country with a specified sender, recipient and end-user. SITCLs will normally be valid for 2 years

- Open general export licences (OGELs) are pre-published licences allowing the export of certain goods to certain destinations. Generally, the quantity of goods allowed for shipment is not limited

8.2 SIELs

- Permanent standard SIELs are for items that are for permanent export to a destination

- Temporary standard SIELs are for where the export is temporary, for example for the purposes of demonstration, trial or evaluation, and the licence is generally valid for one year only. The goods must be returned before the licence expires. Temporary SIELs can cover more than one destination

- Incorporation SIELs are for goods that are due to be incorporated, that is, installing them into another product or higher level system. For incorporation cases there are 2 end-user types. The ‘end user’ is the person/organisation incorporating the goods. The ‘ultimate end user’ is defined as the entity that uses the product or the higher level system into which the exported goods are installed or incorporated

- Transhipment SIELs are needed for the transhipment of certain goods through the UK en-route from one country to another, providing certain conditions are met. This subtype of SIEL is also called a Standard Individual Transhipment Licence (SITL). Most other transhipments (of certain goods through the UK en-route from one country to another) can be made under one of the open general transhipment licences, provided in all cases that the relevant conditions are met

- SIELs for goods covered by the torture regulation concern trade in certain equipment and products which could be used for capital punishment, torture or other cruel, inhuman or degrading treatment or punishment. These are classed as non-military goods but can appear separately to the statistics on licences for non-military goods. Read the guidance about export controls on goods that can be used for torture or capital punishment

8.3 OIELs

Open individual export licences (OIELs) are specific to an individual exporter and cover multiple shipments of specified items to specified destinations and/or, in some cases, specified recipients. Licences permitting permanent export are generally valid for up to 5 years from the date of issue. However, OIELs covering the export to EU member states of goods entered on the Military List and Dealer-to-dealer OIELs (an OIEL subtype) are generally valid for 3 years. Standard OIELs are the most common type of OIEL issued, but there are several other OIEL subtypes:

-

Dealer-to-dealer OIELs authorise Northern Ireland registered firearms dealers to export certain categories of firearms and ammunition solely to other registered firearms dealers in the European Union only, provided that copies of valid documentation are forwarded to the Department of Business and Trade at least 2 working days before each shipment.

-

Cryptographic OIELs authorise the export of specified cryptography hardware or software and the transfer of specified cryptography technology. These licences do not cover hardware, software or technology which includes certain types of cryptanalytic functions.

-

Media OIELs authorise the export of military helmets, body armour, non-military four-wheel drive civilian vehicles with ballistic protection and specially designed components for any of these items, mainly for the protection of aid agency workers and journalists in areas of conflict. The licence permits these goods to be exported to all destinations on a temporary basis only; the goods must be returned to the United Kingdom when no longer required.

-

Continental shelf OIELs authorise the export of controlled goods to the UK sector of the continental shelf for the use only on, or in connection with, offshore installation and associated vessels. The UK sector of the continental shelf is the region of waters surrounding the UK in which the UK has rights over the sea bed, subsoil and their natural resources.

8.4 Global project licences

- Global project licences (GPLs) are a form of export licence that were introduced by framework agreement partners (UK, France, Italy, Sweden, Spain and Germany) to streamline the arrangements for licensing military goods and technologies between them, where these transfers relate to their participation in specific collaborative defence projects. In relation to the collaborative project, each partner state will, as appropriate, issue their own GPLs to permit transfers of specified goods and technology where these are required for that programme. The GPLs operate on a similar basis to UK OIELs. In the UK, applications for GPLs are assessed against the strategic export licensing criteria.

9. Background notes

-

These statistics are designated as official statistics under the Statistics and Registration Service Act 2007. From July 2015 these statistics have been produced to fully comply with the Code of Practice for Statistics. The only exception to code compliance is that on 4 June 2015 the UK Statistics Authority approved a request to be exempt from T3.7 of the Trustworthiness pillar of the Code of Practice for Statistics (that “The name and contact information of the lead statistician or analyst responsible for production should be included in the published statistics”). Please see the UK Statistic Authority’s page for Code of Practice exemption requests for more information. The United Kingdom Statistics Authority has not assessed these statistics for compliance against the code and as such these statistics are not National Statistics.

-

ECJU is in the process of introducing a new digital system for export licensing, known as LITE, which will replace its legacy system, SPIRE. Therefore, at present, two administrative sources, SPIRE and LITE, are used to produce the strategic export controls statistics. With the introduction of LITE in 2021, this release has included data from both SPIRE and LITE from the 2021 Q3 publication onwards. Prior to the 2021 Q3 publication, this release provided data solely from SPIRE. The statement of administrative sources guidance provides more detail on SPIRE and LITE.

-

Whilst the 2023 Q2 publication still includes data from both SPIRE and LITE, there are some limitations in how we have published the LITE data for the 2023 Q1 and 2023 Q2 reporting periods – any SIEL figures that provide the data broken down by initial processing times (including Number/Percentage of SIELs completed within 20 working days, Number/Percentage of SIELs completed within 60 working days, and Median processing time) do not include SIELs processed in LITE for the 2023 Q1 and 2023 Q2 reporting periods. In total, there were 229 SIELs closed in LITE during the 2023 Q1 reporting period and 324 SIELs closed in LITE during the 2023 Q2 reporting period that have not been included in these figures, accounting for 6% and 8% of all SIELs processed (in SPIRE and LITE) respectively. These limitations are caveated alongside the impacted figures in the commentary and Table 4 above, as well as within Table B and Table C that accompany the wider 2023 Q2 publication. Comparing figures from the 2023 Q1 and 2023 Q2 reporting periods with previous reporting periods should be done so with care due to these limitations. For further details, including a high-level overview of data on export licencing decisions made in LITE for each quarter, please see the statement of administrative sources guidance.

-

These limitations result from differences in how SPIRE and LITE currently calculate initial processing times, which up until the end of the 2022 Q4 reporting period, we had manually fixed for SIELs processed in LITE ahead of publication to ensure they were presented on a consistent basis. For further details on how we currently calculate initial processing time, please see the quality and methodology information guidance.

-

Quality issues related to the strategic export controls statistics are outlined in the quality and methodology information guidance and in caveats outlined in the notes of each data table and the country pivot report.

-

In addition, footnotes have been supplied to provide more context for certain licences. Country footnotes are supplied in a data table and give country-specific information on how licence applications have been assessed. Case and goods footnotes are provided on the country pivot report only and aim to offer information on how licensing decisions were made with regards to particular goods and details of their use.

-

A small number of specialised licences have not been counted within this commentary due to how they are processed on SPIRE. Available data on these licences can be found in the ‘other standard licences’ data table as part of each quarterly report.

9.1 Uses of the data

-

Within government, the Foreign, Commonwealth and Development Office (FCDO) and Ministry of Defence (MOD) use the licensing data to inform policy and decision-making. Data are supplied for use in the annual report on Britain’s export control policy and practice during the year. Published by DBT, it is a collaboration between the FCDO, DBT, and the MOD. Please see the strategic export control annual report 2022.

-

The Committee on Arms Export Controls (CAEC) continue to examine the government’s expenditure, administration and policy on strategic exports. The licensing statistics informed their work throughout these periods.

-

Non-government organisations such as Campaign Against the Arms Trade (CAAT) and Amnesty International use the data to monitor strategic exports. Academic and research institutions such as Export Control Advisory Committee (ECAC) and Export Group for Aerospace, Defence and Dual-Use (EGADD) are also known to use the statistics.

9.2 Related statistics

-

UK Defence and Security Exports (UKDSE) publish statistics on UK defence export performance based on sales and new orders. Like the strategic export controls licensing statistics, these do not represent actual exports. Sales may or may not be actually made and new orders may or may not be fulfilled. In addition to providing detail about the types of goods licensed for export, the ECJU’s licensing statistics also give information on end user destinations, the value of licensed goods and they present a picture of usage, such as whether the goods are licensed for permanent export, are to be returned (temporary), are being incorporated and forwarded on or if the goods are merely passing through the UK en-route to another destination (transhipments). The UKDSE statistics do not provide this same level of detail.

-

The aforementioned ‘Strategic export controls annual report’ also presents licensing data. As well as presenting similar data on issued, refused/rejected and revoked licences, plus processing times, it also presents information on refusal criteria counts and information on appeals (against refusals/rejections).

-

The ECJU also reports licensing data to the UN Register of Conventional Arms, which has a main aim of ‘transparency in armaments’ across countries.

9.3 Revisions

- Our licencing statistics revisions policy guidance can be found on the ECJU strategic export controls statistics webpage.

9.4 Further information

-

The most recently published country pivot report and accompanying data tables can be found on DBT’s strategic export controls statistics website.

-

Users can download custom data reports through the ‘strategic export controls: reports and statistics’ web page once registered. The tool offers a variety of filters that can be applied to allow users to download data of specific interest, such as licences which name a certain destination or licences for the shipment of goods with a certain control entry or case summary.