Self-Employment Income Support Scheme statistics: January 2021

Published 28 January 2021

1. Overview

This publication covers the number and value of claims made to the Self-Employment Income Support Scheme (SEISS) administered by HM Revenue and Customs’ (HMRC) up to 31 December 2020.

The release is classified as Experimental Statistics as the methodologies used to produce the statistics are still in their development phase. As a result, the data are subject to revision. These statistics have been produced quickly in response to developing world events.

The Office for Statistics Regulation, on behalf of the UK Statistics Authority, has reviewed them against several key aspects of the Code of Practice for Statistics and regards them as consistent with the Code’s pillars of Trustworthiness, Quality and Value.

1.1 Contact details

For queries or feedback on this publication, please email seiss.statistics.enquiries@hmrc.gov.uk.

For press queries, please contact:

- Dan Allen, tel: 03000 585 024

- Lisa Billard, tel: 07773 091 264

1.2 Next release

The next release will be published on 25 February 2021.

2. Main findings

The main findings from these statistics are:

-

Around 5 million individuals reported self-employment income for the tax year 2018 to 2019, and had their data assessed for potential SEISS eligibility. In order to be assessed, a self-employed individual needed to have traded in the tax year 2018 to 2019 and submitted a Self Assessment tax return on or before 23 April 2020 for that year.

-

Via this process, 3.4 million self-employed individuals were identified as potentially eligible for the SEISS scheme. This means that they met the criteria for the scheme based on Self Assessment returns from the tax year 2018 to 2019 and earlier years. However, some of the potentially eligible businesses will not have been adversely affected by Coronavirus or have ceased trading since the tax year 2018 to 2019 so will not have been eligible.

-

By 31 December 2020 1.9 million (57%) of the potentially eligible population had claimed a third SEISS grant with the value of these claims totalling £5.4 billion.

-

The average value per SEISS 3 claim was £2,800.

- Around two-thirds of the potentially eligible population are male (2.3 million).

- the average claim for females is also lower at £2,200 compared to the average claim for males of £3,100.

-

Around 91% of claimants are aged between 25 and 64 and take-up of the grant in those age groups is at or above 53%. No one age group dominates and claims are evenly spread.

-

The sector with the highest number of potentially eligible individuals and the highest proportion of claims is the construction industry. By 31 December 2020, construction workers had made 659,000 claims for SEISS totalling £2.3bn.

-

The two regions with the highest number of claims are London (394,000) and the South East (275,000), reflecting their relative sizes.

- Of the 1.7 million that did not meet the SEISS criteria, 1.4 million (86%) had trading profits less than non-trading profits (for example, income from employment or investment income), 0.5 million (33%) had trading profits of £0 or made a loss and 0.2 million (11%) had trading profits over £50,000. (please note - individuals may be counted more than once if they have trading profits which meet more than one of these criteria which explains why the figures sum to more than 1.6 million).

3. About this release

The Self-Employment Income Support Scheme (SEISS) provides support for self-employed individuals whose business has been adversely affected by Coronavirus (COVID-19). On the 30 November 2020 applications for the third grant of SEISS opened and will close on 29 January 2021. To make a claim for the third grant businesses must have had a new or continuing impact from coronavirus between 1 November 2020 and 29 January 20201 This is a grant worth 80% of their average monthly trading profits, paid out in a single instalment covering 3 months’ worth of profits, and capped at £7,500 in total. To be eligible for SEISS 3 an individual must have been eligible for SEISS 1 and 2 and also declare that they intend to continue to trade and either:

- are currently actively trading but are impacted by reduced demand due to coronavirus.

- were previously trading but are temporarily unable to do so due to coronavirus.

The data used in this release cover claims for the third grant in the SEISS up to 31 December 2020. This data has been matched with other HMRC data to present breakdowns of claims by:

- age and gender

- sector of the economy

- geography

The first grant, for which applications closed on 13 July 2020, was based on 80% of your trading profits and capped at £7,500 in total. Official statistics on the first SEISS grant are presented in an earlier publication covering data up until 31 July 2020.

The second grant, for which applications closed on 19 October 2020, was based on 70% of your trading profits and capped at £6,570 in total. Official statistics on the second grant are presented in an earlier publication covering data up until 31 October 2020.

Official statistics for the first and second grant are not repeated here.

4. SEISS third grant claims and eligibility

Around 5 million individuals who reported income from self-employment were assessed for SEISS: 3.4 million of these were found to be potentially eligible and 1.7 million were found to be ineligible.

Between 30 November and 31 December 2020, HMRC received 1.9 million claims for the SEISS from a total potentially eligible population of 3.4 million. These claims totalled £5.4 billion with an average award of £2,800 per claimant.

Eligibility for SEISS required an individual to have levels of income which met specific tests on:

- their 2018 to 2019 tax year income, or

- the combination of income for consecutive tax years 2016 to 2017, 2017 to 2018, and 2018 to 2019 where available

Figures below represent all criteria that apply to each individual from both sets of tests. Additionally, within each element individuals can be ineligible for multiple reasons and, as a result, there is a high level of overlap between the categories presented below.

Of the 1.7 million individuals who were assessed to be ineligible:

- 86% (1,439,000) had a trading profit that was less than their non-trading income

- 33% (544,000) had a trading profit £0 or less

- 11% (186,000) had trading profit exceeding £50,000 per year

- 3% (68,000) were ineligible for other reasons

5. SEISS third grant by gender

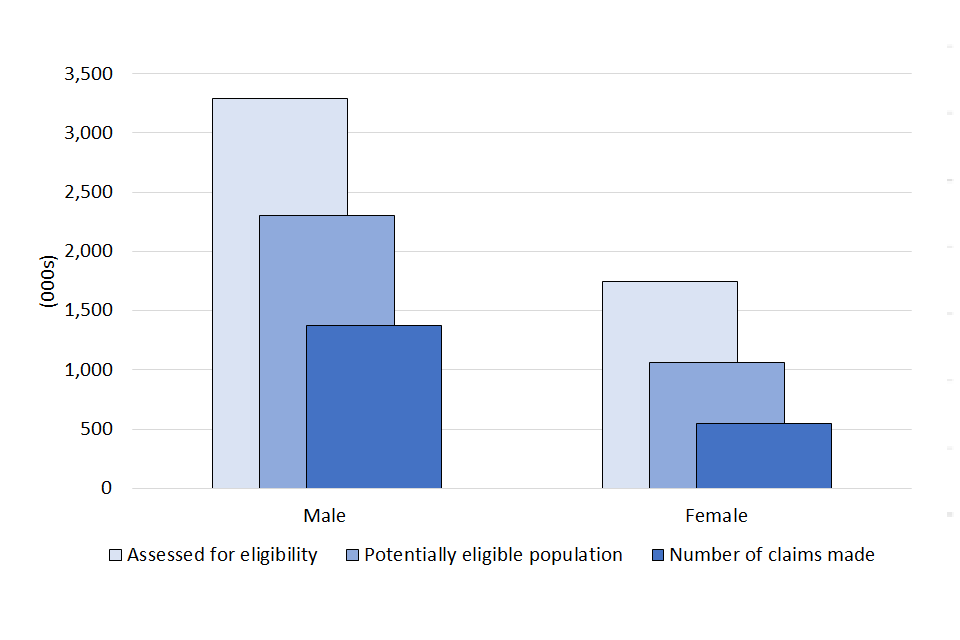

Figure 1 shows the number of SEISS claims for the third grant and the potentially eligible population by gender. Table 1 also shows claim values by gender.

Of 5.0 million individuals who were assessed for potential eligibility, men make up around two-thirds (65%), and also make up a slightly higher proportion (68%) of the potentially eligible population.

By 31 December 2020 HMRC had received 1,376,000 claims from men totalling £4.2 billion compared to 546,000 claims from women for £1.2 billion. Males have a higher take-up rate than females (60% compared to 51%) and their average grant value (£3,100) is higher than the average for females (£2,200).

Figure 1: The SEISS potentially eligible population and third grant claims to 31 December 2020 by gender

Source: HMRC SEISS linked to Self Assessment taxpayer information

Table 1 - SEISS potentially eligible population, number and value of third grant claims to 31 December 2020, by gender

| Gender | Assessed for potential eligibility | Total potentially eligible population | Total no. of claims made | Total value of claims made | Average value of claims |

|---|---|---|---|---|---|

| Male | 3,288,000 | 2,305,000 | 1,376,000 | £4,202m | £3,100 |

| Female | 1,742,000 | 1,061,000 | 546,000 | £1,209m | £2,200 |

| All | 5,038,000 | 3,370,000 | 1,924,000 | £5,417m | £2,800 |

6. SEISS third grant by age group

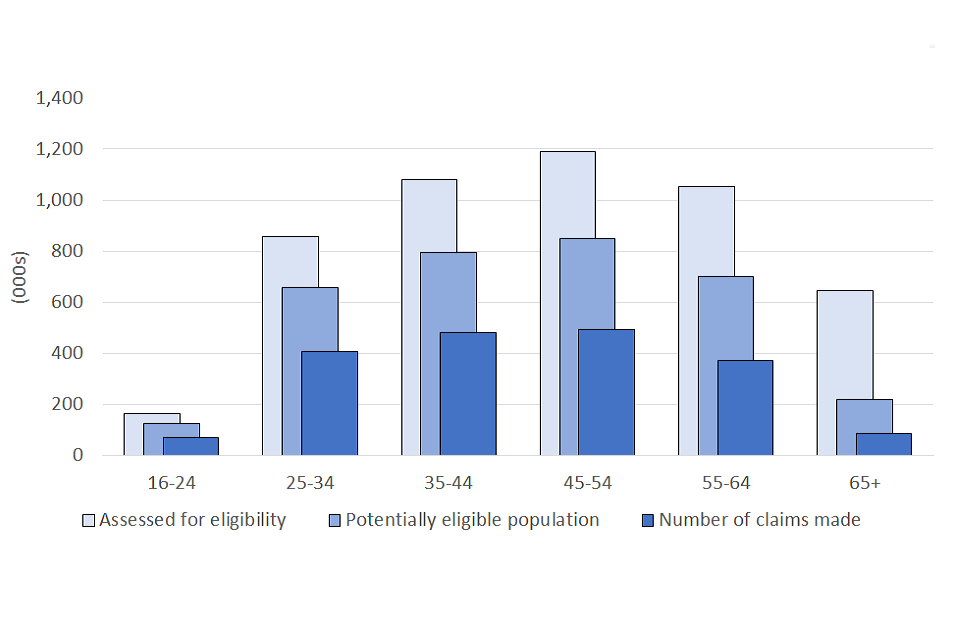

Figure 2 and Table 2 show the assessed for potential eligibility population, the potentially eligible population and volumes of claims made for third grant by age group. Table 2 also shows claim values by age.

Around 89% of individuals who were assessed for potential eligibility were between the ages of 25 and 64, with over 91% of claimants coming from this age group. Take-up of the grant in these age-groups is at or above 58%, with the exception that those between 55 to 64 have a take up rate of 53%. No one age group dominates and claims are evenly spread.

The take up rate is noticeably lower for those who are aged 65 and over (38% have claimed), although they have the highest average claim value at £3,200. The youngest age group have lowest average claim value at £2,100.

Figure 2: The total potentially eligible population and number of claims to 31 December 2020, by age group

Source: HMRC SEISS linked to Self Assessment taxpayer information

Notes

- Age is calculated at the date the SEISS scheme opened on 13 May 2020.

- There is missing age information for 31,000 in the potentially eligible population.

Table 2 - SEISS potentially eligible population, number and value of claims by 31 December 2020, by age band

| Age band (as at 13 May 2020) | Assessed for potential eligibility | Total potentially eligible population | Total no. of claims made | Total value of claims made | Average value of claims |

|---|---|---|---|---|---|

| 16-24 | 164,000 | 124,000 | 69,000 | £146m | £2,100 |

| 25-34 | 857,000 | 656,000 | 405,000 | £1,134m | £2,800 |

| 35-44 | 1,081,000 | 793,000 | 481,000 | £1,365m | £2,800 |

| 45-54 | 1,189,000 | 848,000 | 494,000 | £1,402m | £2,800 |

| 55-64 | 1,053,000 | 699,000 | 372,000 | £1,053m | £2,800 |

| 65+ | 647,000 | 219,000 | 84,000 | £269m | £3,200 |

| Missing | 46,000 | 31,000 | 17,000 | £47m | £2,800 |

| All | 5,038,000 | 3,370,000 | 1,924,000 | £5,417m | £2,800 |

7. SEISS third grant by industry sector

(see Table 3 in the accompanying tables for further details)

Self-employed individuals are asked to provide a description of their business activity on their self-assessment returns. These activities have been mapped across to the Standard Industrial Classification (SIC) 2007 to enable analysis to be carried out by industry sector. Where an individual has multiple sources of self-employed income the activity with the highest income has been used for the SEISS analysis.

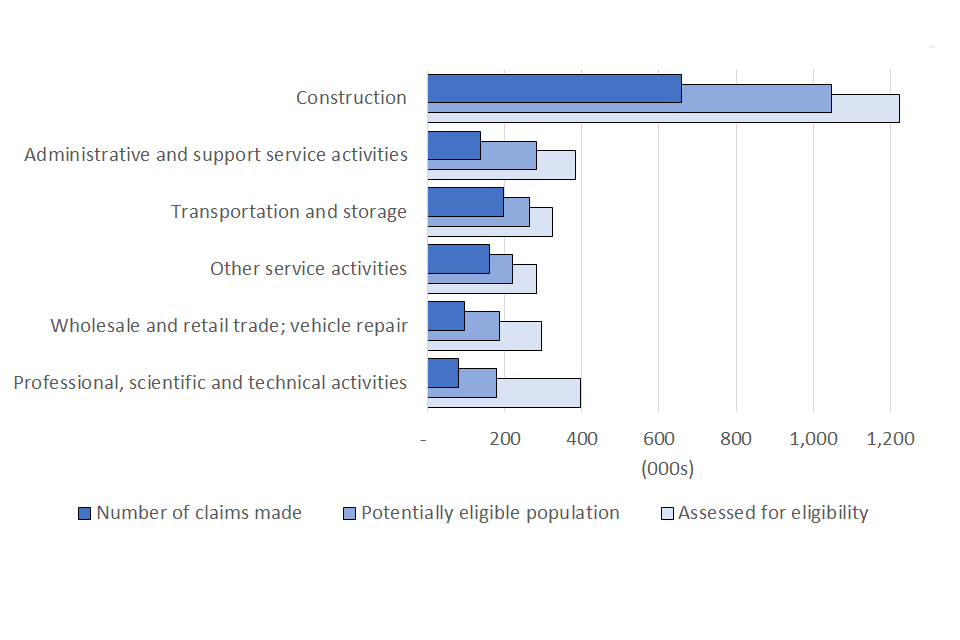

Figures 3 and 4 show the SEISS populations and number of claims for the third grant made by industry sector.

The construction industry has the largest population of individuals who were assessed for potential eligibility with over 1.2 million and just over 1 million of these were potentially eligible to apply. By 31 December 2020 construction workers had made 659,000 claims for SEISS totalling £2.3 billion; an average of £3,400 per claimant.

Self-employed individuals in the transportation and storage sector make up 8% of the potentially eligible population and made 197,000 claims totalling £422 million. Administrative and support services also make up 8% of the potentially eligible population and have made 137,000 claims totalling £271 million.

The highest rates of being assessed as potentially eligible for SEISS were from individuals working in the construction industry (86%) and the transportation and storage sector (82%).

Lower rates of being assessed as potentially eligible for SEISS were found for individuals working in real estate activities (29%), financial and insurance activities (41%) and agriculture, forestry and fishing (45%) and professional, scientific and technical activities (45%).

Figure 3: The SEISS population and number of third grant claims made to 31 December 2020, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

Source: HMRC SEISS linked to Self Assessment taxpayer information

Table 3 - The SEISS population and number of third grant claims made to 31 December 2020, by sector (for the 6 largest SIC industries potentially eligible for the scheme)

| Sector | Assessed for potential eligibility | Total potentially eligible population | Total no. of claims made |

|---|---|---|---|

| Construction | 1,224,000 | 1,047,000 | 659,000 |

| Administrative and support service activities | 384,000 | 283,000 | 137,000 |

| Transportation and storage | 323,000 | 264,000 | 197,000 |

| Other service activities | 284,000 | 220,000 | 161,000 |

| Wholesale and retail trade; vehicle repair | 296,000 | 188,000 | 95,000 |

| Professional, scientific and technical activities | 398,000 | 180,000 | 80,000 |

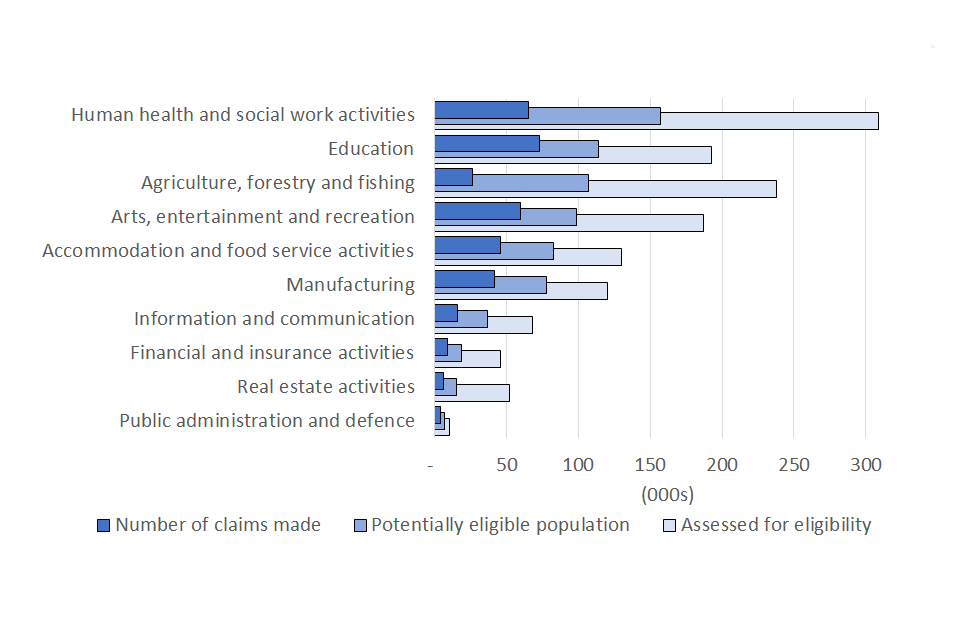

Figure 4: The SEISS population and number of claims for the third grant made to 31 December 2020, by sector; (smaller sectors not shown in figure 3)

Source: HMRC SEISS linked to Self Assessment taxpayer information

Notes:

- 471,000 cases in the potentially eligible population are included as “Unknown and other” and almost all of these (99%) could not be allocated to a SIC code.

Table 4 - The SEISS population and number of claims for the third grant made to 31 December 2020, by sector; (smaller sectors not shown in figure 3)

| Sector | Assessed for potential eligibility | Total potentially eligible population | Total no. of claims made |

|---|---|---|---|

| Human health and social work activities | 309,000 | 157,000 | 65,000 |

| Education | 193,000 | 114,000 | 73,000 |

| Agriculture, forestry and fishing | 238,000 | 107,000 | 26,000 |

| Arts, entertainment and recreation | 187,000 | 99,000 | 60,000 |

| Accommodation and food service activities | 130,000 | 83,000 | 46,000 |

| Manufacturing | 120,000 | 78,000 | 42,000 |

| Information and communication | 68,000 | 37,000 | 16,000 |

| Financial and insurance activities | 46,000 | 19,000 | 9,000 |

| Real estate activities | 52,000 | 15,000 | 6,000 |

| Public administration and defence | 10,000 | 7,000 | 4,000 |

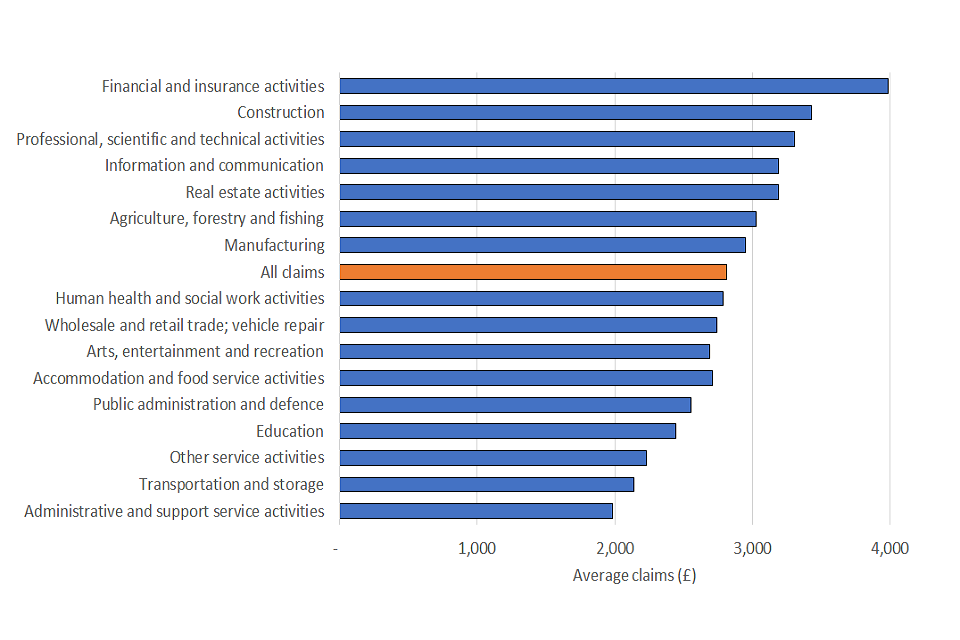

Figure 5 shows the average value of claims by sector which range from £4,000 per claimant in the finance and insurance sector to £2,000 per claimant in administrative and support services.

Figure 5: Average value of claims to 31 December 2020, by primary industry of self-employment, ranked by average claim

Source: HMRC SEISS linked to Self Assessment taxpayer information

Notes

- The allocation to industry represents an individual’s highest earning self-employment.

- 471,000 cases in the potentially eligible population are included as “Unknown and other” and almost all of these (99%) could not be allocated to a SIC code.

Table 5 - Average value of claims to 31 December 2020, by primary industry of self-employment, ranked by average claim

| Sector | Average value of claims |

|---|---|

| Financial and insurance activities | 4,000 |

| Construction | 3,400 |

| Professional, scientific and technical activities | 3,300 |

| Information and communication | 3,200 |

| Real estate activities | 3,200 |

| Agriculture, forestry and fishing | 3,000 |

| Manufacturing | 3,000 |

| All claims | 2,800 |

| Human health and social work activities | 2,800 |

| Wholesale and retail trade; vehicle repair | 2,700 |

| Arts, entertainment and recreation | 2,700 |

| Accommodation and food service activities | 2,700 |

| Public administration and defence | 2,600 |

| Education | 2,400 |

| Other service activities | 2,200 |

| Transportation and storage | 2,100 |

| Administrative and support service activities | 2,000 |

8. SEISS third grant by geography

(see Table 2 in the accompanying tables for further details)

Using the claimant’s Self Assessment address, SEISS claims can be mapped to countries of the UK, English regions and lower geographies.

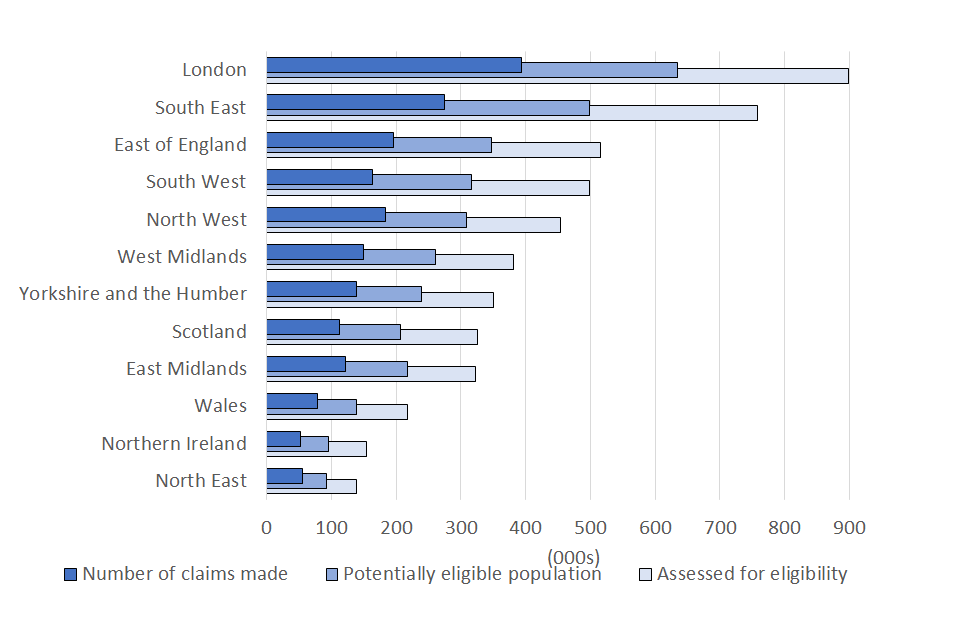

Figure 6 shows the SEISS population and number of claims made by country and region.

London has the largest number of individuals that were assessed for potential eligibility (899,000), the largest potentially eligible population (634,000) and the largest number of claims (394,000) totalling £1.132 billion.

England had the highest proportion of assessed individuals that were found to be eligible (68%), followed by Wales (64%), Scotland (63%) and Northern Ireland (62%).

Take up rate is very even across the UK with most nations and regions having a take up rate close to 58%. Northern Ireland has the highest take up rate (62%) while the take up rate in the South West is the lowest (52%).

Self-employed individuals in Scotland have made 112,000 claims totalling £315 million; in Wales 78,000 claims for £204 million have been made and in Northern Ireland 52,000 claims for £143 million have been submitted.

Figure 6: The SEISS population and number of claims for the third grant made to 31 December 2020 by country and NUTS1 region, ranked by size of assessed for eligibility population

Source: HMRC SEISS linked to Self Assessment taxpayer information

Notes:

- The allocation to location represents the individual’s address registered on their Self Assessment return.

- 13,000 of the potentially eligible population could not be allocated to a NUTS1 region.

Table 6 - The SEISS population and number of claims for the third grant made to 31 December by country and NUTS1 region, ranked by size of assessed for eligibility population

| Sector | Assessed for potential eligibility | Total potentially eligible population | Total no. of claims made |

|---|---|---|---|

| London | 899,000 | 634,000 | 394,000 |

| South East | 759,000 | 499,000 | 275,000 |

| East of England | 515,000 | 314,000 | 196,000 |

| South West | 498,000 | 317,000 | 164,000 |

| North West | 454,000 | 309,000 | 184,000 |

| West Midlands | 382,000 | 260,000 | 149,000 |

| Yorkshire and the Humber | 351,000 | 239,000 | 139,000 |

| Scotland | 326,000 | 207,000 | 112,000 |

| East Midlands | 322,000 | 217,000 | 121,000 |

| Wales | 217,000 | 139,000 | 78,000 |

| Northern Ireland | 154,000 | 96,000 | 52,000 |

| North East | 139,000 | 93,000 | 55,000 |

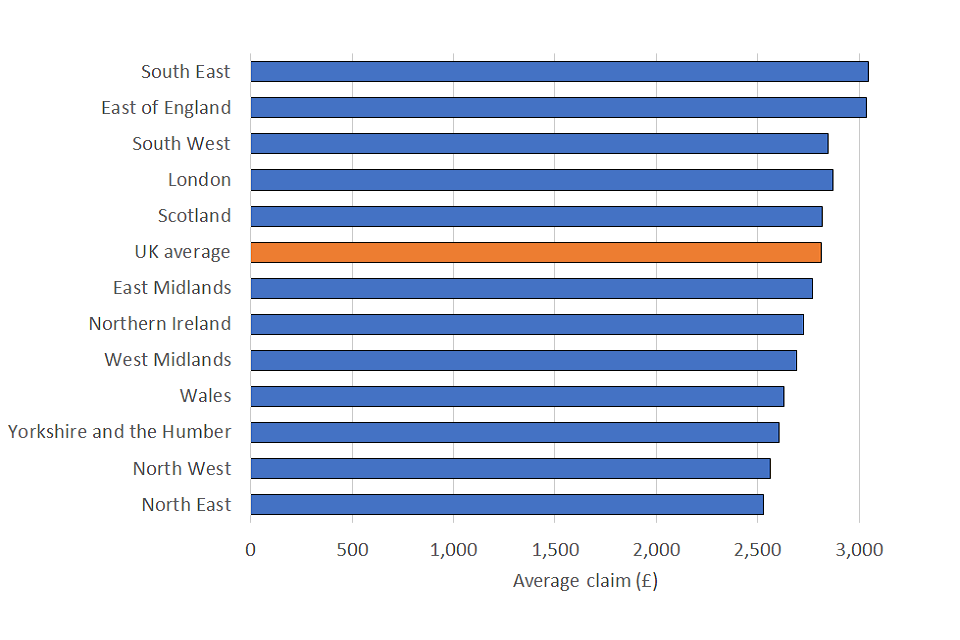

Figure 7 shows the average value of third grant claims by country and region.

The regions and countries with the lowest average claim values are the North East (£2,500) and North West, Yorkshire and the Humber, and Wales (£2,600).

The South East and the East of England (both £3,000) and London (£2,900) have average claim values above the UK average of £2,800.

Figure 7: The average value of claims by NUTS1 region, ranked by value

Source: HMRC SEISS linked to Self Assessment taxpayer information

Notes:

- The allocation to location represents the individual’s address registered on their Self Assessment return.

- 13,000 of the potentially eligible population could not be allocated to a NUTS1 region.

Table 7 - The average value of claims by NUTS1 region, ranked by value

| Sector | Average value of claims |

|---|---|

| South East | 3,000 |

| East of England | 3,000 |

| South West | 2,800 |

| London | 2,900 |

| Scotland | 2,800 |

| UK average | 2,800 |

| East Midlands | 2,800 |

| Northern Ireland | 2,700 |

| West Midlands | 2,700 |

| Wales | 2,600 |

| Yorkshire and the Humber | 2,600 |

| North West | 2,600 |

| North East | 2,500 |

8.1 Sub-regional breakdowns

Tables 4 and 5 in the accompanying Excel table pack provide a breakdown of SEISS claimants by Parliamentary Constituency and Local Authority.

These tables also include a gender breakdown which show the number of male and female claimants and the amount they claim by each area.

The maps below illustrate how the take-up rate for the SEISS scheme has varied across the country.

SEISS claims as a proportion of the potentially eligible population, by Local Authority

Source: Office for National Statistics (ONS) licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright and database right 2020

SEISS claims as a proportion of the potentially eligible population, by Parliamentary Constituency

Source: ONS licensed under the Open Government Licence v.3.0. Contains OS data © Crown copyright and database right 2020

9. SEISS third grant claims by industry sector and geography

(see Table 6 in the accompanying tables for further details)

Sections 9-11 consider the breakdown of the number of claims received in each country and region by different demographics (industry, gender and age). Comparable information relating to the value of claims, the potentially eligible population and take-up rates can be found in tables 6 and 7 in the accompanying tables.

Figure 8 shows the breakdown of claims in each region and country by industry sector. Construction, transport and administrative services have the largest number of claims overall and are shown as separate categories on the chart. Agriculture, forestry and fishing is also large for some areas and is shown separately. Other smaller industries have been combined.

The industry profile of SEISS claimants does not vary greatly between countries and regions. The main exceptions are seen in the construction industry and agriculture, forestry and fishing.

Individuals working in the construction industry account for the highest proportion of claims in every country and region of the UK. London has the highest proportion, with 41% of claims being from those working in construction and Scotland has the lowest with 26%.

Individuals working in agriculture, forestry and fishing account for 7% of all claims made by individuals in Northern Ireland, 4% in Wales, 3% in Scotland and only 1% in England.

Figure 8: The proportion of claims received by 31 December 2020 in each country and region by primary industry of self-employment

Notes:

- The allocation to industry represents an individual’s highest earning self-employment.

- 471,000 cases of the potentially eligible population are included as “Unknown and other” and almost all of these (99%) could not be allocated to a SIC code.

Table 8 - The proportion of claims received by 31 December 2020 in each country and region by primary industry of self-employment

| Proportion of claims by region and sector | Construction | Agriculture, forestry and fishing | Transportation and storage | Administrative and support service activities | Other and unknown |

|---|---|---|---|---|---|

| London | 41% | 0% | 13% | 9% | 37% |

| East of England | 37% | 1% | 9% | 8% | 46% |

| South East | 35% | 1% | 8% | 8% | 48% |

| East Midlands | 34% | 1% | 8% | 7% | 51% |

| West Midlands | 33% | 1% | 12% | 6% | 47% |

| Wales | 34% | 4% | 6% | 6% | 50% |

| South West | 31% | 2% | 6% | 7% | 54% |

| Yorkshire and the Humber | 31% | 1% | 12% | 6% | 50% |

| Northern Ireland | 33% | 7% | 8% | 4% | 48% |

| North West | 31% | 1% | 13% | 6% | 49% |

| North East | 30% | 2% | 12% | 6% | 51% |

| Scotland | 26% | 3% | 12% | 6% | 53% |

10. SEISS third grant claims by gender and geography

(see Table 7 in the accompanying tables for further details)

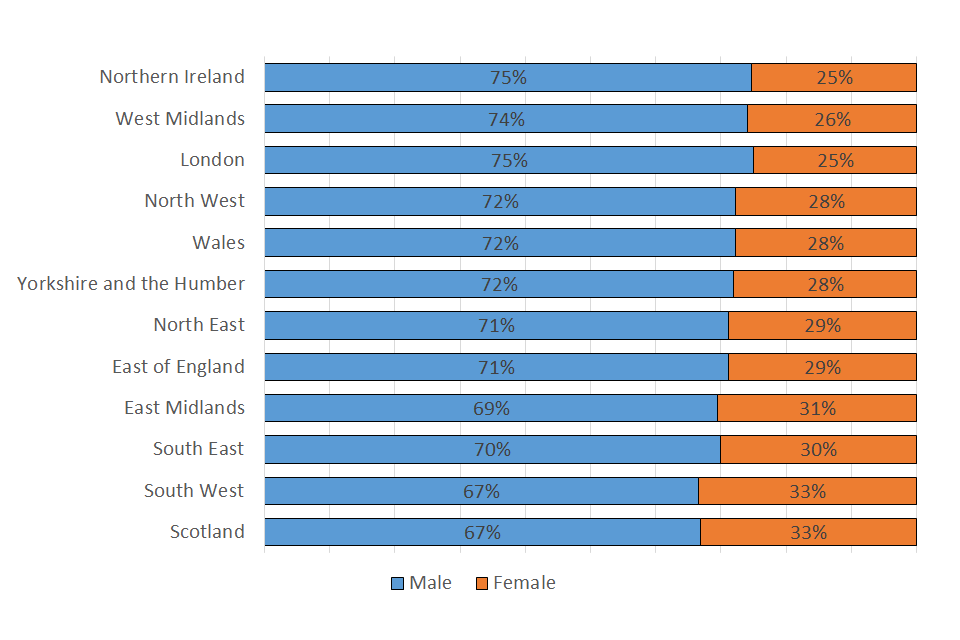

The area with the highest proportion of males in the potentially eligible population is Northern Ireland (73%) and the lowest areas are Scotland and the South West (65% each). A similar pattern is seen in the number of claims received by 31 December 2020 with male claimants accounting for 75% of claims in Northern Ireland and 67% of claims in Scotland.

Since the average claim amount is higher for males than females, men account for an even higher proportion of total claim values. In the West Midlands and London (80 and 81)% of total claim values are from men. The lowest male share is in Scotland and South West where 73% of the total amount claimed is claimed by men.

Figure 9: The proportion of claims received by 31 December 2020 in each country and region by gender

Table 9 - The proportion of claims received by 31 December 2020 in each country and region by gender

| Proportion of claims by region and gender | Male | Female |

|---|---|---|

| Northern Ireland | 75% | 25% |

| West Midlands | 74% | 26% |

| London | 75% | 25% |

| North West | 72% | 28% |

| Wales | 72% | 28% |

| Yorkshire and the Humber | 72% | 28% |

| North East | 71% | 29% |

| East of England | 71% | 29% |

| East Midlands | 69% | 31% |

| South East | 70% | 30% |

| South West | 67% | 33% |

| Scotland | 67% | 33% |

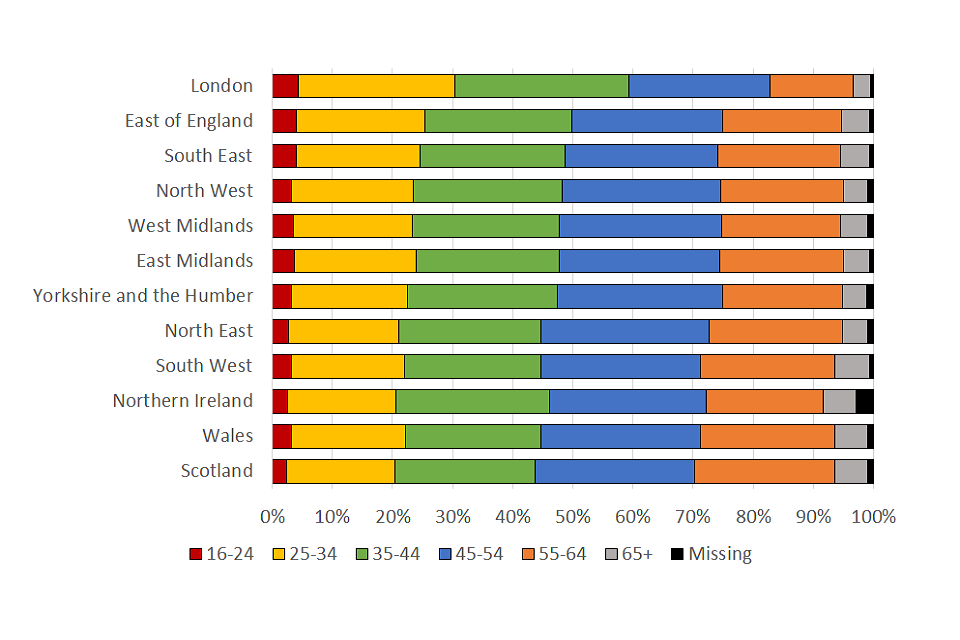

11. SEISS third grant claims by age and geography

(see Table 7 in the accompanying tables for further details)

The age distribution of the potentially eligible population and claims received by 31 December is reasonably consistent across all countries and regions with the exception of London.

Between 41% (Wales, Scotland and Northern Ireland) and 46% (England) of the potentially eligible population in each country and region is aged under 45 except in London where 58% are under 45 and East of England where 47% are under 45.

A similar distribution is observed from claims with the lowest proportion aged under 45 being in Scotland (44% of claims and 42% of claim value) and the highest being in London (59% of claims and 59% of claim value).

Figure 10: Age distribution of claims received by 31 December 2020 in each country and region

Notes:

- Age is calculated at the date the first grant opened on 13 May 2020.

- The age for around 32,000 individuals in the potentially eligible population is not known which is around 1% of each country/region although slightly higher at 3% for individuals living in Northern Ireland.

Table 10 - Age distribution of claims received by 31 December 2020 in each country and region

| Proportion of claims by region and gender | 16-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Missing |

|---|---|---|---|---|---|---|---|

| London | 4% | 26% | 29% | 24% | 14% | 3% | 0% |

| East of England | 4% | 21% | 24% | 25% | 20% | 5% | 1% |

| South East | 4% | 21% | 24% | 25% | 20% | 5% | 1% |

| North West | 3% | 20% | 25% | 26% | 20% | 4% | 1% |

| West Midlands | 4% | 20% | 25% | 27% | 20% | 4% | 1% |

| East Midlands | 4% | 20% | 24% | 27% | 21% | 4% | 1% |

| Yorkshire and the Humber | 3% | 19% | 25% | 27% | 20% | 4% | 1% |

| North East | 3% | 18% | 24% | 28% | 22% | 4% | 1% |

| South West | 3% | 19% | 23% | 26% | 22% | 6% | 1% |

| Northern Ireland | 3% | 18% | 26% | 26% | 19% | 5% | 3% |

| Wales | 3% | 19% | 22% | 26% | 22% | 6% | 1% |

| Scotland | 2% | 18% | 23% | 27% | 23% | 5% | 1% |

12. Background to the SEISS

SEISS was announced on 26 March 2020 as part of the UK government’s support package for businesses and self-employed people during the coronavirus outbreak in early 2020. The scheme was open to self-employed individuals and members of a partnership who met the following criteria:

- traded in the tax year 2018 to 2019 and submitted their Self Assessment tax return on or before 23 April 2020 for that year

- traded in the tax year 2019 to 2020

- intended to continue to trade in the tax year 2020 to 2021

- carried on a trade which had been adversely affected by coronavirus

A business could be adversely affected by coronavirus if, for example:

- they were unable to work because they:

- were shielding

- were self-isolating

- were on sick leave because of coronavirus

- had caring responsibilities because of coronavirus

- they have had to scale down or temporarily stop trading because:

- their supply chain has been interrupted

- they have fewer or no customers or clients

- their staff are unable to come in to work

The grant is not open to limited companies or those operating a trade through a trust.

To work out eligibility, HMRC first look at the 2018 to 2019 Self Assessment tax return. Trading profits must be between £0 and £50,000 and at least equal to your non-trading income. If an individual is not eligible based on the 2018 to 2019 Self Assessment tax return, HMRC will then look at the tax years 2016 to 2017, 2017 to 2018, and 2018 to 2019.

The scheme allows an eligible individual to claim a taxable grant worth 80% of their average monthly trading profits, paid out in a single instalment covering 3 months’ worth of profits, and capped at £7,500 in total. The first SEISS grant closed for claims on 13 July 2020.

On the 17 August 2020 applications for the second SEISS grant opened. This was a taxable grant worth 70% of their average monthly trading profits, paid out in a single instalment covering three months’ worth of profits, and capped at £6,570 in total.

On 30 November 2020 applications for the third SEISS grant opened. This will be is a taxable grant worth 80% of an individual’s average monthly trading profits, paid out in a single instalment covering 3 months’ worth of profits, and capped at £7,500 in total.

The eligibility rules changed slightly for the third grant. To be eligible for SEISS 3 an individual must have been eligible for SEISS 1 and 2 and also declare that they intend to continue to trade and either:

-

are currently actively trading but are impacted by reduced demand due to coronavirus.

-

were previously trading but are temporarily unable to do so due to coronavirus.

The statistics presented in this release mainly cover claims for the third grant in the SEISS scheme up to 31 December 2020.

13. Glossary

The assessed for potential eligibility population are those self-employed individuals who HMRC identified as having traded in the tax year 2018 to 2019 and submitted their Self Assessment tax return on or before 23 April 2020 for that year.

The SEISS potentially eligible population are those who HMRC identified as being potentially eligible for a SEISS grant based on the information held from their Self Assessment returns relating to the tax years; 2016 to 2017, 2017 to 2018 and 2018 to 2019. This is the group who have been invited to claim for a SEISS grant. This does not attempt to assess if a business was affected by coronavirus or whether they continued trading after the tax year 2018 to 2019. So it is the potentially eligible population based only on the information in the Self Assessment forms and not all will apply for the grant.

The assessed to be ineligible population are those self-employed individuals who HMRC identified as having traded in the tax year 2018 to 2019 and submitted their Self Assessment tax return on or before 23 April 2020 for that year, but were found not to be eligible after being assessed against the SEISS criteria. Trading profits must be between £0 and £50,000 and at least equal to your non-trading income.

For an individual to be found ineligible based on the income criteria they need to be found ineligible based on the 2018 to 2019 Self Assessment tax return and the combination of the relevant fields for consecutive tax years 2016 to 2017, 2017 to 2018, and 2018 to 2019. Individuals are also included in the ineligible figures in this publication if an individual’s grant calculation resulted in an amount of £0 or less and if they are recorded as having ceased trading on the Self Assessment systems.

The number of claims is defined as the total number of individuals who had submitted a claim for a SEISS grant by 17.59pm on 31 December 2020 that had been either paid, sent for payment or had been received and were awaiting various checks. Only non-rejected claims are included with the majority of these having been paid or sent for payment. However, a small number of claims were still being processed and could be rejected.

The definitions above apply in the vast majority of cases but there are some other circumstances that are considered when including individuals for assessment and which also may affect potential eligibility to SEISS. However, some of these are only applicable from when the second SEISS grant opens to claims on 17 August and are therefore not included in the statistics in this publication. You can read more about how different circumstances affect SEISS on GOV.UK.

14. Methodology and data sources

14.1 Coverage

This publication covers all self-employed individuals assessed for potential eligibility for the third SEISS grant as at 31 December 2020. Generally, this includes individuals that HMRC identified as having traded in the tax year 2018 to 2019 and submitted their Self-Assessment tax return on or before 23 April 2020 for that year.

Although this covers the vast majority of cases, there are some other circumstances that are considered when including individuals for assessment and which also may affect potential eligibility to SEISS. You can read more about how different circumstances affect SEISS on GOV.UK.

Small changes in the numbers of eligible and ineligible individuals between publications may be observed as HMRC continue to review and monitor HMRC data systems to identify all potentially eligible individuals and to ensure that only genuine HMRC customers are invited to claim.

The claim information covers individuals who had submitted a claim for the SEISS grant by 17.59pm on 31 December 2020 which had not rejected or failed certain compliance checks.

14.2 Data sources used in this release

The data for this release come from HMRC’s system for administering SEISS. It covers the whole population rather than a sample of people or companies.

Additional data from HMRC’s Self Assessment system and other HMRC administrative systems has been matched with SEISS data to produce the data released here.

The age, gender and postcode of residential address has been collected from the Self Assessment account for each individual. The industry information has been collected from the Self Assessment return for the tax year 2018 to 2019, and relates to the self-employment business description provided on that return.

To produce the geographic breakdowns, the claimants’ residential postcode has been matched to Office for National Statistics (ONS) data that links UK post codes to geographic areas. The geographic areas that have been presented in this release are country and English region, Local Authority and Parliamentary constituency.

The Self Assessment system is a live operational dataset and, as such, details such as residential address may be updated at any point. The allocation of geography and industry in these statistics is based on the latest reported information. As a result, it is possible for an individual claimant’s characteristics to change between the first publication of these statistics on 11 June and subsequent publications.

14.3 Ineligible population compared against SEISS eligibility criteria

Analysis of the assessed ineligible population against the eligibility criteria is as a result of additional analysis of the SEISS data in order to provide a description of this group of individuals. An individual can be outside of the criteria for multiple reasons for both the 2018 to 2019 Self Assessment tax return and the tax years 2016 to 2017, 2017 to 2018, and 2018 to 2019. Additionally, it is possible for the same individual to be ineligible due to different criteria across these 2 stages. For the purposes of the figures presented here, ineligible individuals are recorded against all of the categories that apply to that individual. As a result, individuals can be ineligible in multiple ways and there is a high level of overlap between the categories presented.

15. Strengths and limitations

15.1 Experimental Statistics status

This release is classed as Experimental Statistics as the methodologies used to produce the statistics are still in their development phase. This does not mean that the statistics are of low quality, but it does signify that the statistics are new and still being developed. As the methodologies are refined and improved, there may be revisions to these statistics.

15.2 HMRC SEISS Management Information

Management information (MI) on the number and value of SEISS claims received had been published by HMRC at various dates since the scheme was launched on 13th May 2020.

This MI report will no longer be published and instead the HMRC Coronavirus statistics page will point towards these statistics.

15.3 Differences compared to Survey of Personal Incomes

In the Survey of Personal Incomes individuals are considered as Self-Employed if HMRC received or expects to receive Self Assessment forms covering income from self-employment in their 2017 to 2018 Self Assessment tax return.

The population assessed for SEISS eligibility includes only those individuals who submitted 2018 to 2019 Self Assessment returns by 23 April 2020 and included data on self-employment in that return.

15.4 Differences compared to other sources

Other organisations such as the ONS and Institute for Fiscal Studies (IFS) have published information about SEISS either from surveys or estimates derived from previously published data. We believe these HMRC statistics provide a more reliable picture as they are based on administrative data from the SEISS claim and Self-Assessment systems.