PAYE and Corporate Tax receipts from the banking sector (2020)

Updated 6 July 2021

Coverage: United Kingdom

Theme: The Economy

Released: 24 September 2020

Next release: Autumn 2021

Frequency of release: Annual

Statistical contacts:

Ruth Townsend (PAYE): Ruth.Townsend@hmrc.gov.uk

Damian Pritchard (Corporation Tax, Bank Levy and Bank Surcharge): Damian.Pritchard@hmrc.gov.uk

1. About these statistics

This is an official statistics publication produced by HM Revenue and Customs (HMRC). It provides statistics on Pay As You Earn Income Tax and National Insurance contributions (PAYE), Corporation Tax (CT), Bank Levy, Bank Surcharge and Bank Payroll Tax receipts from the banking sector.

2. Key Messages

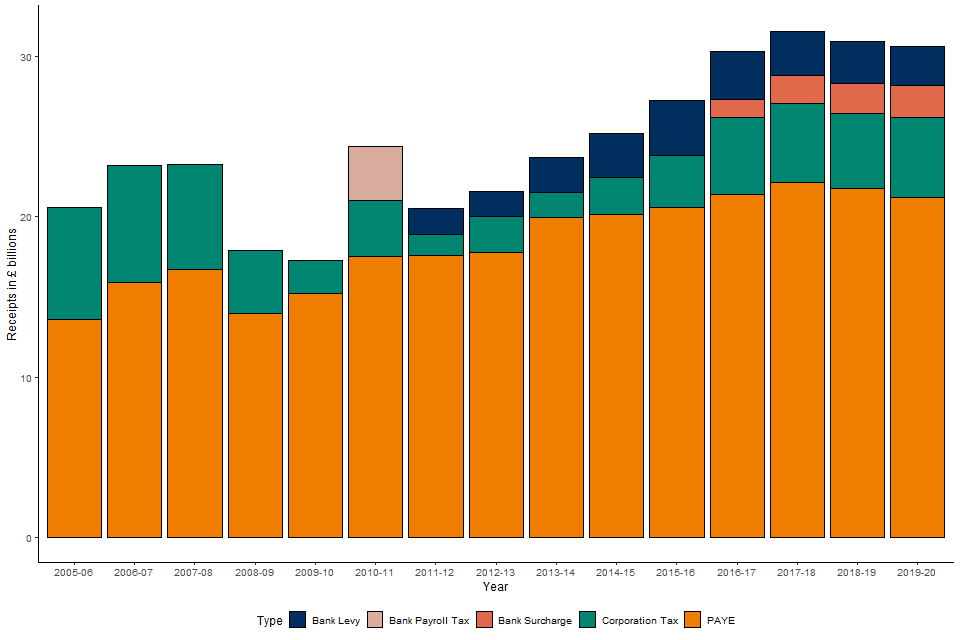

- Chart 1 shows that total PAYE, CT, Bank Levy and Bank Surcharge receipts from the banking sector were £30.7 billion in the tax year ending 2020. This is a decrease of £0.3 billion (1.0%) compared with the previous tax year.

- PAYE receipts from the banking sector were £21.2 billion in the tax year ending March 2020, a decrease of £0.6 billion (2.7%) compared with the previous year. This reduction is likely to be due in part to above inflation increases to the personal allowance and higher rate threshold in this year.

-

Corporation Tax receipts from the banking sector were £5 billion in the tax year ending March 2020, an increase of £0.3 billion (6.9%) compared with the previous year. This increase is mainly due to a payment timing change for the largest companies, from April 2019, which brings forward their Corporation Tax quarterly instalments.

-

Bank Levy receipts were £2.5 billion in the tax year ending March 2020, a 4.6% decrease compared with the tax year ending March 2019. This is mainly driven by year-on-year reductions in Bank Levy rates.

- The COVID-19 pandemic is likely to have started to affect tax receipts towards the end of the tax year ending March 2020, but the main impacts will occur in the tax year ending March 2021.

2.1 Chart 1: PAYE, Bank Payroll Tax, Corporation Tax, Bank Levy and Bank Surcharge Receipts from the banking sector, from the tax year ending March 2006 to the tax year ending March 2020, in £ billions

Chart 1 shows the total receipts from the banking sector between the tax year ending March 2006 and the tax year ending March 2020, with a breakdown by PAYE, CT, Bank Levy, Bank Surcharge and Bank Payroll Tax. The total receipts have increased over this time period from £20 billion to £30 billion.

PAYE data from tax year ending March 2014 onwards is based on improved data matching for banks and may not be directly comparable with earlier years.

3. Introduction

3.1 What does this publication tell me?

This publication provides outturn statistics for PAYE and CT receipts from the banking sector in the UK, alongside receipts from the Bank Payroll Tax, Bank Levy and Bank Surcharge. Not all tax receipts from the banking sector are included in these statistics, in particular irrecoverable VAT and Insurance Premium Tax (IPT). The reasons for this are discussed in definitions and background information, which also includes estimates of receipts from these taxes from the banking sector.

3.2 Who might be interested in these statistics?

This publication is likely to be of interest to policy makers in government, academics, research organisations, the media and the UK banking and financial sectors. It will be of particular interest to those who want to know the PAYE and corporate tax contribution of the banking sector, including its employees.

3.3 What does the receipts table show?

This presents annual figures for the tax year ending March 2006 to the tax year ending March 2020 on PAYE and CT receipts from the banking sector, alongside receipts of Bank Payroll Tax for tax year ending March 2011, the Bank Levy from tax year ending March 2012 and the Bank Surcharge from tax year ending March 2016. The period covered by these statistics (the tax year ending March 2006 to the tax year ending March 2020) was chosen to give a reasonable coverage both before and after the financial crisis. Due to the changing and complex structure of the banking sector it is impractical to extend the statistics to periods earlier than tax year ending March 2006.

3.4 Taxpayer confidentiality

HMRC has a legal duty to maintain the confidentiality of taxpayer information and disclosing information to persons outside of HMRC is only allowed in a limited number of circumstances. These are set out in Section 18 of the Commissioners of Revenue and Customs Act 2005.

The statistics in this release are presented at an aggregate level so that no individual bank’s tax payments can be identified or inferred.

3.5 User engagement

HMRC is committed to providing impartial quality statistics that meet our users’ needs. We encourage our users to engage with us so that we can improve our official statistics and identify gaps in the statistics that we produce.

If you have any comments or questions about these statistics then please contact the responsible statisticians directly.

4. Receipts commentary

The table which accompanies this release as a separate document shows PAYE, Bank Payroll Tax, Corporation Tax, Bank Levy and Bank Surcharge receipts from the banking sector. The following notes assist in interpreting the table.

Table notes:

-

There were small repayments of Bank Payroll Tax in the tax years ending March 2012 and 2013.

-

Bank Surcharge receipts were low in the tax year ending March 2016 as most banks were not due to start paying it until the tax year ending March 2017.

-

Corporation Tax, Bank Levy and Bank Surcharge liabilities fall to companies to pay from their own resources. Sums paid through PAYE include a) Income Tax and National Insurance that employers deduct from employees’ earnings and pensions and pay to HMRC on employees’ behalf, and b) the separate National Insurance contributions for which employers themselves are directly liable.

-

Annual PAYE receipts relate to cash receipts between 1 May and the following 30 April. Annual Corporation Tax receipts relate to cash receipts, gross of company tax credits, between 1 April and the following 31 March. PAYE data from the tax year ending March 2014 onwards is based on improved data matching for banks and may not be directly comparable with earlier years.

-

The gross receipts figure is shown in the table for the (temporary) Bank Payroll Tax. HMRC has estimated that the net yield, taking account of behavioural effects which may have affected other tax receipts, was £2.3 billion. Cash receipts from the Bank Payroll Tax relate to the period 9 December 2009 to 5 April 2010.

-

Annual Bank Levy receipts relate to cash receipts, net of repayments, between 1 April and the following 31 March. The Bank Levy was introduced from 1 January 2011, with payments becoming due for the first time in the tax year ending March 2012.

-

Annual Bank Surcharge receipts relate to cash receipts, net of repayments, between 1 April and the following 31 March. The Bank Surcharge was introduced from 1 January 2016, with payments becoming due for the first time in the tax year ending March 2016.

-

Receipts of Insurance Premium Tax and of irrecoverable VAT paid by the banking sector are not included in this table. Further details on these taxes can be found in definitions and background information.

-

There have been changes to tax rates over the period covered by these statistics. The main rates for the taxes in the table from the tax year ending March 2006 to the tax year ending March 2020 are shown in Appendix B in definitions and background information.

-

Figures may not appear to sum to the totals shown due to rounding to the nearest £0.1 billion.

As shown in Chart 1 banking sector Corporation Tax receipts have varied proportionately more than PAYE receipts over the period. Company profits are generally more sensitive to the economic cycle than pay and employment levels, so Corporation Tax receipts tend to change more than PAYE receipts.

4.1 PAYE

Banking sector PAYE receipts were £21.2 billion in the tax year ending March 2020, a decrease of £0.6 billion compared with the tax year ending March 2019. The relevant Income Tax and National Insurance contributions rates for the period covered by this bulletin are set out in Tables 2, 3 and 4 in Appendix B of definitions and background information.

4.2 Corporation Tax

Corporation Tax receipts from the banking sector were £5 billion in the tax year ending March 2020, an increase of £0.3 billion compared with the tax year ending March 2019. Receipts are presented gross of company tax credits.

In recent years receipts have been lower compared with the period between the tax year ending March 2006 to the tax year ending March 2008 prior to the financial crisis. The financial crisis resulted in lower profits in the banking sector, reducing Corporation Tax liabilities. A further contributing factor has been reductions in Corporation Tax rates. The main rate was 30% until the tax year ending March 2009 and has been cut over a number of years to 19% in the tax year ending March 2018. Further details are provided in Table 1 in definitions and background information.

4.3 Bank Levy

Bank Levy was introduced in January 2011 with the first payments received in August 2011. Receipts increased from the tax year ending March 2013 to the tax year ending March 2016 mainly due to increases in the Bank Levy rate. Bank Levy receipts decreased from £3.4 billion in the tax year ending March 2016 to £2.5 billion in the tax year ending March 2020 mainly due to a series of Bank Levy rate reductions from 1 January 2016. Further details are provided in Table 5 in definitions and background information.

4.4 Bank Surcharge

Bank Surcharge was introduced in January 2016, with payments becoming due for the first time in the tax year ending March 2016. However, payments received between 1 January 2016 and 31 March 2016 were less than £0.1 billion. This is because companies who are liable to pay the Bank Surcharge pay their Corporation Tax in quarterly instalments. Most banking businesses have calendar year accounting periods and were not due to pay the first instalment for their 2016 liabilities until July 2016. Bank Surcharge receipts in the tax year ending March 2020 were £2 billion, up £0.1 billion on the previous year. Bank surcharge rates are provided in Table 6 in definitions and background information.

4.5 Bank Payroll Tax

The Bank Payroll Tax was a temporary tax on awards of discretionary bonuses to banking employees, which applied from 9 December 2009 until 5 April 2010. The gross receipts figure is shown in Chart 1 and the accompanying table. This figure is shown gross, without taking account of behavioural effects which may have reduced receipts of other taxes. HMRC has estimated that the net yield, taking account of behavioural effects which may have affected other tax receipts, was £2.3 billion.

HMRC produces statistics showing tax receipts from the economy as a whole, as well as publications on receipts from specific taxes and duties. These are available on the GOV.UK website.