Headline findings for the Participation Survey (April 2022 to March 2023)

Updated 13 February 2025

Applies to England

Background

February 2025 - A small number of figures have had revisions due to a minor processing error. The corresponding data tables and annual report have been updated. This does not affect any other findings. We expect we may make a small number of similar minor revisions at the end of March, but not to any of our headline indicators.

This section summarises the key findings from the Participation Survey. More detail can be found in the main report.

During the period April 2022 to March 2023 (2022/23), a representative sample of adults in England were asked about their engagement with a number of sectors during the previous 12 months; therefore, many survey questions cover participation stretching from April 2021 to March 2023, depending on when the respondent participated in the survey. Where questions do not cover the previous 12 months (for example live sports), this is stated in the relevant parts of the report and tables. Comparisons of this year’s 2022/23 results are made against the previous year 2021/22 (covering the period of October to March 2022).

In February 2023, there was a Machinery of Government (MoG) change and responsibility for digital policy now sits within the Department for Science, Innovation and Technology (DSIT). This MoG change did not affect the contents of the Participation Survey for 2022/23 - digital questions were still part of the survey and continue to be reported in the same way.

Following on from feedback, we plan to remove the demographic tables from the Participation Survey Quarterly publications, from September 2023. We would continue to include the demographic tables in the annual publications. If you are regularly using the quarterly demographic tables and this proposed change would cause you significant issues, please get in touch with DCMS Survey team by the end of August 2023, outlining which particular breakdowns you would like us to prioritise.

Culture

Total engagement (physical or digital or other[footnote 1]) across all four cultural sectors was higher in 2022/23 compared to the previous year (2021/22). Total engagement in the arts (90%) was the highest, whilst library engagement was the lowest (26%).

- Overall, physical engagement was higher across all cultural sectors than digital engagement.

- Museums and galleries saw the largest increase in engagement compared to the other cultural sectors, with an increase of 9 percentage points in physical engagement from the previous year (digital engagement with museums and galleries remained at a similar level to last year).

Figure 1.1: Physical and digital engagement in the cultural sectors [footnote 1], England: 2021/22 - 2022/23

| 2021/22 | 2022/23 | |

|---|---|---|

| Arts | ||

| Total | 88% | 90%▲ |

| Physical | 87% | 89%▲ |

| Digital | 27% | 28%▲ |

| Libraries | ||

| Total | 22% | 26%▲ |

| Physical | 15% | 19%▲ |

| Digital | 12% | 13%▲ |

| Heritage | ||

| Total | 65% | 69%▲ |

| Physical | 63% | 67%▲ |

| Digital | 16% | 18%▲ |

| Museums & galleries | ||

| Total | 27% | 35%▲ |

| Physical | 24% | 33%▲ |

| Digital | 9% | 9% |

“I’m not interested” and “No reason in particular” were the most common barriers for both physically or digitally engaging with cultural sectors. This has changed from the previous year where “Due to COVID-19 restrictions or concerns” and “I’m not interested” were the most common barriers.

Domestic tourism

In the 12 months prior to completing the survey, 60% of adults took a holiday in England, a 5 percentage point increase from 2021/22 (55%).

Of those who took a holiday in England,

- A third stayed 1 to 2 nights (33%), a 3 percentage point increase from 2021/22;

- 45% spent 3 to 6 nights on holiday, a similar level to 2021/22;

-

17% stayed 7 to 10 nights, a 2 percentage point decrease from 2021/22;

- 43% said they visited museums, galleries, heritage or cultural sites or events, a similar level to 2021/22.

Digital

93% of adults use the internet, which is a similar level to 2021/22 (93%).

- Over half of adults used the internet almost all the time (53%) and only 2% accessed it less often than several times a week.

- The most common internet speeds were between 24 and 100 Mb/s (48%)

- A third of adults were paying between £21 and £30 for their connection (33%).

Most adults owned a smartphone at 91% a 1 percentage point increase from 2021/22.

Whilst 62% owned a laptop.

- Just under half of adults (50%) reported that they do not use personal devices that they own for business purposes.

Overall awareness of 5G has remained similar to 2021/22, with 73% of adults who understood what 5G was.

- More adults reported that they understood 5G and were interested in getting it in the near future (41%) compared to the previous year (38%).

Of respondents who use the internet, 22% of adults took part in digital or online skills training, a 2 percentage point increase compared to the previous year (20%).

- Over half of all adults (54%) felt that this was very or fairly important for current and future careers, but 41% were not interested in doing any training. [footnote 2]

Of those that responded to the survey online[footnote 3], most adults in England were aware of measures to stay safe and secure online.

- Nearly 4 in 5 adults reported that they avoid suspicious links in email, websites, social media messages and pop ups (79%) and nearly three quarters of adults reported that they use different passwords for online accounts (73%). These were similar proportions to 2021/22.

- In general, adults much preferred to use digital tools for identification (for example, providing a passport number online to verify ID) than using hard copies (for example, showing the original documents in person) for things such as opening a bank account, travelling, accessing benefits, and starting a new job. These were similar proportions to 2021/22 apart from opening a bank account for which prefer to use online or digital tools increased by 4 percentage points.

Of those that responded to the survey online, adults in England tended to be more comfortable with the UK government using their data than private companies, similar to 2021/22. Respondents were most comfortable with the UK government using data to make public policies which help keep people safe (67%).

- 44% of adults were comfortable for private companies to use data to grow the economy and create jobs.

- 43% of adults reported that they were comfortable with private companies using data to develop technology to help people do things more efficiently, compared to 43% who were not.

Major events

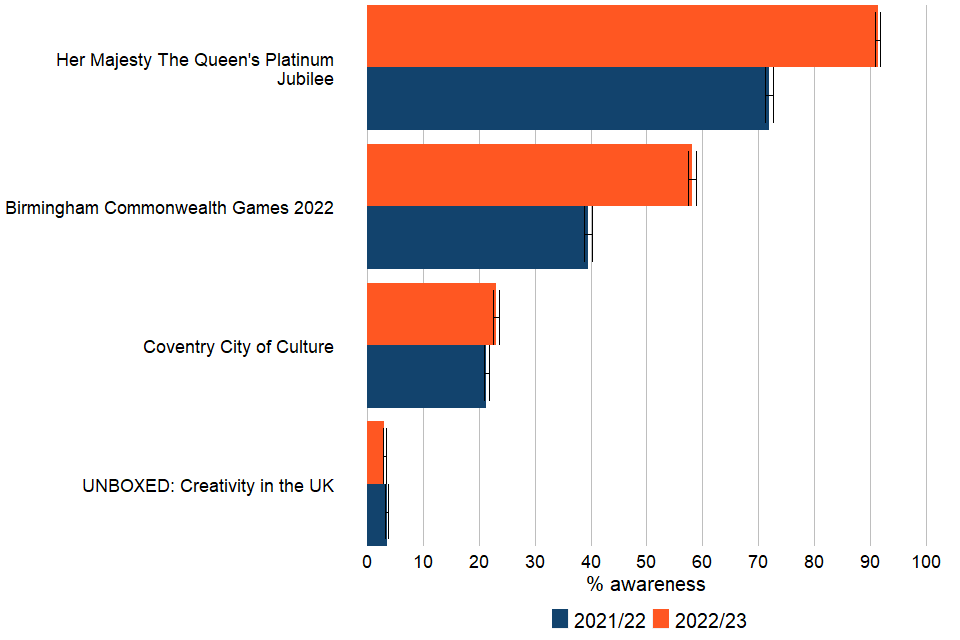

Awareness of Her Majesty The Queen’s Platinum Jubilee was the highest of all the major events we asked about at 91% a 19 percentage point increase from 2021/22 (72%).

- Of the respondents who had heard of the event, 45% of those respondents actually participated in the event.

Respondents had the least awareness of the UNBOXED event with 3% of respondents having heard of the event, a similar proportion to in 2021/22.

- Of the respondents who had heard of the event, around 12% actually participated in the event.

58% of respondents had heard of the Birmingham Commonwealth Games, a 19 percentage point increase from 2021/22.

- Of the respondents who had heard of the event, over a quarter actually participated in the event (28%).

Nearly a quarter of adults had heard of the Coventry City of Culture event, with 23% aware of the event. This is a 2 percentage point increase from 2021/22 (21%).

- Of the respondents who had heard of the event, only 7% of those respondents actually participated in the event.

Figure 1.2: Awareness of selected DCMS major events, England: 2022/23

Belonging to the UK

When asked “How strongly do you feel you belong to the United Kingdom?”, over three quarters of adults (77%) replied “very strongly” or “fairly strongly”, whilst 7% of respondents felt “not very strongly” or “not at all strongly”. There were no changes in responses to this question compared to 2021/22, with the exception of the response “not at all strongly” which has decreased by 1 percentage point.

Live sports

Respondents were asked in the last 6 months if they were able to watch any live sporting events in person. 22% said that they had attended live sports in person in the last six months, a 4 percentage point increase from 2021/22.

Of those live sports,

- Football (65%) was most watched, which was also the most popular in 2021/22;

- Rugby (19%), a 3 percentage point increase from the previous year (16%);

- Some other type of sport (17%), a similar level of popularity to the previous year,

- Cricket (15%), a 4 percentage point increase since the previous year (11%).

These were also the most popular sports to watch live in the previous year.

Over two thirds (65%) of respondents who watched live sports in person said all of these events were professional sports where the participants were being paid. This was a similar proportion to the previous year.

Around three in five adults (59%) said that they had watched live sports on TV.

- Of adults who attended live sports in person in the previous six months, 21% placed a bet.

- Of adults who watched live sports on TV in the last 12 months, 14% placed a bet.

-

Physical engagement means engaging with DCMS sectors in-person, that is, not using digital means. Digital engagement in each sector is defined as visiting a website or using an app related to that sector. ‘Other’ engagement is specific to libraries - respondents were asked if they “used library services in some other way”. This “other” category is not an option for other cultural sectors. ↩ ↩2

-

This is training about digital or online skills rather than any other form of training online. This might include training in how to carry out basic functions such as using digital or online applications to communicate and carry out basic internet searches and to stay safe online. ↩

-

Due to the design of the survey, these questions were only asked of respondents completing the questionnaire online. We would expect that this may have biased the results for these questions due to only online respondents being asked questions about the digital sector. For more information about the survey design, please see the Technical Note from Kantar Public. ↩