Statistical Commentary

Published 27 January 2022

About this release:

This release includes statistics on challenges made by taxpayers (or their representatives) against the 2010 and 2017 local rating lists up to 31 December 2021. It also includes statistics on reviews of rating assessments (known as “reports”) that have either been initiated by the VOA or a billing authority, when new information becomes available.

Responsible Statistician:

Jim Nixon

Statistical enquiries:

Date of next publication:

April 2022

1. Key findings

For England, as at 31 December 2021, the Valuation Office Agency (VOA) had:

- Registered 625,070 checks under the Check, Challenge, Appeal (CCA) system.

- Registered 117,370 challenges under the Check, Challenge, Appeal (CCA) system. 55,570 of these challenges were made as a result of Covid-19 restrictions being imposed. Additional breakdowns of these figures will be available in the next Challenges and Changes release in late April 2022.

- In the last quarter to 31 December 2021, 19,550 checks were registered and as well as an additional 5,170 challenges.

In addition:

- 617,420 checks have been resolved.

- 92,550 challenges have been resolved, 51,550 of which relate to Covid-19. Additional breakdowns of these figures will be available in the next Challenges and Changes release due in late April 2022.

- 12,700 challenges have also been marked as incomplete.

- In the last quarter to 31 December 2021, 19,090 checks and 54,940 challenges were resolved.

- 191,780 Interested Persons (IPs) and 15,600 agents had registered to use the check and challenge service.

- The VOA have approved 572,170 property claims by businesses.

While the statistics do not include the number of appeals made under CCA, as these are the responsibility of the independent Valuation Tribunal Service (VTS), the VTS publish their latest statistics here.

For Wales, as at 31 December 2021 the VOA had:

- Received 620 challenges in the last quarter, with 620 challenges being resolved in the same period. 22,670 remain outstanding.

- For the 2010 list, covering both England and Wales, the quarterly statistics show that, as at 31 December 2021, there were around 10,950 appeals outstanding, down from 12,560 appeals three months previously. These include those awaiting listing, relisting or decisions from the Valuation Tribunal, which the VOA do not control, and some highly complex cases relating to specialist properties where a longer timeframe is necessary to settle the appeals.

As volumes have reached a sufficiently low level, the VOA has taken the decision to stop producing excel tables on the 2010 list following this release. Figures on outstanding cases will still be available through the statistical commentary.

2. Checks, Challenges and Changes against the England 2017 rating list

There has been an increase during the COVID-19 pandemic of interested persons using VOA services which is reflected in the statistics shown in this release.

On 25 March 2021, the government announced that measures brought in as a result of coronavirus, which affect the occupation of property, will not be considered a Material Change of Circumstances (MCC) for the purposes of business rates valuations in the 2017 rating list in England. The Welsh Government also decided to lay similar legislation. More information is available here. A further business rates relief scheme was also announced, to be administered by billing authorities. The Government introduced The Rating (Coronavirus) and Directors Disqualification (Dissolved Companies) Bill to the House of Commons on 12 May 2021. This received Royal Assent (the final stage) on 15 December 2021. The legislation sets out, with retrospective effect, that direct and indirect matters attributable to coronavirus are not to be considered in respect of determinations to alter 2017 rating lists in England. The VOA has issued decision notices for all remaining Challenge cases in England relating to coronavirus measures. In Wales, VOA are contacting ratepayers and asking them to withdraw their cases.

Statistical Summary

Before anyone can access more detailed valuation data about a property, they must prove that they have a legal interest in the property under the non-domestic rating legislation, for example as an owner or occupier or both. To do this, they are required to register to use the system and then can ‘claim their property’ through the VOA’s online service by providing proof of their relationship to the property, such as a copy of a business rates or utility bill. Once the VOA confirm the interested person’s relationship to the property, the claim is approved and the interested person is able to view or request the detailed valuation for that property. The interested party can then start the CCA process. More information is available here.

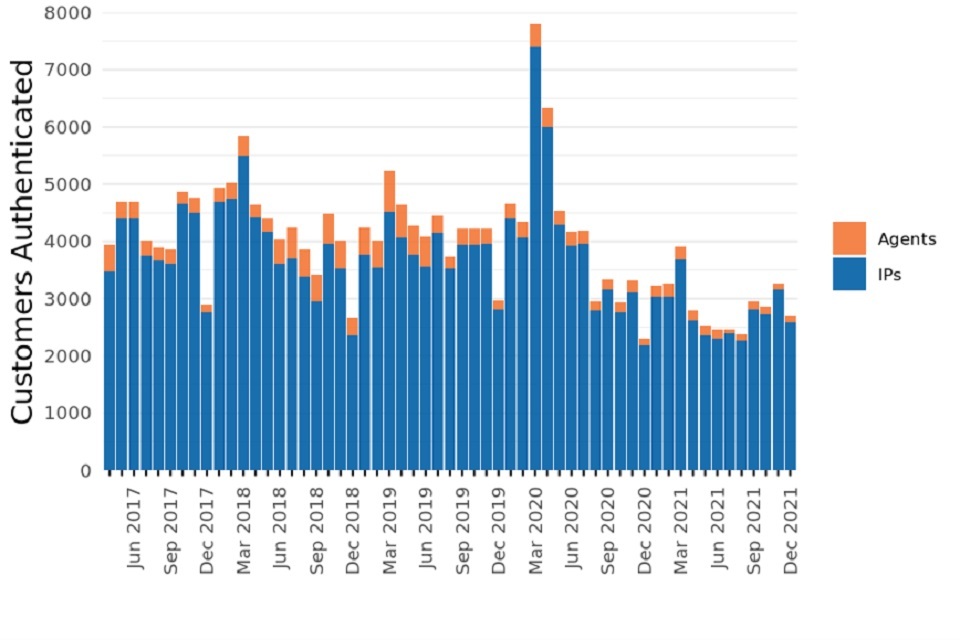

Figure 1: Customer registrations customer type and month, Apr 2017 to Dec 2021

Figure 1: Customer registrations by customer type and month, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 1.2)

The number of interested persons (IPs) and agents registering for CCA each month is shown in Figure 1. More than 90% of registrations are from interested persons rather than agents. Increases seen in March and April 2020 is a spike attributable to the COVID-19 pandemic.

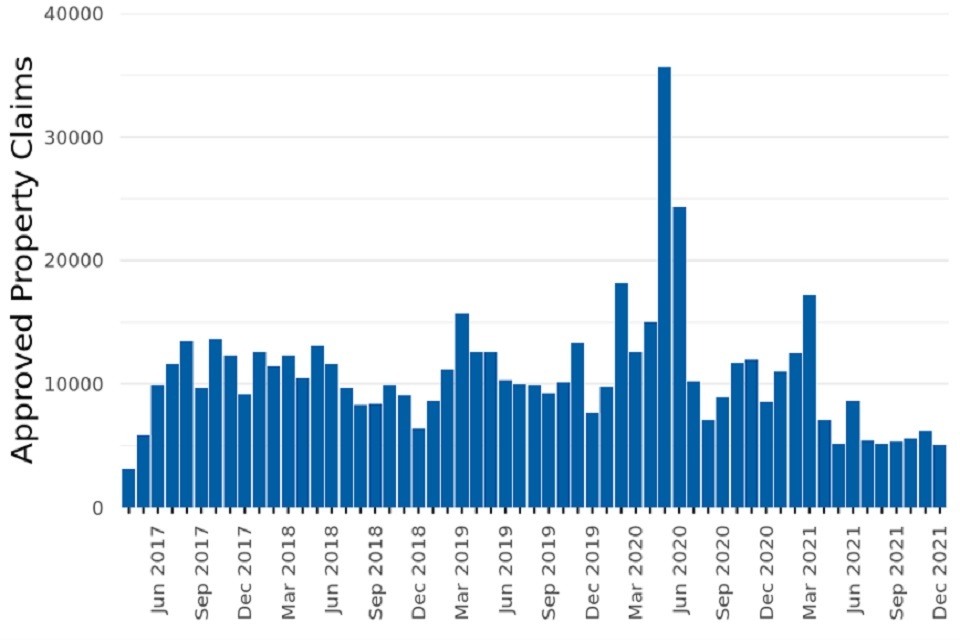

Figure 2: Approved property claims by month, Apr 2017 to Dec 2021

Figure 2: Approved property claims by month, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 1.3)

The number of approved property claims by month is shown in Figure 2. May and June 2020 are the months with the highest number of approved claims. The lag from the peak shown in Figure 1 reflects the time taken from a customer registering for CCA to then claiming a property and having their claim approved by a Valuation Officer.

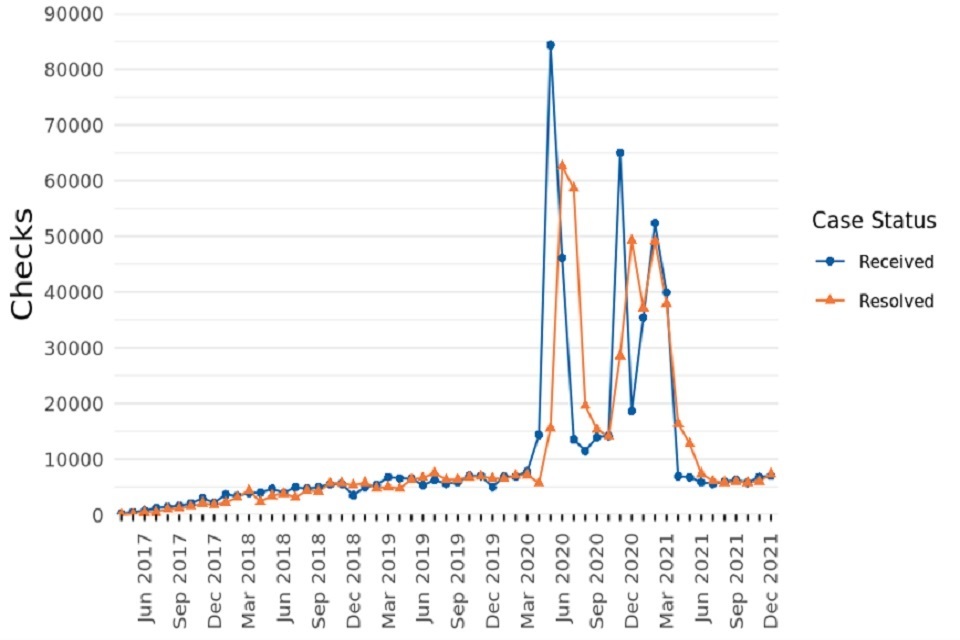

Figure 3: Checks against the England 2017 NDR List by case status and month, Apr 2017 to Dec 2021

Figure 3: Checks against the England 2017 NDR List by case status and month, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 2.1.-2.2)

Figure 3 shows the number of Checks received by month and case status. The 19,550 Checks received in the quarter to 31 December 2021 is 3% of the total received since the start of the list in April 2017. The three spikes are attributable to the COVID-19 pandemic and were coincident with government-imposed restrictions on business.

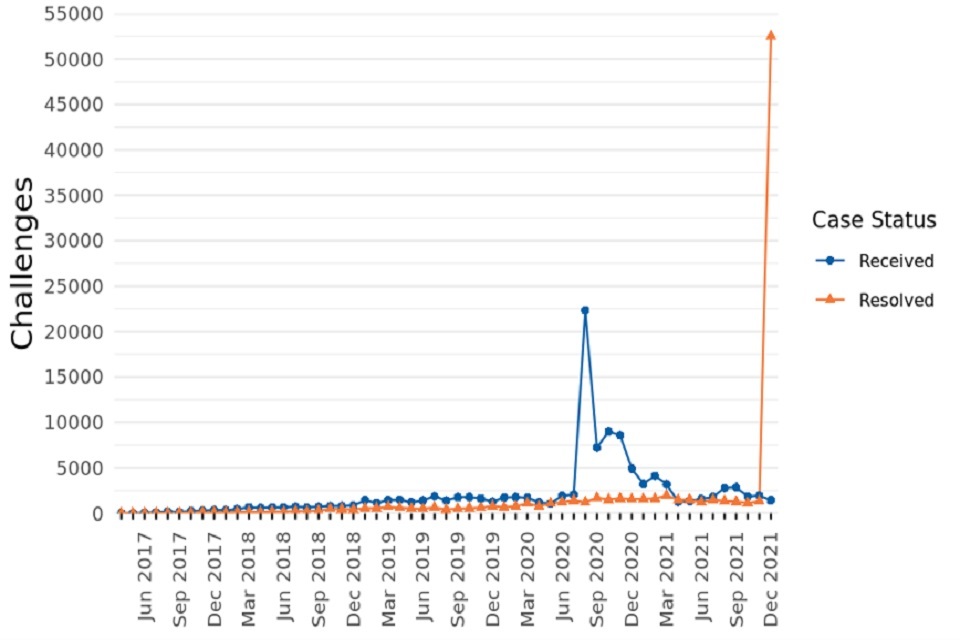

Figure 4: Challenges against the England 2017 NDR List by case status and month, Apr 2017 to Dec 2021

Figure 4: Challenges against the England 2017 NDR List by case status and month, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 2.1-2.2)

Figure 4 shows the number of CCA Challenges received by month and case status. August 2020 saw the highest number of Challenges received in a single month by the VOA and is a consequence of the previous rise seen in Checks (figure 3) attributable to the COVID-19 pandemic.

December 2021 saw the highest number of Challenges resolved in a single month by the VOA and is a result of the Rating (Coronavirus) and Directors Disqualification (Dissolved Companies) Bill being passed through Parliament. Following this the VOA issued decision notices for the Challenge cases in England relating to coronavirus measures. The Act states that measures brought in as a result of coronavirus will not be considered a Material Change of Circumstances. This means that Challenges in England and Wales based on the effect of these measures will not see a change in rateable value.

These cases were resolved as ‘Disagreed’ with no change in rateable value. Further breakdowns of these cases will be available in the next Challenges and Changes publication. The date of this will be published here.

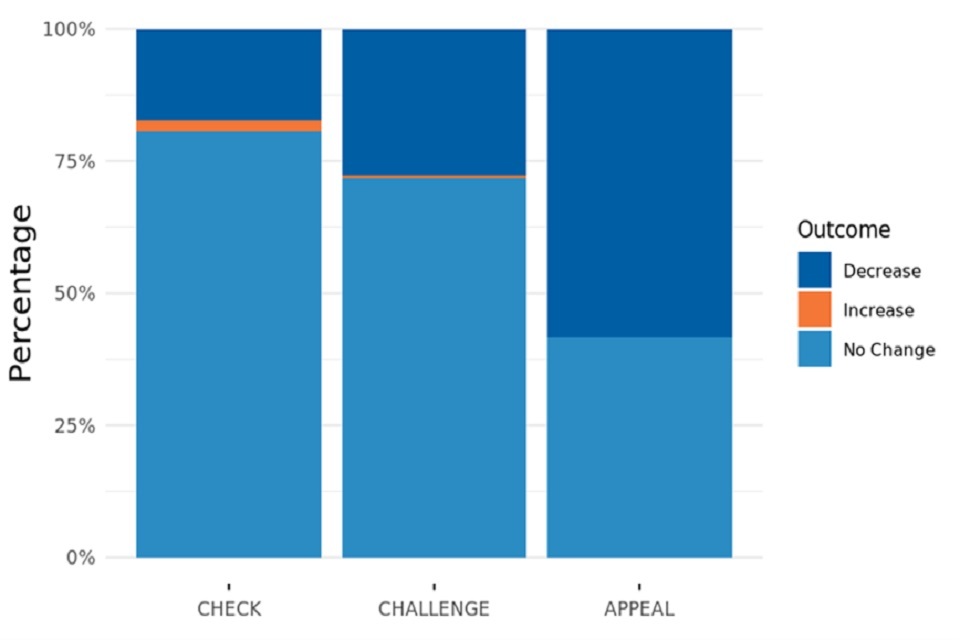

Figure 5: RV change outcome by CCA case type the England 2017 NDR List, Apr 2017 to Dec 2021

Figure 5: RV change outcome by CCA case type the England 2017 NDR List, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 3.1)

Figure 5 shows a percentage breakdown for RV change outcome by CCA case type.

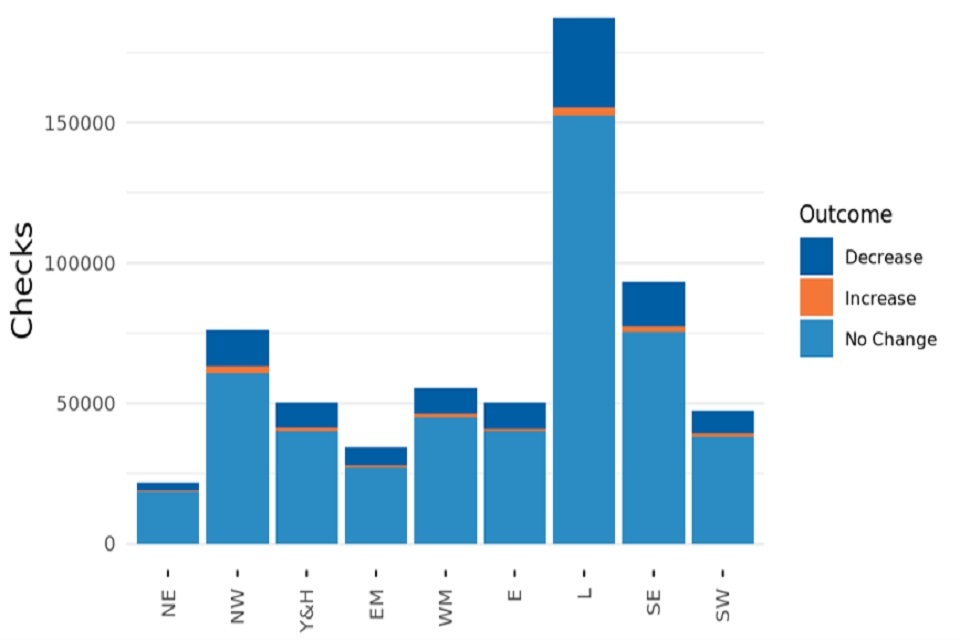

Figure 6: Resolved CCA Checks by region and outcome the England 2017 NDR List, Apr 2017 to Dec 2021

Figure 6: Resolved CCA Checks by region and outcome the England 2017 NDR List, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 3.1)

Figure 6 shows the number of resolved CCA Check cases by geographical region and their outcome.

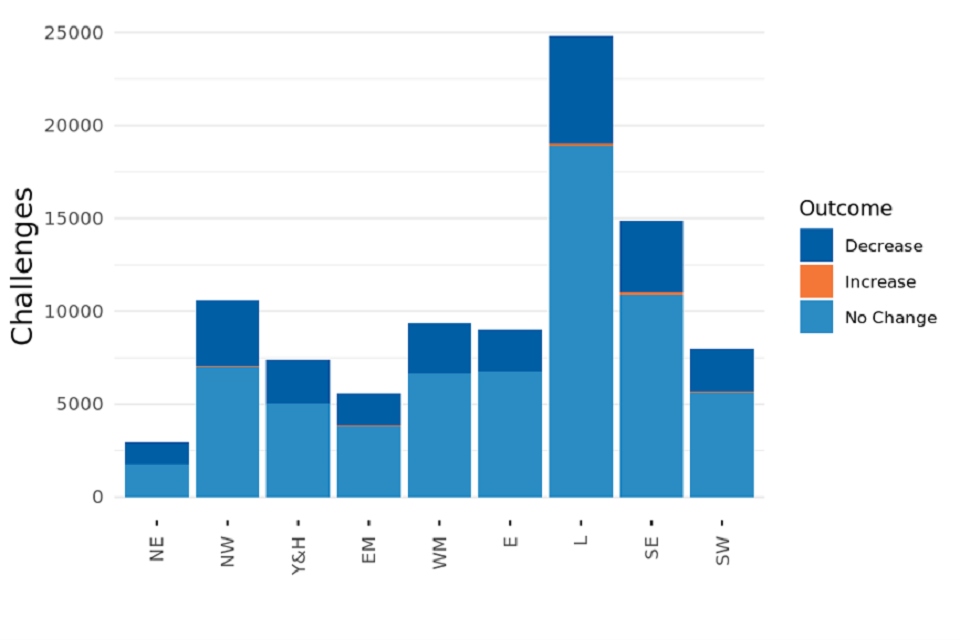

Figure 7: Resolved CCA Challenges by region and outcome the England 2017 NDR List, Apr 2017 to Dec 2021

Figure 7: Resolved CCA Challenges by region and outcome the England 2017 NDR List, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 3.1)

Figure 7 shows the number of resolved CCA Challenge cases by geographical region and their outcome. The large increase in Challenges resulting in no change is attributable to COVID-19 MCC bill being passed through Parliament in December 2021.

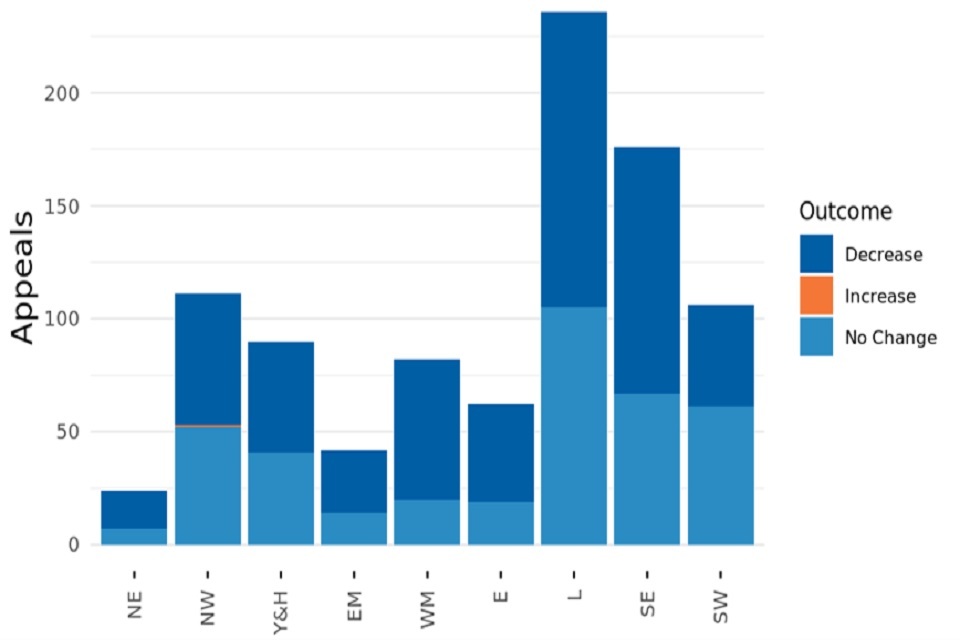

Figure 8: Resolved CCA Appeals by region and outcome the England 2017 NDR List, Apr 2017 to Dec 2021

Figure 8: Resolved CCA Appeals by region and outcome the England 2017 NDR List, Apr 2017 to Dec 2021

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 3.1)

Figure 8 shows the number of resolved CCA Appeal cases by geographical region and their outcome.

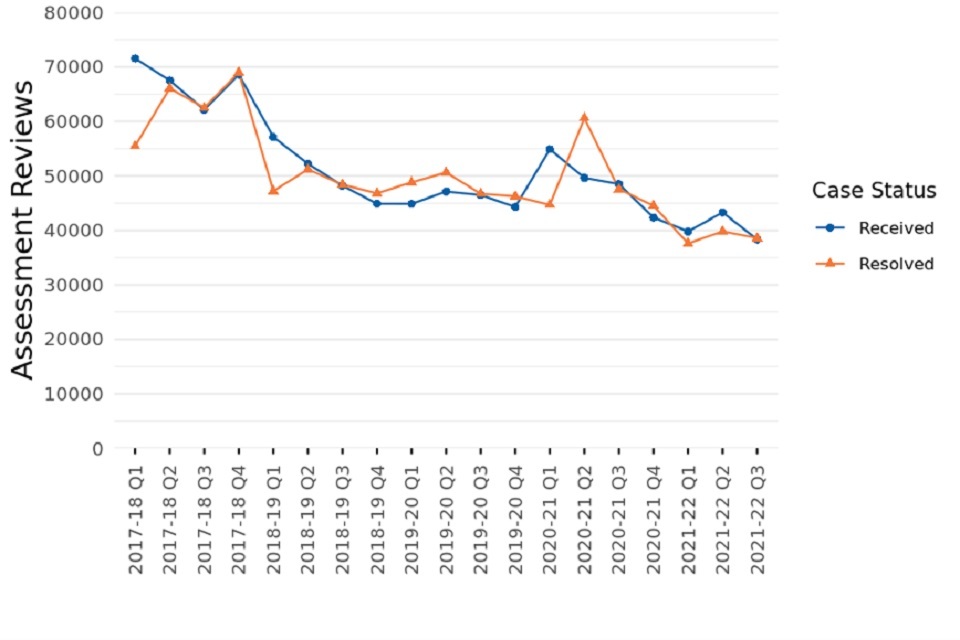

Figure 9: Assessment Reviews against the England 2017 List by case status and quarter, 17-18 Q1 to 21-22 Q3

Figure 9: Assessment Reviews against the England 2017 List by case status and quarter, 17-18 Q1 to 21-22 Q3

Source: C&C against the 2017 local rating list, England, Dec 2021 (Table 4.1 – 4.2)

Figure 9 shows that the number of assessment reviews received and resolved against the England 2017 list have continued to decline in the quarter to 31 December 2021.

3. Challenges and Changes against the Wales 2017 rating list

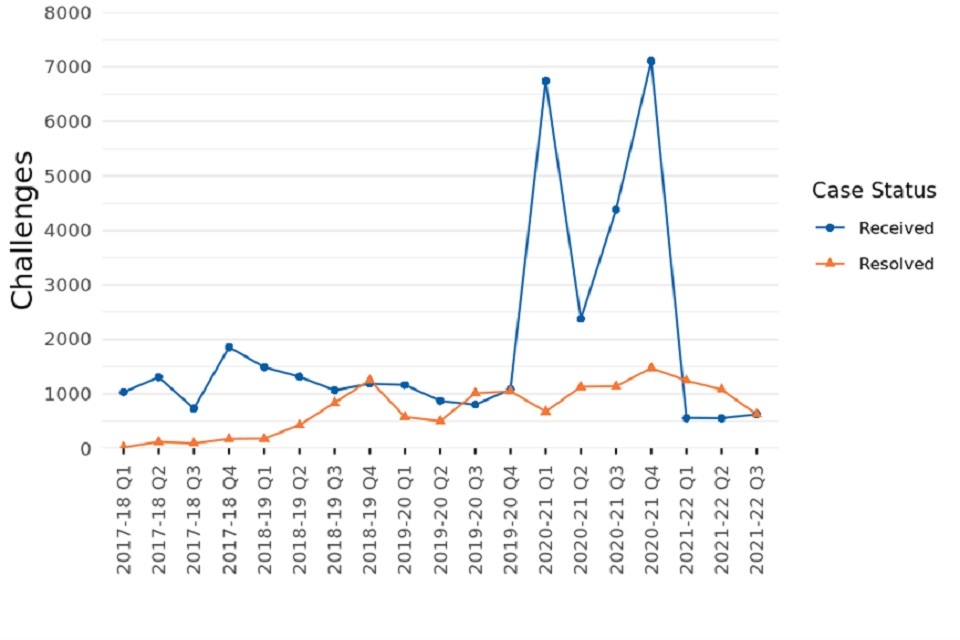

Figure 10: Challenges against the Wales 2017 NDR List by case status and quarter, 17-18 Q1 to 21-22 Q3

Figure 10: Challenges against the Wales 2017 NDR List by case status and quarter, 17-18 Q1 to 21-22 Q3

Source: C&C against the 2017 local rating list, Wales, Dec 2021 (Table 1.1 – 1.2)

Figure 10 shows that the number of challenges received and resolved against the Wales 2017 list have remained largely static in the latest quarter.

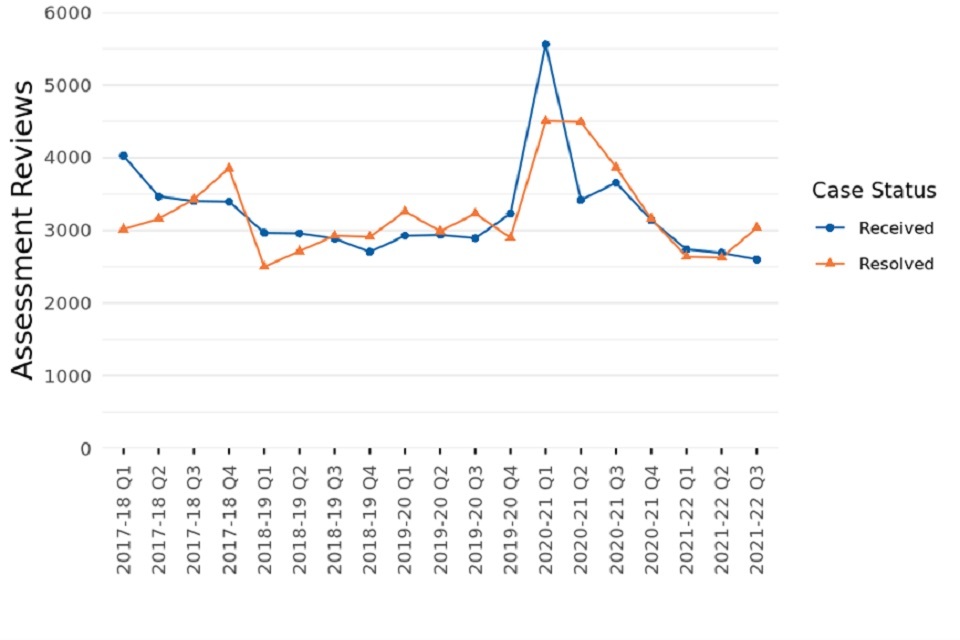

Figure 11: Assessment Reviews against the Wales 2017 List by case status and quarter, 17-18 Q1 to 21-22 Q3

Figure 11: Assessment Reviews against the Wales 2017 List by case status and quarter, 17-18 Q1 to 21-22 Q3

Source: C&C against the 2017 local rating list, Wales, Dec 2021 (Table 3.1 – 3.2)

Figure 11 shows that the number of assessment reviews received against the Wales 2017 list was the lowest on record in the quarter to 31 December 2021. Assessment reviews resolved had a slight increase in the same period.

4. Background notes

This release includes statistics on challenges made by taxpayers (or their representatives) against the 2010 and 2017 local rating lists. It also includes statistics on reviews of rating assessments (known as reports) that have either been initiated by the VOA or a billing authority, when new information becomes available.

Previous quarters’ figures include retrospective changes so will not necessarily be the same as those from previous publications.

Figures in the release note may be rounded to a different level of precision from the figures in the MS Excel tables and should therefore be considered more definitive.

The statistics are derived from VOA’s administrative database and are published at national, regional and billing authority level.

The VOA is required, by the Local Government Finance Act 1988, to compile and maintain accurate rating lists specifying a rateable value for all non-domestic rateable properties in England and Wales. These rateable values provide the basis for national non-domestic rates bills, which are issued by billing authorities. There is a local rating list for each billing authority. However, for simplicity, we have referred to these throughout this publication as one combined ‘rating list’ for those local lists effective from 1 April 2010, and, likewise, one combined ‘rating list’ for those local rating lists effective from 1 April 2017.

Ratepayers, owners, and in limited circumstances, relevant authorities and other persons (known formally as Interested Persons) can make a challenge to alter the rating list if they think an entry is incorrect. Challenges can also be made on behalf of interested persons by their professional representatives.

The process for challenging the rating list currently differs between England and Wales. In Wales a challenge, known as a proposal, is made to the Valuation Officer asking them to change the entry in the rating list. After a period of discussion if the Valuation Officer cannot reach agreement with the ratepayer the matter will then be referred to the Valuation Tribunal Service, at which stage it becomes an appeal. In England a new three stage appeals system was introduced in 2017, called Check, Challenge, Appeal (CCA).

More information about CCA can be found in the Background Information document.

5. Further information

More detailed information on the 2017 local rating list is available on the Agency’s website at the following location: https://www.gov.uk/correct-your-business-rates

Further information on the area codes used in this release please refer to the ONS’s website at the following location: https://www.ons.gov.uk/methodology/geography/geographicalproducts/namescodesandlookups /namesandcodeslistings

Timings of future releases are regularly placed on the VOA research and statistics calendar.

We will keep under review the format of this summary document to improve the presentation of our statistics and welcome feedback from users on the usefulness of the information provided in this summary. As part of our improvement programme, if you’re interested in participating in user research about this statistical release please contact us via statistics@voa.gov.uk