Farming household income in England: 2021/22

Updated 18 December 2025

Applies to England

Farm household income in England: 2021/22 – statistics notice

Release Note

This release replaces the farm household income data and commentary which was published on 23 May 2023 and taken down on 28 June 2023. In the original and historic versions of this release, a single measure of ‘Farm Household Income’ was shown, however, this has been removed due to a concern over data definitions. In this updated release, we use the terminology ‘farm household income’ to relate to three separate measures: Household Share of Farm Business Income, Household Share of Drawings, and Household Off-Farm Income.

Tax estimates have also been removed, due to a concern over the assumptions being made in the calculations.

Finally, all comparisons to Office for National Statistics (ONS) figures have been removed. The ONS figures shown in the original release were for all UK households. For most farms in England, the farmer and their family live on the farm and the farmhouse is often used as an office. Therefore, some of the household expenses, including things that an average employed person spends their income on, can legitimately be claimed as farm expenditure. Although private shares of expenditure, for example, energy costs, insurance, motor costs and property costs, are all calculated in the Farm Business Survey, the measures in this publication may underestimate the total disposable income available to the farm household. Therefore, it is not helpful to compare these figures to the national average household income.

Improvements to this release are planned for the 2024 publication, including reintroducing the measure of total Farm Household Income. If you have any feedback, please contact the Farm Business Survey team at fbs.queries@defra.gov.uk.

Introduction

This release uses information collected in the Farm Business Survey (FBS) to present measures of farm household income for the 2021/22 survey year. This data was last collected in the 2014/15 survey. There are three measures included in this publication (in each of these measures, the term ‘household’ refers to the principal farmer and their spouse or common law partner):

- Household Share of Farm Business Income:

- the annual share of Farm Business Income (FBI), including income from farm diversification, i.e., non-farming activities which use farm resources, attributable to the household

- calculated using the percentage of drawings taken by the principal farmer and their spouse or common law partner, rather than the principal farmer’s legal share of the business as defined in partnership agreements (which frequently reflects tax considerations)

- in essence, FBI is the same as Net Profit; this is the theoretical maximum disposable income for the household, however, the household may choose not to draw this full amount and instead save some of it in the farm business or use some for making additional investments in the farm

- Household Share of Drawings:

- the gross annual income taken from the farm business by the household for investments in capital outside of the farm business (i.e., transferring to personal accounts, purchasing stocks and shares, purchasing property/assets unrelated to the farm) and private expenditure (i.e., personal and corporation taxes, private and national insurance, living expenses)

- reported directly within the Farm Business Survey from the farm’s management accounts

- Household Off-Farm Income:

- the gross annual income of the household from any employment, self-employment or investments not related to the farm, as well as any pensions, social payments and other off-farm income (e.g., income from diversified activities set up independently of the farm business)

- does not include any capital gains, welfare payments made in kind (e.g., free school meals) or windfall receipts/losses (e.g., an inheritance)

- reported within the Farm Business Survey as banded data; the true value is estimated for each farm (see section 5.3.3 for more detail)

- this data will be monitored throughout the Agricultural Transition to see how farms respond to the withdrawal of subsidy payments

In each of these measures, the sample only includes farms which provided a response to the Household Income questions (the share of the drawings taken and the off-farm income). More information on the sample can be found in section 5.2.

For most farms in England, the farmer and their family live on the farm and the farmhouse is often used as an office. Therefore, some of the household expenses, including things that an average employed person spends their income on, can legitimately be claimed as farm expenditure. Although private shares of expenditure, for example, energy costs, insurance, motor costs and property costs, are all calculated in the Farm Business Survey, the measures in this publication may underestimate the total disposable income available to the farm household.

This release includes a time series from 2005/06 to 2014/15 and 2021/22. The 2021/22 survey year covers the first year of the Agricultural Transition period and relates to the 2021/22 Farm Business Income results. It was also the second year of the Covid-19 pandemic. This release provides average (median) farm household income measures, with breakdowns by farm type and size.

Key Results

All measures of farm household income in this release are equivalised, and are therefore representative of a single-adult household. Additionally, values are presented in real terms, meaning that values from previous years have been adjusted for inflation.

The average (median) Household Share of Farm Business Income in England in 2021/22 was:

- £22,200 at the all-farm level, up from £12,400 in 2014/15

- highest in general cropping (£41,000) and dairy (£39,900) farm households

- lowest in lowland grazing livestock (£9,800) and horticulture (£12,000) farm households

The average (median) Household Share of Drawings in England in 2021/22 was:

- £12,800 at the all-farm level, down from £14,900 in 2014/15

- highest in dairy (£21,700) and general cropping (£18,700) farm households

- lowest in lowland grazing livestock (£9,600) and Less Favoured Area (LFA) grazing livestock (£10,600) farm households

The average (median) Household Off-Farm Income in England in 2021/22 was:

- £3,300 at the all-farm level, down from £6,500 in 2014/15

- highest in lowland grazing livestock (£5,800) and Less Favoured Area (LFA) grazing livestock (£5,000) farm households

- lowest in specialist pigs and poultry (£300) and cereals (£900) farm households

Points which apply throughout

-

The England Farm Business Survey is the source for all data presented in tables and charts unless otherwise stated.

-

All figures relate to England and cover a March to February fiscal year, with the most recent year shown ending in February 2022. Fiscal years are shown in YYYY/YY format, for example, the period of 1 March 2021 to 28 February 2022 is shown as 2021/22. To ensure consistency in harvest/crop year and commonality of subsidies within any one FBS year, accounts of farms which have their FBS accounting year ending between 31 December and 30 April have been used. Aggregate results are presented in terms of an accounting year ending on the last day of February, which is the approximate average of all farms in the Farm Business Survey.

-

All figures have been rounded to the nearest £100. Percentages have been calculated on unrounded data and are rounded to the nearest 1%.

-

Due to the small sample sizes, pig and poultry farms have been combined into a single farm type.

-

The acronym ‘LFA’ refers to Less Favoured Area. These areas were established in 1975 to provide support to mountainous and hill farming areas. They are areas where the natural characteristics (geology, altitude, climate, short growing season, low soil fertility, or remoteness) make it difficult for farmers to compete.

-

All figures are presented in real terms, meaning they have been adjusted for inflation (CPIH), and equivalised using the modified OECD equivalence scale. Equivalisation allows the fair comparison of households with differing numbers of adults and children by adjusting all households to the level of a single adult. More detail on this can be found in section 5.3.4.

-

In some years the off-farm income questions were only asked of a sub-sample of farms. Therefore, all years have been reweighted to maintain consistency with the survey population estimates.

-

Due to differences in methodology, it is not possible to compare the results in this release to the previously published farm household income release. See section 5.4 for more detail.

1 Household Share of Farm Business Income in England

This is the share of Farm Business Income attributable to the principal farmer and their spouse or common law partner. Farm Business Income includes income from farm diversification, i.e., non-farming activities which use farm resources, and is, in essence, the same as Net Profit. It is the theoretical maximum disposable income for the household, however, the household may choose not to draw this full amount and instead save some of it in the farm business or use some for making additional investments in the farm.

The Household Share of Farm Business Income is calculated using the percentage of drawings taken by the principal farmer and their spouse or common law partner, rather than the principal farmer’s legal share of the business as defined in partnership agreements. This is because the legal share frequently reflects tax considerations.

The percentage of drawings taken by each partner in a farm business tends to be static over time, therefore, variation in the Household Share of Farm Business Income is much more likely to arise from changes to the Farm Business Income itself. There are many different reasons for variation in Farm Business Income within individual farms over time, for example, a drop in one year may be due to reduced output because of a weather event, increased input costs, or due to a large reinvestment in the farm.

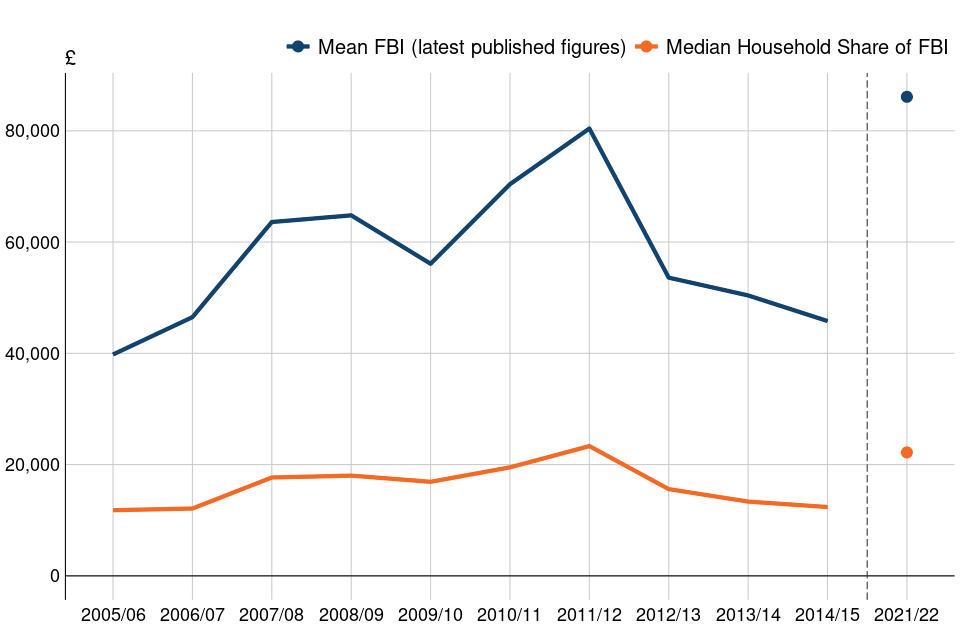

Figure 1.1 Median Household Share of Farm Business Income (equivalised and in real terms) for farming households in England, 2005/06 to 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.64 KB)

Figure notes:

(a) The break in the series shown between 2014/15 and 2021/22 represents the end of the first inclusion of the off-farm income module in the FBS; it was not collected again until the 2021/22 survey

(b) The line and point showing mean Farm Business Income values are the higher ones on the chart and Median Household Share of Farm Business Income are the lower ones

(c) Household Share of Farm Business Income values are adjusted for inflation using the [Consumer Prices Index including owner-occupiers’ housing costs (CPIH)] (https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/l522/mm23) and equivalised using the modified OECD equivalence scale

(d) Farm Business Income values are adjusted for inflation using the Gross Domestic Product at market prices (GDP) implied deflator; the latest Farm Business Income statistics are available in the Farm Business Income in England publication

Figure 1.1 shows the median Household Share of Farm Business Income (FBI) over time, compared with the mean FBI. As expected, Household Share of FBI followed the same pattern as FBI but at a lower value – this is mostly due to the difference between mean and median FBI values (see section 5.4 for more detail), but also because the percentage of drawings taken is not always 100% and FBI values are not equivalised. Between 2005/06 and 2014/15, Household Share of FBI increased by 5%. However, it rose and then fell again between these years, peaking in 2011/12.

Between 2014/15 and 2021/22, median Household Share of FBI rose from £12,400 to £22,200 (an increase of 79%). Farm businesses had an exceptionally strong year in 2021/22, with high output prices resulting in record high mean FBI for almost all farm types despite an increase in input costs. Pig farms were the only farm type where mean FBI decreased compared to 2020/21, due to input costs rising considerably more than output prices.

1.1 Household Share of Farm Business Income in England by farm type

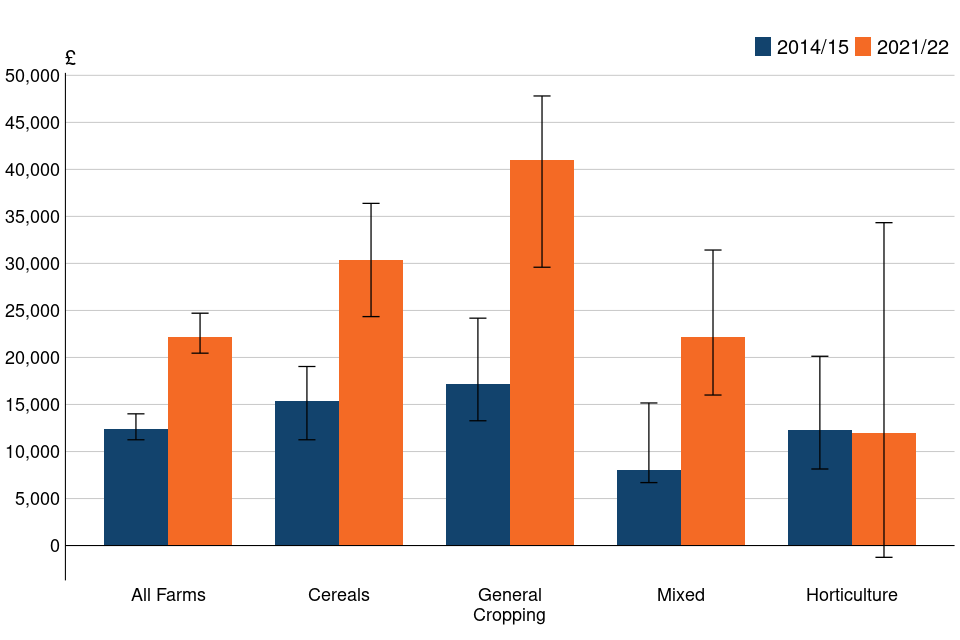

Figure 1.2 Median Household Share of Farm Business Income (equivalised and in real terms) for cropping and mixed farms in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.05 KB)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 1.2 compares the median Household Share of FBI in 2014/15 and 2021/22 across cropping and mixed farms, and the ‘All Farms’ category is included for comparison. As in the Farm Business Income statistics, general cropping farm households had the highest median share of FBI (£41,000) of the cropping and mixed farms in 2021/22, and horticulture farm households had the lowest (£12,000). However, as indicated by the relatively large error bar, the sample size for horticulture farms was smaller than other farm types, so these results should be treated with more caution.

In cropping and mixed farms, horticulture farm households had the smallest change in their median share of FBI between 2014/15 and 2021/22, decreasing by 2% from £12,200 to £12,000. General cropping farm households had the largest change, more than doubling from £17,200 to £41,000.

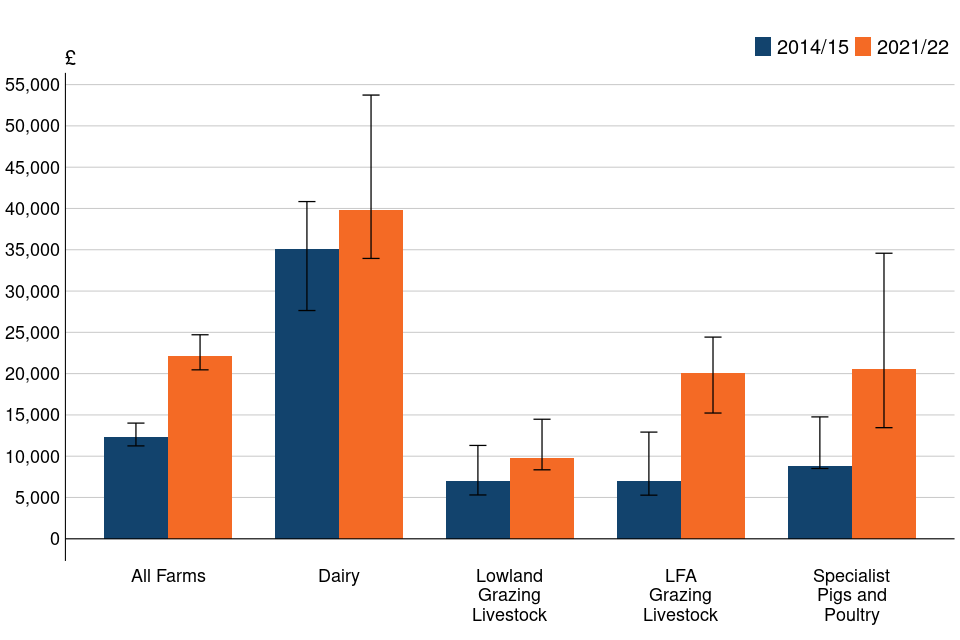

Figure 1.3 Median Household Share of Farm Business Income (equivalised and in real terms) for livestock farms in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.12KB)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the [Consumer Prices Index including owner-occupiers’ housing costs (CPIH)] (https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/l522/mm23) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 1.3 compares the median Household Share of FBI in 2014/15 and 2021/22 across livestock farms, and the ‘All Farms’ category is included for comparison. As with cropping and mixed farms, this shows a similar pattern to the Farm Business Income statistics; dairy farm households had the highest median share of FBI (£39,900) in 2021/22, and lowland grazing livestock farm households had the lowest (£9,800).

For livestock farms, lowland grazing livestock farm households had the smallest change in their median share of FBI, increasing from £6,900 to £9,800. LFA grazing livestock farm households had the largest change, almost tripling from £7,000 to £20,100.

1.2 Household Share of Farm Business Income in England by farm size

Farm sizes are based on the estimated Standard Labour Requirement (SLR) for the business, rather than its land area. For more detail see Section 5.6.

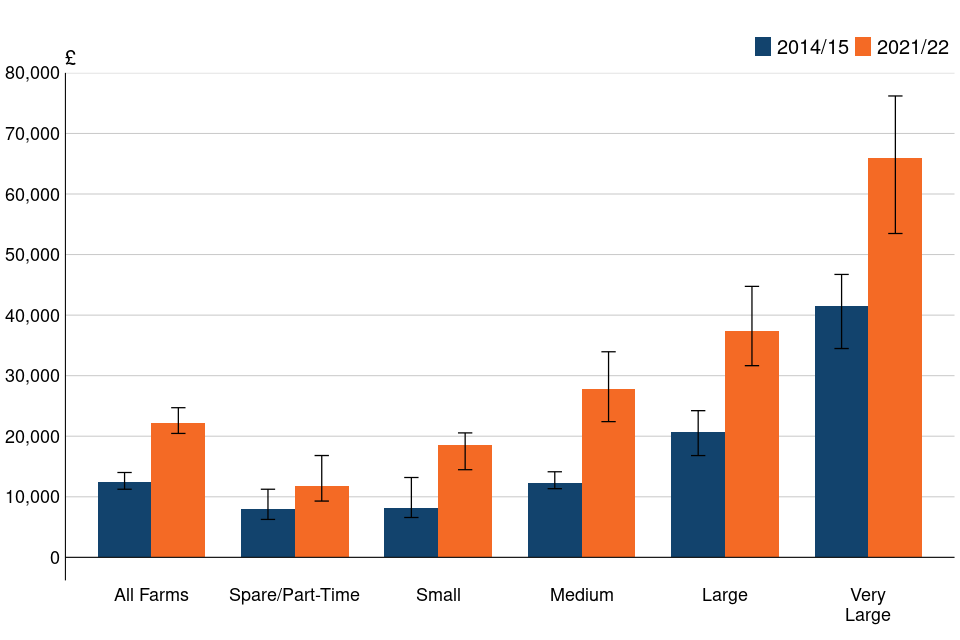

Figure 1.4 Median Household Share of Farm Business Income by farm size (based on SLR) in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.23KB)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 1.4 compares the median Household Share of FBI in 2014/15 and 2021/22 by farm size (based on SLR), and the ‘All Farms’ category is included for comparison. Mean FBI by farm size for all farms can be found in table 3.1 of the Farm Accounts in England statistics. The same pattern shown in these statistics can be seen in the Household Share of FBI, where it increases as the size of the farm increases.

The same pattern is also seen in the change in median share of FBI; spare/part-time farm households had the smallest change in their median share of FBI, increasing from £8,000 to £11,700. Very large farm households had the largest change, increasing from £41,500 to £65,900.

2 Household Share of Drawings in England

The Household Share of Drawings comprises the gross income taken from the farm business by the principal farmer and their spouse or common law partner for investments in capital outside of the farm business and private expenditure. Investments outside of the farm include transferring to personal accounts, purchasing stocks and shares, and purchasing property or assets unrelated to the farm. Private expenditure includes personal and corporation taxes, private and national insurance, and living expenses.

In the Farm Business Survey, total private drawings are reported directly from the management account, and the percentage of drawings taken by the principal farmer and their spouse or common law partner is also reported. The Household Share of Drawings is calculated by multiplying total private drawings by this percentage.

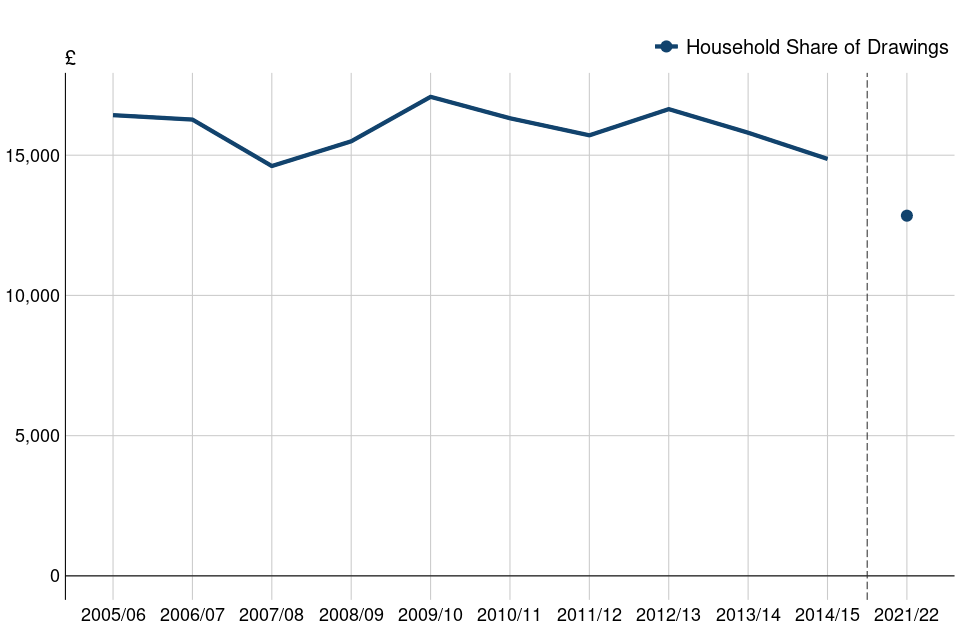

Figure 2.1 Median Household Share of Drawings (equivalised and in real terms) for farming households in England, 2005/06 to 2021/22

View the data for this chart

Download the data for this chart (CSV, 810 Bytes)

Figure notes:

(a) The break in the series shown between 2014/15 and 2021/22 represents the end of the first inclusion of the off-farm income module in the FBS; it was not collected again until the 2021/22 survey

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

Figure 2.1 shows the median Household Share of Drawings over time. For the most part, Household Share of Drawings is more stable than Household Share of FBI. Between 2005/06 and 2014/15, Household Share of Drawings fluctuated, ranging between £14,600 in 2007/08 and £17,100 in 2009/10. Between 2014/15 and 2021/22, median Household Share of Drawings decreased by 14%, from £14,900 to £12,800.

2.1 Household Share of Drawings in England by farm type

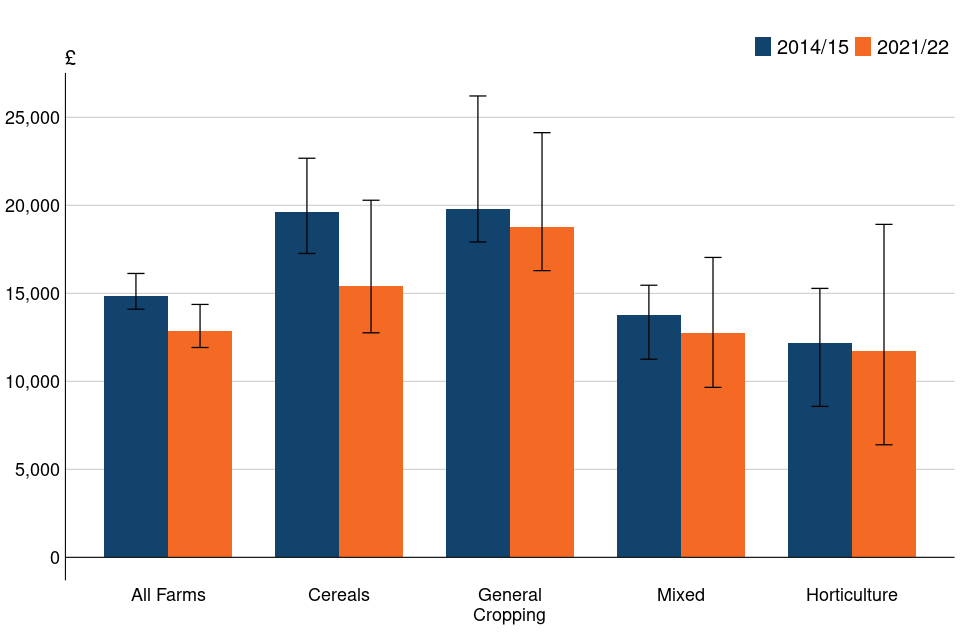

Figure 2.2 Median Household Share of Drawings (equivalised and in real terms) for cropping and mixed farms in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 959 Bytes)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 2.2 compares the median Household Share of Drawings in 2014/15 and 2021/22 across cropping and mixed farms, and the ‘All Farms’ category is included for comparison. As with Household Share of FBI, general cropping farm households had the highest median share of drawings (£18,700) of the cropping and mixed farms in 2021/22, and horticulture farm households had the lowest (£11,700). Again, however, as indicated by the relatively large error bar, the sample size for horticulture farms was smaller than other farm types, so these results should be treated with more caution.

However, unlike with median share of FBI, all cropping and mixed farm households had their median share of drawings decrease between 2014/15 and 2021/22. Horticulture farm households had the smallest change in their median share of drawings, decreasing by 4% from £12,200 to £11,700. Cereals farm households had the largest change, decreasing by 21% from £19,600 to £15,400.

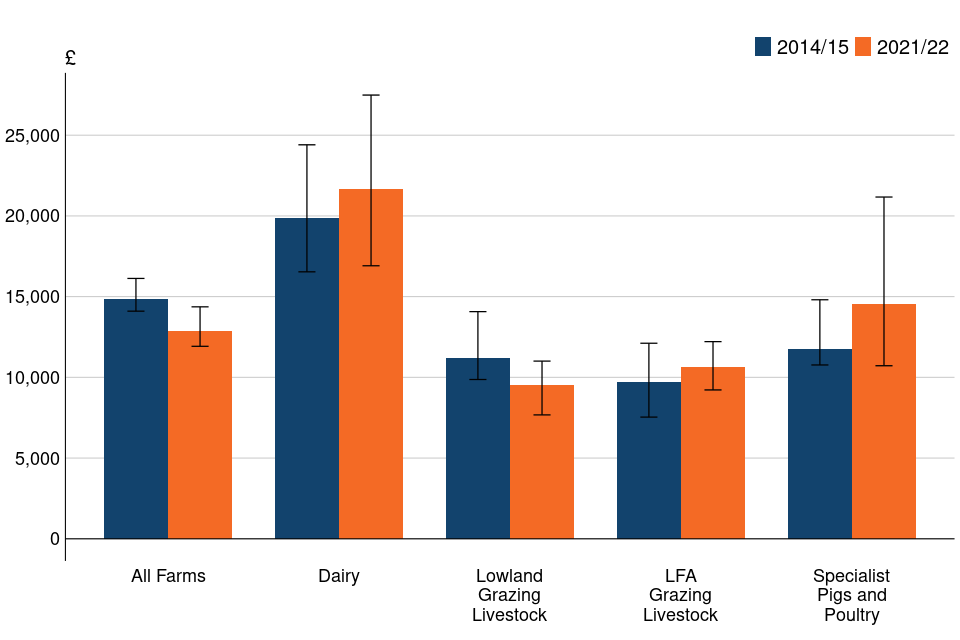

Figure 2.3 Median Household Share of Drawings (equivalised and in real terms) for livestock farms in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.01 KB)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 2.3 compares the median Household Share of Drawings in 2014/15 and 2021/22 across livestock farms, and the ‘All Farms’ category is included for comparison. As with cropping and mixed farms, this shows a similar pattern to Household Share of FBI; dairy farm households had the highest median share of drawings (£21,700) in 2021/22, and lowland grazing livestock farm households had the lowest (£9,600).

For livestock farms, LFA grazing livestock farm households had the smallest change in their median share of drawings, increasing by 10% from £9,700 to £10,600. Specialist pigs and poultry farm households had the largest change, increasing by 24% from £11,800 to £14,500. Lowland grazing livestock farm households were the only livestock farm type whose median share of drawings fell, decreasing by 15%.

2.2 Household Share of Drawings in England by farm size

Farm sizes are based on the estimated Standard Labour Requirement (SLR) for the business, rather than its land area. For more detail see Section 5.6.

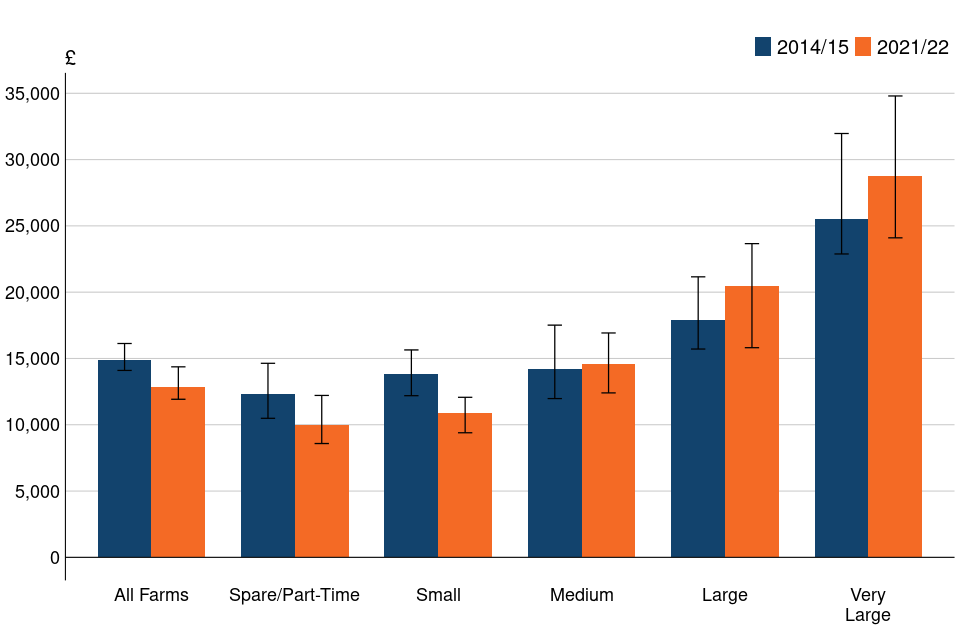

Figure 2.4 Median Household Share of Drawings (equivalised and in real terms) by farm size (based on SLR) in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.09 KB)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 2.4 compares the median Household Share of Drawings in 2014/15 and 2021/22 by farm size (based on SLR), and the ‘All Farms’ category is included for comparison. This shows the same pattern as Household Share of FBI, where the median share of drawings increases as the size of the farm increases.

However, the same pattern is not seen in the change in median share of drawings; medium farm households had the smallest change in their median share of drawings, increasing by 2% from £14,200 to £14,600. Very large farm households had the largest change, increasing from £25,500 to £28,700.

3 Household Off-Farm Income in England

The Household Off-Farm Income is the gross annual income of the principal farmer and their spouse or common law partner from any employment, self-employment or investments not related to the farm, as well as any pensions, social payments and other off-farm income. Other off-farm income may include, for example, income from diversified activities set up independently of the farm business. Off-farm income does not include any capital gains, welfare payments made in kind, for example, free school meals, or windfall receipts and losses, for example, an inheritance.

Off-farm income is reported within the Farm Business Survey as banded data. The true value is estimated for each farm using statistical methods: Mean Constrained Integration over Brackets and Robust Pareto Midpoint Estimator. For more detail on these methods, see section 5.3.3.

Defra are monitoring the role of off-farm income within farm households as they move through the Agricultural Transition period. In previous publications, Household Off-Farm Income was summed with the household’s share of on-farm income to give a total household income figure. However, due to the different measures of household share of on-farm income discussed earlier, the summed measure is not included in this release. All measures presented within this release are provided as medians, therefore, summing them will not give an equivalent result.

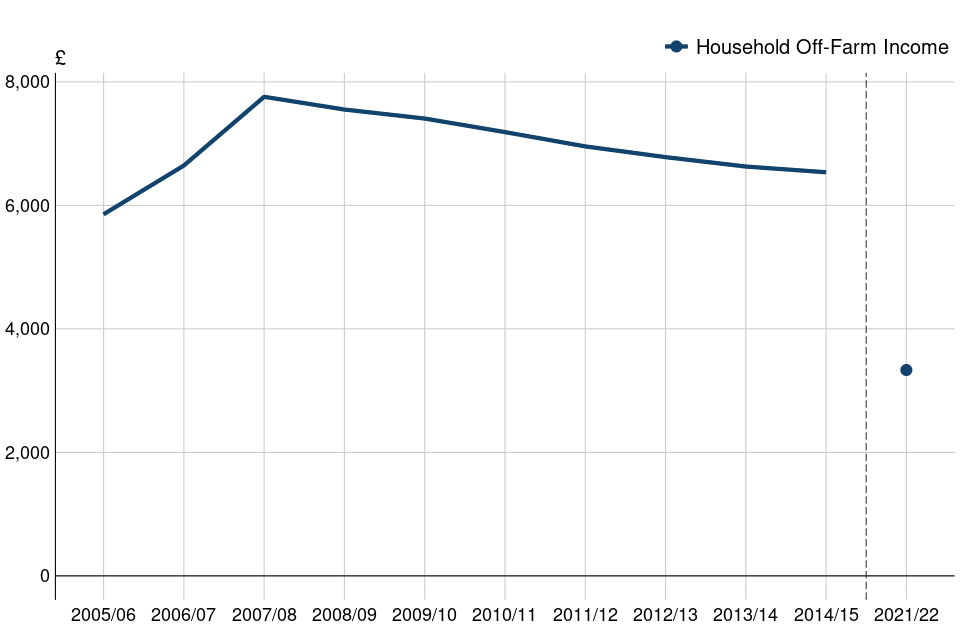

Figure 3.1 Median Household Off-Farm Income (equivalised and in real terms) for farming households in England, 2005/06 to 2021/22

View the data for this chart

Download the data for this chart (CSV, 777 Bytes)

Figure notes:

(a) The break in the series shown between 2014/15 and 2021/22 represents the end of the first inclusion of the off-farm income module in the FBS; it was not collected again until the 2021/22 survey

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

Figure 3.1 shows the median Household Off-Farm Income over time. It rose and then fell again between 2005/06 and 2014/15, peaking in 2007/08; overall, it increased by 12%. Between 2014/15 and 2021/22, median Household Off-Farm Income fell from £6,500 to £3,300 (a decrease of 49%).

3.1 Household Off-Farm Income in England by farm type

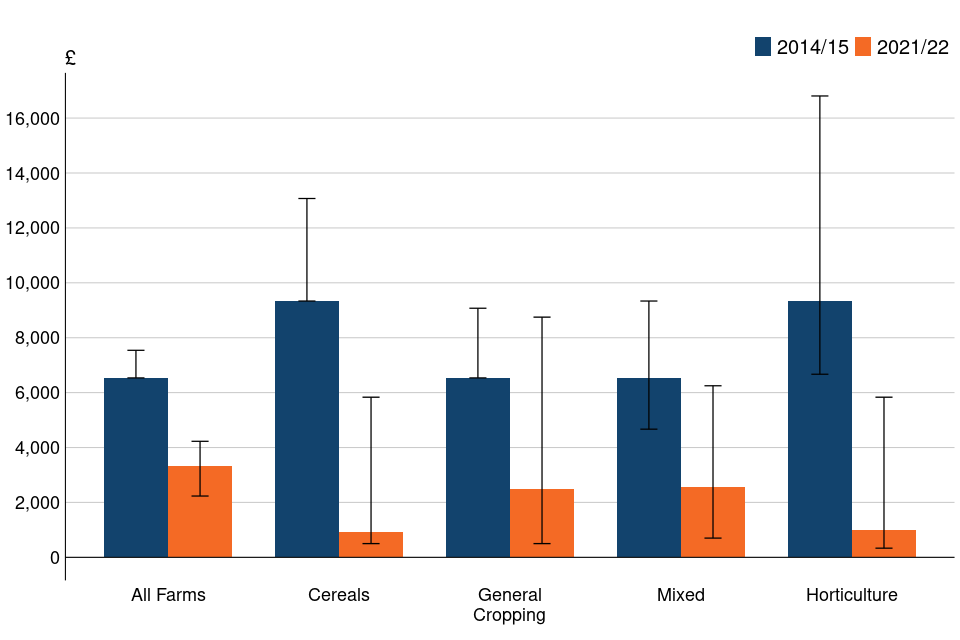

Figure 3.2 Median Household Off-Farm Income (equivalised and in real terms) for cropping and mixed farms in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 904 Bytes)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 3.2 compares the median Household Off-Farm Income in 2014/15 and 2021/22 across cropping and mixed farms, and the ‘All Farms’ category is included for comparison. Mixed and general cropping farm households had the highest off-farm income (both with £2,500) of the cropping and mixed farms in 2021/22, and cereals farm households had the lowest (£900).

All cropping and mixed farm households had their median off-farm income decrease between 2014/15 and 2021/22. Mixed farm households had the smallest change in their off-farm income, decreasing by 61% from £6,500 to £2,500. Cereals farm households had the largest change, decreasing by 90% from £9,300 to £900.

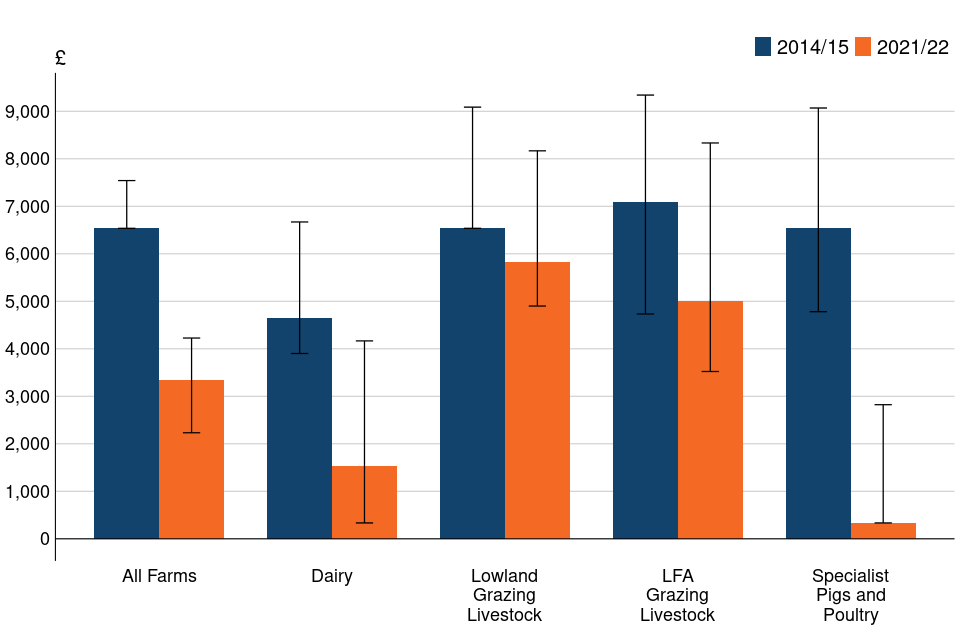

Figure 3.3 Median Household Off-Farm Income (equivalised and in real terms) for livestock farms in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 982 Bytes)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 3.3 compares the median Household Off-Farm Income in 2014/15 and 2021/22 across livestock farms, and the ‘All Farms’ category is included for comparison. Lowland grazing livestock farm households had the highest off-farm income (£5,800) in 2021/22, and specialist pigs and poultry farm households had the lowest (£300).

For livestock farms, lowland grazing livestock farm households had the smallest change in their off-farm income, decreasing by 11% from £6,500 to £5,800. Specialist pigs and poultry farm households had the largest change, decreasing by 95% from £6,500 to £300.

3.2 Household Off-Farm Income in England by farm size

Farm sizes are based on the estimated Standard Labour Requirement (SLR) for the business, rather than its land area. For more detail see Section 5.6.

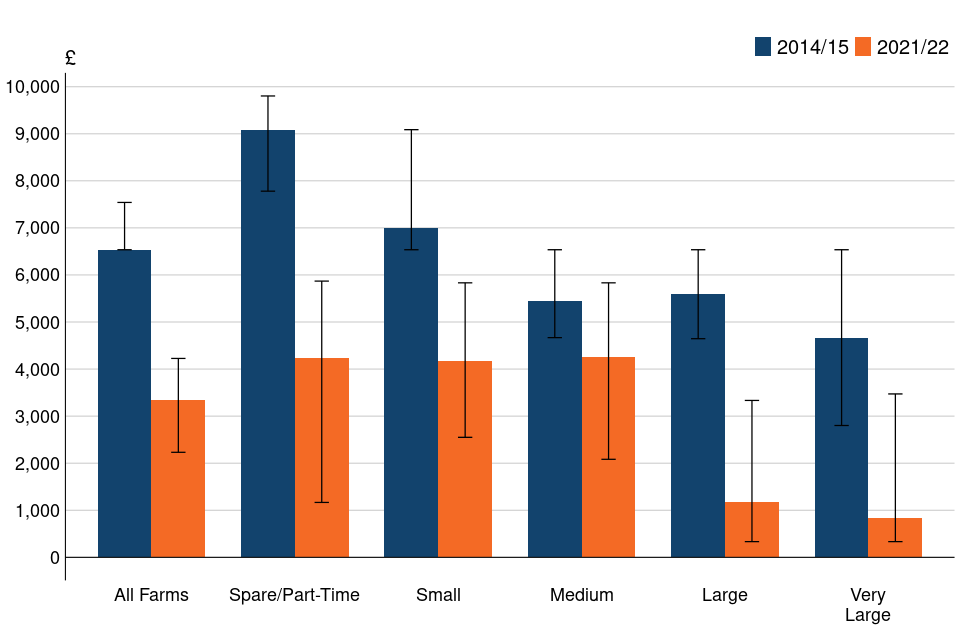

Figure 3.4 Median Household Off-Farm Income (equivalised and in real terms) by farm size (based on SLR) in England, 2014/15 and 2021/22

View the data for this chart

Download the data for this chart (CSV, 1.03 KB)

Figure notes:

(a) The legend is presented in the same order as the bars

(b) Values are adjusted for inflation using the Consumer Prices Index including owner-occupiers’ housing costs (CPIH) and equivalised using the modified OECD equivalence scale; see section 5.3.4 for more details

(c) 95% Confidence Intervals have been presented to show the range where the true value is likely to lie and provides an indication of the degree of uncertainty of the estimate; see section 5.5 for more details

Figure 3.4 compares the median Household Off-Farm Income in 2014/15 and 2021/22 by farm size (based on SLR), and the ‘All Farms’ category is included for comparison. This shows the opposite pattern as the FBI and drawings measures; off-farm income decreases as the size of the farm increases. In 2021/22, spare/part-time, small and medium farm households had similar levels off-farm income at just over £4,000, whereas large and very large farm households each had about a quarter of this.

Medium farm households had the smallest change in their off-farm income, decreasing by 22% from £5,400 to £4,300. Spare/part-time farm households had the largest change, decreasing from £9,100 to £4,200.

4 What you need to know about this release

4.1 Contact details

Responsible statistician: Cat Hand

Email: fbs.queries@defra.gov.uk

4.2 Media Queries

For media queries between 9am and 6pm on weekdays:

Telephone: 0330 041 6560

Email: newsdesk@defra.gov.uk

4.3 National Statistics Status

National Statistics status means that our statistics meet the highest standards of trustworthiness, quality and public value, and it is our responsibility to maintain compliance with these standards.

These statistics last underwent a full assessment (Assessment Report 271 Statistics on Agriculture) against the Code of Practice for Statistics in 2014. Since the last review by the Office for Statistics Regulation, we have continued to comply with the Code of Practice for Statistics across the Farm Business Survey. For general enquiries about National Statistics, contact the National Statistics Public Enquiry Service:

Tel: 0845 601 3034

Email: info@statistics.gov.uk

Find out about call charges

You can find a list of all National Statistics on the Office for Statistics Regulation website.

4.4 User engagement

As part of our ongoing commitment to compliance with the Code of Practice for Official Statistics we wish to strengthen our engagement with users of these statistics and better understand the use made of them and the types of decisions that they inform. Consequently, we invite users to make contact to advise us of the use they do, or might, make of these statistics, and what their wishes are in terms of engagement. Feedback on this statistical release and enquiries about these statistics are also welcome.

4.5 Availability of results

The datasets covering the median farm household income and the composition of farm household income can be found on the farm household income and household composition page.

Other results from the Farm Business Survey can be found at: www.gov.uk/government/collections/farm-business-survey.

All Defra statistical notices can be viewed on the Gov.UK site at: www.gov.uk/government/organisations/department-for-environment-food-rural-affairs/about/statistics.

4.6 Data Uses

Data from the Farm Business Survey are widely used by the industry for benchmarking and inform wider research into the economic performance of the agricultural industry, as well as for evaluating and monitoring current policies. Data on farm household income will help to monitor farm businesses throughout the Agricultural Transition period.

5 Technical note

5.1 Survey content

The Farm Business Survey is an annual survey providing information on the financial position and physical and economic performance of commercial farm businesses in England. It covers all types of farming in all regions of the country with the data being collected by face-to face-interviews with the farmer.

In 2021/22, the Household Income module was reintroduced to collect data on the Drawings from the farm business to the primary household along with the off-farm income from the farmer and spouse.

5.2 Weighting

Results are weighted to represent the full population of farm businesses that have at least 25,000 Euros of Standard Output as recorded in the annual June Survey of Agriculture and Horticulture. In 2021/22, the sample of 1,580 farms represented approximately 52,500 farm businesses in England.

Initial weights are applied to the Farm Business Survey records based on the inverse sampling fraction for each design stratum (farm type and farm size). Dataset Table 17 within the Farm Accounts in England Dataset shows the distribution of the sample compared with the distribution of businesses from the 2021 June Census of Agriculture and Horticulture. These initial weights are then adjusted, using calibration weighting, so that they can produce unbiased estimates of a number of different target variables. More detailed information about the Farm Business Survey can be found on the technical notes and guidance page. This includes information on the data collected, information on calibration weighting and definitions used within the Farm Business Survey.

The data used for this analysis is from those farms present in the Farm Business Survey who provided a response to the Household Income questions (the share of the drawings taken and the off-farm income). In 2021/22 this sub-sample consisted of 940 farms, 59% of the full survey sample. This sub-sample was reweighted using a method that preserves marginal totals for populations according to farm type and farm size groups.

5.3 Methodology for calculating farm household income measures

An updated methodology has been applied to produce a time series back to 2005/06. Previous publications and results are therefore not comparable to the results presented in this release.

5.3.1 Household Share of Drawings

In the Farm Business Survey, total private drawings is reported directly, and the percentage of drawings taken by the principal farmer and their spouse or common law partner is also reported. The Household Share of Drawings is calculated by multiplying total private drawings by this percentage.

5.3.2 Household Share of Farm Business Income

The Household Share of Farm Business Income is also calculated using the percentage of drawings taken by the principal farmer and their spouse or common law partner, rather than that farmer’s legal share of the business as defined in partnership agreements (which frequently reflects tax considerations). The total Farm Business Income is multiplied by the percentage of drawings taken.

5.3.3 Household Off-Farm Income

The Household Off-Farm Income is collected at a gross level as banded data (see Table 5.3.3.1)

Table 5.3.3.1 Off-farm income data collection

| Band | Off-farm income |

|---|---|

| 1 | £0 |

| 2 | £1 to below £1,000 |

| 3 | £1,000 to below £2,500 |

| 4 | £2,500 to below £5,000 |

| 5 | £5,000 to below £7,500 |

| 6 | £7,500 to below £10,000 |

| 7 | £10,000 to below £15,000 |

| 8 | £15,000 to below £20,000 |

| 9 | £20,000 to below £25,000 |

| 10 | £25,000 to below £30,000 |

| 11 | £30,000 to below £40,000 |

| 12 | £40,000 to below £50,000 |

| 13 | £50,000 to below £75,000 |

| 14 | £75,000 to below £100,000 |

| 15 | £100,000 to below £150,000 |

| 16 | £150,000 to below £200,000 |

| 17 | £200,000 or more |

To estimate the true value from banded data for each farm, two methods were used. The first method was Mean Constrained Integration over Brackets (MCIB), developed by Paul Jargowsky and Christopher Wheeler (2018), and involved estimating density functions for each income bracket. These functions captured the variation and relative frequency of households within each bracket, using either linear or uniform approximations. By estimating these density functions, the MCIB methodology provided a more accurate representation of the income distribution.

The MCIB could not estimate the open top band without a grand mean. To address this, the Robust Pareto Midpoint Estimator (RPME), developed by Paul von Hippel et al (2014), was used. The RPME fitted a Pareto distribution to the top band, determining a minimum shape parameter cut-off and using a different mean for estimation, geometric for this report.

Both methods were more accurate than simply taking the midpoint of each band and allowed for the calculation of accuracy measures. The estimates for each band were calculated for each survey year and farm type, and then these were assigned to the corresponding farms as the Household Off-Farm Income value. The median income could then be calculated conventionally.

5.3.4 Equivalisation and adjusting for inflation

All three measures (Household Share of Drawings, Household Share of Farm Business Income and Household Off-Farm Income) were equivalised. Equivalisation refers to adjusting the figures using the number of adults and children in the household, and allows us to fairly compare households of differing compositions. All of the measures are adjusted to the level of a single adult. The OECD-modified equivalence scale is the standard method used; it assigns a value of 1 to the household head, 0.5 to each additional person aged 14 and over and 0.3 to each child aged under 14. The Farm Business Survey does not collect the age of children, therefore, we have assigned a value of 0.5 to each additional adult and 0.3 to each child. For example, the total equivalence value for a household with a married couple and one child is calculated as follows:

1 (first adult) plus 0.5 (second adult) plus 0.3 (child) is 1.8

The income is then divided by this value to give the equivalised income for a single adult. For example, if the household described in the example above had an income of £30,000, their equivalised income would be around £16,700. Therefore, a single person earning £16,700 has a similar standard of living to a family of three with an income of £30,000. On the other hand, the same family would have a poorer standard of living than a single person earning £30,000.

Table 5.3.4.1 Indicative medians of farming household income for differing household compositions in England, 2021/22

| Measure | One adult | One adult and one child | Two adults | Two adults and one child | Two adults and two children |

|---|---|---|---|---|---|

| Household Share of Farm Business Income | £22,200 | £28,800 | £33,300 | £39,900 | £46,600 |

| Household Share of Drawings | £12,800 | £16,700 | £19,300 | £23,100 | £27,000 |

| Household Off-Farm Income | £3,300 | £4,300 | £5,000 | £6,000 | £7,000 |

Table 5.3.4.1 shows the indicative medians of Household Share of Drawings, Household Share of Farm Business Income and Household Off-Farm Income for the 2021/22 survey year for differing household compositions. This demonstrates the effect of equivalisation and also allows the user to compare their income to an equivalent household.

More information on equivalisation can be found on the OECD website, in the ONS Family spending in the UK publication and on the Eurostat website.

After equivalisation, the measures were adjusted for inflation using CPIH. Each of the annual CPIH values was divided by the value for 2021/22 to create a new, rebased, index. The equivalised measures were multiplied by this new index to adjust them for inflation.

Once the equivalised, inflation-adjusted measures were calculated for every farm in each of the survey years, weighted medians for each year, farm type and farm size (based on SLR) were calculated.

5.4 Impact of methodology changes between 2015 and 2023 publications

Defra have taken the opportunity to review the previous methodology to ensure the statistics remain relevant and fit for purpose. As a result, this publication has several changes and the results presented here are not comparable to those published in 2015. This historic data has been recalculated on the new methodology and are available in the accompanying dataset.

A summary of the statistical changes is listed below, along with an estimate of the impact of the change from the previous methodology.

-

This publication shows median figures, as opposed to mean (as was used in the 2015 publication). This is because the income data are highly skewed; in such cases it is best statistical practice to use the median rather than the mean to report averages. The published 2014/15 overall mean Household Share of FBI in the 2015 report was £31,900; calculating a median for the same data gives a result of £19,000, which highlights the skewness of the data. Similarly, the overall mean Household Off-Farm Income figure published in 2015 was £13,400, whereas the median value would have been £8,800.

-

The 2023 published figures have also been equivalised using the OECD-modified scale (see section 5.3.4 for more detail). This reduces the median value to make the household comparable to a single person household.

-

The 2015 report estimated true values for the banded off-farm income by simply taking the midpoint of the bands. In this publication, off-farm income values have been estimated using advanced mathematical methods; this has improved the quality of the off-farm income estimates, reducing the error of the estimates. The overall median using the midpoint method is £8,800, whereas for the mathematical method it is £8,700.

Table 5.4.1 The effect of different methodologies on the 2014/15 survey data

| Household income measure | Mean (published in 2015) | Median | Median (equivalised) | Median (equivalised and inflation-adjusted) |

|---|---|---|---|---|

| Household Share of Farm Business Income | £31,900 | £19,000 | £11,000 | £12,400 |

| Household Off-Farm Income | £13,400 | £8,700 | £5,800 | £6,500 |

Table 5.4.1 demonstrates how the new methodology has affected the results for the 2014/15 survey year. Moving from using the mean to the median results in a decrease of 40% for Household Share of FBI and a decrease of 35% for Household Off-Farm Income. Equivalising the median values results in a further reduction to share of FBI of 42% and to off-farm income of 33%. These equivalised medians are the values that would have been published in 2015 under the new methodology. The results published in this release for 2014/15 have also been adjusted for inflation; this has resulted in an increase of 13% for Household Share of FBI and an increase of 12% for Household Off-Farm Income.

5.5 Accuracy and reliability of the results

In common with other statistical surveys, the published estimates from the Farm Business Survey are subject to sampling error, as we are not surveying the whole population.

We show error bars based on 95% confidence intervals as a measure of uncertainty that may apply to the estimated means. These show a plausible range of values for the results based on our sample. They are calculated as the standard errors multiplied by 1.96 to give the 95% confidence interval. Smaller confidence intervals generally reflect larger sample sizes and greater homogeneity within the group. Conversely, the wider the confidence interval, the smaller the sample size and greater uncertainty of the estimates with less homogeneity. They should be interpreted with more caution. It should also be noted that, because medians are presented in this release and the data are not normally distributed, the ends of the error bars are not equidistant from the medians.

For the Farm Business Survey, the confidence intervals shown are appropriate for comparing groups within the same year only; they should not be used for comparing with previous years since they do not allow for the fact that many of the same farms will have contributed to the Farm Business Survey in multiple years. Standard errors (and therefore confidence intervals) only give an indication of the sampling error. They do not reflect any other sources of survey errors, such as non-response bias. Percentage changes shown within this release are based on unrounded figures. Totals may not necessarily agree with the sum of their components due to rounding.

5.6 Definitions

Private drawings comprise the gross income taken from the farm business by for investments in capital outside of the farm business and private expenditure. Investments outside of the farm include transferring to personal accounts, purchasing stocks and shares, and purchasing property or assets unrelated to the farm. Private expenditure includes personal and corporation taxes, private and national insurance, and living expenses. The percentage of total private drawings going to the principal farmer and their spouse or common law partner is collected and is used to calculate the Household Share of Drawings and the Household Share of Farm Business Income.

Farm Business Income (FBI) for sole traders and partnerships represents the financial return to all unpaid labour (farmers and spouses, non-principal partners and directors and their spouses and family workers) and on all their capital invested in the farm business, including land and buildings. For corporate businesses it represents the financial return on the shareholders capital invested in the farm business. Note that prior to 2008/09 directors remuneration was not deducted in the calculation of Farm Business Income. Farm Business Income is used when assessing the impact of new policies or regulations on the individual farm business. Although Farm Business Income is equivalent to financial Net Profit, in practice the measures are likely to differ because Net Profit is derived from financial accounting principles whereas Farm Business Income is derived from management accounting principles. For example, in financial accounting output stocks are usually valued at cost of production, whereas in management accounting they are usually valued at market price. In financial accounting depreciation is usually calculated at historic cost whereas in management accounting it is often calculated at replacement cost.

Farm Type refers to the ‘robust type’, which is a standardised farm classification system; for this publication, pigs and poultry have been combined into a single farm type category.

Farm Sizes are based on the estimated Standard Labour Requirement (SLR) for the business, rather than its land area. The farm size bands used within the detailed results tables which accompany this publication are shown in the table below. Standard Labour Requirement (SLR) is defined as the theoretical number of workers required each year to run a business, based on its cropping and livestock activities. Table 5.6.1 shows how each farm size is assigned.

Table 5.6.1: Farm size by Standard Labour Requirement (SLR)

| Farm size | Definition |

|---|---|

| Spare & Part-time | Less than 1 SLR |

| Small | 1 to less than 2 SLR |

| Medium | 2 to less than 3 SLR |

| Large | 3 to less than 5 SLR |

| Very Large | 5 or more SLR |

Household is defined, in this publication, as the principal farmer and their spouse or common law partner.

The median is a type of average and is the middle value of the population values, after the values have been ranked by an output variable.