Benefit Combinations to August 2020

Published 23 February 2021

The latest release of these statistics can be found in the benefit statistics collection.

A person in Great Britain may be eligible to claim several of benefits, administered by or on behalf of the Department for Work and Pensions, at the same time. The Benefit Combination statistics offer a picture of the number of individuals claiming at least one benefit as well as the number of claimants for each combination of benefits, as at the end of each quarter, for the period February 2013 to August 2020. For detailed commentary on individual benefits see DWP Benefits Statistics.

The Benefit Combination statistics form part of the DWP Benefits National Statistics release but have experimental status to reflect the fact that methodologies and definitions are under development. The statistics cover:

- Attendance Allowance (AA)

- Bereavement Benefit (BB)

- Carer’s Allowance (CA)

- Disability Living Allowance (DLA)

- Employment and Support Allowance (ESA)

- Housing Benefit (HB)

- Incapacity Benefit (IB)

- Income Support (IS)

- Industrial Injuries Disablement Benefit (IIDB)

- Jobseeker’s Allowance (JSA)

- Pension Credit (PC)

- Personal Independence Payment (PIP)

- Severe Disablement Allowance (SDA)

- State Pension (SP)

- Universal Credit (UC)

- Widow’s Benefit (WB)

Within the statistics, certain benefits are grouped together, where more than one benefit could be claimed to meet a particular need. The groupings used are:

- INCAP, which comprises ESA, IB and SDA (and IS where IB is claimed at the same time), to help with living costs if a claimant is unable to work due to a disability or health condition

- PIP/DLA (and AA for those over State Pension Age) for help with some of the extra costs caused by long-term disability, ill-health or terminal ill-health

Please note that for consistency, all of the figures in the Benefit Combinations release are aligned to a common time point: August 2020. More up-to-date figures have been published for UC, PIP and HB.

1. Total benefit claimants

22.8 million people claimed some combination of DWP benefits in August 2020 (of the 16 benefits included in these statistics). Of these:

- 12.5 million were of State Pension Age (including those in receipt of their State Pension), 30% of whom were claiming more than one benefit

- 9.8 million were of Working Age, 32% of whom were claiming more than one benefit

- 530,000 were under the age of 16 (and in receipt of Disability Living Allowance as a child)

The total number of benefit claimants remained relatively stable between February 2013 and February 2020, between 20 and 21 million, but rose by 2.1 million (10%) by May 2020 and a further 210,000 (1%) by August 2020 due to the economic disruption caused by the coronavirus (COVID-19) pandemic.

2. Working Age combinations

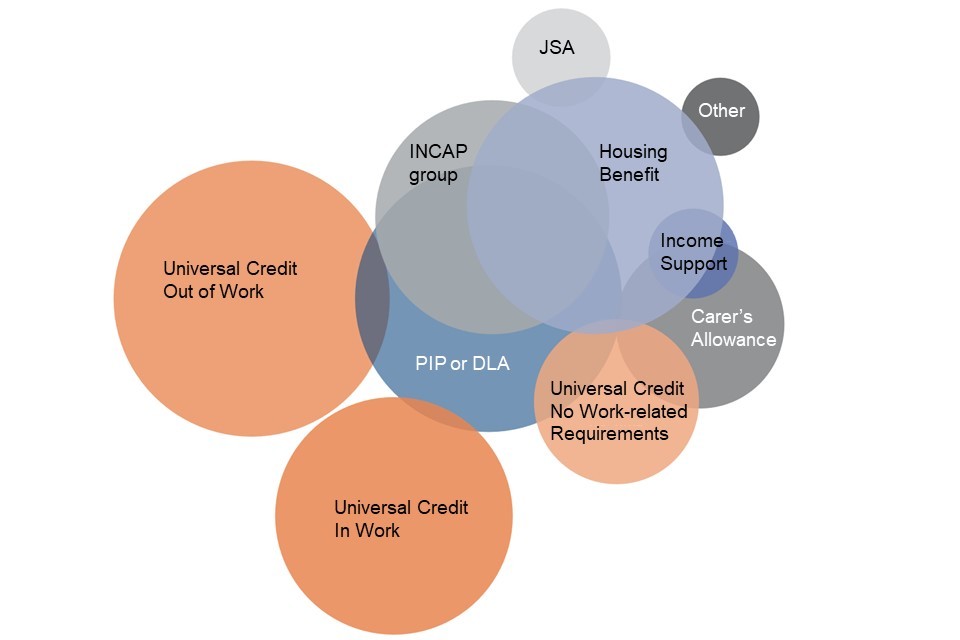

DWP Benefit Combinations, Working Age, August 2020

Note: This illustration uses overlapping circles, where larger circles and overlaps show more people claiming a particular combination of benefits. It is included to demonstrate the complexity of the situation for many claimants. Only the most common combinations are shown and other combinations do occur. It is not always possible for the areas to be exactly proportional to the number of cases for each combination.

Source: Benefit Combination Statistics to August 2020, Stat-Xplore

The most common benefit or combination of benefits claimed by Working Age (WA) individuals is Universal Credit (UC) on its own. Of all WA claimants in August 2020:

- 48% claimed UC and no other benefit

-

9% claimed UC in combination with some other benefit(s)

- 5% claimed PIP or DLA (for help with some of the extra costs caused by long-term disability, ill-health or terminal ill-health) and no other benefit

-

20% claimed PIP or DLA in combination with some other benefit(s)

- 3% claimed Carer’s Allowance and no other benefit

- 7% claimed Carer’s Allowance in combination with some other benefit(s)

The combinations of benefit that people claim are varied. Nearly one in five WA claimants (19% in August 2020) claim some combination other than the top 10 most common possibilities. This can include benefits that appear in the top 10, but in combination with other benefits at the same time. For example, somebody claiming UC with no work requirements as well as PIP or DLA is part of the 11th most common combination (2% of all WA claimants in August 2020).

Top 10 Working Age benefit combinations, August 2020

| Benefits Claimed | Thousands | Percentage |

|---|---|---|

| UC Out of Work only | 2,343 | 24% |

| UC In Work only | 1,866 | 19% |

| INCAP, PIP/DLA and Housing Benefit | 730 | 7% |

| Housing Benefit only | 616 | 6% |

| INCAP and PIP/DLA | 534 | 5% |

| PIP/DLA only | 525 | 5% |

| UC No Work Requirements only | 451 | 5% |

| Carer’s Allowance only | 335 | 3% |

| INCAP only | 249 | 3% |

| INCAP & Housing Benefit | 247 | 3% |

| Any other combination | 1,894 | 19% |

Source: Benefit Combination Statistics to August 2020, Stat-Xplore

Further combinations of benefits, and breakdowns by age, gender, geography, and individual benefits are available from Stat-Xplore.

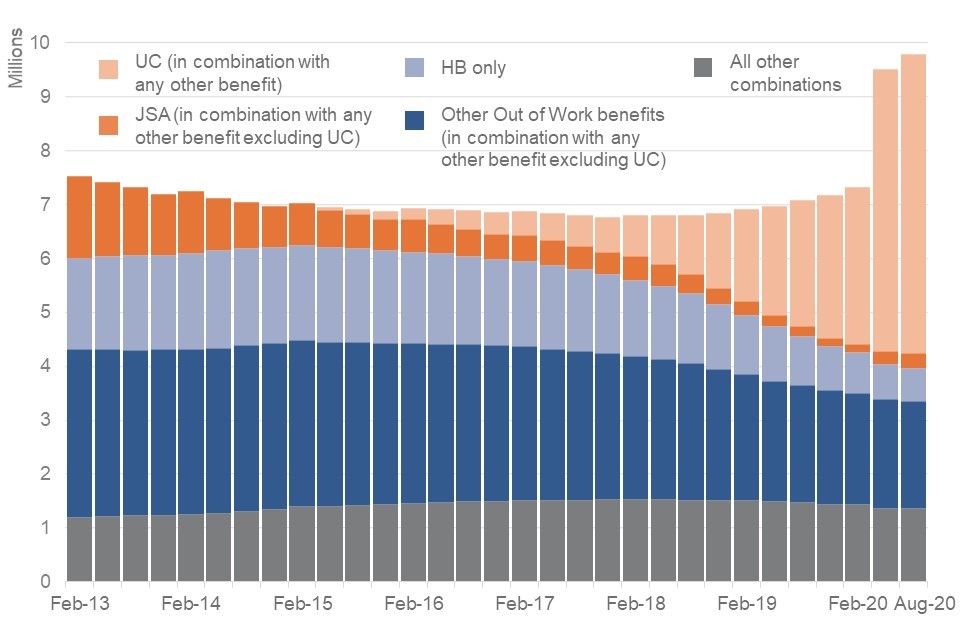

Working Age DWP Benefit Claimants, February 2013 to August 2020

Source: Benefit Combination Statistics to August 2020, Stat-Xplore

Since the introduction of Universal Credit in 2013 the picture of who claims which combination of benefits has been gradually changing, with more people claiming UC and fewer people claiming other benefits. In particular, there have been reductions in the numbers claiming JSA and the other “Out of Work” benefits which comprise ESA, IB, SDA, IS (where CA not also in payment) or PC (where CA not also in payment), as well as reductions in HB.

The economic disruption caused by the coronavirus (COVID-19) pandemic has caused an additional increase in UC claims from March 2020 onwards. A rise has also been seen in JSA claims. In August 2020, 5.8 million Working Age individuals claimed UC and/or JSA (with or without other benefits), up from 3.1 million in February 2020. The remainder of the WA benefit claiming population has reduced slightly from 4.3 million (February 2020) to 4 million (August 2020), in part because some people in this group in February 2020 have started new UC and/or JSA claims by August 2020.

3. State Pension Age combinations

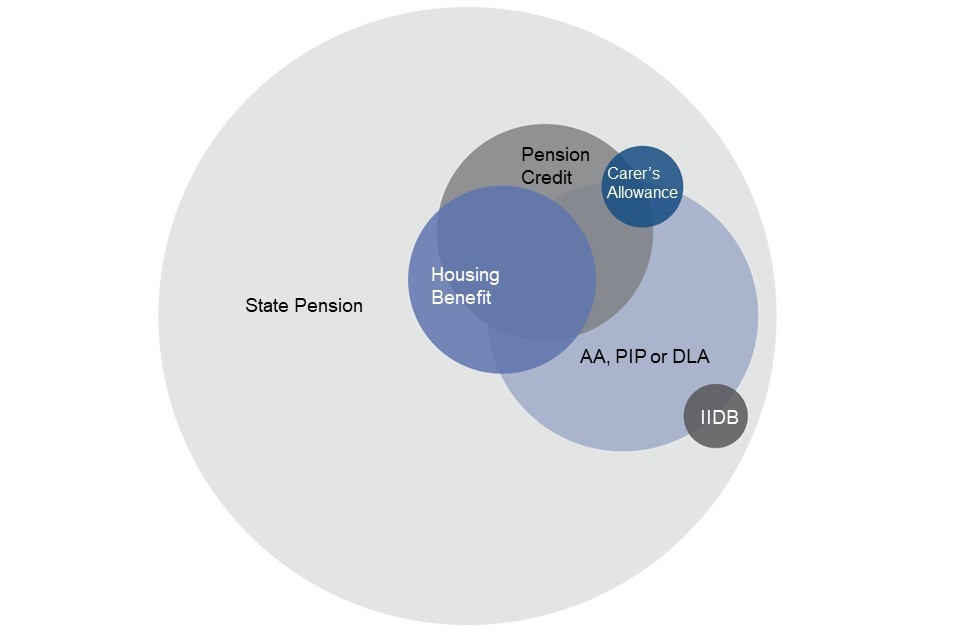

DWP Benefit Combinations, State Pension Age, August 2020

Note: This illustration uses overlapping circles, where larger circles and overlaps show more people claiming a particular combination of benefits. It is included to demonstrate the complexity of the situation for many claimants. Only the most common combinations are shown and other combinations do occur. It is not always possible for the areas to be exactly proportional to the number of cases for each combination.

Source: Benefit Combination Statistics to August 2020, Stat-Xplore

The most common benefit or combination of benefits claimed by State Pension Age (SPA) individuals is State Pension (SP) on its own. Of all SPA claimants in August 2020:

- 70% claimed their State Pension and no other benefit

-

29% claimed their State Pension in combination with some other benefit(s)

- 11% claimed AA, PIP or DLA (for help with some of the extra costs caused by long-term disability, ill-health or terminal ill-health) and their State Pension but no other benefit

-

9% claimed AA, PIP or DLA in combination with some other benefit(s)

- 7% claimed Pension Credit and/or Housing Benefit as well as their State Pension, but no other benefit

- 9% claimed Pension Credit and/or Housing Benefit in combination with some other benefit(s)

Top 10 State Pension Age benefit combinations, August 2020

| Benefits Claimed | Thousands | Percentage |

|---|---|---|

| State Pension (SP) only | 8,740 | 70% |

| AA/PIP/DLA & SP | 1,360 | 11% |

| AA/PIP/DLA, Pension Credit, Housing Benefit & SP | 390 | 3% |

| Pension Credit, Housing Benefit & SP | 354 | 3% |

| Pension Credit, AA/PIP/DLA & SP | 331 | 3% |

| Pension Credit & SP | 331 | 3% |

| Housing Benefit & SP | 245 | 2% |

| AA/PIP/DLA, Housing Benefit & SP | 138 | 1% |

| Carer’s Allowance & SP | 116 | 1% |

| IIDB & SP | 72 | 1% |

| Any other combination | 443 | 4% |

Source: Benefit Combination Statistics to August 2020, Stat-Xplore

Since 2013, the trends in benefit claims amongst those of State Pension age have remained relatively stable, aside from a gradual reduction in Pension Credit claims (due to the introduction of the New State Pension in April 2016, among other factors). Whilst the retirement age has risen (a gradual increase for women from 60 in April 2010 to 65 in November 2018, and for both men and women to 66 by October 2020) the GB population has also aged.

Further explanation and commentary on the statistics for State Pension and Pension Credit can be found in the Benefits Statistics Summary release.

4. About these statistics

Methodology

There are methodological differences between individual benefit series and the combined benefit series, which in some cases give rise to differences in the figures themselves. Further information on methodology, and detail on uses and limitations of the series can be found in the background methodology note. For official statistics on each individual benefit please see the DWP Benefits Statistics collection.

Data Quality Statement

The Benefit Combinations statistics are badged as experimental to reflect the fact that methodologies and definitions for the statistics are under development.

Changes to Benefit Combinations in this release

This document, giving commentary and context to the Benefit Combinations statistics, has been added to the DWP Benefits Statistics collection in February 2021. It will be updated on a 6 monthly schedule as part of the main release.

From February 2021, Industrial Injuries Disablement Benefit (IIDB) was added to the Benefit Combinations statistics for the first time. This includes those who claim Industrial Injuries Disablement Benefit only, Reduced Allowance or Retirement Allowance only, or Industrial Injuries Disablement Benefit with either Reduced Allowance or Retirement Allowance.

The methodology used to include IIDB differs from that in the IIDB quarterly statistics collection in order to align the caseload dates to a common time point (the Benefit Combinations statistics reference date). The IIDB caseload within Benefit Combinations is an estimate based on the published IIDB caseload from five months prior to the reference date, with known deaths occurring within the intervening five-month period removed. For example, IIDB caseload at August 2020 was estimated using the published IIDB caseload as at March 2020 minus all individuals known to have died between March and August.

When adding IIDB to Benefit Combinations, the whole back series was updated and so this did not introduce any discontinuity. Nearly 4 out of 5 IIDB claimants also claim other benefits (79% in August 2020) and were included as individuals in the statistics already, though without their IIDB claim identified. However, between 50,000 and 70,000 claimants in each quarter claim IIDB on its own and so had not previously been captured in overall counts of benefit claimants.

Other methodological changes in February 2021 include:

- Adjustment of cleaning rules to correctly allow concurrent UC and HB claims under some circumstances

- Removal of suspended SP claims

- Inclusion of Child DLA claims

- Addition of new variable to show the number of benefits that an individual is claiming concurrently

- Regrouping “Out of Work” claims to include those who are on UC and have no work requirements

The background methodology note gives detail and impact for each of these changes.

Benefits not included in this Benefit Combinations release

Two DWP benefits – Bereavement Support Payment (introduced from April 2017) and Maternity Allowance are not currently included in the series although work is ongoing to include them in a future release.

Current Benefit Combinations statistics do not include the HMRC administered benefits Child Tax Credit, Working Tax Credit and Child Benefit. Since the introduction of Universal Credit in 2013, most Tax Credits are being gradually replaced by Universal Credit and so individuals who would formerly have claimed tax credits and not appeared in these statistics are now more likely to appear as Universal Credit claimants.

DWP and HMRC analysts are working towards a joint annual publication of benefit combination statistics that would include Tax Credits and Child Benefit, and this is intended to be published at some point in the future.

Benefits in Scotland

The Scotland Act 2016 gives Scottish Parliament powers over a number of social security benefits which had been administered to Scottish clients by the Department for Work and Pensions.

Carer’s Allowance became the first benefit for which executive competence transferred to the Scottish Government in 2018. DWP is administering Carer’s Allowance on behalf of Scottish Ministers, through an agency arrangement, on an interim basis, until the introduction of Carer’s Assistance, which will replace it. However, Social Security Scotland is delivering Carer’s Allowance Supplement for which recipients of Carer’s Allowance who are resident in Scotland are eligible. Benefit Combination statistics in this release do not include data on Carer’s Allowance Supplement.

On 1 April 2020, executive competence for Disability Living Allowance, Personal Independence Payments, Attendance Allowance, Industrial Injuries Disablement Benefit and Severe Disablement Allowance was transferred to the Scottish Government. At this time the Scottish Government’s Cabinet Secretary for Social Security and Older People announced that the introduction of the new Scottish disability and carer benefits would be paused given the impact of the Covid-19 pandemic. Until these benefits are introduced, and while Social Security Scotland continues to build its capacity to deliver them, DWP Ministers have agreed that the DWP will continue delivering the existing benefits on behalf of the Scottish Government under Agency Agreements as they are delivered in England and Wales.

Where to find out more

Read a background methodology note for more detail on derivation of Benefit Combination statistics.

Build your own data tables using Stat-Xplore.