PM Direct at John Lewis

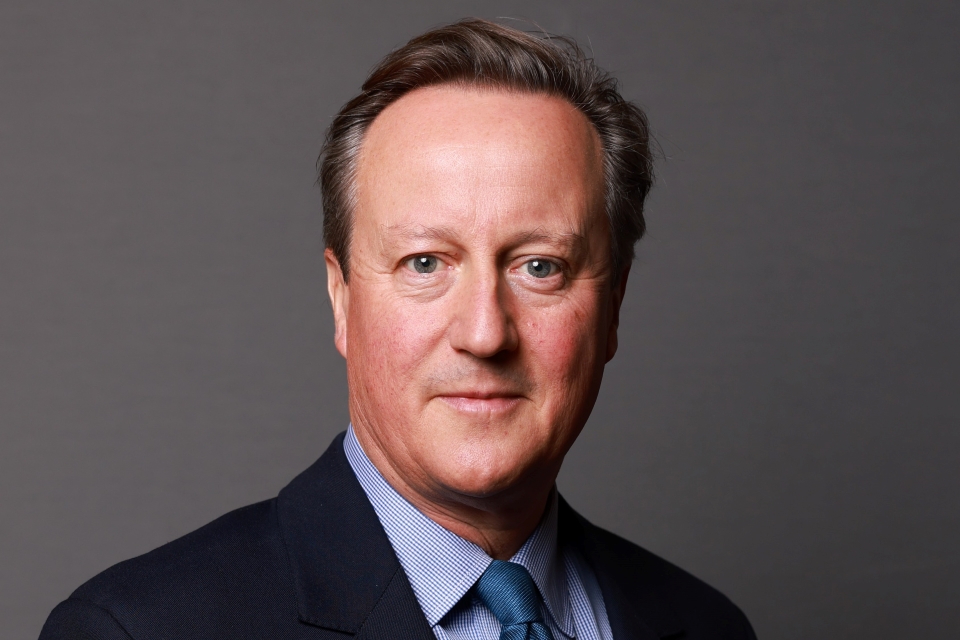

Prime Minister David Cameron was at John Lewis in Cheadle as part of his 4-day economic tour.

Prime Minister

Thank you very much for that word of introduction and thank you for the reception; great to be here in John Lewis. Lots of reasons to be pleased to be here today – to swap the calmness of Prime Minister’s Questions for the bear pit of John Lewis.

First of all, I’m an enormous admirer of your business plan and the way you go about your business. I’ve always believed business is about more than just making money and making profits and profits and loss. Business is about the jobs that you create, the training you give, what you put back into your communities and the way you transform people’s lives. And at John Lewis that’s always been the heart of your business model: the idea that your partners co‑own the business and share in its fortunes, which I think is a great model and something I’d like to see more of.

I’m also a customer; my wife is a frequent visitor to your website, speaks very highly of it.

I wanted to say is how pleased I am to be here in the northwest. We are determined that this recovery is going to be different to previous recoveries and will be better balanced across our country. Now, to do that we need to make sure we’re helping businesses, we’re building infrastructure, we’re training young people right across our country. We are doing that; we’ve really got to take care this recovery takes off around the country.

It’s not a well‑known fact, but actually the unemployment rate here in the northwest is the same as the unemployment rate in London. So it can be done. We are creating jobs in here in the northwest: 33,000 more people in work than when I became Prime Minister, but a lot more to do.

But, above all, what I wanted to say by way of introduction – before taking your questions – is what an important week this is for the British economy. We’ve come through a very difficult recession. We’ve had a very tough time. It’s been extremely difficult for businesses and for Britain’s families. But things are getting better and this is the week when I want to quicken the pace in how things are getting better.

First of all: this week is the week we’ve cut corporation tax – the main tax that companies pay – down to 21%, so we attract more businesses into our country and encourage them to invest more. This is also the week when we say to all our small businesses that we are giving them a new employment allowance by cutting the National Insurance they pay by £2,000. Now, that means about 55,000 companies will come out of National Insurance altogether and it means many companies will see their National Insurance bill fall and they’ll be able to take on more people. And I think that’s a really important change.

The third thing that’s happening this week is: from Sunday, people will be able to earn £10,000 before they start paying any income tax at all. That’s a tax reduction that’s worth £705 to most people in our country. It means that about 3 million people, over the life of this government, will have stopped paying income tax at all. It means someone on minimum wage working a 40‑hour week will have seen their income tax bill come down by two‑thirds. Allowing people to keep more of their own money, to spend as they choose, is a really vital part of our long‑term economic plan and something I hope will make a real difference to families and to businesses right across our country.

That was all I wanted to say by way of introduction; very happy to try and take any questions on any subject, don’t hold back. Doesn’t mean you’ll necessarily get an answer, but I’ll do my best in trying to answer them.

Question

A major competitor of ours reports their profits in Luxembourg. What plans do the government have to level the playing field, in terms of corporation tax, for the likes of Amazon paying their fair share?

Prime Minister

Yes. Absolutely. Really important point. I’m a believer in low taxes, because I think if you keep taxes low – I think that’s good for encouraging businesses to invest, good to let people spend their money as they choose. But I’m in favour of people paying their taxes and I think we’ve seen too many examples where individuals, or indeed businesses, have shuffled off their responsibilities to pay any taxes. Now, there’s no easy answer to this, because, just as we’re reducing our taxes here in the UK, to make us attractive, other countries do that as well.

But the best thing we can do – and what I’ve been pushing as chairman of the G8, last year – is to have a simple tool where companies have to report what they earn and what they pay in every jurisdiction. Why that matters so much is: part of the problem at the moment is companies will sometimes locate their businesses in one part of the world, locate their headquarters in another part of the world and actually pay their taxes somewhere else in the world by – for instance – saying that; “Well everything we sell, a royalty has to go through a company based in Luxembourg” or a company based in some island miles away. And once we’ve got this international tax tool that every company has to use in every jurisdiction, we’ll be able to see what companies are doing and where they’re paying their taxes.

And the good thing about this is that more and more countries are signing up to it. It’s been a bit like one of those snowballs rolling down a hill. To start with, people were saying, “Cameron, why are you going on about this? Nothing will change”. Now we’ve got the whole of the European Union to sign up to it, the countries of the OECD – the, sort of, club of countries around the world of relatively high incomes – they’re all signing up to it too.

So I’m really confident that, over time, you will see less of companies doing exactly what you suggested and more of them – not paying high levels of taxes, that’s not what we need – but paying taxes appropriately in the countries where they operate. And I think Britain has some moral authority in being able to lead this because we’re not charging a high rate of corporation tax. 21% is very competitive and so I expect companies that work in Britain to pay that tax in Britain and increasingly they’ll have to.

Question

Being the mum of 2 grown‑up sons – 25 and 23 – I appreciate the government has put into place help with mortgages and that kind of thing, however, what provision will the government make to make more affordable housing? Otherwise they’re going to be there until they’re about 40. So, it’s all very well to have a cheaper mortgage but there aren’t cheaper houses to buy.

Prime Minister

I mean, the bottom line answer to your question is: in fact, we’re only going to make housing more affordable if we build more houses. I mean, at the end of the day, there’s an enormous demand for people to buy and own their own homes. Our population is growing, so we have to build more homes.

But where I – what I think is really important is recognise – the schemes that we’ve brought forward, like the Help to Buy scheme, that’s not just about helping the demand side of the equation, it also actually encourages the builders to get on and build. And how Help to Buy works – and the idea behind it was a very simple idea, which is, there are quite a lot of people in our country who are earning enough money to afford a mortgage payment, but they can’t get a mortgage with a decent‑size deposit. And the reason for that is they haven’t got a rich mum and dad to give them the deposit.

And this isn’t really a failure of the housing market; it’s a failure of our banks and building societies. They were so damaged in the great crash that they’d got rid of the 95% mortgages, sometimes even the 90% mortgages. And so I thought it was right for us to step in and say, “Look, we don’t want to go back to the bad days of 110% mortgages – borrowing more than the value of the house – but we do want to go back where someone who’s working hard, who’s got a decent income, who can afford the mortgage payments can actually get a 90 or 95% mortgage”.

Now, the act of doing that not only has helped – I hope – people like your grown‑up sons and others, but it has meant that the builders and the property developers and the people with land that they can build on are actually saying, “Okay, I can see there’s demand coming through – I will start to build these houses”.

So there’s no short answer to how you get this done. You need to reform the planning system. We’re doing that; it is not always very popular, but you’ve got to make the planning system faster and it’s got to be able to deliver the homes that people want. You’ve got to make sure we’re not regulating new homes to such an extent that they become incredibly expensive to build. I think the gap in the market is actually: we need more small and medium‑sized companies to go into the building trade. We used to have a lot of builders that size and again the problem has been bank finance, so we’re helping to lend money to them as well.

So take all of these steps and make sure the market is working, but not overinflated. I think we’ll build the houses and then we’ll be able to help people to buy them: like, I hope, your 2 grown‑up sons.

Question

It’s really interesting to hear about the pension changes announced in the recent budget, allowing people the option of how they wish to spend their money. I’m wondering how confident you are that this will not have an adverse effect on the economy and create more boom and bust.

Prime Minister

Yes. I think it’s a really good question and I think there are 2 answers to it. 1 is a sort of emotional answer. Instinctively I feel that people who’ve worked hard and saved all their lives – they are responsible people: they saved bit by bit. And to say to them, “You have to take out an annuity, you can’t spend your own pension savings in the way that you want”, I think is quite condescending because these are very responsible people, that have taken a responsible path.

But I do understand the risk that people say. Well, of course, some people might choose to spend all this money and then they’d be more reliant on the state and on benefits and that would cost money and it might, as you say, create other problems. And so the second answer to the question – the more rational, less emotional argument – is I think the time to make this change is now for this reason: we are profoundly changing the overall pension system. It was the case that you had a basic state pension – £110 – and then you topped it up with a pension credit which was means tested, so that you had a guaranteed basic income. We’re replacing that with a – what’s called the single‑tier pension – 1 pension that you get that will be equivalent to both those things combined, which will be over £140 a week for a single person.

And because we’re introducing that basic pension, even if people chose to go out and blow all their money, yes, they would be reliant on the pension, but they would be reliant on the pension on its own, rather than means‑tested benefits as well. So I think this is the right time to make a change that I, anyway, believe is a good one, because I think we should be trusting people to spend more of their own money as they choose.

And there’s one other thing I’d say about this, because – look, we’ve had this terrible economic recession and crisis and this very difficult time. Part of getting out of that time has been having very, very low interest rates. Now, that is great for young people who want to get on the housing ladder. It’s good for businesses that want to borrow some money and get out and invest. But, actually, really low interest rates for a really long period of time is not really fair on people who are getting close to retirement, or who have retired, who are expecting to get some interest from, perhaps, modest levels of saving. And I think what was great about the budget was it was saying, ‘Look, when it comes to being fair, we also need to be fair to older people and pensioners in our country – who are actually getting less because of these artificially low interest rates and so we should help them in these specific ways.’

So, sorry, a long answer but I think it was really well thought through and I think it’s the right time to do the right thing.

Question

My question is about income tax, and obviously the recent raises in the past few years have really helped a lot of hard‑working families and individuals. Now, Nick Clegg has said that he would like it to rise to about £12,500, so I was wondering if you could perhaps say if you could share that figure in the future, if you won the next election?

Prime Minister

Yeah. I think it’s been a really great thing that we have – as a coalition government we inherited a – the personal allowance, the amount of money you can earn before you pay tax – it’s now going to go up to 10,000 and then, next year, £10,500. Which basically, as I said, means about 3 million people who were relatively low paid won’t be paying any income tax at all; I think it’s a great thing.

Nick has said what he wants to achieve in the next parliament. I haven’t yet set out what I want to put in my manifesto, but I want to cut people’s taxes. I think as an economy grows, as you improve your economic situation, you should think about how you use the money. Now, obviously, as a country we’ve still got a very big budget deficit; we’re still going to have to use a lot of the money to pay down our deficit to get rid of that, and actually in the good years, when the economy is growing, we should be running a small surplus so we can pay down some of our debts.

That’s what a responsible family would do when you’ve the chance to reduce your indebtedness; that’s what a government should. So we’ve got to use it for that but I do believe as an economy grows you should be trying to give back to people some of the money that they’ve earned, that they’ve been working for so hard for your economy.

Now, the best way to do that, whether that’s raising the personal allowance or cutting a tax rate or other ways of doing it, we’ll have a good think and a good look before our manifesto, but there’s no doubt in this parliament, the right thing to do was to take the poorest people out of tax and to give that basic tax reduction for everyone who’s earning effectively under £100,000. I think it’s been a good thing to do and I’m proud of the progress we’ve made together. But wait for the manifesto for the full answer; we’ve got to store up some exciting things there.

Question

It’s just a question really in regards to young parents that work full time; I mean what is the incentive really for them to do so when some people can reduce their hours and be better off with benefits?

Prime Minister

I think this is a really big question, because if we want to be a successful country we’ve got to make sure it pays to work. Now, obviously one of the ways you make it pay to work is reducing people’s taxes, as I’ve just been talking about. The other way you make it pay to work is make sure that you’ve got a welfare system that supports people who can’t work or who are in need, but not a welfare system that supports people who can work but choose not to.

I said on the steps of Downing Street in 2010, I said that those who can’t, we should always help, those who can, should. And that is the kind of way we should approach it. So we’re doing a couple of things here. One is the introduction of this benefit called Universal Credit which means that as you work more hours you should always keep some of what you’re earning rather than having it all drawn down in loss of benefit, so that will make a difference, the tax reductions make a difference, but I think the really big one for parents who want to work is the cost of childcare.

Probably lots of people in this audience have exactly this conversation at home. You look at the hours you both work, you look at the money you’re both making, you look at the childcare bills and you think to yourself, ‘Actually is it worth me working an extra day or 3 days a week or 4 days a week when I have to think of the childcare bills I’m paying?’ And I think it is time to give some specific help to couples like that. So what we’re proposing, which comes in next year – 2015 – I wish we could do it now but it’s complicated and we’ve got to get it right – is basically to say that for the first £10,000 you spend on childcare you should get 20% back. So effectively £2,000 off your childcare bills, which I think for a lot of families – a lot of 2 earner couples, will make a difference between saying ‘I can go out to work because I want to go out to work.’

I’m not in favour of pointing the finger at families and saying ‘You’ve got to take this model or that model, you shouldn’t stay at home.’ Everyone should be able to make their own choices, but right now I think there are a lot of people who would like to work or who would like to work another day or more hours but they can’t because the childcare is too expensive. So I think this tax relief on childcare will help. The other thing is we want to try and keep childcare costs down. They have gone up over recent years, we’ve got to try and make sure we’ve got good quality childcare, but we make sure the regulations aren’t adding to the cost, and I think that’s probably the biggest thing we could do for working parents.

Question

I believe as a single parent there is really no initiative to work full time – and I nearly work full time – because of the way the current tax credits work. And I would urge the government to come up with a new policy to encourage people to contribute the maximum to our country.

Prime Minister

It is a similar question; we use the tax credit system to try and reimburse you for a share – I think now 80% – of the childcare costs that you have. The problem we have, and I think it’ll be helped by the move to Universal Credit, is a lot of people, whether couples or single parents, find that as you work an extra day or an extra 2 days, sometimes you can find that triggers the loss of other money you would be getting, whether housing benefit, whether income support or whether other benefits.

The idea behind Universal Credit is you put together all those benefits in one universal benefit – that’s why it’s called the Universal Credit – and you make sure that if you work another hour or another day you’re always keeping at least a decent share of what you’re earning. So that’s the thinking behind it, because at the moment, as you say, for too many people when they look at the maths and the calculation it doesn’t really work out for them. So it’s a benefits system that supports work for both single parents and 2 earner couples.

Question

An announcement welcomed in the budget, Prime Minister, was the introduction of a pensioner bond to come into force next January. Whilst the possible interest rates look attractive, it’s likely, I’m sure, to be taxed at 20% for much of the majority. Is it possible to try and treat that bond more like an ISA, rather than like something else?

Prime Minister

Very good. Well, first of all, why are we doing this pensioner bond? It goes back to what I said about – because we’ve had artificially low interest rates, and will have them for some time and because that’s been part of the plan for recovering the economy, I just think it’s been unfair, particularly on pensioners, who come to my constituency surgery and say, ‘Look, I’ve worked hard, I saved up, I don’t have huge savings, but I was expecting to get £1‑2,000 income from my savings to supplement my pension and I’m not because interest rates are so low.’ So I think it’s right to have a specific pensioner bond and to say there’s a limit to how much of it you can have, otherwise you get a few rich people just buying the whole lot. So there’s £10 billion worth of pensioner bond available, you can only invest £10,000 each and so it will benefit, if my maths is right, at least a million pensioners. That is the thinking.

Now, what will the tax rate be? Well, that will depend on your marginal tax rate. What we’ve just done is abolish the 10p tax rate on the first £5,000 of savings income, so I hope lots of pensioners will be able to invest in this and pay no income tax because it’ll be within that £5,000 range. Can you put it into an ISA? That’s one of those questions when I start thinking, ‘Help! I’m not an Independent Financial Adviser, I’d better not answer this question or I’ll get in trouble.’ So I’ll ask one of the very clever people who work for me to give you an answer and say, ‘Go tell Alfred’ I think is the answer to that one.

Question

I guess there’s 2 parts to my question. The first is have you got a myWaitrose or a my John Lewis card?

Prime Minister

I’ll answer that in a second. Go on, give me the second one.

Question

The second – Mark Price did some work with you sharing our business model, and I’m just really curious, is there anything that you’ve particularly seen that’s been taken from that into other businesses or anything that really stuck out to you?

Prime Minister

Really good question.

But I have got an interesting supermarket piece of sociology for you, which is there’s something about Waitrose customers is that they are the most talkative. I find that if I shop in Waitrose in Witney it takes me about twice as long because everyone wants to stop you and have a chat, whereas at other supermarkets I find I can dart round very quickly and get my – but anyway, that’s something about your customers, they’re very talkative, engaged people.

The business model, Mark Price has done – I’m not just saying that because I’m here – he’s done extraordinary work for the country; he’s come on trade missions with me, including one to South Africa. I think he ended up actually – he ended up in hospital; he got ill; he had a terrible time, so he was suffering for his country. He’s done great work for Business in the Community with the Prince of Wales. We’ve been trying to borrow a number of things from your model; one is, I think, the idea of greater employee engagement in a company is a good thing, and so we’ve looked at whether we can support through the tax system more businesses incorporating the way that you’re incorporated.

We’ve also looked at what can we do in the public sector where at the moment most people in the public sector work for a simple employer/employee model. There’s quite a good case to say that we should have more mutuals and cooperatives in parts of the public sector; for instance if a team of community midwives want to form their own mutual or cooperative they should be able to do so. In terms of the pension advice that people in the public sector get, I think I’m right in saying that’s now provided by a mutual at the heart of the Civil Service.

So there’s a lot of things that we are borrowing from the business model. Sorry not to have a myWaitrose card, but I have spent money in your shops and I’ve not enjoyed the free coffee which has been quite a – honestly what are people complaining about, what is wrong with a free cup of coffee? And a cake. I didn’t know about that. That’s getting close to bribery, I mean, you know – honestly.

Question

I know that you don’t have the my John Lewis card or the Waitrose card, but I would recommend the Partnership card, which is a great thing.

Prime Minister

Very good, I will bear that in mind. I will bear that in mind.

Question

We heard last week that two-thirds of our nation are either overweight or obese – we’ve also heard a lot about a possible sugar tax. I think that removes personal responsibility. What are your thoughts?

Prime Minister

Yes, I think a sugar tax is – I mean, I’ve had a look at this, it doesn’t seem to me a sensible idea. I think, on this issue, there’s going to be no one single thing that solves this problem. I think there’s a mixture of better education about food, including education about food preparation and cooking, which I think is really important. I think that makes a difference. I think more in terms of sport and exercise in school. We’ve got to make the most of the Olympics; it was a great moment when the whole country got excited about sport and that’s why we put some specific money into primary schools to pay for sports and PE teachers for at least 2 days a week, so they could organise sport in school.

I think better information is part of this. I mean, I think traffic light systems, guideline daily amounts – I think we can keep working on how we make those easy and simple to understand. But I think the straight sugar-tax idea, I wouldn’t get it past my children anyway, that’s for sure. But I think you’ve got to have personal responsibility. You want better educated consumers making rational choices for themselves and their children and in lots of cases that is about teaching people more about food and how to cook, and how to cook healthy, nutritious meals.

Question

Please can you explain why you won’t let British people have a referendum on Europe this parliamentary term?

Prime Minister

Right, very good question. I want us to have a referendum on Europe but I want it to be a proper choice. I think if we have one right now or in the next year, the choice we’d be giving people would actually be a pretty unacceptable choice. We’d be saying to people, ‘Do you want to stay in this European Union which is not working properly – it’s not an acceptable status quo – or do you want to tear it all up and leave altogether?’ And I think it’s much better to say to people, as I’m saying, look, let’s have one more go at changing this organisation and changing our relationship with it, and then, I promise you, there will be a referendum. And you decide, do you want to stay in this changed European Union or do you want to go?

So I’ve set myself the task of renegotiating our position and making some changes in the European Union, and then I promise, by the end of 2017, if I’m Prime Minister, you’ll get that in/out referendum. And it won’t be a funny question, it won’t be, sort of, ‘Do you like the Prime Minister’s new arrangements?’ or, you know, ‘What do you think of this renegotiation?’ It will literally be, ‘Do you want to stay in or get out?’

The things I want to change are, for instance, we’re currently signed up to the concept of ever-closer union, which I think doesn’t work for Britain. We want to be in an organisation that’s about trade, that’s about cooperation, that’s about working together, but we don’t want to belong to a country called Europe. We live in a country called the United Kingdom, we want to stay in the United Kingdom, so let’s get out of ever-closer union. Let’s make sure that Europe – yes, there’s movement to be able to go and work in other countries but not movement to go and claim benefits in other countries. Let’s change that.

Let’s make sure this organisation isn’t costing us too much money, and I’ve cut the budget. The budget is going to be strictly controlled over the next 6 or 7 years. So let’s make some of those changes and then give people the choice. I’m very honest about this. I’m frank about it. When the choice comes, I’m confident we’re going to get some changes like I’ve just set out and I’m confident it’ll be better for us to stay than go.

Why? Because we are a trading nation. We need access to Europe’s markets. We need to be one of those players determining the rules, because if we were on the outside, the rules could be written against us. And I think all the people who work for, you know, great car companies in Britain like Nissan and Honda and Toyota, I think people who work in financial services, people working in businesses like yours – I’m currently in Europe negotiating the digital single market. So the amazing things that you’re doing with bricks and clicks and fulfilment and everything else, we get the rules straightened out in Europe so actually you can – if you want to – you can expand into other countries and make a success of it.

I don’t want us to be on the outside of those rules having them written, possibly against us, and disadvantaging us, but I’m confident I can get changes to make our position better and then persuade you to stay in a reformed European Union. It’ll be your choice and one of the reasons I’m very passionate about giving people this choice is, I think right now people are very frustrated with Europe. There’s too much bureaucracy, too much regulation, too much cost, and people want change and the consent for staying in right now is pretty thin. And so I think you’ve got to make the changes, have the referendum and then you live by the result. It’ll be your decision.

Question

On the subject of referendums, would a yes vote for Scotland be really bad for the rest of the UK?

Prime Minister

I think it would. I mean, I’m passionate about our country, the United Kingdom. I think that this is – it’s really a unique partnership if you think about it. We go and watch the rugby and we cheer ourselves hoarse for England, Scotland, Wales or for Ireland, but actually, you know, we’re an amazing partnership, an extraordinary family. You think of the things we’ve achieved together. Whether it is, you know, beating the Nazis in the Second World War, inventing the NHS, all the things we’ve built together as this great partnership.

And in the end it’s the Scottish people who will decide, it’s their vote, their decision, but I want them to vote knowing that I think the rest of the United Kingdom, the English, the Welsh, the Northern Irish, are really saying, some quite passionately, ‘We want you to stay. It’s your decision, you can decide to leave this United Kingdom, but actually we think, not just you’re better off in, but we think we’re better off, all of us, with you in.’ Because we’ve achieved these things together and I think in this modern world, having the different strengths of Scotland, Wales, Northern Ireland, England together, actually we bring a lot of things, each of us, to this remarkable family. So I think we would be worse off but I think it was right to give them the choice.

I was the prime minister who had, in Scotland, a Scottish National Party government that wanted to hold some sort of referendum. I had a choice, I could either say, ‘No, no, you can’t, it wouldn’t be legal, it wouldn’t be right.’ I could have had that fight but I think that would have been a terrible fight to have. I think it would have built up Scottish resentment and they would have said, ‘We’re not allowed to make our choice.’ So instead I said, ‘If you want a referendum, let’s have one that is decisive, that is fair and that is legal.’ So we have this one-question referendum in September; we’re trusting in their judgement; they are the ones who get to make the choice. But I profoundly hope and I believe they’ll vote to stay in this remarkable family of nations. We’ve an amazing history but, I think, an even stronger future. So if anyone who’s got friends in Scotland who are voting or relations or colleagues, partners, at work, get on the phone and tell them how much we love them and how much we want them to stay. That, I think, is the answer.

Thank you very much, it’s been really lovely coming, you’ve been a great audience and great questions. Thank you very much indeed.