Why the government believes that voting to remain in the EU is the best decision for the UK - with references

Published 6 April 2016

An important decision for the UK

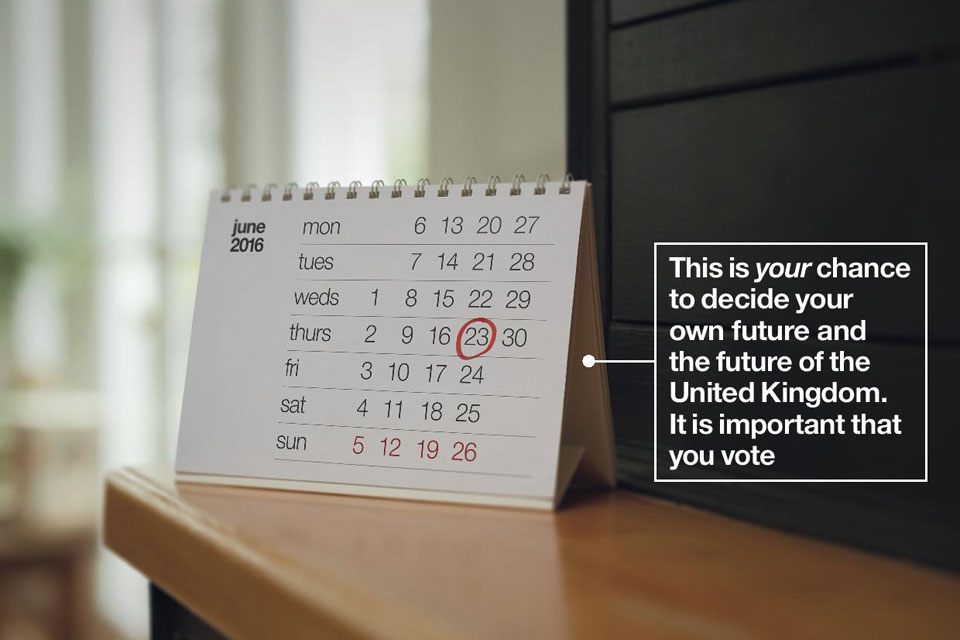

On Thursday, 23 June there will be a referendum. It’s your opportunity to decide if the UK remains in the European Union (EU).

It’s a big decision. One that will affect you, your family and your children for decades to come.

The UK has secured a special status in a reformed EU.[footnote 1]

- we will not join the euro

- we will keep our own border controls

- the UK will not be part of further European political integration

- there will be tough new restrictions on access to our welfare system for new EU migrants

- we have a commitment to reduce EU red tape

The government believes the UK should remain in the EU

This leaflet sets out the facts, and explains why the government believes a vote to remain in the EU is in the best interests of the people of the UK. It shows some of the choices the UK would face if there were a vote to leave.

If you would like further information, please visit the government’s EU referendum website at EUreferendum.gov.uk

A stronger economy

The EU is by far the UK’s biggest trading partner.[footnote 2] EU countries buy 44% of everything we sell abroad, from cars to insurance.[footnote 3] Remaining inside the EU guarantees our full access to its single market. By contrast, leaving creates uncertainty and risk.[footnote 4]

The EU’s single market has over 500 million customers [footnote 5] and an economy over 5 times bigger than the UK’s. [footnote 6] The single market makes it easier and cheaper for UK companies to sell their products outside the UK, creating jobs as a result.[footnote 7]’[footnote 8]’[footnote 9]

Being inside the EU also makes it more attractive for companies to invest in the UK, [footnote 10] meaning more jobs [footnote 11]. Over the last decade, foreign companies have invested £540 billion in the UK, equivalent to £148 million every day [footnote 12].

UK industry and the EU [footnote 13]

| Industry | Jobs | Share of exports going to the EU |

| Aerospace | 110,000 | 47% |

| Chemicals and pharmaceuticals | 136,000 | 54% |

| Financial services | 1,069,000 | 41% |

| Food manufacturing | 373,000 | 53% |

| IT and telecoms | 1,364,000 | 46% |

| Transport | 1,065,000 | 44% |

Over 3 million UK jobs are linked to exports to the EU [footnote 14]

Improving our lives

Cost of living

If the UK voted to leave the EU, the resulting economic shock[footnote 15] would put pressure on the value of the pound, which would risk higher prices of some household goods[footnote 16] and damage living standards.[footnote 17]

Losing our full access to the EU’s single market would make exporting to Europe harder and increase costs.[footnote 18]

Travel abroad

Millions of UK citizens travel to Europe each year.[footnote 19] The EU has made this easier and cheaper.

EU reforms in the 1990s have resulted in a drop in fares of over 40% for lower cost flights.[footnote 20]

From next year, mobile phone roaming charges will be abolished across the EU, saving UK customers up to 38p per minute on calls.[footnote 21]

EU membership also gives UK citizens travelling in other European countries the right to access free or cheaper public healthcare.[footnote 22]

Some argue little would change if we left the EU. But there are no guarantees UK customers would keep these benefits if we left.

If the UK voted to leave the EU, the resulting economic shock would risk higher prices of some household goods [footnote 23]

What happens if we leave?

Voting to leave the EU would create years of uncertainty and potential economic disruption. This would reduce investment and cost jobs.[footnote 24]

The government judges it could result in 10 years or more of uncertainty as the UK unpicks our relationship with the EU and renegotiates new arrangements with the EU and over 50 other countries around the world.[footnote 25]

Some argue that we could strike a good deal quickly with the EU because they want to keep access to our market.

But the government’s judgement is that it would be much harder than that – less than 8% of EU exports come to the UK while 44% of UK exports go to the EU.[footnote 26]

No other country has managed to secure significant access to the single market, without having to:

- follow EU rules over which they have no real say

- pay into the EU

- accept EU citizens living and working in their country [footnote 27]’[footnote 28]

A more limited trade deal with the EU would give the UK less access to the single market than we have now – including for services, which make up almost 80% of the UK economy.[footnote 29] For example, Canada’s deal with the EU will give limited access for services,[footnote 30] it has so far been 7 years in the making and is still not in force. [footnote 31]

Controlling immigration and securing our borders

Securing our borders

The UK is not part of the EU’s border-free zone – we control our own borders which gives us the right to check everyone, including EU nationals, arriving from continental Europe.[footnote 32]

Immigration

The government has negotiated a deal that will make our benefits system less of a draw for EU citizens. In future, new EU migrants will not have full access to certain benefits until they have worked here for up to 4 years. [footnote 33] The government will have greater powers to take action where there is abuse of our immigration system. [footnote 34]

Some argue that leaving the EU would give us more freedom to limit immigration. But in return for the economic benefits of access to the EU’s single market, non-EU countries – such as Norway – have had to accept the right of all EU citizens to live and work in their country. [footnote 35]

Keeping us safer

EU membership means UK police can use law enforcement intelligence from 27 EU countries, [footnote 36] and will have access to fingerprint and DNA information. [footnote 37]

EU co-operation makes it easier to keep criminals and terrorists out of the UK. [footnote 38] Since 2004, using the European Arrest Warrant, over 1,000 suspects have faced justice in UK courts and over 7,000 have been extradited. [footnote 39]

The benefits of EU membership

The UK is part of the EU, a group of 28 countries which exists to promote economic security, peace and stability. [footnote 40] The EU operates as a single, free trading market, without taxes between borders.[footnote 41]

The UK has secured a special status in the EU. The UK has kept the pound, will not join the euro and has kept control of UK borders. We have ensured that no UK powers can be transferred to the EU in the future without a referendum. [footnote 42] The UK will keep full access to the single market, with a say on its rules. For every £1 paid in tax, a little over 1p goes to the EU. [footnote 43] The government judges that what the UK gets back in opportunities, job creation and economic security from EU membership far outweighs the cost.

Opportunities for you and your children

EU membership means you and your family have the right to live, work or study abroad in any of the 27 other member countries. It also guarantees many employment rights.[footnote 44]

The UK as a leading force in the world

The UK is a strong, independent nation. Our EU membership magnifies the UK’s ability to get its way on the issues we care about.[footnote 45] EU action helped prevent Iran from obtaining nuclear weapons;[footnote 46] and the EU is leading the world on tackling climate change.[footnote 47]

A once in a generation decision

The referendum on Thursday, 23 June is your chance to decide if we should remain in or leave the European Union.

The government believes it is in the best interests of the UK to remain in the EU.

This is the way to protect jobs, provide security, and strengthen the UK’s economy for every family in this country – a clear path into the future, in contrast to the uncertainty of leaving.

This is your decision. The government will implement what you decide.

If you’re aged 18 or over by 23 June and are entitled to vote, this is your chance to decide. Registration ends on 7 June. Find out how to register at aboutmyvote.co.uk and register online at gov.uk/register-to-vote.

If you would like to know more about any of the information in this leaflet, go to: EUreferendum.gov.uk.

The government believes that voting to remain in the European Union is the best decision for the UK

- protecting jobs

- a stronger economy

- providing security

The EU referendum is a once in a generation decision. The government believes it is in you and your family’s best interests that the UK remains in the European Union.

Vote on Thursday, 23 June 2016.

If you would like further information, please visit the government’s EU referendum website at EUreferendum.gov.uk.

-

The government has set out the agreement reached at the February European Council in The best of both worlds: The United Kingdom’s special status in a reformed European Union, February 2016. ↩

-

In 2014 total exports of goods and services to the EU were £228,893 million and total exports of goods and services worldwide were £515,191 million. This made exports to the EU 44.4% of the total. The US is our next biggest export market, accounting for 17% of the total. The Pink Book, Office for National Statistics, October 2015, Table 9.3. ↩

-

Methods and sources given in footnote 2. ↩

-

“Leaving aside the debate over the long-term impact of ‘Brexit’, there appears to be a greater consensus that a vote to leave would result in a period of potentially disruptive uncertainty while the precise details of the UK’s new relationship with the EU were negotiated.” The independent Office for Budget Responsibility Economic & Fiscal Outlook, March 2016, page 85. “No country has ever used Article 50 – it is untested. There is a great deal of uncertainty about how it would work.” The process for withdrawing from the EU, HM Government, February 2016, page 7. ↩

-

As of 2015, the population of all of the EU’s 28 member states was 508,223,624. Population statistics, Eurostat, February 2016. ↩

-

In 2015 the combined Gross Domestic Product (GDP) of all 28 EU member states was €14,625,372.9 million and the UK’s was €2,568,052.2 million. Gross domestic product at current market prices, Eurostat, March 2016. The 25 February ONS estimate of 2015 UK GDP in current prices is £1,863,995 million which at the 2015 average pound to euro exchange rate of 1:1.38 (Bank of England) is €2,572,313 million. ↩

-

“One of the major benefits of being part of the EU single market framework is that it has helped to reduce NTBs (non-tariff barriers) within the EU. For example, by harmonising regulations such as product standards across 28 member states, or the passporting regime for financial services. This reduces the overall cost of compliance for businesses as they are only required to comply with one set of standards rather than one for each member state to which they export.” Leaving the EU: implications for the UK economy, PwC, commissioned by the Confederation of British Industry (CBI), March 2016, pages 49 to 50. ↩

-

If we move outside the single market we would have to negotiate a new relationship with the EU. Even the best Free Trade Agreement (FTA) will come with higher administrative costs and red tape in order to export into the single market. In the long-run there is a risk around regulatory divergence, which carries risks of higher barriers to trade. This is described in: Alternatives to membership: possible models for the United Kingdom outside the European Union, HM Government, March 2016. ↩

-

Multiple case studies describing the relative ease of selling products to the EU from the UK are publically available, such as: For exporters overall, “the time for documentary and border compliance is substantially lower on average than for others”. The World Bank Ease of Doing Business Survey, October 2015, page 86. Focusing on the car industry, a report by the Society of Motor Manufacturers & Traders (SMMT) stated: “Access to the EU market is reflected in the fact that 49% of UK-produced vehicles are sold across the largest single market in the world, unhindered by any tariffs or costly regulatory barriers.” The UK Automotive Industry and the EU, KPMG, commissioned by SMMT, April 2014. ↩

-

There is survey, expert and academic evidence supporting the positive role of EU membership and inward investment: “It is significant that 72% of investors surveyed regard access to the European single market as ‘very’ or ‘fairly’ important to the UK’s attractiveness as an investment destination, up from 63% last year.” UK attractiveness survey, Ernst and Young, 2015, page 7. “There is a reason why a more substantial proportion of global banks, internationally active banks, are headquartered in London than in any other European country or all other European countries combined. That is partly because of the cluster of expertise that is here but also, in many cases – and I have had numerous conversations with CEOs who have affirmed this – it is because of the passporting ability of this economy, in terms of its activities, being in London.” The Governor of the Bank of England Mark Carney in Treasury Select Committee oral evidence: The economic and financial costs and benefits of UK membership of the EU, March 2016, question 1004. Academic evidence points to market size as a key determinant of Foreign Direct Investment (FDI). How attractive is the UK for future manufacturing foreign direct investment, Driffield, Nigel, et al., 2013 for the Government Office for Science reviewed existing studies on the importance of different factors on determining FDI and found that market size had high importance, alongside labour costs, labour market flexibility and quality of institutions. ↩

-

“These results show that almost 85,000 new jobs were created by FDI projects recorded in 2014 to 2015”. UKTI Inward Investment Report 2014 to 2015, June 2015, page 1. ↩

-

FDI data show net FDI flows to the UK from the rest of the World were £539.1 billion in the 10 years to 2014. Divided by the number of days in the period the total per day is £147.6 million Office for National Statistics, December 2015, Table 2.1. ↩

-

Services exports data sourced from the Pink Book, Office for National Statistics (October 2015). Goods exports data sourced from HMRC UK trade info, extracted March 2016. Jobs figures sourced from Labour market statistics, Office for National Statistics, March 2016. Aerospace exports based upon HS88 (aircraft, spacecraft and parts thereof). Jobs figures reflect the broad sector. ↩

-

Government estimates based upon Office for National Statistics Trade and National Accounts data show 3.3 million jobs are linked to trade with the EU. Number of regional jobs linked to EU exports, HM Treasury, March 2016. In 2015 there were 33.8 million jobs in the UK. Labour market statistics, Office for National Statistics, March 2016. Other studies in this area include South Bank University (2000) and The National Institute of Economic and Social Research (NIESR, 2000) ↩

-

A vote to leave the EU would create a period of uncertainty for the UK economy and would be an economic shock. “Leaving aside the debate over the long-term impact of ‘Brexit’, there appears to be a greater consensus that a vote to leave would result in a period of potentially disruptive uncertainty while the precise details of the UK’s new relationship with the EU were negotiated.” The independent Office for Budget Responsibility Economic & Fiscal Outlook, March 2016, page 85. “There could be lower levels of activity because of the degree of uncertainty that could affect investment and household spending. That is a reasonable expectation during a period of uncertainty.” Bank of England Governor Mark Carney giving evidence to the Treasury Select Committee, March 2016, question 1044. “Uncertainty associated with the outcome of the forthcoming referendum on EU membership could also weigh on the outlook.” IMF Article IV concluding statement, February 2016, page 6. IMF Managing Director Christine Lagarde stated in a recent CNN interview that “Uncertainty is bad in and of itself, no economic player likes uncertainty – they don’t invest, they don’t hire in times of uncertainty… my hunch, as a European and as a person is that it is bound to be a negative on all fronts.” ↩

-

The consensus amongst experts is that the pound would suffer depreciation following a leave vote as a result of this uncertainty and that sterling depreciation would lead to inflationary pressures for some products. “A number of forecasters suggest that uncertainty could lead to a significant sterling depreciation”. The independent Office for Budget Responsibility, March 2016, page 85. “In terms of the implications of the referendum, we have seen a marked increase in implied volatility in the options market around the date of the referendum, once the date became known, and the skews in the option market, in other words the purchase of downside protection if the pound was going to depreciate”. Governor of the Bank of England Mark Carney, oral evidence to the Treasury Select Committee, question 1088, March 2016. “A sharp currency depreciation would cause another potential problem: a temporary spike in inflation”, BlackRock, February 2016, page 11. “Around one-third of the UK’s CPI basket is imported either directly or indirectly. This suggests a 15 to 20% fall in sterling could eventually raise inflation by up to 5pp [%], depending upon how much of the depreciation was passed on to consumers. Higher inflation would erode real incomes, leaving households with less to spend.” HSBC, Brexit strategies ‘what if the UK leaves?’, referenced by the Financial Times, 24 February 2016. ↩

-

The negative implications for economic activity and living standards are highlighted by the LSE in the study The consequences of BREXIT for UK trade and living standards, Centre for Economic Performance, March 2016. Oxford Economics believe that “most scenarios would impose a significant long-term cost on the UK economy” in Assessing the economic implications of Brexit, March 2016, executive summary. The consensus from experts is that uncertainty would lower investment, economic activity, and living standards in the period following a vote to leave. “A vote to leave the EU could have an impact on firms’ credit risk, as the potential loss of access to the EU single market could have a negative impact on UK firms’ export earnings and put upward pressure on import prices.” PwC commissioned by the Confederation of British Industry (CBI), March 2016, page 40. “If you are outside [the EU] trying to decide where to do investment, where are you going to go: to the one that’s big or the one that has just left?” Catherine Mann, OECD Chief Economist, quoted in the Guardian, 10 March 2016. “The transition to a new set of arrangements would be messy and potentially very costly, not just for the UK but also its closest trading partners.” Stephanie Flanders, JP Morgan, Brexit: How investors should approach the UK referendum, February 2016, page 1. “Ahead of the referendum, the most notable impact on the economy is likely to be that of heightened uncertainty and weaker investment.” The UK & EU: exit emergency, Deutsche Bank Research, 12 February 2016 “We see a Brexit vote as having a large and negative economic impact in the near term – and meaningful implications in the long run. Our overarching view from an investor’s perspective: the likely negative impact on the UK economy is more concrete than any speculative long-term positives.” BlackRock, March 2016, page 7. ↩

-

Supporting evidence given in footnotes 7 to 9. ↩

-

In 2015, UK residents made 47,880,000 visits to the European Union. Monthly overseas travel and tourism. Office for National Statistics, February 2016, Table 3. ↩

-

A number of studies and reports highlight the effect EU reforms have had on the aviation industry: “Air transport liberalisation has increased the number of carriers from 119 in 1992 to a peak of 140 in 2000. The number of routes linking single market countries has risen by 46% since 1992. Fares at the lower end of the market fell by 41% between 1992 and 2000.” The single market: yesterday and tomorrow, Bureau of European Policy Advisers (BEPA), European Commission, page 13. The Mobility and Transport Directorate-General describes the effect of the reforms undertaken between 1987 and 1997, which created the single market for aviation: “Air transport had been traditionally a highly regulated industry, dominated by national flag carriers and state-owned airports. The internal market has removed all commercial restrictions for airlines flying within the EU, such as restrictions on the routes, the number of flights or the setting of fares. All EU airlines may operate air services on any route within the EU.” Website description of EU air transport, DG Transport and Mobility, European Commission. The creation of the low-cost airline market as a result of the reforms in the 1990s is illustrated by European Commission figures: “In 1992, a majority of seats belonged to incumbent air carriers (65.6%, while only 1.5% to low-cost carriers). In 2011 for the first time, low-cost airlines (42.4%) exceeded the market share of incumbent air carriers (42.2%). The trend continued in 2012 (44.8% for low-cost and 42.4% for incumbent).” Fitness check – internal aviation market report on the suitability of economic regulation of the European air transport market and of selected ancillary services, European Commission, July 2013, page 25.:“Since the early 1990s the low-cost sector has seen significant growth in the UK, the pace of which has for several years outstripped that seen in other sectors of the market. The sector now accounts for almost 40% of UK passenger journeys.” Airports Commission: interim report, December 2013, page 67 ↩

-

In 2007 the EU introduced caps on the charges which mobile phone providers can levy when roaming, saving UK customers money when travelling in the EU Regulation (EC) No 544/2009. The £0.38 estimate, which represents the money saved per minute when the roaming charges are abolished next year, is calculated from the cap for outgoing voice calls in the period July 2009 to June 2010. The maximum price allowed was €0.43. This converts into sterling by the average exchange rate between the 2 currencies as published in the Journal of the European Union in the months of April, May and June 2009. The average exchange rate was 0.88312. From 15 June 2017 there will be no extra roaming fee and calls you make in EU countries will be the same as the domestic price. EU Commission’s Digital single market page, last updated March 2016. ↩

-

UK citizens can order a European Health Insurance Card (EHIC): “An EHIC gives you the right to access state-provided healthcare on temporary stays in other European Economic Area (EEA) countries and Switzerland at a reduced cost, or sometimes for free. It will cover immediate and clinically necessary state-funded treatment until your planned return home to the UK.” For further details refer to the NHS webpage on the EHIC. ↩

-

Supporting evidence given in footnotes 15 to 17. ↩

-

Supporting evidence given in footnotes 15 to 17. ↩

-

The European Commission, DG Trade’s World map of trade agreements in force gives a list of the markets covered by EU Trade Agreements. ↩

-

In 2014 total exports in goods and services to the EU were £228,893 million and total exports of goods and services worldwide were £515,191 million. This makes exports to the EU 44.4% of the total. The Pink Book, Office for National Statistics, October 2015, Table 9.3. EU exports of goods and services to the UK are sourced from UNCOMTRADE (goods) and the OECD (services). EU exports to the UK represented 7.8% of total EU exports in 2014. ↩

-

The government and other experts have set out examples of existing relationships with the single market. More information on the obligations of non-EU countries with EU trade deals can be found in: Alternatives to membership: possible models for the United Kingdom outside the European Union, HM Government, March 2016. A policy brief by Jean-Claude Piris, former Director General of the Legal Service of the Council of the European Union, provides assessment and commentary of the different legal arrangements with the EU/single market that the UK might follow in the event of a vote to leave the EU, with particular reference to the existing arrangements that other non-EU countries have secured. If the UK votes to leave, Centre for European Reform, January 2016. A Global Counsel report describes on page 6 the different trade deals countries have with the EU, including the compromises they all must make, including paying into the EU budget and accepting the free movement of EU citizens in their countries. BREXIT: the impact on the UK and the EU, Global Counsel, June 2015, page 6. ↩

-

More information on the cost and obligations involved in Norway’s relationship with the EU is provided in the 2012 report by the Norwegian government’s EEA Review Committee. ↩

-

The Services sector accounted for 79.1% of the UK economy in 2015. ONS GDP low level aggregates, February 2016. ↩

-

The EU-Canada Free Trade Agreement has restrictions on the liberalisation of certain services. For instance, it excludes liberalisation of trade in aviation, broadcasting and some aspects of financial services. European Commission, EU-Canada home page. ↩

-

The EU Commission’s overview of FTA and other trade negotiations confirms that negotiation directives were issued in April 2009. The EU DG Trade’s world map of trade agreements in force confirms that the Canada preferential agreement “has not yet been applied”. ↩

-

Article 1 of Protocol 20 to the Treaty on the Functioning of the European Union (TFEU) makes clear that EU law does not affect the fact that the UK is entitled “to exercise at its frontiers with other member states such controls on persons seeking to enter the UK as it may consider necessary” to verify people’s rights to enter the UK. EU rules on free movement of people around Europe are set out in the Free Movement Directive (2004/38/EC). Article 5 of the free movement directive makes clear that the directive is not about whether border controls are exercised. Since 2010 the UK has refused entry to over 6,500 EEA nationals at the UK border. Over 4,500 of these were stopped at our juxtaposed border Admissions statistics, Home Office, March 2016. More information on UK border control. ↩

-

Details of the deal reached at the February European Council Further details can be found in The best of both worlds: the United Kingdom’s special status in a reformed European Union, HM Government, February 2016, page 29, paragraph 2.96. ↩

-

Our new settlement with the EU secures a commitment to new legislation, which will help to ensure that non-EU nationals will no longer be able to take advantage of EU law to get around UK immigration controls. The government has also secured agreement on the additional action we can take to prevent fraud and abuse of free movement. For fuller details of the agreement see paragraphs 2.116 – 2.123 that focus specifically on reducing abuse of free movement. ↩

-

Supporting evidence given in footnotes 27 to 28. ↩

-

There is more than one measure which enables enforcement to use intelligence from other EU countries. One of the main tools for using EU law enforcement intelligence is Europol. EU countries have to “take the measures necessary to ensure that their national units the unit which represents each country operationally in Europol are able to fulfil their tasks and, in particular, have access to relevant national data” European Council Decision, April 2009. Another example is a European law referred to as the ‘Swedish Initiative’ (Council Framework Decision 2006/960/JHA) which sets out some provisions to facilitate law enforcement information sharing across the EU. ↩

-

In the near future, the UK will participate in Prüm – an operational tool that will give law enforcement access to fingerprint and DNA information from other EU countries. Fuller details of Prüm. ↩

-

This is done, for example, through the sharing and analysis of law enforcement intelligence from across Europe. Europol (an EU agency to assist with law enforcement across Europe) can analyse intelligence from different countries, creating a better picture of threats from organised crime and terrorism across Europe. More information on Europol. The second generation Schengen Information System (SIS II) allows alerts to be shared between member state law enforcement agencies, for example flagging people seeking to enter the UK who are subject to European Arrest Warrants. This enables UK authorities to arrest people at the border on arrival to the UK. Since 2010 the UK has refused entry to over 6,500 EEA nationals at the UK border. Over 4,500 of these were stopped at our juxtaposed border Admissions statistics, Home Office, March 2016. ↩

-

The European Arrest Warrant is a measure that enables swift extradition of offenders and suspects between EU countries. Between 2004 and 2014 (calendar years), 7,137 individuals were surrendered who were wanted from the UK and 1,127 were surrendered by other member states to the UK. Historical European Arrest Warrants statistics: calendar and financial year totals 2004 to April 2015, National Crime Agency, August 2015. ↩

-

Article 2 of the Treaty of the European Union (Lisbon Treaty) states: “[The Union] shall contribute to peace, security, the sustainable development of the Earth, solidarity and mutual respect among peoples, free and fair trade, eradication of poverty and the protection of human rights, in particular the rights of the child, as well as to the strict observance and the development of international law, including respect for the principles of the United Nations Charter.” The Preamble to the Treaty on European Union (Maastricht Treaty) also refers to these collective aims, aiming to promote: “peace, security and progress in Europe and in the world”. ↩

-

The UK is part of the EU Customs Union, which means the movement of goods between member states is not subject to customs duties. ↩

-

More detail on the European Union Act 2011. ↩

-

The UK’s net contribution to the EU averaged approximately £7 billion per annum from 2010 to 2014. This is taken from European Commission outturn data and can be found in EU Finances 2015, Table 3.B. This includes those receipts administered by UK government bodies and those paid directly to UK recipients by the European Commission, including to universities and small businesses. Sterling conversions use average annual exchange rates provided in annex A of EU Finances 2015. Public sector current receipts averaged just over £600 billion over the same 5 year period according to ONS data. ↩

-

More information on EU workers’ rights. ↩

-

“Most of the evidence argued that it was strongly in the UK’s interests to work through the EU in a number of policy areas. The key benefits included: increased impact from acting in concert with 27 other countries; greater influence with non-EU powers, derived from our position as a leading EU country; the international weight of the EU’s single market, including its power to deliver commercially beneficial trade agreements; the reach and magnitude of EU financial instruments, such as for development and economic partnerships; the range and versatility of the EU’s tools, as compared with other international organisations; and the EU’s perceived political neutrality, which enables it to act in some cases where other countries or international organisations might not.” Foreign policy: balance of competences report, HM Government, November 2012, page 6. ↩

-

For information on the EU’s role on Iran, see this European External Action Service (EEAS) page and this US State Department page. ↩

-

For information on the EU’s role on climate negotiations, see this academic paper by the Georgetown Journal of International Affairs and this Reuters article. ↩