West Midlands Local Industrial Strategy

Published 16 May 2019

Credit: HS2

Dedication

Professor Lord Bhattacharyya

Credit: WMG/University of Warwick

The Local Industrial Strategy for the West Midlands builds on the heritage of the region’s manufacturing, research and technology sectors.

The strategy sets out how the West Midlands will take advantage of the incredible skills, infrastructure and innovation of our region.

In that spirit, we dedicate this strategy to the life and achievements of Professor Lord Bhattacharyya, founder of WMG at the University of Warwick.

He was personally responsible for bringing millions of pounds of investment to the West Midlands. Professor Lord Bhattacharyya played a key role in the renewal of Jaguar Land Rover and the West Midlands’ automotive sector.

Most recently the National Automotive Innovation Centre and the UK Battery Industrialisation Centre were direct results of his advocacy.

Professor Lord Bhattacharyya was a constant champion of the West Midlands and a key figure in its industrial renaissance. It is our profound hope that this strategy will build on his vision and achieve his ambition of making the West Midlands a world leader in manufacturing, technology, innovation and skills.

Foreword

The West Midlands is undergoing a renaissance.

The West Midlands is a global force and a major part of the UK economy, generating £99 billion of GVA - 5% of UK output. The region is growing fast, with output up 27% over the past 5 years. A record number of people are in work and the lowest number are out of work. Productivity is increasing too, at twice the rate of the UK in 2017 to 2018. Carbon emissions have reduced by 18% over the last 5 years.

The West Midlands is large and diverse, consisting of 3 interlinked but distinctive economic areas. Its cities, many towns and rural areas are home to communities with very different characteristics. All share a long history of creative design, manufacture and production. Doing things differently and leading the way is what defines the West Midlands. This is a legacy that survived the industrial restructuring of the 1970/1980s and is now the engine of current and future success.

Firms across the region have been supplying components and assembling vehicles from the first bikes to today’s autonomous pods. They built the world’s first production line and now create virtual worlds for testing new products based on real data.

They provide the real-life testing needed to get new medicines from the lab to patients. They provide modern components and materials to global supply chains in a wide range of industries. The region’s digital creative businesses create games played across the world.

Universities and commercial research and development centres across the region are central to the UK. They are developing the skills, products and processes the UK will need tomorrow, as well as being major employers and core to the future of the towns and cities that host them.

Shared leadership to support the delivery of the national modern Industrial Strategy

The modern Industrial Strategy sets out a path to increasing productivity and earning power across the country

It formed a partnership of innovators, job creators and world-class businesses positioning the United Kingdom to seize the global opportunities of the new industrial revolution. And it acknowledged the vital role of ambitious local business and civic leaders to deliver prosperity.

Our collective national and local ambition is for the West Midlands Local Industrial Strategy to demonstrate this approach in action through our collaborative national, regional and local leadership.

Developed locally and agreed with government, this Local Industrial Strategy sets out the priorities to increase the productivity of the West Midlands and our national economy. It belongs to the West Midlands and has been developed in collaboration with hundreds of businesses, civil society organisations and citizens.

But it also marks a change in the way government is working to support the region. It represents the next phase of long-term partnership and builds on important foundations set in place since 2010. These include the previously agreed City Deals, Devolution Deals, Strategic Economic Plans, work across the Midlands Engine and recent packages to support delivery on local ambitions on skills and housing.

Focus

The West Midlands aims to continue growth and success, while ensuring a more inclusive and balanced economy, where all communities and residents benefit and no one is left behind.

In partnership with the government, the West Midlands aims to drive growth and meet government’s national Future of Mobility Grand Challenge. The region’s research strengths across its universities – and its leadership in battery industrialisation – are well established. This Local Industrial Strategy shows how partners will combine these strengths with manufacturing expertise and world-class supply chains in towns such as Darlaston, Walsall and Bloxwich. The country’s first Future Mobility Zone — between Birmingham, Solihull and Coventry — will host the testing of new technologies.

Other priorities — ranging from healthcare innovation to modern services and creative content — show how the region is looking towards shaping future markets. This Local Industrial Strategy also makes clear how the region will boost productivity across the Industrial Strategy’s 5 foundations and maximise the impact of major public and private investment over the coming years. High Speed 2 will soon start to strengthen the region’s connectivity. Coventry is the UK’s City of Culture in 2021. Birmingham will host the Commonwealth Games in 2022.

Evidence led, collaborative and forward looking

This Local Industrial Strategy and its supporting documents published locally are based on a robust evidence base developed by independent commissions and research over the last 3 years. Led by the West Midlands Combined Authority with Local Enterprise Partnerships, it has been co-designed with the involvement of over 350 organisations.

Collectively, we have worked with national and local leaders and with a wide range of businesses, sector groups and the civil society sector as part of a public consultation during the autumn of 2018.

It is not a strategy set in stone and will continue to evolve as the economy changes, working together with the communities and businesses of the West Midlands, including them fully in its implementation.

Rt Hon Greg Clark MP

Secretary of State for Business, Energy and Industrial Strategy

Andy Street

Mayor of the West Midlands

Cllr Ian Ward

Leader of Birmingham City Council

and West Midlands Combined Authority Portfolio Holder for Economic Growth

Jonathan Browning

Chair of the Coventry & Warwickshire Local Enterprise Partnership

and Chair of the West Midlands Combined Authority’s Strategic Economic Development Board

Executive summary

This Local Industrial Strategy comes at a pivotal time in the West Midlands’ history.

The West Midlands is in renaissance: output is up 27% over the past 5 years. Productivity increased last year at twice the rate of the UK average. High Speed 2 will further strengthen the region’s connectivity with national markets – 90% of which are already within a 4-hour drive. The West Midlands, working with partners in the Midlands Engine, is also a growing international force: foreign direct investment projects have trebled since 2011. Carbon emissions have reduced by 18% over the last 5 years.

This Local Industrial Strategy demonstrates how the West Midlands is forging its future and building an inclusive and balanced economy. Together with the supporting documents published locally, it shows the West Midlands is taking action to continue growth in productivity and earning power for all.

It also makes clear how government is backing these efforts, working in partnership with local leaders, business and stakeholders across the region to help realise the West Midlands’ potential.

Seizing opportunities for the future

Building on its distinctive strengths – from transport innovation to data-driven health and life sciences and globally competitive supply chain firms – this Local Industrial Strategy sets out the steps the West Midlands will take to:

- drive growth by strengthening the foundations of productivity; contributing towards the Grand Challenges; and taking advantage of market driven opportunities in mobility, data-driven health and life sciences, modern services, creative content, techniques and technologies; and

- ensure all communities can contribute to and benefit from economic prosperity whilst protecting and enhancing the environment; investing further in social infrastructure; measuring progress; and

- designing actions using a balanced set of inclusive indicators.

Led by the Mayoral Combined Authority, working with Local Enterprise Partnerships and local authorities, this Local Industrial Strategy marks the next stage of the West Midlands’ long-term partnership with government.

It is built on strong foundations. Since 2010, local leaders, working in partnership with government, have delivered historic City Deals with Greater Birmingham and Solihull, Coventry and Warwickshire and the Black Country. Having secured significant Growth Deal funding, the West Midlands then came together as one to take on important new powers and secure new leadership through 2 successful Devolution Deals.

Since the launch of the Industrial Strategy, this partnership has gone from strength to strength. This includes the West Midlands and government agreeing an historic Skills Agreement, unlocking up to £69 million to help equip people with the skills they need to get on, as well as an ambitious outline Housing Package. And, working with the Department for International Trade, the West Midlands is building on positive trade growth and supporting high potential exporters reach global markets.

The West Midlands will build on these strengths and address barriers to growth. Some of the approaches within this Local Industrial Strategy are region wide; others are focused on specific spatial needs or opportunities. It highlights a range of programmes that are already in train and sets out long-term but deliverable ambitions for the future.

Driving growth: Future of Mobility

The Industrial Strategy’s Future of Mobility Grand Challenge recognises the unprecedented change in transport technology expected over the next decades.

Building on its significant existing strengths in research and firms from original equipment manufacturers to connected supply chains in rail, automotive and aerospace, the West Midlands is well placed to shape the UK’s responses to this challenge.

The West Midlands is the centre of transport innovation in the UK, leading the smart, low carbon movement of people and goods. It will build on the UK Battery Industrialisation Centre to consolidate its role as a battery research, development (R&D) and manufacturing hub. By combining the opportunities of 5G, the Future Mobility Zone, High Speed 2 and the Commonwealth Games, it will also create a more connected region.

To continue driving progress towards this priority, the West Midlands will:

- partner with local specialist manufacturers and R&D centres to help create new markets and foreign direct investment opportunities, such as those in Electric and Connected Autonomous Vehicles and battery manufacturing;

- develop an innovative and integrated transport network, including delivering the UK’s first large-scale 5G test bed to enable a new approach to real time data and user management across the whole transport system.

The government is already working in partnership with the West Midlands to support this priority through investments including £20 million for the Future Mobility Zone between Birmingham, Solihull and Coventry; and up to £50 million for 5G trials across the West Midlands.

There is significant public and private investment already in place to help realise these opportunities. To further complement locally led commitments, the government and West Midlands will:

- work with local partners to maximise the region’s contribution to achieving government’s existing ambition to deploy 3 world-leading trials of connected autonomous vehicles by 2021 in the UK, with the West Midlands aiming to deploy the first fully operational connected autonomous vehicles in the region in advance of the 2022 Commonwealth Games;

- help drive up greater foreign direct investment in electric vehicle manufacturing. This includes completing the development of the UK Battery Industrialisation Centre and maximising the impact from the Faraday Battery Challenge; and

- build on its existing partnership that has supported the development of the West Midlands High Speed 2 Growth Strategy. The government will work in partnership with the West Midlands to maximise the benefits that High Speed 2 will bring to the region.

Data-driven health and life sciences

The West Midlands is a growing centre for testing and proving health innovation, working in partnership with businesses and patients.

Building on investment in the Institute of Translational Medicine and 5G, the West Midlands’ ambition is to build on its growing cluster to deliver improved clinical care and health outcomes, alongside significant business growth and scale-up success. This will be through accelerating the commercialisation of treatments and technologies to drive business and patient benefits – this will support the national Life Sciences Industrial Strategy.

To continue driving progress towards this priority, the West Midlands will:

- continue to invest in the business support and networks needed to drive health innovation cluster development;

- improve health outcomes and provide the healthcare jobs of the future through new technical career pathways in local healthcare; more personally-targeted care; and digitally-enabled care;

- convene partners across the West Midlands and Midlands Engine to maximise opportunities through the Strength in Places Fund and other national competitive funds.

To complement locally led commitments, the government will work in partnership with the West Midlands to:

- support the development of a locally led West Midlands Translational Medicine and Med-Tech Commission. This brings together national and local public leaders, government, universities, entrepreneurs and startups, and builds on the strengths of the West Midlands life sciences cluster, underpinned by robust evidence. The Commission will advise on the development of a locally led road map to accelerate commercialisation around the region’s ‘lab to patient’ ecosystem.

- continue to support the West Midlands’ international investment offer in healthcare technologies with the Department for International Trade and local partners, through the existing Midlands Engine Trade and Investment Programme Board. This will explore opportunities in international markets for new therapies, devices and techniques, to drive business growth through increased commercialisation of healthcare technologies.

- build on existing and new partnerships between Government, industry, universities and the NHS in driving innovative product development to form part of West Midlands’ efforts to maximise its contribution to the Artificial Intelligence and Data Grand Challenge mission to transform the prevention, early diagnosis and treatment of chronic diseases, such as cancer, diabetes, heart disease and dementia by 2030.

Modern services

The West Midlands aims to build its reputation as a high-value business and professional services location benefiting from a highly diverse and highly skilled local workforce, through investments in the construction sector, the business environment, infrastructure and skills.

To drive progress towards achieving this priority, the West Midlands will:

- continue to accelerate construction of varied high-quality housing, high grade employment spaces and improved connectivity, maximising the opportunities of High Speed 2 and Birmingham Airport;

- continue to foster innovative partnerships between firms and education institutions, opening up opportunities with clear progression and entry routes for diverse communities and ensuring the availability of the technical skills that are in high demand; and

- design locally led peer-to-peer networks to support and improve the productivity of local firms and bring together professional business services to provide a visible and trusted offer to local firms. Both of these will build on findings and approaches set out in the forthcoming Business Productivity Review.

To complement locally led commitments, the West Midlands Skills Agreement with government will help support more young people and adults to get the skills they need to benefit from the forecast increase in jobs, as well as upskilling and retraining local people of all ages.

Creative content, techniques and technologies

The West Midlands is well placed to take advantage of the global growth in creative content, techniques and technologies, building on a history of success in transforming products, processes and services.

To build on this opportunity, the government and the West Midlands will:

- continue to maximise the opportunities arising from the Department of International Trade’s High Potential Opportunities scheme within the gaming sector in Leamington Spa (Coventry and Warwickshire).

The government and West Midlands will build on the opportunities of the Commonwealth Games and Coventry City of Culture, to develop and showcase digitally-led approaches to resident and visitor services and experiences. The West Midlands’ ambitions will also be supported by the new Digital Skills Partnership.

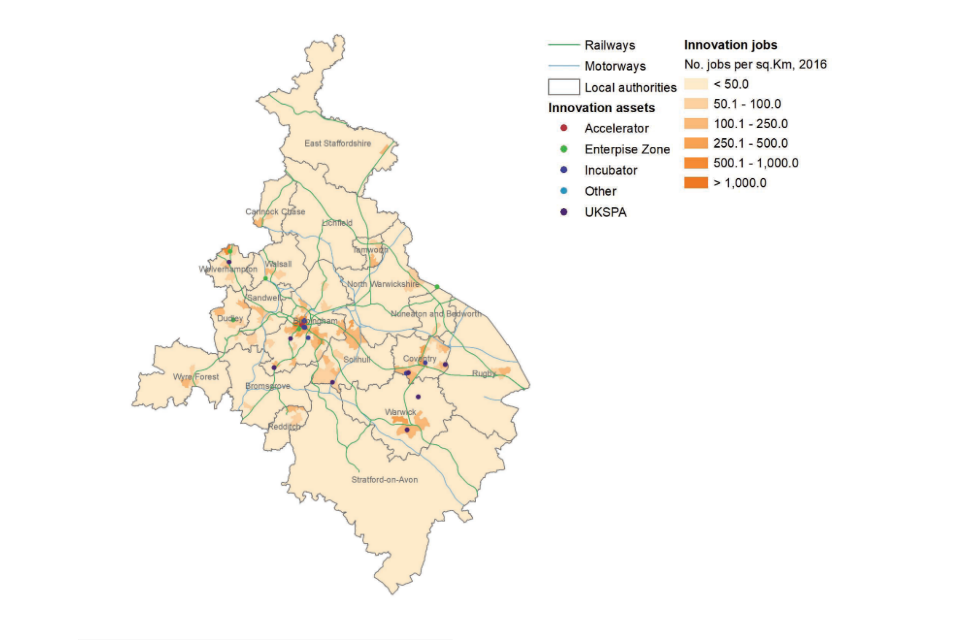

Ideas

The West Midlands aims to further drive up levels of business innovation and the commercialisation of research and development, working in partnership with government, across the Midlands Engine and internationally. The West Midlands will draw on the expertise of its universities, Catapult centres and research strengths, with a focus on mobility, life sciences, digital, and developing the supply chains of the future.

To drive progress towards achieving this priority, the West Midlands will:

- ensure the availability of both space and finance for innovation, encourage cross-sectoral innovation, and deepen the business-led and peer-to-peer networks;

- create new support programmes targeted at local supply chains and smaller, high potential firms, including through demonstrator projects, enabling accessible investment opportunities and access to finance products on attractive terms; and

- create a new foresight programme to generate new ideas and promote awareness of the latest market demand for innovative SMEs and new technologies.

To further complement locally led commitments, the government will work in partnership with the West Midlands to deliver local priorities and achieve the West Midlands’ full role in the national 2.4% research and development target by:

- continuing to support the development of the locally led West Midlands Innovation Framework and new programmes. This will consider, where appropriate, how the opportunities identified in the Local Industrial Strategy could provide an organising framework for bids by local partners into the Strength in Places Fund and other national competitive funds delivered by UK Research and Innovation; and

- helping to build the optimum environment for foreign direct investment in battery R&D and electric vehicle manufacturing.

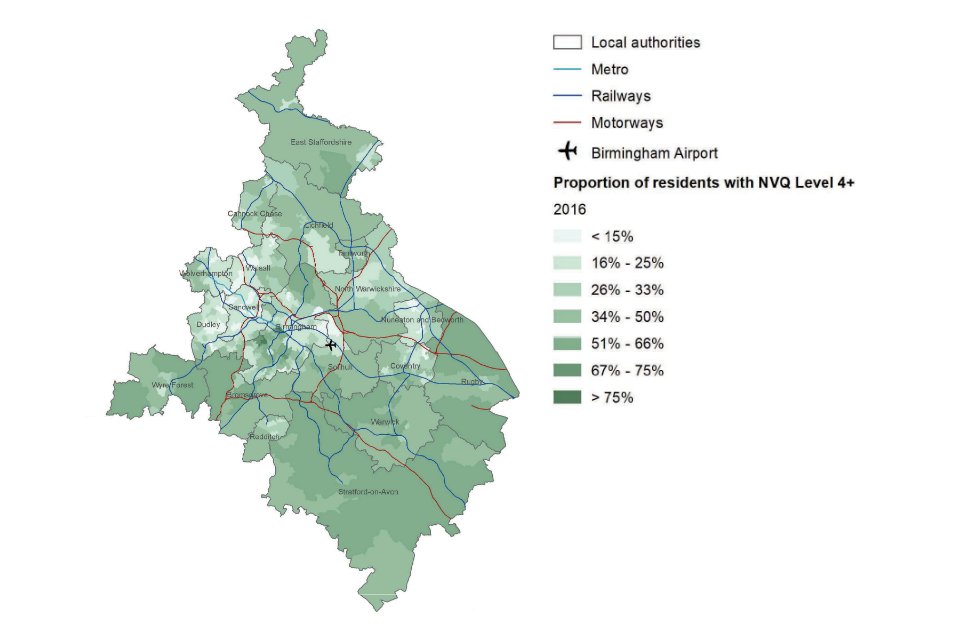

People

The region is highly diverse with a wealth of talent and enterprise, and the devolution of the Adult Education Budget represents an opportunity for the West Midlands to provide more targeted support for local people and to ensure adult education provision best meets local need and supports labour market access and wage progression.

The West Midlands Combined Authority secured a Skills Agreement with government in July 2018, unlocking up to £69 million to boost digital and technical skills, job opportunities and productivity across the region. This will help support more young people and adults into work, as well as upskilling and retraining local people of all ages.

This Local Industrial Strategy and the ambitious West Midlands Regional Skills Plan show how the Skills Agreement will work for the entire region. To further complement locally led commitments detailed in the Regional Skills Plan, and building on the work of the West Midlands Inclusive Growth Unit, the government and West Midlands will:

- support the development of 2 Institutes of Technology (IoT) to deliver higher technical education in the West Midlands. Government will work with the IoT, led by Dudley College to redevelop land to provide teaching facilities for higher level skills programmes. The IoT, led by Solihull College, will focus on advanced manufacturing and Industry 4.0 through greater collaboration of further and higher education and creating pathways from level 3 to level 6 apprenticeships;

- continue improving labour market access and opportunities for disadvantaged communities through the existing locally led Employment Support Framework taskforce. This would include exploring barriers for underrepresented groups, such as women, as demonstrated through the gender employment gap; and

- continue to strengthen early intervention and preventative services. Working with existing local and national resources, this work will continue to bring together national and regional organisations – including Public Health England – supporting economic inclusion and social change.

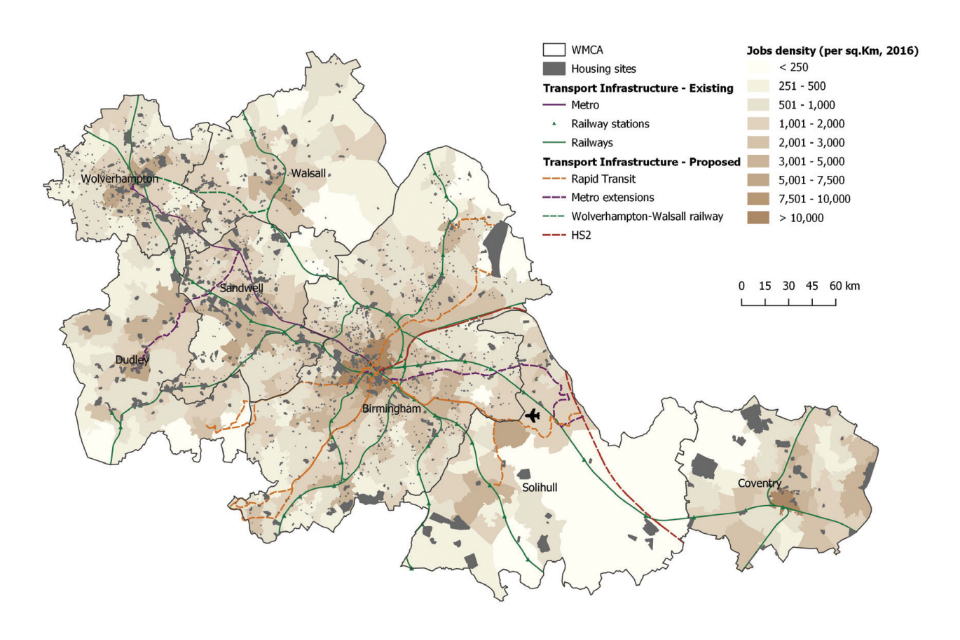

Infrastructure

The Industrial Strategy recognised the transformative effects of High Speed 2 on strengthening the economies and communities of cities, towns and rural areas across the country. The West Midlands is well-placed to realise this potential and deliver a region-wide, digitally enabled, integrated transport system.

The West Midlands has received £332 million of the government‘s £2.25 billion Transforming Cities Fund. This will support the extension of the West Midlands’ Metro System, with an initial focus on connecting cities towns between Wednesbury and Brierley Hill in the Black Country.

The West Midlands is also committed to delivering an ambitious Housing Package. The government is supporting the West Midlands’ growth potential through the Urban Connected Communities Project. This marks the next step in the national 5G Testbed and Trials Programme.

In addition to ongoing and locally led commitments, the government will work in partnership with the West Midlands, including:

- the Department for Business, Energy and Industrial Strategy will continue working with the West Midlands, Energy Capital, regulators and industry partners to explore locally led options on potential new local institutional models for managing regional energy investment and markets; and

- building on its existing partnership that has supported the development of the West Midlands High Speed 2 Growth Strategy, the government will work in partnership with the West Midlands to maximise the benefits that High Speed 2 will bring to the region.

The collaboration on energy, aims to bring together the right stakeholders and collectively manage energy investment efficiently, particularly when innovative technologies are being commercialised or require strategic infrastructure investment.

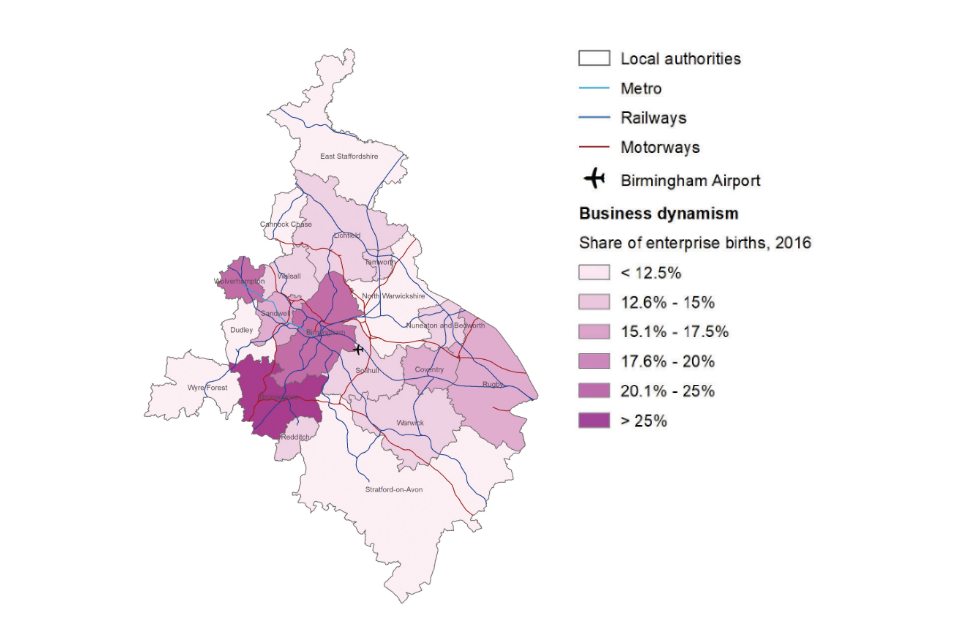

Business environment

Working in partnership with the government and building on the strengths of its existing Growth Hubs, the West Midlands aims to boost business dynamism and productivity. This also includes ongoing work to increase the Midlands Engine’s international reach and success.

To drive progress on this priority, the West Midlands will also support businesses by:

- developing a wrap-around innovation, research and development offer, including facilitating the development and sharing of intellectual property for collaborative innovation and considering where it can improve innovative firms’ access to finance;

- supporting high growth-potential business with the skills needed to innovate through programmes in universities, Catapults, and technology innovation networks;

- developing a range of supply chain programmes, supporting innovation and the switch to electric vehicles, services and the transfer and adoption of new technologies across a wide range of sectors; and

- supporting businesses by establishing a locally led virtual Productivity Factory targeted at SMEs. This will facilitate expert industry benchmarking, coaching, and management masterclasses for firms within the West Midlands, and will draw on learnings from the forthcoming Business Productivity Review.

Places

The West Midlands is home to interlinked but distinctive cities, towns and rural areas in 3 connected economic areas. The Local Industrial Strategy celebrates this, and the region’s wider connections, demonstrating how the strengths of each add up to more than the sum of their parts.

The West Midlands Future of Mobility priority, for example, draws on strong manufacturing supply chains across the Black Country and clusters of R&D intensive firms in Coventry and Warwickshire. This Local Industrial Strategy also shows the spatial impacts of actions on each foundation of productivity, and how High Speed 2 will improve connectivity across the West Midlands.

To drive forward economic opportunities across the region, the West Midlands will:

- continue to work with councils to help transform and revitalise town centres through the Regional Town Centres Task Force. This will complement locally led work to develop expressions of interest to the national Future High Streets Fund and form the basis for intensive work to deliver the government’s Stronger Towns Fund objectives;

- build on the ground-breaking work of the West Midlands Inclusive Growth Unit by developing Inclusive Growth Corridors that put communities at the centre of investment decisions and incorporating the West Midlands Inclusive Growth Framework into decision-making, ensuring that all public expenditure targets the wider set of economic, health and social outcomes which the West Midlands has agreed; and

- establish a virtual Productivity Factory targeted at SMEs. This will facilitate expert industry benchmarking, coaching, and management masterclasses for firms within the West Midlands, and will draw on learnings from the Business Productivity Review.

In addition to locally led commitments, the government will work in partnership with the West Midlands to:

- work with local partners to maximise the long-term impact of the new UK Shared Prosperity Fund once details of its operation and priorities are announced following the Spending Review.

West Midlands Local Industrial Strategy - approach

This strategy and its supporting documents are based on a robust evidence base developed by independent commissions and research over the last 3 years.

Led by the West Midlands Combined Authority with Local Enterprise Partnerships and local authorities, it has been co-designed with the involvement of over 350 organisations. Local leaders also worked with a wide range of businesses, sector groups and the civil society sector as part of a public consultation during the autumn of 2018.

The economy has been considered from 2 perspectives. This has led to the identification of:

- new market driven opportunities for growth; and

- specific barriers and opportunities that exist for each of the foundations of productivity, together with their spatial distribution.

This West Midlands Local Industrial Strategy sets out actions targeted at each of those barriers based on the evidence and where the market alone will not deliver the outcome required. These actions will support the whole of the West Midlands to take advantage of the strategic opportunities ahead. Place is woven throughout, with each foundation section being clear about the spatial distribution of barriers and opportunities. This Local Industrial Strategy does not set new targets. In 2016, the West Midlands agreed a comprehensive approach to monitoring the overall performance of the economy across a wide range of indicators designed to drive an inclusive economy. The Mayor and Combined Authority Board keep these targets under review and publish progress in an annual State of the Region report.

Major new market opportunities

- Future of mobility

- Data driven health and life sciences

- Creative content, techniques and technologies

- Modern services

A distinctive economy Creative and innovative, with global supply chain strengths a diverse and young population, well connected, trading and entrepreneurial. Unique opportunities ahead in the Commonwealth Games and City of Culture.

Sector strengths

- Low carbon technology - Energy and clean growth

- Life sciences - Devices, Diagnostics, rela life testing

- Creative - Games, Next Gen content, process and product design and designer maker

- Aerospace - Precision component manufacturing

- Professional skills - Skills and a full services sector

- Food & drink - Machinery, food & fluid control texh, Photonics R&D

- Logistics/ transport technology - Future mobility

- Rail - Digital rail, High Speed 2

- Automotive - Battery development, Drive train, CAV

- Metals & materials - Innovative supply chains

- Construction - Offsite modern manufacturing, Land remediation

- Tourism - Shakespeare’s England, Commonwealth Games, Business, City of Culture

Actions To unblock barriers to productivity and growth, integrated in places and communities to drive inclusion.

Foundations of productivity - drivers and enablers of growth

- People, skills & employment

- Infrastructure & environment

- Ideas / Innovation

- Business environment

- Place

Strategic opportunities

West Midlands and the Future of Mobility

The West Midlands as the centre of transport innovation in the UK, leading the smart, low-carbon movement of people and goods and connecting communities to new opportunities.

Mobility will change radically.

The next decade will be a period of large-scale change to how people and goods move, with significant innovation in mobility and continued changes to consumer preferences and global markets. This includes not only the shift to electric and connected autonomous vehicles but also rapid technological change such as 5G, with the West Midlands already the home to the UK’s first 5G test-beds.

Adapting to these challenges will create huge economic opportunities nationally and for the West Midlands, driving benefits across the Midlands Engine. The West Midlands will maximise these opportunities by combining advances in data science, artificial intelligence and sensing technology while completing large-scale infrastructure projects such as High Speed 2 and improving the transport network across the region. This involves a range of initiatives, including maximising the impact of the £322 million secured for the West Midlands through the Industrial Strategy’s Transforming Cities Fund.

The scale of the challenge requires local and national collaboration. The government and the West Midlands are already working together to meet the ambitions of the Future of Mobility Grand Challenge. Building on significant investment to date, the West Midlands, working in partnership with the government, commits to the next phase of plans to realise shared goals. This includes:

- working with local partners to maximise the region’s contribution to achieving government’s ambition to deploy 3 world-leading trials of connected autonomous vehicles by 2021 in the UK, with the West Midlands aiming to deploy the first fully operational connected autonomous vehicles in the region in advance of the 2022 Commonwealth Games;

- building the optimum environment for additional foreign direct investment and electric vehicle manufacturing. This will include completing the development of the UK Battery Industrialisation Centre and maximising the impact of funding from the Faraday Battery Challenge; and

- building on its existing partnership that has supported the development of the West Midlands High Speed 2 Growth Strategy, the government will work in partnership with the West Midlands to maximise the benefits that High Speed 2 will bring to the region.

The West Midlands as a global centre of transport and mobility

A history of automotive and cross-sector collaboration

The West Midlands cluster includes cutting edge research and development and established original equipment manufacturers. These are supported by globally competitive, robust and interconnected supply chain firms, including in aerospace, automotive, rail and the crucial supporting industries of metals and materials.

These supply chain strengths underpin the West Midlands’ manufacturing expertise and will drive the wider innovation needed to secure a successful and balanced transition to new mobility solutions, the manufacture of batteries, connected autonomous vehicles and electric vehicle powertrain components, for example, at firms such as Westfield in Dudley, ZF Lemforder in Darlaston and Teepee Electrical in Bloxwich (Walsall).

Business and university partnerships embedding digital and creative techniques

The West Midlands has global research and business strengths in digital and ultra-light rail, logistics, the largest connected autonomous vehicles (CAV) testbed ‘Midlands Future Mobility’ and the leading specialist CAV vehicle manufacturers in Westfield and RDM.

There is also a concentration of highly innovative supply chain firms, working across the full range of manufacturing, materials, design, testing and data services that make up the future mobility industry, including components for future battery manufacture.

These strengths and assets provide the platform for creating, developing, testing and building global and national solutions to the future of mobility and associated supply chains. This includes large scale battery manufacture and successfully managing the move to electric vehicle (EV) powertrains across the full range of transport modes and supply chains.

Connecting all communities of the West Midlands to HS2

This cluster of skills, sectors and assets is matched with significant and locally agreed plans to upgrade public transport infrastructure through High Speed 2, suburban rail, trams and smart buses. This will maximise the opportunity for Transport for West Midlands to transform customers’ experience of travelling around the West Midlands and wider UK, improving connectivity to jobs and skills opportunities. Wider work through the Midlands Connect partnership will enhance connectivity across the Midlands.

Opportunities

The future success of the West Midlands lies in the ability to influence and adapt to long-term trends in mobility. These include:

- creating new markets, such as those in electric and connected autonomous vehicles (CAV) and mobility as a service, through the Future Mobility Zone;

- stimulating further innovation in key areas such as battery research and manufacturing, 5G, and data, with benefits to the supply chain and whole economy;

- taking advantage of growing global markets in very light rail, digital rail and electric and autonomous flight, in firms of all sizes; and

- continuing to develop a clean, integrated transport network, maximising the opportunities presented by High Speed 2, optimising the value of the Transforming Cities Fund and other locally led investments and working smartly with Midlands Connect.

The size of the potential prize is truly significant. CAV alone is worth between £50 and £100 billion to the UK economy and an integrated transport network and arrival of High Speed 2 could add £4 billion to the West Midlands’economy, driving major centres of growth such as UK Central Solihull.

Creating new markets

Electric vehicles

Business and university partnerships will embed digital and creative expertise in electric vehicle design and manufacturing and support the development of new supply chains. For example, Coventry University’s National Transport Design Centre and the Advanced Manufacturing and Engineering Institute provide industry ready graduates and research in electric vehicle and powertrain technologies.

The West Midlands will continue to establish enabling infrastructure to support the development of local charging and energy transmission systems for electric vehicles across the region to enable the future market, with location and approach driven by demand.

Connected autonomous vehicles (CAV)

CAVs could form the majority of cars on the roads in 15 years, with truly self-driving vehicle trials for the public due to begin in the UK in 2021.

The national Industrial Strategy has backed over 200 companies working in consortia on 90 world leading projects on self-driving and connected technologies. As part of this commitment, the West Midlands aims to deploy the first fully operational CAV in the West Midlands in advance of the 2022 Commonwealth Games.

Between now and then, the region will be testing progress on a network of over 50 miles of roads in Coventry, Birmingham and Solihull. This area is now a globally leading ‘real world’ UK testbed for developing the next generation CAVs following over £50 million of recent investment from government and the private sector.

£20 million to establish the UK’s first Future Mobility Zone between Birmingham, Solihull and Coventry.

£50 million into 5G trials in Birmingham, Coventry and Wolverhampton, awarding West Midlands preferred partner status as part of the Urban Connected Communities scheme.

Stimulate further innovation

Battery research and development

Partners will complete the development of the UK Battery Industrialisation Centre, part of the Faraday Battery Challenge, and consider local options to enhance its specifications and energy supply. Collaboration between local public and private sector partners will continue to build the optimum environment for additional foreign direct investment to accelerate battery development and production. This includes local work to build on the West Midlands’ plans to develop a local case for a Gigafactory.

Technology innovation and testing

There are plans to build on government and local investment of up to £50 million for the UK’s first large-scale 5G testbed to enable a new approach to real-time data and user management across the whole transport system. This includes integration with CAV design, testing and operation. Collaboration with other 5G testbeds, including Worcester Manufacturing and the Midlands Engine 5G project, will deliver productivity improvements for the wider supply chain.

Deploying mobility technology into other sectors

Innovation and manufacturing expertise will be applied to West Midlands supply chain firms at all tiers, through new demonstrator and support programmes. For example, stimulating innovation in connected mobility will underpin a new approach to distributed, connected factories and supply chains with significant gains for the wider UK economy and local supply chains across the region and wider Midlands Engine area.

Develop a 21st Century transport system

Future mobility and developing mobility as a service

Build on the £20 million Future of Mobility Zone government investment, together with £80 million locally, to support the development of the underlying systems capability to create an environment to deploy new mobility services. Building the robust digital information layer required to increase journey predictability will be critical. This will be tested in the UK’s first Future Mobility Zone between Birmingham, Solihull and Coventry.

Develop an integrated transport system in the West Midlands

Continue a significant programme of transport investment to develop an integrated, clean, multi modal system linked to the locally led High Speed 2 Growth Strategy. This will improve air quality and directly address productivity challenges by connecting people to new job opportunities and skills provision, improving access to healthcare and green space. It will also be integrated with the 5G network to drive a new traveller-centric system and approach.

Locally led commitments

- To make the West Midlands a UK hub for battery research, development and manufacturing;

- To have the highest electric vehicle adoption and CAV share of vehicle use anywhere in the UK.

- To be the national centre for CAV, electric motor manufacture and supply chains for the full range of electric vehicles; and

- To reduce congestion and journey times through significant ongoing investment in clean, low emission public transport ensuring that every part of the West Midlands is close to local and national opportunities – and the rest of the world – via air, road, rail and digital at UK Central’s international gateway.

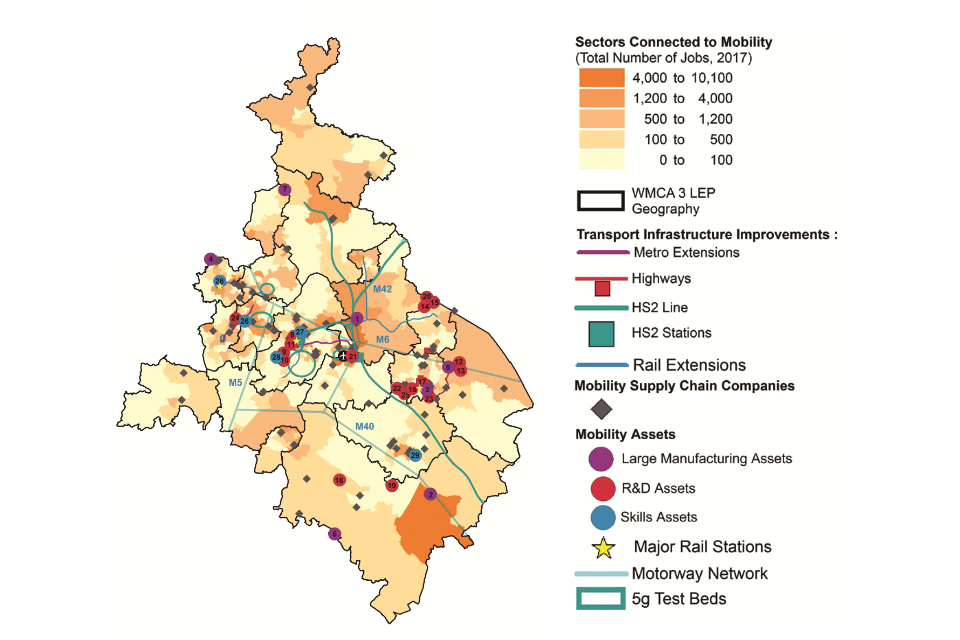

The following map shows the spatial distribution of the opportunity.

Future of Mobility

View a larger version of the map

| Large Manufacturing Assets |

| 1 - Jaguar Land Rover Battery Assembly Centre / BMW |

| 2 - Jaguar Land Rover / Aston Martin Gaydon |

| 3 - Jaguar Land Rover Whitley |

| 4 - Jaguar Land Rover Engine Manufacturing Centre Wolverhampton |

| 5 - Geeley / LEVC |

| 6 - VivaRail |

| 7 - JCB |

| R&D Assets |

| 8 - Aston University Logistics Expertise |

| 9 - Birmiongham Centre for Rail Research & Education |

| 10 - Centre of Excellence in Digital Systems |

| 11 - Energy Systems Catapult |

| 12 - High Temperature Research Centre |

| 13 - Manufacturing Technology Centre (MTC) |

| 14 - MIRA Technology Institute |

| 15 - MIRA Technology Park |

| 16 - National Automotive Innovation Centre (WMG) |

| 17 - National Transport Design Centre (NTDC) |

| 18 - Quinton Rail Technology Centre |

| 19 - Smart City Mobility Centre |

| 20 - TIC-IT (HORIBA-MIRA) |

| 21 - UK Central |

| 22 - UK Mobility Data Institute (WMG) |

| 23 - UK Battery Industrialisation Centre (UKBIC) |

| 24 - Very Light Innovation Centre |

| 25 - Warwick Maufacturing Group |

| Skills Assets |

| 26 - Elite Centre for manufacturing Skills |

| 27 - National College for High Speed Rail |

| 28 - University of Birmingham aeronautical engineering & materials engineering |

| 29 - WCG Trident Centre |

Data-driven healthcare and life sciences

The West Midlands’ aim is to become a centre for testing and proving health innovation and commercialisation, working in partnership with businesses and patients across the region to deliver improved health outcomes, clinical care and business growth.

The global market for testing and proving new devices and techniques is changing

Artificial intelligence (AI) and large data techniques are driving new approaches to healthcare. The increasing use of data and new technologies to enable patient stratification and improved targeting of healthcare interventions is allowing innovations from across different sectors to be applied to the patient. New entrants and established firms across the full range of health and life sciences are driving new and innovative approaches. There is a critical need to de-risk innovations in diagnostics, software and devices.

The UK’s ability to respond and adopt new approaches within its healthcare system will be crucial to shaping these future markets. And testing and evaluation in a relevant real-world environment will be vital if the UK is to commercialise these opportunities to their fullest extent and maximise benefits to health outcomes.

With its distinctive culture, infrastructure and environment, the West Midlands is well-equipped to become a centre for testing and proving health innovation. In doing so, it will help underpin the wider delivery of the government’s Life Sciences Industrial Strategy.

In particular, the development and translational medicine strengths of the West Midlands healthcare innovation ecosystem position it well to help meet the government’s national mission ‘to transform the prevention, early diagnosis and treatment of diseases like cancer, diabetes, heart disease and dementia by 2030.’

The West Midlands’ track-record

The UK has established clusters that lead the world in healthcare and medicine discovery and research. The West Midlands has strengths which complement these as a centre for testing and proving new innovations, approaches and their commercial application.

The West Midlands has developed an integrated eco-system to translate new innovations into patient care at pace and scale. The West Midlands has a track-record in working with patients and their data and making sure that value is returned to the patient, the wider NHS and to the region’s businesses.

The West Midlands possesses nationally-recognised strengths in healthcare data informatics, systems and digitalisation of health care services. These are aligned to strengths in genomics medicine and diagnostics, medical technologies evaluation and clinical trials. Home to the largest NHS England Genomics Laboratory Hub, the Genomics Medicine Centre has been the largest contributor to the 100,000 Genomes programme. The West Midlands also leads the Health Data Research UK Midlands Site, the Midlands and Wales Advanced Therapies Treatment Centre and has 4 regional NHS England Global Digital Exemplars.

These strengths are underpinned by other significant national, competitively-won investments, including over £30m of Innovate UK funding in the last 2 years. These have been integrated to provide the translational environment to develop the testing, evaluation, validation and application of new technologies from other UK and global clusters.

The West Midlands has also forged partnerships for long-term success. Birmingham Health Partners – a strategic alliance between the University of Birmingham and 2 NHS foundation trusts – sustains this integrated translational medicine system across the region. It connects facilities and expertise across all 6 universities and brings together the region’s NHS trusts through the West Midlands Academic Health Sciences Network.

To build on this partnership working, government will support:

- the development of a locally led West Midlands ‘Translational Med-Tech Commission’ bringing together national and local public leaders, government, universities, entrepreneurs and start-ups, and building on the strengths of the West Midlands life sciences cluster, underpinned by robust evidence. This will advise on the development of a locally led roadmap to accelerate commercialisation around theregion’s ‘lab to patient’ ecosystem.

In addition:

- the Department for International Trade and local partners will continue to support the West Midlands’ international investment offer in healthcare technologies through the existing Midlands Engine Trade and Investment Programme Board. This will explore opportunities in international markets for new therapies, devices and techniques, to drive business growth through increased commercialisation of healthcare technologies.

The West Midlands is working to align academic, NHS and industry capabilities across the West Midlands, based on a shared mission to break down sector boundaries and create stronger partnerships with patients. At the core of the West Midlands’ translational offer is the cluster centred on the Queen Elizabeth and Birmingham Women’s Hospitals and University of Birmingham campus and the Institute of Translational Medicine, including a locally led proposal for the Birmingham Life Science Park development. These have the potential to deliver the full range of facilities needed for the development, validation and real-world testing of new healthcare innovations.

The West Midlands’ distinctive strengths

Crucially, the region’s offer and expertise are complementary and distinctive to other UK clusters in providing the:

- co-located translational environment and access to a diverse population. The West Midlands is able to reach 6 million patients across 17 regional NHS Trusts. The West Midlands Genomic Medicine Centre’s connected data systems have the ability to scale innovations to over 20 million patients;

- ability to speed up and de-risk translation. Strong partnerships between businesses, universities and the regional NHS underpin the West Midlands’ ability to support the rapid adoption of new technologies;

- real-world and diverse environment testing coupled with the regulatory innovation. This ensures the ability to scale innovations nationally and internationally;

- required technical, leadership and entrepreneurial skills within the region. The West Midlands possesses the largest teaching hospital in the country and high quality relevant graduate training at other universities; and

- integrating and testing 5G technology in healthcare with the University Hospital Birmingham playing a leading role.

Nationally recognised strengths in:

- Genomics medicine and diagnostics

- Clinical trials

- Medical technologies evaluation and healthcare data informatics and systems

- Digitisation of healthcare services

400 life science businesses in the WMCA area and around 11,000 employees, generating approximately £4 billion turnover.

Strong innovation ecosystem including translational partnerships and facilities and a network of science parks, specialist incubators and innovation support.

Industry strengths and global competitiveness for FDI in high tech medical devices R&D and manufacture.

Strength of clinical and academic centres of excellence including the Queen Elizabeth hospital site which is one of the largest in Europe.

Strong supply of graduate talent with 3 medical schools in the region.

Opportunities

Improving the health of the population

The West Midlands’ approach to supporting innovation will be anchored in partnership with the NHS and the patient population. Through this approach, the West Midlands aims to translate healthcare innovation and commercialisation directly into better health outcomes for citizens across the region. Addressing the critical health challenges of the population, the West Midlands will drive new innovations based on clinical need and tested in an enabled and inter-connected real world environment. This will include developing new approaches to using technology to drive prevention and increase investment in preventative services, creating opportunities for SMEs and social enterprise, alongside improved health outcomes.

Developing the West Midlands’ cluster

National and global firms see the commercial opportunity in the region. The West Midlands has a growing cluster of both large and small firms and an associated supply chain which has raised at least £35 million of investment in the last 12 months. It will continue to invest in the business support and networks needed to drive cluster development across the region. Further significant private sector investment will underpin the region’s offer as the UK centre for testing and proving health innovation. The West Midlands’ aim is that firms will be able to access the full spectrum of support needed to develop and commercialise new health innovations.

Enabling innovation and realising value

The West Midlands will build on recent, competitively won investments of over £150 million across the Birmingham Health Partners campus. By leveraging existing translational infrastructure and expertise across the regional health partnership, the West Midlands aims to establish itself as a flagship location for the development, validation and real-world testing to adoption of healthcare innovation. This includes the locally led proposal for the Birmingham Life Sciences Park development.

Developing the future workforce

This eco-system will nurture employment and enterprise opportunities for local communities across health and life sciences and encourage the flow of techniques and skills from technology and advanced manufacturing sectors. The West Midlands will deliver new programmes from entrepreneurship to technology leadership, in order to provide the workforce with the required skills to deliver the leadership required to enable commercialisation and adoption of new healthcare innovations. This will also train a cadre of new skilled workers who can best exploit the opportunities provided by technological innovation to reduce the burden and improve the outcomes of new healthcare interventions.

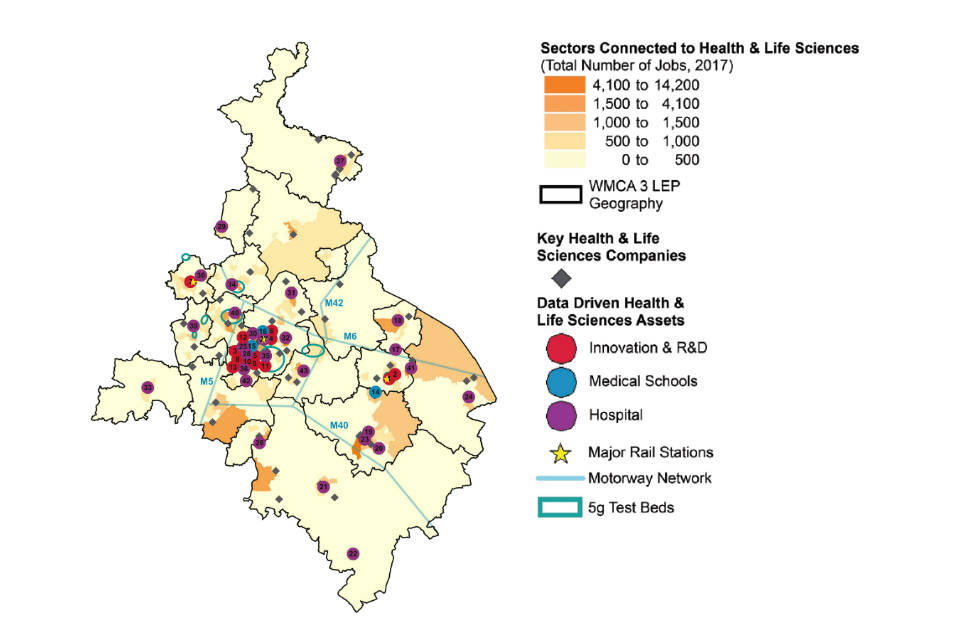

The following map shows the spatial distribution of the opportunity.

Data-driven healthcare innovation

View a larger version of the map

| Innovation & R&D |

| 1 - Coventry University Health Technology Design Institute (HTDI) |

| 2 - Coventry University Alison Gingell Building |

| 3 - Institute for Translational Medicine & Medical Devices Testing & Evaluation Centre (MD-Tec) |

| 4 - Aston Brain Centre |

| 5 - Birmingham Research Park including The bioHub Birmingham |

| 6 - serendip Digital Health Incubator & Innovation Engine |

| 7 - University of Wolverhampton Research Institute in Healthcare Science |

| 8 - Centre for Clinical Haematology |

| 9 - West Midlands Academic Health Science Network |

| 10 - Birmingham Life Sciences Park Development |

| 11 - Birmingham Health Partners |

| 12 - Royal Centre for Defence Medicine |

| 13 - Medicines Discovery Catapult |

| Medical Schools |

| 14 - Warwick Medical School |

| 15 - Birmingham Medical School |

| 16 - aston Medical School |

| Hospitals |

| 17 - C&W NHS Trust |

| 18 - George Elliot Hospital |

| 19 - Warwick Hospital |

| 20 - Leamington Spa Hospital |

| 21 - Stratford Hospital |

| 22 - Ellen Badger Hospital |

| 23 - South Warwickshire NHS Foundation Trust |

| 24 - Hospital of St Cross |

| 25 - Queen Elizabeth Hospital |

| 26 - Alexandra Hospital |

| 27 - Birmingham Children’s Hospital |

| 28 - Birmingham Women’s Hospital |

| 29 - Cannock Chase Hospital |

| 30 - City Hospital, Birmingham |

| 31 - Good Hope Hospital |

| 32 - Heartlands Hospital |

| 33 - Kidderminster Hospital |

| 34 - Walsall Manor Hospital |

| 35 - Moseley Hall Hospital |

| 36 - New Cross Hospital |

| 37 - Queen’s Hospital |

| 38 - Royal Orthopaedic Hospital |

| 39 - Russell’s Hall Hospital |

| 40 - Sandwell General Hospital |

| 41 - University Hospital Coventry & Warwickshire |

| 42 - West Health Hospital |

| 43 - Solihull Hospital |

Modern services

The West Midlands is driving innovation and demand through a ‘full modern services’ offer that benefits the wider local economy, including highly paid, highly skilled roles for all communities.

Technology and the move to services is driving innovation and demand across many sectors

The global trend towards services and the innovative use of business, finance and professional service skills is increasingly important for the long-term growth and success of firms in all sectors and to the vitality of local economies.

Existing business and professional services firms across the West Midlands region, nationally and globally will need to adapt to and adopt new technology, new processes, products and services. Firms in all sectors are rapidly changing their commercial models and skill sets to shift to a more service-based business model. Put simply, the relationships and value creating opportunities between core business and professional services firms and other sectors will become increasingly sophisticated. The West Midlands aims to continue to position itself at the forefront of this transition.

Evidence locally suggests that highly trained accountants and other professionals moving into different tiers of manufacturing companies is common.

New working patterns are emerging whereby core professional services firms are encouraging and supporting professionals to take on dual roles in firms in other sectors. Talented people with the right experience, networks and ability to innovate in these areas are in strong demand across all parts of the economy and supply chains. New working patterns, lifestyle choices and flexible business models are increasingly driving cross sector approaches. The West Midlands is ambitious in being proactive in building on the success that firms have had in increasing employment from our diverse communities.

Growing connectivity, output and workforce

The core ‘full modern service’ strengths of the West Midlands are clustered in Birmingham, Coventry and Warwickshire. Internationally esteemed business schools at Warwick, Aston and Birmingham have more business students than any other location outside London and the South East.

The West Midlands provides the largest ‘full service’ offer outside London, with a highly distributed global client base. It is home to all modern services apart from high-end financial management. Most nationally significant firms have a full-service team operating locally.

Companies have cited the availability and loyalty of skilled talent, the choice of locations, office space and attractiveness of the place to retain talent, as strong drivers of future growth. Birmingham has high and growing levels of graduate retention.

This growth is driven partly by the region’s distinctive distribution of business and professional occupations, which tend to be highly-skilled. The West Midlands is also home to an increasing number of senior business services roles across a wider range of sectors.

Many larger construction firms, for example, now have many hundreds of business service roles each in the West Midlands. There is a major opportunity to continue to develop and foster innovative partnerships and links between firms and education institutions, such as the forthcoming National Brownfield Institute at the University of Wolverhampton. The West Midlands aims to continue opening up job opportunities to communities that may not otherwise see them as accessible and ensuring the availability of the technical skills that continue to be in high demand. The West Midlands is ambitious in being proactive in building on the success that firms have had in increasing employment from our diverse communities.

Opportunities

Significantly higher than average expected GVA growth and new, highly skilled, jobs

Total business, professional and financial services GVA is forecast to double to £50 billion between 2015 and 2030, with growth forecast across all parts of the sector. Employment is currently 400,000 and is expected to grow, with job numbers also rising significantly outside the core sector. Graduates in relevant disciplines from local universities are in high demand nationally, commanding a salary premium. This provides the opportunity to ensure local people from underrepresented communities access these highly skilled and well paid roles.

Driving business performance across all sectors

The West Midlands is seeing the increased application and use of professional business services skills across different parts of the economy. The West Midlands Regional Skills Strategy aims to ensure the long term availability of a distinctive, skilled labour pool and strong talent pipeline of graduates and school leavers into business services role.

The Advanced Services Group at Aston Business School is a globally recognised centre of research excellence on servitization, providing cutting edge support to over 150 business from SMEs to global companies such as Goodyear, Ishida and Nederman with the transition to advanced services.

Application of new technologies and 5G

Changes for which the West Midlands is well placed to take advantage include AI, automation, cyber security and machine learning. With small technology firms, regionally embedded larger firms and expertise in the universities, the West Midlands is a testbed for business innovation to access and embed new applications and techniques, helping core business services firms and wider sectors deliver next generation services locally, nationally and globally. The West Midlands’ 5G network will create new markets and lead to new services.

Improving transport infrastructure to attract talent

The West Midlands is already well connected. HS2 will build on this. Further expansion of Birmingham Airport, through delivery of its locally led Airport Master Plan, aims to increase the West Midlands’ attractiveness to high value business and professional services. Further expansion of Birmingham Airport, through delivery of its locally led Airport Master Plan, aims to increase the West Midlands’ attractiveness to high value business and professional services. Rapid expansion of different types of high-quality housing, high grade employment spaces and improved connectivity within the region will do the same. The West Midlands will also aim to continue to secure significant additional private investment.

Centre for fast growth, highly productive business services

The demand for business services skills across all sectors will drive overall growth and wider productivity gains. The West Midlands will continue to maintain and expand its position as a centre for full modern services. Central to this will be continued investment across the whole regional economy, including in its low emission, integrated transport system; housing; partnerships between universities and businesses; and wider regional skills system.

The West Midlands will design locally led peer-to-peer networks to support and improve the productivity of local firms and bring together professional business services to provide a visible and trusted offer to local firms. Both of these will build on findings and approaches set out in the forthcoming Business Productivity Review.

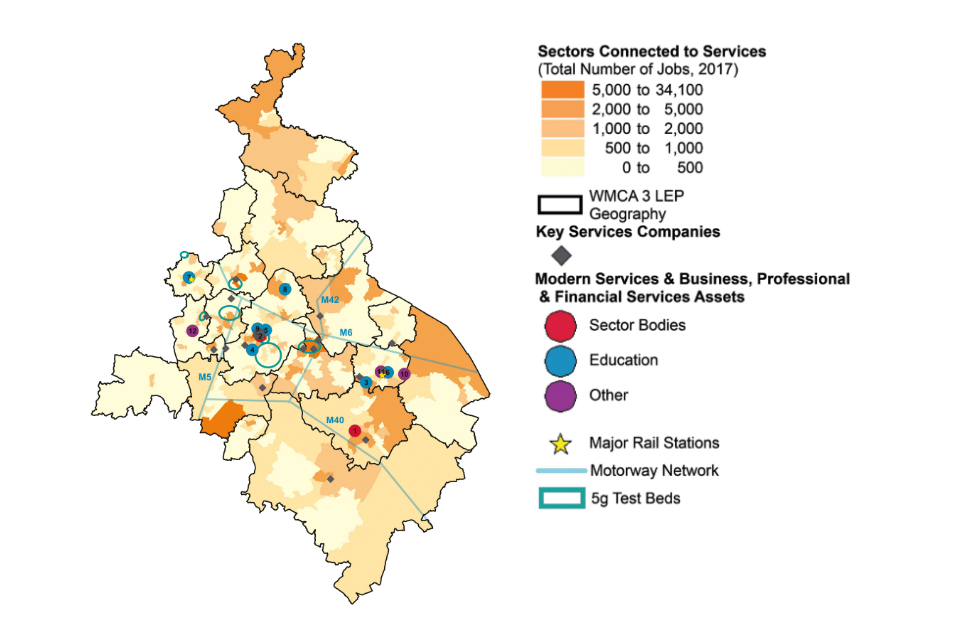

The following map shows the spatial distribution of the opportunity.

Modern services

View a larger version of the map

| Sector bodies |

| 1 - ICAEW Regional Office |

| 2 - BPS Birmingham |

| Education |

| 3 - Warwick Business School |

| 4 - Birmingham Business School |

| 5 - Acton Business School |

| 6 - Coventry Business School |

| 7 - Wolverhampton Business School |

| 8 - Professional Services Academy, BMet |

| 9 - University of Law |

| Other |

| 10 - Coventry & Warwickshire First pro |

| 11 - Friargate Development, Coventry |

| 12 - DY5 Enterprise Zone |

Creative content, techniques and technologies

The West Midlands is growing its core creative industries and creative design skills and techniques as part of the transformation of products, processes and services.

Creative skills and techniques are driving innovation in all industries

Factories of the future will be constructed by designers, data analysts and visualisation specialists, powered by 5G connectivity and involve the rapid design, build and deployment of virtual and physical components. These approaches, such as a ‘distributed factory’, will be developed and adopted in the West Midlands, as our manufacturing and transport supply chains evolve for the future.

Creative content and products continue to evolve and develop new techniques and new markets. The 2021 Coventry City of Culture and 2022 Commonwealth Games will provide significant opportunities to develop and showcase new, creative and digitally led approaches to resident and visitor services and experiences, with the Commonwealth Games venues acting as real-life testbeds and demonstrators for new products and services. 5G connectivity will enable new platforms for content, information and services, creating new market opportunities, with a new “plug and play” 5G accelerator providing rapid product and process development access for digital and creative firms and innovators.

The West Midlands as a centre of creative design, making and business

The West Midlands has a long history of creative business success, from the earliest development of industrial design and processing techniques, to 90,000 creative jobs today. A major feature of the economy is the extent to which the creative communities are engaged in both the core creative industries and in using creative and design skills and techniques in the transformation of products, processes and services in a wide range of future global markets.

The West Midlands’ core creative industries have strengths in next generation creative and commercial content creation and as a production centre for higher budget content. Demand is driving investment in new high value TV and film production capacity and a proposed Media Campus at the National Exhibition Centre.

Population growth and new devices are driving increased demand from consumers for creative experiences, such as theatre, performance and live music, which are stimulating the market for the region’s cultural offer.

In Greater Birmingham and Solihull alone, nearly 60% of design jobs are outside core creative industries with creative skills driving innovation in a wide range of industries. The area in and around Leamington is dubbed ‘Silicon Spa’ for the nationally significant concentration of gaming companies with increasing crossovers with other sectors. The following examples show a very distinctive hallmark of the West Midlands economy:

- design-led thinking originating in the gaming industry is combined with virtual reality (VR) and augmented reality (AR) to develop, prototype and test new vehicles across automotive, aerospace, rail and last mile logistics as well as the wider digital manufacturing sector;

- creative techniques for visualising and manipulating large and complex data sets are driving new approaches to healthcare, personal finance and insurance services, mobility, tourism and culture, and retail environments;

- VR and superfast connectivity are being used to train the next generation of paramedics, engineers and surgeons in environments that are as close to real life as possible;

- modular construction of high quality, low energy homes begins with design-led solutions to components and build. Modular construction is estimated to be worth £2-3 billion per year in the UK, with modular build growing by 25% per year;

- design-led production of new components and diversification into new markets, often with cross-sector impacts; and

- increasing digitisation of services and innovation within culture and media to develop new ways of engaging ‘audiences of the future’.

Opportunities

The West Midlands has the skills, firms, innovative supply chains and assets needed to take advantage of global growth in this creative future for content, techniques and technologies across all the region’s sectors and sub sectors. With a core sector generating over £4 billion of GVA through 10,000 firms and 10% of the UK games industry based in Silicon Spa. To support this the government will;

*maximise the opportunities arising from the Department of International Trade’s High Potential Opportunity programme within the gaming sector in Leamington Spa.

However, the creative economy is about far more than just the strengths in creative industries. The evidence shows that Birmingham and Solihull alone have the potential to add nearly 4,000 new creative enterprises and 30,000 new related jobs with the opportunity to scale this across the West Midlands.

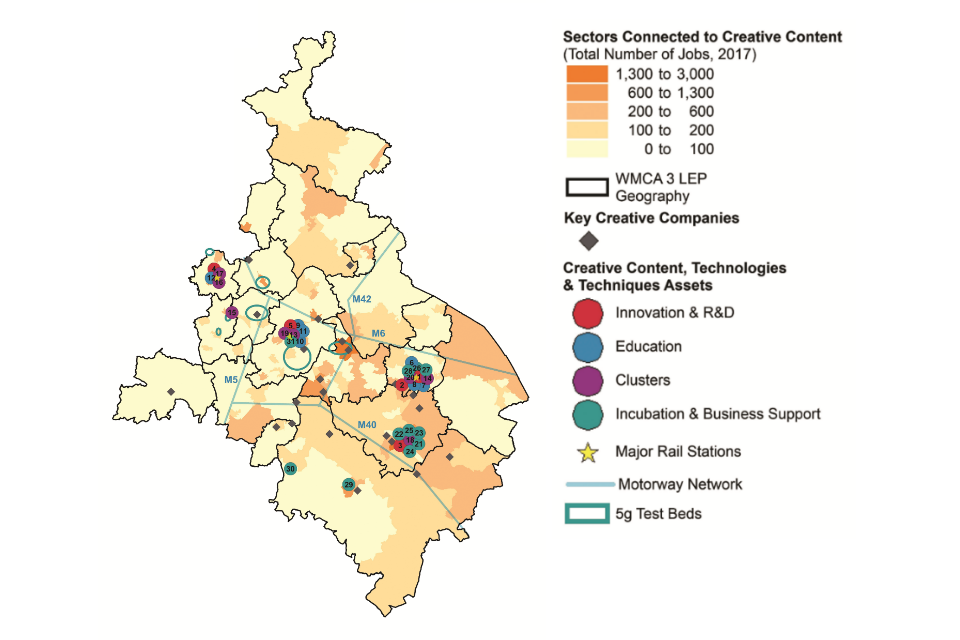

The following map shows the spatial distribution of the opportunity.

Creative content, technologies and techniques

View a larger version of the map

| Innovation & R&D |

| 1 - Coventry University Technology Park |

| 2 - University of Warwick Science Park |

| 3 - Warwick Innovation Centre |

| 4 - Wolverhampton Science Park |

| 5 - Innovation Birmingham Campus |

| Education |

| 6 - Serious Games Institute |

| 7 - Centre of Disruptive Media |

| 8 - Institute of Coding |

| 9 - Birmingham Ormiston Academy |

| 10 - Birmingham Metropolitan College Digital & Creative Career College |

| 11 - Birmingham City University Faculty of Arts, Design & Media |

| 12 - Centre for Art, Design, Research & Experimentation (CADRE) |

| Clusters |

| 13 - Digbeth Creative Quarter |

| 14 - Performance Cluster centred on Royal Shakespeare Company |

| 15 - Black Country Living Museum, part of Dudley Castle Quarter |

| 16 - Wolverhampton Arts & Culture |

| 17 - Springfield Campus |

| 18 - Lemington Spa Creative Cluster ‘Silicon Spa’ |

| 19 - Jewellery Quarter |

| 20 - Coventry City of Culture |

| Incubation & Business Support |

| 21 - Althorpe Enterprise Hub |

| 22 - Arch Creative co-working space |

| 23 - 26HT Incubator |

| 24 - Court Steel Creative Arches |

| 25 - The Warehouse 44 |

| 26 - Electric Wharf |

| 27 - Fargo Village (Fargo) |

| 28 - The Quadrant |

| 29 - Venture House |

| 30 - The Longbarn Village (Alcester) |

| 31 - STEAMhouse |

An inclusive, clean and resilient economy

The West Midlands is committed to driving a more inclusive economy: connecting more of its people with economic opportunities; improving employment and progression; enhancing the environment; increasing wellbeing; and maximising the potential and success of our diverse population.

The West Midlands’ current suite of devolved powers, combined with an economy of renaissance, offers the region a real opportunity to make inclusive growth happen. The West Midlands has agreed a set of indicators and targets that include health and wider social outcomes and is committed to putting these at the heart of local decision making processes. Local powers and flexibility mean that interventions can be designed, tested and implemented based on the needs of local people, businesses and places - including recognising the specific and different challenges facing cities, towns and rural areas and the potential for social enterprise to help deliver smarter, targeted and inclusive approaches.

By designing actions and investments using a wide set of indicators, the West Midlands will ensure that the commitments at the heart of this strategy will enable businesses, a broad range of public partners, and the civil society sector to make the West Midlands more inclusive.

The West Midlands Combined Authority has agreed to develop a local ‘Single Commissioning Framework’ to guide decision-making on specific, existing housing and land investment funds. The aim of this is to ensure these existing, local investments make the maximum contribution to the broad set of outcomes as agreed by the Combined Authority.

The West Midlands is committed to setting out more detailed actions in a West Midlands Inclusive Economy Plan and will locally continue investing in the capacity needed to ensure that all strands of this strategy are delivering the wider social impacts that reflect local partners’ ambitions.

Local partners are determined to ensure that all residents and communities can experience the benefits of rising prosperity. This commitment is supported by independent commissions on leadership and productivity, which concluded that the region will be most successful if it benefits from the creativity, talent and ideas in all its communities.

The opportunity is to build from the action in this Local Industrial Strategy, harnessing the potential of a young and growing population to act boldly where the region has the levers to do so. Partners will seek to pilot new initiatives designed to deliver more inclusive growth. These will build on existing projects such as ‘Thrive West Midlands’, which is working with several hundred businesses and thousands of employees to improve awareness of workplace mental health.

Raising the living standards of all West Midlands’ residents and addressing the low productivity, low pay cycle that some residents experience requires an integrated response across multiple policy areas. The West Midlands has a unique opportunity to do things differently. Partners across the region will implement a West Midlands approach in piloting, experimenting and evaluating what works in the region.

For example, the West Midlands is working with the NHS, government and national partners to continue strengthening early intervention and preventative services. These will be focused on targeted interventions to boost innovation in prevention against some of the most pressing public health issues. This will leverage the region’s 5G status and the convening role of the West Midlands Combined Authority to bring digital innovation into the system in response to some of our critical demand pressures. Better services will deliver better health outcomes and a more innovative care system will create economic benefits.

The West Midlands has identified priority issues on which to develop and test new approaches through a new Inclusive Growth Unit led and funded by the West Midlands Combined Authority. It aims to blend analysis, policy advice and practical action to achieve results.

It has established the Inclusive Growth Framework and Inclusive Growth Toolkit, both of which continue to evolve and be refined, and will be used in developing actions and monitoring the delivery of wider social, environmental and economic outcomes, including this Local Industrial Strategy.

The West Midlands has identified priority issues on which to develop and test new approaches:

- low pay sectors: exploring labour supply and demand, and locally adapted and targeted training and skills, meeting local needs with local innovation and exploring new local approaches to support those in low pay;

- in-work progression: increasing the support available to people to access in-work progression opportunities, including through encouraging more flexible approaches to working patterns and childcare. This will be particularly focused on employers and residents working in historically lower paying sectors, where technological change will open up new, higher skilled roles;

- encouraging and supporting women into sectors which women are currently underrepresented;

- commissioning and procurement: maximising local value, local supply chains, local skills development and local ownership in infrastructure projects. This includes High Speed 2, City of Culture and Commonwealth Games related procurement;

- diversity: on which the Combined Authority and partners can lead by example to promote diversity and increase the employment rate of ethnic minorities by implementing the Leadership Commission’s recommendations;

- bespoke solutions for individuals: focusing on mental and physical health, and barriers to work alongside the wider determinants of wellbeing. Coventry and Warwickshire will run a Year of Wellbeing in 2019 driven by the European City of Sport and develop wellbeing and productivity;

- youth unemployment: developing a fresh new approach by targeting particular groups with tailored interventions, including working with young people through the Transition to Work scheme to create a sustainable pipeline of young talent in the region;

- social enterprises: diversifying the types of economic activity available to create opportunities and improve wellbeing and productivity for people and communities. This will include committing to growing the size of the social economy within the West Midlands; exploring a regional and/or mayoral financing mechanism to support this (such as a regional social enterprise bank or social investment fund) and the drawing together of support mechanisms for social enterprise start-up and scaling; and

- vulnerability: prioritising mental health and complex needs. Delivering a number of interventions via the West Midlands Combined Authority and other partners, this work will focus on relationships between vulnerability, wellbeing and work. These will include interventions such as Individual Placement Support trials (developed with DWP’s Work and Health Unit), Thrive at Work, and partnerships with Public Health England, the West Midlands Fire Service, West Midlands Police and the Office of the Police and Crime Commissioner focused on prevention.

Natural capital

The strategic opportunities and actions set out in this strategy will ensure the West Midlands makes a significant contribution to the UK’s clean growth goals, while continuing to improve the local environment. The West Midlands is home to highly productive low carbon and environmental technology firms, at the forefront of responding to changes in mobility, services and manufacturing processes. This Local Industrial Strategy reflects the West Midlands’ view that the effective stewardship of natural capital is fundamental to long-term social and economic goals.

The West Midlands is committed to celebrating and improving the high quality natural environment, public spaces and biodiversity that make the region a great place to succeed and is integrating the environment into all its decision-making.

The West Midlands will:

- seek to use innovative solutions to address urban challenges like air quality, flood water management, overheating in urban areas and climate change adaptation. We will ‘green’ existing transport routes and improve access for walking and cycling;

- remain committed to developing a long-term plan for Natural Capital and to the principle of an annual net gain for natural capital, developing the tools that enable us to work towards reversing the current trend in biodiversity loss;

- improve air quality through a West Midlands Combined Authority led Low Emissions Strategy and Action Plan. This aims to improve health and wellbeing and provide new clean growth opportunities including working with the private sector, the region will accelerate charging infrastructure for zero emission vehicles across the region, driven by demand; and