Retailer’s checklist for purchases made after 1 January 2021 in Northern Ireland (VAT407 notes)

Updated 31 December 2020

Use the tax-free shopping - retailer’s checklist to help you complete form VAT407.

1. Check that your customer is eligible to buy goods under the VAT Retail Export Scheme

Customers are eligible if they’re:

- visiting Northern Ireland and live outside of Northern Ireland and the EU

- Northern Ireland or EU residents and are leaving the Northern Ireland and the EU for more than 12 months

Eligible customers can only claim back VAT charged on goods when they leave the UK or EU, and only for goods purchased in the 3 months before leaving Northern Ireland and the EU.

If the customer is intending to remove the goods to Great Britain (England, Scotland and Wales) including the Isle of Man, or you later find that they have done so then read part 5.1 of this checklist.

Full details are in Retail Export Scheme (Northern Ireland) (VAT Notice 704).

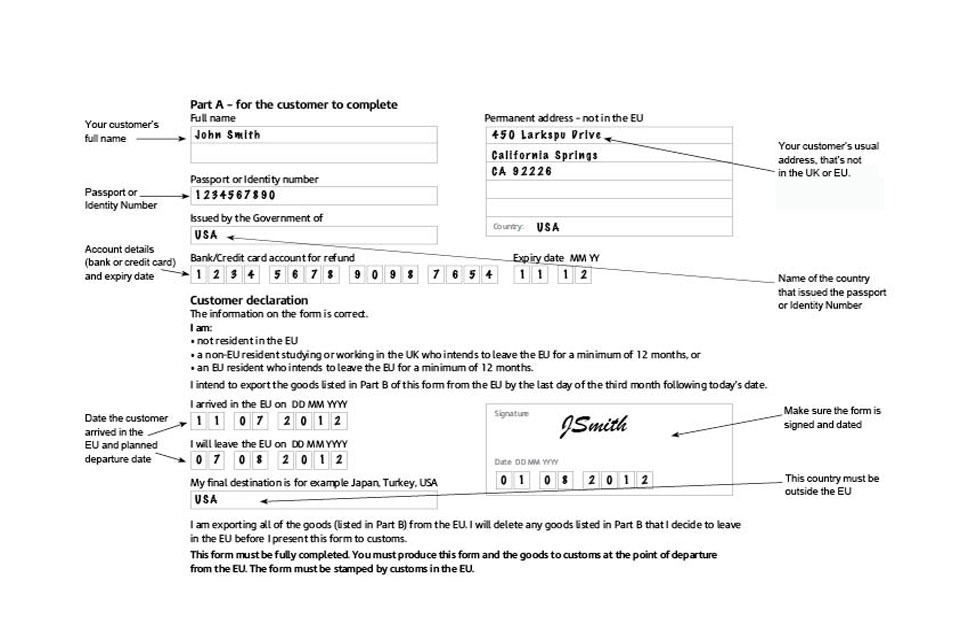

2. Make sure your customer has filled in form VAT407 (or authorised equivalent)

Your customer must complete the form and include:

- their full name

- their residential address - see the list non-EU territories

- their passport or identity number

- the name of the country that issued their passport or identity number

- details of a bank or credit card account - for their refund

- the date they arrived in Northern Ireland or the EU (whichever is the earliest date)

- the date they plan to leave the Northern Ireland or the EU (whichever is the latest date)

They must also sign and date the form.

Image shows an example of form VAT407.

3. Fill in the form and stamp the till receipt

Complete the retailer’s section of the form, and:

- give a full and accurate description of the goods, price, administration charge and the refund due

- sign and date the form

- mark the till receipt to show that the goods have been included on a VAT refund form, for example, stamp the form ‘VAT export’

Then give your customer a pre-paid envelope to return the refund form.

Your customer can find out about how to claim VAT back on tax-free shopping in Northern Ireland.

Remind your customer that when they leave Northern Ireland or the EU, they may need to show Customs their:

- goods

- receipt

- VAT refund form

Remind your customer that when they leave Northern Ireland directly for a non-EU destination they will need to attach a copy of their travel document to the VAT refund form.

You can contact HMRC if you need help with the VAT Retail Export Scheme.

4. VAT: EU countries

Tax-free shopping cannot be used when goods are removed to:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus (including the British Sovereign base areas of Akrotiri and Dhekelia)

- see section 5 for exceptions - Czech Republic

- Denmark

- Estonia

- Finland

- France (including Monaco)

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal (including the Azores and Madeira)

- Romania

- Slovakia

- Slovenia

- Spain (including Majorca, Menorca, Ibiza and Formentera)

- Sweden

5. VAT: non- EU territories

Your customer can use tax-free shopping when goods are removed to:

- Andorra

- The Canary Islands:

- El Hierro

- Gran Canaria

- Fuerteventura

- La Gomera

- La Palma

- Lanzarote

- Tenerife

- The Channel Islands:

- Alderney

- Guernsey

- Herm

- Jersey

- Sark

- The United Nations buffer zone in Cyprus and the part of Cyprus to the north of the UN buffer zone, where the Republic of Cyprus does not exercise effective control

- The Danish territories of:

- the Faroe Islands

- Greenland

- The Finnish territory of the Aland Islands

- The French territories of:

- French Guiana

- Guadeloupe

- Martinique

- Miquelon

- Reunion

- St Pierre

- The German territories of:

- Busingen

- the Isle of Heligoland

- Gibraltar

- Great Britain (England, Scotland and Wales) and Isle of Man

- The Italian territories of:

- Campione d’Italia

- Livigno

- the Italian waters of Lake Lugano

- Liechtenstein

- Mount Athos

- San Marino

- The Spanish territories of:

- Ceuta

- Melilla

- The Vatican City

Your customer can use tax-free shopping when goods are removed to all other countries not separately listed, for example:

- Australia

- China

- Japan

- Turkey

- USA

5.1 Special rules for removals to Great Britain including the Isle of Man

If goods are moved from Northern Ireland to Great Britain including the Isle of Man and Retail Export Scheme is claimed then you must account for the import VAT on behalf of the customer before you refund the VAT. As this will result in no actual refund being due you may decide not to offer Retail Export Scheme to visitors intending to travel to Great Britain.

6. Export timetable

This table shows you the latest date your customer must leave Northern Ireland and the EU with the goods, if they want to claim back the VAT.

| Goods bought in | Must be exported by |

|---|---|

| January | 30 April |

| February | 31 May |

| March | 30 June |

| April | 31 July |

| May | 31 August |

| June | 30 September |

| July | 31 October |

| August | 30 November |

| September | 31 December |

| October | 31 January |

| November | 28 or 29 February |

| December | 31 March |