UK Export Finance Performance Highlights: 2015–16

Published 11 July 2016

We are the UK’s export credit agency. We help UK exporters by providing insurance to exporters and guarantees to banks to share the risks of providing export finance. In addition, we can make loans to overseas buyers of goods and services from the UK.

UK Export Finance is the operating name of the Export Credits Guarantee Department (ECGD), a ministerial department.

1. Key facts about UK Export Finance

We supported 279 companies this year – 23% more than last year.

77% of exporters benefiting from our support in the UK are SMEs.

An estimated 7,000 companies indirectly benefited from UKEF’s support in 2015–16 through exporters’ supply chains.

Key facts graphic 1

In 2015–16 we provided £1.8 billion of support for exports to 69 countries.

In the last five years we’ve provided £15 billion of support for UK exporters.

In total we manage around £20 billion of financial risk.

Key facts graphic 2

We work in partnership with over 70 banks, brokers and other providers to supply export finance and insurance that complements their commercial business.

As the world’s first export credit agency we’ve been supporting UK exports for nearly 100 years.

UKEF received the TXF News Exporters’ Choice Award for 2015.

Key facts graphic 3

2. Minister’s foreword

Lord Price, Minister for Trade and Investment

With its award-winning support for UK exporters, UK Export Finance is ready to play its part in the ambitious whole-of-government push for 100,000 new exporters and £1 trillion of exports by 2020.

Exporting can help businesses grow – and grow fast. The statistics show that in the first two years of exporting alone, a business can grow by up to one third. That means more jobs, more profits, more tax revenue and more benefit to society.

As it approaches its centenary, UKEF is continuing its unique role providing broad shoulders to help UK exporters to win, fulfil and get paid for the overseas contracts that will help them grow. It also has a 21st century challenge: to meet the ever changing demands of businesses as they seek to compete in a global market place. This will require UKEF to keep pace with digital technology, to show innovation in providing the solutions UK companies need and to work in partnership across government and the private sector to support exporters.

The recent history of UKEF indicates it is capable of meeting the challenge. It has been recognised for its innovation – its historic sukuk, its direct lending and its support for loans in local currencies all stand out. It continues to grow its trade finance support for smaller companies, with ambitious plans to take this to the next level. Its close working partnership with UK Trade & Investment is stronger than ever. And it is making great strides in developing future digital processes and technology.

I’d like to extend my thanks to all the staff for their hard work and to encourage them to continue challenging themselves to give the best possible support for UK business success overseas.

3. From the Chief Executive

Louis Taylor, Chief Executive, UK Export Finance

UKEF has now completed the second year of its ambitious three-year business plan, and 2015–16 saw significant progress against our objectives.

As the UK’s export credit agency, we exist to ensure that no viable UK export fails for want of finance or insurance from the private sector. We help exporters access the finance and insurance they need to win export contracts, fulfil them and make sure they get paid. As part of HM Government, we complement, rather than compete with, the private sector, and we do this at no net cost to the taxpayer.

External economic factors in 2015–16 have led to a fall in global demand for all export credit agency support, including UKEF’s. These factors included a slowdown in global growth, a historically low oil price, generally high levels of bank liquidity, a strongly recovering commercial credit insurance market and a slight increase in bank lending.

Nonetheless, in the past year, we have supported more UK exporters than ever before. We have significantly improved awareness of our offering among exporters and potential exporters. And we continue to meet the financial objectives set for us by HM Treasury.

UKEF’s innovative and flexible support gives UK exporters a huge advantage. And to continue to provide our award-winning support we must also continue to be agile and adaptable, anticipating the needs of exporters and finding ways to meet them. By doing so, as we enter the final year of our 2014–17 business plan, we will be in a strong position to help UK exporters realise the world of opportunity out there for them.

4. Business highlights 2015–16

4.1 UKEF’s strategic priorities

Competitive offering

UKEF supported more than £800 million of new UK export contracts via our trade finance and insurance products and issued £1.8 billion of export support.

Over £3 billion of export contracts supported through new trade finance products introduced in 2011 in response to the economic downturn.

We reached an agreement with General Electric that was instrumental in the company committing to a significant investment in the UK, with the potential to create more than 1,000 jobs.

Agile and adaptable

UKEF was the first export credit agency outside China to guarantee a loan in chinese currency (the offshore renminbi), paving the way for UK companies to export more easily to the Chinese market.

We reintroduced cover to support UK companies seeking to compete for business in Iran.

We adopted the Equator Principles during the year, alongside our parallel commitment to meet OECD recommended standards.

Customer service and awareness

Our export finance advisers held more than 2,500 one-to-one interactions with UK companies and more than 1,500 with intermediaries this year.

We developed detailed online product guides to help and encourage bank staff and insurance brokers to use them in support of their clients.

The department began development of a new digital interface to support customer applications that will be made available in 2016–17.

4.2 Award-winning support

- The Banker Middle East Deal of the Year: Securitisation and structured finance for Emirates

- GTR Best deals of 2015: Ham Baker Adams and China Southern Airlines

5. From the Chief Economist

Paul Radford, Chief Economist, UK Export Finance

5.1 Global economic context

Slowdown in global activity and improved bank liquidity contributed to a reduction in demand in 2015–16. A report by Trade Export Finance (TXF) found that global volumes of all export credit agency deals fell by around a third in 2015 compared to 2014.

World economic growth in 2015 is estimated to have been at around 3.1%, 0.3% lower than the previous year (3.4%). This fall was driven by slower growth in emerging markets and developing economies (which accounted for approximately 70% of global growth), and lacklustre growth in advanced economies.

The UK exported £512 billion in 2015, a 0.4% reduction compared to 2014 (£513 billion). The decline in the exports of goods was much sharper at around 3% as a result of lower demand from the EU.

The proportion of UK companies exporting has also shown a downward trend. In the five sectors that received over 90% of UKEF support, the proportion of companies exporting fell in 2014. Figures for 2015 are not yet available.

Exports of goods to non-EU countries grew at a modest 2% owing to higher demand from countries such as the US and UAE.

However, there were sharp falls in the exports of goods to some of the bigger emerging market economies, for example, goods exports to China, India and Russia.

Overall availability of credit for large businesses remained high in 2015, increasing for SMEs, suggesting that companies saw some improvement in access to finance.

However, a 2015 survey by the British Business Bank found that 9% of SMEs cited external finance as a barrier to exporting.

All of this emphasises the the need for UKEF to maintain a product suite that can assist exports in all economic weathers.

6. How we help exporters

6.1 Winning export contracts

The attractive financing terms UKEF can offer to overseas buyers of UK goods and services can help exporters make their bids more competitive.

Historic currency boost

Thanks to UKEF, China Southern Airlines was able to access a UK government-guaranteed loan in offshore Renminbi to purchase an Airbus aircraft. This was alongside support for loans in US Dollars, Euros, Swiss Francs and Japanese Yen.

Backing construction

UKEF was able to support Meraas Holding, the project sponsors of the Dubai Blue Waters Island development, with a US$317.9m loan, enabling UK construction firm Kier Group to win the contract.

6.2 Supporting working capital to fulfil orders

UKEF can help companies access the working capital they need to fulfil a contract, giving them the confidence to take on more contracts and increase their turnover.

Securing cash for growth

Dudley-based Glasscoat International was able to secure the working capital it needed from HSBC to fulfil two important export contracts to Germany and Austria, thanks to UKEF’s bond support scheme.

Unlocking working capital

With the help of our working capital facility, Swansea-based Unit Birwelco was able to access £2m in working capital to enable them to export industrial heaters to Russia.

6.3 Making sure exporters get paid

We can help exporters manage risks in challenging markets, ensuring that they get paid even where the private market is not able to offer insurance.

Protecting against risk

UKEF provided export insurance to ES Global Solutions to ensure that it received payment for a £400,000 track for pre-Olympic testing on the celebrated Copacabana beach in Rio, Brazil.

7. Managing risk

UKEF provides support through economic cycles and market disruptions. Our role is to step in when the commercial market needs us to help support export business.

Many of the loans we support will be repaid over more than 10 years and, in the event of defaults, we will seek to make recoveries. This means that final business losses, as a result of unrecovered claims paid, can take many years to crystallise.

We aim to operate at no net cost to the taxpayer over time, so we charge a premium for each case we support. To make sure we break even over time, we calculate the premium we earn against an estimation of the potential associated risks and costs.

- £122m - a statistical estimate of potential losses that cannot be recovered

- £83m - administration costs

- £27m - a further amount to allow for a portion of unexpected losses

We support UK exporter competitiveness by setting the lowest premium rates permissible, subject to meeting our financial objectives and to aligning with our international obligations, most notably the minimum rates set out by the OECD.

UKEF’s low rate of new claims is evidence of our strengths in risk assessment and underwriting and the currently benign economic environment.

UKEF’s risk management model

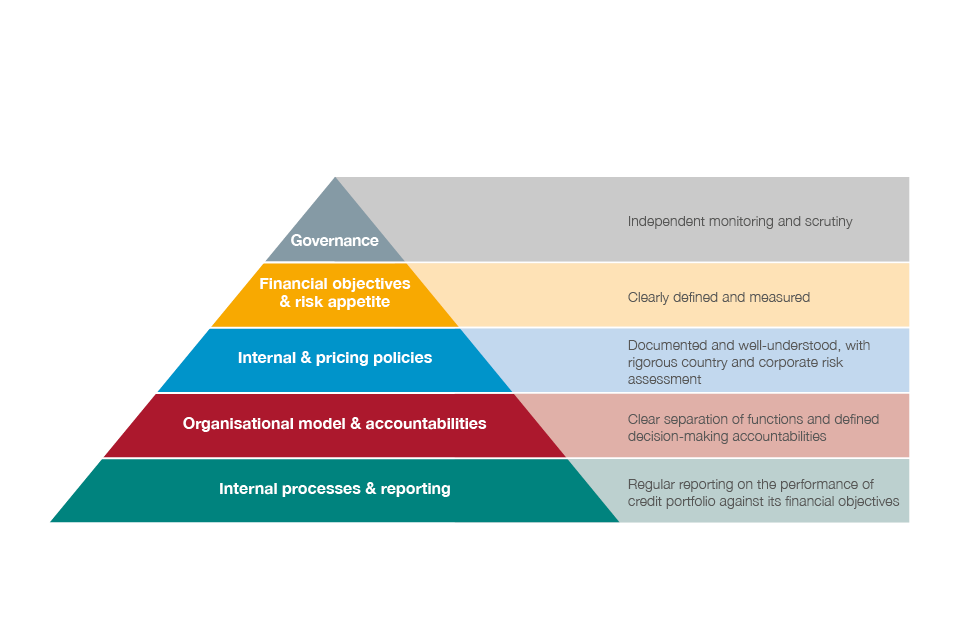

- Governance - independent monitoring and scrutiny

- Financial objectives and risk appetite - clearly defined and measured

- Internal and pricing policies - documented and well-understood, with rigorous country and corporate risk assessment

- Organisational model and accountabilities - clear separation of functions and defined decision-making accountabilities

- Internal processes and reporting - regular reporting on the performance of credit portfolio against its financial objectives

UKEF's risk management model

8. Our people

One of our strategic priorities is to ensure UKEF is a great place to work.

It helps that we are unique. Our people can gain experience of working on award-winning transactions, recognised within the financial sector for their innovation. At the same time, they gain experience of working in a central government department, perhaps shaping international policy, or briefing Ministers on export finance – a distinctive position among OECD export credit agencies. This mix of government with a commercial focus offers the opportunity to develop a wide range of skills, and we are committed to doing more to help our staff fulfil their potential.

8.1 2015 staff survey results

The 2015 staff survey measured experience at work across nine themes. UKEF’s overall staff engagement score was 58%, in line with the civil service average, and we scored highly in six of the nine areas.

- my work (80%)

- organisational objectives and purpose (89%)

- my manager (68%)

- my team (81%)

- inclusion and fair treatment (74%)

- resources and workload (74%)

8.2 Areas for improvement

Three areas received low scores, which we are now addressing through measures such as staff focus groups, a leadership development programme, and improvements to our benefits package.

- learning and development (49%)

- pay and benefits (14%)

- leadership and managing change (41%)

9. Our future

9.1 Our mission

To ensure no viable UK export fails for want of finance or insurance, while operating at no net cost to the taxpayer.

9.2 Our strategy

- competitive offering

- agile and adaptable

- customer service and awareness

- great place to work

9.3 Our priorities for 2016–17

- Improving our performance through a broader and deeper delivery of our mission.

- Becoming more efficient by continuously improving the way we work.

- Increasing our competence by developing our talent and leadership capability.

- Getting better at teamwork by generously collaborating with partners.

- Promoting our brand by building our reputation and stakeholder awareness.

9.4 Our key relationships

Banks and alternative finance providers

Work more closely with banks, speeding up applications and improving awareness of our support.

Customers

Make it easier than ever for companies to access our support, with an online application service and enhanced business development.

Government

Continue to collaborate across government to raise awareness of UKEF support, working as part of the Exporting is GREAT and other campaigns.

People

Restructure our business group so resource can be deployed more quickly and invest in learning and development for staff and leadership.

Find out more about UKEF

Go to the full list of UKEF products

Media enquiries: Andy Aston, Head of News and Corporate Communications

Email Andy.Aston@ukexportfinance.gov.uk

Mobile +44 (0)7458 047053

New business enquiries