UK Capital Investment

Published 21 December 2017

Bristol view

Foreword by Secretary of State for International Trade

It gives me great pleasure to introduce this UK capital investment portfolio, outlining how the Department for International Trade reinforces the UK’s position as a leading global destination for capital investment.

As we move forward into a more global future outside the EU, foreign investors have reaffirmed their confidence in the UK. Flows of inward investment into the UK rose to $254 billion in 2016, making the UK the world’s second largest recipient of foreign direct investment.

The UK is also the leading European destination for venture capital investment, helping innovative firms quickly reach their potential, providing jobs and economic benefits across the UK.

We continue to build on our reputation as a stable, mature market in which to invest. In setting out our ambitions for businesses and communities across the UK in a bold, long-term Industrial Strategy, the government will do all it can to help generate local growth and job creation and make sure the economic benefits are felt by all.

It is an exciting time for the UK. It is clear that this is a place where businesses prosper and where capital investments make strong and safe returns.

I hope you can join us in this success.

Rt Hon Dr Liam Fox MP Secretary of State for International Trade and President of the Board of Trade

Helping you invest successfully in the UK

The UK is a leading global destination for investment, consistently attracting high international capital inflows. The UK offers investors an excellent business environment, strong demographic growth and a thriving economy, with a broad and diverse range of businesses and projects to invest in.

The UK’s Department for International Trade (DIT) helps investors find appropriate projects, smoothing investment journeys with tailored advice, insight and introductions. We promote investor-ready schemes selected by our specialist teams.

DIT’s Capital Investment Directorate focuses particularly on large-scale property and infrastructure development projects as well as opportunities to invest in high-growth UK businesses, particularly in the technology sectors, where we also offer support to encourage entrepreneurs to move to the UK. Sitting at the heart of government, we can provide support, guidance and introductions to open up opportunities for successful investment.

Building in Cambridge

The UK has an open, liberal economy, world-class talent and business-friendly taxation. Government support is substantial in terms of generating the right environments for capital investment: in infrastructure, energy and property, and in growth capital and entrepreneurship. Many international investors benefit from strong personal links to the UK, having been educated here, or enjoying our famous culture and heritage. The UK is truly international in outlook as:

-

in the first half of 2017, 14% of global commercial property investment transactions occurred in the UK, second only to the USA (source: Jones Lang LaSalle)

-

1 in 6 of the top 100 universities in the world, 16 are in the UK (source: QS World University Rankings, 2018)

-

more than £6.7 billion ($9.5 billion) was invested into UK tech firms in 2016, the highest total in Europe (source: PitchBook)

-

the UK is consistently ranked the best country to invest in offshore wind with 5.5GW of installed or under construction offshore wind generation, expected to increase to 10GW by 2020 (source: Crown Estate)

We have a host of exciting investment opportunities in property development and infrastructure across the UK.

Find out more about capital investment opportunities across the UK on invest.great.gov.uk.

DIT’s Capital Investment Directorate

The UK government is committed to supporting international investment into high-growth businesses and profitable property development and infrastructure projects.

DIT’s Capital Investment team leads on this agenda for the UK government and we have a strong track record of working closely with institutional investors and project promoters. Our team has been instrumental in securing billions of pounds of investment.

We work closely with commercial and governmental organisations across the country to understand their priorities and offer support as they promote their projects to potential investors. We also work with investors, building relationships to highlight the UK’s diverse range of investable opportunities - in terms of investment scale and timeframes, risks and returns, sectors and geographies.

DIT realises the value government can add to the investment process, using its global network of international offices to manage relationships locally. We can introduce interested international parties to UK companies with a wealth of sectoral expertise, or to blue-chip domestic investors interested in co-funding models. We also offer expert advice, utilising a range of specialists in:

- property development and finance

- project finance

- energy

- transport

- regulated assets

Our network of UK specialists includes representation across the country, ensuring expert local insight into projects, local government and businesses can be quickly and reliably provided.

For further details or to discuss the potential for an initial meeting, please email: capitalinvestment@trade.gov.uk.

Opportunities in infrastructure

The UK’s 2016 National Infrastructure Plan sets out a £483 billion infrastructure pipeline over 5 years, designed to sustain the UK as a competitive and productive economy that works for everyone. The UK government is committed to working in collaboration with the private sector to deliver this and has recently introduced a number of supporting measures, such as:

- establishing the National Infrastructure Commission as an independent body to advise on long-term infrastructure needs

- a commitment to proceed with the HS2 high-speed rail network offering faster journeys and more capacity between London, the Midlands and the North of England

- a decision to proceed with Hinkley Point C, the first new nuclear power station for a generation

A £2.3 billion Housing Infrastructure Fund could unlock 100,000 new homes in areas of high demand. This will help to fund vital physical infrastructure projects like roads, bridges, energy networks and other utilities.

Euston HS2

HS2 is the flagship project of a major railways investment programme. Across the whole HS2 route, an overall planned £55.7 billion investment will put the cities of Birmingham, Leeds, London, Manchester and Sheffield at the heart of a new high speed rail network, with other cities such as Edinburgh, Glasgow, Liverpool and Newcastle benefiting from reduced journey times. HS2 is already driving investment and development activity along its route and in wider local areas.

Opportunities in energy

An affordable, decarbonised, secure and integrated energy supply for businesses and consumers is at the heart of the UK’s Industrial Strategy. The government incentivises investment into the infrastructure needed to deliver on this strategy in a number of ways, including:

- a statutory target to achieve at least an 80% reduction in greenhouse gases by 2050 against a 1990 baseline

- private law contracts fixing the price that low-carbon electricity generators receive for output, indexed to inflation

- a commitment to close all unabated coal-fired generation plants by 2025

- a capacity market providing energy generators with inflation-adjusted income in return for making electricity available when required

- an inflation-linked renewable heat tariff and a £330 million grant programme to support heat infrastructure delivery

- a tradeable certificate regime under which suppliers of transport fuel must be able to show that a percentage of the fuel they supply comes from sustainable sources

- a commitment to ban new diesel and petrol cars and vans from UK roads by 2040

- a plan to deliver a smarter, more flexible energy system, enabled by energy storage, demand flexibility, smart metering and interconnector infrastructure

Wind turbines

Opportunities in property development

Rapid demographic, economic and technological changes are opening up diverse new opportunities in property development. A shortage of stock means that housing represents a major opportunity for large scale capital investment, including in sub-sectors such as private market sales, build to rent, student accommodation and senior living.

Alongside this, the way people work, shop and spend their free time leads to new developments in retail, leisure, offices and industrial, whilst our successful universities have an increasing role to play in the regeneration of our towns and cities offering co-investment opportunities.

Government support is evident, setting out policies including the Housing White Paper and Industrial Strategy that provide a clear and stable framework for investment.

Leeds city centre

Demographic and economic factors have supported the emergence of the build to rent sector. Household formation is outstripping house building and demand for rented housing is high. PwC has predicted that 25% of households will be living in the private rented sector by 2025, up from 19% in 2014 to 2015.

This is translating into attractive returns from residential property compared to other investments. The government has supported this opportunity through the £3.5 billion Private Rented Sector Housing Guarantee Scheme and the £1 billion Build to Rent Fund.

Opportunities for growth capital

The UK offers a wealth of capital investment opportunities into exciting companies across fast-growing sectors, from technology and financial services to food and drink and life sciences.

The UK remains an innovation-rich environment due to its diversity, entrepreneurial spirit and strength of its research base, underpinned by world-class scientific and academic institutions.

The UK continues to be one of the most attractive places for investment into dynamic, young companies looking for growth capital — being open for business, open to new ideas and welcoming the best talent from around the world.

It is for good reason that the World Bank rates the UK’s business environment as the best of any major European country.

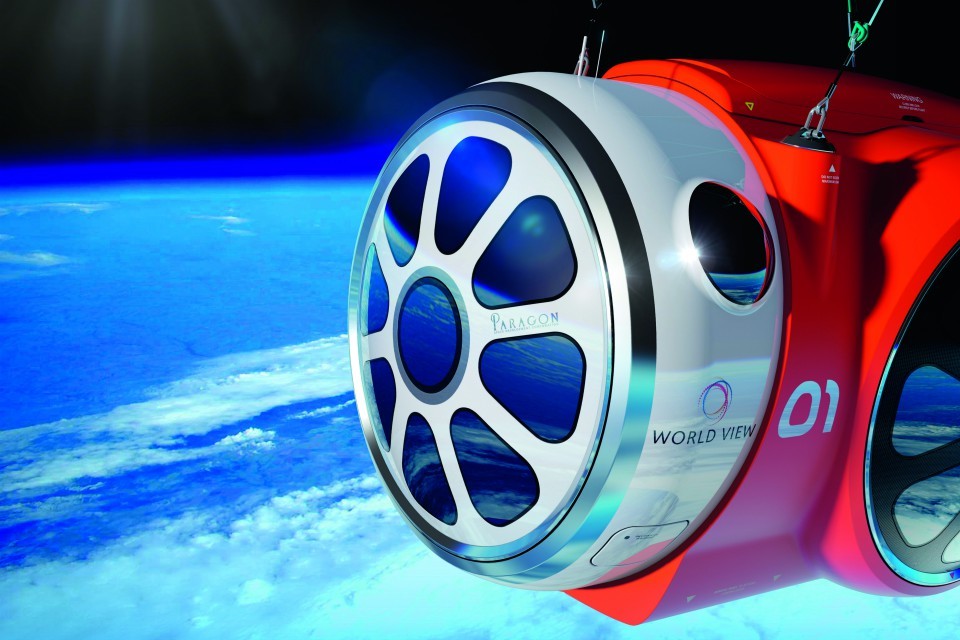

World View vehicle orbiting earth

Opportunities for entrepreneurs

The UK is one of the world’s best places to start or scale an entrepreneurial business, with the joint lowest corporation tax rate in the G20. Doing business in the UK is easy — streamlined processes mean that a company can be registered and ready to trade within 48 hours.

The government also supports innovative businesses through world-leading tax relief. Companies engaged in innovation or research to claim up to 100% relief on their corporation tax, while SMEs are able to access rebates for as much as 125% of their expenditure on research and development.

In 2016, the UK had the highest number of start-up companies valued at over $1billion, known as ‘unicorn’ companies, of any country in Europe. These include companies such as:

- Blippar

- Just Eat

- Shazam

- Skyscanner

- Transferwise

- Zoopla

- Rightmove

As a trend, around one-third of all European unicorn companies are based in the UK.

8 reasons to invest capital in the UK

The UK retains its position as a leading destination for global capital due to its many strengths and assets.

The UK offers:

- varied and liquid markets with transparent pricing

- the City of London as the key global financial centre

- world-leading advisory services

- strong long-term economic and demographic growth

- world-class universities

- a regulatory environment, including the planning system, and rule of law that protect investments

- the benefits of conducting business in English

- strong support for investors from a government committed to keeping the UK as a leading destination for global capital

DIT

DIT has overall responsibility for promoting UK trade across the world and attracting foreign investment to our economy. We are a specialised government body with responsibility for negotiating international trade policy, supporting business, as well as delivering an outward-looking trade diplomacy strategy.

Disclaimer

Whereas every effort has been made to ensure that the information in this document is accurate DIT does not accept liability for any errors, omissions or misleading statements, and no warranty is given or responsibility accepted as to the standing of any individual, firm, company or other organisation mentioned.

© Crown copyright 2017

You may re-use this publication (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence visit: www.nationalarchives.gov.uk/doc/open-government-licence or email: psi@nationalarchives.gsi.gov.uk.

Where we have identified any third party copyright information in the material that you wish to use, you will need to obtain permission from the copyright holder(s) concerned. Any enquiries regarding this publication should be sent to us at enquiries@trade.gov.uk.