Report by the Government Actuary: Terms of Reference

Published 21 July 2025

1. Purpose

The purpose of the report on State Pension age (SPa) by the Government Actuary is to contribute to the evidence examining the latest life expectancy data and to provide advice on:

- whether the rules about pensionable age mean that, on average, a person who reaches pensionable age within a specified period can be expected to spend a specified proportion of his or her adult life in retirement; and

- if not, ways in which the rules might be changed with a view to achieving that result

2. Background

The relevant legislation to increase the SPa includes:

- Pensions Act 2007 – Provision to increase the SPa to 68 over two years starting in April 2044

- Pensions Act 2014 – Provision to bring forward the increase in the SPa to 67 to between April 2026 and April 2028. The result is people born after 5 March 1961 but before 6 April 1977 have a SPa of 67

As required by the 2014 Act, the Secretary of State must commission two independent reports to contribute to the evidence considered during this Review: a report from the Government Actuary and a report on other factors that the Secretary of State considers are relevant to the Review.

The Review will consider a wide range of evidence, including the latest life expectancy data, impacts of previous changes to State Pension age, fiscal costs and impacts on current taxpayers and those who may be, or become, reliant on the State Pension as their primary source of income, as well as how we best support an ageing population and their opportunities to work.

3. Scope of the GAD report

The Secretary of State for Work and Pensions requires the Government Actuary to assess whether the rules about pensionable age mean that on average, a person who reaches pensionable age within a specified period can be expected to spend a specified proportion of his or her adult life in retirement, and if not, ways in which the rules might be changed with a view to achieving that result. The future period and proportions of adult life are specified below.

This report should include:

- commentary on trends in life expectancy data

- assessment of current legislative timings for the rise to 68

- sensitivity analysis as specified below

4. Methodology and Assumptions

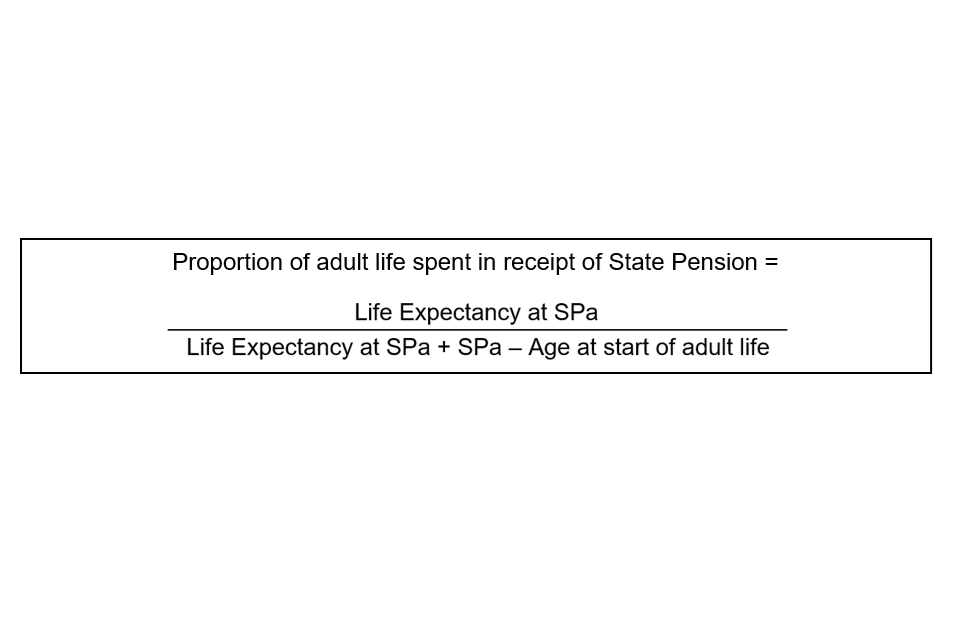

The proportion of adult life spent in receipt of State Pension based on life expectancy at SPa can be expressed as follows:

Proportion of adult life spent in receipt of State Pension =

Life Expectancy at SPa ÷ (Life Expectancy at SPa + SPa – Age at start of adult life)

There are a number of variables that feed into the above formula, including:

- Age when adult life begins

- Measurement of life expectancy

Age when adult life begins

Details of the core principles to guide the SPa review were set out by DWP alongside Autumn Statement 2013[footnote 1]. The DWP background note stated that the age of 20 should be used as the starting age for the purpose of calculating the proportion of adult life spent in receipt of State Pension. This is based on Organisation for Economic Co-operation and Development (OECD) convention and is commonly used as a comparator for matters relating to pensions[footnote 2]. The Government Actuary should therefore consider 20 as the age at which adult life begins.

Measurement of life expectancy

The average “life expectancy at SPa” for use in the Report should be calculated using probabilities of death at each age and in each year, weighted for the different numbers of men and women in the population at the relevant age and year.

The principal projections of UK cohort life expectancy[footnote 3], published by the Office for National Statistics (ONS) publication of 2022-based Cohort life expectancy statistics (released in February 2025) are the appropriate ones that must be used for the purposes of this report by the Government Actuary.

Life expectancies will be based on the age exact as at the middle of the calendar year that falls in the financial year in question.

Historical analysis

The report by the Government Actuary must assess the historic proportion of adult life expected to be spent in receipt of State Pension at male State Pension age over the periods:

- 1992 to 2016 – to match the period used in the 2017 State Pension age review

- 2004 to 2024 – to look at ALiR over the two previous decades

- 1992 to 2024 – to cover both periods

Specified future period and specified proportions of adult life

The report by the Government Actuary must assess the rules around pensionable age and where required, ways in which the rules might be changed to meet the proportions of adult life spent in retirement as far as the published ONS figures (2072) starting from 2030. That is the specified future period for the report. It must include an assessment of the rises to 68 in 2044 to 2046, and whether they are met using the following proportions of adult life spent in retirement.

To allow the Government Review to consider a range of options including the effect of the proportion of adult life measure on State Pension age, the Government Actuary report should include sensitivity analysis and therefore consider the following specified proportions of adult life:

- 32% – as recommended in the 2017 Government review of State Pension age

- 31% – outlined in the 2022 Independent Report

- 30% – to reflect that historical rates have varied between 30 to 31% in recent years

The Government Actuary is invited to conduct sensitivity analysis as follows:

- analysis of the likelihood of upward and downward revision of life expectancy forecasts to reflect recent fluctuations in ONS life expectancy projections, and its effect on State Pension age of entitlement

Modelling the rises of SPa

The proposed methodology suggests that SPa will be increased in the year when the proportion of adult life spent receiving the State Pension, at the current SPa, first reaches the target proportion set by the Secretary of State (rounded to the nearest 0.1%).

Increases in SPa have not happened instantly, but have been phased in over 2 years for each rise to ensure a smooth transition to the new SPa.

If at any point the proportion of adult life spent drawing a State Pension is projected in the following two years to be within 0.1 per cent of the desired proportion, the transition to a further increase would begin.

Geographical Coverage

The analysis will be for the United Kingdom as a whole.

State Pensions policy is reserved in Great Britain so any changes will also apply in Scotland and Wales. Policy on State Pension is transferred to Northern Ireland, although the Executive generally mirrors changes in Great Britain to maintain parity. The UK Government agreed during the passage of the Pensions Act 2014 that the State Pension age Review would consider evidence from across the UK. The Review will therefore consider differences across countries and regions, including Northern Ireland.

5. Deliverables

Findings and recommendations must be submitted to the Secretary of State for Work and Pensions at a date to be determined by the Minister for Pensions/Secretary of State, to inform the forthcoming State Pension age Review.

A final report should be produced and submitted to the Secretary of State for Work and Pensions, who will determine the timing and manner of the publication. The content of the Government Actuary report is the sole responsibility of the Government Actuary who will have the final say on all key outputs and recommendations.

-

For further detail see Department for Work and Pensions (2013), The core principle underpinning future State Pension age rises: DWP background note, December 2013. ↩

-

The Pensions Commission (2005) recommended that official publications use the cohort measurement of life expectancy when describing current and future trends in longevity. ↩