Northern Ireland Office annual report and accounts: 2021 to 22 (accessible version)

Published 30 June 2022

Applies to Northern Ireland

1. Northern Ireland Office

2. Annual Report and Accounts 2021-22

2.1 For the year ended 31 March 2022

Accounts presented to the House of Commons pursuant to Section 6(4) of the Government Resources and Accounts Act 2000

Annual Report presented to the House of Commons by Command of Her Majesty

Ordered by the House of Commons to be printed on 30 June 2022

This is part of a series of Departmental publications which, along with the Main Estimates 2022-23 and the document Public Expenditure: Statistical Analyses 2021, present the Government’s outturn for 2021-22 and planned expenditure for 2022-23.

3. FOREWORD BY THE SECRETARY OF STATE FOR NORTHERN IRELAND

3.1 The Right Honorable Brandon Lewis CBE MP

I am pleased to present the Northern Ireland Office Annual Report and Accounts 2021-22 to Parliament, the third report I have presented as Secretary of State for Northern Ireland. This year, as in the previous two, the UK Government and my department continued to work to protect the Belfast (Good Friday) Agreement and focused its efforts on raising prosperity, improving inclusion and societal integration, maintaining safety, and nurturing a functioning and effective devolved government.

UK Government financial support for Northern Ireland has reached unprecedented levels of investment this year. We have announced more than £730 million[footnote 1] in the new PEACE PLUS programme, and delivered £700m of New Decade New Approach (NDNA) fiscal commitments, £200m of New Deal funding, and signed off the Belfast Region City Deal.

Mindful that the Northern Ireland Protocol has created significant issues for the business community and civic society, my department has worked as a member of the Northern Ireland Protocol taskforce to find practical solutions for people in Northern Ireland.

As Northern Ireland marked its centenary year in 2021, the Northern Ireland Office successfully delivered on its NDNA commitment to mark the centenary celebrating the best of Northern Ireland, encouraging a spirit of mutual respect, inclusiveness, and reconciliation. That work proved that there is an appetite across Northern Ireland to reflect on the past, while building for the future. It is with this in mind, that we have taken forward proposals to address the legacy of Northern Ireland’s past in a sensitive and respectful way, acknowledging honestly the complexities that still exist. I set out policy options for new and effective structures in this area in a Command Paper in July 2021, and introduced legislation in May 2022. We will continue to develop that work next year.

I am also very pleased to record that we have made good progress on identity and language legislation, and in May 2022 the Identity and Language (Northern Ireland) Bill was introduced to Parliament. This legislation will deliver a balanced package of measures for Northern Ireland. In May 2022 I also took further legislative steps to ensure that abortion services are available to girls and women in Northern Ireland.

Our work to create a prosperous and equal Northern Ireland heavily depends on delivering the UK Government’s vision of a safer Northern Ireland. It is, therefore, very pleasing that, for the first time in over a decade, the threat level in Northern Ireland reduced from SEVERE to SUBSTANTIAL in March 2022.

Clearly, however, this year has also brought challenges. Following the First Minister’s resignation in February 2022 and the subsequent failure of the Executive to reform post elections, my department has continued to encourage the Northern Ireland parties to return immediately to a fully functioning Executive. The people of Northern Ireland need strong local political leadership and a stable, accountable Executive that works with the Government to deliver on the issues that matter most.

As we have done during 2021-22, my department will continue to work tirelessly to deliver a levelled-up United Kingdom and to strengthen Northern Ireland’s place within the United Kingdom, by making it a better place to live, to work, and to invest.

Rt. Hon Brandon Lewis CBE MP,

Secretary of State for Northern Ireland

4. Northern Ireland Office Ministers as at 31 March 2022[footnote 2]

The Rt. Hon. Brandon Lewis CBE MP, Secretary of State for Northern Ireland

The Rt. Hon Conor Burns MP, Minister of State

Lord Caine, Parliamentary Under Secretary of State

Further information on our Ministers is available on our website: https://www.gov.uk/government/organisations/northern-ireland-office

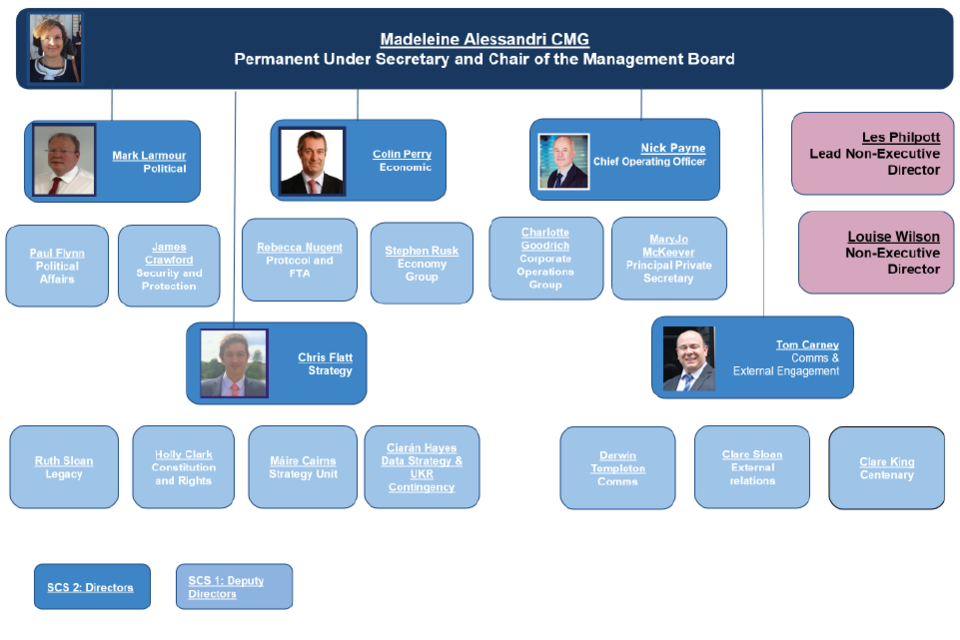

5. Board members as at 31 March 2022[footnote 3]

Madeleine Alessandri, Northern Ireland Office Permanent Secretary and Principal Accounting Officer

Nick Payne, Director

Mark Larmour, Director

Chris Flatt, Director

Colin Perry, Director

Tom Carney, Director

6. Non-Executive Board Members[footnote 4]

Les Philpott, Lead Non-Executive

Louise Wilson, Non-Executive Director

Kirsten Kearney, Board Apprentice Director

7. PERMANENT SECRETARY’S PERSPECTIVE ON PERFORMANCE

7.1 Madeleine Alessandri, Permanent Secretary

In a year dominated by Covid-19, and latterly, the war in Ukraine, I am once again proud of my team for their inclusivity, flexibility, professionalism and sheer tenacity in continuing to work for the people of Northern Ireland in difficult circumstances. All that we have achieved this year is in spite of the pandemic, which caused so much disruption and suffering.

We have welcomed two new ministers into the department – Conor Burns as Minister of State, and Lord Caine as Parliamentary Under Secretary of State. Their appointments have bolstered our ministerial team, strengthening our parliamentary presence and enabled us to reach more people, organisations, and businesses in Northern Ireland through visits and engagements. We have also welcomed and supported the tireless work of the Royal Family, who visited Northern Ireland eight times in 2021-22, reaching out to all parts of the community and recognising the critical role that individuals and organisations play in promoting positive relationships and understanding.

The overarching mission of the NIO remains to deliver on the Government’s commitment to strengthen Northern Ireland’s place in the United Kingdom and make it a better place in which to live, work, and do business. This underpins our Outcome Delivery Plan, which sets out our four core priorities of: Prosperity, Society, Safety and Governance.

In 2021-22, we continued to focus on supporting the stable functioning of the devolved institutions in Northern Ireland. We now look forward to celebrating and reaffirming the principles of the Belfast (Good Friday) Agreement as it reaches its 25th anniversary in April 2023. The NIO was formed in the crucible of the Troubles in 1972. In February 2022, we marked our 50th anniversary as a department. This provided a moment to reflect on the role played by the NIO team over the last 50 years, and the substantial progress that has been achieved for the people of Northern Ireland. Northern Ireland has truly moved forward, becoming a more stable and more peaceful place. Our role (and size) today is very different to the one we had when we were formed. But our commitment to peace and reconciliation in Northern Ireland remains steadfast.

We have, therefore, continued with the difficult task of finding a way forward to address the legacy of the Troubles in Northern Ireland, recognising that access to information is critical to many families. In July 2021, a Command Paper was published setting out our proposals to support truth and reconciliation in Northern Ireland and new legislation was introduced in Parliament in May 2022. We have continued to engage extensively on this issue with the Irish Government, Northern Ireland political parties, and wider society in Northern Ireland. As we have listened, we have been considering how to adapt our proposals in order to deliver for those affected by the Troubles, recognising the divergence of views, and the sensitivity of this issue, particularly for those most directly impacted.

Keeping people safe from terrorism has remained a vital part of the department’s work. In March 2022, the Secretary of State announced that the threat level from terrorism in Northern Ireland has been downgraded from SEVERE to SUBSTANTIAL - the first change in 12 years. While we must continue to be vigilant, this very welcome step is testament to the progress that has been made in Northern Ireland communities, and to the hard work of the police and security services. While there is more work to do to support the Executive, and community work to tackle paramilitaries, the positive downward trajectory of the threat level is encouraging.

For Northern Ireland to continue to flourish and progress, a strong economy is vital. In December 2021, we oversaw the signing of the Belfast Region City Deal, unlocking more than £1billion of investment in the region. The UK also announced an investment of more than £730 million in the new PEACE PLUS programme to support peace and reconciliation in Northern Ireland and we allocated £700m of New Decade New Approach financial commitments.

We have also continued to engage intensively with businesses and civic society to understand the impact of the Northern Ireland Protocol on the people of Northern Ireland, and to inform negotiations with the EU to provide the certainty businesses need and protect the stability of the Belfast/Good Friday Agreement.

2021 was also Northern Ireland’s centenary year, which we marked with a balanced programme of events and initiatives to showcase the achievements and potential of all the people of Northern Ireland. This included the delivery of a business and innovation showcase, a schools programme, an arts exhibition, and much more. The ‘Our Story in the Making’ web page continues to show a global audience what the people of Northern Ireland can achieve.

Against the backdrop of a challenging and busy year, the NIO moved into our new city centre premises at Erskine House in Belfast. In doing so, we have formed a new UK Government hub in Northern Ireland, provided a more modern workspace for our people, and become more accessible to our many stakeholders and partners across Northern Ireland. This sets us up well for the opportunities and challenges ahead in 2022-23.

7.2 Madeleine Alessandri CMG

8. Northern Ireland Office Lead Non-Executive Director’s Report

8.1 Les Philpott, Lead Non-Executive Board Member and Chair of the Northern Ireland Office Audit and Risk Committee.

8.2 Introduction

This is my second report as the Northern Ireland Office’s Lead Non-Executive Director, and Chair of the department’s Audit & Risk Committee. My report reflects on the work of the Board and the Audit & Risk Committee over the last twelve months. It has been prepared in line with HM Treasury guidance, and is based on the information and assurances that were provided to the Board and Audit & Risk Committee during the year.

8.3 2021-22 Overview

During this reporting period, the department continued to operate flexibly and adapted well to the challenges of Covid-19. Moreover, despite continuing to operate remotely for most of the year, the department made significant progress against delivering on its new and ambitious Outcome Delivery Plan (ODP). Programme Delivery Boards for each of the four priority outcomes were established, and the risk management policy was reviewed to ensure that risks were captured and aligned with ODP outcomes. Further information on the department’s achievements, challenges, and risks can be found in the Performance Report section.

The embedding of the department’s ODP across the whole department, regular oversight of progress against plans by the Board, and the operational scrutiny provided by the Executive Committee, has engendered a significant step forward in the quality of reporting and, as a consequence, the level of assurance derived by the senior management team and the Board.

The Board has continued to rise to the challenge of delivering against a complex political framework, in an environment where many of the levers to achieve delivery outcomes are beyond its direct control. This has been particularly true in regard to sustaining effective governance in Northern Ireland, as well as levelling up with the rest of the UK, and achieving greater inclusion.

The Board also reviewed plans and engaged in challenging the development of strategies in respect of the use of resources, workforce planning, communications and engagement, and the arrangements for managing funding announced as part of the New Deal for Northern Ireland; as well as maintaining an oversight on financial management. The non-executive team was fully engaged in supporting the Board on the wide range of issues, by bringing their skills and experience to bear in Board level discussions, and challenging the department’s management of risk.

A key focus for the next 12 months, and in the next iteration of ODP for 2022-23, which will be published later this year, will be to build on the progress made during the last reporting period to achieve the Secretary of State’s vision to make Northern Ireland a better place to live, work and invest.

8.4 Board membership and effectiveness

The Board met three times during 2021-22. There were no changes to the non-executive team during the reporting period. However, Kirsten Kearney replaced Monica Kelly as the Board Apprentice in September 2021.

A review of Board effectiveness was undertaken in summer 2021 and the results were reviewed at the December meeting. The Board noted that there had been a step change in the quality of the papers and servicing of the Board and, that as a result, the Board was able to take a more holistic and strategic focus on issues. It was agreed that a Board away-day would be held in 2022 to facilitate more broadly themed discussions.

8.5 Audit and Risk Committee

The Audit and Risk Committee met four times during the year, where it conducted risk deep dives into functional areas, oversaw the work of the internal and external auditors, and took assurance from the biannual Stewardship Statements provided by senior officials and sponsored bodies.

The Audit and Risk Committee’s membership changed in-year as follows: Ian Summers’ term of office ended in September 2021 and was replaced by Neil Sayers, who took up the role of independent member following an open recruitment process that was publicly advertised on the Cabinet Office website and NIDirect. Louise Wilson also joined the Committee in September 2021.

The Northern Ireland Office Permanent Secretary and Accounting Officer attended all meetings of the Committee during the reporting period. Representatives from internal and external auditors also attended each meeting and provided audit reports accordingly. The Committee acknowledges that the overall internal audit opinion reported a ‘moderate’ level of assurance for 2021-22. I have noted the minor nature of the recommendations in these audits and am assured the department is committed to taking action on these, and the Committee will monitor progress against the implementation of all outstanding recommendations.

I am satisfied that the Committee received effective support from departmental officials and that the Northern Ireland Office operates sound governance arrangements that promote the highest levels of performance and accountability.

8.6 Relationships with other Audit Committees

The Northern Ireland Office sponsors three Non-Departmental Public Bodies (NDPBs): the Northern Ireland Human Rights Commission, the Parades Commission for Northern Ireland, and the Independent Reporting Commission.

Each of these bodies has its own Accounting Officer and the Northern Ireland Human Rights Commission and the Parades Commission for Northern Ireland operate independent Audit Committees. Due to the limited budget and responsibilities, the Independent Reporting Commission has not established its own Audit Committee and the Northern Ireland Office Audit & Risk Committee provides this oversight instead.

During the reporting period, the Committee kept a watching brief on key issues affecting all sponsored bodies and took assurance from the updates provided by sponsor teams, the stewardship statement process, and updates on the external audit activities. I also met with the chairs of the other audit committees to discuss matters of common interest, and took assurance from them that each NDPB was operating effective governance arrangements.

8.7 Acknowledgements

As Chair of the Audit and Risk Committee, I would like to pay tribute to Ian Summers who stood down from the Committee this year after serving as the independent member for seven years. I would also like to thank the auditors and senior officials within the Northern Ireland Office for supporting the ongoing work of the Committee.

Les Philpott

9. PERFORMANCE REPORT

10. Overview

10.1 Our purpose and core values

The Northern Ireland Office (NIO) supports the Secretary of State for Northern Ireland in delivering the UK Government’s strategic priorities for Northern Ireland.

Working across its offices in Belfast and London, the Northern Ireland Office’s portfolio is complex, extensive, and impactful. The department is passionate about delivering for the people of Northern Ireland, and all teams operate in a flexible, empowering, and inclusive way.

10.2 Northern Ireland Office Objectives - 2021-22

The Secretary of State has a clear strategic vision for Northern Ireland:

“To make Northern Ireland a better place to live, work and invest.”

The Northern Ireland Office’s Outcome Delivery Plan for 2021-22 set four strategic outcomes that support this vision, focussed on Prosperity, Society, Safety and Governance. Our whole department effort is focused on delivering these priority outcomes, maximising the use of the resources available.

-

Prosperity Support the levelling up of Northern Ireland’s economy with the rest of the UK

-

Society Support greater inclusion, tolerance, and openness in Northern Ireland

-

Safety Contributing to a safer Northern Ireland, where terrorist and paramilitary groups are less able to cause harm to communities

-

Governance Ensuring that governance in Northern Ireland is responsive, transparent and able to deliver effective public service

The Outcome Delivery Plan for 2021-22 is available at:

Successfully progressing the Outcome Delivery Plan 2021-22, during a period of transition to a hybrid working model post Covid-19, has been achieved through the Northern Ireland Office’s ability to stay flexible and adaptable to manage emerging risks that impact on, and relate to, its work. The department’s robust risk management arrangements, and strengths in working with partners, has helped ensure it has responded to the challenges it has faced throughout the year.

The department has worked particularly closely this year with the Northern Ireland Civil Service (NICS), other parts of the UK Government, and key delivery partners, on some of the government’s most complex challenges. The department also works with the Irish Government, our Arm’s Length Bodies (ALB’s), the PSNI and national security partners, the Northern Ireland business community and a wide range of groups, individuals, and charities, representing all aspects of Northern Ireland’s community and interests.

These effective and mutually beneficial working relationships have helped the department deliver on its strategic objectives. The collaboration between the Northern Ireland Office, colleagues across the UK Government, the Police Service of Northern Ireland (PSNI) and other security partners, to reduce the Northern Ireland Related Terrorism (NIRT) threat level for the first time in over a decade, is testament to what can be achieved when we work together. Throughout the coronavirus pandemic, the Northern Ireland Office worked closely with the Department of Health and Social Care, other government departments, the NICS, and territorial offices, to coordinate our response to the pandemic and ensure the safety of all citizens in Northern Ireland and right across the UK.

Building on the close collaboration throughout the pandemic, the Northern Ireland Office worked closely with the Cabinet Office, and the devolved administrations, to successfully conclude the review of intergovernmental relations (IGR). This was published on 13 January 2022, having received collective agreement from the Government and all devolved administrations to work in line with these updated intergovernmental structures and ways of working.

Progress against each of the Northern Ireland Office’s four priority outcomes for 2021-22 is set out in more detail in the Strategic Performance Analysis section of this Report. Further information on work undertaken throughout the year, such as announcements and other publications is available at: https://www.gov.uk/government/organisations/northern-ireland-office

11. Northern Ireland Office structure

As at 31 March 2022, the Northern Ireland Office employed 184 staff across its offices in Belfast and London. The departmental Board of the Northern Ireland Office, and the Executive Committee, oversees and manages the work of the department. In addition to the core department, there are a range of matters dealt with through a network of associated bodies, such as the Northern Ireland Human Rights Commission, the Boundary Commission for Northern Ireland, and the Independent Reporting Commission (among others). These differ considerably from each other in terms of their formal status, intended purpose, statutory or other responsibilities, the degree of independence from government, and size.

Further information on the range of associated bodies sponsored by the Northern Ireland Office and about the department’s governance structures is available at:

https://www.gov.uk/government/organisations/northern-ireland-office/about/our-governance

12. How our department is organised (as at 31 March 2022)

13. Our finances

13.1 Spending summary highlights for 2021-22

| 2021-22 | 2020-21 | Variance | |

|---|---|---|---|

| Spend By Budget Classification | £millions | £millions | £millions |

| Resource DEL (Voted) | 35.1 | 29.1 | 6 |

| (Departmental operations including depreciation) | |||

| Resource DEL (Non-Voted) | 0.0 | 0.0 | 0.0 |

| (Election Funding) | |||

| AME | |||

| (Non-Cash accounting provisions) | 33.6 | 535.6 | (502) |

| Capital DEL | 1.6 | 0.8 | 0.8 |

| (Expenditure on Departmental non-current assets) | |||

| Non Budget | 19,972 | 19,927 | 345 |

| (NI Executive funding) |

13.2 Funding

The department’s activities are financed by Supply voted by Parliament. Each year the NIO is given Parliamentary approval for its expenditure when Parliament votes the Main Supply Estimates. Subject to Parliament’s agreement, the estimates may be amended during the year at the Supplementary Estimate stage. The estimates are published by Her Majesty’s Stationery Office (HMSO) and contain details of voted monies for all Government departments. The 2021-22 Supplementary Estimates are available at:

https://www.gov.uk/government/publications/supplementary-estimates-2021-22

13.3 Departmental Expenditure Limit (DEL): £42,817,000 (including non-voted expenditure of £nil)

Expenditure arising from:

- overseeing the effective operation of the devolution settlement in Northern Ireland and representing the interests of Northern Ireland within the UK Government;

- expenditure on administrative services;

- expenditure arising from the Stormont House Agreement and the Fresh Start Agreement;

- Head of State related costs and VIP visits to Northern Ireland;

- Northern Ireland Human Rights Commission and other Reviews and Commissions arising from the Belfast/Good Friday Agreement, the Northern Ireland Act 1998, the Northern Ireland Act 2000, the Northern Ireland Act 2009, political development and inquiries;

- work of the Parades Commission for Northern Ireland;

- the Chief Electoral Officer for Northern Ireland, elections and boundary reviews;

- Civil Service Commissioners for Northern Ireland;

- legal services, security, victims of the Troubles including the work of the Independent Commission for the Location of Victims Remains and arms decommissioning;

- compensation schemes under the Justice and Security (Northern Ireland) Act 2007 and Terrorism Act 2000;

- the running of Hillsborough Castle and certain other grants; and

- the Independent Reporting Commission.

This includes associated depreciation and any other non-cash costs falling within DEL.

Income arising from:

- Recoupment of electoral expenses;

- Receipts from the use of video conferencing facilities;

- Fees and costs recovered or received for work done for other departments;

- Freedom of information and data protection act receipts;

- Recovery of compensation paid; recoupment of grant funding;

- Costs and fees awarded in favour of the crown;

- Receipts arising from arms decommissioning;

- Fees and costs recovered or received for the use of the NIO estate; and

- Contributions from third parties to fund grant programmes and monies from other departments to fund projects in Northern Ireland.

During 2021-22, the Department received £5.831m RDEL funding at Supplementary Estimates to cover Erskine House Accommodation move (£0.785m); Crown Solicitor’s Office to cover shortfall in income in insolvency (£0.670m) following Government policy during the Covid-19 pandemic to refrain from pursuing debt recovery from individuals and funding due to a change in the Government’s approach to pursuing legacy cases (£0.212m); funding for IRC to meet its commitments under the 2015 Fresh Start Agreement (£0.451m); funding for a United States Envoy on Northern Ireland (£0.050m); funding for 3 projects under the New Decade, New Approach Northern Ireland Office Annual Report and Accounts 2021-22 20 package (£2.825m) and funding to ensure the continued operation of the Dedicated Mechanism of the Northern Ireland Human Rights Commission (£0.838m).

Additional CDEL funding of £1.666m was received for Erskine House Accommodation move (£0.666) and funding to the Electoral Office of Northern Ireland to purchase a new electoral management system (£1m).

13.4 Annually Managed Expenditure (AME): £749,316,000

This expenditure relates to an increase in the provision for PEACE PLUS due to an increase in the funding committed in the 2021-22 financial year. This expenditure primarily relates to the Machinery of Government (MoG) change in the 2020-21 financial year whereby PEACE PLUS, a cross-border peace and reconciliation programme in Northern Ireland and the border region of Ireland, was transferred to the department from BEIS. During the 2021-22 financial year the NIO have advanced UK-EU negotiations on the UK-EU Financing Agreement on PEACE PLUS. The agreement has not been signed and the treaty has not been ratified at year-end. An increase in funding was also committed during the 2021-22 financial year which has been discounted over the 6 year funding period. The funding commitment for NIO was agreed as €681m during the 2021-22 financial year.

13.5 Non-Budget Expenditure: £20,975,101,000

Expenditure arising from:

- providing appropriate funding to the Northern Ireland Consolidated Fund for the delivery of transferred public services as defined by the Northern Ireland Act 1998, Northern Ireland Act 2000 and the Northern Ireland Act 2009; and

- grants to the Northern Ireland Consolidated Fund and transfers of EU funds.

The department’s final resource Estimate for 2021-22 was £21,765m (2020-21: £23,201m) and the department’s final capital Estimate for 2021-22 was £1.967m (2020-21: £0.897m).

13.6 Comparison of estimate and outturn

Resource

The total outturn shown in the Statement of Outturn against Parliamentary Supply of these Accounts reflects underspend on both the Resource DEL and Resource AME Estimates due to lower than anticipated expenditure on programmes which were delayed due to Covid-19. The net resource outturn for 2021-22 was £20,041m (2020-21: £20,192m) compared with the Estimate of £21,765m (2020-21: £23,201m). This is a variance of £1,724m (2020-21: £3,009m).

The main reasons for this variance are:

- £1,003m funds anticipated to be required by the Northern Ireland Executive were not drawn down from the Consolidated Fund;

- AME funding of £722m was approved which was for the full value of the PEACE PLUS Programme discounted over the funding period and incorporating for foreign exchange differences. The only movement during the year was an increase in the provision of c£30m. The agreement was not signed and the treaty was not ratified during the 2021-22 year, therefore payment did not crystallise;

- other underspends across the remainder of the Department and its ALBs due to lower than anticipated expenditure on programmes and services which were delayed due to Covid-19, or due to staff vacancies which were largely filled by the end of the financial year; and

- higher than anticipated income by the Crown Solicitor’s Office in the final quarter of the year.

The Department received EU Exit funding of £0.61m in 2021-22, against which it spent £0.58m. The funds were spent on staff costs within the Protocol and Free Trade Agreement Team. The team supported policy development on the approach to protocol implementation in the context of Northern Ireland, engaging extensively with a wide range of Northern Ireland stakeholders to inform the approach. This was undertaken in line with the Department’s strategic objectives. All of this funding was provided by HM Treasury.

Capital

The net capital outturn for 2021-22 was £1.59m (2020-21: £0.7m) compared with the Estimate of £1.97m (2020-21: £0.9m). This is a variance of £0.38m (2020-21: £0.2m). This variance resulted from lower than anticipated capital expenditure in a number of projects across the Department and its ALBs, primarily due to a pause in project work as a result of Covid-19.

Net Cash Requirement

The net cash requirement (note SOPS3) outturn was £20,007m (2020-21: £19,656m) compared with the Estimate of £21,581m (2020-21: £22,632m). This is a variance of £1.574m (2020-21: £2,976m). This variance resulted from lower than anticipated drawdowns made by the Northern Ireland Executive during the financial year.

Decisions on how funding to the Executive is spent are managed by the devolved administration and funding is allocated to the Northern Ireland Departments by the Department of Finance (DoF). Each of the Northern Ireland Departments, including DoF, publishes their own financial statements. Additional information regarding the budgets of the Executive and the grants paid by the NIO to the Northern Ireland Consolidated Fund are included in an annex at the end of this document.

13.7 Statement of Financial Position

The net liabilities at 31 March 2022 of £486m (2020-21: £458m) occurs primarily due to a provision for PEACE PLUS made in the prior year (of more than £500m) and increased in the current financial year by c£30m. The Chancellor confirmed an uplift in funding (to honour the previously agreed funding proportions) and the Northern Ireland Executive continues to match fund this uplift. The UK (including match funding from the Northern Ireland Executive) confirmed a final contribution to the Programme on 4th September 2021. The confirmed funding was €681m from NIO and €170m from the Northern Ireland Executive. The public announcement was made in sterling and noted more than £730m of a commitment based on exchange rates at the time of the announcement. During the 2021-22 financial year the NIO have advanced UK-EU negotiations on the Financing Agreement. The status of the Agreement has also been confirmed as an international treaty. As at 31st March 2022, the Agreement is still unsigned and the treaty has not been brought into force, and therefore the announced funding remains a provision at year-end.

This results in the continued material net liability on the Statement of Financial Position. Funding for the programme will be fully met via HMT Estimates processes but this cannot be accrued as income. The agreement is due to be signed and the international treaty ratified during the 2022-23 financial year, at which point the provision will crystallise into a payable. The recognition of this liability does not raise any uncertainty in relation to the department’s going concern status.

The liabilities are disclosed net of assets, which principally comprise property, plant and equipment of which Hillsborough Castle and its surrounding estate is an asset of £80.8m (2020-21: £77.1m) as the remainder of the other assets and liabilities largely offset.

At 31 March 2022 Land and Property Services (LPS) – Department of Finance NI, undertook the quinquennial valuation of Hillsborough Castle increasing the value by c£3.6m to c£79m. Ross’ Auctioneers and Valuers also completed the quinquennial valuation of the antiques within the castle resulting in an increase in value of £0.063m netted with disposals (in Stormont House) of £0.014m giving a closing balance for antiques of £1.767m. The financial assets include loans issued to DoF under the National Loans Fund, but these are balanced by corresponding amounts in current and non-current liabilities.

13.8 External Auditor

These accounts are audited by the Comptroller and Auditor General (C&AG) who is appointed by statute and reports to Parliament on the audit examination. His certificate is included in the Parliamentary accountability and audit report. The audit of the financial statements for 2021-22 resulted in a group audit fee of £159,000 (cash audit fee £41,000, non-cash audit fee £118,000) (2020-21 £184,600; cash fee £39,600, non-cash fee £145,000).

The C&AG may also undertake other statutory activities that are not related to the audit of the department’s accounts such as value for money reports. No such reports directly related to the activities of the NIO were published during the year.

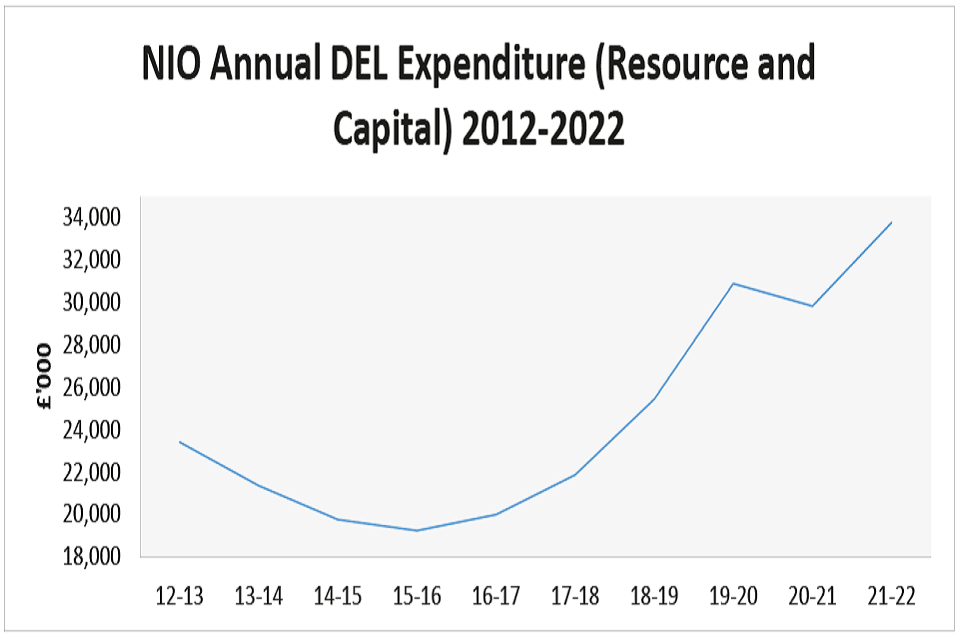

13.9 Long Term Expenditure Trend

The outturn figures have been adjusted to exclude the impact of significant one-off additional areas of expenditure when additional funding was provided e.g. the electoral canvass in 2013-14, European Elections and Assembly Elections in 2014-15, 2016-17 and 2019-20, as well as General Elections in 2015-16, 2017-18 and 2019-20. The increase since 2016 represents additional funding for new areas of expenditure and to address additional pressures e.g. EU Exit, PEACE PLUS as well as increased capital expenditure on IT and infrastructure projects and the decline from 2019-20 largely due to reduced or paused expenditure on items due to Covid-19. The 2021-22 year had additional spend in relation to the Centenary year, EONI Canvass and relocating from Stormont House to Erskine House.

Madeleine Alessandri, Accounting Officer, 22 June 2022

14. STRATEGIC PERFORMANCE ANALYSIS

The section below sets out in detail our four strategic priority outcomes and how we have delivered these during 2021-22.

14.1 Priority Outcome 1: Prosperity

Throughout 2021-22, the UK Government continued to uphold its commitment to deliver a stronger, more secure, and stable economy that works for every part of the UK. The Northern Ireland Office, working alongside the Northern Ireland Executive, Northern Ireland partners, and other UK Government departments, has continued to prioritise strengthening and rebalancing the Northern Ireland economy, as part of the Government’s commitment to taking forward a targeted approach to deliver for the people of Northern Ireland in a way that levels up Northern Ireland with the rest of the UK, and protects its place in a stronger, more prosperous Union.

Over the course of the reporting period, in pursuit of supporting the levelling up of Northern Ireland’s economy with the rest of the UK, the Northern Ireland Office focussed on:

- growing and rebalancing the economy, driving business innovation and investment, and promoting better alignment of jobs and skills, including driving the delivery of City and Growth deals, and building local and regional awareness of UK investments.

- supporting a well-connected Northern Ireland, competing globally and maximising its trade with the rest of the UK, Ireland, and across the world.

- working with partners to develop an evidence based and sustainable economic vision for Northern Ireland, to drive forward the Government’s levelling up agenda, and set out steps the UK Government can take to transform the Northern Ireland economy.

To progress this objective for 2021-22 we:

- released over £700m of New Decade New Approach fiscal commitments, a significant UK Government contribution to levelling up Northern Ireland’s economy with the rest of the UK.

- allocated funds to the International Fund for Ireland.

- allocated 50% (£200m) of New Deal funding for Northern Ireland.

- announced an investment of more than £730 million in the new PEACE PLUS programme, to support economic stability, peace, and reconciliation in Northern Ireland.

- secured the sign off of the Belfast Region City Deal in December 2021, unlocking £1 billion of transformative co-investment, which will deliver more than 20 highly ambitious projects and programmes, and create up to 20,000 new and better jobs.

- supported work on the Community Renewal Fund, which saw over 30 projects across Northern Ireland receiving a share of over £12 million, to help people into work, boost productivity, and grow local economies. This work is an important building block of the UK Shared Prosperity Fund, which contains significant opportunities for Northern Ireland.

- took forward work to prepare for a freeport in Northern Ireland.

The NIO has been mindful that the implementation of the Northern Ireland Protocol has created some uncertainty for the business community. As a member of the Northern Ireland Protocol Taskforce, the NIO undertakes various activities to support this work, and find practical solutions that work for people and businesses in Northern Ireland.

14.2 Priority Outcome 2: Society

The Northern Ireland Office continues to deliver on the UK Government’s vision of supporting greater inclusion, tolerance and openness in Northern Ireland, and has supported the Government in its unwavering commitment to the Belfast (Good Friday) Agreement.

As Northern Ireland marked its centenary year in 2021, the department successfully delivered on its NDNA commitment to mark the centenary in a spirit of mutual respect, inclusiveness, and reconciliation. The centenary marked a significant UK national anniversary. It provided an opportunity to facilitate national recognition and international awareness, and was an opportunity to reflect on the past and to build for the future, celebrating the people, the products, and the places of Northern Ireland. In rising to the challenge of producing a programme of such significance, the NIO successfully delivered a comprehensive programme of communications and engagement activity.

A highlight of the centenary programme was the extremely successful Northern Ireland Business and Innovation Showcase, held in London in September 2021. This event attracted significant participation and received extensive media coverage, reaching thousands of key industry and media stakeholders. The Centenary concert held in Belfast’s Waterfront Hall was another stand-out moment that was broadcast live on Sky Arts, and was viewed by more than 12 million people. The department’s first TV advert in decades was broadcast on UTV and Channel 4, as part of our flagship communications campaign, Our Story in the Making, reaching over 9 million people. A post project evaluation will ensure that we are able to track the longer term cultural benefits of the programme to mark the centenary, and that the delivery lessons learned are captured for future similar programmes, including marking the 25th anniversary of the Belfast (Good Friday) Agreement in 2023.

The efforts of our Centenary Team within the NIO were recognised externally, winning third place in the Diversity & Inclusion Category of the Government’s Project Delivery Profession Awards in March 2022. The NIO’s External Relations team also delivered work across a range of areas, including Royal visits to NI, and supporting NI honours nominations.

The department is committed to leading efforts to help Northern Ireland address the legacy of the past, which remains a highly complex and challenging issue. Over the course of the reporting period, the department developed proposals to establish new and effective structures in this area, publishing a Command Paper on policy options in July 2021, and continuing to engage extensively with the political parties in Northern Ireland, the Irish Government, parliamentarians, and civil society, including victims and survivors groups, to drive progress on this issue. This included many individuals across Northern Ireland, Great Britain, Ireland, and beyond, with vast experience in peacebuilding. We plan to build on this work in 2022-23 following the introduction of legislation in May 2022 that will help people to move forward together, and support the transition to long-term peace and stability, and a brighter future for Northern Ireland.

The department has also continued to deliver on its equality and human rights commitments, working towards an outcome of a more integrated society. Supporting greater integration in education is an important strand of that work, as is implementing and demonstrably supporting efforts to reflect the various aspects of Northern Ireland’s cultural expression. The department was successful in enhancing its insight and understanding of the barriers to integrated education, engaging a comprehensive range of stakeholders, including those from the Executive and in wider civic society, and identifying opportunities to support the sector’s further development. We have also made tangible progress on our commitment to deliver the identity and language legislation envisaged in New Decade, New Approach, which will recognise and celebrate Northern Ireland’s rich diversity and accommodate cultural difference.

We are continuing work to ensure that the Secretary of State for Northern Ireland upholds his duty under Section 9 of the Northern Ireland (Executive Formation, etc.) Act 2019, to ensure that the recommendations in paragraphs 85 and 86 of the 2018 Report of the Committee on the Elimination of Discrimination Against Women (“the CEDAW Report”) are implemented. The department has worked intensively with delivery partners and stakeholders across government, and in the Northern Ireland Civil Service, in our efforts to see abortion services fully established in Northern Ireland.

In March 2021, the NIO laid the Northern Ireland (Abortion) Regulations 2021, which gave the Secretary of State for Northern Ireland the power to direct the implementation of abortion services. In July 2021, the Secretary of State directed[footnote 5] the Department of Health, and the Regional Health and Social Care Boards, to secure the commissioning and availability of abortion services, and the First Minister and deputy First Minister to include proposals for the provision of abortion services on the agenda for the Executive Committee. The direction included a deadline of 31 March 2022 for services to be in place.

On 24 March 2022, with the devolved Department of Health in Northern Ireland still not having presented a set of proposals to the Executive Committee, the Secretary of State for Northern Ireland announced[footnote 6] that the NIO was preparing to make regulations directly after the Assembly elections. These regulations,[footnote 7] which were laid in Parliament on 19 May 2022, remove any obstacle to the provision of abortion services in Northern Ireland, by ensuring that the duty to provide services must be complied with, irrespective of whether the matter has been discussed or agreed by the Executive Committee. They will also confer on the Secretary of State for Northern Ireland the power to do anything that a devolved Minister or department in Northern Ireland could do, for the purpose of ensuring that the recommendations in paragraphs 85 and 86 of the CEDAW report are implemented. A small team within NIO will also be established to provide additional oversight and expert advice, working alongside the Department of Health in Northern Ireland on this going into 2022-23.

The department’s work to help maintain peace, and to facilitate reconciliation, sits at the heart of its ambitions for Northern Ireland, and is part of the department’s continued commitment to maintaining the gains of the peace process and the Belfast (Good Friday) Agreement. The department worked closely with relevant key stakeholders on two significant UK Government funding streams that aim to deliver peace and reconciliation work: the International Fund for Ireland, and the PEACE PLUS Programme.

14.3 Priority Outcome 3: Safety

The Northern Ireland Office continued to deliver on the UK Government’s vision of a safer Northern Ireland, where terrorist and paramilitary groups are able to cause less harm to communities, working with all delivery partners, including national security partners, the PSNI, local community groups, and political leaders.

The security situation in Northern Ireland is in no way comparable to that which existed during the Troubles, but the threat from Northern Ireland Related Terrorism (NIRT) for the majority of this year remained SEVERE (meaning an attack is highly likely). However, for the first time in over a decade, the NIRT threat level was reduced from SEVERE to SUBSTANTIAL (meaning that a terrorist attack is likely) in March 2022. This shows the significant progress that Northern Ireland has made, and continues to make, towards a more peaceful, tolerant, and safer society. There is, however, no complacency in this regard and the government, police, and security partners, will continue to work tirelessly to address the threat posed by terrorism in all its forms.

Key highlights delivered in pursuit of this objective for 2021-22 include:

- Additional security funding and UK Government investment in tackling paramilitary activity secured as part of the Spending Review 2021.

- Improved collaboration across the Safety community, to ensure suitable coordination of action on terrorism, paramilitarism, and organised crime activity.

- Ongoing collaboration with partners to work through the operational aspects of the new regulations following the end of the EU Exit transition period. This has included working towards secondary legislation to transpose EU requirements on explosives precursors into domestic law, as required by the Northern Ireland Protocol.

- We have implemented recommendations from the Independent Reviewer of the Justice and Security (Northern Ireland) Act 2007, including by establishing a working group to identify practical measures that can reduce the number of non-jury trials in Northern Ireland, and examine the indicators which would assist in determining when the provisions could be brought to an end.

- According to the most recently published Security Situation Statistics[footnote 8] for the period 1 March 2021 to 28 February 2022, there was one security related death, compared to three during the previous 12 months, and there were fewer bombings (5 compared to 16), shootings (21 compared to 47), and paramilitary style attacks (48 compared to 62), than during the previous 12 months.

14.4 Priority Outcome 4: Governance

Whilst the political context surrounding the Northern Ireland Executive and the Northern Ireland Assembly throughout this reporting period have been challenging, the Northern Ireland Office remains determined to work towards ‘ensuring that governance in Northern Ireland is responsive, transparent, and able to deliver effective public services’.

The department is committed to helping to reduce the fragility of politics and communities in Northern Ireland, to enhance public confidence in the Belfast (Good Friday) Agreement, and its successors, as the basis for peaceful, resilient politics in Northern Ireland, and to enable a vibrant, active, and thriving democracy at all levels across Northern Ireland.

During the reporting period, difficulties surrounding the implementation of the Northern Ireland Protocol in particular have had a destabilising impact on the political and societal landscape in Northern Ireland. There is increased anxiety in some communities caused by perceptions of the impact of the Northern Ireland Protocol.

As a member of the Northern Ireland Protocol Taskforce, the department undertakes various activities to support this work and find practical solutions that work for people in Northern Ireland. Subsequent to the publication of the “Northern Ireland Protocol: The Way Forward’’ document in July 2021, we continued to work within the Northern Ireland Protocol Task Force to support negotiations with the EU Commission on the changes needed to the Protocol. There has also been extensive engagement with a range of business, political, and civic society actors in Northern Ireland to provide clarity on the Government’s approach, to understand the impacts of the Protocol and to explore solutions.

We remain committed to this work, and have secured ring-fenced resource as part of the recent Spending Review to continue to support the implementation of and negotiations on the Northern Ireland Protocol.

Toward the end of the reporting period, the resignation of Northern Ireland’s First Minister has required the department to intensify its work to deliver against our Governance outcome, and contingency plan on a number of fronts.

Key highlights delivered in pursuit of the Governance objective for 2021-22 include:

- Delivered, as agreed in New Decade, New Approach (NDNA), the Northern Ireland (Ministers Elections and Petitions of Concern) Act 2022 on 7 February 2022, to increase the sustainability of the political institutions in Northern Ireland.

- Progressed key legislation relating to electoral integrity, including changes to franchise, candidacy and absent voting rules for elections in Northern Ireland, as well as increased anti-fraud measures at polling stations.

- Delivered the legislation to amend the list of ID which may be used to vote at Northern Ireland Assembly elections, and as well as the legislation required in respect of election finance.

- Supported the Parliamentary Boundary Commission for Northern Ireland, which commenced the current review of constituency boundaries.

- Continue to progress revised flags regulations to meet the UKGs ongoing commitment on flags in the NDNA, to allow for the alignment of flag flying days in Northern Ireland with the rest of the UK.

- Launched the early design phase of the Social Development Fund, which will support peace and reconciliation in support of positive community outcomes in Northern Ireland. The department is preparing to drive the implementation and delivery phases of the Fund in 2022-23.

- Successfully supported three meetings of the British-Irish Intergovernmental Conference, in June, December 2021 and March 2022. The successful conferences covered economic cooperation, COP26 and climate change, security cooperation, rights and citizenship matters, legacy, and political stability.

- Progressed technical negotiations with the EU Commission on the future UK-EU financing agreement for PEACE PLUS.

- Achieved agreement of a stable text of the UK-EU financing agreement.

- Progressed work to ensure that UKGs New Decade, New Approach commitments are on track for delivery within anticipated timescales.

- Enhanced the UKGs relationships with key US stakeholders, including by providing support to a newly appointed UK Government special envoy on Northern Ireland to the United States, and increased Ministerial engagement programmes in the United States to progress UKG objectives for Northern Ireland.

14.5 Strategic Enablers

Over the course of the last reporting period, the Northern Ireland Office has continued to ensure that we focus on living within our means, driving efficiencies, and reducing costs as far as possible. To this end, we have appointed a new Chief Operating Officer to oversee further improvements and efficiencies across the remainder of the Spending Review period.

Modern and flexible IT has enabled our people to be effective and productive whilst working remotely throughout the Covid-19 pandemic. This required them to be flexible and imaginative in their approach, to ensure that we continued to deliver a high quality service to Ministers and for the citizens of Northern Ireland.

To ensure the department is fit for the future, maximising the use of its resources in the delivery of UK Government priorities for Northern Ireland, the department has throughout the year made continuous improvements to its strategic oversight functions, by enhancing the governance and reporting arrangements surrounding our Outcome Delivery Plan, and developing a new NIO evidence and data baseline. This has enabled the strategic prioritisation of work and resources in-year, and the development of better metrics and evaluation plans for future years. It also enabled a robust and evidence based Spending Review process for the financial year(s) ahead, which secured a positive outcome for the department and leaves us well placed to continue to deliver for the people of Northern Ireland, and to support the Secretary of State for Northern Ireland’s vision to make Northern Ireland a better place to live, work, and invest.

Information on our people, and the most recent people survey results is provided in the Corporate Performance Report.

15. Corporate Performance

15.1 Recruitment Practice

All Civil Service recruitment in the Northern Ireland Office is carried out in accordance with relevant employment legislation, and the Recruitment Principles issued by the Civil Service Commission.

During 2021-22, the Northern Ireland Office also offered young people the opportunity to enhance their employability through the Apprenticeships programme, and extended this opportunity to include a Boardroom Apprentice. The NIO also participated in the Summer Diversity Internship Programme, and was able to offer three roles across a range of policy areas.

The Northern Ireland Office is committed to being an inclusive employer with a diverse workforce, and has continued in 2021-22 to hold a Diversity & Inclusion Charter Mark. We are also an accredited Disability Confident Leader organisation. The department encourages applications from people from the widest possible diversity of backgrounds, cultures, and experiences to join the Northern Ireland Office. The department focused on building an organisation that understands and values staff with a diversity of backgrounds, ideas, skills, and experience, as they contribute to greater creativity, innovation, and effective decision making in meeting our strategic objectives.

15.2 Public Appointments

As at 31 March 2022, the Northern Ireland Office sponsored three executive Non-Departmental Public Bodies, an advisory Non-Departmental Public Body, and a range of smaller bodies and office holders. In addition, the Northern Ireland Office has responsibility for making appointments to the Equality Commission for Northern Ireland.

During the reporting period, the Secretary of State for Northern Ireland appointed a new Chief Commissioner to the Northern Ireland Human Rights Commission, and agreed to the reappointment of the UK Government and Northern Ireland Executive nominees to the Independent Reporting Commission. The department also launched three new competitions during the reporting period to appoint a new Civil Service Commissioner for Northern Ireland, a Human Rights Commissioner for Northern Ireland, and to make eight new appointments to the Equality Commission for Northern Ireland.

The Commissioner for Public Appointments publishes further information on the department’s regulated appointments, including statistical information, which can be found at:

https://publicappointmentscommissioner.independent.gov.uk/publications/

In addition to regulated appointments, the Secretary of State for Northern Ireland also has responsibility for making appointments to a number of statutory and non-statutory positions in public life. In 2021-22, the Secretary of State for Northern Ireland agreed that the functions of the Independent Reviewer of National Security Arrangements should be undertaken by the Independent Reviewer of the Justice and Security (Northern Ireland) Act 2007. The appointment of the Chair of the Northern Ireland Committee on Protection was also extended until 31 March 2022.

The department routinely publishes details of all new and renewed appointments in the news section of our website. Further information on the appointments made in the reporting period are available at:

15.3 Employee Consultation

The Northern Ireland Office recognises the importance of sustaining good employee relations to achieve its objectives. Facilitating a culture of constructive challenge and ongoing consultation with employees, and their representation, is central to that work.

Regular communication and consultation takes place with staff through a variety of channels, including the departmental intranet, weekly all staff meetings, staff bulletins, working groups, and other briefings. More formal consultation exercises also take place with staff, including through the Staff Engagement Group, and the Unions, on matters such as organisational change, and changes to staff terms and conditions, when necessary.

During the year, the department worked closely with the Staff Engagement Group, which represents staff from across all grades, and took their views on issues, ranging from wellbeing and diversity & inclusion initiatives, as well as proposed changes to staff policies. Throughout the year, close engagement with all colleagues has been crucial in helping the department manage the impacts of the pandemic on staff well-being, and to ensure that all colleagues’ views were heard on how to operate flexibly throughout this challenging period, and to then move forward to embed our new hybrid working model as Covid-19 restrictions were lifted. We also introduced a mirror Board in the reporting period, so that staff can provide views on wider operational and policy matters, and contribute to shaping strategic decision-making.

There are a number of internal staff networks representing particular groups of employees, and other groups that our staff can access through our relationship with the Ministry of Justice and the wider Civil Service, including the Northern Ireland Civil Service.

The Northern Ireland Office runs an annual people survey that captures employees’ views on a number of issues. The results from the people survey form the basis of the department’s annual People Plan. The latest Civil Service people survey report is available at:

https://www.gov.uk/government/publications/civil-service-people-survey-2021-results

The department’s commitment to our People Plan priorities contributed to an overall engagement score of 68%, which is slightly down on 2021 (71%), but remains higher than the Civil Service benchmark (66%). This year’s people survey recorded positive increases in the section on Learning & Development, but with room for further progress next year. It also highlighted the impact of remote working, and the need for improvements in some areas, particularly performance management.

15.4 Managing Attendance

Throughout 2021-22, the Northern Ireland Office kept a strong focus on the well-being of its staff and the impact of the Covid-19 pandemic. The majority of staff were able to fulfil their roles whilst working flexibly from home, and for those staff who had to come into the office, care was taken to ensure that the accommodation was Covid-secure in line with government guidelines. Sickness absence figures for the reporting year are included in the Staff Report and show that attendance was better than the Civil Service average for the last reporting period to March 2021.

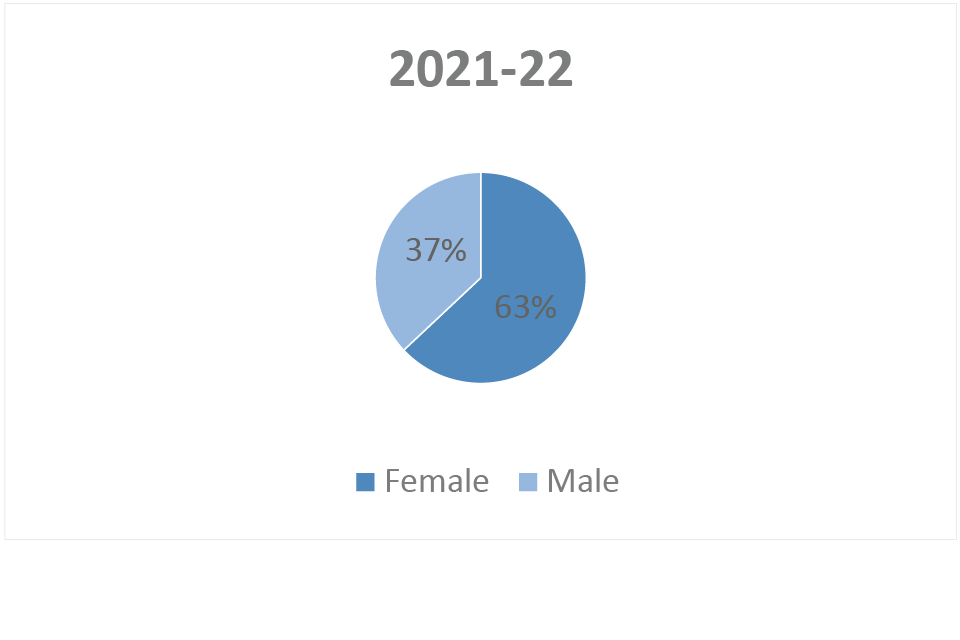

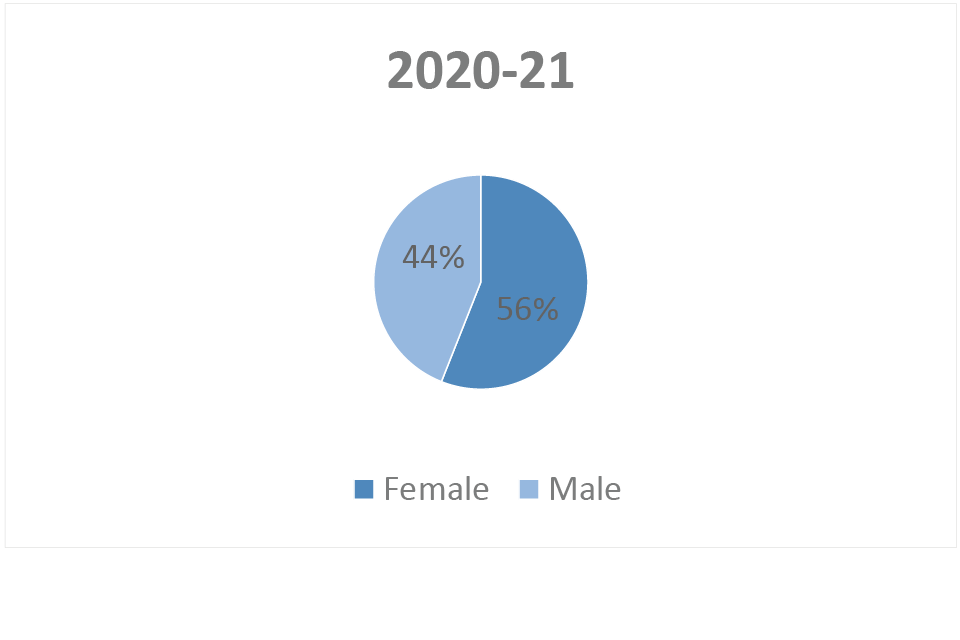

15.5 Diversity and inclusion policy

The Northern Ireland Office recognises the importance of embedding diversity in everything that the department does. Madeleine Alessandri is the department’s overall diversity champion on the Board. The department’s directors each champion various protected characteristics, and we have an active and enthusiastic diversity & inclusion network, supported by advocates for various protected characteristics.

The Northern Ireland Office is committed to:

- eliminating discrimination, harassment, victimisation, and other conduct that is prohibited by, or under equality, legislation;

- advancing equality of opportunity between persons who share a protected characteristic, and persons who do not share it; and

- fostering good relations between persons who share a protected characteristic and persons who do not share it.

The Northern Ireland Office is committed to being an organisation where everyone is:

- treated with fairness and respect;

- able to contribute and develop; and

- confident about how to ensure that the work they do supports equality of outcomes for everyone in society.

The Northern Ireland Office’s people management policies and practices reflect the Civil Service Code and build on the equality legislation and legal obligations under Northern Ireland, and UK law.

Our People Plan communicates our ongoing commitment to a zero tolerance of unfair discriminatory behaviour, harassment, bullying or victimisation, and we will ensure that any allegations are dealt with sensitively and fairly.

15.6 Employment, training and advancement of disabled persons

The Northern Ireland Office is an accredited Disability Confident Leader, and is committed to securing, retaining, and developing people with a disability.

The department has adopted Ministry of Justice policies for staff-related matters, including making reasonable adjustments, where necessary, for staff with disabilities. During the year, the department continued to monitor and report progress against the published Disability Action Plan that articulates our vision, our priorities, and sets out our measures, to promote positive attitudes towards disabled people, and encourages the participation by disabled people in public life. The plan makes a clear statement of our commitment to implementing our equality duties in relation to disability.

Our Diversity & Inclusion Group includes advocates for the promotion of diversity and inclusion across the whole department, including a lead on disability issues.

15.7 Pensions

From 1 April 2015 a new pension scheme for civil servants was introduced – the Civil Servants and Others Pension Scheme or alpha, which provides benefits on a career average basis with a normal pension age equal to the member’s state pension age (or 65 if higher). From that date all newly-appointed civil servants, and the majority of those already in service, joined alpha. Prior to that date, civil servants participated in the Principal Civil Service Pension Scheme (PCSPS). The PCSPS has four sections: three providing benefits on a final salary basis (classic, premium and classic plus) with a normal pension age of 60; and one providing benefits on a whole career basis (nuvos) with a normal pension age of 65.

Those organisations within the boundary covered by the Scheme(s) meet the costs of the contributions paid by employers for their staff by the payment of Accrued Superannuation Liability Charges. This is charged to the Statement of Comprehensive Net Expenditure on an accrued basis annually.

The Northern Ireland Office is also required to meet the additional cost of benefits beyond the normal PCSPS (UK) and PCSPS (NI) benefits in respect of staff who retire early. The Northern Ireland Office provides in full for this cost, charged against the Statement of Comprehensive Net Expenditure, when the early retirement has been announced.

The pension benefits of Northern Ireland Office Board members are outlined in the Remuneration Report.

15.8 Capabilities, learning and development

The Northern Ireland Office is committed to supporting the learning and development of all staff to enable them to do their jobs to the best of their ability and to develop the necessary skills for the present and future. The department encourages staff to take up a minimum of five days eachyear to focus on learning and development, and we maintain a ring-fenced budget for this. Staff at all grades can make use of the Civil Service learning portal, as well as face to face learning.

The department monitors the progression of individual learning against agreed personal development plans, supported by the coaching focus of the department’s performance development scheme.

15.9 Health and Safety

The Northern Ireland Office recognises its obligations under Health and Safety at Work legislation for ensuring, so far as is reasonably practicable, the development of an effective health and safety regime. During the period, the department has ensured that it complied with all Covid-19 specific recommendations in relation to health and safety, to ensure it provides a safe working environment for all.

All staff are required to complete annual mandatory Health & Safety training, and the department keeps its health and safety guidance under review, and makes policies available to all staff on the department’s intranet. During 2021-22, there were no accidents reported to the relevant authorities (nil in 2020-21).

15.10 Social, community and environmental responsibility

The Northern Ireland Office, as part of its corporate responsibility agenda, actively promotes awareness of social, community and environmental issues on its staff intranet, and is committed to promoting inclusion, social mobility, and equality through its human resources and other corporate policies. A major contributor to this is the encouragement of volunteering, whether individually or in groups, including providing special leave for this purpose. Information on volunteering is made easily available to staff through the department’s intranet.

The Civil Service has a long tradition of supporting staff to volunteer, and the Northern Ireland Office is committed to making a positive impact on the community in which it operates. The Northern Ireland Office offers up to five days’ special leave for each member of staff to undertake volunteering. Staff can organise their own volunteering activity, or can visit www.do-it.org.uk for ideas and information on volunteering.

The Northern Ireland Office is also committed to promoting health and well-being. The department supports staff by promoting flexible working, as well as providing mental health well-being information on work-life balance options, on the department’s intranet.

15.11 Whistleblowing/Raising a Concern

The Northern Ireland Office has robust arrangements in place for the prevention, detection and reporting of fraud, and is committed to the highest possible standards of openness, honesty, and accountability. Our arrangements follow the principles outlined in the HM Treasury’s publication Managing Public Money, and Civil Service policies on whistleblowing or raising a concern about any suspicions on matters that staff think are wrong, illegal or endangers others, including fraud, bribery or corruption. During the reporting period, the department refreshed its policy and the nominated officers. There were no reported cases of fraud or whistleblowing during the reporting period (nil in 2020-21).

15.12 Estates management strategy

The Northern Ireland Office’s accommodation in London and Belfast is maintained under lease arrangements. In February 2022, the departmental workspace in Belfast relocated from Stormont House to Erskine House, the new UK Government hub in Belfast city centre. Some accommodation, and a small office for ministers, are also available at Hillsborough Castle, however, responsibility for the management and day-to-day running of Hillsborough Castle rests with the charity, Historic Royal Palaces.

15.13 Payment of suppliers

The Northern Ireland Office paid on average 85% (81% in 2020-21) of invoices within five working days, 92% (92% in 2020-21) within 10 working days, and 98% (97% in 2020-21) within 30 working days, during the reporting period.

15.14 Better Regulation

The Northern Ireland Office is committed to producing less, and better, regulation in line with the government’s general principles of regulation. As such, the department continually looks for ways to reduce regulation, where possible. As part of this process, the department is committed to actively promoting the better regulation agenda across the Northern Ireland Executive, representing the needs of the devolved administration in Whitehall, and vice versa.

During the reporting period, the Northern Ireland Office published one consultation. All Northern Ireland Office consultations are available on our website at:

15.15 Parliamentary Questions

The UK Government has committed to providing departmental Parliamentary Question statistics to the Procedure Committee of the House of Commons on a sessional basis. Northern Ireland Office statistics for the 2021-22 are intended for publication on the Committee’s website in due course.

15.16 Complaints to the Parliamentary Ombudsman

No complaints were made to the Parliamentary Ombudsman about the department during the reporting period.

15.17 Political and Charitable Donations

The department did not make any political or charitable donations in 2021-22 (nil in 2020-21).

15.18 Freedom of Information requests

Statistics on Freedom of Information requests in central government, including those for the Northern Ireland Office, are published quarterly at:

https://www.gov.uk/governcocorre/collections/government-foi-statistics

15.19 Transparency

The Northern Ireland Office, in line with the UK Government’s transparency agenda, regularly publishes information on any significant areas of expenditure, and other items of public interest at: https://www.gov.uk/government/latest?departments%5B%5D=northern-ireland-office

15.20 Sustainable development

The Northern Ireland Office is exempt from complying with HM Treasury guidance on sustainability reporting; to collate the figures would be disproportionately expensive relative to the size of the department. The department is, however, committed to making our estate and operations low impact on the environment and more sustainable and, where possible, we support the delivery of the UK Government’s Greening Government Commitments (GGCs). As an illustration, the department has adopted a virtual by default approach, ensuring that essential business travel is kept to a minimum, and operates out of two government hubs that are managed in accordance with sustainable standards.

We recognise that improving sustainability and the drive to Net Zero is a universal agenda. We have established a Sustainability Group to guide the department as we endeavour to model the behaviours and values underpinning the UN’s Sustainable Development Goals (SDGs). Moreover, we support the development and delivery of sustainable policies and programmes in Northern Ireland and encourage the Northern Ireland Executive to uphold its UK and international obligations, including representation overseas, with regard to the achievement of the UKs GGCs and UNs SDGs.

Madeleine Alessandri, Accounting Officer, 22 June 2022

16. ACCOUNTABILITY REPORT

17. Governance Report

17.1 Ministers

Ministerial titles and names of all ministers who had responsibility for the Northern Ireland Office during the year, and to the date of this report, can be found in the Directors’ Report.

17.2 Permanent Secretary

The Permanent Secretary and Accounting Officer for the Northern Ireland Office is Madeleine Alessandri. Further information about the department’s Permanent Secretary can be found in the Directors’ Report.

17.3 Other Reporting Entities

The names of the chair and chief executive, or equivalent, of the Northern Ireland Office’s other reporting entities as at 31 March 2022 were:

17.4 Northern Ireland Human Rights Commission:

Chief Commissioner: Alyson Kilpatrick

Director/Chief Executive: Dr David Russell

17.5 Parades Commission for Northern Ireland:

Chief Commissioner: Very Revd Dr Graham Forbes CBE

Secretary: Sarah Teer

17.6 Independent Reporting Commission:

Chief Commissioner: Not Applicable

UK Joint Secretary: Chris Atkinson

Further information on the performance and governance of each of these entities can be found in their respective Annual Reports & Accounts. The latest reports are available on their websites.

18. Statement of Accounting Officer’s responsibilities

Under the Government Resources and Accounts Act 2000 (“the GRAA”), HM Treasury has directed the Northern Ireland Office to prepare, for each financial year, consolidated resource accounts. These accounts must detail the resources acquired, held, or disposed of, and the use of resources, during the year by the department and its sponsored non-departmental and other sponsored bodies designated by order made under the GRAA by Statutory Instrument 2021 number 265. The ‘departmental group’, comprises the department and sponsored bodies listed at note 18 to the accounts.

The accounts are prepared on an accruals basis, and must give a true and fair view of the state of affairs of the department, and the departmental group, and of the income and expenditure, Statement of Financial Position, Statement of Changes in Taxpayers’ Equity, and cash flows of the departmental group for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

-

ensure that the department has in place appropriate and reliable systems and procedures to carry out the consolidation process;

-

make judgements and estimates on a reasonable basis, including those judgements involved in consolidating the accounting information provided by non-departmental and other sponsored bodies;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the accounts;

-

prepare the accounts on a going concern basis; and

-

confirm that the Annual Reports and Accounts as a whole is fair, balanced and understandable, and take personal responsibility for the Annual Report and Accounts and the judgments required for determining that it is fair, balanced and understandable.

The Principal Accounting Officer and the Board confirms that this Annual Report and Accounts as a whole is fair, balanced, and understandable. The Principal Accounting Officer takes personal responsibility for the Annual Report and Accounts and the judgements required for determining that it is fair, balanced and understandable.

HM Treasury appointed Madeleine Alessandri as Principal Accounting Officer of the Northern Ireland Office with effect from 6 March 2020.

The Principal Accounting Officer of the department has also appointed the Chief Executives or equivalents of its sponsored non-departmental and other bodies as Accounting Officers of those bodies. During the reporting period, David Russell was Accounting Officer for the Northern Ireland Human Rights Commission, Sarah Teer succeeded Nuala Higgins as the Accounting Officer for the Parades Commission for Northern Ireland, and Chris Atkinson succeeded Marie Patterson as the Accounting Officer for the Independent Reporting Commission.

The Principal Accounting Officer of the department is responsible for ensuring that appropriate systems and controls are in place to ensure that any grants that the department makes to its sponsored bodies are applied for the purposes intended, and that such expenditure and the other income and expenditure of the sponsored bodies are properly accounted for, for the purposes of consolidation within the resource accounts. Under their terms of appointment, the Accounting Officers of the sponsored bodies are accountable for the use, including the regularity and propriety, of the grants received and the other income and expenditure of the sponsored bodies.

The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records, and for safeguarding the assets of the department or sponsored body, are set out in Managing Public Money, published by HM Treasury.

As the Principal Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that the Northern Ireland Office’s auditors are aware of that information. As far as I am aware, there is no relevant audit information of which the auditors are unaware.

19. Governance Statement

19.1 Introduction

The Northern Ireland Office governance statement records the stewardship of the organisation, drawing together evidence on governance and risk management, to give a sense of how successfully the department has responded to the challenges and changes faced during the year.