Insolvency Service Annual Report and Accounts 2022-2023

Published 18 December 2023

Applies to England and Wales

1. Performance Report

Performance overview

Chief Executive’s foreword

This report sets out the solid progress we have made during the last year, supporting our customers and ensuring that we have an Agency fit for the future. We are nearly halfway through implementing our 5-year strategy, helping the UK economy to grow, delivering excellent standards of public services, and putting our customers and stakeholders at the heart of everything we do.

Business insolvencies have risen this year after an unprecedented two years of low numbers during the pandemic. The number of company cases handled by our Official Receivers increased during the year, reaching monthly pre-pandemic levels by the year end. The number of compulsory liquidations was over three times as many this year compared to last year. This is a result of HMRC and other major creditors resuming their winding up activities post pandemic, and some banks taking enforcement action against non-repayment of Bounce Back Loans.

The number of claims to the Redundancy Payments Service also increased from a little under 45,000 last year to just under 60,000 this year.

Increases in personal insolvencies have been relatively small, with bankruptcies remaining, as last year, historically low. The number of Breathing Space applications granted increased more substantially, from just under 60,000 last year to nearly 77,000 this year.

During the year we continued our journey to implement the projects which will deliver our strategic vision for the Insolvency Service to be at the centre of a fair, efficient, and effective insolvency system and to be a global leader in insolvency solutions for citizens and for businesses. This is underpinned and supported by a profession that is recognised for the highest professional, technical and ethical standards when carrying out its work.

This year’s achievements include further modernisation of our technology and infrastructure. We became one of the first Government agencies to enable customers to use a digital form to amend claims for holiday pay owed because of their employer becoming insolvent. We also undertook substantial work to centralise some Official Receivers’ functions, to deliver a more efficient, swifter service for our customers and make better use of our resources.

Our Director Information Hub went live shortly after year end. This provides a single entry-point on GOV.UK to help directors, particularly of small and micro businesses, understand their obligations, identify the risks of possible insolvency, what to do about it and where to find help.

Helping directors before insolvency becomes inevitable is a new area of business for us, and something our stakeholders have warmly welcomed.

Our major programme to transform our workplaces, providing the right locations for our customers, with modern, collaborative workspaces for our people, continued. This significant project supports the long-term ambitions set out in the Government’s Levelling Up and Places for Growth strategies and will see the Agency move from 22 locations to 11 regional hubs, located in places that work for our customers. During the year, we closed our offices at Cambridge, Watford and Southend with colleagues transferring to regional hubs in Ipswich and East London.

In supporting economic confidence, the Insolvency Service has a key role to play in ensuring that business and the public have confidence that where there is an insolvency, it will be dealt with fairly and appropriately, and where there is evidence of misconduct or breaches of the law, action will be taken.

A key area of focus for our work through the year has been misconduct in relation to Covid-19 Financial Support, accounting for nearly half of all director disqualifications outcomes, and 40% of all bankruptcy restrictions. Where possible we have also taken steps to recover the funds lost to the taxpayer because of this type of misconduct, with over £835,000 of claims made against disqualified directors so far and many more cases in the pipeline.

We have continued to develop the insolvency regime to ensure it provides effective, consistent regulation and promotes a vibrant and innovative profession. We undertook a call for evidence on the effectiveness of the personal insolvency regime which received many helpful responses. We published the Government’s response in July and are now working with stakeholders to develop further proposals for consultation. We also worked during the year to determine the best way forward following the Government’s consultation on the future of insolvency regulation and published next steps to strengthen the regulatory framework in September 2023.

To ensure the UK continues to be at the forefront of global insolvency and a major centre for cross-border proceedings, we consulted on the incorporation of two new UNCITRAL Model Laws on cross-border insolvency into UK law, which the Government has now committed to take forward.

In January, we launched our new agency values aligned to our agency strategy and our Inclusion First and People strategies. Our commitment to improving capability has been supported by the launch of a new skills tool to support learning and development plans. We have also successfully supported our people to gain additional skills and qualifications including several members of staff passing the industry “gold standard” joint insolvency examinations, our first lawyer successfully qualifying through the CILEX programme in October 2023, and 43 colleagues joining the Government Counter Fraud profession.

Looking ahead we will continue to work collaboratively to ensure the agency remains effective, adaptable and resilient, delivering economic confidence for businesses and citizens and supporting the country’s economic growth.

The next year will be one where we see a lot of our work to transform our technology come to fruition, providing a strong platform for future delivery. We will also be continuing our journey to transform our workplaces for our people and customers and taking forward plans to improve the insolvency and enforcement regimes.

Dean Beale, Chief Executive

Who we are and what we do

This report is designed to give an overview of the activities and performance of the Insolvency Service during the year. More detailed analysis can be found in our accountability report and financial statements.

Who we are

The Insolvency Service is an Executive Agency of the Department for Business and Trade (DBT), currently based in 19 locations across Great Britain. DBT retains financial and operational supervision over the work we do and approves our strategies and budgets.

On 7th February 2023, the prime minister announced a major machinery of government change which redistributed the activities of several existing government departments, including the Department for Business, Energy & Industrial Strategy (BEIS), and created three new departments, the Department for Business and Trade, the Department for Science, Innovation and Technology, and the Department for Energy Security and Net Zero. The Insolvency Service has been designated to the Department for Business and Trade with accounting officer responsibilities formally transferred from 1st April 2023.

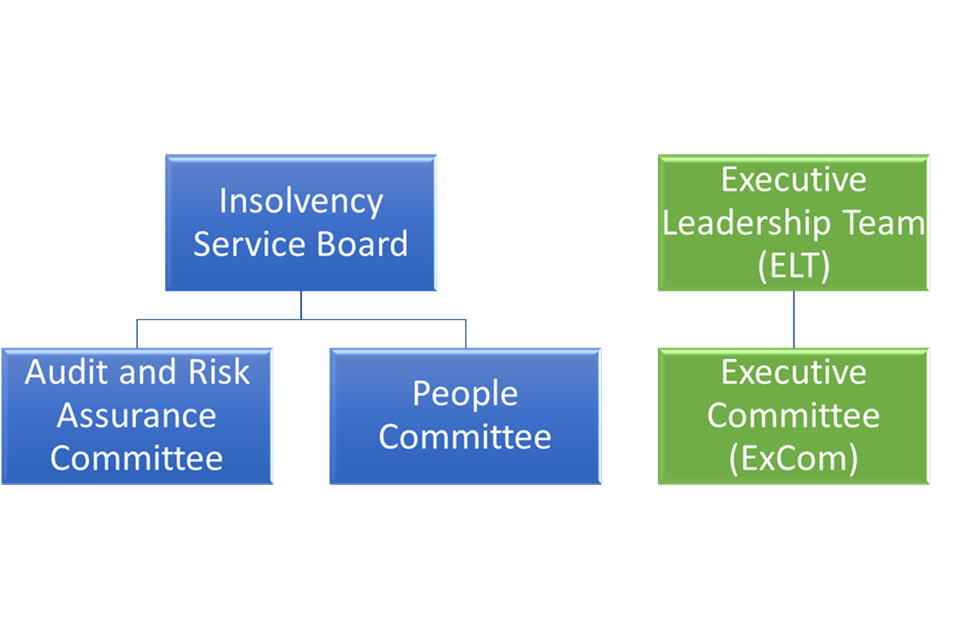

We are governed by the Insolvency Service Board, comprised of executive and non-executive members. The Board is responsible for the long-term success of the agency, which includes setting strategic aims and objectives, making sure that leadership and other resources are in place, challenging and supporting management performance, and reporting to DBT.

Our governance statement provides further detail about our Board and various committees.

For more information on our status as an Executive Agency, the Classification of public bodies: information and guidance summarise the main characteristics of different types of public bodies.

What we do

We oversee and foster a world class insolvency regime. Our core objective is to deliver economic confidence by supporting those in financial distress, tackling financial wrongdoing and maximising returns to creditors.

Our Official Receivers deliver an essential public service by dealing with people subject to bankruptcy and insolvent businesses, realising and distributing assets, helping people to get back on their feet, and carrying out investigations to support the integrity of the insolvency system and the wider business and lending economy.

Our investigators scrutinise director and corporate behaviour, investigating those who abuse the system, and work to disqualify unfit directors to protect the public and business from future harm. We also investigate trading companies and take action to wind them up where they have been operating against the public interest. We investigate and prosecute breaches of company and insolvency legislation and other criminal offences on behalf of DBT.

Our Redundancy Payments Service makes sure people receive redundancy pay from the National Insurance Fund (NIF) and other statutory entitlements when a business fails.

Our adjudicator, Debt Relief Order (DRO) and Breathing Space teams help to support those in financial distress by managing and administering bankruptcy, DRO and Breathing Space applications.

We act as an impartial source of information for the public on insolvency and redundancy matters and advise DBT ministers and other government departments.

Our objectives

This annual report and accounts describe the agency’s performance and achievements for, and reports on, the delivery of objectives we set in our 2022-23 Annual Plan.

Those strategic and operational objectives to continue delivery of excellent customer service were to:

- Strengthen our system regulation and improve the insolvency framework

- Strengthen our reputation and impact in investigation and enforcement

- Sharpen our operating focus

- Shape a new approach to prevent insolvency and rehabilitate through education and guidance

- Strengthen and modernise our technology and infrastructure

- Shape the agency as a great place to work

- Sharpen our financial model to ensure sustainability

Strengthen our system regulation and improve the insolvency framework

| Objective | Status | Commentary |

|---|---|---|

| Issue a call for evidence on the personal insolvency regime | Achieved | The call for evidence was published on 5 July 2022 and ran for 16 weeks. The Government’s response was published on 4 August 2023. |

| Develop proposals to reform the insolvency regulatory regime following our consultation on reforms to the regulatory framework | Achieved | Policy proposals were developed during the year. The Government’s response was published on 12 September 2023. |

| Publish the outcome of our consultation on incorporating two further United Nations Commission on International Trade (UNCITRAL) model laws on cross-border insolvency into UK law | Achieved | The consultation was published on 7 July 2022 and ran for 12 weeks. The outcome was published the following year end on 7 July 2023. |

| Publish a research report on Corporate Insolvency and Governance Act (CIGA) 2020 | Achieved | The interim report was published 21 June 2022 and the final evaluation was published on 19 December 2022. |

| Publish the findings from our research into the impact on landlords of Company Voluntary Arrangements on larger, retail, hospitality, and leisure businesses | Achieved | The report was published 21 June 2022. |

| Conclude a thematic review on monitoring by Recognised Professional Bodies (RPBs) of Insolvency Practitioners’ engagement with the Redundancy Payment Service and publish the report | Achieved | The report has been completed and was published in April 2023. |

Performance analysis

Developing proposals to strengthen the regulatory regime for Insolvency Practitioners

The consultation on the future of insolvency regulation closed in March 2021 and we were encouraged to receive detailed and thoughtful responses from a wide range of stakeholders. These responses have helped to inform further policy development. The government’s response to the consultation was published on 12 September 2023.

Personal Insolvency Review

A call for evidence was issued in July 2022 seeking views on how the personal insolvency framework currently operates and whether reform is necessary. During the consultation period we held meetings with key stakeholders and attended stakeholder events to help inform our evidence gathering. We received 64 responses to the consultation, which highlighted concerns with the current framework and areas for improvement. We have subsequently published a summary of the responses, including an indication of the work we now need to do to develop proposals for reform.

Company Voluntary Arrangements Report

We monitor the UK’s world-class insolvency regime to ensure that it remains a leading restructuring and insolvency jurisdiction when compared to our international competitors. Research such as the Company Voluntary Arrangements (CVA) report that we published in June 2022 supports this work, helping us to gauge whether the regime is working as effectively as it could, and identify where improvements might be made.

CVAs are an important business rescue tool which allow over-indebted companies to restructure their debts and other financial obligations to continue to trade. In recent years, there has been criticism that the procedure can be unfair to landlords of companies in retail, accommodation and food/beverage industries, where the future obligations under property leases are restructured via a CVA.

The research we commissioned to examine this issue found that landlords have broadly been treated equitably.

International Insolvency

We issued a call for evidence in July 2022 seeking views on the implementation of two model laws developed by the United Nations Commission on International Trade Law (UNCITRAL). Implementing these model laws will be an important addition to the tools available to insolvency professionals when dealing with cross-border insolvencies. The responses we received were largely supportive of the implementation of both model laws and our summary of responses, published on 7 July 2023 sets out the work we will now take forward to implement them.

Oversight of Insolvency Practitioner Regulation

We have worked with Recognised Professional Bodies (RPBs) to develop our approach to oversight regulation and agreed improved processes for dealing with complaints about RPBs.

We published our Annual Review of Insolvency Practitioner Regulation in April 2023 and concluded work to examine risk assessment and risk management undertaken by the RPBs, sharing best practice amongst them.

Our thematic review of monitoring by RPBs of the Insolvency Practitioners that deal with Redundancy Payments Service (RPS) claims was concluded and we published a summary report. The review found that the standard of inspection was of an appropriate quality, but that there was variation in the volume of inspection undertaken. Further engagement between the RPBs and RPS to increase the information made available to regulators is being undertaken as a follow up to this report.

Diversity and Inclusion

The Insolvency Service has continued to play a leading role to encourage and support improvements to diversity and inclusion within the insolvency profession. We published the Diversity and Inclusion Steering Group’s Progress Report and Action Plan.

The agency also launched a network of 20 D&I champions from organisations across the insolvency and restructuring landscape, including insolvency practitioner firms, legal practices and regulatory bodies. We are working with champions to inspire change in the insolvency and restructuring profession. They will be participating in outreach work that includes visiting universities and educational establishments across the UK. They are also taking part in research to help identify barriers and drive improvements to recruitment and progression, as well as helping us to collate, share and amplify existing great practice.

In 2022, we undertook pilot outreach work with several universities across the UK, developing materials for our champions to use. We met with students to raise awareness about insolvency and its important role in supporting the economy and the people in the UK, together with the varied career opportunities in this area.

Our dialogue has continued with international partners about shared challenges to boost diversity and inclusion, with mechanisms to help enable cooperation in this space agreed at the annual meeting of the International Association of Insolvency Regulators.

Strengthen our reputation and impact in investigation and enforcement

| Objective | Status | Commentary |

|---|---|---|

| Focus on Covid-19 Financial Support Scheme misconduct, identifying cases where both civil and criminal enforcement action is appropriate and take recovery action | Achieved | There have been 459 disqualification outcomes, 101 bankruptcy restrictions and 6 criminal prosecutions relating to Covid-19 Financial Support Scheme misconduct. |

| Develop our forensic computing capabilities through a hybrid solution using in-house and external expertise and work towards obtaining an International Organisation for Standards accreditation | Achieved | We delivered improved capability for digital forensic processing to support investigations.We commenced planning for delivery in 2023-24 of a new IT capability for investigators to handle and analyse increasing volumes of digital evidence, enhancing data security in line with our Data Strategy.Work has started on achieving an International Organisation for Standards accreditation to reflect our work in the digital forensic profession, working towards best practices and industry standards. |

| Review and, where appropriate refine, our Enforcement Strategy | In progress | The Enforcement Strategy has been reviewed and will be published in 2023-24. Our Strategic Assessment has been updated for 2023-24 and continues to drive our enforcement activities. |

| Continue to grow our membership of the Government Counter Fraud profession (GCFP) | Achieved | This year 43 learners completed the Insolvency Service Investigator Programme (ISIP) qualification and became accredited members of the Government Counter Fraud Profession. |

| Grow our internal legal expertise by expanding specialist training to more of our paralegal officers | Achieved | We have six paralegals studying on our “CILEX” programme, with the first having qualified as a lawyer in October 2023. |

| Commence a project to build flexibility and resilience in Investigation and Enforcement Services | Achieved | The project has commenced with some rotational posts being created within our Investigation and Enforcement Teams and our Legal Services Division. Four civil investigators have completed the Crime ISIP qualification. |

| Provide transparency about our enforcement activities through regular publication of detailed data through our quarterly scorecard | Achieved | Detailed information concerning our enforcement work has been published through our quarterly scorecard, as well as through Official Statistics. |

How we performed

| Tackling financial wrongdoing | 2022-23 | 2021-22 | 2020-21 |

|---|---|---|---|

| Criminal prosecutions | 113 | 119 | 143 |

| Live company investigations | 152 | 168 | 147 |

| Directors disqualified for misconduct | 942 | 802 | 981 |

| Directors disqualified for more than 10 years | 30.9% | 6.0% | 8.5% |

| Bankruptcy restrictions | 250 | 319 | 302 |

Performance analysis

Enforcement outcomes

Our commitment to using our powers to tackle financial wrongdoing and help ensure a level playing field for business is demonstrated by the outcome of our investigation and enforcement activity throughout the year.

There were 942 director disqualifications and 250 bankruptcy restrictions along with 69 criminal prosecutions in 2022-23.

The average length of a disqualification increased to over 7 years with Covid-19 support scheme abuse tending to attract longer disqualification periods (see below). There were 250 bankruptcy restrictions in 2022-23 (319 the previous year) which reflected the historically low number of bankruptcies since the pandemic. The average length of restrictions has increased to over six years and, as with disqualifications, this can be attributed to Covid-19 support scheme abuse cases.

During the year, 69 individuals faced criminal charges[1] brought by the agency and all were convicted. This was lower than last year, when courts were clearing a backlog linked to the pandemic but is similar to 2019-20 (pre-pandemic). Six of these convictions related to Covid-19 support scheme misconduct and four people were sentenced to immediate imprisonment. There were 73 criminal outcomes with financial orders such as fines and cost orders, which included five confiscation orders with a total value of £445,385.

We also undertook 152 investigations into live companies during the year, which resulted in 49 companies being wound up by the court.

More information on our Enforcement Outcomes can be found here.

Covid-19 Financial Support Misconduct

A key area of focus for our work through the year has been misconduct in relation to Covid-19 Financial Support with 459 disqualification outcomes and 101 bankruptcy restrictions that included an allegation connected to misuse of one or more of these schemes. There have also been six criminal prosecutions for offences connected to the abuse of one or more of these schemes.

We received additional funding to help investigate this new area of misconduct, which led to an additional 61 director disqualifications being obtained. Further funding will be deployed to investigating and acting in relation to this type of misconduct over the next two years.

Alongside our enforcement work, we took steps to recover funds lost to the taxpayer. By the end of the year, 39 had provided an undertaking to pay a total of £835,393. Over £230,000 has already been recovered.

Our work in this area will continue and we expect to obtain further enforcement outcomes and recoveries in the coming years.

Enforcement case studies

Covid-19 financial support misconduct

After pleading guilty to offences involving a fraudulent application for a Bounce Back Loan, two directors of a company were sentenced at St Albans Crown Court to two years and six months and two years in prison, with each sentence subsequently being reduced to 18 months on appeal. One director was also disqualified from acting as a director for three years.

They had claimed a £50,000 loan by stating that the company’s turnover was £200,000. However, it was closer to £40,000. After our investigators made contact, and they realised they had been caught, they repaid the Bounce Back Loan in full.

Covid-19 financial support misconduct

A director was disqualified for 11 years following an investigation into how the company obtained a Bounce Back Loan of £50,000 in October 2020.The rules of the Bounce Back Loan scheme were clear that businesses had to have been trading on 1 March 2020 to be eligible for any funding.

Following the company’s liquidation in 2022 with debts of over £150,000, our investigators found it had ceased trading in October 2019, with the restaurant currently at the address being owned by a different company.

They had taken out over £400,000 in cash from the company’s bank account between October 2020, when the loan money was received, and March 2021. Yet there was no evidence to show the funds had been spent for the economic benefit of the company. There are ongoing discussions regarding recovery of funds.

Building company takes deposits despite being insolvent.

The director of a building company took deposits and advanced payments totalling just under £182,000 from five new customers after the company had entered compulsory liquidation in May 2019.

In taking these funds, the director abused the trust of clients knowing that the company could not carry out the work that he promised.

Investigators also discovered that the company had continued to trade despite being wound up and that the director had failed to disclose assets of £35,000 to the liquidator. He had also withdrawn £25,000 from the company accounts for personal use and to pay third parties.

The court ordered that the director be disqualified for a period of 10 years and was also ordered to pay cost of £6,649.

Care home investment scheme

In Hampshire, the director of a company set up as an investment vehicle to build care home accommodation misled investors.

Investors parted with a total of £8.1 million based on marketing materials produced by the company which promised redevelopment of a site it owned in County Durham.

When the company entered liquidation in December 2020, investigators found that before it received the investment funds, the company had been refused planning permission by the local authority to deliver the plans it promised in its marketing materials.

The director did not dispute his actions and accepted a 10-year disqualification undertaking in May 2022.

Live Investigation – Coaching and Mentoring company

A mentoring and coaching limited liability partnership (LLP) was wound up in the public interest following an investigation. The company was incorporated in 2012 and promised life coaching, mentoring, career, and business development services.

Customers paid substantial funds for these services. Accounts showed the LLP received £2.4m between 2014 and 2022. At least half of this income was paid directly to one of the senior members of the LLP.

The LLP failed to deliver up its trading and financial records and therefore investigators were unable to fully determine the exact nature of its business activities and that it filed misleading or false accounts.

The judge deemed efforts by one the LLP’s members to obstruct our work were unacceptable and praised the investigation team for its professionalism.

Director Prosecution and Disqualification

An important part of the agency’s criminal enforcement work concerns protecting the public from so called ‘phoenixing’ or ‘phoenix trading’. This occurs where a company enters insolvent liquidation and the directors form a new company, using the same or similar name, in order to continue trading much as before, often with the deliberate intention of avoiding the claims of the insolvent company’s creditors.

In a recent case, a director was convicted at Liverpool Crown Court of 12 offences under Section 216 of the Insolvency Act 1986 in respect of his ‘phoenix’ companies. The offences were committed despite warnings. At the sentencing hearing which drew national media coverage, the judge found the duration of the offending and risk presented by breach of the statutory protections made the offences “so serious” that they passed the threshold for imprisonment. He imposed a suspended sentence of eight months imprisonment, which the Judge stated would have been more but for the defendant’s early guilty plea and personal mitigation. He was also disqualified from being a company director for five years.

Use of new powers

The sole director of an electrical installations company was disqualified after he applied for Bounce Back Loan funding on two separate occasions, despite his company having already ceased trading and not being eligible for any financial assistance.

Although he later dissolved the company, he was caught thanks to new powers[2] granted to the agency in 2021 which enable us to investigate directors of dissolved companies.

Investigators discovered that not only had the company not been trading since September 2019 – meaning that he had dishonestly applied for the loan – but he had immediately transferred the £15,000 loan to another bank account. Investigators then discovered that he had applied for an extra £5,000 top-up loan for the company in November 2020 – a month after the business had finally been dissolved. He was disqualified for 11 years.

Working with partners

Operation Kingston was an investigation into an Organised Crime Group that we undertook in collaboration with Northumbria Police. It has resulted in 17 companies being wound up in the public interest, with most of those companies exhibiting abuse of the Bounce Back Loan scheme and other fraudulent activity.

Operation Sander was an investigation in collaboration with Birmingham City Council that has resulted in 9 companies being wound up in the public interest to date, principally on the basis that they abused Covid support schemes. Winding up petitions have been issued in respect of five further associated companies.

There was a challenging investigation of a group of companies operating a mentoring scam that targeted vulnerable families and operated in the manner of a cult. The companies were wound up in the public interest despite opposition. Significant national publicity has ensued, including a documentary broadcast by the BBC.

Sharpen our operating focus

| Objective | Status | Commentary |

|---|---|---|

| Review the distribution process for Payment Protection Insurance (PPI) realisations to make it more efficient | Achieved | Improvements have been identified and implemented with average productivity increasing by more than 90% to meet newly agreed targets. |

| Improve the customer experience of those impacted by redundancy | In progress | The implementation of planned improvements has commenced and will be implemented in the first quarter of 2023-24. Overall customer services scores for the Redundancy Payments Service fell from 84% last year to 82% this year. This is largely due to issues in relation to customer contact which will be addressed by the planned improvements. |

| Drive improvements in Official Receiver Services processes to increase efficiency | Achieved | A new Central Case Team was launched in January 2023 to create a single-entry point for most new cases and to deal with high-volume, low-complexity bankruptcy work more efficiently. A new suite of internal performance measures to drive performance has been implemented. |

| Start to implement our new agency data strategy to improve operational decision-making and performance management | Achieved | Implementation is underway with improvements to management information in place and further work planned for 2023-24. |

| Focus on maximising asset realisation in cases where creditors choose not to appoint an Insolvency Practitioner | Achieved | Our target to exceed 40,000 distributions to creditors has been exceeded, with us making 49,674 distributions. Official Receiver Services realised over 18,000 assets to the value of £27.9m this year. |

| Continue our programme of offering professional qualifications to our staff | Achieved | Three candidates have passed the JIEB personal insolvency exam and two have passed the corporate paper. Five new candidates have been enrolled for the JIEB. Four candidates have passed the CIP qualification. |

| Increase engagement with our key stakeholder groups and raise awareness of the Official Receiver’s role | Achieved | We have agreed a new External Communication Plan and increased our engagement with our stakeholders. |

How we performed

| Supporting those in financial distress | 2022-23 | 2021-22 | 2020-21 |

|---|---|---|---|

| New insolvency cases handled by our Official Receivers | 9,028 | 8,467 | 11,607 |

| Debt Relief Orders | 24,267 | 22,601 | 17,938 |

| Online Debtor’s application Bankruptcy orders | 5,558 | 6,669 | 9,830 |

| Breathing Space[1] applications granted | 76,599 | 58,476 | - |

| Breathing Space applications granted for people in a mental health crisis | 1,341 | 908 | - |

| Creditor petition bankruptcy orders | 1,194 | 1,089 | 999 |

| Redundancy payment claims | 59,234 | 44,895 | 96,219 |

| Compulsory liquidations | 2,287 | 712 | 769 |

| Maximising returns to creditors | 2022-23 | 2021-22 | 2020-21 |

| Dividends returned to creditors | £45.7m | £42.7m | £35.9m |

| Reports to Creditors issued within 15 days of an attended interview | 96% | 95% | 66.53% |

| Performance measures | 2022-23 | 2021-22 | 2020-21 |

| At least 84% of our customers are satisfied with our work | 82% | 84% | - |

| Official Receivers returning funds to the economy by making 40,000 distributions to creditors and debtors (new measure) | 49,674 | - | - |

| Issue 85% or more of Breathing Space statutory notices electronically (new measure) | 86% | - | - |

| Issue an Official Receiver’s report to creditors within 15 days of interviewing (or a decision that no interview is required) in at least 93% of bankruptcy and liquidation cases | 95.9% | 95% | 66.5% |

| Process redundancy payment claims in an average time of 14 days or less | 14.4 | 12 | 12.8 |

| Make 95% of bankruptcy orders sought by individuals within 2 working days | 95.9% | 98% | 97.2% |

| Determine 95% of Debt Relief Order applications within 48 hours | 98.9% | 99% | 99% |

| Answer 95% of calls to our enquiry line and at least 85% within 2 minutes | 96.9% 87.5% | 97% 94% | -[2] |

[1] The Debt Respite Scheme (Breathing Space) will give someone in problem debt the right to legal protections from creditor action for up to 60 days. The protections include pausing most enforcement action and contact from creditors, and freezing most interest and charges on their debts, giving them time to get advice and find an appropriate debt solution.

[2] Agency enquiry lines were closed in 2020-21 due to Covid-19 so there are no 2020-21 figures available. #### Maximising returns to creditors

Our centralised asset realisation teams have focused on realising specific assets such as Income Payment Agreements, properties, pensions and complex assets. This has helped to create specialisms and drive efficiencies. The Intelligent Customer function has focused on the timeliness, quality and quantity of solicitors’ instructions to drive asset realisations. Official Receiver Services realised over 18,000 assets to the value of £27.9m this year and distributed £21.3m in 1,705 cases. The PPI team exceeded annual plan targets in year with 43,389 payments, against a target of 31,500 and £24.4m distributed, against a target of £20m.

This performance has been driven by a comprehensive continuous improvement review of processes and a greater focus on individual level performance.

Bounce Back Loans Case Study

Two companies were wound up in March 2021. The sole director of the companies applied for and received bounce back loans totalling £50,000 and £45,000.

Funds obtained under the Bounce Back Loan scheme should only be used to provide an economic benefit to the business. Our investigation established the director had used some of the funds in part for his personal use and, additionally, had loaned funds to a third-party company of which he was a director.

Negotiations with the director and third parties to recover the misapplied bounce back loans, and other company funds, have resulted in the repayments of £16,243 and £7,500.

In addition, repayment agreements signed in respect of the companies are in place with both the director and third-party company. Under the agreements, which commenced in August 2022, the companies will recover a further £31,971 and £41,800.

Liquidation of Health Group Case Study

The group consisted of eight companies offering various forms of cancer treatment, including Proton Beam Therapy (PBT) which operated across the UK. On 13 July 2022 the companies were wound up and the Official Receiver was appointed as liquidator.

On the making of the Orders, the appointed Official Receiver (OR) liaised with local Official Receiver offices, the Environment Agency and Natural Resources Wales to manage the safe shut down of the company sites. This included retaining their physicists who advised on the safe powering down of the multi-million pound PBT machines which contained radioactive materials.

As part of a wider cross-government strategy to ensure an orderly liquidation that would protect patients and minimise treatment disruption, the OR and our Forensic Computing Unit worked with the NHS to assist with the processing of patient data.

IT Services Provider Case Study

The company provided secure data facilities and cloud services to a number of public and private sector entities who in turn provided public services. They had over 150 employees at two locations and in the operating company 2020 annual accounts it reported turnover of £38.1m.

In October 2022 the court appointed the Official Receiver as liquidator and he successfully applied for the appointment of Special Managers from Ernst & Young LLP to assist with the liquidation. The Official Receiver continued to trade the company to ensure public services were maintained whilst he explored the possibility of finding a buyer for the company.

Company staff were retained to assist with the liquidation including the decommissioning of the cloud platform, the migration of the accounts, the secure destruction of c22,000 data bearing devices and the asset realisations. All staff were made redundant by 31 March 2023.

More efficient services

Our Official Receiver Services (ORS) have introduced a new Central Case Team to deal with high-volume, low-complexity bankruptcy work more efficiently. The national OR Central Case Team (CCT) launched in January 2023 and has established a robust case management and tracing team, improved the customer journey and reduced the cost of administering a case. Local OR offices can now focus on managing the administration and investigation of complex insolvencies.

Following a detailed planning phase during the second half of the year, OR Aftercare launched on 24 April 2023. This new team brings technical and administrative expertise together to form one function within ORS to manage the follow up aftercare activities. The new team will create a more efficient way of dealing with queries once OR CCT and local offices have completed their work. Our local offices will be freed up to focus solely on new and current case work, sharpening our focus and enhancing local office resilience.

By centralising aftercare enquiries, we will be able to consider new approaches to different query types, and deliver a more efficient, swifter service to our customers. We will gain better data and insight into the range and nature of our aftercare work and how we can best approach the management of enquiries in the future.

ORS have also implemented a new suite of internal performance measures to drive up performance and increase efficiency. The measures will be reviewed and developed in 2023-24 to provide additional focus on key areas.

Engagement activities

Our stakeholder engagement board has been revitalised and we have continued our regular liaison across the range of our key stakeholder organisations. Our external communications plan includes regular blogs focusing on specific issues to help our stakeholders. The first published blog for Debt Awareness Week resulted in a 2300% increase in viewing traffic. We have highlighted the work of ORS through R3’s recovery magazine and at the agency’s annual Insolvency Live event.

We have improved our stakeholder and customer information to help inform those with problem debt and have worked with the Money and Pensions Service and other organisations that approve Debt Relief Order (DRO) intermediaries to better understand why individuals may have ended up in bankruptcy rather than a DRO or other debt solution. We have also improved our information on GOV.UK.

Our professionalism was recognised by the insolvency industry when it awarded the Turnaround, Restructuring and Insolvency award for Business Continuity to the Official Receiver and the special managers appointed to deal with the Baglan Bay power plant.

All these activities have supported us to help deliver economic confidence and in particular highlight the Official Receiver’s key role when returning money to creditors. They have helped to raise awareness about the essential public service we deliver to help support those in financial distress, as well as our role in tackling financial wrongdoing.

Agency Complaints

| 2022-23 | 2021-22 | 2020-21 | |

|---|---|---|---|

| Total complaints received | 306 | 339 | 406 |

| Tier 1 | 226 | 259 | 317 |

| Tier 2 | 60 | 59 | 68 |

| Tier 3 | 20 | 21 | 21 |

We answered 95% of complaints within 10 working days and 100% within 20 working days. 74% of our customer complaints are resolved at Tier 1 with only 9% of all formal complaints escalating to the final tier. We are continuing to focus on learning lessons from complaints, with our lessons learned process identifying some 130 required improvements and attendant mitigating actions being implemented.

The Parliamentary and Health Service Ombudsman (PHSO), our oversight regulator, has launched a set of UK Central Government Complaint Standards. The standards will provide a unified approach to complaint handling across all government departments. These standards will support better communication between providers and the public, leading to improved, more efficient public services. We are in the process of adopting these new standards which will offer an excellent opportunity for us to ensure we continue to utilise best practice in our complaint handling, allow the public to better understand the complaints handling process and uphold our commitment to learning from our mistakes.

Shape a new approach to prevent insolvency and rehabilitate through education and guidance

| Objective | Status | Commentary |

|---|---|---|

| Continue the development of a company healthcheck tool | Objective amended | Following the discovery phase of this project, a decision was taken in line with feedback received from stakeholders to replace a healthcheck tool with a content hub. The first phase of this was launched on 10 July 2023. |

Performance analysis

Director Education

Our Director Education activity is focused on developing a suite of guidance materials and signposting to direct company directors to external sources of advice and guidance as to preventative steps they can take throughout the life of their company to avoid insolvency or mitigate the negative impacts on creditors and themselves should their company fail.

Following the initial stage of the project, a decision was taken in line with feedback received from stakeholders to replace a healthcheck tool with a content hub. The healthcheck tool had been conceived as a web-based tool in which directors could input company information and be steered towards tailored guidance. Having engaged with stakeholders, it was felt that the strategic objective could be achieved more expediently through a static content hub with content updated and evolved on an ongoing basis. This approach has been quicker to deliver at a lower cost and enabled the agency to respond to an identified need to support businesses and company directors.

Extensive user research was undertaken, including with directors of small companies (our target users), other government departments like HMRC and Companies House and industry bodies such as the Institute of Directors and the Federation of Small Businesses, to understand their education requirements. To deliver something quicker at a lower cost, we have developed a Directors Information Hub to be hosted on GOV.UK. This provides information and guidance, in the form of content pages, signposting, case studies and animation videos to support directors to make informed choices.

The Hub was launched at Insolvency Live in July 2023 and we are continuing to review, update and evaluate content to ensure it remains current and meets the education needs of directors of small companies. We will continue to iterate the hub over time with quarterly content releases, more animations and case studies and considerations of additional capabilities within the hub itself.

Strengthen and modernise our technology and infrastructure

| Objective | Status | Commentary |

|---|---|---|

| Continue to develop our customer digital services to automate more processes, improve customer access to information via a dedicated portal and reduce the number of enquiries | In progress | The creditor portal is progressing well, and delivery of the full service is on track for 2023-24. We have successfully partnered with the Government Digital Service to pilot a new Form Builder tool for government to improve channels for customers to submit information. |

| Maintain and build our customer ‘net easy score’ and use the findings to help inform our future systems development | Achieved | We have maintained our performance and delivered several changes and enhancements that will improve the user experience. |

| Complete the remaining elements of our programme of work to update our technology | In progress | Our remediation programme is almost complete with one application to still be remediated. |

| Enhance Teams collaboration by introducing more functionality | In Progress | We continue to use Microsoft Teams as our unified communications solution and have introduced monthly Calling All Colleagues sessions hosted by the Chief Executive using Microsoft Teams Live. Further work is now planned for delivery in 2024-25. |

| Improve the user experience scores in the People Survey | Achieved | We stayed ahead of our expected trajectory and have a considerable programme of improvements underway which should be reflected in next year’s performance. |

| Progress the design and development of a new case management system for Official Receiver Services and Estate Account Services | Achieved | The development of the new case management system, including new management information capability, is underway and on target for implementation in 2024-25. |

| Start to implement the new data strategy | Achieved | The principles for the data strategy have been approved, along with the new operating model for data and analysis, with implementation underway. |

How we performed

| Performance measures | |||

|---|---|---|---|

| 2023-22 | 2021-22 | 2020-21 | |

| Customer service - net easy score | |||

| ‘Overall, how easy was it to complete your application/submit your information today’ | 81% | 81% | - |

| People survey response to how our user community feels about the tools to do their job | 58% | 58% | 57% |

Performance analysis

We have worked with an external company to better understand our technology costs and look at how we can try to reduce these going forward. Whilst further work is required to fully understand these results, it is an important step towards improving efficiency whilst ensuring staff have the right tools for the job.

In line with this work, we have also conducted a substantial piece of work through our Modern Workplace Technology project which mapped out the different roles that we have across the agency and the technological requirements of those roles, to ensure we provide the right tools to staff in the coming year.

We have delivered relevant changes to our Case Management systems to facilitate the new ways of working as required by the newly formed Central Case Team, which will drive extra efficiencies in the organisation.

Application remediation

Our remediation programme has successfully brought 17 applications up to date and back into support over the last few years. The programme has delivered a significant amount of work whilst maintaining both our internal and external customer satisfaction and user experience scores.

Our customers – internal

We have delivered a range of changes and enhancements that will improve the user experience or enable them to carry out their interactions with us more efficiently.

We have provided our investigators with new software so they can draw down information from open-source data streams, providing a well-rounded picture of companies and individuals in a fraction of the time previously spent performing the task. They also have wider access to accounting software to quickly analyse accounting information, identify suspicious transactions and improve the evidence provided to court, removing the previous processes of manually converting data.

Improved technology means users are now able to use dictation software on laptops to create documents and emails, helping reduce the amount of time spent sat at the desk. Our Performance & Analysis teams have new data solutions and new automated data flows from external sources into our case management programmes contribute to improving our efficiency.

The first part of our ongoing work around our Forensic Computing Provision has been completed, increasing our capability for forensic investigations and ensuring the agency is able to meet any demand for these critical services. The second phase of the project is on track to go live in the 2023-24 financial year. This will be a new cloud-based service that will enhance operational flexibility and security to enable investigators to securely access cases directly.

Our customers – external

Our new service digitalising the ‘Returns for Creditors’ and ‘Proof of Debt’ forms, which will massively improve our service for customers, successfully passed its alpha assessment. We were the first Government agency to publish a form using the Government’s new form building tool on GOV.UK. This form allows customers to amend a redundancy claim for holiday pay, making the process easier, more accessible, and with inbuilt validation to help customers provide the right information first time.

Transforming workplaces

The transforming workplaces project aims to deliver an improved estate to respond to changes in the way people work and interact with government services. Responding to the increased use of online and telephony channels by our customers, stakeholders and employees, we are transforming the way we operate and the places where we work.

The project is pursuing a key goal to increase collaboration and improve our flexibility and sustainability by creating 11 regional centres around the UK to enable multi-directorate and multi-functional working. It will also deliver savings and the cost of our estate will more overtly demonstrate value for money.

Following the closure of our offices in Watford, Southend and Cambridge, we have developed multiple support schemes throughout the year to help our staff members in their move to our newly formed regional centres.

In June 2023, we moved to a new Government owned office in Edinburgh and have also started designing the refit of the Manchester hub. This will improve the working conditions for our people, offering vibrant spaces which are fit for the future.

Shape the agency as a great place to work

| Objective | Status | Commentary |

|---|---|---|

| Adopt the Cabinet Office Functional Standards[1] management standards | Achieved | Business planning has been introduced to assure the compliance with the structural standard GovS001. The process of self-assessment, peer review, and continuous improvement has been implemented for the subject specific standards and linked to corporate governance processes. |

| Introduce Heads of profession and increase skills and expertise so that all our people are a member of at least one of the Civil Service Professions | Achieved | Heads of profession and profession leads have been appointed. A ‘professions zone’ has been created to engage all staff in one or more professions and this is supported by our skills tool. A capability hub is being built to add to our upskilling facilities. |

| Develop our system of performance related reward to make it more inclusive and competitive | Achieved | Our scheme to give individual directorates more control and make them more accessible was implemented in July 2022. |

| Undertake a review of our appraisal system to improve both the consistency and quality of our people performance management | Achieved | The review is complete and recommendations will be progressed in 2023-24. |

| Commit to an agency environmental policy | Achieved | Our environmental policy is in place and its objectives are embedded within our procurement activities and in our new Sustainability Strategy. |

| Undertake an agency sustainability review | Achieved | A full review has been completed and used to inform the development of the new sustainability strategy. |

| Develop an agency Sustainability Strategy that will include objectives and targets aligned with our parent department’s Sustainability Strategy and the international Sustainable Development Goals | Achieved | The Sustainability Strategy was introduced in November 2022. |

[1] These are a suite of management standards developed by the Cabinet Office to create a coherent, effective and mutually understood way of doing business within government organisations Functional Standards - GOV.UK (www.gov.uk)

How we performed

| Performance measures | 2022-23 | 2021-22 | 2020-21 |

|---|---|---|---|

| Ensure at least 5% of our headcount will be apprentices (new measure). | 3% | - | - |

| Fill 95% of roles against our resourcing profile (new measure). | 99% | - | - |

| Improve our people survey scores across all the 9 themes of the 2022 people survey. | Not achieved. | ||

| Downturn in 4 themes, static in 3 and 2 increases. | Not achieved. | ||

| Downturn in 8 themes and 1 static. | - |

Performance analysis

People Survey

The annual Civil Service People Survey looks at civil servants’ attitudes to, and experience of working in government departments. The agency response rate to the survey was 76% compared to 65% for the Civil Service as a whole. Of the 9 survey themes, the agency was above or equal to the Civil Service benchmark in 6 and higher or equal in 3 of the High Scoring benchmarks. However, when comparing the results with last year’s survey, the agency showed a downturn in 4 themes, 3 remained static and there were 2 increases.

The overall engagement score has reduced from 2021 and is now 59% compared to 62%, against a target of 65%. The Civil Service overall score and benchmark was 66%. This was not unexpected given some significant changes in the agency. Progressing our transforming workplaces project to consolidate the number of our offices and move to 11 regional hubs has impacted those whose local offices face closure.

The agency performs well in areas associated with performance recognition and follows a similar trend to the wider population on wellbeing. The People Survey leadership ratings dropped 4% which was disappointing. We intend to invest more in leadership development and will undertake an assessment to provide an objective view of the current status and agree outcomes to drive future activity.

We are developing an action plan that will focus on improving key areas that will be most impactful to both our performance and our people. Progress will be monitored by our People Committee throughout next year.

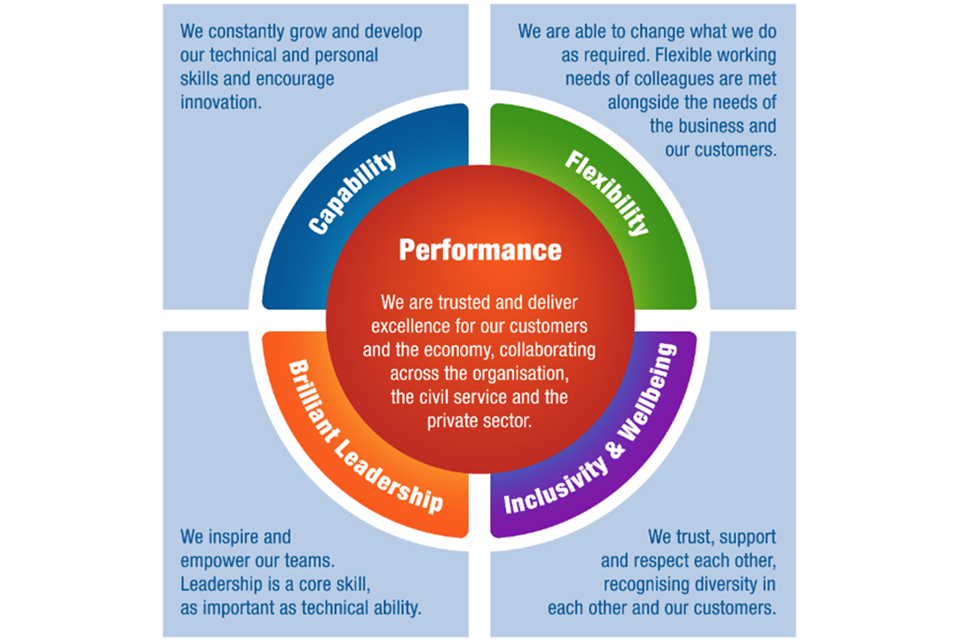

Agency values

Our agency values are the core values that form the foundation on which we perform our work and conduct ourselves. A significant piece of work was completed during this year to develop and introduce new agency values. The existing values framework was outdated and needed refreshing to better align with our agency five-year strategy, and our Inclusion First and People Strategies. The new values were launched in January 2023.

Improving capability and professionalism

The agency has developed a Skills Tool for employees to capture and build on personal skills, knowledge and qualifications. The tool will help identify gaps for learning and development and provide an agency-wide skills profile. This will aid flexible resourcing and inform strategic workforce planning. It will enable the agency to get people resource into the right places at the right times. It will also facilitate improved talent development and upskilling of employees. The agency will review skills and capability metrics in the coming year to determine appropriate assurance measures and use them to develop plans for building future capability and aid succession planning.

Having exceeded our target of 41 apprentices last year by 5, we did not achieve our target this year of having 5% of our headcount as apprentices. We continue to be keen to have a wide range of apprenticeships in the agency to enable us to develop talent internally through professional routes. Our entry level business administration and operational delivery apprenticeships are now well established and in the last year we have seen some of our apprentices progressing into higher level professional apprenticeships and joining our in-house accredited learning programme to become investigators or examiners.

Recognition for our apprentices

An Official Receiver Examiner was shortlisted for the Best Apprentice or Newcomer in the prestigious Public Sector Counter Fraud Awards. This award is presented to apprentices or new recruits in the Counter Fraud sector who have made impressive progress and demonstrated huge potential to go further. They had completed the examiner qualification 3 months ahead of schedule whilst obtaining over 50 Bankruptcy Restrictions and dealing with several complex defended cases.

Our Apprentice of the Year award recognised one of our Business Administration apprentices in the PPI team who realise assets relating to mis-sold payment protection insurance and distribute funds to creditors. They were recognised for their determination, motivation and initiative to learn new skills.

We are successfully supporting our people to gain additional skills and legal qualifications, with our first candidate to participate in our CILEX[3] programme, having fully qualified as a lawyer in October 2023, with a further five students participating in the scheme. Three candidates have passed the JIEB personal insolvency exam and two have passed the corporate paper. Five new candidates have been enrolled for the JIEB. Four candidates have passed the CIP qualification.

Diversity, Inclusion and Wellbeing

We continue to make progress in line with our Inclusion First Strategy, which makes a significant contribution to making the agency a great place to work. Diversity issues are regularly considered by our People Committee. Wellbeing activities have focused on improving mental health and interventions have led to a reduction in mental health absences by 35%.

Sustainability

Following on from the establishment of our new Environmental Policy in March 2022, the agency has now committed to a new Sustainability Strategy. We have set our vision in this space to be ‘an agency that is resilient and adapted to a changing climate’. Our Strategy is based around six main themes: carbon and energy management, waste and resource management, biodiversity and nature recovery, sustainable procurement, sustainable travel, and a sustainable workforce.

For each theme, we have set clear objectives and targets, both aligned with government legislation and policy, but also considering best practice from both the private and public sector. We have committed to establishing a new Sustainability Team to deliver our objectives and we now have dedicated resource in respect to waste and recycling, engagement, and monitoring and reporting.

We have continued to adopt Sustainability Appraisal of large programmes and plans to identify potential sustainability issues, or where improvements can be made, including the future locations for our estate, and in respect to our upcoming new Sustainable Procurement Strategy.

Sustainable Development Goals (SDGs)

As a government agency we have a responsibility to help to deliver the SDGs. We have incorporated them into the development of our Sustainability Strategy and as an agency, we are committed to playing our part in their delivery. In section 5 of our Strategy, we have highlighted the relevant SDGs and how we can deliver change through our daily business activities, how we manage our estate, and via our supply chain.

Greening Government Commitments

In line with the government’s target for all departments to reduce the environmental impact of their activities from 2021 to 2025, we continue to report on the Greening Government Commitments (GGCs). The headline figures are as follows:

| GGC reporting year 2022-23 | GGC reporting year 2021-22 | Baseline year 2017-18 | ||

|---|---|---|---|---|

| Energy (KWH) [1] | 558,832 | 438,398 | Reported under BEIS totals | |

| Water (m3) | 4,153 | 4,242 | 3,888 | |

| Travel (km) | 2,480,086 | 780,132 | 1,853,038 | |

| Paper usage (A4 reams equivalent) | 3,682 | 2,228 | 24,363 |

[1] Energy, water, and waste figures reflect only 11 of our offices, as those leased from other government departments are out of scope to prevent double counting, as per the GGC guidance. See section below on ‘Waste’ for further updates on our waste data.

Energy 8

| Usage (kwh) | CO2e (t) | Expenditure (£) | |

|---|---|---|---|

| Mains standard grid electricity[1] | 558,832 | 116.97 | 187,283.98 |

| Natural Gas[2] | - | - | - |

[1] Some of our offices are on green electricity tariffs. We are in the process of determining which offices these are, but in the meantime all electricity usage is included under “mains standard grid electricity”.

[2] Some of our offices use gas as well as electricity, but we are not currently capturing this data. We are working on collecting this data to have a better understanding of our carbon emissions.

The overall electricity consumption in our offices has increased from last year. This is likely due to increased office attendance following the end of the Covid-19 lockdown restrictions. We have a mandatory minimum 40% office attendance requirement for most staff.

Transport

| Distance (km) | CO2e (t) | Expenditure (£) | |

|---|---|---|---|

| Non-fleet vehicles | 370,454 | 63.23 | 210,891 |

| Rail | 1,995,576 | 70.82 | 562,240 |

| Taxi | 1,860 | 0.28 | 3,867 |

| Domestic flight | 74,123 | 9.64 | 13,977 (total for all flights) |

| Other flights | 38,073 | 3.54 |

As with energy, our distance travelled increased in 2022-23 compared to 2021-22. This is largely due to the lockdown in 2021-22 which placed restrictions on travel. In addition, we are now including taxi travel, which has not been counted previously.

Waste

| Amount (t/ A4 reams equivalent) | CO2e (t) | Expenditure (£) | |

|---|---|---|---|

| Paper usage | 3,682 | 0.02 | 16,425.80 |

We are currently waiting for waste figures from our Facilities Management company ISS, who are contracted to provide these.

Compared to a 2017-18 baseline, our paper usage has decreased by over 80%. We are investigating ways to further reduce this, with an objective to move towards a paperless office environment in line with the agency’s digital first principles.

Water

We do not have water submetering at our sites, so these figures are estimated based on total floor area at in-scope sites. We have used CIRIA estimates for “good practice” as our office use is limited with no catering, external use of water, washing of fleet, or watering of plants. We are working with our landlords to install submeters so that we have a more accurate picture of water usage across our estate.

Mitigating and adapting to Climate Change

As per our Sustainability Strategy, we have an objective to assess options for carbon offsetting in the context of achieving net zero. Caution will be taken to ensure this is done appropriately to reduce the risk of greenwashing.

We are in the process of rationalising our estate, reducing the number of offices from 22 to 11. It is anticipated that this will reduce our carbon emissions further.

Our travel and subsistence policy and guidance encourages employees to consider alternative methods to flying. In addition, we are drafting a new sustainable travel policy which will be completed by 2023-24.

We are in the process of assessing our risks as an agency in view of a changing climate. Our upcoming Carbon and Energy Management Plan will examine actions the agency can take to both mitigate and adapt to climate change.

Minimising waste and promoting resource efficiency

As an agency, we implement waste to reuse schemes. As part of our work to create regional centres, we have set up a procedure for office furniture, such as desks, to be collected by reuse organisations. These organisations send the collected furniture to be reused by charities.

Procuring sustainable products and services

Our Sustainable Procurement Working Group have been developing our Sustainable Procurement practice in line with Defra’s Flexible Framework and working on a new Sustainable Procurement Strategy that includes new Environmental Sustainability requirements in our tender processes. The Sustainable Procurement Strategy will be published in 2023-24.

ICT and Digital

The Insolvency Service have adopted the Greening Government: ICT & Digital Services Strategy. As part of this, we report annually on our ICT emissions, waste, sustainability strategy statements and policy results.

Rural Proofing

We remain committed to meeting the needs of rural businesses and communities. As part of our upcoming estate rationalisation project ‘Transforming Workplaces’, we have ensured that we will maintain office locations in Scotland, Wales and each of the English regions. We have undertaken a Sustainability Appraisal of our Transforming Workplaces project to identify any issues or improvements that can be factored into the decision-making process. We seek to embed Defra’s rural proofing impact assessment into the agency’s existing Sustainability Appraisal Framework to enable policy makers to take rural proofing into consideration at an early stage.

Biodiversity and Nature Recovery.

We are developing biodiversity and nature plans tailored to our regional centres. Whilst the agency does not have any landholdings, we are keen to work with our landlords to develop opportunities for nature recovery and improved biodiversity. We are also keen to raise awareness of local green infrastructure to our staff in our regional centres, as we recognise the benefits that access to nature has for our mental wellbeing and physical health.

Sharpen our financial model to ensure sustainability

| Objective | Status | Commentary |

|---|---|---|

| Reduce the structural deficit in our Official Receiver Services by increasing income and reducing costs | Achieved | The ORS Financial Sustainability project has delivered around £5m of annual cashable benefits to date and improved operational efficiency. Work has been undertaken to begin reviewing our ORS related fees to appropriately reflect the costs of service provision. Whilst the project has delivered substantial benefits this year as planned, operational volumes remain well below historical levels and forecasts, meaning that further benefits will be required in future years to mitigate an underlying structural deficit. In 2022-23, we have recognised an additional £137m across 2021-22 and 2022-23 financial years which is due to be surrendered to the Consolidated fund. This income relates to historic cases and does not address the structural deficit. |

| Assess opportunities to introduce commercial models to flexibly manage surges in demand for our services | Achieved | Our ORS Financial Sustainability project has identified options for an Intelligent Resourcing model that will offer alternative solutions should operational volumes increase materially. |

| Benchmark our central costs to ensure that they are appropriate for our future size and shape of the organisation | Achieved | We have benchmarked all our central costs. A major project has been initiated as part of our five-year strategy to transform our workplaces, halving our estates footprint and leading to savings in annual property costs. An independent review of our IT cost base indicated that material cost reductions may be available, and recommendations from that review will be taken forward at pace. |

| Manage organisational headcount so that we meet cross-Government targets | Achieved | At the end of March 2023, agency staffing levels stood at 1,580 FTE, 9% below the March 2025 assumption agreed at SR21 with our sponsor department BEIS. |

How we performed

| Performance measures | 2022-23 | 2021-22 | 2020-21 |

|---|---|---|---|

| Ensure all relevant procurements include social value and sustainability evaluation criteria at a minimum of 10% of overall score | Achieved | Achieved | Not applicable |

| Meet or exceed the Government target of 33% of spend going to Small and Medium-sized Enterprises (SMEs) by March 2023 | 33.4% | 35% | 35% |

| Pay 80% of supplier invoices within 5 calendar days | 97% | 96% | 96% |

| Pay 100% of supplier invoices within 30 working days | 99% | 100% | 100% |

| Where contracts meet the criteria, we will ensure all our suppliers adhere to the Prompt payment Code[1] | Not applicable | Not applicable | Not applicable |

[1] The Prompt Payment Code only applies to contracts over £5m and there were no contracts that fulfilled this criterion in 2020-21, 2021-22 and 2022-23. This measure has not been included in the next annual plan.

Performance Analysis

Improved financial sustainability

Our work to improve the financial sustainability and resilience of the agency by implementing more efficient and flexible operational processes has been delivered to plan. We have established workstreams to develop intelligent resourcing models to enable us to be more flexible should case numbers start to rise unexpectedly.

We have delivered annual cashable benefits this year through the implementation of the increase to company and creditor deposit fees and the introduction of two new centralised functions into ORS bringing more efficient and flexible operational processes. Based on our estimate of future case volumes the annual cashable benefits are forecast to be £3.7m in 2023/24, increasing to c. £5m from 2024/25 when volumes reach the forecast steady state. The OR Central Case Team launched in January 2023 and operates nationally to administer high-volume, non-complex cases, reducing the cost of administering a case. The OR Aftercare team launched in April 2023 created a more efficient query handling service.

A dedicated workstream has been established to review all our ORS related fees to evaluate whether they should be changed to help ensure full cost recovery.

Although our project to improve financial sustainability has delivered planned benefits, the operational context remains very challenging. Operational case volumes remain well below pre-pandemic levels. Organisational costs (particularly IT and estates) have also been significantly impacted by recent large increases in inflation.

Financing

We are financed through a combination of funding and income from three sources.

1. Funding from our sponsor Department, the Department for Business, Energy, and Industrial Strategy (BEIS)[5].

During 2022-23 this amounted to £68.1m (2021-22: £71.8m) of which £0.0m was for capital (2021-22: £2.3m) (see Statement of Changes in Taxpayers Equity).

2. Income from HMRC National Insurance Fund (NIF) to undertake administration of the Redundancy Payment Scheme.

For 2022-23, this amounted to £9.5m (2021-22: £10.0m) (see Note 4); We also received funding from HMRC NIF to make payments to individuals who have been made redundant where the employer cannot pay. The funding for these payments for 2022-23 was £275m (2021-22: £256m) (see Statement of Changes in Taxpayers Equity).

3. Income generated from fees charged for work carried out on Insolvency Case administration by the Official Receiver Services (ORS).

Income recognised in 2022-23 was £115.1m (2021-22: £117.8m) (see Notes 1 and 5 for more details). It should be noted these balances include the recognition of additional excess income from PPI receipts in respect of previous case years. Excluding these, the Agency’s fees recognised are £49.1m (2021-22 £46.5m).

Financial results

We are reporting a £10.4m surplus against our budget allocation for the financial year 2022-23.

This was due to a lower-than-expected outturn against our budget allocation for activities funded by BEIS of £15.6m. These were primarily because of the pausing of the Statutory Debt Repayment Plan (SDRP) project[6], reductions in non-ringfenced projects expenditure, reduction in dilapidations provision and lower than anticipated costs of investigation and litigation activities.

The underspend is offset by an overall deficit on our fee funded activity of £8.9m (see Note 5), which was £2.7m higher than our expected deficit of £6.2m. This was as a result of lower than anticipated OR case volumes (£4.5m) and reduced Payment Protection Insurance (PPI) distribution activity due to system issues (£2.7m). These deficits were partially offset by higher than expected asset realisations in our National Interest Cases (£4.5m). Further details of performance after excess income was recognised can be seen in the Parliamentary Accountability Report.

There was also a surplus of £0.7m in the HMRC funding to support Redundancy Payment Services.

Expenditure

Our total operating expenditure compared to 2021-22 has increased by £27m to £441m (see Statement of Comprehensive Net Expenditure). The increase is largely driven by an increase in Redundancy Payment Service payments of £8.5m due to a rise in the number of awards made compared to last year, (though the average value of award has reduced), an increase of £6.1m in temporary staffing costs and an increase in our legal and enforcement costs of £7.3m.

Income

Note 4 shows that total operating income has increased by £1.8m to £155.1m.This is due to the Agency’s recognition of PPI receipts as income relating to historic cases and movements in the Redundancy Payment Scheme expected receipts.

Assets

As at 31 March 2023, we had assets of £501m. Our assets include property, plant and equipment, intangible assets, financial assets, trade receivables, cash, and cash equivalents. £145m of this related to debt assets or receivables and £336m to cash and cash equivalents. Assets have increased this year by £55m compared to last year. This is due to cash received on fees charged on settlement of historic PPI claims on insolvent estates.

Liabilities

As at 31 March 2023, we had liabilities of £184m of which £176m related to trade payables and provisions. This includes excess cash receipts due to the Consolidated Fund of £137m which is due to the surrender to HM Treasury. (see Note 11).

The overall position of assets and liabilities held by us on 31 March 2023 was £317m (see Statement of Financial Position).

Capital

In 2022-23, our capital expenditure was £1.7m (2021-22: £2.6m). Virtually all of this expenditure related to the creation of additional right of use assets on office leases extensions. See Note 6.

Where we spent our money

RPS £292.4m (2021-22: £283.9m). We are responsible for making payments from the National Insurance Fund to employees who have been made redundant because of an insolvency, and/or where the employer has certain debts due to its employees other than redundancy (e.g., unpaid wages, holiday pay, notice pay etc.). We then seek recovery of the amounts paid, either directly from a solvent employer or by lodging a claim in the insolvency case. This amount also includes any National Insurance contributions payable by us to HM Revenue and Customs. The National Insurance Fund re-imburses us daily for the claims paid out.

Permanent and non-permanent staffing £87.8m (2021-22: £81.6m). This represents payment for salaries inclusive of pension and National Insurance contributions and is net of recoveries relating to outward secondees.

IT Infrastructure £25.7m (2021-22: £22.3m). We spent this to provide functions such as Service Governance, Cyber Security, Information Governance, Service Architecture, Business Relationship Management and Application Services. In addition, we continued our journey to modernise the technology used by our customers and our people.

Investigations £3.0m (2021-22: £2.3m). This represents that amount that we spend externally on investigations and enforcement. This is to support National Interest Cases and other investigations, director and corporate behaviour and those who abuse the system. We undertook a range of investigation and enforcement activities which helped maintain confidence in the UK as a great place to work and do business. We undertook investigations into live companies and company directors’ conduct in relation to companies in formal insolvency. We also investigated criminal misconduct in company and personal insolvency cases. The vast majority of our spend on investigations arises from staff costs.

Civil and Criminal Legal costs £10.7m (2021-22: £4.2m). These costs cover civil litigation work to disqualify company directors for misconduct, the winding up of companies acting contrary to the public interest and providing advice on the conduct of statutory enquires and insolvent investigations. These costs also include criminal enforcement activity, including the prosecution of a wide range of offences across England and Wales concerned with insolvency related crime and corporate misconduct, providing advice for example on drafting new criminal offences and enforcement strategies. As part of our criminal enforcement activity, we pursued confiscation to deprive criminals of the proceeds of their crime.

Estates £5.2m (2021-22: £4.0m). We spent this on accommodation costs, including operating leases.