Social Security Advisory Committee annual report 2024 to 2025

Published 9 October 2025

Chair’s Foreword

This annual report marks another year of rigorous scrutiny and constructive advice from the Social Security Advisory Committee, delivered during a period of significant reform to the social security system under a new Government.

It is not uncommon that this Committee’s recommendations, while not wholly accepted at the time they are made, feature in some shape or form in policy announcements in the years that follow. This year has provided particularly striking examples of our advice influencing government thinking.

The Chancellor’s 2024 Budget commitment to anchor the Carer’s Allowance Earnings Limit to 16 times the hourly National Living Wage represents the adoption of a welcome reform we have advocated over successive years. Meanwhile, the Government’s Green Paper, Pathways to Work: reforming benefits and support to get Britain working,[footnote 1] contains clear echoes of several of our previous reports.

Our 2020 report on how DWP involves disabled people emphasised the importance of co-production becoming the ‘norm’. The Green Paper’s proposed ‘collaboration committees’ - bringing together people with lived experience and other experts with “a genuine ability to influence outcomes” - reflects this principle.

Our 2022 report on out-of-work disability benefit reform called for de-risking the journey into paid work. We highlighted claimant concerns about losing PIP, being deemed ‘fit for work’ if a job does not work out, facing greater conditionality, and losing financial support. The Government’s proposed ‘right to try’ - guaranteeing that work itself will never trigger a benefit reassessment - directly addresses these fears.

That same year, our extensive study of contributory benefits recommended fundamental reform of New Style JSA and ESA. The Green Paper’s plans for a new ‘Unemployment Insurance’ benefit, providing greater income protection for those who have paid into the system, represent significant progress on this long-neglected area.

While we are encouraged to see our advice continue to bear fruit, we recognise that successful implementation will depend on the detail. The Committee will continue to scrutinise proposals carefully, providing advice to ensure these reforms achieve their intended outcomes without unintended consequences.

This year brought significant changes to our membership. We bid farewell to Kayley Hignell, Dr Gráinne McKeever and Charlotte Pickles, whose expertise and insights have been invaluable. Their influence will continue through the echoes of their advice in current policy proposals.

I welcome the fresh perspectives that our newest members[footnote 2] have brought during this year: Les Allamby, bringing his experience as Northern Ireland’s former Chief Human Rights Commissioner; Rachel Chiu, with her frontline expertise in housing and homelessness prevention; Daphne Hall, offering decades of welfare rights advocacy; Professor Stephen Hardy, combining academic rigour with judicial experience; Jacob Meagher, contributing legal expertise and disability rights perspective; and Dr Suzy Walton, bringing governance experience from across multiple sectors. Their breadth of expertise has enriched our deliberations considerably over the past year.

I am also grateful for the dedication of both the Secretariat and all my longer-serving Committee colleagues, whose expertise and commitment ensure we provide the Secretary of State with rigorous, well-informed advice on matters affecting millions of people who depend on the social security system.

Dr Stephen Brien

Chair

About Us

Our Remit

Originally established by the Social Security Act 1980,[footnote 3] the Social Security Advisory Committee (SSAC) is an independent statutory body that provides advice on social security and related matters.[footnote 4]

The Committee has, by statute, a vital role in the scrutiny of detailed and complex draft social security regulations and in the provision of impartial, well-informed and constructive advice to the Secretary of State for Work and Pensions. We also have an important role in identifying and providing advice on wider related issues through our independent research.

Statutory responsibilities of SSAC

- To perform a mandatory scrutiny of most of the proposed regulations that underpin the social security system on behalf of the Secretary of State, for the benefit of both the Department for Work and Pensions (DWP) and Parliament;

- To provide advice and assistance to the Secretary of State for Work and Pensions, whether in response to a specific request or on our own initiative.

Advice offered formally by the Committee in relation to proposals for secondary legislation must be published by the Secretary of State, along with the Government’s response to our conclusions and recommendations. The response must include a statement showing the extent to which the Secretary of State has given effect to the Committee’s recommendations and, if any are rejected, the reason(s) why. The Secretary of State’s statement must be laid before Parliament, alongside the Committee’s report and the relevant regulations. While there is no obligation upon the Secretary of State to respond to other forms of advice from the Committee, or to act on any of the advice we offer.

We perform a similar role for the Department for Communities in Northern Ireland where social security powers are fully devolved.[footnote 5] During the 2024-25 reporting year, we also had a non-statutory role offering advice to HM Treasury Ministers and HM Revenue and Customs (HMRC) on tax credits, National Insurance, Child Benefit and Guardian’s Allowance.[footnote 6]

The statutory scrutiny of secondary legislation is the Committee’s priority, and takes precedence over other activity undertaken by the Committee. But where resources permit, and as part of our general advisory functions, we:

- undertake our own detailed studies as part of our independent work programme;

- informally scrutinise regulations that are exempt from our statutory scrutiny;

- engage with public consultation exercises conducted by Government and others where we believe that we can add value and it is appropriate to do so;

- respond to specific requests for advice from ministers and officials.

The Committee’s membership is intentionally diverse, with each member having a particular expertise, experience and interest of relevance to our work. Members are appointed to the Committee in a personal capacity, however they draw on experience from a range of organisations with whom they are connected, as illustrated below. Together they ensure that our advice is impartial, evidence based and reflects a range of perspectives. A full list of Committee members during 2024-25 is provided at annex B, and biographies at annex C.

How we deliver our remit

1) Scrutiny of draft regulations

The Committee’s primary function is the mandatory scrutiny of the government’s social security proposals in the form of draft regulations, and this takes priority over our other business. This is a unique role for an advisory body dealing with a highly significant area of government policy. Most social security regulations are subject to scrutiny by the Committee, the significant exceptions being regulations which are made by virtue of, or consequential upon, a recent Act of Parliament; go to other advisory bodies (for example the Industrial Injuries Advisory Council); or which set benefit rates.

The SSAC’s oversight function is constitutionally important. Parliament’s ability to scrutinise subordinate legislation is limited by pressures on parliamentary time and an absence of detailed expertise among most Members of Parliament in a complex system. Our scrutiny role therefore provides constitutional comfort that the secondary legislation delivers the Government’s policy intent without introducing unintended consequences or impacting particular groups. This scrutiny of the UK position is becoming more important as devolutionary powers over social security are being exercised, creating the potential for unintended geographical consequences as devolved and reserved social security systems interact.

In reviewing draft regulations there are a number of issues that the Committee considers. We examine whether there is clarity around the policy objective, whether the regulations deliver that policy objective and whether the regulations themselves are clear. That requires us to examine whether the regulations fit within the overall context of the social security system, including whether:

- there are unintended conflicts with existing priorities or obligations,

- the regulations are proportionate to the policy intent,

- the regulations increase or reduce overall complexity, and

- interested and affected groups have been consulted.

We explore whether the consequences of the regulations have been properly analysed by government. That includes examining whether alternatives have been or could be considered. In considering the impact of the changes on individuals and on groups of people, our starting point is generally supporting documentation from the government on equality considerations, identifying who will benefit or who will lose out from the measures. It is important that the Department provides strong equality analysis so that our statutory obligation to provide high quality advice is delivered as effectively as possible.

We also explore whether the practicalities of implementation have been considered so that operational delivery of the legislative intent can be assured. Part of that enquiry includes understanding the impact on the advice sector, on employers, on local authorities, and on front line staff who will have to deliver the changes, as well as on how claimants will be able to understand their entitlements.

The Committee has the power to take regulations on ‘formal reference’. In such cases, the Committee would normally undertake a public consultation after which we produce and submit our recommendations to the Secretary of State. Our report must then be presented to Parliament together with the regulations and with a statement setting out the extent (if any) to which the Secretary of State proposes to give effect to the Committee’s recommendations and - where they are not accepted – the reasons for that decision.

In reality, the majority of draft regulations are scrutinised without formal reference, either through Committee meetings at which Departmental officials answer our questions about the legislation; or though postal scrutiny with a sub-group of the Committee reviewing the regulations following written exchanges with officials. We adopt this latter approach when any advice we offer takes the form of engaging with officials on the technical details of the draft legislation.

Legislation provides for an exception to the scrutiny process being undertaken before regulations are laid in circumstances where the Secretary of State considers that the urgency of the proposals are such that it would be inexpedient to consult the Committee.[footnote 7] In such cases, the Committee will subsequently scrutinise the regulations after they have been laid or implemented, with the same powers of formal reference available to us as if urgency had not been invoked.

The Committee sees its role as making a positive contribution to help ensure that regulations are as good as they can possibly be. We are grateful for the co-operation of - and constructive discussions with - DWP and HMRC, as well as good working relationships across devolved governments, to build an accurate picture of how the regulations will work. We have no authority to make policy changes in social security but being an independent arms’ length body enables us to get valuable insight from our stakeholders into the issues that the legislation addresses. In providing advice to government through detailed scrutiny of social security proposals we bring all of these interests together to improve the quality of social security legislation.

SSAC scrutiny of regulations in 2024-25

The Committee considered 14 packages of regulations during 2024-25.

| Numbers of regulations scrutinised in 2022-23 | Scrutiny at SSAC meeting | Cleared by correspondence |

|---|---|---|

| 14[footnote 8] | 8 | 6 |

The Committee decided to take two sets of these regulations on formal reference:

- The Universal Credit and Employment Support Allowance (Work Capability Assessment) (Amendment) Regulations 2024.[footnote 9]

- The Universal Credit, Personal Independence Payment, Jobseekers Allowance and Employment and Support Allowance (Claims and Payments) (Modification) Regulations 2025.[footnote 10]

Of the 14 sets of regulations presented to the Committee, two were HMRC-led and dealt with under our Memorandum of Understanding with HM Treasury and HM Revenue and Customs.

In some circumstances, the Committee may agree to consider regulations by correspondence. This only applies to very straightforward and non-contentious regulations, or to those of a minor and technical nature. Six of the regulations fell into that category during this reporting year.

The Secretary of State for Work and Pensions invoked ‘urgency’ on three occasions in this reporting year.[footnote 11] These included the regulations brought forward by the Government to means test the Winter Fuel Payment from 2024-25.[footnote 12] Additionally, HMRC presented one package of regulations to us after they had been laid because it was of the view that it would be inexpedient to arrange prior consultation.

A detailed breakdown of all the regulations subject to statutory scrutiny by the Committee in 2024-25 is provided at annex A.

Delivering our statutory responsibilities

To undertake our statutory functions well, it is essential that the Committee:

- has a clear understanding of the full extent of how the Department’s regulations are likely to impact - positively or otherwise - different groups of individuals, in particular those with protected characteristics; and

- whether the Government’s policy intent is likely to be achieved.

We rely on the Department’s support in identifying who is going to be affected and to establish what the potential impacts will be, highlighting disparity where that exists. This analysis of impact is essential both in ensuring that the Committee can discharge its statutory duties effectively, and to provide high quality support to the Department.

The application of broad first-principles logic and curiosity, together with a wider consideration of all groups likely to be affected, by the Department is therefore essential. Failure to do so would mean that the full range of consequences – intended or otherwise – cannot be fully understood or effectively monitored.

During the course of this year, we have received some good-quality analyses of impact which have been comprehensive and – where data has not been available – have explored what other proxy evidence might be available to demonstrate likely impact. However, the standard of equality assessments and analyses of impact has been variable and this is something that needs to be addressed. Our experience is that the Department seeks to demonstrate that the proposals do not discriminate against protected characteristics, rather than providing a broader and comprehensive assessment of impact. This would mean considering disparate outcomes rather than considering adverse impacts because of a protected characteristic. It also means examining not just those with protected characteristics, but also identifiable groups relevant for the regulations.

We have had some very constructive discussions with the Department about this issue, and are encouraged by its positive response at a senior level. The Committee will continue to support DWP colleagues by continuing to regularly provide constructive and specific feedback to enable them to strengthen their approach.

2) Provision of independent advice

Our remit also includes the power to advise the Secretary of State on social security issues, either following a specific request from the Department or on our own initiative. The issues that we examine, and on which we provide advice to Ministers, are designed to reflect the strength of expertise and experience on the Committee, as well as the added value of our unique and trusted relationship with the Department.

We seek to ensure that the analysis we carry out as part of our independent work programme:

- provides an evidence base for our work, improving members’ ability to scrutinise regulations and provide credible independent advice to ministers;

- adds value to the debate on a topic that is of current interest to government or a broad range of our stakeholders;

- stimulates debate or discussion on a specific topic; and

- introduces new thinking or data analysis.

Our advice takes various forms. For example:

- providing briefings for officials on common lessons we have observed from our scrutiny of regulations;

- papers reporting back on the key themes emerging from workshops with interested parties conducted under ‘Chatham House’ rules;

-

correspondence to Ministers and senior officials where we have identified an issue that requires a more considered response; and

- substantial and detailed reports based on our research projects.

Our Chair also has regular discussions with the Ministerial team, providing another avenue by which we might provide or reiterate our advice.

So how do we determine what issues we should examine? Over the course of the year, we talk to Ministers, senior officials, operational staff responsible for delivering DWP policies and external stakeholders to identify timely issues on which our advice would be valued. The knowledge and experience of Committee members are also an important resource when identifying potential topics.

Our modest resources require us to evaluate potential projects against a range of criteria before we commit to them:

- Why is it an important question now? For example, is this a significant emerging issue which is aligned to the Department’s priorities; or is it a regular area of concern arising from our work?

- Are there any data sources – and what are they and what does the data tell us?

- Has anyone else looked at (or is currently examining) this issue, if so, what further value can we add?

- Why is SSAC uniquely positioned to do this work? For example, would access to work coaches or detailed discussions with officials be of value?

- What resources will it require, and do we have the capacity and capability to do justice to the issue?

- What can we expect to add to the debate or existing evidence base?

- Is there an opportunity for our work to influence Ministers and have impact?

The value of our independent advice should not be solely determined by whether or not our recommendations and advice deliver policy change. There are broader benefits from this strand of our work, for example:

- it makes SSAC better equipped to undertake its statutory functions (primarily scrutiny of regulations);

- our work helps ‘join the dots’ where work is being undertaken by separate parts of Department and the broader impact, interaction with the rest of the social security system, and potential inconsistencies and/or unintended consequences are less visible to individual teams;

- conventional research can be expensive, so our work delivers value for money;

- it provides the Secretary of State, and Parliament, with constitutional comfort on complex issues.

It is important that our advice to the Secretary of State is evidence based and reflects insight gleaned from a wide range of experiences and perspectives. We remain grateful to our extensive stakeholder community who engage with us on our projects and to officials from DWP, HMRC and other government departments who provided factual information to ensure that we are able to achieve that.

Our advice in 2024-25

Through our scrutiny of regulations and our independent work programme we have provided advice to the Secretaries of State either side of the General Election on key areas and assisted in the development and refining of policy in a number of priority areas, including:

Health and Work Capability Assessment Reform; and Get Britain Working White Paper[footnote 13]

History has shown that reforming health and disability benefits is fraught with risk. Previous attempts made by successive governments have often failed to meet their goals, leading to rising costs while damaging trust and causing real harm to claimants.

Because the stakes are so high, including for a significant number of claimants in vulnerable situations, we believe it is imperative that any changes are robustly tested and trialled. This is the only way to ensure that policy is informed by high-quality evidence and analysis, avoiding the mistakes of the past.

We have been engaging closely with the Secretary of State, the wider ministerial team, expert advisers and officials at the Department on this aspect. Our advice has been provided through several routes, initially through our scrutiny of the Universal Credit and Employment and Support Allowance (Work Capability Assessment) (Amendment) Regulations 2024, which the Committee had decided to take on formal reference before they were subsequently withdrawn following the General Election on 4 July 2024.[footnote 14] Informed by with this Committee’s advice and recommendations, the incoming Government, following scrutiny, they have had a chance to review our recommendations and hope they will be considered when changes develop in this area following the publication of the Pathways to Work: Reforming Benefits and Support to Get Britain Working Green Paper.[footnote 15]

We will, in due course, fulfil our statutory duty by scrutinising regulation that stem from the Green Paper. In addition, we will continue to engage constructively with the Department on the development of proposals that fall outside our formal scrutiny remit, for example those changes being brought forward in primary legislation and/or guidance. Our goal is to provide advice and add value across the entire reform programme and support the government in getting this right.

Winter Fuel Payments

On 29 July 2024, the Chancellor of the Exchequer announced that the Government would limit payment of the Winter Fuel Payment to those in receipt of Pension Credit and other relevant benefits. This proposal formed part of the Fixing the foundations: public spending audit 2024 to 2025 policy paper,[footnote 16] setting out the government’s plans to alleviate public finance pressures. This led to The Social Fund Winter Fuel Payment Regulations 2024 being presented to this Committee for statutory scrutiny in September 2024.[footnote 17] Our scrutiny took place after the Regulations had been laid, as the Secretary of State took the decision that the urgent nature of this secondary legislation (which had to come into force ahead of the qualifying week which commenced on 16 September) meant that it would be inexpedient for prior consultation of the Committee to take place.

Following our scrutiny of the regulations, we wrote to the Secretary of State making a number of recommendations and observations, for example highlighting the potential risks associated with limiting the payments in this way and expressing concern that a full consideration of the impacts was not available to us during the scrutiny process.[footnote 18] In particular, we were concerned about the lack of understanding about the potential impact on those who were not in receipt of Pension Credit or another qualifying benefit, but who might be placed in a vulnerable situation by the change of policy, for example:

- those in receipt of disability benefits, as this group may experience higher heating costs as a consequence of managing the effects of a disability or chronic illness; and

- those in receipt of Pensioner Housing Benefit.

It is regrettable that the speed at which these proposals were conceived and delivered inhibited the Department’s ability to think through the consequences and potential mitigations for those in vulnerable situations who would be impacted by this policy change.

Universal Credit: Child Maintenance deductions

Following the announcement of the Fair Repayment Rate for Universal Credit by the Chancellor of the Exchequer in the Spring Budget, there became an issue of how this would impact Child Maintenance deductions being taken directly through Universal Credit through the means of third-party deductions.

DWP developed a package of temporary regulations to stop this from happening and presented these proposals to an extraordinary meeting of SSAC for scrutiny on 14 February 2025.

At that meeting, we accepted that DWP needed to legislate quickly to prevent children losing out. However, the particular solution DWP had adopted meant that more households than before would have child deductions made, and some would see substantial increases in total deductions. Whilst this would benefit the households where their children (from a previous relationship) lived, the evidence we saw told us very little about the composition of, or impact on, households whose monthly income would drop as a result, including the impact on any children in their current household. We concluded that this was partly because of the absence of available data, and partly because DWP had not carried out sufficient analysis of potential effects, in particular the various ways the changes might affect disabled people.[footnote 19] We were also concerned about potential risks arising from child maintenance deductions displacing other deductions like those for fuel, and we thought that the date the regulations would come into force was not well enough aligned with the Fair Repayment Rate change.

As a consequence, we took these regulations on formal reference. Normally when we do this we consult widely to ensure that our analysis is as well informed as possible. However, a solution had to be put in place in time for the introduction of the Fair Repayment Rate. This meant it was not possible to consult others if we were to provide timely advice on the proposals. We therefore decided to rely on our own analysis of the issues, based on the information presented to us by DWP officials, the knowledge and experience of our members and our own 2020 report on the way social security affects separated families.[footnote 20]

This led to a positive response from the Minister for Social Security and Disability,[footnote 21] most notably an assurance to align the coming into force date of the regulations and the Fair Repayment Rate in line with our recommendations.

Following the outcome of the evaluation, we look forward to undertaking our scrutiny of the subsequent regulations which will be introduced later in the year ahead of the sunset clause taking effect.

Infected Blood Capital Disregard

In September 2024, we undertook our statutory scrutiny of The Social Security (Infected Blood) (Amendment) Regulations 2024, which ensure that payments received from the Infected Blood Compensation Scheme are disregarded as income/capital in means-tested benefits. While the Department’s officials gave us strong reassurances around the processes for handling disbursements to affected people who are already in receipt of means-tested benefits, the handling of longer-term investments and the procedures for subsequent benefit applications from affected people, perhaps years later, were less well addressed. For example:

- Reliance on “estate”: while understanding the Department’s thought process in reaching this approach, we considered that it contained flaws and complexity, for example in certain circumstances where: there are a number of beneficiaries to an estate; someone has died intestate; the proceeds of an estate are contested through the Inheritance (Provision for Family and Dependants) Act 1975; 1 or, descendants who may have had significant debts or have been declared bankrupt. From the perspective of pragmatic disbursement of compensation to those affected people, there are understandable merits of such an approach, especially since there is no requirement to track the payments. However, in order to attach a disregard to (current and future) benefit entitlements, we considered there to be a greater need to be able to have certainty around who is an eligible recipient.

- Disregard relating to interest or income from capital: it was proposed that any interest or income derived from the compensation payment would be disregarded for the purpose of means-tested benefits. However, we identified a small number of potential scenarios where the position is less clear. For example, in circumstances where: there is an aggregation of capital; an amount of capital exists before the compensation payment is made; where the compensation payment is reinvested in other ventures which may deliver a financial return e.g. in buy to let housing where the return will be in terms of rent and capital growth. While acknowledging that numbers affected are likely to be relatively small, to ensure absolute clarity for decision-makers and affected people, we recommended that an amendment be made to the regulations (or amending regulations be brought forward at the earliest opportunity) to provide absolute clarity on this point for the avoidance of doubt. A clear approach to the disaggregation of existing capital and compensation payments as money is spent is needed so that those receiving compensation can be clear about the impact of monies spent for future benefit entitlement.

Our advice to the Minister for Social Security and Disability[footnote 22] also made some longer-term recommendations. In particular it highlighted that, over a number of years, the Committee has scrutinised several packages of secondary legislation which set out how individual compensation payments (e.g. following specific acts of terrorism, the Grenfell Tower fire, amongst others) would be treated by the benefit system. We consider there is a persuasive case for a legislative framework to be introduced which could be applied to compensation schemes where there are similar characteristics and the same policy intent. Such future-proofing approach would reduce the number of occasions on when secondary legislation would need to be brought forward and ensure a consistent, and tested, approach being taken.

Our letter to the Minister also commended the Department’s officials for the way in which they approached this scrutiny process. They made a significant effort in ensuring that the Committee was well-prepared for this scrutiny by providing an informal briefing and keeping us in touch with emerging developments. In addition to ensuring we were well-informed ahead of the scrutiny, this prior engagement enabled us to provide early feedback and offer ways in which the regulations could be improved, for example by widening the scope of the disregard to ensure that all beneficiaries of estates would benefit from the proposed disregard and removing any dependency on a precise definition of “affected persons”. We regard this as a model approach to preparing for the Committee’s statutory scrutiny process and would encourage that this approach be adopted for other urgent and/or complex legislation.

Work Coach Discretion

As part of our independent work programme, the Committee periodically delves into specific topics to gather evidence that informs our statutory duties. This learning and development process is crucial for ensuring that we can effectively scrutinise regulations and, where appropriate, provide credible independent advice to ministers.

In recent years the Committee has observed an increase in the circumstances in which work coaches are required to apply discretion. To better understand this trend and its implications, the Committee was keen to undertake some work to map out the various areas where discretion is applied, and explore how this has evolved over time.

Since the inception of Universal Credit, we have become increasingly aware that the use of Work Coach discretion has incrementally increased in light of successive legislative changes that have been subject to our scrutiny.

In reviewing our minutes and on the basis of discussions with DWP officials during such scrutiny, it would appear to us that this is the case. The minutes show that, when questioned on how work coaches will take on an additional element of discretion, the Department often notes that it already empowers work coaches to provide individual tailoring in similar ways or that work coaches are familiar with the health issues and wider barriers.

Discretion appears to rely on the work coach to make judgment calls on a case-by-case basis, often referred to as tailoring. Training and guidance offer structure to the work coach’s decision-making, but the work coach, with the support and advice of other work coaches and team leaders, must decide whether the particular conditions are sufficient to determine whether an action is reasonable and necessary to take.

As part of this, we have reflected back to SSAC’s 2019 report on the effectiveness of Claimant Commitments[footnote 23] to compare how expectations of work coaches have changed. As part of this report, we recommended that the DWP develop a more rigorous approach to ensure that work coach discretion is applied fairly and systematically. We continue to work closely with the Department to explore avenues in which this can be considered, with a view to this being a potential consideration as part of the changes suggested in the Get Britain Working White Paper.[footnote 24]

This issue remains of interest to the Committee, and we will continue to keep it under close review.

Stakeholder engagement

Relationship with DWP ministers

The Committee’s primary role, as set out in statute, is to provide advice and assistance to the Secretary of State for Work and Pensions.[footnote 25] It is therefore essential that we have a constructive relationship with DWP’s ministers. We have been committed to building a robust, candid and constructive relationship with all incumbents of these roles over the past year, in keeping with the Committee’s status as an independent and impartial expert adviser. We are grateful for the regular and positive engagement from the Secretaries of State and their ministerial teams during the course of this year – both prior and subsequent to the UK General Election in July 2024. This has helped to ensure there is a good understanding of our respective roles, and established the reputation of the Committee as a trusted adviser which strives to provide timely, well-informed advice, which is of value to: Ministers; policy officials who work hard to ensure that the Government’s policy intent is captured in legislation; operational teams responsible for delivering it; and those who rely on the social security system for support.

Parliament

As we mention earlier in this report, while our role is to provide advice to the Secretary of State for Work and Pensions, that advice is also for the benefit of Parliament with our work featuring in a number of Parliamentary Questions and debates during the course of the year.

The Committee gives evidence to the Work and Pensions Committee when invited to do so. Our Chairman also has occasional meetings with the Chair of the Work and Pensions Committee, and other Parliamentarians, to discuss the Committee’s role and work where that is appropriate.

External stakeholders

It has been a longstanding priority for this Committee that our advice is well-informed, evidence-based and that it takes account of a wide range of perspectives – including those of claimants and taxpayers. The evidence and insight our stakeholders contribute to SSAC’s work are greatly valued. Our network of stakeholders, on whose experience and expertise we draw, contains over 300 organisations and bodies representing a wide spectrum of interests and insights. This includes voluntary sector organisations representing and/or serving the interests of claimants, policy-makers, think tanks, local authorities, employers, and academia drawn from across England, Northern Ireland, Scotland and Wales.

We consider it particularly important to have a strong understanding of the impact of the UK government’s social security policies in Northern Ireland, Scotland and Wales where different challenges and opportunities may exist. While we benefit from the advice and insight of Committee members based in Northern Ireland and Wales,[footnote 26] we endeavour to additionally undertake regular stakeholder engagement within each of the devolved nations, and to have regular meetings with key organisations, for example the Department for Communities (NI) and the Scottish Commission on Social Security.

While face-to-face stakeholder meetings and operational visits have enormous value, we are also mindful of the benefits of online engagement which extends our reach to a more diverse and geographically spread stakeholder group, and this means that our advice to Ministers is enriched by a wider range of experience and insights than is possible through face-to-face engagement alone. We will continue to endeavour that we achieve a good balance between both methods of engagement to ensure a good breadth of knowledge and understanding of all aspects of social security is reflected in our work.

Visits

Visits to DWP’s operational sites are also important. They are essential in helping the Committee to develop greater insight into the operational delivery of DWP’s policies through talking to staff responsible for that delivery at DWP Jobcentres, service centres and call centres.

The objective of these visits are two-fold:

-

to identify emerging issues, build insight and gather evidence for potential areas of future independent advice; and

-

to develop a greater awareness of issues that would benefit SSAC’s statutory scrutiny of regulations (eg examining the full range of responsibilities work coaches have and how discretion is applied, and reviewing whether or not recent secondary legislation we have scrutinised has been delivered as planned or whether there have been unintended consequences etc).

These visits are extremely informative, and we are grateful to the Department for accommodating our requests to visit its operational sites and, in particular, to the knowledgeable and committed staff at Canterbury, Stockport and Westminster with whom we have engaged during the course of the year.

We look forward to continuing our programme of visits - including to the devolved nations - during 2025-26.

Transparency

The Committee has a proven track record regarding transparency in relation to all aspects of its business. For example, our reports, correspondence with Ministers, minutes of meetings and responses to Freedom of Information requests are all published routinely on our website. We are also transparent about Committee members’ interests, and the costs associated with delivering our work, both through this report or in response to Freedom of Information requests.

We also endeavour to keep interested parties up to date with developments through regular stakeholder meetings, blogs by Committee members and via our X (formerly known as Twitter) and LinkedIn accounts.

Our resources

The Committee’s budget allocation in 2024-25 was £350,000. All of our operational costs are met by this allocation, including our Chair’s annual remuneration, Committee members’ fees and the staff costs associated with our small secretariat.[footnote 27]

The staffing costs associated with our secretariat account for the majority of our annual expenditure. We fund four (FTE) staff who are on loan from DWP at a cost of around £260,000.

The Committee is required by statute to have between 10 and 13 members, plus a Chairman. During 2024-25 our Chairman received an annual remuneration of £22,000, while Committee members were paid a fee set at a daily rate of £256.80.

Reimbursement of reasonable business expenses relating to travel and subsistence are also payable in accordance with DWP’s policy. A breakdown of these costs in 2024-25 is provided at annex F.

We keep our expenditure under regular review to ensure that we are cost conscious in our use of public funds and delivering good value for money, while ensure that our working arrangements are optimal, delivering effective and high-quality outputs.

The following table sets out a high-level overview of our expenditure during 2024-25.

| Category of expenditure | Amount |

|---|---|

| Staff costs | £258,056.02 |

| Professional fees | £59,484.54 |

| Travel | £9,700.88 |

| Other | £1,168.55 |

| Total | £329,999.99 |

Looking forward to 2025-26

Consistent with the Committee’s statutory remit, our work priorities for the coming year are:

-

Scrutiny of draft regulations: we will undertake impartial, effective and timely scrutiny of draft regulations relating to social security benefits. The Committee’s scrutiny of secondary legislation takes priority over its other work.

-

Provision of independent and impartial advice: the Committee will undertake a small number of research projects,[footnote 28] providing impartial, well-informed and constructive advice to the Secretary of State for Work and Pensions on issues relating to social security and welfare reform. We will ensure that we have the capacity and capability to be responsive and provide constructive, timely responses and advice on emerging priority issues.

We will also engage fully and constructively with:

- the Government’s review of all arm’s length bodies, as announced by the Chancellor of the Duchy of Lancaster in early April 2025;[footnote 29]

- a review of the DWP/SSAC Framework Agreement; and

- a review of the Memorandum of understanding between HM Treasury, HM Revenue and Customs and the Social Security Advisory Committee following the closure of tax credits.

Another priority will be the effective induction of four new Committee members following their appointment in autumn 2025.[footnote 30]

All of the activities undertaken during 2025-26 will be consistent with the Committee’s Results Framework.[footnote 31]

Scrutiny of draft regulations

The Committee will continue to explore how it can effectively add value to the regulations process further upstream, so that the proposals presented to us for statutory scrutiny have already benefitted to some degree from our input and are in the best possible shape before they are laid in Parliament. The Committee’s ambition is to be regarded as a trusted resource that can add value to the process rather than a hurdle to be overcome at the point of scrutiny. The Department has already responded positively to the Committee’s ambition by agreeing to present the majority of their proposals early on in the process. This has been invaluable in ensuring that we are able to familiarise ourselves with the issues, and share some initial observations and advice, before the formal scrutiny session. The Department has also voluntarily brought to us regulations that fall outside of our statutory remit for informal scrutiny. We regard all of this as a very positive step forward, and will continue to work with the Department to further strengthen the value we provide to them.

To ensure we can deliver this priority effectively, we will keep under review our ability to undertake a high quality and forensic scrutiny of draft secondary legislation, taking steps to further strengthen our technical understanding of the benefit system as necessary.

We will also continue to support officials by providing insight to the scrutiny process and advice on how to prepare for it. We shall continue to keep under review our written guidance for staff who will be presenting regulations to us to ensure that it is as clear, informative and transparent as possible, for example by emphasising the importance of providing a comprehensive analysis of impact (both on protected characteristics and more broadly) and a discrete articulation of a clear policy intent – both of which will enable the Committee to be more focussed and effective in its deliberations and discussions with officials. We will also continue to provide constructive feedback on the draft regulations and supporting papers provided to us, and contribute to the Department’s workshops for staff on strengthening its legislation.

Independent advice

The issues that we examine, and on which we provide independent and impartial advice to Ministers, will reflect the strength of expertise and experience on the Committee as well as our trusted relationship with the Department. So, taking advantage of our unique ability to help in areas where other organisations are less equipped to do so.

Our programme of independent advice is designed to:

- provide an evidence base for our work, improving members’ ability to scrutinise regulations and provide credible independent advice to ministers;

- add value to the debate on a topic that is of current interest to government or a broad range of our stakeholders;

- stimulate debate or discussion of a specific topic; and/or

- introduce new thinking on data analysis.

While there must be a clear line drawn in terms of SSAC’s independence and impartiality, we are keen that the advice we provide is timely and useful and delivers outcomes consistent with our Results Framework. With this in mind, we will discuss our plans with the Department as we finalise the scope for each project to ensure that our advice is well-targeted and constructive and can have maximum impact.

Our objectives

There are a number of specific activities on which we intend to focus during 2024-25 in order to be effective in delivering our priorities. In particular, we aim to:

Committee membership

- recruit, and effectively induct, four new Committee members to fill our current vacancies, including a statutory member for workers, and a Scotland member;

Provision of advice

-

continue to work constructively and effectively with DWP to ensure that our respective roles in the delivery of high-quality draft regulations are delivered well and in a timely manner;

- continue our programme of appropriate and timely independent and impartial advice to the Secretary of State through proactive and timely examination of emerging priority areas;

- further embed our results framework, including reviewing our past recommendations on a regular basis for continued relevance and to ensure that the impact of our advice is understood;

Ensuring our work is evidence based

- develop more active and targeted stakeholder engagement to ensure that our advice to Ministers is well-informed, takes account of a wide range of perspectives and provides constructive support to the policy-making process. We will:

- be inclusive of stakeholders in Scotland, Northern Ireland and Wales to ensure that their voice is heard in the advice we provide to Ministers and that the impact of greater devolution - including city devolution and localisation - of social security provision is understood;

- engage with diverse stakeholders including claimants, advice agencies, voluntary organisations, academics and other experts;

- take steps to ensure effective engagement with diverse communities including disabled people and people from ethnic minority communities;

- ensure that we develop an understanding of the operational issues that are likely to flow from new policy initiatives, and are able to review the progress of the implementation of Universal Credit, through a programme of visits to DWP sites and other stakeholders;

Ways of working

-

further strengthen our links, both at ministerial and official level, with:

-

the Department for Work and Pensions, further developing our trusted relationship to maximise our ability to provide high quality, well-informed and timely advice on a range of social security matters;

- the Department for Communities to ensure the effective delivery of our statutory duties in Northern Ireland;[footnote 32] and

-

HMRC and HM Treasury under our Memorandum of Understanding to ensure that due account is taken of their role in relation to benefit matters, particularly any residual matters relating to tax credits and their migration to Universal Credit.

- to ensure that the way we work as a Committee and our individual behaviours are, at all times, consistent with the Seven Principles of Public Life and SSAC’s own Code of Conduct.

- make the best use of our people and financial resources, in a cost conscious manner and reflecting our commitment to diversity and inclusion. We will continue to seek to benchmark ourselves against other organisations of a similar size and/or remit, and identifying areas of best practice.

Equality, diversity and inclusion

All of our work - including our scrutiny of draft regulations, our research projects, our recruitment exercises and our engagement of stakeholders - will reflect equality, diversity and inclusion.

Measuring our success

We will report on the degree to which we have achieved these objectives in our 2025-26 Annual Report. Our performance will be informed by:

- feedback from the Department and our other stakeholders on the usefulness of our work (both scrutiny of regulations and our independent work programme) and advice to Ministers; and

- an in-year effectiveness review of the Committee.

Success criteria will consider the degree to which we have delivered:

- rigorous scrutiny of draft regulations within agreed deadlines.

- provision of pertinent, well-informed and influential advice to Ministers, informed by our stakeholders’ experience, expertise and other evidence.

- strong engagement and collaboration with the DWP, HM Revenue and Customs, Department for Communities Northern Ireland and other appropriate Government and devolved bodies.

- transparency of the Committee’s operation and expenditure, including publication of our minutes, reports, the fees and expenses for each Committee member, and the costs of our secretariat.

Our operating principles

Whilst undertaking its activities the Committee will remain conscious of its responsibilities:

- to utilise the skills, expertise and experience of a diverse Committee membership, ensuring that it operates effectively as a team;

- to provide an independent view (independent of both Government and other interested parties) which is evidence based and which reflects a wide range of perspectives;

- for cost conscious management of its budget (£350,000)[footnote 33]

- for confidentiality where appropriate

- to be transparent

- for quality governance in accordance with the DWP/SSAC Framework Agreement and the Government’s Code of good practice on the sponsorship of arm’s length bodies.

- To undertake a regular assessment of risks, and ensuring plans are in place for managing them.

Annex A: Regulations subject to SSAC statutory scrutiny during 2024-25

Annex B: Committee membership during 2024-25

Committee Membership

Dr Stephen Brien (Chair)

Les Allamby

Bruce Calderwood

Rachel Chiu

Carl Emmerson

Daphne Hall

Stephen Hardy

Kayley Hignell[footnote 36]

Phil Jones

Professor Gráinne McKeever[footnote 37]

Jacob Meagher

Charlotte Pickles[footnote 38]

Dr Suzy Walton

Committee Secretariat

Denise Whitehead (Committee Secretary)

Kenneth Ashworth

Dale Cullum[footnote 39]

Gabriel Ferros[footnote 40]

Kyle Robertson[footnote 41]

Annex C: SSAC members: biographies[footnote 42]

Dr Stephen Brien (Chair)

Dr Stephen Brien was appointed as Chair of the Social Security Advisory Committee from 14 September 2020. Stephen is passionate about finding solutions to reduce poverty and improve the lives of the most vulnerable in the UK.

From 2017 to 2023 Stephen was Director of Policy at the Legatum Institute. In addition to overseeing the Institute’s policy programmes, his research focused on the socio-economic drivers of prosperity around the world.

From 2015 to 2017, Stephen was an advisor to governments in both the Middle East and sub-Saharan Africa. He has been a Director at Social Finance; and he also advised the UK Department for Work and Pensions (DWP) from 2010 to 2013.

Prior to joining DWP, Stephen spent 15 years at Oliver Wyman, where he was a Partner, and served a term as the head of its London Office. He is the author of Dynamic Benefits (the blueprint for Universal Credit) and Outcome-based Government.

Les Allamby

Les is currently the Discretionary Support Commissioner for Northern Ireland and member of the Policing Board for Northern Ireland. He is a member of the Carers’ Poverty Commission for Carers (NI). Les is also currently the Chair of NIACRO, and the personal litigant reference group.

Les was the Chief Commissioner of the Northern Irish Human Rights Commission from September 2014 to August 2021. He is a solicitor, and his former roles include the Director of the Law Centre (Northern Ireland), vice chair of the Social Security Advisory Committee 2005-2014 and Chair of the Northern Ireland Social Security Standards Committee 1999-2004.

Les recently chaired an independent panel for Department for Communities to recommend further social security mitigations for Northern Ireland. He has written extensively on social policy, legal rights and justice issues.

Les joined the Committee in February 2024.

Bruce Calderwood

Bruce is a trustee of the Avenues Group, a charity specialising in supporting people with complex needs. He was for many years a senior official in DWP in a wide range of roles. He ended his civil service career as the director in the Department of Health responsible for policy on mental health, disability and equality. In this role he led the team which created the 2010 to 2015 coalition government’s mental health strategy and its review of services for learning disabled people following the Winterbourne View scandal.

Bruce joined the Committee in October 2016, and is the Chair of the Committee’s Regulations sub-committee.

Rachel Chiu

Rachel is the Co-Founder and Director of Business Development at Spring Housing Association, a charity providing access to accommodation and support for people in housing need, and preventing homelessness across the West Midlands.

In this role she has contributed to policy and practice to improve standards and regulation in the supported accommodation sector both locally and nationally. Rachel is also a trustee and Chair for charities including almshouses and arts organisations.

Rachel joined the Committee in January 2024.

Carl Emmerson

Carl is Deputy Director of the Institute for Fiscal Studies (IFS). He is an editor of the annual IFS Green Budget, and his research includes analysis of the UK public finances and the design of the tax and benefit system, in particular relating to state and private pensions. Carl is also on the advisory panel of the Office for Budget Responsibility.

Carl was appointed to the Committee in August 2016, and is the Chair of SSAC’s Independent Work Programme Steering Group.

Daphne Hall

Daphne is an editor at rightsnet - a social welfare law website providing daily news and case law updates as well as hosting a discussion forum for advisers across the UK. She is also the Vice Chair of the National Association of Welfare Rights Advisers.

Previously, Daphne spent 25 years working as a frontline adviser for Bristol City Council, Springfield Psychiatric Hospital and Citizens Advice. For many years, she was also a contributing author to Child Poverty Action Group’s Welfare Benefits and Tax Credits Handbook, and to Disability Rights UK’s Disability Rights Handbook.

Daphne joined the Committee in January 2024.

Professor Stephen Hardy

Stephen is a Professor of Law and the Dean of the Faculty of Business, Law and Politics at the University of Hull.

Stephen has published widely in employment and social security law. Formerly, he was a practising Barrister, specialising in employment, commercial and public law and is an Academic Associate of 33 Bedford Row Chambers.

Since 2011 has been a fee-paid Judge of the Social Entitlement Chamber. He is also a Fellow of the Academy of Social Sciences.

Stephen was appointed to the Committee in January 2024.

Philip Jones

Phil has been Chief Executive of the Welsh Social Enterprise, Business in Focus since October 2021. Business in Focus provides a suite of business support services across Wales, including the delivery of the Welsh Government’s flagship ‘Business Wales’ service. Phil was previously the Director of Prince’s Trust Cymru for five years and before that, the Wales Area Manager for The Royal British Legion. Phil also served in the Armed Forces for over 25 years as an officer in The Royal Welsh. His service included a wide variety of operational, training, intelligence, and strategic communications roles worldwide, including the Ministry of Defence.

Phil joined the Committee in February 2018, and is the Chair of SSAC’s Communications and Stakeholder Engagement sub-committee.

Jacob Meagher

Jacob is a practising barrister (England and Wales, Republic of Ireland, Australia, and New Zealand); is a Research Associate at the University of Cambridge Centre for Business Research; and a Board Member and Trustee of the Snowdon Trust.

Jacob joined the Committee in January 2024.

Dr Suzy Walton

Suzy is a chartered director, occupational psychologist and scientist. As a former senior civil servant, she has worked in the Cabinet Office and the Ministry of Defence. She was awarded a PhD for research into military suicide. Suzy is a Vice-President of Combat Stress, a charity for veterans’ mental health. She is also a disciplinary panel member of the Judicial Conduct Investigations Office (Ministry of Justice) and a member of the Independent Reconfiguration Panel (Department of Health).

Suzy has been a member of multiple boards including the Institute of Directors, the global Association of Chartered Certified Accountants, and Birmingham Children’s Hospital.

Suzy has been a non-executive director/lay member on many government committees including the State Honours Committee (Cabinet Office), the Higher Education Funding Council for England (BEIS), the Ethics Group of the National DNA Database (Home Office), the Science Advisory Council (Defra) and the National Specialist Commissioning Group (Department of Health). She is also a former Vice President of the Royal Society of Medicine and former Deputy Chair of the Royal Society of Arts, the Internet Watch Foundation and the University of Westminster.

Suzy joined the Committee in January 2024.

Annex D: Register of business interests

| Member | Social Security Advisory Committee: register of interests[footnote 43] |

|---|---|

| Dr Stephen Brien | Member, Social Metrics Commission Technical Adviser, Poverty Strategy Commission Charity Trustee, The Centre for Social Policy Studies Senior Fellow, The Future Africa Forum Senior Fellow, Artha Global |

| Les Allamby | Discretionary Support Commissioner for Northern Ireland Occasional legal opinion work and representation at Social Security Appeal Tribunals for Law Centre (NI) Chair of NIACRO and on the Council of Justice Member, Carers Poverty Commission (NI) for Carers NI Member, Carer’s Poverty commission for Carers UK Independent Member, Policing Board (NI) Member, CPAG |

| Bruce Calderwood | Trustee of Avenues Group, a charity providing services to people with complex needs |

| Rachel Chiu | Director of Business Development, Spring Housing Association Chair, Sir Josiah Mason Trust Trustee, Lench’s Trust |

| Carl Emmerson | Deputy Director of the Institute for Fiscal Studies Advisory board member of the Office for Budget Responsibility Member of the Methodological Review Panel for the Census |

| Daphne Hall | Editor, Rightsnet Vice Chair, National Association of Welfare Rights Advisers Occasional training to local welfare rights organisations on self-employed basis Close family member is employed by DWP |

| Professor Stephen Hardy | Professor of Law, employee of the University of Hull Judicial Office Holder, fee Paid Judge (Ministry of Justice) Honorary Treasurer of the Society of Legal Scholars Member, Society of Legal Scholars |

| Phil Jones | Chief Executive, Business in Focus Patron, Motivational Preparation College for Training and the Motivation and Learning Trust |

| Jacob Meagher | Barrister Reasonable Adjustment (Sole Trader, provides Equality Act advice) Director, Meagher Consultancy Limited (dormant) Trustee and Board Member, Snowden Trust Independent Panel Member, Ministry of Justice Membership, Barrister of England & Wales, and of Ireland, Australia, New Zealand Senior Fellow, The Higher Education Academy Fellow, Royal Society for Public Health Independent consultant to Cognassit |

| Dr. Suzy Walton | Strategic Advisor, Institute of Directors Vice President, Combat Stress Board member (lay), National Independent Reconfiguration Panel, Department of Health and Social Care Disciplinary Panels member, The Judicial Conduct Investigations Office (Ministry of Justice) Member, Security Vetting Appeals Panel, Cabinet Office UK’s representative for the Global Network of Director Institutes (GNDI) Fellow, Institute of Directors (Chartered Director) Member, British Psychological Society (Chartered Occupational Psychologist) Life Fellow of the Royal Society of Arts |

The Committee’s register of business interests is regularly updated and published on SSAC’s website.

Annex E: Attendance at Committee meetings 2024-25

| April 2024 | May 2024 | June (5th) 2024 | June (19th) 2024 | August 2024 | September 2024 | October 2024 | November 2024 | December 2024 | January 2025 | February 2025 | March 2025 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stephen Brien | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Les Allamby | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Bruce Calderwood | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Rachel Chiu | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Carl Emmerson | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes |

| Daphne Hall | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stephen Hardy | Yes | No | Yes | Yes | Yes | No | Yes | Yes | Yes | Yes | No | No |

| Kayley Hignell[footnote 44] | Yes | Yes | No | No | No | - | - | - | - | - | - | - |

| Phil Jones | No | Yes | Yes | No | Yes | Yes | No | Yes | No | Yes | Yes | No |

| Grainne McKeever | Yes | Yes | - | - | - | - | - | - | - | - | - | - |

| Jacob Meagher | Yes | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Charlotte Pickles | Yes | Yes | No | No | - | - | - | - | - | - | - | - |

| Suzy Walton | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Annex F: Fees and expenses paid to Committee members in 2024-25

| Travel[footnote 45] | Subsistence | Fees | |

|---|---|---|---|

| Dr Stephen Brien[footnote 46] | £0.00 | £0.00 | £22,000.00 |

| Les Allamby | £183.80 | £139.95 | £3,971.84 |

| Bruce Calderwood | £0.00 | £0.00 | £4,460.10 |

| Rachel Chiu | £0.00 | £0.00 | £3,064.48 |

| Carl Emmerson | £143.64 | £7.00 | £3,732.16 |

| Daphne Hall | £0.00 | £38.83 | £4,211.52 |

| Professor Stephen Hardy | £0.00 | £0.00 | £1,934.56 |

| Kayley Hignell[footnote 47] | £0.00 | £0.00 | £856.00 |

| Philip Jones | £84.80 | £49.45 | £2,413.92 |

| Professor Grainne McKeever[footnote 48] | £180.58 | £7.59 | £821.76 |

| Jacob Meagher | £120.23 | £95.97 | £7,019.20 |

| Charlotte Pickles[footnote 49] | £0.00 | £0.00 | £0.00 |

| Dr Suzy Walton | £166.50 | £12.60 | £4,468.32 |

Annex G: Our Results Framework

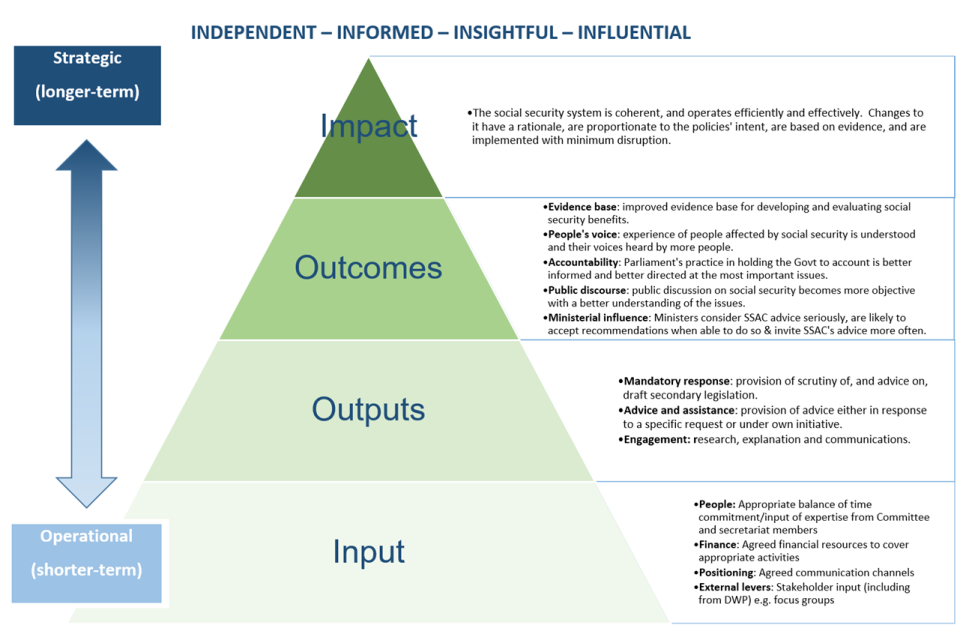

The image shows the following from strategic (longer-term) results to operational (shorter-term) results.

Impact

- The social security system is coherent and operates efficiently and effectively. Changes to it have rationale, are proportionate to the policies’ intent, are based on evidence, and are implemented with minimum disruption.

Outcomes

- Evidence base: improved evidence base for evaluating social security benefits.

- People’s voice: experience of people affected by social security is understood and their voices heard by more people.

- Accountability: Parliament’s practice in holding the government to account is better informed and better directed at the most important issues.

- Public discourse: public discussion on social security becomes more objective with a better understanding of the issues.

- Ministerial influence: Ministers consider SSAC advice seriously, are likely to accept recommendations when able to do so and invite SSAC’s advice more often.

Outputs

- Mandatory response: provision of scrutiny of, and advice on, draft secondary legislation.

- Advice and assistance: provision of advice either in response to a specific request or under own initiative.

- Engagement: research, explanation and communications.

Input

- People: appropriate balance of time commitment / input of expertise from Committee and secretariat members.

- Finance: agreed financial resources to cover appropriate activities.

- External levers: stakeholder input (including from DWP), for example focus groups.

Social Security Advisory Committee

7th Floor, Caxton House

Tothill Street

London SW1H 9NA

Telephone: 0300 046 0323

E-mail: ssac@ssac.gov.uk

Website: www.gov.uk/ssac

X: @The_SSAC

LinkedIn: Social Security Advisory Committee

-

Pathways to Work: Reforming Benefits and Support to Get Britain Working Green Paper - GOV.UK ↩

-

Appointed in January 2024 ↩

-

Modified by The Social Security Administration Act 1992. ↩

-

The Committee superseded the National Insurance Advisory Committee (which had a long-established role in the scrutiny of draft regulations) and the Supplementary Benefits Commission (which advised Ministers on aspects of policy relating to supplementary benefits) both of which were simultaneously abolished. ↩

-

The scrutiny of social security in Scotland is undertaken by SSAC in relation to reserved social security benefits (including Universal Credit), but it has no authority to scrutinise Scotland’s devolved social security measures. The Scottish Commission on Social Security undertakes scrutiny of Scotland’s devolved social security measures. ↩

-

SSAC’s Memorandum with HM Treasury and HM Revenue and Customs will be reviewed during 2025 following the closure of tax credits. ↩

-

Social Security Administration Act 1992, section 173(1)(a) ↩

-

Included in this number is two packages of regulations presented to the Committee on 22 May, immediately prior to the announcement of the General Election, with which the incoming Government decided not to proceed. ↩

-

These regulations were presented to the Committee on 22 May, immediately prior to the announcement of the General Election. The incoming Government subsequently decided not to proceed with the proposals as presented to the Committee. ↩

-

SSAC’s report and the Secretary of State’s response: The Universal Credit, Personal Independence Payment, Jobseekers Allowance and Employment and Support Allowance (Claims and Payments) (Modification) Regulations 2025 ↩

-

Section 173 (1)(a) of The Social Security Administration Act 1992 ↩

-

Exchange of correspondence between SSAC’s Chair and the Secretary of State for Work and Pensions about means-testing of Winter Fuel Payments. ↩

-

Pathways to Work: Reforming Benefits and Support to Get Britain Working Green Paper - GOV.UK ↩

-

Fixing the foundations: public spending audit 2024-25 - GOV.UK ↩

-

The Social Fund Winter Fuel Payments Regulations 2024: letter to the Secretary of State for Work and Pensions - GOV.UK; The Social Fund Winter Fuel Payments Regulations 2024: Secretary of State for Work and Pensions reply to SSAC - GOV.UK ↩

-

DWP were aware that the impacts were uncertain and as a result had decided to time limit them to a year so that they could be assessed. ↩

-

SSAC Occasional Paper 22: Separated parents and the social security system - GOV.UK ↩

-

The Universal Credit, Personal Independence Payment, Jobseeker’s Allowance and Employment and Support Allowance (Claims and payments)(Modification) Regulations 2025 (SI 2025/**) - GOV.UK ↩

-

The Social Security (Infected Blood Capital Disregard) (Amendment) Regulations 2024: exchange of correspondence between Dr Stephen Brien (SSAC Chair) and the Minister for Social Security and Disability ↩

-

Improving the effectiveness of the Claimant Commitment as a tool to support people into work - GOV.UK ↩

-

And the Northern Ireland Department responsible for social security, currently this is the Department for Communities. ↩

-

A Scotland member, Professor Sharon Wright, was appointed in autumn 2025. ↩

-

Four FTE staff ↩

-

Commencing with a study into how the benefit system influences the choices made by young people. ↩

-

Hundreds of quangos to be examined for potential closure as Government takes back control Cabinet Office press release 7 April 2025. ↩

-

These appointments were made on 1 September 2025: New appointments to the Social Security Advisory Committee - GOV.UK ↩

-

SSAC’s Results Framework is held at annex G. ↩

-

Social Security Administration Act 1992 s.170 and the Social Security Administration (Northern Ireland) Act 1992 ss.149–151 ↩

-

£260,000 of which are allocated to staff costs. ↩

-

The Department has confirmed that the remaining measures presented as part of this package of regulations will not be taken forward. Following discussion with the Department, we consider this to be the conclusion of SSAC’s scrutiny of the draft regulations. The Department has confirmed that it will return to SSAC if any measures are subsequently taken forward which require secondary legislation ↩

-

The Department has confirmed that, following the outcome of a judicial review into the lawfulness of the consultation on the WCA descriptors, these regulations have been withdrawn. Following discussion with the Department, we consider this to be the conclusion of SSAC’s scrutiny of the draft regulations. The Department has confirmed that it will return to SSAC if any measures are subsequently taken forward which require secondary legislation ↩

-

To September 2024 ↩

-

To May 2024 ↩

-

To August 2024 ↩

-

To March 2025 ↩

-

To February 2024 ↩

-

To December 2024 ↩

-

As at 31 March 2025 ↩

-

Should a social security benefit be in payment to a Committee member or a close family member, this would be separately declared to the Committee Chair direct. ↩

-

SSAC member to September 2024 ↩

-

This relates to reimbursement of costs incurred by Committee members. It does not reflect costs of travel arranged by the secretariat via DWP’s contractors. ↩

-

The Chair received annual remuneration of £22,000 during 2024-25. ↩

-

To September 2024 ↩

-

To May 2024 ↩

-

To August 2024 ↩