The UK Safety Tech Sector: 2021 analysis

Updated 15 June 2023

1. Ministerial Foreword

The government remains committed to ensuring that the UK is the safest place in the world to go online. Last year, our ‘Safer Technology, Safer Users: The UK as a world-leader in Safety Tech’ report highlighted how the UK is leading in developing new solutions that are being used worldwide to safeguard and protect users from harm, and to detect and remove illegal content.

In May 2021, the government published the Online Safety Bill. This Bill sets out a new regulatory framework for online safety and companies’ responsibilities to keep UK users, particularly children, safer online - including robust action to counter illegal content and activity.

We know that the safety tech sector has great potential to help us meet these commitments. Technology is part of the solution to protecting users online. The UK has made significant progress in areas such as content moderation, digital forensics, and filtering - and these are key in the fight against online harms.

Over the last year, we have consulted extensively with industry, academia and the public to better understand how the UK can tackle online harms. We set out our commitment to grow the UK safety tech sector, to support digital growth and high-value employment across the UK, and to better protect UK users online.

We have committed funding to initiatives to support the safety tech sector to develop innovative new solutions, and to protect as many users as possible globally. This includes the Online Safety Data Initiative that will help safety tech companies access the datasets they need to train new online safety products that identify and remove harmful and illegal content.

We also recognise the need to promote the solutions available within the UK and, in 2020, we launched the Safety Tech Innovation Network and the Directory of UK Safety Tech Providers. We have also harnessed collaboration with partners such as the Online Safety Tech Industry Association (OSTIA) and Age Verification Providers Association (AVPA).

Issues of internet safety are not exclusive to the UK. To tackle online harms, there is a need for global collaboration, mutual commitments and the setting of shared standards. We therefore welcome that the G7, led by the UK’s innovative approach, has agreed shared principles on how to tackle the global challenge of online safety. This includes our commitment to sharing information, research and best practice for the development and adoption of safety technology, and to supporting innovation that drives digital growth.

Online safety will continue to be a global issue within a global marketplace, and we are encouraged by this year’s report that highlights the UK continues its role as a world-leader in safety tech.

Caroline Dinenage MP Minister of State for Digital and Culture

2. Key Findings

This research update highlights that the safety tech sector continues to grow at pace. The key metrics are covered below.

Companies

The number of companies providing safety tech products and services has now reached 100 firms (an increase of 43%).

There are encouraging signs of newly registered start-ups using Artificial Intelligence for good, particularly in the domains of tackling disinformation and developing new approaches to content moderation and video and image analysis at scale.

Further, there are other businesses within the domains of cyber security, RegTech, and AI developing new safety tech solutions for the market.

Revenues and Employment Growth

We estimate that total revenues have reached £314m in the most recent financial year.

This reflects an increase of £88m since last year’s analysis, and means that the sector’s revenue has grown by 39% in the last year.

Within the safety tech sector, there are currently an estimated 2,200 Full-Time Equivalent (FTE) employees. This is an increase of 500 people since last year’s report, i.e. employment growth of 29%.

Investment Performance

There has been sustained interest in safety tech by the investment community, with £39m raised in 2020 across 22 deals.

The sector is maturing, as reflected by SuperAwesome’s acquisition by Epic Games, and the increasing scale of Series A and venture stage investments in safety tech scale-ups.

Support for the Safety Tech Sector

There are now a wider range of initiatives available for the safety tech sector compared to twelve months ago, e.g. the formation of OSTIA, the Safety Tech Innovation Network, and the world’s first Safety Tech Conference held by DCMS, DIT and CogX.

Initiatives such as the Online Safety Data Initiative will help unlock barriers to data-sharing, and encourage new activity in the sector.

3. Introduction

In May 2020, the Department for Digital, Culture, Media and Sport (DCMS) published ‘Safer Technology, Safer Users: The UK as a world-leader in Safety Tech’.

This research provided an overview of the UK’s online safety technology sector, identified considerable growth in recent years, and highlighted a range of innovative companies focused on tackling online harms through a range of technical solutions.

Definition Recap: Safety Tech providers develop technologies or solutions to facilitate safer online experiences, and protect users from harmful content, contact or conduct.

This research focuses on firms that:

- Often work closely with law enforcement, to help trace, locate and facilitate the removal of illegal content online

- Work with social media, gaming, and content providers to identify harmful behaviour within their platforms

- Monitor, detect and share online harm threats with industry and law enforcement in real-time

- Develop trusted online platforms that are age-appropriate and provide parental reassurance for when children are online

- Verify and assure the age of users

- Actively identify and respond to instances of online harm, bullying, harassment and abuse

- Filter, block and flag harmful content at a network or device level

- Detect and disrupt false, misleading or harmful narratives; and

- Advise and support a community of moderators to identify and remove harmful content

In April 2021, DCMS commissioned Perspective Economics to update the sectoral analysis figures one year on, to identify how the safety tech sector has grown in the last year.

This includes exploring the number of businesses now offering safety tech solutions, or engaging with new initiatives such as the Safety Tech Innovation Network.

It also includes an updated estimate of the size of the safety tech sector in the UK, measured through revenue and employment, and review of the investment landscape.

Methodology

The research team developed a definition for Online Safety Tech, including a taxonomy for products and services considered in scope.

The team identified company trading data for the 100 safety tech providers using Bureau van Dijk FAME (for financial metrics), Beauhurst (a research platform that identifies high-growth and high potential firms in the UK, including investment data), and through direct consultation and an online survey of industry members.

The full methodology used for this research is consistent with that set out within Appendix B of the ‘Safer Technology, Safer Users’ report.

4. Number of Safety Tech Firms Active in the UK

As of April 2021, we have identified 100 registered businesses active in the UK providing safety tech products and services.

This reflects 32 newly identified providers, and includes newly registered safety tech start-ups, as well as existing technology firms that have been identified as now providing safety tech solutions.

The table below sets out the number of safety tech firms by taxonomy area (and includes a definition of each). Please note this reflects the perceived ‘best-fit’ for each company. However, many companies do offer multiple products and services.

| Taxonomy Classification | Short Definition | Number of Firms |

| System-wide governance | Automated identification and removal of illegal content: use of technology to identify and enable the removal of illegal child sexual exploitation and abuse (CSEA) material, and terrorist content including imagery and video. | 13 |

| Platform level | This includes organisations that support content moderation through identifying and flagging to human moderators for action; Potentially illegal content or conduct, such as grooming, hate crime, harassment or suicide ideation; Harmful content or conduct which breaches site T&Cs, such as cyberbullying, extremism or advocacy of self-harm. | 20 |

| Age orientated online safety | Enabling age-appropriate online experiences through use of age assurance and age verification services to limit childrens’ exposure to harmful content, or development of child-safe content. | 15 |

| User Protection | User, parental or device-based products that can be installed on devices to help protect the user from harm. | 13 |

| Network Filtering | Products or services that actively filter content, through black-listing or blocking content perceived to be harmful. This can include solutions provided to schools, businesses or homes to filter content for users. | 14 |

| Information Environment | Flagging of content with false, misleading and/or harmful narratives, through the provision of fact-checking and disruption of disinformation (e.g. flagging trusted sources). | 12 |

| Online Safety Professional Services | Advisory support with implementing technical solutions. Enabling the development of safer online communities and embedding safety-by-design. | 13 |

| Total | 100 |

Within the last year, there has been growth across all categories (with respect to the number of companies), with firms added including:

- Checkstep, founded in 2020 with offices in London, Bulgaria, and soon the US. They provide content moderation at scale, and focus on themes of online harm detection, transparency of moderation, online learning and AI fairness.

- Legitimate, a Belfast-based start-up, which aims to bring truth and transparency to the internet through source verification, and development of a verified search engine.

- NewsGuard Technologies have been active in the UK for several years, but recently incorporated in the UK in May 2020. They provide rating of websites that are providing reliable journalism or are sharing false or misleading news.

- Veracity Collective provide training and specialist consultancy in countering disinformation and securing information integrity.

- Samurai Labs develop products in the domain of online harms detection and prevention. Founded in Poland, the team now has a UK presence.

- Just Ask Max is a digital well-being service for companies, schools and families that provides help with issues such as screen-time and cyber bullying.

- Digital Safety CIC provides advisory support and training on issues of online safety, risk and safeguarding.

5. Location

The map below sets out the registered locations of the hundred providers identified. We note that there is continued growth of safety tech across the regions, as more than half (58%) of firms are based outside of London. Hotspots continue to include areas such as Edinburgh, Leeds and London. There is also emerging activity in areas such as Greater Manchester, Oxford, Bristol, and Belfast.

Locations of UK safety tech companies

6. Estimated Revenue and Employment

Revenue

We estimate that total revenues for the last financial year have reached £314m.

This reflects an increase of £88m since last year’s analysis, and means that the sector’s revenue has grown by 39% in the last year.

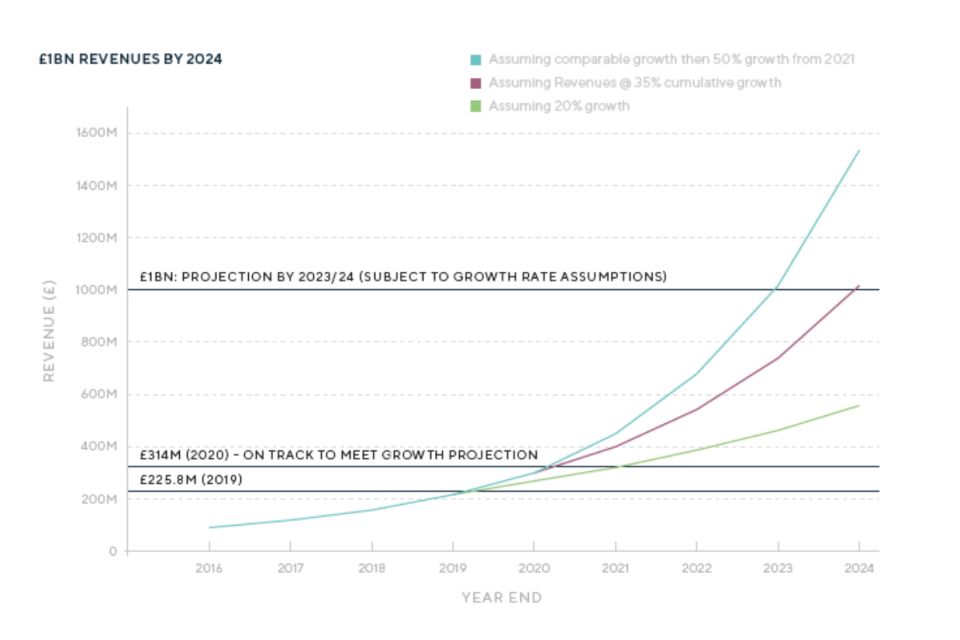

The previous analysis highlighted that UK safety tech had consistently grown by 35% per annum between 2016-2019. This still remains an emerging sector, but it continues to grow at an expanding and impressive pace.

Overall, this means that safety tech is arguably one of the UK’s fastest growing emerging technology sectors. For example, in comparison, the rate of tech GVA contribution to the UK economy has grown on average by 7% per year since 2016.

Based on this year’s performance, the sector remains on track to hit its £1bn revenue target by the mid 2020s, as set out in last year’s report.

Revenue increase of UK safety tech companies

Employment

We estimate that across the safety tech sector, there are currently 2,200 Full-Time Equivalent (FTE) employees. This is an increase of 500 people since last year’s report - a total employment growth of 29%.

7. Investment in Safety Tech Providers

In last year’s report, the research noted that UK safety tech providers hold an estimated 25% global market share. As a result of considerable growth within UK safety tech, there has been sustained interest from the investment community.

Further, the previous research highlighted that the UK could see its first safety tech unicorn (a company worth over $1 billion) emerge in the coming years.

2020 was an important year for investment in safety tech firms. The impact of COVID-19 has also raised new markets for some of these firms, driven by factors such as children using devices more at home during lockdowns, and the implementation of technology developed by safety tech firms e.g. ID verification and privacy-by-design to help tackle COVID-19.

Example Investments Raised in 2020

- In September 2020, Epic Games announced the acquisition of SuperAwesome, a kidtech platform used by hundreds of companies to ensure that digital engagement with children is safe, private and compliant with laws such as COPPA, GDPR-K, CCPA and others

- Logically, a tech start-up that uses AI to detect misinformation and to provide a fact-checking service raised £2.5m to develop its product in Q2 2020

- SafeToNet (safeguarding technology that detects and filters risk in real-time) raised over £2.5m in Q3 2020 through a crowdfunding campaign with Seedrs

- Pimloc (a deep learning platform enables private businesses and public organisations to protect sensitive or personal data in video) raised a £1.4m seed investment in Q4 2020.

- Cyan (an Edinburgh based tech company that helps law enforcement, social media, and cloud providers find and block harmful content) secured a £5m Series A investment round in Q1 2021.

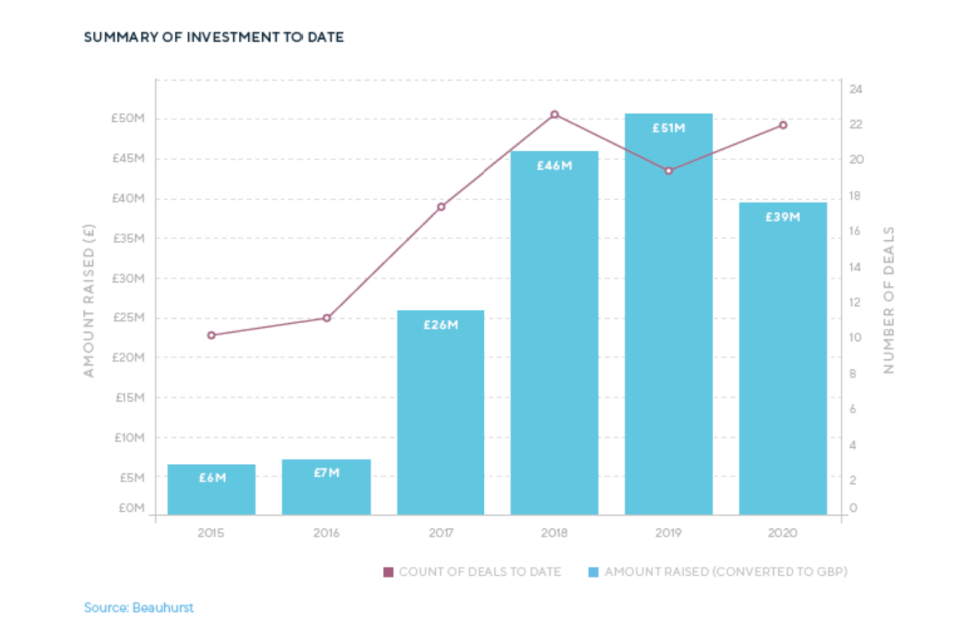

Overall, the total external investment raised by the sector in 2020 reached £39m across 22 deals.

Whilst the total amount of investment has fallen slightly (from £51m in 2019), this does not include the value of some undisclosed deals, and it is therefore likely that investment performance in 2020 was higher than in 2019.

Investment growth in UK safety tech companies

8. Exports and International Activity

Within last year’s research, we noted that:

“As a sector, UK Safety Tech providers are outward-looking, and recognise that issues relating to online harms cannot be tackled within one single jurisdiction, but rather require international collaboration and outreach. Export markets are growing - there is a keen desire to export and work internationally, in full recognition that technologies and solutions developed within the UK can have global relevance and application.”

Today, more than half (52%) of UK safety tech companies already have an identifiable international presence.

The role of UK safety tech providers operating within a global market, and protecting users worldwide continues to be a strong theme. In 2020, DCMS and DIT jointly developed the Directory of UK Safety Tech Providers, which provides a list of UK-based companies that provide safety tech solutions, and are keen to work both domestically and internationally to support organisations embed safety tech solutions.

This sustained promotion of UK safety tech providers will be increasingly important as the UK seeks to build upon its estimated 25% global market share.

Indeed, in the last year, many safety tech providers have expanded their international reach. This includes:

- SafeToNet recently acquired 77 mobile phone shops across Germany, which will be branded as SafeToNet Family Stores. These Family stores will sell contracts from Deutsche Telekom, Vodafone and Telefonica. Smartphones and tablets made by Samsung, Nokia, Apple and others will include SafeToNet online safety software so that mobile devices and tablets are ‘Safe Out of the Box’ and children are protected online from day one.

- GoBubble continued the global reach of its young person centred content moderation SaaS (GoBubbleWrap) with a five-year agreement with Vietnamese telco Mobicast, to bring the entire ecosystem of GoBubble services to be available to all 26 million children in Vietnam. GoBubbleWrap checks all user generated content in 70 countries and helps developers by reducing the risk of inappropriate content under 16s might see.

- Cyan has recently secured initial sales with US law enforcement, and established international partnerships with US based DATAPILOT, and the National Center for Missing & Exploited Children (NCMEC) who evaluated their tech favourably. Cyan is also part of an inaugural International Growth Program for Australia led by the UK Government’s Digital Trade Network Initiative, and are developing global partnerships to create international Contraband Filters from national datasets of child abuse imagery, which will use Cyan’s ground-breaking search tools to scan against.

- Crisp provides early-warning risk intelligence on the agendas, tradecraft and interplay of individuals and groups, predicting potential impacts to leading brands, global enterprises and social media platforms as early as possible. They have been collaborating with Kroll (a global provider of services related to governance, risk and transparency) across the UK, US, and Europe to deliver this intelligence to shared clients with Kroll providing the investigatory expertise needed to act upon it.

9. Supporting the Safety Tech Sector

The 2020 report also set out a range of recommendations to help grow the safety tech ecosystem relating to:

- A need to promote and increase awareness of the UK safety tech sector

- Supporting safety tech firms to access the right forms of capital for growth

- Getting the policy landscape right – with government providing leadership, guidance and appropriate legislation to address online harms Enabling improved access to data, including promotion of data-sharing, privacy by design, and collaborative partnerships

- Supporting innovation, cross-disciplinary research and development in safety tech

These recommendations have been heard, and a range of actions have been taken forward by government, industry and academia in the last year. These include:

| April 2020 | The Online Safety Technology Industry Association (OSTIA) launches with 14 founder members at Leeds Digital Festival. |

| May 2020 | DCMS publishes the first UK Safety Tech Sectoral Analysis: ‘Safer Technology, Safer Users: The UK as a world-leader in Safety Tech’’ |

| August 2020 | The UK Safety Tech Providers Directory is published by DCMS and the Department for International Trade (DIT) |

| September 2020 | ICO’s Age Appropriate Design Code comes into force; Safety Tech Unconference 2020 |

| October 2020 | Launch of the Safety Tech Innovation Network |

| November 2020 | UN Internet Governance Forum holds Open Forum session on the global safety tech market |

| December 2020 | UK Government emphasises value of safety tech in its full response to the Online Harms White Paper |

| February 2021 | DCMS launches £2.6m ‘Online Safety Data Initiative’ |

| March 2021 | The world’s first Safety Tech Conference: Unleashing the Potential for a Safer Internet with CogX; |

| March 2021 | Cross-sector collaboration to grow the German Safety Tech sector begins with two industry roundtables. |

| April 2021 | The UK Safety Tech Association (OSTIA) marks its first birthday, announcing a 62% membership increase during the year. More than a third of all UK safety tech businesses are now OSTIA members. |

| April 2021 | G7 publishes its Internet Safety Principles, which include a commitment to collaborate on safety tech. |