Detailed Overview of the Gigabit Infrastructure Subsidy Scheme v0.7

Updated 26 July 2024

Published 1 June 2021

1. Delivering a gigabit-capable UK: Gigabit Infrastructure Subsidy

Detailed overview of the Gigabit Infrastructure Subsidy scheme

2. Project Gigabit

Building fast, reliable broadband for everyone in the UK

3. Purpose

This paper gives an “end-to-end” overview of how we will manage the Gigabit Infrastructure Subsidy scheme within Project Gigabit.

4. The Need for Gigabit Broadband

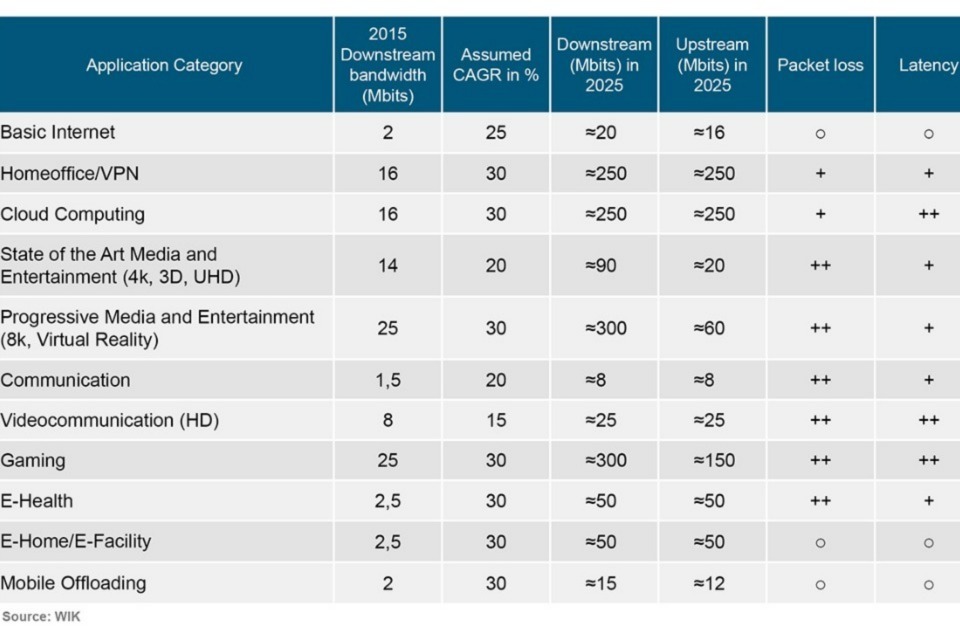

The increasing need for ever faster, better connectivity is clear, as applications become ever more sophisticated and innovative use cases move from development into the market, the basic underpinning infrastructure needs to match the ambition. Ofcom have undertaken a range of studies into future demand for broadband at all speeds to inform their regulatory posture. Working with WIK, they have calculated the likely data requirements for popular internet applications up to 2025 (Figure 2 below)

Figure 1 - Application Categories with their capacity and quality requirements in 2025[footnote 1]

This report’s key findings are:

-

The main driver of increasing bandwidth demand has been video. In 2016, in the UK, Internet video accounted for 68% of Internet traffic. Notwithstanding developments in compression technology, video traffic is expected to increase as traffic moves from other media to the Internet and as the quality of video increases.

-

Consumer cloud traffic is also expected to grow significantly – and will add to demand for upstream connectivity. Gaming is a further growth sector.

-

Looking forward, the main new developments are expected in the ‘tactile Internet’ and immersive media. Remote diagnostics and autonomous driving are examples of tactile applications requiring very low latency. Virtual reality (which has applications in many other spheres) will also place significant demands on the quality of broadband connections. As broadband in the home improves, these connections may become increasingly suitable for home working and small business use as well.

-

Based on WIK’s modelling of expected demand for current and future consumer and business applications in the home, we estimate that around 40% of UK households may require at least 1Gbit/s downstream and 600Mbit/s upstream by 2025, with more than 40% having demand for at least 300Mbit/s symmetric. Even under a less aggressive scenario, in which forecast bandwidth for some services are reduced, and we assume there is no use of advanced media such as 8K and VR (except for gaming). We estimate that more than 50% of households would still require download speeds of at least 300Mbit/s by 2025 of which 8% would require Gigabit bandwidths.

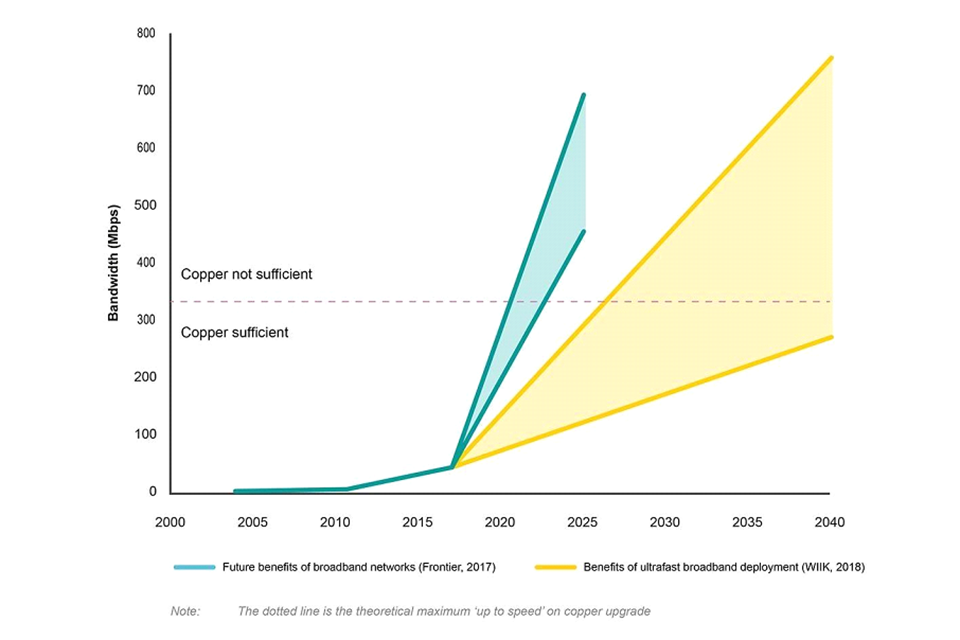

The UK National Infrastructure Commission has also published a further forward look into demand for high speed internet to 2040[footnote 2]. This is summarised in Figure 3 below:

Historic average UK broadband bandwidth and forecasted future bandwidth demand

Figure 2 - Historic average UK broadband bandwidth and forecasted future bandwidth demand[footnote 3]

This evidence demonstrates that historical growth in demand for ever faster internet connection with ever lower latency is anticipated to continue. This is expected to be driven by identified applications such as gaming and TV, but also potentially boosted by new data-hungry services based around the Internet of Things, VR or immersive media. The disjunct between the demand for connectivity to enable these services, which will arrive further down the line, and the time taken to deliver the connectivity is one of the key challenges we are seeking to address.

5. UK Commitment to Broadband

The Future Telecoms Infrastructure Review (FTIR) was published in July 2018 and laid out a vision for a full fibre and 5G future for the UK. The potential benefits to the UK are considerable:

- work commissioned by the UK’s National Infrastructure Commission (NIC) estimated net benefits from investment in FTTP with 100% coverage of up to £28 billion (in present value terms) by 2050. This is before taking account of the potential for FTTP to deliver wider economic benefits, for example, improvements in productivity

- a study commissioned by Ofcom finds that investment in broadband has had significant benefits to the UK economy and that increased connectivity has a positive relationship with economic growth and productivity

- study undertaken for Cityfibre has predicted that the total economic impact of deploying ‘full fibre’ (FTTP) broadband networks across 100 distinct UK city and towns, could reach £120 billion over a 15 year period

- evaluation of the NBS 2012 found that making superfast broadband speeds available also appeared to raise the productivity of firms. It is estimated that the programme led to a net increase in national economic output (GVA) of £690m by June 2016

The key findings of the FTIR were that, despite over 97% coverage of superfast broadband, largely based on copper user connections, the UK was in danger of falling behind on rolling out fibre and 5G connections. It proposed a more proactive approach than has been taken historically in the UK. With NGA broadband, the UK Government waited for the market to largely complete its roll-out in commercially viable areas and then sought to extend networks beyond those with State gap-funding. This was an effective approach in the circumstances where the challenge was to augment copper connections which were already in place. The challenge of building a full fibre network is much greater and the opportunity cost of the delay in connecting non-commercial areas is also much greater.

Recognising this, the FTIR proposed, as part of a wider range of measures under the Project Gigabit, an “Outside In” procurement approach, named the Gigabit Infrastructure Subsidy. In essence this procurement approach seeks to minimise market distortion by relying on industry to build where it makes commercial sense to do so, but, rather than wait for this process to run its course, FTIR recommends that we identify the non-commercial areas, expected to be at the outside of the networks, and to build to these premises in parallel to commercial build, seeking to provide gigabit-capable connectivity across all areas of the UK at the same time, ensuring no areas are systematically left behind.

FTIR predicted that:

- at least a third (with the potential to be substantially higher) of UK premises are likely to be able to support three or more competing gigabit-capable networks;

- up to half of premises are likely to be in areas that can support competition between two gigabit-capable networks;

- there are likely to be parts of the country (c.10% of premises) that, while potentially commercially viable for at least one operator, may not benefit from investment within a reasonable timeframe, if at all; and

- In the final c.10% of premises, the market alone is unlikely to support network deployment and additional funding of some description will be required to ensure national coverage.

6. Project Gigabit and Gigabit Infrastructure Subsidy Procurement Approach

The proposal for this approach is to build naturally on the successful National Broadband Schemes approved by the European Commission in 2012 and 2016[footnote 4] to deliver gigabit-capable networks to the 20% of UK premises which are not expected to be delivered commercially. We have applied our experience from the earlier programmes, supported by extensive evaluation work[footnote 5], to refine the delivery mechanism and adapt it to the specific need to deliver gigabit-capable networks. The proposed approaches have been tested with industry (details at Annex A) and are detailed below.

The UK Government National Infrastructure Strategy outlines how the government is working with industry to target a minimum of 85% gigabit-capable coverage by 2025. This is a key part of our £5 billion Project Gigabit and its nationwide target. The 2020 Spending Review sets out the timeline for how the first £1.2bn tranche of the £5 billion we have promised will be made available to industry. The spending profile takes into account extensive engagement by the department with suppliers in the telecoms industry, and what we believe that the industry will be able to deliver by 2025 in these hard to reach areas at this stage. We will continue to work with industry to accelerate that as much as possible, whilst continuing to utilise subsidy to deliver the programme.

The FTIR estimated that the full cost of nationwide coverage is £30bn. Project Gigabit is looking to provide funding to the premises which are unlikely to receive gigabit-capable broadband within a reasonable timeframe, if at all. We estimate this to be approximately 20% of premises (i.e. the “final 20%”). Current estimates for the public sector funding requirement in the region of £5bn. It is anticipated that projects under the National Broadband Scheme for the UK for 2016-2020 will deliver a proportion of the required premises coverage. There is also likely to be a contribution from clawback payments from the 2012 and 2016 Decisions[footnote 6]. However, we are allowing for the full amount of £5bn in this document and the Programme may invest beyond this figure subject to a non-material increase of up to 20% provided that such funding is invested with the wider compatibility requirements as set out in this document .

The legal basis for the BDUK spending is Section 13A of the Industrial Development Act 1982, and for any Local Authority contributions Section 31 of the Local Government Act 2003, or other relevant legal instruments where the source of funding is from other UK Government, Devolved Administrations or public sector sources.

The proportion of government subsidy for each procurement will depend on the outcome of the open tender processes and thus will vary from contract to contract. While the majority of contracts will require an aid intensity of less than 100%, we expect that there will be cases that will require 100% aid funding. This is because of the challenges posed by legacy network deployment decisions, extreme topography, network re-configuration and very low premises densities. Additionally, as with the NGA networks supported, we are working to deliver infrastructure in anticipation of future demand, meaning that early uptake of full gigabit-capable services is likely to be low initially. Given the existing infrastructure in place to deliver Superfast/NGA access, there may also be revenue expenditure in reusing that for supply of gigabit-capable networks.

7. Role of BDUK as the “national competence centre”

Project Gigabit is to be operated and monitored by Building Digital UK (BDUK), which acts in this context as the national competence centre (NCC). The NCC’s responsibilities include: (i) the central coordination of Subsidy Control aspects of the Gigabit Infrastructure Subsidy scheme; (ii) acting as a conduit for, and assurance of the use of, central Programme funds; (iii) acting as an assurance function for compliance with subsidy control requirements, whether projects are delivered by BDUK or any other bodies; and (iv) providing support, guidance, information sharing and toolkits for BDUK and any implementing bodies, such as the devolved administrations.

For the Gigabit Infrastructure Subsidy scheme, the intention is for BDUK to direct resources for qualifying projects, so it will ensure that the NCC operates in a functionally separate capacity within BDUK in making its assessments (BDUK will operate the NCC as a separate team from those responsible for running the procurements).

8. The Procurement approach

We intend to use year 1 as a learning year and make any changes to the procurement approaches for subsequent years, with an ongoing continuous improvement cycle built into all procurement routes. Improvements or changes to the procurement approach will be compliant with PCR 2015. Following extensive engagement with industry and taking account of the diversity of suppliers in the industry, we envisage using three procurement routes to award contracts on the Gigabit Infrastructure Subsidy scheme:

- A Dynamic Purchasing System to award contracts for smaller intervention areas of up to 10,000 premises;

- A restricted procurement procedure to award contracts for larger intervention areas of up to the region of 150,000 premises; and

- A single supplier framework agreement, designed as a ‘catch all’ for areas of the country where there is no competition, or where procurements have failed through other procurement routes, or where a commitment to a substantially larger scale requirement secures a step-change investment in capacity and greater pace of delivery.

8.1 Dynamic Purchasing System (DPS)

A DPS allows suppliers to join and leave at any time. The DPS will be designed to have low barriers to entry for new and small suppliers in the market and DCMS will take on a central role in supplier and market management in order to encourage new entrants and maximise competition for the procurements. The DPS is an appropriate route to market for multiple, similar procurements over multiple years and will allow a standardised and simplified route to market for both the contracting authority and suppliers.

8.2 Large Contracts

A restricted procedure will be used to procure large contracts as it allows DCMS to down-select suppliers from the competition through an initial Selection Questionnaire (SQ). This SQ stage is important given the increased risk DCMS is undertaking with larger contracts. Suppliers who meet the criteria at the SQ stage will be invited to bid for individual contracts. There will be a new restricted procedure for each release of contracts under this procurement route.

8.3 Framework Agreement

The framework agreements are intended to be single supplier agreements and will primarily include eligible premises in locations identified with no effective competition, potentially covering a county or multiple counties. The frameworks will also include intervention areas that were not successfully procured through other procurements. Suppliers will be required to build to any premises called off under these frameworks.

As noted above, the procurement approach will include an ongoing continuous improvement cycle and this could include the use of other valid procurement procedures as set out in the PCR 2015.

8.4 Industry Consultation

We have undertaken an initial consultation with the market to test various elements of our procurement strategy for the programme. The consultation process to date has consisted of a number of industry days, group workshops, requests for information (RFI) and one to one meetings with suppliers. The majority of these took place over the summer and autumn of 2020 and focussed on the DPS. Through this engagement in 2020 it was identified that the market has an appetite for larger scale procurements and contracts and, following feedback, procurements for larger contracts was designed. More detailed engagement with the market is continuing on these procurements, with the most recent engagement having taken place on the 4th February 2021 to formally brief the market on how these larger contracts will operate. Engagement with the market on the frameworks began with the market in January 2021 to formally establish market interest and capacity for these largest scale procurements.

From the consultation processes we were able to confirm that gap funding was the funding model most suppliers would be interested in bidding for. This model is most compatible with current business models. Suppliers were in agreement that data accuracy is important and a 3 year period to take account of build plans through an open market review would provide the right balance of granularity and forecasting. Forward pipelines and certainty of funding, bundle size and location were all cited as being important to remove barriers to entry and revenue, cost and supply chain uncertainty.

An ongoing process of consultation with industry is central to the successful delivery of the programme and is described in more detail below.

9. Guiding Principles

9.1 Seeking to remedy an identified market failure

The programme is in line with the objectives of the “UK’s Future Telecoms Infrastructure Review”. The overall objectives of the Programme are to supplement expected market delivery of 80% of UK premises to provide gigabit-capable connectivity across all areas of the UK at the same time, ensuring no areas are systematically left behind.

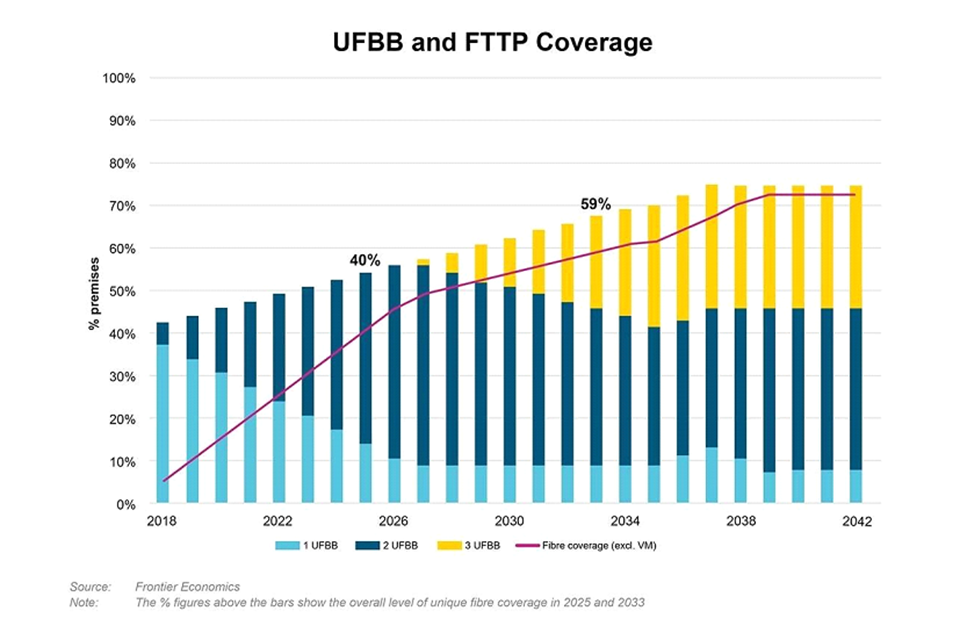

There are a number of factors influencing investment decisions by infrastructure providers, key of which are the level of demand, cost of deployment and availability of capital. These factors collectively have meant that, in absence of intervention, network infrastructure concentrates in areas which are commercially viable and fails to cover areas which are not. Historically, we have seen this effect in the roll-out of telephone networks (the UK nationalised numerous telephone providers in 1911[footnote 7], bringing them under the General Post Office, to promote coverage), NGA networks, and successively with 2G, 3G and 4G mobile networks. The FTIR contains a detailed market analysis commissioned from Frontier Economics[footnote 8]. Their assessment of what they call the “do nothing” model (Section 5) is made against five key criteria: pace; coverage; quality, innovation and price; total cost; how costs could be recovered; and feasibility. The report makes clear that they do not expect industry to meet the objectives for gigabit-capable coverage, missing both pace and coverage and anticipating that commercial roll-out will “top-out” at c75% - see Figure 4 below.

New fibre coverage and degree of competition over time

Figure 3 - New fibre coverage and degree of competition over time (p59 Frontier Economics Report)

9.2 The Approach

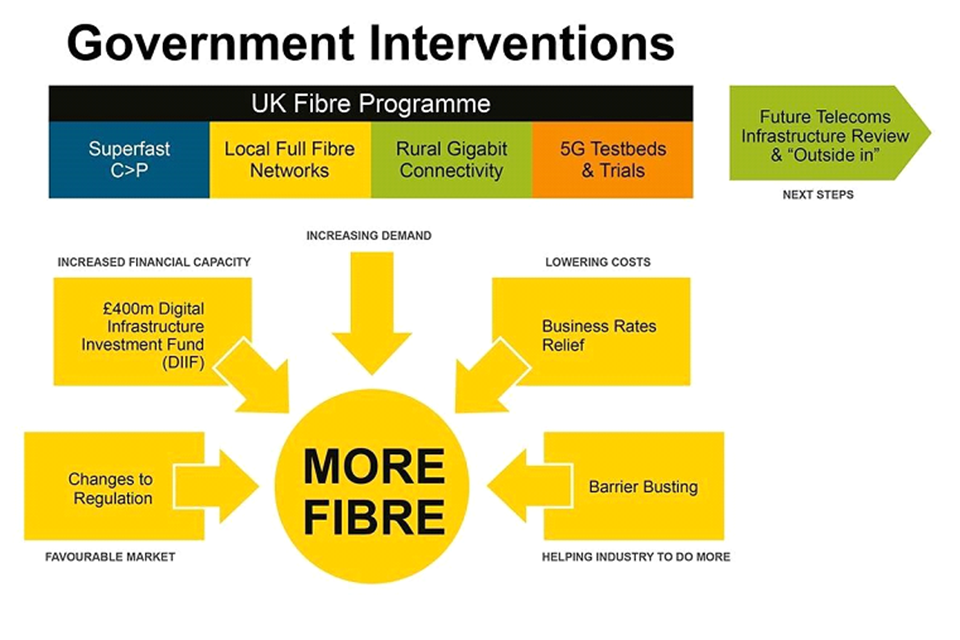

The Gigabit Infrastructure Subsidy scheme is not the only mechanism the UK Government is using to promote Gigabit connectivity.

Government fibre interventions

The Digital Infrastructure Investment Fund, managed by the Treasury, and Business Rates relief on fibre[footnote 9] have been welcomed by industry and both help to create a supportive financial regime. The DCMS-led Barrier-Busting Taskforce has been working with industry to identify practical solutions to common problems around planning, highways access and access to local and central government infrastructure and has produced a wide range of resources to support in the Digital Connectivity Portal.

There are a range of interventions which we are working with Ofcom[footnote 10] to deliver, including: - Ofcom’s Wholesale Fixed Telecoms Market Review 2021-26 seeks to create the best possible conditions for companies to invest in gigabit-capable broadband so customers in all parts of the UK can enjoy the benefits it provides, while protecting customers as the UK transitions to new, faster fibre networks. The regulations set out will: * Continue pricing flexibility for BT’s wholesale services with speeds above 40 Mbps to support incentives to invest in fibre network build. * Maintain access and pricing controls on Openreach copper network until alternative networks are available to protect consumers in the transition to new networks. * Facilitating market entry by continuing to require Openreach to allow network competitors to reuse its existing network of underground ducts and telegraph poles. This regulation makes it cheaper and easier for competitive networks to deploy gigabit broadband across the country. * As part of the WFTMR, Ofcom have also secured a commitment from Openreach to connect 3.2 million premises in the hardest to reach 30% of the country with full fibre by the end of the review period (2026). We have engaged closely with Ofcom to consider how this commitment interacts with government funding in these areas, to ensure the interventions work together to maximise coverage and value for money.

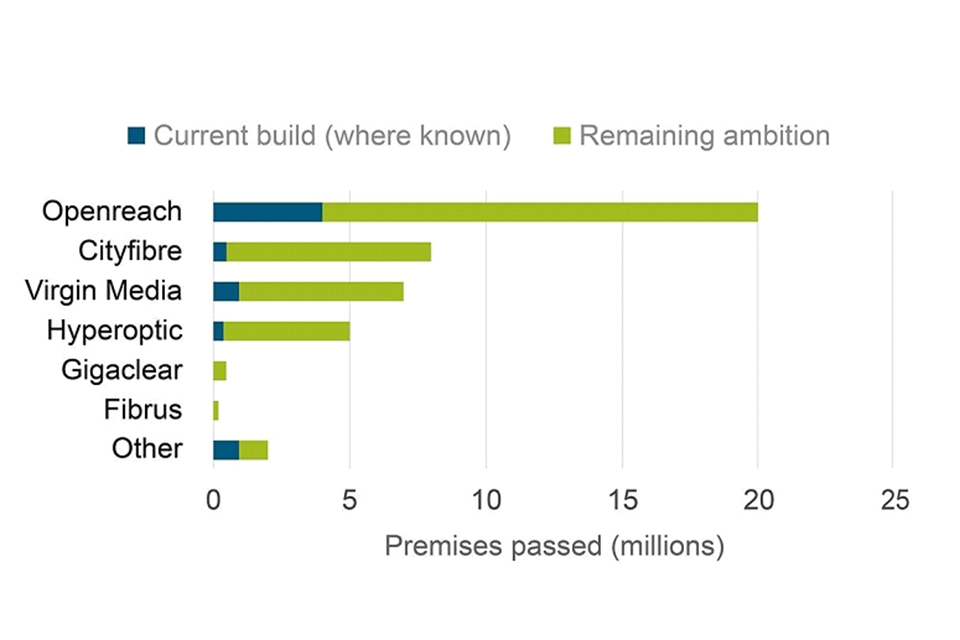

The current expectation is that these interventions will stimulate the market in a range of areas, as well as delivering some connectivity directly. They have already served to highlight government interest in gigabit-capable networks to the market leading to a wide range of announcements by infrastructure providers: * Openreach have announced that they will deliver 20m premises by the mid-to-late 2020s. * City Fibre have announced a deal with Vodafone to rollout a 1Gbps capable Fibre-to-the-Home (FTTH) broadband network to a “minimum” of 1 million homes in 12 of their existing cities and towns by around 2021, with the “potential to extend” this to up to 5 million (in circa 50 towns and cities) by 2025 and announced an ambition of 8 million premises. * Virgin Media have announced 4m additional premises through “Project Lightning” of which about 60% are (to date) Full Fibre. Depending on the outcome of its proposed merger with O2, this additional commitment may rise to 7 million. They are also planning to upgrade their existing cable network to support 1Gbps to 15m premises by the end of 2021 (Upgrade to DOCSIS 3.1). * Hyperoptic has aspirations to rollout FTTP to 5 million premises by the end of 2024 * A large number of regional providers have announced plans in the hundreds of thousands of premises, and three already pass more than 100,000 premises with FTTH networks.

We are closely monitoring market commitments and delivery (see Figure 5 below) and these announcements have provided confidence in the assumption that the market will deliver 80% coverage. However, it is unlikely that they alone can deliver the nationwide coverage we require.

Full Fibre Operator Market Dashboard - estimated market activity to end of quarter 2 of financial year 2019 to 2020.

Figure 5 - Full Fibre Operator Market Dashboard - estimated market activity to end Q2 19/20

9.3 Direct Impact

Experience from the two aid schemes we have run to date, allied with feedback from industry and the analysis undertaken for FTIR make clear that, without the incentive of government funding being made available, the roll-out of gigabit-capable networks would not take place to the extent and in the timeframe which is required to deliver the significant benefits gigabit-capable networks can deliver.

The continuous Open Market Review and Public Review processes described in Section 8 will ensure that in the target areas no comparable investment would take place without the application of subsidy in the near future of 3 years. It therefore follows that through the application of subsidy, operator investment decisions will have been changed and therefore this demonstrates a change in the economic behaviour of beneficiaries.

The application of wholesale access across the newly created network may also incentivise further investment in network capability.

9.4 Protecting Public Funds

The design and approaches outlined below in Section 8 are explicitly designed to respectively ensure that subsidy is only spent in areas which would not otherwise receive gigabit-capable networks in a timely fashion, to ensure that public funding is spent as effectively as possible and that the subsidy provided is limited to what is the minimum necessary to deliver the objective.

Elements of the measure that meet the requirements to limit the amount of subsidy provided to beneficiaries to what is necessary include: * Robust mapping and Public Review processes to ensure appropriate targeting. * Transparency and consultation with operators on the design of individual interventions and procurements. * Ensuring that a step change in capability is delivered. * Through a competitive selection process for all procurements that will fully meet the requirements of PCR 2015. * Choosing the Most Economically advantageous offer. * Operating on a technology neutral basis enabling the most appropriate technical solution to meet the objective. * Encouraging the re-use of existing infrastructure and ensuring that incumbent providers are not advantaged unduly by the application of infrastructure sharing via an Access to Infrastructure Code of conduct process. * The building of open access networks with a set of specific forms of network access that goes beyond the current regulatory requirements and ensuring competitive pricing of these through price benchmarking mechanisms. * Implementing appropriate monitoring and application of clawback mechanisms to ensure that operators are not over compensated. * Going beyond the base requirements of the TCA with specific requirements to ensure that there is a high level of transparency around the use of public funds in the scheme (See also 7.6).

The design of the programme, focused on only intervening where market conditions are least attractive, responding to market developments over time, and seeking to allow entrants to the market beyond the incumbent * should limit any distortion of competitive markets and any crowding out of private investment. The wholesale access model should also allow effective competition at the wholesale and access layers, in areas where there is none currently.

9.5 Transparency

The subsidy will be awarded in a transparent manner, through open tendering. The design of the measure will ensure that public authorities, communications providers and other interested parties have full transparency in relation to the application of the subsidy (See Section 8).

Additionally, BDUK will publish all relevant information about the individual contracts awarding subsidy throughout the programme in line with the requirements of the TCA.

10. Design of the Gigabit Infrastructure Subsidy scheme

The government has a range of responsibilities to ensure effective use of public funds and to avoid interference with existing markets, and the Gigabit Infrastructure Subsidy scheme has been designed to meet these.

10.1 Detailed mapping and analysis of coverage

One of the key challenges in ensuring that public money is only spent where it is needed through the Gigabit Infrastructure Subsidy scheme is to ensure that we correctly identify the intervention area as areas which are not commercially viable for the building of gigabit-capable networks and are not planned to be built within the next three years, but also to develop a process which can track the changes in commercial investment over the life of the project and analyse how those changes have impacted not only on existing coverage, but on how extending infrastructure brings new areas into commercial viability.

Working in conjunction with Ofcom in order to limit the burden on industry, we will perform a continuous coverage mapping exercise at the level of individual premises[footnote 11]. This will allow us to define the premises which will be targeted by the Gigabit Infrastructure Subsidy scheme. This will be updated regularly and in particular prior to every release of premises either to individual “call-offs” on the DPS or to the other procurement processes. The target premises will be those which do not have existing or planned gigabit-capable networks[footnote 12]. An area with no existing or planned provision of a technology is designated as “White”; an area with a single existing or planned supplier is “Grey”; an area with two or more existing or planned suppliers is “Black”; and areas where a single supplier demonstrates planned build within 3 years is “Under Review” if identified as being potentially at risk of not being completed.

In adopting a continuous coverage mapping exercise at the level of individual premises and with appropriate due diligence in respect of whether operators have resources to invest in or upgrade existing network capability to gigabit-capable infrastructure, Project Gigabit can design and assure intervention areas covering all premises unlikely to receive gigabit coverage through commercial plans and needed to achieve the gigabit coverage target in an area and that this does not result in the crowding out of private sector investment or making public investment where it is not needed.

The premises identified will be grouped into appropriately sized sets of requirements for suppliers to bid on. Current analysis suggests that these most difficult to reach areas will be located largely in rural rings around more densely populated towns and cities. Whilst the expectation is that the majority of sites will be in rural areas, there are genuine barriers to deployment in some urban areas which push premises requiring gigabit capable broadband connectivity beyond commercial reach. Where that is the case, demonstrated through an OMR/PR process, we will consider the inclusion of these urban areas to enable the provision of gigabit capable broadband infrastructure We will group requirements according to geographical layout (taking account of obstructions such as rivers, roads etc) and presence of existing infrastructure in order to increase competition and facilitate the efficient rollout of appropriately scaled networks. The different procurement routes will identify different sizes of bundles for procurement.

The high level process is currently expected to be as follows:

- Invite suppliers to continuously upload, on a rolling basis, planned (over the next three years ) and existing coverage into a database held by BDUK.

- Run a continuous Open Market Review for target areas, in order to create a procurement pipeline to signal to the market which areas we are focussing on to ensure the most up to date information for those areas ahead of a procurement.

- Update coverage mapping to identify eligible premises in the target areas.

- Group into requirements release.

In the first instance, we will rely on undertaking this process for specific areas until the data systems are fully up and running.

The coverage mapping will identify the premises which are most difficult to reach with gigabit-capable technology. The intervention area will be the remainder of premises, once we have removed the following:

- all existing premises with gigabit-capable coverage (1Gbps+).

- those premises which would not achieve a “step change” when provided with gigabit-capable coverage;

- All credible planned coverage disclosed by operators for coverage in the categories above.

As part of the mapping process, operators will be requested to provide speed data at a premises level. End users premises should be connected via reasonable connection costs and service provision within industry normal delivery timescales.

At the outset of the Gigabit Infrastructure Subsidy scheme and while the NBS 2016 scheme is still delivering contracts in parallel, then any intervention under the Gigabit Infrastructure Subsidy scheme will avoid projects being progressed under NBS 2016 (even while these are delivering NGA solutions). Furthermore, where the NBS 2016 scheme has delivered solutions to premises with gigabit-capable solutions, then there will not be any likelihood of overbuilding these areas for the duration of the Gigabit Infrastructure Subsidy scheme as these premises will be excluded as they have met the gigabit-capable criteria.

The £5 billion investment announced at the March Budget 2020 committed to delivering networks with gigabit-capable solutions, at 1Gbps and higher. However, there may be some instances where delivering gigabit-capable solutions is uneconomic or does not provide value for money during the lifetime of the Scheme. There could be a number of reasons for this: geography, rurality, terrain and premises sparsity. Although these premises are out of scope for the £5 billion, the UK Government is exploring options for improving connectivity to these premises through the Very Hard to Reach consultation, launched in March 2020. The solution for these premises has not yet been identified, but one option may be to identify bundles on the DPS that would be issued whereby bids could be acceptable if they provide a minimum ultrafast solution. BDUK could consider awarding contracts on the basis that the solution does provide ultrafast solutions. Specific details will be published around the eligibility criteria for the application of subsidy for Ultrafast capable infrastructure in the event that this is required including mapping of target areas and technology performance and other eligibility criteria.

10.2 Public Review

In the same way as we do currently for NBS 2016, before issuing the requirements to market, we will run a public review on the proposed intervention area to allow any party to raise concerns over the intervention, but particularly to allow infrastructure providers to clarify whether they provide services to any of the target premises or have plans to do so within the next three years which have not been captured in the OMR process. All responses to the public review (including updates notified as part of the continuous OMR process) will be reviewed and addressed ahead of finalising the requirements. As with the NBS 2016 approach, this may result in the removal of some premises from the requirements.

With NBS 2016, the public review also included confirmation of the lotting and contracting approaches. For the Gigabit Infrastructure Subsidy scheme, the lotting is closely tied to the decision on procurement type and we will consult industry on an ongoing basis as part of developing a publicly available pipeline of procurements, rather than as part of the Public Review process.

A public review must last for at least one month. The procurement will aim to ideally start within one month of the public review being finished, or at least within six months, with any procurements starting later having a clear justification. Results of a public review are valid for three years after which if changes or additions to existing intervention areas are proposed, mapping and public review must be redone.

The public review will be published on a central, public, readily accessible website and will contain at least:

(i) a description of the proposed broadband scheme, including objectives of the measure, proposed network capabilities sought and basis of intervention (e.g. what download and upload speeds will need to be provided and why, what investment models are considered); criteria for determining which infrastructures are considered able to provide reliably 1Gbps download or more, and which networks will be excluded from overbuilding, together with a description of open access requirements;

(ii) a map of the target areas (based on the mapping exercise), which should include both the current and the planned broadband infrastructure (if available at that stage);

(iii) a request for stakeholders’ views on the measure;

(iv) an invitation to market participants to submit information about their current and planned investments (at premises level) to deploy gigabit-capable networks (and what download and upload speeds can/will be reliably provided over such networks) in the target areas (depending on the scope of the measure) in the next 3 years;

(v) details for interested stakeholders on how to respond, including the deadline for response; and

(vi) what information has to be provided to demonstrate that planned investments are credible.

If any meaningful comments are made by stakeholders in response to the public consultation, they will be investigated by the implementing body. If an operator currently operates a similar infrastructure or has plans to invest in similar broadband infrastructure in the target area in the next three years, the areas concerned by private investment will be carved out of the target areas. However, that will only be the case if the investment plan is credible and the investment itself will lead to significant improvements in terms of gigabit-capable coverage within a three-year period, with completion of the planned investment foreseen within a reasonable time frame thereafter. The implementing body will seek evidence from providers to support their statements that investment will take place within a three-year period. Evidence could include a business plan, a detailed calendar deployment plan, proof of adequate financing or any other type of evidence that would demonstrate the credible and plausible character of the planned investment by private sector network providers. If such evidence is not forthcoming, an implementing body may reasonably conclude that such investment plans are unlikely to take place and either designate the premises as “white”, or “under review” whereby we will monitor the plans submitted to ensure that the proposed coverage is delivered - see below. If it is not, we reserve the right to let contracts to deliver coverage to those ‘under review’ premises after consultation with the supplier in question.

In the event of any disagreement with a network provider, the implementing body, which will usually be BDUK, will inform the NCC who will seek to resolve the matter as part of its role as scheme administrator. Implementing bodies are not required to take into account any existing infrastructure or investment plans announced by network providers following the conclusions of the public review, save where the implementing body wishes to do so. The NCC will provide updated guidance regarding mapping and public reviews. This will ensure that this guidance is adequately publicised to ensure transparency of the guidance generally, and this rule in particular, for network providers.

There remains the risk identified in NBS 2016 that a mere “expression of interest” by a private investor could delay delivery of gigabit-capable broadband in the target area if subsequently such investment does not take place and public intervention has been prevented. The implementing body may therefore require certain commitments from the private investor before ruling out public intervention. Those commitments should ensure that significant progress in terms of coverage will be made within the three-year period or for the longer period foreseen for the supported investment. It may request the operator to enter into a contract which outlines the deployment commitments. That contract could foresee a number of “milestones” which would have to be achieved during the three-year period and reporting on the progress made. If a milestone is not achieved, the granting authority may then go ahead with its public intervention plans.

BDUK will be responsible for mapping and targeting areas for the scheme, and the NCC, acting independently will assure that the process described above has been followed. Ofcom will be used for consultation purposes as and when required for visibility of target area purposes whilst the scheme is in operation.

10.3 Step change

In meeting the speed requirements, all projects must meet the step change requirements as set out in this document.

The UK will make subsidy available to support a “step change” in broadband capability. The Gigabit Infrastructure Subsidy scheme requires that download speeds have to be at least doubled by the intervention and substantially higher upload speeds need to be provided. As well as doubling of download speeds, a step change can be demonstrated if, as the result of the public intervention: (1) significant new investments in the broadband network are undertaken by the selected bidder (i.e. investments that must include civil works and installation of new passive elements) and (2) the subsidised infrastructure brings significant new capabilities to the market in terms of broadband service availability, capacity, speeds and/or competition. The scheme does not foresee the grant of subsidy for marginal investments related merely to the upgrade of active components of the network (e.g. vectoring alone), which do not normally ensure a “step change” and are therefore not eligible for subsidy.

The Gigabit Infrastructure Subsidy scheme will ensure the doubling of available download speeds as a minimum when compared to any existing local broadband capabilities, including in localities that have previously benefited from subsidy for NGA and/or Basic Broadband provision, but excluding those localities that have previously received subsidy for gigabit-capable networks (e.g. previously-subsidised networks with over 500 Mbps download capability would be ineligible for further subsidy, even if existing subscribers had taken lower-speed services from such a network).

10.4 Competitive selection process

NBS 2016 had four funding models available to contracting authorities to allow flexibility in delivery. In practice, the only model which has been used by BDUK programmes targeting broadband coverage to date has been the gap-funding model. This is a model which is familiar to industry and is a good fit with the operating models of the main suppliers and has received overwhelming support in market consultations. Notwithstanding this, we feel that the challenge presented by the approach may well require different models in some of the areas to which we are committed to provide coverage, but which have virtually no interest from suppliers. The intention is to make five models available, the four from NBS 2016, and an additional one, all listed below for completeness:

- Investment gap funding - The contracting authority procures a private sector partner who will finance, design, build, own and operate the broadband infrastructure. A capital subsidy is paid to the private sector operator who are paid during and upon completion of deployment. The private sector partner retains ownership of the network after the contract expires. The public subsidy is the minimum amount necessary for the private sector to deliver the project whilst also making an acceptable rate of return. The model includes clawback mechanisms which correct ‘over-subsidy’ to ensure the subsidy provided is the minimum required.

- Concession to build-operate-transfer - Under this approach the contracting authority lets a concession contract to build, operate and generate revenues from a network. The private sector partner will derive economic benefit from, and bears the commercial risk associated with, the infrastructure for the duration of the contract. At the end of the concession, the network returns to public hands and the public entity can decide to either re-tender the contract, operate the network itself, or sell the network.

- Public sector owned supplier - An arms-length company, owned by one or more contracting authorities, would invest in, and provide, broadband infrastructure services to end customers through service contracts. Once deployed the network would be owned and managed as a wholesale provider by the public entity who would commercially operate the network, as well as manage the associated commercial revenues and risks.

- Public private partnership - The contracting authority forms a Joint Venture (“JV”) or Special Purpose Vehicle (“SPV”) with a private sector supplier or suppliers. The JV or SPV would invest in, and provide, broadband infrastructure services to end customers (e.g. service providers/retailers wishing to use the infrastructure network) through service contracts, with the public body and supplier sharing the profits or liabilities. Both parties own equity in the entity (most commonly 50/50) and split the risks and rewards of ownership. Equity is invested by the public entity and the private sector over the deployment period in proportion to their shareholdings.

- Co-operative - Essentially a variant on (3) above, this model recognises that many public bodies may not be best placed to manage and exploit wholesale fibre networks. In time, it would be possible to establish a Co-operative to manage the network assets (duct and fibre) developed. The purpose of this Co-op would be to provide a central resource which can undertake marketing, billing and management of network assets on behalf of the members. Potential wholesale customers could join the Co-op to allow them access to the assets. The members would retain ownership of their assets throughout, but allow the Co-op to have exploitation rights. This is a model recognised by industry, with one private example being the London Internet Exchange (LINX), and has the advantage of demonstrating the State aid concept of pari passu i.e demonstrating that the relevant public body is not acting to distort markets. The public sector retains ownership of its own assets and grants access to them via the co-op. The private sector also grants access to its own assets (retained under private ownership) through the same vehicle.

Given market feedback, BDUK will develop tender and contracts documentation based on the gap funding model, though the key principles would be applied in contracting under any of the models listed above. Financing will be provided by capital grants as the approach is to utilise the gap funding model with the market (other delivery models set out above could mean other financing options, including revenue funding, could be considered such as loans or possibly equity investment in a joint venture). Whereas in NBS 2016 local bodies procured the majority of contracts and BDUK only procured occasionally, this time we expect BDUK to procure the vast majority of contracts, though we will leave it open to allowing other parties to procure where that would be the most appropriate approach. This is in response to lessons learnt from the 2012 and 2016 programmes, where local delivery gave advantages of local knowledge and resourcing, but gave significant disadvantages. The relationship between large suppliers and small local delivery bodies can sometimes become imbalanced, requiring significant management effort at BDUK to support local bodies. We have found also that we often need to resolve issues recurrently, as suppliers try to take differing approaches with different delivery bodies. Finally, the local bodies themselves have varying levels of expertise in the letting and management of contracts, again requiring significant effort by BDUK to ensure they remain within the bounds of NBS 2016. Central contracting will give us greater control over strategic contract and supplier management, and will assist in focusing targeting of premises on an objective basis.

By electing to use multiple, recognised PCR compliant routes to market such as a DPS, framework and restricted procurements to manage the procurements for the programme, we will create a community of suppliers, available through a number of routes to bid for procurements as they are launched over the life of the programme.

The DPS will provide a list of pre-qualified suppliers who will then be able to bid for call off contracts as and when the requirements are released through the e-tendering portal. Entry criteria onto the DPS will be designed to reduce barriers to entry for all suppliers but more so for small and medium sized enterprises/altnets and new entrants to the market. Access to the DPS will be open throughout its life. We will continue regular market engagement, which is already underway in the development of the procurement strategy, up to the launch of the DPS. This will ensure that the market is aware of the opportunities, understand the requirements and are able to bid to enter into the DPS. Market feedback is already shaping the procurement strategy and contracts; for example in response to feedback we aim to align the bidding process as much as possible with small and medium sized suppliers loan application processes to investors, to reduce their work loads and maximise their opportunities.

Entry criteria to the DPS are expected to include, but will not be limited to:

- evidence of gigabit-capable technology solutions;

- demonstration of financial standing;

- acceptance of the terms and conditions (including wholesale access and reporting requirements) and code of conduct.

Restricted procurements and frameworks will be let on a consistent basis, with as much synergy between the procurements as possible to maintain consistency within the programme for BDUK and for suppliers. Depending on the size and value of the contracts, entry criteria will be adjusted accordingly.

Once suppliers have engaged with the procurements either through joining the DPS, entering into the bidding process for any procurement or qualifying for a framework, market engagement will continue on a quarterly basis, or more regularly if required. We will share the indicative long term view of the procurement pipeline with suppliers on a quarterly basis to enable them to plan their bidding activity and manage their supply chains. In addition each supplier will be invited to discuss and participate in programme wide, cross supplier, continuous improvement initiatives such as improvements in way-leave application processes, ways of working with local authorities, bidding practices etc. in order to support the Barrier Busting initiatives described above.

We plan to release requirements on a regular basis (likely to be annual, with the potential to have multiple releases in peak years). Premises eligible for funding will be grouped into bundles and these bundles will be released to the market through the various procurement routes in line with the pre-published “pipeline” which will allow transparency with the market, but will also be responsive to market feedback on capacity to bid for and deliver contracts. This will allow us and the market to manage our procurement and bidding activity and resource. This cycle is subject to scenario testing, further market engagement and feedback. Suppliers are able to bid for as many contracts as they choose in each release. However, each contract will be treated separately to simplify the management of contracts in-life. Based on market engagement to date, contract size will vary by procurement route and will be dependent on local geographies and dispersion of premises (subject to further market engagement). This varied size of contracts will be attractive to small, medium and large suppliers in the market. Pre-qualification on the DPS or framework allows us to streamline the evaluation of call off bids only to the specifics of the requirements for that project and thus speed up the procurement timeline. Contract design and build periods will be as close to 3 years as possible which aligns with the proposed 3 year OMR timeframe for seeking information on planned private investments. Where contracts are likely to exceed this timescale due to their size, interim OMRs will be run to ensure build remains relevant to the needs of the local area and to ensure that there remain no commercial plans to provide coverage. Where possible, evaluation will be closely aligned across all the procurement routes to create consistency and lower suppliers’ barriers to entry for the different procurements.

The detailed evaluation process is under development and subject to consultation with industry, but the expectation is that bids (call offs or post SQ ITT responses) will be assessed against:

- Network design and technical solution;

- completed contract schedules e.g. sub contractors, key personnel etc.;

- project plan showing delivery against milestones within the specified timescale;

- pricing for every eligible premise in the requirements; and

- meeting wholesale access requirements.

We are considering how to take advantage of efficiencies in one supplier winning multiple contracts. This can be evaluated through the bidding process or applied retrospectively as an efficiency review across all procurement cycles.

All procurements will be managed through appropriate e-tendering platforms and will be integrated with the Google Cloud Platform (GCP), which will also host our premises database, Open Market Review (OMR) capability and our contracting, reporting and contract management database. Each supplier will have access to the GCP for contract management and reporting requirements.

10.5 Most economically advantageous offer

Entry to the DPS and the SQ stage of restricted procedures will be evaluated on a pass/fail basis as much as possible. There will be no pricing evaluation at this stage of the process.

At the call off/ITT stage, bids will be evaluated on both price and quality. This is still under development. However, the expectation is that price will be worth no more than 50% of the overall score and no less than 20% of the overall score. The tender documents will specify the requirements for the target network and the wholesale access obligations. BDUK will adopt the Most Economically Advantageous Tender (MEAT) criteria in the tender documents which aligns with good procurement practice and set out in the tender document.

There will be greater emphasis on aspects such as social value in the quality criteria than in previous procurements. The social value element of the quality criteria will be decided with the relevant Local Authority/Devolved Administration (similar to the approach previously implemented on NBS 2016). Every call-off/procurement will have a social value question that is 10% of the evaluation. However, the questions will vary depending on the local priorities.

The contracts will be separated into 3 stages, as is often used in the construction industry and is consistent with how the telecoms companies currently secure funding from their investors. The bidding process will run much like the bidding process is on the Superfast Programme where suppliers carry out desk top modelling in order to submit a bid.

Stage 1 of the contract delivery will be the detailed design, survey and cost model stage. By including this payment milestone, the parties can agree, prior to commencing build, which premises are actually eligible (i.e. to account for data errors) and what the maximum cost for each premises will be based on a better understanding of the topography and issues on the ground. This will reduce the need for in-life contract changes and should allow the supplier to manage build with a reduced need to come back to the authority for approval to make changes. Any changes in the number of premises, cost and time for delivery will be agreed at the conclusion of stage 1. There will be a break clause after stage 1, which can be used if the original bid is materially different to the outcome of this stage or for convenience should there be a change in policy or funding.

At the end of contract delivery Stage 2, the build stage, a clawback mechanism will be in place to recover any over-estimation of aid for the infrastructure.

Stage 3 is the monitoring stage which monitors take up and wholesale access obligations for the network over a minimum of 7 years with a maximum of 15 years. There will also be a take up clawback mechanism in place for the remainder of the term to adjust for any under-estimation of take up and revenue.

Due to the competition in the market, it is expected that significant numbers of the procurements may not generate more than one or two bidders. One possible value for money control in such circumstances could be to commission an independent third party review; however, the cost overhead of such a process would far exceed the incremental benefit over existing protections. Suppliers would be required to agree to a pre-defined and exhaustive list of cost categories for the purposes of forming the bid cost and in-life cost reporting. This would serve to increase the already extensive database of benchmark data which BDUK holds on the cost of building broadband infrastructure. As such, BDUK will be best placed to review and compare the quality of bids, even in single bidder situations. If BDUK is concerned about the outcome of a procurement exercise, we will be able to call on the Cabinet Office Commercial team and the Government Internal Audit Agency to review suppliers’ proposed cost calculations.

10.6 Technological neutrality

Different technical solutions could be used to meet the objectives of the project. The UK will ensure that procurement does not favour a particular technology or network architecture (or mix of these) and that bids are assessed on the basis of objectively defined criteria. Specifically, the tender will focus on outcomes rather than technology i.e. maximum coverage at minimum cost.

The UK will define technology neutral, objective criteria for gigabit-capable networks within three months of the publication of the required transparency notices required under the Trade and Cooperation agreement around the following criteria:

- Wholesale infrastructure capable of supporting gigabit-capable downstream wholesale and retail services directly or via third-party providers without restriction, as set out below.

- Connections that are gigabit-capable (capable of delivering 1000Mbps or more download speeds) at the time of delivery of the connection without the need for future hardware upgrades or modification[footnote 13] i.e. gigabit capability to be available from day one and if the consumer takes a slower speed it must be soft upgradeable without undue delay.At least one wholesale product with a download speed capability of at least 1Gbps and an upload speed of at least 200Mbps with busy hour performance as laid out below.

- products with a clear and comprehensible explanation of the minimum, normally available[footnote 14] and maximum advertised download and upload speeds.[footnote 15]

- Low data latency in accordance with Ofcom regime or codes of practice recent industry norms and Industry Standards for the requirements of real-time services(or otherwise, in the absence of prevailing standards 10 ms and below for ninety-five per cent (95%) of the time).

- Supports real-time services (e.g. voice/video calling, telematics, telemedicine etc.) with performance indicators (e.g. jitter, packet loss etc.) in line with recent industry standards, norms or in the absence of industry standards, i.e. 2ms for jitter, zero point one per cent (0.1%) for packet loss for ninety-five per cent (95%) of the time.

- Actual data speeds and performance during the busiest hours of the day (not more than 4 out of every 24), that do not degrade below 33% of the access line speed capability, this being the minimum download speed and an upload speed equivalent to 20% of the minimum download speed and providers’ service specifications

- Actual data speeds and performance that do not degrade outside of the busiest hours below 95% of the higher of the download and upload speeds set out above.In the event that such minimum download speeds are regulated by a new minimum set by the Regulator, such new minimum download speeds shall apply for the duration of this Agreement. On becoming aware of the new minimum download speeds, the Supplier shall promptly provide confirmation of such to the Authority for its written approval.

- Actual data speeds and performance that do not degrade as take-up of services approaches 100% of the addressable market (including any part arising from switch-off of legacy networks), to be demonstrated by firm commercial and technical (including capacity upgrade) plans to be submitted at the contract bid stage and to be based upon forecasts of up to 7 years.

- Where service offerings and performance vary by locality e.g. as a result of subscribers’ distances from infrastructure, gigabit capability to be maintained for all potential customers.

- Order fulfilment and rectification within typical industry timescales, supported by demonstrably efficient wholesale service management processes;

- Maintenance of customer service levels and network availability in line with industry norms, ideally supported by Service Level Agreements.

- Service provision that does not unfairly discriminate against particular types of services, providers, subscribers or third parties (e.g. via traffic shaping or Quality of Service measures).

- Offering of wholesale access products on open and non-discriminatory terms in line with the principle of technological neutrality, to enable the interconnection to the subsidised network of any technology which other communications providers and/or retail providers may reasonably consider appropriate in accordance with the wholesale access requirements.

BDUK will also:

- Establish assessment criteria and processes to ensure gigabit-capable networks-compliance of any supplier networks before award of any subsidy.[footnote 16]

- Monitor suppliers’ adherence to these criteria during design, deployment and operational service.

Fixed Wireless Access networks may be eligible for Subsidy provided that the criteria set out above are met.

Regarding mobile networks (including 5G networks) and/or networks with movable equipment, the UK would require providers receiving subsidy to demonstrate that the criteria set out above can be met, in particular where performance varies if subscriber terminals (or other network elements) can move in their environment. The UK is not currently aware of any compliant mobile network architecture; therefore it would be incumbent upon providers to demonstrate compliance in accordance with the objective criteria that the UK will establish.

Once the requirements for broadband provision have been met, the resulting infrastructure must be made available on open access and commercial terms to competent third party operators (including other communications providers, individuals and organisations) for any reasonable purpose (including private circuits, CCTV etc.) i.e. a reasonable purpose for open access by third party operators does not necessarily need to conform to the criteria set out above.

10.7 Use of existing infrastructure

In order to minimise the call on public funds, BDUK will encourage suppliers to use existing infrastructure and facilities where possible, which may include:

- Use of suppliers’ own infrastructure;

- use of other suppliers’ infrastructure (including BT Openreach regulated products); and

- use of other existing utilities infrastructure (including, for example, water and sewerage pipes and relevant electricity infrastructure).

Existing infrastructure will be identified as far as possible through the mapping, OMR and Public Review processes. The UK will include all collected information on available existing infrastructure in their procurement documents (in particular in “invitations to tender”) in a manner that protects commercially sensitive data.

As with the NBS 2016, and to meet requirements for bidders with existing infrastructure in the target intervention area to share information with the aid granting authority and to provide that information to other bidders, BDUK will require all bidders to sign up to an Access to Infrastructure Code of Conduct. This has been accepted by industry and as with the NBS 2016 Code of Conduct, this would include standards for:

- the level of detail of information that should be provided;

- the formats and structures of human-readable and machine-readable data;

- the time frames in which the information is to be provided;

- the acceptable terms of a non-disclosure agreement; and

- the obligations to make available the infrastructure for use in other bids.

We do not propose requiring suppliers to provide additional forms of access to their existing network (unless required to do as a regulatory requirement), as this would be likely to dissuade smaller bidders from participating in procurements. Nevertheless, it is anticipated that the vast majority of the infrastructure in the intervention areas can be accessed using existing products (i.e. BT and Openreach products required under Significant Market Power regulations) or as a result of new legislation (e.g. The Communications (Access to Infrastructure) Regulations 2016 on measures to reduce the cost of deploying high-speed electronic communications networks).

Where a bidder does not meet the terms of the Access to Infrastructure Code, they will be excluded from individual procurements and from the DPS/frameworks until they do so. The bid process will be conducted to a timetable that allows sufficient time for bidders to compile bids with information provided by other suppliers within the Access to Infrastructure Code time frames, and allows for any non-compliance issues that might impact other bidders to be resolved efficiently.

Recent initiatives by Ofcom to derestrict PIA (Passive Infrastructure Access) and DPA (Duct and Pole Access) should allow suppliers to offer the fullest range of broadband services over existing regulated infrastructure, and these derestricted products should be adopted wherever possible.

10.8 Wholesale access

To ensure that the public receives the maximum benefit from publicly-funded infrastructure, all bids must commit to offer passive and active access, as set out below, to the subsidised network under fair and non-discriminatory conditions to all competent third party operators who request it (including other communications providers, individuals and organisations) for any reasonable purpose (e.g. mobile backhaul, private circuits, CCTV etc). The NCC will act as a central point for contact by any access seekers who do not feel that the access is sufficient to be considered as “effective”, for example through excessive delays between quote and delivery. We will seek to ensure that there are sufficient controls in the contracts with suppliers to allow us to address any concerns from access seekers.

The relevant wholesale access products must be offered for a minimum of 7 years, or indefinitely in the case of new passive infrastructure. If in the course of that period the supplier and/or infrastructure is sold, the wholesale access obligation must be transferred to the new owner of the supplier and/or of the infrastructure.

In case the network operator also provides retail services, a reference offer for wholesale services must be made available to competitors at least 6 months before starting the provision of retail services. In addition, the network operator must undertake accounting separation of wholesale and retail services.

10.9 Specific forms of network access

The following products will need to be made available for open access across the whole network deployment, and insofar as relevant to the specific technologies involved: new ducts, poles, fibre, cabinets, masts, antennas and active bit-stream equipment; and existing infrastructure of all types:

| Infrastructure Component | Access Requirements |

|---|---|

| Ducts | Where new duct[footnote 17] infrastructure is required as part of a network build, this must be configured to support at least three competing infrastructure providers and designed to support alternative technologies (e.g. sub-duct or cabling) with similar sizes and/or physical characteristics. •Access must be provided to all Points of Flexibility (PoF) including originating and terminating nodes, joint nodes, junction nodes, aggregation nodes, splitter nodes, distribution nodes, chambers, footway boxes, and equivalents irrespective of the nomenclature used. •The supplier is not obliged to provide for new ducts where this is not a requirement for their network build. For example, in FTTP networks the laying of direct buried fibre in soft verges or uncultivated land will be acceptable provided that the wholesale access requirement is met by the dark fibre for three competing infrastructure providers. However, in this case, the UK expects that sub-duct installation will be required under a public highway by the Highway Authority. |

| Fibre | New pole infrastructure[footnote 18] must be configured to support at least three competing infrastructure providers with suspended duct or dark fibre infrastructure including joint, junction and distribution nodes. Where active equipment is installed on poles then refer to mast section below for access requirements. •Access must be made available at appropriate Points of Flexibility (PoF) in the network: •at the telephone exchange or Point of Presence (PoP)’s Optical Distribution Frame (ODF) or equivalent •at cabinets or similar local distribution points •all relevant PoFs including originating and terminating nodes, junction nodes, aggregation nodes, splitter nodes, distribution nodes, chambers, footway boxes, and equivalents irrespective of the nomenclature used •Access must be provided for at least three competing infrastructure providers via: •dark fibre[footnote 19] •space for active and optical equipment (of a size and type similar to the supplier’s equipment) •existing power supplies (metered or unmetered, and equivalent to the supplier’s access in all other respects). |

| Cabinets | Access to cabinet space and existing power supplies must be provided for at least three competing infrastructure providers upon request. •Extra-large cabinets to accommodate potential competitors do not need to be deployed from the outset; however, designs that would comply with local planning regulations and reasonable landowner conditions should be prepared for new cabinets or upgrades to be deployed in a timely manner if and when access is reasonably requested.[footnote 20] •Such access will be subject to cabinet space being able to be provided legally and in accordance with local authority planning regulations. |

| Masts | Access to mast space, antenna apertures or for other active equipment and existing power supplies must be provided for at least three competing infrastructure providers upon request. •Extra-large masts to accommodate potential competitors do not need to be deployed from the outset. However, designs that would comply with local planning regulations and reasonable landowner conditions should be prepared for new masts or upgrades to be deployed in a timely manner if and when access is reasonably requested.[footnote 21] •Such access will be subject to masts space being able to be provided legally and in accordance with local authority planning regulations, and to it being legally, commercially and technically possible. |

| Antennae | Access to shared antenna systems (where multiple operators feed radio signals to the same antennas) should be provided or supported where technically feasible, and in particular where planning rules could impede other forms of mast capacity expansion. |

| Active Bit-Stream Equipment | Bit-stream access for broadband and associated backhaul must be provided by infrastructure providers at appropriate Points of Interconnection such as telephone exchanges, PoPs or cabinets e.g for Virtual Unbundled Local Access (VULA) or equivalent. •New subsidised network infrastructure must either be dimensioned to meet the likely capacity requirements of competing providers, or be capable of being expanded to meet it upon demand. Existing infrastructure must support the capacity requirements of competing providers where technically feasible. •Bit-stream access must be provided over standardised or fully defined technical interfaces. •Accommodation for access seekers’ necessary interconnection equipment must be provided including access to suitable power supplies. |

| Existing Infrastructure | Infrastructure access requirements as set out above equally apply to existing infrastructure in the intervention areas. Existing assets should support all forms of access as set out above: 1. where technically feasible (e.g. given reasonable loading factors and existing capacity); and 2. legally feasible (e.g. where conditions placed on access to existing infrastructure or other commercial terms imposed by an infrastructure owner would not prevent the Wholesale Access Requirements being met). Except where Ofcom does not oblige the specific form of access to be provided on the infrastructure owner’s existing infrastructure and where such access is at the sole discretion of the infrastructure owner. |

10.10 General forms of network access

In addition to offering specific forms of access (as set out above) a supplier must in all cases offer new forms of network access, to both existing and new network infrastructure used in the intervention area[footnote 22], where requested by any communications operator demonstrating “reasonable demand” for a product that is not already available.

Reasonable demand is demonstrated when:

- the access seeker provides a coherent business plan (based on a product price that is consistent with the pricing principles set out below) which justifies the development of the product on the subsidised network;

- no comparable access product is already offered in the same geographic area by another operator at equivalent prices to those of more densely populated areas; and

- the introduction of the new wholesale access products should deliver sustainable and effective competition in the downstream market(s).

As with NBS 2016, the UK authorities will undertake detailed discussions with a cross-section of broadband operators on the wholesale access requirements, a process that began in August 2019. As the proposals are broadly in line with those currently in place, we do not anticipate strong objections, but we will confirm this position through continuation of our formal market engagement.

10.11 Wholesale access pricing

All wholesale access products will in all cases be provided on the basis of fair and reasonable pricing.

Where wholesale access products are not required under UK regulation, the pricing of open access products shall be proposed by bidders as part of the procurement process. Thus, bidders will propose pricing for all relevant access products. In doing so, bidders must observe the benchmarking rules set by the UK authorities. Thus, pricing will be benchmarked following pricing principles set out by Ofcom and based upon:

- UK or European benchmarks of competitive offerings; and/or

- non-discriminatory allocation of costs among Subsidy recipients and any access seekers.

The UK will seek technical advice from Ofcom as to the appropriateness of the wholesale benchmark pricing points and pricing policy proposed by suppliers. Where a new product is required, the UK recognises that the supplier will potentially incur additional costs in three categories:

- initial deployment and maintenance costs; and/or

- new access product development and associated re-engineering costs; and/or

- costs associated with stranded assets that may have been created as a result of any new access product or change of asset use.

The access seeker will always be required to pay for their deployment and maintenance costs. However, if the access seeker is not required to meet the product development or stranded asset costs, then they would need to be met by the supplier.

As above, these aspects of wholesale access will be shared with industry to allow them to feed in their views. We will seek to confirm that the consensus view (cf NBS 2016 para 128) still holds that there is currently little evidence of market demand for access to physical infrastructure assets in the target area, meaning that designing a network with excess capacity (to allow for at least 3 alternative operators) is likely to have limited competition benefits. However, it remains clear that a requirement for additional infrastructure capacity would also increase costs and deliverability constraints considerably. These factors would combine to reduce overall coverage within the available budget, and make smaller operators (less able to rely on their own existing infrastructure) less competitive in procurements.

Nevertheless, the UK authorities recognise that it may not be possible to forecast future uses of the infrastructure and that public funds should promote future competition where possible. The UK therefore proposed that suppliers are allowed to build efficient networks that, while they may not initially provide capacity (for up to 3 operations), are extensible, wherever technically and legally feasible, such that the provision of extra capacity is deferred until a need is identified by an access seeker in the future. The incremental cost of providing the additional capacity would not be directly charged to the access seeker, but would be met by the supplier. In line with the long duration of the 2016 scheme, any changes in the wholesale access market should be reflected in this scheme, and third party operators should have access to other wholesale access products if they are able to demonstrate “reasonable demand” for such additional access.

The UK authorities have already published guidance to stakeholders on the application of price controls in Subsidy funded broadband projects.[footnote 23] BDUK will follow this guidance in establishing a benchmark process in line with that in place for NBS 2016 and will monitor compliance for the life of the contracts. It describes Ofcom’s role in providing technical advice on the appropriateness of the wholesale benchmark pricing points and any pricing policies proposed. The guidance also provides a recommended approach to identifying appropriate benchmarks (e.g. establishing whether a telephone line rental price should be added to the broadband rental price) and provides examples of why some limited variation from the benchmark could be permissible if well justified (e.g. for a time-limited variation to attract customers).

Thus, the UK will ensure that a benchmark pricing mechanism is included in the contract with the successful supplier. Benchmark prices and a corresponding mechanism (including benchmarking criteria) will be set out clearly in the first instance in the tender documents. The mechanism will set out the framework applicable to gigabit-capable networks. It must also establish the mechanism applicable to non-broadband products. Non-broadband products could include voice services, packaged voice/broadband services and any other services. Every product sold on the subsidised network will be under benchmark controls.