Project Gigabit progress update, June 2023

Published 30 June 2023

Foreword

This government wants to ensure that everyone has access to great connectivity wherever you are in the UK. Wherever you are born, wherever you grow up, wherever you study and wherever you work, you should be able to enjoy fast and reliable internet access and all the opportunities and entertainment that comes with it. Closing the digital divide is a priority, levelling up is our mission.

This is why we are investing £5 billion in Project Gigabit, our commitment to deliver lightning-fast, reliable broadband to every corner of the United Kingdom.

I am so proud of the progress already made and the speed of delivery, and it is exciting to see how much more is still to come. We now have 30 live procurements and contracts in place; an investment of £1.4 billion supporting the rollout of gigabit-capable broadband to hard-to-reach areas across the UK.

People in rural parts of Cambridgeshire are set for boosted broadband thanks to the £69 million contract awarded in March, while the most recent contract awards total £318 million and cover hundreds of miles and around 218,000 premises across Norfolk, Suffolk and Hampshire. From Portsmouth to Beccles and the Broads, we are making a significant investment that is set to transform a great many people’s lives.

But it is all about delivery. That is why I am so pleased to see that construction is under way in the areas where Project Gigabit contracts were first awarded last year - North Dorset, Teesdale, North Northumberland and Cumbria - and the first homes and businesses connected and benefitting from access to gigabit-capable, reliable broadband in North Dorset and Cumbria. I take great satisfaction from knowing that soon thousands of homes and businesses in these communities will be able to enjoy the very best gigabit broadband access, allowing people to work from home, communicate online with friends and family, shop, bank and stream the latest music and the biggest blockbuster films.

We know what a huge impact a fast, reliable broadband connection can have on individuals, families and businesses. Lightning-fast connectivity can act like rocket boosters to a local economy, bringing the best digital access but also job and training prospects, attracting new talent and retaining skilled and knowledgeable local people. This government is laser-focused on growing the economy - indeed, it is one of the Prime Minister’s Five Key Priorities. The work of BDUK is the government delivering on that priority.

Rt Hon Chloe Smith MP

Secretary of State for the Department for Science, Innovation and Technology

Summary

We now have a total of 30 live procurements and contracts worth £1.4 billion in place to support the deployment of gigabit-capable broadband to hard-to-reach areas across the UK.

Since the previous progress update we have:

- Signed six new contracts in Cambridgeshire, the New Forest, North Shropshire, Norfolk, Suffolk and Hampshire. This combined investment of £425 million will bring gigabit-capable broadband to up to 284,000 premises. In total, we now have twelve contracts in place

- Launched 11 new local and regional procurements, with a combined indicative value of £410 million, to cover up to 225,500 premises

- The first connections have been made in North Dorset and Cumbria, ensuring homes and businesses are already benefiting from access to gigabit-capable, reliable broadband

ThinkBroadband reports that 76% of UK premises are now able to access a gigabit-capable connection. On top of this, over 50% of UK premises are now covered by a full-fibre network, up from just 22% in April 2021, which demonstrates the pace and scale of network build.

The government has also recently published its Wireless Infrastructure Strategy setting out the steps it will take to ensure that all parts of the UK have the connectivity they need to unlock opportunities for growth and prosperity. It has also launched a £7 million fund as part of their Unleashing Rural Opportunity action plan, aiming to test out new ways to bring together satellite, wireless and fixed line internet connectivity to allow remote areas to access lightning fast, reliable connectivity for the first time.

Progress towards a gigabit UK

This section outlines the level of gigabit-capable coverage across the devolved nations and regions, in urban and rural areas, by supplier and by residential and business premises.

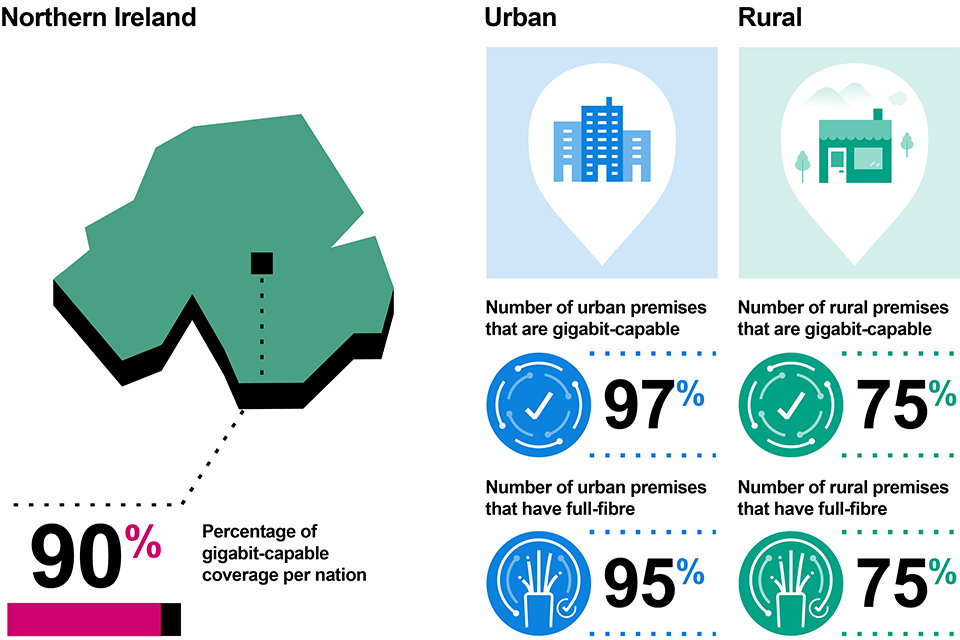

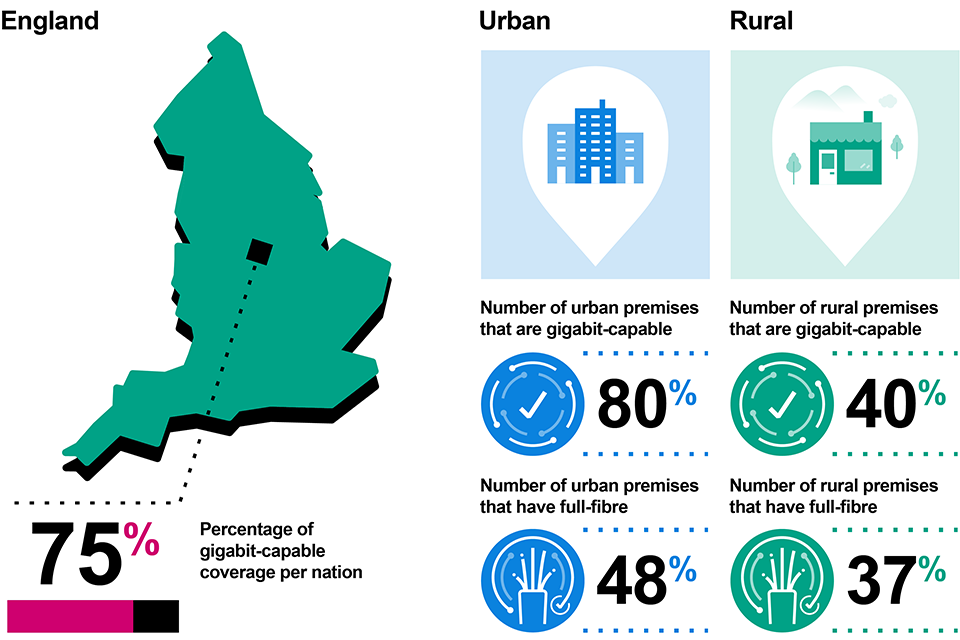

The graphs and infographics displaying the latest coverage data from Ofcom’s Spring 2023 Connected Nations update illustrate that the deployment of gigabit-capable and full-fibre broadband across the UK is progressing steadily. Between September 2022 and January 2023 coverage grew by 1 to 2% for Wales, Northern Ireland and England, while Scotland experienced a slightly smaller increase.

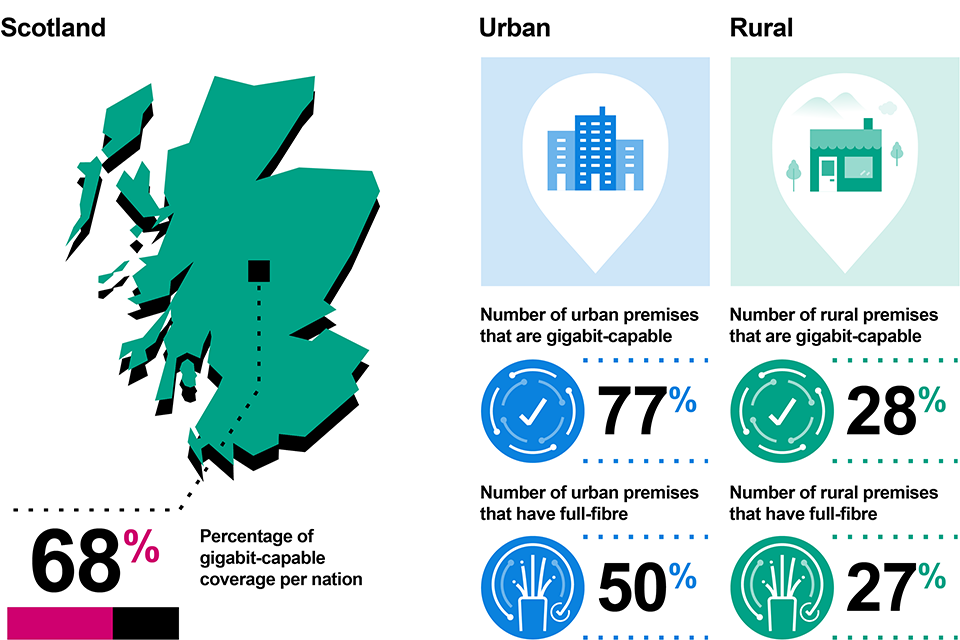

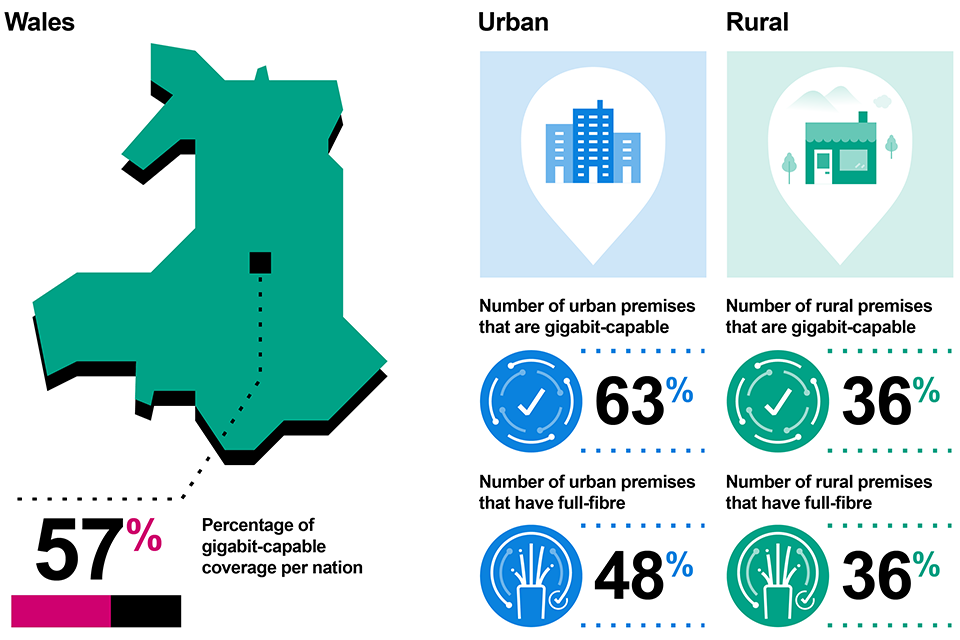

A closer look at rural and urban residential premises reveals a consistent upward trend in coverage across both categories. Deploying broadband infrastructure in urban areas is typically easier and faster due to the density of premises which explains why Scotland and Wales, both starting from lower urban coverage levels, have experienced some of the most substantial increases in coverage across the nations as suppliers ramp up their roll out across Welsh and Scottish towns and cities.

Rural areas continue to experience positive upticks in coverage despite their more difficult and sparsely populated deployment environments. Both Scotland and Wales saw a 3% increase in gigabit-capable coverage and 4% increase in full fibre coverage across rural areas. Northern Ireland saw a noteworthy growth of 9% gigabit-capable broadband across rural premises and a 3% increase in urban areas, whilst England saw a 4% and 5% growth rate across urban and rural premises respectively.

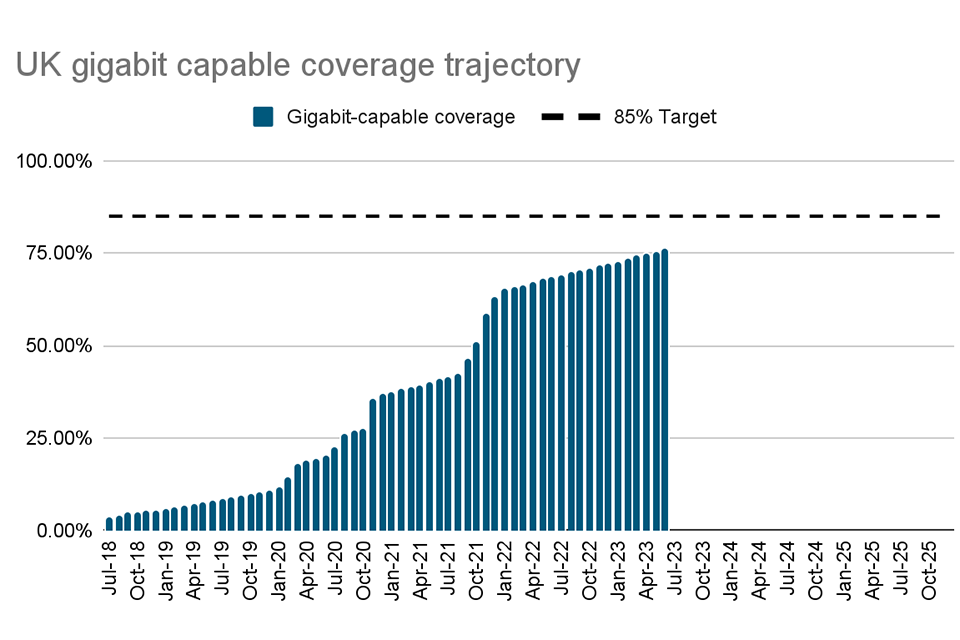

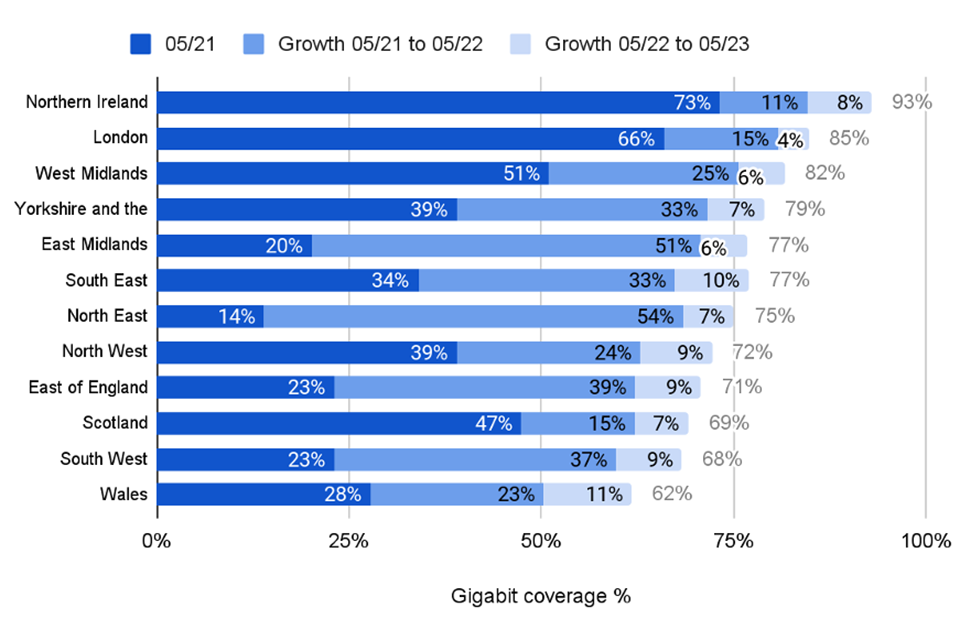

Based on more recent coverage data provided by ThinkBroadband at a regional and devolved nation level, Wales (8%), Northern Ireland (7%), and the English regions of the South East (6%) and North West (6%) have seen the biggest increases in gigabit coverage since April 2022. Overall, these improvements are also shown in the UK gigabit-capable coverage trajectory chart, which outlines our progress towards our goal of 85% of the UK having access to gigabit-capable speeds by 2025.

The information we outline is based on two broadband coverage data sources:

- Independent website ThinkBroadband.com, which provides the most up-to-date information on national coverage, and is used to provide national and regional coverage statistics. This was sourced in June 2023 and represents the latest coverage snapshot up to that date

- Ofcom data collected in January 2023 for its Connected Nations Spring Update 2023 report, which is the most up-to-date source of coverage broken down by residential and business premises, as well as rural and urban premises

The graph below shows how gigabit coverage has increased since July 2018, and how this tracks against our forecast trajectory, combining BDUK and commercial delivery, towards our coverage target.

UK gigabit-capable coverage trajectory (Source: DSIT analysis, ThinkBroadband. Data is accurate as of 27 June 2023.)

The graphics below show the coverage of gigabit-capable and full-fibre broadband across the UK by nation, broken down by rural and urban premises.

Gigabit-capable coverage across the devolved nations (Source: ThinkBroadband, May 2023) and broken down by rurality and type of infrastructure (Source: Ofcom, Connected Nations Report Update, May 2023. Data accurate as of January 2023.)

Gigabit-capable coverage by region and devolved nation, previous 12 months growth (Source: ThinkBroadband, May 2023)

The graph below shows the growth in gigabit-capable broadband coverage across the devolved nations and the regions of England since the launch of Project Gigabit.

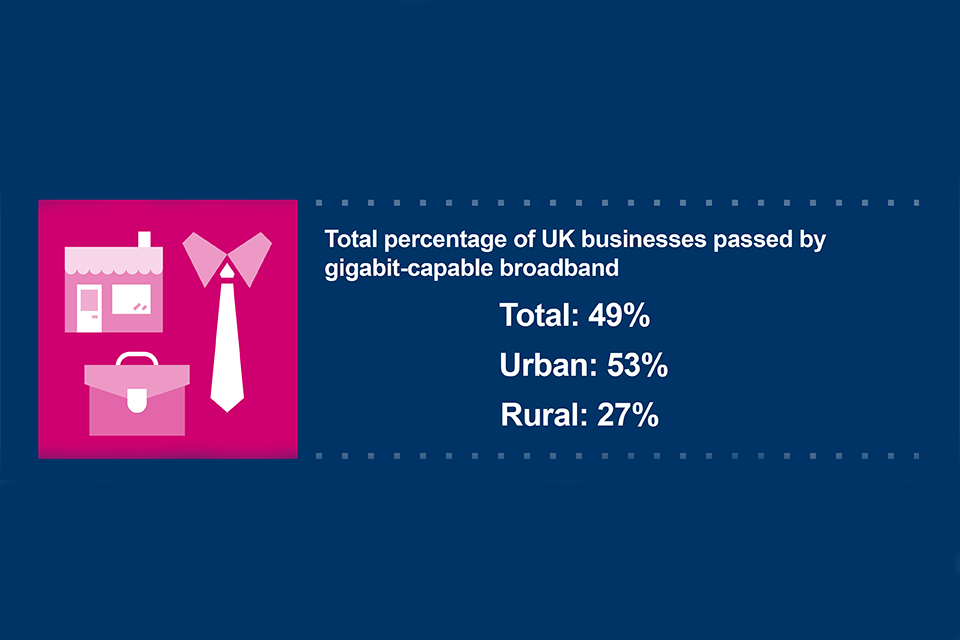

In January 2023 (the latest date for which this information was collected by Ofcom), 49% of business premises had access to gigabit-capable broadband. This comprises 27% of business premises coverage in rural areas and 53% in urban areas.

Gigabit-capable coverage by business premises (Source: Ofcom, Connected Nations Report, May 2023. Data accurate as of January 2023)

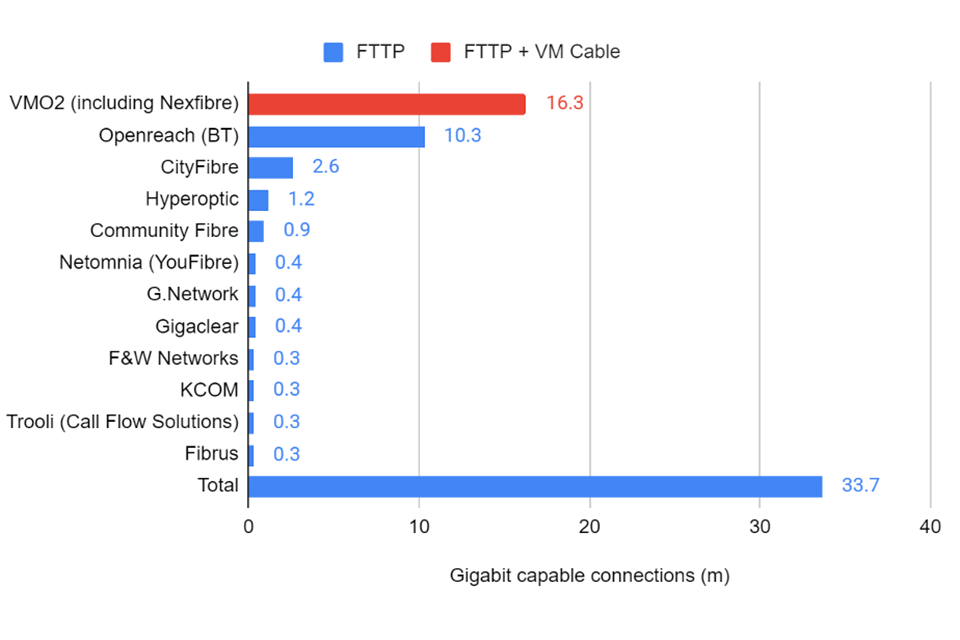

Premises passed (million) by a gigabit-capable network, broken down by supplier (Source: Operator Reports. Data is accurate as of June 2023.)

The graph below shows the number of premises passed with gigabit-capable broadband by supplier. Since we presented this data in the last update, Openreach have added 1.5 million premises, while Hyperoptic have added 300,000 premises. The data for this chart is reliant on reporting and public announcements by operators.

Update on Project Gigabit Delivery Plans

Project Gigabit Procurements

Since our last progress update, we have announced a further six new contracts in Cambridgeshire, the New Forest, North Shropshire, Norfolk, Suffolk and Hampshire. This combined investment of £425 million will bring gigabit-capable broadband to up to 284,000 premises. In total, we now have twelve contracts in place worth a combined £590 million covering over 376,000 premises, with more to be announced imminently.

Since February 2023 we have launched 11 regional and local procurements across England, covering Derbyshire, West Yorkshire and the York area, South Yorkshire, North East Staffordshire, Leicestershire and Warwickshire, Nottinghamshire and West Lincolnshire, Mid West Shropshire, North Oxfordshire, South Oxfordshire, Dorset and South Somerset, and Cornwall and Isles of Scilly. In total these are worth £410 million and will cover up to 225,500 premises. We expect to launch procurements in Cheshire and Lincolnshire and East Riding in the coming weeks.

We have continued to develop and refine our first cross regional procurement. We have designed this alternative approach to reach premises in areas where we have established there is insufficient market appetite to support a local or regional intervention following engagement with suppliers. So far we have identified the following areas set to benefit from this procurement; Lancashire, North Wiltshire and South Gloucestershire, West and Mid-Surrey, Staffordshire, West Berkshire, Hertfordshire, North West, Mid and South East Wales, West and North Devon.

Our initial analysis of the major English metropolitan areas has provided us with a clear understanding of the significant commercial activity present in large urban conurbations. It is likely that some small pockets of poor urban digital connectivity will remain unserved by the commercial market without government intervention. In order to accurately ascertain how to best serve these premises, we have chosen to pause our procurement timeline and engage the market, councils and other local stakeholders on the most suitable design and scale of any future intervention. In addition, our market engagement in Essex and East Surrey has revealed significant planned commercial activity, leaving only a limited number of premises eligible for subsidy. The market has shown limited interest in bidding for what would be smaller-sized procurements in these areas, and so we will consider alternative interventions.

We did not receive any suitable bids for our initial Mid West Shropshire procurement. However, we have re-engaged the market and are confident that we will secure a solution for the area within the new timeframe we have set, maximising coverage whilst securing value for public money.

The responses to the latest national Open Market Review (OMR), which ran from 20 January to 3 March, are being evaluated. A total of 48 suppliers, our largest ever response, submitted their coverage plans to help us build a more accurate picture of the areas where we might need to intervene and ensure our build works in tandem with commercial rollout. We now intend to launch a new iteration of this national OMR every four months (May, September, January).

As part of ongoing work to refine the ways we use public funding to serve uncommercial sub-gigabit premises, we are now considering the use of smaller, more flexible contracts to target sub-gigabit gaps in the network which the market may leave behind. We are at an early stage, and will consult the market in detail on this new route to market in due course.

In Wales, in addition to the areas we propose to be covered by our cross regional procurement, we are proposing a regional procurement for North Wales which we plan to launch by the end of the year, and we are finalising the most appropriate approach for South West Wales. In Northern Ireland, the Open Market Review data has been evaluated, and a Public Review has been launched before a procurement is launched in the autumn. The Scotland Public Review has concluded and analysis and intervention area design is underway. The Scottish Government has committed to launch procurements in the autumn.

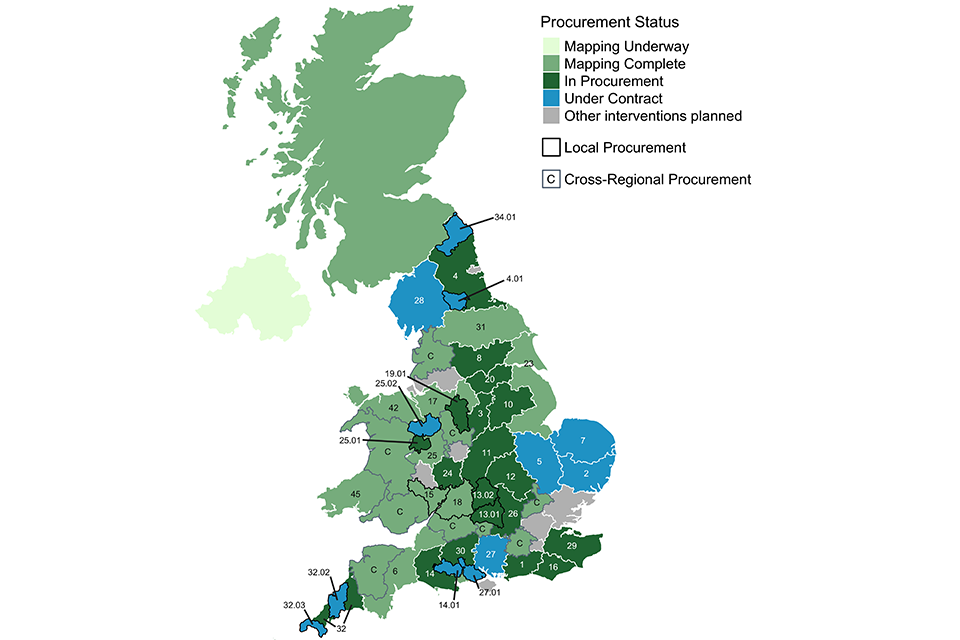

Project Gigabit Procurement Progress (Source: BDUK. Data is accurate as of 23 June 2023.)

Project Gigabit Intervention Areas Map

Gigabit Vouchers

Over 117,000 vouchers have been issued so far under the Gigabit Broadband Voucher Scheme and its previous iterations. To date, 89,000 of these vouchers have been used to connect premises to gigabit-capable broadband. Please visit the annex section for a more detailed breakdown.

We continue to consider opportunities for vouchers to deliver alongside our other interventions. We are committed to maintain as flexible an approach as possible for suppliers, to maximise the delivery of gigabit-capable broadband services to beneficiaries. As part of this, we have begun to approve a number of projects that allow for the continued application for voucher projects in areas that have closed for procurement, where the project can be delivered at pace and does not impact on the delivery of the procurement.

This flexible use of vouchers allows BDUK to fill in smaller areas and presents an accessible product for suppliers to harness their existing commercial plans, with a much lower barrier to entry than other routes to market, such as procurements.

Public Sector Hub upgrades

The procurement for the Midlands Gigahubs project has commenced and will deliver gigabit-capable connections to over 230 sites utilising additional funding from the Department for Levelling Up, Housing and Communities.

The Department for Education (DfE) project is expected to run five regional procurements across England. These procurements aim to reach up to 2,000 schools in total, with a mix of BDUK and DfE funding.

Our NHS Scotland project has now completed and we are currently going through the closure process, having connected five sites. Build is under way for our other existing Gigahub projects in Dorset, Oxfordshire and Leicestershire, with 44 sites already connected.

Case study

Gigabit Broadband Voucher Scheme in action: Elvington Scout Group

Elvington Scout Group, based near York, helps children and young adults reach their full potential, and develop skills including teamwork, time management, leadership, initiative and self-motivation.

Since April 2023, thanks to the Gigabit Broadband Voucher Scheme, the Scout group can now access a fast, reliable broadband connection. What’s more, independent internet service provider Fibre and Communication Technology Company (FACTCO) is providing the Scout Hut with two years of full-fibre broadband free of charge, with broadband speeds up to 30 times faster than before.

Cub Scout Erin McEwan-Wright, 8, is one of 85 scouts who benefit from the full-fibre connection. She said: “I use my iPad for Times Table Rockstars which helps me learn my times tables. I also use my laptop for playing horse games; the quicker the internet is, the quicker I can feed and groom my horses!”

Deputy Group Scout Leader Tracy McEwan says that having fast and reliable internet is vital for the Scout Hut and the Elvington community. She added: “With several badges dedicated to Scouts using the internet safely, managing cyberbullying, protecting themselves online and other tips and tricks, relying on quality internet is crucial. We also rely on the internet to download large files, such as videos, and not waiting for downloads saves us a lot of time.”

Project Gigabit across the Union

Scotland

In early March, the Scottish Government carried out market engagement to gauge the level of potential interest in Project Gigabit in Scotland and better understand suppliers’ delivered and planned commercial build. On 23 March, the Scottish Government launched a Public Review (PR), seeking to validate the findings of its most recent Open Market Review (OMR), which closed in October 2022. The PR invited responses from suppliers, businesses, the public and service providers. The PR closed on 24 April and analysis is currently being undertaken. The Scottish Government has committed to launch procurements in the autumn

The Scottish Government’s £600 million Reaching 100% (R100) programme, supported with £49.5m of additional UK government investment, continues to deliver, with over 20,000 gigabit-capable connections now delivered across Scotland.

Gigabit vouchers continue to be actively delivered in Scotland. There have now been 3,400 Project Gigabit voucher funded connections of which 400 benefited from the Scottish Government top-up. A further 800 vouchers have been issued for connection in the next 12 months.

Case study

Gigabit vouchers delivering for a remote island.

The Isle of Jura, an Inner Hebrides island off the west coast of Scotland, is one of the UK’s most sparsely populated areas. Not only is Jura very hard to reach in geographic, logistical and commercial terms, it also presents a very challenging physical environment for engineers to build fibre infrastructure.

To date, BDUK has invested £150 million in the Digital Scotland Superfast Broadband (DSSB) and Reaching 100% (R100) programmes in Scotland. Thanks to DSSB, submarine fibre cables were deployed to Jura in 2014, which brought superfast broadband to around half of the island’s 217 premises. Scottish Government investment into Jura’s 4G mobile network has delivered further fibre infrastructure within the island. Both the DSSB and 4G investments have made an ambitious BDUK Gigabit Broadband Voucher Scheme project financially commercially viable; ambitious in terms of delivering full-fibre gigabit connectivity to an entire very remote rural island.

As of April 2023, a BDUK voucher-funded Openreach Fibre Community Partnership on Jura has made excellent progress, delivering more than 100 connections.

Wales

In Wales, we have engaged broadband suppliers to establish their commercial deployment plans and understand where government intervention will be needed. Areas across North West Wales, Mid Wales and South East Wales will be included in a cross regional procurement we plan to launch in the summer. In addition, we are planning to launch a regional procurement in North Wales by the end of the year, and we are finalising the most appropriate approach for South West Wales.

Active voucher projects continue to deliver in Wales, but the scheme remains paused for new projects as the intervention areas for procurement are finalised. As of the end of May 2023, we had connected 3,000 homes and businesses in parts of Wales using vouchers. In addition, a further 2,300 vouchers had been issued for connection within the next 12 months.

Meanwhile, the latest phase of the Welsh Government’s Superfast Cymru programme has completed delivery of gigabit-capable infrastructure in Wales. Data from the fourth quarter of 2022 to 2023 showed that the project had provided over 36,000 premises with access to gigabit-capable broadband.

Northern Ireland

Northern Ireland maintains the lead for gigabit-capable broadband across the UK with over 90% coverage, made possible by a competitive commercial supplier market and substantial UK government funding.

The initial scope of Project Stratum has increased by 8,400 premises to a new total of 85,000 premises, enabled by an injection of £32 million of additional funding from BDUK. Fibrus is continuing to build ahead of target with 61,000 premises passed to the end of March 2023.

Northern Ireland’s Department for Economy (DfE) is leading the rollout of Project Gigabit, with BDUK continuing to engage and support the evaluation of data from the Open Market Review, determining the best solution and implementation to reach all eligible premises. Following the OMR evaluation, the DfE launched a Public Review on 6th June which will conclude in July 2023.

As of the end of May 2023, 8,300 homes and businesses in parts of Northern Ireland had been connected using vouchers. In addition, a further 1,300 vouchers had been issued for connection within the next 12 months.

Relevant policy, legislative and regulatory updates

Wireless Infrastructure Strategy

On 11 April, the government published the Wireless Infrastructure Strategy, setting out the steps to ensure that all parts of the UK have the connectivity they need to unlock opportunities for growth and prosperity.

The strategy sets out how the government will drive high quality 5G across the UK and deliver a new policy framework to help operators by improving the economics of investing in high quality 5G, as well as outlining the government’s commitment to extending 4G coverage to 95% of the UK’s landmass through the Shared Rural Network. The government has also announced an ambition of nationwide coverage of standalone 5G to all populated areas by 2030.

Very Hard To Reach premises

In April, the government launched an £8 million fund to provide capital grants to further promote new satellite connectivity to a small cohort of up to 35,000 of the very hardest to reach premises. Further details on the value of the grants, and how to apply, will be released in due course.

This work follows the launch of the government’s Alpha Trial programme in December 2022, to test the capability and viability of low earth orbit satellites to deliver high-speed connectivity to homes and businesses in very hard to reach areas.

The government has announced seven of its Alpha Trial sites, using a mixture of both OneWeb and Starlink equipment. These sites include some of the most remote areas of the UK including Eryri National Park (Snowdonia), North York Moors, Papa Stour and Lundy Island. This month has seen the island of Papa Stour connected to OneWeb’s satellite system, which will beam high-speed, reliable broadband connections to the island from space. This was also the first commercial deployment of a Kymeta OneWeb terminal in Europe, delivered by Clarus Networks and also supported by Shetland Islands Council.

Smart Infrastructure Pilots programme

The Smart Infrastructure Pilots programme, a joint programme between DSIT and the Department for Transport (DfT), will provide up to £1.5 million in funding for six local authority-led pilots, which will be matched by smart service providers working with the participating local authorities, to procure and test innovative smart multi-purpose columns or lampposts.

Barrier Busting

The Product Security and Telecommunications Infrastructure Act 2022 is now in the implementation phase, following Royal Assent in December 2022. Provisions relating to upgrading and sharing of telegraph poles commenced in February 2023. Provisions relating to upgrading and sharing of ducts under private land commenced in April 2023. These provisions will make it easier for operators to deploy gigabit broadband networks without the need for lengthy negotiations with site providers.

DSIT and DfT have announced a programme of more ambitious trials for a more flexible permitting system, focused on rural areas. This would significantly reduce the administrative burden.

Unleashing Rural Opportunity

In June, the government launched a £7 million fund as part of their Unleashing Rural Opportunity action plan, aiming to test out new ways to bring together satellite, wireless and fixed line internet connectivity, helping support farmers and tourism businesses to access lightning fast, reliable connectivity in remote areas for the first time.

The government has also announced the appointment of Simon Fell MP as the UK’s first Rural Connectivity Champion. Mr Fell will support rural businesses to access and adopt the digital connectivity they need to encourage commercial investment in 5G and support economic growth.

Update on commercial investment in UK gigabit infrastructure

Since the last progress update, suppliers have announced the following new investments: Gigaclear (£420 million), Toob (£300 million), Netomnia and YouFibre (£230 million), Grain (£130 million), 4th Utility (£25 million) and Lothian Broadband (£20 million).

The following suppliers announced their latest overall progress deploying gigabit-capable broadband to premises across the UK: Virgin Media (16 million), Openreach (10 million), Hyperoptic (1.15 million), F&W Networks (335,000), Fibrus (250,000), Brsk (150,000), Lit Fibre (100,000), Zzoomm (100,000), GoFibre (35,000), WeLink (27,500), Truespeed (15,000), Quickline (10,000) and County Connect (3,700).

Finally, suppliers continue to announce more gigabit-capable broadband deployment plans including but not limited to:

- CityFibre (March, Yaxley - Cambridgeshire, Solihull, Loughborough, Bracknell, Inverness)

- Connect Fibre (Killamarsh - Derbyshire and Thorne - South Yorkshire)

- County Broadband (Parts of Suffolk)

- Fibrus (Across North East England)

- Freedom Fibre (Ellesmere Port, Hooton, and Bromborough - North West)

- Gigaclear (Buckden, Kimbolton - Cambridgeshire, Adderbury, Hook Norton, Bloxham, Milcombe - Oxfordshire, Gomshall and Westcott, with Wonersh - Surrey )

- Giganet (Scotland)

- GoFibre (Portlethen, Newtonhill, Newport-on-Tay, Tayport, locations across Scotland and the North of England)

- Grain (Leeds, Halifax, Castleford, Barnsley, Gillingham, Brighton)

- INeedBroadband (Parts of Nottinghamshire)

- Netomnia (Deal and Walmer - Kent, Hoddesdon, Bishop Auckland, Castleford, Macclesfield and Didcot)

- Ogi (Cardiff, Tonyrefail and Tonypandy -Rhondda Cynon Taff)

- Openreach (Scotland, Wales and locations in North, Central and South England)

- Quickline (Parts of Yorkshire and Lincolnshire)

- RunFibre (Over - Gloucestershire)

- Spring Fibre (Lincolnshire)

- Truespeed (Bleadon - Somerset, Beckington, Frome, Faulkland, Norton St Philips and Trowbridge - South West England )

- Virgin Media (East Grinstead, Southall, West London)

Annex

Project Gigabit procurement pipeline

Live contracts

| Local or regional supplier procurement | Area and Lot number | Contract signature date | Estimated number of premises in scope of the contract (subject to change) | Contract value |

|---|---|---|---|---|

| Local | North Dorset (Lot 14.01) | 25 August 2022 | 7,000 | £6.3 million |

| Local | Teesdale (Lot 4.01) | 22 September 2022 | 4,000 | £6.7 million |

| Local | North Northumberland (Lot 34.01) | 14 October 2022 | 3,700 | £7.4 million |

| Regional | Cumbria (Lot 28) | 29 November 2022 | 59,000 | £108.5 million |

| Local | Central Cornwall (Lot 32.02) | 19 January 2023 | 9,200 | £18 million |

| Local | South West Cornwall (Lot 32.03) | 19 January 2023 | 9,500 | £18 million |

| Regional | Cambridgeshire and adjacent areas (Lot 5) | 23 March 2023 | 44,400 | £69 million |

| Local | New Forest (Lot 27.01) | 27 March 2023 | 10,400 | £13.8 million |

| Local | North Shropshire (Lot 25.02) | 19 April 2023 | 12,000 | £24 million |

| Regional | Norfolk (Lot 7) | 28 June 2023 | 62,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | 28 June 2023 | 79,500 | £100.5 million |

| Regional | Hampshire (Lot 27) | 28 June 2023 | 75,500 | £104.2 million |

Live and upcoming procurements:

The tables below show the live procurements and upcoming procurements posted on the GOV.UK website. Our planned timetable is subject to market feedback and suppliers being willing and able to respond. In some cases more time will be required to run the end-to-end process.

The pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded. The low and high contract values represent a possible range of funding; actual contract values are likely to be spread across the range for each lot. This pipeline is subject to change based on emerging data and feedback, following open market reviews, public reviews and market engagement.

Live procurements

| Local or regional procurement | Area and Lot number | Procurement start date | Estimated contract award date (subject to change) | Number of premises in scope of the procurement (subject to change) | Indicative contract value (£ million) (subject to change) |

|---|---|---|---|---|---|

| Regional | North East England (Lot 4) | 7 November 2022 | May 2023 | 51,850 | £82.7 million |

| Regional | Worcestershire (Lot 24) | 6 October 2022 | July to September 2023 | 18,400 | £39.4 million |

| Regional | Buckinghamshire, (part of) Hertfordshire and East of Berkshire (Lot 26) | 28 November 2022 | July to September 2023 | 40,300 | £58.8 million |

| Regional | Kent (Lot 29) | 13 December 2022 | July to September 2023 | 72,000 | £112.3 million |

| Regional | West and East Sussex (Lots 16 and 1) | 13 January 2023 | July to September 2023 | 62,100 | £100.6 million |

| Regional | South Wiltshire (Lot 30) | 17 February 2023 | October to December 2023 | 19,000 | £24.8 million |

| Regional | Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | 28 February 2023 | October to December 2023 | 30,300 | £51.4 million |

| Regional | Derbyshire (Lot 3) | 28 February 2023 | October to December 2023 | 18,200 | £33.4 million |

| Regional | Leicestershire and Warwickshire (Lot 11) | 23 March 2023 | November 2023 to January 2024 | 45,400 | £71.5 million |

| Regional | Nottinghamshire and West of Lincolnshire (Lot 10) | 24 March 2023 | November 2023 to January 2024 | 35,700 | £58.6 million |

| Local | South Oxfordshire (Lot 13.01) | 30 March 2023 | August to September 2023 | 6,500 | £17 million |

| Local | North Oxfordshire (Lot 13.02) | 31 March 2023 | August to September 2023 | 4,900 | £11.2 million |

| Local | North East Staffordshire (Lot 19.01) | 4 April 2023 | September to November 2023 | 6,200 | £16.6 million |

| Regional | West Yorkshire and York Area (Lot 8) | 27 April 2023 | November 2023 to January 2024 | 29,000 | £60.9 million |

| Regional | South Yorkshire (Lot 20) | 27 April 2023 | November 2023 to January 2024 | 32,400 | £44.4 million |

| Local | Mid West Shropshire (Lot 25.01) | 18 May 2023 | November 2023 to January 2024 | 6,000 | £12 million |

| Regional | Dorset and South Somerset (Lot 14) | 30 May 2023 | January to March 2024 | 22,600 | £43.2 million |

| Regional | Cornwall and Isles of Scilly (Lot 32 ) | 23 June 2023 | April to June 2024 | 18,600 | £41.2 million |

Upcoming procurements:

| Local or regional procurement | Area and Lot number | Procurement start date | Estimated contract award date (subject to change) | Estimated number of premises outside supplier plans (subject to change) | Indicative contract value (£ million) (subject to change) |

|---|---|---|---|---|---|

| Regional | Cheshire (Lot 17) | July 2023 | January to March 2024 | 17,700 | £44.8 million |

| Local | Herefordshire (Lot 15) | July 2023 | January to March 2024 | 7,900 | £21.5 million |

| Local | Gloucestershire (Lot 18) | July 2023 | January to March 2024 | 4,900 | £15.6 million |

| Regional | Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | July 2023 | January to March 2024 | 74,200 | £119.3 million |

| Regional | North Yorkshire (Lot 31) | July to September 2023 | April to June 2024 | 41,900 | £63 to £127 million |

| Cross Regional | Lancashire, North Wiltshire and South Gloucestershire, West and Mid-Surrey, Staffordshire, West Berkshire Hertfordshire (Call-Off 1) |

July 2023 | April 2024 to June 2024 | 57,500 | £149.7 million |

| Cross Regional | West and North Devon, North West and Mid Wales, South East Wales (Call-Off 2) |

July 2023 | April 2024 to June 2024 | 47,700 | £139.7 million |

| TBC | Devon and North Somerset (Lot 6) | TBC | TBC | TBC | TBC* |

*We are currently undertaking the design process for our Devon and North Somerset intervention. With a number of options remaining on the table, we have included it in the pipeline as TBC, but will be firming up our proposed intervention in due course.

If you are a supplier who wishes to view and/or register interest for any of the opportunities under Project Gigabit, all details can be found online here.

Gigabit vouchers issued or claimed

| Fiscal year | Total vouchers issued | of which yet to be connected | of which used to fund a connection |

|---|---|---|---|

| 2017 to 2018 | 40 | 0 | 40 |

| 2018 to 2019 | 6,900 | 0 | 6,900 |

| 2019 to 2020 | 15,800 | 0 | 15,800 |

| 2020 to 2021 | 18,400 | 0 | 18,400 |

| 2021 to 2022 | 27,400 | 4,500 | 22,900 |

| 2022 to 2023 ( p )* | 45,700 | 20,200 | 25,500 |

| 2023 to 2024 ( p )* | 3,200 | 1,200 | 2,000 |

| Total | 117,500 | 25,900 | 91,600 |

*as of 17 May 2023

Source: BDUK as of January 2023

( p ) - provisional

Notes:

1. Figures rounded to the nearest 100, except for 2017 to 2018

2. Removal of 2 vouchers from 2021/22 figures due to voucher status change

Public Sector Hubs

| Fiscal year | Rural Gigabit Connectivity | LFFN ( p ) | GigaHubs | Total |

| 2017 to 2018 | 0 | 0 | 0 | 0 |

| 2018 to 2019 | 0 | 0 | 0 | 0 |

| 2019 to 2020 | 20 | 0 | 0 | 20 |

| 2020 to 2021 | 220 | 1,700 | 0 | 1,920 |

| 2021 to 2022 | 780 | 3,900 | 10 | 4,690 |

| 2022 to 2023 | 0 | 0 | 40 | 40 |

| 2023 to 2024 | 0 | 0 | 0 | 0 |

| Total | 1,020 | 5,600 | 50 | 6,670 |

Source: BDUK as of May 2023

Notes:

1. Figures rounded to the nearest 10