Project Gigabit: Phase One Delivery Plan

Updated 21 April 2021

Foreword

Oliver Dowden

‘Project Gigabit’ is the government’s national mission to deliver lightning-fast, reliable broadband for everyone in the UK.

It is a mission championed by the Prime Minister, and one we share with industry, regulators, local councils, consumer groups and fellow citizens. We know the shift to gigabit-capable broadband will deliver a huge leap forward for this country - opening up infinite possibilities for business, technology, healthcare, education and more.

We have already made great strides with our rollout. Just over a year ago, only 9% of premises had access to gigabit broadband. That figure has already shot up to 39%, thanks to the hard work of the telecoms industry, supported by the government, local authorities and Ofcom. That means over 11 million homes and businesses across the country can now enjoy the advantages of cutting-edge connectivity. However, we must do more and quickly.

Project Gigabit is our £5 billion mission to connect every corner of the UK, so that no community is left out of this connectivity revolution. Phase 1 will provide one million hard-to-reach buildings with gigabit coverage, as well as new funding for gigabit vouchers, and to connect rural public buildings.

I was also delighted to announce the first Project Gigabit funding in Scotland, and we are working closely with the Scottish, Welsh and Northern Irish governments on how we can go further and faster through extra investment.

Project Gigabit is designed for today’s - and tomorrow’s - telecoms market: one that is rapidly changing, fast-paced and has a dynamic range of telecoms providers of all sizes. We are determined to take a pro-competition approach, with all suppliers able to play their part. Thorough local market reviews will shape the type, size and boundaries of each contract to maximise competition and ensure public money is targeted at places that would otherwise be left behind.

The pipeline may change, and we will update on this quarterly. I am urging industry and local authorities to continue working with us to keep the pipeline full of opportunities - targeting the areas of greatest need and where telecoms providers are best placed to move quickly.

Together, we are delivering one of the largest ever upgrades to our digital infrastructure - connecting the entire country for generations to come.

Oliver Dowden, Secretary of State for Digital, Culture, Media and Sport

Introduction

The government wants to deliver nationwide coverage of gigabit-capable broadband as soon as possible and is confident that the private sector will deliver gigabit connectivity to the most commercial 80% of the country by 2025. To support this, the government will continue to implement an ambitious programme of work to remove barriers to broadband deployment.

We also want to encourage commercial investment and stimulate suppliers to go further into harder to reach areas, by using subsidies to stretch that commercial activity further.

We are targeting a minimum of 85% gigabit-capable coverage by 2025 but will seek to accelerate rollout further to get as close to 100% as possible.

In December 2020, we published Planning for Gigabit Delivery in 2021 asking for input from local and devolved government and telecoms providers to help us shape how best to use public subsidy to deliver these objectives.

We’re delighted with the constructive and positive feedback to the paper from 96 organisations across the telecoms industry and local government, which we have summarised in Appendix B. We’re very grateful for the work which many have put in to help review and improve the approach we set out.

This paper builds on the December 2020 proposals and the responses we have received and sets out our immediate delivery plans.

Delivery Approach

We are working hard to deliver gigabit networks in a rapidly changing environment, at a fast pace and with a dynamic range of telecoms providers. Following Ofcom’s publication of the Wholesale Fixed Telecoms Market Review 2021-26 in March, setting the regulatory environment for commercial delivery, this document presents our proposals to subsidise gigabit network build to get as close to 100% as possible. We have designed a process that recognises this environment and provides space for commercial investment, but also drives subsidised deployment in harder to reach areas.

We are already delivering gigabit networks to areas that currently have the lowest speeds. Our on-going Superfast Broadband Programme is currently delivering gigabit-capable connections to half of the remaining premises in the UK who cannot access speeds of greater than 30Mbps (see Appendix A for a map of superfast interventions which continue in 2022). Upgrades to public sector hub site connectivity and vouchers (small grants) for residential and business customers are being used to ensure that premises requiring subsidy in order to upgrade their connection to gigabit-capable can be included in suppliers’ network build plans.

We are now starting gigabit procurements for telecoms providers to compete for subsidies to deliver gigabit capable networks to specific areas across the UK. These procurements will deliver gigabit coverage where the market would not otherwise be willing to invest because of the high costs.

We have already started the preparations for these gigabit procurements in the first areas, and will be extending to all areas in the next three months. The first step is to request, formally, information from the market to assess the extent of their plans and enable us to accurately identify the target intervention area. From this information, we will procure coverage for these premises, prioritising, where possible, implementation in areas which currently have the lowest speeds.

The first phase of gigabit procurements, covering an estimated 1 million hard to reach homes and businesses, will deliver a combination of longer-term Regional Supplier contracts covering county-sized areas and more focused Local Supplier contracts targeting deployment in smaller areas where there is a clear opportunity to deliver at pace. This document sets out the likely phasing of the Regional Supplier procurements, and the way we will work with partners to define and deliver Local Supplier procurements across the UK. The aim is to intervene right across the UK at pace. Our pipeline will be dynamic and respond to changes in the market. In particular, we are asking providers in this publication to suggest to us further locations where they believe a Local Supplier procurement could offer pace and good value for money.

Many areas are already embarking on major, new gigabit deployments. Several large contracts have been let recently and are now delivering gigabit coverage: Scotland’s R100 contracts, the Stratum contract in Northern Ireland, Connecting Devon and Somerset and the Superfast Cymru contracts in Wales. We will focus in the short and medium term on ensuring the suppliers appointed succeed in delivering in these areas, and extend gigabit access as far as possible. We have recently committed UK Gigabit Programme funding, for instance, to extend gigabit delivery to an additional 5,000 premises in the R100 Central contract in Scotland. We are in discussions with the devolved administrations, suppliers and public authorities in Scotland, Wales and Northern Ireland about how to implement procurements and other interventions that align with their current rollouts of gigabit-capable infrastructure.

Supporting the market to deliver

Most gigabit delivery will be funded commercially, and we have heard from many organisations which are seeking or have secured significant investment to drive delivery. This is really positive, and we will continue to support the vibrant and dynamic commercial market to enable operators to deliver as far as possible.

For the hardest to reach 20% of UK premises, there is consensus that public subsidy will be needed to complete gigabit delivery.

A substantial number of respondents confirmed there remains broad support for direct intervention in the market through contracting telecoms providers to build in areas that would otherwise not get coverage.

Additionally, many telecoms provider respondents to the consultation explained how they harness DCMS’ vouchers to extend commercially funded delivery into these areas and supported the intent to maintain and build on the successes of the Gigabit Broadband Voucher Scheme.

The next sections set out in more detail the type and location of the supplier contracts we intend to procure.

Procurements

We will procure telecoms providers to build gigabit networks with the support of public subsidy through a range of procurements.

Regional, Cross-Regional and Local Suppliers

All telecoms providers have a role to play in delivery of gigabit capability, and our intended commercial and procurement structure enables capable providers of all sizes to take advantage of the subsidy available to build in hard to reach areas. We have termed telecoms providers procured to deliver subsidised gigabit networks in an intervention area Regional Suppliers, Cross-Regional Suppliers and Local Suppliers.

Procuring Regional Suppliers

Regional Suppliers will be selected to have capability, experience and funding to deliver cost effectively, rapidly and at scale across their respective areas. A telecoms provider may be successful in being appointed as the Regional Supplier for multiple areas if it has sufficient capacity.

Regional Suppliers will be appointed through competition for each area of the UK to lead delivery typically to between 70,000 and 150,000 uncommercial premises[footnote 1], prioritising build in harder to reach areas where there is the least likelihood of commercial gigabit investment.

Regional Suppliers will design and deliver in one or more phases, which we have termed “drawdowns”, and may be required to provide costed options for further areas at bid stage. Prior to each drawdown going ahead, there will be an opportunity to review changes in local commercial deployment and adjust Regional Suppliers’ plans as necessary before proceeding.

We will encourage telecoms providers to continue their commercial build of gigabit networks. Even after the Regional Suppliers have been appointed, there is a ‘window of opportunity’ for commercial deployment ahead of build plans being finalised for each forthcoming contractual drawdown.

The response from potential bidders for Regional Supplier contracts has been very positive, and telecoms providers who can operate at scale have expressed an interest in competing in all areas of the UK. We are hopeful that this will result in competitive procurements in most areas and we will procure each area using individual “Restricted” procedures under Public Contracts Regulations where this is the case.

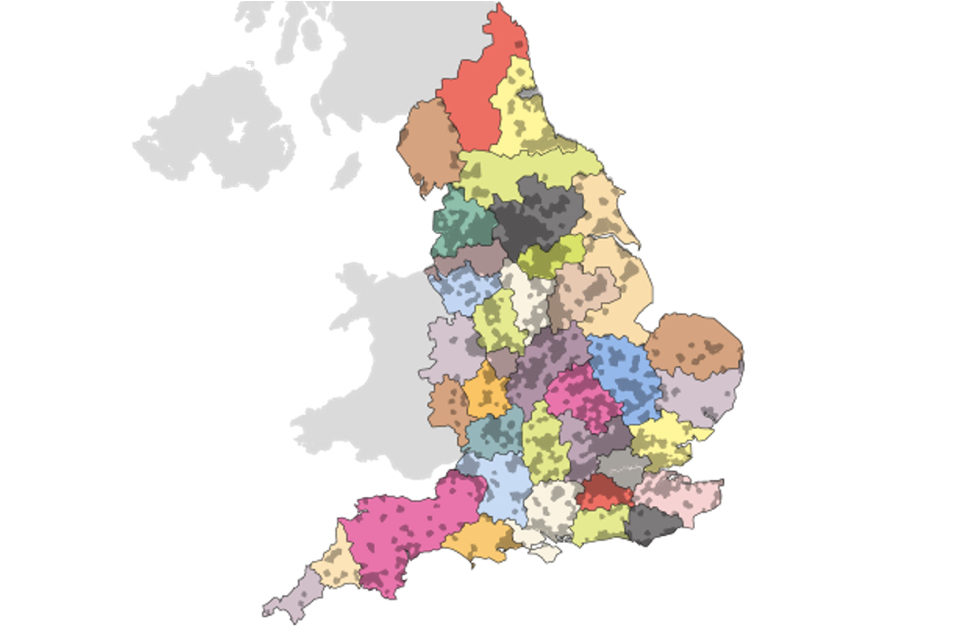

The map below shows the 38 proposed Regional Supplier areas for England (Scotland, Northern Ireland and Wales have recently let contracts and may subsequently create additional Regional Supplier areas in due course)

Map showing the 38 proposed Regional Supplier areas for England

The version of the map shown above gives a high level view of the approach, but is not suitable for more detailed analysis. An HTML and geopackage version of this map, and a spreadsheet mapping exchange areas to lots is available for broadband providers on request via the Digital Connectivity Portal (Resources for Communications Network Providers) page.

Appendix A provides approximate sizes of each lot and an index of lot numbers.

Revised procurement areas

We had considerable feedback on the December 2020 map of “large procurement” areas. Many fed-back that areas marked as “forecast build” actually contained a large proportion of premises that were not commercial and where intervention would be beneficial. Conversely, we had feedback that areas likely to be targeted commercially were missed off the map. This is a product of the granularity of the December map and the dynamic nature of the telecoms market. In fact, a substantial proportion of the Final 20% is in areas shown previously as “forecast build”. To address this, we have now made the areas contiguous, including not only the Final 20% of premises where we expect to intervene but also most of the 80% of premises expected to be delivered commercially. We describe in the Defining Intervention Areas and Procurement Boundaries section below how we will ensure we only intervene where necessary.

We also received feedback from telecoms providers and local authorities that the boundaries for regional supplier procurements should align more closely to local authority boundaries where possible, both for ease of administration and to help with liaison with highways authorities during implementation. We have therefore aligned boundaries with local authority boundaries where this is possible while preserving natural implementation units.

Procuring Cross-Regional Suppliers

In parallel with the procurements for individual regional areas, we are starting work on cross- regional framework procurements so that we have an efficient, alternative route to appoint suppliers with national delivery capability for multiple regions where there is unlikely to be effective competition from suitable bidders for regional procurements. We have begun market engagement on this additional procurement route and will gauge when and where to use the frameworks as we monitor the level of interest in the pipeline and responses to individual procurements.

Procuring Local Suppliers

We will appoint Local Suppliers through smaller competitions in areas where specialist network providers, typically with a geographic focus, are likely to be able to deliver better overall pace, coverage and value than a Regional Supplier.

Local Suppliers will be appointed to implement more focused contracts, typically of between 1,000-8,000 uncommercial premises, called off through a competition on a Dynamic Purchasing System to be procured by BDUK.

Stakeholders may notice that the maps released in December showed areas planned for smaller procurements, separate from the larger procurement areas, whereas the updated maps here show none. We remain absolutely committed to the concept of Local Supplier contracts and the Dynamic Purchasing System.

Specifically, we expect such competitions to attract providers bidding to expand their existing networks, able to use alternative techniques to reach areas which may not be economically viable for larger providers and/or taking advantage of additional available capacity.

There has been broad support across smaller telecoms providers and local authorities for smaller contracts in some specific circumstances. While some telecoms providers suggested general areas of England which would be of interest, we have only received a limited number of specific proposals and these are often in different areas from those we suggested in the December maps. Many telecoms providers have further suggested that vouchers may provide a more flexible way to complete smaller targeted deployments.

This feedback suggests that Local Supplier contracts should not be constrained to areas outside Regional Supplier areas, and should instead be targeted at areas wherever they can offer incremental delivery pace and value, whether these are close to urban areas or in the most rural areas. This means that Local Supplier procurement areas will need to be developed on a case-by-case basis. For this reason, no Local Supplier areas are shown on the map in this document - they could be incorporated anywhere on the map.

Where we intend to run a competition for a Local Supplier as part of our pipeline, these procurements may be run ahead of, at the same time as, or after Regional Supplier procurements covering the same region. The successful Local Supplier’s area will be excluded from the Regional Supplier’s intervention area.

We will assess where Local Supplier contracts are likely to offer better value on a case-by-case basis, area by area, normally before the Regional Supplier procurement commences. We will be seeking to identify and develop such procurement opportunities and will continue to engage with the market and local authorities, but to create the greatest choice of Local Supplier procurements to assess and from which to include, we need telecoms providers to contact us at bduksuppliers@dcms.gov.uk with specific suggestions of locations.

Defining Intervention Areas and Procurement Boundaries

Many telecoms providers responding to the consultation and planning their own significant investments expressed nervousness that we would run procurements in areas which would result in subsidised intervention where they are planning to build commercially. It is clearly not in our interests (or the interests of taxpayers) to do so and our intention will be to minimise any prospect of public subsidised ‘overbuild’[footnote 2] wherever possible. To achieve this we will continue to use the Open Market Review and Public Review processes to survey the market’s plans for an area, similar to those that have previously been used for the Superfast Broadband Programme. It will be important that all telecoms providers - whether or not they intend to bid for procurements - engage with these processes to minimise any risks of overbuild, and this will be a requirement under the programme.

We will define potential intervention areas and the boundaries of cross-regional, regional and local supplier procurements down to individual premises level, designing interventions to avoid areas where commercially funded rollout is most likely.

We are in the process of implementing a rolling Open Market Review process, establishing a maintained national view of commercial build plans for the following three years. Telecoms providers will be asked to provide their existing and planned coverage at individual premises level. We will incorporate these responses - following appropriate due diligence to assure plans are underpinned with appropriate resources and capabilities - into a complete picture of forecast gigabit-capable infrastructure coverage for the UK.

We have started to gather data from the largest telecoms providers and will continue to work over the coming weeks with more telecoms providers, focusing on those active in early procurement areas. This will give a more comprehensive up to date view of commercial delivery and will avoid the need for having dedicated local Open Market Reviews.

We will exclude premises from any intervention where gigabit-capable networks are available or where we are confident there are committed commercial build plans which will deliver gigabit. This will provide a pool of premises where market data suggests there is a lower probability of commercial deployment and we can therefore target intervention.

From this pool, we will identify premises where we believe that commercial deployment is relatively more likely to take place, even if it is not currently committed, or where the boundary between commercial and un-commercial premises is currently harder to identify. These areas include the remaining premises without gigabit coverage / plans within:

-

Ofcom Area 2[footnote 3]

-

Exchange areas with more than 75% of premises already able to access fibre

-

Exchange areas with committed plans (verified through Public Review) to build to more than 75% of premises in the exchange area

-

Ofcom Area 3[footnote 4] exchange areas where Openreach has announced it will build fibre under Ofcom Regulated Asset Base (RAB) measures, and

-

Other areas assessed as being likely to benefit from commercially funded or voucher supported gigabit build

These premises may still be included within a procurement boundary, but we will defer intervention to these areas in favour of prioritising other areas less likely to see commercial build. This will typically be done by including them within a procurement boundary, but requiring that they are not built until a future drawdown, before which we can reassess the intervention area and the extent of commercial build in the meantime.

In the map below we show the areas within each Regional Supplier contract that will be prioritised within the project and those, shaded grey, that we plan for later deployment.

Map shows areas within each Regional Supplier contract that will be prioritised within the project

The next step will be to work out how we combine target premises into procurements. We will work with local bodies and telecoms providers to define draft procurement areas, identifying which are in potential Local Supplier contracts, Regional Supplier contracts and Cross-Regional Supplier contracts.

We will assess where Local Supplier contracts are likely to offer a more efficient route to early delivery than regional contracts. The factors we will consider when assessing potential Local Supplier contracts include:

-

whether there are credible prospective bidders for the contract, with capacity, technology and financial standing to deliver gigabit solutions to the required standards

-

whether a Local Supplier contract is likely to deliver greater coverage, pace and value for money than including as part of a Regional Supplier contract instead, and

-

whether the Local Supplier contract would leave any isolated areas which would be hard to deploy to subsequently

Even where premises are designated for a Local Supplier procurement, Regional Suppliers may be asked to provide a costed option in case the Local Supplier procurement does not deliver the outcomes predicted.

Finally, and no more than 6 months before we commence any procurements, we will conduct a Public Review using the specific, proposed intervention area for the procurement. This will allow telecoms providers to clarify whether they provide services to any of the target premises or have plans to do so within the next three years which have not been captured in the Open Market Review process. All responses to the Public Review (including updates notified as part of the continuous Open Market Review process) will be reviewed and addressed ahead of finalising the requirements. We may therefore need to refine the classification of premises and the procurement boundaries.

Iterations of the Pipeline

We anticipate that the market will remain dynamic for some time - many telecoms providers have told us of potential deployments but also explained that plans may change depending on a range of factors including take-up, investment objectives and technology.

Our approach must also therefore remain dynamic. For example, we may adjust forthcoming procurement boundaries and timelines if we discover more commercial build than expected, or add a new Local Supplier procurement into the pipeline, or potentially switch from Regional Supplier to Cross-Regional Supplier procurements if competitive pressure is less than expected in a region and we believe this would create a better outcome for the programme. We will conduct formal market engagement on the pipeline on a quarterly basis to inform these decisions.

We will retain close engagement with local authorities to ensure a collective understanding of the planned provision in each local authority area (including commercial delivery, delivery under continuing Superfast Broadband Programme contracts, vouchers, and new procurements).

This close engagement will also be maintained with Regional, Cross-Regional and Local Suppliers in order that intervention areas are designed in such a way that maximises competition whilst taking account of any commercial build plans.

Phasing of the procurement pipeline

Many local authorities have said that procurement could help stimulate deployment in their areas, while some others have very active commercial, superfast and voucher build work. Some are therefore keen to proceed to procurement rapidly, and others have recommended deferring new interventions to create space for existing or planned delivery activity to settle.

Our proposals for phasing procurements respond to these needs. Procurements will be delivered in the following sequence:

-

Initial procurements. A learning phase for Regional Supplier and Local Supplier procurements in partnership with local authorities. Locations are selected from areas with accurate current market data, well-resourced local authority teams and known market interest.

-

Further procurements in areas ready to move ahead. We will add further procurements to our pipeline, sequencing to build pace of deployment and prioritise areas where early intervention drives the greatest benefits. We will provide quarterly updates starting in June 2021 with details of confirmed procurements.

-

Later procurements in areas where other interventions are taking priority or where there is significant commercial activity. Procurements to address areas where there is significant active gigabit implementation expected, often due to live Superfast Broadband Programme contracts already delivering gigabit coverage to the area, or potentially substantial commercial investment plans. In these instances, proceeding with new procurements risks interfering and inefficiently overbuilding existing plans or crowding out commercial investment. These areas are still expected to require subsidy once existing initiatives are closer to maturity and will still be incorporated in the procurement pipeline.

Phase 1 Procurements - Learning

We started the process of procuring in some areas with the pilot launch of the Cumbria Open Market Review late last year, and have been working with other areas since. The first areas for procurement have been selected so that we, local authorities and telecoms providers can start live delivery in a controlled way, learning which elements of the processes work well and which need to be improved so that we can scale up delivery with confidence.

The areas we have selected are those where there is a clear requirement, industry support and supplier interest expected for the procurement, where the local authority is able to support the procurement development process and where we can establish good market data to map the intervention area.

Phase 1a

We are commencing first Regional Supplier procurements in:

-

Cambridgeshire and adjacent areas (Lot 5[footnote 5]) (including Peterborough and parts of Northamptonshire, Essex, Hertfordshire and Rutland)

-

Durham, South Tyneside & Tees Valley areas extending into Northumberland (Lot 4) (covering the local authority areas of Durham, Darlington, Stockton, Hartlepool, Middlesbrough, Redcar and Cleveland, Sunderland, Gateshead, South Tyneside and part of Northumberland)

-

West of Cumbria, including the Lake District National Park (Lot 28)

-

North and West Northumberland and East Cumbria (Lot 34)

-

West of Cornwall and Isles of Scilly (Lot 32)

-

East of Cornwall (Lot 33)

We estimate these projects would provide gigabit coverage to up to 510,000 hard to reach premises.

Dependent on the outcome of the Public Review processes, we expect to procure six Regional Supplier contracts and potentially five Local Supplier contracts in these areas.

We will begin the procurements for the first Regional Supplier projects in the spring.

In addition, we are procuring Local Suppliers in discrete areas within:

-

Essex

-

Dorset

These procurements are being conducted in partnership with local authorities, who are running the Open Market Review and Public Review processes on our behalf.

We will launch the Dynamic Purchasing System for suppliers interested in bidding for Local Supplier Contracts in the spring and the first call-offs for contracts under this process will take place in the summer.

Phase 1b

We are commencing work on a number of other areas where additional procurements can be brought forward to help build pace for the programme while still supporting the learning phase.

The areas that we are now progressing in Phase 1b are:

-

Norfolk (Lot 7)

-

Shropshire including Telford and Wrekin (Lot 25)

-

Suffolk (Lot 2)

-

Worcestershire (Lot 24)

-

Hampshire and Isle of Wight (Lot 27)

We estimate these projects would provide gigabit coverage to up to 640,000 hard to reach premises.

These are areas where the market has expressed interest in early intervention, where there is a high percentage of premises in the “Final 20%” and a relatively high proportion of premises unable to access superfast (>30Mbps) broadband.

For these and subsequent procurements, we will be managing the Open Market Review and/or Public Review as centralised and scalable BDUK processes, working with local authorities and telecoms providers to build an accurate picture of commercial and subsidised gigabit build plans. From this, we will be able to assess procurement boundaries for Regional Supplier and Local Supplier contracts, and how best to time procurements. This data gathering process will be managed by BDUK to help build the national picture of market plans.

This list is not exhaustive, and we are simultaneously exploring with all remaining local authorities whether there is capacity to add further areas in the coming weeks. We will provide further information on these areas in a further update in June 2021.

Phase 2 Procurements - Maintaining Momentum

There are many further regions where early intervention would help deliver our programme objectives:

-

Bedfordshire, Northamptonshire and Milton Keynes (Lot 12)

-

Buckinghamshire, Hertfordshire and East of Berkshire (Lot 26)

-

Derbyshire (Lot 3)

-

East Sussex (Lot 16)

-

Kent (Lot 29)

-

Lancashire (Lot 9)

-

Leicestershire and Warwickshire (Lot 11)

-

Nottinghamshire and West of Lincolnshire (Lot 10)

-

Oxfordshire and West Berkshire (Lot 13)

-

South Yorkshire (Lot 20)

-

Staffordshire (Lot 19)

-

Surrey (Lot 22)

-

West Yorkshire and parts of North Yorkshire (Lot 8)

-

West Sussex (Lot 1)

-

Wiltshire and South Gloucestershire (Lot 30)

-

Potential projects in Scotland, Wales and Northern Ireland (Lots TBC)

We are aiming to commence preparations in each of these areas by starting our National Open Market Review in the next three months. This will provide us information to help align our local approach, plan interventions and inform any early procurement activity, including for public sector hub upgrades or further Local Supplier contracts. We are already working with all local authorities and telecoms providers to sequence further delivery options, assessing maturity of data, telecoms provider readiness, market interest and to identify local authorities with the immediate capability and capacity to support the commencement of interventions in their areas.

It is our intention to commence procurements across the UK at the earliest opportunity. We will provide an updated procurement pipeline every three months starting in June 2021 with further detail on the dates and expected contract values for these procurements. The procurement pipeline is dynamic and we will be reviewing timing of procurements based on the best data we have at the time of issuing the pipeline.

We intend to prioritise deployment areas in the pipeline based on the following criteria:

-

Confidence in contribution to delivery of addressable Final 20% premises by 2025. Note that this does not necessarily favour larger areas: several small areas delivered rapidly in parallel may deliver overall greater pace than one larger area.

-

Confidence in delivery of addressable sub-30Mbps premises, differentiating further on the proportion of sub-10Mbps premises

-

Impact of timing on potential competition, recognising telecoms providers will have different optimum windows for bidding in a procurement

-

Impact of timing on potential commercial deployments or other BDUK interventions, recognising the potential crowding out and deadweight effects of procurements

-

Regional distribution effects, aiming to ensure - either through existing or new interventions - we are building gigabit in all parts of the UK;

-

Impact of timing on aggregate supply chain capacity

-

Any relevant delivery considerations affecting readiness to build in specific local areas, e.g. availability of local authority resources, data quality issues.

Responses to the consultation suggest that the design work required to bid for larger procurements is specialised and significant, and for many prospective bidders, this will form a bottleneck if multiple areas are procured simultaneously. We have also heard that over time, this pressure should ease as telecoms providers become familiar with the process and develop capability. We will aim to avoid procuring all areas of interest to an individual bidder simultaneously.

Future phasing

Some respondents asked for regional supplier delivery to be deferred in some areas where there is particularly strong gigabit delivery activity forecast in the short term and early intervention might destabilise commercial investment. We are already delivering gigabit through the Superfast Broadband Programme in many locations, and until these deployments are more mature, it would be risky to run regional gigabit procurements.

We are therefore expecting to bring forward procurements later in the process for areas where there is a lot of existing or planned build because early intervention could destabilise commercial investment. It could also increase the risk of taxpayer funding being used to deliver gigabit connections that would otherwise have been delivered commerialy, without public subsidy.

Specifically, we are expecting regional supplier procurements in the following areas to be released later in the programme for the following areas:

-

Birmingham and the Black Country (Lot 35)

-

Cheshire (Lot 17)

-

Devon & Somerset (Lot 6)

-

Herefordshire & Gloucestershire (Lots 15, 18)

-

Dorset (Lot 14) (although note some Local Supplier contracts are being progressed here)

-

Essex (Lot 21) (although note some Local Supplier contracts are being progressed here)

-

Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23)

-

Greater London (Lot 37)

-

Merseyside and Greater Manchester (Lot 36)

-

Newcastle and North Tyneside (Lot 38)

-

Northern North Yorkshire (Lot 31)

-

Remaining projects in Scotland, Wales and Northern Ireland (Lots TBC)

These areas remain a focus for delivery and telecoms providers who have communicated plans to deploy are encouraged to implement investment plans as soon as possible in these areas. Where commercial delivery is committed, we will avoid subsidised delivery, so there is a window of opportunity in these areas to drive commercial deployment forward.

In addition, we still encourage the use of vouchers and we may target Local Supplier procurements to enable completion of infrastructure in specific circumstances.

Scotland

The UK government has already invested over £15m in providing gigabit capable connections with local authorities and other public bodies in Scotland including Shetlands Council, Highlands Council, NHS Scotland, Tay Cities, and Dumfries and Galloway through the Local Full Fibre Network and Rural Gigabit Connectivity Programmes.

We are actively working with the Scottish government to explore opportunities to bring forward further deployment in Scotland. This will be in addition to the Scottish government’s current large-scale broadband programme – the Reaching 100% (R100) programme – which will result in at least £600 million of public investment being routed through three regional contracts (covering North, Central and South of Scotland). DCMS continues to support all three contracts through the BDUK assurance processes.

The R100 programme was originally conceived to deliver a Scottish government commitment of ensuring 100% access to superfast broadband. However, the vast majority of connections to be delivered across all three R100 contracts will be full fibre, and will make a significant contribution to the UK-wide gigabit target.

As a first immediate step we and the Scottish government are working together to utilise and add value to these contracts by increasing the number of premises that are given gigabit coverage. This resulted in the recent announcement that the UK government was committing the first spend from the UK Gigabit programme to an additional £4.5 million for the R100 Central contract, to extend gigabit access to an additional 5,000 premises, taking total gigabit access across the Central contract area to over 30,000 premises. Work is continuing to assess the potential for similar investment in the other R100 contracts and any such further investments will be announced as soon as they are confirmed.

In parallel, both governments are collaborating to scope the next phase of gigabit activity in Scotland, which could be delivered alongside R100. This will be informed by the emerging approach for England outlined in this document alongside an assessment of the distinct characteristics of Scotland, and the challenges that these can pose in relation to telecoms delivery, as well as analysis of commercial investment plans and the view of the wider supplier market. Gigabit rollout in Scotland will also need to align with the R100 programme implementation timeline and the possible intervention areas.

This will lead to a number of new gigabit contracts which could include Local Supplier projects and Regional Supplier projects, with the possibility also of a Cross-Regional Supplier procurement if appropriate. The UK government and Scottish government will use a similar approach as in England to prioritise deployment areas, taking account of the specific circumstances of the delivery issues in Scotland. Projects will be developed jointly by the UK government and Scottish government through a collaborative approach, in which it is expected that the Scottish government will be the lead partner on implementation management on behalf of DCMS.

Wales

Building on the success of the Superfast Cymru project, which brought fibre to the cabinet and fibre to the premises to around 750,000 premises across Wales in five years, the Welsh government has embarked on a further project to address broadband availability. The Welsh government’s current project, which will provide access to full fibre broadband to a further 39,000 premises across Wales, will complete next year, bringing total overall public sector investment in the delivery of high speed broadband infrastructure via these contracts to over £268m. We are actively working with the Welsh government to explore opportunities to utilise the current contracts to address additional premises.

The UK government has also invested over £25m invested in projects that will provide gigabit-capable connections to around 700 public sector sites across Wales. We are currently working with the Welsh government, who are overseeing three projects on behalf of local bodies, and with Pembrokeshire and Denbighshire direct. These projects were part of the Local Full Fibre Networks and Rural Gigabit Connectivity Programmes, and will continue under the UK Gigabit Programme.

The Welsh government and UK government are also working together to develop future gigabit-capable interventions in Wales that align with those proposed in England, Scotland and Northern Ireland. Our shared goal is to build on existing work and to develop an approach that reflects the unique combined challenges of topography and population distribution across the country. Our approach will take into account the plans and ambitions of the market and opportunities to align with public sector organisational priorities and boundaries, such as the Corporate Joint Committees in Wales.

The next steps will be to determine the geographic bounds of the interventions in Wales, with imminent plans to share data, and establish the timelines for delivery, with work already under way planning for an Open Market Review in the next three-four months with suppliers about their plans that will enable the identification of target intervention areas.

Northern Ireland

The Northern Ireland government is currently delivering the large-scale broadband improvement scheme Project Stratum, which has £165 million of public investment. This will radically transform rural broadband connectivity by extending gigabit-capable full fibre broadband infrastructure to approximately 76,000 homes and businesses across Northern Ireland.

Project Stratum’s objective is to reach as many of the remaining sub superfast premises in Northern Ireland as possible. All the 76,000 connections to be delivered will be full fibre, and will make a significant contribution to the UK-wide gigabit target.

A small number of sub superfast premises still remain outside the scope of Project Stratum and we are actively working with the Northern Ireland government to explore opportunities to utilise and add value to the Project Stratum contract by extending it to include as many of these premises as possible that will still require a solution.

Both governments are also committed to collaborating to scope the next phase of gigabit activity in Northern Ireland, which would be delivered in addition to Project Stratum. This will be informed by the emerging approach for England and an assessment of the distinct characteristics of telecoms delivery in Northern Ireland alongside analysis of commercial investment plans and the view of the wider supplier market.

Gigabit Broadband Vouchers

Vouchers are an important way for government to support residents and businesses in getting early access to gigabit connectivity. They are small grants to individual residents and businesses that support the installation costs of a new gigabit capable connection. They provide communities the opportunity to group them together and engage collectively with suppliers to bring connectivity across wider areas. They have also been “topped up” by some local authorities and devolved administrations, raising their maximum value and supporting connections in even harder to reach areas.

To date the Gigabit Broadband Voucher Scheme has helped to connect over 40,000 homes and businesses to gigabit-capable broadband. We are building on the success of this approach and committing up to £210m for vouchers worth up to £1,500 for residents and up to £3,500 for businesses in rural areas currently without access to ultrafast services as part of the UK Gigabit Programme from April 2021. We are also continuing our “top up” approach enabling local authorities or devolved administrations to supplement the scheme.

Government is targeting voucher funding at the hardest to reach premises, where it can have the most impact; we will avoid areas where the market may be able to deliver commercial networks without public subsidy and where public money may ‘crowd out’ commercial investment and reduce taxpayer value for money. Vouchers will not be available in areas where there are plans to deliver coverage with public funding in the short term so they complement BDUK’s procurements to provide gigabit connectivity in the hardest to reach rural areas. This means that we will assess eligibility for vouchers on a dynamic basis, responding to the market’s investment plans and other public interventions.

Where we believe that premises may benefit from commercial deployment or otherwise expect them to be addressed through public intervention, they will cease to be eligible for vouchers, to avoid undermining existing commercial investment cases or duplicating subsidy. We will, however, continue to honour any vouchers already issued at that stage for providers to claim completed, eligible, gigabit connections.

We have been working with suppliers to help judge projects that would meet the new eligibility criteria, and transition those projects that were submitted within a recent deadline. The majority of premises will retain their eligibility under the new voucher conditions, but to help individuals check, we will be launching a new eligibility checker. Where eligible, consumers will be able to contact registered suppliers to understand how vouchers could be used as part of a project to connect their community. Where not eligible, we will explain why and provide information so that consumers can identify what connectivity options are available to them and timelines for when we would reappraise eligibility if network build plans have changed or not progressed as expected. Providers will also be able to alert where they believe our eligibility assessment may be based on inaccurate records, just as they can today.

It is also important that telecoms providers monitor when and where procurements are planned. We will pause the issue of new vouchers while we survey the market through the Public Review process and initiate procurements for target intervention areas. This is so bidders have a stable baseline through the process. Once a contract has been awarded, we will understand which premises are covered in immediate implementation plans and which will be part of a later phase. In the latter case, we are likely to make these areas eligible for vouchers again for communities and providers that are seeking a connection sooner than otherwise planned.

Public Sector Hubs

The procurement of connectivity services in the public sector can help to drive the availability of gigabit infrastructure and services into the hardest to reach parts of the UK. We have successfully helped procure a number of Public Sector Hubs in remote areas.

We have set up a Dynamic Purchasing System (RM6095) with Crown Commercial Services for Gigabit-Capable Connectivity and now have 41 suppliers fully registered. Local authorities and devolved administrations are procuring services from the DPS, working with the supplier market to reduce barriers for the commercial sector to deliver gigabit services to the hardest to reach areas.

We expect many other government departments and authorities to participate in regional procurements, with 100-200+ hubs sites expected in each regional procurement. As well as facilitating greater delivery of public services online, we estimate these hub sites will have c.30 premises passed with little incremental cost and c.200 addressable premises within 250-300 metres and so provide a platform for suppliers to extend connectivity in these local communities.

The hubs programme remains highly active, with over £50m of future work in the pipeline including Oxfordshire, Dorset, Leicestershire and Lincolnshire due to commence their procurements imminently, with estimated funding value c.£12m.

Very Hard To Reach Premises

A small number of UK premises are expected to be prohibitively expensive to reach and providing a gigabit-capable broadband connection to such premises from our UK Gigabit programme funding may not represent value for money. These premises are typically, but not exclusively located in remote areas, and are often far from other premises or from other currently existing telecommunications infrastructure.

Previous estimates have suggested that less than 1% of UK premises (300,000) may prove to be prohibitively expensive under current value-for-money metrics. However, other evidence suggests that a proportion already benefit from gigabit-capable connections and as we successfully deliver ongoing superfast contracts and voucher projects to more of these premises, this number may fall.

Our rural communities need good digital connectivity to thrive in an increasingly connected world, and we are committed to ensuring that no part of the UK is left behind and will explore all possible options for improving broadband connectivity for these very hard to reach premises.

We have released a Call for Evidence on the challenges and approaches to delivering improved broadband connectivity to these premises which due to expense may not be addressed through the UK Gigabit Programme, and we encourage all interested stakeholders to respond.

Project Gigabit Next steps

Project development

We will be undertaking the following steps to progress the pipeline of procurements as quickly as possible:

-

We will continue to work with the relevant local authorities in the early areas to complete Open Market Reviews and Public Reviews and develop shared plans

-

We will extend the Open Market Review process to cover the UK as quickly as possible so that we can make informed choices about procurement

-

We will identify further areas to add to the initial phase of procurements, along with a list of subsequent regions where early intervention would help deliver our programme objectives

-

We will publish a further update on the subsequent projects in June 2021 and will provide an updated procurement pipeline every three months from then on with further detail on the dates and expected contract values for these procurements

-

We will continue to take forward discussions on potential procurements in Scotland, Wales and Northern Ireland and will add these into the pipeline as they become confirmed

Telecoms providers

Respond to Open Market Reviews and Public Reviews

As we move towards procurement, we will be collecting commercial build plans in Open Market Review and Public Review. We will use information we receive to shape the procurements and refine the premises which are included in the scope of any procurement, so it is very important all telecoms providers respond as fully as possible.

Continue voucher deployments

All telecoms providers are encouraged to promote vouchers to customers as they extend existing commercial deployments into adjacent hardest to reach areas, where these meet the eligibility conditions for the vouchers.

Register on Dynamic Purchasing System and bid for work

We encourage all interested telecoms providers with the necessary capabilities to register for the upcoming Dynamic Purchasing System to be able to bid for Local Supplier contracts when they are procured. Once registered, providers will be issued with opportunities and can bid to undertake work.

Suggest specific opportunities for Local Supplier contracts

The pipeline for the Dynamic Purchasing System will be iterative, responding to specific opportunities. We will identify candidate opportunities in partnership with local authorities, and assess them using criteria set out in the previous section.

Telecoms providers should therefore suggest to us bduksuppliers@dcms.gov.uk and local authorities areas where they believe a Local Supplier procurement could offer pace and good value for money. This may be, for instance, because the provider has an existing or planned network which can be extended cost-effectively, tailored technical approaches or strong community links and believes it could be competitive.

Bid in procurements for Regional Supplier or Cross-Regional Supplier contracts

Larger telecoms providers and consortia (those with the capacity and standing to deliver Regional Supplier contracts) are encouraged to bid for the Regional Supplier contracts. These will provide larger contracts for substantial contiguous areas, enabling the winning providers to scale up and commit to supply-chain partners.

Appendix A provides our proposed maps for Regional Supplier contract boundaries and includes lot numbers for each and their approximate sizes. These will evolve in light of Open Market Review, Public Review information and continued engagement with telecoms providers.

Local authorities

BDUK will continue to work closely with local authorities to take forward the development and implementation of interventions:

-

We will work with the local authorities in each of the proposed areas to ensure that there is a shared understanding of the local priorities and proposed approach, including their data requirements

-

We want to see delivery in all local authority areas as soon as possible and we encourage local authorities to identify opportunities for Local Supplier contracts, given that once we have qualified the opportunity and completed Public Review, these procurements can be launched in any area through the Dynamic Purchasing System separate from the phasing identified in this document for Regional Supplier contracts

-

As each area comes forward in the pipeline, we will work with the relevant local authorities to ensure that all known supplier activity is captured in the Open Market Review and Public Review processes, and that any anomalies in data returns are addressed and resolved

-

We will work with local authorities through the pre-procurement and procurement stages, including asking the local authorities to help set the social value element of the bid evaluation

-

When contracts go into delivery we will continue working closely with the local authorities to ensure a joined-up approach to managing deployment, including utilising the knowledge and experience of local teams in dealing with local delivery issues, in addition to statutory functions such as planning and streetworks

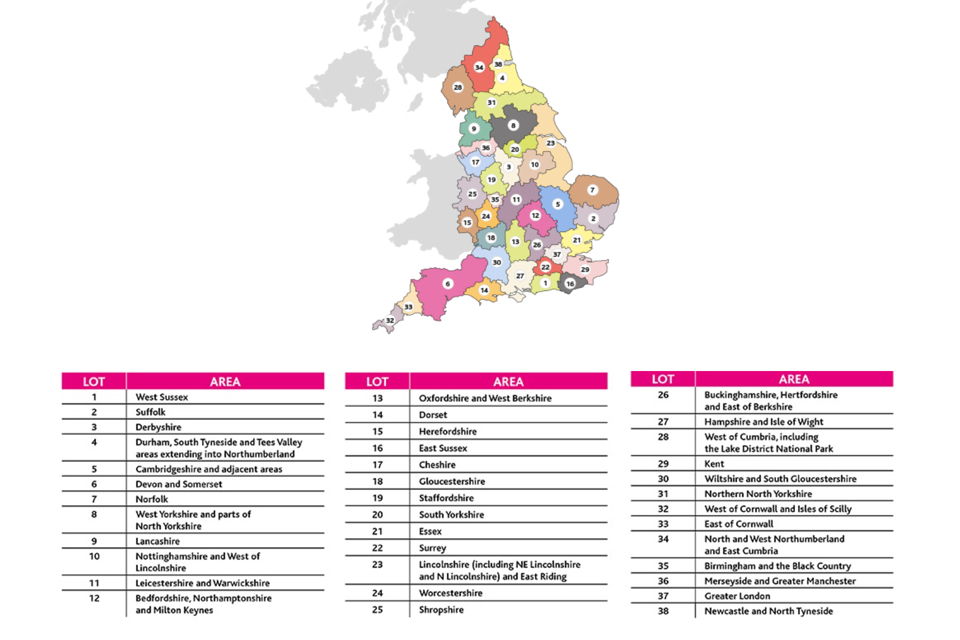

Appendix A – Regional Procurement Boundaries

The map below shows the proposed boundaries for Regional Supplier procurements with a lot number assigned for each. Local Supplier procurements and premises with committed gigabit build plans will be removed from these areas before procurement once we have complete market information. The lot numbering does not relate to sequencing of procurement or delivery, which will be determined in accordance with the phasing approach described in this document.

The proposed boundaries for Regional Supplier procurements with a lot number assigned for each.

The exact sizes of each procurement area will be determined once Open Market Review and Public Review has been completed. The table below shows the estimated sizes split into premises which are expected to be built to as soon as possible, and those which will be phased later because they are in areas where commercial build is more likely such as Ofcom Area 2.

| Lot | Area | Estimated F20 premises - early drawdowns (,000) | Estimated further F20 premises - later drawdowns (,000) |

| 1 | West Sussex | 50 to 70 | 40 |

| 2 | Suffolk | 80 to 100 | 20 |

| 3 | Derbyshire | 30 to 50 | 50 |

| 4 | Durham, South Tyneside and Tees Valley areas extending into Northumberland | 40 to 60 | 70 |

| 5 | Cambridgeshire and adjacent areas | 60 to 80 | 60 |

| 6 | Devon and Somerset | 170 to 190 | 100 |

| 7 | Norfolk | 120 to 140 | 40 |

| 8 | West Yorkshire and parts of North Yorkshire | 50 to 70 | 100 |

| 9 | Lancashire | 10 to 30 | 80 |

| 10 | Nottinghamshire and West of Lincolnshire | 40 to 60 | 70 |

| 11 | Leicestershire and Warwickshire | 50 to 70 | 80 |

| 12 | Bedfordshire, Northamptonshire and Milton Keynes | 30 to 50 | 60 |

| 13 | Oxfordshire and West Berkshire | 40 to 60 | 30 |

| 14 | Dorset | 30 to 50 | 40 |

| 15 | Herefordshire | 20 to 40 | 0 |

| 16 | East Sussex | 30 to 50 | 30 |

| 17 | Cheshire | 30 to 50 | 70 |

| 18 | Gloucestershire | 20 to 40 | 20 |

| 19 | Staffordshire | 30 to 50 | 50 |

| 20 | South Yorkshire | 10 to 30 | 50 |

| 21 | Essex | 50 to 70 | 50 |

| 22 | Surrey | 10 to 30 | 100 |

| 23 | Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding | 110 to 130 | 40 |

| 24 | Worcestershire | 30 to 50 | 30 |

| 25 | Shropshire | 40 to 60 | 20 |

| 26 | Buckinghamshire, Hertfordshire and East of Berkshire | 40 to 60 | 110 |

| 27 | Hampshire and Isle of Wight | 80 to 100 | 80 |

| 28 | West of Cumbria, including the Lake District National Park | 40 to 60 | 20 |

| 29 | Kent | 60 to 80 | 70 |

| 30 | Wiltshire and South Gloucestershire | 50 to 70 | 50 |

| 31 | Northern North Yorkshire | 30 to 50 | 0 |

| 32 | West of Cornwall and Isles of Scilly | 40 to 60 | 0 |

| 33 | East of Cornwall | 20 to 40 | 10 |

| 34 | North and West Northumberland and East Cumbria | 20 to 40 | 10 |

| 35 | Birmingham and the Black Country | 0 | 40 |

| 36 | Merseyside and Greater Manchester | 0 | 100 |

| 37 | Greater London | 0 | 100 |

| 38 | Newcastle and North Tyneside | 0 | 10 |

Premises numbers shown in the table above are those:

1. Modelled as being in the final 20%

2. Without current access to gigabit speeds, according to Ofcom Connected Nations 2020 data, and

3. Where BDUK does not currently have intervention plans

This data does not include the most recently signed Superfast Broadband Programme contracts and reflects other BDUK interventions data from a snapshot taken in October 2020.

Target premises assigned to the ‘later drawdowns’ column are those within Openreach exchanges:

1. Where 50% or higher of all premises are in Ofcom Area 2

2. In Ofcom Area 3 where Openreach has announced it will build fibre under Ofcom Regulated Asset Base (RAB) measures.

3. Where 75% or higher of all premises have current access to gigabit speeds, according to Ofcom Connected Nations 2020 data

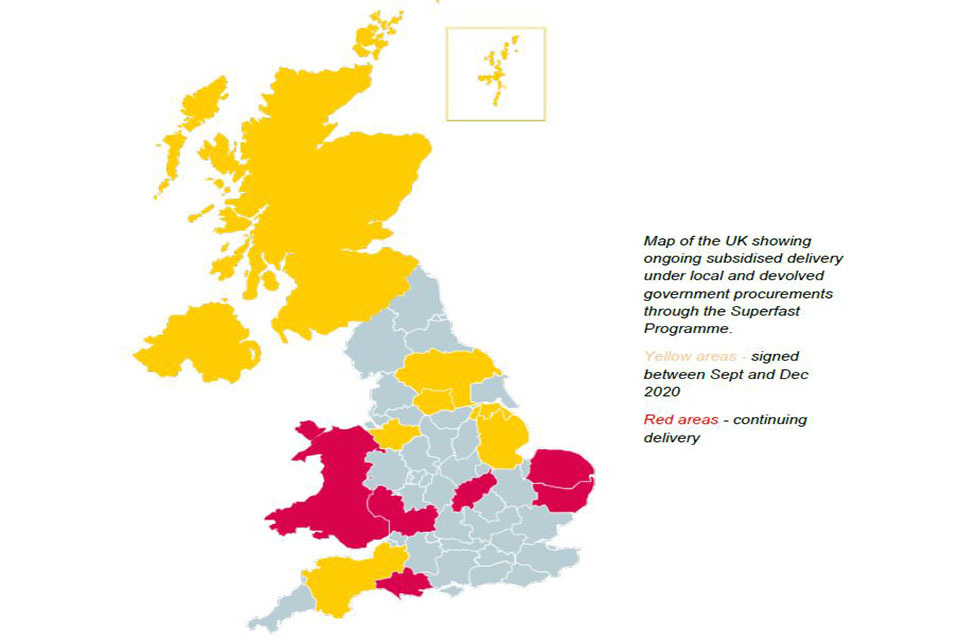

Superfast Broadband Programme

The map below shows the areas where subsidised delivery under local and devolved government procurements through the Superfast Broadband Programme is ongoing. Areas where contracts were signed between September to December 2020 are shown in yellow, and those where we expect delivery to continue at scale into 2022 are shown in red.

Map of the UK showing ongoing subsidised delivery under local and devolved government procurements through the Superfast Programme.

Appendix B – Summary of Responses

We received 96 responses to our Planning for Gigabit Delivery in 2021 publication, providing substantial and detailed feedback from local government, the telecoms marketplace and elsewhere. This was a substantial response, providing a very encouraging level of support for the programme, and considerable practicable suggestions. We are very grateful to all those who responded.

The publication asked questions predominantly of telecoms providers and local bodies on the nature of the large procurement areas and small procurements shown within the document, as well as the relative benefits of the voucher scheme. Telecoms providers were also asked about their interest and capacity to bid for the procurement pipeline.

Large Procurement areas

Question 1) Please provide feedback on the proposed large procurement areas and if proposing any changes provide accompanying rationale. Are the boundaries in the right places? Are the areas the right size - would smaller or larger be better?

Telecoms providers who responded were largely supportive of the proposed approach to procure large procurement areas. Support was greatest from the larger operators to which the procurements were targeted, with several confirming that these would indeed enable economies of scale and more efficient delivery for their organisations. Some recommended larger volumes of premises (including several specific proposals for new, bigger procurements in areas that we had not proposed) and some recommended including smaller sizes Some smaller operators were in favour of only using the small procurement approach instead, and a handful of operators were not supportive of procurements, believing them to be premature while there remained commercial activity in these areas.

A substantial majority of local bodies were supportive of the large procurement areas, with only a small number favouring smaller procurements instead. There were considerable recommendations, based on local knowledge, for amendments to the procurement boundaries, predominantly aiming to prevent potential gaps in coverage. Several local bodies highlighted risks resulting from greater complexity when procurement boundaries crossed administrative boundaries. Conversely a couple of local bodies specifically recommended that one procurement area was extended across administrative boundaries in order to fully enclose a National Park and avoid a disparate approach.

Our response: The interest from telecoms providers was more substantial than we were anticipating and the number of potential competitors, as well as the specific proposals for more, larger procurements from the larger providers, has guided us towards including more, larger Regional Supplier procurements, as described in this document. We have also changed procurement boundaries based on the feedback from local bodies in particular to ensure we won’t leave gaps in coverage. And in many cases we have designed procurements to follow closer to local body boundaries where we think there will be value in simplifying the number of stakeholder interactions in delivering the project.

Small Procurement areas

Question 2) Please provide specific proposals for small area procurement bundles, including rationale. Are there smaller areas of the right characteristics (of the right size, including sub-superfast premises and including a blend of more expensive and cheaper premises) which you feel would be suitable for DPS procurements? When would you ideally like these procurements to start?

Question 3) Please provide views on how we have constructed the example small (DPS) procurement areas in Annex A, including the way we have selected an intervention area and the use of MSOA/LSOA boundaries. How can we make these bundles as attractive as possible to the market?

There was a similar level of support for the small procurements as for the large procurements among telecoms providers, although this time with more of a skew towards support from smaller organisations. A few providers recommended including a greater volume of premises or otherwise clustering the procurements to achieve greater scale, and a few identified additional value in coordinating the timing of small procurements with adjacent large procurements so they could complement each other. However a larger number of - typically even smaller - organisations supported smaller areas, e.g. enclosing just an individual parish, and believed that dropping down as low as 500 premises would still remain economically viable. A similar proportion expressed their belief that the voucher scheme could be a simpler and better mechanism to achieve coverage with a lower transaction cost than for procurement processes.

Although many providers confirmed their intention to register for the Dynamic Purchasing System and named broad regions where they expected to bid for opportunities, there were very few recommendations for specific areas where they would like to see procurements. Only a few providers expressed a view on whether to use Openreach telephone exchange footprints or statistical areas (MSOA[footnote 6]) as boundaries for small procurement areas, with one describing MSOAs as an effective compromise between achieving scale and avoiding homogeneity, but more supported the use of administrative or alternative approaches over using Openreach infrastructure.

Local bodies were also supportive of small procurements and their ability to encourage the involvement of smaller bidders, with only a small minority believing they were too small to be viable. Several local bodies also identified specific areas that they thought would suit small procurements, although these were not, in general, underpinned with confidence in specific bidder interest.

Our response: The feedback from telecoms providers and local authorities confirms that there remains a strong level of interest in smaller procurements through the Dynamic Purchasing System. As described in this document, the lack of specific proposals to consider has made it hard to develop specific procurement areas so far, but we remain committed to the procurement route and will follow up with smaller telecoms providers expressing interest, particularly where they have proposals for areas to include in procurements.

Vouchers

Question 4) Where do you feel vouchers are a better way to achieve delivery? Please explain the rationale for your answer and whether you think there are strategic improvements we could make to the scheme.

Telecoms providers were extremely supportive of the intended continuation of the voucher scheme and described the benefit they can bring, both to commercial deployment and as a complement to procurements. In particular, providers regularly referenced the value of vouchers to help infill uncommercial gaps in their otherwise contiguous networks. A common concern among respondents was the extent to which vouchers would still be available following the procurement process, including among those operators not intending to bid for the procurements.

Telecoms operators made numerous suggestions for changes to the operation of the voucher scheme. A common suggestion was to increase the value of the voucher and the time available between issuing the voucher and connecting the customer to help serve harder to reach premises. Another request was that we end the obligation to aggregate customers into a scheme and allow providers to serve a single customer. A few providers went further and asked us to break the link with serving customers altogether and instead reward providers for passing premises and making gigabit capable infrastructure and services available. In addition, we received considerable feedback on the operational processes and controls of the scheme.

Local bodies were also overwhelmingly supportive of a continuation of the voucher scheme, although were more focused on retaining alignment with procurements to prevent the vouchers undermining them. Like telecoms providers, some local bodies also suggested an increase in the value of the voucher, including wanting to extend successful local top-ups.

A community representative highlighted a concern, especially for larger voucher-based projects, where some suppliers may try to transfer the funding risk for the project onto the community, requiring them to ‘make good’ if the aggregate worth of their connection vouchers turns out to be insufficient to meet the project’s cost, creating a significant potential financial exposure. Another gavean example of where a supplier sought to mitigate the risk by requiring such additional commitment from the community to take-up future services to make the overall project unviable.

Our response: As explained in this document, we are now able to confirm new funding is available for the voucher scheme from April 2021 based on targeting the hardest to reach areas through changes to eligibility criteria, and will continue to support providers to grow their pipeline of eligible projects. We are not expecting to immediately implement major changes in the design of the voucher scheme ahead of relaunching the scheme, however respondents’ feedback has been useful in our work to regularly evaluate the effectiveness of our vouchers and consider changes to its design.

Pipeline construction

Question 5) Which procurements are you most interested in?

Question 6) When would you like procurements to start and how many areas should we release? What is the maximum number of concurrent large and/or small procurements you could participate in, over what period and why? Are there things we can do to help speed the process up?

Telecoms providers’ collective responses were beyond our expectations with interest expressed in bidding for virtually all parts of the UK, with several providers potentially intending to compete in the same areas, which is encouraging for the development of our procurement pipeline.

Most telecoms providers told us they were ready to bid for procurements ‘as soon as possible’ or in any event by Summer 2021. However a significant minority proposed late 2021 / early 2022 would be preferable - in one case this was because a respondent expected this to be the timescale when Covid restrictions would be lifted. Several respondents were indifferent on timing so long as there was plenty of notice ahead of their launch to prepare bid teams.

Telecoms providers’ capacity to bid for multiple procurements in parallel differed significantly, with one provider ready to bid for 10 procurements concurrently, but more common were responses proposing between three and five concurrent bids. We received suggestions of quarterly and six-monthly releases of procurements.

Although this question was aimed at telecoms providers, where local authorities did respond, the majority wanted procurements for their areas to start as soon as possible, although a few recommended waiting until the completion of live superfast contracts first.

Our response: This document provides an update on the procurement pipeline and the initial releases. As we build the pipeline further we will incorporate providers’ feedback on their capacity to bid for procurement opportunities.

Some other themes

- Overbuild concerns: many telecoms providers expressed their concern that the procurement boundaries on the maps enclosed areas where they had existing coverage or where they planned to build commercially.

As we describe in this document, each procurement will be preceded by a Public Review process to identify and exclude confirmed areas of commercial network build, and prioritise implementation to focus on areas where commercial build is less likely.

- Omitted areas: several respondents - including telecoms providers, local authorities and communities - expressed concern for the risk of areas missing out. In some cases the risk expressed was suppliers would find them too difficult to serve in practice and not fulfil their contractual obligations. In others, the risk would be they were omitted from procurement areas altogether in anticipation of commercial build instead.

We will carefully scrutinise the deliverability of operators’ claims of commercial plans to cover areas before removing them from intervention areas and we will retain the flexibility within contracts to direct suppliers to include premises or areas where commercial build has not been fully realised.

- Broadband infrastructure: a few respondents suggested we consider infrastructure requirements in our procurements rather than solely the speed of services delivered to premises. For example, recognising investments in backbone fibre accessible to the market and stimulating further network build, or making provision for 5G fixed wireless access.

Our procurements will be subject to the UK’s subsidy regime and will require our investment in network infrastructure to be open and accessible to other network operators. Our procurements will also be technology neutral, enabling fixed wireless solutions to be bid. In addition we are studying the hybrid fibre and wireless solutions deployed through the voucher scheme in very hard to reach areas and will regularly reappraise how our approach facilitates the maximum level of network coverage.

- Perceived reduction in funding: a small number of respondents expressed their concern that the government had appeared to have reduced its financial commitment to the programme in the recent Spending Review from £5bn to £1.2bn.

This is not the case. The Spending Review allocated £1.2 billion over 4 years to support the rollout of gigabit-capable broadband, as part of the government’s £5 billion commitment to support rollout to hardest to reach areas (under the UK Gigabit Programme). The spending profile takes into account extensive engagement with suppliers in the telecoms industry, and what we believe the industry will be able to deliver by 2025 in these hard to reach areas at this stage. As set out in the National Infrastructure Strategy, we expect that by 2025 at least 85% of premises will have access to gigabit-capable connections and we will continue to work with industry to accelerate the rollout further to get as close to 100% as possible. We remain committed to investing £5 billion in bringing gigabit coverage to the hardest to reach areas and will continue to work with suppliers to accelerate this investment, taking account of industry capacity.

- Wider social benefits: a few respondents proposed we include an obligation for a social tariff upon contracted suppliers. Another respondent recommended an increased focus on suppliers’ labour standards and employment practices. As part of the procurement process, we will be evaluating bidders’ plans to create social value to encourage a wide range of economic, social and environmental benefits.

Respondents

Telecommunications Providers and Industry Bodies

-

Airband

-

Alncom

-

Axione

-

Broadband for the Rural North Ltd

-

Box Broadband

-

Broadway Partners Ltd

-

Cerberus Networks Ltd

-

CityFibre Ltd

-

CNI - Cooperative Network Infrastructure

-

Connectus

-

County Broadband

-

FACTCo

-

Fern Trading Ltd (Jurassic and Swish Fibre)

-

Fibre Me Ltd

-

Fibrus

-

Freedom Fibre

-

FullFibre

-

Gigaclear

-

Glide

-

Grayshott Gigabit

-

INCA

-

Jurassic Fibre

-

KCOM Group

-

Openreach

-

Quickline Communications

-

Secure Web Services Ltd

-

Spectrum Fibre Ltd

-

Spring Fibre Ltd

-

Swish Fibre

-

TalkTalk

-

Telcom Networks Ltd

-

Trooli

-

Truespeed

-

Virgin Media

-

Vodafone

-

Voneus

-

Wessex Internet Ltd

-

WightFibre

-

Wildanet

Local Bodies

-

Association of South Essex Local Authorities (ASELA)

-

Black Country Consortium LEP

-

Buckinghamshire Council and Buckinghamshire LEP

-

Cheshire East Council

-

Cheshire West and Chester Council

-

Cornwall County Council

-

Cumbria County Council

-

Cumbria LEP

-

Derbyshire County Council

-

Devon and Somerset (Connecting Devon and Somerset)

-

Dorset Council

-

Durham County Council

-

East Riding Council

-

East Sussex County Council

-

Essex County Council

-

Greater Manchester Combined Authority

-

Halton Borough Council

-

Hampshire County Council

-

Herefordshire and Gloucestershire (Fastershire)

-

Hertfordshire County Council

-

Kent County Council

-

Lancashire County Council

-

Leicestershire County Council

-

Mid Bedfordshire Council

-

Norfolk County Council

-

Northamptonshire County Council

-

North Lincolnshire Council

-

North of Tyne Combined Authority

-

North Yorkshire County Council

-

Northumberland County Council

-

Nottinghamshire County Council

-

Oxfordshire County Council

-

Perth and Kinross Council

-

Plymouth Council

-

Rutland County Council

-

Shropshire Council

-

Solihull & Warwickshire (Connecting Solihull & Warwickshire)

-

South Gloucestershire Council

-

South Tyneside Council

-

South Yorkshire (Superfast South Yorkshire)

-

Staffordshire County Council

-

Suffolk County Council

-

Surrey County Council

-

Swindon Borough Council

-

Telford and Wrekin Council

-

Warrington Borough Council

-

West Berkshire Council

-

West Sussex County Council

-

West Yorkshire Combined Authority

-

Wiltshire Council

-

Worcestershire County Council

Other organisations and individuals

-

Balderton community, Cheshire

-

Ropely Community, Hampshire

-

Individual - 1

-

Communication Workers Union (CWU)

-

The Bit Commons

-

Grey Sky

-

These are now significantly larger than those presented in December in response to feedback - see Revised Procurement Areas below for more details. ↩

-

This is where an existing gigabit-capable network is overbuilt by another gigabit-capable network. In general, this is beneficial for consumers and, in the most commercial 80% of the country, we expect there to be at least two gigabit-capable networks in time. However, our analysis suggests that it is only economic to deploy a single network in the hardest to reach 20% of the country because of the costs of deployment compared to the potential returns from consumers. ↩

-

In its Wholesale Fixed Telecoms Market Review (WFTMR), Ofcom identified Area 2 as “potentially competitive areas for gigabit deployment” (c.70% of the country) ↩

-

Ofcom Area 3 are “non-competitive areas” (c.30% of the country) ↩

-

Please see Appendix A for the proposed boundaries of each lot. ↩

-

Medium Super Output Areas ↩