Private Finance Initiative and Private Finance 2 projects: 2019-21 summary data (HTML)

Published 12 April 2023

1 - Introduction

About this publication

This summary note provides information about Private Finance Initiative (PFI) and Private Finance 2 (PF2) projects at 31 March 2021. It reports on data collected between 2019 and 2021 PFI, and is an update of the note published in 2019. It is published in line with HM Treasury’s commitment to provide transparency regarding PFI and PF2 projects.

The Infrastructure and Projects Authority (IPA) collates this on behalf of HM Treasury. This publication only includes projects that are delivered or supported by departments and devolved administrations, and procured under the standard PFI and PF2 contract terms.

Other forms of PPP, such as NHS projects under the Local Improvement Finance Trust (LIFT) programme, those procured under the non-profit distributing (NPD) and hub models used in Scotland and the Mutual Investment Model in Wales, are not covered in this publication.

The information is provided by the central government departments and devolved administrations that have procured or sponsored projects. The contracting public sector entities for most projects are local authorities, NHS Trusts and other arm’s length bodies.

Where there are gaps in the data, this is because it has not been provided by the department and/or contracting authority responsible for the project. The data in this publication is not audited by HM Treasury or IPA, although IPA continues to work with departments to improve its quality and reliability.

At Budget 2018, the Chancellor announced that the government would no longer use PFI or PF2 for new projects as it was considered inflexible, overly complex and a source of significant fiscal risk to government. This policy does not affect the devolved administrations. Due to this change in policy, this portfolio consists of a decreasing number of projects which each have a diminishing number of years left in contract. As a result, the portfolio represents a decreasing amount in financial liabilities for the public sector.

About the Private Finance Initiative and Private Finance 2

PFI and PF2 are forms of Public Private Partnerships (PPPs). Public Private Partnerships (PPP) are long-term contractual arrangements between a public sector entity and a private sector provider.

The private sector provider is engaged to design, build, finance, maintain and operate infrastructure assets and related services. The risks associated with construction delay, cost overrun and maintenance of the asset are transferred to the private sector partner.

The public sector entity does not pay for the asset during construction, as the associated costs of construction are financed by the private sector. Once the asset is operational and services are being provided the public sector entity pays a monthly fee – sometimes referred to as a ‘unitary charge’ – to the private sector provider. This payment includes the costs of construction, financing costs, lifecycle replacement expenditure, maintenance and services.

The payment is subject to performance, which means that payments are reduced if services are not delivered to the standards set out in the contract. This form of payment mechanism provides an incentive for the private sector provider to meet their performance obligations and underpins the transfer of risk to the private sector.

PPPs have been used to deliver investment in infrastructure across a wide range of sectors including hospitals, schools, roads, prisons, waste management and energy-from- waste infrastructure, housing, and military accommodation and equipment.

Until 2012, PFI was the government’s preferred model of PPP. In 2012, PFI was replaced with PF2 in response to concerns about value for money. PF2 contracts provide greater transparency about the financial returns of project companies. This information is included in this publication. PF2 was discontinued in 2018.

A data collection exercise was not undertaken in 2020 due to the reprioritisation of resources during the Covid pandemic. This also caused delays to the 2019 and 2021 publications. The 2022 data collection is currently being completed and will return to an annual publication cycle.

Information provided alongside this publication

The excel spreadsheet published alongside this spreadsheet sets out detailed information for each PFI project as at March 2021:

- unique HMT project ID and name of the project

- sponsoring department and the procuring authority

- sector and region

- key dates such as the beginning and end of the procurement process

- contract duration

- balance sheet and budgeting treatment

- capital value

- contract expiry date

- forecast annual payments

- project company name and address

A second spreadsheet sets out the same information, plus details of project company shareholders, as at March 2019.

PFI Centre of Excellence & PFI Contract Management Programme

The government continues to support the portfolio of existing PFI and PF2 contracts, seeking to ensure that they deliver value to the taxpayer. In 2020, the IPA set up the PFI Centre of Excellence and the PFI Contract Management Programme – a collaboration between the centre, departments and functions – to manage the risks in operational PFI projects. The aim of the programme is that contracting authorities have the capabilities, knowledge and tools they need to manage their PFI contracts effectively and to engage confidently with their private sector partners.

The programme comprises four projects:

- Contract Expiry – managing the risks of contract expiry and ensuring value for money as contracts end;

- Improving Operational Performance – improving the performance and efficiency of operational contracts;

- Building Capability – building capability through system learning, guidance and training; and

- Advice & Support – providing expert support and advice to departments and contracting authorities.

In summer 2021, the IPA published ‘Managing the Risks of PFI Contract Expiry’[footnote 1] which sets out how IPA provides support to authorities in managing the risks of PFI contract expiry. IPA provides PFI expiry-related review, guidance, advice and support for public bodies in England that is integrated within our wider programme of PFI training, contract management support and advice. The aim is to ensure that private sector counterparties meet their contractual obligations through to the expiry of the PFI project, and that there is an efficient and effective hand-back and take-forward process allowing for continuity of all required services on PFI expiry.

Expiry Health Checks: IPA offers all PFI projects within 7 years of expiry an initial expiry health check, with further reviews at 5 and 3 years. The health check involves a review by the IPA of key project documentation and a structured interview process with the contracting authority. The review process uses a diagnostic tool to help assess and benchmark the project’s readiness for expiry. The output from health checks is a short report which identifies the key issues and action recommendations for an authority. IPA is able to offer follow-on support either directly or through its PFI Expert Associates. To date IPA has undertaken over 100 Expiry Health Checks.

Systems Learning: In December 2021 the IPA published an analysis of the findings from the first phase of health checks[footnote 2]. This provides some vital lessons for the public sector, particularly around the need to start preparing early for contract expiry and ensuring projects are set up for success with appropriate governance, leadership people and plan.

Expiry Guidance: ‘Preparing for PFI contract expiry’[footnote 3] was published in February 2022 and provides practical guidance to contracting authorities on managing the expiry of PFI contracts and the transition to future services provision. It is not prescriptive but offers a framework for approaching PFI contract expiry and transition, based on practical experience. This guidance is supplemented by an expiry toolkit of further documents providing related additional tools and materials to support authorities in managing expiry. It is intended that this toolkit will be added to, over time, to reflect the growing expiry experience in the market and to provide a practical reference base.

Building Capability: Last year IPA launched a facilitated contract expiry training course for contract managers and others involved in managing and overseeing the expiry of PFI contracts and transition to future services. This contract expiry training will be complemented by a programme of PFI contract management e-learning modules which will be launched in spring 2023.

Expert Advice & Support: In December 2021, IPA launched a campaign to form a pool of PFI Expert Associates to work with the IPA to provide greater capacity and access to specific skills and expertise. The campaign generated a significant response of high- quality applicants with deep expertise in PFI. These associates are working alongside IPA commercial specialists to provide expert support and advice to authorities.

Further information about the PFI Centre of Excellence and PFI Contract Management Programme can be found IPA’s gov.uk web page.[footnote 4]

2 - PFI Portfolio Overview

2a - Projects by department

As of 31 March 2021, there were 694 PFI projects with a total capital value of £54.7bn across the portfolio. These projects were split across the three devolved administrations and 15 Government departments.

| Department | Projects |

|---|---|

| DFE | 172 |

| DHSC | 140 |

| SG | 78 |

| DFT | 56 |

| DLUHC | 56 |

| HO | 36 |

| MOD | 35 |

| NIE | 31 |

| DEFRA | 25 |

| WG | 21 |

| MOJ | 18 |

| DCMS | 17 |

| HMRC | 3 |

| DWP | 2 |

| HMT | 1 |

| SIA | 1 |

| CO | 1 |

| FCDO | 1 |

The two largest departments by number of projects (Department for Education and Department of Health and Social Care) account for 312 projects, which represents 45% of the total number of projects in the portfolio. It is also worth noting that the 172 DfE projects include a greater number of individual school buildings in total as each individual project can include more than one building or school. For example, this includes one individual contract comprising over 80 schools.

Six departments have three or less projects each (HM Revenue and Customs, Department for Work and Pensions, HM Treasury, Security and Intelligence Agencies, Cabinet Office and the Foreign, Commonwealth and Development Office). These departments have 9 projects in total, which represents 1% of the total number of projects in the portfolio.

2b - Projects by sector

Projects are categorised into 20 sector groups[footnote 5].

| Sector | Projects |

|---|---|

| Schools | 219 |

| Hospitals and Acute Health | 160 |

| Offices | 38 |

| Waste | 35 |

| Emergency Services | 35 |

| Roads and Highway Maintenance | 31 |

| Street Lighting | 31 |

| Other | 21 |

| Social Care | 19 |

| Housing (HRA) | 19 |

| Military facility | 16 |

| Housing (Non-HRA) | 14 |

| Leisure Facilities | 13 |

| Prisons | 12 |

| Courts | 9 |

| Libraries | 7 |

| Housing (Military) | 6 |

| IT Infrastructure and communications | 3 |

| Equipment | 2 |

| Tram/Light Rail | 2 |

Reflecting the large footprint of DfE and DHSC in the PFI portfolio, the two most popular sectors for PFI projects are “Schools” and “Hospitals and Acute Health”. Together, these two sectors represent 379 projects or 55% of the total number of projects in the portfolio.

671 projects provided a descriptive sector for their project, representing 97% of the total number of projects in the portfolio. However, 21 projects were unable to provide a descriptive sector for their project and are recorded as “Other”.

2c - Projects by procuring authority type

| Authority | Projects |

|---|---|

| Local | 351 |

| Devolved | 130 |

| NHS | 103 |

| Central | 46 |

| ALB | 31 |

| Police | 21 |

| Fire | 12 |

Projects are categorised into seven categories based on the type of procuring authority. These categories display the split in projects procured across the public sector with central, local and devolved governments representing key segments of the portfolio. We also categorise procuring authorities that are NHS, Police or Fire authorities as these represent public sector bodies with a history of PFI procurement. Finally, we categorise authorities that are described as arm’s length-bodies (ALBs). This term is used to cover a wide range of public bodies, including non-ministerial departments, non-departmental public bodies, executive agencies and other bodies, such as public corporations.

51% of the projects in the portfolio are procured by local government authorities such as local councils. The bulk of the remaining projects are procured by devolved and NHS authorities, which represents the large number of PFI projects procured by and sponsored by the devolved administrations as well as the large number of NHS Trust projects in the portfolio.

Central government and ALB procured projects represent only 11% of the total number of the portfolio.

Size of Portfolio

The portfolio has reduced from 704 to 694 projects since the previous data collection in 2018. The change is due to the expiry and cancellation of projects as well as the inclusion of projects not previously included in the portfolio. The full list of these projects is included in Annex B and C along with the reasons for their previous exclusion.

3 - Future Unitary Charge Payments

Across the portfolio, there are £152.2bn of unitary charge (UC) payments remaining from the 2021-22 financial year onwards.

3a - Unitary Charge Payments by year

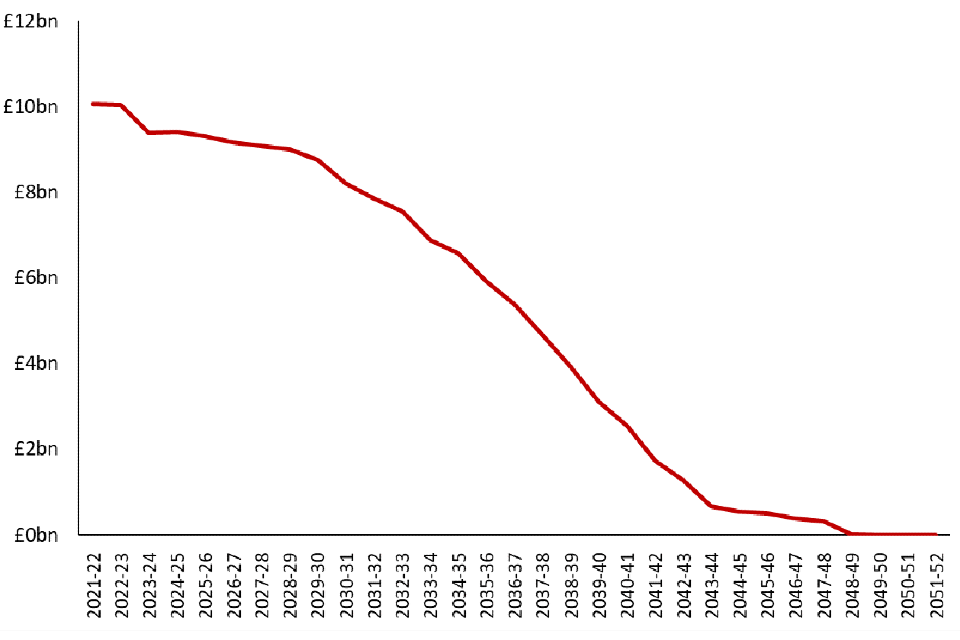

Unitary Charge Payments by year

UC payments for the financial year 2021/22 stand at £10.0bn. This is the highest figure for any of the remaining financial years and payments will reduce year on year from 2021/22. Over the next 10 financial years, there is an estimated £92.4bn of UC payments that will be made. This figure represents 61% of the total estimated UC payments remaining.

Yearly UC payments across the portfolio are estimated to decrease in the future as projects expire. For this reason, financial years in the near future are estimated to have higher UC payments than those financial years past that point. The last year where UC payments are expected to be made is in 2049/50 with a payment of £1.9m.

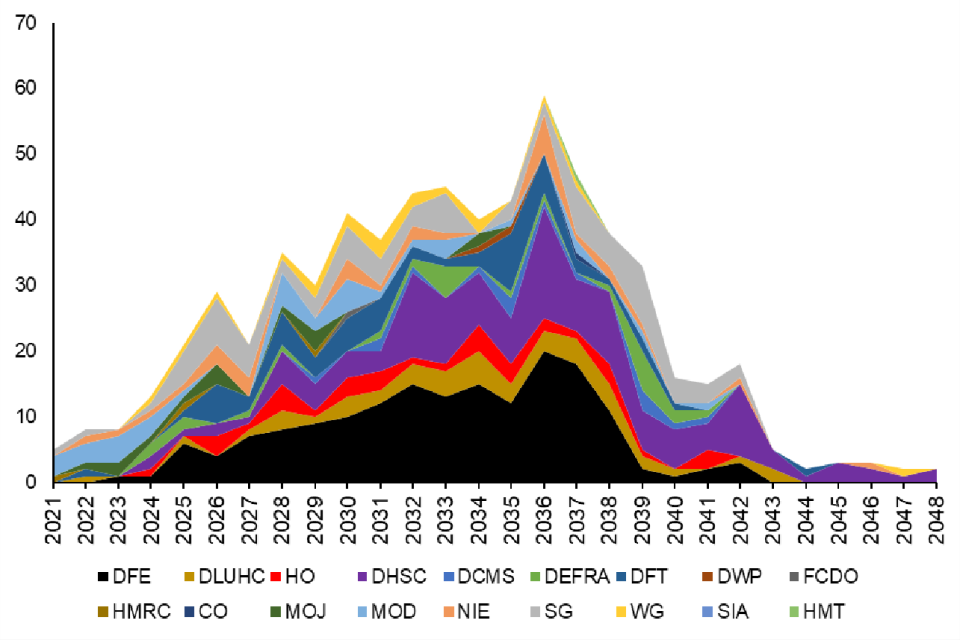

3b - Unitary Charge Payments by department by year

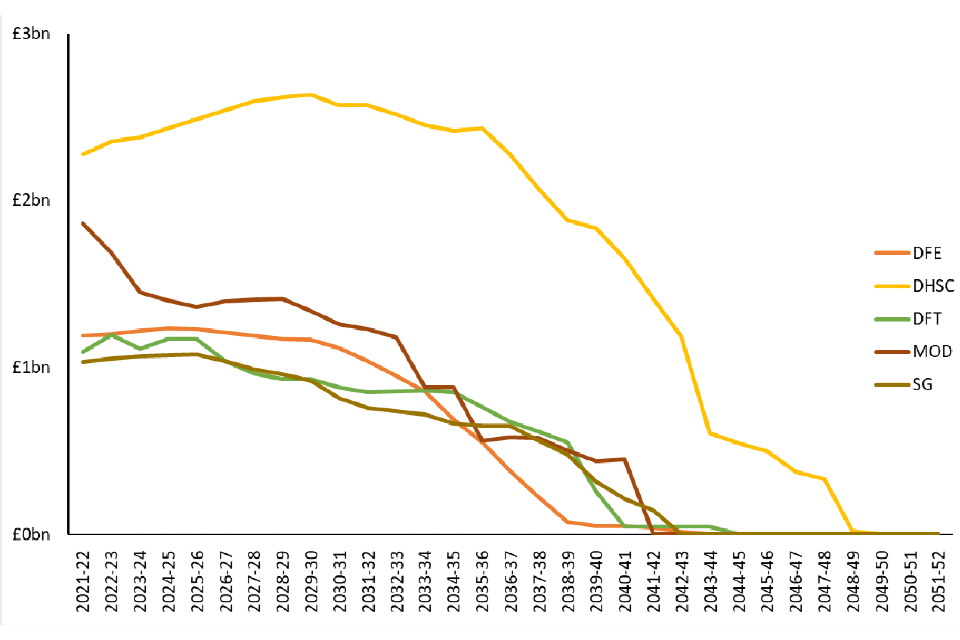

Unitary Charge Payments by department by year

The graph above displays the top 5 departments or devolved administrations by remaining UC payments. Despite DfE having the greatest number of projects, it is DHSC that has the largest remaining UC payments profile. Also, while DLUHC has the fourth largest number of projects of any department or devolved administration, it does not appear in the top 5 for remaining UC payments due to the typically smaller project size.

The following table displays all departments/devolved administrations and their total remaining UC payments from largest to smallest.

| Department | Estimated remaining UC payments |

|---|---|

| DHSC | £52.0bn |

| MOD | £22.7bn |

| DFT | £16.9bn |

| DFE | £16.9bn |

| SG | £15.9bn |

| DEFRA | £9.6bn |

| DLUHC | £4.1bn |

| NIE | £3.9bn |

| HO | £3.5bn |

| MOJ | £3.4bn |

| WG | £1.1bn |

| DCMS | £0.9bn |

| SIA | £0.8bn |

| HMT | £0.5bn |

| DWP | £0.4bn |

| HMRC | £0.3bn |

| FCDO | £0.1bn |

| CO | £17m |

3c - Unitary Charge Payments by sector by year

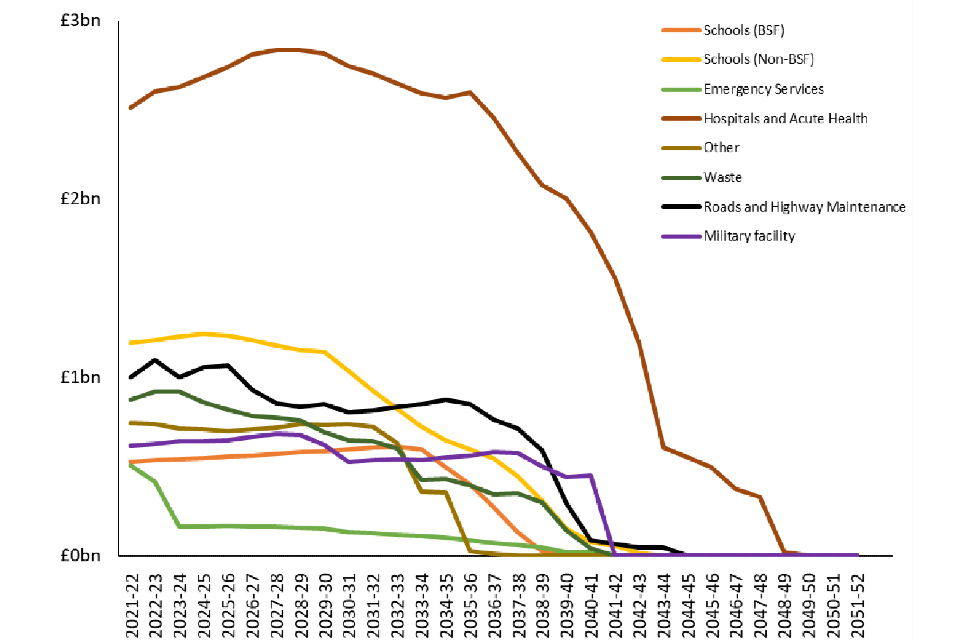

Unitary Charge Payments by sector by year

The above graph details the estimated remaining UC payments profile for the highest sectors. While Hospitals and Acute Health reflect the largest single sector of remaining UC payments, Schools (BSF/Non-BSF), Emergency Services, Waste, Roads and Highway Maintenance and Military facilities and Other projects all represent significant categories of remaining spend. Each of these categories has at least £500m of UC payments in the 2021/22 financial year.

While most sectors follow a similar trend of decreasing UC payments over time as projects expire, there are some sectors such as Non-BSF Schools and Military facilities that experience increasing UC payments year-on-year over the near future as increasing UC payments due to indexation outweigh reduced UC payments due to project expiry.

4 - Contract Expiry Dates

4a - Expiries by year

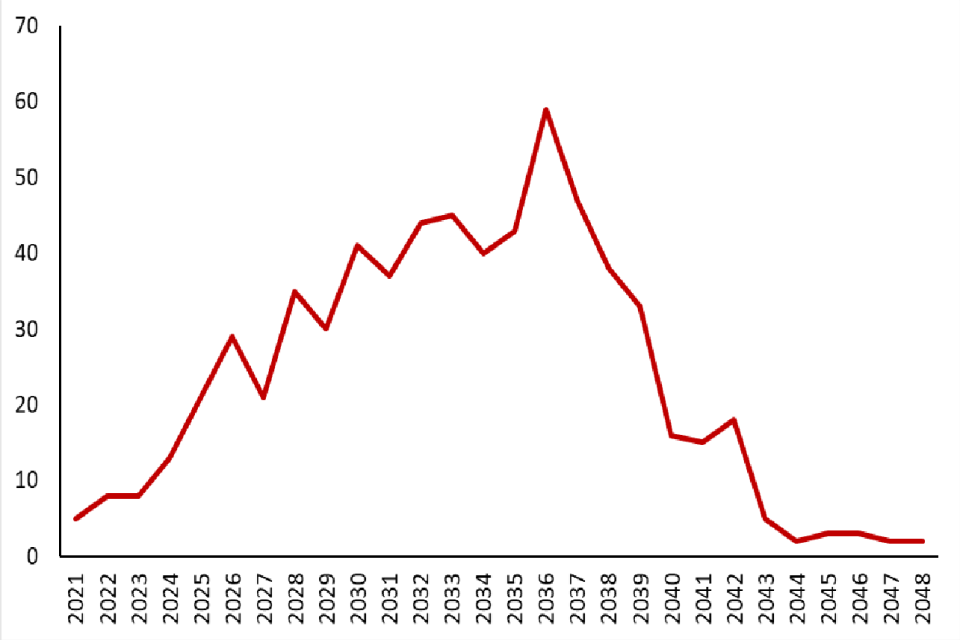

Expiries by year

Yearly contract expiries will continue to increase from 5 in the 2021 calendar year to an expected peak of 59 in 2036[footnote 6]. Following this, there is a steep decline in the number of expiries each year. From 2043 onwards there are 5 or less expiries each year with the final two expiries coming in 2048.

For a small number of DHSC contracts that have break clauses, their expiry dates are listed at their first contract break date.

4b - Expiries by department

Expiries by department

The peak year for expected contract expiries is 2036 when 59 contracts expire. At this point contract expiries decrease for most departments, with a smaller number of projects expiring after that point. Yearly expiries in these later years are driven by many DHSC project expiries.

5 - PF2 Equity Return Data

To improve transparency under PF2, the government required the private sector to provide actual and forecast equity return information for publication.

This section sets out the equity internal rate of return (IRR) data as at 31 March 2021 for these PF2 projects. These projects are all schools. The data for each of these projects are also included in a supporting spreadsheet available alongside this report on the gov.uk website.

| Project | Financial Close | Total Expected Returns | Expected Returns | Expected Returns | Expected Returns |

|---|---|---|---|---|---|

| Nominal | Nominal | Real | Real | ||

| Inc. Fees | Exc. Fees | Inc. Fees | Exc. Fees | ||

| NE | 10/03/2015 | 12.2% | 12.2% | 9.3% | 9.3% |

| NW | 25/3/2015 | 12.4% | 12.2% | 9.6% | 9.5% |

| Yorkshire | 19/3/2015 | 11.1% | 11.1% | 8.0% | 8.0% |

| Hertfordshire, Luton and Reading | 19/3/2015 | 10.2% | 10.0% | 7.1% | 6.9% |

| Midlands | 12/8/2015 | 7.5% | 7.1% | 3.0% | 2.9% |

Annex A - Summary data for 2019, 2020 & 2021

This annex sets out data on a comparative basis as at 31 March 2019, 2020 and 2021. While data collection did not occur in 2020 due to the reprioritisation of resources during the Covid pandemic, we have presented comparative statistics for the year based on the 2019 dataset with projects believed to be expired by 31 March 2020 removed. A full list of these projects can be found in Annex D.

1 - Projects by department

| Department | 2019 | 2020 | 2021* |

|---|---|---|---|

| DfE | 173 | 173 | 172 |

| DHSC | 125 | 125 | 140 |

| SG | 78 | 78 | 78 |

| DLUHC (formerly MHCLG) | 59 | 59 | 56 |

| DfT | 58 | 57 | 56 |

| HO | 39 | 39 | 36 |

| MOD | 39 | 36 | 35 |

| NIE | 30 | 30 | 31 |

| DEFRA | 25 | 25 | 25 |

| WG | 21 | 20 | 21 |

| MOJ | 20 | 20 | 18 |

| DCMS | 17 | 17 | 17 |

| HMRC | 4 | 4 | 3 |

| DWP | 2 | 2 | 2 |

| BEIS | 1 | 1 | 0 |

| FCDO (formerly FCO) | 1 | 1 | 1 |

| SIA | 1 | 1 | 1 |

| HMT | 1 | 1 | 1 |

| CO | 0 | 0 | 1 |

| Total | 694 | 689 | 694 |

*A number of projects had data first collected on them in the 2021 data collection cycle which has caused an increase in the number of projects in the portfolio year on year.

These projects are set out in Annex B.

2 - Projects by sector

| Sector | 2019 | 2020 | 2021 |

|---|---|---|---|

| Hospitals and Acute Health | 144 | 143 | 160 |

| Schools (Non-BSF) | 150 | 150 | 152 |

| Schools (BSF) | 66 | 66 | 67 |

| Offices | 41 | 41 | 38 |

| Emergency Services | 38 | 38 | 35 |

| Waste | 35 | 35 | 35 |

| Roads and Highway Maintenance | 31 | 31 | 31 |

| Street Lighting | 31 | 30 | 31 |

| Other | 29 | 29 | 21 |

| Housing (HRA) | 20 | 20 | 19 |

| Social Care | 19 | 19 | 19 |

| Military facility | 13 | 12 | 16 |

| Housing (Non-HRA) | 14 | 14 | 14 |

| Leisure Facilities | 14 | 14 | 13 |

| Prisons | 12 | 12 | 12 |

| Courts | 9 | 9 | 9 |

| Libraries | 6 | 6 | 7 |

| Housing (Military) | 7 | 6 | 6 |

| IT Infrastructure and communications | 3 | 2 | 3 |

| Tram/Light Rail | 2 | 2 | 2 |

| Equipment | 2 | 2 | 2 |

| Underground Rail | 1 | 0 | 0 |

| Secure Training Centres (YJB) | 1 | 1 | 0 |

| Total* | 688 | 682 | 693 |

*Totals may not add up to the total number of projects in the portfolio each year due to the presence of some projects that did not provide a sector for categorisation.

3 - Projects by procuring authority

| Department | 2019 | 2020 | 2021* |

|---|---|---|---|

| Local | 356 | 355 | 351 |

| Devolved | 129 | 128 | 130 |

| NHS | 88 | 88 | 103 |

| Central | 54 | 51 | 46 |

| ALB | 31 | 31 | 31 |

| Police | 23 | 23 | 21 |

| Fire | 13 | 13 | 12 |

| Total | 694 | 689 | 694 |

4 - Future unitary charge payments

| Year | 2019 | 2020 | 2021 |

|---|---|---|---|

| Remaining UC Payment | £176.7bn | £166.6bn | £152.2bn |

Annex B: Joiners

The following table displays all projects that submitted a return in the 2021 data collection period but had not previously submitted data returns in at least one previous year. This list includes a number of NHS projects that had previously not required DHSC approval that the department became aware of during the 2021 data collection following discussion with NHS Property Services, hence why they are first being reported now.

Future unitary charge payments are decreasing year on year as projects approach expiry and have fewer years of payments to make. Projects that reach expiry no longer have unitary charge payments. Projects that first reported data in the 2021 data collection are not reflected in the remaining UC payment figures for 2019 and 2020.

| Unique HMT Project ID | Project Name | Department | Procuring Authority | Reason |

|---|---|---|---|---|

| 2101 | Braintree Community Hospital | Department of Health and Social Care | Mid Essex Hospital Services NHS Trust | Included after DHSC/NHS notification |

| 2102 | Four Specialist Care Centres | Department of Health and Social Care | West Northamptonshire Council | Included after DHSC/NHS notification |

| 2103 | Peterborough City Hospital - The Cavell Centre | Department of Health and Social Care | Cambridgeshire & Peterborough NHS Foundation Trust | Included after DHSC/NHS notification |

| 2104 | EMI Homes PFI | Department of Health and Social Care | Essex Partnership University NHS Foundation Trust | Included after DHSC/NHS notification |

| 2105 | MH Unit at Coventry & Warwickshire | Department of Health and Social Care | Coventry and Warwickshire Partnership NHS Trust | Included after DHSC/NHS notification |

| 2106 | The Meadows | Department of Health and Social Care | Stockport Healthcare NHS Trust | Included after DHSC/NHS notification |

| 2107 | Stanley Primary Care Centre | Department of Health and Social Care | County Durham Primary Care Trust | Included after DHSC/NHS notification |

| 2108 | Peterborough City Care Centre - PFI (NHS portion) | Department of Health and Social Care | Peterborough Primary Care Trust | Included after DHSC/NHS notification |

| 2109 | Agnes Unit | Department of Health and Social Care | Leicestershire Partnership NHS Trust | Included after DHSC/NHS notification |

| 2110 | Epping Forest Unit St Margaret’s Hospital | Department of Health and Social Care | Princess Alexandra Hospital NHS Trust | Included after DHSC/NHS notification |

| 2111 | West Mendip Community Hospital | Department of Health and Social Care | The Mendip Primary Care Trust | Included after DHSC/NHS notification |

| 2112 | Gravesham Community Hospital | Department of Health and Social Care | The Dartford & Swanley PCT | Included after DHSC/NHS notification |

| 2113 | Savernake Hospital | Department of Health and Social Care | Kennet and North Wiltshire Primary Care Trust | Included after DHSC/NHS notification |

| 2114 | Liskeard Community Hospital | Department of Health and Social Care | North & East Cornwall Primary Care Trust | Included after DHSC/NHS notification |

| 2115 | Sedgefield Community Hospital | Department of Health and Social Care | South Durham Health Care National Health Service Trust | Included after DHSC/NHS notification |

| 2116 | Wedgewood Unit Bury St Edmunds | Department of Health and Social Care | Norfolk & Suffolk NHS Foundation Trust | Included after DHSC/NHS notification |

| 2117 | The Cornerstone Centre | Department of Health and Social Care | Mancunian Community Health National Health Service Trust | Included after DHSC/NHS notification |

| 2119 | Lisburn Primary & Community Care Centre 3PD (Private Development) project | Northern Ireland Executive | South Eastern Health and Social Care Trust | Included following first return |

| 626 | Renal Dialysis Unit, Ysbyty Glan Clwyd | Welsh Government | Betsi Cadwaladr University Health Board | Previously technically omitted |

| 431 | Defence Fixed Telecommunications Service (DFTS) | Ministry of Defence | Ministry of Defence | Original expiry date of 31/07/2019 so marked as a leaver in the 2019/20 financial year. Project would then report an expiry of 31/07/2023 so is marked as a joiner in the 2020/21 financial year. |

Annex C: Leavers by 31 March 2021

| Unique HMT Project ID | Department | Project Name | Procuring Authority | Reason |

|---|---|---|---|---|

| 5 | Department for Business, Energy and Industrial Strategy | RRS Ernest Shackleton | UK Research and Innovation | Expired |

| 12 | Department for Education | Castle Hill Primary School | Bolton | Duplicate of HMT ID 12 |

| 134 | Ministry of Housing, Communities and Local Government | Manchester Domestic Energy Services | Manchester | Expired |

| 137 | Ministry of Housing, Communities and Local Government | Salt Barns | Norfolk | Expired |

| 148 | Ministry of Housing, Communities and Local Government | New Council Offices | Copeland | Expired |

| 179 | Home Office | Dorset Emergency Services Partnership Initiative (DESPI) | Dorset Fire and Rescue Service | Duplicate of HMT ID 403 |

| 249 | Department for Transport | M6 Toll (formerly Birmingham Northern Relief Road ‘BNRR’) | HIGHWAYS ENGLAND | Concession w/o unitary charge so out of scope for data collection |

| 373 | Department of Health and Social Care | Redevelopment of Acute Hospital services | The Whittington Hospital NHS Trust | Terminated |

| 408 | Home Office | Ystrad Mynach Police Station | Gwent Police Authority | Terminated |

| 424 | Ministry of Defence | Attack Helicopters Training - Apache Simulator Training | MINISTRY OF DEFENCE | Expired |

| 438 | Ministry of Defence | Hawk Simulator | MINISTRY OF DEFENCE | Expired |

| 473 | Ministry of Justice | National Probate Records Centre | Her Majesty’s Courts and Tribunal Service | Project is no longer a PFI |

| 489 | Ministry of Justice | Milton Keynes STC | Youth Justice Board | Project is no longer a PFI |

| 1040 | Home Office | Vehicle Services | Nottinghamshire Police Authority | Terminated |

| 1300 | Department of Health and Social Care | Sancroft (Pathfinder) | Harrow | Terminated |

Annex D: Leavers by 31 March 2020

| Project ID | Project name | Department | Reason |

|---|---|---|---|

| 465 | Tornado GR4 Simulator | Ministry of Defence | Expired |

| 431 | Defence Fixed Telecommunications Service (DFTS) | Ministry of Defence | Original expiry date of 31/07/2019 so marked as a leaver in the 2019/20 financial year. Project would then report an expiry of 31/07/2023 so is marked as a joiner in the 2020/21 financial year. |

| 457 | RAF Lossiemouth Family Quarters | Ministry of Defence | Expired |

| 633 | Energy Management Royal Gwent/St Woolos Hospitals | Welsh Government | Expired |

| 269 | Connect | Department for Transport | Expired |

Annex E: Leavers by 31 March 2019

| Project ID | Project name | Department | Reason |

|---|---|---|---|

| 787 | Redevelopment of Royal Liverpool University Hospital | Department of Health and Social Care | Cancelled |

| 1511 | Midland Metropolitan Hospital | Department of Health and Social Care | Cancelled |

| 680 | Hertfordshire Waste | Department for Environment, Food and Rural Affairs | Cancelled |

| 250 | NRTS | Department for Transport | Expired |

| 369 | Roseberry Park Hospital | Department of Health and Social Care | Cancelled |

| 169 | Camden Chalcots Estate | Ministry of House, Communities and Local Government | Cancelled |

| 640 | Garth Olwg Lifelong Learning Centre | Welsh Government | Cancelled |

| 278 | Brent Street Lighting | Department for Transport | Expired |

| 1036 | Mearnskirk | Scottish Government | Expired |

Annex F: Key terms

| Data | Definition |

|---|---|

| Capital Value | This is the total nominal capitalised cost of the project as recorded in the financial model at financial close. This includes SPV debt plus total shareholder investment (equity and shareholder loans) plus any authority capital contribution. |

| Department | Name of the sponsoring department |

| Equity | This is the combination of shares and subordinated debt invested in the project |

| Financial Close | The date the project reached contract signature |

| Procuring Authority | The procuring authority responsible for commissioning the project |

| Project IRR | The projected nominal pre-tax project Internal Rate of Return (IRR). This reflects the operating margin for the project, pre-debt and equity costs |

| Special Purpose Vehicle (SPV) | The name of the project company carrying out the project |

| Unitary Charge (UC) | The payment made by the procuring authority to the contractor from the start of operation until the end of the contract. It covers the cost of the construction of the asset, of borrowing debt and equity investment, taxes, operating services such as cleaning, and maintenance |

| Weighted Average Cost of Capital | The total cost of capital for the project, calculated as the blended rate of equity (including equity and shareholder loans) and senior debt costs based on the gearing of the project |

Contact IPA

www.gov.uk/IPA IPA@ipa.gov.uk @ipagov

Cabinet Office

Correspondence team

70 Whitehall

London SW1A 2AS

publiccorrespondence@cabinetoffice.gov.uk

General enquiries: 020 7276 1234

HM Treasury

Correspondence team

1 Horse Guards Road

London

SW1A 2HQ

public.enquiries@hmtreasury.gsi.gov.uk

General enquiries: 020 7270 5000

© Crown Copyright 202X

Produced by the Infrastructure and Projects Authority

You may re-use this information (excluding logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-licence/

or email: psi@nationalarchives.gsi.gov.uk

Where we have identified any third party copyright material you will need to obtain permission from the copyright holders concerned.

Alternative format versions of this report are available on request from ipa@ipa.gov.uk