Office of the Public Guardian annual report and accounts 2020 to 2021 (HTML version)

Updated 13 December 2022

Applies to England and Wales

Annual report presented to Parliament pursuant to Section 60 of the Mental Capacity Act 2005

Accounts presented to the House of Commons pursuant to Section 7 of the Government Resources and Accounts Act 2000

Accounts presented to the House of Lords by Command of Her Majesty

Ordered by the House of Commons to be printed on 21st July 2021

Performance report

Overview

The overview provides a summary update on the work of the Office of the Public Guardian (OPG), our purpose, the main barriers to the achievement of our aims and how we have performed during the year.

The overview includes:

- the Chief Executive’s statement, giving his perspective on our performance in 2020 to 2021

- a description of OPG’s purpose and objectives, our relationship with the MoJ, and the key risks and issues we managed during the year

- a performance summary, outlining how we performed against our service delivery aims

Our performance and accountability are explained in greater detail in the remaining pages of the report.

The main risks managed within OPG in 2020 to 2021 included:

- responding to the challenge of the coronavirus (COVID-19) pandemic, and the pace and scale at which we have adapted our services for our customers and our staff

- the impact of EU transition – this hasn’t directly impacted our services, but it has shifted government priorities and the legislative programme

Further detail on these and the other risks managed during the year can be found in the section on Risk appetite

Nick Goodwin

Statement from the CEO Nick Goodwin

Unprecedented is a word often heard these days. But in reflecting on the year that has passed, there is no better description for the challenges we’ve faced at the Office of the Public Guardian (OPG). In dealing with, and largely overcoming these challenges, we have been constant in our commitment to protecting the needs of some of the most vulnerable adults in England and Wales.

As we’ve all spent more time away from our loved ones, we’ve been reminded of the value of our relationships and in supporting those who need help. The work OPG does to give force to such supportive relationships has never been more important. The COVID-19 pandemic has also highlighted the pressing need for a modernised lasting power of attorney (LPA), so citizens can access our services easily and securely, and to improve OPG’s resilience in providing those services. I am pleased that, later this year, the Ministry of Justice (MoJ) intends to consult on modernising LPAs.

This year we’ve struggled with paper-based processes. With local and national restrictions, and social distancing measures in place in our offices, it is right we’ve worked hard to keep our people safe. Our capacity to handle paper and register LPAs has reduced as a result and we’ve experienced delays to LPAs, with registration times currently taking up to 15 weeks. But we’ve continued to maintain an excellent quality of service as our customer satisfaction sits at 92.2% for our lasting powers of attorney service and 78.2% for deputyships.

Despite these challenges, I’m proud to say the passion and motivation of our people has been second to none, and we’ve protected them in the office and at home, focussing on mental and physical wellbeing so they feel supported and safe while doing such vital work. Maintaining a sense of purpose and togetherness while dispersed. This has been reflected across all 10 key indicators of the annual People Survey where we saw increases across the board.

We have also reached out to support our colleagues working on the front line in the NHS and social services, through good communications and by introducing, at rapid pace, a COVID-19 specific service. Our successful new rapid register search helped identify adults at risk who have a power of attorney (PoA) or deputyship in place, to allow public sector colleagues to make best-interest decisions. We have received over 1,600 requests since its launch, and we will continue to look at ways to improve how we share data with our colleagues to further support them in the work which they do.

Last year presented us with opportunities to innovate at pace. We’ve pushed ahead with work to modernise LPAs, launched our new Use an LPA service, carried out virtual visits and court hearings and facilitated home working across many of our teams.

And our Your Voice, Your Decision campaign has engaged people from communities most affected by COVID-19, working alongside over 100 LPA Partners across England and Wales, to make sure that people now, and in the future, have the information they need to make an informed decision about getting a lasting power of attorney.

The MoJ’s historic power of attorney refund scheme has successfully administered over £1.5 million in refunds for 37,694 customers. The deputyship refund scheme has also administered over £6.1 million in refunds for 19,690 customers. We’ve also managed to reduce our outstanding debt this year by undertaking a historic debt chase which has resulted in us having the lowest debt position for many years. In addition, our new debt policy will support us managing our debt position going forwards.

The year has been difficult. We’ve overcome many challenges. And I would like to express my thanks and gratitude to our people and to our customers for their patience. We move into the next year with positivity. Our services are more essential than ever, and our people have a great sense of pride and purpose.

With our values guiding us, we will continue to feed into MoJ’s Outcome Delivery Plan to ensure we offer swift access to justice for those who require our services, and carry forward some of the essential learnings and innovation from this year to achieve our ambition to protect people’s best interests now and into the future.

Nick Goodwin

Chief Executive and Public Guardian for England and Wales

About the Office of the Public Guardian

Introduction

The Public Guardian is appointed by the Lord Chancellor under Section 57 of the Mental Capacity Act 2005 (MCA). As the Chief Executive and Accounting Officer of the OPG, the Public Guardian is personally responsible to the Lord Chancellor and Secretary of State for Justice for the effective operation of the agency, including the way the agency spends public money and manages its assets.

The Public Guardian is supported by OPG in the delivery of his statutory functions under the MCA and the Guardianship (Missing Persons) Act 2017.

The Public Guardian’s responsibilities extend throughout England and Wales. Separate arrangements exist for Scotland and for Northern Ireland.

The government ministers responsible for OPG in this reporting period were:

-

The Right Honourable Robert Buckland QC Lord Chancellor and Secretary of State for Justice (from July 2019)

-

Alex Chalk MP, Parliamentary Under Secretary of State for Justice (from February 2020)

As an MoJ executive agency, alongside HM Courts and Tribunals Service (HMCTS), HM Prison and Probation Service (HMPPS) and the Legal Aid Agency (LAA), our aims are in line with MoJ’s single departmental plan. We feed into MoJ’s outcome delivery plan in a number of ways and our future plans are fully aligned with, and driven by, MoJ’s strategic enablers of great people, new ideas, better outcomes and sustainability.

We act to ensure the best possible service for users by working to make our services efficient and more accessible, through policies driven by evidence.

What does OPG do?

OPG was established in October 2007. We support and enable people to plan ahead for both their health and finances to be looked after should they lose capacity. We also safeguard the interests of people who may lack the mental capacity to make certain decisions for themselves.

We are responsible for:

- registering lasting and enduring powers of attorney (LPA and EPA)

- supervising deputies appointed by the Court of Protection (CoP)

- supervising guardians appointed by the High Court

- maintaining the public registers of deputies, guardians, LPAs and EPAs and responding to requests to search the registers

- investigating representations, complaints or allegations of abuse made against guardians, deputies and attorneys acting under registered powers

Our customers and stakeholders

We serve several types of customers and stakeholders, including:

- donors – people who have made either an LPA or an EPA

- attorneys – people who have been appointed under EPAs or LPAs to make decisions on behalf of donors

- deputies – lay or professional individuals or public authorities (such as solicitors or local authorities) who have been appointed by the CoP to manage the welfare or finances of people lacking capacity

- those subject to deputyship orders – people who lack capacity to make certain decisions and and in relation to whom a deputy has been appointed by the CoP to make those decisions

- missing persons – people who have been reported missing and whose affairs are being managed by a guardian appointed by the High Court

- guardians – individuals who have been appointed by the High Court to manage the property and financial affairs of a person who is absent or has gone missing

- other stakeholders – relatives of donors or those subject to deputyship orders, GPs or other health professionals, charities, and the legal sector

Key issues, risks and uncertainties

The key risks that we faced in 2020 to 2021 are outlined here. Against this backdrop we continued to deliver our day-to-day business.

In 2020 to 2021 OPG has dealt with the impact of EU transition, and although this hasn’t directly impacted our services, it has naturally shifted government priorities and the legislative programme.

However, the biggest uncertainty has been around the COVID-19 pandemic, and the pace and scale at which we have adapted our services to reflect government guidelines and the needs of our users and staff. OPG will move into the year ahead still dealing with the impact of COVID-19 on our services and our people.

Performance achievements

Measuring our performance

During 2020 to 2021 we have continued to review our performance measures, ensuring the underlying measures drive the day-to-day business and are fit for purpose, measuring the right information in the right way.

Key Performance Indicators (KPIs) are used to monitor performance and our risk management process helps to highlight key issues in relation to delivery of those KPIs and the wider performance within the organisation. Risk management helps manage uncertainty. One key uncertainty that needs to be managed throughout the year is incoming workload – as we are funded from income and level of workload also impacts on the ability to meet KPIs.

How have we performed?

OPG has an important set of customer indicator targets – performance against these is given below, along with the key workload levels for the past financial year. More detail on the full range of targets, performance and how they are measured can be found in Performance targets.

The challenges of COVID-19 have made it difficult for us to meet some of our performance targets, especially as we have been adapting the way in which we work so it is safe for our staff. Throughout, we have focused on maintaining our service delivery and striving for excellent customer service. At the same time, we’ve strived to improve our services – both how the service works and the way that people access services.

Some targets have been harder to meet than others. For instance, we have not achieved our aim to register LPAs within 40 days. More information on some of the key challenges around this, and the service improvements we have introduced in our power of attorney team can be found here.

Our visits team faced major challenges during 2020 to 2021 due to COVID-19 restrictions. While many visits were initially delayed – we prioritised visits to focus on our most urgent cases. These challenges impacted on other areas of the business such as investigations and our legal team. To deal with this effectively our visits team introduced virtual visits.

|

57,777 As at 31 March 2021 we were supervising 57,777 deputyship orders, a decrease of 3,016 from the end of 2019 to 2020 |

|

691,746 The number of applications to register LPAs and EPAs received in 2020 to 2021, a decrease of 225,804 on 2019 to 2020. |

|

5.3 million We ended the year with over 5.3 million powers of attorney on the register. |

Our achievements

|

58 days Average actual clearance time for power of attorney applications Target: 40 days |

|

33 days Average time to obtain annual reports Target: 40 days |

|

7 days Average time to review annual reports Target: 15 days |

|

79% Customer satisfaction survey % with PoA services (very or fairly satisfied) Target: 80% |

|

78% Customer satisfaction survey % with deputyship services (very or fairly satisfied) Target: 80% |

|

94% Customer satisfaction survey % with digital services (very or fairly satisfi ed) Target: 80% |

|

94% % of safeguarding risk assessments carried out within 2 days Target: 95% |

|

75 days Average time to conclude investigations Target: 70 days |

|

56% % of calls answered within 5 minutes Target: 90% |

|

82% % of complaints fully responded to within deadline Target: 90% |

The impact of COVID-19 on OPG

COVID-19 has had a significant impact on OPG and how we provide our services, especially as a large amount of our processes are still paper-based. However, it has also allowed us to innovate at pace. We have:

- reviewed our processes to allow us to work in a more digital way, streamlining certain paper-based processes and the number of staff needed in the office

- prioritised the safety and wellbeing of our staff while they worked in a more agile way

- supported our staff, including our Contact Centre, so they can work from home where possible, following government guidelines while continuing to deliver our services. We expect some element of home working will continue in the future

- introduced a recruitment freeze as part of our mitigation for financial under-recovery and carried out remote interviewing for business-critical roles

- carried out display screen equipment (DSE) assessments online

- implemented critical business-continuity and recovery planning

- created a GOV.UK hub which is regularly updated with information on how COVID-19 is affecting our services and providing relevant guidance for our users

Our Services

The pandemic highlighted societal inequalities worldwide and in England and Wales, particularly for those from lower socio-economic and minority ethnic communities. As an organisation we’ve reflected on our role and responsibility to all citizens and the part we can play in the UK government’s ‘levelling up’ agenda, and identified two areas where we can improve our offer considerably.

Our reliance on paper-based processes has shown the critical need to modernise. Not only to future-proof ourselves against future crises, but also to improve access to our services. Thats why we’re pleased to be launching, in collaboration with MoJ, a consultation paper gaining views on our plans for modernisation of the LPA service in 2021. Through this work, we hope to make the service more widely accessible and fit for the future for all in society, and have already commenced our stakeholder engagement for this work.

We are proud of the work we have done educating the public on LPAs and the benefits of making decisions for the future which support and reflect their wishes should they lose mental capacity. In Summer 2020, with support from the Cabinet Office, we refocused our Your Voice, Your Decision. public-facing campaign at pace, targeting our communications to audiences most impacted by COVID-19.

Working together

We launched a new COVID-19 specific service to provide rapid register searches for colleagues in the NHS and Local Authority so they can identify adults at risk with an LPA, EPA or deputyship in place. With over 1,600 searches received since launch, this has supported our colleagues with making key medical decisions and managing increased number of patients.

Power of Attorney services

Volumes to our Contact Centre have increased and calls have taken longer than usual as they have become more challenging and complex. Average wait time has been approximately 12 minutes. However we recognise that while our call wait time targets haven’t been reached, we have continued to provide quality support to our customers and we are proud of this.

Supervision services

We kept in touch with our most vulnerable and non-compliant customers by phone, to check on their wellbeing and to provide any additional support. For example, if they were struggling (due to restrictions) to visit the person subject to the deputyship order, to get bank statements or to post the report to us.

Visits

We successfully conducted 60% of our target visits virtually where possible. In line with government guidelines, we carried out garden and socially distanced visits which have been prioritised for the most urgent visits, this has helped protect some of the most vulnerable in society.

Complaints

We have seen a higher number of complaints since COVID-19 and have extended our target of 10 days for resolution where appropriate.

Investigating concerns

Organisational backlogs impacted the investigation triage and support (ITAS) process, meaning it has taken longer than normal for safeguarding concerns to be identified and sent to the ITAS team. The risk assessing of concerns remained our main priority and were actioned as soon as they were identified and sent to the safeguarding team.

Investigations

During the initial lockdown from March 2020, cases accepted for investigation fell by 28% and government guidelines on social distancing impacted on our ability to conduct physical visits. Our investigation targets were impacted by the reduction of physical visits. We refocused our attentions onto our ‘further action’ cases during this time, with the aim of closing the oldest cases while ensuring recent cases remained on track.

Legal team

As a consequence of the pandemic, the vast majority of hearings have been carried out through video conferencing. The team has taken advantage of the opportunities this has presented in relation to reduced travelling time, and more flexible use of external counsel.

There has been a decrease in the number of investigation cases being completed and referred to the Legal team, providing an opportunity to clear a substantial amount of outstanding work. This year the team submitted 582 investigation cases to court which is an increase of 84% on the previous year. We also made a further 689 applications in relation to other matters.

Our people

During the pandemic, the People Development teams have provided essential wellbeing support for our staff, redesigned our learning and development offer and enabled business critical recruitment by making best use of online opportunities.

The focus on mental health at OPG is really reassuring. I know who to talk to if I need it, which has made a world of difference while adapting to working from home, I feel mental health is something taken seriously

Laura - Registrations Officer

Health and safety

The COVID-19 pandemic has required us to make significant changes in our offices, such as reducing the number of staff and introducing lateral flow testing – our health and safety team have been excellent in making sure that we have COVID-secure premises which adhere to all government guidelines.

OPG’s programme of inspections were maintained, and we provided updates and reports to trade union representatives who were not able to attend these.

Finance

Social distancing measures had a significant impact on the volume of applications received to register lasting powers of attorney, with a reduction of 24.6% in 2020 to 2021 compared to 2019 to 2020. Although some business activities and costs were also curtailed (such as visits, outgoing post, use of agency staff and staff travel) the drop in PoA volumes was by far the most significant factor in OPG recovering only 76.7% of its costs, well short of the target of 100%. The uncertainty created by the pandemic meant that OPG was as reliant as ever upon the support of its MoJ finance business partners and MoJ Analytical Services’ demand and income forecasting models.

OPG incurred additional costs of £164k making our office accommodation safe for staff to work in and providing equipment to facilitate remote working where practical.

Performance Analysis

OPG 2025 transformation programme

In the OPG business plan for 2020 to 2021, we had two key areas of work – OPG 2025, our transformation programme, and OPG’s business as usual (BAU).

OPG 2025, is about changing how we provide our services long term so we can improve lives together. We’ll make better use of digital products, services and smarter ways of working so we can offer more support, advice and provide more efficient services.

A digital future will make our services more accessible, flexible and simpler for customers to use in a way that is affordable and convenient for them.

In 2020 to 2021, we progressed our transformation work by:

- using more digital tools across the business – reducing the amount of paper which we use while delivering our essential services

- sourcing a new site to operate from – we will be looking to move to this from our current Birmingham location by the end of 2021

- finalising transformation planning so we can focus on bringing this to life and the projects which will help deliver this

- developing a future operational model which ensures we are sustainable for the future

- continuing to develop a professional approach to the management of change, including impact assessment and prioritisation

- developing a Strategic Outline Case for Modernising LPA to clarify the scope, objectives, benefits and costs of early project phase

- launching the Use an LPA service to make LPAs easier to use

- promoting lasting powers of attorney – adapted to meet the needs of COVID-19. This focused on people most affected by the pandemic, those from lower socio-economic and ethnic minority backgrounds

- holding successful stakeholder roundtable event, led by Minister Chalk, MP, to progress the next phase of modernising the process of making and registering LPAs

Insight, performance and analytics

We have:

- created a data strategy to improve organisational data capability and drive data informed decision-making. This will mean responsiveness and efficiency in meeting our customer needs

- started work on customer journey mapping to understand the customer experience better which will allow OPG to make improvements based on this

- started work on improving our support and guidance, so we can better understand where to focus improvements and proto-typing new ways of communicating and sharing guidance so that customers can navigate the service with ease and clarity

Our business as usual

We are committed to providing an excellent service for all our customers now and in the future.

Our role is registering powers of attorneys, supervising court-appointed deputies and guardians and investigating concerns. This includes building a supported, inclusive and motivated workforce that lives by its values. OPG is a great place to work, but we want everyone to feel like it is a brilliant place to work.

In 2020 to 2021 we continued to improve our business as usual by:

- striving to achieve our performance and customer service targets, moving our resource into areas which have struggled – ensuring that our users can still access our services

- promoting mental wellbeing for all staff and supported them in dealing with COVID-19 and the many ways this has affected individuals

- implementing home working at pace across many teams – including more flexible use of IT and agile working

- continuing to foster greater inclusivity at OPG – ensuring that OPG continues to be a brilliant place to work

Lasting powers of attorney

Registration of LPAs is an important service for the public, therefore, it’s key that we strive for continuous improvement and development of our LPA services, so our customers have a positive experience.

The main customer service targets in this area are user-focused, these are:

- registering LPAs within 40 days

- answering 90% of calls within 5 minutes – service delivery and average wait time targets for dealing with calls will not be achieved

- respond to 90% of complaints within 10 working days

We have maintained our complaints performance and 82% of complaints were completed within target.

We have also continued our successful administration of the MoJ-led Historic Refunds scheme having now completed the third of a six-year campaign, which saw 37,694 customers receive £1,575,812.63 in refunds.

The key challenges faced by power of attorney service in 2020 to 2021 have been:

- maintaining service delivery due to the impact of COVID-19, this has required us to change how we operate and we have also seen staff morale fluctuate. We reviewed our processes, prioritised key work and ensured our staff wellbeing was a priority

- staffing issues due to attrition and a recruitment freeze. We have upskilled and trained staff from other parts of OPG to provide support where possible

Good morning, I have today received my LPA which has now been registered. I wish to thank you but most of all I just want to tell you what lovely people are in your employ. As you will appreciate, filling in the forms seemed very daunting, so much so, that I had to ring your office on three occasions with a query. Each and every one of them was so kind and helpful. The past few months must have been quite a challenge at times but hopefully, before long, we will all be back to normal. Once again, thank you very much and I wish you all a very happy, healthy future.

Feedback from contact centre customer

Service improvements

While delivering our day-to-day business, we have continued to look at ways to improve our services for our users. We have updated some of our services:

- we’ve expanded our rapid register service so colleagues from relevant public sector organisations can request a search of our register for urgent concerns about someone who may have an LPA or deputyship in place

- launched the Use an LPA service in June 2020, activation codes have been provided to 1,120,000 donors and attorneys on 366,000 LPA’s. Attorneys on 68,604 LPA’s have registered to use the service, and 21,155 access codes have been provided to organisations

We improved ways to interact with our customers:

- improved the way we interact with our customers by providing Human Voice of Justice training to staff

- carried out analysis by conducting regularly monthly Quality Assurance checks across all our core Power of Attorney services to identify key areas for improvements to customer service delivery, providing regular feedback and support to staff

- carried out a data cleanse exercise, during which staff identified the top four errors on hundreds of LPA applications. This information has been used to strengthen training and will inform improvements to our customer service delivery

We delivered training and improved our ways of working from home:

- delivered technical training and upskilled 160 members of staff to support power of attorney service

- conducted a high-level review of our quality strategy and made improvements to support team leaders – adopting a risk-based approach

- invested in telephony and digital solutions to support additional flexibility and working from home

- introduced remote print and post

- implemented smarter working, so more of our staff were able to work from home – this was positively received by staff and we saw an increase in productivity

- introduced a Safeguarding Hub to ensure safeguarding concerns are raised appropriately

Feedback from Staff:

Work on registration in the past year has been hard work, but at the same time, strangely exciting. Through communication, we have come up with innovative ideas on keeping the workflow going, showing us the creative side of managers and staff alike. Our senior management have allowed us to try new ways of working, whilst supporting us with more flexible working hours. The situation enforced the Registration units to collaboratively work together forming closer working relationships and being able to use skills across more teams. We have pulled together in a way that could not have been envisioned prior to COVID-19 and gives us a great platform to build on for the future.

Sue, Unit Manager

Supervision

Current workload

The supervision caseload was 57,777 deputyship orders in 2020 to 2021 compared to 60,793 in 2019 to 2020. Excellent performance throughout the year has allowed all our performance indicators to be met.

This year 54.05% of annual reports were submitted digitally, compared to 44.13% in 2019 to 2020. And our guardianship and deputyship fee refunds scheme have been incorporated into business as usual with no adverse impact on our customer service or performance.

We’ve also made changes to the Lay Customer journey providing more flexibility around touchpoints. This means we can provide a more personalised and targeted service, which should reduce levels of non-compliance.

The key challenge faced by the service in 2020 to 2021; a number of complex and challenging Court of Protection judgments, including Various LPAs and the ACC and others judgment. We’ve changed our processes and communications to reflect these. Several high-profile cases which have required a great deal of work from the Deputyship Investigations and Supervision teams and ensured these were communicated in a timely fashion to those impacted.

Service improvements

We are focussing on:

- our processes for minimising and managing non-compliance (failure to comply with the Court Order by which the Court of Protection grants the deputyship)

- interactions and mutual working with our bond suppliers, to ensure correct procedures were followed, security was provided and any discrepancies were addressed

- introducing end-to-end case management across lay teams for each lay deputy in order to manage every aspect of their case and to whom they can direct any queries

- a review of the information provided to prospective deputies before they apply to court, so they clearly understand the duties of a deputy before they take on the responsibility

- a review, in line with the supervision audit (2019) completed by Government Internal Audit Agency (GIAA), of our Professional and Public Authority Standards

We have also reduced the time allowed for deputies to report to us so we can provide better protection for our customer. And in line with the supervision audit (2019) we have completed a ‘formal review undertaken and documented, detailing delivery, impact and ongoing development of QA process.’ As recommended, the biennial review now forms parts of our business-as-usual processes.

We have completed and implemented our technical training review. This means that we are able to support improvements across supervision and by aligning our trainers with different areas of the business on rotation, we are then able to ensure they remain up to date with every aspect of our work. The Supervision Support and Consolidation Team (SSCT) is also working with our policy team to check our job cards are up to date and reflect current OPG policy and practice.

I should like to inform you of a gentleman, Ben, Supervisor for Lay Team 6 who has gone above and beyond to help, assist and advise me with my deputyship. I have been a deputy for over five years, and he is the first contact who has genuinely guided me to be a better deputy. During his busy day he has found the time to contact me by phone instead of email (which can be cold and misread). He is a credit to the OPG.

Feedback from customer

Missing persons

We are now supervising five guardianship orders, an increase from two in 2019 to 2020. The numbers may be small, however this essential work helps families with a missing loved one during a traumatic time.

Investigations

The 2020 to 2021 business year has been a challenge for all of us but through all the difficulties and changes, the one constant was the dedication of our colleagues to continue safeguarding our vulnerable adults. The pandemic has led to more adults being put at risk with access to help them being more restricted. That has not waivered us as investigators from finding new innovative ways of working to continue collaborating with other agencies and using technology and any other tools available to provide the high level of service expected. We remain fully committed and proud of the work we all do to ensure the safety of our donors every day.

Amina – investigator

Overall, investigations declined from 3,099 in 2019 to 2020 to 2,089 in 2020 to 2021. Investigations targets were heavily impacted by the pause of physical visits to customers due to COVID-19, however, we were quick to innovate and introduce virtual visits.

Public Guardian reports summarise an investigation and provide recommended actions. We were unable to meet our target of PG reports to be signed off within 70 days of receipt, in 2020 to 2021 this was at 74.6 days. To safeguard our customers, we focused on clearing investigation phase cases, which meant our target of ‘action implemented where no court action necessary within 25 days of PG report being signed off’, was 31.6 days.

We closed 2,073 investigations in 2020 to 2021 compared to 2,649 in 2019 to 2020 and have 680 open cases which are active investigations compared to 700 open cases in 2019 to 2020.

Changes in legal case review have been brought forward, this is expected to have a positive impact on overall timescales as well as the quality of our decisions. We are also making more changes to how we conduct different aspects of our investigations which will result in efficiencies in our service.

The percentage of investigations that result in court action is 22.81%. In the majority of cases no action is taken (63.85%) or additional measures short of court action are used to resolve any issues and get the attorneyship or deputyship back on track (13.34%).

Service improvements

We introduced many innovations and process changes this year. These include:

- weekly review of backlog of cases awaiting a visit to identify alternative ways of clearing them. For example, using previous capacity evidence from a Public Authority

- intensive training programme for new senior investigators and investigators with a buddying system to support them. This strengthened the team’s position for any potential increase in cases

- a taskforce was set up during October to concentrate on the Further Action (FA) cases with the aim of closing the oldest cases in this phase as well as ensuring the more recent cases remain on track

A case that went to court

A concern was raised regarding a donor’s capacity to execute both their health and welfare (HW), and property and financial affairs (PFA) LPAs.

A general visit was commissioned, and the certificate provider was contacted. The certificate provider was satisfied that the donor understood the decision he was making. The certificate provider has stated that he was satisfied that the donor could weigh up and retain information to understand what making an LPA would mean and no coercion had taken place.

The visitor took a different view from the certificate provider and concluded that it was difficult to determine if the donor had capacity to execute the LPAs. Due to the conflicting capacity evidence, a special visitor was commissioned to carry out a retrospective capacity assessment.

The special visitor’s opinion was that the donor lacked capacity to execute the LPAs.

An application to the court was made, and the court revoked the LPAs.

A case that did not go to court

A concern was raised regarding a donor’s capacity to execute both their health and welfare (HW), and property and financial affairs (PFA) LPAs.

The investigation highlighted a conflict of interest in that attorney one was paying her daughter (donor’s granddaughter) and son-in-law for providing care. The donor had moved in with the granddaughter and husband. Attorney one stated the donor had always supported her financially and added that the payments were always for care and nothing else.

On reviewing the donor’s finances, many gifts were identified. However, these were prior to any evidence that the donor lacked mental capacity to make financial decisions. However, it was noted that attorney one held a joint account with the donor.

The donor was assumed to have dementia, but this was not formally diagnosed.

The funds paid for care were deemed reasonable as the donor would incur high costs if supplied through a private care company. Also, of note was that the donor was not paying for food, utilities or rent while living in the property of the granddaughter and husband.

Attorney one was asked to re-account in three months’ time to show she was managing the donor’s finances appropriately and in the donor’s best interests. Also, attorney one was to provide evidence within 30 days that her name had been removed from a joint account she held with the donor.

Attorney one subsequently re-accounted, and there were no further transactions of concern. Also, evidence was provided to show her name was removed from the joint account she shared with the donor. As attorney one demonstrated she was acting in accordance with the MCA 2005 and Code of Practice, the investigation was closed.

Legal and information directorate

During 2020 to 2021 our legal team have:

- begun the process of reshaping the team to improve structures and processes for litigation and advisory work

- concentrated on clearing a significant amount of outstanding work through to court application

- been involved in a number of judgments that have set direction for OPG and external professionals

Key challenges this year have been:

- staffing issues meant there was a reliance on locum solicitors

- backlogs in the court application process

Visits

This year, we have paused physical visits and the majority of our visits have been carried out virtually, with some garden and socially distanced visits. We protected our customers by completing over 1,200 virtual and garden visits to support investigations and ensure that our priority cases were completed. And we have continued to support our new deputies by carrying out their visits virtually as well.

To help meet the demand for specific medical/capacity visits, OPG appointed 11 Special Visitors. Special Visitors are medically trained visitors who usually assess retrospective mental capacity and diagnose impairments of the mind or brain.

We have allocated 100% of standard visit commissions within five working days, completed 99.6% of urgent visit commissions within two working days and forwarded 99.9% of visit reports to the correct officer within five working days. Visitor appraisals were successfully completed again and we saw a sustained improvement in the quality of the work produced.

Service improvements

We have improved our service by:

- implementing virtual assurance visits to ensure that professional and public authority deputies are supported

- introducing universal secure email accounts for all contract visitors

A number of our visitors reach the end of their contracts in 2021, so in the next financial year we will run three recruitment campaigns. One for general visitors in England, and two in Wales, for general visitors and special visitors, to ensure we meet demand and fulfil our Welsh language commitments.

Safeguarding

Our investigation triage and support team (ITAS) complete risk assessments and triaging of any safeguarding concerns. We have achieved our five-day triage target currently 97.9% against 95%.

During 2020 to 2021 our ITAS team have:

- continued to develop safeguarding practices, these have resulted in implementation of safeguarding training modules

-

attended awareness events to engage with local authorities to make them aware of our roles and responsibilities and encourage joined up working, focussing on key areas such as Essex. Essex local authority approached OPG independently and we are currently in the process in approaching all local authorities in England and Wales following recommendations from our Senior Safegaurding Practitioner

- been marked substantial by an internal audit by the Government Internal Audit team in MoJ – reflecting our healthy position

- reviewed our staffing and processes to show we are achieving best value for money

- reviewed the information on OPG’s website to ensure customers know how to submit concerns and what information we require

Complaints

We manage customer complaints through a tiered complaints process – first tier complaints are considered by the business area responsible.

If a customer is unhappy with a response, the complaint can be escalated to the second tier and at this stage the complaint, and its handling, is reviewed by the Public Guardian. If a customer remains unhappy, they can ask their MP to refer their complaint to the Parliamentary and Health Service Ombudsman (PHSO) for an independent review.

One case was referred this year and was partially upheld by PHSO.

This year has been challenging, and our complaints team have been impacted by delays in other parts in OPG, such as processing of LPAs, fluctuating levels of complaints and complex cases – this has meant it has been difficult to meet our target of responding to 90% of customer complaints within 10 working days. Whilst on average we were able to respond to complaints within nine working days, we were only able to respond to 82% of the complaints within 10 days, against our target of 90%.

We have focused on:

- making sure our customers are updated on progress with their complaints, especially when we are unable to meet our targets

- using our customer feedback and complaints data to drive improvements within OPG – using data more effectively

- continuing the roll-out of the Human Voice of Justice writing style within complaints and other customer focused areas. We have worked closely with First Word to deliver a bespoke training package to complaints staff. We are now working on the implementation of a second cohort of training

Example of an improvement that has been made

A complaint was investigated by PHSO – it was partially upheld and we were given actions to implement. Two of these action points were around reviewing our investigation closure letters and complaints responses.

The Ombudsman asked us to review whether we could include more details in the responses (in line with GDPR guidelines), they also asked to consider providing additional information to our customers about how they can request information following an investigation.

An action plan was created, and collaborative work was undertaken by investigations, complaints, Information Assurance and the legal team to carry out the recommendations made by PHSO. We had a three-month deadline to complete the actions.

The letters were fully reviewed, and new templates were created, with an improved structure and additional information included. The Information assurance team provided wording to be inserted which will assist our customers in requesting information and making FOI requests. This wording will also be circulated for use in complaints responses, improving the service we provide our customers.

The Ombudsman responded and were satisfied that we had completed all the requirements of their final report and recommendations.

OPG received 4,146 complaints in 2020 to 2021

|

4,146 complaints received in 2020 to 2021 compared with 5,723 in 2019 to 2020 |

|

82% Of complaints responded to in 10 working days Target: 90% |

|

9 days Was the average responses time to a complaint Target: 10 days |

|

3,155 complaints about LPAs |

|

244 complaints about deputyships |

Top three LPA complaints

- delays in processing LPAs, handling and scanning on documents, delays in contacting customers and advising of issues with application

- contact with OPG – unhappy with the service provided either over the phone or in writing

- lost documents – LPAs and LPA sections misplaced or lost in the office

Top three deputyship complaints

- deputy/attorney – complaints about professional deputies sent to the Pro team by third parties

- letter content – tone of chase letters, chase letters going out after we have been sent information and requests for further information

- contact with OPG – tone of contact, issues with being able to get through and requests for further information

Our People

We have implemented a range of measures and tailored wellbeing support, prioritising the health, safety and wellbeing of all our staff in dealing with COVID-19 and the many ways this has affected them. We have promoted mental wellness activities for all colleagues, delivered Positive Emotion, Engagement, Relationships, Meaning, and Accomplishments (PERMA) wellbeing training, introduced a winter wellbeing package and daily call-back service with our mental health first aiders and mental health allies. These measures have ensured our staff have the information and support they need, when they need it and the knowledge of where to go for further help if required.

We have maintained our focus this year on becoming a truly inclusive organisation, representative of the communities we serve and committed to listening to how our staff feel. We are pleased to see the impact of our work from previous years reflected in our People Survey scores. OPG’s inclusion task force continues to meet regularly to talk about diversity and inclusion at OPG. Since July 2020, conversations have focused on race. Starting with a series of Race Listening Sessions, hosted by our PROUD network, we listened to what staff were telling us and we used what we learnt from these sessions to feed into our race action plan. ‘Listen, learn and lead’ is the framework we will continue to use to achieve our future inclusion goals.

By working closely with our Inclusion Taskforce, staff networks and people teams we have continued to improve and adapt processes so we are a fully inclusive recruiter. This is reflected through our recruitment content, in our diverse interview panels which have exceeded MoJ targets and in our re-accreditation as a Disability Confident Leader – accredited by the Department of Work and Pensions (DWP).

Despite the pandemic and our recruitment freeze, we have still been able to deliver on our commitment to support social mobility. In 2020 to 2021, OPG recruited a total of 14 candidates through various routes into work schemes, six through sector-based work academy, seven through care leavers scheme and one Fast Streamer. In response to social distancing restrictions, OPG introduced a process of remote interviewing for all business critical roles. Due to the level of success this process is now BAU across all of OPG at every grade. We have only recruited to business-critical roles this year and we have achieved this through successfully embedding virtual interviewing capability into our recruitment processes.

We have continued to focus on strengthening our leadership capability and we have invested in our leaders and their development through our new, Line Manager Essentials programme that we have delivered to over 12 cohorts, improving leadership capability and confidence. We have delivered two more cohorts of our flagship leadership development programme ‘Bridges’ aimed at helping BAME colleagues unlock their potential and progress into leadership roles and we have launched a new pilot programme ‘Reach’ supporting disabled staff to progress their careers.

More broadly, our Learning and Development team have redesigned our comprehensive learning programme to be delivered virtually which, alongside the introduction of our new OPG Learning Hub, means we provide a wide spectrum of flexible and readily accessible learning and development options.

Service improvements

We have improved our people services by:

- establishing a people committee to hold our people strategy and performance to account

- increasing our people data reporting to aid knowledge and inform appropriate action or intervention

- increasing our workforce diversity and diverse future leaders’ pipelines through delivery of four Bridges programme cohorts and one Reach programme cohort

- ensuring we always have diverse and representative interview panels – exceeding MoJ targets in this area

- launching the OPG online Learning Hub

- redesigning all our learning and development programmes for online delivery

- developing and launching our new talent management strategy and career conversation framework and guides

- creating our virtual interviewing process and guidance for vacancy managers Key achievements from 2021 to 2021:

Our bullying, harassment and discrimination scores reduced by 8% in the 2020 People Survey.

Our inclusion and fair treatment score improved by 3% in the 2020 People Survey.

OPG was a finalist in two categories of the 2020 UK Social Mobility Awards (SOMOs): Recruitment and progression programme and Mentor of the year and our Bridges programme nomination received a ‘highly commended’ award.

We have also:

- extended our People Strategy to 2025 that supports our OPG 2025 transformation programme

- published our Race Inclusion Action plan to tackle race inequality

- published our 2021 corporate engagement action plan focused on engagement priorities from OPG’s 2020 People Survey

- developed and delivered a management of change support programme for our operational directorates

- launched our Confide Advisors Network

- conducted a Mental Health Review – action from this will be implemented as part of OPG’s People Strategy during 2021 to 2022

- worked collaboratively with the Legal Aid Agency, Criminal Injuries Compensation Authority, Parole Board and Official Solicitor and Public Trustee to launch a learning and development strategy to promote consistency of our approach to learning and development and also provide a modern and flexible offer for our people

2020

- inclusion and fair treatment 77%

- bullying and harassment (number who said they had experienced) 9%

- discrimination 12%

- OPG anti-BHD video exploring unwanted behaviours

- Launch of the Confide Advisor Network

- review and gap analysis of Civil Service inclusion expectations

2019

- inclusion and fair treatment 74%

- bullying and harassment (number who said they had experienced) 17%

- discrimination 20%

- OPG award-winning internal inclusion communication campaign

- OPG inclusion video – exploring what inclusion means to our people

- staff inclusion focus groups

- delivery of mutual respect sessions

- annual celebration of National Inclusion Week

- internal communication campaign to increase staff diversity declaration

2018

- inclusion and fair treatment 69%

- bullying and harassment (number who said they had experienced) 17%

- discrimination (as previous) 21%

- monthly Deputy Director Inclusion summits 2018

- launch of Equality, Diversity and Inclusion Advisors

- development of mandatory BHD awareness e-learning

- launch of centralised BHD grievance investigation process

- annual celebration of National Inclusion Week

2017

- inclusion and fair treatment 71%

- bullying and harassment (number who said they had experienced) 19%

- discrimination (as previous) 21%

- ACAS Bullying, Harassment and Discrimination (BHD) investigation report

Communications and engagement

Since the start of the pandemic, we’ve adapted to the challenges of communicating effectively to an office and home-based workforce – introducing regular OPG-wide livestream events to ensure everyone has the information they need and opening up a forum for conversation. Since launch, these events reach over 700 of our 1,500+ workforce and receive an average of 200 questions per session. Our intranet COVID-hub has received over 13,639 visits since it was created as a central reference point for staff.

We’ve put our values at the heart of our communications, working with colleagues in the Learning and Development team to communicate support for mental and physical wellbeing including bank holiday wellbeing packs. Staff survey data has shown the value of this approach – 88% of staff felt supported by managers since the COVID-19 pandemic, and 85% of staff felt confident senior leaders were handling the impact of the outbreak on the OPG (source – Cabinet Office pulse survey June 2020).

We have collaborated with colleagues in contact centre, legal, policy and others to ensure our users have up to date information on changes to guidance in line with government guidelines, liaising with colleagues across government to ensure consistency of messaging.

Below is a list of some of the stakeholder events where OPG has either hosted or attended.

External event – presentations

| Delegates | |

| The Water Services Regulation Authority (OFWAT) | 30 |

| Hackney safeguarding network | 10 |

| Older people’s commissioner Wales | 30 |

| Adult safeguarding summit | 30 |

| Age Cymru | 35 |

| Singaporean Public Guardian virtual visit | 5 |

| Her Majesty’s Revenue and Customs (HMRC) | 50 |

| Cabinet Office | 30 |

| Safeguarding Adults National Network (SANN) | 30 |

| Together for Health | 400 |

Our challenges for 2020 to 2021 have been:

- responding to updated government guidance at speed

- adapting our approaches to the new communications landscape – going from face-to-face engagement to virtual

- ensuring our staff are engaged, informed and feel supported – maintaining a sense of purpose and togetherness

Our key successes for 2020 to 2021:

- our GOV.UK COVID-19 guidance has been viewed over 146,803 times since April 2020

- hosted our first ever virtual staff People Awards in September 2020, with over 360 attendees, and the largest ever number of nominations from staff across OPG

- successfully launched new channels including a staff GOV.UK notify service for urgent COVID-19 related messages, and stakeholder newsletter

We have also been recognised for our work, through a number of industry awards:

- Internal Communications and Engagement Awards 2020 – CIPR Internal Communications Team of the Year Award

- Internal Communications and Engagement Awards 2020 – Best Internal Communications (Bronze winner)

- Public Service Communications Awards 2020 – Diversity and inclusion category (Bronze winner)

- Institute of Internal Communications National Awards 2020 – Best culture communications (Award of Excellence)

Your Voice, Your Decision

Our public-facing campaign – Your Voice, Your Decision – received backing from Cabinet Office to relaunch in Summer 2020 with a renewed focus on those groups most heavily impacted by COVID-19 – those from lower socio-economic and minority ethnic backgrounds. With £14,000 from Cabinet Office we launched a successful drive to raise understanding of LPAs amongst these groups using targeted radio advertising, public service announcements, Facebook advertising, and partner engagement. To date we have over 100 LPA partners from a range of sectors working with us to help those least likely to have an LPA learn of the benefit of putting their future in the hands of those they trust.

We focused our communications on real life stories that have proven to resonate with our target audience groups. We did this through wide range of channels and for the first time we produced four radio adverts in English and Welsh with a script about being stuck inside during COVID-19 and around LPA service and looking after children.

- three radio ads were broadcasted across England and Wales reaching up to 700,000 listeners

- we ran four Facebook adverts over a month in March 2021 gaining 309,439 impressions converting 1% traffic to the campaign site resulting in 93% new users

- we ran public service announcements through Cabinet Office Radio Filler service from June 2020 to March 2021, gaining over 5,399 transmissions over commercial channels and 4,520 downloads from community channels

Your Voice Your Decision poster

Financial Performance

Income forecasting

We have maintained our strong demand and income forecasting capabilities over the past year, through our continued collaborative partnership with MoJ Analytical Services, and central analytical teams within Finance Business Partnering. Due to the COVID-19 pandemic, income for the year varied substantially from initial projections, with income from power of attorney applications coming in 30% below forecast, and income from deputyship services 5% below, due to reductions in demand for services. We review and update in-year demand and income forecasts as part of the monthly routines for financial and performance management, using the insight gained to model likely impact of internal and external environment changes.

Financial performance

This section provides commentary to support the Financial Statements and our performance during the past year. Note 2 to the Financial Statements details the Fees and Charges for the income below, and notes 3-5 provide further details on the expenditure across OPG. Below are the key balances for OPG in 2020 to 2021.

76.7%

Cost recovery, 24.0% reduction

Power of Attorney income

The COVID-19 pandemic had a significant impact on the volume of power of attorney applications received when lockdown and other social distancing measures were in place

£51.4m A decrease of 24.6%

Supervision income

A sharp increase in cases terminating coincided with the first wave of the pandemic, overall volumes were down by just 2% at year-end compared to 2019 to 2020

£10.6m - An increase of 0.2%

Staff costs

A charge of £1,965k in respect of IR35 tax liability was the most significant factor increasing staff costs

£51.2m

An increase of 6%

Professional visitor reports

Social distancing measures impacted on the number of targeted visits undertaken

£1.7m

A decrease of 40%

Postage

The key driver for postage costs is the volume of power of attorney applications received and as such have reduced accordingly

£2.9m

A decrease of 21.8%

In 2020 to 2021 OPG recovered 76.7% of its costs, recording a deficit of £18.9m. This was primarily driven by a 25% drop in the volume of new power of attorney applications, notably so when lockdown and other social distancing measures were in place. Demand for power of attorney registrations is a key driver for OPG’s financial performance. It is the first year that OPG has failed to achieve full cost recovery.

Nick Goodwin

Chief Executive and Accounting Officer

13 July 2021

Sustainability report

We are committed to reducing our impact on the natural world and to support our communities. To do this we measure our impact on the world and work to reduce our consumption of limited resources, emissions of greenhouse gases and unnecessary travel.

Data collection and scope of reporting

We report on utilities used, travel, and waste generated. These are measured against previous years and in conjunction with the Greening Government Commitment Targets (GGC). The GGC’s targets lapsed in 2014 to 2015 but were revised in March 2018, so we are now reporting against these new commitments, for which MoJ has specific targets.

Our data is taken directly from utility meters, suppliers, and waste disposal contractors. Where we share buildings and utility supplies we base our consumption figures on the space occupied.

We do not have fleet vehicles and mileage of personal vehicles (grey fleet) used for business travel are recorded in expenses claims.

We are only required to report on back-office paper use, however the issuing of LPA packs to customers is a significant use of paper and we report on these as well. A new outsourced printing service has been introduced which has replaced in-office printing. Figures for this service are included in the paper use reporting.

At year’s end, our data is collated into the MoJ’s departmental annual report and accounts.

The impact of COVID-19

The impact of COVID-19, with the majority of staff working from home, has significantly changed the waste, water and travel figures. OPG has met the targets for this year, however, these should not be used for future benchmarking due to the unprecedented nature of the year.

Our estates information

OPG occupies estate in Birmingham and Nottingham. The year 2017 to 2018 figures set the baseline against which future years will be measured internally, after many years of expansion and changes.

OPG’s team of five in Petty France are not included in this report as figures for this site are reported by MoJ directly.

Our targets

The GGC targets and OPG’s performance are set out in the tables below.

As in previous years, OPG has not met the paper target due to the ongoing increase in workload and headcount since the baseline years. These areas are discussed in detail below.

We have however met the carbon dioxide emissions and the volumes of waste sent to landfill targets.

There were no domestic flights recorded.

Please note, that comparison of these tables below to previous years should take into account changes of baseline years.

| Greening Government Commitment |

MoJ target to 2020 | Our position 31 March 2021 |

Outcome |

| Greenhouse gas emissions | 38% reduction from 2009 to 2010 | 70% reduction | Met |

| Domestic flights | Reduce domestic flights by 30% vs 2009 to 2010 | No domestic flights were made | N/A |

| Waste | Total waste 31% reduction against 2015 to 2016 | 21% decrease | |

| less than 10% to landfill | 0% | Met | |

| Increase recycling and exceed 2015 to 2016 levels (59%) | 100% | Met | |

| Water | 4% reduction against 2014 to 2015 | Water consumption readings not reported due to COVID-19. Please refer to water section | |

| Paper | 50% reduction against 2009 to 2010 | 160% increase in absolute terms, 70% fall in use per case | Not met |

Total consumptions and emissions figures, along with expenditures where available are shown below

| CO2 sources | Amounts | Tonnes CO2e | Expenditure |

| Gas (scope 1) | 570,000kWhr | 99 | £17,000 |

| Electricity (scope 2) | 807,000 kWhr | 187.5 | £172,600 |

| Travel (scope 3) | |||

| Rail (inc. London Underground) | 6,575km | 0.247 | £2,200 |

| Grey fleet (cars) | 4,534km | 0.76 | £1,600 |

| Air | N/A | N/A | N/A |

| Finite resources | Amount | Expenditure | |

| Waste | Total | 41.8 tonnes | |

| Recycled | 70% | ||

| Energy from waste | 30% | Unknown as part of the service charge for the building | |

| Water | Water consumption readings not reported due to COVID-19. Please refer to water section | Unknown as part of the service charge for the building | |

| Paper | 9,420 reams (back office) 23,000 reams outsourced 23,000 as LPA packs |

£25,000 |

Waste

We have zero to landfill waste disposal contracts in our Birmingham and Nottingham offices, so all of our waste was recycled or reused by conversion to fuel oil. All of our paper and cardboard waste was recycled in a closed loop.

Our total waste generated is difficult to measure against previous years, as the vast majority of staff are working from home due to COVID-19 restrictions, so there was much less waste generated in the office, for example, food waste.

In our 2019 to 2020 annual report, it was anticipated that the effects of separated waste streams at each of our offices would be reported this year. Again, due to COVID-19 restrictions these figures have no validity in comparison to 2019 to 2020. It is anticipated that 2021 to 2022 will provide robust data for reporting.

Water

The previous targets for water use were set on a per-FTE basis. The new targets are for an absolute reduction. Due to continuous expansion of headcount since 2014 to 2015 our water use has increased by 60% to March 2020, missing the target. Due to COVID-19 restrictions water meter readings are not a meaningful recording of water use by OPG this financial year, as our buildings have shared occupancy and have been occupied at different rates for differing periods with only one main meter. This has made it impossible to estimate OPG’s water use. Replacements for antiquated and unreliable, leaky, fill and flush mechanisms on toilets have been installed in March 2021, and this will improve future water use.

Paper usage

As in previous years, OPG has missed the target of 50% reduction in back-office paper use, due to the growth of the business in the reporting and measuring period. 2020 to 2021 ended with use increasing by 185% on the 2009 to 2010 baseline. There was a 4% drop in paper use over 2019 to 2020, primarily due to COVID-19 reducing the number of LPA applications received. However, improved efficiencies in the outsourced printing systems and increased use of email, telephone and other digital contact routes have been utilised as well.

Travel

In 2020 to 2021 travel was almost eliminated by COVID-19 restrictions. A total of 6,500 kilometres were travelled by rail and 4,000 by private car, less than 1% of the previous year’s figures.

Restrictions made it difficult for Court of Protection visitors to supervise deputies by conducting face-to-face visits, in many cases these were carried out virtually. Travel between offices was effectively nil, and where necessary, was generally made by private car to ensure the safety of staff.

OPG has taken on board many of the lessons learned and alternatives provided by virtual meeting tools and it is anticipated that a significant amount of travel will be permanently eliminated in future years, replaced by online methods. It is anticipated that dedicated virtual meeting tools will be provided in the new Birmingham site.

We work closely with local councils and transport operators to enable staff to take advantage of heavily discounted bus, travel and park and ride facilities. The cycle to work scheme is heavily promoted and changing facilities and a secure cycle store are provided. Active travel options are also promoted as part of OPG’s wellbeing agenda to promote exercise and healthier lifestyles.

Other Utilities

Utility consumption has not fallen as much as expected, given 70% or more of OPG’s staff worked from home for the majority of 2020 to 2021. This is because business critical activities were maintained at both main sites, and the major costs of heating and lighting remained the same for one person or 1,600. There was some minor reduction in electricity use of 17% (24% reduction in CO2 emissions due to greening the grid) on 2019 to 2020 due to closing off unused floors and wings, and reduced power use by laptops on site.

Only our Birmingham office uses gas. Due to meter recording issues it is estimated that gas use is the same as 2019 to 2020 at around 570,000.

A project to replace all the old fluorescent tube lights at Embankment House was completed in March 2021, which will reduce OPG’s electricity and CO2 by 3% annually with a pay-back time of 4.5 years.

Embedding sustainability in our future

COVID-19 accelerated many changes to improve flexibility in how we work. The ability for the majority of staff, including OPG’s call handlers to work from home allowed for increased flexibility in working patterns, reduced demand for office space, reduced commuting and improved work-life balance. It is anticipated that, while most staff will return to the office, the majority will spend some time working from home or in hubs.

The inability to travel between offices has demonstrated the effectiveness of remote collaboration tools and virtual meetings for most cases. While there will always be some need for in-person meetings and cross-site visits, the need for travel between offices should be vastly reduced.

There were no in-person events held this year. However, messaging and communications were maintained, and lessons learned from external events mean that future events will have a virtual aspect, allowing even more staff to join in or catch up at a time which suits them.

Nick Goodwin

Chief Executive and Accounting Officer

13 July 2021

Accountability Report

Corporate governance report

Introduction

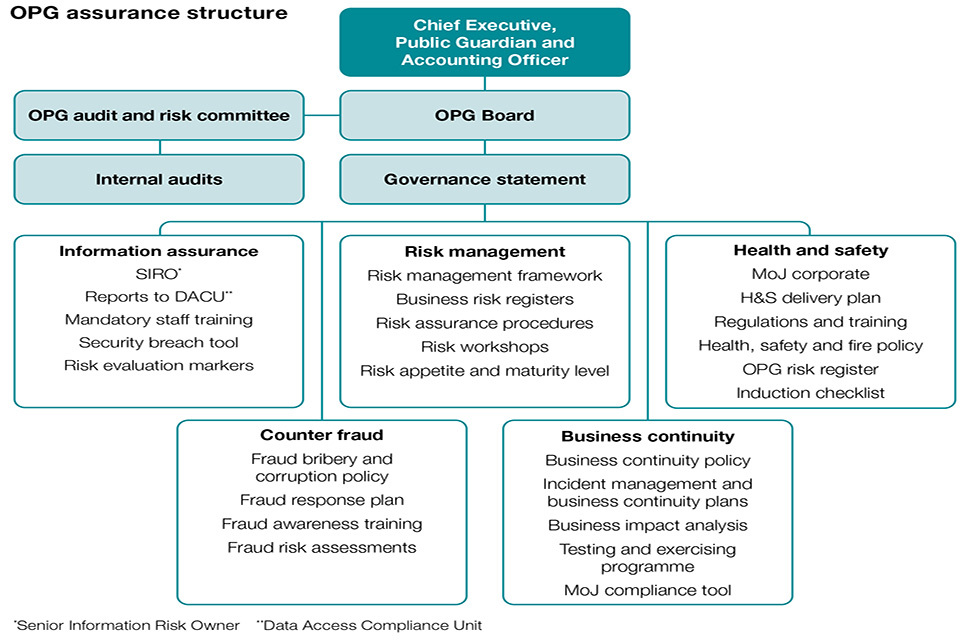

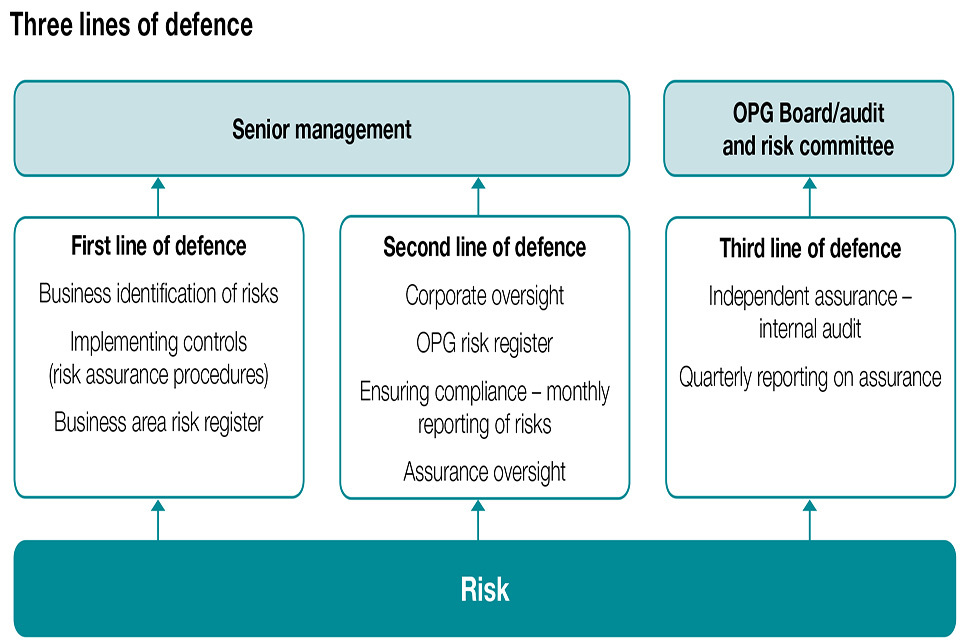

The purpose of the corporate governance report is to explain the composition and organisation of the entity’s governance structures and how they support the achievement of the entity’s objectives.

Our framework document sets out the arrangements for governance, accountability, financing, staffing and operations.

As chief executive and accounting officer for OPG, I am responsible for OPG’s use of resources in carrying out its functions as set out in the framework document. Managing Public Money, as issued by HM Treasury, also sets out the responsibilities of an accounting officer.

As accounting officer, I am personally responsible for: safeguarding the public funds for which I have charge, ensuring propriety and regularity in the handling of public funds, and day-today operations and management of OPG. In addition, I must ensure that OPG as a whole is run in accordance with the standards, in terms of governance, decision making and financial management.

My report outlines the governance arrangements in place to manage risks to the achievement of OPG’s agreed objectives and targets. It also provides effective oversight and control over OPG’s resources and assets. It includes:

- directors’ report

- statement of accounting officer responsibilities

- governance statement

Directors’ report

Introduction

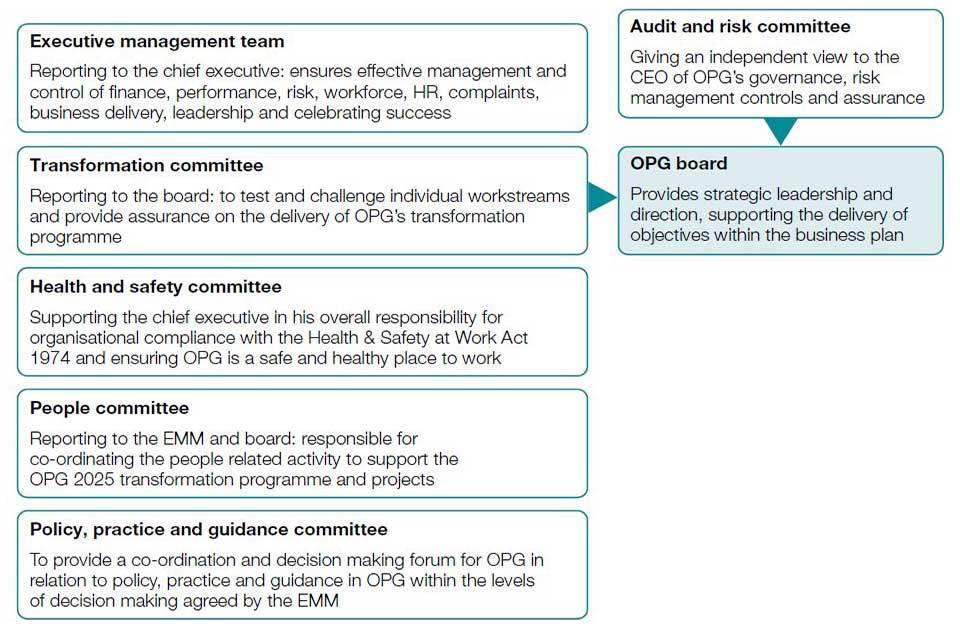

The structure of the OPG board, the audit and risk committee (ARC) and the executive team are given below. They are responsible for setting OPG’s strategic direction and monitoring performance against agreed objectives.

Statement of directors’ interests

Non-executive directors (NEDs) are required to declare any directorships and conflicts of interest on appointment. All board members are also required to declare any conflicts of interest before the start of each meeting.

There were four declarations of Interest from 1 April 2020 to 31 March 2021:

- Shrin Honap: made declaration at OPG Board on 1 April 2020 – appointed as NED at Low Level Waste Repository Ltd (LLWR)

- Shrin Honap: made declaration at OPG Board on 5 Jan 2021 – appointed to the Pensions Determination Panel from 1 Jan 2021 (a needs role not a NED role)

- Alison Sansome: declaration made at 1 Sept 2020 OPG Board – now a member of the Code Adjudication Panel (CAP) for the Phone-paid Services Authority (PSA)

- Anne Fletcher: declaration made at 19 Jan 2021 audit and risk committee – appointed to the Pensions Determination Panel

Personal data incidents

Consideration was given to whether any incident involving personal data was so serious that it should be reported to the Information Commissioner’s Office. There have been zero incidents.

The governance statement considers further information assurance and data security practices in OPG.

Health and safety

OPG acknowledges its legal responsibilities in relation to the health, safety and welfare of its employees and for all people using its premises.

The membership of the OPG Board consists of:

Public Guardian/Chief Executive (chair), Nick Goodwin

Five OPG senior civil servants

Julie Lindsay

Jan Sensier (on secondment from March 2020 to support MHCLG with COVID-19 response)

Chris Jones (acting Deputy Director from April 2020)

Sunil Teeluck (on secondment from August 2020 to 3 May 2021)

Stuart Howard (Interim Deputy Director from August 2020. Acting deputy Director from 3 May 2021)

Five non-executive directors

Alison Sansome

Shirnivas Honap

Karin Woodley

Anne Fletcher (appointment ended 31 Jan 2021)

Dr Jackie Craissati (appointed from 1 Feb 2021)

MoJ representative

Abigail Plenty/Laura Beaumount (job share)

MoJ finance representative

Paul Henson

Georgia Bottomley

Statement of Accounting Officer’s responsibilities

Under Section 7(2) of the Government Resources and Accounts Act 2000, HM Treasury has directed OPG to prepare for each financial year a statement of accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of OPG and of its income and expenditure, statement of financial position and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis

-

make judgments and estimates on a reasonable basis

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the financial statements

-

prepare the financial statements on a going concern basis

-

confirm that the annual report and accounts as a whole is fair, balanced and understandable and take personal responsibility for the annual report and accounts and the judgements required for determining that it is fair, balanced and understandable

The principal accounting officer of the MoJ has designated the chief executive as accounting officer of OPG. The responsibilities of an accounting officer, including responsibility for the propriety and regularity of the public finances for which the accounting officer is answerable, for keeping proper records and for safeguarding the OPG’s assets, are set out in Managing Public Money published by HM Treasury. As the accounting officer, I confirm that I:

- have taken all the steps I ought to have taken to make myself aware of the relevant audit information

- and to establish that OPG’s auditors are aware of that information

So far as I am aware, there is no relevant audit information of which the auditors are unaware.

Nick Goodwin

Chief Executive and Accounting Officer

13 July 2021

Governance statement

This statement explains how I, as accounting officer, have discharged my responsibility to manage and control OPG’s resources during the year. I went on secondment from 31 August to 2 November 2020 to support HMCTS COVID-19 response, leaving Julie Lindsay as acting as Chief Executive whilst also maintaining her role as COO. The responsibilities of Public Guardian role remained with myself. This statement describes OPG’s governance arrangements and provides an assessment of how I have balanced risk, assurance and control throughout 2020 to 2021.

Introduction

The MoJ Permanent Secretary is the department’s Principal Accounting Officer. The responsibilities of an Accounting Officer are set out in chapter 3 of Managing Public Money, issued by HM Treasury. The Principal Accounting Officer designated me as the Accounting Officer for OPG’s administrative expenditure, and defined my responsibilities and the relationship between OPG’s Accounting Officer and the Principal Accounting Officer.

The Public Guardian is a statutory office holder appointed by the Lord Chancellor and Secretary of State for Justice under Section 57 of the MCA 2005. This statutory role is combined with the administrative role of the chief executive of OPG and accounting officer for the agency, as set out in the MoJ/OPG framework document.

The Public Guardian is assured that the processes and controls over the activities of all business areas are robust and effective and can be evidenced. Specifically he has had regularly monitored financials, risk and performance of the agency, implementing opportunities for improved customer service. The board membership has remained the same and can also provide assurance for this period of time. There have been no departures and our governance framework takes into account the code of practice.

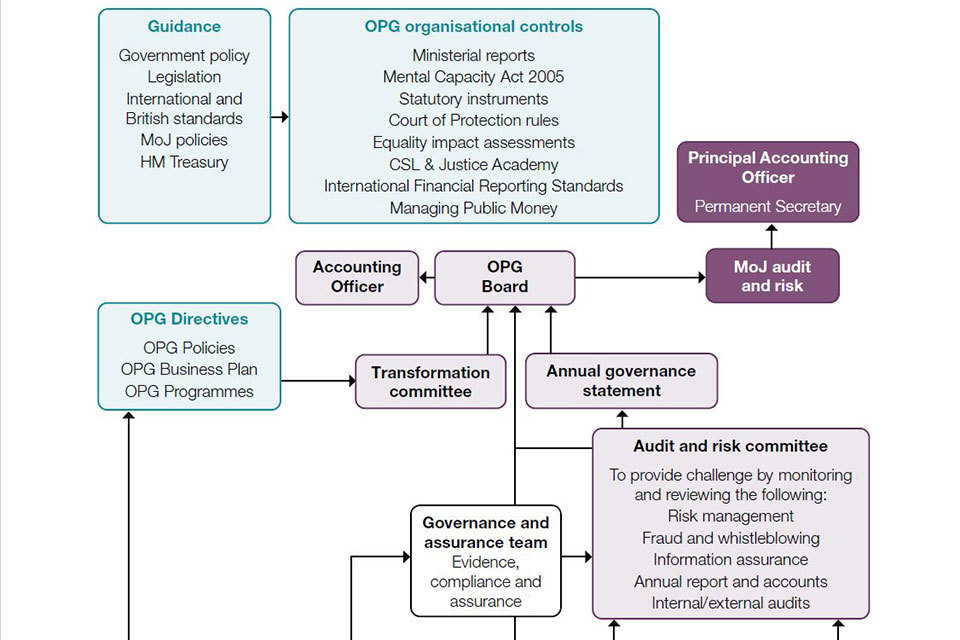

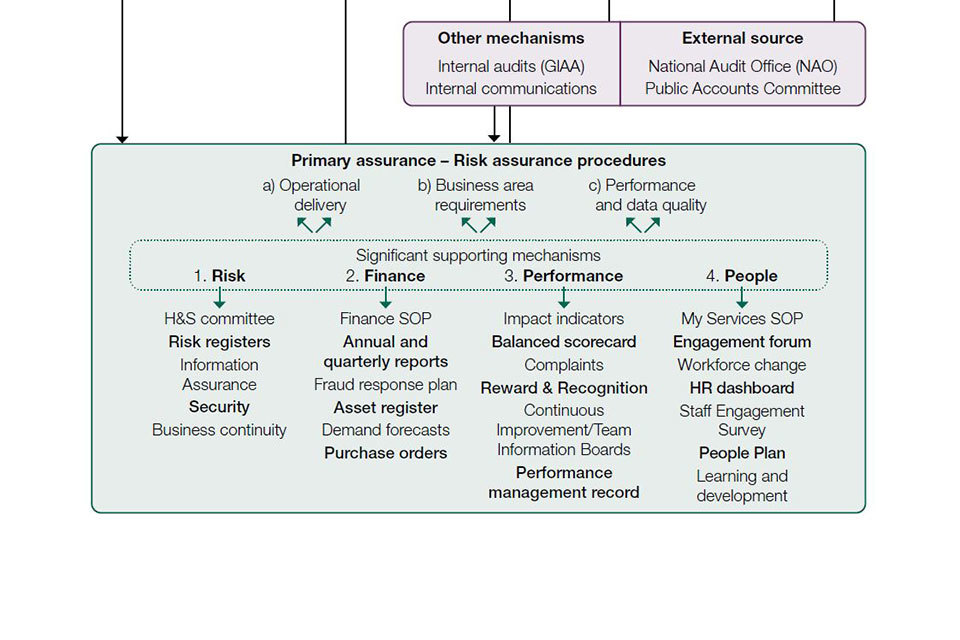

Governance framework

The effectiveness of OPG’s governance arrangements, risk management and the system of internal control are set out within this governance statement. This Governance Framework has been reviewed during the year against the relevant codes such as Corporate Governance in Central Government Departments: Code of Best Practice to ensure it is fit for purpose. To reinforce the importance of this within the agency, the executive responsible for corporate governance has undertaken the CIPFA Diploma in Corporate Governance during 2020 to 2021.