OPG annual report 2019 to 2020 - HTML version

Updated 27 April 2021

Applies to England and Wales

Annual report presented to Parliament pursuant to Section 60 of the Mental Capacity Act 2005 Accounts presented to the House of Commons pursuant to Section 7 of the Government Resources and Accounts Act 2000 Accounts presented to the House of Lords by Command of Her Majesty Ordered by the House of Commons to be printed on 14th July 2020

Performance report

Overview

The purpose of the overview is to give a summary about the Office of the Public Guardian (OPG), our purpose, the main barriers to the achievement of our aims and how we have performed during the year.

The overview includes:

-

the Chief Executive’s statement, giving his perspective on our performance in 2019 to 2020

-

a description of OPG’s purpose, what we do, our customers and stakeholders, our relationship with the Ministry of Justice (MoJ), and the key risks and issues we managed during the year

-

a performance summary, outlining how we performed against our service delivery aims

Our performance and accountability are explained in greater detail in the remaining pages of the report.

The main risks managed within the OPG in 2019 to 2020 included:

-

managing the impact of Brexit on the government’s priorities, and OPG’s transformation programme, meant that OPG could not advance its OPG 2025 programme as planned

-

ensuring that OPG had both the required levels of staffing and the skills needed to take its work forward

-

responding to the emerging challenge of the coronavirus (COVID-19) outbreak

Nick Goodwin Chief Executive and Public Guardian for England and Wales

Statement from the CEO

I am pleased that in my first report at OPG I am able to present a positive picture of the year – although we continue to face challenges, we have achieved the majority of our aims and targets and there is much to be proud of in how we have done so.

Given we strive to put user’s needs at the heart of all we do at OPG, it is gratifying that despite significantly increased workloads, we have managed to meet most of our customer service indicators. We are registering our powers of attorney in an average of 40 days, reviewing annual deputyship reports within 15 working days and achieving over 80% in our power of attorney customer satisfaction surveys.

This year we implemented the Guardianship (Missing Persons) Act 2017 and launched a new service which aims to support people at a very difficult time in their lives. This change required a significant amount of collaborative working between MoJ colleagues, OPG staff and key stakeholders.

Since joining the OPG in July 2019, I have been particularly proud of and impressed by the passion and focus of our staff. That is why I am particularly pleased that our staff engagement scores have improved. Across all 10 key indicators of the annual People Survey we saw increases, including employee engagement by 3% (now 62%), and inclusion and fair treatment by 5% (now 74%).

One of our key performance challenges this year was faced by our legal team. Due to rising workloads, recruitment challenges and team changes, the outstanding workload increased. Over recent months, teams across OPG have been working to better support this work, and while our headline indicators will take some time to improve, we are now in a much better position for the coming year.

Towards the end of the year we have faced the considerable challenge of continuing to provide our services, many of which are paper-based, against the background of COVID-19. I am very proud of how the organisation has pulled together to continue to deliver our core services during this time – we have innovated at pace to introduce new ways of working that will provide benefits for both staff and users now and into the future.

Of course, there remains much we want to improve on as an organisation, both in terms of improving on our performance and in developing the services people will need in the future. As the needs of society change, and as technology provides us with opportunities to do things better, we must develop, refine and improve our services. Our OPG 2025 transformation programme will help us adapt to meet these expectations and I am committed to continuing to pursue our ambition of a fully digital lasting power of attorney (LPA) over the coming year.

It is an exciting time to be at OPG. There is much work to be done to build on the considerable achievements of my predecessor, Alan Eccles CBE.

Nick Goodwin Chief Executive and Public Guardian for England and Wales

About the Office of the Public Guardian

Introduction

The Public Guardian is appointed by the Lord Chancellor under Section 57 of the Mental Capacity Act 2005 (MCA). As the Chief Executive and Accounting Officer of the OPG, the Public Guardian is personally responsible to the Lord Chancellor and Secretary of State for Justice for the effective operation of the agency, including the way the agency spends public money and manages its assets.

The Public Guardian is supported by OPG in the delivery of his statutory functions under the MCA and the Guardianship (Missing Persons) Act 2017.

The Public Guardian’s responsibilities extend throughout England and Wales. Separate arrangements exist for Scotland and for Northern Ireland.

The government ministers responsible for OPG in this reporting period were:

-

The Right Honourable David Gauke Lord Chancellor and Secretary of State for Justice (until July 2019)

-

The Right Honourable Robert Buckland QC Lord Chancellor and Secretary of State for Justice (from July 2019)

-

Edward Argar MP, Parliamentary Under Secretary of State for Justice (until July 2019)

-

Wendy Morton MP, Parliamentary Under Secretary of State for Justice (between July 2019 and February 2020)

-

Alex Chalk MP, Parliamentary Under Secretary of State for Justice (from February 2020)

As an MoJ executive agency, alongside HM Courts and Tribunals Service (HMCTS), HM Prison and Probation Service (HMPPS) and the Legal Aid Agency (LAA), our aims are in line with MoJ’s single departmental plan. We act to ensure the best possible service for users by working to make our services efficient and more accessible, through policies driven by evidence.

What does OPG do?

OPG was established in October 2007. We support and enable people to plan ahead for both their health and finances to be looked after should they lose capacity. We also safeguard the interests of people who may lack the mental capacity to make certain decisions for themselves.

We are responsible for:

-

registering lasting and enduring powers of attorney (LPA and EPA)

- supervising deputies appointed by the Court of Protection (CoP)

- supervising guardians appointed by the High Court

- maintaining the public registers of deputies, guardians, LPAs and EPAs and responding to requests to search the registers

- investigating representations, complaints or allegations of abuse made against guardians, deputies and attorneys acting under registered powers.

Our customers and stakeholders

We serve several types of customers and stakeholders, including:

- donors – people who have made an LPA or EPA to protect their welfare or finances should they lose capacity in the future

- attorneys – people who have been appointed by donors to manage their welfare or finances should they lose capacity in the future

- clients (known as ‘P’) – people who have lost capacity and whose welfare or financial affairs are subject to proceedings before the CoP

- deputies – lay or professional individuals or authorities (such as solicitors or local authorities) who have been appointed by the CoP to manage the welfare or finances of a client

- missing persons – people who have been reported missing and whose affairs are being managed by a guardian appointed by the High Court

- guardians – individuals who have been appointed by the High Court to manage the property and financial affairs of a person who is absent or has gone missing

- other stakeholders – relatives of a client or donor, GPs or other health professionals, charities, and the legal sector

Key issues, risks and uncertainties

The key risks that we faced in 2019 to 2020 are outlined here. Against this backdrop we continued to deliver our day-to-day business.

In 2019 to 2020 OPG has had to deal with the impact of Brexit on government priorities and legislative programme.

This has impacted on OPG’s ability to take forward its work on a fully digital LPA as quickly as it would have wished. Key to the OPG has also been managing the cost recovery risk - one that was successfully mitigated during the year. Towards the end of the year the agency also had to deal with the COVID-19 outbreak, which added considerable uncertainty – but which will have a greater impact in the year ahead.

Performance analysis

Measuring our performance

During 2019 to 2020 we have continued to review our performance measures, ensuring the underlying measures drive the day-to-day business and are fit for purpose, measuring the right information in the right way. We have developed an improved balanced scorecard that is better placed to help inform business decisions and fully supports our customers and the delivery of our key aims and objectives. OPG uses its Key Performance Indicators (KPIs) to monitor the performance within the organisation and its risk management process helps to highlight key issues in relation to delivery of those KPIs and the wider performance within the organisation. Risk management is also used within OPG to help manage uncertainty, One key uncertainty that needs to be managed throughout the year is incoming workload - as the agency is funded from income and level of workload also impacts on the ability to meet KPIs.

How have we performed?

OPG has an important set of customer indicator targets and performance against these is given below, along with the key workload levels for the past financial year. More detail on the full range of targets, performance and how they are measured can be found in the performance annex. Performance has been maintained in most areas against an increase in workload, with a continued focus on delivery to users and making sure that our services are of the level expected. At the same time, we have strived to improve our services – both the service itself and the way that people access the services.

Some targets have proven harder to meet than others. For instance, we have not achieved our aim to complete all investigations within 70 days. More information on what actions we are taking to achieve this target and prioritise urgent cases can be found here.

Our legal team also faced major performance challenges during 2019 to 2020 due to rising workloads, and difficulties recruiting lawyers, the need to train new lawyers and changes in working practices have led to increasing levels of outstanding work. These challenges impact on other areas of the business such as investigations. To deal with this effectively our legal team has worked with other parts of the business to determine the priority of the work we submit to court, such as situations where we are seeking removal of deputy/attorney, or court applications dealing with potentially fraudulent LPAs. This has ensured that the most urgent cases are dealt with first.

Taking in a significant number of new lawyers, unaccustomed to both the OPG and the Civil Service, has meant a change in dynamic and direction. We have increased scrutiny of the work being submitted for court action and are developing our feedback loops to the business to improve the quality of the work. We are also working with other teams to implement efficiencies to our processes.

The efforts towards reducing the level of outstanding work are ongoing and we expect this to last well into 2020 to 2021, however the changes we are implementing will make us more robust in the future.

In the OPG business plan for 2019 to 2020 we had two key areas of work – OPG 2025 and the OPG business as usual (BAU). We have done a considerable amount of work in both areas – with some of the highlights given below.

Within the OPG 2025 programme we have taken forward work on:

-

research to understand what our users and potential users need from an LPA

-

‘Use an LPA’, which allows our users to use an electronic version of an LPA – currently at private beta stage

-

our case management system, to the point where supervision cases can now be undertaken on the new system, as well as the registration of LPAs

Within the BAU sphere we have:

-

continued to work to achieve our targets and put resources into those areas where performance has not been to target

- published our revised Welsh Language Scheme following approval by the Welsh Language Commissioner

-

continued to look at how we can get people into the OPG from a wide range of backgrounds – more detail of our work on social mobility can be found here

-

produced a learning and development strategy and programme for the OPG and launched this within the agency

- launched the processes for the supervision of Court Appointed Guardians for missing persons

|

2.3% As at 31 March 2020 we were supervising 60,793 deputyship orders, an increase of 1,385 from the end of 2018/19 (59,408) |

|

917,550 Was the number of applications to register LPAs and EPAs received in 2019 to 2020, an increase of 81,600 on 2018 to 2019 (835,950). |

|

4.7 million We ended the year with over 4.7 million current PoAs on the register. |

Our achievements

|

40 days Average actual clearance time for power of attorney applications Target: 40 days |

|

38 days Average time to obtain annual reports Target: 40 days |

|

11 days Average time to review annual reports Target: 15 days |

|

89% Customer satisfaction survey % with PoA services (very or fairly satisfied) Target: 80% |

|

77% Customer satisfaction survey % with deputyship services (very or fairly satisfied) Target: 80% |

|

95% Customer satisfaction survey % with digital services (very or fairly satisfi ed) Target: 80% |

|

98% % of safeguarding risk assessments carried out within 2 days Target: 95% |

|

74 days daysAverage time to conclude investigations Target: 70 days |

|

92% % of calls answered within 5 minutes Target: 95% |

|

88% % of complaints fully responded to within deadline Target: 90% |

OPG 2025 transformation programme

Our transformation programme, OPG 2025, is about changing how we provide services so we can improve lives together. It’ll help us to make our long-term aims a reality. We’ll make better use of digital products, services and smarter ways of working to free up our time to offer more support, advice, better outcomes for everyone and a more efficient service.

A digital future will make our services more available, more flexible and simpler for customers to use in a way that is affordable and convenient for them. We’ll do this while making sure our services are accessible to all of our customers.

In 2019 to 2020, work progressed to help us towards achieving our six goals. Our goals will help us to put in place the foundations for OPG’s future. In the last year we have:

- Launched OPG’s first ever marketing campaign in Islington and Leeds, receiving over 5,000 visits to our ‘your voice, your decision’ campaign site in the first six months

- Carried out research to explore the potential for a fully digital LPA service.

- Built and tested the ‘use an LPA’ digital service to help attorneys use their LPA more easily.

- Started research to look at the impact LPAs have had on our society and how we could further develop services to meet the needs of our customers.

- Successfully migrated our data onto our LPA case management system, shutting down old systems and reducing costs.

Our 2025 programme will be highly dependent on securing the necessary legislative change needed to deliver a fully digital LPA and digital resources. The COVID-19 pandemic might mean we have to reprioritise in year.

Powers of attorney

Current work

My key role is to be a part of a service that is offered to help vulnerable people with registering a document which is so important and vital in their lives. I have a great team which works together and staff engagement is highly encouraged at all times

Nisba Bibi – Stage One Administration Officer

Powers of attorney (PoAs) are vital to empowering people to plan for the future while they have the capacity to do so. EPAs were replaced by LPAs when the MCA 2005 came into force in October 2007 and can no longer be made. Those that were made before this time can still be registered with the OPG when necessary. Registration of PoAs is an important service for the general public and so service delivery on a day-to-day basis is as important as continued improvement and development of those services.

A power of attorney should be a standard consideration, along with a pension, bus pass and making a will.

Dr Johanna Roberts

When I did a lasting power of attorney for myself, I did it online and all on a Sunday morning

Mr Roger Payne

The main customer service targets in this area – registering PoAs within 40 days and answering calls within 5 minutes – are user-focused, and performance has been maintained against all of these whilst workloads have increased (more detail on these targets is given in Performance Annex). The increase in workload is higher than in previous years (9.76% increase this year compared with 8.42% last year).

Our LPA registration process involves several different areas that aren’t directly covered by targets but that do impact on our users. Our casework function, for example, reviews PoAs and works with donors and attorneys to ensure the documents can be registered. If a PoA cannot be registered because of errors on the document, our casework team can support donors to submit a correct document that can be registered.

The service has faced two main challenges in 2019 to2020:

-

The ability to maintain a consistent overall staffing profile, which has been a particular issue within our Power of Attorney Services, where staff leaving OPG to move to other areas of the Civil Service and within the agency is higher than other areas of OPG.

-

The wish to drive uptake of LPAs with the fact they are still paper based - so that efficiencies in processes cannot fully eliminate the need for additional staff to process increasing caseloads.

To address the first of these issues, analysis of exit interviews is providing more detailed intelligence and robust recruitment planning has been implemented and monitored. OPG’s Centralised Recruitment team now provides a dedicated resource for recruitment across OPG and is able to anticipate and respond to changing workforce needs. More information on how we have improved our recruitment processes this year is available[here]{#people).

To address the second issue, we are making progress with our 2025 strategy, which aims to provide fully digital LPAs, and we have also had multiple users test ‘Use an LPA’ in private beta, which will support full rollout in 2020 to 2021 with the aim of providing a simpler customer journey.

‘Use an LPA’ will allow our donors and attorneys to share a summary of their LPA information to organisations including banks, building societies, utility companies, hospitals and other government departments in a digitally instant way.

Service improvements

At the same time as delivering the day-to-day business we have continued to look at how we can improve our services for our users.

-

We have removed reliance on legacy IT systems, which now allows for more streamlined and efficient customer interactions. Decommissioning our legacy casework management system will save £85,000 a year in licensing costs and enable us to help keep our fees as low as possible.

-

We have developed a robust quality checking strategy in place across our PoA Service to monitor and feed back on quality issues. Since implementation, overall quality of LPAs registered correctly has improved from 91% to 96%.

-

PoA Service, like many areas of OPG, has implemented smarter working, and has seen an increase in staff working from home following changes to business processes. This greater flexibility has had a positive impact on staff morale, and has realised increased productivity levels and will, in time, allow OPG to reduce its office footprint and so reduce overheads.

Flexible working has enhanced my life. Having a disability, it helps with my work life balance and helps me manage in my daily life.

Caroline Brown – Acting Casework Unit Manager

- OPG has continued to work with MoJ policy colleagues to pursue OPG’s ambition to introduce a fully digital LPA as part of the OPG 2025 programme. This is also affording an opportunity for review of current and future paper based processes to identify any opportunities for efficiencies and additional safeguards.

Customer feedback

A Contact Centre advisor took a call from an anxious customer who was apprehensive with computers and using our “Digital Assist” facility. She was grateful to the advisor who was helping her, commenting on how sensitively they had helped her to overcome her anxiety. She also expressed how caring OPG Contact Centre staff seem when she calls and how they always have just the right amount of time to help without rushing.

Supervision

Current workload

When someone loses capacity and they have not appointed an attorney, the Court of Protection will appoint a deputy to make decisions on their behalf. As the person does not have a say in choosing who acts on their behalf these deputies are supervised by the OPG.

The supervision caseload has been very consistent over the year – it ended 2019 to 2020 on 60,793 deputyship orders compared to 59,408 in 2018/19. Excellent performance throughout the year means we have achieved all performance indicators, despite some of the challenges we have faced.

I am quite a new starter and was not sure what I would find working for the Civil Service would be like but I am enjoying it. I am surprised that in such an administrative job I still do feel what we do here is a vital part of helping people live the best life they can at every stage. I previously did a lot of volunteering work with vulnerable people and as I look through the cases here at OPG I really recognise all the different kinds of characters and the deputies who work so hard to support people. It is great to be part of ensuring all these people are cared for, whatever their very individual needs are.

Beverly Robinson, Supervision Case Manager

As part of the supervision process, deputies complete an annual report that OPG reviews. This review ensures that there are no concerns with the report, the spending and decisions on behalf of the client have been accounted for, and that they were made in their best interests. Where there are concerns the deputy will be contacted for further information and if it is felt necessary a visitor may be sent to gather that information or an investigation may be started. All of this forms part of the OPG safeguarding regime.

66.98% of all reporting lay deputies used the “complete your deputy report” service to submit their annual reports electronically and we have stopped issuing paper reports as the norm for new deputyship cases.

The service has faced the following challenges this year:

-

As with PoA Service, although the staff turnover has improved compared to last year, the ability to retain an overall staffing profile continues to be a challenge. In supervision and investigations teams we have had a turnover of 12.7% over the year – with many of these staff leaving to take up roles in other government departments. This has been particularly the case at Bands D and C within the Nottingham teams.

-

The planned migration from a legacy IT system to a new case management system was delayed, which meant for the majority of the year we were still working with a legacy system that is not easily adaptable to the processes we have in place. It is planned that the migration will happen within 2020 to 2021. The date will be dependent on the business impact of COVID-19.

Service improvements

-

We are developing improved working practices with the Court of Protection in order to ensure court orders are served on OPG promptly so we can begin supervising deputies as soon as they are appointed, reducing the risk to the client and improving safeguards.

-

Improvements in smarter working practices have led to an increase in flexibility and productivity.

Feedback from customers

Extract from a visit report:

She stated that whenever she has any queries, she has felt well supported by the OPG, and made a special mention about a staff member in the Lay Deputyship team, who she said has been very helpful.

Missing persons

In July 2019 OPG began the supervision of guardianship orders under the Guardianship (Missing Persons) Act 2017, ensuring guardians are acting in line with the authority provided to them by the High Court and decisions are made in the best interests of the person for whom they are appointed to act. Since launching in July, we are now supervising two guardianship orders.

There was a significant amount of work involved in the implementation of this new legislation and many teams within OPG and across MoJ were heavily involved. There has been engagement with key stakeholders, including financial institutions, regulators and charities, to make sure that the service is developed to meet the needs of this new group of users.

The missing persons project board, including OPG staff, was chosen by judges as the winner of the MoJ’s Working Together Award, in recognition of its outstanding work in setting up OPG’s Guardianship service.

Investigations

The work I do as an investigator for the Office of the Public Guardian is an essential role in the overall safeguarding agenda for ‘adults at risk of abuse’. We work closely with partner agencies and members of the public to protect adults who may not have the capacity to make their own decisions. The work is immensely rewarding because you know ‘adults at risk’ will be in a safer position as a result of your work.

Anna Freeman, Investigator

Investigations have continued to rise within OPG from 2,883 in 2018/19 to 3,099 in 2019 to 2020, but this increase is in line with the increase in PoAs and court orders on the register.

Due to an increase in investigations and a high staff turnover, we did not achieve our aim of concluding all investigations in an average of 70 days – the average achieved was 74 days. We closed 3,099 investigations this year in comparison to a clearance of 2,617 last year with the same staffing levels as 2018/19. We have continued to look for improvements in our processes throughout the year to enable us to speed up investigations while still giving each case the time it needs to be resolved properly.

To safeguard our customers, we prioritised the reduction of our outstanding investigations (those over 70 days) and decreased these by 53%. This impacted on our ability to meet our clearance target of 70 days, but has safeguarded our vulnerable customers. While concentrating on our oldest cases and clearing existing cases, we ended the year with a workload of 691 investigations – a decrease of 27% from the same time the year before.

- The percentage of investigations that result in court action is 30.49%

- In the majority of cases, 53.44%, no action is taken

- 16.07% required additional measures short of court action to resolve any issues and get the attorneyship or deputyship back on track

The challenges that we have faced within our legal team has meant that we have experienced delays in taking cases to court. To deal with this effectively our legal team has worked with other parts of the business to determine the priority of the work we submit to court, such as situations where we are seeking removal of deputy/attorney or court applications dealing with potentially fraudulent LPAs. This has ensured that the most urgent cases are dealt with first.

Examples of outcomes of investigations

A case that did not go to court

Concerns were raised to OPG that an attorney was mismanaging the donor’s finances and had declined a care package recommended by the local authority. Additionally, a concern was raised that the donor originally lacked capacity to execute her LPAs.

The investigation did not identify misappropriation of the donor’s funds by the attorney but there were indications that the donor’s accounts were being mismanaged.

The attorney did decline a care package recommended by health care professionals, however, following a best interest meeting, the local authority was satisfied that the attorney had accepted their recommendations and that she was working with them to achieve the donor’s best interests.

Insufficient evidence was obtained during the investigation to establish that the donor lacked capacity to execute her LPAs.

The attorney was asked to re-account in three months’ time, to enable her to evidence that she was managing the donor’s accounts appropriately.

The attorney subsequently provided a full and satisfactory account, supported by documentary evidence, demonstrating that she is acting in accordance with the MCA 2005 and Code of Practice, and therefore the investigation was closed.

A case that involved the court

Concerns were raised to OPG that the donor’s care home fees and personal allowance were not being paid. The donor’s care home fees were in significant arrears and the donor was at risk of being evicted.

The local authority had therefore applied for funding to secure the donor’s place. The care home stated that the donor would benefit from regular personal allowance and informed the court of protection visitor that the donor was not able to have her hair done for her birthday due to lack of funds.

During the investigation the attorney did not provide a full account to OPG and continued to take cash from the donor’s account. There was no evidence to prove that the money was used to benefit the donor. The attorney had failed to account for £39,132.40 of cash withdrawals. Over 20% of the donor’s assets had been withdrawn and not spent on the donor.

There was a vast sum of money unaccounted for, but rather than an application to court to direct the attorney to account, an application was made to remove the attorney as the investigation found that the attorney was clearly not acting in the donor’s best interests or adhering to the MCA 2005 and Code of Practice.

The court subsequently removed the attorney and cancelled the LPA and appointed a panel deputy to manage the donor’s finances to include powers to investigate and recover the donor’s funds.

Mediation

From the end of 2018 throughout 2019, we carried out a pilot of using mediation in investigations in certain circumstances, in cases where the parties agreed to this. The pilot and evaluation is now complete. We will not be pursing the pilot further at this time as the findings demonstrated limited success in preventing cases going to Court. We will be sharing our findings publicly in the near future.

Visits

The most rewarding part of my work is visiting different people, with different life experiences from all walks of life. For me, the greatest challenge is to ‘give a voice’ to people who use our service and record their wishes and feelings as accurately as I can.

Barbara Joyce – Court of Protection visitor

Key to safeguarding are the visits that take place. The work that they undertake is varied – ranging from medical (special) visits to assess the retrospective capacity of individuals, visits as part of an investigation (both in relation to PoAs and deputyships); to more general visits to help ensure attorneys and deputies are acting in the best interests of the client. All of this helps to ensure that individuals who are potentially at risk are safeguarded.

This year there has been a greater demand for visitors than ever before, leading to more urgent visits and medical visits. Urgent visits now comprise 33% of the visiting profile, up from 29% in 2018/19. There has also been a 36% increase in medical visit commissions. The number of special visitor commissions compared to special visitors has decreased the team’s operational effectiveness in allocating such commissions in an expedient manner and receiving reports in time.

Given the increasing number of visits, OPG has continued to recruit visitors to allow us to meet the demand. Additionally, a visits strategy has been developed and agreed, and once implemented will benefit our clients.

Safeguarding

The main focus of our safeguarding activity has been the implementation of recommendations from the safeguarding study – in particular dynamic risk assessments – to ensure that OPG never fails to recognise and act on concerns where donors are potentially at immediate risk. “No wrong door” referrals have been implemented to ensure that local authorities are informed of all safeguarding concerns in cases where OPG does not have jurisdiction to investigate.

Examples of cases where we were unable to investigate, but ensured that concerns were passed on to relevant authorities:

-

Concerns were raised via a solicitor on behalf of a donor who noticed unauthorised transactions being made by his attorneys from his bank account. The attorneys removed his bank cards. The donor revoked his LPA as he retained capacity, but was then subjected to abusive and coercive behaviour from the revoked attorneys attempting to pressure him into reinstating them on a new LPA.

-

Concerns were raised from a donor who wanted to object to the registration of her LPA but has short-term memory issues. The donor felt coerced and pressured by her proposed attorney but felt she is still able to manage her own finances.

We are continuing to deliver the recommendations from the safeguarding study to ensure we can best support our customers and provide the best possible service.

We have continued to engage with external stakeholders, particularly local authorities, to explain OPG’s role in safeguarding vulnerable adults. We have carried out several stakeholder and safeguarding events over the year, as well as presenting at care and NHS events, which helped us establish new working relationships.

Below is a list of some of the stakeholder events where OPG has either presented or had a presence in order to raise awareness and strengthen its role in safeguarding vulnerable adults.

External event – presentations

| Delegates | |

| OPG Safeguarding Roundtables | 20 |

| National Trading Standards Wales Conference | 100 |

| National Safeguarding Conference | 120 |

| Safeguarding Adults Boards Wales | 45 |

| NHS Wales Safeguarding National Network | 15 |

| Health Care Plus Event | 100 |

| The Care Show | 100 |

| Caring UK Shows x 4 | 400 |

| Civil Service Operational Delivery | 250 |

External event – market stall

| Delegates | |

| NHS London Safeguarding Event | 500 |

| NHS Health and Care Expo | 5000 |

| Healthcare Plus EventExternal | 6000 |

Complaints

We manage customer complaints in accordance with our published complaints policy. This is a tiered complaints process – first tier complaints are considered by the business area responsible.

If a customer is unhappy with this response, the complaint can be escalated to the second tier and at this stage the complaint, and the way it was handled, is reviewed by the Public Guardian. If a customer remains unhappy, they can ask their MP to refer their complaint to the Parliamentary and Health Service Ombudsman (PHSO) for an independent review.

One case was formally accepted by the PHSO for full investigation this year.

Over the last year we have continued to focus on improving the quality of our complaints responses to ensure we are resolving issues at the earliest opportunities and learning lessons.

Feedback from the complaints peer reviews, which were carried out in the previous year, have informed our approach to a more consistent writing style across complaints. The tier 2 team carried out a trial of writing in a new way - ensuring our responses were clearer, easier to understand and contained more empathy. This trial has proved successful and we have received positive feedback from customers, as a result we have started to roll the style out across all complaints teams and this will continue over the next year.

An example of the style of letters before and after the change is below:

Before

I am sorry you have not received the payment. I can confirm that the £20 payment I authorised was to recognise the inconvenience we had caused you. I have investigated and unfortunately there was an issue that wasn’t addressed immediately for which I apologise.

I would like to assure you that the payment is being processed, and should reach you soon.

After

Thank you for your letter. I’m sorry you haven’t received the payment promised to you. I understand this must be frustrating, and I can understand why you would like clarification from us.

Your payments have been processed

I’m happy to tell you the £20 payment for the inconvenience we caused you has now been processed. This payment should reach you within the next 15 days.

What went wrong

After investigation I can see we failed to process your payment because of a technical mistake that wasn’t discovered immediately. This meant your payment wasn’t processed in the correct timeframe.

I have taken this matter very seriously, and would like to thank you for highlighting this issue with me. Please be assured I have taken this matter forward, and we will learn lessons from this. We will look at our processes, and make changes to ensure these types of mistakes don’t happen again.

Once again, I’m sorry for the continuing delays you have experienced, and thank you for your time and patience.

|

5,723 the number of complaints received 2019 to 2020 Compared with 6,013 in 2018 to 2019 A decrease of 290 |

|

88% Of complaints responded to in 10 working days Target: 90% |

|

7days Was the average responses time to a complaint |

|

4,564 complaints about LPAs in a caseload of 917,550 (0.5%) |

|

267 complaints about deputyships in a caseload of 60,793 (0.4%) |

Top 3 LPA complaints

- Delays in processing LPAs, delays in contacting customers and advising of issues with application

- Lost documents – LPAs and LPA sections misplaced or lost in the office

- Failure to follow procedure – making incorrect decisions on the case, not carrying out the correct actions

Top 3 deputyship complaints

- Concerns about the deputy – relatives/third parties unhappy with decisions of deputy on behalf of the client

- Contact with OPG – unhappy with quality of contact whether in writing or over the phone

- Letter content – customers unhappy with tone of correspondence, or the information contained in letter

Our people

We have done a significant amount of work around staffing and working with our staff to make OPG a great place to work.

We have seen significant improvements in the recruitment of staff this year. OPG’s centralised recruitment team now provides a dedicated resource for recruitment across OPG and is able to anticipate and respond to changing workforce needs. Throughout the year we achieved the following:

- Ran 87 recruitment campaigns for 463 posts, for which we received 7,674 applications

- Made 390 formal offers, 380 were accepted

- Achieved an 82% hire against target rate, an improvement from 71% in the previous year

- We have reduced the time it takes to hire a new staff member from 52 days in March 2019 to 42 days by March 2020

- The latest PoA Services rolling recruitment campaign was so successful that it filled immediate business resourcing requirements and generated a merit list sufficient for a further two operational recruitment phases

We have been carrying out exit interviews to provide insight as to how we can continue to reduce staff turnover and improve OPG’s attraction rate for potential employees. We are proud to have increased diversity in OPG’s workforce, meaning we are more representative of the society we serve.

OPG did not meet its apprenticeship target for 2020, however this was an MoJ-wide issue predominantly as a result of challenges with suppliers in the first half of the year and certain apprenticeship provision being withdrawn due to funding.

The sector based work academy helped me in many ways and was a perfect opportunity to start a lifelong career within the Civil Service. I feel privileged to have had the opportunity, OPG is a fantastic place of work with lots of opportunities for progression within the business.

Kerry Lyons, Administrative Officer

All OPG’s routes into work schemes, particularly OPG’s SBWA, provide existing OPG staff with opportunities to support the recruitment, learning and development of candidates recruited under these schemes. This includes conducting mock interviews during the recruitment process, coaching candidates through technical training and supporting candidate future development through mentoring.

Improving the staff engagement figures was an important focus for OPG this year and we were pleased that scores improved across all 10 key indicators of the annual People Survey. Employee engagement increased by 3% (now 62%) and inclusion and fair treatment improved by 5% (now 74%).

2017

- Inclusion and fair treatment 71%

- Bullying and harassment (number who said they had experienced) 19%

- Discrimination (as previous) 21%

2018

- Inclusion and fair treatment 69%

- Bullying and harassment (number who said they had experienced) 17%

- Discrimination (as previous) 21%

- Monthly Deputy Director Inclusion summits 2018

- Launch of Equality, Diversity and Inclusion Advisors

- Development of mandatory BHD awareness e-learning

- Launch of centralised BHD grievance investigation process

- Annual celebration of national inclusion week

2019

- Inclusion and fair treatment 74%

- Bullying and harassment (number who said they had experienced) 17%

- Discrimination 20%

2020

- OPG anti-BHD video exploring unwanted behaviours

- Launch of the Confide Advisor Network

- Review and gap analysis of Civil Service inclusion expectations

We regularly undertake engagement with the relevant trade union to discuss appropriate matters, with the trade union being able to raise issues to discuss should they wish to do so.

This year we launched a new learning and development guide and specific pathways to ensure that staff are aware of all the opportunities they can undertake to carry out their jobs and develop. We also introduced a new staff development advisor process, ensuring we are meeting the right learning needs for OPG staff. This has led to multiple new learning interventions including stress risk assessments and better conversations.

Following the implementation of our mental health and wellbeing strategies last year, we were extremely pleased to receive the MIND Gold award for supporting the mental wellbeing of staff.

As well as our missing persons team winning an MoJ award this year, we also had another award winner. Mohammed-Khaled Ahsan, who works as an operational delivery manager on the twilight shift in Axis, was the winner of the spotlight award. This category was decided by a staff vote across MoJ, and aims to recognise a person who changes things for the better.

Financial performance

Income forecasting

We have continued to strengthen our demand and income forecasting capabilities in the last year. We achieved a variance against the forecast income from powers of attorney of 2.8% and variance against forecast deputyship services income of 2.7%. As part of our collaborative partnership with MoJ Analytical Services, and central analytical teams within Finance Business Partnering, we now have statistically robust models in place for forecasting both demand for our services and the income we expect that demand to generate.

We review and update in-year demand and income forecasts as part of the monthly routines for financial and performance management, using the insight gained to model likely impact of internal and external environment changes.

Financial performance

This section provides commentary to support the Financial Statements and our performance during the past year. The Financial Statements are set out on pages 70 to 91. Note 2 to the Financial Statements here details the Fees and Charges for the income below, and notes 3-5 provides further details on the expenditure across OPG. Below are the key balances for OPG in 2019 to 2020.

100.7%

Cost recovery - No change

Power of Attorney income

Demand for PoA registrations increased until very late in the financial year before a reduction as the COVID-19 pandemic took hold

£68.1m An increase of 8.0%

Supervision income

Case volumes grew by 2.3% year on year but the growth was late in the year and weighted towards minimal fee cases

£10.6m - A decrease of 7.3%

Staff costs

Staff numbers increased to meet the increasing demand for OPG’s services, including investigations

£48.4m - An increase of 13.3%

Professional visitor reports

OPG conducted more visits than in previous years, particularly medical and urgent visits

£2.7m - An Increase of 10.2%

Estates costs

Despite increasing staff numbers, smarter use of the MoJ estate and increased use of remote working arrangements kept estates costs stable

£2.3m - Remained constant

In 2019 to 2020 OPG had a surplus of £557k this was primarily driven by the volume of new Power of Attorney applications. It is the third consecutive year, and the third time, that OPG has achieved a cost recovery close to the target of 100%. Demand for power of attorney registrations is a key driver for OPG’s financial performance. With the COVID-19 pandemic, OPG’s 2020 to 2021 demand forecasts have factored in a fall in demand for this service which has been reflected in the 2020 to 20 to 2021 budget setting.

Sustainability report

We are committed to reducing our impact on the natural world and to support our communities. To do this we measure our impact on the world and work to reduce our consumption of limited resources, emissions of greenhouse gases and unnecessary travel.

Data collection and scope of reporting

We report on utilities used, travel and waste generated. These are measured against previous years and in conjunction with the Greening Government Commitment (GGC) targets. The GGC targets lapsed in 2014/15 but were revised in March 2018, so we are now reporting against these new commitments, for which MoJ has specific targets.

Our data is taken directly from utility meters, suppliers and waste disposal contractors. Where we share buildings and utility supplies we base our consumption figures on the space occupied.

We do not have fleet vehicles, and mileage of personal vehicles (grey fleet) used for business travel are recorded in expenses claims.

We are only required to report on back office paper use, however the issuing of LPA packs to customers is a significant use of paper, and in the spirit of transparency we report on these as well. Estimations of the carbon emissions of completed LPA packs travelling via the post have also been made. At year end our data is collated into the MoJ’s departmental annual report and accounts.

Our estates information

The OPG occupies estates in Birmingham and Nottingham. The year 2017/18 figures set the baseline against which future years will be measured internally, after many years of expansion and changes.

OPG’s team of five in Petty France is not included in this report as figures for this site are reported by MoJ directly.

Our targets and achievements

The GGC targets and OPG’s performance are set out in the tables below. As in previous years the OPG has not met the total waste, water and paper targets due to the ongoing increase in workload and headcount since the baseline years. In the case of paper, although there is an increase in real terms, there has been a decrease in the amount of paper used per case – a fall of 70% since the 2009/10 baseline. The provision of a digital tool that can be used to complete LPA forms prior to signature has seen a significant drop in the number of packs OPG has sent out to our customers.

Our waste has increased but this is in line with both our increase in headcount and in workload within the agency. We look to recycle where we can – such as batteries and this year we have looked to recycle crisp wrappers for charity. We also look to separate waste in our buildings where we can.

Our failure to meet our targets on water is due to the increase in headcount since the baseline was measured in 2014/15. However, we are looking at ways to reduce the water use per FTE – and are currently investigating why our water use has increased in our Embankment House building.

We have however met the carbon dioxide emissions and the volumes of waste sent to landfill targets.

Overall our CO2 emissions from utilities have fallen by 61% since 2009/10. This is partly due to OPG’s actions as we moved to newer, more efficient buildings, as well as using much lower powered IT equipment since March 2018, and partly because of increased decarbonisation of the UK electricity supply. Our use of electricity and gas have fallen even though we have greater headcount – much of this down to servicing and managing of our heating and cooling systems – allowing for more efficient use.

As in previous years the number of domestic flights made is too low to allow meaningful comparisons between years, however four were made where train journeys would have been excessively long or meant travelling on the previous day.

Note that comparison of these tables below to previous years should take into account changes of baseline years.

| Greening Government Commitment |

MoJ target to 2020 | Our position 31 March 2020 |

Outcome |

| Greenhouse gas emissions | 38% reduction | 61% reduction | Met |

| Domestic flights | Reduce domestic flights by 30% vs 2009/10 | Four domestic flights were made, but numbers are too few to give meaningful comparisons | N/A |

| Waste | Total waste 31% reduction against 2015/16 | 160% increase | Not met |

| less than10% to landfill | 0% | Met | |

| Increase recycling and exceed 2015/16 levels (59%) | 100% | Met | |

| Water | 4% reduction against 2014/15 | 60% increase | Not met |

| Paper | 50% reduction against 2009/10 | 190% increase in absolute terms, 70% fall in use per case | Not met |

Total consumptions and emissions figures, along with expenditures where available:

| CO2 sources | Amounts | Tonnes CO2e | Expenditure |

| Gas (scope 1) | 540,187 | 99.2 | £17,000 |

| Electricity (scope 2) | 973,379 | 269.9 | £172,600 |

| Travel (scope 3) | |||

| Rail (inc. London Underground) | 1,045,450km | 48.9 | £279,733 |

| Grey fleet (cars) | 121,600km | 21.8 | £30,400 |

| Air | 3,700 | 0.58 | £417 |

| Finite resources | Amount | Expenditure | |

| Waste | Total | 74.5 tonnes | |

| Recycled | 70% | ||

| Energy from waste | 30% | This forms part of the service charge for the building | |

| Water | 6,965 cubic metres | ||

| Paper | 37,715 reams (back office) 9,495 as LPA packs |

£128,679 |

Travel

In 2019 to 2020 travel fell compared to previous years by 14% to 1.17 million kilometres travelled. Further work is still required to reduce travel between our offices in the coming year, and improved remote working technology is being purchased to facilitate this by reducing further the need to travel for meetings.

Travel by car is a necessity for the fulfilment of the Public Guardian’s duty to supervise deputies by means of Court of Protection visitors who attend P’s and deputy’s homes. The nature of these visits makes public transport an infeasible option in most circumstances.

We work closely with local councils and transport operators to enable staff to take advantage of heavily discounted bus travel and park and ride facilities. The cycle to work scheme is heavily promoted and changing facilities and a secure cycle store are provided. Active travel options are also promoted as part of OPG’s wellbeing agenda to promote exercise and healthy lifestyles.

OPG operates an MoJ commuter hub at Embankment House for the use of staff who would normally need to commute to remote offices.

Embedding sustainability in our work

We give staff regular sustainability updates through internal bulletins. Blogs and our network of sustainability champions engage staff in encouraging a sustainable approach to all our work. The sustainability champions review ideas from staff on how to reduce our environmental impact and implement suggestions where practical, and keep them updated on successful implementations.

The sustainability group works closely with OPG’s various diversity and wellbeing groups to encourage sustainable actions and volunteering. Staff are able to engage in sustainability activities and volunteer with external partners. There is an allowance of five days of volunteering leave per member of staff per annum.

A greater emphasis has been given to flexible working methods such as working from home or commuter hubs to avoid unnecessary travel and this has been taken up by many staff. This also allows the OPG to delay estate expansion as a higher headcount can be accommodated in the same space.

New IT devices also allow for easy tele- and video-conferencing and remote collaborative working and so the need to travel has been reduced. Additional technology procurement and associated training sessions will further embed remote, collaborative working.

Nick Goodwin

Chief Executive and Accounting Officer

14th July 2020

Accountability report

Corporate governance report

Introduction

The purpose of the corporate governance report is to explain the composition and organisation of the entity’s governance structures and how they support the achievement of the entity’s objectives.

Our framework document sets out the arrangements for governance, accountability, financing, staffing and operations.

The document can be read in full here

As Chief Executive and Accounting Officer for OPG, I am responsible for OPG’s use of resources in carrying out its functions as set out in the framework document. Managing Public Money as issued by HM Treasury also sets out the responsibilities of an Accounting Officer.

As Accounting Officer, I am personally responsible for: safeguarding the public funds for which I have charge, ensuring propriety and regularity in the handling of public funds, and day-today operations and management of OPG. In addition, I must ensure that OPG as a whole is run in accordance with the standards, in terms of governance, decision making and financial management.

My report outlines the governance arrangements in place to manage risks to the achievement of OPG’s agreed objectives and targets. It also provides effective oversight and control over OPG’s resources and assets. It includes:

- directors’ report

- statement of Accounting Officer responsibilities

- governance statement

Directors’ report

The structure of the OPG board, the audit and risk committee (ARC) and the executive team are explained here. They are responsible for setting OPG’s strategic direction and monitoring performance against agreed objectives.

Statement of directors’ interests

Non-executive directors are required to declare any directorships and conflicts of interest on appointment. All board members are also required to declare any conflicts of interest before the start of each meeting. There were no declarations made during 2019 to 2020.

Personal data incidents

Consideration was given to whether any incident involving personal data was so serious that it should be reported to the Information Commissioner’s Office. There were no incidents of such severity during the year. The governance statement considers further information assurance and data security practices in OPG.

Health and safety

OPG acknowledges its legal responsibilities in relation to the health, safety and welfare of its employees and for all people using its premises.

The membership of the OPG Board consists of:

Public Guardian/Chief Executive (chair)

Alan Eccles (until June 2019)

Nick Goodwin (from July 2019)

Three OPG senior civil servants

Julie Lindsay

Jan Sensier

Sunil Teeluck

Three non-executive directors

Alison Sansome

Shirnivas Honap

Karin Woodley

MoJ representative

Abigail Plenty/Laura Beaumount (job share)

MoJ finance representative

Paul Henson

Statement of Accounting Officer’s responsibilities

Under Section 7(2) of the Government Resources and Accounts Act 2000, HM Treasury has directed OPG to prepare for each financial year a statement of accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of OPG and of its income and expenditure, statement of financial position and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual and in particular to:

-

observe the Accounts Direction issued by HM Treasury, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis

-

make judgments and estimates on a reasonable basis

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the financial statements

-

prepare the financial statements on a going concern basis

-

confirm that the annual report and accounts as a whole is fair, balanced and understandable and take personal responsibility for the annual report and accounts and the judgements required for determining that it is fair, balanced and understandable

The Principal Accounting Officer of the Ministry of Justice has designated the Chief Executive as Accounting Officer of OPG. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding OPG’s assets, are set out in Managing Public Money published by HM Treasury.

As the Accounting Officer, I can confirm that I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that OPG’s auditors are aware of that information. So far as I am aware, there is no relevant audit information of which the auditors are unaware.

Nick Goodwin

Chief Executive and Accounting Officer

14th July 2020

Governance statement

This statement explains how I, as Accounting Officer, have discharged my responsibility to manage and control OPG’s resources during the year. This statement describes OPG’s governance arrangements and provides an assessment of how I have balanced risk, assurance and control throughout 2019 to 2020.

Introduction

The MoJ Permanent Secretary is the department’s Principal Accounting Officer. The responsibilities of an Accounting Officer are set out in chapter 3 of Managing Public Money, issued by HM Treasury. The Principal Accounting Officer designated me as the Accounting Officer for OPG’s administrative expenditure, and defined my responsibilities and the relationship between OPG’s Accounting Officer and the Principal Accounting Officer.

The Public Guardian is a statutory office holder appointed by the Lord Chancellor and Secretary of State for Justice under Section 57 of the MCA 2005. This statutory role is combined with the administrative role of the chief executive of OPG and accounting officer for the agency, as set out in the MoJ/OPG framework document.

There was a change in Public Guardian in June 2019. As part of that handover process the outgoing Public Guardian provided assurance to the incoming Public Guardian on the processes and controls over the activities of the Agency within that period of time. The Board membership (including the financial representative) remained the same and also provided assurance for that period of time. The new Public Guardian was fully inducted into the Agency and as part of that was provided with the financial, risk and performance reports for the year as a whole.

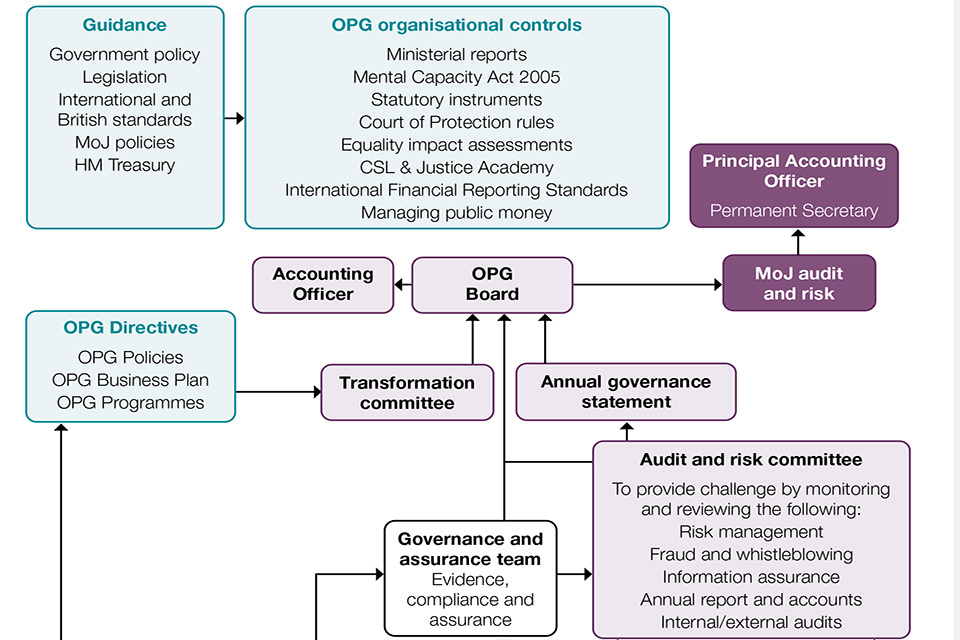

Governance framework

The effectiveness of OPG’s governance arrangements, risk management and the system of internal control are set out within this governance statement.

The statement includes the required assessment of compliance with the Treasury’s Corporate Governance Code. While the focus of the code is on ministerial departments, where applicable, OPG applies the principles that it considers are commensurate with its size, status and legal framework.

OPG governance framework

The current board and committee structures are shown below.

OPG board

Provides strategic leadership and direction, supporting the delivery of objectives within the business plan

Audit and risk committee

Giving an independent view to the CEO of OPG’s governance, risk management controls and assurance

Executive management team

Reporting to the Chief Executive: Ensures effective management and control of fi nance, performance, risk, workforce, HR, complaints, business delivery, leadership and celebrating success

Transformation committee

Reporting to the Board: To test and challenge individual workstreams and provide assurance on the delivery of OPG’s transformation programme

Health and safety committee

Supporting the Chief Executive in his overall responsibility for organisational compliance with the Health & Safety at Work etc Act 1974 and ensuring OPG is a safe and healthy place to work

What the board does

In 2019 to 2020, the board led OPG both strategically and operationally. It also scrutinised and challenged issues affecting our performance and policies. The board has eight main areas of responsibility:

• to protect and enhance the reputation of OPG by steering and overseeing the direction of OPG in delivering its aims and objectives

-

to operate within the MoJ/OPG framework document agreed with the Minister and the appropriate Director General. Its members take decisions collectively and not as representatives of the business areas which they may lead

-

to provide strategic direction, agreeing business aims, objectives and planning, while setting targets for the organisation and delivering the vision

-

to monitor our performance, communicating with staff on values and behaviour, while overseeing operations and managing risk

-

to approve the allocation of the annual budget and any significant in-year changes to it

-

to support the maintenance of a strong working relationship between our staff and its partner organisations

-

to approve our corporate governance framework and controls, and monitor their operation quarterly

-

to ensure that the planning, performance and financial management of OPG is carried out efficiently and effectively and with openness and transparency. Also, contribute to the development of, and approve, our annual business plan

Key successes and effectiveness

In addition to receiving finance, performance and risk papers at each meeting, the board:

-

regularly reviewed and held to account those in MoJ responsible for delivery of services to the OPG via functional leadership arrangements to ensure all are working together to deliver the OPG priorities

-

the Board is provided with financial, performance and risk information on a regular basis and are free to ask for additional information should they require it. The Board find the data acceptable as other forums such as the Audit and Risk Committee are in place to ensure the data that goes to the Board is correct and a fair reflection of the situation within the agency

-

continued to provide the strategic direction on the OPG 2025 programme of work to ensure a clear understanding throughout the agency of the key priorities for delivery

-

provided the strategic decisions necessary to ensure the agency finances remained within budget

-

carried out an away day – the outcome of the day was a clearer understanding and focus on the strategy of the agency, especially in relation to the OPG 2025 transformation programme and sustainability of the agency. It also included a session on Board effectiveness – including a decision to undergo an external review of the Board and OPG governance meetings in the following year

Our sub-committees and independent advisory committee

The board has two sub-committees: the executive management meeting (EMM) and the transformation committee (TC). OPG’s audit and risk committee is an independent advisory committee to the board. The board delegates work to the committees/executives so small groups can examine issues in more detail. The committees then present their findings to the board for discussion and conclusion (following “Corporate governance in central government departments: Code of Good Practice”).

| Executive management meeting | Transformation committee | Audit and risk committee | |

| Role and responsibilities | To focus primarily on the day-to-day operational delivery of OPG’s business, including finance, performance, risk, workforce, change/planning, complaints, HE (attendance management, recruitment), business delivery leadership employee engagement and celebrating success | To bring together the key stakeholders from across OPG and partners to ensure the portfolio of change programmes in OPG are delivered successfully The TC has a delegated governance structure below it to ensure delivery of the portfolio of projects |

To advise on how improvements may be facilitated and determine progress on management responses to risks identified Approve the work of both internal and external audits Agree that accounting policies are correct and applied appropriately to the transactions of the organisation Provide recommendations to the Accounting Officer on all matters the committee consider apt |

| Chair | Moved from a rotating chair (the membership of the committee) to Nick Goodwin, Public Guardian and Chief Executive, being sole chair | Jan Sensier, Deputy Director, Strategy and Corporate Services | Shrinivas Honap, Non-Executive Board Director |

| Executive management meeting | Transformation committee | Audit and risk committee | |

| Key successes and achievements | * Day-to-day management of performance and finance * Representation of OPG at external events * OPG Business Plan signed off by Alan Eccles, Mike Driver, Perm Sec and Ministers prior to publication in April 2019 * Held two away days to review Board’s effectiveness. Both days were independently facilitated * Review of governance framework * OPG’s communications and engagement strategy 2019 to 2020 – approval sought for the next phase of communications and engagement campaigns (‘Your voice, your decision’ campaign) * Approved the new format peformance report (April 2019). The report is now set out in quadrants with additional commentary * Supervision fees refund – approval received from Special Advisers (SpAds) * Missing persons – Minister agreed fee regime i.e. £320 general fee and £200 set up fee. Remissions and exemptions will also apply |

* Delegation of responsibility for the delivery of the portfolio from OPG Board * Ensuring the framework and strategy for OPG 2025 vision is on track * Ensuring delivery of the portfolio of projects within OPG * Approval of Strategic Outline Business Case |

* Continued provision of assurance to the Public Guardian in matters in relation to the management of the entire risk framework and specific individual risks and their resultant mitigating actions * Ensuring the annual audit programme is delivered in a cost-effective manner while ensuring all significant risk areas are reviewed by both internal and external audit * Agreements on how counter fraud risks would be identified and monitored * Oversee progress on GDPR Compliance * Advise on whether the OPG Annual Report and Accounts can be signed off |

| OPG Board | Executive management |

Audit and risk committee |

Transformation committee |

||||||||

| No. of meetings attended |

No. of eligible meetings |

No. of meetings attended |

No. of eligible meetings |

No. of meetings attended |

No. of eligible meetings |

No. of meetings attended |

No. of eligible meetings |

||||

| Alan Eccles CEO & Public Guardian (to June 2019) | 3 | 3 | 3 | 3 | 2 | 2 | 0 | 3 | |||

| Nick Goodwin – CEO & Public Guardian (from July 2019) | 8 | 7 | 9 | 2 | 2 | 3 | 7 | ||||

| Sunil Teeluck Head, Legal and Information | 10 | 11 | 9 | 11 | 4 | 4 | 4 | 10 | |||

| Julie Lindsay Chief Operating Officer | 11 | 11 | 10 | 11 | 9 | 10 | |||||

| Jan Sensier Deputy Director of Strategy and Corporate Services | 11 | 11 | 8 | 11 | 4 | 4 | 8 | 10 | |||

| Paul Henson Deputy Director Finance | 10 | 11 | 3 | 9 | 4 | 4 | 2 | 10 | |||

| Abigail Plenty Laura Beaumont Deputy Director Vulnerability Policy (deputy Liz Eaton, Mental Capacity) | 11 | 11 | |||||||||

| Shrinivas Honap Non-Executive Director | 9 | 11 | 4 | 4 | - | - | |||||

| Alison Sansome Non-Executive Director | 10 | 11 | 9 | 10 | |||||||

| Karin Woodley Non-Executive Director | 7 | 11 | 4 | 4 | - | - | |||||

| Anne Fletcher Independent Member Audit and Risk | 4 | 4 | - | - | |||||||

| Iain Dougall Head, Power of Attorney Service (to February 2020) | 7 | 9 | 9 | 10 | |||||||

| Marie Owen Head, Power of Attorney Service (from February 2020) | 1 | 2 | 1 | 1 | |||||||

| Angela Johnson Head, Policy and Practice (to August 2019) | 5 | 5 | - | - | |||||||

| Ria Baxendale Head, Policy | 7 | 11 | 8 | 10 | |||||||

| Chris Jones Head, Performance, Planning and Business Dev. | 9 | 11 | 9 | 10 | |||||||

| Helen Journeaux Head, Governance, Assurance and Corp. Services | 9 | 11 | 3 | 4 | 9 | 10 | |||||

| Marie Lane – Head, People Development | 7 | 11 | 6 | 10 | |||||||

| Jill Twigger – Head, Supervision & Investigation Services (from Feb 2020) | 1 | 2 | - | - | |||||||

| Matthew Butler – Acting Head, Supervision & Investigation Services (from Sept 2019 to Feb 2020) | 4 | 5 | 5 | 5 | |||||||

| May Smith – Senior Finance Business Partner (from Jan 2020) | 1 | 2 | 2 | 2 | |||||||

| Gemma Harvey – Head of Management Accounts and BP | 9 | 9 | 8 | 10 | |||||||

| Claire Davies – Financial Controller (to Jan 2020) | 7 | 9 | 5 | 8 | |||||||

| Meera Bhalla – Senior HR Business Partner | 9 | 11 | 3 | 10 | |||||||

| Lucy Denton – Head, Communications | 10 | 11 | 9 | 10 | |||||||

| Sarah Slack – Head, Digital (to August 2019) | 3 | 5 | 2 | 5 | |||||||

| Matthew Machell – Digital (Sept to Nov 2019) | 3 | 3 | 2 | 3 | |||||||

| Su Morgan – Head, Digital (from Nov 2019) | 2 | 2 |

Terms of reference

OPG Board and committee terms of reference (ToR) are in line with the Financial Reporting Council’s Guidance on Board Effectiveness (March 2011) and Good Governance Standard for Public Services, published by the Chartered Institute of Public Finance and Accountancy (CIPFA)/ Office for Public Management Ltd (OPM), to ensure its governance arrangements are reflected within the ToRs.

Work has been undertaken during 2019 to 2020 to ensure that the OPG Operating Framework is still fit for purpose given the changes to the size of the agency over time, and to also review it and ensure its consistency with those documents listed above. The ToRs have been reviewed to ensure that consistency and clarity of governance is being applied across the business, and ensure there are clear lines of decision making and strengthen the ownership and accountability of OPG’s overall governance framework, and these have been pulled together into one clear document.

This document also outlines the links between the Board and its committees, tolerances and a clear review framework for all. This Operating Framework also includes new sub-committees below the EMM and came into force from April 2020 with a review taking place after it has been in place for 12 to 18 months.

Internal audit

As Accounting Officer and Chief Executive, I have established and maintained arrangements for the provision of internal audit services from the Government Internal Audit Agency (GIAA) within OPG in accordance with the objectives and standards for internal audit set out in the Public Sector Internal Audit Standards (published by HM Treasury). This enables an independent and objective evaluation on management performance in the delivery of effective arrangements for governance, risk management and internal controls.

MoJ receives copies of OPG’s annual internal audit plans and annual report from me. MoJ and Cabinet Office are notified of any fraud or irregularity within the definition set out by HM Treasury.

GIAA undertook six audits on behalf of OPG during 2019 to 2020. All of the internal audit assignments completed were rated as either moderate or substantial.

| Rating | Audit title | |

| Substantial | Budget management Supervision of deputies Internal communications Transformation |

|

| Moderate | OPG productivity measures |

Performance management |

| Limited | NIL | |

| Unsatisfactory | NIL |

The Head of Internal Audit in his annual report for 2019 to 2020 has given the OPG a moderate annual opinion on the framework of risk management, governance and control. A moderate opinion is defined as ‘Some improvements are required to enhance the adequacy and effectiveness of the framework of governance, risk management and control.’

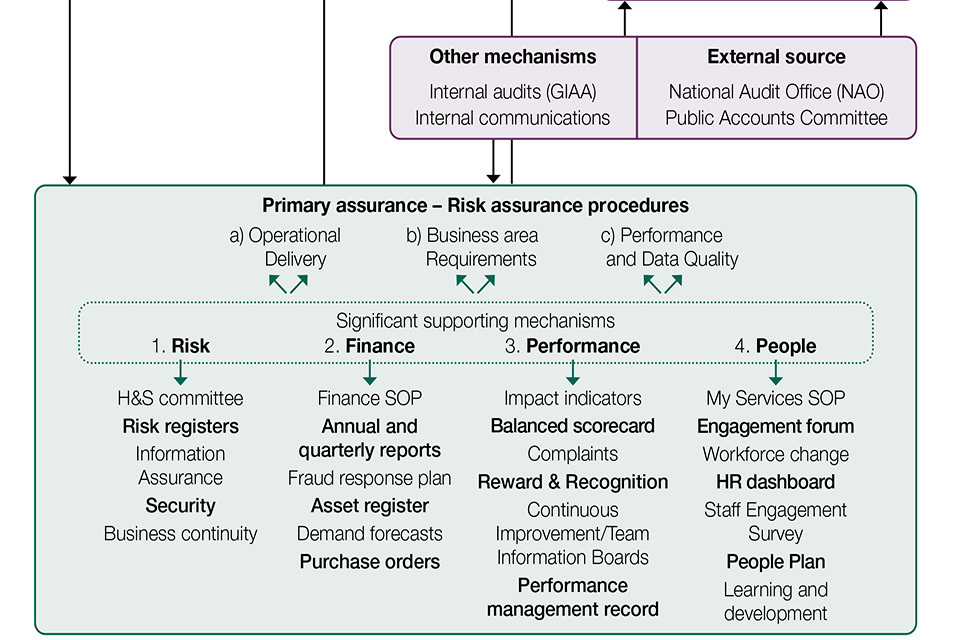

Risk management, control and assurance

OPG maintains a consistent approach to the management of risk within the organisation. Risk management is effectively used to alert the business of actual threats or emerging issues likely to impact the achievement of business objectives.

The main corporate level risks considered over the year were:

-

GDPR compliance

-

Functional Leadership

-

Failure to achieve cost recovery

-

Delays in taking cases to court where legal action is required

-

Staff retention

-

Brexit and its impact on government priorities and legislative programme

The issues and emerging risks that will need to be managed in the year ahead include:

-

COVID-19 – the need to evaluate the management of financial and operational performance as a result of the challenges posed by the virus. This will need to include a recovery plan

-

Ensuring a sustainable, appropriate and affordable OPG estate – ensuring that we learn from the current COVID-19 situation to ensure that the estate can facilitate the more flexible working practices that will continue into the future

-

Wider stakeholder engagement to ensure that all are aware of the services OPG offer and the value that they add and to ensure that there is a high level of knowledge of the MCA within areas such as the health and social care section

Risks below corporate level are managed within directorates and if necessary risks are escalated to the corporate register. The governance team liaise monthly with business areas to update registers in preparation for board and committee meetings. Further examination on the management of risk is undertaken at a face-to-face mid-year review meeting with the Accounting Officer. This is attended by risk owners who each discuss the management and control of the risks identified and planned action to achieve risk closure by year end.

Processes have also been put in place in OPG during the year to ensure that corporate risk and programme risk are looked at together in regular review meetings so that there is a clear understanding of the total risk environment within the agency. Significant risks from the programme are escalated onto the corporate risk register. During the year work was also undertaken to look at how risk is managed within the OPG – with a move towards looking at risks by category – such as finance, performance, programme and then have sub risks listed below those. This work continues with the intention of moving over fully to this way of managing risk during 2020.