Nuclear Decommissioning Authority: Annual Report and Accounts 2023 to 2024

Published 9 October 2024

Overview of performance 2023/24

This overview section provides an insight into our work during 2023/24 and highlights areas of progress for this year. We have described these using our five strategic themes.

Chair’s statement

Chris Train OBE

It has been a pleasure to be Interim Chair of the NDA for much of this year, after taking on the responsibility in September 2023. Transitioning from my role as a non-executive director has given me the opportunity to see first-hand more of the challenges faced and the impressive steps being taken to progress our unique and vital mission. Without doubt, a highlight has been meeting so many highly skilled and committed members of the workforce across the NDA group.

Focus on the nuclear sector and its future has reinforced the importance of the mission being delivered by all those who are part of the group. The Board has continued to monitor front-line decommissioning progress, ensuring and promoting the highest standards of safety, security and environmental compliance.

There continue to be challenges, including the impact of the fiscal environment with inflation leading to increased costs, and an ongoing competition for key skills such as project management and procurement that are vital to the work we do. Alongside many industries, there is also an increased threat in areas such as cyber security, with the NDA developing and growing its capability and experience. I am pleased that the NDA group is responding to these challenges and we have continued to see notable and meaningful steps taken forward to reduce high hazards and deliver on wider commitments to the UK Government, devolved administrations, regulators and other stakeholders.

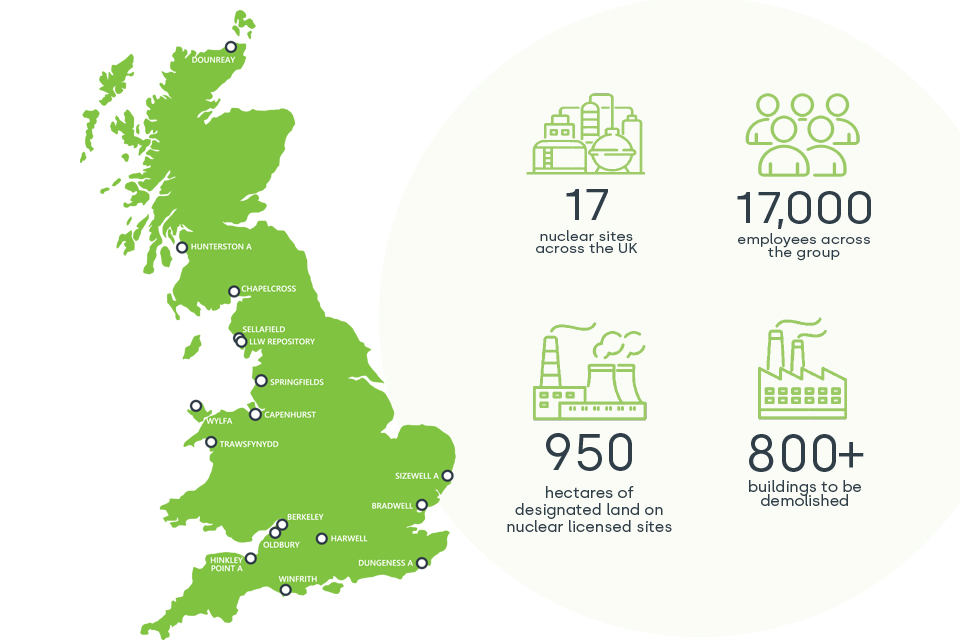

At its heart the NDA is a people business, reliant on 17,000 staff and an even larger supply chain. Creating and protecting a positive working environment is critical and so the Board has welcomed the ongoing efforts to create great places to work. Just one example this year is the further development of group-wide ‘speak up’ arrangements. This ensures that everyone, at all levels and in every corner of the group, has a voice and a route to speak confidentially should they ever require it.

Sustaining thousands of skilled jobs is just one example of how the NDA brings wider benefits to society. Another is a strong commitment to sustainability and, as Board members and I have had the opportunity to speak with staff this year and participate in site visits and events, we have been encouraged by a very clear and strong commitment to making a positive difference.

The benefits of working as one NDA group also continue to be demonstrated. As this model matures and embeds, the Board has paid particular interest in reviewing and approving group key targets which provide suitable challenge and ensure each part of the group has clear objectives aligned to delivering the overall mission during the next year.

The NDA’s work will continue well into the next century and, with programmes stretching that far into the future, it’s inevitable that progress needs to be monitored and programmes need to be adjusted to take account of learning, experience and new and emerging technologies. The Board has continued to provide scrutiny to these plans during the year, in particular looking at updates to the expected programme at Dounreay, to ensure it provides credible information that can inform future decisions about decommissioning.

On 1 June Peter Hill CBE began his tenure as Chair of the NDA and I would like to congratulate him on his appointment. He brings a wealth of experience to the position that will be of huge benefit to the Board and wider NDA group. I’d like to extend my thanks to my Board colleagues, David and his leadership team, and all those who have supported me during my tenure as Interim Chair and as a non-executive director on the Board.

I am delighted that my involvement with the NDA group will continue following my appointment as Chair of Sellafield Ltd, one of the NDA’s subsidiary companies. The passion and commitment of those tackling Europe’s largest decommissioning site at Sellafield has always been clear for me to see, so I’m looking forward to getting more involved to help shape a successful future for Sellafield and the wider NDA group.

Chris Train OBE

Interim Chair, NDA

(September 2023 – May 2024)

Peter Hill CBE appointed NDA Chair

The Department for Energy Security and Net Zero has appointed Peter Hill CBE as Chair of the NDA, effective from 1 June 2024. Peter has wide experience in executive, non-executive and chair roles across a number of FTSE listed companies and in government.

Group Chief Executive’s statement

David Peattie

This has been a significant year for the nuclear sector with heightened focus on its role supporting the UK’s energy security plans and the contribution it can make to help achieve carbon net zero.

That attention has also highlighted the importance of our mission, from safely decommissioning the NDA’s existing sites to preparing to take responsibility for more, while ensuring we can manage radioactive waste for our existing programme and new nuclear. Our work developing skills and providing high quality careers, supporting a vibrant supply chain and contributing to the communities in which we operate also provides real value.

We recently published an updated social impact and communities strategy and I remain proud that we’re making a difference across the UK. We’ve invested almost £50 million of direct socio-economic funding in the last four years, leveraging millions of pounds of further investment from partners. This means we’re supporting significant projects and enabling permanent and sustainable change in our site communities.

Delivering our mission

I’m pleased that this year’s report contains many examples of industry-leading performance in all parts of the NDA group. However, we have seen an increase in some incident rates and we’re taking the appropriate steps to maintain focus and improve what remains strong performance. We’ve also seen enhanced scrutiny of our cyber security arrangements as the world adjusts to the increased threat level in this area. We have a clear strategy and continue to invest in our capability, including the development of a group cyberspace collaboration centre.

For the first time, Sellafield is removing waste from all four high hazard legacy ponds and silos. Sellafield is a complex site with unique challenges when planning and executing projects. It’s important this vital work receives appropriate scrutiny, so we welcome the National Audit Office’s decision to undertake a routine review of the site’s high hazard and risk reduction activities. This builds on previous reports, most recently in 2018, and we’re fully supporting the process.

Community engagement continues in the ongoing process to identify a suitable location for a Geological Disposal Facility. Further investigations have been undertaken to help evaluate the technical suitability of potential host communities, with Nuclear Waste Services determining that Allerdale did not have the correct geology to continue in the process. While we were disappointed to see the local authority withdraw from discussions in South Holderness, it’s an example of the transparent process we’re following.

Waste disposal took a step forward with the start of final capping of historic trenches and vaults which are now full and ready for permanent closure at the Low Level Waste (LLW) Repository. We also saw 1,000 drums of waste being moved by train from Winfrith to the repository for disposal. This is an important example of our group operating model in action – with Nuclear Restoration Services, Nuclear Waste Services and Nuclear Transport Solutions working together to complete the project.

I’m encouraged to see more examples of this type of working. Our group model has been further embedded, with Magnox renamed Nuclear Restoration Services, after joining with Dounreay and in preparation for other sites joining. This completes our group’s top-level structure and we’re now focused on getting the most from it to provide even greater value, something which is particularly important in a difficult fiscal environment where every pound matters.

Part of the way we can deliver greater value is investing in technology and innovation, shaping the way we deliver in the future. We were delighted to showcase some of this work at a series of roadshows this year, updating established stakeholders and delivering on a commitment in our strategy to reach new audiences.

Creating great places to work

One of those audiences is our future workforce. Ensuring we have the right resources is a continued priority as we face competition for key skills. A highlight of my year was speaking to candidates for our graduate programme. More than 500 applicants took part in an assessment event in Manchester, as we double the number of opportunities in 2024 to 120.

Speaking to future employees was insightful and the importance of sustainability to them was clear. It remains a priority for us as we deliver one of the world’s most important environmental programmes and I’m delighted to publish a report this year setting out the progress we’re making.

Recruitment isn’t just about those starting careers. We’ve continued to develop our existing people, and we launched a new group careers website to attract candidates from other sectors. As part of our involvement in a sector-wide skills taskforce, we were also a founding supporter of Destination Nuclear - a national marketing campaign with a simple message, ‘whatever you do, you can do nuclear’.

Within the group, we were proud to see two colleagues recognised in His Majesty the King’s New Year’s Honours List. Michelle Pearse, NDA Quality and Business Support Manager was awarded a British Empire Medal, while Nuclear Transport Solutions Managing Director of Shipping Peter Buchan was made a Member of the Order of the British Empire. It’s well-deserved recognition for both, who are a credit to the group and sector.

Trusted to do more

As we head into the twentieth year of the NDA’s existence, I’m pleased to say that we’ve created a platform for growth with further opportunities to use our vast skills and experience. The Vulcan site, adjacent to Dounreay, is potentially set to transfer to us for decommissioning, while preparations continue for the first advanced gas-cooled reactor site to join us. There is significant change coming and we’re working hard to be ready.

Being trusted to do more isn’t just about decommissioning additional sites. Nuclear Transport Solutions is undertaking pioneering work with many customers, designing transport packages for new nuclear projects and helping develop solutions to transport the next generation of atomic batteries for space exploration. Its work also extends beyond nuclear, as it maintains contracts with companies including Tesco. It really is a fascinating time to be part of the NDA group.

Thank you

Peter Hill has recently been appointed as NDA Chair and I’d like to welcome Peter to his new position. He succeeds Ros Rivaz who completed her term as Chair in August 2023 and, on behalf of all of us at the NDA, I’d like to thank her for her leadership of the Board, her strong interest in our mission and our people, and her energy and good humour. We wish her well in her future endeavours. Between September 2023 and May 2024, Chris Train acted as Interim Chair and the Board would like to thank him for his leadership and stewardship. Chris has now stepped down from the NDA Board to become Chair of Sellafield Limited and we look forward to working with him in that role.

As ever, I also want to pay tribute to 17,000 colleagues throughout the group and all those who are delivering our mission. I continue to work closely with the UK Government, devolved administrations, and stakeholders internationally, nationally and locally in our communities. I welcome their challenge and support and am proud of all that we achieve together.

David Peattie FREng HonFNucl

Accounting Officer and Group Chief Executive Officer

3 October 2024

Financial review

Kate Bowyer, Group Chief Financial Officer

Despite continued economic uncertainty, our significant external revenue and portfolio management of costs has ensured successful control of financial risks and opportunities.

Overview

The scale and complexity involved in managing the group’s finances and mitigating its risks is clear. The risks materialise in both the day to day management of our spend and balancing the longer-term risks and opportunities to ensure progress across all our sites.

Summary of financial performance

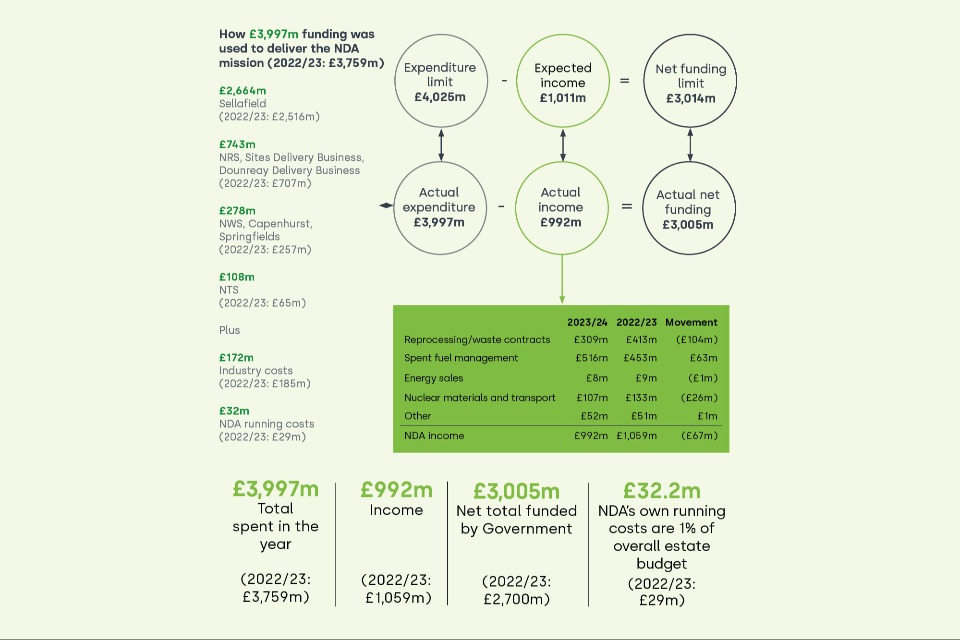

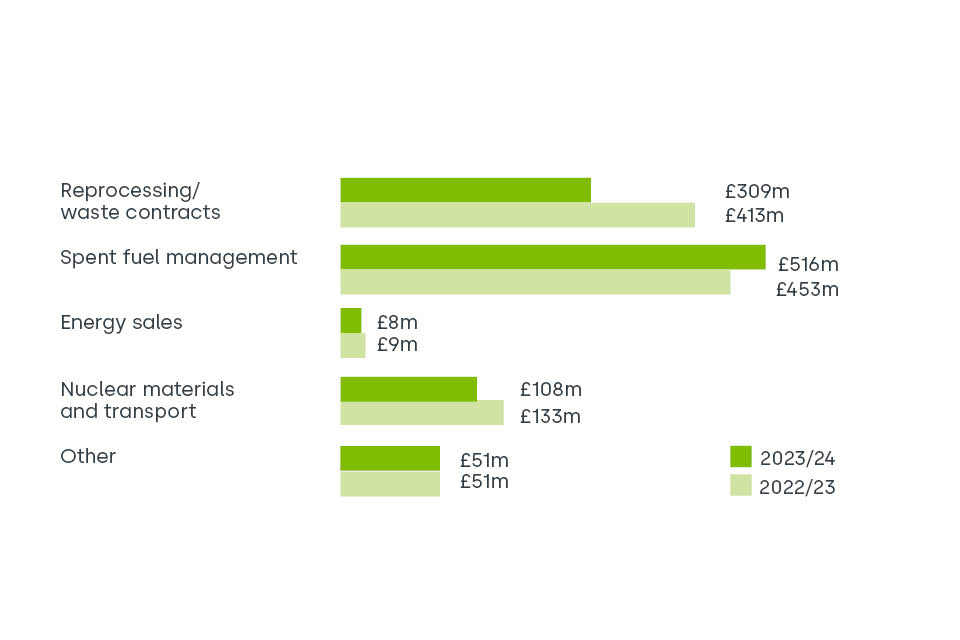

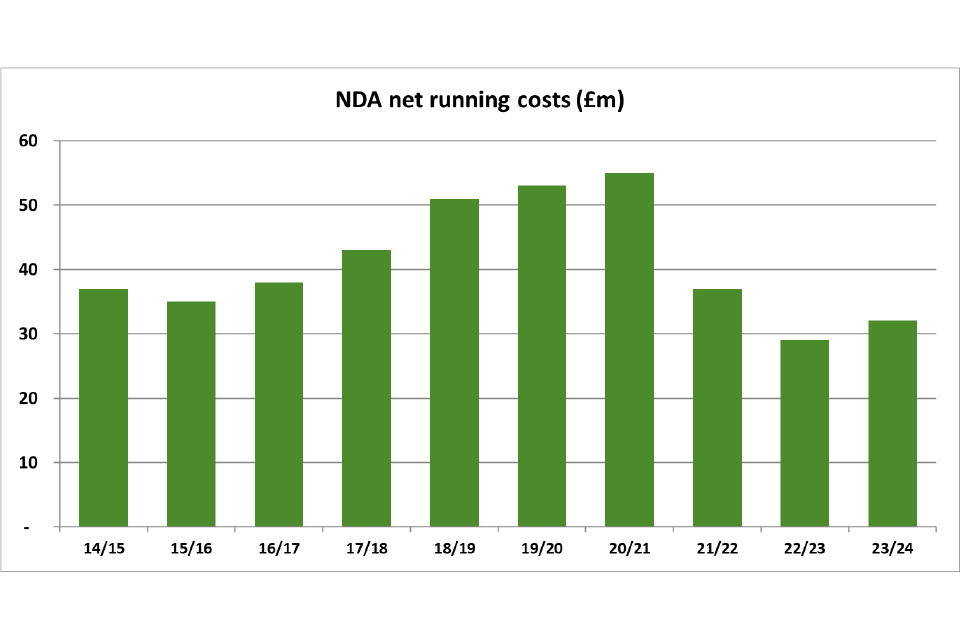

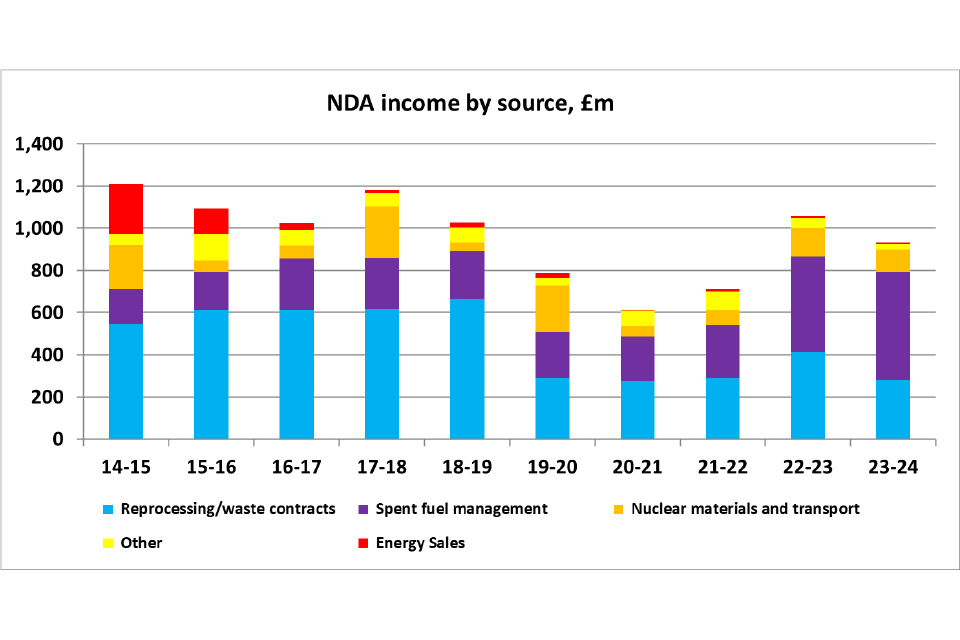

Commercial revenues remained strong at £992 million (2022/23: £1,059 million) due to higher levels of fuel deliveries from the UK’s operational nuclear power stations.

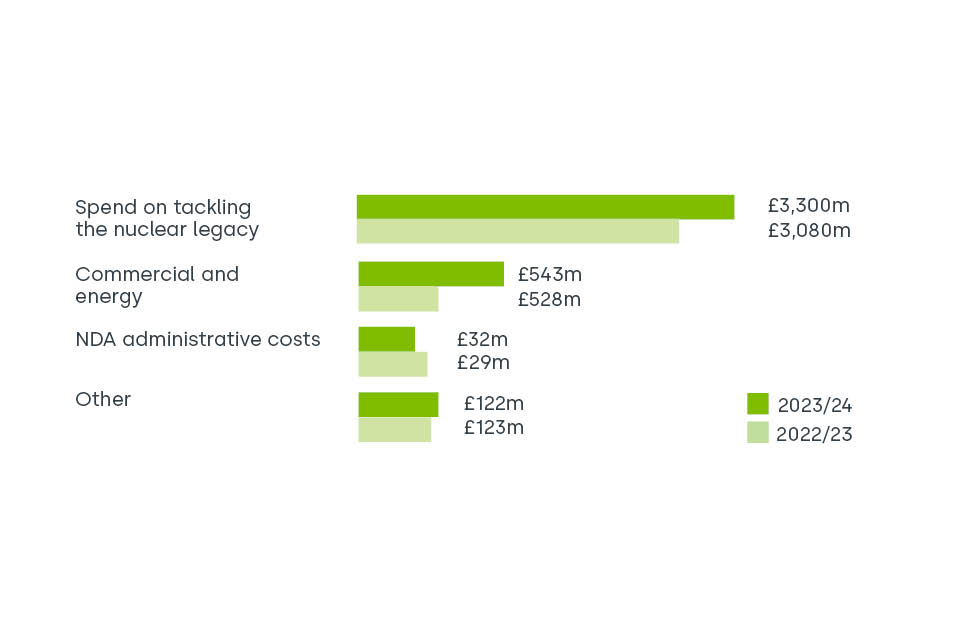

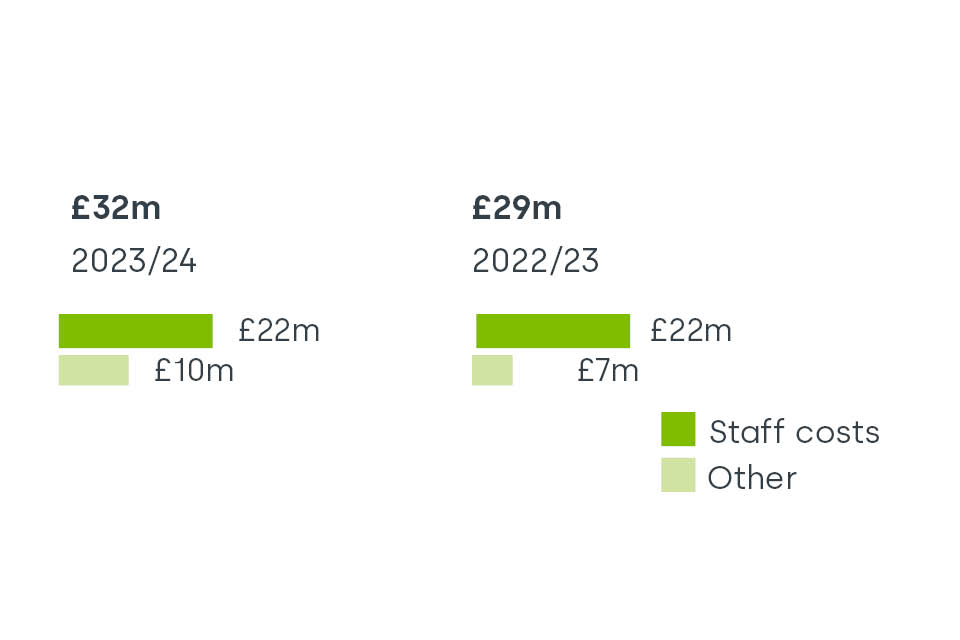

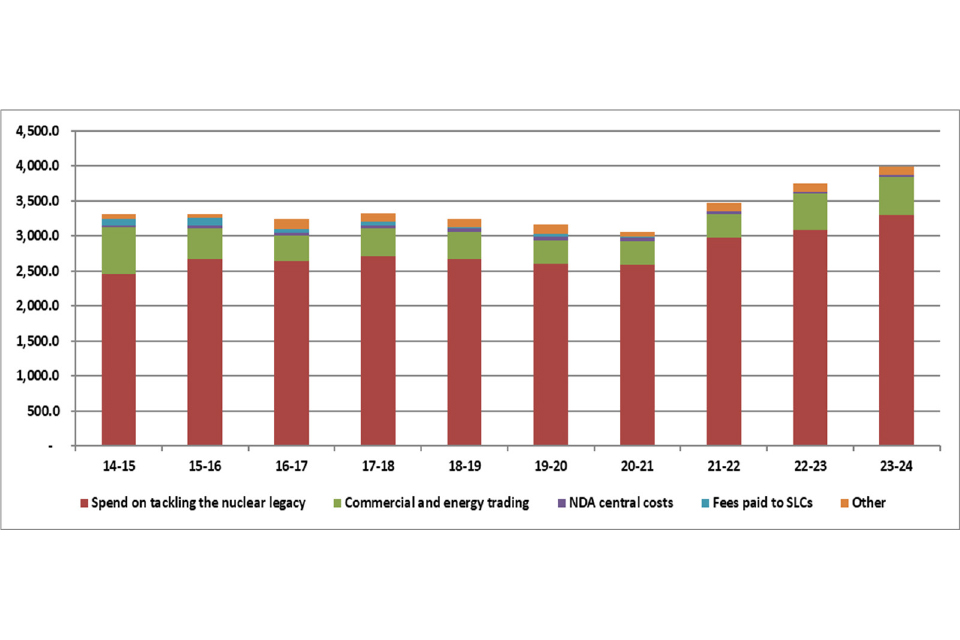

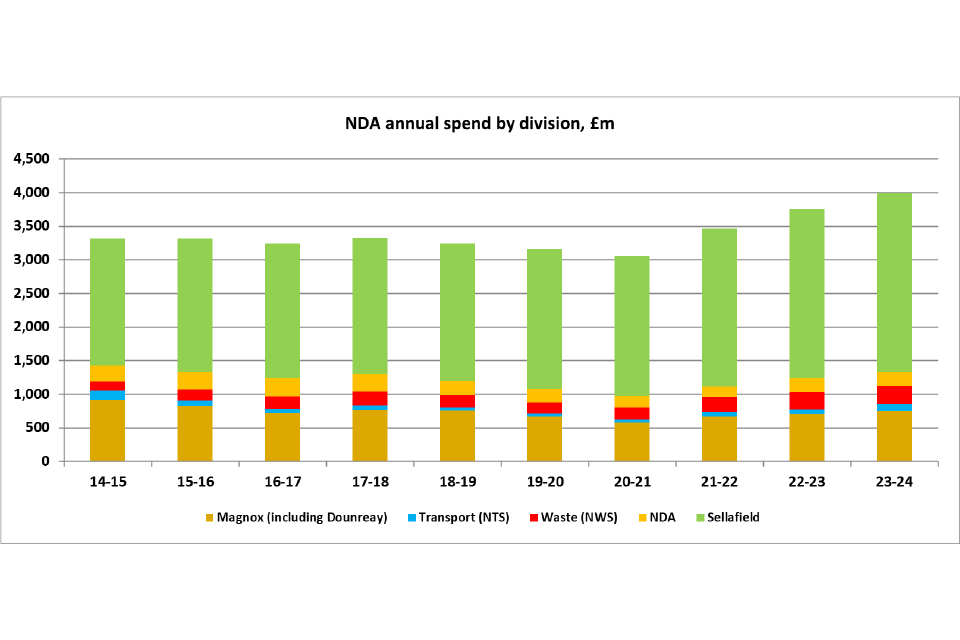

Net expenditure for the year was £3,005 million (2022/23: £2,700 million), within the updated supplementary estimate envelope of £3,014 million (2022/23: £2,833 million). Capital investment was £2,390 million (2022/23: £2,193 million) and our resource expenditure was £1,606 million (2022/23: £1,566 million).

Statement of Financial Position

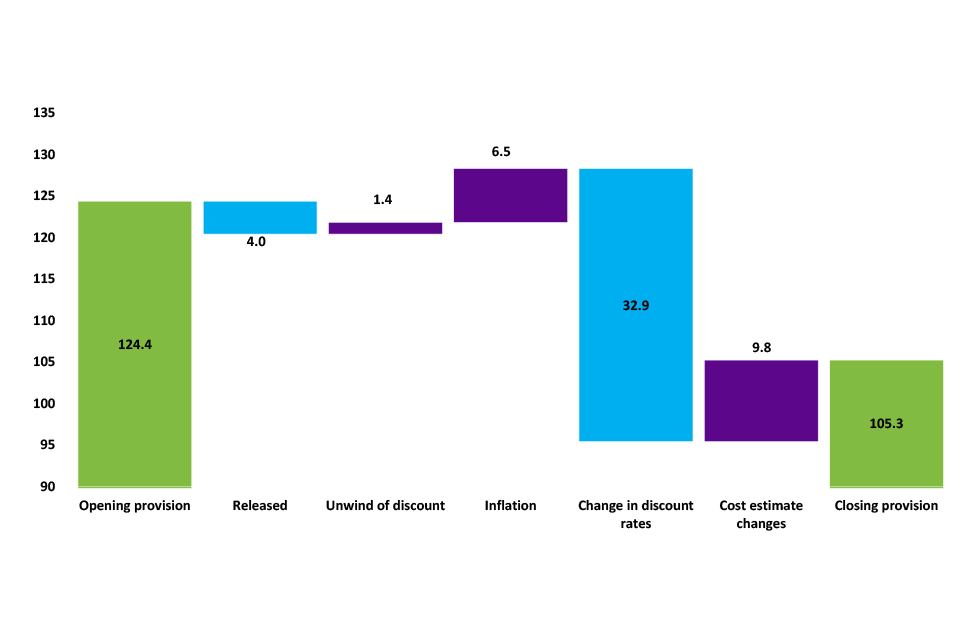

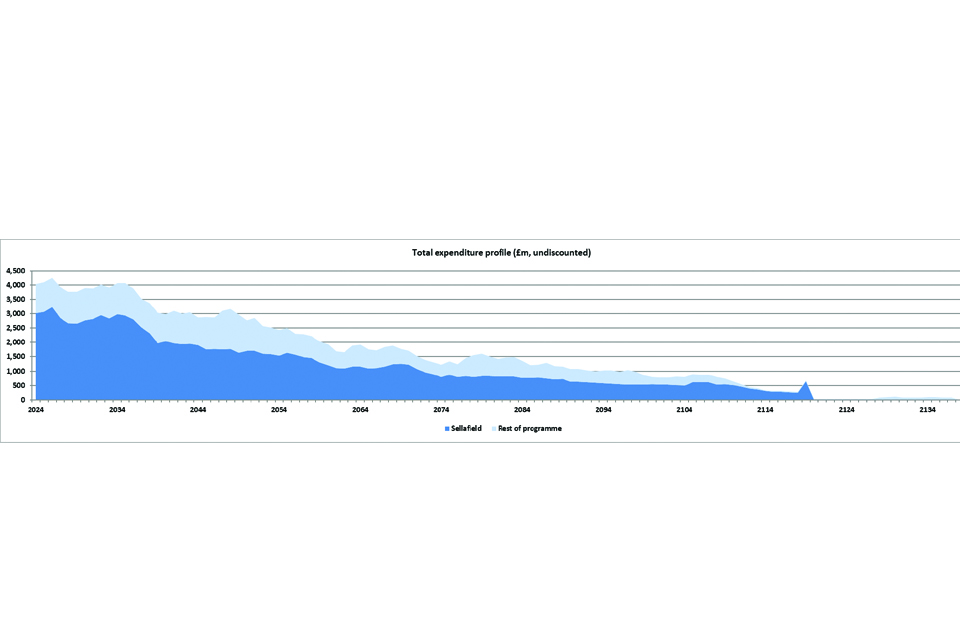

The group’s Statement of Financial Position is dominated by the nuclear provision: the discounted best estimate of the future costs of the decommissioning mission of £105.3 billion (2023: £124.4 billion). It is important to highlight the inherent uncertainty of this estimate and that it represents a single value in a credible range of potential outcomes. The principal movement was the reduction arising from the change of the discount rate, partly offset by changes in estimated costs and realisable savings.

Spending review

We are responding to the Government’s recent spending review commission covering 2025/26 and future years, and are preparing our longer-term plans and mission progress reporting in advance of a settlement later in the year.

We are fully aware of our role in ensuring that every pound is spent effectively and reported transparently to ensure sustained and efficient progress.

One NDA: Formation of Nuclear Restoration Services and Nuclear Waste Services

Since the final business came under full NDA ownership in 2021, two major steps have been taken to deliver increased taxpayer value by simplifying our structure, reducing duplication, and establishing greater co-ordination between similar businesses:

-

Magnox and Dounreay joined in April 2023, with Nuclear Restoration Services launched as a new combined brand in October 2023.

-

Nuclear Waste Services continued its transformation by merging Radioactive Waste Management Limited and Low Level Waste Repository Limited into a single legal entity), effective April 2024.

Our people: recruiting, developing, and retaining the best finance professionals

During the year, several skilled and committed members of the team have moved to different roles within the group, including in our operating companies. Sharing of our best talent is a key part of our strategy and I am proud of the way the team have adapted to the changes.

To develop our finance leaders of the future, we have continued our graduate and apprentice programmes. I am delighted that some of the earlier intakes of graduates have chosen to continue working in full time positions across the group and I look forward to many more following in their footsteps.

Kate Bowyer

Group Chief Financial Officer

Performance against financial targets

Performance against financial targets

Figures in the above graphic are prepared on the basis of Government financial reporting (HM Consolidated Budgeting Guidance) which differs in part from the basis used to prepare the financial statements.

The NDA and our mission

We’re responsible for keeping the UK’s former nuclear sites and facilities, once at the heart of supporting national defence and generating nuclear power for electricity, safe and secure, as we decommission them and overcome the challenges of managing nuclear waste. It’s one of the most important environmental programmes in the world, protecting people and the planet.

Our 17,000 strong, skilled group workforce works hard on behalf of the UK, using innovation and technology to overcome the challenges of identifying and removing nuclear waste from ageing facilities, so we can store it safely and permanently dispose of it. The work is complex and challenging. Dealing with all the waste, dismantling hundreds of buildings and facilities, and building a geological disposal facility (GDF), to dispose of the most radioactive nuclear waste, will take decades. However, by investing today in the challenges left over from the UK’s proud nuclear history, we can remove the burden for future generations and continue to deliver social and environmental benefits through our jobs, knowledge, skills, technology and social investment.

Our team is working with partners in research and industry to drive innovation, using cutting-edge technology to reduce hazards and risks, so that over time the sites can be used again for worthwhile purposes.

Our history

The UK is a pioneer of nuclear technologies, which have been part of our lives since the 1950s. Our sites and facilities have been at the heart of delivering nuclear benefits for the UK, including national defence programmes and supplying safe, low-carbon power to UK homes, businesses, schools and hospitals, for decades.

Unlike modern day equivalents, our old nuclear plants and facilities weren’t designed to manage the nuclear waste they created, or for decommissioning. There are limited historical records on what, or how much, nuclear waste was left on some of the sites during their working lives.

Generating nuclear power today will not leave future generations with the challenges we’re trying to overcome. Nuclear waste produced today is carefully managed, and following in the footsteps of other countries, a GDF will provide us with a safe way of disposing of higher active waste, permanently in England and Wales. Scotland has a distinct policy for higher activity radioactive waste which sets out a near site, near surface approach.

Aiming for the highest standards

How we go about our work is very important to us and we must deliver results safely, responsibly, and sustainably. Our commitment to creating environmental and social benefits builds on our long history of providing value for the UK and we want to ensure that our actions and decisions continue to have a lasting, positive impact.

Trusted to do more

Our work is expanding - we have been asked to use our specialist expertise and skills to decommission newer reactors as they reach the end of their power-generating lives. Arrangements have been agreed by the UK Government, Scottish Government and EDF Energy for the NDA group to decommission Britain’s seven advanced gas-cooled reactor (AGR) stations.

The AGRs will reach the end of their operational lives over the next 10 years and, after defueling, with the fuel being transferred to Sellafield for interim storage, will transfer to NRS for decommissioning.

The NDA group

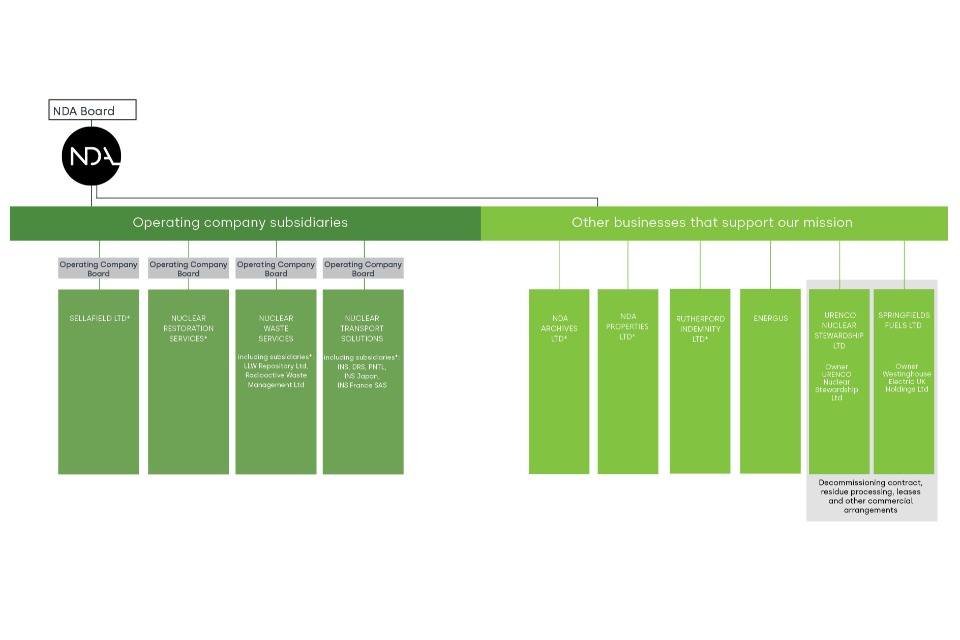

Our group is made up of the Nuclear Decommissioning Authority (NDA), an executive non-departmental public body, and the following operating companies:

- Sellafield

- Nuclear Restoration Services

- Nuclear Waste Services

- Nuclear Transport Solutions

- Other NDA group companies include NDA Archives Ltd, NDA Properties Ltd, Rutherford Indemnity Ltd and Energus.

Find out more about us at nda.gov.uk

UK sites map

The NDA organisational structure

Department for Energy Security and Net Zero (DESNZ)

DESNZ is the UK Government sponsor of the NDA and sets policy and funding

UK Government Investments (UKGI)

UKGI provides strategic oversight of the NDA’s corporate governance and performance

Our mission is to decommission the UK’s earliest nuclear sites safely, securely and cost-effectively. Doing this with care for our people, communities and the environment is at the heart of our work.

The Scottish Government has particular duties and responsibilities in relation to the NDA under the Energy Act 2004 and sets policy for devolved matters in relation to Scotland.

The NDA is not directly accountable to the Welsh Government or Parliament, but we have socio-economic obligations to our communities and are accountable for the environmental performance to the Welsh regulator, which is a Welsh Government sponsored body.

NDA organisational structure

*NDA Group for Statutory Accounts This diagram shows the group structure at 31 March 2024. On 1 April 2023 Dounreay became a division of Magnox Ltd and, in October 2023, the operating company was rebranded Nuclear Restoration Services, operating under a single operating company board.

On 1 April 2024 Low Level Waste Repository Ltd and Radioactive Waste Management Ltd became Nuclear Waste Services, a single legal entity operating under one operating company board.

Working with our stakeholders

Working closely with our stakeholders is at the heart of how we operate. Open and transparent engagement is a critical enabler to the successful delivery of our mission and we could not make progress without the support and confidence of our stakeholders.

Our partners include:

- UK Government and Parliament, devolved administrations and regulators

- Employees, workforce and trade unions

- Commercial partners

- Customers

- Local communities

- Other influencers such as Councils, non-governmental organisations and international organisations

Many of our relationships span decades, with long-standing site histories. We strongly value those connections and are committed to further deepening the relationships through richer, more meaningful discussions. We’re also keen to engage new audiences recognising that our work will continue into the next century.

Reaching stakeholders

Locally

SSGs are long-established forums for open and transparent communication between communities near nuclear licensed sites, the NDA group including the site operator, and regulators. There are 14 across the UK, providing an opportunity for stakeholders to find out more about work undertaken, and allowing decision-making to be informed by the local views.

This year marks 20 years of their existence and we will conduct a review to recognise successes and explore potential changes to strengthen future effectiveness.

Regionally

In the last year, we’ve hosted three successful regional events in response to feedback requesting more information about how we’re solving technical decommissioning challenges.

The innovation and technology roadshows in Cumbria, Glasgow and Bangor were designed in partnership with regional universities and welcomed over 200 delegates at each event. A wide range of stakeholders attended, including a younger audience to which we highlighted the range of careers available in the group.

Our virtual stakeholder summit, ‘Creating meaningful conversations’, covered progress delivering our mission and wider contributions to sustainability, social value, and skills.

Nationally

We were a key sponsor of the Nuclear Industry Association’s (NIA) ‘Week in Parliament’, providing MPs with the opportunity to gain a better understanding of the contribution nuclear makes to the economy, and also partnered at an event in the Senedd, Cardiff to showcase the importance of the sector in Wales.

We’re working with others to provide platforms for discussion on mission progress and issues influencing decommissioning plans. In December, approval was given to establish a Cross Party Group (CPG) of Members of the Scottish Parliament to discuss the civil nuclear sector in Scotland, with the first meeting held in March.

We’re building engagement with non-governmental organisations, listening to perspectives through our jointly chaired forum meetings, and have extended our partnership with the Nuclear Institute Young Generation Network (YGN) to 2025.

Our engagement with local authorities also continues, in particular by working with Nuleaf in England and Wales, which is a nuclear decommissioning and radioactive waste management special interest group of the Local Government Association, and SCCORS in Scotland which provides advice to Scottish local authorities on radiation and radioactive waste matters.

Internationally

The NDA group operates internationally, working with a range of international partners to share experience and learning from others. From actively engaging with the International Atomic Energy Agency on behalf of the UK and chairing working groups on topics such as radioactive waste, to participating in tripartite agreements with the United States and Canada, we recognise the importance of such open dialogue.

“The NDA can only successfully deliver its mission with a social licence to operate, which is granted through the creation of productive relationships with site communities.

Effective engagement with these communities lies at the heart of the NDA’s site stakeholder groups (SSGs) and help to us to build trust on all sides, which is the lifeblood of healthy debate and challenge.

Between the NDA and the SSGs we have built valuable connections over the years to promote two-way engagement and foster open dialogue, allowing the SSGs to become a ‘critical friend’ to the organisation and its subsidiaries and to positively work through any issues as they arise.

The SSGs have achieved much during the 20 years since their establishment, not least helping to demystify the industry and allowing constructive comment on how the UK tackles the challenges of nuclear decommissioning.”

Cllr Aled Morris-Jones

Wylfa and National SSG Forum Chair

Sustainability in the NDA

Our commitment to creating environmental and social benefits builds on our long history of providing value for the UK and we want to ensure that our actions and decisions continue to have a lasting, positive impact.

This year we continued to progress and implement the NDA’s Sustainability Strategy and roadmap, embedding the approaches into different parts of the organisation and wider group.

We’re committed to supporting Government aspirations to be carbon net zero. However, sustainability is a much broader commitment to the way our work is delivered, aligned with the United Nations Sustainable Development Goals (UN SDGs).

Extensive engagement has been undertaken to understand the impact of our work and the factors that influence it. This resulted in the development of our definition for sustainability as well as identification of tangible sustainability legacies that are outlined in our Sustainability Strategy:

Our definition of sustainability- To create value through nuclear decommissioning - at pace, affordably, with participation and creatively.

| At pace | Keep safety and security paramount, optimise progress in decommissioning |

| Affordably | Consider the long-term value for money alongside short-term financing, optimising investment decisions |

| With participation | Seek and support the opinions, plans and aspirations of our workforce, communities and stakeholders |

| Creatively | Decommission our nuclear sites, enhancing the environment and achieving carbon net zero |

The United Nations Sustainable Development Goals (SDGs) are a blueprint for peace and prosperity, now and into the future. We are committed to delivering our mission in line with the UN SDGs.

Delivery of our mission

Decommissioning

- Deliver our mission safely, securely, protecting people and the environment

- Be outcomes based, high performing and innovative

- Balance pace and priority of activities to provide lifetime value for money and achieve intergenerational equity

- Be guided by sustainability criteria embedded in delivery and outcomes

Environmental

- Protect, remediate, and enhance the environment

- Be recognised by our stakeholders for our environmental performance

- Achieve net zero

Socio-economic

- Empower people and communities to create sustainable local and regional economies

- Think internationally and act locally on nuclear skills, developing the capabilities of the UK skills base to facilitate decommissioning and the wider nuclear sector

- Be a positive contributor to the national and international trade agenda

Cultural

- Engage openly, transparently, and authentically

- Work together to establish respectful and inclusive working environments so our people can perform at their best

- Create an impact conscious and future focused mindset

- Be trusted to deliver in a safe, responsible, and timely manner

Putting sustainability at the heart of our decision-making

Sustainability is a high priority in all parts of the NDA group. We’re reporting on our sustainability work in the early part of this document and examples of the progress we’re making can be found in different chapters throughout, recognising that it touches every part of our work. Case studies in the report also show the UN SDGs to which they contribute.

Read the NDA group sustainability report 2024

In addition, an NDA group Sustainability Review 2024 sets out the progress, opportunities and challenges two years after publication of our Sustainability Strategy.

Each of the sustainability legacy areas identified in our strategy is led by a senior representative of the NDA and has its own set of associated outcomes. The cultural legacy is collectively owned by a Sustainability Next Generation group. This is made up of young people from different professional backgrounds with representatives from each of the operating companies.

Governance and incentivisation

A governance structure that reaches all levels of the NDA group is fundamental to achieving the vision.

The group risk and assurance section of this report outlines how the Board committees work and maintain oversight, including on sustainability. Complementary to this, the NDA and our operating companies work together with clear leadership at different levels to achieve the vision. Several incentives are given to sustainability across the NDA group. One of these is the NDA’s Long Term Incentive Plan, which has set incentivised targets until 2026. This year Nuclear Restoration Services and Sellafield also had sustainability targets linked to corporate incentives.

NDA purpose through the UN SDG’s

The Energy Act 2004 sets out the principal and supplementary functions of the NDA, which can be aligned to 11 of the UN SDGs. This reflects the NDA group’s ambition to transform nuclear legacies into opportunities for local, regional and national sustainable development.

Nevertheless, the three main sectors the NDA supports and impacts are Nuclear Medicine, Nuclear Energy and Defence. These can be directly aligned to the UN SDGs as shown to the right; three, seven and nine.

Delivering the NDA mission contributes to society and brings a sense of purpose. It helps to enable Good Health and Wellbeing, Affordable and Clean Energy, and Industry, Innovation and Infrastructure.

UN sustainability goals

Taskforce for Climate Related Financial Disclosures (TCFD)

Taskforce for Climate Related Financial Disclosures (TCFD) provides a framework for organisations to analyse, understand, and disclose climate-related financial information.

Compliance statement

We are committed to ensuring that our business is set up to effectively identify and manage our climate related risks and opportunities.

We’ve reported on climate-related financial disclosures consistent with HM Treasury’s TCFD-aligned disclosure application guidance which interprets and adapts the framework for the UK public sector.

We’ve complied with the TCFD recommendations and recommendations disclosures around: governance (all recommended disclosures) metrics and targets (disclosures (b). This is in line with the central Government’s TCFD-aligned disclosure implementation timetable. We plan to make disclosures for Strategy, Risk Management and Metrics and Targets disclosures (a) and (c) in future reporting periods in line with the central government implementation timetable.

TCFD Pillar: governance

Recommended disclosure:

- Describe the Board’s oversight of climate-related risks and opportunities

- Describe management’s role in assessing and managing risks and opportunities.

Overview of our actions:

- The NDA is sponsored by the Department for Energy Security and Net Zero (DESNZ).

- UK Government Investments (UKGI) provides strategic oversight of our corporate governance and corporate performance.

- The Board is accountable to our sponsoring department, DESNZ, for all aspects of our company performance.

- NDA’s Strategy approval is reserved to the NDA Board.

- The NDA Board has delegated to the Audit, Risk and Assurance Committee (ARAC) responsibility for reviewing the risk management framework, adequacy and effectiveness of control processes and the application of risk appetite. This includes risks and controls relevant to climate resilience. The ARAC reports after each of its meetings to the NDA Board.

- The Environmental, Sustainability and Governance Board Committee reporting to the Board, is the main overseer of climate-related risks.

- Sustainability is a new critical enabler since the publication of NDA Strategy 4 (March 2021) making it a key transformation theme for the NDA.

TCFD Pillar: metrics and targets

Recommended disclosure:

- Disclose the metrics used to assess climate related risks and opportunities in line with the company’s strategy and risk management process

- Disclose Scope 1, Scope 2 and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks

- Describe the targets to manage climate-related risks and opportunities and performance against targets.

Overview of our actions:

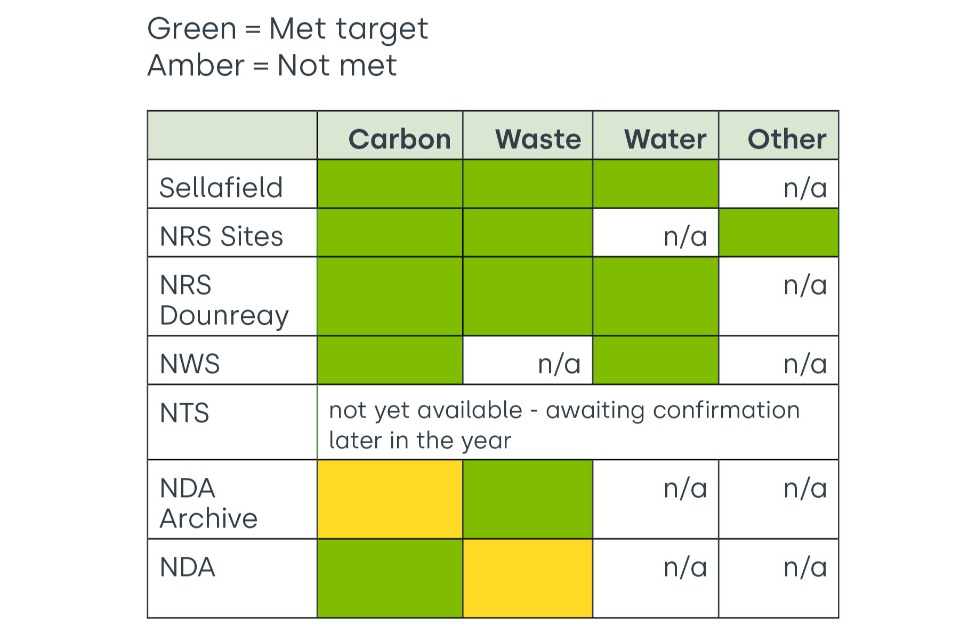

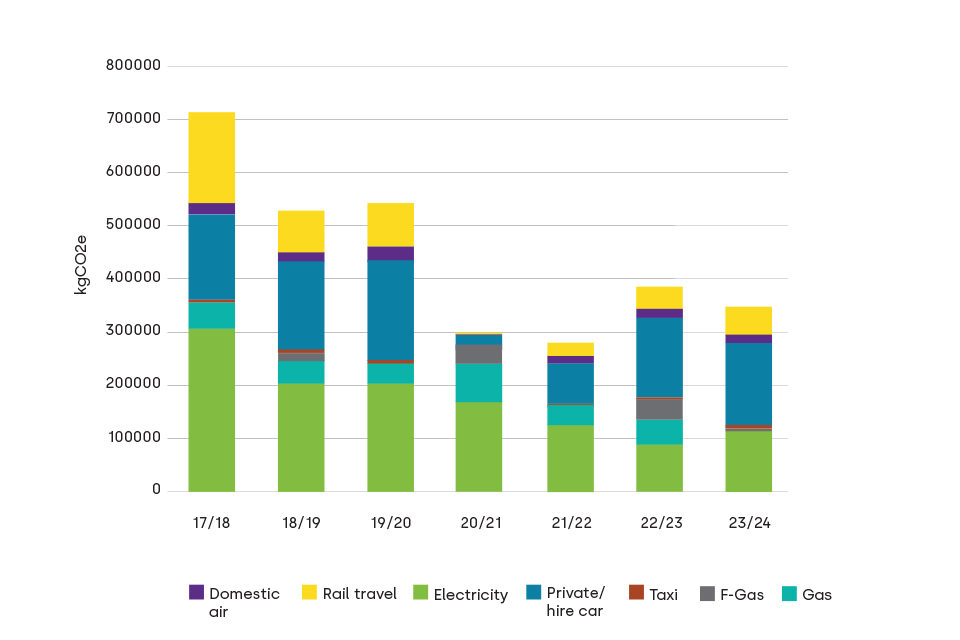

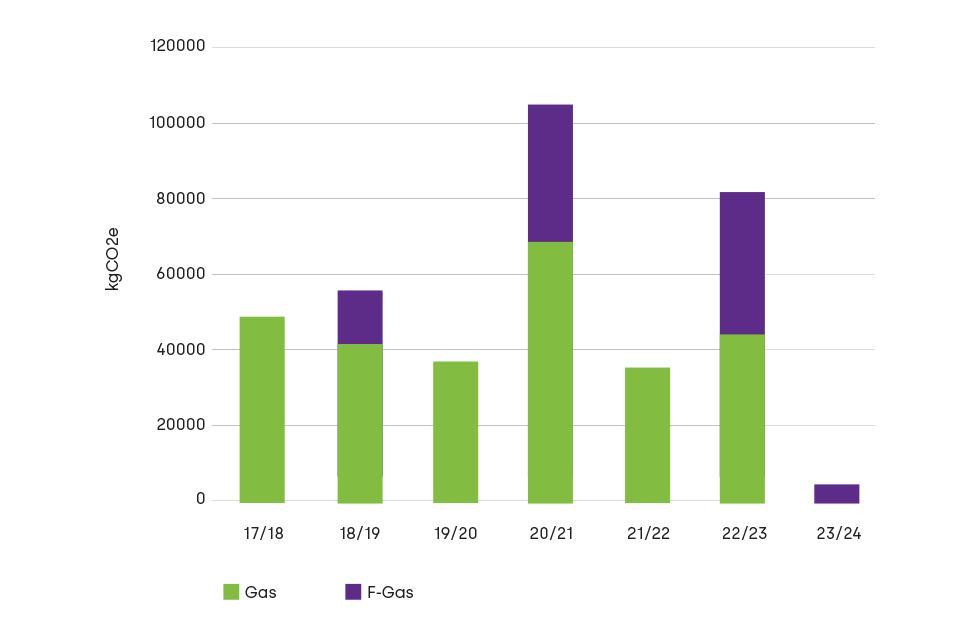

- Environmental Policy Statement contains our carbon commitments, including that the NDA group will be carbon net zero by 2050, and will take into account the targets of devolved governments. We continue to work with our operating companies on the delivery of our carbon management plans and have made significant reductions in our carbon footprint.

- We have continued to use our environmental key performance indicators across the group, focusing on assets, compliance, audit progress, training, skills and experience.

- We are also developing an implementation plan for BSI Publicly Available Specification (PAS) 2080: Carbon Management in Buildings and Infrastructure, the recognised good practice standard.

- We’re tracking environmental events group-wide, including an environmental-total recordable incident rate (e-TRIR) measure aimed at tracking significant environmental events in a similar manner to conventional safety total recordable incident rate data. We’ve reviewed these measures, made minor enhancements and believe they provide an improved picture of environmental performance. These indicators will be reviewed again with an intent to set targets for e-TRIR once sufficient evidence has been collected.

- We’ve continued to assure ourselves of environmental compliance and performance across the NDA group through a range of reviews, assurance visits, environmental performance metrics and engagements.

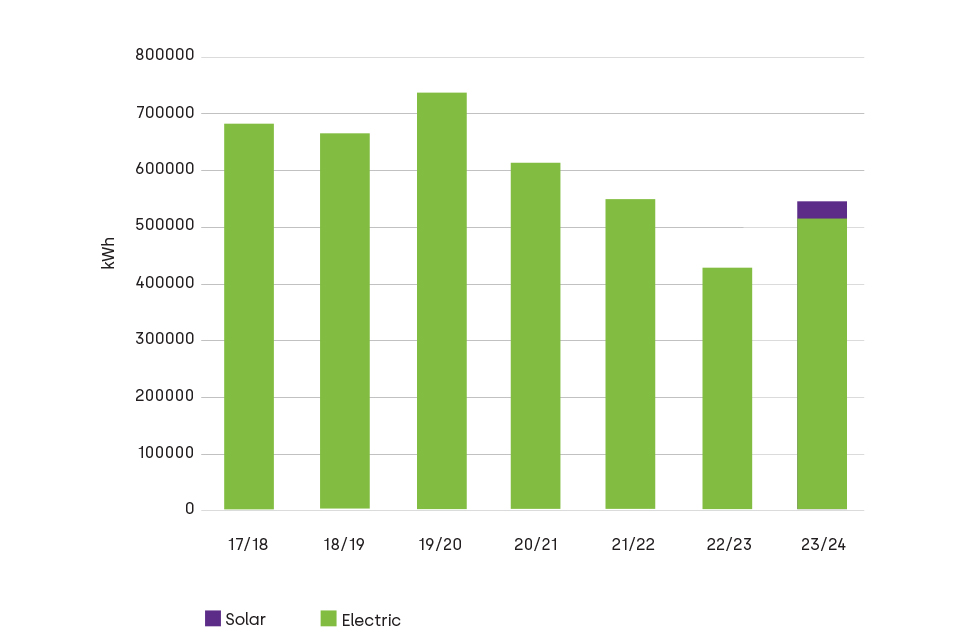

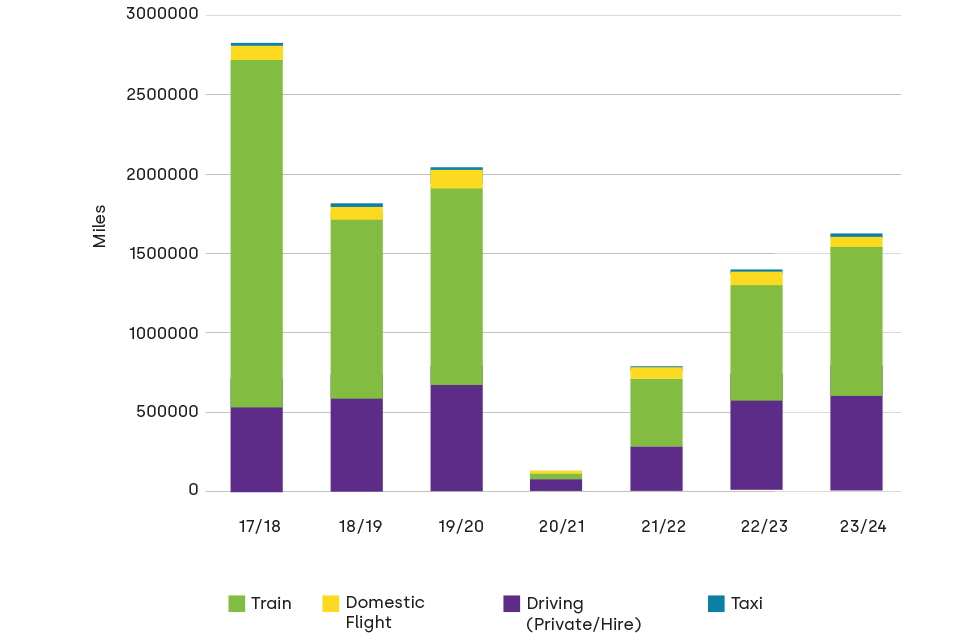

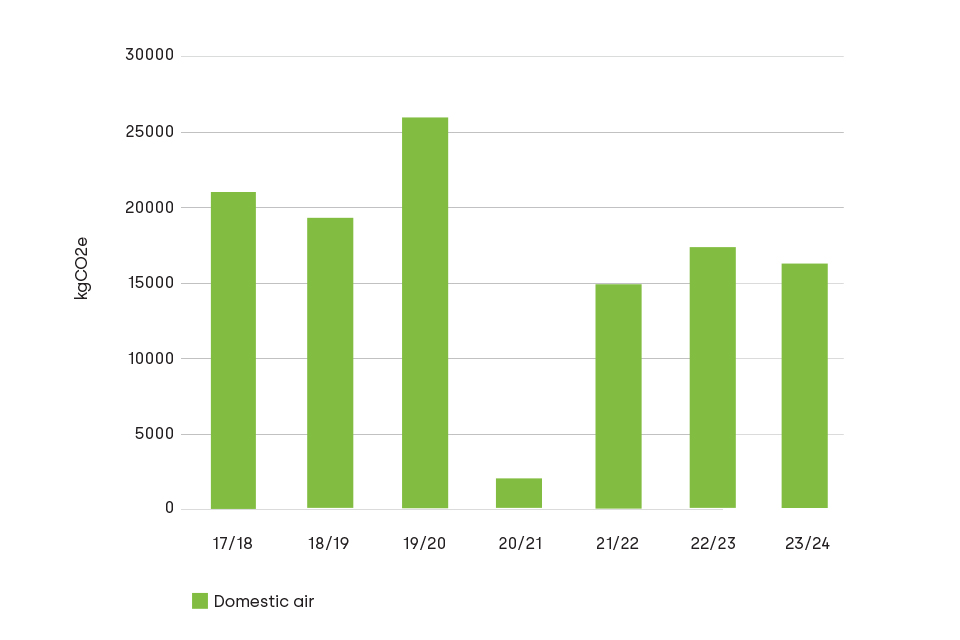

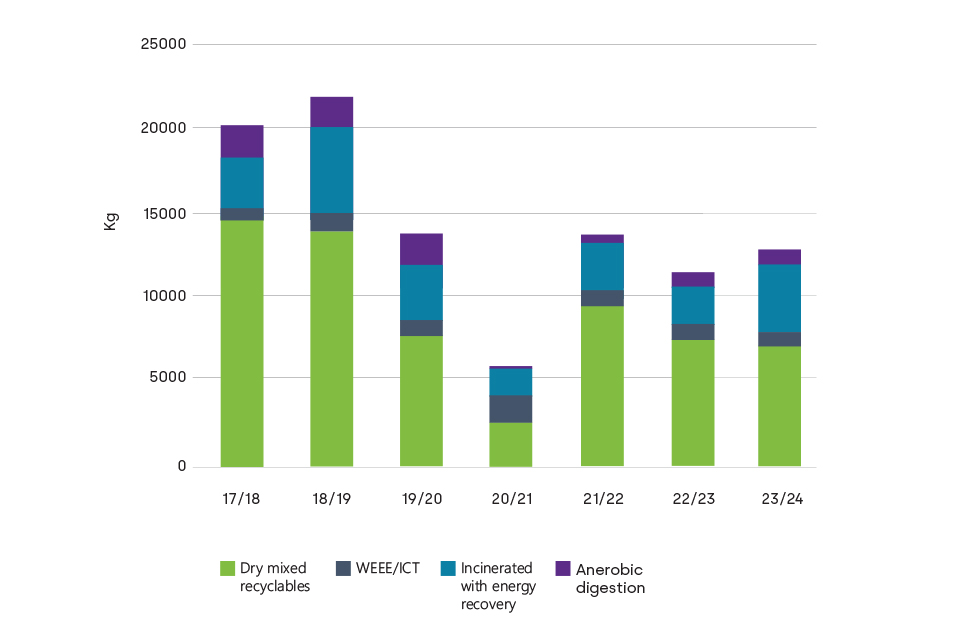

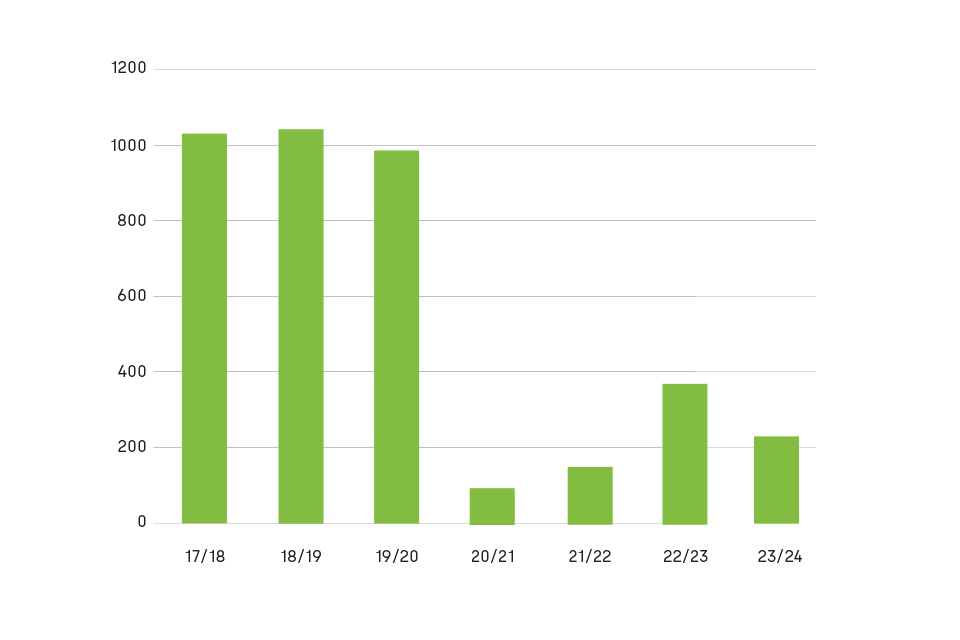

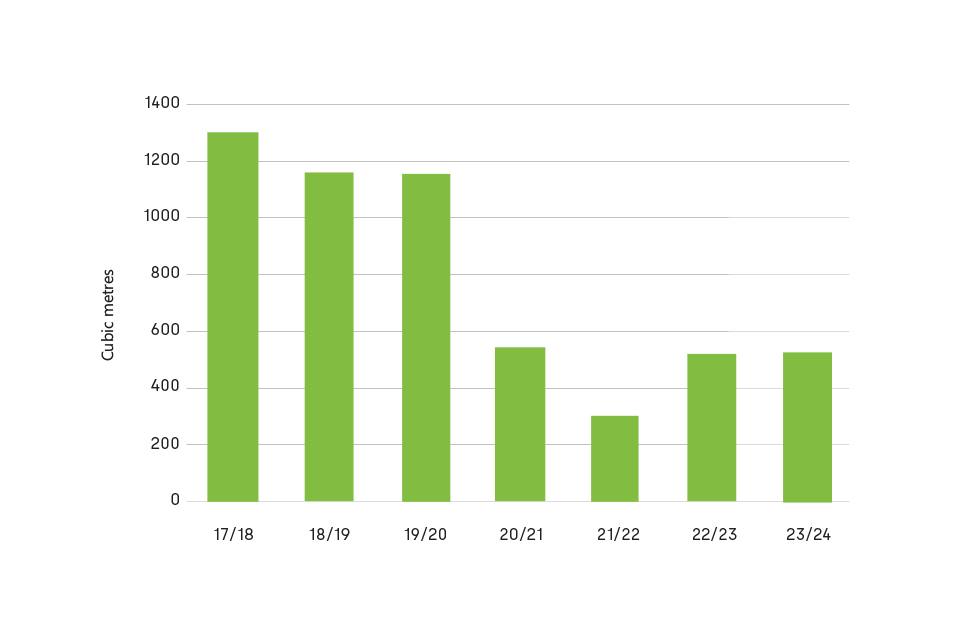

- As part of our commitment to environmental sustainability, we participate in the Greening Government Commitments (GGC) scheme (NDA Only). GGC sets out the actions Government departments and their Partner Organisations will take to reduce their impacts on the environment.

- We’re committed to work to best practice in reducing operating companies emissions and setting net zero targets in line with Government climate targets.

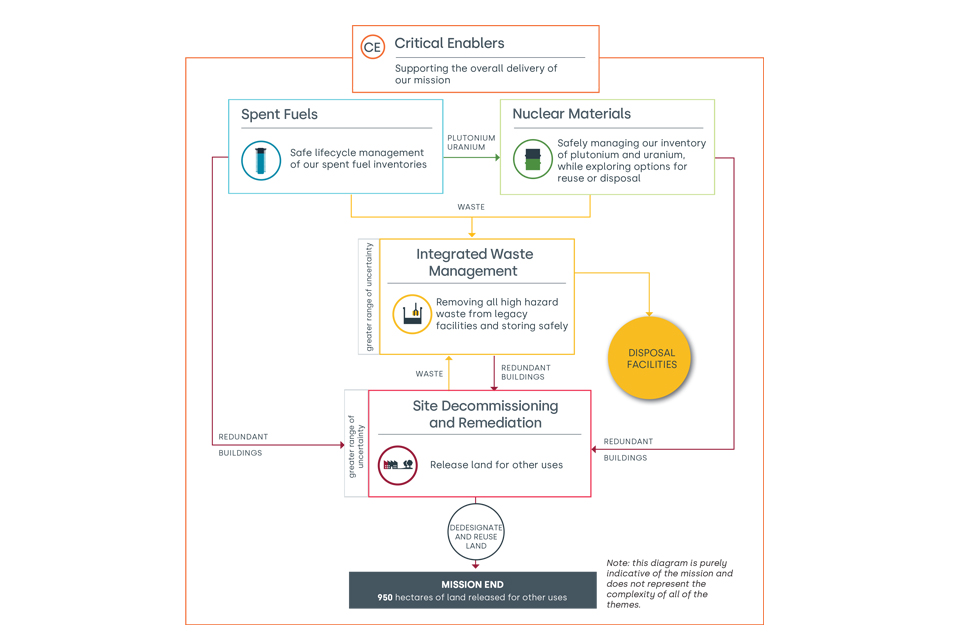

Our strategic approach and themes

Our strategic themes

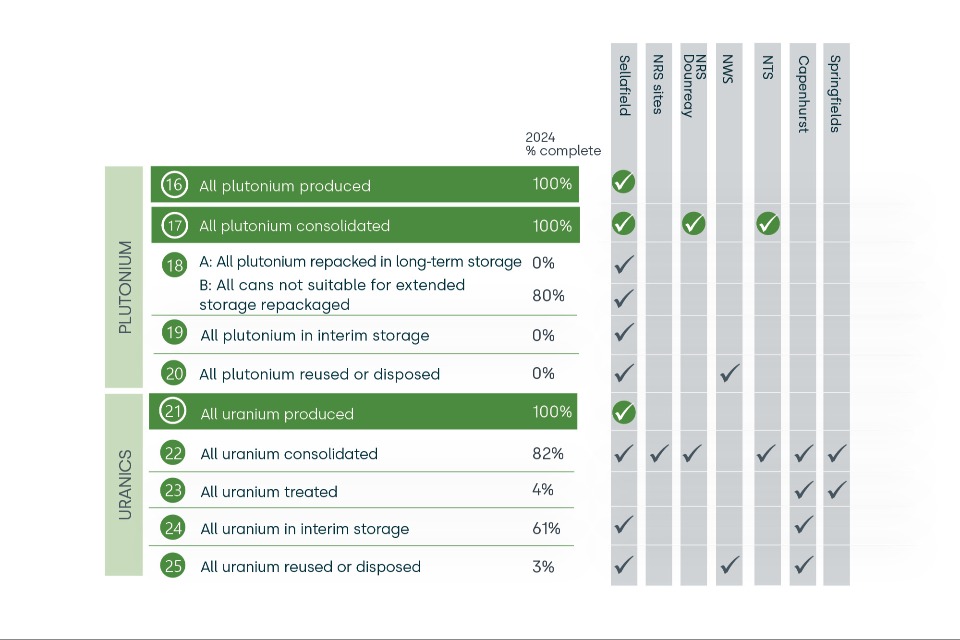

We use five strategic themes to describe all the activities needed to deliver the NDA’s mission.

The first four relate directly to decommissioning work and are known as driving themes: Spent Fuels, Nuclear Materials, Integrated Waste Management and Site Decommissioning and Remediation.

The fifth theme, Critical Enablers, describes the important activities needed to support the delivery of our mission. The diagram below demonstrates how they interact.

Integration of our strategies

Our most urgent tasks are dealing with the highest-hazard materials, spent fuel, nuclear materials and highly-radioactive wastes. Only once the inventory has been removed and either securely stored or disposed of, can the redundant nuclear facilities be dismantled and demolished.

Strategic themes diagram

Our driving themes and strategic outcomes

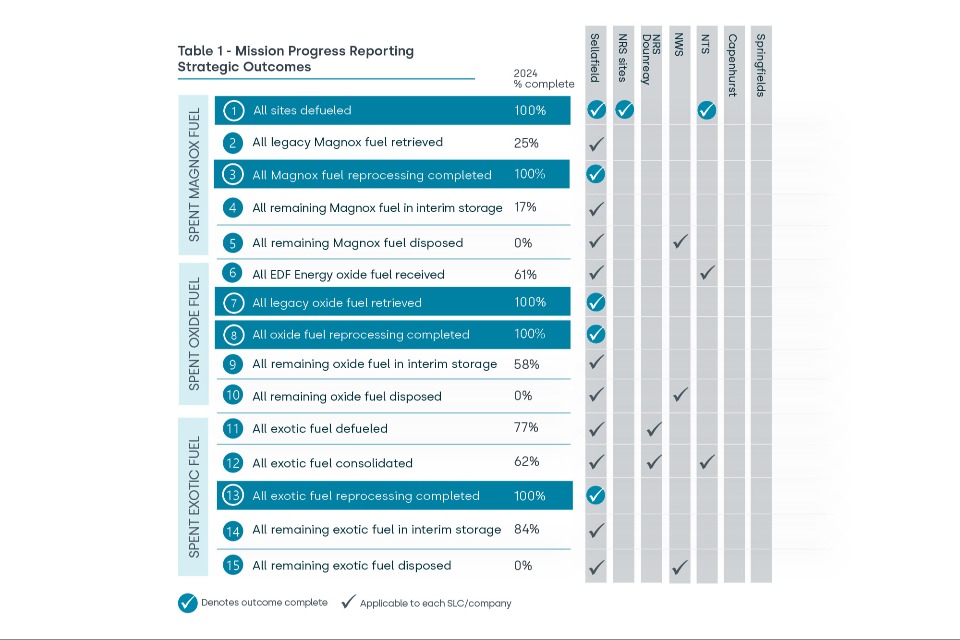

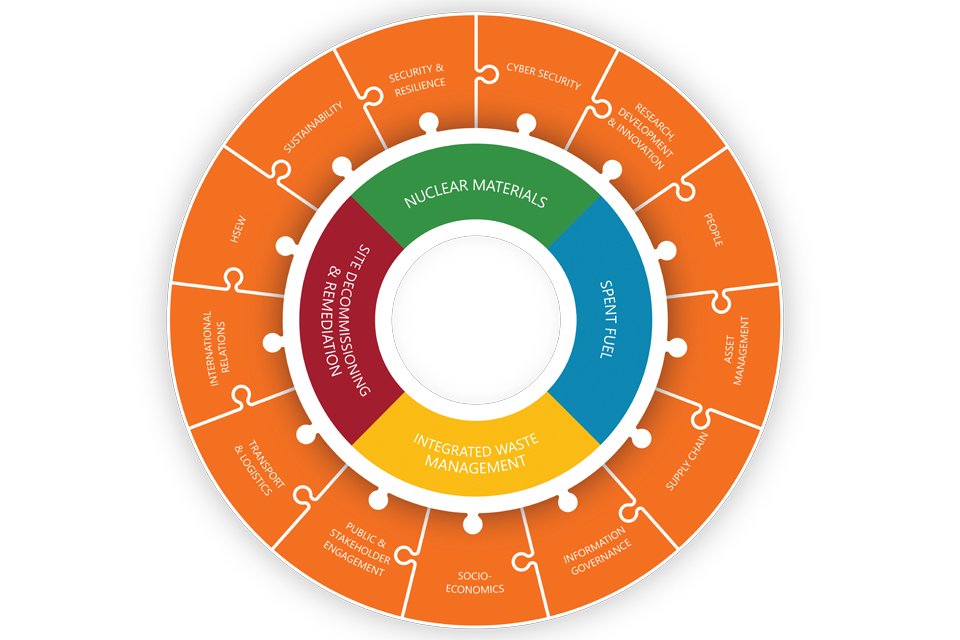

Across our four driving themes, we break our mission down into 47 strategic outcomes. These outcomes represent the significant pieces of work that must be achieved to deliver our mission.

In March 2021 we published our latest Strategy and updated our outcomes to ensure they continue to align with our strategic approach.

Increasingly, we’re building a more accurate picture of the work that has been completed across our 47 outcomes and that which is still left to do.

The percentage figures in the charts on the following pages show the proportion of work that has so far been completed towards the achievement of each outcome. Overall, good progress continues to be made across our mission as we safely manage our nuclear inventory and reduce the risks associated with it.

The last year saw progress across a number of fronts to deliver our mission. This ranged from high hazard reduction, with key milestones at Sellafield as retrieval of waste began from ponds and silos on the site, to important critical enabler activities. This included a large focus on skills, as we supported the work of the UK Government and invested in programmes such as graduate recruitment and development.

Case studies for 2023/24: United Nations Sustainable Development Goal icons appear next to each case study show how the NDA’s work is contributing to the important sustainability agenda.

Strategic outcomes: Our strategy identifies 47 strategic outcomes that, at a very high level, cover all of the work needed to deliver our mission

UK Government and devolved administrations update radioactive substances and nuclear decommissioning policy

An updated radioactive substances and nuclear decommissioning policy for the UK was published in May 2024. It replaced a policy initially published in 1995, with many technological and sector changes during since that time.

The update encourages innovation in waste treatment techniques – from greater recycling to research into extracting isotopes from nuclear materials for use in diagnosis and treatment of cancers, with the option of disposal being the last resort. This will minimise impact on the environment and help reduce the amount of waste for disposal.

In addition to England and Wales existing long-term plans to dispose of the highest risk radioactive waste in a geological disposal facility (GDF) hundreds of metres underground, the option to use a facility closer to the surface for less hazardous radioactive waste will be considered. While a GDF is not expected to be ready until the 2050s, Near Surface Disposal could be available much sooner in England and Wales for some suitable intermediate level waste, allowing for quicker and more cost-effective decommissioning.

Case studies for 2023/24

Spent Fuels Strategic outcomes 1-15

Our strategy defines our approach to managing the diverse range of spent fuels for which we are responsible, which are divided into Magnox, Oxide and Exotic. Once spent fuel is removed from a reactor, it is stored in a pond or dry store until it can be dispatched to Sellafield. For more information on the types of spent fuels we manage, see our Strategy document.

The NDA’s strategy has been to bring the reprocessing programme to an end. The THORP reprocessing plant and the Magnox reprocessing plant have now closed. All remaining spent fuel will be safely stored until a permanent solution for disposal is available. The strategy for all remaining spent fuels is to place them in an interim store pending a future decision on whether to classify them as waste for disposal in a GDF. For planning purposes, we assume that all the remaining spent fuels will be disposed of in a GDF.

Our spent fuel work is separated into 15 strategic outcomes that we must deliver, outlined below.

Strategic outcomes 1-15

Spent Fuels case studies

Major projects assessed

A number of major projects at Sellafield have been subject to independent assessments in the last year.

The Sellafield Product and Residue Store Retreatment Plant (SRP) and SIXEP Continuity Plant (SCP) achieved green delivery confidence assessments from the Infrastructure and Projects Authority (IPA), while a Replacement Analytical Project (RAP) improved its position from a previous red rating to amber.

The same methodology was used by the NDA to undertake an assessment of the site’s Box Encapsulation Plant Product Store, resulting in a green confidence assessment.

Richard Lennard, Head of Client for Project Delivery at Sellafield, said: “While these achievements are impressive, they don’t guarantee overall success. We must remain alert and focused on consistent and systematic performance. The IPA’s delivery confidence assessment is their view of the likelihood of the project delivering its objectives to time and cost – it’s great to have but at the same time it’s not a guarantee of future performance.”

Hunterston B defueling on track

Defueling of the first reactor at Hunterson B has been completed on time and on budget. Site owner EDF Energy is aiming to have the second reactor defueled and all spent fuel off-site in preparation for the site ownership to change to the NDA group in 2026 ready for decommissioning to be undertaken.

NDA group companies are playing a leading role in supporting defueling, with Nuclear Transport Solutions transporting the spent fuel by rail to Cumbria where Sellafield is ensuring the material is safely stored ahead of final disposal in the future.

Nuclear Materials Strategic outcomes 16-25

Our strategy defines our approach to dealing with the inventory of uranics and plutonium currently stored on some of our sites. These nuclear materials are by-products from different phases of the fuel cycle, either manufacturing or reprocessing.

All nuclear materials must be managed safely and securely, by either converting them into new fuel or immobilising and storing them until a permanent UK disposal facility is available.

All of our plutonium is stored at Sellafield. Although uranium is located at a number of our sites, we are continuing to consolidate it at sites best suited to its management. For more information on the types of nuclear materials we manage, see our Strategy document.

Our nuclear materials work is separated into 10 strategic outcomes that we must deliver, outlined below.

Strategic outcomes 16-25

Nuclear Materials case study

Consolidation of uranics

The NDA is responsible for safely managing approximately 70,000 tonnes of uranium. This is in various forms and has been generated as a legacy of the UK’s civil nuclear programme.

We’ve made good progress in ensuring that all materials are safely stored, monitored and maintained across the NDA estate. We’ve continued to drive towards the transportation of the above remaining categories of material, due for consolidation from across the NDA estate to the Capenhurst site. Some materials were not able to be transported to Capenhurst in 2023/24 as targeted.

Integrated Waste Management Strategic outcomes 26-39

Our strategy considers how we manage all forms of waste arising from operating and decommissioning our sites, including waste retrieved from legacy facilities.

Managing the large quantities of radioactive waste from electricity generation, research, the early defence programme and decommissioning is one of our biggest challenges. Some of this radioactive waste is in a raw (untreated) form, some has been treated and is being interim stored and, in the case of low level waste, some has already been permanently disposed of.

Retrieving, treating and interim storing the radioactive waste from Sellafield’s four legacy ponds and silo facilities is our highest priority. For more information on the types of waste we manage, see our Strategy document

Our Integrated Waste Management (IWM) work is separated into 14 strategic outcomes that we must deliver, outlined below.

Strategic outcomes 26-39

Integrated Waste Management case studies

First box of waste enters store at Sellafield

Sellafield’s Box Encapsulation Plant Product Store Direct Import Facility (BEPPS-DIF) received its first box of historic nuclear waste from the site’s Pile Fuel Cladding Silo in early 2024, paving the way for accelerated decommissioning of the silo.

BEPPS is a large, purpose-built, above ground store that can house intermediate level wastes safely and securely for the next hundred years. The Direct Import Facility is a later addition to the facility and allows waste to be sent directly from silo to store, accelerating clean-up of legacy.

Glovebox training facility opens

A state-of-the-art national glovebox training facility opened at Sellafield in 2023, providing a purpose-built facility to allow operators to build their skills in a safe and controlled environment.

Developed by the UK Alpha Resilience and Capability (ARC) Programme, the glovebox training facility provides a standardised approach to training, allowing learners from around the country to hone their craft more quickly and effectively.

A glovebox is a sealed container with a window and flexible gloves that allow the user to manipulate nuclear materials from the outside in a safe environment

Drums moved to the Low Level Waste Repository for disposal

Nuclear Restoration Services, Nuclear Transport Solutions and Nuclear Waste Services, have safely and successfully transported 1,000 drums of radioactive waste from Winfrith in Dorset to the Low Level Waste Repository in Cumbria for final disposal. The waste was transported using rail instead of road, reducing carbon emissions. The project frees up the facility that had housed the material for alternative use and means better value for taxpayers, with long-term waste storage no longer needed. This demonstrates the value of collaboration across the NDA group, leading to more efficient and sustainable nuclear decommissioning and waste management solutions.

A drum from the Treated Radwaste Store (TRS) at Winfrith ready to be disposed of at the LLW Repository site in Cumbria.

Aerial surveys to support Geological Disposal Facility site search

Nuclear Waste Services has concluded a six month programme of marine aerial surveys in Mid and South Copeland, and Theddlethorpe, providing information about the presence and numbers of birds and marine wildlife in the area. Together with other environmental surveys, this will inform baseline data as part of work to understand if an area is suitable for a Geological Disposal Facility in the future, while remaining committed to environmental protection and preservation.

First retrieval of historic nuclear waste

The first retrieval of historic nuclear waste from Sellafield’s Pile Fuel Cladding Silo (PFCS) was successfully achieved during summer 2023, representing a monumental step forward for Sellafield’s oldest waste store and one of the most complex and difficult decommissioning challenges in the world.

The silo was built in the 1950s to store cladding from nuclear fuel used in the UK’s earliest reactors. After over a decade of preparations for retrievals, operators were finally able to reach into the silo using a remote grab to remove the waste and place it into a stainless-steel box for transfer to a modern store.

Communities engaged in search for Geological Disposal Facility site

Communities have continued to be engaged and have their say about the potential of hosting a Geological Disposal Facility (GDF). Following a comprehensive and robust evaluation of information, it was concluded in September 2023 that Allerdale in Cumbria would no longer be taken further in the search for a suitable host site. This is because of a limited volume of suitable rock as well as geology in the area being unlikely to support a post closure safety case.

Separately East Riding Council voted to withdraw from the South Holderness GDF Working Group early in 2024 following a vote by council members. Engagement continues with three other communities in England about siting a GDF in their areas, two in Cumbria (Mid Copeland and South Copeland), and one in Lincolnshire near Theddlethorpe.

Site Decommissioning and Remediation Strategic outcomes 40-47

Our strategy defines our approach to decommissioning redundant facilities and managing land quality in order that each site can be released for its next planned use.

After the buildings on our sites have been decommissioned, decontaminated and dismantled, the land will be cleaned up to allow it to be released for other uses. At that point, ownership would transfer to the new user of the land.

We’re currently assessing alternatives for the final stages of decommissioning that could lead to earlier release of land, continued employment and opportunities to reuse it.

Our site decommissioning and remediation work is separated into eight strategic outcomes that we must deliver, outlined below.

Strategic outcomes 40-47

Site Decommissioning and Remediation case studies

Hazards reduced at Nuclear Restoration Services

Nuclear Restoration Services met an operational target to remove 7,000m2 of asbestos during the year. This included a final area cleaned from Hinkley Point A site’s boiler houses. Three of the four boiler houses are now cleared, removing a total surface area of approximately 55,721m2 - that’s the equivalent of just over eight football pitches.

In addition, at the Wylfa site, administration and ancillary buildings have been safely demolished, clearing a 1,249m2 area – more than six singles tennis courts.

Power stations have boiler houses which contain steam boilers that are used to produce electricity. They are found in nuclear and non-nuclear sites but contain conventional risks such as asbestos.

First capping of historic trenches and vaults begins

Nuclear Waste Services has begun work to permanently secure nuclear waste vaults at the Low Level Waste Repository site in Cumbria.

Activity to start to cap the site’s historic, and now full, trenches and vaults ready for closure started in November last year. A long-term programme is now underway to permanently close the existing vaults and trenches – and initial work on the ground has begun.

Decommissioning Trawsfynydd moves forward

Bulk retrieval of remaining Intermediate Level Waste has been completed at Trawsfynydd, with 60 boxes of waste encapsulated. Meanwhile, as the Nuclear Restoration Services lead and learn site for reactor dismantling, the procurement process has moved forward to reduce the height of the site’s two reactor buildings by about a third. Scope has also been developed for reactor dismantling, including scheme design and characterisation work.

The site continues to prepare the ponds facility for demolition and has submitted an environmental permit application for the in-situ disposal of lightly contaminated ponds facility demolition waste. Finally, welfare facilities and the sewage treatment plant have been upgraded.

Our critical enablers

Our fifth strategic theme, critical enablers, covers the important activities needed to support the overall delivery of our mission.

Critical enablers diagram

Critical enabler case studies

Socio-economics

New Social Impact and Communities Strategy launched

A new Social Impact and Communities Strategy has been published setting out our approach to supporting communities and maximising the social impact of our work.

The Energy Act (2004) provides us with a legal duty to have regard for the impact of our activities on communities near sites, as well as our wider responsibilities under the Social Value Act (2012).

In addition to direct economic impact, socio-economic funding is designed to help local communities grow and diversify. Over the last four years, we’ve invested almost £50 million of direct socio-economic funding and, by doing so, it has leveraged millions of pounds of further investment from partners.

The updated strategy takes account of the UN Sustainable Development Goals and UK socio-economic priorities, including those set out by the Just Transition Commission (Scotland) and in the Wellbeing of Future Generations (Wales) Act 2015. It informs individual social impact strategies and plans of the NDA’s operating companies and has been developed in consultation with representatives from local communities.

Health, safety, environment and wellbeing

NDA partners with Hey Girls

We’ve partnered with social enterprise Hey Girls to provide complimentary period products to staff and help tackle period poverty across Cumbria.

The partnership is part of our drive to ensure workspaces are a welcoming, inclusive and safe place for employees and to create positive change in the community.

For every product ordered by the NDA one is also donated to community partners like local charity the Whitehaven Community Trust to support people across the region, with around 3,000 products being donated so far.

Kerry Maxwell O.B.E, Chief Executive at Whitehaven Community Trust, said: “We will be distributing the products from our Senhouse Centre in Whitehaven town centre across the community, particularly looking to support those most vulnerable including victims of domestic abuse and providing products through local foodbanks.”

Sustainability

New sustainability report coming soon

The NDA group is publishing a new sustainability report setting out the progress being made towards the goals of its sustainability strategy, published in 2022.

The document sets out the NDA’s four sustainability legacies and the opportunities to contribute to global efforts, aligned with the United Nation’s Sustainable Development Goals.

Available on the NDA website, progress is covered relating to safety and hazard reduction, the environment, people, communities and the supply chain.

Security and resilience

Remote monitoring of sensitive sites (RMSS) competition

Around £1.5million of funding has been made available for innovations to enable the remote monitoring of legacy nuclear sites. The competition, run by the Defence and Security Accelerator (DASA), is seeking proposals for a complete Autonomous Security Alarm and Interdiction Network (ASAIN).

The system independently monitors, tracks and detects security breaches, keeping human operators away from harm while giving them the information they need to inform their response. It enables risks to be managed proportionately and delivers value for money for the taxpayer. The competition will have a six month development phase, followed by a 12 month test and evaluation phase on an NDA site.

Transport and logistics

NTS begins transport solution development to help space exploration

Nuclear Transport Solutions (NTS) is developing bespoke transport solutions to help launch the next generation of atomic batteries for space exploration. The batteries, also known as radioisotope power sources, are being developed by National Nuclear Laboratory (NNL) and University of Leicester, with funding provided by the UK Space Agency and the European Space Agency.

A team of expert engineers are using years of experience and extensive knowledge of nuclear transport to ensure these revolutionary batteries, which are the first to use americium 241 as a radioactive source, reach their launch site safely and securely. The batteries work for decades, without need for maintenance over the many years in which a spacecraft could be travelling.

Research, development and innovation

Robot proves itself in Dounreay radioactive area

A robot quadruped designed by Boston Dynamics, has been put to work on trials which saw it map out a four-storey evaporator cell at Dounreay which hadn’t been accessed in over 20 years.

The robot, commonly known as Spot, has been collecting important radiological data for the team to use when planning the decommissioning of the facility, and to gain useful experience on how both Spot and survey equipment should be used. A team of 12 have supported the trials, including staff at Dounreay and specialist provider Createc.

A wooden mock-up of the evaporator cell entrance and temporary containment was constructed in a clean area to test the abilities of Spot and train the operators who would support it, before the work moved into the radioactive evaporator cell. Once inside, Spot collected data to give the team a complete three-dimensional map of the area and radiological data to create a full dosimetry map showing areas of higher radioactivity along with information from physical samples taken. This will enable the team to develop a radiological fingerprint and plan the decommissioning in an efficient and effective way, keeping people safe. There is significant potential to share this learning across the NDA group.

People and skills

The challenge:

Ensuring that we have the right skills and talent to deliver our nationally important long-term decommissioning mission. Skill shortages, an increased number of opportunities within the wider energy sector and an ageing workforce are all contributing factors to why this challenge is an increasing priority for the NDA group. This means focusing efforts on attracting and retaining talent at all stages of their career from early careers to those with experience in a range of professional disciplines working in other industries and sectors.

The solution:

-

More than 600 graduates took part in the NDA’s first-ever large-scale graduate recruitment and assessment event at a major Manchester conference centre, with the number of graduate opportunities available across the group doubling in 2024 to more than 120. Alongside the formal assessment process, candidates heard from expert speakers, spoke to current graduates and accessed exhibitions and interactive content to find out more about decommissioning.

-

A new group-wide careers website has been launched making opportunities in the NDA and all its operating companies accessible in one place to a wider, more diverse audience. Group Chief People Officer David Vineall said: “It’s vital we have the right people to deliver our mission and that means attracting high quality candidates at all stages of their career. ndagroup.careers is a one stop shop for the career opportunities available with us, helping us say hello to a national audience and demonstrating that together we are one extraordinary group with so many possibilities.”

-

The NDA supported the creation of a National Nuclear Strategic Plan for Skills with expectations that 40,000 new jobs will need to be filled in the sector by the end of the decade. We also supported the launch of Destination Nuclear – a new national campaign to raise the profile of the nuclear industry with a message that whatever you do, you can do nuclear. In its initial launch period, it has already reached new audiences through a mix of online, billboard and radio advertising.

-

We’re working collaboratively across the group to ensure we create great places to work, enabling people to perform at their best and stay within the group to further their personal and professional development. Areas of focus include building career pathways, offering learning and development routes including a highly acclaimed Leadership Academy and facilitating the opportunity for colleagues to experience different parts of the NDA group in both secondments and permanent roles.

The outcome:

We’re reaching new audiences and attracting people with different skills and backgrounds to deliver the NDA group’s mission. There’s still more to do and the NDA will continue to support the National Nuclear Strategic Plan and other initiatives to maintain focus in this area.

Asset Management

Asset management system standardised

Work has been carried out this year to standardise asset management systems across the NRS sites to help prepare for a successful handover of the EDF Advanced Gas-cooled Reactors (AGR).

The goal has been to support NRS in developing a blueprint for intelligence in asset management.

This has meant working with group colleagues to develop a full programme plan and functional specifications to give them a library of documentation and proven guidance that will support them in looking after the assets across their fleet of stations.

This should ultimately lead to improved safety, reliability and performance with all of the information available on a platform that can be adopted across the NDA group.

Cyber security

Event encourages cyber careers

We hosted Cumbria’s first ever cyber security ‘Capture the Flag’ competition for secondary schools across Cumbria to encourage pupils to consider a career in cyber security. Students were given a showcase of cyber techniques and the career opportunities in the field available across the NDA group.

Additionally, provisions were considered to allow students of all abilities and backgrounds to attend, making the event inclusive and accessible for all attending. Students also had the opportunity to hear from cyber experts at the NDA and the Group Industrial Cyberspace Centre, as well as engage with former apprentices and graduates who started their careers in cyber in the NDA group and could talk about their own experience getting into the industry.

Information Governance

Improving privacy and data governance

We’ve implemented a new privacy management system to automate the Data Protection Impact Assessment (DPIA) process. Prior to this, assessments were carried out manually and were treated as stand-alone documents that weren’t living or integrated effectively into the business.

The data protection team therefore wanted to increase visibility, streamline the task and share this benefit with others.

As part of the process, a new group-wide standardised assessment template was developed taking further advantage of our efforts to work as part of one NDA group. To date, more than 85 impact assessments have been undertaken, not only simplifying the process for staff, but increasing the effectiveness and reducing the potential for non-compliance with the UK General Data Protection Regulations (UK GDPR).

Supply chain

innovation partnership established to manage asbestos waste

Two contracts have been awarded to establish an innovative partnership for the enhanced management of asbestos waste.

Nuclear Waste Services will oversee the partnership to test and develop new solutions to treat asbestos, helping to deliver efficiencies and enable more effective waste management. It is projected that the work could help realise multi-million pound cost savings.

Innovation partnerships are a new procurement approach for the NDA, harnessing the power and expertise of the supply chain from research and development through to deployment.

Contracts have been awarded to two consortia: * Veolia Nuclear UK Solutions, Cyclife UK Ltd and Waste to Glass sas * React 2 consisting of Galson Sciences, and Thermachange

Public and stakeholder engagement

Partnership extended with Young Generation Network

We’ve extended our partnership with the Nuclear Institute Young Generation Network to 2025. The organisations have been working together since 2020 to maximise learning opportunities for NDA group staff and engage with young people interested in working in the sector.

The partnership helps us to reach more early career nuclear professionals and hear from them directly, to understand better how to support and develop them as the future pioneers of the sector.

Successes include establishing a joint steering committee and young persons shadow boards to inform the group’s work and provide novel perspectives. The organisations also hosted a series of Decommissioning Spotlights webinars which attracted over 6,000 young professionals from across the industry.

International relations

Global nuclear representatives discuss stakeholder engagement

We met American and Canadian counterparts to share best practice around how best to deliver effective stakeholder engagement around nuclear decommissioning during 2023. The trilateral partnership encourages collaboration on the successful decommissioning and remediation of legacy nuclear sites and the safe management of their radioactive waste.

Attendees at the London summit explored how each body engages with communities, regulators, NGOs, local authorities, and government. The three countries also shared best practice on how to involve younger people, ensuring that not only their voices are heard but that they are also aware of the vast opportunities available for those considering a career within the industry.

David Peattie FREng HonFNucl

Accounting Officer and Group Chief Executive Officer

3 October 2024

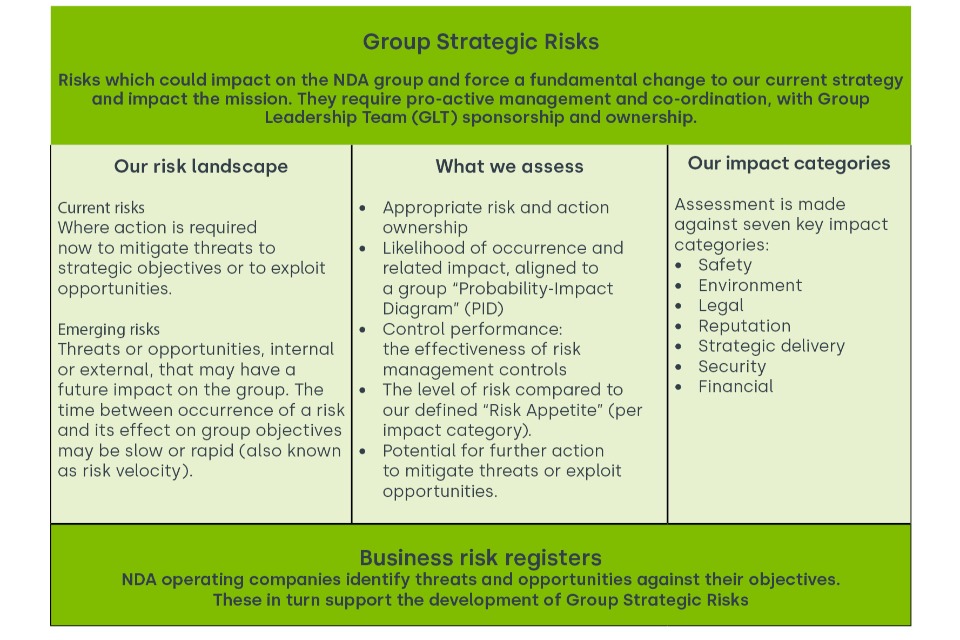

Accountability report

The accountability report sets out how we meet our key accountability requirements to Government. The report is divided into three sections:

The corporate governance report which:

- Includes details of the Board members and leadership team

- Explains the governance structures and reviews our risk management and the internal control systems

Remuneration and people report which:

- Discloses the remuneration of our Board members

- Highlights employee matters and details staff numbers, costs and pension arrangements

Parliamentary accountability and audit report which includes:

- The Parliamentary accountability disclosures, reporting on losses and special payments and remote contingent liabilities of interest to Parliament

- The Audit report prepared by the National Audit Office setting out the Audit opinion on the annual accounts

Governance statement

The NDA is sponsored by the Department for Energy Security and Net Zero (DESNZ). UK Government Investments (UKGI) provides strategic oversight of our corporate governance and corporate performance, working closely with and reporting directly to UK Government senior officials and providing advice to ministers. The formal arrangements between us and our sponsoring department are set out in a framework document, supported by a memorandum of understanding between DESNZ and UKGI. The Scottish Government also has an important governance role to ensure its expectations are met.

The following Governance Statement provides an insight into the corporate governance framework for the NDA and our group entities during 2023/24. The framework is used to measure our performance and effectiveness in the delivery of strategic and operational objectives.

The NDA’s Governance Framework

The NDA is a body corporate governed through the Energy Act 2004; the Government’s NDA framework document; and Cabinet Office guidelines for non-departmental public bodies (NDPBs). We also draw on best practice as set out in the UK Corporate Governance Code where appropriate. This is within the context that our value is not primarily financially metric driven and that our remuneration policy is in line with public sector guidance.

Our governance is under constant review with the latest Group Operating Framework (GOF) published in July 2022. Developed with input from all parts of the NDA group, the GOF is a suite of co-created documents that set out how the group is organised, governed and works together. With the support of DESNZ and UKGI, the NDA is focused on building on the work of the GOF to deliver more effective and efficient group governance.

The Energy Act 2004 requires us to prepare a strategy for carrying out our functions and to prepare an annual business plan in respect of each financial year. The strategy and annual business plan must be approved by the Secretary of State and, to the extent appropriate, by the Scottish Ministers.

Certain scopes of work require approval from DESNZ. Where work falls outside our delegated authority, we must seek approval before commencing the work and demonstrate that it is affordable, aligned to our mission and provides value for money.

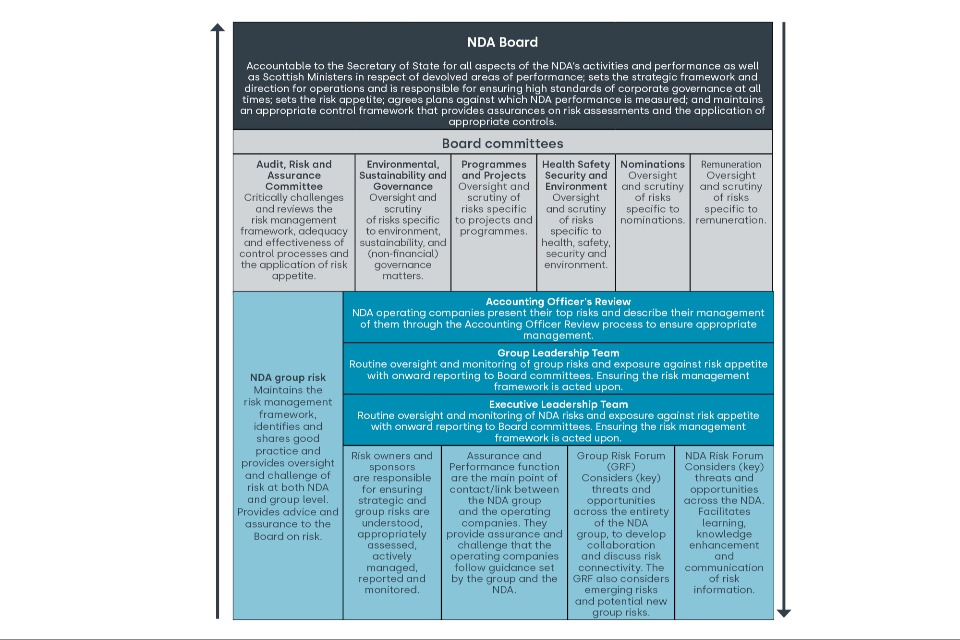

The Board

The NDA Board is responsible for all aspects of our activities and performance. It sets the strategic framework and direction for operations; is responsible for ensuring high standards of corporate governance at all times; sets the risk appetite; agrees plans against which our performance is measured; and ensures the maintenance of an appropriate control framework that provides assurances on risk assessment and the application of appropriate controls.

At the date of this report, the NDA Board is comprised of seven non-executive Board members, including the Chair, a Senior Non-Executive Member, and two executive members: the Group Chief Executive Officer (CEO) and the Group Chief Financial Officer (CFO). The Group General Counsel and Company Secretary attends all Board meetings.

The names and biographies of the Board members who served during the period 1 April 2023 to 31 March 2024, their respective terms of office and memberships of the committees of the Board, can be in the Governance statement section.

Whilst recognising the unique role of the UKGI Representative on the Board, all Non-Executive Members of the Board are considered independent of the Executive and senior management. Janet Ashdown and Evelyn Dickey both reached nine year tenures in 2024. The Secretary of State for DESNZ has considered their independence and believes that they still meet these requirements. Their terms of office have been extended to 31 January 2025 to support an effective transition as new board members are appointed.

The Chair of the Board is accountable to the Secretary of State for our activities and performance in implementing our strategy and annual business plan, for formulating the Board’s strategy for discharging our statutory functions and duties and for providing effective leadership and direction of the Board.

The Chair is supported by the Senior Non-Executive Member. The Senior Non-Executive Member leads the annual performance review of the Chair.

The Group CEO is responsible for the leadership and operational management of the NDA. As CEO they are accountable to the Board and as Accounting Officer to Parliament for: NDA activities, public funds employed, ensuring targets are met and for implementing the strategy and plans approved by the Board and DESNZ.

At 31 March 2024, the Board’s gender balance was 50:50, with two senior board positions (Senior Independent Member and CFO) being held by women.

Board committees

The Board is advised by, and delegates some of its responsibilities to, six committees:

-

Audit, Risk and Assurance Committee (ARAC)

-

Nominations Committee (NOMCO)

-

Remuneration Committee (REMCO)

-

Programmes and Projects Committee (P&PCO)

-

Health, Safety, Security and Environment Committee (HSSE)

-

Environmental, Sustainability and Governance Committee (ESG)

Each committee is chaired by a non-executive Board member. Membership of the committees is made up of a combination of executive and non-executive Board members as appropriate. The majority of members on the committees are always non-executive members.

The Group General Counsel and Company Secretary attends most committee meetings. Other Board members, members of the Executive Leadership Team (ELT), external advisors, representatives from the operating companies and other key stakeholders attend meetings at the invitation of the respective committee chairs.

Each committee reports directly to the Board by way of a Committee Chair’s report and committee minutes are made available to all Board members as appropriate. Urgent matters are escalated by the Committee Chair to the Board as appropriate.

The membership, meeting attendance records, purpose, responsibilities and key activities within the year of each committee can be found on pages 68 to 78.

Executive Leadership Team

The Board delegates execution of strategy and day-to-day operational management of the NDA to the CEO and their ELT. The ELT comprises the: Group Chief Financial Officer; Group Chief Assurance and Performance Officer; Group Chief People Officer; Group Chief Commercial and Business Development Officer; Group Chief Corporate Affairs Officer; Group Chief of Staff and Security Officer; Group General Counsel and Company Secretary and Group Chief Nuclear Strategy Officer.

Representatives from our three control functions were co-opted into the ELT from April 2024 to further embed these important areas of work into all ELT decision making. The Group Chief Ethics and Compliance Officer; Group Director of Internal Audit and NDA Risk Director now attend all ELT meetings. The Group Organisation Development Director has also been co-opted into the ELT until the end of 2024/25 to support the ELT on the continued embedment of One NDA across the group.

Board members

Peter Hill CBE, Non-Executive Chair

(From 1 June 2024) (Term of office ends 30 November 2027)

Board skills and experience:

Peter has wide experience in executive, non-executive and chair roles across a number of FTSE listed companies and in government. Peter has been a non-executive board member of UK Trade and Investment, the Royal Air Force and an agency of the Foreign, Commonwealth and Development Office.

He has previously been Chair and a non-executive director on the Boards of a number of organisations spanning the manufacturing, research, aerospace and defence and chemicals industries amongst others. His executive career began with multinational mining groups Anglo American, Rio Tinto, BP Minerals and Consolidated Gold Fields. During this time, he held a variety of roles covering planning, operations, project management and corporate finance. He subsequently held senior management positions with FTSE 100 engineering groups BTR and Invensys and was an executive director on the Board of Costain Group plc, the then international engineering and construction company which completed major infrastructure projects worldwide.

For nine years he was the Chief Executive Officer of Laird plc, transforming it from an industrial conglomerate to a focussed international electronics company. Peter holds a BSc in Engineering and an MBA from the London Business School, he is a Chartered Engineer and a Fellow of the Institute of Materials, Minerals and Mining.

External appointments:

Peter is currently chair of Keller Group plc.

David Peattie, FREng HonFNucI Executive Board Member – Group Chief Executive Officer and Accounting Officer

Board skills and experience:

David was appointed Group Chief Executive Officer for the NDA in 2017, following a 33 year career in a number of technical, commercial and senior management positions in the oil and gas industry, including as Head of BP Russia, where he was responsible for BP’s interests in the TNK-BP joint venture as well as its businesses in the Russian Arctic and Sakhalin. He was also BP’s lead director on the board of TNK-BP and Chair of its Health, Safety and Environment Committee.

David has significant global experience of leadership in the energy, oil and gas industries, and a strong track record in tackling complex commercial and engineering challenges in the UK and internationally. Prior to taking up his role at the NDA, David was Chief Executive Officer at Fairfield Energy, where he managed the performance of North Sea assets and oversaw the start of the decommissioning project for the Dunlin Alpha Platform.

External appointments:

David is Chair of Pacific Nuclear Transport Limited, the international nuclear shipping company, partly owned by the NDA. David served a term as Patron of Women in Nuclear UK from 2020 to 2022.

David is a Fellow of the Royal Academy of Engineering, a Chartered Engineer, a Fellow of the Institute of Materials, Minerals & Mining (IOM3), and an Honorary Fellow of the Nuclear Institute.

He has personally established and funds undergraduate bursaries for Engineering students at the University of Dundee.

Kate Bowyer, Executive Board Member-Group Chief Financial Officer

Board skills and experience:

Kate joined the NDA as CFO in May 2023 and plays a key role on our Group Leadership Team and on our Board. Kate brings a wealth of financial and leadership expertise to the role, joining from Muse Places, part of the Morgan Sindall group. In her role as Managing Director, Kate led the delivery of regeneration projects with private and public sector partners, bringing sustainable and transformational change to towns and cities across the UK. Prior to this, Kate was Chief Financial Officer of The Crown Estate, a £14 billion land and property owner and manager.

External appointments:

None

Janet Ashdown, Senior Non-Executive Board Member

(Term of office ends: 31 January 2025)

Board skills and experience:

Janet worked for BP plc for over 30 years, holding a number of local and global positions in fuel supply, manufacturing, oil trading and retail marketing. She was a senior leader in BP, running its UK retail and commercial fuel business in her last role. Until the end of 2012, Janet was Chief Executive Officer of Harvest Energy Ltd.

External appointments: