New Computerised Transit System (NCTS) - web declaration completion rules

Updated 4 January 2019

UK – NCTS Web Channel - Declaration Completion Rules

1. Document Control

1.1 Change log

| Version | Date | Change details | Status |

|---|---|---|---|

| 0.1 | 6 October 2004 | First version | Draft for informal review |

| 1.0 | 16 November 2004 | Second version | Agreed for use |

| 2.0 | 7 March 2005 | Third version | Agreed for use |

| 2.1 | 17 May 2005 | Fourth version draft | Draft for informal review |

| 3.0 | 9 June 2005 | Fifth version | Agreed for use |

| 3.1 | 16 November 2006 | SAD Harmonisation | Final version |

| 3.2 | 16 January 2013 | NCTS - TIR | Final version |

| 4.0 | 1 August 2017 | UCC and IE15 | Final version |

| 4.1 | 18 December 2018 | Guarantee liability | Final version |

1.2 Changes

New Computerised Transit System (NCTS) became mandatory for Transports Internationaux Routiers (TIR) declarations from 1 January 2008.

Croatia started using NCTS from 1 July 2012.

Turkey started using NCTS from 1 December 2012.

Union Customs Code (UCC) implemented 1 May 2016.

2. Introduction

The tables are intended to assist declarants and notifiers to complete the Union/Common Transit Declarations (at departure) and Arrival Notifications (at destination), which are to be sent to the NCTS system by a web-based procedure. They give specific guidance on the completion rules of the 4 main electronic messages which will be sent by traders into the NCTS.

These tables provide only a basic guide to the co-relation between the data fields on the electronic message and the boxes on the paper Single Administrative Document (SAD), formerly used for the paper based transit (OTS) declaration and the information required to complete the fields.

Definitive guidance is provided in EU Regulation 952/2013 (UCC) and its Implementing and Delegated Provisions, specifically:

- Regulation 2015/2447, Annex 72.04, Section 2, II - particulars to be entered in the various boxes

- Regulation 2015/2447, Annex B, formats and codes of the common data requirements for declaration

- Regulation 2015/2446 Annex B common data requirements and in the equivalent Annexes A7, D1, D2 and A9, to Appendix III of the Convention on Common Transit

Further and more complete guidance on the completion of a transit declaration is contained in the UK Tariff, Volume 3, in the Transit Manual: Common and Union transit - European commission and in the UK Supplement to the Transit Manual.

List of Tables:

Table 1 - IE15 Transit Declaration: Data

Table 2 - IE14 Cancellation Request

Table 3 - IE07 Arrival Notification

Table 4 - IE044 Unloading Remarks

3. NCTS Message Tables

Table 1 – IE15 Transit Declaration

| Field | Mandatory Optional or Dependant |

Required contents | SAD box equivalent |

|---|---|---|---|

| Overview | |||

| LRN (Local Reference Number) | M | Declarant’s own reference number. No strict format, but must not exceed 22 characters. This must be unique for every declaration. | Box 7 |

| Declaration type | M | From the drop down list choose the type of declaration, for example, T1/T2/T2SM for goods destined for San Marino/T2F. If the goods are of mixed status, for example, T1 and T2, use T- in the header information, and specify the type at the individual item level. TIR users must select the code ‘TIR’. | Box 1 |

| Type of procedure | M | Choose Normal or Simplified procedure by selecting the appropriate radio button. Note: Simplified procedure is only to be used by Authorised Consignors. TIR users must select ‘Normal’ |

|

| Container | O | Containerised indicator. Check the box to indicate ‘Yes’, and confirm that the goods are in a container. | Box 19 |

| Place of declaration | M | Enter the location where the declaration is being made. This is a free text box. | Box 54 |

| Representative name | D | This field is to be used if the principal makes use of an authorised representative to make the declaration. | Box 50 |

| Representative capacity | O | Optional field – free text to state the capacity held by the representative. | Box 50 |

| Country of dispatch | D | Select the appropriate country from the drop down list. | Box 15/15a |

| Office of departure | M | Enter the code in the required format for example, GB000051. Use the ‘Look up’ table to verify the code if you’re unsure. | Box C |

| Country of destination | D | Select a country from the drop down list. | Box 17a |

| Office of destination | M | Enter the code in the format for example, IT071100. Use the ‘Look up’ table to verify the code if you are unsure. | Box 53 |

| Office of Transit | D | Enter the code in the format for example, CH006521. Note: this field must be completed when goods move to or via an EFTA country, or across a non-UK/non-EU/EFTA country. Note: offices of transit are not required for movements of goods entered to TIR. |

Box 51 |

| Inland transport mode | O | May be used to enter the code for the mode of transport upon departure. Codes for SAD Harmonisation are 1=Sea, 2=Rail, 3=Road, 4=Air, 5=Post, 7=Fixed transport installation, 8=Inland waterway and 9=Own propulsion. | Box 26 |

| Identity of means of transport at departure | D | Enter the name of the ship, prefix and flight number of the aircraft, identifying the number of the rail wagon or the registration number of the road vehicle on which the goods are directly loaded when the goods are presented at the office of departure. This box may be omitted in certain circumstances with the details subsequently being recorded in box 55. | Box 18 |

| Nationality of means of transport at departure | D | Enter the nationality of the means of transport declared at departure. Select the country from the drop down list. Note: although this field is shown as dependant in NCTS, the option applies to movements by rail only. For transit movements by all other forms of transport completion of this field is mandatory. |

Box 18 |

| Transport mode at the border | O | Enter the code for the active means of transport, which, it’s expected, will be used, on exit from the customs territory of the UK or EU. Codes for SAD Harmonisation are 1=Sea, 2=Rail, 3=Road, 4 = Air, 5 = Post, 7 = Fixed transport installation, 8 = Inland waterway and 9 = Own propulsion. | Box 25 |

| Identity of means of transport crossing the border | D | Enter the identity of the active means of transport, which it’s expected, will be used on exit from the customs territory of the UK or EU. | Box 21 |

| Type of means of transport crossing the border | O | Select the code for the type of the active means of transport, which, it’s expected will be used, on exit from the customs territory of the UK or EU. Note: In the case of combined transport, or where several means of transport are used, the active means of transport is the one which propels the whole combination. For example, if a lorry is on a ship, then the ship will be the active means of transport. |

Box 21 |

| Nationality of means of transport crossing the border | D | Enter the nationality of the active means of transport, which, it’s expected, will be used, on exit from the customs territory of the UK or EU. Select the country from the drop down list. | Box 21 |

| Trader details | |||

| Consignor | Can be used at either header or item level but not both. | ||

| EORI (TIN) | O | Up to 17 characters for the Economic Operator Registration and Identification Number. | Box 2 |

| Name | M | Enter the consignor’s trading name. | Box 2 |

| Street and number | M | Enter the appropriate details from the consignor’s address. | Box 2 |

| Postal code | M | Enter the appropriate details from the consignor’s address. | Box 2 |

| City | M | Enter the appropriate details from the consignor’s address. | Box 2 |

| Country code | M | Select the country from the drop-down list. | Box 2 |

| Consignee (Note: a consignee is mandatory for goods moving to UK/EU/EFTA countries) | |||

| EORI (TIN) | O | Up to 17 characters for the EORI number. | Box 8 |

| Name | M | Enter the consignee’s trading name. | Box 8 |

| Street and number | M | Enter the appropriate details from the consignee’s address. | Box 8 |

| Postal code | M | Enter the appropriate details from the consignee’s address. | Box 8 |

| City | M | Enter the appropriate details from the consignee’s address. | Box 8 |

| Country code | M | Select the country from the drop-down list. | Box 8 |

| Principal | |||

| EORI (TIN) | M | Up to 17 characters for the Principal’s EORI number. Note: if the principal’s EORI number is known to NCTS then only the EORI number need be entered. |

Box 50 |

| Name | D | Enter the principal’s trading name. | Box 50 |

| Street and number | D | Enter the appropriate details from the principal’s address. | Box 50 |

| Postal code | D | Enter the appropriate details from the principal’s address. | Box 50 |

| City | D | Enter the appropriate details from the principal’s address. | Box 50 |

| Country Code | D | Select the country from the drop-down list. | Box 50 |

| Goods summary (normal procedure) | |||

| Items | M | Enter the total number of items to be input on the declaration. | Box 5 |

| Total packages | D | Enter the total number of packages for all of the items on the declaration. | Box 6 |

| Gross mass | M | Enter the gross mass in kilograms. For a multi-item declaration this figure must accurately represent the total gross mass of all the items. Note: gross mass is the aggregate mass of the goods with all their packaging, excluding containers or transport equipment. |

Box 35 |

| Place of loading | O | The use of this field is optional for goods travelling between member states. May be used to identify a shed, wharf or other area where the goods are to be loaded to the transport. | Box 27 |

| Agreed location code | D | Only tick this box under normal procedure, when the declaration is being ‘pre-lodged’. Use of this field will result in the declaration being placed in the submitted state. The MRN will not be issued until an officer at the office of departure ‘accepts’ the declaration electronically, after the goods are present at the office of departure. | Box 30 |

| Agreed location of goods | D | To be used only under normal procedure (see above), and will be completed in accordance with local practice agreed with the office of departure. | Box 30 |

| Customs sub place | D | This field is to be used only under the normal procedure, when the goods are situated in customs approved facilities directly associated with an office of departure. For example, warehouse, DEPS, ERTS and other temporary storage facilities including unattended or occasionally attended port or airports. Note: a customs sub place is ‘any place designated, approved and controlled by a customs office of departure or destination for the presentation and examination of goods, for the purpose of commencing or ending a transit movement at that office’. |

Box 30 |

| Goods summary (simplified procedure only) – additional fields | |||

| Authorised location of goods code | D | An authorised consignor need not present the goods at the office of departure, but at a nominated authorised location, which can be: - the trader’s own premises - a customs controlled area at an office of departure - other customs approved facilities directly associated with an office of departure, for example, warehouse, DEPS, ERTS and other temporary storage facilities including unattended or occasionally attended port or airports. Authorised locations must be approved by the designated office of departure and must be individually specified in the Trader’s authorisation. |

Box 30 |

| Control result date limit | M | Enter the date by which the consignment is expected to arrive and be processed by the office of destination. This will be agreed with the office of departure and specified in the trader’s authorisation. | |

| Goods information - Add item level | |||

| Item number | M | Insert the item number. | Box 32 |

| Gross mass | O | The gross mass is the aggregate mass of the goods with all their packaging, excluding containers or transport equipment. | Box 35 |

| Net mass | O | The net mass is the mass of the goods themselves without any packaging. | Box 38 |

| Description of goods | M | The goods description must be the normal trade description expressed in sufficiently precise terms to allow immediate and unambiguous identification and classification. | Box 31 |

| Commodity code | D | The commodity code will be mandatory where: - the transit declaration is made by the same person, and at the same time as, or following a customs declaration which includes a commodity code (for example, an export declaration). - Union legislation so provides - for all declarations relating to sensitive goods. A minimum of 6 digits and a maximum of 8 digits of the HS code must be declared. |

Box 33 |

| Quantity of high risk goods. | D | To be completed whenever the declared commodity code relates to high risk goods under Regulation 952/2013 in quantities equal to or greater than those shown in column 3 of Appendix A of this document. | |

| Declaration type | D | This field must only be completed at item level if the code ‘T-‘ was used to code the field ‘Declaration Type’ in the header. Use the codes T1, T2 etc to specify the status of the goods covered by the individual item. The code ‘TIR’ is required for all TIR declarations. |

Ex box 1 |

| Country of dispatch | O | This field is to be used when more than one country of dispatch is declared. If only one country of dispatch is to be declared, this field must not be used, but rather the country of dispatch field in the header should be completed. Select the country from the drop down list. |

Ex box 15a |

| Country of destination | D | This field is to be used when more than one country of destination is declared. If only one country of destination is to be declared, this field must not be used, but rather the country of destination field in the header should be completed. Select the country from the drop down list. |

Ex box 17a |

| Trader-Consignor | D | May be used if not completed at header level. Use the header level consignor field when only one consignor is declared. | Box 2 |

| Trader-Consignee | D | Required if not completed at header level and the transit is going to a UK/EC/EFTA country. Use the header level consignee field when only one consignee is declared. | Box 8 |

| Packages | |||

| Type of packages | M | Select the appropriate code for the type of packages being used. A ‘look up’ for the list of package codes is provided, but further details can be found in Delegated Regulation 2015/2446. | Box 31 |

| Number of packages | D | Enter the number of packages, unless the package type entered is a code for ‘Bulk’ or ‘Unpacked’, when the field becomes optional. | Box 31 |

| Number of pieces | D | May only be used if the code for ‘Unpacked’ is declared in the ‘kind of packages’ field. | Box 31 |

| Marks and numbers of packages | D | To be used for all declarations unless the package type entered is a code for ‘Bulk’ or ‘Unpacked’, when the field becomes optional. | Box 31 |

| Container number | D | Should only be completed if the containerised indicator has been activated in the header. | Box 44 |

| Special Mentions | |||

| Code | O | Select the relevant 3-digit code from the drop down list to show the type of export transaction being used. This field must always be completed when the goods are to be exported from the European Union. Use of code DG02 will result in the word ‘Export’ being printed on the declaration. | Box 44 |

| Additional information | D | A 70 character free text field used to identify any related export documents or electronic export declarations. For example, any NES declaration immediately preceding the transit movement. Input either the NES entry number or the UCR. | Box 44 |

| Export from EC | D | Only to be used if additional Information ID is ‘DG0’ or ‘DG1’. If this field is used, use the tick box to indicate a ‘Yes’. | Box 44 |

| Export from country | D | Only to be used if additional Information ID is ‘DG0’ or ‘DG1’. Complete using the standard 2 digit country codes. Select the country from the drop down list. Note: Cannot be used at the same time as ‘Export from EC’ field. |

Box 44 |

| Produced documents/certificates | |||

| Document type | O | Please select the relevant code from the drop down list provided. For TIR the code is ‘952’. | Box 44 |

| Document reference | O | Enter the reference number of the relevant ‘produced document’. TIR users must enter the TIR Carnet number . | Box 44 |

| Complement of information | O | An optional field for further information if required. | Box 44 |

| Previous administrative references | |||

| Previous Document type | D | Please select the relevant code from the drop down list provided. Enter the code for any previous CT/Status documents, when subsequent or replacement documents are issued. | Box 40 |

| Previous document reference | D | Enter the reference number of the relevant ‘previous document’. | Box 40 |

| Complement of information | O | An optional field for further information if required. | Box 40 |

| Guarantee information | |||

| Guarantee type | M | Choose the appropriate guarantee type from the drop down list. TIR users must select code ‘B’. | Box 52 |

| Guarantee reference number | D | Enter the guarantee reference number in this field if the ‘guarantee type’ field contains the code ‘0’, ‘1’, ‘2’, ‘4’ or ‘9’. | Box 52 |

| Other guarantee reference | D | Enter the other guarantee reference number in this field if the ‘guarantee type’ field contains codes other than ‘0’, ‘1’, ‘2’, ‘4’ or ‘9. Note: This field cannot be used when the guarantee reference number field is used. TIR users must enter the TIR Carnet reference number. This must agree exactly with the information entered in box 44. |

Box 52 |

| Guarantee liability amount | D | For type 0, 1, 2, 4 and 9 guarantees: UK Guarantees – calculate and enter the appropriate liability amount. This field must be completed. Foreign Guarantees - you are encouraged to enter the actual liability amount. If not completed, a (£) sterling equivalent of €10,000 will be automatically input by the system and the value in (£) sterling will be displayed once the declaration is accepted. | Box 52 |

| Validity limitation non-EC | D | Enter the country identity for any country on the ‘Contracting Parties’ list for which the nominated guarantee is not valid. For example, ex-EFTA, San Marino or Andorra. | Box 52 |

| Access code | D | Enter your 4 digit confidential access code, which corresponds to your guarantee reference number. TIR users must leave this field blank. |

Table 2 Transit Declaration – IE14 Cancellation Request

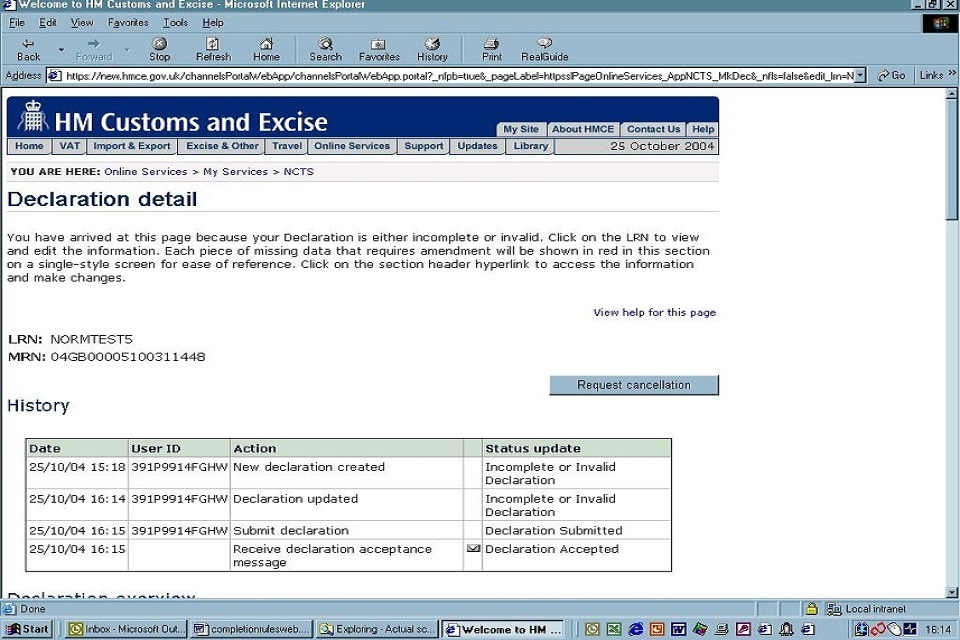

If you wish to cancel a declaration made via the web channel, clicking the ‘Request Cancellation’ button from this page opens a box for you to give the reason why you are requesting cancellation. Submitting this message sends the cancellation request to the office of departure.

You will be sent either an acceptance or rejection message depending on the decision of the office of departure.

Example of request cancellation made via the web channel.

This image shows an example of a request cancellation made via the web channel.

Table 3 – Transit declaration – IE07 Arrival Notification

| Field | Mandatory Optional or Dependant |

Required contents | SAD box equivalent |

|---|---|---|---|

| Main information | |||

| Movement Reference Number (MRN) | M | Enter the unique MRN displayed on the top right of the TAD. | |

| Place of notification | M | A plain text box to be completed according to local practice, agreed with the office of destination. | |

| Presentation customs office | M | Enter the code for the office of destination in the format ‘2a country+6nOffice identifier’ for example, GB000051. Look up tables are provided if you are unsure of the office codes. | |

| Type of arrival | M | This field is used to differentiate between simplified procedure and normal procedure for registering arrivals. | |

| Customs sub place | D | To be used only under normal procedure, when the goods have arrived at customs approved facilities directly associated with an office of destination. For example, warehouse, DEPS, ERTS and other temporary storage facilities including unattended or occasionally attended port or airports. A customs sub place is ‘Any place designated, approved and controlled by a customs office of departure or destination for the presentation and examination of goods, for the purpose of commencing or ending a transit movement at that office’. | |

| Arrival agreed location of goods code | O | There are no current plans for this field to be used in the UK. Completion of this box will result in the declaration going into the ‘Arrival reported’ state, and will require an ‘Arrived’ transaction to be completed by the customs officer at the office of destination. Note: Cannot be used at the same time as customs sub place. |

|

| Arrival agreed location of goods | O | There are no current plans for this field to be used in the UK. Completion of this box will result in the declaration going into the ‘Arrival reported’ state, and will require an ‘Arrived’ transaction to be completed by the customs officer at the office of destination. Note: Cannot be used at the same time as customs sub place. |

|

| Arrival authorised location of goods | D | For simplified procedures only. An authorised consignee need not present the goods at the office of destination, but at an authorised location, which can be: - the trader’s own premises - a customs controlled area at an office of destination - other customs approved facilities directly associated with an office of destination for example, warehouse, DEPS, ERTS and other temporary storage facilities including unattended or occasionally attended port/airports. Authorised locations must be approved by the designated office of destination and must be specified in the trader’s authorization. |

|

| Destination trader details | |||

| Destination trader EORI (TIN) | O | Up to 17 characters for the EORI number. Note: If the EORI number is known to NCTS then only the EORI number need be entered. |

|

| Destination trader name | D | Enter the appropriate details of the destination trader’s name. | |

| Destination trader street and number | D | Enter the appropriate details from the destination trader’s address. | |

| Destination trader postal code | D | Enter the appropriate details from the destination trader’s address. | |

| Destination trader city/town | D | Enter the appropriate details from the destination trader’s address. | |

| En Route Event (Incident) | |||

| Place | M | Place where the en route event took place. | Box 56 |

| Country code | M | Country where the en route event took place. Please select from drop-down list provided. | |

| Already in NCTS | M | This field is used to record whether the transhipment has been recorded on NCTS by a customs office en route or a transit office. Check the box as ‘Yes’ or ‘No’. | |

| Incident information | O | A free text field to record the details of the incident. | Box 56 |

| Date reported | M | Enter the date of the incident using the drop-down arrows to select the appropriate date, month and year. Note: Forward dating is not allowed by NCTS. |

Box G |

| Reported by | O | Field for the name or title of the authority making the endorsement (free text). | Box G |

| Place reported | O | Place where the endorsement is being made (free text). | Box G |

| Country reported | O | Please select the country code of the endorsement authority from the drop-down list. | Box G |

| Seals | If seals have been changed, enter all new seal identification numbers or marks. | Box 56 | |

| En Route Event (Transhipment) | |||

| Place | M | Place where the transhipment occurred. | |

| Country | M | Please select country where transhipment occurred from drop-down list. | |

| Already in NCTS? | This field is used to record whether the transhipment has been recorded on NCTS by a customs office en route or a transit office. Check the box as ‘Yes’ or ‘No’. | ||

| New transport means identity | O | Enter the name of the ship, prefix and flight number of the aircraft, identifying number of the rail wagon or the registration number of the road vehicle on which the goods are directly loaded when the transhipment occurs. Box 18 may be omitted in certain circumstances with the details subsequently recorded in this box. | Box 55 |

| New transport means nationality | O | Please select the 2 digit code for the nationality of the new means of transport from the drop-down list. Note: Either ‘New transport means identity’ and ‘New transport means nationality’ or ‘new container number’ or both must be used when a transhipment has been declared. Box 18 may be omitted in certain circumstances with the details subsequently recorded in this box. |

Box 55 |

| Date reported | M | Enter the date of the incident using the drop-down arrows to select the appropriate date, month and year. Note: Forward dating is not allowed by NCTS. |

|

| Reported by | M | Enter the name or title of the authority making the endorsement (free text). | Box F |

| Place reported | O | Enter the place where the endorsement is being made (free text). | Box F |

| Country reported | O | Please select the country code of the endorsement authority from the drop-down list. | Box F |

| Container number | D | Either ‘New transport means identity’ and ‘New transport means nationality’ or ‘new container number’ or both must be used when a transhipment has been declared. See notes in other box 55 references above). | Box 55 |

Table 4 - IE044 Unloading remarks

| Field | Mandatory Optional or Dependant |

Required contents | TAD box equivalent |

|---|---|---|---|

| Reference data. The following data is displayed: MRN, transport ID at departure, transport nationality, number of items and number of packages. Destination trader details are also shown as follows: EORI number, name, trader, street and number, town, postcode and country |

|||

| Main information | |||

| Unloading results | M | Select the appropriate button (Satisfactory or Unsatisfactory). | |

| State of seals OK? | M | Select the appropriate button (OK or Not OK). | |

| Unloading complete | M | Select the box to indicate that unloading has been completed. | |

| Unloading date | M | This will automatically be set be default to the current date but may be overwritten. | |

| Check declared information The following fields will need to be completed showing the found value but only if there is a difference to the declared field as shown in the ‘Unloading Permission’ message |

|||

| Total number of items | M | This will show the number of items declared (which are greyed out and cannot be changed). Please enter the number of items found (if different from the Unloading Permission). | Box 6 |

| Total number of packages | M | This will show the number of packages declared (which are greyed out and cannot be changed). Please enter the number of packages found (if different from the Unloading Permission). | |

| Total gross mass | M | This will show the total gross mass declared (which is greyed out and cannot be changed). Please enter the total gross mass (if different from that on the Unloading Permission). | |

| Number of seals | O | This will show the number of seals declared (which are greyed out and cannot be changed). Please enter the number of seals found (if different from those on the Unloading Permission). | |

| Identity of seals | This will show the identity of seals (which are greyed out and cannot be changed). Please enter the identity of seals if different from those on the Unloading Permission. |

| Other things to report This is a free text field for you to advise us of anything else that should be reported. |

|||

| Add new item found | |||

| If you find an item in the goods that was not expected to arrive (discrepancies between the Unloading Permission and the actual goods) then please select this box and complete the details for the new item. |