New burdens doctrine: guidance for government departments

Updated 29 July 2022

Applies to England

1. Background

1.1 Successive governments have sought to keep the pressure on council tax bills to a minimum through some form of ‘New Burdens doctrine’. This requires all Whitehall departments to justify why new duties, powers, targets and other bureaucratic burdens should be placed on local authorities, as well as how much these policies and initiatives will cost and where the money will come from to pay for them.

1.2 In 2010, the Cabinet has agreed that all New Burdens on local authorities must be properly assessed and fully funded by the relevant department. This guidance sets out the process that departments must follow when considering New Burdens[footnote 1]. Departments cannot expect to receive collective Cabinet clearance of proposed policies and initiatives if they fail to follow this guidance.

2. Context

2.1 To ensure that the pressure on council tax is kept down, the net additional cost of all New Burdens placed on local authorities (including parishes, police and fire and rescue authorities) by central government must be assessed and fully and properly funded.

2.2 The department leading on the policy giving rise to the New Burden is responsible for ensuring that this is done, and the necessary resource transfer is made. Full consideration of the cost of new proposals is a key element of good policy making and should therefore be viewed as core business.

2.3 This document provides a step-by-step guide to the New Burdens Doctrine, including the definition of New Burdens, the responsibility on departments for handling them, and the process which should be followed in all cases. It replaces all previous versions of the New Burdens rules.

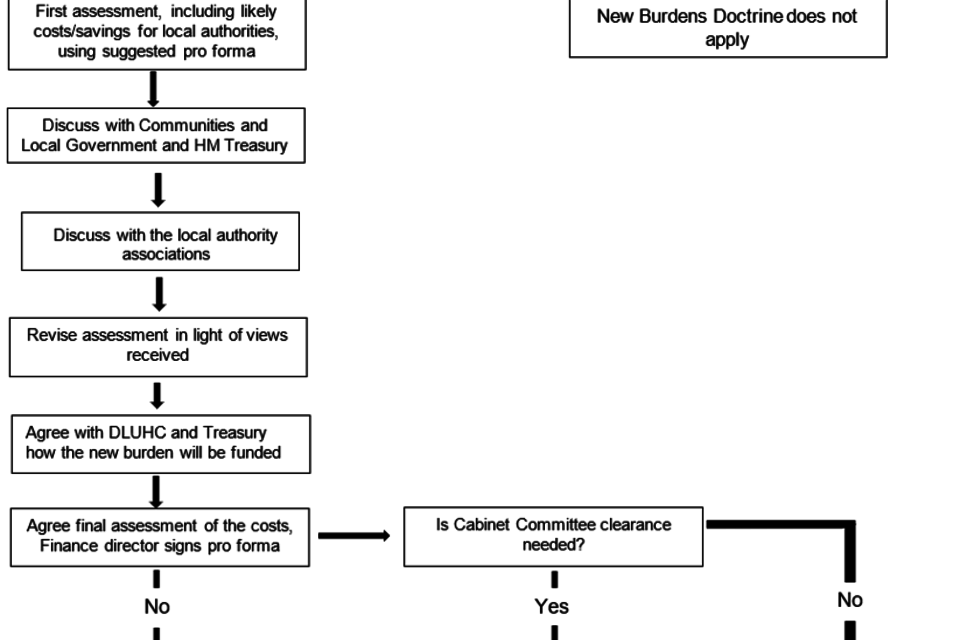

2.4 The introduction below provides an overview of the procedure, which you may find helpful to read before using the detailed guidance which follows. The key stages in the process are shown in the flow chart in Annex A.

What are New Burdens?

2.5 Broadly, a New Burden is defined as any policy or initiative which increases the cost of providing local authority services. This includes duties, powers, or any other changes which may place an expectation on local authorities, including new guidance. In some cases, a New Burden may arise as a result of a transfer of function. The full definition of what constitutes a New Burden can be found in Section 3.

2.6 The Doctrine seeks to keep the pressure on council tax down. It covers all types of local authorities that either raise council tax or set a precept. This includes parishes, police and fire and rescue authorities.

2.7 Where local services are delivered by parts of local government without tax raising powers, for example, National Park Authorities. Good practice is for the relevant lead department to conduct a new burdens assessment without a new requirement they do so. This will help ensure any new or additional requirements are assessed and funded.

2.8 The New Burdens Doctrine only applies where central government requires authorities to do something new or additional. Action to ensure that they adequately fulfil a role for which they are already funded is not a New Burden.

2.9 In cases where central government strongly encourages authorities to follow new policies, or to increase effort on delivering existing policies, without a new requirement that they do so, we encourage departments to consider what resources local authorities may need to help achieve the policy objective. However, such encouragement is not in itself a New Burden. Notwithstanding, strong encouragement on its own may not achieve uniform delivery of the policy objective across the whole of local government.

2.10 The New Burdens process provides a helpful tool through the New Burdens Assessment, which evaluates the financial implications on the sector. See further information about the New Burdens process below and if you have any questions please contact the New Burdens Team - newburdens@levellingup.gov.uk.

2.11 The New Burdens Doctrine does not apply to local government participating in any unlawful activity or disregarding established government statutory guidance. Where a department is clarifying existing legislation or guidance, it may not create a new burden, if there is no expectation of the sector undertaking existing duties in a new way. Please discuss this with the New Burdens Team at DLUHC.

2.12 The New Burdens Doctrine is government guidance and is applied at ministerial discretion. Please get in touch with the New Burdens Team if you have any questions.

What needs to be done with New Burdens?

2.13 The department leading on the policy is responsible for securing the resources needed to fund the net additional cost falling on local authorities from its policy, and for making any necessary resource transfer. This is covered in more detail in Section 5.

2.14 The lead department should inform the Department for Levelling Up, Housing and Communities and HM Treasury of the potential New Burden at the earliest possible stage and will need to quantify the likely costs. It should also discuss the New Burden and possible additional costs with the relevant local authority associations.

2.15 It is essential that the assessment of the costs should be as accurate as possible. The relevant departmental finance director is required to take responsibility for signing off these assessments (see Section 5). A pro forma is attached at Annex B for the assessment of New Burdens, which can usefully form the basis of discussions, and should be updated throughout the process. Where a policy or programme is at a comparatively early stage of development, it is permissible to submit an initial draft of this pro forma with key information and provide updated versions at later stages.

2.16 Once the assessment of the New Burden is complete, the relevant departmental finance director will need to sign the pro forma and return it to the Department for Levelling Up, Housing and Communities.

How will the assessment be used?

2.17 Where Cabinet Committee clearance is required for policies or programmes that give rise to New Burdens departments should ensure that assessments are signed off and returned to the Department for Levelling Up, Housing and Communities in advance of Cabinet clearance. Letters seeking cabinet clearance should indicate that the assessment has been completed.

2.18 The costs of a small number of selected New Burdens will also be evaluated after the event to check the robustness of the estimates made and to confirm that the correct procedures were followed. More information is provided in Section 6.

Who can I contact for further advice?

2.19 Implementation of the New Burdens Doctrine is overseen by the New Burdens Team in the Department for Levelling Up, Housing and Communities. The team would be happy to discuss the procedure and draft assessments with you and encourage you to contact them as soon as a potential New Burden has been identified.

3. Defining New Burdens

3.1 A burden will arise where new powers/duties/expectations could lead to authorities having to increase spending. It does not have to be a new duty. A new power also creates a New Burden. The government does not generally provide powers unless it expects them to be used, and authorities will generally come under pressure to make use of the powers they have been given.

3.2 Nor do New Burdens result only from new legislation: they can arise from authorities being asked to exercise existing powers and functions in new ways, e.g. in new guidance. If it is the government’s policy that authorities should do something and that this will cost them more money, the department responsible for the policy must ensure that the necessary funding is provided. A New Burden can also arise from changes causing an authority to lose income.

3.3 The key definition of a New Burden is a change that could lead to an increase in council tax if it was not additionally funded by central government. The New Burdens procedure applies to all of the following initiatives whenever they solely, mainly or disproportionately affect local government (there may be other examples not listed here):

-

new duties, or extension of existing duties under primary legislation or regulations. It is important that departments are as clear as they can be about what they expect local authorities to do and how much it will cost. Particular care is required where a duty is couched in general terms, since in these situations it may be harder to predict the consequences of the new duty and consequently its likely costs. Departments also need to be careful that legislation achieves the original policy aim which has been costed. Particular care needs to be taken when (for example) legislation is amended during the Parliamentary process. Amendments of this type can result in different policy outcomes and therefore different cost consequences

-

new powers, or extension of existing powers under primary legislation or regulations, where these are introduced as a result of a decision by government that further work is needed in particular areas. Such powers represent a New Burden even if they have been requested by local government. If departments are considering new powers, then they must assume that councils will use them. Departments should therefore discuss with the relevant local authority associations at an early stage sensible assumptions on the extent to which new powers will be used. It is not acceptable to argue there is no burden because local authorities can choose not to use the powers. Where central government goes to the trouble of developing or legislating for a specific discretionary measure, it must be on the basis that authorities are expected to make some use of it, creating potential costs for authorities, and potential pressure on council tax

- transfer of function from central to local government

- review of, or change to, local authority procedures

- creation of new reporting requirements outside the local performance framework

- charging authorities for data or information currently provided without charge

- restraint on fee levels that are charged by local authorities, or exemptions from such fees or charges of certain categories of persons or application

- reductions in existing levels or rates of government grant or subsidies to local government generally which are paid directly or indirectly to local authorities, except where activity by authorities is expected to reduce in proportion, in which case this should be made clear to them. This does not apply where the government is proposing a change to the distribution of grant to individual local authorities and there is no change to the amounts being given to local government as a whole

3.4 As local authority expenditure is planned in net terms, for the purposes of these rules any proposal which would result in reduced income to local authorities counts as a New Burden in the same way as the imposition of a specific new task or duty.

3.5 The New Burdens procedure applies to all burdens, regardless of cost. However, where the aggregate value of all a department’s burdens (i.e. the total of all burdens in a particular financial year) is below £100,000, that department will not be required to make any transfer.

3.6 Where new policies and programmes are directly funded as part of a Spending Review and a funding transfer is made to local government, they should not be subject to a further New Burdens assessment. Those that are not so funded will need to be assessed in the usual way.

3.7 In the case of reduced departmental budgets leading to reductions in funding for local authority services; this situation need not lead to New Burdens as long as departments are aware that such reductions may lead to a reduction in current service levels.

3.8 Activity by Whitehall departments in support of the government’s aim to rebuild the Military Covenant should generally be assessed and funded by the department with lead responsibility for the policy area in question - and not by the Ministry of Defence. Any such New Burdens would need to be mutually agreed beforehand, and only where the lead department is sure that it has the necessary resources.

3.9 The New Burdens Doctrine does not apply to policies which apply the same rules to local authorities and to private sector bodies (for example changes in general taxation, or employment legislation that applies to all organisations), unless these have a disproportionate effect on local government.

4. Responsibility for New Burdens

4.1 For each initiative, there will be an identifiable department in the lead. The following list outlines how this will be determined for the different types of new burdens:

-

where an initiative emanates solely from one department, that will be the lead department

-

where the initiative emanates solely from an executive agency or other sponsored body, the lead department will be that one which has sole or lead responsibility for that body

-

where there are several departments or bodies involved, the lead department should be agreed between them. The Department for Levelling Up, Housing and Communities and HM Treasury will decide on the lead department in cases of dispute

-

in the case of No 10 Policy Unit recommendations, it will be for the lead department to take forward the issue of costs arising from New Burdens

-

in relation to proposals imposed by other bodies which are in pursuit of government policy, it will be for the department with responsibility for the area covered by the proposal to secure additional provision

-

in the case of Private Members Bills which would impose New Burdens on local authorities, departments with lead responsibility for these Bills are responsible for finding the provision for additional costs which fall on local authorities

5. The process

5.1 This section outlines the key stages in the assessment of New Burdens.

Early consideration

5.2 All new initiatives must be assessed during their formative stage for their effects on local government current expenditure and/or manpower. The lead departments should inform the Department for Levelling Up, Housing and Communities at the earliest possible stage of any new initiative affecting local government.

5.3 In addition, the HM Treasury Local Government team, who are responsible for considering overall issues of local government spending, must be informed, as well as the relevant Treasury spending team.

5.4 If it is proposed that a New Burden should be financed by the levying of fees or charges on industry, the Department for Business, Energy and Industrial Strategy should be consulted.

5.5 This early assessment of the impacts on local authorities should be linked to the drawing up of the impact assessment, which must be carried out for all policy changes, which could affect the public or private sectors, charities, the voluntary sector or small businesses. However, it should be remembered that the separate New Burdens assessment must also be completed to draw out the specific implications for local authorities. The important difference between the New Burdens and impact assessment process is covered in paragraphs 5.16 and 5.32.

5.6 The financial implications may not always be readily apparent to the lead department. If there is doubt, the lead department should consult the New Burdens Team and explain the proposed change to them and to other departments whose interests might be affected.

Quantifying the costs

5.7 Once you have identified that the new initiative will have an impact on local government, you should begin, at the earliest possible point, to estimate the costs/savings for local authorities. This is a key component of good policy making and will help to ensure that the initiative is designed to achieve its objective in the most effective way. It may well be that these early estimates will be revised later in the process, as more information becomes available to you.

5.8 In calculating the costs, the finance section in the relevant department(s) should be consulted at the beginning of the process, particularly as the relevant departmental finance director is required to take final responsibility for the accuracy of the assessment.

5.9 As outlined in the pro forma at Annex B, the lead department will need to provide the best estimate of all the costs/savings for local authorities which will result from the new proposal. This will include the overall costs to local government, any one-off implementation costs/set- up/transition costs and the recurring costs for a minimum of the first 3 years. Where possible, these costs can usefully be considered in terms of staff and non-staff costs, and revenue and capital costs. In undertaking their assessments, departments should demonstrate that they have considered the direct and indirect impact on pay and pensions costs.

5.10 In relation to new powers, it is the extent to which the government wants or expects them to be used that is the relevant factor in determining the size of the overall burden. There is no requirement to cost and fund on the assumption that the power is used by all authorities if it is reasonable to assume that it will not be taken up by all authorities. In some cases, powers may remove barriers to authorities’ effectiveness. This can be particularly true in relation for example to policing. In such cases the evidence would be expected to show that there is either no or a reduced net additional cost.

5.11 Estimated costs need to be the reasonable cost. There should be no expectation that government will meet all additional expenditure by local authorities regardless of value for money.

5.12 The Treasury’s Green Book should also be consulted. The Green Book describes how economic, financial, social and environmental assessments of a policy should be combined.

5.13 You should note that the date when a New Burden is considered to take effect is when the policy has an impact on local authorities, not when the policy was originally conceived or collectively agreed.

5.14 It is important to remember that these rules concern the impact of policies on council tax in each individual year. Departments cannot argue that short term costs will be offset against long term savings. Short term costs are generally quantifiable, as is the impact on council budgets once implementation begins. The savings are often longer term. Only specific identified cost savings (rather than vague, non-specific, or unquantifiable savings) can be offset against identified costs and this should be on a year-by-year basis (so longer term cost savings could reduce a New Burden over time).

5.15 Such savings must be additional to the annual savings authorities are expected to make and their treatment needs to be consistent with the appropriate Treasury guidance on efficiency (see below). If the focus of a policy change is purely and simply to enable efficiencies, then the net additional cost is likely to be negative.

5.16 One way of complying with the New Burdens procedure is to identify specific areas of work which local authorities would stop undertaking in order to fund the additional work, either through deregulation or a change to legislation. This must however be within the lead department’s areas of responsibility or, if in another department’s policy area, with their explicit agreement. This should not include a general assumption about re-prioritising or efficiency savings. Any savings used to offset costs must be clearly additional to the annual savings that authorities are expected to make, which will have already been taken into account in the overall finance settlement.

5.17 Departments may also be planning to work with local authorities to generate savings through ‘whole area’ approaches to service delivery. Where this is the case, and where departments intend to use these savings to offset anticipated New Burdens, they must describe how those savings will be achieved and clearly identify the duplication between service areas from which they expect the savings to arise. Where an overlap occurs with a service under the policy responsibility of another government department, they must also demonstrate they have the explicit agreement of that department that the savings achieved can be used in this way. (As with all savings to offset New Burdens, these must be clearly additional to any annual savings that authorities are already expected to make.)

Discussing the assessment

5.18 Even if you can provide only incomplete information initially, lead departments are asked to discuss their estimates with the Department for Levelling Up, Housing and Communities as early as possible in the process. Where the territorial administrations are involved, you will also need to discuss the costs with them.

5.19 Once you have a set of cost estimates, you should discuss them with the Local Government Association and, if appropriate, with London Councils and police and fire associations. Where possible, you may also find it helpful to discuss estimates directly with local authorities who will do the proposed work.

5.20 In these discussions you should set out clearly what the objective of the proposal is, what local authorities would be expected to do, and whether it will apply to all authorities equally (as highlighted above, this is particularly important where a new power is proposed). As with all effective consultation, it is important that you give the associations sufficient time to consider fully the likely costs.

5.21 Note that, while you will want to consider fully the views of the associations, there is no obligation to agree your final assessment with them. It may be that the local authority assessment of the costs will be higher than your own, particularly if it transpires that their assessment covers the gross cost rather than the net additional costs falling on local government. All government departments should ensure in dealings with local government that no expectations are given that government will meet all additional expenditure by local authorities regardless of value for money.

5.22 Ideally, you should also seek, where possible, independent corroboration of these figures. Following these discussions, the lead department should agree with the Department for Levelling Up, Housing and Communities (and, where relevant, territorial administrations) its final assessment of the likely cost. The Treasury (both the Local Government team and the relevant spending team) will need to be brought in if agreement cannot be reached without their involvement.

5.23 Savings from reduced burdens should be discussed with the local authority associations and agreed with the Department for Levelling Up, Housing and Communities in the same way as the costs associated with New Burdens.

Providing the resources

5.24 Where a department considers that it requires additional resources to fund a New Burden, it is responsible for securing those resources. If a department introduces off-setting measures at the same time to reduce other burdens on local authorities, it will need to fund the net additional cost. As outlined above, departments should not consider general efficiency savings within local authorities to be an available source of funding for New Burdens. Nor should they assume, that authorities can absorb the cost of a New Burden through reduced expenditure on existing functions. Such assumptions will result in increased pressure on council tax, which the government is collectively committed to avoiding.

5.25 In some cases, departments, working with authorities, may be able to identify specific opportunities for reprioritisation and reduction of activity within their service area. Authorities may also achieve efficiency savings greater than expected at the time of the Local Government Finance Settlement. The treatment of these savings needs to be consistent with the appropriate efficiency guidance and if in doubt departments should consult Treasury.

5.26 Resources should be provided in 1 of 4 ways:

Unless there are good reasons not to do so, the usual expectation is that the lead department will transfer the resources from its Departmental Expenditure Limits (DEL) into Local Government DEL (LG DEL) at the start of each Spending Review period so that it can be included in the Local Government Finance Settlement (LGFS).

- LGFS funding is distributed by the Department for Levelling Up, Housing and Communities (DLUHC) on behalf of government as a whole, using a variety of formulae to determine grant allocations to specific authorities. DLUHC seeks to minimise the conditions attached to Settlement funding, so that local authorities have the freedom to spend the money as they see fit to meet their statutory duties and local priorities.

- Wherever possible, departments should set timetables that enable resource transfers to be made in advance of the settlement covering the financial year in which the New Burden will take effect (ie at least 4 months before the start of the financial year in which the New Burden will take effect). Policy leads will need to have identified the provision to transfer and to have discussed with the Department for Levelling Up, Housing and Communities by the early summer of the year preceding the financial year in which the New Burden will take effect. By the end of August, policy leads will need to have instructed their vote managers to tally the transfer of funding for the following financial year (and onwards) on the Treasury database, although precise timing should be discussed with the Department for Levelling Up, Housing and Communities at an early stage.

- If the cost of a burden is projected to vary over time for any reason (for instance where a policy is implemented in stages), then this should be reflected in the level of the transfers for each of the years.

If the department does not have funding from within its own programmes, it will need to be funded through a successful Spending Review bid.

- Unless HM Treasury gives a firm commitment, departments must not assume that they will be successful in negotiating funding for burdens in Spending Reviews. There should be no consultation on proposals or other public commitments unless departments have identified the funding for the burden from within existing programmes. Equally, departments should not announce a New Burden but make provision of a transfer conditional on their success in securing resources. If a New Burden is imposed, a transfer must be made.

- For those burdens not met through a successful Spending Review bid, the department will need to transfer funds into the relevant settlement, starting in the year when the burden is imposed.

- Transferring money into the Local Government Finance Settlement does not absolve a department from responsibility for ensuring that its policies are funded. Lead departments remain responsible for managing the pressures authorities face on their services and negotiating finance for their services in future Spending Reviews.

If the decisions are made after the Spending Review/ Local Government Finance Settlement has been announced, funding will need to be paid through a specific grant to cover the net additional costs, assuming these are not covered by fees and charges.

- Departments can make a Section 31 Grant payment at any point during the Spending Review period to pay for policy changes implemented after the Local Government Finance Settlement.

- Where it is not possible to pay through either the Settlement or a Section 31 Grant, a specific revenue grant can be provided on a non-ringfenced basis. This might be where there is a contentious new duty and ministers consider that there needs to be transparency of funding in the early years. However, the government wishes to avoid the proliferation of specific revenue grants since numerous grants create inefficiencies as they are a burden on both central and local government to administer.

- Ringfenced grants will only be agreed by the Department for Levelling Up, Housing and Communities and HM Treasury in exceptional circumstances. Please contact the relevant team in the Department for Levelling Up, Housing and Communities at an early stage if you wish to discuss these rules. If you have ringfencing queries, please contact section31grant@levellingup.gov.uk

- Departments should not - other than in exceptional circumstances make transfers conditional on the way that the resources are distributed to, or used by, local authorities. Local authorities are responsible for their own spending decisions. Resources for local government are normally distributed through general grant mechanisms on the basis of broad allocation formulae. Unless there are compelling reasons for doing otherwise, grants funding should not be made through a bespoke distribution.

- Departments will need to ensure that the specific power being used to pay the grant does not in itself ringfence the funding by restricting the grant to certain types of expenditure.

The costs will be covered through new fees and charges to be levied by local authorities. If this is what is proposed, these must also be discussed both with HM Treasury, because of the broader financial issues involved, and with the Department for Business, Energy and Industrial Strategy, owing to the possible burdens on industry.

5.27 If a reduction in a department’s programme places a new burden on local authorities, the department must transfer into the appropriate settlement an amount to cover the full cost of the burden. Departments may not count reductions in their own programmes as savings for public expenditure purposes until they have done so.

5.28 Where there are genuine cost savings to local authorities, through for example transfers of responsibility, transfers of funding out of the settlement would be appropriate. Where a function is transferred from authorities to a central government department or agency, savings to local government may be transferred to the relevant department, subject to Treasury consent. Treasury approval is required to use any transfers for other purposes.

Signing off by finance directors

5.29 Once the costs of the New Burden have been fully assessed, the lead department’s relevant finance director will need to sign off the assessment on the pro forma at Annex B and send this to the Department for Levelling Up, Housing and Communities. Where Cabinet Committee clearance is required, departments should ensure that the signed off pro forma is sent to the Department for Levelling Up, Housing and Communities in advance of this, and the letter seeking clearance should indicate that the assessment has been made[footnote 2].

5.30 The assessment of costs should also be in line with the Impact Assessment assuming one is required. The New Burdens assessment can cross-refer to the impact assessment and draw upon the evidence that underpins it. However, the New Burdens assessment must contain distinct information about the scope and cost of new policies and programmes for local authorities. For example, Impact Assessments identifies the overall financial impacts (usually based on the Net Present Value) of a policy, whereas the New Burdens assessment requires a year-by-year profile of costs and savings in line with council tax bills[footnote 3].

5.31 If the proposal changes during the course of clearance being agreed, an updated assessment of costs will be required.

5.32 Where Cabinet clearance is not required, the assessment should also be signed off by the relevant departmental finance director and sent in advance of making the change to the New Burdens Team in Department for Levelling up, Housing and Communities, where it will be kept on a database.

5.33 Note that, if the department’s assessment of the new policy is that, although it impacts on local authorities, it does not place a net additional cost on them, this will still need to be confirmed and signed off by the relevant departmental finance director and sent to Department for Levelling up, Housing and Communities.

6. Review and evaluation

Liaison meetings with finance directors

6.1 To help ensure that a complete picture is being maintained of the New Burdens arising from departments’ policies, departmental finance directors will meet with the Department for Levelling Up, Housing and Communities officials (and Treasury officials, where appropriate) twice per year – normally around April and September. The purpose of these meetings will be:

- to review departments’ compliance with New Burdens guidance

- to agree the current list of ‘live’ New Burdens and

- to identify any potential New Burdens that may emerge in the future

6.2 The meetings will also be an opportunity to discuss post- implementation scrutiny of assessments (see below), and to learn from the approach each department has taken to scrutiny reviews.

Post-implementation scrutiny

6.3 Each year the assessments of a small number of New Burdens from a range of departments will be independently evaluated after the event. A framework outlining the remit of the scrutiny, selection of New Burdens, arrangements for scrutiny and the nature of the outcomes expected is set out below.

Remit

6.4 Post-implementation scrutiny will be expected to include the following areas:

- the robustness of the department’s assessment of estimated costs to local authorities and the underlying assumptions

- compliance by the department with the New Burdens procedures

6.5 In light of the accountability of departments’ finance directors in signing off assessments, it is expected that they and the Department for Levelling Up, Housing and Communities will work closely together to ensure that the scrutiny is carried out appropriately and to a high standard, and from an independent perspective.

6.6 When reviewing their original estimate of costs, departments will usually need to liaise with local authorities and undertake other evidence and data collection. They should also work with other departments, where relevant, and with officials in the Department for Levelling Up, Housing and Communities when reviewing compliance with procedures.

6.7 Reviews may conclude that costs turned out to differ from the original New Burdens estimate. This ought not to be surprising nor a cause for criticism; nor will there be an automatic assumption that departments must make good under-estimates (or indeed recoup over-estimates). There is a recognition that:

- funding decisions are inevitably based on the best available information at the time

- the post-implementation scrutiny itself will be based on assumptions and estimates, albeit informed by experience on the ground and

- actual costs will depend on how local authorities choose to implement policies – something over which departments may not have control

Selecting New Burdens for scrutiny

6.8 It is of course good practice for policy makers to review the impact of their policies once implemented, and that will often include the impact on local authorities. Departments will naturally be free to organise such reviews whenever they feel it is appropriate. However, the Department for Levelling Up, Housing and Communities will also take responsibility for selecting a limited number of New Burdens for independent post-implementation scrutiny each year.

6.9 Selections will be made with input as appropriate from HM Treasury and in consultation with the department(s) concerned. The bi-annual meetings with departmental finance directors will be helpful in this. The expectation will be that on average no more than 6 New Burdens from across the whole of government will be selected for independent scrutiny per year and that there should normally be no more than one for an individual department - as arrangements need to ensure that individual departments are not unduly burdened with reviews. However, the possibility that circumstances may require more cannot be ruled out.

6.10 Reviews will not be restricted to cases with substantial costs or where there are claims of under-funding. Selection will be made from all New Burdens cases including small cases and those where no net costs have been assumed. This is to generate findings representative of the wide range of policies and programmes that are subjected to a New Burdens assessment.

Scrutiny arrangements

6.11 Departments will be informed of the New Burdens selected for independent scrutiny at least 3 months before the review needs to take place. Reviews must reflect the guidance in this document. In particular, they must reflect the focus of government’s approach to New Burdens – the principle of funding authorities fully in order to avoid putting pressure on council tax.

6.12 The independence of these reviews is an important feature distinguishing them from the ongoing policy development and monitoring work routinely undertaken by departments. The form of this independent perspective will be agreed on a case-by-case basis between DLUHC and the department as the scrutiny is planned. It could involve (for example) external researchers, the department’s analytical function or a combination or resources. However, the review should not be led by the policy team that prepared the original assessment.

6.13 The Department for Levelling Up, Housing and Communities will be full partners in any review, and departments will need to discuss and agree arrangements with DLUHC officials. HM Treasury will also, need to be content with the review’s terms of reference and timescale. DLUHC will only get involved in the detailed governance of a review in exceptional cases (except, of course, where DLUHC is itself the department responsible for the new burden in which case HMT and the local government directorate within DLUHC will apply the same approach to DLUHC as to any other department). The management arrangements for the reviews should reflect DLUHC’s/Treasury’s need to see progress reports, and to have the opportunity to comment on their reports and conclusions whilst still in draft.

6.14 The scale and cost of these reviews will depend on the policy area concerned. The expectation is that they will be relatively modest, and that the cost would not exceed £50,000 in most cases – but there may be exceptions. Responsibility for carrying out the reviews lies with departments themselves. They will also be expected to organise, and meet the costs of, the scrutiny from within their existing resources – no new resources will be provided for this. It will also be for departments to liaise with the appropriate local authority associations and stakeholders as necessary to gather evidence

6.15 Final reports should be delivered to the finance directors of the departments concerned, and copied to DLUHC and Treasury, in line with arrangements agreed when the scrutiny is set up.

6.16 These scrutiny reviews will inevitably involve a variety of stakeholders. Although it is not the intention that the reviews should produce a published document. Departments should assume that the arrangements they make for them, and their outcomes, may eventually have to be put into the public domain. All documentation should be prepared with that in mind.

Outcomes

6.17 Departments should look to generate a short report (no more than 10 pages), which addresses as a minimum the following issues independent scrutiny:

- lessons learnt about how well the department’s internal New Burdens procedures work

- lessons learnt about their engagement with the Department for Levelling Up, Housing and Communities and HMT

- a view of the robustness of the estimates made in the original New Burdens assessment and reasons for any divergence

- information that could inform future policy and funding decision

7. Further advice

7.1 The New Burdens Team at the Department for Levelling Up, Housing and Communities are happy to discuss the process with you and to answer any queries that you may have. As outlined above, you are encouraged to contact them as early as possible in the New Burdens process.

Annex A: New Burdens process – key stages

Accessible version of flowchart

1. Does the proposal affect local authorities?

- If yes go to step 2

- If no Is there evidence to support this? If no go to step 2. If yes New Burdens doctrine does not apply

2. Agree the lead department responsible for the assessment

3. First assessment, including likely costs/saving for local authorities, using suggested pro forma

4. Discuss with DLUHC and Treasury

5. Discuss with local authority associations

6. Revise assessment in light of views received

7. Agree with DLUHC and Treasury how the new burden will be funded

8. Agree final assessment of the costs; Finance Director signs pro forma

8a.Is Cabinet Committee clearance needed?

- If no Send pro forma to DLUHC and go to step 9

- If yes Send pro forma to DLUHC in advance of seeking Cabinet Committee clearance and go to step 9

9. Assessment selected for post-implementation review? (1/2/3 years after assessment)

- If no (End of New Burdens process)

- If yes Independent review of assessment (End of New Burdens process)

Annex B: New Burden assessment pro forma

The pro forma is available as a separate download

Annex C: Glossary of terms

Billing authorities

Billing authorities are the 309 authorities that are empowered to set and collect council taxes, and manage the Collection Fund, on behalf of itself and other local authorities in its area. In England, district councils (metropolitan and shire), the Council of the Isles of Scilly, unitary authorities, London boroughs, and the City of London are billing authorities. For the City of London, the billing authority is the Common Council of the City of London. These are also sometimes known as lower-tier authorities.

Council tax

This is a local charge (or charges) set by the billing authority in order to collect sufficient revenue to meet their demand on the collection fund and the precepts issued by the precepting authorities. It replaced the community charge on 1 April 1993 and is based on the value of the property. The Valuation Office Agency assesses the properties in each district area and assigns each property to 1 of 8 valuation bands in England; A to H. The tax is set on the basis of the number of Band D equivalent properties. Tax levels for dwellings in other bands are set relative to the Band D baseline.

Departmental expenditure limit

Spending Reviews enable firm departmental expenditure limit spending plans for departments’ programme and administration expenditure to be set and controlled over the lifetime of the Review. The departmental expenditure limit spending plans are strictly enforced, as departments are expected to prioritise competing pressures, and fund these within their overall annual limits (as set in Spending Reviews). As there are no annual reviews for departments to bid for extra funds, the departmental expenditure limit system provides a strong incentive to control costs and maximise value for money.

Duty

A requirement on local government or other public sector organisation to provide a particular service or perform a particular function.

Dedicated Schools Grant

There was a change in the funding of specific and formula grants in 2006-07 largely due to changes in the way that expenditure on schools is funded. From 2006-07, local authorities receive Dedicated Schools Grant as a specific ringfenced grant rather than funding previously included in formula grant. Funding is allocated through four funding blocks, which each comprise different proportions of the total DSG: the Schools Block, the High Needs Block, the Early Years Block and the Central Schools Services Block.

Efficiency savings

Efficiency savings are those savings which can be saved from budgets through better organisation of operations; greater use of information and communication technologies; better utilisation of assets; more economical procurement practices; partnership arrangements with other authorities and the private sector; and from the automation of clerical and administrative procedures. Efficiency savings do not affect the standard or level of service to the population at large.

Green Book

The HM Treasury Green Book describes how economic, financial, social and environmental assessments of a policy should be combined.

Government grant

A sum of money granted by central government to a lower level of government or to a dependency for a programme of work etc. There are a number of mechanisms for making grants, with different purposes and rules.

Housing revenue account

A local authority statutory account, within the general fund, covering current income and expenditure on its housing services relating to its own housing stock. The Housing Revenue Account is a record of revenue expenditure and income relating to an authority’s own housing stock and dates back to the Housing Act 1935. Most other local authority services are funded through council tax and central government support for the benefit of all local taxpayers. However housing is provided directly to a relatively small sub-group of local taxpayers and council tenants and funded by the rents they pay and by central government subsidy.

The Housing Revenue Account is a ringfenced account. The ringfence was introduced in the Local Government and Housing Act 1989, to ensure that rents paid by local authority tenants make a fair contribution to the cost of providing the housing service. Rent levels can therefore not be subsidised by increases in the council tax and equally, local authorities are prevented from increasing rents in order to keep council tax levels down.

Impact assessment

A continuous process to help the policy-maker fully think through and understand the consequences of possible and actual government interventions in the public, private and third sectors; it is also a tool to enable the government to weigh and present the relevant evidence on the positive and negative effects of such interventions, including by reviewing the impact of policies after they have been implemented.

Lead department

The department leading on the policy giving rise to the New Burden, and therefore responsible for ensuring the New Burden is funded. Where there is more than one department with policy involvement, agreement should be reached about which department is in the lead. If agreement cannot be reached DLUHC and HMT will make a decision. NB More than one department can contribute to the costs of a New Burden, but only one department can take ultimately responsibility as the ‘lead department’.

Local Government Finance Settlement

The Local Government Finance Settlement is the annual determination made in a Local Government Finance Report by affirmative resolution of the House of Commons in respect of the following year of:

- the amount of Revenue Support Grant and Redistributed Business Rates to be distributed to local authorities;

- how that support will be distributed; and

- the support for certain other local government bodies (known as specified bodies).

Levy

This is a payment that a local authority is required to make to a particular body (a levying body). Levying bodies include national parks authorities and passenger transport authorities.

New Burden

A New Burden is any new policy or initiative which increases the cost of providing local authority services and could lead to an increase in council tax if it was not additionally funded by central government. This includes duties, powers, or any other changes which may place an expectation on local authorities, including new guidance. A New Burden can also arise from authorities being asked to exercise existing powers and functions in new ways or changes that would cause them to lose income.

New Burdens Doctrine

The collectively-agreed principle that government as a whole will ensure that New Burdens falling on local authorities are fully funded. The New Burdens Doctrine does not apply to authorities that do not raise council tax e.g. National Parks.

New Burdens assessment

A pro forma for the assessment of New Burdens that must be signed off by the relevant departmental finance director. It is the completion of this form which provides the Cabinet with the necessary reassurance that there will be no upward pressure on council tax levels as a result of the New Burden.

Net additional cost

The additional total cost to a local authority from a New Burden less any specific savings that arise from that New Burden.

Net present value

This is the difference between the present value of cash inflows and the present value of cash outflows. Net Present Value is largely used in capital budgeting to analyse the affordability of an investment or project. Net Present Value includes all cash flows including initial cash flows such as the cost of purchasing an asset, whereas a present value does not.

Post-implementation scrutiny

The independent assessment of a selected small number of new burdens after implementation. Scrutiny includes assessing the robustness of the estimated costs to local authorities, the underlying assumptions and the compliance of the department with the New Burdens procedures.

Powers

A legal power to enable local government or other public sector organisation to take action.

Precept

The amount of money (council tax) that a local or major precepting authority has instructed the billing authority to collect and pay over to it in order to finance its net expenditure, i.e. budget requirement less income from revenue support grant, redistributed non-domestic rates and principal formula police grant.

Precepting authority

This is an authority which sets a precept to be collected by billing authorities through the council tax bill. County councils, police authorities, the Greater London Authority, fire and rescue authorities, parish councils and mayoral combined authorities are all precepting authorities.

Revenue Support Grant

Revenue Support Grant is a central government grant given to local authorities which can be used to finance revenue expenditure on any service. The amount of Revenue Support Grant to be provided to authorities is established through the Local Government Finance Settlement.

Ringfencing

When the government gives money and predetermines the activities for which it can be used, rather than allowing the local authority to make the decision.

Ringfencing allows the council less flexibility and control but is intended to protect vulnerable services.

Section 31

Section 31 of the Local Government Act 2003 (“section 31”) is a wide-ranging power which enables any Minister of the Crown, with the consent of the Treasury, to pay grant to any local authority in England towards expenditure incurred or to be incurred by the authority. The power should largely eliminate the need in future legislation for specific powers to pay grants to local authorities. It is designed to allow authorities more flexibility in the use of resources than specific powers had in the past, which constrain their use.

Specific grants

Specific grants allocation and distribution are set centrally and are linked to the specific policy initiatives and expectations. These grants are for specific initiatives and cannot be used for general expenditure.

Spending Review

A Spending Review sets firm and fixed Departmental Expenditure Limits. It is the government’s main tool for deciding how much money will go into public services; and provides a formal structure for evaluating the effectiveness of public spending.

Within the review, the government decides how much it can afford to spend, reviews its expenditure priorities, and sets the targets for the key improvements in public services that the public can expect over the Spending Review period. Put simply, it provides the budgets required to deliver a department’s agreed objectives

-

This guidance applies to burdens on local authorities in England. Where New Burdens apply in Wales, Scotland or Northern Ireland, the appropriate devolved administration(s) and local authority associations should also be consulted. ↩

-

See separate guidance on the circumstances in which Cabinet clearance is required. ↩

-

See separate guidance on the preparation of Impact Assessments. ↩